Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - BIRCH BRANCH INC | v320847_ex32-2.htm |

| EX-31.1 - CERTIFICATION - BIRCH BRANCH INC | v320847_ex31-1.htm |

| EX-32.1 - CERTIFICATION - BIRCH BRANCH INC | v320847_ex32-1.htm |

| EX-31.2 - CERTIFICATION - BIRCH BRANCH INC | v320847_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2012

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______.

BIRCH BRANCH, INC.

(Exact name of registrant as specified in Charter)

| Colorado | 333-126654 | 84-1124170 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Commission File No.) | (IRS Employee Identification No.) |

c/o Henan Shuncheng Group Coal Coke Co., Ltd.

Henan Shuncheng Group Coal Coke Co., Ltd. (New Building), Cai Cun Road Intersection,

Anyang County, Henan Province, China 455141

(Address of Principal Executive Offices)

+86 372 323 7890

(Issuer Telephone number)

| (Former Name or Former Address if Changed Since Last Report) |

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2)has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No x

State the number of shares outstanding of each of the issuer’s classes of common equity, as of August 8, 2012: 32,047,222.

BIRCH BRANCH, INC.

QUARTERLY REPORT ON FORM 10-Q

August 14, 2012

TABLE OF CONTENTS

| PAGE | |||

| PART 1 – FINANCIAL INFORMATION | 2 | ||

| Item 1. | Financial Statements (Unaudited) | 2 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 34 | |

| Item 4. | Controls and Procedures | 34 | |

| PART II – OTHER INFORMATION | 35 | ||

| Item 1. | Legal Proceedings | 35 | |

| Item 1A. | Risk Factors | 35 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 35 | |

| Item 3. | Defaults Upon Senior Securities | 35 | |

| Item 4. | Mine Safety Disclosures | 35 | |

| Item 5. | Other Information | 35 | |

| Item 6. | Exhibits | 35 | |

| SIGNATURES | 36 | ||

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to Birch Branch, Inc. and its subsidiaries. “SEC” refers to the Securities and Exchange Commission.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

Birch Branch, Inc.

Consolidated Balance Sheets

As of June 30, 2012 and December 31, 2011

(Stated in US Dollars)

| 6/30/2012 | 12/31/2011 | |||||||

| (Unaudited) | (Audited) | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 3,991,097 | $ | 2,704,987 | ||||

| Restricted cash | 165,136,404 | 142,168,060 | ||||||

| Bank notes receivable | 4,280,051 | 145,162 | ||||||

| Trade receivables, net | 34,958,447 | 15,822,298 | ||||||

| Other receivables | 9,978,039 | 7,514,142 | ||||||

| Related party receivables | 9,829,010 | 3,500,715 | ||||||

| Inventories | 33,472,936 | 50,042,822 | ||||||

| Advances to suppliers and prepayments | 74,745,332 | 66,450,939 | ||||||

| Deposits | 2,982,340 | 3,301,491 | ||||||

| Total current assets | 339,373,656 | 291,650,616 | ||||||

| Non-current assets: | ||||||||

| Property, plant and equipment, net | 142,308,930 | 68,927,116 | ||||||

| Construction in Progress | 30,366,688 | 83,621,292 | ||||||

| Intangible assets, net | 825,524 | 870,903 | ||||||

| Long-term investments | 25,752,825 | 24,352,460 | ||||||

| Total non-current assets | 199,253,967 | 177,771,771 | ||||||

| Total assets | $ | 538,627,623 | $ | 469,422,387 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Liabilities | ||||||||

| Current liabilities: | ||||||||

| Bank notes payable | $ | 231,298,113 | $ | 186,890,191 | ||||

| Short term bank loans | 75,052,570 | 66,538,879 | ||||||

| Accounts payable | 98,957,591 | 68,841,304 | ||||||

| Accrued liabilities | 3,081,508 | 660,695 | ||||||

| Taxes payable | 15,898,875 | 12,199,742 | ||||||

| Other payable | 9,773,273 | 9,179,612 | ||||||

| Long-term bank loans, current portion | 6,324,211 | 3,142,331 | ||||||

| Capital lease obligation, current portion | 4,134,631 | 4,087,562 | ||||||

| Customer deposits | 19,812,313 | 8,202,109 | ||||||

| Total current liabilities | 464,333,085 | 359,742,425 | ||||||

| Non-current liabilities: | ||||||||

| Notes payable to related party | 64,392,843 | 70,190,769 | ||||||

| Forgivable loans | 7,008,806 | 6,235,959 | ||||||

| Long-term bank loans | - | 3,142,332 | ||||||

| Capital lease obligation, non-current portion | 10,198,819 | 11,509,361 | ||||||

| Total non-current liabilities | 81,600,468 | 91,078,421 | ||||||

| Total liabilities | $ | 545,933.553 | $ | 450,820,846 | ||||

The accompanying notes are an integral part of these consolidated financial statements

| 2 |

Birch Branch, Inc.

Consolidated Balance Sheets

As of Jun 30, 2012 and December 31, 2011

(Stated in US Dollars)

| 6/30/2012 | 12/31/2011 | |||||||

| (Unaudited) | (Audited) | |||||||

| Stockholders’ Equity | ||||||||

| Preferred stock, 50,000,000 shares authorized, $0 par value, 0 shares issued and outstanding | $ | - | $ | - | ||||

| Common stock, 500,000,000 shares authorized, $0 par value, 32,047,222 and 32,047,222 shares issued and outstanding as of June 30, 2012 and December 31, 2011 | 6,963,403 | 6,963,403 | ||||||

| Statutory reserve | 234,683 | 234,683 | ||||||

| Retained earnings | (21,410,453 | ) | 6,369,358 | |||||

| Accumulated other comprehensive income | 6,472,224 | 4,594,559 | ||||||

| Non-controlling interest | 434,213 | 439,538 | ||||||

| Total stockholders’ equity | (7,305,930 | ) | 18,601,541 | |||||

| Total liabilities and equity | $ | 538,627,623 | $ | 469,422,387 | ||||

The accompanying notes are an integral part of these consolidated financial statements

| 3 |

Birch Branch, Inc.

Consolidated Statements of Operations

For the three months and six months ended June 30, 2012 and 2011

(Stated in US Dollars)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Revenues | $ | 124,421,166 | $ | 107,899,146 | $ | 200,666,826 | $ | 187,932,441 | ||||||||

| Cost of revenues | 122,241,886 | 101,111,277 | 203,944,779 | 172,571,056 | ||||||||||||

| Gross profit | 2,179,280 | 6,787,869 | (3,277,953 | ) | 15,361,385 | |||||||||||

| Operating expenses: | ||||||||||||||||

| Sales and marketing | 4,740,319 | 2,674,728 | 6,157,072 | 4,800,537 | ||||||||||||

| General and administrative | 2,715,185 | 2,489,127 | 7,309,315 | 4,641,387 | ||||||||||||

| Total operating expenses | 7,455,504 | 5,163,855 | 13,466,387 | 9,441,924 | ||||||||||||

| Income (loss) from operations | (5,276,224 | ) | 1,624,014 | (16,744,340 | ) | 5,919,461 | ||||||||||

| Other income (expenses): | ||||||||||||||||

| Interest income | 1,069,337 | 445,038 | 2,096,381 | 776,897 | ||||||||||||

| Interest expense | (6,154,606 | ) | (3,978,828 | ) | (13,837,291 | ) | (7,920,141 | ) | ||||||||

| Other income | 526,092 | 534,207 | 726,143 | 739,870 | ||||||||||||

| Other expenses | (11,459 | ) | (27,862 | ) | (26,029 | ) | (149,583 | ) | ||||||||

| Total other income (expenses) | (4,570,636 | ) | (3,027,445 | ) | (11,040,796 | ) | (6,552,957 | ) | ||||||||

| Income (loss) before provision for income taxes | (9,846,860 | ) | (1,403,431 | ) | (27,785,136 | ) | (633,496 | ) | ||||||||

| Provision for (benefit from) income taxes | - | (204,265 | ) | - | - | |||||||||||

| Net income (loss) | $ | (9,846,860 | ) | $ | (1,199,166 | ) | $ | (27,785,136 | ) | $ | (633,496 | ) | ||||

| Net income attributable to: | ||||||||||||||||

| - Common stockholders | (9,844,267 | ) | (1,194,180 | ) | (27,779,811 | ) | (632,744 | ) | ||||||||

| - Non-controlling interest | (2,593 | ) | (4,986 | ) | (5,325 | ) | (752 | ) | ||||||||

| Other Comprehensive Income/(Loss) | ||||||||||||||||

| Foreign currency translation adjustments | (14,046 | ) | 821,411 | 1,877,665 | 965,495 | |||||||||||

| Total Comprehensive Income/(Loss) | $ | (9,860,906 | ) | $ | (377,755 | ) | $ | (25,907,471 | ) | $ | 331,999 | |||||

| Earnings per share | ||||||||||||||||

| - Basic | $ | (0.31 | ) | $ | (0.04 | ) | $ | (0.87 | ) | $ | (0.02 | ) | ||||

| - Diluted | $ | (0.31 | ) | $ | (0.04 | ) | $ | (0.87 | ) | $ | (0.02 | ) | ||||

| Weighted average shares outstanding | ||||||||||||||||

| - Basic | 32,047,222 | 32,047,222 | 32,047,222 | 32,047,222 | ||||||||||||

| - Diluted | 32,047,222 | 32,047,222 | 32,047,222 | 32,047,222 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

| 4 |

Birch Branch, Inc.

Consolidated Statements of Stockholders’ Equity

As of June 30, 2012 and December 31, 2011

(Stated in US Dollars)

| Accumulated | ||||||||||||||||||||||||||||||||

| Non- | Other | |||||||||||||||||||||||||||||||

| Common Stock | Registered | Statutory | Retained | controlling | Comprehensive | Total | ||||||||||||||||||||||||||

| No. of Shares | Amount | Capital | Reserve | Earnings | Interest | Income | Equity | |||||||||||||||||||||||||

| Balance at January 1, 2011 (Audited) | 32,047,222 | $ | - | $ | 6,963,403 | $ | 234,683 | $ | 38,499,365 | $ | 427,395 | $ | 3,366,695 | $ | 49,491,541 | |||||||||||||||||

| Apportionment of loss to non-controlling interest | (12,143 | ) | 12,143 | - | ||||||||||||||||||||||||||||

| Net income for year ended December 31, 2011 | (32,117,864 | ) | (32,117,864 | ) | ||||||||||||||||||||||||||||

| Foreign currency translation gain | 1,227,864 | 1,227,864 | ||||||||||||||||||||||||||||||

| Balance at December 31, 2011 (Audited) | 32,047,222 | $ | - | $ | 6,963,403 | $ | 234,683 | $ | 6,369,358 | $ | 439,538 | $ | 4,594,559 | $ | 18,601,541 | |||||||||||||||||

| Apportionment of loss to non-controlling interest | 5,325 | (5,325 | ) | - | ||||||||||||||||||||||||||||

| Net income for six months ended June 30, 2012 | (27,785,136 | ) | (27,785,136 | ) | ||||||||||||||||||||||||||||

| Foreign currency translation gain | 1,877,665 | 1,877,665 | ||||||||||||||||||||||||||||||

| Balance at June 30, 2011 | 32,047,222 | $ | - | $ | 6,963,403 | $ | 234,683 | $ | (21,410,453 | ) | $ | 434,213 | $ | 6,472,224 | $ | (7,305,930 | ) | |||||||||||||||

| 5 |

Birch Branch, Inc.

Consolidated Statements of Cash Flows

For the six months ended June 30, 2012 and 2011

(Stated in US Dollars)

| Six Months Ended June 30, | ||||||||

| 2012 | 2011 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (27,785,136 | ) | $ | (633,496 | ) | ||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 7,076,021 | 4,229,481 | ||||||

| Bad debt expense | - | 79,620 | ||||||

| Change in assets and liabilities: | ||||||||

| Increase in Trade receivables | (19,036,586 | ) | (1,926,474 | ) | ||||

| Decrease/(Increase) in Inventories | 16,884,785 | (4,855,376 | ) | |||||

| Increase in Prepayments and other receivables | (10,065,097 | ) | (25,778,631 | ) | ||||

| Decrease/(Increase) in Related party receivables | 612,017 | (561,584 | ) | |||||

| Increase in Accounts payable | 28,706,225 | 23,107,098 | ||||||

| Decrease in Other payables and current liabilities | 18,133,509 | (10,149,136 | ) | |||||

| Net cash provided by (used in) operating activities | 14,525,738 | (16,488,498 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Increase in restricted cash | (22,073,739 | ) | (54,882,726 | ) | ||||

| Long-term investment in equities | (1,247,125 | ) | - | |||||

| Acquisitions of property, plant and equipment | (10,596,516 | ) | (3,638,778 | ) | ||||

| Increase in construction in progress | (14,383,931 | ) | (21,636,736 | ) | ||||

| Increase in Bank notes receivable | (4,133,976 | ) | (744,049 | ) | ||||

| Collection/(Advance) loans to individuals and companies | (227,762 | ) | - | |||||

| Advance to related parties | (6,918,283 | ) | - | |||||

| Net cash used in investing activities | (59,581,332 | ) | (80,902,289 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from borrowings from bank and others | 40,316,843 | 29,617,521 | ||||||

| Repayment of bank borrowings and others | (32,221,853 | ) | (24,137,708 | ) | ||||

| Increase in bank notes payable | 43,231,899 | 79,680,310 | ||||||

| Repayment of capital lease obligation | (1,654,603 | ) | 11,663,302 | |||||

| Proceeds from deposit for capital lease obligation | 339,926 | 1,846,047 | ||||||

| Proceeds from forgivable loans | 733,607 | - | ||||||

| Payment to related parties | (6,239,608 | ) | - | |||||

| Net cash provided by financing activities | 44,506,211 | 98,669,472 | ||||||

| Net increase in cash | 1,286,110 | 2,024,762 | ||||||

| Effect of exchange rate changes | 1,835,493 | 746,077 | ||||||

| Cash at beginning of the period | 2,704,987 | 9,213,760 | ||||||

| Cash at end of the period | $ | 3,991,097 | $ | 11,238,522 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest received | $ | 985,879 | $ | 776,897 | ||||

| Interest paid | 9,976,831 | 9,863,174 | ||||||

| Non-Cash Investing and Financing Activities: | ||||||||

| Addition of PPE transferred from CIP | $ | 69,382,559 | $ | - | ||||

| Accounts Payable for constructions | $ | 976,872 | $ | |||||

The accompanying notes are an integral part of these consolidated financial statements

| 6 |

Birch Branch, Inc.

Notes to Unaudited Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 1. | The Company and Principal Business Activities |

| A. | Organizational History |

| I. | Ultimate Holding Company |

| a.) | Birch Branch, Inc. (“BRBH”) was incorporated in the State of Colorado on September 29, 1989. BRBH was originally formed to pursue real estate development projects until December 16, 2006. Unless the context requires or is otherwise indicated, the term the “Company” includes BRBH and the following entities, after giving effect to the Share Exchange (as defined herein): |

| II. | Intermediary Holding Companies |

| a.) | Shun Cheng Holdings HongKong Limited (“Shun Cheng HK”) is an investment holding company that was incorporated in Hong Kong on December 18, 2009. |

Shun Cheng HK does not have any operations. Its sole purpose is to act as an intermediary holding company.

| b.) | On March 17, 2010, under the laws of the Henan Province, in the People’s Republic of China (“PRC”), Anyang Shuncheng Energy Technology Co., Ltd. (“Anyang WOFE”) was incorporated as a wholly-foreign owned entity. Anyang WOFE is wholly-owned by Shun Cheng HK. |

Anyang WOFE does not conduct operations. All operations are conducted through the operating entities via a variable interest entity agreement detailed below.

| III. | Operating Entities |

All of the Company’s operations are located in the PRC, and are conducted through its operating entities detailed below:

a.) Henan Shuncheng Group Coal Coke Co., Ltd. (“SC Coke”) is a limited liability company organized in the PRC on August 27, 1997 as Anyang ShunCheng Washing Co., Ltd. In February 2005, the name was changed to Coal Coking Co., Ltd. In August 2007, the name was changed to the current name of Henan Shuncheng Group Coal Coke Co., Ltd. SC Coke has three shareholders: Wang Xinshun, Wang Xinming and Cheng Junsheng (collectively, the “SC Coke Shareholders”) owning 60%, 20% and 20% interests, respectively.

SC Coke is located in the Henan Province coal chemical industry cluster area in Anyang County, about 40 kilometers (approximately 25 miles) to the northwest of Anyang City. SC Coke is principally engaged in the processing of coal into coke, and related byproducts of cleaned coal, tar, crude benzene, and ammonium sulfate.

b.) Henan Shuncheng Group Longdu Trade Co., Ltd. (“Longdu”) is a limited liability company organized in the PRC on May 25, 2004. SC Coke holds an 86% interest in Longdu. The Company’s Chairman, Mr. Wang Xinshun, owns a 5% interest in Longdu.

Longdu is principally engaged in coal-washing and the production of refined coal, medium coal and coal slurry. The majority of Longdu’s coal is sent to the Company for further processing, while the remainder is sold to outside customers.

| 7 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| B. | Variable Interest Entity Agreement |

On March 19, 2010, Anyang WOFE entered into four contractual arrangements that for accounting purposes will be collectively known as the variable interest entity (“VIE”) agreement with the SC Coke Shareholders. The VIE agreement entitles Anyang WOFE to 100% of the future earnings and losses of both SC Coke, and its proportional 86% share of the earnings of Longdu. The Company filed with the Securities and Exchange Commission (“SEC”) a Current Report on Form 8-K on July 2, 2010 that included the documents comprising the VIE agreement as exhibits. The Company accounted for the VIE agreement, in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810-10, by consolidating SC Coke and Longdu as operating entities (similar to a subsidiary) of both Anyang WOFE and the Company, because the Company: (1) has the authority to direct the operations of SC Coke and Longdu, (2) has the authority to provide financial support for SC Coke and Longdu, and (3) is primary beneficiary of the results of operations of SC Coke and Longdu. The significant terms of the VIE agreement are detailed for each of the contractual arrangements below:

| I. | Entrusted Management Agreement |

Anyang WOFE has full and exclusive rights to manage SC Coke. These rights include, but are not limited to: appointment and dismissal of the members of the board of directors, hiring and termination of managerial and administrative personnel, and control over assets, which includes deployment and disposition thereof, and related cash flows generated by these assets.

Anyang WOFE is entitled to receive a quarterly management fee paid 45 days in arrears from the end of the quarter equivalent to SC Coke’s earnings before taxes for the quarter, subject to quarterly and annual adjustments.

Anyang WOFE is subject to operational risk and is obligated to settle debts on behalf of SC Coke, if SC Coke does not have sufficient funds to pay its debts itself.

| II. | Exclusive Option Agreement |

Anyang WOFE, or parties designated by Anyang WOFE, has been granted the irrevocable right to purchase all or part of the ownership interest of SC Coke from the SC Coke Shareholders for the minimum possible price permissible by PRC law. The option is exercisable only to the extent that such purchase does not violate any PRC law then in effect. The purchase right is exclusively granted to Anyang WOFE and is not transferable without the express written consent of the SC Coke Shareholders.

The SC Coke Shareholders cannot dispose, assign or mortgage SC Coke assets or operations without the express written consent of Anyang WOFE.

Unless unanimously terminated by all parties, the Exclusive Option Agreement remains in effect for SC Coke, the SC Coke Shareholders, and Anyang WOFE and their successors.

| III. | Shareholders' Voting Proxy Agreement |

The SC Coke Shareholders have irrevocably appointed the board of directors of Anyang WOFE as their proxy to vote on all matters that require the approval of the SC Coke Shareholders. These voting rights include, but are not limited to, the election of directors and the chairman of the board.

| 8 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

In the event that PRC regulations change (which regulations presently prohibit the transfer of SC Coke to Anyang WOFE), the SC Coke Shareholders may be exclusively permitted to transfer their ownership in SC Coke to Anyang WOFE; however, they are strictly prohibited from transferring their ownership in SC Coke to any other individuals or entities.

The SC Coke Shareholders have agreed to irrevocably and unconditionally indemnify the board of directors of Anyang WOFE from claims arising from the exercise of any of the powers conferred upon Anyang WOFE under the agreement.

| IV. | Shares Pledge Agreement |

The SC Coke Shareholders have pledged all of their ownership interests in SC Coke, including rights to PRC registered capital and dividends related to ownership in SC Coke, to guarantee their obligations under the Entrusted Management Agreement, the Exclusive Option Agreement and the Shareholders’ Voting Proxy Agreement.

| C. | Share Exchange Agreements |

On June 28, 2010, BRBH closed a share exchange transaction (the “Share Exchange”) in which BRBH issued 30,233,750 common shares to the former shareholders of Shun Cheng HK in exchange for all of the issued and outstanding shares of Shun Cheng HK. In connection with the Share Exchange, certain shareholders of BRBH agreed to cancel 435,123 common shares and BRBH issued 540,472 common shares to financial consultants. Immediately prior to the closing of the Share Exchange there were 1,708,123 common shares outstanding. Upon completion of the Share Exchange and transactions contemplated by the Share Exchange agreement, there were 32,047,222 common shares outstanding. Immediately following the closing of the Share Exchange, the former shareholders of Shun Cheng HK and the original shareholders of BRBH own approximately 95% and approximately 5% of BRBH’s issued and outstanding common shares, respectively.

The Share Exchange has been accounted for as a recapitalization of Shun Cheng HK in which BRBH (the legal acquirer) is considered the accounting acquiree and Shun Cheng HK (the legal acquiree) is considered the accounting acquirer. As a result of the Share Exchange, BRBH is deemed to be a continuation of the business of Shun Cheng HK. Accordingly, the financial data included in the accompanying consolidated financial statements for all periods prior to June 28, 2010 is that of the accounting acquirer Shun Cheng HK. The historical stockholders’ equity of the accounting acquirer prior to the Share Exchange has been retroactively restated as if the Share Exchange occurred as of the beginning of the first period presented.

| 2. | Summary of Significant Accounting Policies |

| A. | Financial Statement Presentation |

The financial statements are prepared in accordance with the accounting principles generally accepted in the United States of America (“US GAAP”). The consolidated financial statements include the accounts of BRBH, Shun Cheng HK, Anyang WOFE, SC Coke, and Longdu. All intercompany transactions, such as sales, cost of sales, and balances due to/due from, investment in subsidiaries, and subsidiaries’ capitalization have been eliminated.

| 9 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| B. | Non-controlling Interest |

14% of the registered capital of Longdu is owned by parties other than SC Coke. The Company’s Chairman, Mr. Wang Xinshun, owns a 5% interest in Longdu, while other investors own the remaining 9% interest. Mr. Wang’s and the other investors’ share of capital, retained earnings, and income are separately disclosed on the Company’s balance sheet and statement of operations.

| C. | Use of Estimates |

The preparation of consolidated financial statements in conformity with US GAAP requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, and expenses and the related disclosure of contingent assets and liabilities. Significant estimates and assumptions are used for, but not limited to: (1) allowance for trade receivables, (2) economic lives of property, plant and equipment, (3) asset impairments, and (4) contingency reserves. The Company bases its estimates on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates. In addition, any change in these estimates or their related assumptions could have an adverse effect on the Company’s operating results.

| D. | Foreign Currency Translation |

The accompanying consolidated financial statements are presented in U.S. Dollars. The functional currency of the Company’s operating entities is the RMB, the official currency of the PRC. Capital accounts of the consolidated financial statements are translated into U.S. Dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of the balance sheet date. Income and expenditures are translated at the average exchange rates for the six months ended June 30, 2012 and 2011. Currency translation adjustment results from translation to U.S. Dollar for financial reporting purposes are recorded in other comprehensive income as a component of owners’ equity. A summary of the conversion rates for the periods presented is as follows:

| 6/30/2012 | 12/31/2011 | 6/30/2011 | ||||||||||

| Period/year end RMB: U.S. Dollar exchange rate | 6.3249 | 6.3647 | 6.4640 | |||||||||

| Average RMB: U.S. Dollar exchange rate | 6.3074 | 6.4735 | 6.5482 | |||||||||

RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into U.S. Dollars at the rates used in translation.

| E. | Comprehensive Income |

The Company accounts for comprehensive income in accordance with the provisions of ASC topic 220, Comprehensive Income , which establishes standards for reporting comprehensive income or loss and its components in the financial statements. The accumulated other comprehensive income represents foreign currency translation adjustments.

| F. | Revenue Recognition |

In accordance with ASC 605-10, the Company recognizes revenue upon receipt of an acceptance of goods document issued by its customers. Each customer enters into an annual master sales agreement with the Company which will indicate a total volume for the year, and an acceptable range of prices, given market fluctuations on a short term basis, for the Company’s coke and coal byproducts. Final determination of the price for coke is determined on individual purchase orders which lie in the aforementioned price range. The Company’s coke and coal byproducts are fully usable at the point of shipment. From a revenue recognition perspective, the Company believes that collectability of the revenue is reasonably assured at the time that customers acknowledge receipt and accept the Company’s product. The Company has not experienced any material return of products, and as such, it has not prepared allowances for returns.

Customer payments received prior to completion of the above criteria are recorded as a liability on the Company’s balance sheet as unearned revenue.

| 10 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 3. | Trade Receivables |

The Company’s trade receivables as of June 30, 2012 and December 31, 2011, as well as the activity in the Company’s allowance for bad debts for the six-month ended June 30, 2012 and the year ended December 31, 2011 are set forth below:

| 6/30/2012 | 12/31/2011 | |||||||

| Trade Receivables | $ | 39,229,881 | $ | 20,093,732 | ||||

| Less: Allowance for Bad Debt | 4,271,434 | 4,271,434 | ||||||

| Trade Receivables, net | 34,958,447 | 15,822,298 | ||||||

| Allowance for Bad Debts | ||||||||

| Beginning Balance | 4,271,434 | 1,653,287 | ||||||

| Provision for bad debts | - | 2,618,147 | ||||||

| Less: Allowance write back because of bad debt recovery | - | - | ||||||

| Ending Balance | $ | 4,271,434 | $ | 4,271,434 | ||||

| 4. | Other Receivables |

Other receivables as of June 30, 2012 and December 31, 2011 are detailed in the table below:

| 6/30/2012 | 12/31/2011 | |||||||

| Project safety deposit | $ | 7,905 | $ | 110 | ||||

| Non-collateralized, non-interest bearing loans to individuals and companies receivable on demand | 4,012,458 | 3,784,696 | ||||||

| Others | 5,957,676 | 3,729,336 | ||||||

| $ | 9,978,039 | $ | 7,514,142 | |||||

| 5. | Inventories |

The components of the Company’s inventories as of June 30, 2012 and December 31, 2011 are as follows:

| 6/30/2012 | 12/31/2011 | |||||||

| Raw materials | $ | 4,321,659 | $ | 1,588,832 | ||||

| Work in process and semi-finished goods | 7,130,174 | 19,162,264 | ||||||

| Finished goods | 22,021,103 | 29,291,726 | ||||||

| Total inventories | $ | 33,472,936 | $ | 50,042,822 | ||||

| 6. | Advances to Suppliers and Prepayments |

The components of the Company’s advances to suppliers and prepayments as of June 30, 2012 and December 31, 2011 are as follows:

| 6/30/2012 | 12/31/2011 | |||||||

| Construction projects prepayments | $ | - | $ | - | ||||

| Prepayments for raw materials in operations | 74,745,332 | 66,336,798 | ||||||

| Prepaid taxes | - | 114,141 | ||||||

| $ | 74,745,332 | $ | 66,450,939 | |||||

| 11 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 7. | Property, Plant and Equipment, net |

The components of the Company’s plant and equipment are as follows:

| Accumulated | ||||||||||||

| 6/30/2012 | At Cost | Depreciation | Net | |||||||||

| Buildings and plant | $ | 35,820,788 | $ | 5,700,997 | $ | 30,119,791 | ||||||

| Machinery and equipment | 135,429,558 | 25,484,969 | 109,944,589 | |||||||||

| Electronic equipment | 1,103,353 | 533,441 | 569,912 | |||||||||

| Vehicles | 3,770,939 | 2,341,233 | 1,429,706 | |||||||||

| Wastewater treatment and environmental equipment | 822,364 | 577,432 | 244,932 | |||||||||

| Total plant and equipment | $ | 176,947,002 | $ | 34,638,072 | $ | 142,308,930 | ||||||

| Accumulated | ||||||||||||

| 12/31/2011 | At Cost | Depreciation | Net | |||||||||

| Buildings and plant | $ | 35,576,186 | $ | 4,820,117 | $ | 30,756,069 | ||||||

| Machinery and equipment | 1,388,507 | 848,902 | 539,605 | |||||||||

| Electronic equipment | 3,604,960 | 1,982,054 | 1,622,906 | |||||||||

| Vehicles | 54,974,689 | 19,277,467 | 35,697,222 | |||||||||

| Wastewater treatment and environmental equipment | 817,221 | 505,907 | 311,314 | |||||||||

| Total plant and equipment | $ | 96,361,563 | $ | 27,434,447 | $ | 68,927,116 | ||||||

Depreciation expenses related to plant and equipment were $ 7,025,020 and $ 4,180,356 for the six months ended June 30, 2012 and 2011, respectively.

| 8. | Construction in Progress |

The components of the Company’s construction in progress are as follows:

| Description | 6/30/2012 | 12/31/2011 | ||||||

| Coking furnace | $ | 340,921 | $ | 40,380,647 | ||||

| Office buildings | 4,988,510 | 5,662,946 | ||||||

| Plant and facilities | 1,914,984 | 26,582,072 | ||||||

| Sewage system | 566,186 | 35,526 | ||||||

| Deposits for construction projects | 22,556,087 | 10,960,101 | ||||||

| $ | 30,366,688 | $ | 83,621,292 | |||||

| 9. | Investments |

The following tabulation presents SC Coke’s investment in non-controlled entities, which are not included in the consolidation:

| Investment | Ownership | Type | 6/30/2012 | |||||||||

| Anyang Rural Credit Cooperative - Tongye Branch | 11.26 | % | Equity | $ | 5,818,274 | |||||||

| Anyang Urban Credit Cooperative | 11.26 | % | Equity | 9,451,375 | ||||||||

| Ansteel Group Metallurgy Stove Co., Ltd. | 19 | % | Equity | 2,463,280 | ||||||||

| Anyang Xinlong Coal (Group) Hongling Coal Co., Ltd. | 16 | % | Equity | 8,019,896 | ||||||||

| $ | 25,752,825 | |||||||||||

| 12 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 10. | Bank Notes Payable |

The following table provides the name of the financial institutions, due dates, and amounts outstanding at June 30, 2012 for the Company’s bank notes payable:

| Financial Institution | Due Date | 6/30/2012 | ||||||

| Guangdong Development Bank - Anyang Branch | 9/5/2012 | 3,162,105 | ||||||

| Guangdong Development Bank - Anyang Branch | 9/16/2012 | 3,162,105 | ||||||

| Guangdong Development Bank - Anyang Branch | 9/19/2012 | 3,162,105 | ||||||

| Guangdong Development Bank - Anyang Branch | 9/20/2012 | 1,581,053 | ||||||

| Guangdong Development Bank - Anyang Branch | 9/6/2012 | 3,162,105 | ||||||

| Guangdong Development Bank - Anyang Branch | 9/27/2012 | 1,581,053 | ||||||

| Guangdong Development Bank - Anyang Branch | 10/16/2012 | 2,371,579 | ||||||

| Guangdong Development Bank - Anyang Branch | 10/27/2012 | 3,162,105 | ||||||

| Guangdong Development Bank - Anyang Branch | 11/30/2012 | 2,371,579 | ||||||

| China Construction Bank - Zhongzhou Branch | 9/19/2012 | 6,324,212 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 7/5/2012 | 6,324,212 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 7/6/2012 | 3,162,105 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 7/6/2012 | 3,162,105 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 8/21/2012 | 1,581,053 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 9/21/2012 | 3,162,105 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 9/28/2012 | 3,162,105 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 11/24/2012 | 2,371,579 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 12/5/2012 | 5,059,369 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 12/7/2012 | 4,743,158 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 12/7/2012 | 3,162,105 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 12/12/2012 | 3,004,000 | ||||||

| Shanghai Pudong Development Bank -Zhengzhou Branch | 12/26/2012 | 2,371,579 | ||||||

| Commercial Bank of Anyang | 8/6/2012 | 9,486,316 | ||||||

| Commercial Bank of Anyang | 11/29/2012 | 6,324,211 | ||||||

| Commercial Bank of Anyang | 10/1/2012 | 4,743,158 | ||||||

| Commercial Bank of Anyang | 12/11/2012 | 3,162,105 | ||||||

| Bank of Luoyang - Zhengzhou Branch | 10/11/2012 | 4,743,158 | ||||||

| Bank of Luoyang - Zhengzhou Branch | 10/26/2012 | 1,581,053 | ||||||

| Bank of Luoyang - Zhengzhou Branch | 12/27/2012 | 3,320,211 | ||||||

| China Everbright Bank - Zhengzhou Branch | 7/30/2012 | 6,314,319 | ||||||

| China Everbright Bank - Zhengzhou Branch | 8/20/2012 | 4,743,158 | ||||||

| China Everbright Bank - Zhengzhou Branch | 8/21/2012 | 3,162,105 | ||||||

| China Everbright Bank - Zhengzhou Branch | 10/12/2012 | 3,162,105 | ||||||

| China Everbright Bank - Zhengzhou Branch | 12/20/2012 | 7,272,842 | ||||||

| China Everbright Bank - Zhengzhou Branch | 8/15/2012 | 3,162,105 | ||||||

| China Everbright Bank - Zhengzhou Branch | 8/27/2012 | 1,581,053 | ||||||

| China Everbright Bank - Zhengzhou Branch | 10/26/2012 | 3,162,105 | ||||||

| China Everbright Bank - Zhengzhou Branch | 11/8/2012 | 3,162,105 | ||||||

| Bank of Mingsheng - Zhengzhou Branch | 8/8/2012 | 7,905,263 | ||||||

| Bank of Mingsheng - Zhengzhou Branch | 8/13/2012 | 3,952,632 | ||||||

| Bank of Mingsheng - Zhengzhou Branch | 10/20/2012 | 7,272,842 | ||||||

| Bank of Mingsheng - Zhengzhou Branch | 12/4/2012 | 7,114,737 | ||||||

| Bank of Mingsheng - Zhengzhou Branch | 12/15/2012 | 1,976,316 | ||||||

| Bank of Mingsheng - Zhengzhou Branch | 10/24/2012 | 1,581,053 | ||||||

| China Citic Bank- Anyang Branch | 11/21/2012 | 1,581,053 | ||||||

| China Citic Bank- Anyang Branch | 11/25/2012 | 3,162,105 | ||||||

| China Citic Bank- Anyang Branch | 11/28/2012 | 3,636,421 | ||||||

| Bank of Ping Ding Shan | 9/26/2012 | 9,486,316 | ||||||

| China Merchants Bank - Anyang Branch | 9/13/2012 | 7,905,263 | ||||||

| Bank of China-Huojiacun Branch | 9/15/2012 | 6,403,263 | ||||||

| Industrial Bank-Weiyi Branch | 7/9/2012 | 7,905,263 | ||||||

| Industrial Bank-Weiyi Branch | 7/10/2012 | 7,905,263 | ||||||

| Industrial Bank-Weiyi Branch | 7/12/2012 | 6,324,211 | ||||||

| Industrial Bank-Weiyi Branch | 8/28/2012 | 1,581,053 | ||||||

| Industrial and Commercial Bank of China - Shuiye Branch | 10/27/2012 | 1,581,053 | ||||||

| China Minsheng Banking Corp. | 8/15/2012 | 3,636,421 | ||||||

| $ | 231,298,113 | |||||||

The bank notes payable do not carry a stated interest rate, but do carry a specific due date. These notes are negotiable documents issued by financial institutions on the Company’s behalf to vendors. These notes can either be endorsed by the vendor to other third parties as payment, or prior to coming due, they can factor these notes to other financial institutions. These notes are short term in nature and, as such, the Company does not calculate imputed interest with respect to them. These notes are collateralized by the Company’s deposits as described in Note 2 E - Restricted Cash.

| 13 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 11. | Loans |

The components of the Company’s loans payable are as follows:

| Due | Interest | |||||||||||||||

| Name of Creditors | Note | Date | Rate | 6/30/2012 | ||||||||||||

| Anyang Rural Credit Cooperative - Tongye Branch | A | 3/23/2013 | 10.933 | % | 4,743,158 | |||||||||||

| Shanghai Pudong Development Bank - Zhengzhou Branch | B | 9/11/2012 | 6.710 | % | 6,324,211 | |||||||||||

| Shanghai Pudong Development Bank - Zhengzhou Branch | C | 3/23/2013 | 7.820 | % | 6,324,211 | |||||||||||

| Shanghai Pudong Development Bank - Zhengzhou Branch | D | 8/21/2012 | 6.710 | % | 1,581,053 | |||||||||||

| Bank of China - Huojiacun Branch | E | 9/27/2012 | 7.216 | % | 3,162,105 | |||||||||||

| Commercial Bank of Anyang | F | 6/14/2013 | 6.310 | % | 3,162,105 | |||||||||||

| Agricultural Bank of China - Anyang Branch | G | 10/10/2012 | 8.856 | % | 1,106,737 | |||||||||||

| Agricultural Bank of China - Anyang Branch | H | 10/10/2012 | 8.856 | % | 1,581,053 | |||||||||||

| Agricultural Bank of China - Anyang Branch | I | 10/10/2012 | 8.856 | % | 1,581,053 | |||||||||||

| Agricultural Bank of China - Anyang Branch | J | 10/10/2012 | 8.856 | % | 3,636,421 | |||||||||||

| Guangdong Development Bank - Anyang Branch | K | 7/14/2012 | 7.216 | % | 4,743,158 | |||||||||||

| Bank of Luoyang - Zhengzhou Branch | M | 7/14/2012 | 7.872 | % | 3,162,105 | |||||||||||

| Bank of Luoyang - Zhengzhou Branch | N | 4/9/2013 | 7.872 | % | 3,162,105 | |||||||||||

| Bank of Luoyang – Zhengzhou Branch | 12/20/2012 | 7.020 | % | 1,581,053 | ||||||||||||

| China Citic Bank – Anyang Branch | O | 1/8/2013 | 7.544 | % | 3,162,105 | |||||||||||

| China Merchants Bank - Anyang Branch | P | 11/9/2012 | 7.544 | % | 1,581,053 | |||||||||||

| China Merchants Bank - Anyang Branch | Q | 11/30/2012 | 7.544 | % | 1,581,053 | |||||||||||

| Zhengzhou Bank - Nongye Eastern Road Branch | R | 12/14/2012 | 8.528 | % | 4,743,158 | |||||||||||

| Industrial Bank - Weiyi Branch | S | 1/13/2013 | 7.216 | % | 4,743,158 | |||||||||||

| ICBC - Shuiye Branch | T | 9/7/2012 | 7.216 | % | 4,268,842 | |||||||||||

| ICBC - Shuiye Branch | U | 10/1/2012 | 7.216 | % | 2,845,895 | |||||||||||

| China Construction Bank - Anyang Branch | V | 9/26/2012 | 6.655 | % | 1,581,053 | |||||||||||

| China Construction Bank - Anyang Branch | W | 10/26/2012 | 6.710 | % | 3,162,105 | |||||||||||

| China Citic Bank - Anyang Branch | X | 7/26/2012 | 7.216 | % | 3,162,105 | |||||||||||

| Tongye Credit Cooperatives - Anyang Branch | Y | 12/21/2012 | 15.088 | % | 4,695,726 | |||||||||||

| $ | 81.376,781 | |||||||||||||||

| 14 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

SC Coke has collateralized its debt obligations above. Refer to notes below for collateral corresponding to each obligation.

| A. | Guaranteed by Henan Hubo Cement Co., Ltd and Linzhou Hongqiqu Electrical Carbon co., Ltd |

| B. | Guaranteed by Anyang Liyuan Coking Co., Ltd and shareholders (Xinshun Wang, xinming Wang and Junsheng Cheng) |

| C. | Guaranteed by Anyang Liyuan Coking Co., Ltd |

| D | Guaranteed by Anyang Liyuan Coking Co., Ltd |

| E. | Guaranteed by Henan Xinlei Coking Group Co., Ltd |

| F. | Guaranteed by Linzhou Hongqiqu electrical Carbon Co., Ltd |

| G | Guaranteed by Henan Hubo Cement Co., Ltd |

| H. | Guaranteed by Henan Hubo Cement Co., Ltd |

| I. | Guaranteed by Henan Hubo Cement Co., Ltd |

| J. | Guaranteed by Henan Hubo Cement Co., Ltd |

| K | Guaranteed by Henan Henan Chengyu Coking Co., Ltd and Henan Hubo Cement Co., Ltd |

| M | Guaranteed by Anyang Xinpu Steel Co., Ltd, Xinshun Wang and Fengyun Wu |

| N. | Guaranteed by Xinlei Group Cheng Chen Coking and Xinshun Wang |

| O. | Guaranteed by Henan Chengyu Coking Co., Ltd |

| P. | Guaranteed by Anyang Liyuan Coking Co., Ltd and Henan Chengyu Coking Co., Ltd |

| Q | Guaranteed by Anyang Liyuan Coking Co., Ltd and Henan Chengyu Coking Co., Ltd |

| R. | Guaranteed by Anyang Liyuan Coking Co., Ltd and Linzhou Hongqiqu electrical Carbon Co., Ltd |

| S. | Guaranteed by Henan Yutian Chemical Co., Ltd and Henan Chengyu Coking Co., Ltd |

| T. | Guaranteed by Cleaned coal |

| U | Guaranteed by Cleaned coal |

| V. | Guaranteed by Linzhou Hongqiqu electrical Carbon Co., Ltd |

| W | Guaranteed by Linzhou Hongqiqu electrical Carbon Co., Ltd |

| X | Guaranteed by Henan Shuncheng Group Coking Co., Ltd and Henan Small Corporation Investment Co., Ltd |

| Y | Guaranteed by Anyang Nianxinpu Steel Co., Ltd |

| 12. | Other Payable |

Other payable as of June 30, 2012 and December 31, 2011 is detailed in the table below:

| 6/30/2012 | 12/31/2011 | |||||||

| Project safety deposit | $ | 1,702,817 | $ | 2,681,680 | ||||

| Payable for raw materials in operation | - | 20,542 | ||||||

| Advances from individuals and companies payable on demand | 8,017,071 | 5,477,457 | ||||||

| Others | 53,385 | 999,933 | ||||||

| $ | 9,773,273 | $ | 9,179,612 | |||||

| 13. | Notes Payable to Related Party |

| Creditor | Note | 6/30/2012 | 12/31/2011 | |||||||||

| Chairman, Wang Xinshun | A | $ | 24,728,950 | $ | 25,785,216 | |||||||

| SC Coke Shareholders | B | 39,663,893 | 44,405,553 | |||||||||

| $ | 64,392,843 | $ | 70,190,769 | |||||||||

| 15 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| A. | Notes Payable to Wang Xinshun |

On May 23, 2010, SC Coke entered into a formal loan agreement with the Company’s Chairman, Mr. Wang Xinshun, for amounts owed to him in the amount of approximately $35.6 million at December 31, 2009. The significant terms of the loan are: (a) 12 year term, beginning as of December 31, 2009 to December 31, 2021, (b) 3% fixed simple annual interest, (c) SC Coke has the option, but not the obligation, to pay interest for the first two years, (d) after the first two years, the balance of the loan will be amortized over the remaining 10 years of the term and SC Coke is required to make monthly interest and principal payments, and (e) Mr. Wang Xinshun is prohibited from declaring default against SC Coke.

The Company has neither accrued nor paid any interest for the note payable to Mr. Wang Xinshun during the six months ended June 30, 2012.

| B. | Notes Payable to SC Coke Shareholders |

On March 31, 2010, the SC Coke Shareholders, and Anyang Xinlong Coal (Group) Hongling Coal Co., Ltd., Anyang Huichang Coal Washing Co., Ltd. and Anyang Jindu Coal Co., Ltd (collectively, the “third party lenders”) formalized the terms for approximately $35.5 million of loans previously extended to SC Coke by the three lenders.

On June 21, 2010, the SC Coke Shareholders entered into an agreement with the third party lenders to assume the obligations of the third party lenders, and concurrently the third party lenders released SC Coke from any liability.

Also, on June 21, 2010, SC Coke and the SC Coke Shareholders entered into a debt agreement for the original principal amount of the loans due to the third party lenders (approximately $35.5 million), the significant terms of which are: (a) 15 year term, commencing on June 21, 2010, (b) 2% fixed simple annual interest, (c) SC Coke has the option, but not the obligation, to pay interest when accrued, and (d) the SC Coke Shareholders do not have the ability to declare a default.

| 14. | Forgivable Loans |

SC Coke is currently the beneficiary of two government grants that are generally intended to be used towards capital technology improvement with the end goal of increased production and energy efficiency. The grants were awarded during 2008 and 2009, respectively. These grants have been recorded as forgivable loans in the liability section of the balance sheet. SC Coke has received payment of the grants, but has not yet met all the criteria set forth under the grant. Upon receiving government approval of fulfilling all of the criteria set forth under the grant, SC Coke will credit the balance to other income on the consolidated statement of operations. SC Coke will also appropriate that same amount from retained earnings to statutory reserves indicating that the assets associated with these grants are not available for dividend distribution.

| 16 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 15. | Related Party Transactions |

SC Coke has specified the following transactions with related parties with ending balances as of June 30, 2012:

| A. | Trade Receivables and Revenue |

| (a) | Angang Steel Group Metallurgy Furnace Co., Ltd (Angang), in which SC Coke owns a 19% stake, is one of the customers of SC Coke. |

There was an ending balance in accounts receivable from Angang of approximately $47,801 as of June 30, 2012.

Revenue recorded in the consolidated financial statements from Angang amounts to approximately $ 699,732 for the six months ended June 30, 2012.

| B. | Deposits and Cost of Revenues |

| (a) | The Chairman and majority owner, Mr. Wang Xinshun, owns a 43.86% interest in Anyang Bailianpo Coal Co., Ltd. (Bailianpo) which provides raw coal to SC Coke. |

SC Coke had outstanding prepayment to Bailianpo of $434,997 as of June 30, 2012.

There were purchase transactions from Bailianpo amounted to approximately $63,713 for the six months ended June 30, 2012.

| (b) | SC Coke holds a 16% interest in Anyang Xinlong Coal (Group) Hongling Coal Co., Ltd. (Anyang Xinlong), which is a coal mine located in Anyang County providing SC Coke with a substantial portion of its coking coal requirements. |

SC Coke has an ending balance in accounts receivable from Anyang Xinlong of $61,314 as of June 30, 2012.

| C. | Advance to relatives of the Chairman |

As of June 30, 2012 and December 31, 2011, the advances to relatives of the Chairman are $9,284,898 and $2,351,815, respectively

| 17 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 16. | Income Taxes |

The Company and its operating entities are subject to income tax under the jurisdictions where they operate. The following table details the Company and its operating entities, and the statutory tax rates to which they are subject:

| Entity | Country of Domicile | Income Tax Rate | ||||||

| Birch Branch, Inc. | USA | 15.00%-35.00 | % | |||||

| Shuncheng Holdings HongKong Ltd. | HK | 16.50 | % | |||||

| Anyang Shuncheng Energy Technology Co., Ltd. | PRC | 25.00 | % | |||||

| Henan Shuncheng Group Coal Coke Co., Ltd. | PRC | 25.00 | % | |||||

| Henan Shuncheng Group Longdu Trade Co., Ltd. | PRC | 25.00 | % | |||||

Although the Company is subject to United States income taxes, it is a holding company with no operations or profits within the U.S. borders. The Company currently only incurs expenses in the United States that are associated with being a public company.

Income (loss) before taxes and provision for taxes (tax benefit) consisted of the following for the six months ended June 30, 2012 and 2011, respectively:

| 6/30/2012 | 6/30/2011 | |||||||

| Income (loss) before tax: | ||||||||

| USA | $ | - | $ | - | ||||

| HK | 4 | 7 | ||||||

| PRC | (26,746,368 | ) | (633,503 | ) | ||||

| Total: | $ | (26,746,364 | ) | $ | (633,496 | ) | ||

| Provision for income taxes: | ||||||||

| US Federal | - | - | ||||||

| State | - | - | ||||||

| PRC | $ | - | $ | - | ||||

| Total provision for taxes (tax benefit): | $ | - | $ | - | ||||

| Effective tax rate | 25 | % | 25 | % | ||||

The differences between the U.S. federal statutory income tax rates and the Company’s effective tax rate for the six months ended June 30, 2012 and 2011 are shown in the following table:

| 6/30/2012 | 6/30/2011 | |||||||

| US statutory tax rate | 35 | % | 35 | % | ||||

| Lower rates in the PRC | -10 | % | -10 | % | ||||

| Accrual and reconciling items | -25 | % | ||||||

| Fully reserved net Operating Loss | -25 | % | ||||||

| Effective tax rate: | 0 | % | 0 | % | ||||

| 18 |

Birch Branch, Inc.

Notes to Consolidated Financial Statements

As of June 30, 2012 and December 31, 2011

| 17. | Commitments and Contingencies |

Third Party Guarantees

SC Coke entered into agreements as a guarantor of debt for seventeen companies (the “guarantees”) in the amount of approximately $114,942,526 at June 30, 2012. Of the aforementioned guarantees, seven of the thirty companies have, in turn, guaranteed debts of approximately $69,566,317 on behalf of SC Coke at June 30, 2012. SC Coke has not historically incurred any losses due to such debt guarantees. Additionally, the Company has determined that the fair value of the guarantees is immaterial. For more details of the outstanding guarantees, see the table below:

| Guarantee | ||||||||||

| Guarantee Beneficiary | Creditor | End | 6/30/2011 | |||||||

| Linzhou Hongqiqu Electrical Carbon Co., Ltd | Agricultural Bank of China - Linzhou Branch | 2013.4.16 | 3,162,105 | |||||||

| Linzhou Hongqiqu Electrical Carbon Co., Ltd | Agricultural Bank of China - Linzhou Branch | 2013.1.11 | 4,743,158 | |||||||

| Linzhou Hongqiqu Electrical Carbon Co., Ltd | Agricultural Bank of China - Linzhou Branch | 2013.5.20 | 3,162,105 | |||||||

| Linzhou Hongqiqu Electrical Carbon Co., Ltd | Agricultural Bank of China - Linzhou Branch | 2013.6.18 | 7,905,263 | |||||||

| Linzhou Hongqiqu Electrical Carbon Co., Ltd | Agricultural Bank of China - Linzhou Branch | 2012.9.2 | 7,905,263 | |||||||

| Linzhou Hongqiqu Electrical Carbon Co., Ltd | Agricultural Bank of China - Linzhou Branch | 2013.2.13 | 3,162,105 | |||||||

| Henan Hubo Cement Co., Ltd. | Bank of China - Anyang Branch | 2012.11.14 | 4,743,158 | |||||||

| Henan Liyuan Coking Co., Ltd | China Merchants Bank - Anyang Branch | 2013.1.31 | 1,581,053 | |||||||

| Henan Liyuan Coking Co., Ltd | Shanghai Pudong Development Bank -Zhengzhou Branch | 2013.12.20 | 7,905,263 | |||||||

| Henan Liyuan Coking Co., Ltd | Shanghai Pudong Development Bank -Zhengzhou Branch | 2012.8.16 | 7,114,737 | |||||||

| Henan Liyuan Coking Co., Ltd | China Merchants Bank - Anyang Branch | 2012.9.20 | 3,162,105 | |||||||

| Henan Liyuan Coking Co., Ltd | China Merchants Bank - Anyang Branch | 2012.8.1 | 3,162,105 | |||||||

| Henan Liyuan Coking Co., Ltd | Bank of Luoyang - Zhengzhou Branch | 2012.8.20 | 4,743,158 | |||||||

| Henan Liyuan Coking Co., Ltd | Bank of China - Pangeng Branch | 2013.3.23 | 6,324,211 | |||||||

| Henan Chengyu Coking Co., Ltd | Guangdong Development Bank - Anyang Branch | 2012.9.20 | 9,486,316 | |||||||

| Henan Xinlei Group | China Minsheng Banking - Zhengzhou Branch | 2012.10.10 | 1,581,053 | |||||||

| Henan Fengtai Food Co., | China Minsheng Banking - Zhengzhou Branch | 2012.8.26 | 1,581,053 | |||||||

| Anyang Zhanqian Materials Co. | Shanghai Pudong Development Bank -Zhengzhou Branch | 2013.1.15 | 1,581,053 | |||||||

| Anyang Houde Trade Co., Ltd | Citic Bank - Anyang Branch | 2013.6.15 | 1,581,053 | |||||||

| Anyang Xinpu Steel Co., Ltd | City Cooperative | 2013.6.4 | 7,114,737 | |||||||

| Anyang Qili Cement Co., Ltd | Bank of Anyang | 2013.5.5 | 632,421 | |||||||

| Anyang Hongyuan Yinsheng Steel Co., Ltd | Bank of Anyang | 2013.5.5 | 158,105 | |||||||

| Henan Shuncheng Group Longdu Trade Co., Ltd | Citic Bank - Anyang Branch | 2012.7.27 | 3,162,105 | |||||||

| Henan Yuxin Acticated Carbon Co., Ltd | China Construction Bank - Anyang Branch | 2013.1.4 | 1,897,263 | |||||||

| Anyang Lichuang Trade Co. | Guangdong Development Bank - Anyang Branch | 2012.9.10 | 3,162,105 | |||||||

| Henan Yulong Coking Co., Ltd | Tongye Credit Union | 2013.2.15 | 3,162,105 | |||||||

| Linzhou Fengbao Pipe Co., Ltd | China Minsheng Banking - Anyang Branch | 2013.3.30 | 7,905,263 | |||||||

| Anyang Zhongyang Industrial Co., Ltd | Shanghai Pudong Development Bank -Zhengzhou Branch | 2012.9.6 | 790,526 | |||||||

| Anyang Zhongyang Industrial Co., Ltd | Shanghai Pudong Development Bank -Zhengzhou Branch | 2012.9.20 | 790,526 | |||||||

| Anyang Zhongyang Industrial Co., Ltd | Bank of Luoyang - Zhengzhou Branch | 2012.11.26 | 1,581,053 | |||||||

| $ | 114,942,526 | |||||||||

| 19 |

Capital Lease Obligations

SC Coke has entered into a non-cancellable lease agreement for certain machinery and equipment. The following table details SC Coke’s commitments for minimum lease payments and the related principal outstanding at June 30, 2012:

| Quarter ending June 30, 2012: | Principal | Payments | ||||||

| 2012 | $ | 2,179,057 | $ | 2,845,193 | ||||

| 2013 | 3,995,914 | 4,877,473 | ||||||

| 2014 | 4,349,836 | 4,877,473 | ||||||

| 2015 | 2,640,541 | 2,863,417 | ||||||

| 2016 | 1,168,102 | 1,193,091 | ||||||

| Total future minimum lease payments | $ | 14,333,450 | $ | 16,656,647 | ||||

Accrued Payment of Enterprise Income Taxes

Effective January 1, 2008, PRC government implements a new 25% income tax rate for all enterprise regardless of whether domestic or foreign enterprise without any tax holiday. Certain local government has the authority to defer the enterprise’s tax payment in a way to support local business. SC Coke is subject to the 25% tax rule. However, Anyang City government defers SC Coke income tax payment by implementing fixed payment quota instead of determining based on taxable income assessment. As of June 30, 2012, SC Coke had accrued approximately $15.9 million liability for estimated taxes. In the event that, PRC tax authority starts to collect this deferral, SC Coke will be subject to an overdue fine at the rate of 0.05% per day of the amount of taxes in arrears. The tax authority may also impose an additional fine of 50% to five times the underpaid taxes. SC Coke has been unable to determine the potential penalties and interest related to the overdue tax balance at this time.

SC Coke has available funds to cover the unpaid tax liability, but may not have sufficient funds available to pay the fine. The Chairman entered into a tax indemnity agreement on May 23, 2010, pursuant to which he agreed to indemnify SC Coke for any interest, penalties or other related extra costs resulting from the prior and any future tax underpayments in tax years in which he managed and operated SC Coke. The indemnification is capped at $35.6 million.

| 20 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto contained elsewhere in this Report. The following discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements.

Background

Operating through Henan Shuncheng Group Coal Coke Co., Ltd. (“SC Coke”), a variable interest entity incorporated under the laws of People’s Republic China (“PRC”), we are a vertically integrated coke producer with facilities and operations based solely in the PRC, principally in Henan Province. SC Coke, which operates and derives its revenue solely in the PRC, has a coke production plant with current capacity of approximately 1.7 million tons of coke annually, equity ownership in a coal mine and two coal washing plants (producing refined coal).

We control SC Coke and its operations through a series of contractual arrangements between Anyang Shuncheng Energy Technology Co., Ltd. (“Anyang WOFE”), our Chinese wholly-foreign owned enterprise subsidiary, and SC Coke and its shareholders.

Corporate History

We were incorporated in the State of Colorado on September 28, 1989. We were previously a residential real estate holding company. In September 2006, we sold our real estate assets to its then president and, effective December 6, 2006, our plan was to evaluate the structure and complete a merger with, or acquisition of, prospects consisting of private companies, partnerships or sole proprietorships.

On May 14, 2010, we entered into a share exchange agreement (the “Share Exchange Agreement”) with Shun Cheng Holdings Hong Kong Limited (“Shun Cheng HK”), the former shareholders of Shun Cheng HK (the “Shun Cheng HK Shareholders”), and our former principal shareholders, pursuant to which the Shun Cheng HK Shareholders agreed to transfer all of the issued and outstanding securities of Shun Cheng HK to us in exchange for 30,233,750 shares of our common stock (the “Share Exchange”). The Share Exchange closed on June 28, 2010, at which time Shun Cheng HK became our wholly-owned subsidiary. The acquisition of Shun Cheng HK has been accounted for as a reverse merger. For accounting purposes, Shun Cheng HK is the acquirer in the reverse acquisition transaction and, consequently, its financial results have been reported on a historical basis.

The corporate structure of the Company, after taking into account the Share Exchange, is as follows:

| 21 |

Contractual Arrangements

Our relationships with SC Coke and its shareholders are governed by a series of contractual arrangements, described below, through which we exercise management rights over SC Coke. None of the Company, Shun Cheng HK, and Anyang WOFE owns any direct equity interest in SC Coke. On March 19, 2010, Anyang WOFE entered into the following contractual arrangements with SC Coke and its shareholders:

Entrusted Management Agreement. Pursuant to the entrusted management agreement between Anyang WOFE, on the one hand, and SC Coke and Wang Xinshun, Wang Xinming and Cheng Junsheng (collectively, the “SC Coke Shareholders”), on the other hand, (the “Entrusted Management Agreement”), SC Coke and the SC Coke Shareholders agreed to entrust the business operations of SC Coke and its management to Anyang WOFE until Anyang WOFE acquires all of the assets or equity of SC Coke (as more fully described under “Exclusive Option Agreement” below). Under the Entrusted Management Agreement, Anyang WOFE manages SC Coke’s operations and assets, and controls all of SC Coke’s cash flow and assets through entrusted or designated bank accounts. In turn, it is entitled to any of SC Coke’s net earnings as a management fee, and is obligated to pay all SC Coke’s debts to the extent SC Coke is not able to pay such debts. Such management fees payable by SC Coke shall accrue until such time as the parties shall mutually agree. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of SC Coke by Anyang WOFE is completed.

Shareholders’ Voting Proxy Agreement. Under the shareholders’ voting proxy agreement (the “Shareholders’ Voting Proxy Agreement”) between Anyang WOFE and the SC Coke Shareholders, the SC Coke Shareholders irrevocably and exclusively appointed the board of directors of Anyang WOFE as their proxy to vote on all matters that require SC Coke shareholder approval. The Shareholders’ Voting Proxy Agreement shall not be terminated prior to the completion of the acquisition of all assets or equity of SC Coke by Anyang WOFE.

Exclusive Option Agreement. Under the exclusive option agreement (the “Exclusive Option Agreement”) between Anyang WOFE, on the one hand, and SC Coke and the SC Coke Shareholders, on the other hand, the SC Coke Shareholders granted Anyang WOFE an irrevocable exclusive purchase option to purchase all or part of the shares or assets of SC Coke. The option is exercisable at any time on or after June 28, 2010, but only to the extent that such purchase does not violate any PRC law then in effect. The exercise price shall be the minimum price permitted under the PRC law then applicable and such price, subject to applicable PRC law, shall be refunded to Anyang WOFE or SC Coke for no consideration or the minimum consideration permitted under the PRC law then applicable, whichever is more, in a manner decided by Anyang WOFE, at its reasonable discretion.

| 22 |

Shares Pledge Agreement. Under the shares pledge agreement between Anyang WOFE, on the one hand, and SC Coke and the SC Coke Shareholders, on the other hand, (the “Shares Pledge Agreement”), the SC Coke Shareholders pledged all of their equity interests in SC Coke, including the proceeds thereof, to guarantee all of Anyang WOFE’s rights and benefits under the Entrusted Management Agreement, the Exclusive Option Agreement and the Shareholders’ Voting Proxy Agreement. Prior to the termination of the Shares Pledge Agreement, the pledged equity interests cannot be transferred without Anyang WOFE’s prior consent.

Overview

SC Coke, which operates and derives its revenue solely in the PRC, is a vertically integrated coke producer, that has a coke production plant with current capacity of approximately 1.7 million tons of coke annually, equity ownership in a coal mine and two coal washing plants (producing refined coal). From our refined coal production process, byproducts such as medium coal and coal slurry are produced and sold. From coke production, SC Coke recycles and produces coke byproducts, including crude benzol, amsulfate, coal gas and tar. These coke byproducts are either marketed and sold, or recycled and consumed to provide electricity for its internal operations. For the purpose of this discussion, such refined coal and coke byproducts are referred to as “secondary products.”

The PRC coke manufacturing industry is highly competitive. The average sale prices for products are driven by a number of factors, including the particular composition and grade or quality of the coal or coke being sold, prevailing market prices for these products in the Chinese local, national and global marketplace, timing of sales, delivery terms, negotiations between SC Coke and its customers, and relationships with those customers.

The Chinese coking industry is also a regionalized business where supply of raw materials and the demand for coke become uneconomical at long distances as transportation costs become prohibitive. SC Coke estimates that supply of raw materials and demand for coke to be delivered by truck transportation is uneconomical beyond 800 kilometers (approximately 500 miles); and access to and delivery by rail becomes a critical competitive factor. SC Coke is located in close proximity to the main coal mining provinces of Shanxi and Henan in China and has a private railway line, approximately 1.7 kilometers (approximately 1 mile) in length, which provides connection to the national railway network.

As the coke industry is highly dependent on the iron and steel industries, it is affected by many of the same factors that impact the iron and steel industries. Iron and steel are basic commodities that are required in many other industries, such as construction, infrastructure works, automotive and aerospace. The iron and steel industries are highly cyclical and have historically been very volatile. Similarly, the price and demand for coke has also experienced such cyclicality and volatility. SC Coke intends to focus on better recycling and use of its secondary products, in particular coke byproducts. The applications for coke byproducts are expected to be more diverse; therefore, demand factors for coke byproducts are likely to be different from the factors applicable to the iron and steel industries; for example, coal tar is used for the treatment of psoriasis and amsulfate is used as agricultural fertilizer.

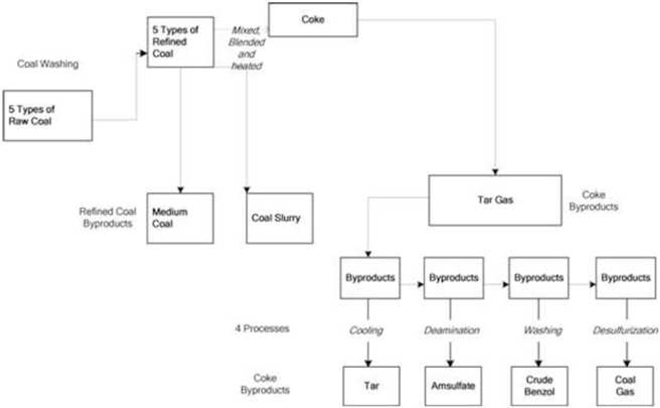

The primary raw material for coke production is coal, principally coking coal. Raw coal is washed to produce refined coal which is the main raw material for SC Coke’s coke production. Coke prices are highly correlated to coal prices. SC Coke’s production process is as follows:

| 23 |

Because of our reliance on coal, SC Coke acquired an equity ownership interest in a coal mine. Although SC Coke has developed multiple sources of coal supplies and long term relationships with its coal suppliers, because of the PRC government policies of encouraging consolidation in the coal mining industry, SC Coke may continue to invest in coal mines, if, when and where opportunities are available and the terms of such investments are economically attractive.

The PRC government recently adopted policies to encourage consolidation in the PRC coal mining industry whereby smaller and inefficient coal mines have been shut down. Similarly in the iron and steel industries, which are SC Coke’s main customers, companies have been merged and consolidated by the government. We believe that the coke manufacturing industry may face similar consolidation pressures in the future. Accordingly, SC Coke intends to continue its capacity expansion to maintain its competitive positioning.

SC Coke has started construction on two additional coke ovens which when completed are expected to increase SC Coke’s production capacity to approximately 3.0 million tons of coke annually. This increase in coke production may produce sufficient quantities of coke byproducts to allow SC Coke to potentially consider producing further downstream secondary products; for example, crude benzol, a current byproduct, may be processed further to produce benzene.

For the reasons above, the availability of expansion capital is critical to SC Coke to facilitate capacity expansion, downstream diversification or upstream acquisitions. If such capital is unavailable on commercial terms, if at all, SC Coke’s growth and business could be materially adversely affected.

Results of Operations

Three Months ended June 30, 2012 Compared to the Three Months ended June 30, 2011

Revenues. During the three months ended June 30, 2012, the primary business of production and sale of coke has contributed 87% of SC Coke’s total revenues.

| 24 |

Primary Products

SC Coke’s revenues for the three months ended June 30, 2012 and 2011, contributed by its primary products of coke and refined coal, were as follows:

| Revenues | ||||||||||||

| Coke | Refined Coal | Total | ||||||||||

| Revenues | ||||||||||||

| Three months ended June 30 2012 | $ | 107,840,834 | $ | 1,219,569 | $ | 109,060,403 | ||||||

| Three months ended June 30 2011 | 90,114,622 | - | 90,114,622 | |||||||||

| Increase (decrease) | $ | 17,726,212 | $ | 1,219,569 | $ | 18,945,781 | ||||||

| % Increase (decrease) | 20 | % | n/a | 21 | % | |||||||

| As Percentage of Total Revenues | ||||||||||||

| Three months ended June 30 2012 | 87 | % | 1 | % | 88 | % | ||||||

| Three months ended June 30 2011 | 84 | % | 0 | % | 84 | % | ||||||

| Quantity Sold (metric tons) | ||||||||||||

| Three months ended June 30 2012 | 429,184 | 6,000 | 435,184 | |||||||||

| Three months ended June 30 2011 | 365,026 | - | 365,026 | |||||||||

| Increase (decrease) | 64,158 | 6,000 | 70,158 | |||||||||

| % Increase (decrease) | 18 | % | n/a | 19 | % | |||||||

| Average Price Per Ton | ||||||||||||

| Three months ended June 30 2012 | $ | 251.27 | $ | 203 | ||||||||

| Three months ended June 30 2011 | 246.87 | n/a | ||||||||||

| Increase (decrease) | $ | 4.40 | $ | n/a | ||||||||

| % Increase (decrease) | 2 | % | n/a | |||||||||

Revenues for the three months ended June 30, 2012 increased significantly from the revenues for the three months ended June 30, 2011 by 18,945,781, from $90,114,622 primarily from the up in coke market.

Sales volume for coke benefited from the coke market, while sales volume for refined coal increased due to the decrease in the amount of refined coal available for external sales. Sales volume for coke for the three months ended June 30, 2012 increased over the comparable period in 2011 by 18% (from 365,026 tons to 429,184 tons); and there was no sales on refined coal for the three months ended June 30, 2011.

Product unit price for coke was kept at a low level. When compared with the same period of 2011, average sales price per ton for coke increased from $246.87 to $251.27.

Because of the up in product unit price and sales volume, revenues generated from coke and refined coal increased from $90 million for the three months ended June 30, 2011 to $109 million for the three months ended June 30, 2012.

| 25 |

Secondary Products

SC Coke’s secondary product revenues for the three months ended June 30, 2012 and 2011were as follows:

| Medium | Crude | Coke | Coke | |||||||||||||||||||||||||||||||||

| Coal | Benzol | Amsulfate | Coal Gas | Tar | Grain | Powder | Others | Total | ||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||||||

| Three months ended June 30 2011 | $ | 235,791 | $ | 4,652,583 | $ | 396,644 | $ | 1,619,523 | $ | 6,716,248 | $ | 345,565 | $ | 3,367,512 | $ | 450,658 | $ | 17,784,524 | ||||||||||||||||||

| Three months ended June 30 2012 | $ | 140,726 | $ | 4,424,130 | $ | 214,295 | $ | 845,313 | $ | 5,352,929 | $ | 21,654 | $ | 3,779,245 | $ | 582,471 | $ | 15,360,763 | ||||||||||||||||||

| Change | $ | (95,065 | ) | $ | (228,453 | ) | $ | (182,349 | ) | $ | (774,210 | ) | $ | (1,363,319 | ) | $ | (323,911 | ) | $ | 411,733 | $ | 131,813 | $ | (2,423,761 | ) | |||||||||||

| % Change | -40 | % | -5 | % | -46 | % | -48 | % | -20 | % | -94 | % | 12 | % | 29 | % | -14 | % | ||||||||||||||||||

| As% of Total Revenues | ||||||||||||||||||||||||||||||||||||

| Three months ended June 30 2011 | 0.22 | % | 4.31 | % | 0.37 | % | 1.50 | % | 6.22 | % | 0.32 | % | 3.12 | % | 0.42 | % | 16.48 | % | ||||||||||||||||||

| Three months ended June 30 2012 | 0.11 | % | 3.56 | % | 0.17 | % | 0.68 | % | 4.30 | % | 0.02 | % | 3.04 | % | 0.47 | % | 12.35 | % | ||||||||||||||||||

Along with the increase in coke production and sales, the total revenue of our secondary products decreased to $15.4 million for the three months ended June 30, 2012 from $17.8 million for the three months ended June 30, 2011, which was a decrease of 14%. Revenue contribution from secondary products as a percentage of total revenues was 12%, for the three months ended June 30, 2012, compared with 16% for the three months ended June 30, 2011. The decreased percentage of revenues contributed by secondary products was primarily from the decrease in the sales of tar.