Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Thompson Creek Metals Co Inc. | a12-18264_28k.htm |

Exhibit 99.1

|

|

Second Quarter 2012 Financial Results Investor Call August 14, 2012 |

|

|

Cautionary Statements This document contains ‘‘forward-looking statements’’ within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Act of 1934, as amended and applicable Canadian securities legislation, which are intended to be covered by the safe harbor created by those sections and other applicable laws. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Our forward-looking statements include statements with respect to: the future financial or operating performance of the Company or its subsidiaries and its projects; future inventory, production, sales, cash costs, capital expenditures and exploration expenditures; future earnings and operating results; expected concentrate and recovery grades; statements as to the projected development of Mt. Milligan and other projects, including expected production commencement dates; Mt. Milligan development costs; future operating plans and goals; and future molybdenum prices. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking statements can be found in the section entitled ‘‘Risk Factors’’ in Thompson Creek’s Annual Report on Form 10-K for the year ended December 31, 2011, Quarterly Report on Form 10-Q for the three months ended March 31, 2012, and other documents filed on EDGAR at www.sec.gov and on SEDAR at www.sedar.com. Although we have attempted to identify those factors that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors that cause results or events to differ from those anticipated, estimated or intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, the reader is cautioned not to place undue reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, and investors should not assume that any lack of update to a previously issued forward-looking statement constitutes a reaffirmation of that statement. |

|

|

Company All Incidence Recordable Rate (AIRR) 1 2007 – 2012 YTD (June) Includes lost time and reportable incidents. 3 |

|

|

Second Quarter and YTD 2012 Financials 1 Excludes $1.9 million non-cash gain related to warrants. Refer to slide 16 for GAAP reconciliation. 2 Excludes $1.8 million non-cash gain related to warrants. Refer to slide 16 for GAAP reconciliation. 3 See Form 10-Q for the quarter ended June 30, 2012 for additional information. Refer to slide 17 for GAAP reconciliation. 4 Includes capital leases.US$ millions except as noted Quarter 2012 2012 Revenue $113.5 $227.1 Operating (Loss) Income $(18.4) $(34.9) Net (Loss) Income $(14.8) $(13.7) Non-GAAP Adjusted Net (Loss) Income $(16.7)1 $(15.5)2 Operating Cash (Used) $(20.4) $(17.3) Net (Loss) Income per share Diluted $(0.09) $(0.08) Non-GAAP Adjusted Net (Loss) Income per share Diluted $(0.10)1 $(0.09)2 Molybdenum Production 4.1 M lbs 8.5 M lbs Production Cash Costs3 $ 14.57/lb $ 13.73/lb Average Realized Price $ 14.55/lb $ 14.64/lb Cash+ S-T Investments(06/30/12) $409.5 Total debt (06/30/12)4 $611.1 |

|

|

1 Molybdenum oxide production costs (US$/lb Mo) include all stripping costs and excludes Endako start-up and commissioning costs. Guidance numbers for Endako assume an exchange rate of US$1 = C$1 for Endako costs. Molybdenum Production & Cash Costs Molybdenum Production (M lbs) 2011 Actual 2012 Guidance 2013 Guidance 2012 2012 2012 2nd Half Actual Actual Guidance Thompson Creek Mine EndakoMine (75% share) Total Production 21.3 7.0 28.3 16.0-17.0 6.5-7.5 22.5-24.5 19.0-22.0 9.0-10.5 28.0-32.5 2.5 1.6 4.1 6.0 2.5 8.5 10.0-11.0 4.0-5.0 14.0-16.0 Cash Costs ($/lb) 2011 Actual 2012 Guidance 2013 Guidance 2012 2012 Actual Actual 2nd Half Guidance Total Cash Cost $7.94 $9.25-$10.25 $7.25-$8.50 $14.57 $13.73 $6.75-$8.00 Components: Thompson Creek Mine $6.66 $7.50-$8.50 $6.00-$7.00 $13.46 $11.67 $6.00-$7.00 EndakoMine $11.86 $12.00-$13.75 $9.25-$10.75 $16.37 $18.51 $8.50-$10.75 |

|

|

1 Cash capital expenditures guidance numbers are as of August 9, 2012. 2 Includes YTD 2012 actual cash expenditures. For Endako, represents our share. 3 Excludes capitalized interest and debt issuance costs. Costs are in C$ and assume a CAD/USD exchange rate of C$1.00 = US$1.00. 4 Includes amounts for equipment purchased under capital leases, as well as first-fills, spare parts and commissioning parts. Cash Capital Expenditures1 in millions 2012 estimate2 2013 estimate 9 N/A 74 492 305 757 393 1,253 2012 YTD Inception thru 06/30/12 Operations - US$ 35-40 15-20 Endako Expansion - C$2,3 78 - Mt. Milligam - C$2,3 750-825 190-245 Total 863-943 205-265 6 |

|

|

Pro-Forma Cash Capital Expenditures Funding As of June 30, 2012 - in millions of US Dollars 1 Cash capital expenditures guidance numbers are as of August 9, 2012. Assumes CAD/USD exchange rate of 1.00. 2 Includes for Mt. Milligan approximately $30 million for first fills, spare parts, & commissioning parts, and a contingency of $59 million. Assumes an independent third party lease arrangement for the permanent camp at Mt. Milligan. Net revolver availability defined as availability under Revolving Credit Facility less minimum liquidity. Minimum liquidity is currently $836 Cash on hand Estimated equipment financing Royal Gold proceeds New Royal Gold proceeds High estimate CapEx remaining Q312 thru Q413 Net revolver availability Net other Cash Flows Q312 thru Q413total capital funding in placedefined as (i) the amount of cash on hand and (ii) availability under the Revolving Credit Facility and (iii) expected payment from Royal Gold that will be received in the quarter following the measurement date. Availability under the revolver is subject to meeting minimum EBITDA covenant and other conditions under the Fifth Amendment to the Credit Facility. Represents estimated cash flow from operations using a molybdenum oxide price of $12/lb, net of debt service, reclamation and other cash uses. Capital cash uses Capital funding sources Other net funding sources $822 3 4 1,2 $410 $99 $127 $200 $176 3 $22 4 7 |

|

|

Mt. Milligan A Great Asset with Robust Economics Reserve calculation utilized conservative metals pricing of $1.60/lb Cu and $690/oz Au Current resource is open at depth and possibly extends laterally Multiple exploration drill targets within company’s land position Mt. Milligan geophysical and geochemical signature repeated on several targets within the holdings Revenue potential equal to existing operations 1 Estimated cash costs recently updated and include operating costs, refining/smelting costs, and transportation. Assumes average annual production of 89 million lbs of copper in concentrate (85.4 million lbs of payable copper) and 262,000 oz of gold in concentrate (256,760 oz of payable gold) for years 1-6 of full production. Exchange rate is assumed at parity (C$1.00 = US$ 1.00). 2 Bloomberg pricing as of 08/13/12: Cu - $3.44/lb; Au - 47.75% @ $1,620oz and 52.25% @ $435/oz (per Amended and Restated Gold Stream Agreement with Royal Gold). 2 Significant annual cash flow potential in millions of US dollars1 Upside Potential Cash Costs Cash Revenue - Current pricing $245+/-10% $550 8 |

|

|

~80% of project capex spent or contractually committed High end of Mt. Milligan capital guidance in millions of Canadian dollars A Clear Path to Project Completion As of June 30, 2012 9 ~$1.5B Cash spent to 6/30/2012 757 Purchase commitments 347 Committed lump-sum contracts116 Non-fixed cost remaining 239 Contingency 59 Total project capex |

|

|

Mt. Milligan Project Development Update Milestones achieved through July 31, 2012 Water dam (part of Tailings Storage Facility “TSF”) completed and 9.8 M cubic meters of water stored TSF construction on track for completion by second quarter 2013 Construction camp capacity at 1070 beds All concrete foundations for primary crusher and concentrator plant complete All concrete work within concentrator building complete Roof on building – two sides completely enclosed Assembly of SAG and ball mills underway Mechanical equipment and piping installation underway Electrical installation underway On-site power substation energized in July 2012 Power to mine shovel energized in July 2012 Mining commenced in second quarter 2012 in support of TSF construction Four 793 haul trucks and one 994 loader in operation One 7495 shovel in commissioning for operation at end of August Shovel being constructed |

|

|

Mt. Milligan Project Development Update EPCM progress (thru July 31, 2012) Mt. Milligan remains on schedule: Start up expected Q3 13 Commercial production expected Q4 13 |

|

|

Mt. Milligan Development Update Concentrator Building June 2012 Assembly of SAG Mill April 2012 Assembly of SAG Mill August 2012 Concentrator Building March 2012 |

|

|

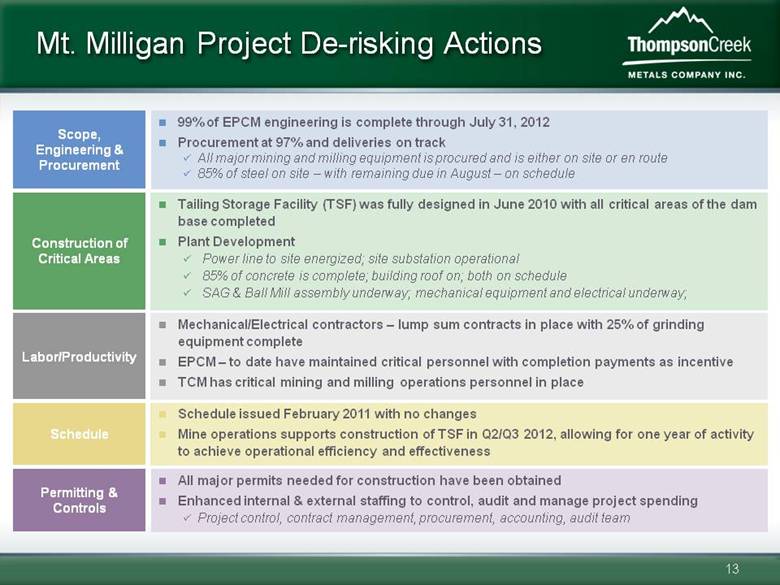

Mt. Milligan Project De-risking Actions All major permits needed for construction have been obtained Enhanced internal & external staffing to control, audit and manage project spending Project control, contract management, procurement, accounting, audit team 99% of EPCM engineering is complete through July 31, 2012 Procurement at 97% and deliveries on track All major mining and milling equipment is procured and is either on site or en route 85% of steel on site – with remaining due in August – on schedule Scope, Engineering & Procurement Construction of Critical Areas Tailing Storage Facility (TSF) was fully designed in June 2010 with all critical areas of the dam base completed Plant Development Power line to site energized; site substation operational 85% of concrete is complete; building roof on; both on schedule SAG & Ball Mill assembly underway; mechanical equipment and electrical underway; Permitting & Controls Schedule Schedule issued February 2011 with no changes Mine operations supports construction of TSF in Q2/Q3 2012, allowing for one year of activity to achieve operational efficiency and effectiveness Labor/Productivity Mechanical/Electrical contractors – lump sum contracts in place with 25% of grinding equipment complete EPCM – to date have maintained critical personnel with completion payments as incentive TCM has critical mining and milling operations personnel in place |

|

|

Mt. Milligan Future Milestones 2012 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Process building grinding area enclosed (3 sides) Mechanical mill installation begins 230kV permanent power energized and available onsite Delivery and assembly of major mining equipment Mining equipment fleet ready Mine development for TSF construction Pre-stripping initiated Concentrator building fully enclosed (except SAG access) Pebble crushing building – foundation complete Truck shop complete SAG wrap around motor mechanically complete Reclaim water ready for pre-commissioning Primary crusher ready for testing SAG Mill, west & east ball mills ready for pre-commissioning Process plant mechanical/pre-commissioning complete Commissioning started First feed Commencement of commercial production Indicates completed. |

|

|

Appendix |

|

|

16 Appendix Non-GAAP Reconciliation Non-GAAP Financial Measures Non-GAAP financial measures are intended to provide additional information only and do not have any standard meaning prescribed by Generally Accepted Accounting Principles (“GAAP”). These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. Reconciliation of Adjusted Net Income to GAAP Net Income Adjusted net income (loss), and adjusted net income (loss) per share are considered key measures by our management in evaluating our operating performance. Management uses these measures in evaluating our performance as it represents a profitability measure that is not impacted by changes in the market price of our warrants. These measures do not have standard meanings prescribed by US GAAP and may not be comparable to similar measures presented by other companies. Management believes these measures provide useful supplemental information to investors in order for them to evaluate our financial performance using the same measures as management. As of June 30, 2012 there were no remaining warrants outstanding. Weighted Average Basic Shares Weighted Average Diluted Shares Net (Loss) Income Shares (000’s) $/share Shares (000’s) $/share Net (loss) income $ (14.8) 168,168 $ (0.09) 168,168 $ (0.09) Add (Deduct): Unrealized (gain) loss on common on stock purchase warrants (1.9) 168,168 (0.01) 168,168 (0.01) Non-GAAP adjusted net (loss) income $ (16.7) 168,168 $ (0.10) 168,168 $ (0.10) For the Three Months Ended June 30, 2012 (unaudited — US$ in millions except shares and per share amounts) Weighted Average Basic Shares Weighted Average Diluted Shares Net (Loss) Income Shares (000’s) $/share Shares (000’s) $/share Net (loss) income $ (13.7) 168,111 $ (0.08) 168,111 $ (0.08) Add (Deduct): Unrealized (gain) loss on common stock purchase warrants (1.8) 168,111 (0.01) 168,111 (0.01) Non-GAAP adjusted net (loss) income $ (15.5) 168,111 $ (0.09) 168,111 $ (0.09) For the Six Months Ended June 30, 2012 (unaudited — US$ in millions except shares and per share amounts) |

|

|

17 Appendix Non-GAAP Reconciliation (Continued) Reconciliation of Cash Cost per Pound Produced, Weighted Average Cash Cost per Pound Produced, and Average Realized Sales Price per Pound Sold Cash cost per pound produced, weighted average cash cost per pound produced and average realized sales price per pound sold are considered key measures in evaluating our operating performance. Cash cost per pound produced, weighted average cash cost per pound produced and average realized sales price per pound sold are not measures of financial performance, nor do they have a standardized meaning prescribed by US GAAP and may not be comparable to similar measures presented by other companies. We use these measures to evaluate the operating performance at each of our mines, as well as on a consolidated basis, as a measure of profitability and efficiency. We believe that these non-GAAP measures provide useful supplemental information to investors in order that they may evaluate our performance using the same measures as management and, as a result, the investor is afforded greater transparency in assessing our financial performance. US$ in millions, except per pound amounts - unaudited 1 Mined production pounds are molybdenum oxide and HPM from our share of the production from the mines; excludes molybdenum processed from purchased product. 2 Cash costs represent the mining (including all stripping costs), milling, mine site administration, roasting and packaging costs for molybdenum oxide and HPM produced in the period. Cash cost excludes: the effect of purchase price adjustments, the effects of changes in inventory, corporate allocation stock-based compensation, other non-cash employee benefits, depreciation, depletion, amortization and accretion, and commissioning and start-up costs for the Endako mill. The cash cost for the Thompson Creek mine, which only produces molybdenum sulfide and HPM on site, includes an estimated molybdenum loss (sulfide to oxide), an allocation of roasting and packaging costs from the Langeloth facility, and transportation costs from the Thompson Creek mine to the Langeloth facility. 3 Other operations represent activities related to the roasting and processing of third-party concentrate and other metals at the Langeloth facility and exclude product volumes and costs related to the roasting and processing of Thompson Creek mine and Endako mine concentrate. The Langeloth facility costs associated with roasting and processing of Thompson Creek mine and Endako mine concentrate are included in their respective operating results above. Three months ended June 30, 2012 Six months ended June 30, 2012 Operating Expenses (in millions) Pounds Produced (1) (000’s lbs) $/lb Operating Expenses (in millions) Pounds Produced(1) (000’s lbs) $/lb Thompson Creek Mine Cash costs — Non-GAAP (2) $ 34.2 2,544 $ 13.46 $ 69.6 5,966 $ 11.67 Add/(Deduct): Stock-based compensation - 0.1 Inventory and other adjustments 6.1 6.1 GAAP operating expenses $ 40.3 $ 75.8 Endako Mine Cash costs — Non-GAAP (2) $ 25.8 1,575 $ 16.37 $ 47.7 2,577 $ 18.51 Add/(Deduct): Stock-based compensation 0.1 0.3 Commissioning and start-up costs 2.9 5.2 Inventory and other adjustments (4.3) 2.8 GAAP operating expenses $ 24.5 $ 56.0 Other operations GAAP operating expenses (3) $ 43.0 $ 78.4 GAAP consolidated operating expenses $ 107.8 $ 210.2 Weighted-average cash cost — Non-GAAP $ 60.0 4,119 $ 14.57 $ 117.3 8,543 $ 13.73 |

|

|

Credit Facility Fifth Amendment Overview Thompson Creek completed a fifth amendment to its credit facility to allow for the following changes: Covenant changes and other enhancements - Waiver of senior secured leverage test - Increased the minimum liquidity maintenance covenant level from $75 million to $100 million, extended through maturity (regardless of the completion of Mt. Milligan) - Added quarterly minimum EBITDA covenant of $0 million for the quarter ending 12/31/12; added quarterly minimum EBITDA levels for the quarters ending 3/31/13 through 12/31/13 Added lender liquidity protections for borrowings and prepayments (i.e. Revolving Credit cannot be drawn unless unrestricted cash falls below $50 million and borrowings must be paid down when unrestricted cash balance is above $75 million until unrestricted cash is equal or less than $75 million) Added Mt. Milligan/Endako ongoing technical progress report requirements and added a requirement for an independent engineering review selected by the banks at both properties Incorporated reps as a condition precedent to funding (including prospective capital requirements and funding which are expected to be available) Added delivery of a 3-month rolling forecast prepared monthly and a weekly historical report showing actual sources and uses of funds |

|

|

Thompson Creek Metals Company NYSE:TC TSX:TCM www.thompsoncreekmetals.com Pamela Solly Director, Investor Relations Phone: (303) 762-3526 Email: psolly@tcrk.com |