Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Target Acquisitions I, Inc. | Financial_Report.xls |

| EX-31.1 - Target Acquisitions I, Inc. | e609890_ex31-1.htm |

| EX-32.2 - Target Acquisitions I, Inc. | e609890_ex32-2.htm |

| EX-32.1 - Target Acquisitions I, Inc. | e609890_ex32-1.htm |

| EX-31.2 - Target Acquisitions I, Inc. | e609890_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED March 31, 2012

|

OR

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______ TO ________.

|

COMMISSION FILE NUMBER: 000-53328

TARGET ACQUISITIONS I, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

26-2895640

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

Chunshugou Luanzhuang Village, Zhuolu County, Zhangjiakou, Hebei Province, China

|

075600

|

|

(Address of principal executive offices)

|

(Zip code)

|

Issuer's telephone number: 86-313-6732526

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the number of shares outstanding of each of the issuer's classes of common equity, for the period covered by this report and as at the latest practicable date:

At May 15, 2012, we had outstanding 8,000,100 shares of common stock.

Explanatory Note

This amendment is being filed to amend the following items in response to a letter of comment we received from the Staff of the Division of Corporation Finance, Securities and Exchange Commission and includes a restatement of the consolidated financial statements previously filed:

Part I: Item 1 (Financial Statements) and Item 2 (Management’s Discussion and Analysis of Financial Condition and Results of Operations).

Part II: Item 1A. (Risk Factors) and Item 6 (Exhibits).

i

TARGET ACQUISITIONS I, INC.

PART I

FINANCIAL INFORMATION

|

Item 1. Financial Statements

|

|

|

Consolidated Balance Sheets as of March 31, 2011 and 2010

|

1

|

|

Consolidated Statements of Operations and Other Comprehensive Loss Three Months Ended March 31, 2012 and 2011 (unaudited)

|

2

|

|

Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2012 and 2011 (audited)

|

3

|

|

Notes to Consolidated Financial Statements

|

4

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

17

|

|

PART II

|

|

|

OTHER INFORMATION

|

|

|

Item 1A. Risk Factors

|

26

|

|

Item 6. Exhibits

|

26

|

|

Signatures

|

27

|

Special Note Regarding Forward Looking Statements

This report contains forward-looking statements. The forward-looking statements are contained principally in the section entitled “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

ii

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

TARGET ACQUISITIONS I, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

MARCH 31, 2012 (UNAUDITED) AND DECEMBER 31, 2011

|

2012

(Restated)

|

2011

(Restated)

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash & equivalents

|

$

|

62,064

|

$

|

196,116

|

||||

|

Inventory

|

675,764

|

672,127

|

||||||

|

Advance to suppliers

|

128,280

|

-

|

||||||

|

Other receivable

|

50,288

|

-

|

||||||

|

Total current assets

|

916,396

|

868,243

|

||||||

|

NONCURRENT ASSETS

|

||||||||

|

Property and equipment, net

|

9,379,162

|

9,596,034

|

||||||

|

Intangible assets

|

588,961

|

598,205

|

||||||

|

Construction in progress

|

360,434

|

196,004

|

||||||

|

Deferred tax assets

|

3,251

|

3,248

|

||||||

|

Total noncurrent assets

|

10,331,808

|

10,393,490

|

||||||

|

TOTAL ASSETS

|

$

|

11,248,204

|

$

|

11,261,733

|

||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accrued liabilities and other payables

|

$

|

419,306

|

$

|

248,768

|

||||

|

Payable to contractors

|

873,806

|

872,891

|

||||||

|

Income taxes payable

|

131,341

|

131,201

|

||||||

|

Advance from shareholder

|

235,133

|

-

|

||||||

|

Total current liabilities

|

1,659,586

|

1,252,860

|

||||||

|

NONCURRENT LIABILITY

|

||||||||

|

Accrued expense

|

13,005

|

12,991

|

||||||

|

Total liabilities

|

1,672,591

|

1,265,851

|

||||||

|

CONTINGENCIES AND COMMITMENT

|

||||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Preferred stock: $0.001 par value; 10,000,000 shares authorized, no shares issued and outstanding

|

-

|

-

|

||||||

|

Common stock, $0.001 par value; authorized shares 100,000,000; issued and outstanding 8,000,100

|

8,000

|

8,000

|

||||||

|

Paid in capital

|

5,296,312

|

5,296,312

|

||||||

|

Statutory reserves

|

557,253

|

557,253

|

||||||

|

Accumulated other comprehensive income

|

560,542

|

550,570

|

||||||

|

Retained earnings

|

3,153,758

|

3,583,747

|

||||||

|

Total stockholders' equity

|

9,575,613

|

9,995,882

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

11,248,204

|

$

|

11,261,733

|

||||

The accompanying notes are an integral part of these consolidated financial statements.

1

|

TARGET ACQUISITIONS I, INC. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE LOSS

|

|

THREE MONTHS ENDED MARCH 31, 2012 AND 2011 (UNAUDITED)

|

|

2012

(Restated)

|

2011

(Restated)

|

|||||||

|

Operating expenses

|

||||||||

|

General and administrative

|

$

|

429,047

|

$

|

333,326

|

||||

|

Loss from operations

|

(429,047

|

)

|

(333,326

|

)

|

||||

|

Non-operating income

|

||||||||

|

Interest income

|

66

|

813

|

||||||

|

Interest expense

|

(920

|

)

|

(11

|

)

|

||||

|

Financial expense

|

(88

|

)

|

-

|

|||||

|

Total non-operating income (expenses), net

|

942

|

(802

|

)

|

|||||

|

Loss before income tax

|

(429,989

|

)

|

(332,524

|

)

|

||||

|

Net loss

|

(429,989

|

)

|

(332,524

|

)

|

||||

|

Other comprehensive income

|

||||||||

|

Foreign currency translation gain

|

9,720

|

64,943

|

||||||

|

Comprehensive loss

|

$

|

(420,269

|

)

|

$

|

(267,581

|

)

|

||

|

Basic weighted average shares outstanding

|

8,000,100

|

8,000,000

|

||||||

|

Basic net earnings per share

|

$

|

(0.05

|

)

|

$

|

(0.04

|

)

|

||

The accompanying notes are an integral part of these consolidated financial statements.

2

|

TARGET ACQUISITIONS I, INC. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

THREE MONTHS ENDED MARCH 31, 2012 AND 2011

|

|

(UNAUDITED)

|

|

2012

(Restated)

|

2011

(Restated)

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net loss

|

$

|

(429,989

|

)

|

$

|

(332,524

|

)

|

||

|

Adjustments to reconcile net loss to net cash

|

||||||||

|

used in operating activities:

|

||||||||

|

Depreciation and amortization

|

261,970

|

250,761

|

||||||

|

(Increase) decrease in current assets:

|

||||||||

|

Inventory

|

(2,926

|

)

|

(164,075

|

)

|

||||

|

Other receivable

|

(50,184

|

)

|

-

|

|||||

|

Advance to suppliers

|

(128,013

|

)

|

-

|

|||||

|

Increase (decrease) in current liabilities:

|

||||||||

|

Unearned revenue

|

-

|

30,380

|

||||||

|

Accrued liabilities and other payables

|

170,058

|

82,797

|

||||||

|

Income taxes payable

|

-

|

(135,166

|

)

|

|||||

|

Net cash used in operating activities

|

(179,084

|

)

|

(267,827

|

)

|

||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Construction in progress

|

(163,883

|

)

|

-

|

|||||

|

Acquisition of property, plant & equipment

|

(25,657

|

)

|

-

|

|||||

|

Net cash used in investing activities

|

(189,540

|

)

|

-

|

|||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Advance from related parties

|

234,645

|

-

|

||||||

|

Net cash provided by financing activities

|

234,645

|

-

|

||||||

|

EFFECT OF EXCHANGE RATE CHANGE ON CASH & EQUIVALENTS

|

(73

|

)

|

1,769

|

|||||

|

NET DECREASE IN CASH & EQUIVALENTS

|

(134,052

|

)

|

(266,058

|

)

|

||||

|

CASH & EQUIVALENTS, BEGINNING OF PERIOD

|

196,116

|

283,299

|

||||||

|

CASH & EQUIVALENTS, END OF PERIOD

|

$

|

62,064

|

$

|

17,241

|

||||

|

Supplemental Cash flow data:

|

||||||||

|

Income tax paid

|

$

|

-

|

$

|

135,166

|

||||

|

Interest paid

|

$

|

-

|

$

|

-

|

||||

The accompanying notes are an integral part of these consolidated financial statements.

3

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2012 (UNAUDITED) AND DECEMBER 31, 2011

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Target Acquisitions I, Inc. (“the Company” or “Target”) was incorporated in the state of Delaware on June 27, 2008 to raise capital intended to be used in connection with its business plan which may include a possible merger, acquisition or other business combination with an operating business.

Effective October 1, 2011, the Company entered into a share exchange with China Real Fortune Mining Limited (“Real Fortune BVI”), and the shareholders of Real Fortune BVI, pursuant to which the Company acquired 100% of the issued and outstanding capital stock of Real Fortune BVI for 8,000,000 of the Company’s common shares. Immediately prior to the consummation of the share exchange, there were 100 shares of the Company’s common stock outstanding (after retirement of 4,999,900 common shares). Upon completion of the foregoing transactions, the Company had 8,000,100 shares of common stock issued and outstanding. Real Fortune BVI was incorporated on September 13, 2010 in the British Virgin Islands (“BVI”) to serve as an intermediate holding company.

The acquisition of Real Fortune BVI was accounted for as a recapitalization effected by a share exchange, wherein Real Fortune BVI was considered the acquirer for accounting and financial reporting purposes with no adjustment to the historical basis of its assets and liabilities. Real Fortune BVI’s shareholders become the Company’s majority shareholders and have control of the Company Target was a non-operating public shell prior to the acquisition. As a result of the acquisition of Real Fortune BVI, Target is no longer a shell company. Pursuant to Securities and Exchange Commission (“SEC”) rules, the merger or acquisition of a private operating company into a non-operating public shell with nominal net assets is considered a capital transaction in substance, rather than a business combination. As a result, the accompanying consolidated financial statements were retroactively restated to reflect the recapitalization.

Zhangjiakou Tongda Mining Technologies Service Co., Ltd. (“China Tongda”) was incorporated on August 17, 2010 as a wholly foreign owned entity under the laws of the People’s Republic of China (“PRC”). China Tongda is 100% owned by Real Fortune Holding Limited (“Real Fortune HK”), a company incorporated and registered in Hong Kong on April 23, 2010 by Changkui Zhu, the CEO of the Company, who then owned 100% of Real Fortune HK. On April 14, 2011, Mr. Zhu sold 100% of his ownership interest in Real Fortune HK to Real Fortune BVI for HKD 10,000 ($1,286), which was the registered share capital of Real Fortune HK. Both China Tongda and Real Fortune HK had no operations at the time of ownership transfer. Accordingly, since April 14, 2011, Real Fortune HK has been 100% owned by Real Fortune BVI. Real Fortune BVI is ultimately owned by a group of shareholders who are the shareholders of Zhuolu Jinxin Mining Co., Ltd. (“China Jinxin”). Therefore, China Tongda was directly controlled by Real Fortune HK, and Real Fortune HK was directly controlled by Real Fortune BVI prior to the execution of a series of contractual agreements between China Tongda and China Jinxin in May 2011, described below.

China Jinxin was incorporated in China on December 21, 2006. China Jinxin is engaged in iron ore processing and iron ore concentrate production in the PRC. The main product of China Jinxin is iron ore concentrate.

On May 9, 2011, China Jinxin and its shareholders entered into a series of agreements, including a Management Entrustment, an Exclusive Purchase Option and Equity Pledge Agreements with China Tongda, and each shareholder of China Jinxin granted China Tongda an irrevocable power of attorney to appoint China Tongda as his attorney-in-fact to exercise all of its rights as equity owner of China Jinxin. According to these agreements, Wholly Foreign Owned Enterprise (“WFOE”) acquired management control of China Jinxin whereby WFOE is entitled to all net profits of China Jinxin as a management consultation and technical supporting fee, and is obligated to manage and fund China Jinxin’s operations and pay its debts. As a result of these agreements, China Tongda is considered the primary beneficiary of China Jinxin, and China Tongda must consolidate the results of operations of China Jinxin, as China Tongda contractually controls the management of China Jinxin and China Jinxin granted an irrevocable proxy to China Tongda or its designee as defined by FASB Interpretation No. 46R, “Consolidation of Variable Interest Entities” (“FIN 46R”), included in ASC Topic 810, Consolidation, an Interpretation of Accounting Research Bulletin No. 51, which requires certain VIEs to be consolidated by the entity’s primary beneficiary if the equity investors in the entity do not have the characteristics of a controlling financial interest or sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties.

4

The Management Entrustment Agreement is for 30 years, or until May 9, 2041, and will be extended automatically for successive 10 year periods thereafter, except that the agreement will terminate (i) at the expiration of the initial 30-year term, or any 10-year renewal term, if WFOE notifies China Jinxin not less than 30 days prior to the applicable expiration date that it does not want to extend the term, (ii) upon prior written notice from WFOE, or (iii) upon the date WFOE acquires all of the assets, or at least 51% of the equity interests, of China Jinxin. The term of each Exclusive Purchase Option Agreement is 30 years, or until May 9, 2041, and will be extended automatically for successive 10-year periods thereafter, unless WFOE notifies China Jinxin and the shareholder of China Jinxin granting the option at least 30 days prior to the applicable expiration date that it does not want to extend the option.

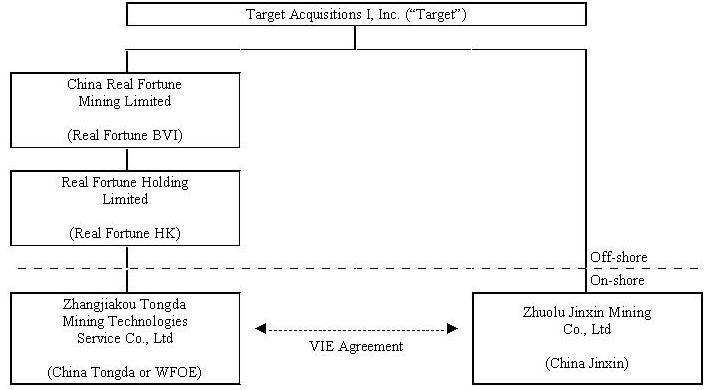

China Jinxin’s results of operations, assets and liabilities are consolidated in the Company’s financial statements from the earliest period presented. The Group’s structure as of March 31, 2012 is as follows:

Through contractual arrangements between China Tongda and China Jinxin, the Company controls China Jinxin’s daily operations and financial affairs. As a result of these agreements, China Tongda is considered the primary beneficiary of China Jinxin (see Note 2) and accordingly, China Jinxin’s results of operations and financial condition are consolidated in the group financial statements. All issued and outstanding shares of China Jinxin are ultimately held by 15 Chinese citizens.

5

The consolidated interim financial information as of March 31, 2012 and for the three month periods ended March 31, 2012 and 2011 was prepared without audit, pursuant to the rules and regulations of the SEC. Certain information and footnote disclosures, which are normally included in consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”) was not included. The interim consolidated financial information should be read in conjunction with the Financial Statements and the notes thereto, included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, previously filed with the SEC.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s consolidated financial position as of March 31, 2012, results of operations and cash flows for the three month periods ended March 31, 2012 and 2011, as applicable, were made. The interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements were prepared in conformity with US GAAP. Target and Real Fortune BVI’s functional currency is the US Dollar (‘‘USD’’), Real Fortune HK’s functional currency is Hong Kong Dollar (‘‘HKD’’) and China Tongda’s and China Jinxin’s functional currency is Chinese Renminbi (‘‘RMB’’). The accompanying financial statements were translated from functional currencies and presented in US Dollars ($).

Principles of Consolidation

The consolidated financial statements include the financial statements of the Company, its subsidiaries and VIE subsidiary for which the Company’s subsidiary China Tongda is the primary beneficiary. All transactions and balances among the Company, its subsidiaries and VIE subsidiary were eliminated in consolidation.

The Company follows FIN 46R, ASC 810, Consolidation, which requires a VIE be consolidated by a company if that company is subject to a majority of the risk of loss from the VIE or is entitled to a majority of the VIE’s residual returns.

In determining China Jinxin is the VIE of China Tongda, the Company considered the following indicators, among others:

China Tongda has the right to control and administer the financial affairs and operations of China Jinxin and to manage and control all assets of China Jinxin. The equity holders of China Jinxin as a group have no right to make any decision about China Jinxin’s activities without the consent of China Tongda. China Tongda should be paid quarterly, management consulting and technical support fees equal to all pre-tax profits, if any, of that quarter. If there are no earnings before taxes and other cash expenses, then no fee shall be paid. If China Jinxin sustains losses, they will be carried to the next period and deducted from the next service fee. China Jinxin has the right to require China Tongda pay China Jinxin the amount of any loss incurred by China Jinxin.

The shareholders of China Jinxin pledged their equity interests in China Jinxin to China Tongda to guarantee China Jinxin’s performance of its obligations under the Equity Pledge Agreement. If either China Jinxin or its equity owners is in breach of the Equity Pledge or Exclusive Purchase Option Agreements, then China Tongda shall be entitled to require the equity owners of China Jinxin to transfer their equity interests in China Jinxin to it.

The shareholders of China Jinxin irrevocably granted China Tongda or its designated person an exclusive purchase option to acquire, at any time, all of the assets or outstanding shares of China Jinxin, to the extent permitted by PRC law. The purchase price for the shareholders’ equity interests in China Jinxin shall be the lower of (i) the actual registered capital of China Jinxin and (ii) RMB 500,000 ($78,000), unless an appraisal is required by the laws of China.

6

Each shareholder of China Jinxin executed an irrevocable power of attorney to appoint China Tongda as its attorney-in-fact to exercise all of its rights as equity owner of China Jinxin, including 1) attend the shareholders’ meetings of China Jinxin and/or sign the relevant resolutions; 2) exercise all the shareholder's rights and shareholder's voting rights that the shareholder is entitled to under the laws of the PRC and the Articles of Association of China Jinxin, including but not limited to the sale or transfer or pledge or disposition of the shares in part or in whole; 3) designate and appoint the legal representative, Chairman of the Board of Directors (“BOD”), Directors, Supervisors, the Chief Executive Officer, Financial Officer and other senior management members of China Jinxin; and 4) execute the relevant share purchases and other terms stipulated in the Exclusive Purchase Option and Share Pledge Agreements.

Use of Estimates

In preparing financial statements in conformity with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Significant estimates, required by management, include the recoverability of long-lived assets, allowance for doubtful accounts, and the reserve for obsolete and slow-moving inventories. Actual results could differ from those estimates

Cash and Equivalents

For financial statement purposes, the Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. Based on historical collection activity, the Company had $0 allowances at March 31, 2012 and December 31, 2011.

Inventory

Inventory consists of iron ore, iron ore concentrate and supplies. Inventory is valued at the lower of average cost or market, cost being determined on a moving weighted average basis method; including labor and all production overheads.

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the period benefited. Maintenance and repairs are expensed as incurred. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using shorter of useful live of the property or the unit of depletion method. For shorter-lived assets the straight-line method over estimated lives ranging from 3 to 20 years is used as follows:

|

Office Equipment

|

3-5 years

|

|

Machinery

|

10 years

|

|

Vehicles

|

5 years

|

|

Building

|

20 years

|

7

Impairment of Long-Lived Assets

Long-lived assets, which include property and equipment and intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Recoverability of long-lived assets to be held and used is measured by comparing of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by it. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds its fair value. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. Based on its review, the Company believes that, as of March 31, 2012 and December 31, 2011, there were no impairments of its long-lived assets.

Income Taxes

The Company utilizes Statement of Financial Accounting Standards (“SFAS”) No. 109, “Accounting for Income Taxes,” codified in FASB ASC Topic 740, which requires recognition of deferred tax assets and liabilities for expected future tax consequences of events included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company follows FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, (“FIN 48”), codified in FASB ASC Topic 740. When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about their merits or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50% likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of income. At March 31, 2012 and December 31, 2011 the Company did not take any uncertain positions that would necessitate recording a tax related liability.

Revenue Recognition

The Company’s revenue recognition policies are in compliance with SEC Staff Accounting Bulletin (“SAB”) 104 (codified in FASB ASC Topic 605). Sales are recognized when a formal arrangement exists, which is generally represented by a contract between the Company and the buyer; the price is fixed or determinable; title has passed to the buyer, which generally is at the time of delivery; no other significant obligations of the Company exist and collectability is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are recorded as unearned revenue.

Sales are the invoiced value of iron ore concentrate, net of value-added tax (“VAT”). All of the Company’s iron ore concentrate sold in the PRC is subject to a value-added tax of 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing the finished product. The Company records VAT payable and VAT receivable net of payments in the financial statements. The VAT tax return is filed offsetting the payables against the receivables. Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government.

8

Cost of Goods Sold

Cost of goods sold (“COGS”) consists primarily of amortization of asset retirement cost, direct material, direct labor, depreciation of mining plant and equipment, which is attributable to the production of iron ore concentrate. Write-down of inventory to lower of cost or market is also recorded in COGS.

Concentration of Credit Risk

The operations of the Company are in the PRC. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by the political, economic, and legal environments in the PRC, and by the general state of the PRC economy.

The Company has cash on hand and demand deposits in accounts maintained with state-owned banks within the PRC. Cash in state-owned banks is not covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in these bank accounts.

Statement of Cash Flows

In accordance with SFAS No. 95, “Statement of Cash Flows,” (codified in FASB ASC Topic 230), cash flows from the Company’s operations are calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

Fair Value of Financial Instruments

Certain of the Company’s financial instruments, including cash and equivalents, accrued liabilities and short-term debt, carrying amounts approximate their fair values due to their short maturities. ASC Topic 825, “Financial Instruments,” requires disclosure of the fair value of financial instruments held by the Company. The carrying amounts reported in the balance sheets for current liabilities each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments and their expected realization and the current market rate of interest.

Fair Value Measurements and Disclosures

ASC Topic 820, “Fair Value Measurements and Disclosures,” defines fair value (“FV”), and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for FV measures. The three levels are defined as follow:

|

●

|

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

|

|

|

●

|

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

|

|

|

●

|

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement.

|

As of March 31, 2012 and December 31, 2011 the Company did not identify any assets and liabilities that are required to be presented on the balance sheet at FV.

9

Foreign Currency Translation and Comprehensive Income (Loss)

The functional currency of China Jinxin is RMB. For financial reporting purposes, RMB were translated into USD as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet dates. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period.

Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive income”. Gains and losses resulting from foreign currency transactions are included in income. There was no significant fluctuation in the exchange rate for the conversion of RMB to USD after the balance sheet date.

The fluctuation of exchange rates does not imply free convertibility of RMB to other foreign currencies. All foreign exchange transactions continue to take place either through the People’s Bank of China (“PBOC”) or other banks authorized to buy and sell foreign currencies at the exchange rate quoted by the PBOC.

The Company uses SFAS No. 130 “Reporting Comprehensive Income” (codified in FASB ASC Topic 220). Comprehensive income is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. Comprehensive income for March 31, 2012 and December 31, 2011 consisted of net income and foreign currency translation adjustments.

Earnings per Share (EPS)

Basic EPS is computed by dividing net income by the weighted average number of common shares outstanding for the period. Diluted EPS is computed similar to basic EPS except that the denominator is increased to include the number of additional common shares that would have been outstanding if all the potential common shares, warrants and stock options had been issued and if the additional common shares were dilutive. Diluted EPS are based on the assumption that all dilutive convertible shares and stock options and warrants were converted or exercised. Dilution is computed by applying the treasury stock method for the outstanding options and warrants, and the if-converted method for the outstanding convertible instruments. Under the treasury stock method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later) and as if funds obtained thereby were used to purchase common stock at the average market price during the period. Under the if-converted method, outstanding convertible instruments are assumed to be converted into common stock at the beginning of the period (or at the time of issuance, if later).

Segment Reporting

SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information” requires use of the “management approach” model for segment reporting, codified in FASB ASC Topic 280. The management approach model is based on the way a company’s management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company.

SFAS 131, codified in FASB ASC Topic 280, has no effect on the Company’s financial statements as substantially all of its operations are conducted in one industry segment – iron ore mining.

New Accounting Pronouncements

In May 2011, the FASB issued ASU No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in US GAAP and IFRSs”, which is adopted for fiscal years, and interim periods beginning after December 15, 2011 for public entities with retrospective application. There was no material impact on our consolidated financial statements upon adoption.

10

In June 2011, the FASB issued ASU No. 2011-05, “Presentation of Comprehensive Income”. Under the amendments in this ASU, an entity has two options for presenting its total comprehensive income: to present total comprehensive income and its components along with the components of net income in a single continuous statement, or in two separate but consecutive statements. The amendments in this ASU are required to be applied retrospectively and are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011, with early adoption permitted. There was no material impact on our consolidated financial statements upon adoption.

In September 2011, the FASB issued ASU No. 2011-08, Intangibles—Goodwill and Other (Topic 350)—Testing Goodwill for Impairment, to simplify how entities test goodwill for impairment. ASU No. 2011-08 allows entities to first assess qualitative factors to determine whether it is more likely than not that the FV of a reporting unit is less than its carrying amount. If greater than 50% likelihood exists that the FV is less than the carrying amount then a two-step goodwill impairment test as described in Topic 350 must be performed. The guidance provided by this update becomes effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. The Company adopted this ASU beginning with its Quarterly Report on Form 10-Q for the three months ended March 31, 2012. There was no material impact on our consolidated financial statements upon adoption.

In December 2011, The FASB issued ASU No. 2011-12, Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income in ASU 2011-05. ASU 2011-12 defers the requirement a company present reclassification adjustments for each component of accumulated other comprehensive income (“AOCI”) in both net income and other comprehensive income (“OCI”) on the face of the financial statements. All other requirements in ASU No. 2011-05 are not affected by ASU No. 2011-12, including the requirement to report comprehensive income either in a single continuous financial statement or in two separate but consecutive financial statements. Public entities should apply these requirements for fiscal years, and interim periods within those years, beginning after December 15, 2011. The adoption of this standard did not have a material impact on the Company’s consolidated financial position and results of operations.

As of March 31, 2012, there are no other recently issued accounting standards not yet adopted that would have a material effect on the Company’s consolidated financial statements.

3. INVENTORY

Inventory consisted of the following at March 31, 2012 and December 31, 2011:

|

2012

|

2011

|

|||||||

|

Material

|

$

|

21,053

|

$

|

18,102

|

||||

|

Finished goods

|

654,711

|

654,025

|

||||||

|

Total

|

$

|

675,764

|

$

|

672,127

|

||||

4. MINING RIGHTS

The Company is currently negotiating with the Department of Land and Resources of Hebei Province and the local Zhuolu county government to obtain the rights to mine in the geographical location where it currently mines. Pending the final contract, the Company accrued the cost of mining rights based on the quantity of ore extracted. The Company used $0.38 (RMB 2.4 per ton) based on a royalty rate prescribed by the local authority based on purity of ore in the subject mines. If the rate per ton of ore changes when the contract is finalized, the Company will account for the change prospectively as a change in accounting estimate.

11

5. PROPERTY AND EQUIPMENT, NET

Property and equipment consisted of the following at March 31, 2012 and December 31, 2011:

|

2012

|

2011

|

|||||||

|

Building

|

$

|

6,928,817

|

$

|

6,921,560

|

||||

|

Production equipment

|

4,068,725

|

4,064,463

|

||||||

|

Transportation equipment

|

1,225,434

|

1,206,957

|

||||||

|

Office equipment

|

98,269

|

89,675

|

||||||

|

12,321,245

|

12,282,655

|

|||||||

|

Less: Accumulated depreciation

|

(2,942,083

|

)

|

(2,686,621

|

)

|

||||

|

$

|

9,379,162

|

$

|

9,596,034

|

|||||

Depreciation for the three months ended March 31, 2012 and 2011 was $252,120 and $241,324, respectively.

6. ADVANCE FROM SHAREHOLDER

At March 31, 2012, the Company owed one shareholder $235,133 (RMB 1,480,000) for purchase of equipment to be used in construction in progress. This advance was non-interest bearing and payable on demand.

7. INTANGIBLE ASSETS

Intangible assets consisted mainly of land use rights. All land in the PRC is government-owned and cannot be sold to any individual or company. However, the government grants the user a “land use right” to use the land. The Company acquired land use rights during 2006 for $0.75 million (RMB 5 million). The Company has the right to use the land for 20 years and is amortizing such rights on a straight-line basis for 20 years.

Intangible assets consisted of the following at March 31, 2012 and December 31, 2011:

|

2012

|

2011

|

|||||||

|

Land use rights

|

$

|

789,669

|

$

|

788,842

|

||||

|

Less: Accumulated amortization

|

(200,708

|

)

|

(190,637

|

)

|

||||

|

Net

|

$

|

588,961

|

$

|

598,205

|

||||

Amortization of intangible assets for the three months ended March 31, 2012 and 2011 was $9,850 and $9,438, respectively. Annual amortization for the next five years from March 31, 2012, is expected to be: $39,400, $39,400, $39,400, $39,400 and $39,400.

8. CONSTRUCTION IN PROGRESS

The construction in progress represented purchase of equipment and installation for future iron ore refining.

9. DEFERRED TAX ASSETS

Deferred tax asset is the difference between the tax and book for accrued mine restoration cost.

12

10. ACCRUED LIABILITIES AND OTHER PAYABLES

Accrued liabilities and other payables consisted of the following at March 31, 2012 and December 31, 2011:

|

2012

|

2011

|

|||||||

|

Accrued payroll

|

$

|

16,964

|

$

|

29,380

|

||||

|

Accrued mining rights

|

70,283

|

70,209

|

||||||

|

Other payables

|

332,059

|

128,700

|

||||||

|

Other

|

-

|

20,479

|

||||||

|

Total

|

$

|

419,306

|

$

|

248,768

|

||||

As of March 31, 2012, Other payables consisted of an advance from a third party of $203,359 for the new production line construction. This advance bears no interest and will be repaid when the project is completed. As of December 31, 2011, Other payables also consisted of the short-term borrowing of $128,700 from a third party for capital contribution of China Tongda by Real Fortune HK, which bears no interest and is payable on demand.

11. LONG TERM ACCRUED EXPENSE

Under local environmental regulations, the Company is obligated at the end of the mines useful life to restore and rehabilitate the land that is used in the mining operation. The Company estimates it would cost $0.56 million (RMB 3.5 million) for such efforts.

The Company accrued expense based on the actual production volume during the period. As of March 31, 2012 and December 31, 2011, the long term accrued expense for environment restoration was $13,005 and $12,991, respectively.

12. PAYABLE TO CONTRACTORS

In 2007 and 2008, the Company entered into contracts with an equipment supplier and a construction Company for equipment and construction of a water pipeline for $5.75 million (RMB 38 million). The Company recorded the payable in 2009. In 2010, the Company amended the payment terms and paid $2.2 million (RMB 14.5 million) and agreed to pay the remaining balance as follows: $2.08 million (RMB 13.5 million) on December 31, 2011, and $1.47 million (RMB 10 million) on December 31, 2012, which was recorded as a non-current liability. During 2011, the Company paid $2.86 million (RMB 18.0 million). For the three months ended March 31, 2012, the Company did not make any payment for this payable.

The Company recorded the restructuring of this payable in accordance with ASC 470-60-35-5, as it was a modification of terms of a payable, it did not involve a transfer of assets or grant of an equity interest. Accordingly, the Company accounted for the effects of the restructuring prospectively from the time of restructuring, and did not change the carrying amount of the payable at the time of the restructuring as the carrying amount did not exceed the total future cash payments specified by the new terms.

13. INCOME TAXES

The Company’s operating subsidiary was governed by the Income Tax Laws of the PRC and various local tax laws. Effective January 1, 2008, China adopted a uniform tax rate of 25% for all enterprises (including foreign-invested enterprises).

The following table reconciles the PRC statutory rates to the Company’s effective tax rate for the three months ended March 31, 2012 and 2011:

13

|

2012

|

2011

|

|||||||

|

US statutory rates

|

(34.0)

|

%

|

(34.0)

|

%

|

||||

|

Tax rate difference

|

9.0

|

%

|

9.0

|

%

|

||||

|

Valuation allowance

|

25.0

|

%

|

25.0

|

%

|

||||

|

Tax (benefit) per financial statements

|

-

|

%

|

-

|

%

|

||||

14. MAJOR CUSTOMER AND VENDORS

One customer accounted for 100% of the Company’s sales for the three month periods ended March 31, 2012 and 2011. The Company made a long-term (ten year) strategic contract with Handan Steel Group Company (“HSG”) a state-owned enterprise, and agreed to sell to HSG. The selling price was determined based on market value after deduction of the cost for ensuring the Company a proper profit margin. HSG agreed to purchase all the Company’s products regardless of the change of the market. The Company is economically dependent on HSG. However, with the high demand of iron ore concentrate in China, the Company believes there are other buyers available if HSG is unable to execute the contract. The Company had no sales for the three months ended March 31, 2011 due to the PRC government’s energy saving and emission reduction plan. The sales were resumed in the second quarter of 2011. The Company ceased sales in the three months ended March 31, 2012 due to the upgrading of its production lines for improving the iron ore refinement and iron ore concentration rate. The upgraded production line project will be finished in August 2012. The accounts receivable balance due was $0 at March 31, 2012 and December 31, 2011.

There were no vendors which accounted for over 10% of the Company’s total sales for the three months ended March 31, 2012 or 2011.

15. STATUTORY RESERVES

Pursuant to the corporate law of the PRC effective January 1, 2006, the Company is now only required to maintain one statutory reserve by appropriating from its after-tax profit before declaration or payment of dividends. The statutory reserve represents restricted retained earnings.

Surplus reserve fund

The Company’s Chinese subsidiaries are now required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory surplus reserve fund until such reserve balance reaches 50% of the Company’s registered capital. The Company’s Chinese subsidiaries are not required to make appropriation to other reserve funds and do not have any intentions to make appropriations to any other reserve funds. There are no legal requirements in the PRC to fund these reserves by transfer of cash to restricted accounts, and the Company’s Chinese subsidiaries do not do so.

The surplus reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or converted into share capital by issuing new shares to existing shareholders in proportion to their shareholding or by increasing the par value of the shares currently held by them, provided that the remaining reserve balance after such issue is not less than 25% of the registered capital.

Common welfare fund

Common welfare fund is a voluntary fund that the Company can elect to transfer 5% to 10% of its net income, as determined under PRC accounting rules and regulations, to this fund. The Company did not make any contribution to this fund during the three months ended March 31, 2012 or 2011.

This fund can only be utilized on capital items for the collective benefit of the Company’s employees, such as construction of dormitories, cafeteria facilities, and other staff welfare facilities. This fund is non-distributable other than upon liquidation.

14

16. CONTINGENCIES AND COMMITMENTS

The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company’s sales, purchases and expenses are denominated in RMB and all of the Company’s assets and liabilities are also denominated in RMB. The RMB is not freely convertible into foreign currencies under the current law. In China, foreign exchange transactions are required by law to be transacted only by authorized financial institutions. Remittances in currencies other than RMB may require certain supporting documentation in order to effect the remittance.

All mineral resources in China are owned by the state. Thus, the Company’s ability to obtain iron ore is dependent upon the ability to obtain mineral rights from the relevant state authorities or purchase ore from another party that has obtained mining rights from the state. It is generally not feasible to transport iron ore any significant distance before processing. The Company has yet to obtain long term rights to any iron mine and there is no assurance that the Company will be able to do so. Although the Company has extracted iron ore from the Zhuolu Mine on which the Company’s production facilities are located, the Company does not have the right to do so and can be subjected to various fines and penalties. The Company is not able to determine the amount of fines and penalties at current stage; however, the Company believes the fine and penalty is negotiable with the authority. If the Company is not able to obtain mining rights to the Zhuolu Mine in the future, the Company will have to cease mining operations at the Zhuolu Mine and the Company will seek to acquire iron ore from third parties. The failure to obtain iron ore reserves for processing at all or on reasonably acceptable terms would have a material adverse impact on our business and financial results.

17. RESTATEMENT OF FINANCIAL STATEMENTS

The financial statements for the date at March 31, 2012 and December 31, 2011 and for the three months ended March 31, 2012 and 2011 were restated to reflect the following:

Because the Company had not yet acquired the mining rights and no future economic benefit arose from the mining rights, it should not have recorded and capitalized as a noncurrent asset for the anticipated asset retirement cost for restoring the mine when it is fully extracted; accordingly, it should not have recorded the anticipated corresponding noncurrent liability of asset retirement obligation. The Company should instead expense and accrue the mine restoration cost for the area it mined during the period.

The following table presents the effects of the restatement adjustment on the accompanying consolidated balance sheet for March 31, 2012:

|

Consolidated Balance Sheet at March 31, 2012

|

As

Previously

Reported

|

Restated

|

Net

Adjustment

|

|||||||||

|

Deferred tax asset

|

$

|

-

|

$

|

3,251

|

$

|

3,251

|

||||||

|

Accumulated other comprehensive income

|

$

|

560,542

|

$

|

560,290

|

$

|

(252

|

)

|

|||||

|

Retained earnings

|

$

|

3,150,254

|

|

$

|

3,153,758

|

|

$

|

3,504

|

||||

|

Total stockholders’ equity

|

$

|

9,572,361

|

$

|

9,562,607

|

$

|

(3,251)

|

||||||

15

The following table presents the effects of the restatement adjustment on the accompanying consolidated statement of operations for the three months ended March 31, 2012:

|

As Previously

|

Net

|

|||||||||||

|

Reported

|

Restated

|

Adjustment

|

||||||||||

|

Consolidated Statement of Operations and Comprehensive loss

|

||||||||||||

|

General and administrative expenses

|

$

|

412,493

|

$

|

429,047

|

$

|

16,554

|

||||||

|

Income (loss) from operations

|

$

|

(412,493

|

)

|

$

|

(429,047

|

)

|

$

|

(16,554

|

)

|

|||

|

Interest income (expense)

|

$

|

115,568

|

$

|

66

|

|

$

|

(115,502

|

)

|

||||

|

Total non-operating income (expenses)

|

$

|

114,560

|

$

|

(942

|

)

|

$

|

(115,502

|

)

|

||||

|

(Loss) before income taxes

|

$

|

(297,933

|

)

|

$

|

(429,989

|

)

|

$

|

(132,056

|

)

|

|||

|

Income tax benefit

|

$

|

(31,868

|

)

|

$

|

-

|

$

|

31,868

|

|||||

|

Net (loss)

|

$

|

(266,065

|

)

|

$

|

(429,989

|

)

|

$

|

(163,924

|

)

|

|||

|

Foreign currency translation gain

|

$

|

18,290

|

$

|

9,720

|

$

|

(8,570

|

)

|

|||||

|

Comprehensive (loss)

|

$

|

(247,775

|

)

|

$

|

(420,269

|

)

|

$

|

(172,494

|

)

|

|||

|

Basicnet earnings per share

|

$

|

(0.03

|

)

|

$

|

(0.05

|

)

|

$

|

(0.02

|

)

|

|||

The following table presents the effects of the restatement adjustment on the accompanying consolidated statement of operations for the three months ended March 31, 2011:

|

As Previously

|

Net

|

|||||||||||

|

Reported

|

Restated

|

Adjustment

|

||||||||||

|

Consolidated Statement of Operations and Comprehensive loss

|

||||||||||||

|

General and administrative expenses

|

$

|

334,262

|

$

|

333,326

|

$

|

(936

|

)

|

|||||

|

(Loss) from operations

|

$

|

(334,262

|

)

|

$

|

(333,326

|

)

|

$

|

936

|

||||

|

Interest expense

|

$

|

(14,081

|

)

|

$

|

(11

|

)

|

$

|

14,070

|

||||

|

Total non-operating income (expenses)

|

$

|

(13,268

|

)

|

$

|

802

|

|

$

|

14,070

|

|

|||

|

(Loss) before income taxes

|

$

|

(347,530

|

)

|

$

|

(332,524

|

)

|

$

|

15,006

|

|

|||

|

Net (loss)

|

$

|

(347,530

|

)

|

$

|

(332,524

|

)

|

$

|

15,006

|

|

|||

|

Foreign currency translation gain

|

$

|

64,019

|

$

|

64,943

|

$

|

924

|

||||||

|

Comprehensive (loss)

|

$

|

(283,511

|

)

|

$

|

(267,581

|

)

|

$

|

15,930

|

|

|||

|

Basic net earnings per share

|

$

|

(0.04

|

)

|

$

|

(0.04

|

)

|

$

|

0.002

|

|

|||

16

The following table presents the effects of the restatement adjustment on the accompanying consolidated statement of cash flows for three months ended March 31, 2012:

|

As Previously

|

Net

|

|||||||||||

|

Reported

|

Restated

|

Adjustment

|

||||||||||

|

Consolidated Statement of Cash Flows

|

||||||||||||

|

Net loss

|

$

|

(266,065

|

)

|

$

|

(429,989

|

)

|

$

|

(163,924

|

)

|

|||

|

Change in asset retirement cost and obligation

|

$

|

(115,502

|

)

|

$

|

-

|

$

|

115,502

|

|||||

|

Depreciation and amortization

|

$

|

224,044

|

$

|

261,970

|

$

|

37,926

|

||||||

|

Change in deferred tax

|

$

|

3,244

|

$

|

-

|

$

|

(3,244

|

)

|

|||||

|

Accrued liabilities and other payables

|

$

|

191,431

|

$

|

170,058

|

$

|

(21,373

|

)

|

|||||

|

Income taxes payable

|

$

|

(35,113

|

)

|

$

|

-

|

$

|

35,113

|

|||||

|

Net cash provided by (used in) operating activities

|

$

|

(179,084

|

)

|

$

|

(179,084

|

)

|

$

|

-

|

||||

The following table presents the effects of the restatement adjustment on the accompanying consolidated statement of cash flows for the three months ended March 31, 2011:

|

As Previously

|

Net

|

|||||||||||

|

Reported

|

Restated

|

Adjustment

|

||||||||||

|

Consolidated Statement of Cash Flows

|

||||||||||||

|

Net loss

|

$

|

(347,530

|

)

|

$

|

(332,524

|

)

|

$

|

15,006

|

||||

|

Accretion of interest on asset retirement obligation

|

$

|

12,168

|

$

|

-

|

$

|

(12,168

|

)

|

|||||

|

Depreciation and amortization

|

$

|

232,720

|

$

|

250,761

|

$

|

18,041

|

||||||

|

Accrued liabilities and other payables

|

$

|

81,082

|

$

|

82,797

|

$

|

1,715

|

||||||

|

Income taxes payable

|

$

|

(112,572

|

)

|

$

|

(135,166

|

)

|

$

|

(22,594

|

)

|

|||

|

Net cash provided by (used in) operating activities

|

$

|

(267,827

|

)

|

$

|

(267,827

|

)

|

$

|

-

|

||||

Overview

We are a company engaged in iron ore mining, processing and the production of iron ore concentrate in the People’s Republic of China (“PRC”) through our variable interest entity, China Jinxin. Currently, our only product is iron ore concentrate.

On October 1, 2011, we completed a transaction, effective the close of business September 30, 2011, pursuant to which we acquired 100% of the issued and outstanding capital stock of Real Fortune BVI for 8,000,000 shares of our common stock, which effectively constituted 100% of our issued and outstanding capital stock immediately after the consummation of the acquisition. The Share Exchange was accounted for as a recapitalization of Real Fortune BVI effected by a share exchange, wherein Real Fortune BVI is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of Real Fortune BVI have been brought forward at their book value and no goodwill has been recognized. Consequently, the historical consolidated financial statements of Real Fortune BVI are now the historical financial statements of Target Acquisitions I, Inc.

17

As a result of our acquisition of Real Fortune BVI, we now own all of the issued and outstanding capital stock of Real Fortune BVI, which in turn owns all of the issued and outstanding capital stock of Real Fortune HK, which in turn owns all of the issued and outstanding capital stock of China Tongda. In addition, we effectively and substantially control China Jinxin through the VIE Agreements among China Tongda, China Jinxin and the shareholders of China Jinxin.

The following chart reflects our organizational structure as of the date of this report.

Status of Production

Through China Jinxin we currently own an iron ore concentrate production line in Zhuolu County with an annual production capacity of 300,000 tons of iron ore concentrate. We began construction of this facility in 2007 and initiated production at the facility in March 2010. Our operations to date have been limited. We have not yet obtained the necessary permits to mine any iron ore. Initially we were granted the right to process iron ore recovered during the construction of our production facilities and ancillary roads; however, since August 2010, we have been mining iron ore on the mine upon which our production facilities are located even though we do not have the right to do so. If we are unable to obtain the necessary permits to mine in the areas surrounding our production facilities in the future and are challenged by related government authorities, we will have to purchase iron ores from third parties for processing at our production facilities.

To date, we have received only temporary manufacture licenses granted by the agencies of the local government, which allow us to process ore that we obtained from Zhuolu Mine or other third parties to utilize our facility.

18

Our ability to profit from this facility is wholly dependent upon our ability to extract and process iron ore from Zhuolu Mine and sell the output for a price that enables us to generate a profit. To date, all of our sales have been made to a single customer. We entered into a ten year contract with this customer which expires in January 2019. Pursuant to this agreement, we agreed to sell the customer, HSG all of the output from our facility, which it agreed to purchase. The price paid to us by HSG is to be determined by HSG in light of the quality of our product and market prices and result in a proper margin to us. Thus, our ability to profit from our current production facility over the next seven years will be determined by the prices we receive from HSG. We cannot guarantee that HSG will not offer a price below what it pays to the Company’s competitors. The lower price will reduce the Company’s profit margin. However, if the Company is not satisfied with the price set by HSG, it can attempt to renegotiate the price. In an effort to obtain a higher price from HSG, we refused to deliver iron ore concentrate we produced in the fourth quarter of 2011.

The volume of the iron ore concentrate we sell is determined, in part, by the quality of the crude iron ore we process and the rate at which we process such crude ore. Inasmuch as the price we sell our concentrate to HSG should result in a gross profit, our ability to operate profitably will be determined by the volume of iron ore concentrate we produce and our operating expenses. Our facilities began processing crude iron ore in March 2010 and were idle for approximately six months due to a government shutdown of our electricity. Thus, to date, our facilities have not operated at maximum capacity for a full year on an uninterrupted basis.

Our current production plant can process up to 800,000 tons of iron ore every year. However, during the three months ended March 31, 2012 and 2011, the Company did not produce any iron ore or process any iron ore concentrate. In the first quarter of 2012, the Company stopped operations to upgrade its production line. In the first quarter of 2011, operations were halted due to the implementation by the local Chinese government of an “Energy Saving and Emission Reduction Plan” to reduce local power consumption for a certain period, and our installation of power equipment to enable us to maintain a stable power supply to our production equipment even during government cutbacks. The following table sets forth our tons of iron ore processed and tons of iron ore concentrate we produced, for the years indicated:

|

2010

|

2011

|

|||||||

|

Iron ore processed (tons)

|

397,860

|

326,393

|

||||||

|

Production volume of iron ore concentrate (tons)

|

110,569

|

70,440

|

||||||

All mineral resources in China are owned by the state. Thus, our ability to obtain iron ore is dependent upon our ability to obtain mineral licenses from the relevant state authorities or purchase ore from another party that has obtained mining rights from the state. It is generally not feasible to transport iron ore any significant distance before processing. We believe, as evidenced by our shareholders willingness to finance the construction of our facilities, that there is sufficient iron ore in the vicinity of our facilities to enable us to operate them at a profit. Nevertheless, we have yet to obtain long term rights to any iron mine and there is no assurance that we will be able to do so. Although we have extracted iron ore from the Zhuolu Mine on which our production facilities are located, we do not have the right to do so and can be subjected to various fines and penalties. However, given that the Company paid geological survey fees for the local government on the application of the mining rights on Zhuolu Mine and has not received any challenges from any authorities on our mining activities, the Company believes that even if fines and penalties are assessed against us are in the future, the amount should be negotiable with the authorities. If we are unable to obtain mining rights to the Zhuolu Mine in the future, we will have to cease mining operations at the Zhuolu Mine and we will seek to acquire iron ore from third parties. The failure to obtain iron ore reserves for processing at all or on reasonably acceptable terms would have a material adverse impact on our business and financial results.

To date we have been dependent upon cash advances from the shareholders of China Jinxin and cash generated from the operation of our production facilities. If we were not to obtain sufficient iron ore for processing, it is likely that our operations would cease unless these individuals would continue to provide sufficient funds to maintain our plant and equipment until such time as our operations could be resumed.

19

We may seek to grow our operations by acquiring mining rights and other production facilities. The cash necessary to acquire such rights may exceed that we have on hand. In such event, we may seek to raise the necessary cash through bank loan or the issuance of equity to the vendors of such rights, our shareholders or third parties. There can be no assurance such cash will be available to us on reasonable terms, if at all. The prices and terms at which we issue equity securities and the performance of any rights or facilities we acquire, will determine whether we operate profitably.

The profitability of the mining industry in China in general and of our company in particular, is highly dependent upon the demand for iron ore and other metals within China. This demand in turn, is heavily influenced by general economic factors, such as the rate of growth of the economy and of the construction industry. There can be no assurance that China will maintain the rapid rates of growth it has experienced in the recent past. If the rate of growth of the Chinese economy were to slow demand for iron and steel could fall, adversely impacting our operations.

Results of Operations

Comparison of the Three Months Ended March 31, 2012 and 2011

|

2012

|

2011

|

Dollar

Increase (Decrease)

|

Percentage

Increase (Decrease)

|

|||||||||||||

|

Operating expenses

|

$

|

429,047

|

$

|

333,326

|

95,721

|

28.7

|

%

|

|||||||||

|

(Loss) from operations

|

(429,047

|

)

|

(333,326

|

)

|

(95,721

|

)

|

(28.7

|

)%

|

||||||||

|

Other Income (Expenses), net

|

(942)

|

802

|

(1,744)

|

N/M

|

||||||||||||

|

(Loss) before income taxes

|

(429,989

|

)

|

(332,524

|

)

|

(97,465)

|

(29.3

|

)%

|

|||||||||

|

Net (loss)

|

$

|

(429,989

|

)

|

$

|