Attached files

EXHIBIT 99.3

| PRECISION AEROSPACE COMPONENTS, INC. AND SUBSIDARIES | |||||||||||||||||||

| UNAUDITED PRO FORMA COMBINED CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||||||||||||||

| March 31, 2012 | |||||||||||||||||||

| ASSETS | Historical | ||||||||||||||||||

| PAOS | FDMC | Pro Forma Adjustments | Pro Forma | ||||||||||||||||

| CURRENT ASSETS | |||||||||||||||||||

| Cash and cash equivalents | $ | 220,151 | $ | — | $ | $ | 220,151 | ||||||||||||

| Accounts receivable | 767,944 | 2,480,807 | (182,407 | ) | c | 3,066,344 | |||||||||||||

| Inventory, net | 4,313,468 | 8,834,293 | (407,260 | ) | c | 12,740,501 | |||||||||||||

| Prepaid expenses | 49,479 | 164,542 | (164,542 | ) | c | 49,479 | |||||||||||||

| Prepaid income taxes and income taxes receivable | 113,317 | — | 113,317 | ||||||||||||||||

| Deferred tax asset | 558,434 | (558,434 | ) | a | — | ||||||||||||||

| 5,464,359 | 12,038,076 | (1,312,643 | ) | 16,189,792 | |||||||||||||||

| — | |||||||||||||||||||

| PROPERTY AND EQUIPMENT - Net | 22,026 | 44,559 | (325 | ) | b | 66,260 | |||||||||||||

| OTHER ASSETS | |||||||||||||||||||

| Deferred tax asset | 796,182 | (796,182 | ) | a | — | ||||||||||||||

| Deposits | 26,073 | — | 26,073 | ||||||||||||||||

| Other assets | 80,000 | 6,826 | (1,957 | ) | c | 84,869 | |||||||||||||

| Intangible assets | 499,000 | c | 499,000 | ||||||||||||||||

| 106,073 | 803,008 | (299,139 | ) | 609,942 | |||||||||||||||

| TOTAL ASSETS | $ | 5,592,458 | $ | 12,885,643 | $ | (1,612,107 | ) | $ | 16,865,994 | ||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||||||||||||||

| CURRENT LIABILITIES | |||||||||||||||||||

| Accounts payable and accrued expenses | $ | 600,949 | $ | 2,782,803 | $ | (401,579 | ) | c | $ | 2,982,173 | |||||||||

| Line of credit and current portion of long term debt | 1,470,000 | 4,263,688 | 3,113,156 | d | 8,846,844 | ||||||||||||||

| — | |||||||||||||||||||

| 2,070,949 | 7,046,491 | 2,711,577 | 11,829,017 | ||||||||||||||||

| LONG -TERM LIABILITIES | |||||||||||||||||||

| Deferred tax liability | — | — | |||||||||||||||||

| Long term debt | — | — | — | ||||||||||||||||

| TOTAL LIABILITIES | 2,070,949 | 7,046,491 | 2,711,577 | 11,829,017 | |||||||||||||||

| COMMITMENTS AND CONTINGENCIES | — | — | — | — | |||||||||||||||

| STOCKHOLDERS' EQUITY | |||||||||||||||||||

| Preferred Stock A $.001 par value; 7,100,000 shares authorized | |||||||||||||||||||

| at March 31, 2012 and December 31, 2011; 5,945,378 shares issued and outstanding | 5,945 | — | — | 5,945 | |||||||||||||||

| 3,199 | (3,199 | ) | a | ||||||||||||||||

| Preferred Stock B $.001 par value; 2,900,000 shares authorized | — | ||||||||||||||||||

| 0 shares issued and outstanding | — | — | |||||||||||||||||

| Common stock, $.001 par value; 100,000,000 shares authorized | — | ||||||||||||||||||

| at March 31, 2012 and December 31, 2011; 3,688,497 shares issued and outstanding | 3,688 | — | — | 3,688 | |||||||||||||||

| 1,453 | (1,453 | ) | a | — | |||||||||||||||

| Additional paid-in capital | 11,191,205 | 5,761,697 | (4,624,592 | ) | a,c,d | 12,328,310 | |||||||||||||

| — | |||||||||||||||||||

| Retained earnings (deficit) | (7,679,329 | ) | 72,803 | 305,560 | b,g | (7,300,966 | ) | ||||||||||||

| TOTAL STOCKHOLDERS' EQUITY | 3,521,509 | 5,839,152 | (4,323,684 | ) | 5,036,977 | ||||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 5,592,458 | $ | 12,885,643 | $ | (1,612,107 | ) | $ | 16,865,994 | ||||||||||

| 1 |

| PRECISION AEROSPACE COMPONENTS, INC. AND SUBSIDARIES | ||||||||||||||||

| UNAUDITED PRO FORMA COMBINED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS | ||||||||||||||||

| Quarter Ended March 31, 2012 | ||||||||||||||||

| Historical | ||||||||||||||||

| PAOS | FDMC | Pro Forma Adjustments | Pro Forma | |||||||||||||

| Total Net Revenue | $ | 2,106,021 | $ | 6,292,994 | $ | — | $ | 8,399,015 | ||||||||

| Total Cost of Goods Sold | 1,508,076 | 4,583,412 | — | 6,091,488 | ||||||||||||

| Gross Profit | 597,945 | 1,709,582 | — | 2,307,527 | ||||||||||||

| Operating Expenses | ||||||||||||||||

| General and Administrative Expenses | 466,558 | 1,078,947 | — | 1,545,505 | ||||||||||||

| Professional and Consulting Fees | 85,498 | 29,873 | (15,000 | ) | b | 100,371 | ||||||||||

| Depreciation | 5,585 | 15,421 | — | 21,006 | ||||||||||||

| Total Operating Expenses | 557,641 | 1,124,241 | (15,000 | ) | 1,666,882 | |||||||||||

| Income Before Other Income (Expense) | 40,304 | 585,341 | 15,000 | 640,645 | ||||||||||||

| Other Income (Expense) | ||||||||||||||||

| Interest Expense | (15,873 | ) | (43,876 | ) | (64,539 | ) | d | (124,288 | ) | |||||||

| Gain on bargin purchase of FDMC | — | — | 395,099 | g | 395,099 | |||||||||||

| (15,873 | ) | (43,876 | ) | 330,560 | 270,811 | |||||||||||

| Income (Loss) Before Provision (Benefit) for Income Taxes | 24,431 | 541,465 | 345,560 | 911,456 | ||||||||||||

| Provision (Benefit) for income taxes | (42,714 | ) | 177,412 | 40,000 | f | 174,698 | ||||||||||

| Net Income (Loss) Applicable to Common Shares | $ | 67,145 | $ | 364,053 | $ | 305,560 | $ | 736,758 | ||||||||

| Net Income (Loss) Per Basic Shares | $ | 0.02 | $ | 0.20 | ||||||||||||

| Net Income (Loss) Per Diluted Shares | $ | 0.01 | $ | 0.06 | ||||||||||||

| Weighted Average Number of Basic Common Shares Outstanding | 3,688,497 | 3,688,497 | ||||||||||||||

| Weighted Average Number of Fully Diluted Common Shares Outstanding | 12,927,617 | 12,927,617 | ||||||||||||||

| 2 |

| PRECISION AEROSPACE COMPONENTS, INC. AND SUBSIDARIES | ||||||||||||||||||

| UNAUDITED PRO FORMA COMBINED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS | ||||||||||||||||||

| Year Ended December 31, 2011 | ||||||||||||||||||

| Historical | ||||||||||||||||||

| PAOS | FDMC | Pro Forma Adjustments | Pro Forma | |||||||||||||||

| Total Net Revenue | $ | 7,728,836 | $ | 21,465,697 | $ | — | $ | 29,194,533 | ||||||||||

| Total Cost of Goods Sold | 5,320,981 | 16,050,214 | — | 21,371,195 | ||||||||||||||

| Gross Profit | 2,407,855 | 5,415,483 | — | 7,823,338 | ||||||||||||||

| Operating Expenses | ||||||||||||||||||

| General and Administrative Expenses | 1,923,060 | 4,220,763 | — | 6,143,823 | ||||||||||||||

| Professional and Consulting Fees | 288,244 | 124,868 | (64,868 | ) | b | 348,244 | ||||||||||||

| Depreciation | 55,013 | 29,016 | — | 84,029 | ||||||||||||||

| Total Operating Expenses | 2,266,317 | 4,374,647 | (64,868 | ) | 6,576,096 | |||||||||||||

| Income Before Other Income (Expense) | 141,538 | 1,040,836 | 64,868 | 1,247,242 | ||||||||||||||

| Other Income (Expense) | ||||||||||||||||||

| Interest Expense | (82,915 | ) | (176,648 | ) | (258,158 | ) | d | (517,721 | ) | |||||||||

| Impairment of Assets - FDMC | (5,399,036 | ) | 5,399,036 | e | — | |||||||||||||

| Impairment of Assets - PAOS | (2,558,180 | ) | — | (2,558,180 | ) | |||||||||||||

| Gain on purchase of FDMC | — | — | 395,099 | g | 395,099 | |||||||||||||

| Other | — | (252,209 | ) | — | (252,209 | ) | ||||||||||||

| (2,641,095 | ) | (5,827,893 | ) | 5,535,977 | (2,933,011 | ) | ||||||||||||

| Income (Loss) Before Provision (Benefit) for Income Taxes | (2,499,557 | ) | (4,787,057 | ) | 5,600,845 | (1,685,769 | ) | |||||||||||

| Provision (Benefit) for income taxes | (2,973 | ) | 244,584 | (244,584 | ) | f | (2,973 | ) | ||||||||||

| Net Income (Loss) Applicable to Common Shares | $ | (2,496,584 | ) | $ | (5,031,641 | ) | $ | 5,845,429 | $ | (1,682,796 | ) | |||||||

| Net Income (Loss) Per Basic Shares | $ | (0.85 | ) | $ | (0.57 | ) | ||||||||||||

| Net Income (Loss) Per Diluted Shares | $ | (0.85 | ) | $ | (0.57 | ) | ||||||||||||

| Weighted Average Number of Basic Common Shares Outstanding | 2,942,680 | 2,942,680 | ||||||||||||||||

| Weighted Average Number of Fully Diluted Common Shares Outstanding | 2,942,680 | 2,942,680 | ||||||||||||||||

| 3 |

UNAUDITED PRO FORMA COMBINED CONDENSED CONSOLIDATED FINANCIAL INFORMATION

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINING FINANCIAL INFORMATION

1. Basis of Presentation

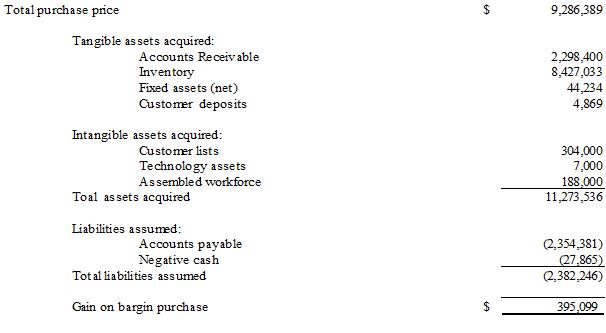

On May 25, 2012, Precision Aerospace Components, Inc. (the “Company”), acquired the assets of Fastener Distribution and Marketing Company, Inc., which included Aero-Missile Components, Inc. and Creative Assembly Systems, Inc. for $9,286,389.05. The Company completed the acquisition by entering into an Asset Purchase Agreement (the “Purchase Agreement”), dated as of the 25th day of May, 2012, by and among Fastener Distribution and Marketing Company, Inc., Aero-Missile Components, Inc., Creative Assembly Systems, Inc., Precision Aerospace Components, Inc., APACE Acquisition I, Inc., and Apace Acquisition II, Inc., and by entering into appropriate bills of sale, and other agreements to support the transaction. The Company recapitalized its existing debt and paid for the acquisition with a new credit facility consisting of a $2.5 million term loan and a $10 million revolving loan. The Company established the new credit facility by entering into a Loan and Security Agreement (the “Credit Agreement”) among Precision Aerospace Components, Inc., Freundlich Supply Company, Inc. (“Freundlich”), Tiger-Tight Corp., APACE Acquisition I, Inc., and Apace Acquisition II, Inc., the lenders from time to time party to the Agreement and Newstar Business Credit, LLC, as administrative agent, dated as of May 25,2012, pursuant to which the Lenders: (i) made a term loan in the original principal amount of $2,500,000 to the Company (the “Term Loan”), and (ii) established a revolving credit facility in an aggregate principal amount of up to $10,000,000 in favor of the Company, all as more fully described in the Credit Agreement.

On May 25, 2012, the Company used the proceeds of the Term Loan and an initial $6,346,843.54 advance under the Revolving Loan to (i) fund the acquisition of the assets of the Sellers and other amounts owing pursuant to the Purchase Agreement or in connection with the acquisition of the assets of the Sellers; (ii) pay off the outstanding obligations of Freundlich and Guaranteed by the Company under that certain Line of Credit Letter and Demand Promissory Note, each dated June 9, 2011, as amended, by and among Freundlich the Company, and Israel Discount Bank and Guaranteed by the Company (iii) pay certain transaction fees and expenses in connection with the acquisition of the assets and the Loan and Security Agreement. Borrowings under the revolving loan may also be used to finance capital expenditures and for working capital and other general corporate purposes.

The unaudited pro forma consolidated balance sheet as of March 31, 2012 gives effect to the acquisition of FDMC as if it had occurred as of March 31, 2012. The unaudited pro forma combining statements of operations for the 3 months ended March 31, 2012 combines the operating results of the Company for the 3 months ended March 31, 2012 and the operating results for FDMC for the 3 months ended March 31, 2012, and was prepared under the assumption that the acquisition of FDMC had occurred as of January 1, 2012. Since FDMC has historically reported financial results using a June 30 year, the FDMC operating results for the year ended December 31, 2011 were obtained by adding the operating results for the twelve months ended December 31, 2011, and the proforma operating results for the year ended December 31, 2011 was prepared under the assumption that the acquisition occurred January 1, 2011.

| 4 |

The unaudited pro forma financial information is not necessarily indicative of the results of operations that would have been reported if the combination had been completed as presented in the accompanying unaudited pro forma combining balance sheet and statements of operations. The unaudited pro forma combined financial information presented is based on, and should be read in conjunction with, the historical financial statements and the related notes thereto for both the Company and the FDMC Business.

2. Explanation of pro forma adjustments

The following pro forma adjustments are included in the unaudited pro forma combined condensed consolidated balance sheet and/or the unaudited pro forma combined condensed consolidated statements of operations

| (a) | The elimination of FDMC non-retained assets, liabilities and equity. |

| (b) | The elimination of FDMC excess professional fees. |

| (c) | An increase (decrease) to reflect the value of assets acquired from the seller on the closing date. |

| (d) | An increase in line of credit to acquire the assets of FDMC from the seller on the closing date. |

| (e) | The elimination of FDMC Goodwill expense for the impairment of assets. |

| (f) | The effect on income taxes related to the transaction. |

| (g) | The preliminary allocation of purchase price to net assets acquired is summarized below: |

| (h) | Allocation of purchase price over fair value of tangible net assets, acquired to identified intangible. |

| 5 |