Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d391367d8k.htm |

First Quarter FY 2013

Earnings Presentation

Bristow Group Inc.

August 7, 2012

Exhibit 99.1 |

2

Fourth quarter earnings call agenda

Introduction

CEO remarks and operational highlights

Current and future financial performance

-

Q1 FY13 financial results discussion

-

New contract awards

Closing remarks

Questions and answers

Linda McNeill, Director Investor Relations

Bill Chiles, President and CEO

Jonathan Baliff, SVP and CFO

Bill Chiles, President and CEO |

3

Forward-looking statements

This presentation may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements about our future business, operations, capital expenditures, fleet composition,

capabilities and results; modeling information, earnings guidance, expected operating margins

and other financial projections; future dividends, share repurchase and other uses of excess

cash; plans, strategies and objectives of our management, including our plans and strategies to

grow earnings and our business, our general strategy going forward and our business model;

expected actions by us and by third parties, including our customers, competitors and

regulators; the valuation of our company and its valuation relative to relevant financial

indices; assumptions underlying or relating to any of the foregoing, including assumptions regarding

factors impacting our business, financial results and industry; and other matters. Our

forward-looking statements reflect our views and assumptions on the date of this

presentation regarding future events and operating performance. They involve known and unknown

risks, uncertainties and other factors, many of which may be beyond our control, that may cause

actual results to differ materially from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and

other factors include those discussed under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our

Annual Report on Form 10-K for the fiscal year-ended March 31, 2012 and our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2012. We do not undertake any obligation, other

than as required by law, to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. |

4

Chief Executive Officer comments

Bill

Chiles,

President

and

CEO |

5

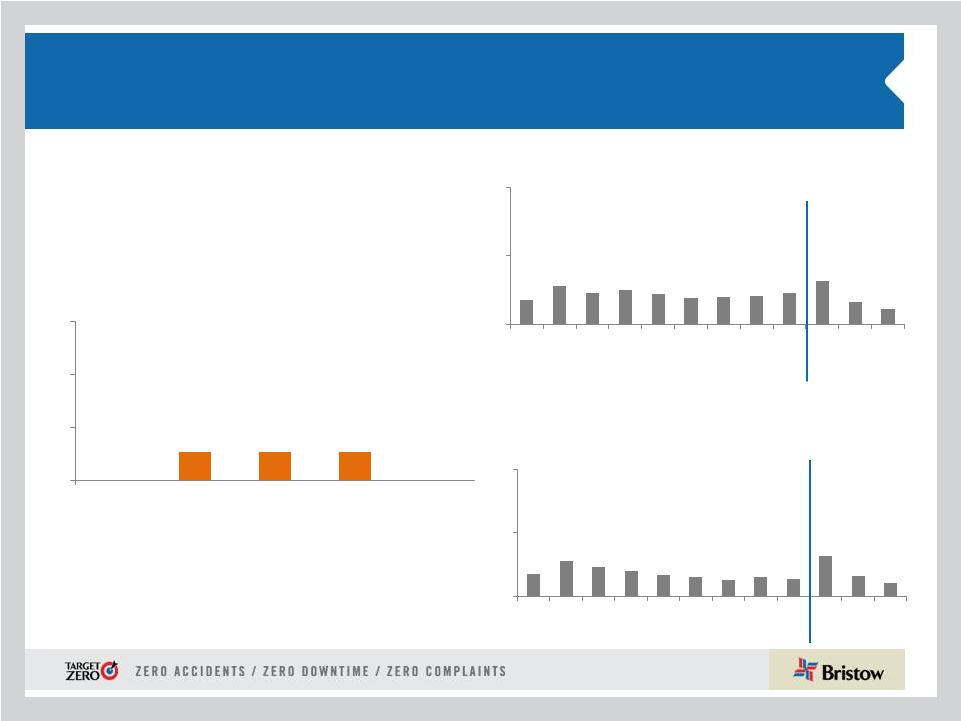

Operational safety review

* Includes consolidated commercial operations only

Total Recordable Injury Rate* per 200,000 man-

hours (cumulative)

Lost Work Case Rate* per 200,000

man-hours (cumulative)

Commercial Air Accident Rate* per 100,000

Flight Hours (Fiscal Year)

FY12

FY12

FY13

FY13

0

0.54

0.53

0.53

0

0

1

2

3

FY09

FY10

FY11

FY12

Q1 FY13

0.18

0.28

0.23

0.25

0.22

0.19

0.2

0.21

0.23

0.32

0.16

0.11

0

0.5

1

J

A

S

O

N

D

J

F

M

A

M

J

0.18

0.28

0.23

0.2

0.17

0.15

0.20

0.15

0.14

0.32

0.16

0.11

0

0.5

1

J

A

S

O

N

D

J

F

M

A

M

J |

6

Q1 FY13 Highlights

•

The strong

operating

performance

in

Q4

FY12

continued

in

Q1

FY13

with

GAAP

EPS up 14% and adjusted EPS higher by 50% year-over-year

•

Cash flow from operations of $55.4 million up ~ 5% year-over-year

•

Four

out

of

five

business

units

generated

positive

BVA**

with

an

overall

increase of $17.3 million over Q1 FY12 from increased revenue and margin

improvement

•

EPS guidance

for

the

full

FY13

is

reaffirmed

at

$3.25

-

$3.55

•

Q1 operating revenue of $320.7M (12% increase from Q1 FY12, 1% increase from Q4

FY12) •

Q1 GAAP EPS of $0.65 (14% increase from Q1 FY12, 67% increase

from Q4 FY12) •

Q1 adjusted EPS* of $0.81 (50% increase from Q1 FY12, 34% decrease from Q4

FY12) •

Q1 adjusted

EBITDAR*

of

$84.3M

(26%

increase

from

Q1

FY12,

15%

decrease

from

Q4

FY12)

* Adjusted

EPS

and

adjusted

EBITDAR

amounts

exclude

gains

and

losses

on

dispositions

of

assets

and

any

special

items

during

the

period.

See reconciliation

of

these

items

to

GAAP

measures

in

the

appendix

hereto

and

in

our

earnings

release

for

the

quarter

ended

June

30,

2012.

** Bristow

Value

Added

(BVA)

is

calculated

by

taking

Gross

Cash

Flow

less

the

product

of

Gross

Operating

Assets

times

a

capital

charge of

10.5%. Sample calculation for Q1 FY12 and Q1 FY13 can be found in the appendix

hereto. |

7

•

Global E & P spending is expected to rise by 11% in 2012 even in

the face of

worldwide economic uncertainty and upcoming U.S. presidential elections

•

Supermajors continue to earmark deepwater and ultra deepwater projects,

especially in response to weakness in the natural gas sector

•

Secular trends, such as continued deepwater development, higher safety

requirements, and an acceleration of newer technology, are expected to support

demand for additional larger helicopters

•

The Gulf of Mexico activity demonstrates all of these trends as rising dayrates

across all rig classes and solid contract momentum support the bullish

outlook for helicopter demand in this region

•

Continued momentum around the world for search and rescue (SAR) work is

contributing to tightness in helicopter supply

Current market environment |

8

•

Europe represented 39% of Bristow operating

revenue and 42% of adjusted EBITDAR* in Q1

FY13

•

Operating revenue increased to $123.2M in Q1

FY13 from $108.3M in Q1 FY12 with the

addition of four large aircraft and increased

activity with existing clients and new contracts

in NNS and Norway

•

Adjusted EBITDAR increased to $39.7M in

Q1FY13 from $35.7M in Q1 FY12 while

adjusted EBITDAR margin remained relatively

flat at 32.2% in Q1 FY13 versus 33.0% in Q1

FY12

Outlook:

•

Bristow is shortlisted for UK SAR program

with results to be announced in early 2013

•

High activity continues as demonstrated by

new awards for nine aircraft recently

announced. Additional awards are

anticipated next quarter.

FY13 adjusted EBITDAR margin

expected to be ~ low thirties

Europe (EBU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

9

West Africa (WASBU)

•

Nigeria represented 21% of Bristow operating

revenue and 22% of adjusted EBITDAR* in Q1 FY13

•

Operating revenue of $66.4M in Q1 FY13 increased

27% from $52.3M in Q1 FY12 due to strong activity

and a 12% increase in flight hours compared to Q1

FY12

•

Adjusted EBITDAR increased to $21.2M in Q1 FY13

from $15.4M in Q1 FY12 with adjusted EBITDAR

margin of 32% in Q1 FY13 vs 30% in Q1 FY12

•

Outlook:

•

Improved service through Client Promise

initiative continues to drive strong results: Two

existing contracts extended with better pricing

and terms

•

Upcoming heavy maintenance on several

aircraft will impact Q2 and Q3 FY13

•

We continue to work on optimizing the

operating model in this business unit as part

of the local content initiative

FY13 adjusted EBITDAR margin expected

to be ~ low thirties

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

10

•

•

North America represented 17% of Bristow operating

revenue and 13% of adjusted EBITDAR* in Q1 FY13

•

Adjusted EBITDAR almost doubled to $12.2M in Q1 FY13

vs. $6.3M in Q1 FY12 and adjusted EBITDAR margin of

23.2% in Q1 FY13 increased significantly from 14.3% in

Q1 FY12

•

Sequential improvement of almost 50% in adjusted

EBITDAR from $8.2M in Q4 FY12 to $12.2M in the

current quarter

•

The business model performed with key parameters

significantly better: several mid-teen price increases,

large aircraft working and costs contained

Outlook:

•

Our business is improving in FY13 similar to other

oil service deepwater sector recoveries -

more

rigs, more people, and better results

•

Client Promise initiative continues to deliver

positive results

FY13 adjusted EBITDAR expected to be ~ low

twenties

North America (NABU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

11

Australia (AUSBU)

•

Australia represented 12% of Bristow operating

revenue and 11% of adjusted EBITDAR* in Q1 FY13

•

Operating revenue of $38.2M in Q1 FY13 decreased

from $40.9M in Q1 FY12 due to a decrease in overall

flight activity

•

Adjusted EBITDAR increased to $10.3M in Q1 FY13

from $8.3M in Q1 FY12 and adjusted EBITDAR

margin increased to 27.0% in Q1 FY13 from 20.2% in

Q1 FY12 reflecting better asset utilization along with

lower operating costs

•

INPEX award of a ten-year contract for up to

six large aircraft with an option to add a long

term SAR aircraft with the start date in FY14

•

Aircraft will be redeployed as short term

contracts roll off. This will impact performance

in Q2 and Q3 FY13

•

An additional medium aircraft contract award

with improved terms

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. Outlook:

FY13

adjusted

EBITDAR

margin

expected to

be ~ mid to high twenties |

12

Other International (OIBU)

Other International (OIBU)

•

Other International represented 11% of Bristow operating revenue

and 12% of adjusted EBITDAR* in Q1 FY13

•

Operating revenue decreased to $33.2M in Q1 FY13 vs. $34.5M

in Q1 FY12 due to decrease in activity in Ghana and the end of a

contract in the Baltic Sea

•

Adjusted EBITDAR margin of 36.2% in Q1 FY13 decreased from

48.1% in Q1 FY12 due primarily to decreased earnings from

unconsolidated affiliates (particularly Lider in Brazil), activity

reduction in Mexico, and increased operating costs in Trinidad

•

Lider equity earnings decreased to $0.0M in Q1 FY13 compared

to $2.7M in Q1 FY12

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. Outlook:

•

Potential new opportunities in Caspian, East Africa, Southeast

Asia, and the Caribbean

•

Petrobras awarded Lider contracts for five new large aircraft, with

one leased by Bristow to Lider, with operations scheduled to

commence starting in August 2012 through April 2013

•

Lider’s second half of the year is expected to be better than the first

half as operations under new contracts begin. Currency fluctuations

make it difficult to predict if this will translate into higher equity

earnings

FY13 adjusted EBITDAR margin expected to be ~ low

to mid forties |

13

Financial discussion

Jonathan

Baliff,

SVP

and

CFO |

14

Financial highlights:

Adjusted EPS and EBITDAR Summary

Q1FY2012 to Q1FY2013 adjusted EPS bridge

Q1FY2012 to Q1FY2013 adjusted EBITDAR bridge (in millions)

$0.54

$0.81

$0.28

$0.08

$0.09

Q1FY2012

Operations

Corporate and Other

FX Changes

Q1FY2013

$67.0

$84.3

$15.9

$5.4

$4.0

Q1FY2012

Operations

Corporate and Other

FX Changes

Q1FY2013

Adjusted EPS and EBITDAR amounts exclude gains and losses on dispositions of assets and any special

items during the quarter. See reconciliation of these items to GAAP in the appendix

hereto and in our earnings release for the quarter ended June 30, 2012 .

* |

15

LACE rate increased with overall LACE declining

due to sales of less productive aircraft

YTD

LACE

Rate

increased

with

the

improvement

in

contract

terms

and

higher

utilization

of

aircraft,

especially

in

NABU

and

WASBU

($ in millions)

* YTD FY13 LACE rate is annualized

295

290

279

268

263

164

159

153

149

147

0

50

100

150

200

250

300

350

FY09

FY10

FY11

FY12

YTD FY13

Consolidated commerical aircraft

Large Aircraft Equivalent (LACE)

164

159

153

149

147

6.14

6.49

7.15

7.89

8.55

0

1

2

3

4

5

6

7

8

9

0

50

100

150

200

250

300

350

FY09

FY10

FY11

FY12

YTD FY13*

LACE

LACE Rate

See appendix hereto for more information on LACE and LACE Rate. LACE and LACE Rate excludes Bristow

Academy, affiliate aircraft, aircraft held for sale, aircraft construction in progress, and

reimbursable revenue. |

16

BVA –

Six Quarters

Year over year improvement for Q1 FY13

BVA* Q4 FY11 –

Q1 FY13

*See 10-Q for more information on BVA and appendix hereto for GAAP

reconciliation. •

Q1 FY13 BVA is $1.9M,

which is a $17.3M

improvement over Q1

FY12

•

Positive year-over-year

change in BVA is driven

by:

Revenue growth in

Europe, West Africa,

and North America

Margin improvements,

including lower

corporate G&A

-3.6

-15.4

1.1

13.6

1.9

-20

-15

-10

-5

0

5

10

15

20

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

0 |

17

Our progress on BVA continues with stronger

operating cash flow generation in Q1 FY13

Net cash provided by operating activities

See 10-Q for more information on cash flow provided by operating

activities 29.6

35.0

25.7

52.9

55.4

127.9

195.4

151.4

231.3

0

40

80

120

160

200

240

280

320

FY09

FY10

FY11

FY12

Q1 FY13 |

18

Recently announced contract awards provide growth and

demonstrate the success of Bristow’s Client Promise

Norway:

•

Contract renewal for four

S-92s starting Sep 2014

for seven-year term with

option to extend for five

years, using existing a/c

•

New contract for SAR

services for three

EC225s starting Sep

2014 for five-year term

with option to extend for

five years, using two new

option a/c and one

leased a/c

UK:

•

New contract for one

S-92 starting in July

2012

•

New contract for one

EC225 starting Aug

2012 for minimum of

two years

•

One a/c is reflected in

our fleet and one a/c is

leased

Brazil:

•

Lider was awarded

contracts for five S-92s

for five-year terms.

One a/c is leased to

Lider by Bristow and is

scheduled to start work

in Aug 2012 with the

rest starting by Apr

2013

Australia:

•

New contract with

INPEX for up to six

EC225s starting in

2014 for ten-year term

with an option to add a

long term SAR a/c,

using one new option

aircraft and five

existing a/c

20 large aircraft

4 = Existing contract extensions

16 = Incremental new contracts

All contracts are at higher pricing

and better terms |

19

Financial highlights:

FY13 guidance reaffirmed

•

EPS guidance range $3.25

- $3.55, excluding aircraft sales and

special items •

Depreciation and amortization expense ~ $90 –

$95 million

•

SG & A expense ~ $135 -

$140 million

•

Interest expense ~ $38 -

$43 million

•

Tax ~

20% -

24 %

(assuming revenue earned in same regions and same mix)

•

LACE* (Large Aircraft Equivalent) ~ 152-156 (FY13 average)

•

LACE Rate* ~ $7.90 -

$8.20 million per LACE aircraft per year

•

Anticipate a better overall second half of FY13 compared to the first half

* Excludes Bristow Academy, aircraft held for sale, CIP, and reimbursable

revenue. |

20

Conclusions

•

Our focus on execution is delivering results with Target Zero /

Client Promise being the top priority

•

Strong financial profile with liquidity, and prudent balance

sheet management (our adjusted debt to equity is 71% vs.

peer* average of 248%)

•

We are delivering a balanced shareholder return through

dividend increases (quarterly dividend of $0.20 per share or

33% increase from Q1 FY12) and opportunistic share

repurchases

* Our peer group includes CHC, ERA, Inaer Aviation, and PHI. Data from latest

filings as of July 29, 2012. ERA based on S-1 pro-forma. |

21

Appendix |

22

Organizational Chart -

as of June 30, 2012

Business

Unit

(%

of

FY13

Operating

Revenue)

Corporate

Region

(

#

of

Aircraft

/

#

of

Locations)

Joint

Venture

(#

of

aircraft)

Key

Operated Aircraft

Bristow owned and/or operated

357 aircraft as of June 30, 2012

Affiliated Aircraft

Bristow affiliates and joint

ventures operated 194 aircraft

as of June 30, 2012 |

23

Aircraft Fleet –

Medium and Large

As of June 30, 2012

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Mature Aircraft Models

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332L Super Puma

18

Twin Turbine

23

-

23

-

AW189

16

Twin Turbine

-

-

-

6

EC225

25

Twin Turbine

18

-

18

-

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

32

4

36

11

82

4

86

17

LACE

76

Medium Helicopters

AW139

12

Twin Turbine

7

2

9

-

Bell 212

12

Twin Turbine

1

14

15

-

Bell 412

13

Twin Turbine

34

20

54

-

EC155

13

Twin Turbine

3

-

3

-

Sikorsky S-76A/A++

12

Twin Turbine

15

5

20

-

Sikorsky S-76C/C++

12

Twin Turbine

52

31

83

-

112

72

184

-

LACE

51 |

24

Aircraft Fleet –

Small, Training and Fixed

As of June 30, 2012 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

•LACE does not include held for sale, training and fixed wing

helicopters Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

Bell 206B

4

Turbine

1

2

3

-

Bell 206 L-3

6

Turbine

4

6

10

-

Bell 206 L-4

6

Turbine

29

1

30

-

Bell 407

6

Turbine

39

-

39

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

6

3

9

-

83

12

95

-

LACE

21

Training Helicopters

AW139

12

Twin Turbine

-

3

3

-

Bell 412

13

Twin Turbine

-

8

8

-

Bell 212

12

Twin Turbine

-

15

15

-

AS355

4

Twin Turbine

5

-

5

-

AS350BB

4

Turbine

-

36

36

-

Agusta 109

8

Twin Turbine

-

2

2

-

Bell 206B

6

Single Engine

12

-

12

-

Robinson R22

2

Piston

12

-

12

-

Robinson R44

2

Piston

2

-

2

-

Sikorsky 300CB/Cbi

2

Piston

45

-

45

-

Fixed Wing

1

-

1

-

77

64

141

-

Fixed Wing

3

42

45

-

Total

357

194

551

17

TOTAL LACE (Large Aircraft Equivalent)

147 |

25

Operating lease strategy: lowering the cost and amount of

capital needed to grow

•

Of the 56 aircraft currently leased in our fleet, 30 are training and 26 are

commercial (18 LACE)

•

18 LACE aircraft represent approximately 12% of our commercial fleet

•

Our

goal

is

for

commercial

fleet

operating

leases

to

account

for

20-30%

of

our

LACE

Leased aircraft as of June 30, 2012

Large

Medium

Small

Total

Leased LACE

Total LACE

% Leased

EBU

8

-

-

8

8

47

17%

WASBU

-

1

-

1

1

22

2%

NABU

2

11

1

14

8

30

26%

AUSBU

1

-

2

3

2

18

11%

OIBU

-

-

-

-

-

32

0%

Total

11

12

3

26

18

147

12% |

26

Consolidated Fleet Changes and Aircraft Sales for

Q1 FY13

EBU

WASBU

NABU

AUSBU

OIBU

Total

Large

3

-

-

3

-

6

Medium

2

1

-

1

7

11

Small

-

-

-

-

-

-

Total

5

1

-

4

7

17

Aircraft held for sale by BU

EBU

WASBU

NABU

AUSBU

OIBU

BA

Total

Large

8

-

2

1

-

-

11

Medium

-

1

11

-

-

-

12

Small

-

-

1

2

-

-

3

Fixed

-

-

-

-

-

-

-

Training

-

-

-

-

-

30

30

Total

8

1

14

3

-

30

56

Leased aircraft in consolidated fleet

# of A/C Sold

Received*

Q1 FY13

4

19

$

Totals

4

19

$

* $ in millions

Q 1 FY13

Fleet Count Beginning Period

361

Delivered

S-92

2

Total Delivered

2

Removed

Sales

(4)

Other*

(2)

Total Removed

(6)

357

* Includes destroyed aircraft, lease returns

and commencements

Fleet changes |

27

Operating Revenue, LACE and LACE rate by BU

Operating

revenue

LACE

LACE Rate

2,3

EBU

123.2

47

10.60

WASBU

66.4

22

12.35

NABU

52.6

30

7.05

AUSBU

38.2

18

8.48

OIBU

33.2

32

4.22

Total

313.6

147

8.55

Operating Revenue, LACE, and LACE Rate by BU

as of June 30, 2012

1

1) $ in millions

2) LACE Rate is annualized

3) $ in millions per LACE

4) OIBU LACE rate is lower than other business units’ LACE rate due to a large proportion of

revenue being from dry leases 4 |

28

Order and options book as of June 30, 2012

#

Helicopter

Class

Delivery Date

Location

Contracted

#

Helicopter

Class

Delivery Date

3

Large

December 2012

EBU

3

1

Large

September 2013

2

Large

December 2012

WASBU

0

1

Large

December 2013

2

Large

March 2013

EBU

2

1

Large

March 2014

1

Large

September 2013

EBU

0

1

Large

June 2014

1

Large

September 2013

NABU

0

1

Large

September 2014

2

Large

December 2013

OIBU

0

1

Large

December 2014

1

Large

September 2014

NABU

0

1

Large

March 2015

1

Large

December 2014

OIBU

0

2

Large

June 2015

1

Large

March 2015

OIBU

0

2

Large

September 2015

1

Large

June 2015

EBU

0

2

Large

December 2015

1

Large

March 2016

EBU

0

1

Large

March 2016

1

Large

June 2016

AUSBU

0

2

Large

June

2016

17

5

2

Large

September 2016

2

Large

December 2016

* Six large ordered aircraft expected to enter service beginning

1

Large

March 2017

in calendar year 2014 are subject to the successful development

1

Large

June 2017

and certification of the aircraft.

1

Large

September 2017

1

Large

December 2017

1

Medium

June 2013

4

Medium

December 2013

3

Medium

June 2014

2

Medium

September 2014

2

Medium

June 2015

36

ORDER BOOK*

OPTIONS BOOK |

29

Adjusted EBITDAR margin* trend

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

EBU

31.2%

31.7%

31.9%

28.0%

30.8%

29.8%

31.5%

34.6%

34.4%

32.7%

WASBU

31.7%

36.8%

33.7%

39.1%

36.0%

33.7%

36.9%

35.8%

34.3%

35.2%

NABU

18.3%

20.0%

14.9%

17.7%

17.8%

20.8%

25.8%

15.9%

8.5%

18.5%

AUSBU

26.5%

36.7%

34.4%

31.3%

32.4%

33.2%

26.1%

27.0%

31.1%

29.3%

OIBU

34.4%

37.6%

25.9%

25.1%

31.0%

18.3%

40.2%

37.4%

59.4%

39.3%

Consolidated

24.7%

27.8%

24.7%

23.9%

25.3%

23.8%

27.5%

25.9%

29.6%

26.7%

2013

Q1

Q2

Q3

Q4

Full Year

Q1

EBU

33.0%

31.4%

30.7%

36.1%

32.9%

32.2%

WASBU

29.5%

35.5%

37.2%

36.6%

35.0%

31.9%

NABU

14.3%

20.6%

14.8%

19.4%

17.3%

23.2%

AUSBU

20.2%

14.4%

23.5%

35.6%

24.3%

27.0%

OIBU

48.1%

19.1%

47.8%

42.9%

39.5%

36.2%

Consolidated

23.4%

24.0%

27.6%

31.2%

26.6%

26.3%

2010

2011

2012

* Adjusted EBITDAR excludes special items and asset dispositions and calculated by taking adjusted

EBITDAR divided by operating revenue |

30

Adjusted EBITDAR* reconciliation

* Adjusted EBITDAR excludes special items and asset dispositions

($ in millions)

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

Net income

$24.0

$33.7

$27.1

$28.7

$113.5

$20.9

$38.8

$42.3

$31.2

$133.3

Income tax expense

9.5

11.2

5.7

2.6

29.0

8.5

3.3

-11.8

7.1

7.1

Interest expense

10.0

10.6

11.0

10.8

42.4

11.0

11.5

13.8

9.9

46.2

Gain on disposal of assets

-6.0

-4.9

-2.4

-5.3

-18.7

-1.7

-1.9

0.0

-5.1

-8.7

Depreciation and amortization

18.2

18.5

20.7

17.4

74.7

19.3

21.0

21.3

27.7

89.4

Special items

2.6

-2.5

-1.1

1.0

0.0

0.0

0.0

-1.2

2.4

1.2

EBITDA Subtotal

58.2

66.7

60.9

55.1

240.9

58.1

72.7

64.4

73.3

268.5

Rental expense

7.0

7.0

7.2

6.3

27.3

6.6

6.1

8.7

7.7

29.2

Adjusted EBITDAR

$65.2

$73.6

$68.1

$61.3

$268.2

$64.7

$78.8

$73.1

$81.1

$297.7

3/31/2013

($ in millions)

Q1

Q2

Q3

Q4

Full Year

Q1

Net income

$21.2

$3.0

$26.5

$14.6

$65.2

$24.2

Income tax expense

6.6

-1.9

7.1

2.4

14.2

6.2

Interest expense

9.0

9.5

9.8

10.0

38.1

8.8

Gain on disposal of assets

-1.4

1.6

2.9

28.6

31.7

5.3

Depreciation and amortization

22.7

25.4

22.7

25.3

96.1

21.4

Special items

0.0

24.6

0.0

3.4

28.1

2.2

EBITDA Subtotal

58.1

62.1

68.9

84.3

273.4

68.0

Rental expense

9.0

9.1

12.8

15.1

46.0

16.3

Adjusted EBITDAR

$67.0

$71.2

$81.8

$99.5

$319.5

$84.3

3/31/2010

3/31/2011

3/31/2012

Fiscal year ended,

Fiscal year ended, |

31

Bristow Value Added (BVA)

Sample calculation

Bristow

Value

Added

=

Gross

Cash

Flow

–

(Gross

Operating

Assets

X

Capital

Charge)

BVA

= GCF -

(

GOA X 10.5%** )

Bristow Value Added calculation for Q1 FY12

($15.4)

=

$60* -

(

$2,874* X 2.625%** )

Bristow Value Added calculation for Q1 FY13

$1.9 =

$80* -

(

$2,976* X 2.625%** )

* Reconciliation for these items follows right after

this slide ** Quarterly capital charge of 2.625% is based on

annual capital charge of 10.5% |

32

Gross Cash Flow Presentation

Special items:

(in millions)

Gross Cash Flow Reconciliation

Q1 FY12

Q1 FY13

Net Income

21

24

Depreciation and Amortization

23

21

Interest Expense

9

9

Interest Income

(0)

(0)

Rent

9

16

Other Income/expense-net

(0)

1

Gain/loss on Asset Sale

(1)

5

Special Items

0

2

Tax Effect from Special Items

0

(2)

Earnings (losses) from Unconsolidated Affiliates, Net

(6)

(2)

Non-controlling Interests

0

1

Gross Cash Flow before Lider

$54

$75

Gross Cash Flow - Lider proportional

6

5

Gross Cash Flow after Lider

$60

$80

FY13 includes: $2.2m special charge for severance costs related to the termination of a contract

in the Southern North Sea |

33

Gross Operating Asset Presentation

(in millions)

Adjusted Gross Operating Assets Reconciliation

Q1 FY12

Q1 FY13

Total Assets

2,701

2,740

Accumulated Depreciation

463

468

Capitalized Operating Leases

136

194

Cash and Cash Equivalents

(117)

(227)

Investment in Unconsolidated Entities

(210)

(201)

Goodwill

(30)

(29)

Intangibles

(7)

(4)

Assets Held for Sale: Net

(34)

(18)

Assets Held for Sale: Gross

77

86

Adj. for gains & losses on assets sales

(0)

116

Accounts Payable

(51)

(58)

Accrued Maintenance and Repairs

(11)

(16)

Other Accrued Taxes

(4)

(7)

Accrued Wages, Benefits and Related Taxes

(33)

(43)

Other Accrued Liabilities

(18)

(27)

Income Taxes Payable

(16)

(10)

Deferred Revenue

(9)

(13)

ST Deferred Taxes

(10)

(15)

LT Deferred Taxes

(155)

(142)

Adjusted Gross Operating Assets before Lider

$2,672

$2,794

Adjusted Gross Operating Assets - Lider proportional

202

182

Adjusted Gross Operating Assets after Lider

$2,874

$2,976 |

GAAP reconciliation

Three Months Ended

June 30,

2012

2011

(In thousands, except per

share amounts)

Adjusted operating income

.................................................

47,470

$

34,989

Gain (loss) on disposal of assets

.....................................

(5,315)

1,416

Severance costs for termination of a contract

................. (2,162)

—

Operating income

................................................................

39,993

$

36,405

Adjusted EBITDAR

............................................................

84,273

$

67,025

Gain (loss) on disposal of assets

.....................................

(5,315)

1,416

Severance costs for termination of a contract

................. (2,162)

—

Depreciation and amortization

....................................... (21,372)

(22,708)

Rent expense

..................................................................

(16,274)

(8,953)

Interest expense

..............................................................

(8,774)

(8,955)

Provision for income taxes

............................................. (6,180)

(6,606)

Net income

..........................................................................

24,196

$

21,219

Adjusted net income

...........................................................

29,618

$

19,878

Gain (loss) on disposal of assets

(i)

.................................

(4,234)

1,167

Severance costs for termination of a contract

(i)

.............

(1,722)

—

Net income attributable to Bristow Group

.......................... 23,662

$

21,045

Adjusted diluted earnings per share

.................................... 0.81

$

0.54

Gain (loss) on disposal of assets

(i)

.................................

(0.12)

0.03

Severance costs for termination of a contract

(i)

.............

(0.05)

—

Diluted earnings per share

.................................................. 0.65

0.57

34 |

35

Leverage Reconciliation

*Adjusted EBITDAR exclude gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of June 30, 2012

736.3

$

1,540.7

$

2,277.0

$

32.3%

Adjust for:

Unfunded pension liability

109.8

109.8

NPV of all lease obligations

217.0

217.0

Letters of credit

1.5

1.5

Adjusted

1,064.6

$

(d)

1,540.7

$

2,605.3

$

40.9%

Calculation of debt to adjusted EBITDAR multiple

Adjusted EBITDAR*:

FY 2012

336.8

$

(e)

Annualized

449.1

$

= (d) / (e)

3.16:1 |

36

Bristow Group Inc. (NYSE: BRS)

2103

City

West

Blvd.,

4

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us

th |