Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Blink Technologies, Inc. | f8k080812_epunk.htm |

| EX-99.1 - PRESS RELEASE - Blink Technologies, Inc. | f8k080812ex99i_epunk.htm |

| EX-10.2 - FORM OF CANCELLATION AGREEMENT, GONZALES - Blink Technologies, Inc. | f8k080812ex10ii_epunk.htm |

| EX-10.3 - FORM OF CANCELLATION AGREEMENT, DORNAN - Blink Technologies, Inc. | f8k080812ex10iii_epunk.htm |

Exhibit 10.1

Addendum

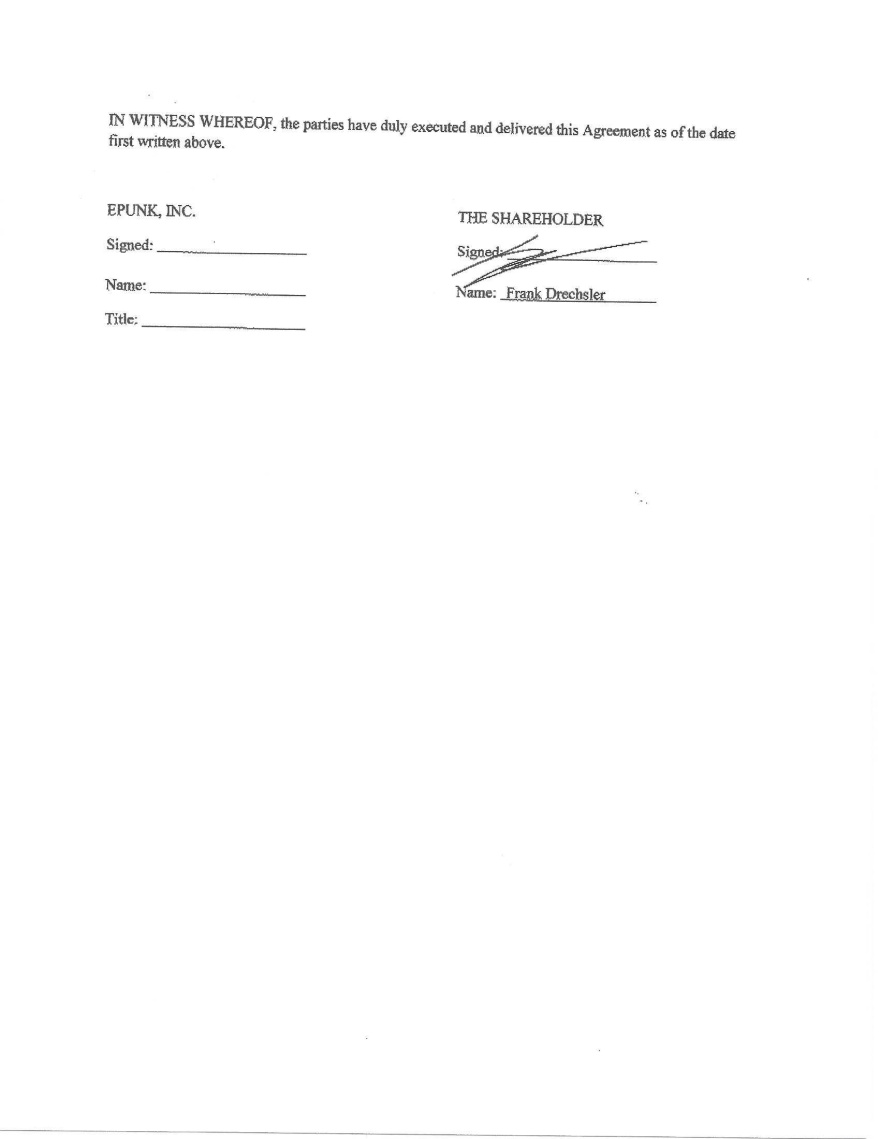

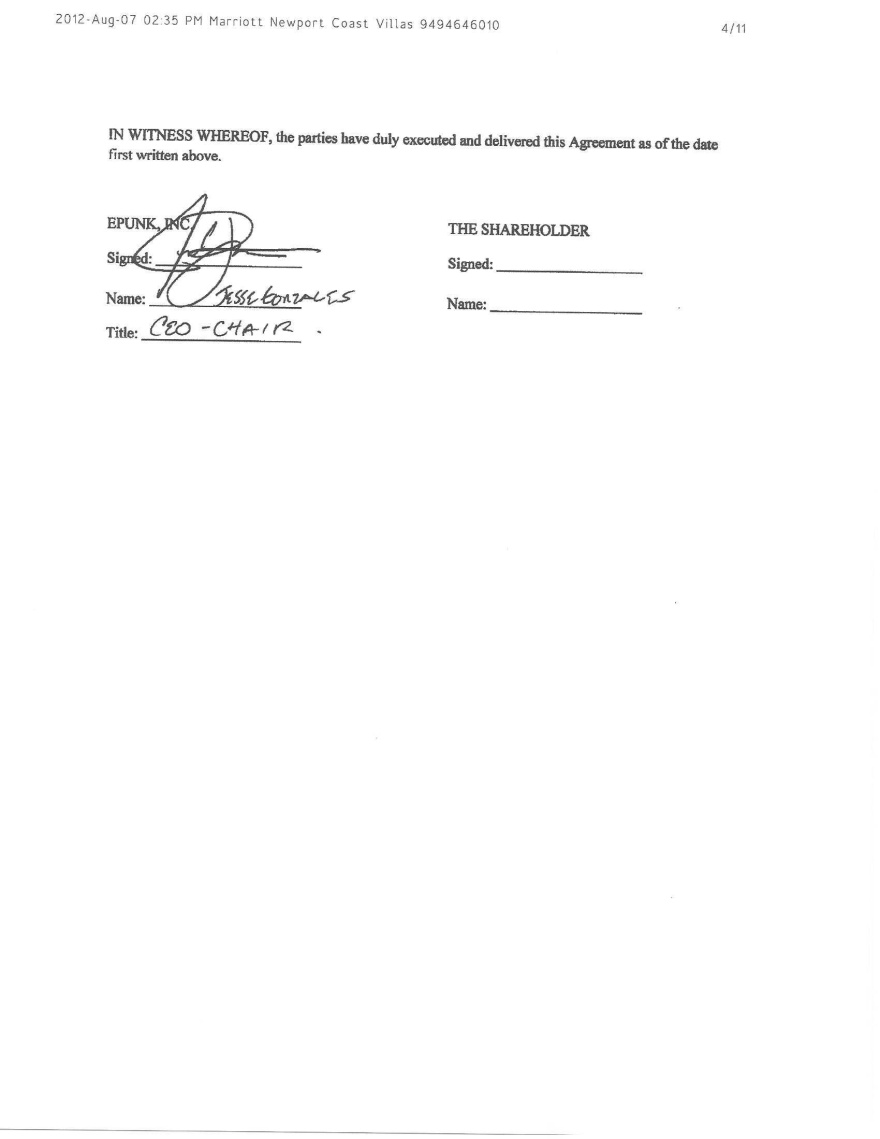

SHARE CANCELLATION AGREEMENT

(Drecshler)

THIS SHARE CANCELLATION AGREEMENT (the "Agreement") is effective as of the 7th day of August, 2012 (the "Effective Date")

BETWEEN:

EPUNK INC., a corporation incorporated under the laws of Nevada, having a an office at 1060 Calle Negocio, Suite B, San Clemente CA 92673 (the "Company");

AND:

FRANK DRECSBLER, a businessperson with a residence at (the

"Shareholder")

WHEREAS:

|

A.

|

The Shareholder is the registered and beneficial owner of 4,750,000 shares of the Company's common stock;

|

|

B.

|

The Shareholder resigned from director position with the Company effective January 30, 2012 (the "Resignation");

|

|

C.

|

The Company is in the process of seeking financing for working capital purposes; and

|

|

D.

|

In connection with the Shareholder's resignation and reduced role with the Company in the future, and the Company's efforts to seek financing, the Shareholder and the Company wish to cancel 1,900,000 shares of common stock in the Company.

|

THIS AGREEMENT WITNESSES THAT in consideration of the premises and mutual covenants contained in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound hereby, agree as follows:

I . CANCELLATION OF SHARES

|

a.

|

The Shareholder hereby agrees to cancel 1,900,000 shares of the Company's common stock and deliver a certificate representing such shares to the Company for cancellation and return to treasure (the "Surrendered Shares").

|

|

b.

|

The Shareholder retains 2,850,000 shares of common stock in the Company (the "Remaining Shares").

|

2. CONSIDERATION

|

a.

|

The Shareholder recognizes and acknowledges that the consideration for cancelling the Surrendered Shares will be the increase in value of the Remaining shares following completion of the financing.

|

3. REPRESENTATIONS

|

a.

|

The Shareholder represents and warrants to the Company that:

|

|

i.

|

He is the owner of the Surrendered Shares;

|

1

|

ii.

|

He has good and marketable title to the Surrendered Shares; and

|

|

iii.

|

The Surrendered Shares are free and clear of all liens, security interests, pledges, encumbrances or liabilities of any kind whatsoever.

|

4. MISCELLANEOUS

|

a.

|

Time. Time is expressly declared to be of the essence in this Agreement.

|

|

b.

|

Presumption. This Agreement or any section thereof shall not be construed against any party due to the fact that said Agreement or any section thereof was drafted by said party.

|

|

c.

|

Titles and Captions. All article, section and paragraph titles or captions contained in this Agreement are for convenience only and shall not deemed part of the context nor affect the interpretation of this Agreement.

|

|

e.

|

Good Faith, Cooperation and Due Diligence. The parties hereto covenant, warrant and represent to each other good faith, complete cooperation, due diligence and honesty in fact in the performance of all obligations of the parties pursuant to this Agreement. All promises and covenants are mutual and dependent.

|

|

f.

|

Assignment. This Agreement may not be assigned by either party hereto without the written consent of the other, but shall be binding upon the successors of the parties.

|

|

g.

|

Notices. All notices required or permitted to be given under this Agreement shall be given in writing and shall be delivered, either personally or by express delivery service, to the party to be notified. Notice to each party shall be deemed to have been duly given upon delivery, personally or by courier, addressed to the attention of the officer at the address set forth heretofore, or to such other officer or addresses or by such other means as either party may designate, upon at least five days written notice, to the other party.

|

|

h.

|

Entire agreement. This Agreement contains the entire understanding and agreement among the parties. There are no other agreements, conditions or representations, oral or written, express or implied, with regard thereto. This Agreement may be amended only in writing signed by all parties.

|

|

i.

|

Waiver. A delay or failure to exercise a right under this Agreement, or a partial or single exercise of that right, shall not constitute a waiver of that or any other right.

|

|

j.

|

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same Agreement. In the event that the document is signed by one party and faxed to another the parties agree that a faxed signature shall be binding upon the parties to this Agreement as though the signature was an original.

|

|

k.

|

Successors. The provisions of this Agreement shall be binding upon all parties, their successors and assigns.

|

|

1.

|

Counsel. The parties expressly acknowledge that each has been advised to seek separatecounsel for advice in this matter and has been given a reasonable opportunity to do so.

|

|

m.

|

Jurisdiction. The parties hereby consent to the jurisdiction of the state and federal courts in the city of San Diego, California, for all matters arising from this Agreement.

|

|

n.

|

Currency. Unless otherwise noted, all references to currency in this Agreement are to US Dollars.

|

2

3

4