Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Tower Group International, Ltd. | d392728d8k.htm |

1.

Second Quarter 2012

Earnings Call Presentation

Exhibit 99.1 |

1

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a "safe

harbor" for forward-looking statements. This presentation and any

other written or oral statements made by or on behalf of Tower may

include forward-looking statements that reflect Tower's current

views with respect to future events and financial performance. All statements

other than statements of historical fact included in this presentation are

forward-looking statements. Forward-looking statements can

generally be identified by the use of forward-looking terminology such as "may," "will," "plan," "expect,"

"project," "intend," "estimate," "anticipate,"

"believe" and "continue" or their negative or variations or similar terminology.

All forward-looking statements address matters that involve risks and

uncertainties. Accordingly, there are or will be important factors that

could cause the actual results of Tower to differ materially from those indicated in these

statements. Please refer to Tower’s filings with the SEC, including

among others Tower’s Annual Report on Form 10-K for the year

ended December 31, 2011 and subsequent filings on Form 10-Q, for a description of the important factors that

could cause the actual results of Tower to differ materially from those

indicated in these statements. Forward-looking statements

speak only as of the date on which they are made, and Tower undertakes

no obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future developments or otherwise.

Notes on Non-GAAP Financial Measures

Operating income excludes realized gains and losses, acquisition-related

transaction costs and the results of the reciprocal business, net of

tax. This is a common measurement for property and casualty insurance companies. We

believe this presentation enhances the understanding of our results of

operations by highlighting the underlying profitability of our insurance

business. Additionally, these measures are a key internal management performance

standard. Operating earnings per share is operating income divided by diluted

weighted average shares outstanding. Operating return on equity is

annualized operating income divided by average common stockholders' equity.

Total premiums include gross premiums written through our insurance

subsidiaries and produced as managing general agent on behalf of other

insurance companies, including the reciprocal exchanges. |

2

Overview of the Operating Results |

3

Second Quarter Snapshot

Second quarter operating results

•

Net operating loss of $15.5 million, or ($0.39) per diluted share compared

with operating income of $26.0 million, or $0.63 per diluted share same

period last year

»

Excluding the after-tax loss reserve charge of $42 million, Tower achieved

strong operating results

Organic growth initiative and improving market conditions drive strong

top line growth

•

14.9%

top

line

growth

in

2Q

driven

from

growth

from

new

business

units

•

Improving market conditions, especially in property and specialty lines of

business •

Developing a strong pipeline of organic growth opportunities

Exercised option to combine with Canopius Holdings Bermuda Limited

and Canopius Bermuda Limited (together, “Canopius Bermuda”)

•

Will

enable

Tower

to

create

a

global

specialty

insurance

company

with

greater

diversification

•

Access to U.S., Bermuda and Lloyd’s markets supported by an efficient

international holding company structure

•

Enables

Tower

to

increase

its

ROE

target

to

13%

to

15%

within

18

months

of

merger |

4

Second Quarter 2012 Highlights

*Stockholders equity reduced by $95 million from stock repurchases and

dividends since 2Q11 -

0.3

3.3

42.3

4.6

2Q12

Storms

Dev.

Pro -

Forma

2Q12

2Q11

Storms

Dev.

Pro -

Forma

2Q11

Operating Earnings ($ millions)

2Q12

2Q11

0.08

1.08

0.11

-

0.01

2Q12

Storms

Dev.

Pro -

Forma

2Q12

2Q11

Storms

Dev.

Pro -

Forma

2Q11

Operating EPS (Loss)

2Q12

2Q11

2Q12

2Q11

Book Value per Share ($)*

2Q12

2Q11

Stockholders' Equity ($ millions)* |

5

Second Quarter Highlights

109.7

94.1

93.3

93.4

1.2

15.6

2.1

-

0.1

2Q12

Storms

Dev.

Pro -

Forma

2Q12

2Q11

Storms

Dev.

Pro -

Forma

2Q11

Combined Ratio (%)

2Q12

2Q11

1.3

16.2

1.7

-

0.1

2Q12

Storms

Dev.

Pro -

Forma

2Q12

2Q11

Storms

Dev.

Pro -

Forma

2Q11

Operating ROE (%)

2Q12

2Q11 |

6

Organic Growth Initiative is Driving Top Line Growth

Organic Growth Initiative Second Quarter 2012 Status

Expand products:

•

Continued product expansion into mono-line commercial property, inland

marine, surety and package policies focusing on affluent clients

Develop entrepreneurial businesses

•

Continued

production

from

newly

created

businesses

including

assumed

reinsurance

($48

million

of

GWP in the second quarter), customized solutions and National Commercial

Property business units Develop key processes related to generating

organic growth •

Recently expanded marketing department developing a pipeline of organic growth

opportunities 537.6

468.0

2Q12

2Q11

Gross Premiums Written and Managed

($ millions)

15% |

7

Business Segment Results

Commercial

Personal**

Insurance

General

Specialty

Services

Business Units / Products

Small business;

Middle market

National Programs, E&S,

Customized Solutions,

Transportation and

Assumed Reinsurance

Homeowners and

private passenger

auto

2Q12 GPW* ($ millions)

$175

$195

$168

$9***

2Q11 GPW* ($ millions)

185

131

152

8***

2Q12 % of total GPW

33%

36%

31%

n/a

Commercial Consolidated

Loss Ratio

83.3%

52.1%

n/a

Expense Ratio

32.2%

39.8%

n/a

Combined Ratio

115.5%

91.9%

n/a

Retention

78%

92%

n/a

Renewal Premium Change

4.2%

2.6%

n/a

Segment

Summary

* Gross premiums written and managed

** Loss, Expense and Combined ratios exclude

reciprocal business ***Total revenue for the segment

Accelerated focus

on small premium

size segment across

all lines of business

Seeing signs of

pricing improvement

in the middle

market business

Completed

termination of

unprofitable program

business with a

focus on profitable

specialty programs

Growth driven

primarily by

assumed

reinsurance

business

Successful rollout of

personal lines

system; on pace to

replace legacy

system by middle of

2012

Continued expansion

into affluent

personal lines

market

Expanding licensing

to expand writings

in other states and

thereby increasing

fee income |

8

Net Loss and Loss Expense Ratio, Excluding Reciprocals

Prior to the charge, Tower has had minimal history of adverse

development •

Prior to the 2Q charge, less than $30 million total adverse development since

going public in 2004 (including $7 million from late reported storm

losses in 2011) •

$65M

2Q

reserve

strengthening

is

a

culmination

of

multi-year

actions

that

began

in

the

4Q

2009 to mitigate prolonged soft market conditions

»

Reserve charge should allow Tower’s prospective financial results to

fully reflect current accident year profitability going forward

Positive reserves and underwriting outlook

•

Reserve strengthening improves the overall reserve position

»

6-30 reserves now exceed the year end 2011 central estimates developed by

the outside actuaries

•

Historical loss ratio remains favorable after reserve strengthening (62.3 %

from 2008 to 2011 excluding 2.4 point of storm losses)

•

Shift in business mix, corrective underwriting and claims cost reduction

projected to reduce 2012 accident year loss ratio by 2 to 4 points

(61.5% projected in 2012) 77.3

60.5

62.4

1.2

15.6

2.1

-0.1

2Q12

Storms

Dev.

Pro -

Forma

2Q12

2Q11

Storms

Dev.

Pro -

Forma

2Q11

Loss

Ratio

and

Reserves

(%)

2Q12

2Q11

60.4 |

9

19.2%

17.8%

10.8%

11.3%

3.6%

3.9%

33.6%

33.0%

2Q12

2Q11

Commissions, net of ceding commissions

OUE, net of fees

BB&T expenses

Expense Ratio Excluding Reciprocals

Revised

allocation

to

claims

costs

resulted

in

1

point

year

over

year

increase

in

other underwriting expenses (OUE)

Commission rate higher year over year due to assumed reinsurance, this should

trend down in second half of year

As

systems

initiatives

relating

to

personal

lines

are

completed,

we

expect

scale

advantage to drive expense ratio down

Note: Excludes reciprocals |

10

Improving Investment Performance

Note: Excludes reciprocals

$2,434

$2,281

6-30-2012

6-30-2011

Cash and Invested Assets ($millions)

4.8

4.7

6-30-2012

6-30-2011

Tax-

Equivalent Fixed Income

Yield (%)

$30

$30

6-30-2012

6-30-2011

Net Investment Income

($millions)

Alternative

investment

commitment

remains

modest

but

assets

have

begun

to generate positive returns in 2Q12 and should provide higher yield and

diversification from interest rate risk inherent in fixed-income

investments, and reduce capital markets volatility

Operating cash flows improved in 2Q12 as compared to 2Q11

|

11

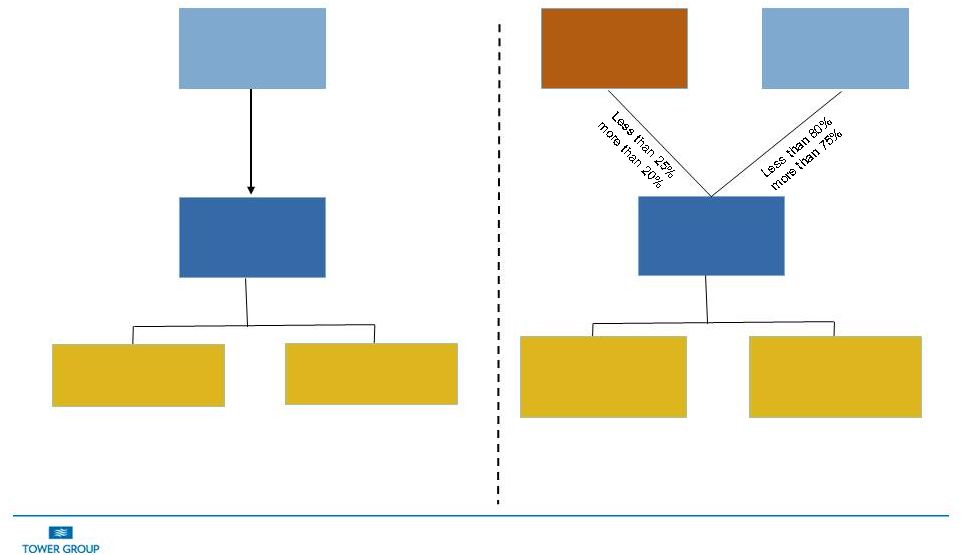

High Level Merger Corporate Chart

*CP RE used solely to reinsure US Pool

100%

CURRENT STATE

Note: After merger completion, Tower expects U.S. and Bermuda

operations to have comparable capital bases. TWGP shareholders

get$1.25 per share in cash consideration and the company increases

its capital by between $190 million to $240 million

POST MERGER

Tower

Shareholders

US HOLDCO

CP RE

US POOL*

New

Shareholders

Tower

Shareholders

Bermuda

Operations

Lloyd’s and CPRe

business

Tower and its

Subsidiaries

U.S. Operations

Tower Group

International

Holding Company |

12

Positive Trends and Guidance

2Q12*

2H12*

2012 Target*

Trend

through remainder of 2012

Annual GPW Growth

14.9%

< 5%

Anticipate growth on the upper end of our 5% to 10% range

due to organic growth initiatives and improving market

conditions

Loss Ratio

77.3%

61.5%-62.5%

The loss ratio trend for 2H12 should improve due to re-

underwriting and pricing actions, shift to profitable specialty

and property business and declining impact of the runoff

business. No further adverse development is anticipated

Expense Ratio

33.6%

33.5%-34.5%

Expense ratio should benefit over remainder of year from

lower acquisition cost trends, lower systems costs at end of

year and leveling of OUE by year end

Combined Ratio

110.9%

95.0%-97.0%

Future improvement will be driven primarily by reduction in

loss and expense ratios expected over the balance of the

year

Investment Yield

4.8%

4.6%-4.8%

Continued growth in invested asset base and book yield

stabilization due to alternative and strategic investments

Operating ROE &

2012 Guidance

(5.9%)

10.0%

-11.0%

We expect to see improvement to 10%-12% range occurring

in second half of year and continuing into 2013

*Excludes reciprocals

99.5%

5.0%

$1.45

4.7%

-

$1.55

-

6.0%

-

4.8%

-

101.5%

33.5%

-

34.5%

66%

67%

-

5%

10%

- |