Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Born, Inc. | Financial_Report.xls |

| EX-32 - EXHIBIT 32.1 - Born, Inc. | tcln0810form10kex321.htm |

| EX-31 - EXHIBIT 31.2 - Born, Inc. | tcln0810form10kex312.htm |

| EX-32 - EXHIBIT 32.2 - Born, Inc. | tcln0810form10kex322.htm |

| EX-31 - EXHIBIT 31.1 - Born, Inc. | tcln0810form10kex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☑ ANNUAL REPORT UNDER SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED APRIL 30, 2012

☐ TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934

For the transition period from _______________ through _______________

TECHS

LOANSTAR, INC.

_______________________________________

(Name of small business in its charter)

| Nevada | 0-4682058 |

| (State or other jurisdiction of incorporation) | (IRS employer ID Number) |

| 319 Clematis Street, Suite 400 | |

| West Palm Beach, FL. 33401 | |

| 561-514-9042 | |

| (Address and Telephone Number including area code of registrant's principal executive offices) | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Check whether the issuer: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months ( or for such shorter period that the registrant was required to submit and post such files.

Yes ☐ No ☑ (Not required by smaller reporting companies)

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of "accelerated filer" and "large accelerated filer" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

State issuer's revenues for its most recent fiscal year. $40,900

As of October 31, 2011, the aggregate market value of the shares of common stock held by non-affiliates (computed by reference to the most recent offering price of such shares) was $5,014,823

As of August 8, 2012, there were 2,214,556,789 shares of common stock issued and outstanding.

| TABLE OF CONTENTS | ||

| PART I | Page | |

| Item 1. | Description of Business | 4 |

| Item 1A. | Risk Factors | 16 |

| Item 1B. | Unresolved Staff Comments | 26 |

| Item 2. | Description of Property | 26 |

| Item 3. | Legal Proceedings | 26 |

| Item 4. | Mine Safety Disclosures | 26 |

| PART II | ||

| Item 5. | Market for Common Stock and Related Stockholder Matters | 26 |

| Item 6. | Selected Financial Data | 28 |

| Item 7. | Management's Discussion and Analysis of Plan of Operations | 28 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 30 |

| Item 8. | Financial Statements and Supplementary Data | 30 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 31 |

| Item 9A(T). | Controls and Procedures | 31 |

| Item 9B. | Other Information | 32 |

| PART III | ||

| Item 10. | Directors, Executive Officers, Promoters and Control Persons; Compliance with Section 16(a) of the Exchange Act | 33 |

| Item 11. | Executive Compensation | 34 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 37 |

| Item 13. | Certain Relationships and Related Transactions | 37 |

| Item14. | Principal Accountant Fees and Services | 38 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 38 |

| Signatures | 40 | |

| Certifications |

PART I

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the "Securities Act) and the Securities Exchange Act of 1934, as amended, (the "Exchange Act"). Various matters discussed in this document and in documents incorporated by reference herein, including matters discussed under the caption "Plan of Operation," may constitute forward-looking statements for purposes of the Securities Act and the Exchange Act. These statements are based on many assumptions and estimates and are not guarantees of future performance and may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Techs Loanstar, Inc. (the "Company" or "Techs Loanstar") to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. The words "expect," "anticipate," "intend," "plan," "believe," "seek," "estimate," and similar expressions are intended to identify such forward-looking statements. The Company's actual results may differ materially from the results anticipated in these forward-looking statements.

ITEM 1. DESCRIPTION OF BUSINESS

OVERVIEW

References in this Report to "Techs Loanstar," "Registrant," "we," "our," "us," and the "Company" refer to Techs Loanstar, Inc. Techs Loanstar was incorporated in the State of Nevada as a for-profit company on April 7, 2006. On March 14, 2012 the Company changed its name with the Secretary of State of Nevada to Quture International, Inc. The Company plans to file with the appropriate regulatory bodies the name change as well as a new ticker symbol to better reflect the company's core business.

SHARE EXCHANGE TRANSACTION WITH QUTURE, INC.

On July 25, 2011, the Company entered into a securities exchange agreement with Quture, Inc., a Nevada corporation (“Quture”). Pursuant to the Agreement, the Company agreed to acquire all of the outstanding capital stock of Quture in exchange for a number of shares of the Registrant’s common stock, par value $0.001 per share (the “Common Stock”) equal to eighty-five percent (85%) of the issued and outstanding common stock of the Company following the Exchange.

On August 9, 2011, the Registrant entered into and consummated the First Amendment to the Agreement Concerning that Exchange of Securities (the “Share Exchange Agreement”) with Quture and the shareholders of Quture. Upon consummation of the transactions set forth in the Share Exchange Agreement (the “Closing”), the Registrant adopted the business plan of Quture.

Pursuant to the Share Exchange Agreement, the Registrant acquired all of the outstanding capital stock of Quture in exchange (the “Exchange”) for the original issuance of an aggregate of 1,938,543,110 shares (the “Exchange Shares”) of the Registrant’s common stock, par value $0.001 per share (the “Common Stock”). The Registrant initially issued 400,000,000 Exchange Shares to the shareholders of Quture and, following an amendment of the Registrant’s Articles of Incorporation, the remaining Exchange Shares were available to be issued to Quture shareholders. The Exchange Shares were issued on a pro rata basis, on the basis of the shares held by such security holders of Quture at the time of the Exchange. As a result of the Exchange, Quture became a wholly-owned subsidiary of the Registrant and the shareholders of Quture beneficially at Closing, owned approximately eighty-five percent (85%) of the issued and outstanding Common Stock of the Registrant. The parties have taken the actions necessary to provide that the Exchange is treated as a “tax free exchange” under Section 368 of the Internal Revenue Code of 1986, as amended. The Agreement contains customary representations, warranties and covenants of the Registrant and Quture for like transactions. The foregoing descriptions of the above referenced agreements do not purport to be complete. For an understanding of their terms and provisions, reference should be made to the Agreement attached as Exhibit 10.1 to the Current Report on Form 8-K filed August 12, 2011 with the Securities and Exchange Commission (the “SEC”) and the Current Report on Form 8K/A filed on September 22, 2011 with the SEC.

On August 10, 2011, as a covenant to the Agreement, holders of a majority of the Registrant’s outstanding Common Stock voted to amend the Registrant’s Articles of Incorporation to increase the number of its authorized shares of capital stock from 900,000,000 shares to 2,510,000,000 par value $0.001 shares (the “Amendment”) of which (a) 2,500,000,000 shares were designated as Common Stock and (b) 10,000,000 shares were designated as blank check preferred stock.

At the effective time of the Exchange, our board of directors and officers was reconstituted by the resignation of Henry Fong as Director, President and Chief Executive Officer of the Registrant and the appointment of G. Landon Feazell as a member of the Registrant’s Board of Directors, Chief Executive Officer and President, and Geoffrey L. Feazell as Treasurer and Secretary of the Registrant.

For SEC reporting purposes, Quture is treated as the continuing reporting entity that acquired Techs (the historic registrant). The reports filed after the transaction have been prepared as if Quture (accounting acquirer) were the legal successor to Techs’ reporting obligation as of the date of the acquisition. Therefore, all financial statements filed subsequent to the transaction reflect the historical financial condition, results of operations and cash flows of Quture, for all periods prior to the share exchange and consolidated with Techs from the date of the share Exchange. Quture previously had a December 31 fiscal year end, but has now assumed the fiscal year end of Techs Loanstar, Inc., the legal acquirer. Accordingly, the financial statements presented herein are the audited financial statements for the years ended April 30, 2012 and 2011 are of Quture, Inc., and from August 9, 2011 are consolidated with Techs Loanstar, Inc. All share and per share amounts of Quture have been retroactively adjusted to reflect the legal capital structure of Techs pursuant to FASB ASC 805-40-45-1.

Quture was incorporated in the state of Nevada on April 21, 2011. The Company develops medical software with tools and analytics to reduce costs while improving clinical performance, outcomes, predictive insight, and evidence-based best clinical processes. Effective July 1, 2011, Quture merged with Q3, LLC (“Q3”), a Florida Limited Liability Company, whereby Quture was the legal acquirer and Q3 is the accounting acquirer. Accordingly, Quture’s historical financial results, includes Q3 prior to July 1, 2011 and consolidated with Quture from July 1, 2011.

Quture is an emerging healthcare knowledge solution company created to transform health and healthcare by developing the standard in measuring clinical performance and outcomes. The Company’s products focus on using actual clinical data from existing electronic databases to measure performance and outcomes applying analytics. The Quture technology leverages its Application Partnership with InterSystems Corporation. InterSystems’ technology is already used in over 66% of the hospitals in America. Quture, using this fully developed technology platform converts manual processes to electronic processes to integrate clinical data from existing disparate electronic data sources in healthcare organizations. The Company’s product uses InterSystems’ data integration product Ensemble already programmed for every electronic medical record (EMR) and database. Quture is immediately able to collect and integrate performance metrics into the InterSystems Cache database customized for the Quture application through this partnership. By licensing the InterSystems technology and implementing the company’s clinical content and performance measures, Quture has the potential to develop the most powerful clinical knowledge database in the world. Quture will deliver to customers the clinical data for value-based purchasing. Performance-based and value calculated clinical data will ultimately determine what payers do and do not want to pay for and the clinical knowledge to support new mandated payment systems while improving care.

Quture, Inc. (“Quture”), a Nevada corporation, was formed in April 2011 and on July 25, 2011 entered into a Share Exchange Agreement (the “Agreement) with Techs Loanstar (“TCLN”). Pursuant to the Agreement, Quture became a subsidiary of TCLN. Corporate strategy includes filing for a name change of Techs Loanstar to Quture International, Inc., in Nevada and completing negotiations with another subsidiary to leverage its technology for Quture’s planned expansion. The initial focus of Quture’s products is for hospital customers and influencers. Quture then intends to market its other product to physicians and physician groups, especially invasive physicians. Quture’s fully developed and existing products, discussed below, are being enhanced and migrated to the InterSystems technology platform. Performance and outcomes measurement functionality is the core intellectual property, technology and clinical content of both products, one primarily for hospitals and one primarily for surgery centers and physicians performing invasive procedures. Quture then plans to rapidly expand its products and business to patients and payers, leveraging its clinical performance knowledge and database. Product strategy inevitably first focuses on health care and then expands to personalized medicine, health and wellness.

We believe the Company’s products and services will become an essential technology and tool to improve care and health, while reducing costs. The demand to measure performance is coming from all stakeholders involved in both payment and delivery. Measuring performance is now mandatory and is the new foundation of how providers are reimbursed, granted privileges to practice in hospitals, and, in the near future, selected by patients for their care.

The core competence of Quture pivots on its product with clinical content to measure performance. Quture’s clinical content is evidence-based optimal clinical processes and clinical performance measures developed for over 35 years as the leading the hospital performance measurement company. This content has been developed through external peer review and peer review products and services. We know what to measure, where to find it, and how to use it to continuously improve clinical processes. Quture intends to license its transformative and disruptive technology and, through relationships with its customers, continuously develop its clinical database and expand upon its clinical content to know what works, which best provides these specific clinical services, and the relative cost to outcome ratio determining value.

Quture’s mission is to become the international standard in healthcare performance and outcomes measurement. Quture provides healthcare organizations, insurers, government and private sector payers, and others in the healthcare community with performance and outcomes measurement tools and data sets. Industry experts agree that these performance measures are the “transformative tool” that reduce medical cost and improve quality of care. Quture’s management team has 35 years of experience and a long history of working with many of the nation’s leading healthcare institutions as a leader and innovator in measuring clinical performance. The Company intends to potentially accelerate its growth and revenues through mergers and acquisitions. Existing relationships provide the Company with unique business opportunities for such mergers and acquisitions.

Quture is conceived on the premise that optimal health and health care can be empowered by its performance and outcomes tools and the clinical data that will be derived from that technology. Quture is dedicated to the proposition that its quality-value equation is an unparalleled business opportunity and within the existing core competence of the Company.

TARGET MARKETS AND MARKETING STRATEGY

Our target markets encompass the total array of customers of health and healthcare products, data, and services. Marketing strategy sequences this market beginning with hospitals, then physicians and physician groups, and then patients and payers.

We intend to introduce the Company’s QualOptima performance measurement product into the market after completion of a formal “clinical trial” at the University of Miami, Miller School of Medicine and Jackson Memorial Hospital. The proof of concept Phase I portion of that demonstration project has been successfully completed based on sample data and to the satisfaction of Quture and InterSystems The QualOptima product is further demonstrated at Niagara Falls Memorial Hospital, Niagara Falls, New York, for performance measurement of nursing-sensitive measures to become “interdisciplinary” performance measurement. An existing customer of Quture, Springhill Medical Center, Springhill, LA, is evaluating the QualOptima product to replace its existing license with Quture for peer review. The QualOptima product will then have been demonstrated, if successful, to transition from strictly peer review to performance measurement on the InterSystems platform for interdisciplinary performance and outcomes measurement. Quture then intends to evaluate data from these hospital projects for return on investment (ROI) potential of the QualOptima product for commercial marketing and sales. After successful demonstration in cooperation with InterSystems, where the InterSystems products are being demonstrated to meet the requirements and specifications of Quture, the QualOptima product will be formally launched and then commercialized. QualOptima is now being expanded from the demonstration in anesthesiology to the more than 40 medical specialties. The Company plans to negotiate contracts and licenses to install QualOptima in reference hospitals during the fall months of 2012 as part of the go to market strategy of the Company.

The “go to market strategy” will focus on existing strong relationships with major hospital corporations, including their self-insured trusts, at several flagship hospitals, designed to mature into sales to large hospital systems. We anticipate other reference hospital installations will focus on specific product components, including the relationship between performance and outcomes measures, one focused on the natural language processing software component and aggregated medical specialties and specific federal initiatives, such as re-hospitalizations and hospital acquired conditions. Significantly, the Niagara Falls Memorial Hospital project is focused on a hospital acquired condition, eliminating or at least reducing cather-acquired urinary tract infections.

Initial sales are being pursued through marketing and sales for installation. Initial customers will be carefully coordinated with InterSystems. InterSystems will accompany Quture sales engineers with their own sales engineers for sales presentations. The Company is also partnering with prominent national healthcare law firms and accounting firms, jointly conducting several summit meetings for their clients and inviting potential customers – stressing compliance and the threat of negligent credentialing as motivators and leveraging their representation and influence with hospital boards and senior executives. The Quture product database and clinical process, quality and patient safety management, and medical staff credentialing processes will provide new and unique consulting opportunities for these firms in concert with Quture.

The Company anticipates marketing and sales of the QSurg product will follow introduction of the QualOptima product, projected by Quture to begin six (6) months after commencement of marketing and sales of QualOptima.

PRODUCTS

Quture owns two (2) fully developed and tested products; both are being migrated from a Microsoft technology platform onto the InterSystems technology platform, with the Cache object-oriented database serving as the foundation for each and providing a unified Quture database to be called the “Qualytx” database. Real-time clinical data is captured electronically from multiple vendor disparate databases using the Ensemble interface engine and aggregated into the Qualytx database. The DeepSee dashboard and Zen report writer technology are functionalities existing in the InterSystems Ensemble Enterprise suite of products. The Quture products on the InterSystems platform are (QualOptima) or are planned to be (QSurg) as follows:

QualOptima – clinical performance measurement with analytics,

And

QSurg – surgery center electronic medical record (EMR) with a simplified QualOptima (“QuOp”) performance analytics application embedded.

QUALOPTIMA

QualOptima – electronically captures, integrates, and analyzes performance and outcomes data from Quture’s performance metrics from multiple vendor product disparate hospital databases. QualOptima contains the proprietary library of performance measures, with precisely defined numerator and denominator specifications, including all performance measures published by the Physician Consortium for Performance Improvement (PCPI) of the American Medical Association. The performance measures are mapped at key interventions or data “nodes” in an evidence-based optimal clinical process, as follows:

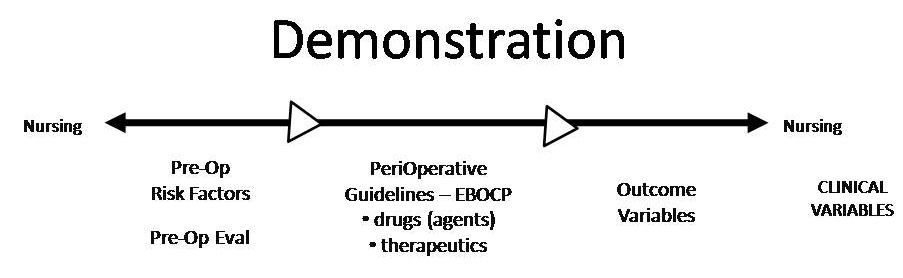

The clinical data structure includes individual patient risk factors, performance measures based on evidence-based optimal clinical processes, and outcomes measures. The product demonstration underway with Keith Candiotti, M.D, is based on his design for the product in anesthesiology, as follows:

QualOptima is a single product (not a “suite” of products) with components designed to satisfy the mandates imposed on hospitals through governmental regulation and accreditation standards (see Governmental Regulations). These components are:

Performance measurement (the fundamental component discussed above)

Proctoring

Triggers

Peer review

Cost analysis for value calculations

The performance measurement component implements the InterSystems data capture and integration functionality (“interface engine”) of the Ensemble product. Ensemble uses data connections known as application programming interfaces (“API’s”) which are already programmed for every vendor’s EMR and database. The driver for this component is the accreditation standard of the Joint Commission requiring measurement of performance of each individual physician for each clinical privilege the hospital must grant to practice every two years but measured at least every six (6) months. Manual data abstraction to satisfy this requirement is no longer practical after recent imposition of this standard. This requirement and publication of performance measures as the minimum threshold requirement to avoid negligent credentialing litigation presents a compelling need for the Quture product.

Quture’s product provides the clinical “failure mode and effects analysis” (FMEA) used in other industries to proactively design optimal processes. Improving processes of care and reducing costs is not a marketing mantra for Quture, but it is the compelling business case for hospital customers to license QualOptima.

“Proctoring” is the required process for hospitals to evaluate the current clinical competence of practitioners to perform specific patient interventions or treat certain conditions. Proctoring is required of all physicians new to a hospital or on the medical staff and applying to perform a new clinical “privilege”. Quture’s existing product QReview is ideally suited to perform proctoring, and the new QualOptima product will use this software methodology to electronically conduct proctoring.

“Triggers” are clinical indicators and are required as part of Ongoing Professional Practice Evaluation to monitor safety concerns. QualOptima implements the published triggers, but electronically conducts this required process instead of traditional manual data abstraction. The Company further employs its license to electronically “machine read” free text in crucial EMR documents to identify triggers and to “learn” from electronic pattern and trend analytics.

Peer review is the traditional business of the Founder of Quture, with over 35 years of performance measurement using this methodology and with the best software product for conducting peer review formally called QReview. When this product is completely migrated onto the InterSystems platform, peer review will be integrated with the three (3) components above for performance measurement, proctoring, and triggers to dramatically enhance the functionality of the former product. For example, we expect peer review will be capable of being performed remotely by physicians in Quture’s QualPRO expert panel of physicians in every medical specialty. The former strength of the product to impose quality of care question sets to standardize peer review for “structured” review will be dramatically improved to use performance measures electronically for “structured explicit review”.

QualOptima also introduces another new functionality to integrate quality and patient safety data into the Qualytx database using the Ensemble interface engine from the multitude of data “silos” of all the quality and risk functions in hospitals, each with its own software product. Overcoming the impediment of disparate databases has been a product design now included in the QualOptima product.

The QualOptima product has two different configurations to accommodate both large hospitals, some with systems and system-wide programs, and small and rural hospitals. Small and rural hospitals will be able to contract for monthly access to cloud computing the QualOptima solution that would otherwise not be affordable. The InterSystems product platform will be installed on secure servers and operated remotely at a reduced operating cost using InterSystems’ Ensemble Enterprise pricing model. For larger hospitals, who want their servers on their side of the “firewall” for data security and control, the pricing model and product server licensing from InterSystems provides the other product configuration.

QSURG

QSurg - is a fully developed and tested electronic medical record product for surgery centers. This product is the only EMR with a fully functional performance analytics application embedded in the workflow and data capture. The QSurg EMR introduced capturing patient data at point of care in the operative and patient care areas. The product was built for tablet PC’s several years ago, anticipating this hardware opportunity and in an Application Partnership with Motion Computing, the best tablet for operative areas since it can be antiseptically cleaned and is a closed system with a special Intel processor.

QSurg is the electronic medical record (EMR) for surgery centers and hospitals, eliminating storing paper and having patient data readily available at point of care, measures performance focused on efficiency and effectiveness (such as OR turnover times) and absence of complications (such as infection rates), enhances revenue, and improves patient safety and outcomes, and complies with federal and state regulations.

Dr. Candiotti has been the consulting physician for the anesthesiology application of the QSurg product. The demonstration project at the University of Miami, Jackson Memorial Hospital, has already resulted in a unique anesthesiology application embedded in the QSurg product.

CUSTOMERS

Quture has begun marketing its products to the array of heath care providers, primarily focused on hospitals, hospital systems, and their insured trusts, as well as health maintenance organizations, physician groups, and provider groups (collaboratives). Initial operations and sales are structured in traditional licensing models, most favorably subscription based sales. Operationally, the Company provides performance measures for customer selection from the QuOp Performance Measures Library. The metrics of numerator and denominator integration using the Ensemble interface engine will be installed in coordination with InterSystems engineers. Support for the product will be first and primarily with InterSystems, supported in an advisory capacity by Quture. Regional Health Information Exchanges are a target customer for the InterSystems HealthShare product and should be considered as a potential customer by Quture.

New federal incentives have created new health care organizational models that may be targets for Quture products. First and most important among these are Accountable Care Organizations (ACO’s). New regulations creating Health Homes, where payments are bundled for those organizations to divide between providers and can be divided based on performance and results for value are important as customers. State cooperative insurance exchanges are another example of new structures as potential customers. Purchasers ranging from the federal government to employers to health savings accounts are target customers, as well.

Customers of the proctoring product are unique and include device manufacturers, pharmaceutical and proteonomics companies, and medical equipment companies.

The QSurg product is designed for physician office surgical/invasive procedure facilities, ambulatory surgery centers, and surgical hospitals.

Products, data sets and clinical knowledge, including predictive clinical and personalized knowledge, are planned as discussed for patients as customers of Quture. As performance results become transparent and medicine becomes personalized, participatory, and predictive, patients will become customers of Quture.

Performance measurement is intended to evolve into customers for measuring Good Clinical Practice (GCP) applications of the Quture’s products and data sales to pharmaceutical and stem cell companies, medical device, equipment and supply manufacturers.

COMPETITION

Quture competitors are profiled for the performance measurement and analytics product. There is no identical competitor for this product, as demonstrated by the matrix graphic below. However, there are three (3) categories of companies and products that provide some elements similar to the Quture product: performance measurement but based on billing/administrative data rather than Quture’s clinical data, clinical content products that attempt to connect with a software product to deliver extensive content (primarily publishing companies), and niche products primarily for peer review (where the peer review product of Quture now enhanced for performance and outcomes measurement).

Performance Measurement Based on Billing/Administrative Data:

Premier (www.premierinc.com) - Products such as QualityConnect and the Premier Integrated Performance Platform provide users with performance and quality data. The legacy products remain primarily reliant on billing/administrative data rather than point of care clinical data. The Quest program, for example, connects healthcare providers to share knowledge about quality, performance, patient safety and group contracting for hospital products and services. These programs collect data from participating hospitals to share clinical knowledge so that hospitals can learn from one another..

3M Health Information Systems (http://solutions.3m.com) – Software analyzing billing/administrative data and claiming significance as performance measurement and analysis. Reliance on administrative data correlates co-morbidity data and uses algorithms and formulas to claim calculation of quality of care information. Software and consulting services solutions across the health care continuum for transcription, speech recognition, clinical documentation improvement, document management, computer-assisted coding, quality, and revenue cycle management.

Xerox (www.midasplus.com) – ACS Healthcare Solutions was acquired including the Midas+ product solutions, operated as a separate business unit of Affiliated Computer Services, Inc., a Xerox Company, The product array relies primarily upon billing/administrative data to collect quality, patient safety, and financial information. Midas+ became an integral component of the transformational outsourcing, consulting, revenue cycle and analytics solution that HCS provides to its hospital clients. Midas+ continues to be responsible for its direction, development, sales, implementation, and support with respect to the products and services it offers its clients. As part of the ACS and HCS family, Midas+ has the financial, technical, and administrative support of ACS, a premier provider of business process and information technology solutions.

Thompson-Reuters (www.thomsonreuters.com) – Thomson Reuters announced they were exiting the health care business segment, then introduced their new suite of software called “Payment Reform Solutions” suite. Quture believes that this portfolio of products has now been sold but is without details as to that sale. The new product suite claims to include risk analytics to use real time clinical data to better coordinate care, manage costs and maintain quality for value-based purchasing. It is unclear how this new product relates to their treatment pathways (see Clinical Content Companies) and the performance product called “Advantage Suite” (including the CareDiscovery module) and Physician Performance Assessment. However, these products are clearly based on their “Medical Episode Grouper” (MEG) and, therefore, use billing and administrative data, not clinical data, as the basis for these products.

Quantros (www.quantros.com) - The Quantros suite of products includes safety and risk management, with its “Safety Events Manager” the core application, for analysis of events and near misses entered into the system, regulatory and compliance reporting, and infection control, quality and performance reporting and analysis off the events application. The suite of products includes a patient safety organization system and a dashboard graphics display for multiple constituencies.

Clinical Content Companies

Elsevier – Elsevier is a major publisher of prominent medical books and journals. In an effort to leverage the clinical content in these publications, as “the world’s leading provider of science and health information,” the European company has acquired software tools such as MEDai. MEDai Pinpoint claims to provide analytics for population management, clinical surveillance, predictive analytics, physician profiling and performance, and outcomes analysis. Data collection requires developing API connections for customers, however.

Hearst – Hearst Corporation acquired First DataBank to enter the patient safety and quality healthcare quality focused primarily on drug databases. Hearst acquired Zynx Health to expand clinical content to evidence-based resources of physician order sets, interdisciplinary plans of care, alerts and reminders. The Zynx customizable templates are intended to provide clinical support and include content to reduce care disparities, minimize errors, and save staff time through goals and expected outcomes, clinical interventions, and embedded links to relevant research and quality measures.

Thomson Reuters – Micromedix (www.micromedix.com) – The clinical decision support system of Thomson Reuters and aggregated products that run off the clinical content acquired in their acquisition of Micromedix includes products running on their evidence-based reference information for drug, disease, and toxicology management and for patient education. These can interface with products like MarketScan® Treatment Pathways. Thomson Reuters’ modules for real-time clinical decision support and then performance, quality, and financial analytics (see Performance Measurement products above).

Niche Products:

Medkinetics (www.medkinetics.com) – The Medkinetics product is primarily designed as medical staff credentialing for Ongoing and Focused Professional Practice Evaluation through performance measurement and peer review. The Electronic Physician Record® (EPR®) quality & performance improvement product is a physician peer review product. The system relies on user development of individual performance improvement plans.

Acesis (www.acesis.com) – The Acesis Healthcare Improvement Platform provides templates for performance improvement projects, process control/checklists, patient experience/satisfaction, peer review, root cause analysis, adverse event reporting, incident reporting, and morbidity and mortality review. The system combines core measures with other custom criteria for peer review in the product template. The system combines core measures and other custom criteria to determine reasons for peer review in the template. The product relies upon each organization developing safety event classification definitions, taxonomy and algorithms in order to determine the level of harm and event type. .

HCPRO – HCPRO is essentially a publishing company focused on compliance in health care. The Greeley Company is primarily a services company that provides educational and templates for credentialing, quality and risk management processes including external peer review. The Core Privilege Plus web-based software product with core privileging data designed to implement criteria-based privileging.

The Quture performance and outcomes analytics product does not compete with electronic medical record (EMR) companies. The product integrates clinical data from these EMR products but integrates data from multiple vendor products for each customer.

There are competitors to Quture’s surgery center QSurg electronic medical record producte, primarily ZChart and source Medical (www.sourcemed.net), but this is primarily a company whose products are focused on scheduling, billing, and inventory. Neither of these products competed with the performance measuremenet and quality improvement component of the Quture product. There are two significant outcomes measurement companies, including Outcome Sciences (www.outcome.com) and Surgical Outcomes (SOIX).

| COMPANY | CLINICAL DATA BASED | BILLING CODE BASED | PERFORMANCE MEASURES* | DISPARATE DATA** | PEER REVIEW | TJC / MU*** COMPLIANT | FINANCIAL |

| QutureX | X | X | X | X | X | X | |

| Medkinetics | X | X | |||||

| Premier | X | X | X | ||||

| Acesis | X | X | X | X | |||

| HCPRO | X | X | |||||

| 3M | X | X | X | ||||

| XEROX | X | X |

* QualOptima – is the only product integrating nationally published performance measures and electronically capturing numerator/denominator data.

** Disparate data in competitor products based solely on billing codes.

*** TJC (The Joint Commission) and MU (Meaningful Use) relevant to the HITECH Act.

There can be no assurance that the Company will compete successfully with existing or new competitors, or that the competition will not have a material adverse effect on the business, operating results or financial condition of the Company (See “RISK FACTORS”).

LIQUIDITY AND CAPITAL RESOURCES

Quture now has significant opportunities to capitalize the Company. The traditional potential sources of capital are possible proceeds from private placements, issuance of notes payable, loans from its officers, and cash from future revenues after the Company commences sales as well as funding from accounts receivable. The Company may require additional financing to continue operations, and there is no assurance that such additional financing will be available. However, the Company is now engaged in exploring funding opportunities based on funding other subsidiary companies of Quture, specifically the established subsidiaries of Quture Euro, LLC and the Qx Health Exchange, as well as potential additional subsidiaries including but not limited to a finance company subsidiary and/or a personalized medicine subsidiary.

POTENTIAL FUTURE PROJECTS AND CONFLICTS OF INTEREST

Members of the Company’s Management may serve in the future as an officer, director or investor in other entities. Neither the Company nor any shareholder would have any interest in these projects. Management believes that they have sufficient resources to fully discharge their responsibilities to all projects they have organized or will organize in the future, if any.

GOVERNMENT REGULATION

Statutes unique to health care that could potentially impact the Company include but are not limited to the following federal statutes:

Health Insurance Portability and Accountability Act of 1996 (HIPPA) Privacy and Security Rules – protects the privacy of individually identifiable health information. The HIPPA Privacy and Security Rules set national standards for the security of electronically protected health information. The confidentiality provisions of the Patient Safety Rule protect identifiable information being used to analyze patient safety events and improve patient safety. There are severe monetary sanctions for violations of these rules and statutory provisions.

Patient Protection and Affordable Care Act (2010) – provides that all Americans have access to quality, affordable health care and will create the transformation within the health care system necessary to contain costs. The Congressional Budget Office (CBO) has determined that the Patient Protection and Affordable Care Act is fully paid for, will provide coverage to more than 94% of Americans while staying under the $900 billion limit that President Obama established, bending the health care cost curve, and reducing the deficit over the next ten years and beyond. The Patient Protection and Affordable Care Act contains nine titles, each addressing an essential component of reform:

| • | Quality, affordable health care for all Americans |

| • | The role of public programs |

| • | Improving the quality and efficiency of health care |

| • | Prevention of chronic disease and improving public health |

| • | Health care workforce |

| • | Transparency and program integrity |

| • | Improving access to innovative medical therapies |

| • | Community living assistance services and supports |

Revenue provisions

Some of the significant provisions to the Company include development of new patient care and payment models. A new Center for Medicare & Medicaid Innovation will be established within the Centers for Medicare and Medicaid Services to research, develop, test, and expand innovative payment and delivery arrangements. Accountable Care Organizations (ACOs) that take responsibility for cost and quality received by patients will receive a share of savings they achieve for Medicare. The HHS Secretary will develop a national, voluntary pilot program encouraging hospitals, doctors, and post-acute providers to improve patient care and achieve savings through bundled payments. A new demonstration program for chronically ill Medicare beneficiaries will test payment incentives and service delivery using physician and nurse practitioner-directed home-based primary care teams. Beginning in 2012, hospital payments will be adjusted based on the dollar value of each hospital’s percentage of potentially preventable Medicare readmissions.

Title III. Improving the Quality and Efficiency of Health Care provides for improvement of quality and efficiency of U.S. medical care services for everyone, and especially for those enrolled in Medicare and Medicaid. Payment for services will be linked to better quality outcomes. The Patient Protection and Affordable Care Act will make substantial investments to improve the quality and delivery of care and support research to inform consumers about patient outcomes resulting from different approaches to treatment and care delivery. New patient care models will be created and disseminated. Rural patients and providers will see meaningful improvements. Payment accuracy will improve. The Medicare Part D prescription drug benefit will be enhanced and the coverage gap, or donut hole, will be reduced. An Independent Medicare Advisory Board will develop recommendations to ensure long-term fiscal stability.

The Health Care Quality Improvement provisions create a new program to develop community health teams supporting medical homes to increase access to community-based, coordinated care. It supports a health delivery system research center to conduct research on health delivery system improvement and best practices that improve the quality, safety, and efficiency of health care delivery. And, it support medication management services by local health providers to help patients better manage chronic disease. The Act provides for the establishment of a private, nonprofit entity (the Patient-Centered Outcomes Research Institute) governed by a public- private board appointed by the Comptroller General to provide for the conduct of comparative clinical outcomes research. The Act provides Support for Prevention and Public Health Innovation, which empowers the HHS Secretary to provide funding for research in public health services and systems to examine best prevention practices.

Title IV: Prevention of Chronic Disease and Improving Public Health provides for better orienting the nation’s health care system toward health promotion and disease prevention, a set of initiatives will provide the impetus and the infrastructure. A new interagency prevention council will be supported by a new Prevention and Public Health Investment Fund. Barriers to accessing clinical preventive services will be removed. Developing healthy communities will be a priority, and a 21st century public health infrastructure will support this goal.

The Act provides for the creation of American Health Benefit Exchanges. By 2014, each state will establish an Exchange to help individuals and small employers obtain coverage. Plans participating in the Exchanges will be accredited for quality, will present their benefit options in a standardized manner for easy comparison, and will use one, simple enrollment form.

American Recovery Act and Reinvestment Act of 2009 (ARRA) – HITECH Act “Meaningful Use” provisions and financial incentives - The Medicare and Medicaid EHR Incentive Programs provide a financial incentive for the "meaningful use" of certified EHR technology to achieve health and efficiency goals. These incentives are designed to reduce medical errors, makes patient records and data available to providers, create reminders and alerts, clinical decision support, and e-prescribing/refill automation. The criteria for meaningful use will be staged in three steps over the course of the next five years. Stage 1 (2011 and 2012) sets the baseline for electronic data capture and information sharing. Stage 2 (expected to be implemented in 2013) and Stage 3 (expected to be implemented in 2015) will continue to expand on this baseline and be developed through future rule making.

To demonstrate meaningful use successfully, eligible professionals, eligible hospitals and CAHs are required also to report clinical quality measures specific to eligible professionals or eligible hospitals and CAHs. Eligible professionals must report on 6 total clinical quality measures: 3 required core measures (substituting alternate core measures where necessary) and 3 additional measures (selected from a set of 38 clinical quality measures). Eligible hospitals and CAHs must report on all 15 of their clinical quality measures.

Health Information Technology for Economic and Clinical Act of ARRA (see above) – basically establishes four (4) major goals that advance the use of health information technology, such as electronic medical records by:

Requiring the government to take a leadership role to develop standards by 2010 that allow for the nationwide electronic exchange and use of health information technology to improve quality and coordination of care;

Investing $20 billion in health information technology infrastructure and Medicare and Medicaid incentives to encourage doctors and hospitals to use HIT (health information technology) to electronically exchange patients’ health information;

Saving the government $10 billion, and generating additional savings throughout the health sector, through improvements in quality of care and care coordination, and reductions in medical errors and duplicative care; and strengthening federal privacy and security law to protect identifiable health information from misuse as the health care sector increases use of Health IT.

The Act provides immediate funding for health information technology infrastructure, training, dissemination of best practices, telemedicine, inclusion of health information technology for clinical education, and State grants to promote health information technology.

The legislation establishes a voluntary certification process for health information technology products. The National Institute of Standards and Technology will provide for the testing of such products to determine if they meet national standards that allow for the secure electronic exchange and use of health information.

The Act further provides significant financial incentives through Medicare and Medicaid programs to encourage doctors and hospitals to adopt and use certified electronic health records. Physicians will be eligible for $40,000 to $65,000 for showing that they are meaningfully using health information technology, such as through the reporting of quality measures. Hospitals are eligible for many millions of dollars in the Medicare and Medicaid programs to similarly use health information technology. Federally qualified health centers, rural health clinics, children’s hospitals and others will be eligible for funding through the Medicaid program.

Incentive payments for both physicians and hospitals to continue for several years, but are phased out over time. Eventually, Medicare payments are reduced for physicians and hospitals that do not use a certified electronic health record that allows them to communicate with others.

ITEM 1A - RISK FACTORS

RISK FACTORS

OUR SECURITIES ARE HIGHLY SPECULATIVE, AND PROSPECTIVE PURCHASERS SHOULD BE AWARE THAT AN INVESTMENT IN THE SECURITIES INVOLVES A HIGH DEGREE OF RISK. ACCORDINGLY, PROSPECTIVE PURCHASERS SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS IN ADDITION TO THE OTHER INFORMATION IN THIS CURRENT REPORT AND RELATED EXHIBITS, INCLUDING OUR FINANCIAL STATEMENTS.

RISK FACTORS ASSOCIATED WITH OUR BUSINESS

We have a limited operating history on which to base an investment decision.

We are a newly created startup company that has very limited operating history. As a startup company, we are subject to unforeseen costs, expenses, problems and difficulties inherent in new business ventures. There is no history upon which to base any assumption as to the likelihood that the company will prove successful. We cannot provide investors with any assurance that our services will attract customers; generate any operating revenue or ever achieve profitable operations. If we are unable to address these risks, there is a high probability that our business can fail.

We have inadequate capital and need for additional financing to accomplish our business and strategic plans.

We have very limited funds, and such funds are not adequate to develop our current business plan. Our ultimate success may depend on our ability to raise additional capital. In the absence of additional financing or significant revenues and profits, the company will have to approach its business plan from a much different and much more restricted direction, attempting to secure additional funding sources to fund its growth, borrowing money from lenders or elsewhere or to take other actions to attempt to provide funding. We cannot guarantee that we will be able to obtain sufficient additional funds when needed, or that such funds, if available, will be obtainable on terms satisfactory to us.

We have a limited history of success and profitability.

We have limited current business operations and may incur significant losses and negative operating cash flow for the foreseeable future, and we may never achieve or maintain profitability. We may incur losses for the foreseeable future and may never become profitable.

Our management team may not be able to successfully implement our business strategies.

If our management team is unable to execute on its business strategies, then our development, including the establishment of revenues and our sales and marketing activities would be materially and adversely affected. In addition, we may encounter difficulties in effectively managing the budgeting, forecasting and other process control issues presented by any future growth. We may seek to augment or replace members of our management team or we may lose key members of our management team, and we may not be able to attract new management talent with sufficient skill and experience.

Our products are new and innovative and have not been established in the healthcare marketplace.

The Company’s initial products are new to the hospital and physician market and may take time or even fail to become accepted as having value or sufficient return on investment for potential users. We could encounter significant delays in adoption of these innovations and new tools, which would harm or at least delay our revenue projections. The Company’s business plan and revenue projections are based upon rapid market penetration and achieving critical mass to become the international standard for performance measurement. The marketing and sales of our products depends upon our “blue ocean” strategy to introduce “disruptive” unique technology and define our market niche with a new series of products. Health care has traditionally resisted clinical quality data and information, and the Company’s strategy is directly related to federal initiatives and accreditation standards that are now favorable, but are subject to change and to enforcement variables that could significantly affect the Company and adversely affect its gross revenue, margins and projections.

Our products and services may suffer from uncertainty of market acceptance, and we may have difficulty commercializing them.

The Company is currently engaged in migrating developed products to a new technology platform and is in various stages of developing new software and technology products. Continued product and service development and commercialization efforts are subject to all of the risks inherent in the development of new products and services, including unanticipated development problems, lack of acceptance in the market, as well as the possible insufficiency of funds to undertake development and commercialization, any of which could result in abandonment or substantial change in the development of a specific product or service. In addition, demand and market acceptance for newly developed products and services are subject to a high level of uncertainty and the Company does not have any assurance that its concepts and ideas will achieve market acceptance. Achieving market acceptance of the Company’s new products and services will require substantial marketing efforts and the expenditure of significant funds. If the Company’s business concepts and device concepts and devices do not achieve market acceptance in a fairly cost-effective and quick time frame, the Company and its prospects will be materially adversely affected and it could well cause the Company to fail.

We may not be able to compete initially or maintain market share even if originally successful.

The sale of the Company’s proposed products and services involve competitive businesses, and the Company faces or may face significant competition. The Company will compete with many other companies, most of which have far greater experience, product penetration, financial and personnel resources, marketing and distribution organizations and overall market power than the Company. There can be no assurance that the Company will be able to compete effectively or respond successfully to any future changes in the competition or that additional competitors will not enter the market. There is also no assurance that other parties will not try to copy ideas developed by the Company. The failure to meet these challenges could have a material adverse effect on the Company and its business and could cause the Company to fail. There can also be no assurance that the Company’s products will remain viable and attractive alternatives for customers.

We may not be able to protect our intellectual property, which would potentially harm or jeopardize the Company.

The Company is currently attempting to secure provisional patents and convert provisional patents to permanent patents on its products and on the products being developed or marketed by the Company. There is no assurance that the Company will receive the patents that may be necessary to protect our intellect property; that the patents would not be significantly narrowed in their scope; that the patents would turn out to be a material advantage to the Company; that other parties will not find ways to circumvent the benefits of any such patents; that other ideas on which the Company’s business plan is based will not be utilized by competitors of the business or that competitors will not find improved methods of achieving what the Company plans to achieve, leaving the Company without the ability to effectively compete.

We are significantly dependent on key software and technology partnerships.

The Company’s products and development strategy rely upon an application partnership with InterSystems and a strategic vendor relationship with a development company that are not essential but are vital to our products and success.

If we are unable to achieve our milestones and strategic challenges our success could be delayed or jeopardized.

The product plan during capitalization focuses on software products for hospitals, which are the primary customer for the Company’s initial product offering. There are other potential customer and influencers, such as health and liability insurance companies, healthcare law firms, financial healthcare consulting and accounting firms, and governmental and regulatory entities. There are numerous newly formulated entities, as well, such as accountable care organizations and state insurance exchanges (“co-ops”) that appear to be logical customers and influencers in the Company’s strategic product plan. Initially, our product plan relies upon the successful migration of our products to a new technology platform and the success of that technology to achieve the technical specifications and requirements of the product design. Despite initial assessments of product performance, there could be any series of recognized or unrecognized performance challenges and/or impediments that could affect the Company’s product development and performance milestones and strategic challenges with customers and influencers. Our other existing product, an electronic medical record for surgery centers with integrated performance measurement integrated, has similar risks.

If we fail to manage growth effectively or prepare for product scalability, it could have an adverse affect on our employee efficiency, product quality, working capital levels and results of operations.

Any significant growth in the market for our products or our entry into new markets may require an expansion of our employee base for managerial, operational, financial, and other purposes. As of July 31, 2011, we had zero full time employees. During any period of growth, we may face problems related to our operational and financial systems and controls, including quality control and delivery and service capacities. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the development of new products, and the hiring of additional employees. For effective growth management, we will be required to continue improving our operations, management, and financial systems and controls. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

If we are unable to retain key executives and other key affiliates, particularly our founder and medical/clinical experts, our growth could be significantly inhibited and our business harmed with a material adverse affect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and operational and technical expertise of certain key personnel. Mr. G. Landon Feazell, our Chief Executive Officer and President, performs key functions in the operation of our business. The loss of Mr. Feazell could have a material adverse effect upon our business, financial condition, and results of operations. We do not maintain key-person insurance for members of our management team because it is cost prohibitive at this point. If we lose the services of any senior management and medical experts, including our QualPRO panels, we may not be able to locate suitable or qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and prospects.

Our management team may not be able to successfully implement our business strategies.

If our management team is unable to execute on its business strategies, then our development, including the establishment of revenues and our sales and marketing activities would be materially and adversely affected. In addition, we may encounter difficulties in effectively managing the budgeting, forecasting and other process control issues presented by any future growth. We may seek to augment or replace members of our management team or we may lose key members of our management team, and we may not be able to attract new management talent with sufficient skill and experience.

Our success in the future may depend on our ability to establish and maintain strategic alliances, and any failure on our part to establish and maintain such relationships would adversely affect our market penetration and revenue growth.

We may be required to establish strategic relationships with third parties. Our ability to establish strategic relationships will depend on a number of factors, many of which are outside our control, such as the competitive position of our product and marketing plan relative to our competitors. We may not be able to establish other strategic relationships in the future. In addition, any strategic alliances that we establish may subject us to a number of risks, including risks associated with sharing proprietary information, loss of control of operations that are material to developed business and profit-sharing arrangements. Moreover, strategic alliances may be expensive to implement and subject us to the risk that the third party will not perform its obligations under the relationship, which may subject us to losses over which we have no control or expensive termination arrangements. As a result, even if our strategic alliances with third parties are successful, our business may be adversely affected by a number of factors that are outside of our control.

Our financial results may not meet the expectations of investors and may fluctuate because of many factors and, as a result, investors should not rely on our revenue and/or financial projections as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations investors may negatively impact the value of our securities. Operating results may fluctuate due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in operating results could cause the value of our securities to decline. Investors should not rely on revenue or financial projections or comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods results of operations may be below the expectations of investors. This could cause the market price of our securities to decline. Factors that may affect our quarterly results include:

| • | delays in sales resulting from potential customer sales cycles | |

| • | variations or inconsistencies in return on investment models and results | |

| • | delays in demonstrating product performance or installations | |

| • | resistance from medical and/or clinical professionals to the products | |

| • | changes in competition | |

| • | Changes or threats of significant changes in legislation or rules or standards that would change the drivers for product adoption. |

Our strategy may include acquiring companies which may result in unsuitable acquisitions or failure to successfully integrate acquired companies, which could lead to reduced profitability.

We may embark on a growth strategy through acquisitions of companies or operations that complement existing product lines, customers or other capabilities. We may be unsuccessful in identifying suitable acquisition candidates, or may be unable to consummate desired acquisitions. To the extent any future acquisitions are completed, we may be unsuccessful in integrating acquired companies or their operations, or if integration is more difficult than anticipated, we may experience disruptions that could have a material adverse impact on future profitability. Some of the risks that may affect our ability to integrate, or realize any anticipated benefits from, acquisitions include:

| • | unexpected losses of key employees or customer of the acquired company; | |

| • | difficulties integrating the acquired company’s standards, processes, procedures and controls; | |

| • | difficulties coordinating new product and process development; | |

| • | difficulties hiring additional management and other critical personnel; | |

| • | difficulties increasing the scope, geographic diversity and complexity of our operations; | |

| • | difficulties consolidating facilities, transferring processes and know-how; | |

| • | difficulties reducing costs of the acquired company’s business; | |

| • | diversion of management’s attention from our management; and | |

| • | adverse impacts on retaining existing business relationships with customers. |

Our Chief Executive Officer and certain stockholders possess the majority of our voting power, and through this ownership, control our Company and our corporate actions.

Our current CEO and President, G. Landon Feazell, holds approximately 70% of the voting power of the outstanding shares immediately after this Share Exchange Agreement and shares distribution. Mr. Feazell has a controlling influence in determining the outcome of any corporate transaction or other matters submitted to our stockholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, election of directors, and other significant corporate actions. As such Mr. Feazell also has the power to prevent or cause a change in control; therefore, without his consent we could be prevented from entering into transactions that could be beneficial to us. The interests of Mr. Feazell may give rise to a conflict of interest with the Company and the Company’s shareholders. For additional details concerning voting power please refer to the section below entitled “Description of Securities.”

There is a substantial lack of liquidity of our common stock and volatility risks.

Our common stock is quoted on the OTCQB under the symbol “TCLN.” The liquidity of our common stock may be very limited and affected by our limited trading market. The OTCQB market is an inter-dealer market much less regulated than the major exchanges, and is subject to abuses, volatilities and shorting. There is currently no broadly followed and established trading market for our common stock. An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded.

The trading volume of our common stock may be limited and sporadic. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained. As a result of such trading activity, the quoted price for our common stock on the OTCQB may not necessarily be a reliable indicator of our fair market value. In addition, if our shares of common stock cease to be quoted, holders would find it more difficult to dispose of or to obtain accurate quotation as to the market value of, our common stock and as a result, the market value of our common stock likely would decline.

The market price for our stock may be volatile and subject to fluctuations in response to factors, including the following:

•

|

the increased concentration of the ownership of our shares by a limited number of affiliated stockholders following the Share Exchange may limit interest in our securities; |

| • | variations in quarterly operating results from the expectations of securities analysts or investors; |

| • | revisions in securities analysts’ estimates or reductions in security analysts’ coverage; |

•

|

announcements of new attractions or services by us or our competitors; |

•

|

reductions in the market share of our services; |

•

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

•

|

general technological, market or economic trends; |

•

|

investor perception of our industry or prospects; |

•

|

insider selling or buying; |

•

|

investors entering into short sale contracts; |

•

|

regulatory developments affecting our industry; and |

•

|

additions or departures of key personnel. |

Many of these factors are beyond our control and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time, including as to whether our common stock will sustain current market prices, or as to what effect that the sale of shares or the availability of common stock for sale at any time will have on the prevailing market price.

Our common stock may never be listed on a major stock exchange.

We anticipate seeking the listing of our common stock on a national or other securities exchange at some time in the future, assuming that we can satisfy the initial listing standards for such exchange. We currently do not satisfy the initial listing standards and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing, the trading price of our common stock could suffer, the trading market for our common stock may be less liquid, and our common stock price may be subject to increased volatility.

A decline in the price of our common stock could affect our ability to raise working capital and adversely impact our ability to continue operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. A decline in the price of our common stock could be especially detrimental to our liquidity and our operations. Such reductions may force us to reallocate funds from other planned uses and may have a significant negative effect on our business plan and operations, including our ability to develop new services and continue our current operations. If our common stock price declines, we can offer no assurance that we will be able to raise additional capital or generate funds from operations sufficient to meet our obligations. If we are unable to raise sufficient capital in the future, we may not be able to have the resources to continue our normal operations.

Concentrated ownership of our common stock creates a risk of sudden changes in our common stock price.

The sale by any shareholder of a significant portion of their holdings could have a material adverse effect on the market price of our common stock.

Sales of our currently issued and outstanding stock may become freely tradable pursuant to Rule 144 and may dilute the market for your shares and have a depressive effect on the price of the shares of our common stock.

A substantial majority of the outstanding shares of common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) (“Rule 144”). As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. Rule 144 provides in essence that a non-affiliate who has held restricted securities for a period of at least six months may sell their shares of common stock. Under Rule 144, affiliates who have held restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies quoted on the OTCQB). A sale under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

The securities issued in connection with the Share Exchange are restricted securities and may not be transferred in the absence of registration or the availability of a resale exemption.

The shares of common stock being issued in connection with the Share Exchange are being issued in reliance on an exemption from the registration requirements under Section 4(2) of the Securities Act and Regulation D promulgated thereunder or Regulation S. Consequently, these securities will be subject to restrictions on transfer under the Securities Act and may not be transferred in the absence of registration or the availability of a resale exemption. In particular, in the absence of registration, such securities cannot be resold to the public until certain requirements under Rule 144 promulgated under the Securities Act have been satisfied, including certain holding period requirements. As a result, a purchaser who receives any such securities issued in connection with the Share Exchange may be unable to sell such securities at the time or at the price or upon such other terms and conditions as the purchaser desires, and the terms of such sale may be less favorable to the purchaser than might be obtainable in the absence of such limitations and restrictions.

If we issue additional shares or derivative securities in the future, it will result in the dilution of our existing stockholders.

Our Certificate of Incorporation authorizes the issuance of up to 2,500,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share. Our board of directors may choose to issue some or all of such shares, or derivative securities to purchase some or all of such shares, to provide additional financing in the future.

We do not plan to declare or pay any dividends to our stockholders in the near future.