Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELCATH SYSTEMS, INC. | d397149d8k.htm |

Investor Presentation

(NASDAQ: DCTH)

August 2012

Exhibit 99.1 |

2

DELCATH SYSTEMS, INC

Forward-looking Statements

This presentation contains forward-looking statements within the meaning of the Safe Harbor

Provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statement are

subject to certain risks and uncertainties that can cause actual results to differ materially

from those described. Factors that may cause such differences include, but are not limited to, uncertainties relating to: the

benefits of the Gen 2 CHEMOSAT system and market acceptance of the same, patient outcomes using the

Gen 2 CHEMOSAT system, agreements with additional early launch centers in Europe, our ability

to manufacture CHEMOSAT systems and the time required to build inventory and establish

commercial operations in Europe, adoption, use and resulting sales, if any, for the CHEMOSAT

system in the EEA, our ability to successfully commercialize the chemosaturation system and the potential of the

chemosaturation system as a treatment for patients with cancers in the liver, acceptability of the

Phase III clinical trial data by the FDA, our ability to address the issues raised in the

Refusal to File letter received from the FDA and the timing of our re-submission of our

NDA, re-submission and acceptance of the Company's NDA by the FDA, approval of the Company's NDA

for the treatment of metastatic melanoma to the liver, adoption, use and resulting sales, if

any, in the United States, approval of the CHEMOSAT system in foreign markets, approval of the

current or future chemosaturation system for other indications and/or with other chemotherapeutic

agents, actions by the FDA or other foreign regulatory agencies, our ability to obtain reimbursement

for the CHEMOSAT system, our ability to successfully enter into distribution and strategic

partnership agreements in foreign markets and the corresponding revenue associated with such

foreign markets, uncertainties relating to the timing and results of research and development projects and future

clinical trials, acceptance of our IND amendment, submission and publication of the Phase II and III

clinical trial data, the timing and use, if any, of the line of credit from SVB and our ability

to access this facility, and uncertainties regarding our ability to raise additional capital

and obtain financial and other resources for any research, development and commercialization activities. These factors, and

others, are discussed from time to time in our filings with the Securities and Exchange Commission

including our annual report on Form 10-K and our reports on Forms 10-Q and 8-K. You

should not place undue reliance on these forward-looking statements, which speak only as of

the date they are made. We undertake no obligation to publicly update or revise these forward-looking statements to

reflect events or circumstances after the date they are made. |

3

DELCATH SYSTEMS, INC

Our Mission

Concentrating the Power of Chemotherapy for Disease Control in the Liver

We are a cancer therapy company

Our technology offers the opportunity to gain control of tumors

in the liver

The liver is a site where uncontrolled disease is often life-limiting

or leads to withdrawal of systemic treatments in favor of

palliative care

We plan on being a fully-integrated company and are building

the infrastructure to develop and commercialize our products in

Europe and North America

o

In Europe our first product is approved and we have begun selling it

We believe that our first product, CHEMOSAT, may extend the

lives of a large number of cancer patients |

4

DELCATH SYSTEMS, INC

Existing Liver Cancer Treatments Have Significant Limitations

The Problem

•

Metastatic disease to the liver, brain or lungs is often the life-

limiting location of solid tumors

o

In contrast to the brain and lungs, where systemic chemotherapy

and radiation can exert some degree of local control, tumors in the

liver are not particularly responsive to chemotherapy and radiation

therapy

•

Existing treatments to control tumors in the liver include:

Surgical resection

Radioembolization (SIRT)

Chemoembolization (TACE)

Radiofrequency ablation (RFA), Microwave, Cryoablation

Hepatic arterial infusion (HAI)

Systemic chemotherapy |

5

DELCATH SYSTEMS, INC

Existing Liver Cancer Treatments Have Limitations

Unmet Medical Need Exists for More Effective Liver Cancer Treatments

Treatment

Advantages

Disadvantages

Systemic

–

Non-invasive

–

Repeatable

–

Systemic toxicities

–

Limited efficacy in liver

Regional

(e.g., Isolated Hepatic Perfusion)

–

Therapeutic effect

–

Targeted

–

Invasive/limited repeatability

–

Multiple treatments are

required but not possible

Focal

(e.g. surgery, radioembolization,

chemoembolization, radio

frequency ablation)

–

Partial removal or

treatment of tumors

–

Only 10% to 20% resectable

–

Invasive and/or limited

repeatability

–

Treatment is limited by

tumor size, number of

lesions and location

–

“See a tumor, treat a tumor” |

6

DELCATH SYSTEMS, INC

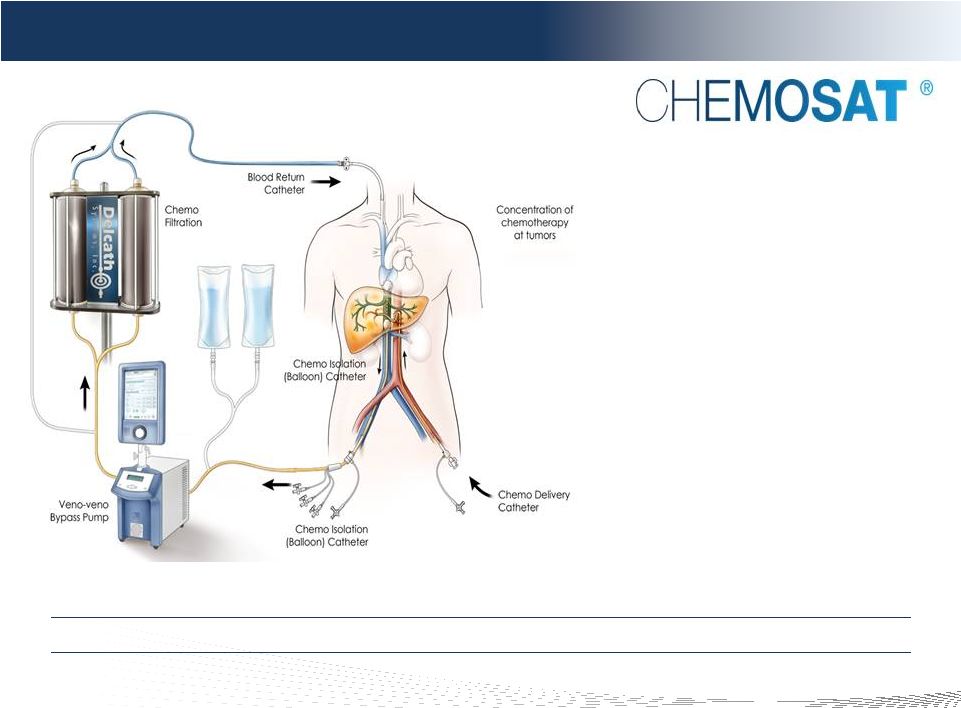

Concentrating the Power of Chemotherapy for Disease Control in the Liver

Our Solution

•

Our proprietary CHEMOSAT system isolates the liver

circulation, delivers an ultra-high concentration of

chemotherapy (melphalan) to the liver and filters most of the

chemotherapy out of the blood prior to returning it to the patient

•

The procedure typically takes approximately two hours to

complete and involves a team including the interventional

radiologist and perfusionist

•

CHEMOSAT (Gen 2) has demonstrated minimal systemic

toxicities and impact to blood components in initial commercial

use and may complement systemic therapy

•

CHEMOSAT has been used on approximately 200

patients to

date through clinical development and early commercial launch

|

7

DELCATH SYSTEMS, INC

Chemosaturation

1.

ISOLATE

2.

SATURATE

3.

FILTRATE

The Delcath CHEMOSAT System

Improved disease control in the liver

Treats entire liver (macro and micro)

Controls systemic toxicities

Allows for over 100x effective dose

escalation at tumor site

Repeatable & minimally invasive,

Complements systemic therapy

Minimally Invasive, Repeatable Liver Procedure That Could Complement Systemic

Therapy Note: Image not to scale. |

8

DELCATH SYSTEMS, INC

Concentrating the Power of Chemotherapy for Disease Control in the Liver

The Data

•

We conducted a randomized Phase 3 study under a Special

Protocol Assessment (“SPA”) using Generation 1 of our

chemosaturation system in patients with melanoma (ocular and

cutaneous) metastatic to the liver

•

Melanoma liver metastases are relatively homogeneous

regardless of origin

•

Liver metastases are typically the life-limiting aspect of the

disease

•

Melanoma is notoriously insensitive to systemic chemotherapy

and our study was a great demonstration of our technology’s

potential in a challenging histology |

9

DELCATH SYSTEMS, INC

Phase III Clinical Trial Design

Randomized to CS

92 patients: ocular

or cutaneous melanoma

Best Alternative Care (BAC)

Investigator and patient decision

(any and all treatments)

CS/Melphalan

Treat every 4 weeks x 4 rounds

(responders

can receive up to 6 rounds)

Cross-over

Primary Trial Endpoint

•

Statistically significant difference in Hepatic Progression

Free Survival (“hPFS”): p < 0.05 (IRC)

•

Over 80% of Oncologic drugs approved by FDA between

2005 –

2007 on endpoints other than overall survival

Modeled hPFS for Trial Success:

7.73 months (CS)

vs.

4 months (BAC)

Secondary Trial Endpoints

•

Investigator hPFS

•

Hepatic response

and duration of hepatic response

•

Overall response

and duration of overall response

•

Overall Survival –

Diluted by Cross Over

•

SAP calls for analysis of various patient cohorts

Pre-CS (Baseline)

Post-CS (22+ Months)

Hepatic Response –

Metastatic Melanoma

Fully Powered, 93 Patient, Randomized, Multi-Center NCI Led Study

CS = ChemoSaturation (CHEMOSAT) |

10

DELCATH SYSTEMS, INC

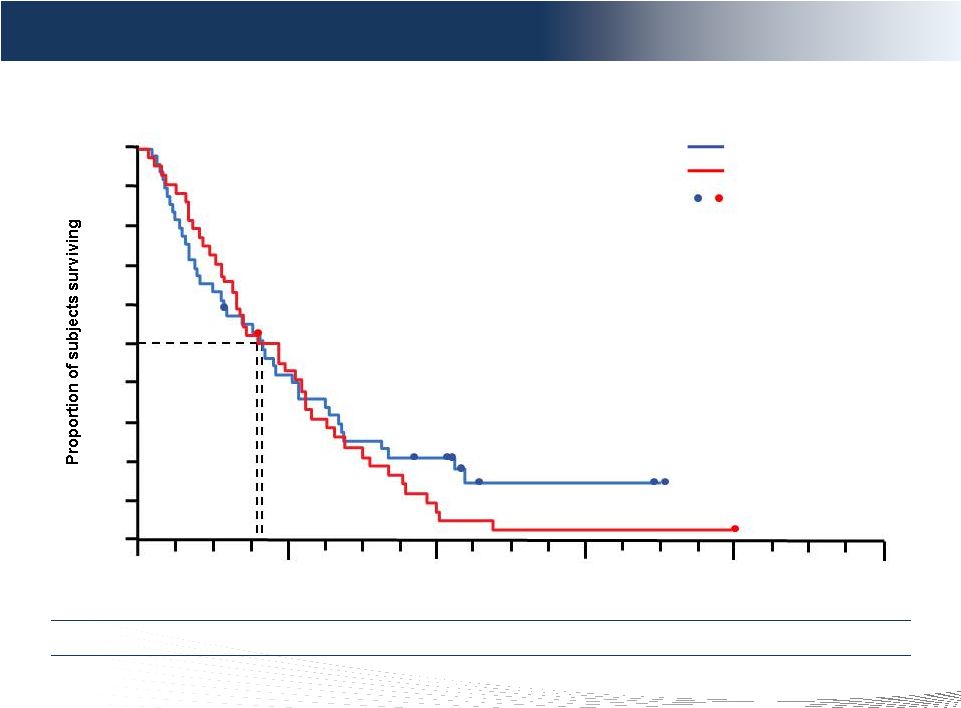

Phase 3 –

Primary Endpoint hPFS (ITT –

IRC Analysis)

CS-PHP Demonstrated >4x Improvement in Primary Endpoint of hPFS

April 30, 2010

p-value=0.0001

HR=0.39 |

11

DELCATH SYSTEMS, INC

Phase 3 Hepatic Progression Free Survival (ITT -INV*)

p<0.0001

Hazard Ratio: 0.35

(CI: 0.23-0.54)

0

5 10 15

20

25

30 35

Months

CS-PHP

BAC

8.0

1.6

1.0

Survival probability

0.8

0.6

0.4

0.2

0.0

CS-PHP Demonstrated a 5x Improvement in Primary Endpoint of hPFS

* Updated Investigator results presented at 2011 ECCO/ESMO

Annual Meeting. |

12

DELCATH SYSTEMS, INC

Phase 3 Overall Progression-free Survival (ITT –

INV*)

p<0.0001

Hazard Ratio: 0.36

(CI: 0.23-0.57)

0

5 10 15

20

25

30 35

Months

CS-PHP

BAC

6.7

1.6

1.0

Survival probability

0.8

0.6

0.4

0.2

0.0

CS also Demonstrated a Highly Statistically Significant Improvement in Overall

PFS * Updated Investigator results presented at 2011

ECCO/ESMO Annual Meeting. |

13

DELCATH SYSTEMS, INC

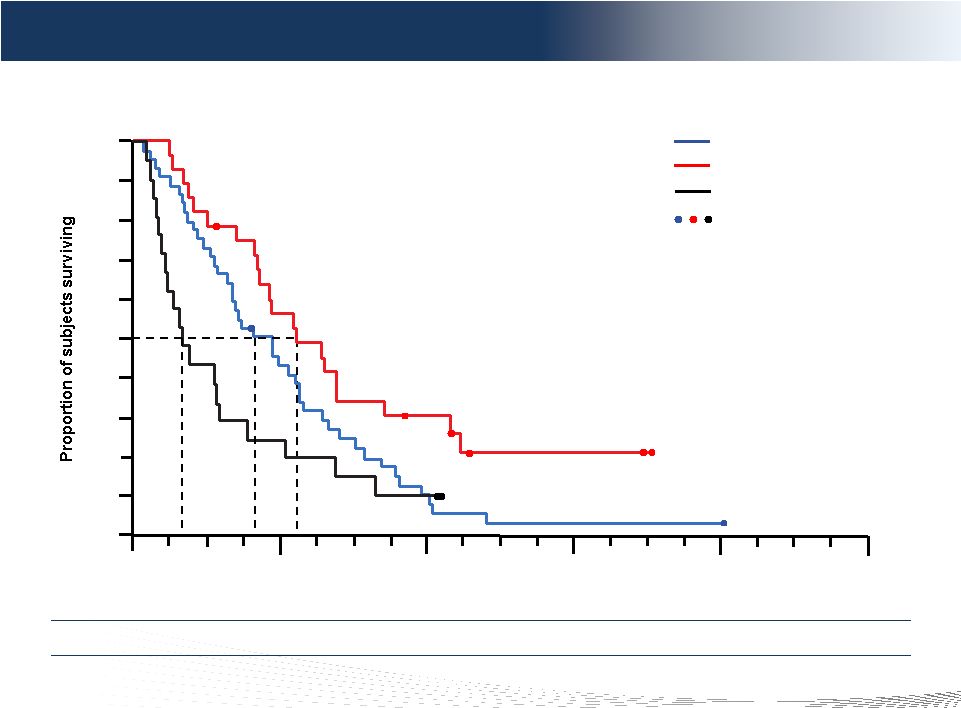

Overall survival (ITT population)

12

36

0

24

48

Time (months)

60

9.8

p-value = 0.4170

BAC

PHP

Censored observations

10.0

BAC vs PHP

55% Cross-over

HR=1.20 (CI: 0.78-1.85)

Overall Survival Confounded By Crossover Study Design

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0 |

14

DELCATH SYSTEMS, INC

Overall survival (ITT population)

Time (months)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

12

36

0

24

48

60

4.1

PHP randomized

BAC crossover*

BAC only*

Censored observations

PHP randomized vs PHP crossover vs BAC only

9.8

13.1

Overall Survival Tail PHP Treated Patients

* Similar patient characteristics and demographics between BAC crossover and BAC

only |

15

DELCATH SYSTEMS, INC

Overall survival (ITT population)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

12

36

0

24

48

60

11.4

Total PHP incl. crossover

BAC only

Censored observations

Time (months)

Total PHP vs BAC only

4.1

Overall Survival Tail For Treated Patients

15

DELCATH SYSTEMS, INC |

16

DELCATH SYSTEMS, INC

Positive Phase III Results

•

Primary endpoint exceeded (hPFS:IRC), p value = 0.0001,

hazard ratio of .39 as of 4/2010

o

Treatment arm

shows

4.4x

median

hepatic

progression

free

(hPFS)

survival

compared

to

control

arm

o

CS/PHP median hPFS of 7.0

months compared to 1.6 months for BAC

o

86% overall clinical benefit (CR + PR + SD)

•

Secondary endpoints support results

o

OS Secondary

endpoint

–

No

difference

in

Kaplan-Meier

curves

due

to

cross

over

treatment

response

(10.6 months compared to 10.02 months) as of

6/2012 o

CS/PHP

median

overall

PFS

of

5.42

months

vs.

1.64

months

for

BAC

as

of

6/2012

•

OS exploratory cohort analysis favorable

o

Median survival of 9.8 months for treatment arm compared to 4.1 months

non-crossover BAC patients o

Median survival of 11.4 months for all patients treated with melphalan, including

crossover o

8 CS/PHP-treated patients and 2 BAC-treated patients still alive as of

6/2012 •

Gen 1 Safety profile –

expected and consistent with currently approved labeling

for melphalan

o

30-day deaths on PHP: 3/44 patients (6.8%)

1 Neutropenic Sepsis (2.3%); 1 Hepatic Failure 2.5% (95% tumor burden); 1 gastric

perforation o

30-day deaths on BAC: 3/49 patients (6.1%)

Trial Outcomes Favorable and Consistent with Special Protocol Assessment

|

17

DELCATH SYSTEMS, INC

Melphalan Sensitivity: In Vitro Tumor Cell Lines Study

We Believe CHEMOSAT Will Be Effective On a Wide Variety of Cancer Histologies

|

18

DELCATH SYSTEMS, INC

Our Opportunity

•

At the concentrations of melphalan we are achieving in the

liver, we believe CHEMOSAT will be effective on a wide variety

of histologies

•

We believe that physicians are recognizing the broad

applicability of CHEMOSAT, based on early experience and

their interest in testing our technology with melphalan in a

variety of tumor histologies

•

CE Mark approved broad indication

•

Large global market opportunity with pharmaceutical-like gross

margin ~ 80%

Concentrating the Power of Chemotherapy for Disease Control in the Liver

|

19

DELCATH SYSTEMS, INC

CHEMOSAT -

Potential Multi-Billion Dollar Market

8,708

6,563

4,085

8,212

7,202

33,966

19,861

33,953

52,143

5,585

7,671

99,749

0

25,000

50,000

75,000

100,000

125,000

150,000

175,000

200,000

USA

EU

APAC

$7 Billion Annual Global Opportunity with Pharmaceutical-Like Gross

Margins Sources: LEK Consulting, GLOBOCAN, Company estimates.

*TPM for initial U.S. labeled indication only.

EU: Initial target countries of Germany, UK, Italy, France, Spain, Netherlands,

Ireland. APAC: Initial target countries of China, Japan, S. Korea, Taiwan,

Australia. Assumes 2.5 treatments per patient.

Assumes EU ASP of $15K; US ASP of $25K; APAC ASP of $5K.

55,389

$2.2 B

8,708*

$2.6 B

189,943

$2.2 B

HCC

CRC

Melanoma

NET |

20

DELCATH SYSTEMS, INC

Approved (CE Mark Device)

Regulatory Filing (NDA) Planned in August, 2012

Application Submitted/ Planned –

Mutual Recognition of European

CE Mark in 2012-2013

Global Commercialization Status

On The Cusp of Addressing A Multi-Billion Dollar Global Market in Next Two

Years |

21

DELCATH SYSTEMS, INC

European Commercialization Strategy

Strategy:

•

Focus efforts in 7 Target Countries (EU 5 + Netherlands & Ireland)

•

8-10 leading EU cancer centers as initial training centers

•

Validate business model and demonstrate scalability

•

Push and Pull marketing and selling strategy

Tactics & Execution:

•

Educate medical oncologists via contract organization

•

Sell to hospital-based interventional radiologists, surgeons and C-suite

decision makers with combination of direct sales and distributors

•

Hospitals procure melphalan from third parties and physicians use at their

discretion •

Establish European patient education & awareness programs (PR, website)

•

Leverage existing new technology reimbursement channels, while pursuing permanent

procedure reimbursement

•

Clinical trials to generate additional data for CRC and HCC to support revenue

ramp up Currently In Initial Training and Marketing Phase

|

22

DELCATH SYSTEMS, INC

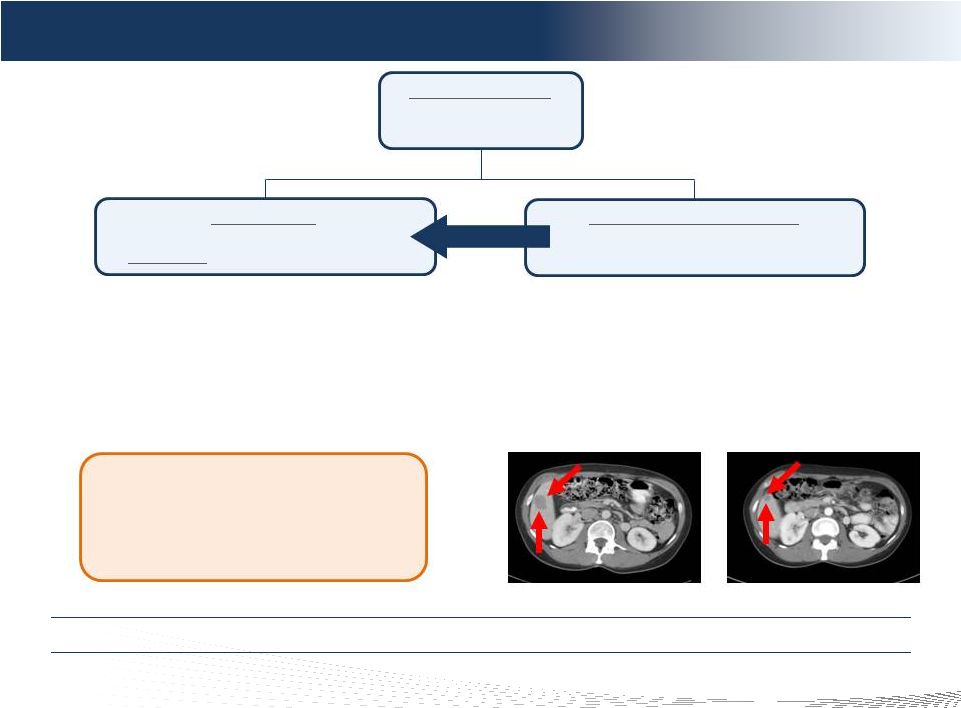

Patient Referral Path

Interventional

Radiologist

Offers chemosaturation

procedure

Patient

Primary

Care

Medical

Oncologist

Offers systemic therapy

Surgical

Oncologist

Offers resection or

other focal therapy

Chemosaturation

Diagnosis

of Cancer

Identification of liver

involvement

with no

improvement from systemic

therapy

When liver disease is

controlled,

patients

return

to

the

Medical

Oncologist for additional systemic therapy |

23

DELCATH SYSTEMS, INC

CHEMOSAT Training and Marketing Commenced in Europe

Continue Training and Marketing Centers Roll-Out

•

Entered training and marketing agreements with leading cancer centers in

Europe o

Milan, Italy –

European Institute of Oncology (IEO)

o

Frankfurt,

Germany

–

Johann

Wolfgang

Goethe-Universität

(JWG)

o

Kiel, Germany –

Universitätsklinikum Schleswig-Holstein

o

Villejuif, France –

Cancer Institute Gustave Roussy (IGR)

o

Barcelona, Spain –

El Hospital Quiron

o

Naples, Italy –

Instituto Nazionale Tumori Fondazione "G. Pascale"

o

Amsterdam, The Netherlands –

Netherlands Cancer Institute-Antoni van Leeuwenhoek Hospital

o

Erlangen, Germany –

University Hospital of Erlangen

o

Pamplona, Spain –

Clinica Universidad de Navarra

o

Bordeaux, France –

Hôpital Saint-André

o

Galway, Ireland –

University Hospital Galway

o

Leiden, The Netherlands –

Leiden University Medical Center

o

Southampton, United Kingdom –

Southampton University Hospital

•

Training completed and patients treated at IEO, Italy; JWG University Hospital,

Frankfurt, Germany; IGR, France; UHG, Ireland

o

Liver metastases from cutaneous melanoma, ocular melanoma, gastric cancer, breast

cancer, and cholangiocarcinoma

•

Selected Quintiles to support EU launch with medical science liaisons (MSL)

|

24

DELCATH SYSTEMS, INC

European Reimbursement Considerations

•

No centralized pan-European medical device reimbursement body –

reimbursement mechanisms vary greatly at national and regional levels across

our target markets

•

Working with reimbursement specialists to develop a plan in each

of our key

markets

for

both

interim

and

long

term

reimbursement

•

Interim reimbursement plans expected to begin coming online during fourth

quarter:

o

Currently, initial procedures are being covered by private payment and research

funding

o

Apply for funding under existing New Technology Payment programs

o

Italy –

Regional Applications being submitted

o

Germany -

interim reimbursement process is being actively sponsored and driven by the German

Radiology Society

o

United Kingdom -

key centers in the area of cutaneous and ocular melanoma have applied for interim

funding

Reimbursement Mechanisms in Place to Support Commercial Launch

|

25

DELCATH SYSTEMS, INC

International Strategy beyond EU and US

•

Leverage CE Mark to obtain reciprocal regulatory approvals for CHEMOSAT

System in other international markets

•

International regulatory submissions status:

Application submitted and expected approvals in

Australia

-

2012 (Gen 1 approved) (Gen 2 expected in Aug)

Hong Kong

-

2012 (Gen 2 expected in Dec.)

Canada

-

2012 (Gen 2 expected in Dec.)

S. Korea

-

2012 (Gen 2 expected in Dec.)

Singapore

-

2013

Brazil

-

2014

Israel

-

2014

Intend to submit applications

Argentina

Mexico

Russia

India

Japan

China and Taiwan

•

Utilize 3

rd

party melphalan and doxorubicin available to physicians

Combination of Strategic Partnerships and Specialty Distributors

|

26

DELCATH SYSTEMS, INC

U.S. FDA Regulatory Status

•

Pre-NDA submission meeting with FDA conducted in January 2012

o

Satisfied with FDA response

o

Addressed RTF related issues

Manufacturing plant inspection timing

Product and sterilization validation

Additional statistical analysis clarification

Additional safety data

•

Completed data entry and monitoring

o

Completed data migration to new FDA compliant CDISC database

o

Created new Case Report Form (CRF)

•

We locked database on May 25, 2012

•

Will include Gen 2 Filter as part of the Chemistry, Manufacturing and Control

module •

Plan to file NDA submission in August 2012

•

Initiated

dialogue

with

FDA

to

discuss

optimal

approval

path

for

Gen 2

•

Amended IND and Expanded Access Program (EAP) and Gen 2 was accepted by the

FDA for use in EAP, compassionate care and clinical trials in the US

|

27

DELCATH SYSTEMS, INC

U.S. Commercialization Strategy

•

Initial focus on leading cancer centers and referring community hospitals

•

Educate Medical Oncologists via Medical Science Liaison (MSL)

•

Direct strategy to sell to Interventional Radiologists and Surgeons: 12

sales territories ultimately expanding to as many as 60 territories as

revenues ramp

•

5 Clinical Specialists initially to support site initiation and training

•

Utilize top centers from Phase III trial as Centers of Excellence for

training and support

•

Intend to seek chemosaturation specific codes based upon value

proposition relative to other cancer therapies

Direct Sales Channels Supplemented with Contract MSLs

|

28

DELCATH SYSTEMS, INC

Clinical Development Program

•

Goal:

o

Expand indications for HCC and mCRC with US registration trials

o

Generate robust clinical data to support commercialization

•

IND Amendment accepted by the FDA to include Gen 2 in Expanded Access Program

(EAP), compassionate use and all future clinical trials

o

Plan to initiate EAP for metastatic melanoma in September 2012

•

Initiate EU Registry in Q4 2012-

Collect specific standardized data from commercial use

of CHEMOSAT in Europe

•

Planned Clinical Trials (first patient enrolled in 2013)

o

HCC

Global Phase 2 randomized 1L CHEMOSAT Melphalan vs. Sorafenib

US registration

–

Global Phase 3 Randomized 2L CHEMOSAT Melphalan vs. BSC for Sorafenib

Failure Asia Phase 3 Randomized 2L CHEMOSAT Doxorubicin vs. BSC for

Sorafenib Failure o

mCRC

Global Phase 2 Signal Seeking/Safety 2L CHEMOSAT Melphalan

US Registration

–

Global Phase 3 Randomized 2L CHEMOSAT Melphalan vs. Approved Alternatives

Establish CHEMOSAT as the Standard of Care (SOC) for Disease Control in the

Liver |

29

DELCATH SYSTEMS, INC

2012 Milestones

•

First patients have been treated with CHEMOSAT Melphalan in Europe -

Done

•

Execute contract for MSL services in EU –

1Q 2012 (Quintiles was selected to

support EU launch of CHEMOSAT) -

Done

•

Secure agreements with 8-10 leading cancer centers in EU -

Done

•

Obtain CE Mark for Gen 2 CHEMOSAT Melphalan -

Done

•

US NDA submission in August 2012

•

Submission for publications of Phase III data and mNET arm of Phase II data

– 2H 2012

•

First patients enrolled in EAP –

2H 2012

•

Obtain approval of CE Mark for CHEMOSAT Doxorubicin –

2H 2012

•

Potential Asia strategic partnership –

dedicated BD with China a top priority

•

Initiate EU Registry in Q4 2012 |

30

DELCATH SYSTEMS, INC

Financial Update

Cash & Cash Equivalents:

$29.3 million at June 30, 2012

Financing:

$21.1 million (net) raised in a follow-on equity

offering in May 2012

ATM Program

$31.0 million remaining as of July 31, 2012

Working Capital Line of Credit:

$20.0 million credit facility

Debt:

None

Cash Spend:

$14.2 million in 2Q2012

Shares Outstanding:

65.7

million

(79.4

million

fully

diluted

)

Institutional Ownership:

20%

Market Capitalization:

$113 million as of July 31, 2012

Avg. Daily Volume (3 mo.):

1,100,000

1) Fully diluted includes an additional 4.7 million options and 9 million

warrants 1 |

31

DELCATH SYSTEMS, INC

Team

Executive

Title

Prior Affiliation(s)

Years of

Experience

Eamonn Hobbs

President and CEO

AngioDynamics, E-Z-EM

31

Graham Miao, Ph.D.

EVP & CFO

D&B, Pagoda Pharma, Schering-Plough,

Pharmacia, JP Morgan

22

Krishna Kandarpa, M.D.,

Ph.D.

CMO and EVP, R&D

Harvard, MIT(HST), Cornell, UMass

32

Agustin Gago

EVP, Global Sales

AngioDynamics, E-Z-EM

30

Jennifer Simpson, Ph.D.

EVP, Global Marketing

Eli Lilly (ImClone), Johnson & Johnson

(Ortho Biotech)

22

Peter Graham, J.D.

EVP, General Counsel &

Global Human Resources

Bracco, E-Z-EM

17

David McDonald

EVP, Business Development

AngioDynamics, RBC Capital Markets

29

John Purpura

EVP, Regulatory Affairs & Quality

Assurance

E-Z-EM, Sanofi-Aventis

28

Harold Mapes

EVP, Global Operations

AngioDynamics, Mallinkrodt

26

J. Chris Houchins

SVP, Clinical and Medical Affairs

Arno, Schering-Plough, Pfizer,

Pharmacia, GD Searle

21

Gloria Lee, M.D., PH.D.

SVP, Global Clinical Development

Hoffmann-La Roche, Syndax

Pharmaceuticals, Inc.

20

Bill Appling

SVP Medical Device R&D

AngioDynamics

26

Dan Johnston, Ph.D.

VP, Pharmaceutical R&D

Pfizer, Wyeth

11 |

32

DELCATH SYSTEMS, INC

Appendices |

33

DELCATH SYSTEMS, INC

Appendix I

Intellectual Property |

34

DELCATH SYSTEMS, INC

Intellectual Property

•

Patent Protection

o

5 U.S. patents in force and 5 U.S. patent applications pending

o

6 foreign patents in force (with patent validity in 22 countries) and 15 foreign

patent applications pending

o

Primary device patent set to expire August 2016

o

Up to 5 years of patent extension post FDA approval

•

Trade Secret Protection

o

Developed improved filter media via new manufacturing processes

•

FDA Protection

o

Orphan Drug Designation granted for melphalan in the treatment of ocular

melanoma, cutaneous melanoma and metastatic neuroendocrine tumors, as well as

for doxorubicin in the treatment of HCC

Provides 7 years of marketing exclusivity post FDA approval

o

Additional Orphan Drug applications to be filed for other drugs and indications,

including melphalan for HCC and CRC

Multiple Levels of Protection |

35

DELCATH SYSTEMS, INC

Appendix II

CHEMOSAT Market Opportunity

by Disease and Target Counties |

36

DELCATH SYSTEMS, INC

Market Opportunity by Disease (patients)

•

Europe

–

Largest

near-term

opportunity

•

CRC

–

Largest

opportunity

worldwide

•

Melanoma

–

Largest

opportunity

is

in

US

•

China

-

Largest

opportunity

for

HCC

Market

Opportunity

defined

as

Total

Potential

Market

(TPM)

for

CHEMOSAT

®

1.Primary cancer incidence

2.Adjusted for predominant disease in the liver (primary or metastatic

cancer)

3.Adjusted

for

addressable

patients

via

Delcath

CHEMOSAT

® |

37

DELCATH SYSTEMS, INC

Europe Market by Disease –

Device Only

Germany

(Direct)

UK

(Direct)

France

(Indirect)

Italy

(Indirect)

Spain

(Indirect)

Netherlands

(Direct)

Ireland

(Direct)

Total

Potential

(patients)

Potential

Market

($ MM)

1,2,3

Total Potential Market #Patients

Ocular

Melanoma

404

297

295

285

197

79

19

1,576

$ 62

Cutaneous

Melanoma

1,625

994

753

801

360

379

73

4,987

$ 206

CRC

9,902

5,300

5,475

7,281

4,016

1,644

335

33,953

$1,339

HCC

(Primary)

1,637

720

1,514

2,597

1,087

82

35

7,671

$277

NET

1,783

1,336

1,353

1,299

974

360

98

7,202

$ 281

TOTAL

15,351

8,647

9,389

12,263

6,634

2,545

560

55,389

$ 2,166

Europe Presents Significant Potential Market Opportunity

Sources: LEK Consulting, GLOBOCAN, Company estimates.

1) Assumes 2.5 treatments per patient.

2) Assumes ASP of ~$15K USD.

3) Assumes mix of direct sales and distributors. |

38

DELCATH SYSTEMS, INC

US Market by Disease –

Device and Drug Combination

Liver Metastasis

Potential Market

# Patients

Potential Market

# Procedures

Potential Market

($MM)

1,2

Ocular

Melanoma

1,685

4,213

$ 105

Cutaneous

Melanoma

7,023

17,557

$ 439

TOTAL MELANOMA

(Initial Expected Label)

8,708

21,770

$ 544

CRC

19,861

49,653

$ 1,241

HCC (Primary)

5,586

13,964

$ 349

NET

8,212

20,530

$ 513

OTHER TOTAL

(Potential Label Expansion)

33,659

84,147

$ 2,104

TOTAL

42,367

105,917

$ 2,648

Sources: LEK Consulting, GLOBOCAN, Company estimates.

1) Assume 2.5 treatments per patient.

2) Estimated ASP of $25K. |

39

DELCATH SYSTEMS, INC

APAC Market by Disease

China

(Device)

S. Korea

(Device)

Japan

(Device)

Taiwan

(Device)

Australia

(Device)

Total

Potential

(patients)

Potential

Market

($MM)

1,2

Total Potential Market #Patients

HCC

(Primary)

85,780

3,258

8,296

2,152

263

99,749

$ 1,156

Other

CRC

31,127

3,245

14,298

1,441

2,031

52,143

$ 642

NET

29,197

1,048

2,759

500

462

33,966

$ 393

Ocular

Melanoma

1,765

66

175

31

96

2,134

$ 25

Cutaneous

Melanoma

382

43

136

246

1,144

1,951

$ 23

OTHER

TOTAL

62,472

4,403

17,368

2,218

3,733

90,194

$ 1,083

TOTAL

148,104

7,661

25,665

4,370

3,996

189,943

$ 2,239

APAC Target Markets Represent Over $2 Billion Potential Market Opportunity

Sources: LEK Consulting, GLOBOCAN, Company estimates.

1) Assume 2.5 treatments per patient.

2) Estimated ASP of ~$5K. |

40

DELCATH SYSTEMS, INC

Appendix III

CHEMOSAT Melphalan Phase I and II |

41

DELCATH SYSTEMS, INC

Melphalan Dosing & Background

•

Well understood, dose dependant, tumor preferential, alkylating cytotoxic agent

that demonstrates little to no hepatic toxicity

•

Manageable systemic toxicities associated with Neutropenia and

Thrombocytopenia

•

Drug dosing 12x higher than FDA-approved dose via systemic IV

chemotherapy •

Dose delivered to tumor is over 100x higher than that of systemic IV

chemotherapy

Type

Dosing (mg/kg)

Multiple Myeloma (label)

0.25

Chemoembolization

0.62

Surgical Isolated Hepatic Perfusion (IHP)

1.50

Myeloablation

2.50-3.50

Chemosaturation (PHP)

3.00

An Established Drug for Liver Cancer Therapy |

42

DELCATH SYSTEMS, INC

Phase II NCI Trial –

Metastatic Neuroendocrine Cohort

Pre-CS

(Baseline)

Post-CS #2

(+4 Months)

Post-CS #1

(+6 Weeks)

Compelling Clinical Data in Attractive mNET Market

Phase II mNET Tumor Cohort (n=24)*

Number (n)

Primary Tumor Histology

Carcinoid

4

Pancreatic Islet Cell

20

Response

Not Evaluable (Toxicity, Incomplete Treatment, Orthotopic Liver

Transplantation)

4

Progressive Disease

2

Minor Response / Stable Disease

4

Partial

Response

(30.0%

-

99.0%

Tumor

Reduction)

13

Complete Response (No Evidence of Disease)

1

Objective Tumor Response

14

Objective Tumor Response Rate

70%

Duration (months)

Median Hepatic PFS

15.5

Overall Survival After CS

30.4

*Presentation at ECCO/ESMO 2011 annual meeting. |

43

DELCATH SYSTEMS, INC

Phase II NCI Trial –

HCC Cohort

•

Hepatocellular

carcinoma

(HCC)

is

the

most

common

primary

cancer

of

the liver, with approximately 749,000* new cases diagnosed worldwide

annually

•

Nine patients with tumors of hepatobiliary origin: five HCC patients and

four cholangiocarcinoma patients

•

Both groups received CHEMOSAT procedures and had positive efficacy

signals

•

The responses were especially encouraging in the HCC group and

consisted of confirmed partial response or durable stable disease

•

Safety profile –

expected and consistent with pivotal US Phase III

melanoma trial

•

Intend to invest in new HCC trials with CHEMOSAT

Encouraging Initial Positive Signal for Primary Liver Cancer

*Source: GLOBOCAN |

44

DELCATH SYSTEMS, INC

•

Substantial clinical evidence of benefit of using melphalan to treat

mCRC via isolated hepatic perfusion (IHP) procedure

o

Over 800 patients treated in 15 studies since 1998

o

Patients treated only once

o

Median response rate of 47% (range 29%-76%)

1

•

Delcath Phase

II

NCI

Chemosaturation

Trial

–

mCRC

Cohort

o

Challenges enrolling at NCI

o

16 patients treated since 2004

o

Inconclusive efficacy due to advanced disease status (generally 5

th

or 6

th

line)

o

Safety profile –

expected and consistent with pivotal FDA Phase III

melanoma trial

•

Intend to invest in new mCRC trials with CHEMOSAT Melphalan

Strong Rationale for Using CHEMOSAT with Melphalan to Treat mCRC

1) van Iersel LB, Koopman M, Van D, V, et al. Ann Oncol. 2010;21:1662-7.

Phase II NCI Trial –

mCRC Cohort |

Appendix IV

Published Phase I/II Studies of

Doxorubicin with PHP (percutaneous hepatic

perfusion) for HCC

45

DELCATH SYSTEMS, INC |

46

DELCATH SYSTEMS, INC

CHEMOSAT Doxorubicin Development

•

Multiple published Phase I/II studies from MD Anderson Cancer Center

and Yale with percutaneous hepatic perfusion (PHP) and Kobe

University using doxorubicin show promising response rates for HCC*

•

Status:

o

First pass removal efficiency 95% in initial in vitro studies

o

Utilize new trade secret manufacturing process

o

Intend to file and seek CE Mark approval in 2H 2012

o

Plan to use CHEMOSAT Doxorubicin in Asia Phase III 2L

HCC trials

•

Expected Benefits:

o

Multiple treatments

o

Reduced systemic toxicity for improved safety profile

o

Concomitant therapy (complements systemic therapies)

Addressing the Large HCC Market Opportunity in China

|

47

DELCATH SYSTEMS, INC

Phase I/II Studies of PHP-Doxorubicin For HCC

Delivered Safely in Multiple Studies with Promising Response Rates

1) Ku Y et al. Chir Gastroenterol 2003;19:370–376.

2) Curley SA et al. Ann Surg Oncol 1994;1:389–99.

3) Ravikumar TS et al. J Clin Oncol 1994;12:2723–36.

4) Hwu WJ et al. Oncol Res 1999;11:529–37.

No. of

pts

No. of

PHP/

pt

Disease stage

(tumor diameter)

Treatment

Median survival

(mo)

Response

Rates

Reference

HCC

(n=79)

CHM

(n=23)

1–4

1–2

IV A: n=66

IV B: n=13

All multiple

bilobar

Extrahepatic disease in 52%

Doxorubicin 60

–150 mg/m

2

Cisplatin

50–150 mg/m

2

Mitomycin C 50–200 mg/m

2

16

13

HCC pts

RR 64.5%

5-year

survival 20.3%

Kobe

1

Phase I/II

HCC

(n=11)

1–3

Mean

9.5 cm

Doxorubicin 60

–120 mg/m

2

6.5

13 (responders)

2 (non-responders)

RR 20%

MDACC

2

Phase I

HCC

(n=5)

CHM

(n=8)

Other

(n=8)

2–4

Extrahepatic disease in 17%

Doxorubicin 50

–120 mg/m

2

5-FU 1000–5000 mg/m

2

NR

RR 22%

Yale

3

Phase I

HCC

(n=7)

Other

(n=11)

1–10

NR

Doxorubicin 90

–120 mg/m

2

23 (responders)

8 (non-responders)

RR 58%

Yale

4

Phase I |

48

DELCATH SYSTEMS, INC

Appendix V

Product Development Pipeline |

49

DELCATH SYSTEMS, INC

Product Development Pipeline

•

Melanoma liver mets

•

Proprietary drug-melphalan &

CHEMOSAT

•

All liver cancers –

melphalan

•

Class III medical device

•

3

rd

party melphalan

•

Gen 2 melphalan CE Mark

•

CHEMOSAT for additional drugs

•

CHEMOSAT for other organs (lung

and brain)

•

mCRC and HCC indications

Initial Opportunity

Near Term (< 5 years)

Intermediate Term (> 5 years)

•

Doxorubicin system CE Mark

•

mCRC and HCC clinical trials

•

CHEMOSAT for additional drugs

•

CHEMOSAT for other organs (lung

and brain)

•

CHEMOSAT Melphalan in South

Korea, Japan

•

CHEMOSAT Doxorubicin in

China and Taiwan

•

3

rd

party doxorubicin

•

CHEMOSAT for additional drugs

•

CHEMOSAT for other organs (lung

and brain)

•

CHEMOSAT Melphalan in

Australia and Hong Kong

•

3

rd

party melphalan

Development Aligned to Address Significant Market Opportunity

|

51

DELCATH SYSTEMS, INC

©

2011 DELCATH SYSTEMS, INC. ALL RIGHTS RESERVED

Concentrating the Power of Chemotherapy

TM |