Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REDWOOD TRUST INC | d386902d8k.htm |

| EX-99.1 - PRESS RELEASE DATED AUGUST 2, 2012 - REDWOOD TRUST INC | d386902dex991.htm |

|

|

|

TABLE OF CONTENTS

|

| Introduction |

4 | |||

| Shareholder Letter |

5 | |||

| Quarterly Overview |

7 | |||

| Financial Insights |

12 | |||

| u Balance Sheet |

12 | |||

| u GAAP Income |

16 | |||

| u REIT Taxable Income and Dividends |

20 | |||

| u Cash Flow |

21 | |||

| Sequoia Residential Mortgage Loan Business |

23 | |||

| Residential Real Estate Securities |

24 | |||

| Commercial Real Estate Business |

27 | |||

| Investments in Consolidated Entities |

29 | |||

| Appendix |

31 | |||

| Eminent Domain Discussion |

32 | |||

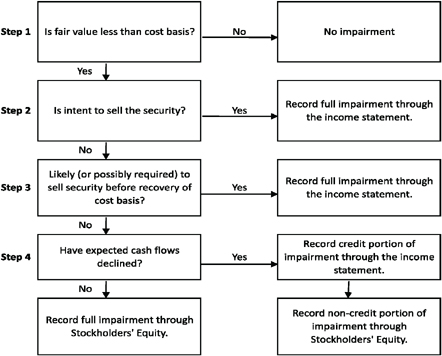

| Accounting Discussion |

33 | |||

| Glossary |

34 | |||

| Financial Tables |

41 | |||

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 1 |

|

|

|

CAUTIONARY STATEMENT

|

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2011 under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: (i) our statements relating to our overall outlook for Redwood and where Redwood is headed in the future, our statement relating to our ability to pivot in response to changes in the mortgage finance market, our statement that we like the new opportunities that are opening up for our business, our statement that recent developments and the stabilizing housing sector have us well positioned for the second half of 2012 and for 2013, our statement that our residential business has the potential to generate sustainable earnings power, and statements relating to our plan to drive earnings higher; (ii) our statements relating to opportunities to invest in residential securities, our belief that there will continue to be sufficient market liquidity for the types of residential securities investments that we are financing in part with short-term debt, and any statements relating to how we might use various types of debt financing to finance residential securities investments in the future; (iii) any statements relating to future activities we may engage, including that we hope to be an active seller of loans to the GSE by the end of the fourth quarter of 2012 and any statements relating to our future level of investment in mortgage servicing rights and the profitability of such investments, future sales of whole loans (other than through securitization transactions) and the profitability of such sales; (iv) any statements relating to our competitive position and our ability to compete in the future (and our statement that on the competitive front, things are slowly improving due to certain large banks reducing or eliminating their wholesale lending channels), including our ability to effectively compete to acquire residential securities and residential mortgage loans and our ability to compete to originate and acquire commercial debt investments; (v) any statements relating to our future investment strategy and our ability to find investments with attractive risk return profiles, including, without limitation, statements relating to our efforts to acquire residential mortgage loans, make commercial debt investments, and make investments in residential securities in the secondary market; (vi) our statement that we are on track to reach our goal of investing $400 million or more of equity capital in third-party residential securities, new Sequoia residential securities, and commercial debt investments; (vii) our statement that, in our opinion, proposed programs under which municipalities would acquire mortgage loans through eminent domain as a means by which to modify the terms of those loans for homeowners will not gain meaningful nationwide traction; (viii) our statement that we are currently on track to meet or exceed our 2012 goal of purchasing of $2 billion of residential mortgage loans in 2012, our statements relating to acquiring the residential mortgage loans included in our pipeline of residential mortgage loans that we have identified for purchase or plan to purchase, including the amount of such loans that we planned to purchase or have identified for purchase at June 30, 2012 and July 31, 2012, and our statement that it is our intent to

| 2 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

CAUTIONARY STATEMENT

|

finance our residential mortgage loans held for sale primarily through the use of warehouse lines of credit; (ix) statements relating to future residential loan securitization and sale transactions, the timing of the completion of those future transactions, and the number and size of those transactions we expect to complete in 2012 and future periods, which future transactions may not be completed when planned or at all, and, more generally, statements regarding the likelihood and timing of, and our participation in, future transactions of these types and our ability to finance residential loan acquisitions through the execution of these types of transactions, and the profitability of these transactions; (x) our statement that we expect to recover an aggregate of $5 million of loan loss reserves that relate to none Sequoia securitization entities in future periods upon the payoff or deconsolidation of those entities; (xi) any statements relating to the cash flows we expect to receive from our investments; (xii) our statements relating to our estimate of our investment capacity (including that we estimate our investment capacity was $90 million at June 30, 2012) and our statement that we believe this level of investment capacity should sustain our capital needs into the fourth quarter of 2012; (xiii) any statements relating to future market and economic conditions and the future volume of transactions in those markets, including, without limitation, future conditions in the residential and commercial real estate markets and related financing markets, and the related potential opportunities for our residential and commercial businesses; (ivx) our beliefs about, and our outlook for, the future direction of housing market fundamentals, including, without limitation, home prices, household formation and demand for housing, delinquency rates, foreclosure rates, prepayment rates, inventory of homes for sale, and mortgage interest rates and their potential impact on our business and results of operations and our beliefs that certain delinquency trends should eventually cause total mortgage delinquencies to fall, that, absent a second recession, low interest rates should protect from additional downside movement in home prices, that we believe housing prices are in the process of stabilizing, and that we do not expect housing, in general, to be a significantly appreciating asset class for several years; (xv) any statements relating to the future direction of commercial real estate fundamentals and statements regarding the competitive landscape for, and availability of, financing for commercial real estate; (xvi) our statements that we expect that mezzanine lending opportunities will continue to drive our commercial investment activity for the next few quarters, that we believe we can originate (and are targeting) between $200 and $250 million in commercial mezzanine loans in 2012, that we anticipate an increase in our senior commercial loan origination activity in the near term (and any statements about the potential to generate fees or other income by originating such senior mortgage loans), and that we currently plan on establishing a financing facility for our commercial loans by the end of 2012 and plan on eventually completing a non-recourse term financing of our commercial loans in later 2012 or 2013; (xvii) our expectations regarding credit reserves, credit losses, the adequacy of credit support, and impairments and their impact on our investments (including as compared to our original expectations and credit reserve levels) and the timing of losses and impairments, and statements that the amount of credit reserves we designate are adequate or may require changes in the future; (xviii) any statements relating to our expectations regarding future interest income and net interest income, future earnings, future gains, future earnings volatility, and future trends in operating expenses and the factors that may affect those trends, including that we expect the level of operating expense in the third quarter of 2012 to be similar to the level of operating expense in the second quarter of 2012; (ixx) our Board of Directors’ intention to pay a regular dividend of $0.25 per share per quarter in 2012; and (xx) our expectations and estimates relating to the characterization for income tax purposes of our dividend distributions and our expectations and estimates relating to tax accounting and our anticipation of additional credit losses for tax purposes in future periods (and, in particular, our statement that, for tax purposes, we expect an additional $130 million of credit losses on residential securities to be realized over an estimated three-to-five year period).

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 3 |

|

|

|

INTRODUCTION

|

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). We urge you to review these documents, which are available through our web site, www.redwoodtrust.com.

This document, called The Redwood Review, is an additional format for providing information about Redwood through a discussion of many GAAP as well as non-GAAP metrics, such as taxable income and economic book value. Supplemental information is also provided in the Financial Tables in this Review to facilitate more detailed understanding and analysis of Redwood. When we use non-GAAP metrics it is because we believe that these figures provide additional insight into Redwood’s business. In each case in which we discuss a non-GAAP metric you will find an explanation of how it has been calculated, why we think the figure is important, and a reconciliation between the GAAP and non-GAAP figures.

References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. References to “at Redwood” exclude all consolidated securitization entities (with the exception of the resecuritization we completed in the third quarter of 2011) in order to present our operations in the way management analyzes them.

Note that because we round numbers in the tables to millions, except per share amounts, some numbers may not foot due to rounding.

We hope you find this Review helpful to your understanding of our business. We thank you for your input and suggestions, which have resulted in our changing the form and content of The Redwood Review over time.

We welcome your continued interest and comments.

|

Selected Financial Highlights

| ||||||||||||

| Quarter: Year | GAAP Income (Loss) per Share |

REIT Taxable Income (Loss) per Share(1) |

Annualized GAAP Return on Equity |

GAAP

Book Value per Share |

Non-GAAP Economic Value per Share (2) |

Dividends per Share | ||||||

| Q210 | $0.35 | $0.04 | 11% | $12.71 | $13.37 | $0.25 | ||||||

| Q310 | $0.25 | ($0.11) | 8% | $13.02 | $13.73 | $0.25 | ||||||

| Q410 | $0.18 | ($0.01) | 6% | $13.63 | $14.31 | $0.25 | ||||||

| Q111 | $0.22 | $0.09 | 8% | $13.76 | $14.45 | $0.25 | ||||||

| Q211 | $0.11 | $0.02 | 4% | $13.04 | $13.81 | $0.25 | ||||||

| Q311 | $0.01 | $0.09 | 1% | $12.22 | $13.33 | $0.25 | ||||||

| Q411 | ($0.03) | $0.04 | (1%) | $11.36 | $12.45 | $0.25 | ||||||

| Q112 | $0.37 | $0.13 | 13% | $12.22 | $13.18 | $0.25 | ||||||

| Q212 | $0.24 | $0.22 | 8% | $12.00 | $12.87 | $0.25 | ||||||

| (1) REIT taxable income (loss) per share for 2011 and 2012 are estimates until we file tax returns for those years. | ||||||||||||

| (2) Non-GAAP economic value per share is calculated using estimated bid-side values (which take into account available bid-side marks) for our financial assets and estimated offer-side values (which take into account available offer-side marks) for our financial liabilities and we believe it more accurately reflects liquidation value than does GAAP book value per share. Non-GAAP economic value per share is reconciled to GAAP book value per share in the Financial Insights section and in Table 3 in the Financial Tables in this Review. | ||||||||||||

| 4 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

SHAREHOLDER LETTER

|

Dear Fellow Shareholders:

At the mid-year point, we are on track to deliver on our “three big themes” for 2012: improving our capital efficiency, getting fully invested, and building the franchise value of our residential and commercial businesses.

Our arduous two-year effort to rebuild and reposition our residential and commercial loan businesses is beginning to pay off. It increasingly looks like we made some good calls in handicapping the investment landscape and in positioning our businesses so they have options to pivot in response to changes in the evolving mortgage finance market. We are a long way from declaring victory, but we like our steady progress, the way the playing field is slowly tilting in our direction, and the new opportunities that are opening up for our businesses.

Our basic strategy for success — in a deleveraging world, one awash with liquidity and dominated by government intervention — is to build operating businesses capable of creating their own investments and fee-generating opportunities. That means building flexible and scalable loan platforms and having the right skill sets to unite and bring value to lenders and investors. The upfront investment has been a drag on earnings. Now, with the operating leverage we have built into our businesses, the plan is to ramp loan volume and seek to drive earnings higher.

On the residential front, we are making good progress toward this goal. In June, we completed our third jumbo-loan securitization of 2012, compared to completing only two securitizations in all of 2011, and we have laid the groundwork for additional securitizations in the second half of 2012. Each of our six securitizations in the post-crisis period has been met with strong investor demand. More importantly, the economics of our deals have remained attractive, the number of sellers we buy loans from is increasing, and the volume of loans we have identified to purchase is rising.

Outside our securitization activities, we have also been active in buying and selling hybrid mortgage loans to generate fee income. Our next step is to add conforming loans to our product menu. We are now in the process of getting approval to sell loans to Fannie Mae and Freddie Mac. We hope to be an active GSE loan seller by the end of the fourth quarter.

On the competitive front, things are also slowly improving. All four of the biggest U.S. banks have announced a significant reduction or complete elimination of their wholesale lending channels. Many small originators will now need to find new buyers, such as Redwood, to purchase their loans.

We are also hopeful that the stabilizing housing market will reduce pressure on Congress to maintain the government’s current dominant presence in the mortgage market. The decision in the Fall of 2011 to allow the temporary increase in the conforming loan limits to lapse did not have an adverse effect on the housing market, as the private sector immediately stepped up and provided mortgage financing to this portion of the market on attractive terms to borrowers.

On the commercial side, our team had its biggest production quarter to date for mezzanine loans. We are focused on a number of initiatives, including obtaining interim and permanent financing to increase the returns on our commercial portfolio and recycle capital for reinvestment. We expect to continue to originate attractive mezzanine loans and eventually transition to originating senior loans that can be sold to investors and generate fee income as well as additional mezzanine lending opportunities. We completed our first such senior loan transaction in the second quarter.

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 5 |

|

|

|

SHAREHOLDER LETTER

|

Our ramped up investment pace will likely cause us to consider options for raising capital toward the end of the year. Rest assured, our financial incentives are closely aligned with yours and we “get it” when it comes to potential dilution from issuing common equity. As an internally managed company, our compensation is tied to return on equity, and is not based on the amount of equity. Additionally, we are shareholders as well. Our decision process will be based on what we believe is in the best long-term interest of shareholders.

Building anything valuable almost always seems to cost more and take longer. At the end of the day, the most important thing is — did you build it right? Your team at Redwood is bullish about where we are and where we are headed.

As an aside, we are loath to add to the media hype surrounding the proposed use of eminent domain by several California municipalities to acquire performing underwater mortgages out of private-label securitization trusts, but here are some of our thoughts and we have included a summary discussion of this topic in an Appendix. In our opinion, at the end of the day (which likely means years), this program will not gain meaningful nationwide traction. It faces constitutional and other legal hurdles, and strong investor opposition. Additionally, there does not appear to be meaningful Federal support for the plan, which, if implemented broadly, would be detrimental to the GSEs and federally insured banks. Importantly, it is likely that if a municipality adopts the program, its homeowners will face higher mortgage rates, as the providers of the capital who fund residential loans need assurance that mortgage loans won’t be cherry-picked and seized for private gain. We would not be surprised if some lenders ring-fenced participating municipalities and cut off financing completely.

As always, thank you for your patience and continued support.

|

| |

| Martin S. Hughes | Brett D. Nicholas | |

| CEO | President |

| 6 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

QUARTERLY OVERVIEW

|

Second Quarter 2012 Results

Overview

We made steady progress in the second quarter of 2012, particularly in the face of a slowing U.S. economy and an escalating fiscal crisis in Europe. We continued to put excess capital to work, we completed our third securitization in 2012 with good economics, and we added a number of new loan sellers to our residential conduit. Additionally, the size of our residential loan pipeline grew at a rate that exceeded our projections and could potentially allow us to complete another two securitizations before the end of the year. Our commercial business was able to more than double its loan production from the first quarter of 2012 and is making headway into the senior commercial loan origination space. We believe that these developments — along with a stabilizing housing sector that bucked the overall downward economic trend we observed in the second quarter — have us well positioned for the second half of 2012 and for 2013.

In the second quarter of 2012, we were successful in growing investment income, supplementing this income with mortgage banking profits, and containing our overhead expenses. Our reported GAAP earnings were $0.24 per share for the second quarter of 2012 and reflected a $3 million (or 11%) increase in net interest income compared to the first quarter of 2012, primarily as a result of interest generated by new assets we acquired after ramping up our investment activity in the first half of the year. While our $2 million of income from mortgage banking activities was lower than the $4 million we reported in the first quarter of 2012, the overall decline in mortgage banking income was largely due to timing — our first quarter results included an additional securitization (in January 2012) made up of loans from our 2011 pipeline (loans we hold for sale and loans we plan to purchase). The economics of our recent securitizations continued to improve in the second quarter of 2012 and we became active in the whole loan sales market. As we detail in the Sequoia Residential Mortgage Loan Business section of this Quarterly Overview, we are currently on track to meet or exceed our 2012 goals for the volume of residential loans acquired and Sequoia securitizations completed.

Our second quarter 2012 GAAP income was also affected by a $5 million mark-to-market (MTM) decline in the value of our residential interest-only (IO) securities due to declining mortgage rates during the quarter. But, not surprisingly, there is more to the story from an earnings standpoint. We hold IOs as investments, but also consider potential valuation changes due to their sensitivity to interest movements as part of our overall risk management strategy for our pipeline. Why? Generally speaking, we would expect the value of our pipeline to move in the opposite direction of our IO securities (i.e., if mortgage rates decline, then the pipeline value should increase). At June 30, 2012, we believe that economically the $5 million MTM decline on our IO securities was offset by pipeline gains. However, for accounting purposes at quarter end, we are not allowed to recognize any of our pipeline gains until the loans are accumulated and sold. On the other hand, we are required to recognize the MTM declines on our IO securities. We expect this accounting timing difference to reverse as we sell loans in the third and fourth quarters of 2012. For your sake, we wish it was not that complicated.

To us, an important take-away from our GAAP results for the second quarter of 2012 is that our residential business has the potential to generate sustainable earnings power that could result from continued positive margins on our sales or securitizations of residential loans, and additional long-term investments in Sequoia securities that we believe will generate attractive returns over time. The “GAAP Income” section of this Redwood Review provides additional details on our earnings for the second quarter of 2012.

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 7 |

|

|

|

QUARTERLY OVERVIEW

|

Overview (continued)

We paid a quarterly dividend of $0.25 per share for both the first and second quarters of 2012. While our GAAP earnings of $0.61 per share through the first half of 2012 exceeded the $0.50 per share we distributed to shareholders over the same period, our REIT taxable income of $0.35 per share continues to be affected by the timing of credit losses on legacy investments and remains subdued. As we further describe in the REIT Taxable Income section of this Redwood Review, the credit losses we currently expect to realize in 2012 to determine our taxable income were substantially reserved for in prior years for GAAP reporting purposes.

Our GAAP book value declined to $12.00 per share at June 30, 2012. While net income nearly offset our dividend, the rally in Treasury prices during the quarter reduced the value of our hedge for our long-term debt by $0.19 per share. Combining these and other factors, our GAAP book value decreased to $12.00 per share in the second quarter of 2012 from $12.22 per share at the end of the first quarter of 2012, as detailed in the following table.

|

Changes in GAAP Book Value Per Share |

||||||||||||

| ($ in per share)

|

| |||||||||||

| Q2 2012 | Q1 2012 | Variance | ||||||||||

|

Beginning book value |

$ | 12.22 | $ | 11.36 | $ | 0.86 | ||||||

| Net income |

0.24 | 0.37 | (0.13 | ) | ||||||||

| Dividends |

(0.25 | ) | (0.25 | ) | - | |||||||

| Unrealized (losses) gains on hedges |

(0.19 | ) | 0.18 | (0.37 | ) | |||||||

| Unrealized gains on securities |

0.03 | 0.52 | (0.49 | ) | ||||||||

| Other, net

|

(0.05 | ) | 0.04 | (0.09 | ) | |||||||

|

Ending book value |

$ | 12.00 | $ | 12.22 | $ | (0.22 | ) | |||||

During the second quarter of 2012, our estimate of non-GAAP economic value decreased by $0.31 per share to $12.87 per share. The decrease was a result from $0.26 per share valuation change in our long-term debt and associated hedge liabilities, $0.21 per share of cash operating and interest expense, $0.25 per share of dividends paid to shareholders, and $0.05 per share from other items. These decreases were offset by $0.46 in cash flow and net positive market valuations on our securities and investments.

| 8 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

QUARTERLY OVERVIEW

|

Investment and Portfolio Sales Activity

During the second quarter of 2012, our capital deployment remained elevated and on track to reach our goal of investing $400 million or more of equity capital during 2012. We put $112 million of equity capital to work during the second quarter of 2012 to acquire $195 million of investments (and used $83 million of short-term debt to finance a portion of these new investments). Highlights of the quarter included our June Sequoia securitization, additional secondary investments in senior third-party residential mortgage-backed securities (RMBS), and investments in eight newly originated commercial mezzanine loans. The following table summarizes our first half of 2012 investment activity.

|

Quarterly Investment Activity |

| |||||||||||||||

| ($ in millions)

|

| |||||||||||||||

| Q2 2012 | Q1 2012 | YTD 2012 | ||||||||||||||

|

New Sequoia RMBS |

$ | 23 | $ | 61 | $ | 84 | ||||||||||

| Third-party RMBS |

103 | 223 | 326 | |||||||||||||

| Less: Short-term debt |

(83 | ) | (175 | ) | (258 | ) | ||||||||||

| Total residential |

43 | 109 | 152 | |||||||||||||

| Commercial loans

|

69 | 27 | 96 | |||||||||||||

| Equity capital invested |

$ | 112 | $ | 136 | $ | 248 | ||||||||||

In the second quarter, we sold $49 million of third-party RMBS and realized GAAP gains of $7 million on these sales.

At June 30, 2012, we estimate our investment capacity, defined as the amount of capital we have readily available for long-term investments, was $90 million, compared to $183 million at March 31, 2012. Based on our current expectation for new investment activity and our ability to recycle capital, we believe this capacity should sustain our capital needs into the fourth quarter of 2012. Our efforts to raise capital for new investments could include freeing up additional capital internally through sales or asset-specific financings, the issuance of corporate debt or preferred equity, or the issuance of common equity. Our approach to raising capital will continue to be based on what we believe to be in the best long-term interest of shareholders.

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 9 |

|

|

|

QUARTERLY OVERVIEW

|

Residential Loan Business

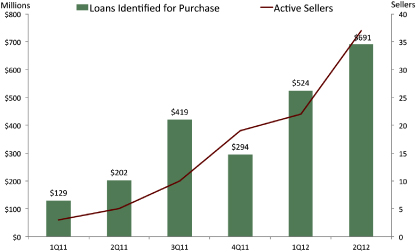

Our residential loan business continues to gain momentum. In the second quarter of 2012, we completed one $294 million securitization (SEMT 2012-3), our third securitization this year, and retained $23 million (market value) of securities for our investment portfolio. We also completed two whole loan sales totaling $86 million. We added 17 loan sellers to our conduit during the second quarter to increase the total to 37 at June 30, 2012. Perhaps most notably, the volume of loans we identified for purchase increased to $691 million in the second quarter, up from $524 million in the first quarter and $294 million in the fourth quarter of 2011.

Our second quarter securitization produced a GAAP gain of $4 million before hedge costs. Similar to our March 2012 securitization, by entering into a preliminary agreement with the underwriter of the transaction, we were able to reduce our hedging timeframe and costs, which contributed to the positive results from executing this transaction.

In anticipation of future securitizations, we held $254 million of residential loans at June 30, 2012, and at July 31, 2012, we held $383 million and had identified another $518 million that we planned to purchase. We currently expect to complete our next securitization in the third quarter of 2012. We are selectively adding regional and community banks as well as independent mortgage companies to our seller list. We continue to find growing interest from loan sellers who want to work with an established loan aggregator like Redwood, which works to our advantage because there are fewer of us as a result of the financial crisis and the reduction in wholesale origination at the major banks. Additionally, bank loan sellers appreciate that Redwood is not a bank and, therefore, not a competitor for their customer relationships. With 37 loan sellers at June 30, 2012, we are comfortably on track to exceed our year-end 2012 goal of 40 sellers and now expect 50 sellers by the end of the year. We continue to target purchasing at least $2 billion of residential loans in 2012 and believe we are on track to meet or exceed that amount.

At the end of the second quarter of 2012, we owned mortgage servicing rights (MSRs) on $364 million of prime-quality jumbo residential loans that were sourced through our conduit. The capitalized value of these MSRs was $2 million, or 55 basis points of the mortgage loans. We earn fees from these MSRs, but do not service any loans in-house, nor do we currently plan to do so.

| 10 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

QUARTERLY OVERVIEW

|

Commercial Real Estate Business

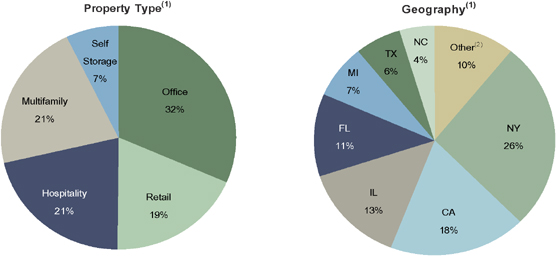

We originated eight additional commercial loans totaling $69 million in the second quarter of 2012, up from five loans and $27 million in the first quarter of 2012. At June 30, 2012, our commercial portfolio is comprised of 26 loans totaling $247 million made in connection with third parties (banks, insurance companies, and Freddie Mac) that originated nearly $1.6 billion of new commercial mortgages on multifamily, office, self-storage, and hospitality properties. As we expected, the pace of our investment activity increased from the prior quarter, and we expect that mezzanine lending opportunities will continue to drive our commercial investment activity for the next few quarters. Currently, our commercial portfolio generates a gross yield of 10% and is funded entirely with equity capital.

While we believe we can originate between $200 million and $250 million of commercial loans in 2012, we are currently allocating no more than $300 million of equity capital to our commercial business. We expect this business to grow organically through the future establishment of a repurchase facility and eventual completion of term financing through a non-recourse securitization of our loan portfolio in late 2012 or 2013.

Residential Securities Portfolio

From the standpoint of non-agency RMBS investors, the second quarter of 2012 was volatile in sentiment without a sustained bullish or bearish trend in pricing. Prices were well supported through the middle of the second quarter, with good liquidity and steady two-way demand for buying and selling securities. Concerns about Europe began to resurface during the second half of the quarter, with many market makers unwilling to add to their investment positions. The tone changed again in mid-July, and the general level of prices increased for non-agency RMBS. We continue to expect volatility and select buying opportunities as the market remains sensitive to macroeconomic indicators and the headlines coming from Europe.

In the second quarter of 2012, we continued employing what we believe to be prudent amounts of short-term recourse financing against our securities portfolio in order to free up equity capital for additional long-term investments. Most of the RMBS we are currently financing are more liquid senior securities that have demonstrated strong investor demand. We believe there will continue to be sufficient market liquidity for these types of RMBS investments, particularly with the changes to regulatory capital rules that were announced for banks in early June. These capital requirements are substantially reduced for seasoned, higher-quality non-investment grade RMBS with sufficient credit support.

At June 30, 2012, our residential securities portfolio totaled $1 billion and was financed with a combination of $360 million of short-term debt, $193 million of non-recourse resecuritization debt, and $447 million of equity capital.

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 11 |

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet

| u | The following table shows the components of our balance sheet at June 30, 2012. |

|

Consolidating Balance Sheet |

| |||||||||||

| June 30, 2012 ($ in millions)

|

| |||||||||||

| At Redwood |

Consolidated Entities |

Redwood

Consolidated |

||||||||||

| Residential loans |

$ | 256 | $ | 3,216 | $ | 3,472 | ||||||

| Commercial loans |

247 | 12 | 259 | |||||||||

| Real estate securities - Third party |

983 | 255 | 1,237 | |||||||||

| Real estate securities - Sequoia |

74 | - | 74 | |||||||||

| Cash and cash equivalents |

70 | - | 70 | |||||||||

| Total earning assets |

1,629 | 3,483 | 5,112 | |||||||||

| Other assets

|

97 | 37 | 134 | |||||||||

| Total assets |

$ | 1,726 | $ | 3,520 | $ | 5,246 | ||||||

| Short-term debt |

$ | 455 | $ | - | $ | 455 | ||||||

| Other liabilities |

74 | 62 | 136 | |||||||||

| Asset-backed securities issued |

193 | 3,371 | 3,564 | |||||||||

| Long-term debt |

140 | - | 140 | |||||||||

| Total liabilities |

862 | 3,433 | 4,295 | |||||||||

| Stockholders’ equity

|

864 | 87 | 951 | |||||||||

| Total liabilities and equity |

$ | 1,726 | $ | 3,520 | $ | 5,246 | ||||||

| u | We present this table to highlight the impact that our Consolidated Entities had on our GAAP balance sheet at June 30, 2012. As shown, Redwood’s $87 million GAAP investment in these consolidated entities increased our consolidated assets by $3.5 billion and liabilities by $3.4 billion. |

| u | We are required under GAAP to consolidate the assets and liabilities of certain Sequoia and Acacia securitizations that are treated as secured borrowing transactions. However, the securitized assets of these entities are not available to Redwood. Similarly, the liabilities of these entities are obligations payable only from the cash flow generated by their securitized assets and are not obligations of Redwood. |

| u | Included in Consolidated Entities are $3.2 billion of assets related to Sequoia securitizations (representing securitizations that were completed before 2012 and accounted for under GAAP as secured borrowings) and $303 million of assets related to Acacia securitization entities. The three securitizations that we completed since the beginning of 2012 were accounted for under GAAP as sales of assets. As a result, these securitizations were not consolidated and are not reflected in Consolidated Entities. The securities we retained from those securitizations are reflected on our balance sheet in Real Estate Securities — Sequoia. |

| u | The consolidating balance sheet presents the assets and liabilities of the resecuritization we completed during the third quarter of 2011 at Redwood, although these assets and liabilities are owned by the resecuritization entity and are legally not ours and we own only the securities and interests that we acquired from the resecuritization entity. At June 30, 2012, the resecuritization accounted for $325 million of assets ($323 million of available-for-sale securities at fair value and $2 million of other assets) and $193 million of asset-backed securities issued (at historical cost). Our $132 million investment in this resecuritization equals the difference between these assets and liabilities. |

| 12 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Real Estate Loans

| u | At June 30, 2012, we had $256 million of unsecuritized residential real estate loans, as compared to $303 million at March 31, 2012. The decrease reflects $339 million of residential loan acquisitions less $5 million of principal payments, $86 million of whole loan sales, and $294 million from the most recent securitization. The majority of our unsecuritized residential real estate loans (and others we have identified for future acquisition) is intended to be securitized in future periods. See the Sequoia Residential Mortgage Loan Business section on page 23 for more information. |

| u | At June 30, 2012, we had $247 million of commercial loans (excluding $12 million of legacy commercial loans at Acacia), as compared to $178 million at March 31, 2012. The increase reflects the origination of eight loans totaling $69 million. See the Commercial Real Estate Business section beginning on page 27 for more information. |

Real Estate Securities

| u | The following table presents the fair value of real estate securities at Redwood at June 30, 2012. We segment our securities portfolio by vintage (the year(s) the securities were issued), priority of cash flow (senior, re-REMIC, and subordinate), and by the quality of underlying loans (prime and non-prime). |

|

Real Estate Securities at Redwood (1) June 30, 2012 ($ in millions) |

||||||||||||||||||||||||

| % of Total | ||||||||||||||||||||||||

| <=2004 | 2005 | 2006-2008 | 2012 (3) | Total | Securities | |||||||||||||||||||

| Residential |

||||||||||||||||||||||||

| Prime |

$ | 25 | $ | 184 | $ | 282 | $ | 16 | $ | 507 | 48 | % | ||||||||||||

| Non-prime (2) |

100 | 159 | 6 | - | 265 | 25 | % | |||||||||||||||||

| Total Seniors |

$ | 125 | $ | 343 | $ | 288 | $ | 16 | $ | 772 | 73 | % | ||||||||||||

| Re-REMIC |

||||||||||||||||||||||||

| Prime |

$ | 2 | $ | 56 | $ | 89 | $ | - | $ | 147 | 14 | % | ||||||||||||

| Total Re-REMIC |

$ | 2 | $ | 56 | $ | 89 | $ | - | $ | 147 | 14 | % | ||||||||||||

| Subordinates |

||||||||||||||||||||||||

| Prime |

$ | 56 | $ | 7 | $ | 3 | $ | 58 | $ | 124 | 11 | % | ||||||||||||

| Non-prime (2) |

8 | - | - | - | 8 | 1 | % | |||||||||||||||||

| Total Subordinates |

$ | 64 | $ | 7 | $ | 3 | $ | 58 | $ | 132 | 12 | % | ||||||||||||

| Total Residential |

$ | 191 | $ | 406 | $ | 380 | $ | 74 | $ | 1,051 | 99 | % | ||||||||||||

| Commercial subordinates

|

$

|

5

|

|

$

|

1

|

|

$

|

-

|

|

$

|

-

|

|

$

|

6

|

|

|

1

|

%

| ||||||

|

Total real estate securities |

$ | 196 | $ | 407 | $ | 380 | $ | 74 | $ | 1,057 | 100 | % | ||||||||||||

(1) Included in the residential securities table above are $323 million of senior securities that are included in a resecuritization that we completed in July 2011. Under GAAP accounting, we account for the resecuritization as a financing even though these securities are owned by the resecuritization entity and are legally not ours. We own only the securities and interests that we acquired from the resecuritization entity, which amounted to $128 million at June 30, 2012. As a result, to adjust at June 30, 2012 for the legal and economic interests that resulted from the resecuritization, Total Residential Senior Securities would be decreased by $323 million to $449 million, Total Re-REMIC Residential Securities would be increased by $128 million to $275 million, and Total Residential Securities would be reduced by $195 million to $856 million.

(2) Non-prime residential securities consist of $271 million of Alt-A senior and subordinate and $2 million of subprime subordinate securities.

(3) All of the securities from the 2012 vintage have been retained from our Sequoia securitizations.

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 13 |

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Real Estate Securities (continued)

| u | The table below details the change in fair value of securities at Redwood during the second and first quarters of 2012. |

|

Real Estate Securities at Redwood |

| |||||||

| ($ in millions)

|

| |||||||

| Three Months Ended | ||||||||

| 6/30/2012 | 3/31/2012 | |||||||

| Beginning fair value |

$ | 1,009 | $ | 751 | ||||

| Acquisitions |

126 | 284 | ||||||

| Sales |

(49 | ) | (53 | ) | ||||

| Gain on sale |

7 | 6 | ||||||

| Effect of principal payments |

(33 | ) | (20 | ) | ||||

| Change in fair value, net |

(3 | ) | 41 | |||||

| Ending fair value |

$ | 1,057 | $ | 1,009 | ||||

| u | Our acquisitions in the second quarter included $95 million of prime senior securities, $14 million of Alt-A senior securities, and $17 million of prime subordinate securities. These acquisitions include $23 million of retained securities from our most recent securitization. The amount of equity capital deployed for these acquisitions was $43 million, net of short-term borrowings. |

Investments in the Securitization Entities

| u | Our investments in Consolidated Entities, as estimated for GAAP, totaled $87 million at June 30, 2012. This amount reflects the estimated book value of our retained investments in these entities based on the difference between the consolidated assets and liabilities of the entities in the aggregate according to their GAAP carrying amounts. Management’s estimate of the non-GAAP economic value of our investments in Consolidated Entities was $94 million. Of this amount, $46 million consisted of IOs at Sequoia entities and $48 million consisted of senior and subordinate securities we retained at Sequoia and Acacia entities. To determine this estimate of non-GAAP economic value, we used the same valuation process that we follow to fair value our other real estate securities as described in the Accounting Discussion in the Appendix. |

| 14 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Debt

| u | At June 30, 2012, we had short-term mortgage warehouse debt outstanding of $95 million, which was used to finance a portion of our $256 million inventory of residential mortgage loans held for sale. At June 30, 2012, we had two uncommitted mortgage warehouse facilities with an aggregate borrowing capacity of $400 million. In addition, subsequent to June 30, 2012, we established an additional uncommitted warehouse facility with a borrowing capacity of $200 million. It is our intent to finance our residential mortgage loans held for sale primarily through the use of warehouse lines. |

| u | At June 30, 2012, we had short-term debt incurred through securities repurchase facilities of $360 million secured by $473 million of our RMBS at market value, resulting in a debt-to-equity leverage ratio for these RMBS of 3.2x (excluding the portion of our cash we designate as a liquidity capital cushion related to these short-term borrowings). |

| u | At June 30, 2012, we had $193 million outstanding of asset-backed debt issued at a stated interest rate of 1-month LIBOR plus 200 basis points related to our resecuritization of senior securities with a market value of $323 million. For GAAP, Redwood’s investment in the resecuritized assets is the difference between the outstanding balance of the resecuritized securities (including other assets of $2 million) and the balance of the asset-backed debt, or $132 million. We estimate the non-GAAP economic value or our investment to be $126 million because we estimate the fair value of the $193 million of debt (at historical cost) to be $199 million using the same valuation process we used to fair value our other financial assets and liabilities. |

| u | At June 30, 2012, we had $140 million of long-term debt outstanding due in 2037 with a stated interest rate of three-month LIBOR plus 225 basis points. In 2010, we effectively fixed the interest rate on this long-term debt at a rate of approximately 6.75% (excluding deferred debt issuance costs) through interest rate swaps. Although we report our long-term debt in accordance with GAAP based on its $140 million historical cost, we estimate the non-GAAP economic value of this debt at $73 million based on its stated interest rate using the same valuation process used to fair value our other financial assets and liabilities. |

Capital and Cash

| u | At June 30, 2012, our total capital was $1.1 billion, including $951 million of shareholders’ equity and $140 million of long-term debt. We use our capital to invest in earning assets, meet lender capital requirements, and to fund our operations and working capital needs. |

| u | Our cash balance was $70 million at June 30, 2012. We hold cash for two main reasons. First, we hold cash in an amount we believe will be sufficient to comply with covenants, to fund haircuts (or the difference between the amounts advanced to us by our lenders and the value of the pledged loans and securities) on our warehouse and repo borrowing facilities, to meet potential margin calls, and to cover near-term cash operating expenses. Second, we hold cash in anticipation of having opportunities to invest at attractive yields. |

| u | We estimate that our investment capacity was $90 million at June 30, 2012. |

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 15 |

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income

| u | The following table provides a summary of our consolidated GAAP income for the second and first quarters of 2012. |

|

GAAP Income |

| |||||||

| ($ in millions, except per share data)

|

| |||||||

| Three Months Ended | ||||||||

| 6/30/2012 | 3/31/2012 | |||||||

| Interest income | $ | 60 | $ | 59 | ||||

| Interest expense | (29 | ) | (31 | ) | ||||

| Net interest income | 31 | 28 | ||||||

| Provision for loan losses | 1 | - | ||||||

| Other market valuation adjustments, net | (5 | ) | (1 | ) | ||||

| Net interest income after provision and other market valuation adjustments | 27 | 27 | ||||||

| Mortgage banking activities, net | 2 | 4 | ||||||

| Operating expenses | (15 | ) | (15 | ) | ||||

| Realized gains, net | 7 | 14 | ||||||

| Provision for income taxes | (1 | ) | - | |||||

| GAAP income | $ | 20 | $ | 30 | ||||

| GAAP income per share | $ | 0.24 | $ | 0.37 | ||||

| u | Our consolidated GAAP net income for the second quarter of 2012 was $20 million, or $0.24 per share, as compared to $30 million, or $0.37 per share, for the first quarter of 2012. The $10 million decrease resulted from lower realized gains and mortgage banking activities income, partially offset by higher net interest income and recovery of prior period loan loss provision expenses. |

| 16 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income (continued)

| u | The following tables show the estimated effect that Redwood and our Consolidated Entities had on GAAP income for the second and first quarters of 2012. |

|

Consolidating Income Statement |

| |||||||||||

| Three Months Ended June 30, 2012 | ||||||||||||

| ($ in millions)

|

| |||||||||||

| At Redwood |

Consolidated Entities |

Redwood Consolidated |

||||||||||

| Interest income | $ | 27 | $ | 27 | $ | 53 | ||||||

| Net discount (premium) amortization | 8 | (2 | ) | 7 | ||||||||

| Total interest income | 35 | 25 | 60 | |||||||||

| Interest expense | (6 | ) | (23 | ) | (29 | ) | ||||||

| Net interest income | 29 | 2 | 31 | |||||||||

| Provision for loan losses | - | 2 | 1 | |||||||||

| Other market valuation adjustments, net | (6 | ) | 1 | (5 | ) | |||||||

| Net interest income after provision and other market valuation adjustments | 22 | 4 | 27 | |||||||||

| Mortgage banking activities, net | 2 | - | 2 | |||||||||

| Operating expenses | (15 | ) | - | (15 | ) | |||||||

| Realized gains, net | 7 | - | 7 | |||||||||

| Provision for income taxes | (1 | ) | - | (1 | ) | |||||||

| Net income | $ | 16 | $ | 4 | $ | 20 | ||||||

|

Consolidating Income Statement |

| |||||||||||

| Three Months Ended March 31, 2012 | ||||||||||||

| ($ in millions)

|

| |||||||||||

| At Redwood |

Consolidated Entities |

Redwood Consolidated |

||||||||||

| Interest income | $ | 24 | $ | 28 | $ | 52 | ||||||

| Net discount (premium) amortization | 8 | (1 | ) | 7 | ||||||||

| Total interest income | 32 | 27 | 59 | |||||||||

| Interest expense | (6 | ) | (25 | ) | (31 | ) | ||||||

| Net interest income | 26 | 2 | 28 | |||||||||

| Provision for loan losses | - | - | - | |||||||||

| Other market valuation adjustments, net | - | - | (1 | ) | ||||||||

| Net interest income after provision and other market valuation adjustments | 26 | 2 | 27 | |||||||||

| Mortgage banking activities, net | 4 | - | 4 | |||||||||

| Operating expenses | (15 | ) | - | (15 | ) | |||||||

| Realized gains, net | 6 | 7 | 14 | |||||||||

| Provision for income taxes | - | - | - | |||||||||

| Net income | $ | 21 | $ | 9 | $ | 30 | ||||||

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 17 |

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income (continued)

Redwood Parent

| u | Net interest income at Redwood was $29 million for the second quarter of 2012, as compared to $26 million for the first quarter of 2012, an increase of $3 million. The increase was primarily the result of higher interest income from residential securities. |

| u | Total interest income from our securities portfolio was $26 million for the second quarter of 2012, an increase of $3 million compared to $23 million in the first quarter of 2012. Declining investment yields were offset by increasing average balances, as acquisitions of $126 million outpaced principal repayments and sales. |

| u | Residential loans at Redwood generated $4 million of interest income during the second quarter of 2012, a slight increase from the first quarter of 2012, as the average balance of loans rose modestly. These loans are financed at Redwood prior to being pooled and securitized through our Sequoia program, or sold as whole loans. The amount of interest earned at Redwood is dependent upon prevailing mortgage rates and the pace of our loan purchase and sale activity. |

| u | Commercial loans at Redwood generated $5 million of interest income in both the second and first quarters of 2012. We originated $69 million of commercial loans in the second quarter of 2012, as compared to $27 million in the first quarter of 2012, bringing the total portfolio to $247 million as of June 30, 2012. |

| u | Interest expense at Redwood was $6 million in both the second and first quarters of 2012. This interest expense was derived from $140 million of long-term debt at an effective cost of 6.88%, $198 million (average balance) of ABS issued debt (related to the resecuritization of certain of our senior residential securities) at a cost of LIBOR plus 2%, as well as interest paid on short-term repurchase and warehouse facilities utilized during the second quarter. The realized portion of deferred security issuance costs is also reflected in interest expense. |

| u | Net negative market valuation adjustments on securities and derivatives were $6 million for the second quarter, an increase from less than $1 million in the first quarter of 2012. This increase was primarily a result of lower market valuations on IO securities retained from recent securitization transactions. These IO securities help us to manage risks associated with our residential loan pipeline and consequently reduce the amount of risk management derivatives we may otherwise use to manage our pipeline. |

| u | Our income from mortgage banking activities, net, was $2 million in the second quarter of 2012, a decline of $2 million compared to the first quarter of 2012. This decline is largely the result of timing — our first quarter results included gains from both a January securitization (made up of loans from our 2011 pipeline) and one completed later in the quarter. On a per securitization basis, the $5 million GAAP gain on sale from our June securitization was our largest since we restarted our Sequoia securitization platform in 2010. These gains were offset by a $1 million increase, as compared to the first quarter, in negative valuation adjustments on MSRs and derivatives used to manage risks associated with our residential loan pipeline. |

| u | During the second quarter of 2012, we recognized $7 million of gains from the sale of securities compared to $6 million recognized in the first quarter of 2012. |

| u | Operating expenses at Redwood were $15 million during both the second and first quarters of 2012. We expect a similar level of quarterly operating expenses in the third quarter of 2012. |

| 18 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income (continued)

Consolidated Entities

| u | We recognized net income of $4 million for the second quarter from our investments in Legacy Sequoia and Acacia securitization entities, as compared to a net income of $8 million for the previous quarter. This decrease in net income is primarily a result of $7 million in gains recognized upon deconsolidation of certain Sequoia securitization entities during the first quarter. The remaining assets at Consolidated Entities continue to decline with no new reinvestment. |

| u | We released a net $2 million of loan loss reserves during the second quarter of 2012 due to credit stability in our legacy Sequoia portfolio and our belief that expected future loan losses will be covered by our $55 million reserve at June 30, 2012. In future quarters, seasonal factors in housing as well as a sustained economic slowdown could require us to resume recording loan loss provisions. |

| u | There are currently nine Sequoia entities for which we have aggregate loan loss reserves of $5 million in excess of our reported investment for GAAP purposes, an amount we expect to recover in future periods upon the payoff or deconsolidation of those entities. During the first quarter of 2012, we sold variable interests in five Sequoia securitizations issued between 2001 and 2003 and determined upon completion of an accounting analysis that we should derecognize the associated assets and liabilities of these securitizations for financial reporting purposes. We deconsolidated $307 million of real estate loans and other assets and $307 million of ABS issued and other liabilities and realized gains of $7 million that were comprised of both recoveries of excess provisions as well as cash raised by selling our interests in these entities. |

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 19 |

|

|

|

FINANCIAL INSIGHTS

|

REIT Taxable Income and Dividends

Summary

As a REIT, Redwood is required to distribute to shareholders at least 90% of its REIT taxable income (and meet certain other requirements), although Redwood’s Board of Directors can declare dividends in excess of this minimum requirement. REIT taxable income is defined as income as calculated for tax that is earned at Redwood and its qualified REIT subsidiaries. Redwood also earns taxable income at its taxable subsidiaries, which it is not required to distribute. To the extent Redwood retains taxable income that is not distributed to shareholders, it is taxed at corporate tax rates. A reconciliation of GAAP and taxable income is set forth in Table 2 in the Financial Tables in this Review.

Overview

| u | Redwood’s estimate of REIT taxable income for the second quarter of 2012 was $17 million, or $0.22 per share, as compared to estimated REIT taxable income of $10 million, or $0.13 per share, for the first quarter of 2012. |

| u | Credit losses from legacy investments decreased in the second quarter and continue to have a significant but declining impact on our REIT taxable income. In the second quarter of 2012, realized credit losses as calculated for tax purposes totaled $5 million, as compared to $10 million in the first quarter of 2012, and were charged directly to REIT taxable income since the tax code does not allow for the establishment of credit reserves. |

| u | Our REIT taxable income will likely continue to vary from period to period due to the timing of realized credit losses. Based on the securities we currently own, we expect an additional $130 million of credit losses to be realized over an estimated three- to five-year period for tax purposes. |

| u | Redwood’s estimated total taxable income, defined as the sum of REIT taxable income plus the taxable income at our taxable REIT subsidiaries, was $17 million, or $0.22 per share in the second quarter of 2012, as compared to estimated taxable income of $8 million, or $0.11 per share in the first quarter of 2012. From a tax perspective, our taxable REIT subsidiaries, taken together, did not generate taxable income. However, we recorded a tax provision for GAAP at the taxable REIT subsidiary level in the second quarter for tax we expect to pay on excess inclusion income passed through from certain Sequoia securitization entities completed since 2010. The excess inclusion income was not earned at the REIT and will not affect the tax characterization of our 2012 dividends. |

| u | On May 17, 2012, our Board of Directors declared a regular dividend of $0.25 per share for the second quarter, which was paid on June 29, 2012, to shareholders of record on June 15, 2012. |

| u | On August 2, 2012, our Board of Directors declared a regular dividend of $0.25 per share for the third quarter, which will be paid on September 28, 2012, to shareholders of record on September 14, 2012. |

| u | In November 2011, the Board of Directors announced its intention to pay a regular dividend of $0.25 per share per quarter in 2012. |

| 20 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

FINANCIAL INSIGHTS

|

Cash Flow

| u | The sources and uses of cash in the table below are derived from our GAAP Consolidated Statements of Cash Flow for the second and first quarters of 2012, aggregating and netting all items in a manner consistent with the way management analyzes them. This table excludes the gross cash flow generated by our Sequoia and Acacia securitization entities (cash flow that is not available to Redwood), but does include the cash flow distributed to Redwood as a result of our investments in these entities. The beginning and ending cash balances presented in the table below are GAAP amounts. |

|

Redwood Sources and Uses of Cash |

| |||||||

| ($ in millions)

|

| |||||||

| Three Months Ended | ||||||||

| 6/30/2012 | 3/31/2012 | |||||||

| Beginning cash balance | $ | 150 | $ | 267 | ||||

| Business cash flow (1) | ||||||||

| Loans, securities, and investments (2) |

63 | 60 | ||||||

| Operating expenses |

(12 | ) | (12 | ) | ||||

| Interest expense on other borrowed funds |

(5 | ) | (4 | ) | ||||

| Dividends |

(20 | ) | (20 | ) | ||||

| Net business cash flow | 26 | 24 | ||||||

| Investment-related cash flow | ||||||||

| Acquisition of residential loans |

(339 | ) | (660 | ) | ||||

| Origination/acquisition of commercial debt investments |

(69 | ) | (27 | ) | ||||

| Acquisition of securities, net (3) |

(51 | ) | (164 | ) | ||||

| Investments in New Sequoia Entities |

(23 | ) | (61 | ) | ||||

| Total investment-related cash flow |

(482 | ) | (912 | ) | ||||

| Financing and other cash flow | ||||||||

| Proceeds from residential loan sales |

387 | 753 | ||||||

| Proceeds from repo debt, net |

56 | 183 | ||||||

| Repayment of warehouse debt, net |

(42 | ) | (170 | ) | ||||

| Margin (posted) returned, net |

(20 | ) | 21 | |||||

| Derivative pair-off |

(5 | ) | (11 | ) | ||||

| Changes in working capital |

- | (5 | ) | |||||

| Net financing and other cash flow

|

376 | 771 | ||||||

| Ending cash balance | $ | 70 | $ | 150 | ||||

| (1) | Cash flow from securities and investments can be volatile from quarter to quarter depending on the level of invested capital, the timing of credit losses, acquisitions, sales, and changes in prepayments and interest rates. Therefore, (i) cash flow generated by these investments in a given period is not necessarily reflective of the long-term economic return we will earn on these investments; and, (ii) it is difficult to determine what portion of the cash received from an investment is a return “of” principal and what portion is a return “on” principal in a given period. |

| (2) | Sources of cash from residential securities include the cash received from the securities that were included in the resecuritization we engaged in during the third quarter of 2011, net of the principal and interest payments made in respect of the ABS issued in that resecuritization. |

| (3) | Total sales of securities in the second quarter of 2012 were $49 million. Securities sales of $6 million made in the first quarter that settled in April are reflected in the second quarter cash flow. Total acquisitions of securities in the second quarter of 2012 were $103 million. Securities acquisitions of $3 million made in the first quarter that settled in April are reflected in the second quarter cash flow. There were no unsettled trades at the end of the fourth quarter of 2011 or the second quarter of 2012. |

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 21 |

|

|

|

FINANCIAL INSIGHTS

|

Cash Flow (continued)

| u | Business cash flow totaled $26 million in the second quarter of 2012, as compared to $24 million in the first quarter. Contributing to the $2 million increase in business cash flow was a $3 million increase in principal and interest payments from residential loans, securities and investments, which was partially offset by a $1 million increase in interest expense. |

| u | The $63 million of cash flow from our loans, securities, and investments continued to exceed the sum of our cash operating expenses of $12 million, interest expense on borrowed funds of $5 million, and dividends of $20 million. |

| u | Notable sources of cash in the second quarter included $300 million from the proceeds from our residential securitization, $87 million from whole loan sales, and $56 million from repurchase facilities used to finance a portion of our third-party RMBS acquisitions. |

| u | Notable uses of cash in the second quarter included $339 million for the acquisition of residential loans, as compared to $660 million in the first quarter when we completed two securitizations, $42 million to reduce warehouse debt, and $20 million for dividends. |

| u | Our uses of cash for long-term investments totaled $143 million, consisting of $69 million for commercial loan investments, $51 million for the acquisition of seasoned third-party RMBS (net of sales of $49 million), and $23 million to acquire securities from SEMT 2012-3, which was completed in the second quarter of 2012. |

|

Cash Used for Long-term Investments |

| |||||||||||||||||||

| ($ in millions)

|

| |||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| 6/30/12 | 3/31/12 | 12/31/11 | 9/30/11 | 6/30/11 | ||||||||||||||||

|

Commercial |

$ |

69 |

|

$ |

27 |

|

$ |

60 |

|

$ |

27 |

|

$ |

29 |

| |||||

| RMBS, net of sales |

51 | 164 | 35 | 48 | 15 | |||||||||||||||

| New Sequoia

|

|

23

|

|

|

61

|

|

|

-

|

|

|

19

|

|

|

-

|

| |||||

| Total cash used for long-term investments |

$ | 143 | $ | 252 | $ | 95 | $ | 94 | $ | 44 | ||||||||||

| u | Cash flow from securities and investments can be volatile from quarter to quarter depending on the level of invested capital, the timing of credit losses, acquisitions, sales, and changes in prepayments and interest rates. |

| 22 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

SEQUOIA RESIDENTIAL MORTGAGE LOAN BUSINESS

|

Summary

We purchase newly originated loans (mainly prime jumbo loans) that meet our collateral criteria from approved originators on a flow or bulk basis. Loans acquired through this process (our “conduit”) are expected to be securitized through Sequoia securitization entities, which acquire residential mortgage loans from our conduit and issue RMBS backed by these loans, or are sold privately as whole loans. Most of the senior or investment-grade rated RMBS issued by Sequoia Entities are sold to third-party investors; Redwood generally acquires the subordinate or non-investment grade securities but has also acquired senior securities and interest-only securities from the Sequoia Entities.

Quarterly Update

| u | On June 27, 2012, we closed SEMT 2012-3, a $294 million securitization of 331 prime jumbo mortgage loans, which marked our third securitization in 2012 and our sixth in the post-financial crisis period. Our initial investment in SEMT 2012-3 was $23 million. |

| u | At June 30, 2012, we held $115 million (estimated economic value) of RMBS issued from these six Sequoia securitizations that total $1.9 billion. Included in the $115 million are $41 million of investments from the 2010 and 2011 deals which we have consolidated and accounted for as financings under GAAP and $74 million in securities we retained from the 2012 deals that were accounted for as sales under GAAP. We are currently holding less than we initially retained from these six securitizations, as after we close a transaction we may subsequently sell certain securities that we initially retained. |

| u | As of June 30, 2012, there were no delinquencies in the loans underlying these six securitizations and there have not been any credit losses relating to these securitizations. |

| u | At June 30, 2012, residential loans purchased and held on our balance sheet for future securitization or loan sales totaled $254 million, and the pipeline of residential loans we have identified for purchase totaled $476 million. |

| u | At July 31, 2012, residential loans purchased and held on our balance sheet for future securitization or loan sales totaled $383 million and the pipeline of residential loans we have identified for purchase totaled $518 million. |

| u | At June 30, 2012, we had 37 active sellers, up from 28 at April 30, 2012. We are comfortably on track to exceed our year-end 2012 goal of 40 active sellers and are now targeting 50 active sellers by the end of the year. |

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 23 |

|

|

|

RESIDENTIAL REAL ESTATE SECURITIES

|

Summary

Redwood invests in securities that are backed by pools of residential loans. Some of these investments in residential securities consist of senior prime and non-prime securities, and non-senior securities. Residential prime securities are mortgage-backed securities backed by prime residential mortgage loans. Residential non-prime securities are mortgage-backed securities backed by non-prime (Alt-A, Option ARM, and Subprime) residential mortgage loans. Non-senior securities include subordinate and re-REMIC securities.

Senior securities are those interests in a securitization that have the first right to cash flows and are last in line to absorb losses. Subordinate securities are those interests in a securitization that have the last right to cash flows and are first in line to absorb losses. A re-REMIC is a resecuritization of RMBS where the cash flow from and any credit losses absorbed by the underlying RMBS are allocated among the securities issued in the resecuritization transaction in a variety of ways.

The following discussion refers only to the residential securities owned by Redwood, but excludes securities owned by Acacia entities, and exclusive of Redwood’s investments in Acacia.

This discussion includes the securities that we resecuritized during the third quarter of 2011.

In the Financial Tables in the Appendix, information on the residential securities we own and underlying loan characteristics is set forth in Tables 5 through 8B.

Quarterly Update

| u | Interest income generated by our residential securities was $25 million in the second quarter of 2012, resulting in an annualized unlevered yield of 11% on the $937 million average amortized cost of these securities. |

| u | We financed our holdings of residential securities with short-term debt secured by securities (repo debt), through the resecuritization transaction we completed during the third quarter of 2011 (resecuritization debt), and with equity capital. During the second quarter, average repo debt amounted to $342 million and the average resecuritization debt amounted to $198 million. |

| u | At June 30, 2012, the fair value of the residential securities we own totaled $1.05 billion, consisting of $507 million in prime senior securities, $265 million in non-prime senior securities, $147 million in re-REMIC securities, and $132 million in subordinate securities. Each of these categories is further discussed on the following pages. |

| u | At June 30, 2012, 40% of the residential securities we held were fixed-rate assets, 18% were adjustable-rate assets, 26% were hybrid assets that reset within the next year, 10% were hybrid assets that reset between 12 and 36 months, and 6% were hybrid assets that reset after 36 months. |

| 24 | THE REDWOOD REVIEW | 2ND QUARTER 2012 |

|

|

|

RESIDENTIAL REAL ESTATE SECURITIES

|

Quarterly Update (continued)

| u | The following table presents information on residential securities at Redwood at June 30, 2012. For GAAP, we account for the large majority of these securities as available-for-sale (AFS) and others as trading securities, and in both cases the securities are reported at their fair value at the report date. |

|

Residential Securities at Redwood |

| |||||||||||||||||||

| June 30, 2012 | ||||||||||||||||||||

| ($ in millions)

|

| |||||||||||||||||||

| Senior | ||||||||||||||||||||

| Prime | Non-prime | Re-REMIC | Subordinate | Total | ||||||||||||||||

| Available-for-sale securities (1) |

||||||||||||||||||||

| Current face |

$ | 540 | $ | 313 | $ | 237 | $ | 273 | $ | 1,363 | ||||||||||

| Credit reserve |

(35 | ) | (19 | ) | (58 | ) | (109 | ) | (221 | ) | ||||||||||

| Net unamortized discount |

(53 | ) | (60 | ) | (74 | ) | (38 | ) | (225 | ) | ||||||||||

| Amortized cost |

452 | 234 | 105 | 126 | 917 | |||||||||||||||

| Unrealized gains |

41 | 13 | 43 | 10 | 107 | |||||||||||||||

| Unrealized losses |

(2 | ) | (5 | ) | (1 | ) | (5 | ) | (13 | ) | ||||||||||

| Trading securities

|

|

16

|

|

|

23

|

|

|

-

|

|

|

1

|

|

|

40

|

| |||||

| Fair value of residential securities |

$ | 507 | $ | 265 | $ | 147 | $ | 132 | $ | 1,051 | ||||||||||

| Fair value of AFS securities as a % of face value (2) |

91 | % | 77 | % | 62 | % | 48 | % | 74 | % | ||||||||||

| Amortized cost of AFS securities as a % of face value (2) |

84 | % | 75 | % | 44 | % | 46 | % | 67 | % | ||||||||||

(1) Included in the residential securities table above are $323 million of senior securities that are included in a resecuritization that we completed in July 2011. Under GAAP accounting, we account for the resecuritization as a financing even though these securities are owned by the resecuritization entity and are legally not ours. We own only the securities and interests that we acquired from the resecuritization entity, which amounted to $128 million at June 30, 2012. As a result, to adjust at June 30, 2012 for the legal and economic interests that resulted from the resecuritization, Total Residential Senior Securities would be decreased by $323 million to $449 million, Total Re-REMIC Residential Securities would be increased by $128 million to $275 million, and Total Residential Securities would be reduced by $195 million to $856 million.

(2) Does not include trading securities.

| u | Securities are acquired assuming a range of outcomes based on modeling of expected performance at the individual loan level for both delinquent and current loans. Over time, the performance of these securities may require a change in the amount of credit reserves we designate. |

| u | In the second quarter of 2012, credit losses on our residential securities at Redwood totaled $12 million, as compared to credit losses of $14 million in the first quarter of 2012. In each quarter, all of the losses came from our subordinate securities. We expect future losses to extinguish a large percentage of the subordinate securities as reflected by the $109 million of credit reserves we have provided for the $273 million face value of those securities. Until the losses occur, we will generally continue to earn interest on the face value of those securities. |

| u | Additional information on interest income and yields for our securities portfolio is reported in the Financial Tables in the Appendix. |

| THE REDWOOD REVIEW | 2ND QUARTER 2012 | 25 |

|

|

|

RESIDENTIAL REAL ESTATE SECURITIES

|

Housing Prices

| u | Our outlook for housing is unchanged from three months ago. If you compare house prices to local incomes, housing is inexpensive by historical standards in most of the country. Record low interest rates are providing an additional boost to home affordability, and in general this should protect from additional downside movement in prices, absent a second recession. There is still an overhang of supply, especially from “shadow” inventory not listed on the market, but the situation is improving: the National Association of Realtors reported that existing home inventories in June 2012 declined 24% year-over-year, and are at the lowest level since 2002. We believe housing is in the process of stabilizing, but we do not expect housing, in general, to be a significantly appreciating asset class for several years. |

Delinquencies

| u | Delinquencies fell in the second quarter, but remain at historically elevated levels. According to LoanPerformance data, serious (90+ day) delinquencies fell by 0.17% quarter-over-quarter to 10.92% for prime loans and fell 0.92% quarter-over-quarter to 28.49% for Alt-A loans. The loans underlying Redwood’s portfolio of RMBS that were issued prior to 2008 have lower delinquency rates than the market as a whole: 7.33% of our prime loans, and 17.16% of our Alt-A loans, are 90+ days delinquent. |

| u | Early-stage roll rates (from loans “always current” to 30 days delinquent) improved in the second quarter. Of previously “always current” prime loans, 0.49% missed their first payment in June 2012, down from 0.56% in March 2012, while the same metric for Alt-A fell 0.21% to 0.87%. These roll rates are high by historical standards but well below 2008 — 2011 levels, and are showing no sign of a “double dip” in mortgage performance. This trend should eventually cause total delinquencies to fall, but for now the slowdown in new defaults is being balanced by an extension in liquidation timelines. |

Prepayments