Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d396787d8k.htm |

PSEG Public Service Enterprise Group Goldman

Sachs Power & Utility Conference New York, NY

August 14, 2012

EXHIBIT 99 |

2

Forward-Looking Statement

• adverse changes in the demand for or price of the capacity and energy that we

sell into wholesale electricity markets, • adverse changes in energy

industry law, policies and regulation, including market structures and a potential shift away from competitive markets toward subsidized market mechanisms,

transmission planning and cost allocation rules, including rules regarding how

transmission is planned and who is permitted to build transmission in the future, and reliability standards,

• any inability of our transmission and distribution businesses to obtain

adequate and timely rate relief and regulatory approvals from federal and state regulators,

• changes in federal and state environmental regulations that could increase our

costs or limit our operations, • changes in nuclear regulation and/or

general developments in the nuclear power industry, including various impacts from any accidents or incidents experienced at our facilities

or by others in the industry, that could limit operations of our nuclear generating

units, • actions or activities at one of our nuclear units located on a

multi-unit site that might adversely affect our ability to continue to operate that unit or other units located at the same site,

• any inability to balance our energy obligations, available supply and trading

risks, • any deterioration in our credit quality, or the credit quality of

our counterparties, including in our leveraged leases, •

availability of capital and credit at commercially reasonable terms and conditions and our ability to meet cash needs,

• changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units, • delays

in receipt of necessary permits and approvals for our construction and development activities,

• delays or unforeseen cost escalations in our construction and development

activities, • any inability to achieve or continue to sustain, our

expected levels of operating performance, • increase in competition in

energy supply markets as well as competition for certain rate-based transmission projects,

• any inability to realize anticipated tax benefits or retain tax credits,

• challenges associated with recruitment and/or retention of a qualified

workforce, • adverse performance of our decommissioning and defined

benefit plan trust fund investments and changes in discount rates and funding requirements, and

• changes in technology and customer usage patterns.

Readers are cautioned that statements contained in this presentation about our future

performance, including future revenues, earnings, strategies, prospects, consequences and all other statements that

are not purely historical, are forward-looking statements for purposes of the safe

harbor provisions under The Private Securities Litigation Reform Act of 1995. When used herein, the words “anticipate”,

“intend”, “estimate”, “believe”, “expect”,

“plan”, “should”, “hypothetical”, “potential”, “forecast”, “project”, variations of such words and similar expressions are intended to identify forward-looking statements.

Although we believe that our expectations are based on reasonable assumptions, they

are subject to risks and uncertainties and we can give no assurance they will be achieved. The results or

developments projected or predicted in these statements may differ materially from

what may actually occur. Factors which could cause results or events to differ from current expectations include, but are

not limited to:

For further information, please refer to our Annual Report on Form 10-K, including

Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange

Commission. These documents address in further detail our business, industry

issues and other factors that could cause actual results to differ materially from those indicated in this presentation. In

addition, any forward-looking statements included herein represent our

estimates only as of today and should not be relied upon as representing our estimates as of any subsequent date. While we may

elect to update forward-looking statements from time to time, we specifically

disclaim any obligation to do so, even if our internal estimates change, unless otherwise required by applicable securities laws.

|

3

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance

with

generally

accepted

accounting

principles

in

the

United

States (GAAP). Operating Earnings is a non-GAAP financial measure that

differs from Net Income because it excludes gains or losses associated with

Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM)

accounting, and other material one-time items. PSEG presents

Operating Earnings because management believes that it is appropriate for

investors to

consider results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders understand

performance trends. This information is not

intended to be viewed as an

alternative to GAAP information. The last page in this presentation (Page A)

includes a list of items excluded from Income from Continuing Operations to

reconcile to Operating Earnings, with a reference to that slide included on

each of the slides where the non-GAAP information appears.

|

PSEG – The Business of

PSEG Caroline Dorsa

Executive Vice President and Chief Financial Officer |

5

Growing an operationally excellent, integrated

generation, transmission and distribution business

PSE&G positioned

to meet NJ’s

energy policy and

economic growth

objectives

with a $5.4 billion

investment program

through 2014

PSEG Power’s

low-cost, base load

and load following fleet

is geographically well

positioned and

environmentally

responsible

PSEG Energy Holdings

positioned to pursue

attractive renewable

generation

opportunities

Assets $17.5B

Operating Earnings

$521M

Assets $11.1B

Operating Earnings

$845M

Assets $1B

Operating Earnings

$5M

Assets and operating earnings are for the year ended 12/31/2011.

* See page A for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. Electric & Gas Delivery

and Transmission

Regional Wholesale Energy

Renewable Investments |

6

2012 –

A year of significant accomplishment

•

NJBPU approved North

Central Grid

transmission line

•

Proposing up to $883

million solar energy

investment through

Solar 4 All and Solar

Loan programs

•

Improved to 2

place

(from

10

)

on

the

2012

J.D. Power Electric

Utility Residential

Customer Satisfaction

Study-East Region

•

Improved availability

of gas-fired CCGT

fleet and strong

nuclear performance

•

O&M under control

•

400 MW of new

peaking generation

for summer 2012

•

Continued de-risking

of legacy portfolio

•

Denver building sold

•

IRS settlement on

LILO/SILO tax

matters

•

IRS audit resolution

•

25 MW Solar project

in Arizona

th

nd |

7

Focused program to improve operating efficiency and

direct capital investment to PSE&G reduced the impact

of lower energy prices on operating earnings

•

O&M Growth per year

•

Transmission Rate Base

•

Utility Cap Stimulus Spending

•

Utility Solar & EE Cap Exp

•

EFORd Rate

CCGT

Coal

•

Nuclear Generation

•

Holdings Solar Investment

•

2.4% (planned)

•

$866

•

$0

•

$0

•

1.6%

•

8.4%

•

29.3TWh

•

$0

•

0.4% (actual)

•

$1,600

•

$760

•

$687

•

1.1%

•

6.6%

•

30.1TWh

•

$120

2008

PSEG Focus

($ millions, except as noted)

2011

$2.91

$2.74

Operating Earnings Per Share

$69.85

$43.57

PJM West RTC ($/MWh)

*See page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings; All periods reflect Texas in Discontinued Operations. |

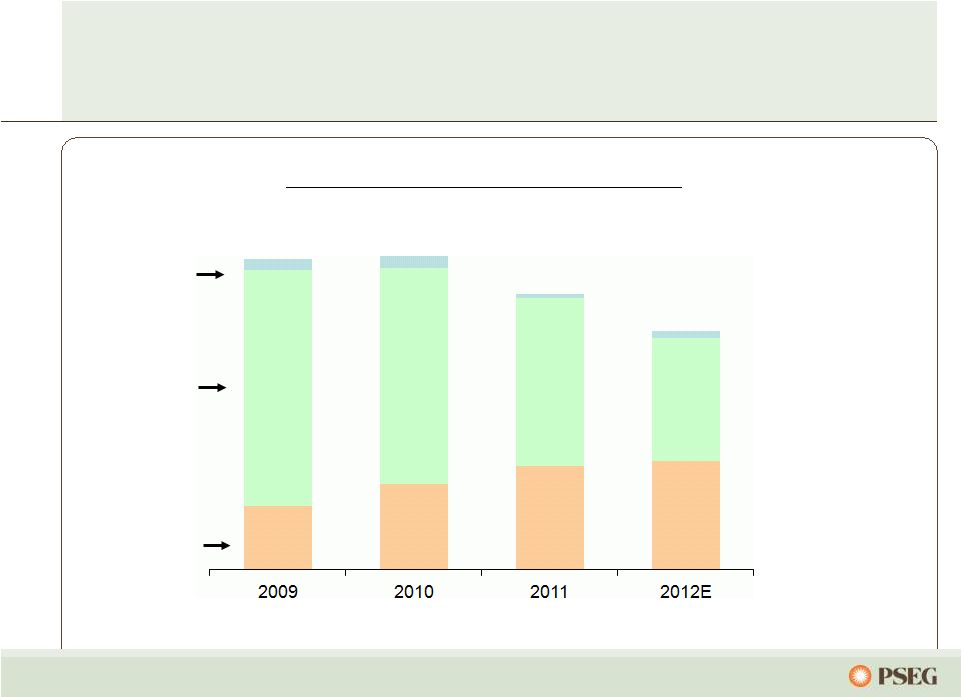

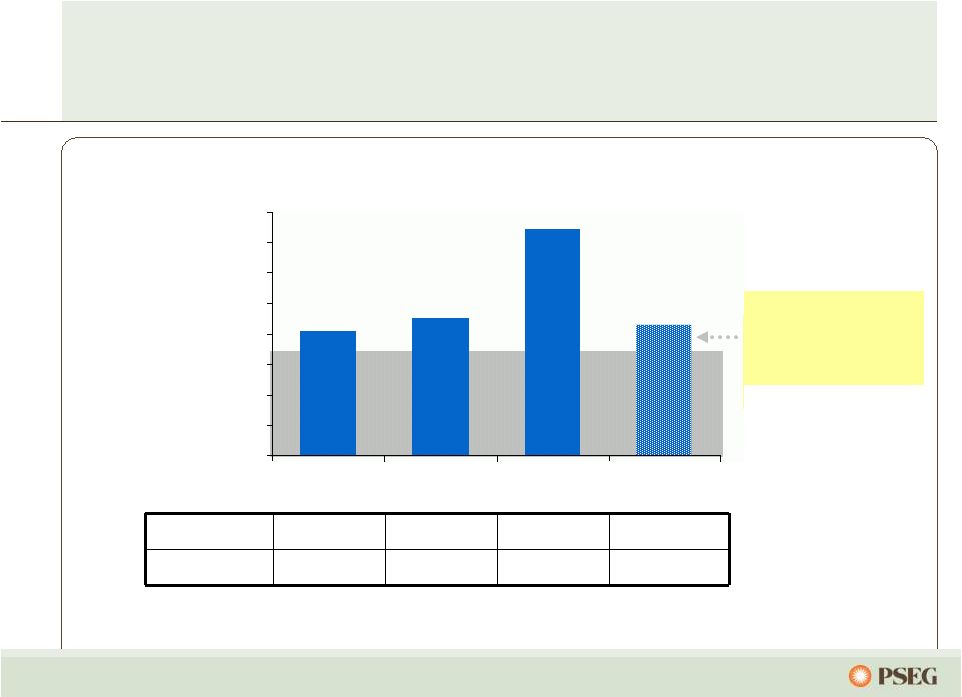

8

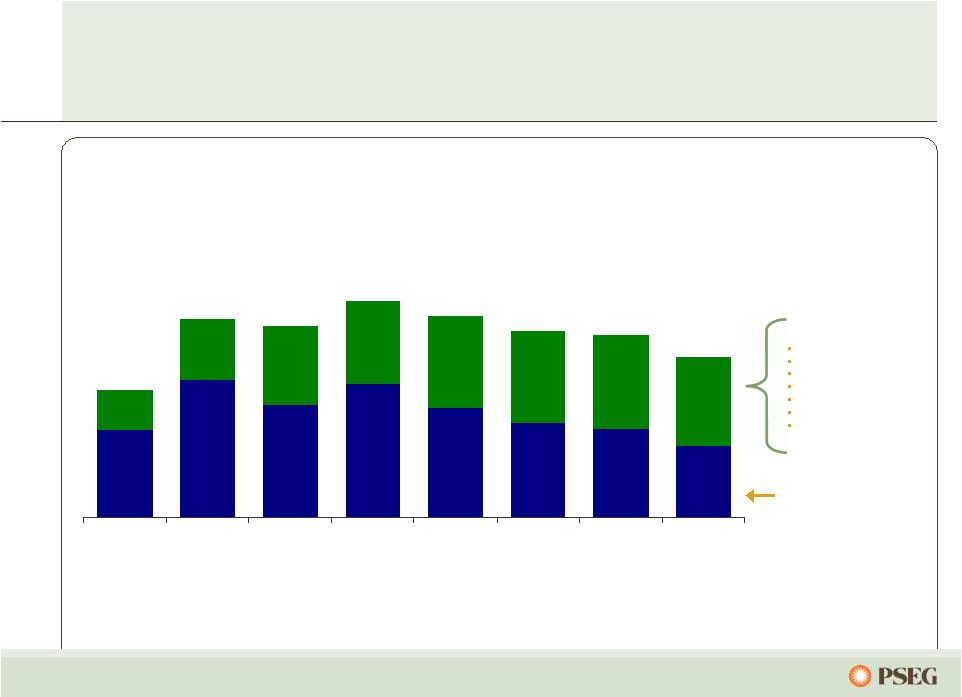

Our business mix has changed with PSE&G

forecast to grow to 45% of 2012 operating earnings

Operating Earnings by Subsidiary*

*See page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings; All periods reflect Texas in Discontinued

Operations. E = Estimate. $3.09

$3.12

$2.74

PSE&G

Power

Other

Guidance

$2.25-$2.50

$1.13

to

$1.31

$1.05

to

$1.10

$0.07 to $0.09

$0.04

$1.67

$1.03

$2.15

$0.12

$0.85

$0.11

$2.35

$0.63 |

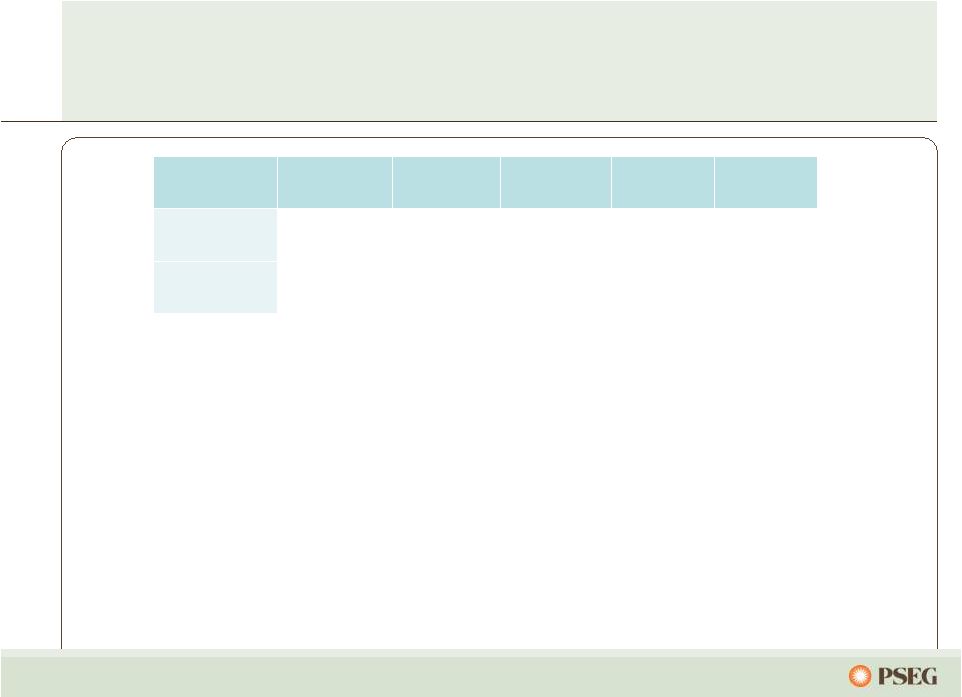

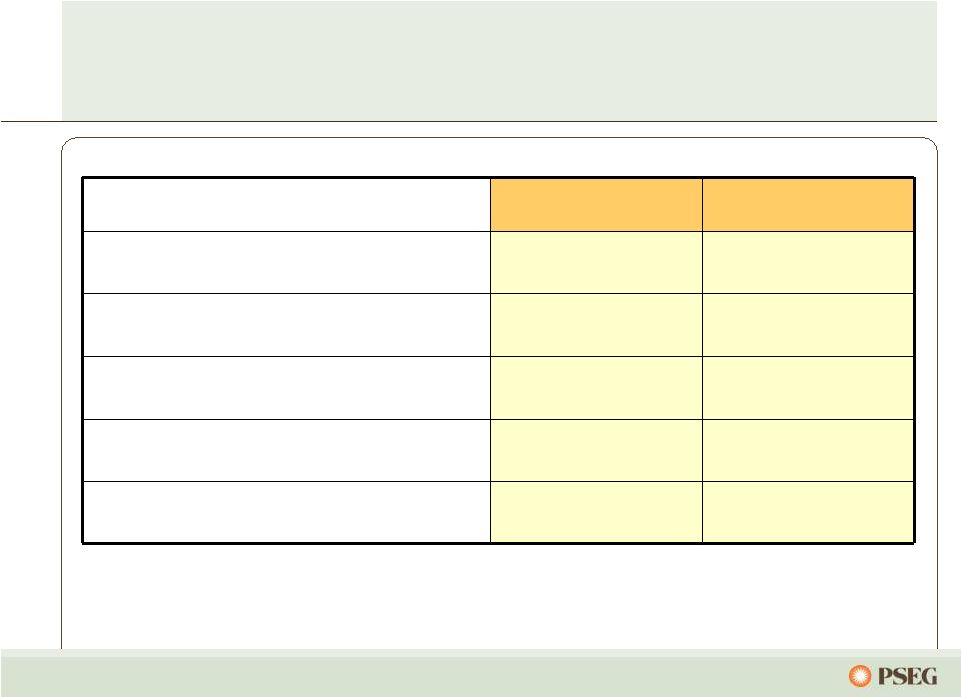

9

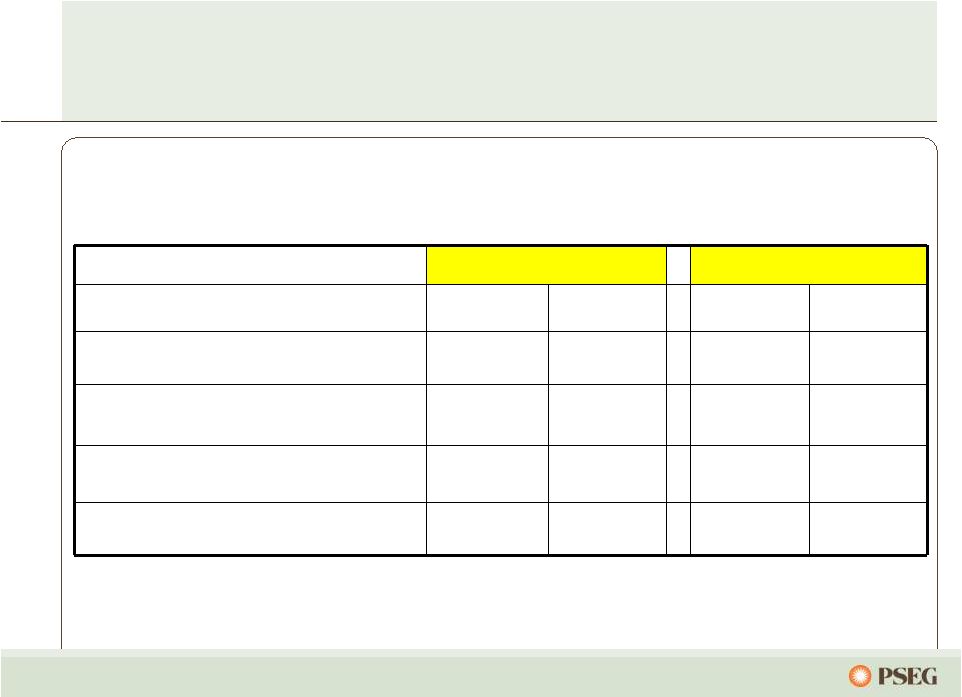

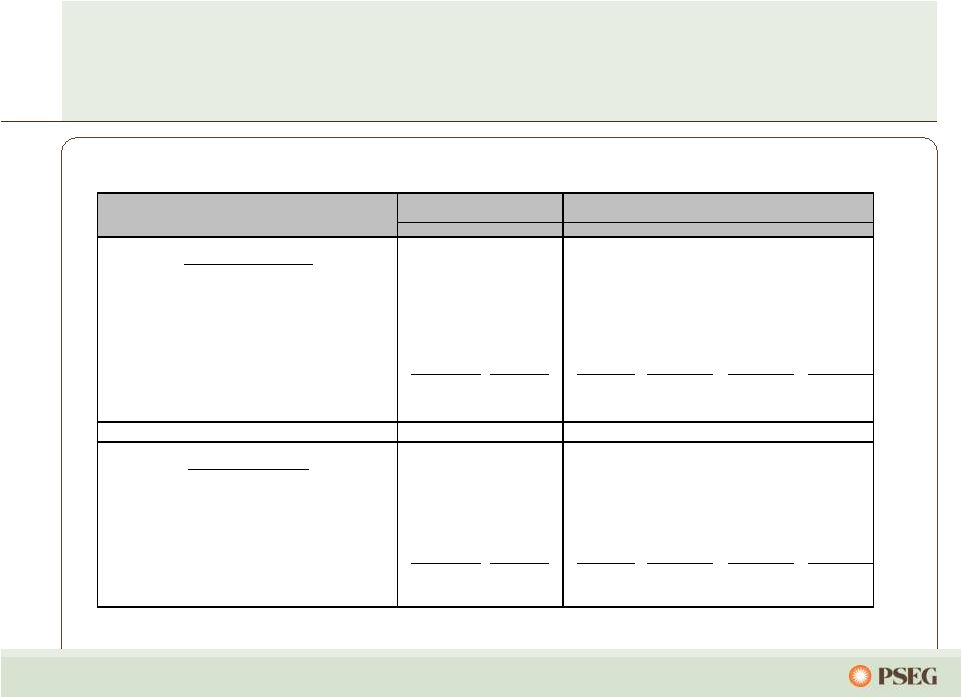

First-Half 2012 Operating Earnings by Subsidiary

–

In Line with Expectations

Operating Earnings

Earnings per Share

$ millions (except EPS)

2011

2012

2011

2012

PSEG Power

$ 452

$ 306

$ 0.89

$ 0.60

PSE&G

268

298

0.53

0.59

PSEG Energy Holdings/Enterprise

12

43

0.02

0.09

Operating Earnings*

$ 732

$ 647

$ 1.44

$ 1.28

Six Months ended June 30

* See Page A for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

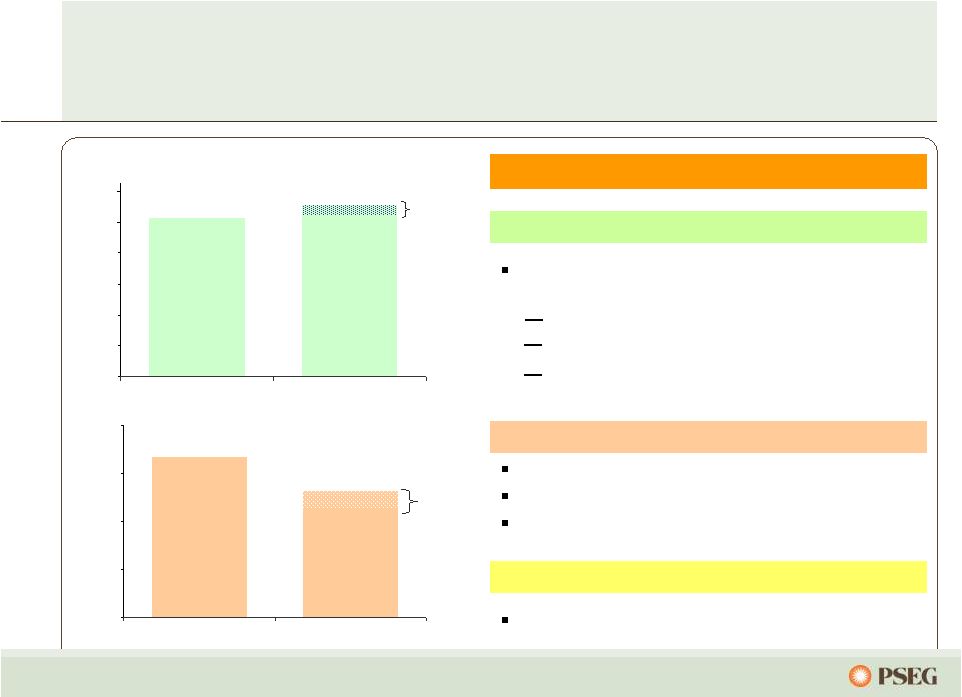

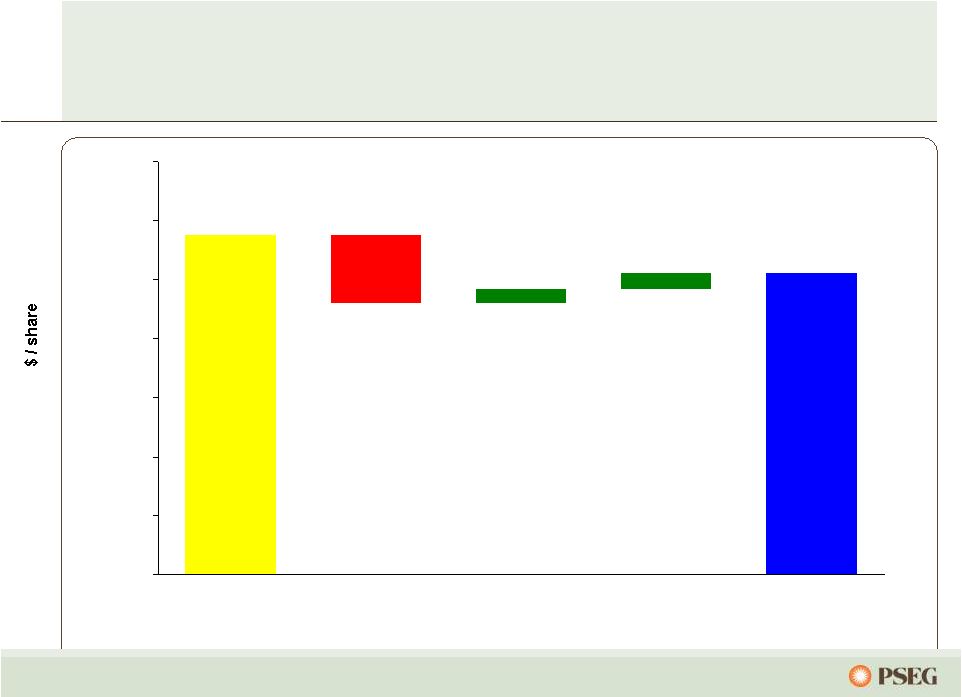

10

Guidance

$1.31

$1.13

PSEG’s 2012 earnings guidance of $2.25 to $2.50

reflects continued improvement at PSE&G and a

decline in margins at Power

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

2011 Operating Earnings*

2012E Earnings Guidance*

PSE&G Earnings Per Share

2012 Assumptions

PSE&G

Growth in investments that provide

contemporaneous returns

Transmission

Distribution economic stimulus programs

Programs supporting NJ’s Energy Master

Plan

Power

Impacted by lower energy prices

Near term effects minimized by hedges in place

~400MW new Peaking capacity in-service mid

2012

Energy Holdings / Parent

Operating earnings guidance of $0.07 to $0.09

$0.00

$0.50

$1.00

$1.50

$2.00

2011 Operating Earnings*

2012E Earnings Guidance*

Power Earnings Per Share

Guidance

$1.10

$1.05

*See page A for Items excluded from Income from Continuing Operations to reconcile to Operating

Earnings; 2011 reflects Texas in Discontinued Operations. E = Estimate

|

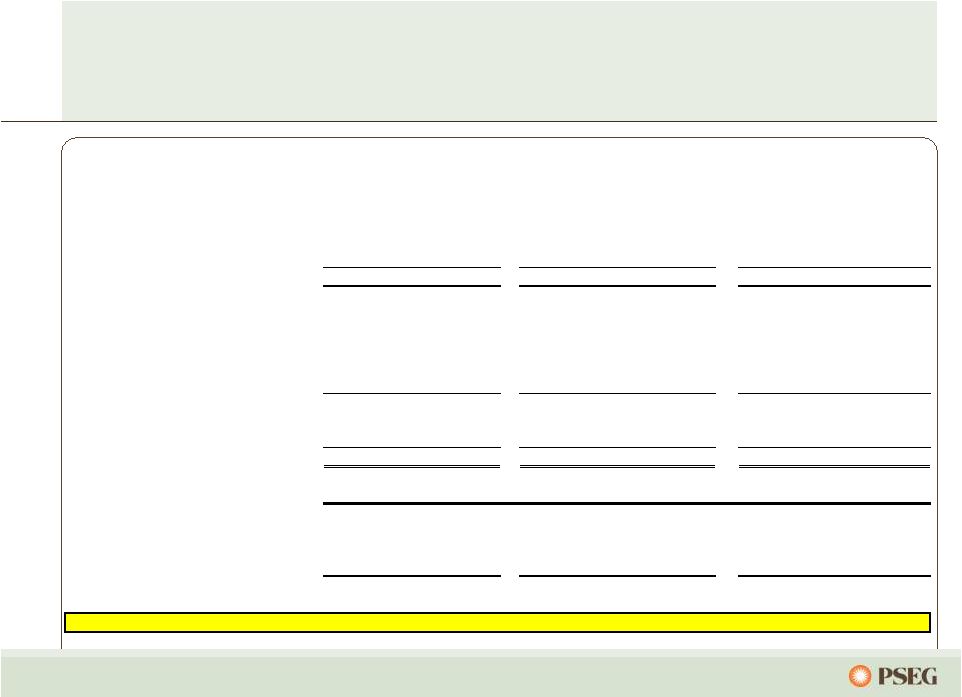

11

PSEG’s long-term outlook is influenced by Power’s

hedge position and increased investment at

PSE&G

2013

2014

Each $1/mcf Change in Natural Gas

Each $2/Mwh Change in Spark Spread

Each $2/Mwh Change in Dark Spread

Each 1% Change in Nuclear Capacity Factor

Each 3% Change in Depreciation Rate

Segment EPS Drivers

$0.01

$0.01

$0.01

$0.01

$0.01

$0.01

$0.01

$0.01

$0.01

$0.01

$0.12

-

$0.15

$0.04

$0.01

$0.01

$0.01

$0.01

-

$0.04

$0.04

$0.01

$0.01

$0.01

Note:

EPS

impacts

assume

normal

market

commodity

correlation

and

demand.

Each $100 Million of Incremental Investment

Each 1% Change in Sales:

Electric

Gas

Each 1% Change in O&M

Each 10 bp Change in ROE |

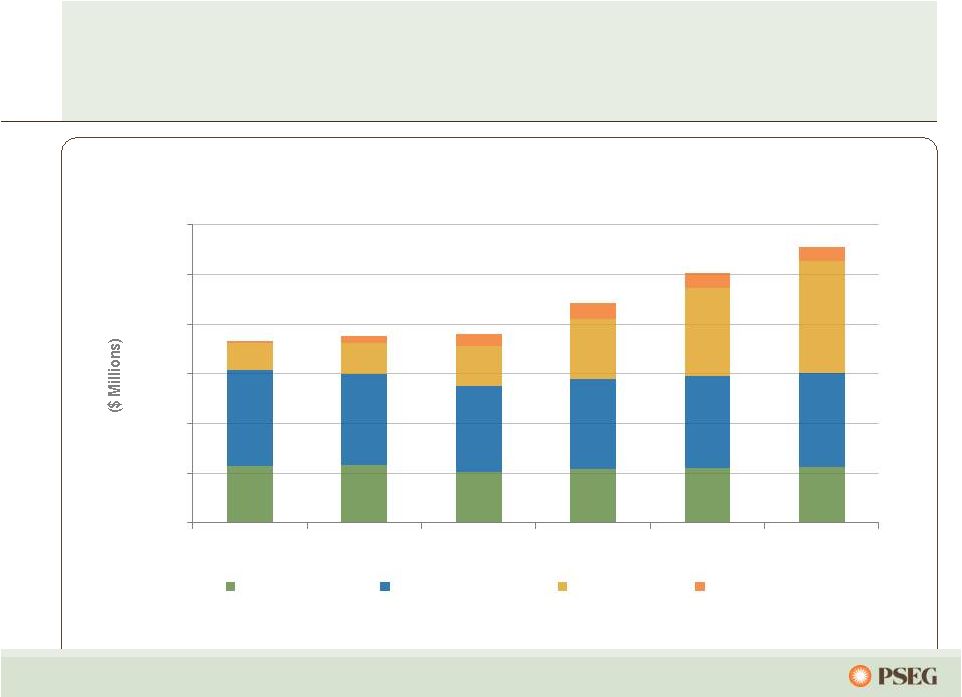

12

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

2011

2012E

2013E

2014E

O&M

Pension

PSEG Consolidated O&M

(1)

CAGR (’11-’14) = 2.9%

(1)

Excludes O&M related to PSE&G clauses. E = Estimate.

Focus on business drivers supports overall cost

control

2012 –

2014:

Cyclical maintenance

expenses at Power

Growth in transmission &

appliance service

Headcount relatively flat

Total fringe costs declining |

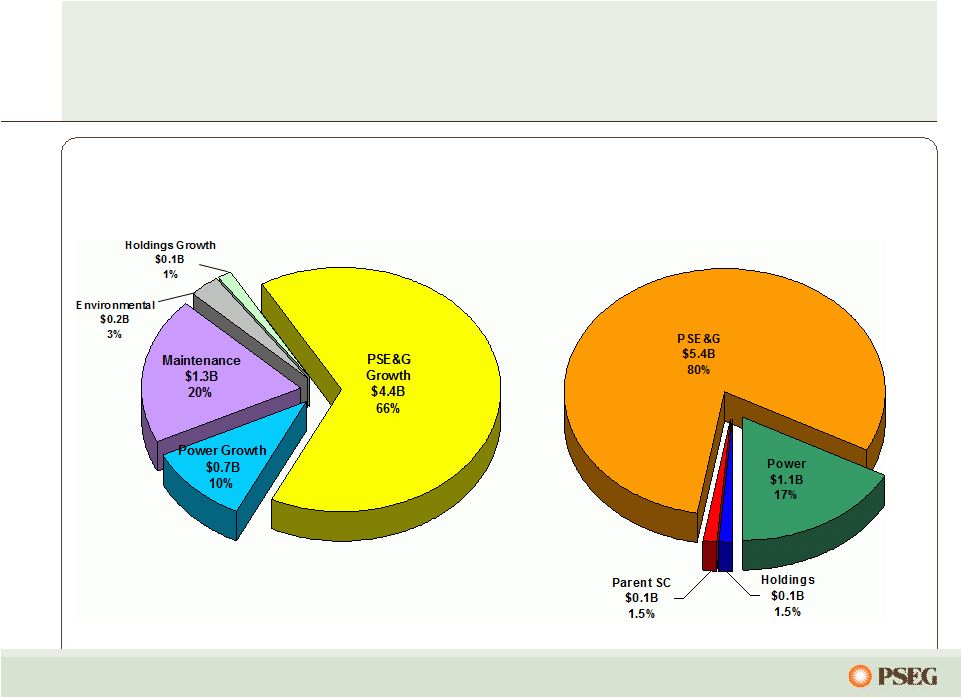

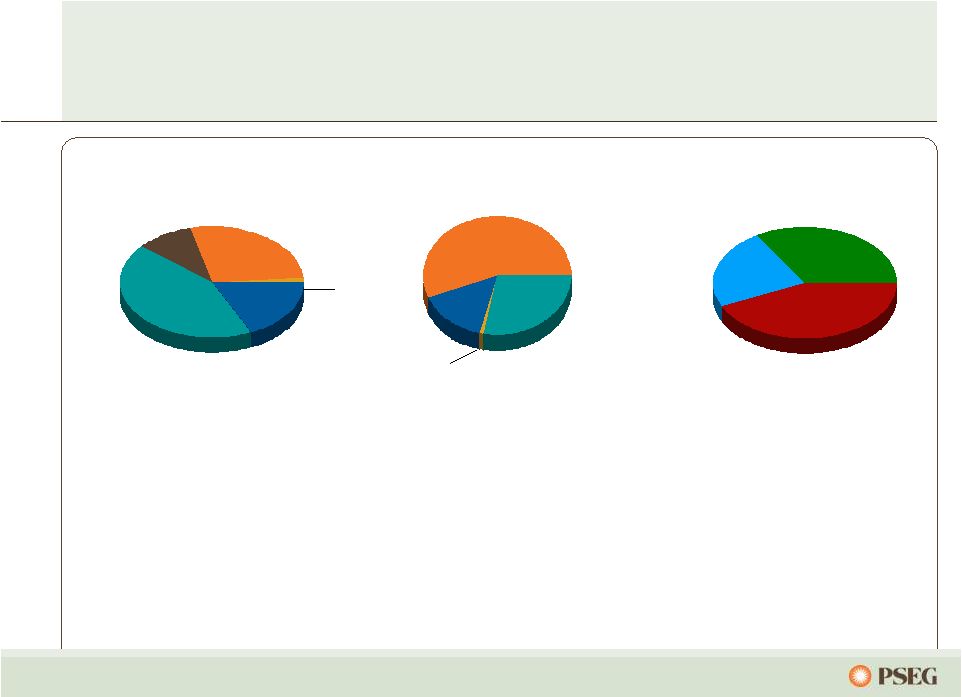

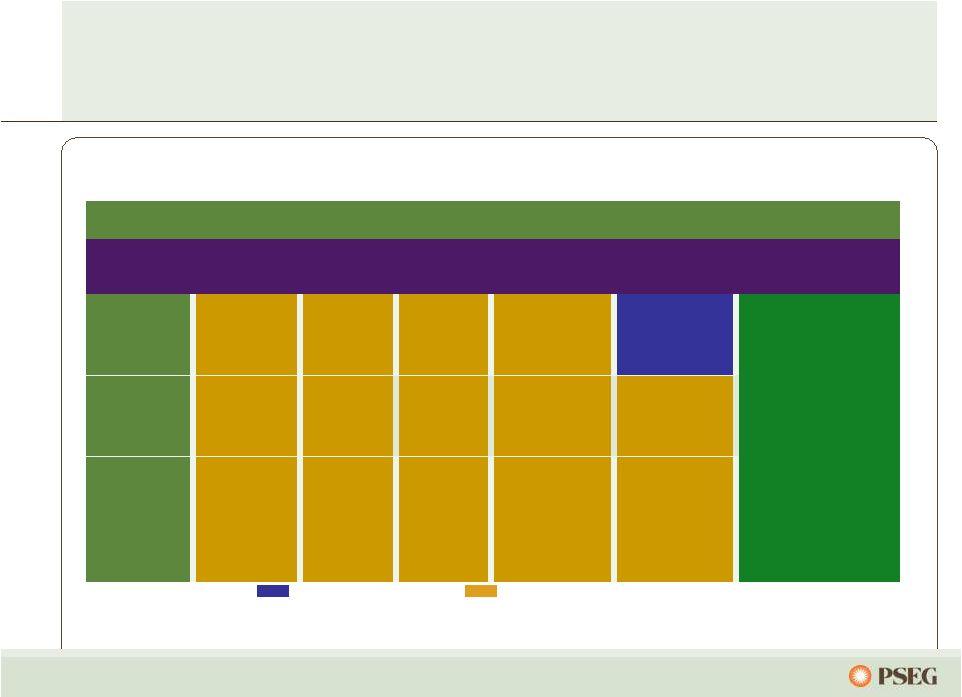

13

Investments focused on growth to meet

customer requirements

PSEG 2012-2014E Capital Spending*

$6.7 Billion

by Subsidiary

PSEG 2012-2014E Capital Spending*

$6.7 Billion

Growth / Environmental / Maintenance

E = Estimate; Capital excludes IDC and AFUDC. *This forecast does not reflect

the impact of new proposals recently filed with the NJBPU. |

14

30%

35%

40%

45%

50%

55%

2012E

2013E

2014E

30%

35%

40%

45%

50%

55%

2012E

2013E

2014E

PSEG Power

Funds from Operations / Total Debt

PSEG

Debt as Percent of Capital

•

Credit metrics remain above our floor levels, notwithstanding near-term

power market expectations

•

Investment Capacity exceeds $700 million in all years even with large capital

expenditures at PSE&G

•

PSEG maintains its capital structure throughout the forecast period

A

solid

financial

strategy

–

balance

sheet

strength

to direct investments to the areas of greatest

growth and value potential |

15

PSEG’s strong credit profile provides the financial flexibility

for over $1B of additional capital investment in the

regulated business

2012-2014E PSEG Sources & Uses

Sources

Uses

Power Cash

from Ops

PSE&G Cash

from Ops

(1)

Debt

Redeemed

PSE&G Capital

Investment

Power Capital

Investment

Shareholder

Dividend

Debt

Issuances

Holdings

& Other

Net Cash

Flow

Cash

(1)

PSE&G Cash from Operations adjusts for securitization principal repayments of

~$680 Million in 2012-2014. E=Estimate. B=Billion. |

16

PSEG is working with the state to advance energy policy,

build infrastructure, and develop jobs …

helping to make

Governor Christie’s vision a reality

Photo:

PSEG

Hackensack,

NJ

Solar

Farm

Groundbreaking

–

July

31,

2012 |

17

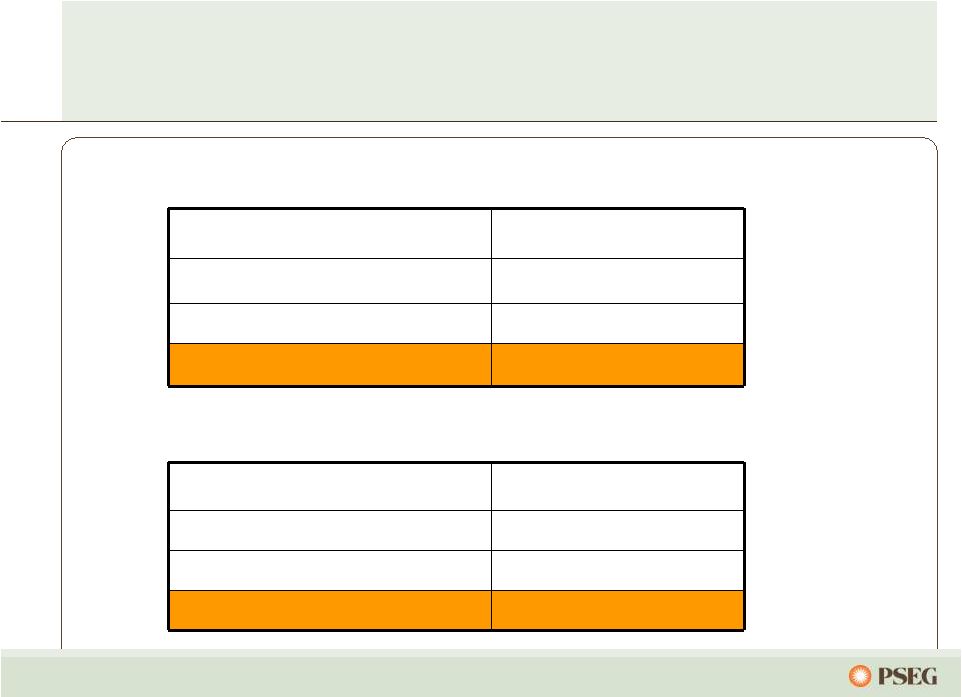

In addition to new reliability based transmission projects and future

dividend growth, PSEG has the potential to increase its investment in

PSE&G through several multi-year programs under review

Potential Investment ($ millions)

Per Year Potential

Gas Infrastructure

$250-$300

Energy Efficiency

$35-$40

Total Potential Investment (Per Year)

$285-$340 Million

PSE&G

filed

proposals

with

the

BPU

to

increase

its

investment

in

solar

by

up

to

$883 million through existing programs over a multi-year period of time

… Program Investment

($ millions)

Solar 4 All Extension (over 5 years)

Up to $690

Solar Loan (over 3 years)

Up to $193

Total Potential Investment

Up to $883 Million

and is evaluating the potential for increased investment in energy efficiency

and gas infrastructure … |

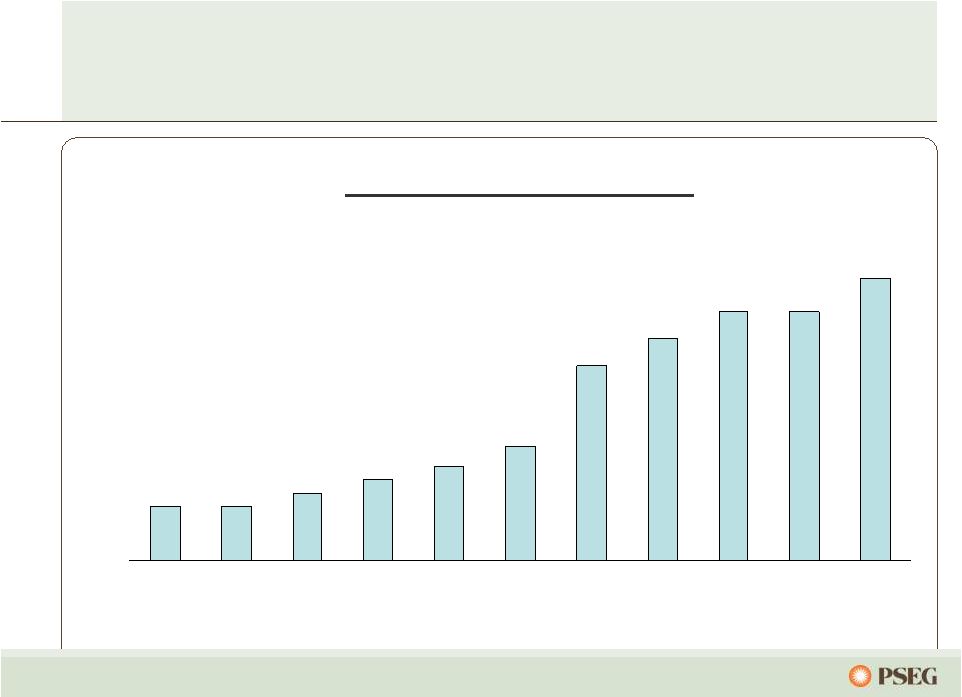

18

18

18

The

business

of

PSEG:

Returning

cash

to

investors

through common dividends and preserving flexibility to

invest for future growth

PSEG Annual Dividend Rate

$1.08

$1.08

$1.10

$1.12

$1.14

$1.17

$1.29

$1.33

$1.37

$1.37

$1.42

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Payout

Ratio

111%

62%

70%

63%

66%

43%

44%

43%

44%

50%

60%*

5-year Rate of Growth 3.95%

10-year Rate of Growth 2.78%

*Based on mid-point of 2012 operating earnings guidance.

|

19

PSEG Value Proposition

Operating

Excellence

Regulatory/

Market

Drivers

Financial

Strength

Disciplined

Investment

•

•

•

–

Environmental compliance costs and low natural gas prices to force

retirements of 11 to 25 GW of existing generation in PJM

–

Infrastructure upgrades/reliability requirements driving regulated

investment •

•

•

•

power and 13% CAGR in regulated rate base

in position to benefit from higher market prices for

PSEG

Clean, low cost Nuclear, CCGT, and Coal generating fleet

Large, reliable electric and gas distribution operations

Energy markets in midst of transformational change

finance growth opportunities

Meaningful 2012 dividend increase and revised dividend

policy

Management long-term incentive leveraged to

shareholder value creation

Strong balance sheet provides flexibility and liquidity to

|

The

Business

of

PSE&G

Ralph LaRossa

President and Chief Operating Officer |

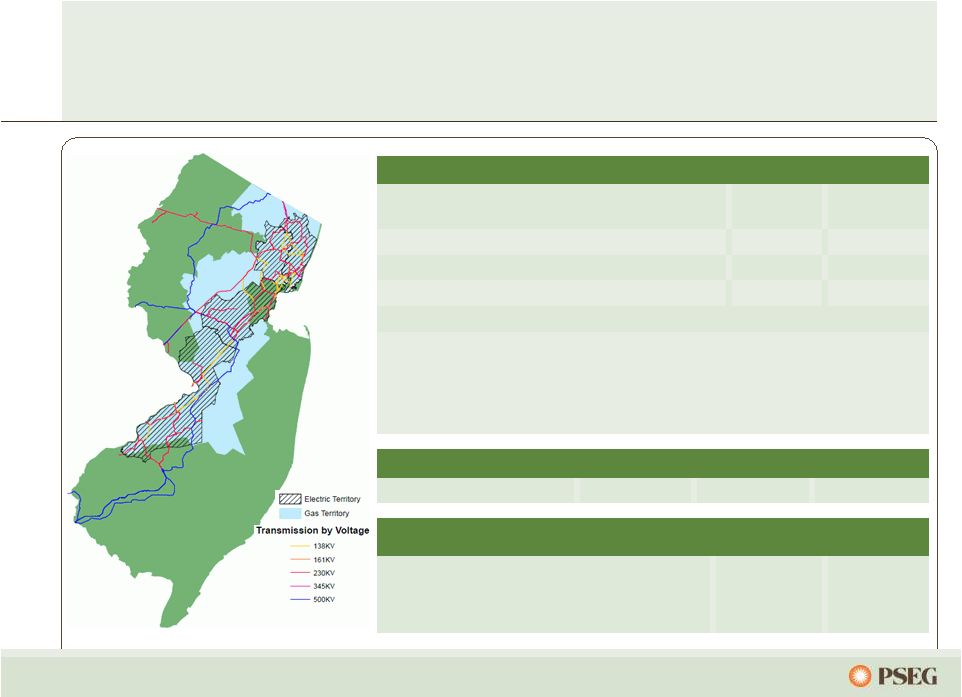

21

PSE&G is the largest electric and gas distribution

and transmission utility company in New Jersey

providing renewable and energy efficiency solutions

* Weather

normalized

-

estimated

annual

growth

per

year

over

forecast

period.

** Specific projects approved for incentive rate treatment with additional

ROE. *** Energy

Efficiency

Annualized

Savings

(includes

conversion

of

gas

savings).

Electric

Gas

Customers

Growth

(2007 –

2011)

2.2 Million

0.7%

1.8 Million

0.7%

Electric Sales and Gas Sold and Transported

42,506 GWh

3,527 M Therms

Projected

Annual

Load

Growth

(2012

–

2014)

0.8%*

0.1%*

Historical

Annual

Peak

Load

Growth

Transmission

(2007

–

2011)

1.7%

Projected

Annual

Load

Growth

Transmission

(2012

–

2014)

1.4%

Sales Mix

Residential

33%

60%

Commercial

57%

36%

Industrial

10%

4%

Transmission

Electric

Gas

Approved Rate of Return

11.68% ROE**

10.3% ROE

10.3% ROE

Renewables and Energy Efficiency

2009-2011

Total Program

Plan

Solar Loan

38 MW

81 MW

Solar 4 All

59 MW

80 MW

Energy Efficiency Initiative (annualized equivalent)***

282 GWh

402 GWh |

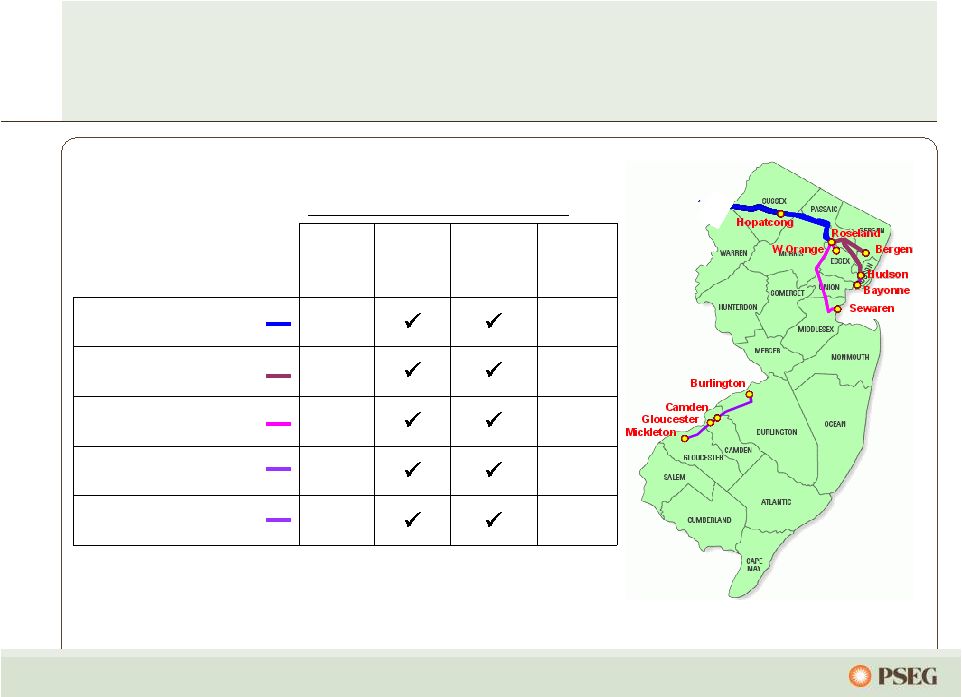

22

Approved

ROE

Inclusion of

CWIP in

Rate Base

100%

Recovery of

Costs Due to

Abandonment

Total

Estimated

Project

Costs

Susquehanna-Roseland

12.93%

$790

Northeast Grid Reliability

11.93%

$895

North Central Reliability

11.68%

$390

Burlington –

Camden 230kV

11.68%

$381

Mickleton –

Gloucester 230kV

11.68%

$435

Major

Transmission

Projects

FERC and PJM support for transmission investment has

created substantial opportunities for PSE&G to improve

reliability while earning contemporaneous returns |

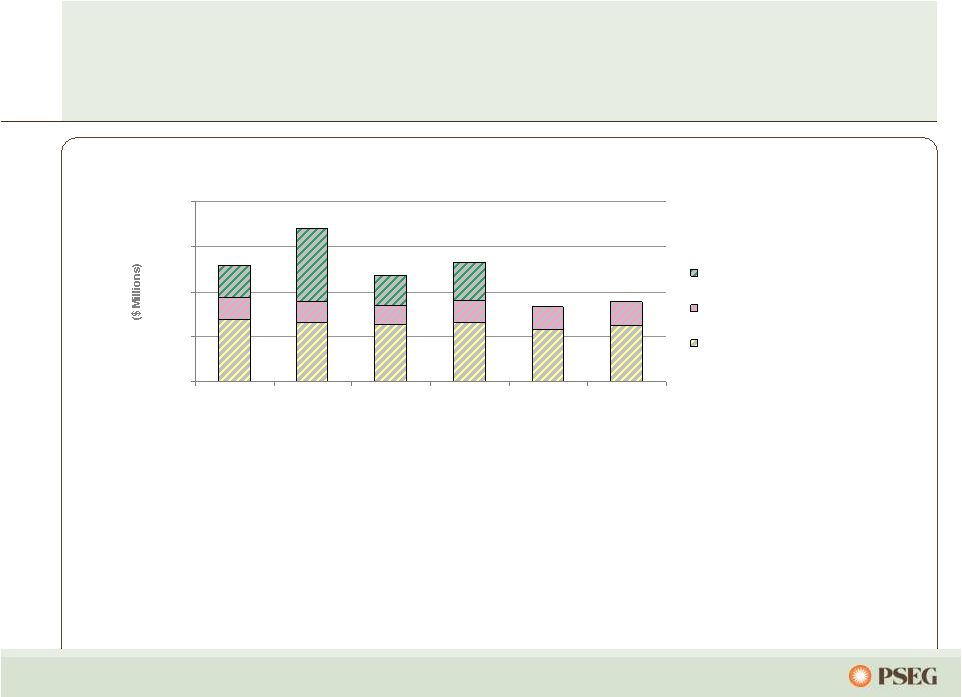

23

PSE&G is replacing aging distribution infrastructure

to improve reliability at a reasonable return

0

250

500

750

1,000

2009

2010

2011

2012E

2013E

2014E

Dist. Capital Infrastructure

Programs

Distribution New Business

Distribution Base

•

Capital Infrastructure Program II was approved in 2011 with spending through

2012

•

Recent incidents in the gas industry have led to enhanced focus on safety of

natural gas pipeline systems

•

Utility storm response in NJ is under review by the Board of Public Utilities

Capital Expenditures |

24

PSE&G is proactively and aggressively

investing in infrastructure

Potential Investment ($ millions)

Per Year Potential

Gas Infrastructure

$250-$300

Energy Efficiency

$35-$40

Total Potential Investment (Per Year)

$285-$340 Million

PSE&G

filed

proposals

with

the

BPU

to

increase

its

investment

in

solar

by

up

to

$883 million through existing programs over a multi-year period of time

… Program Investment

($ millions)

Solar 4 All Extension (over 5 years)

Up to $690

Solar Loan (over 3 years)

Up to $193

Total Potential Investment

Up to $883 Million

and is evaluating the potential for increased investment in energy efficiency

and gas infrastructure … |

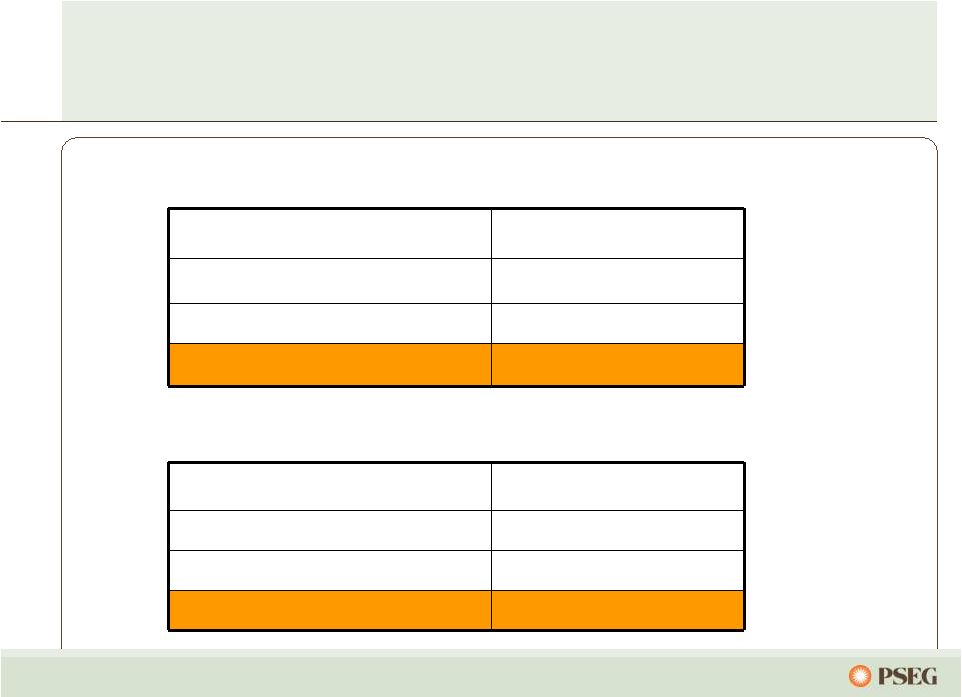

25

as filed –

could grow to $1.5 billion over 5 years …

($ in Millions)

Investment

as of 6/30/12

Approved

Investment

Under

Existing

Programs

New

Proposals*

Total

Solar Loan

I & II

$177

$248

$193

$441

Solar 4 All

$401

$456

$690

$1,146

Total

$578

$704

$883

$1,587

+

=

*On July 31, 2012, PSE&G filed with the NJBPU to invest up to $883 million in

additional solar energy projects over the next three to five years. PSE&G investment in solar

energy – if approved |

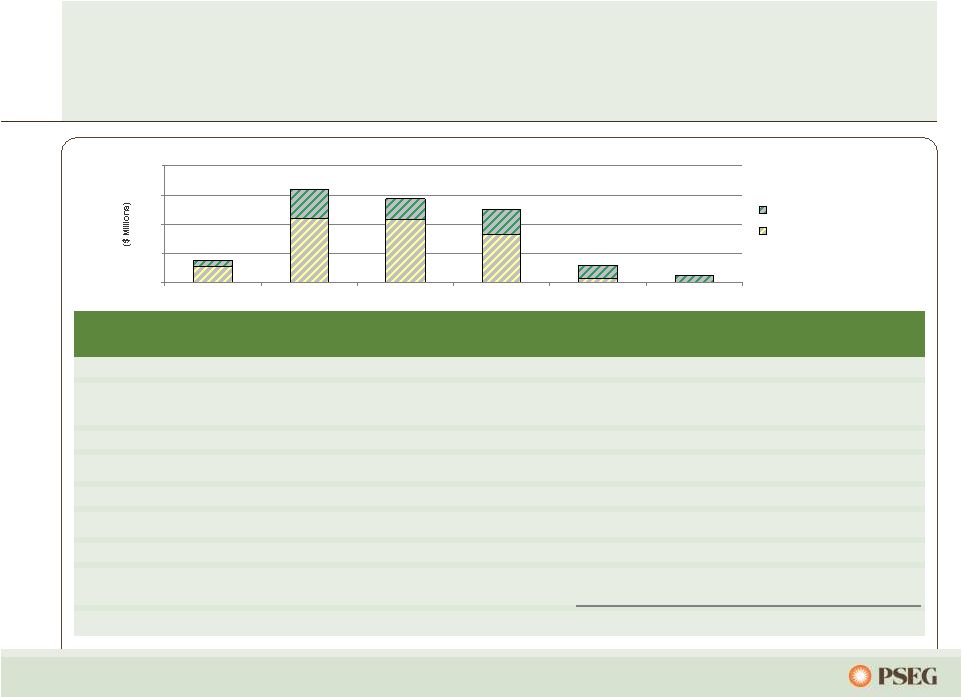

26

Providing solutions to New Jersey’s energy and

economic development goals

0

100

200

300

400

2009

2010

2011

2012E

2013E

2014E

Energy Efficiency

Renewables

($ Millions)

Approval Date

Total

Amount

Spending

Thru 2011

Remaining

Spending

Renewables

Solar Loan I & II

April 2008/

November 2009

$248

$127

$121

Solar 4 All

July 2009

456

361

95

Energy Efficiency

Carbon Abatement

December 2008

46

40

6

Energy Efficiency Economic Stimulus

July 2009

166

144

22

Demand Response

July 2009

45

15

30

Energy Efficiency Economic Stimulus

Extension

July 2011

95

-

95

Total

$1,056

$687

$369

Capital Expenditures*

*This forecast does not reflect the impact of new proposals recently filed with

the NJBPU. |

27

PSE&G’s investment program provides opportunity

for ~13% annualized growth in rate base from

2011*

PSE&G Projected Rate Base

*Starting from 2011 year-end Rate Base of $7.6 billion. This forecast

does not reflect the impact of new proposals recently filed with the NJBPU.

0

2,000

4,000

6,000

8,000

10,000

12,000

2009

2010

2011

2012

2013

2014

Gas Distribution

Electric Distribution

Transmission

Solar/Energy Efficiency |

The

Business

of

PSEG

Power |

29

Asset diversity enables fleet optimization in

response to changing market dynamics

18%

44%

8%

Fuel Diversity

Coal

Gas

Oil

Nuclear

Pumped

Storage

1%

Energy Produced*

Total GWh: 53,980

56%

15%

Pumped Storage

& Oil <1%

Nuclear

Coal

Gas

Total MW: 13,060

28%

9%

* 2011

•

Well suited to serve load shaped

products

•

Market knowledge and experience to

maximize the value of our assets

•

Multiple emission controls installed

Intermediate

Energy Market Served

Total MW: 13,060

28%

23%

34%

43%

Baseload

Peaking

•

Low-cost portfolio

•

Fuel flexibility

•

Regional focus in competitive, liquid markets

•

Assets favorably located near customers/load

centers |

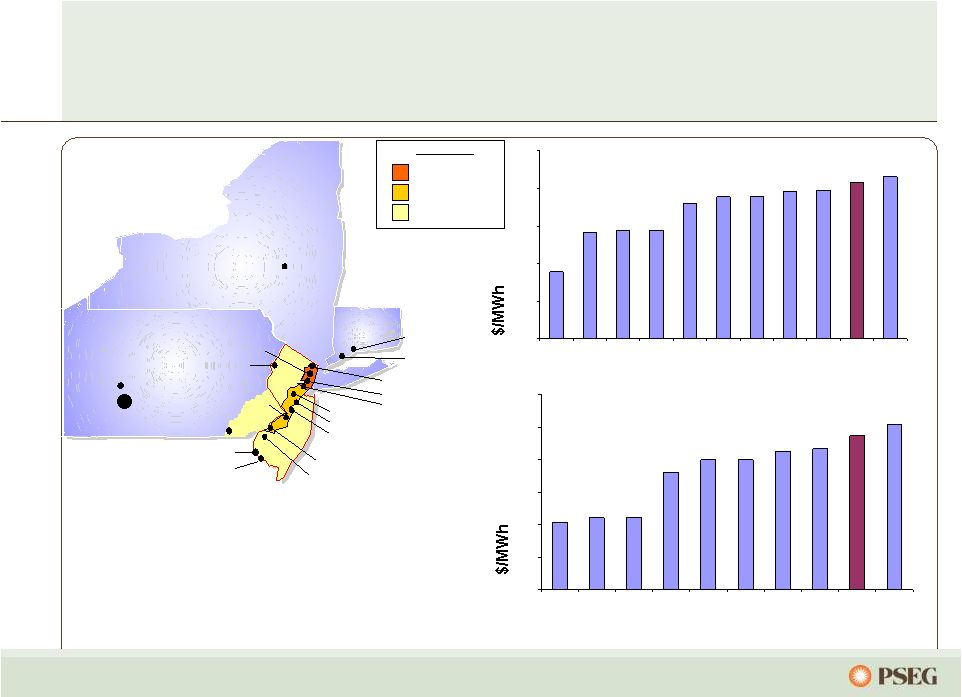

30

$0

$1

$2

$3

$4

$5

$6

PPL

RECO

METED

PECO

JCPL

PEPCO

AECO

DPL

PSEG

BGE

$40

$42

$44

$46

$48

$50

WESTERN

HUB

PPL

RECO

METED

PECO

JCPL

PEPCO

AECO

DPL

PSEG

BGE

A well positioned fleet

Note: Reflects prices of original PJM load zones.

•

PSEG Power 2011 basis ~$5/MWhr RTC

•

While 5 year average has declined, volatile

periods help to maintain pricing

•

Premium pricing also seen in capacity

markets

2011 RTC LMPs

2011 Basis to PJM West RTC

Current plant locations

New Haven

Bridgeport

Bethlehem Energy Center

(Albany)

Conemaugh

Keystone

Peach Bottom

Bergen

Kearny

Essex

Sewaren

Edison

Linden

Mercer

Burlington

National Park

Hudson

Hope Creek

Salem

Yards Creek

PSEG North

PSEG Zone

Eastern MAAC

RPM Zones |

31

Conclusion of major environmental spend places

Power in good position to meet CSAPR and MATS

Current Regulations and Compliance Measures

Description

Hudson

(NJ)

Mercer

(NJ)

Keystone

(PA)

`Bridgeport

(CT)

Conemaugh

(PA)

Status

NO

x

SCR

SCR

SCR

Low No

x

Burners

SCR

2014

Power is well

positioned for

CSAPR & MATS

SO

2

Scrubber

Scrubber

Scrubber

Ultra-low

Sulfur Coal

Scrubber

Mercury/

Particulate

Baghouse &

Activated

Carbon

Baghouse

& Activated

Carbon

Scrubber &

SCR, ESP

Baghouse &

Activated

Carbon

Scrubber &

SCR, ESP

Capital Spend Planned

No Additional Capital Spend Planned |

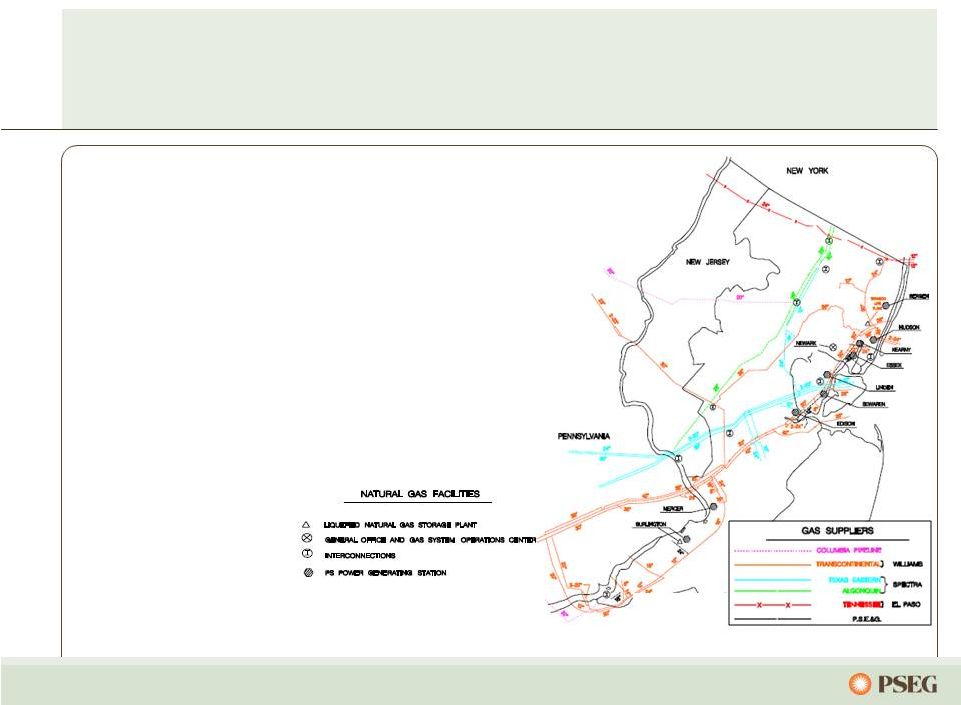

32

An active gas management strategy providing

economic value to customers and our fleet

•

Large portfolio of gas transportation & storage assets

•

Manage gas supply needs of PSE&G and PSEG Power

•

Responsible for over 400 bcf of gas supply in 2011

•

126 bcf consumed by Power’s gas fired assets in 2011;

NJ units used 11% of total PJM gas

•

Well positioned to access Marcellus supplies; nearly

40% of pipeline capacity is adjacent to the region

•

Residential rates decreased eight times since January,

2009; total savings $614, or 35% |

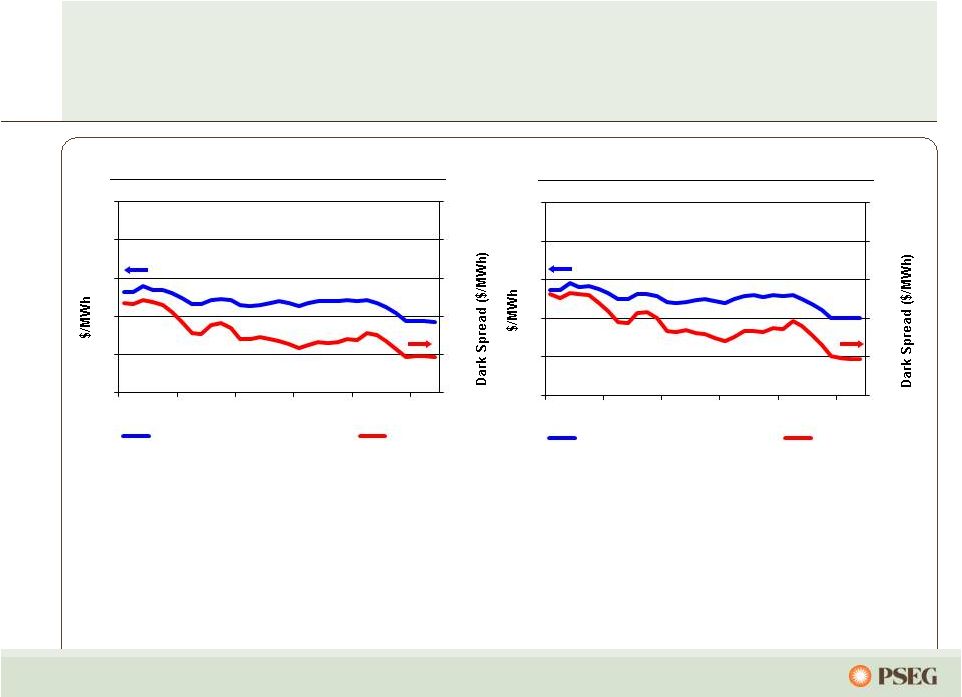

33

33

Actively managing our fleet in a volatile commodity

market, with an asset profile that provides diverse

opportunities for value creation

•

Steep natural gas decline has had a major impact on US power prices and Dark

Spreads •

Coal prices have been supported by long-term contracting and international

demand •

Decline in Dark Spread has led to reduced coal-fired generation in the last 15

months •

Power’s investments in dual-fuel capability at Hudson and Mercer coal

units have made them more attractive than many other coal units in this

environment, and we have switched to gas generation as economics

dictate 2014 Forward Prices & Dark Spread*

2013 Forward Prices & Dark Spread*

* As of April 27, 2012.

-

10

20

30

40

50

0

20

40

60

80

100

Aug-09

Feb-10

Aug-10

Feb-11

Aug-11

Feb-12

Western Hub RTC Forward 2013

Dark Spread

-

10

20

30

40

50

0

20

40

60

80

100

Aug-09

Feb-10

Aug-10

Feb-11

Aug-11

Feb-12

Western Hub RTC Forward 2014

Dark Spread |

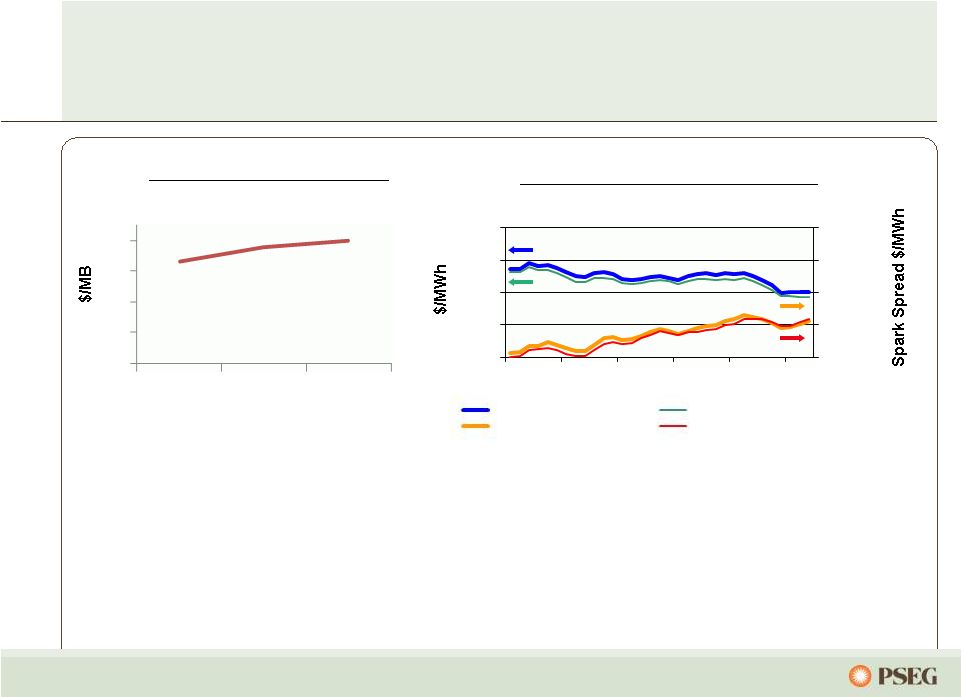

34

34

•

Low power prices are not a good environment for any merchant generator, although

Power is more of a hybrid with long-term contracting through BGS sales

as well as forward hedging •

Forward markets signal continued strength in Spark Spreads and Heat Rates

•

Strong spark spreads in the Northeast have benefitted our gas-fired

fleet •

Power is well positioned with hedged nuclear output and efficient combined cycle

margin contribution

Henry Hub Gas Forwards*

2013 and 2014 RTC

Forward Prices & Spark Spread*

Managing our fleet to capitalize on volatility

* As of April 27, 2012.

0

1

2

3

4

2013

2014

2015

-

10

20

30

40

0

20

40

60

80

Aug

-09

Feb-10

Aug

-10

Feb-11

Aug

-11

Feb-12

Western Hub RTC Forward 2014

Western Hub RTC Forward 2013

2014 Spark Spread

2013 Spark Spread |

35

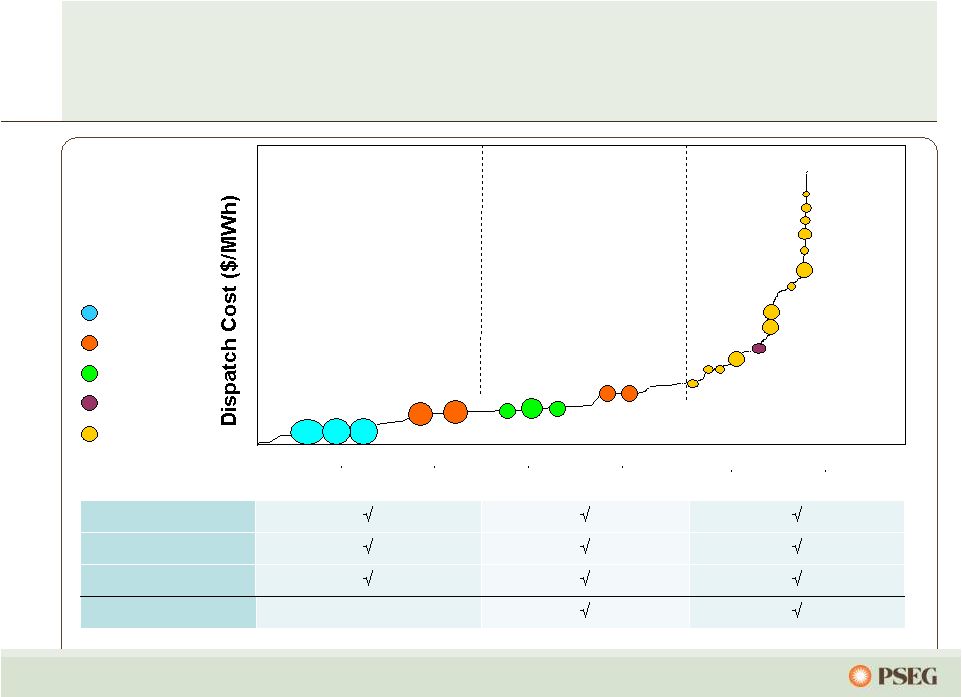

PJM assets are well positioned along the dispatch curve

and maintain fuel optionality while also reducing the risk of

serving full requirements contracts

Energy Revenue

Capacity Revenue

Ancillary Revenue

Dual Fuel

Peaking units*

Load following units

Nuclear

Coal

Combined Cycle

Steam

Peaking

Baseload units

Illustrative

Salem

Hope

Creek

Keystone

Conemaugh

Hudson 2

Linden 1,2

Burlington 8-9-11

Edison 1-2-3

Essex 10-11-12

Bergen 1

Sewaren 1-4

Mercer 1, 2

Bergen 2

Sewaren 6

Mercer 3

Kearny 10-11

Linden 5-8 / Essex 9

Burlington 12 / Kearny 12

Peach

Bottom

Yards

Creek

National Park

Salem 3

Bergen 3

* Some units have been announced for future retirements. |

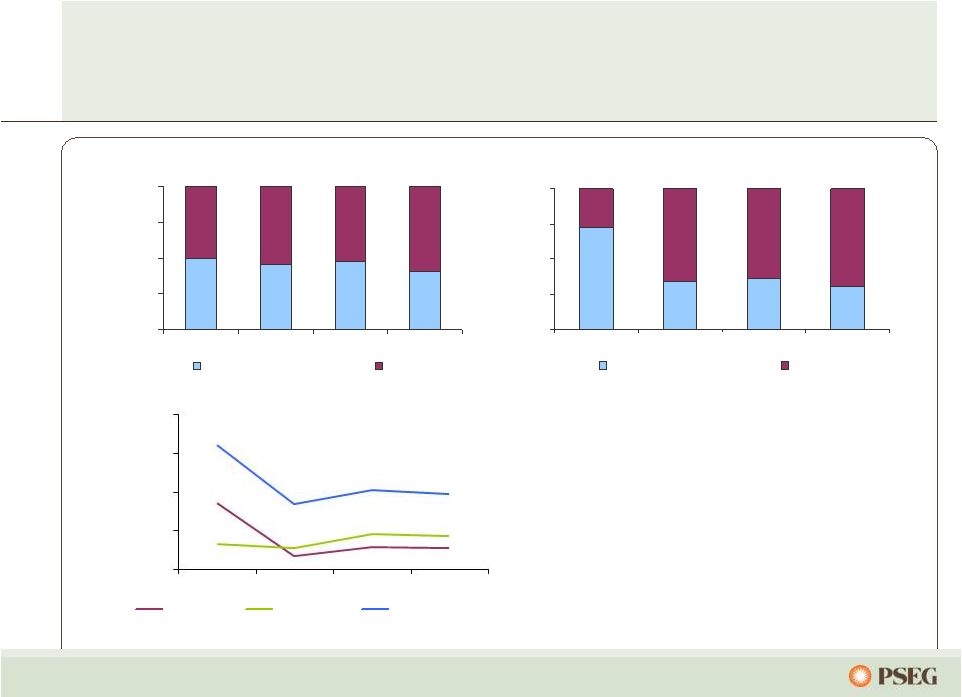

36

2008

2009

2010

2011

Dark Spread

Spark Spread

PSEG Zone LMP's

Maximizing the dispatch of our coal and gas fleet to

maintain unit margins

$/MWh

•

Market prices have declined since 2008

•

Although dark spreads have declined, spark

spreads have increased

•

Since 2008 there has been active coal/gas

switching in our fleet

•

Coal generation and margin percentage

have been replaced by our combined cycle

output

50%

45%

47%

41%

50%

55%

53%

59%

0%

25%

50%

75%

100%

2008

2009

2010

2011

Coal

Gas

72%

34%

36%

30%

28%

66%

64%

70%

0%

25%

50%

75%

100%

2008

2009

2010

2011

Coal

Gas

% PSEG’s PJM Coal/Gas Generation

% PSEG’s PJM Coal/Gas Energy Margin

$0

$25

$50

$75

$100 |

37

Managing our ancillary revenue stream, which contributes

$100M in annual margin for Power, with potential to expand

services as dependence on intermittent resources grows

Reactive

Regulation

Sync/Non-sync

Reserves

Black Start

Nuclear

Coal

Combined Cycle

CT |

38

Note: PJM totals do not include ATSI and DEOK regions; announced retirement

totals inclusive of retirements from 1/1/2010. The EPA is in the process of

implementing Clean Air Act rules which will impact supply

Region

Total Capacity

(GW)

Total Coal Capacity

(GW)

Unscrubbed

Capacity

(GW)

Announced Coal

Retirements

(GW)

Announced Coal

Retirements

(as % of total)

PJM

180

79

30

14

8%

NY ISO

37

2.6

0.6

0.8

2%

ISO-NE

32

2.8

2.1

0.4

1%

U.S. Total

1,036

320

129

43

4%

Cross State Air Pollution Rule (CSAPR)

•

Final rule issued July 2011, having effective date January 2012

•

Rule

would

institute

new,

more

stringent

trading

program

for

NO

x

and

SO

2

emissions

•

US DC Circuit Court ruled to stay implementation on 12/30/11 pending judicial

review •

Final decision expected in 2012

Mercury and Air Toxics Standards (MATS)

•

Final rule released December 2011

•

Will require coal and oil-fired units to meet strict emissions limits, or

retire •

Effective early 2015; provides case-by-case extensions where needed to

comply Source: MJB&A Tracking, Ventyx Velocity, EPA NEEDS v4.10,

PJM, NYISO, ISO-NE. As of 4/27/2012. |

39

PSEG Power’s Position

Criteria Pollutants

(CSAPR)

•

Well positioned on NO

X

and SO

2

, net of anticipated allowances

Mercury & Air Toxics

(MATS)

•

Generally well positioned on Hg, particulate matter, and HCl

•

Comprehensive coal controls (SCR planned at Conemaugh)

High Electric Demand

Days (HEDD)

•

Compliance strategy under review (retirements or investments)

Coal Combustion

Byproducts

•

Power uses dry ash systems

•

Coal ash and scrubber waste tested as non-hazardous

316(b) Cooling Water

Regulations

•

Power shares general industry exposure on capital expenditure

•

Ongoing, positive industry dialogue with EPA

•

Power has over $150M in estuary enhancement program at Salem

Market uplift expected as a result of environmental rules (due to retirements,

derates, higher VO&M costs or higher emission allowances prices)

Estimated energy impact of CSAPR and MATS: $2-$5/MWh, not fully reflected in

current forward prices Retirements (MATS and HEDD) will provide strong support

to capacity markets Power is generally well positioned to meet the anticipated

requirements: Positioned to benefit from environmental leadership

|

40

$/MW-day

2011 / 2012

2012 / 2013

2013 / 2014

2014 / 2015

2015 / 2016

Power’s

Average Prices

$110

$153

$244

$162

$167

Rest of Pool Prices

$110

$16

$28

$126

$136

PSEG Power Cleared Approximately 9,000 MW

•

No New PSEG Power Generation Cleared the Auction

•

Preserving Optionality of HEDD Sites

2015/2016 RPM Auction Influenced By:

•

Updated

Demand

Curve

•

Updated

Transfer

Capabilities

•

Environmental

Retirements

•

New Build •

Below MOPR Bids

The Reliability Pricing Model has recognized the

locational value of Power’s generating fleet with

sites in the eastern part of PJM

PJM Cleared Approximately 4,900 MW of New Generation |

41

Full Requirements Component

Capacity Markets/RPM

Growing Renewable Energy Requirements

Component for Market Risk

Favorably hedging our generation at customer/load

centers through Power’s participation in each of the

BGS auctions

Market Perspective –

BGS Auction Results

3 Year Average

Round the Clock

PJM West Forward

Energy Price

Capacity

Load shape

Transmission

Congestion

Ancillary services

Risk premium

Green

Note: BGS prices reflect PSE&G Zone.

2005

2006

2007

2008

2009

2010

2011

2012

$44 -

$46

$67 -

$70

$58 -

$60

$68 -

$71

$56 -

$58

$48 -

$50

$65.41

~ $21

$102.51

~ $32

$98.88

~ $41

$111.50

~ $43

$103.72

~ $47

$95.77

~ $47

$45 -

$47

~ $48

$94.30

~ $46

$37 -

$38

$83.88 |

42

Contracting longer term hedges and other products

provides medium term financial stability

Contracted Energy*

Volume TWh

17

35

35

Base Load

% Hedged

100%

85-90%

45-50%

(Nuclear and Base Load Coal)

Price $/MWh

$58

$54

$54

Volume TWh

10

18

19

Intermediate Coal, Combined

% Hedged

30-35%

0%

0%

Cycle, Peaking

Price $/MWh

$58

$54

$54

Volume TWh

28-30

52-54

53-55

Total

% Hedged

70-75%

55-60%

25-30%

Price $/MWh

$58

$54

$54

Jul -Dec

2012

2014

2013

*

Hedge percentages and prices as of June 30, 2012. Revenues of full requirement load deals based

on contract price, including renewable energy credits, ancillary, and transmission components but excluding capacity. Hedges include positions with

MTM accounting treatment and options.

|

The

Business

of

PSEG

Holdings |

44

Holdings has significantly reduced its portfolio and

will continue to monetize legacy assets

Solar

Investments

Regulated

Energy

Leases &

Other

Merchant

Energy

Leases

LILO/SILO

Leases

International

Investments

Holdings Investment

Portfolio

$4.9B

$1.2B

Merchant

Energy Leases

Regulated

Energy Leases

& Other

Texas

Texas Transfer &

Sale ~$600M

LILO/SILO Lease

Terminations

~$1.2B

International &

Other Global

Asset Sales

~$2.1B

Dynegy Lease

Reserve ~$0.2B

2006

2011

Transactions

reflect

market

values

for

asset

dispositions

or,

in

the

case

of

Dynegy,

Note:

2006

and

2011

data

reflect

book

values

of

assets.

book value reserve taken in 2011. |

45

LIPA, a New York State agency, owns T&D and generation assets (formerly LILCO)

–

1.1 million electric customers

–

Public / private business model:

•

T&D owned by LIPA

•

Privately operated

–

Sound T&D operations, but ongoing rate concerns, challenged storm restoration

efforts, low customer satisfaction ratings

December

2011

–

PSEG

and

partner

Lockheed

Martin

selected

to

manage

T&D

system

–

10-year LIPA Management Services agreement approved by New York State Office of

the Comptroller, NYS Attorney General and IRS

–

Transition period: 2012

–

2013

–

Contract operating period:

2014

-

2023

–

Economic terms:

•

Fixed fee escalating at regional CPI

•

Up to 15% incentive fee for certain performance metrics

The

business

of

PSEG:

Finding

opportunities

to

extend and profit from our operational excellence |

46

PSEG Resources Leveraged Lease Portfolio

Lessee

Equipment

6/30/12

Invested

(millions)

S&P

Credit

Rating*

REMA (GenOn)

Keystone, Conemaugh & Shawville (PA)

3 coal fired plants (1,162

equity MW)

$ 335

B-

Dynegy Holdings

Danskammer & Roseton Generating Station (NY)

370 MW coal fired and 1,200 MW oil/gas fired

-

-

Edison Mission

Energy (EME)

Powerton & Joliet Generating Stations (IL)

2 coal-fired generating facilities (1,640 equity MW)

218

CCC

Merrill Creek –

(PECO, MetEd,

Delmarva P&L)

Reservoir in NJ

131

BBB,

BBB-,

BBB+

Grand Gulf

Nuclear station in Mississippi (154 equity MW)

66

A+

Renaissance Ctr.

Office towers located in Detroit, MI leased to GM

41

BB+

Wal-Mart

Portfolio of 6 Wal-Mart stores

12

AA

E-D Centers

Portfolio of 8 shopping centers

23

NR

Total Leases

$ 826

*Indicative recent rating as of 8/9/2012 reflecting either Lessee, additional

equity collateral support or parent company unsecured debt rating.

|

Appendix |

48

PSEG 2012 Operating Earnings Guidance

-

By Subsidiary

$ millions (except EPS)

2012E

2011

PSEG Power

$575 –

$665

$ 845

PSE&G

$530 –

$560

$ 521

PSEG Energy Holdings/Parent

$35 –

$45

$ 23

Operating Earnings*

$1,140 –

$1,270

$ 1,389

Earnings per Share

$ 2.25 –

$ 2.50

$2.74

* See page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

49

PSEG Q2 2012 –

Cash Update and Financing

Activities

Cash position at June 30 was in excess of $750 million

PSEG’s debt as a percent of capital was 41% as of June 30

Power’s debt as a percent of capital was 34% as of June 30

Moody’s upgraded PSE&G’s secured debt rating to A1 with a Stable

outlook and affirmed ratings of PSEG and Power (Baa1) with Stable

outlooks

Fitch upgraded PSE&G’s secured debt rating to A+ with a Stable

outlook and affirmed ratings of PSEG and Power (BBB+) with Stable

outlooks |

50

Power and Parent available liquidity totaled

approximately $4.2 billion at June 30, 2012

Company

Facility

Date

Facility

Usage

Liquidity

($Millions)

PSE&G

5-year Credit Facility

Apr-16

$600

$16

$584

5-Year Credit Facility (Power)

Mar-17

$1,600

$121

$1,479

5-Year Credit Facility (Power)

Apr-16

$1,000

$0

$1,000

5-Year Bilateral - Credit Suisse (Power)

Sep-15

$100

$100

$0

5-year Credit Facility (PSEG)

Mar-17

$500

$12

$488

5-year Credit Facility (PSEG)

Apr-16

$500

$0

$500

Total

$4,300

$249

$4,051

$704

PSE&G ST Investment

$0

Total Liquidity Available

$4,755

Total Parent / Power Liquidity

$4,171

PSEG /

Power

PSEG Money Pool ST Investment |

51

PSEG Consolidated Debt / Capitalization

(1)

Long-Term Debt includes Debt due within one year; excludes Securitization Debt

and Non-Recourse Debt. (2)

Power includes Texas Non-recourse Debt

December 31, 2010

December 31, 2011

June 30, 2012

PSE&G Short-term Debt

PSEG Money Pool Short-term Debt

Total Short-term Debt

Long-term Debt (1)

Power(2)

PSE&G

Holdings

Parent/Services

Total Long-term Debt

Total Common Stockholders' Equity

9,633

10,270

10,644

TOTAL CAPITALIZATION

$17,445

$17,330

$18,086

December 31, 2010

December 31, 2011

June 30, 2012

Debt

$7,812

9,633

$7,060

10,270

$7,442

10,644

Total Common Stockholders' Equity

Debt Plus Equity

$17,445

$17,330

$18,086

Debt Ratio

44.8%

40.7%

41.1%

PSEG Consolidated ($ Millions)

0

64

64

3,455

4,283

0

10

7,748

$0

0

0

16

0

16

2,751

4,270

0

39

7,060

2,686

4,696

0

44

7,426

$

$ |

52

PSEG Consolidated Debt / Capitalization

(1)

Includes debt due within one year and short-term debt; excludes Securitization

Debt and Non-Recourse Debt. Debt

7,812

7,060

7,442

Common Shareholders Equity

9,633

10,270

10,644

Debt plus Equity

17,445

17,330

18,086

Debt Ratio

44.8%

40.7%

41.1%

(in $Millions)

6/30/2012

12/31/2010

12/31/2011

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

Debt (1)

Equity |

53

PSEG Power

Funds from Operations / Total Debt

Our focus on building a strong balance sheet

places us in an advantageous position to capitalize

on selected new opportunities

Power’s free cash flow

produces solid credit

measures despite low

natural gas prices

Free Cash Flow

(1)

~950

~750

~1,725

Average: ~415

Dividends to Parent

850

(2)

549

500

Average: ~525

(in $Millions)

(1)

Free Cash Flow represents cash from operations less cash used for Capital

investment; E = Estimate. (2)

Excludes dividend to Parent associated with transfer of Texas assets to PSEG

Power. 80%

70%

60%

50%

40%

30%

20%

10%

0%

2009

2010

2011

2012-2014E

Average |

54

Tax Update

Definitive agreement reached with the IRS that settles the tax

treatment for challenged lease transactions (LILO/SILO) for all

tax years

Settlement reached with the IRS for all federal audit issues for

tax years 1997-2006

Expected net refund of ~$170M |

55

Operated by PSEG Nuclear

PSEG Ownership: 100%

Technology: Boiling Water Reactor

Total Capacity: 1,173 MW

Owned Capacity: 1,173 MW

License Expiration: 2046

License renewal approved

July 2011

Next Refueling

Fall 2013

Operated by PSEG Nuclear

PSEG Ownership: 57%,

Exelon –

43%

Technology: Pressurized Water Reactor

Total Capacity: 2,326 MW

Owned Capacity: 1,336 MW

License Expiration: 2036 and 2040

License renewal approved

June 2011

Next Refueling

Unit 1 --

Spring 2013

Unit 2 --

Fall 2012

Operated by Exelon

PSEG Ownership: 50%

Technology: Boiling Water Reactor

Total Capacity: 2,247 MW

Owned Capacity: 1,123 MW

License Expiration: 2033 and 2034

Next Refueling

Unit 2 –

Fall 2012

Unit 3 –

Fall 2013

Hope Creek

Salem Units 1 and 2

Peach Bottom Units 2 and 3

Our five unit nuclear fleet is a critical element of

Power’s success |

56

$1.28

.07

.06

(.29)

$1.44

0.00

0.25

0.50

0.75

1.00

1.25

1.50

1.75

YTD 2012

Operating

Earnings*

YTD 2011

Operating

Earnings*

PSEG Power

PSE&G

PSEG Energy

Holdings/

Enterprise

PSEG EPS Reconciliation –

YTD 2012 versus

YTD 2011

Lower Pricing (.16)

Lower Volume (.03)

Lower Capacity (.11)

Financing Costs .03

O&M .02

Weather (.01)

Other (.03)

Transmission .05

Renewables

and Other

Investments .01

O&M (.04)

Weather and

Demand (.02)

D&A (.02)

Taxes .07

Other .01

Tax settlement

* See Page A for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. |

57

Items Excluded from Income from Continuing

Operations to Reconcile to Operating Earnings

Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a

non-GAAP financial measure and how it differs from Net Income. Public

Service Enterprise Group Reconciling Items Excluded from Continuing Operations

to Compute Operating Earnings (Unaudited)

Pro-forma Adjustments, net of tax

2012

2011

2011

2010

2009

2008

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

9

$

42

$

50

$

46

$

9

$

(71)

$

Gain

(Loss)

on

Mark-to-Market

(MTM)

(a)

(PSEG Power)

42

8

107

(1)

(11)

14

Lease Related Activity (PSEG Energy Holdings)

6

-

(173)

-

29

(490)

Market Transition Charge Refund (PSE&G)

-

-

-

(72)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

-

34

-

-

(13)

Total Pro-forma adjustments

57

$

50

$

18

$

(27)

$

27

$

(560)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

507

508

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.02

$

0.08

$

0.10

$

0.09

$

0.02

$

(0.14)

$

Gain

(Loss)

on

MTM

(a)

(PSEG Power)

0.08

0.02

0.21

-

(0.02)

0.03

Lease Related Activity (PSEG Energy Holdings)

0.01

-

(0.34)

-

0.05

(0.96)

Market Transition Charge Refund (PSE&G)

-

-

-

(0.14)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

-

0.06

-

-

(0.03)

Total Pro-forma adjustments

0.11

$

0.10

$

0.03

$

(0.05)

$

0.05

$

(1.10)

$

(a) Includes the financial impact from positions with forward delivery

months. Years Ended

December 31,

Six Months Ended

June 30, |