Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN REALTY INVESTORS - AMERICAN REALTY INVESTORS INC | ari8k081512.htm |

|

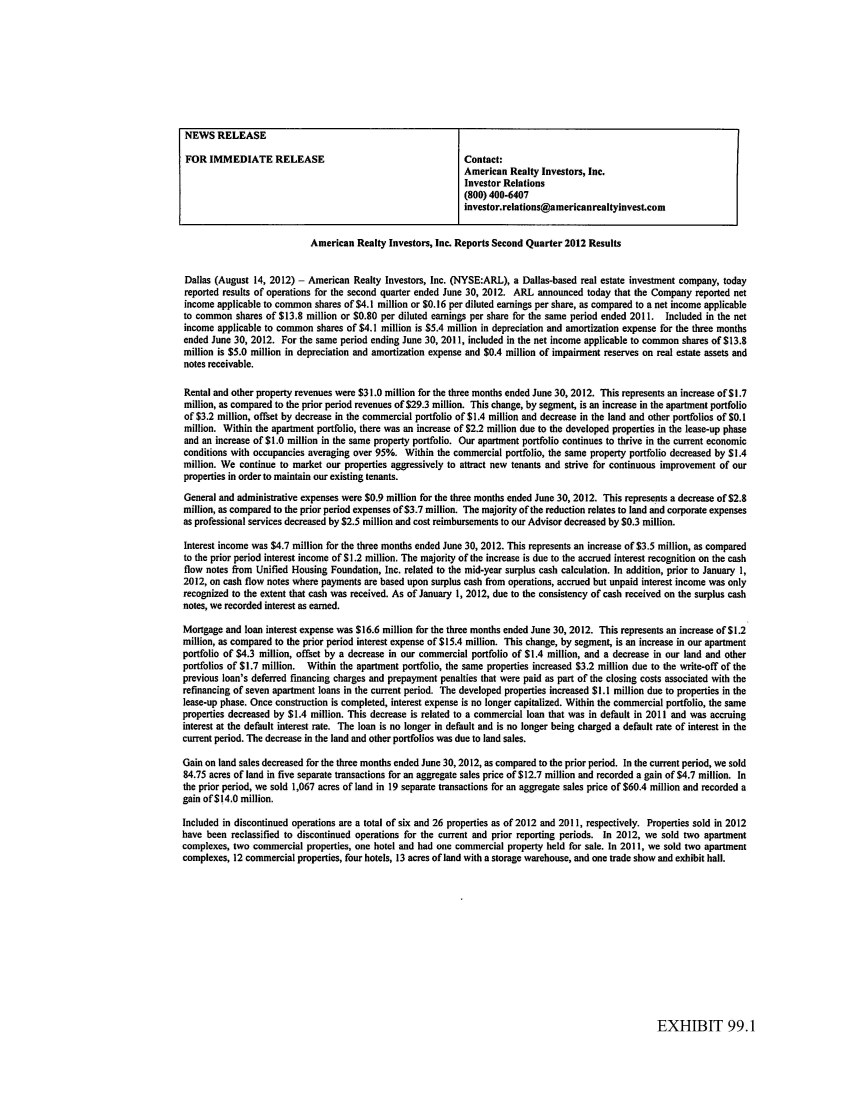

AMERICAN REALTY INVESTORS, INC.

|

||||||||||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

||||||||||||||||

|

(unaudited)

|

||||||||||||||||

|

For the Three Months Ended

|

For the Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

(dollars in thousands, except share and per share amounts)

|

||||||||||||||||

|

Revenues:

|

||||||||||||||||

|

Rental and other property revenues (including $167 and $0 for the three months and

$335 and $0 for the six months ended 2012 and 2011 respectively from affiliates and

related parties)

|

$ | 31,016 | $ | 29,306 | $ | 60,598 | $ | 56,480 | ||||||||

|

Expenses:

|

||||||||||||||||

|

Property operating expenses (including $258 and $383 for the three months and $550

and $631 for the six months ended 2012 and 2011 respectively from affiliates and

related parties)

|

15,674 | 15,407 | 31,087 | 30,667 | ||||||||||||

|

Depreciation and amortization

|

5,393 | 4,958 | 10,821 | 10,162 | ||||||||||||

|

General and administrative (including $937 and $1,241 for the three months and

$1,817 and $2,429 for the six months ended 2012 and 2011 respectively from

affiliates and related parties)

|

935 | 3,692 | 3,507 | 6,915 | ||||||||||||

|

Provision on impairment of notes receivable and real estate assets

|

- | 444 | - | 5,622 | ||||||||||||

|

Advisory fee to affiliate

|

2,700 | 3,462 | 5,359 | 6,984 | ||||||||||||

|

Total operating expenses

|

24,702 | 27,963 | 50,774 | 60,350 | ||||||||||||

|

Operating income (loss)

|

6,314 | 1,343 | 9,824 | (3,870 | ) | |||||||||||

|

Other income (expense):

|

||||||||||||||||

|

Interest income (including $4,624 and $1,104 for the three months and $7,865 and

$1,603 for the six months ended 2012 and 2011 respectively from affiliates and

related parties)

|

4,723 | 1,203 | 8,063 | 1,871 | ||||||||||||

|

Other income (including $1,500 and $0 for the three months and $3,000 and $0

for the six months ended 2012 and 2011 respectively from affiliates and

related parties)

|

2,171 | 551 | 3,800 | 1,765 | ||||||||||||

|

Mortgage and loan interest (including $931 and $1,275 for the three months and

$1,853 and $1,580 for the six months ended 2012 and 2011 respectively from

affiliates and related parties)

|

(16,641 | ) | (15,439 | ) | (34,219 | ) | (29,897 | ) | ||||||||

|

Loss on sale of investments

|

- | - | (362 | ) | - | |||||||||||

|

Earnings from unconsolidated subsidiaries and investees

|

33 | 22 | 150 | (73 | ) | |||||||||||

|

Total other expenses

|

(9,714 | ) | (13,663 | ) | (22,568 | ) | (26,334 | ) | ||||||||

|

Loss before gain on land sales, non-controlling interest, and taxes

|

(3,400 | ) | (12,320 | ) | (12,744 | ) | (30,204 | ) | ||||||||

|

Gain on land sales

|

4,738 | 14,029 | 3,716 | 19,373 | ||||||||||||

|

Income (loss) from continuing operations before tax

|

1,338 | 1,709 | (9,028 | ) | (10,831 | ) | ||||||||||

|

Income tax benefit

|

1,537 | 1,942 | 2,548 | 2,351 | ||||||||||||

|

Net income (loss) from continuing operations

|

2,875 | 3,651 | (6,480 | ) | (8,480 | ) | ||||||||||

|

Discontinued operations:

|

||||||||||||||||

|

Loss from discontinued operations

|

(277 | ) | (2,130 | ) | (975 | ) | (5,099 | ) | ||||||||

|

Gain on sale of real estate from discontinued operations

|

4,668 | 7,679 | 8,256 | 11,816 | ||||||||||||

|

Income tax expense from discontinued operations

|

(1,537 | ) | (1,942 | ) | (2,548 | ) | (2,351 | ) | ||||||||

|

Net income from discontinued operations

|

2,854 | 3,607 | 4,733 | 4,366 | ||||||||||||

|

Net income (loss)

|

5,729 | 7,258 | (1,747 | ) | (4,114 | ) | ||||||||||

|

Net (income) loss attributable to non-controlling interest

|

(1,064 | ) | 7,175 | 112 | 9,345 | |||||||||||

|

Net income (loss) attributable to American Realty Investors, Inc.

|

4,665 | 14,433 | (1,635 | ) | 5,231 | |||||||||||

|

Preferred dividend requirement

|

(613 | ) | (613 | ) | (1,226 | ) | (1,230 | ) | ||||||||

|

Net income (loss) applicable to common shares

|

$ | 4,052 | $ | 13,820 | $ | (2,861 | ) | $ | 4,001 | |||||||

|

Earnings per share - basic

|

||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 0.10 | $ | 0.89 | $ | (0.66 | ) | $ | (0.03 | ) | ||||||

|

Income from discontinued operations

|

0.25 | 0.31 | 0.41 | 0.38 | ||||||||||||

|

Net income (loss) applicable to common shares

|

$ | 0.35 | $ | 1.20 | $ | (0.25 | ) | $ | 0.35 | |||||||

|

Earnings per share - diluted

|

||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 0.05 | $ | 0.59 | $ | (0.66 | ) | $ | (0.03 | ) | ||||||

|

Income from discontinued operations

|

0.11 | 0.21 | 0.41 | 0.38 | ||||||||||||

|

Net income (loss) applicable to common shares

|

$ | 0.16 | $ | 0.80 | $ | (0.25 | ) | $ | 0.35 | |||||||

|

Weighted average common share used in computing earnings per share

|

11,525,389 | 11,525,389 | 11,525,389 | 11,509,341 | ||||||||||||

|

Weighted average common share used in computing diluted earnings per share

|

25,679,951 | 17,394,553 | 11,525,389 | 11,509,341 | ||||||||||||

|

Amounts attributable to American Realty Investors, Inc.

|

||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 1,811 | $ | 10,826 | $ | (6,368 | ) | $ | 865 | |||||||

|

Income from discontinued operations

|

2,854 | 3,607 | 4,733 | 4,366 | ||||||||||||

|

Net income (loss)

|

$ | 4,665 | $ | 14,433 | $ | (1,635 | ) | $ | 5,231 | |||||||

|

AMERICAN REALTY INVESTORS, INC.

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

(unaudited)

|

||||||||

|

June 30,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

(dollars in thousands, except share and

par value amounts)

|

||||||||

|

Assets

|

||||||||

|

Real estate, at cost

|

$ | 1,066,094 | $ | 1,120,122 | ||||

|

Real estate held for sale at cost, net of depreciation ($3,290 for 2012 and $1,752 for 2011)

|

2,329 | 15,015 | ||||||

|

Real estate subject to sales contracts at cost, net of depreciation ($15,042 and $9,790 in 2012 and 2011)

|

48,515 | 49,982 | ||||||

|

Less accumulated depreciation

|

(154,499 | ) | (158,489 | ) | ||||

|

Total real estate

|

962,439 | 1,026,630 | ||||||

|

Notes and interest receivable

|

||||||||

|

Performing (including $114,613 and $104,969 in 2012 and 2011 from affiliates and related parties)

|

118,710 | 110,136 | ||||||

|

Non-performing (including $0 and $0 in 2012 and 2011 from affiliates and related parties)

|

5,908 | 4,787 | ||||||

|

Less allowance for estimated losses (including $18,962 and $8,962 in 2012 and 2011 from affiliates and related parties)

|

(23,383 | ) | (13,383 | ) | ||||

|

Total notes and interest receivable

|

101,235 | 101,540 | ||||||

|

Cash and cash equivalents

|

18,090 | 20,312 | ||||||

|

Investments in unconsolidated subsidiaries and investees

|

7,437 | 10,746 | ||||||

|

Other assets (including $21 in 2012 and $11 in 2011 from affiliates and related parties)

|

71,044 | 76,243 | ||||||

|

Total assets

|

$ | 1,160,245 | $ | 1,235,471 | ||||

|

Liabilities and Shareholders’ Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Notes and interest payable

|

$ | 800,162 | $ | 855,619 | ||||

|

Notes related to assets held for sale

|

3,868 | 13,830 | ||||||

|

Notes related to subject to sales contracts

|

55,503 | 44,516 | ||||||

|

Stock-secured notes payable and margin debt

|

26,133 | 26,898 | ||||||

|

Affiliate payables

|

13,816 | 10,294 | ||||||

|

Deferred gain (including $75,727 and $71,964 in 2012 and 2011 from sales to related parties)

|

77,572 | 78,750 | ||||||

|

Accounts payable and other liabilities (including $1,925 and $1,822 in 2012 and 2011 to affiliates and related parties)

|

91,921 | 110,307 | ||||||

| 1,068,975 | 1,140,214 | |||||||

|

Shareholders’ equity:

|

||||||||

|

Preferred stock, Series A: $2.00 par value, authorized 15,000,000 shares, issued and outstanding 3,353,954 shares in

2012 and 2011 (liquidation preference $10 per share), including 900,000 shares in 2012 and 2011 held by subsidiaries

|

4,908 | 4,908 | ||||||

|

Common stock, $.01 par value, authorized 100,000,000 shares; issued 11,941,174 shares and outstanding 11,525,389

shares in 2012 and 2011

|

115 | 115 | ||||||

|

Treasury stock at cost; 415,785 shares in 2012 and 2011 and 229,214 and 236,587 shares held by TCI as of 2012 and 2011.

|

(6,395 | ) | (6,395 | ) | ||||

|

Paid-in capital

|

107,092 | 105,388 | ||||||

|

Retained earnings

|

(49,121 | ) | (47,486 | ) | ||||

|

Accumulated other comprehensive income

|

(786 | ) | (786 | ) | ||||

|

Total American Realty Investors, Inc. shareholders' equity

|

55,813 | 55,744 | ||||||

|

Non-controlling interest

|

35,457 | 39,513 | ||||||

|

Total equity

|

91,270 | 95,257 | ||||||

|

Total liabilities and equity

|

$ | 1,160,245 | $ | 1,235,471 | ||||