Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ION GEOPHYSICAL CORP | d393177d8k.htm |

| EX-99.1 - PRESS RELEASE - ION GEOPHYSICAL CORP | d393177dex991.htm |

ION

Earnings Call – Q2 2012

Earnings Call Presentation

August 8, 2012

Exhibit 99.2 |

Earnings Call Introduction

Corporate Participants & Contact Information

CONTACT INFORMATION

If you have technical problems during the call, please contact DRG&L at 713 529

6600. If

you

would

like

to

listen

to

a

replay

of

today's

call,

it

will

be

available

via

webcast

in

the

Investor

Relations

section

of

the

Company's

website

-

www.iongeo.com

for

approximately

12

months.

BRIAN HANSON

Chief Executive Officer

GREG HEINLEIN

Chief Financial Officer

2 |

Earnings Call Introduction

FORWARD-LOOKING STATEMENTS

The information included herein contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934.

Actual results may vary fundamentally from those described in these

forward-looking statements.

All forward-looking statements reflect numerous assumptions and involve a

number of risks and uncertainties.

These risks and uncertainties include risk factors that are disclosed by ION

from time to time in its filings with the Securities and Exchange

Commission. 3 |

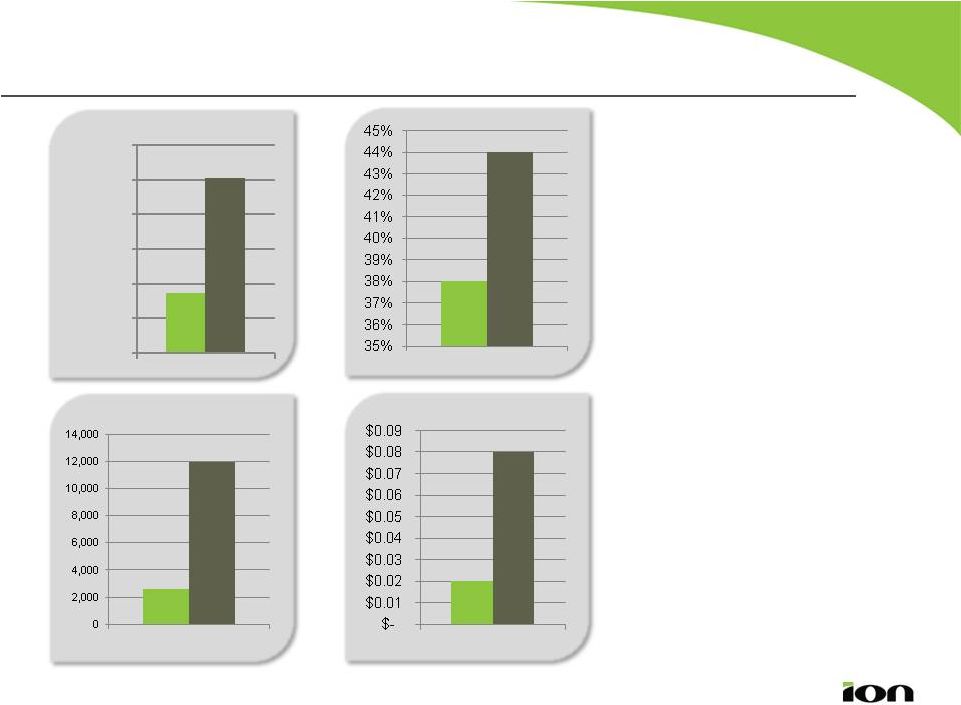

ION Q2

2012 Highlights Continued Momentum –

Solid Q2

4

Revenues

($ Thousands)

Q2 11

Q2 12

Gross Profit

Q2 11

Q2 12

Up 19%

Diluted EPS

Q2 11

Q2 12

Net Income

($ Thousands)

Q2 11

Q2 12

•

Strong revenue

growth

•

Good gross margins

•

EPS up 300%

Up 300%

80,000

85,000

90,000

95,000

100,000

105,000

110,000 |

Market

Observations International Data Processing Picking Up

Fifth sequential quarterly improvement in

ION DP revenues

International demand

up

--

Europe, Africa,

Middle East

Continued rebalancing of our portfolio

beyond Gulf of Mexico

Ended Q2 with record data processing

backlog

Introduced new broadband processing

technology,

WiBand ,

with

20+

projects

underway

5

Conventional Image

WiBand Image

WiBand Projects

TM |

Market

Observations Continued Growth in Marine Seismic Activity

6

Towed Streamer market tightening

Good growth in Seabed market

Launched Calypso

TM

seabed

acquisition system in Q2 at EAGE

Growing demand for ION’s Acquisition

Optimization Services |

7

Solid performance --

revenues, operating profits, margins.

Ended Q2 with record backlog.

Continued rise in international exploration –

Africa, Latin America, Australia

and the Arctic.

GeoVentures

TM

Acquisition and Data Library Programs –

1H 2012 |

Summary

Industry remains robust

International activity is strong

Well positioned to grow

Remain confident in our ability to

deliver against plan

8 |

Software

Systems

Solutions

9

Solutions

revenues of $72 million,

up

47% Y/Y

Software

revenues

of

$10

million,

up

6% in local currency Y/Y

Systems

revenues of $23 million,

down

23% Y/Y

Q2 revenue growth led by strong growth in

Solutions segment

Financial Overview

Revenues by Segment

-

20

40

60

80

100

120

Q2 11

Q2 12 |

Solutions Segment

Financial Overview

Revenue by Type

Multi-client Investments

Solutions Backlog

Q4

11

$134 M Data

Processing

Data

Libraries

New

Ventures

Q2

11 $117 M

10

Q3

11 $106 M

Q1

12

$129 M $150 M

$130 M

Data Processing and New Ventures activity strong.

Backlog growing well.

Q2

12

$153 M |

Software Segment

Financial Overview

Revenue by Type (GBP)

Services

Software Systems

% of Seismic Vessels with Orca

®

Orca-Permanent

Spectra/Pre-Orca

ION versions

11

Continued steady growth in Q2.

Added two Orca vessels.

Growing demand for on-board services.

-

1

2

3

4

5

6

7

Q2 11

Q2 12

41%

59% |

Systems Segment

Financial Overview

Revenue by Type

Towed Streamer Equipment

OBC

Other

12

Q2 soft as expected –

timing of revenue recognition.

Good reception for Calypso at EAGE.

-

5

10

15

20

25

30

35

Q2 11

Q2 12 |

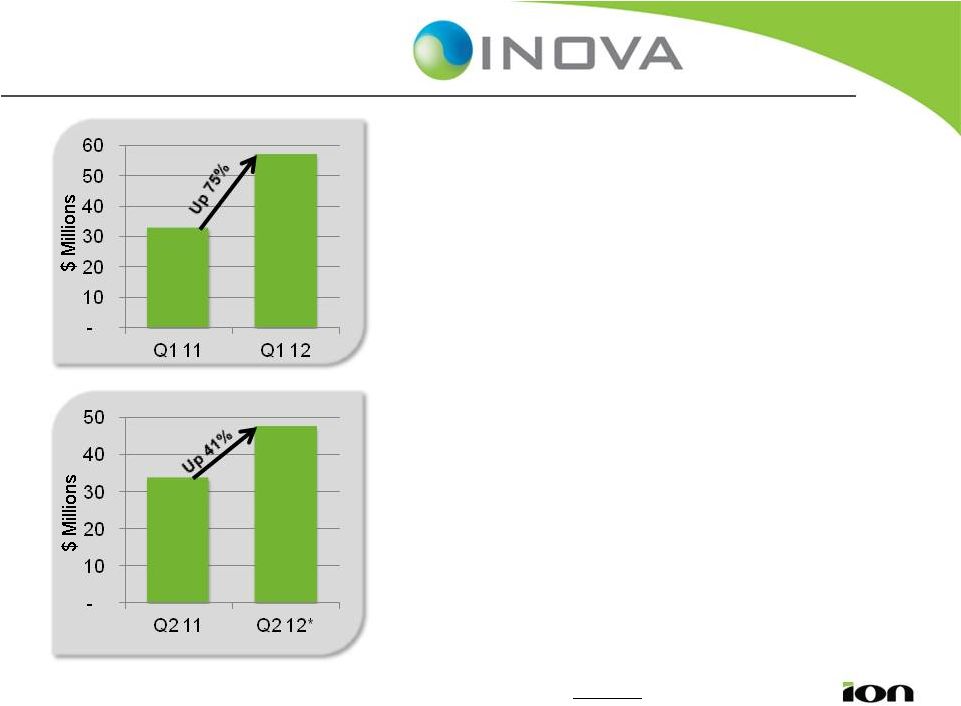

INOVA

Geophysical Financial Overview

Revenues

13

*Forecast

Revenues

**ION

to

share

in

49%

of

these

results.

2012

estimates

are

unaudited.

Q1 2012

•

Revenues of $56.8 million with operating

income of $8.9 million**

•

Delivered 15,000 channels of G3i™

•

Delivered first 3 UniVib™ units

•

Significant number of Vibrator sales Q2 2012 •

Estimated revenues of $45 to $49 million

with an operating loss of ($3) to ($4) million**

•

Delivered an additional 9,000 channels of G3i

•

First sale of new wireless Hawk™ system

|

Financial Overview

Cash Flow

Three Months Ended

June 31,

SUMMARIZED CASH FLOW

2012

2011

Cash from operations

$

38,556

$

20,349

Working capital

(5,023)

(11,283)

Multi-client investment

(28,054)

(34,195)

PP&E Capital Expenditures

(3,122)

(3,566)

Free Cash Flow

2,357

(28,695)

Other Investing & Financing

(6,171)

(7,186)

Cash flow, including ST investments

(3,814)

(35,881)

Cash, Cash Equivalents & ST Investments (Beginning of Period)

87,096

130,834

Cash, Cash Equivalents & ST Investments (End of Period)

$

83,282

$

94,953

Good free cash flow and strong cash position

14 |

Financial Overview

Balance Sheet as of June 30, 2012

Capital Employed*

Capital Book Value

Cash

Net Fixed Assets

Multi-Client Data Library

Goodwill & Equity in INOVA

Equity

Debt

** Net Debt = Debt less Cash

Other Working Capital

15

*Assets less Current Liabilities

Net Debt of $22M**

0

100

200

300

400

500

600

0

100

200

300

400

500

600

$187M

$83M

$177M

$87M

Q2

Q1

$105M

$105M

Q1

Q2 |

Continued Momentum in Q2

16

•

Strong first half 2012

•

Expect solid Y/Y growth

throughout 2012

•

Continue to anticipate

2012

multi-client

investment

in

$130

-

$150

range

•

Remain positive on outlook to

achieve Y/Y quarterly

improvement for balance of 2012 |

17 |