Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWTEK BUSINESS SERVICES, INC. | d390587d8k.htm |

Newtek Business Services, Inc.

NASDAQ: NEWT

Second Quarter 2012

Financial Results Conference Call

July 31, 2012 4:15 PM

Hosted By:

Barry Sloane, CEO and Chairman

Jennifer C. Eddelson, CAO

Investor Relations

Public Relations

Newtek Investor Relations

Rubenstein Public Relations, Inc.

Jayne Cavuto

(212) 356-9571

jcavuto@thesba.com

Jonathan Goldberg

(212) 843-9335

jgoldberg@rubensteinpr.com

Jennifer Seley

(212) 843-8295

jseley@rubensteinpr.com

Exhibit 99.1 |

Safe Harbor Statement

The statements in this slide presentation including statements regarding

anticipated future financial performance, Newtek's beliefs, expectations,

intentions or strategies for the future, may be "forward-looking

statements" under the Private Securities Litigation Reform Act of 1995. All

forward-looking statements involve a number of risks and uncertainties that

could cause actual results to differ materially from the plans, intentions

and expectations reflected in or suggested by the forward-looking

statements. Such risks and uncertainties include, among others, intensified

competition,

operating

problems

and

their

impact

on

revenues

and

profit

margins,

anticipated

future business strategies and financial performance, anticipated future number of

customers, business prospects, legislative developments and similar matters.

Risk factors, cautionary statements and other conditions which could cause

Newtek’s actual results to differ from management's current

expectations are contained in Newtek’s filings with the Securities and

Exchange

Commission

and

available

through

http://www.sec.gov

Our Capcos operate under a different set of rules in each of the

six jurisdictions and these place

varying requirements on the structure of our investments. In some cases,

particularly in Louisiana or in certain situations in New York, we do not

control the equity or management of a qualified business, but that cannot

always be presented orally or in written presentations. 2

|

Second Quarter 2012 Conference Call Agenda

Q2 2012 Financial Performance, Cash Position, Balance Sheet

NEWT Buy Back of Common Stock

Commentary, Developments and Business Trends

Focus on Revenue Growth

New Financing Arrangement with Summit Partners

Reaffirm 2012 Guidance

3 |

Second Quarter Key Performance Statistics

The Company had consolidated pretax income of $1.9 million; an increase of

$1.8 million, a 1320% improvement, compared to the second quarter of 2011

The Company had consolidated net income of $1.2 million; a $1.5 million

increase, or a 530% improvement compared to the second quarter 2011, and

EPS of $0.03/diluted share compared to a loss of $(0.01)/diluted

share for the

second quarter 2011

The Company had consolidated Modified EBITDA for the second quarter 2012

of $3.7 million, as compared to $1.7 million for the second quarter 2011

The Company had EPS of $0.07 per diluted share for the six months ended

June 30, 2012, as compared to $0.01 per diluted share for the six months

ended June 30, 2011

Electronic payment processing segment pretax income increased 42% to $1.9

million in the second quarter of 2012 as compared to $1.3 million in the second

quarter of 2011

Small business finance segment pretax income increased 43% to $1.5 million in

the second quarter 2012, compared to $1.0 million in the second quarter

2011 4 |

Second Quarter Key Performance Statistics

Servicing fee income generated through our SBA lender grew 170% period over

period from $729 thousand during the second quarter of 2011, to $2.0 million in

the second quarter of 2012

Our SBA lender closed $52.0 million in loans during the first six months of 2012

as compared to $49.3 million during the same period in 2011

The Company bought back 780,920 shares of its common stock in the open

market under its one million share authorization during the quarter

The Company closed a $10-

$15 million, five year credit agreement with

Summit Partners, of which $10 million was drawn during the quarter. The funds

will be used to support Newtek's continued growth and provide working

capital necessary to expand its product offering

The Company is reaffirming its Full Year 2012 Guidance for EPS of between

$0.10 and $0.14 per diluted share, pretax income between $6.5 million and $8.5

million, and Modified EBITDA between $14.3 million and $16.3 million

5 |

Second Quarter 2012 Financial Results

Q2 2012 vs. Q2 2011 core operating segment revenue:

–

Electronic Payment Processing: $21.4 million –

up 3% from Q2 2011

(revenue up 11.1% excluding impact of Durbin Amendment)

–

Managed Technology Solutions:

$4.6 million –

down 4% from Q2 2011

–

Small Business Finance:

$6.0 million –

up 30% after adjusting for fair

value accounting adjustment related to timing of recognition of premium

income included in prior quarter

Q2 2012 vs. Q2 2011 core operating segment pretax income:

–

Electronic Payment Processing: $1.9 million –

up 42% from Q2 2011

–

Managed Technology Solutions:

$1.1 million –

up 12% from Q2 2011

–

Small Business Finance:

$1.5 million -

up 43% from Q2 2011

6 |

Cash Position

•

The Company had $32.0 million in cash and cash equivalents and

restricted cash at June 30, 2012, up from $25.4 million at December

31, 2011

–

Equates to $0.66 cash per share,

–

Equates to $0.91 cash per share when including restricted cash

7 |

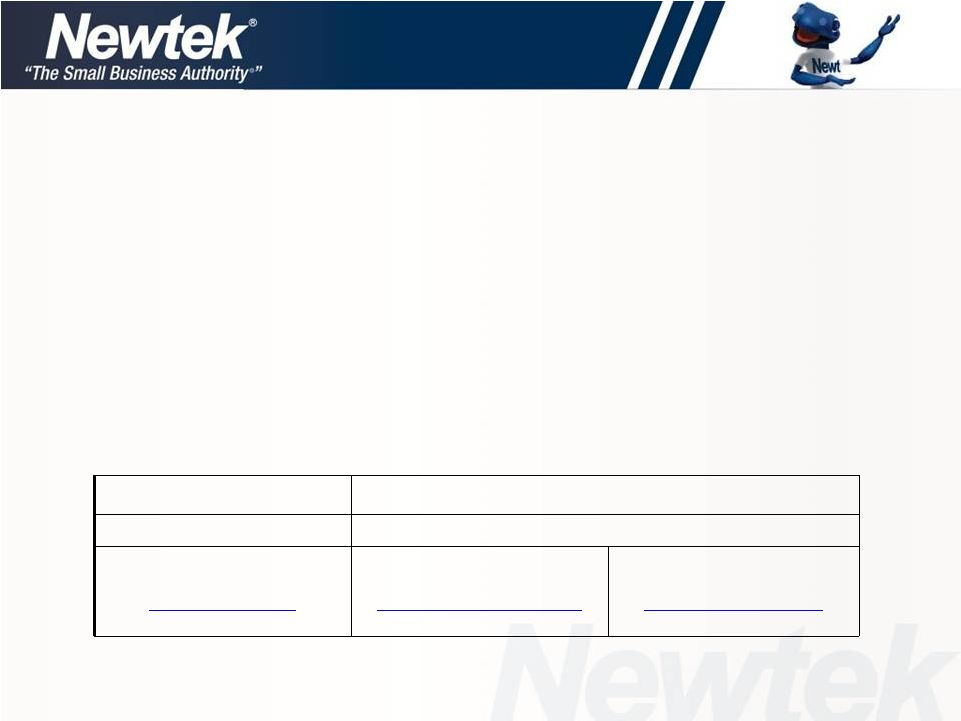

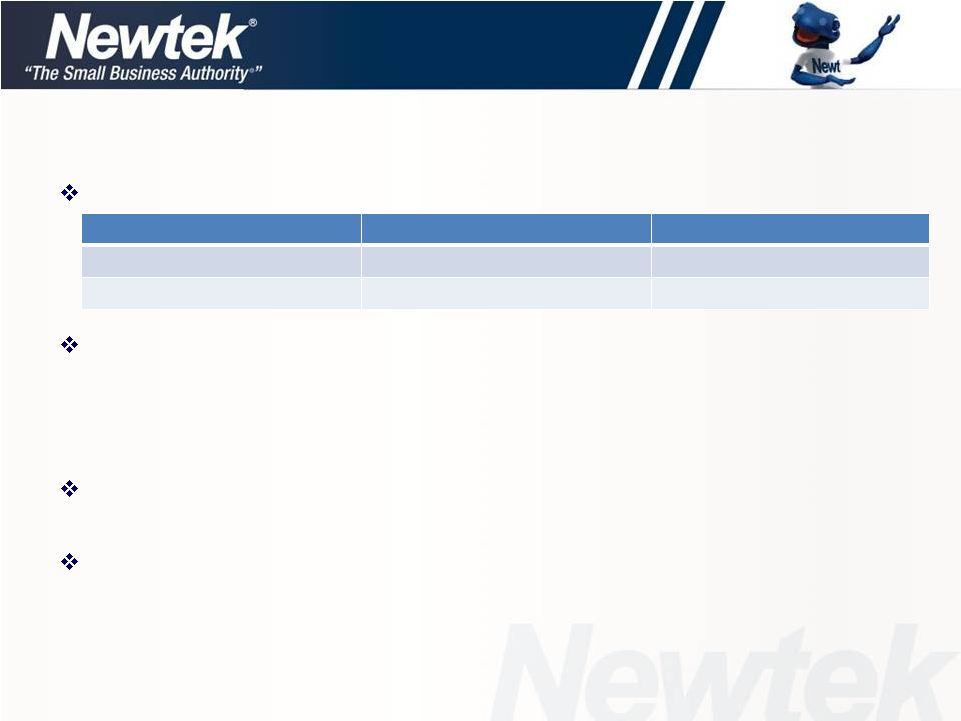

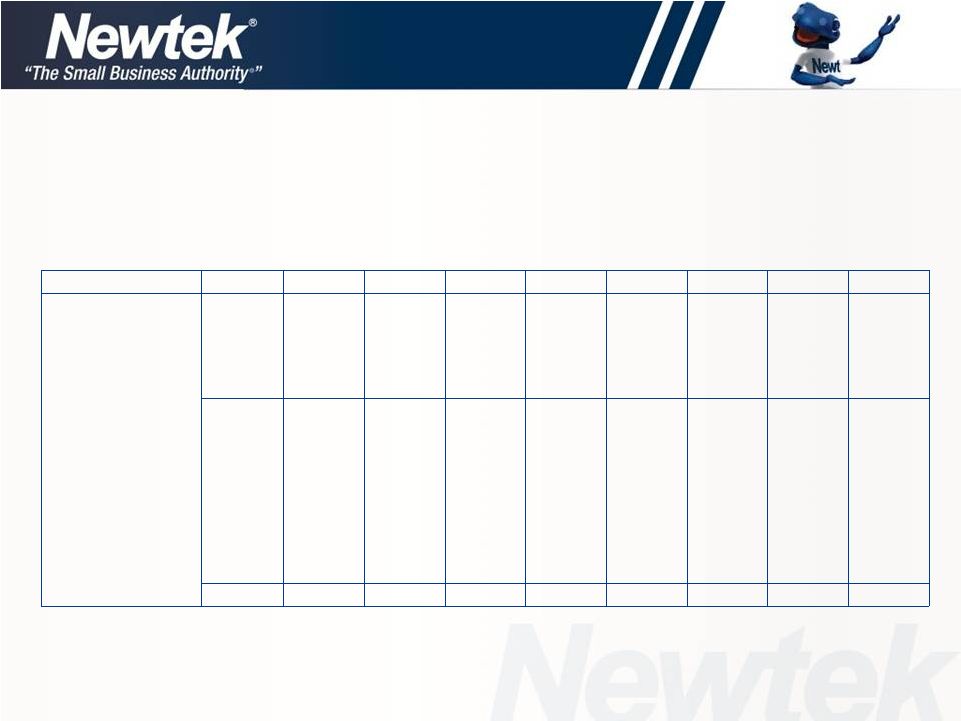

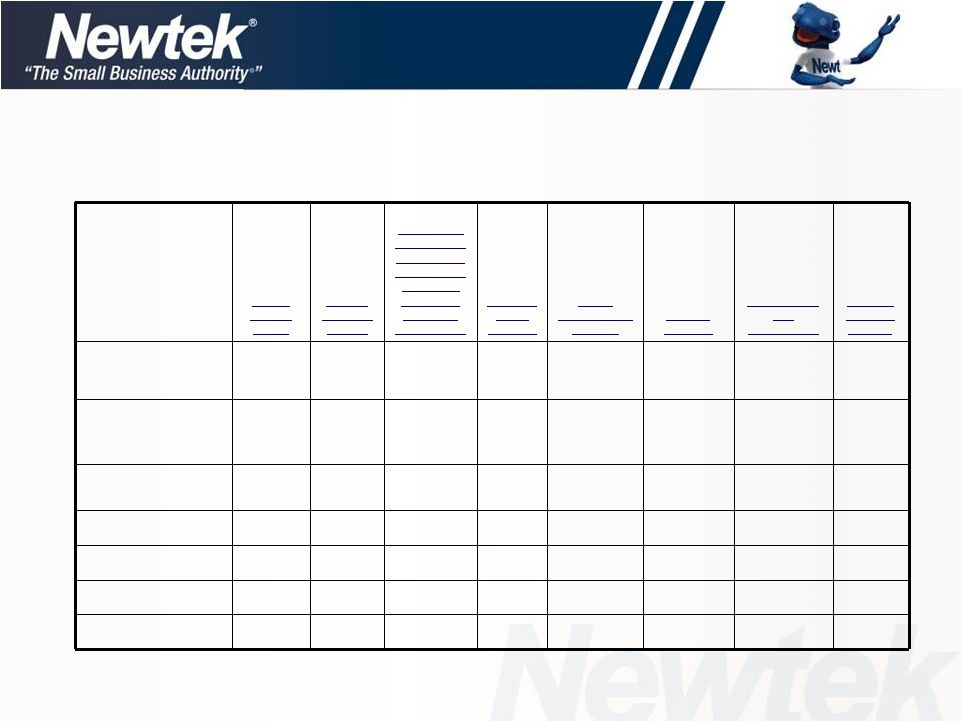

8

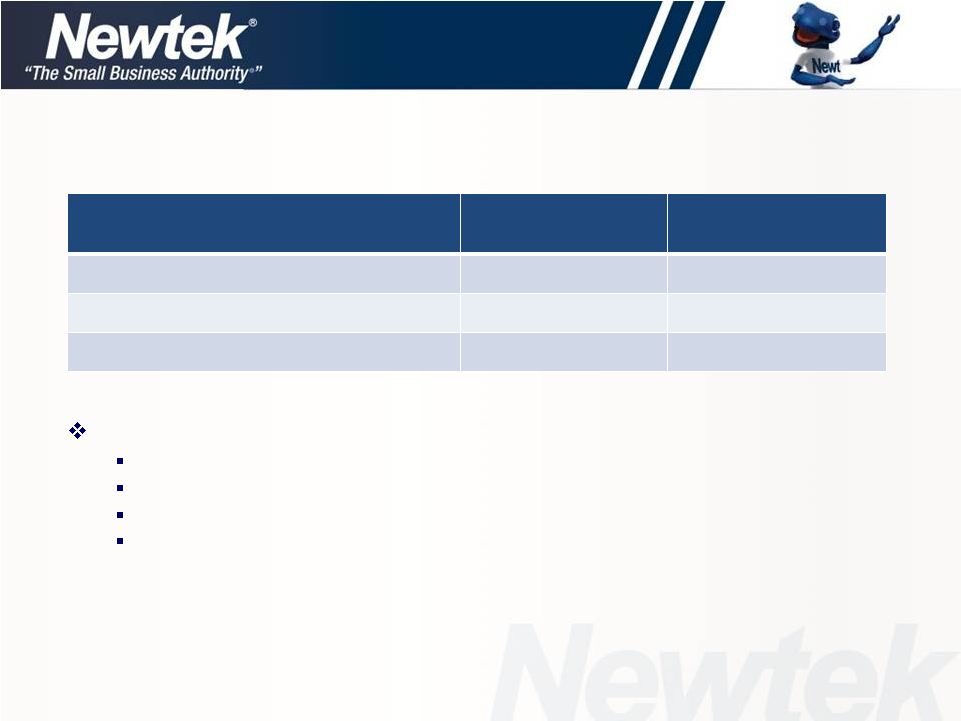

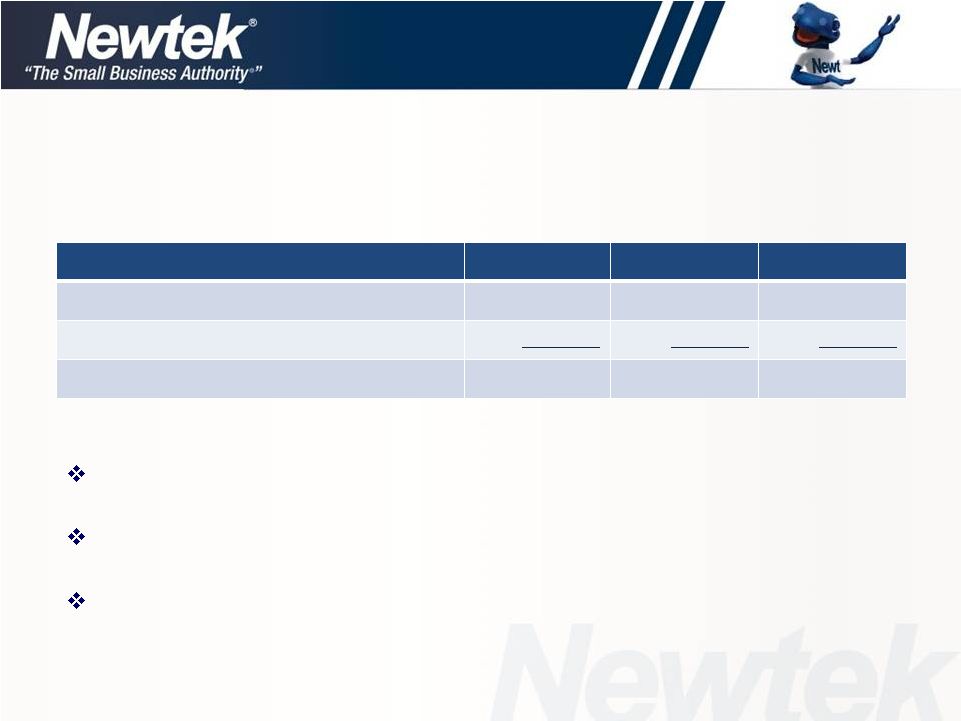

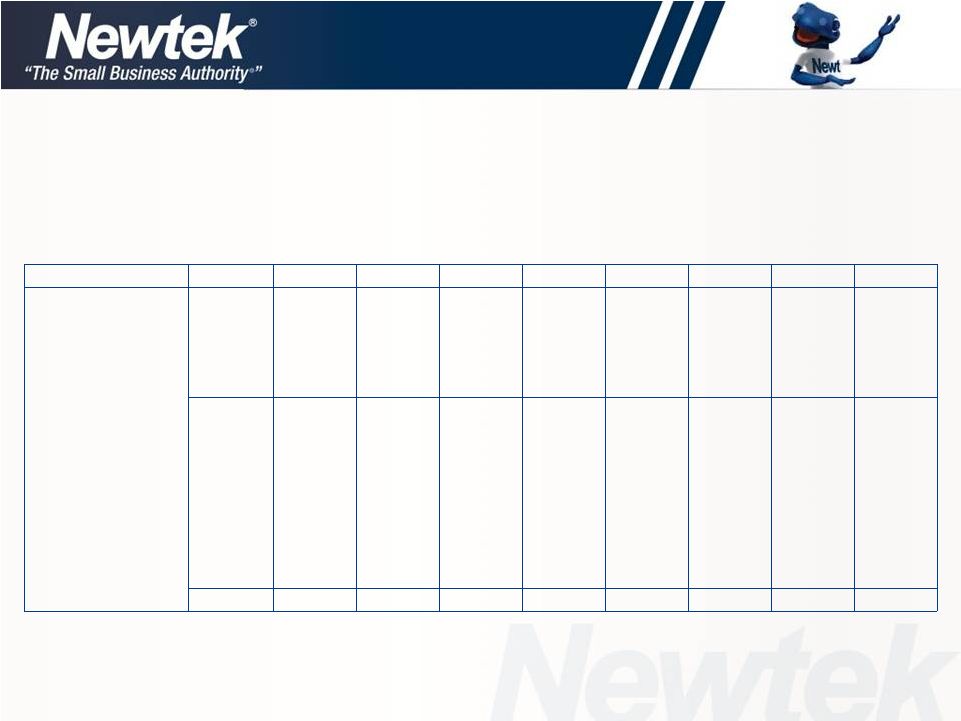

Selected Balance Sheet Items

In thousands of dollars

Major changes in Assets and Liabilities

Increase of $11.7 million in Cash and cash equivalents

Increase of $8.1 million in SBA loans held for investment

Increase of $13.1 million in Notes payable

Decrease

of

$5.4

million

in

Credits

and

Notes

payable

in

credits

in

lieu

of

cash

Balance at

June 30, 2012

Balance at

December 31, 2011

Total Assets

$ 142,994

$ 132,010

Total Liabilities

78,986

72,711

Total Equity

64,008

59,299 |

Reduced Effect of Capco on

Consolidated Results

Balance sheet illusionary leverage

•

$11.6 million –

Credits in lieu of cash

•

$11.6 million –

Notes payable in credits in lieu of cash

Management time

Accounting cost

Other miscellaneous costs

9 |

Future Year End Balance of Tax Credits

10

$ in millions

$0

$5

$10

$15

$20

$25

$30

$35

$40

2010

2011

2012

2013

2014

2015

2016 |

Newtek Buy Back of Common Shares

During the second quarter of 2012, the Company repurchased

780,920 shares of common stock under its one million share

authorization

Average buy back price $1.1862

Represents great value to our shareholders

On Friday, July 27, 2012, our stock price closed at $1.50/share,

up 32% since most recent stock repurchase

11 |

Market Comparable Trends

Market comparables positioning themselves similarly to Newtek

Universal Business Payment Solutions (“UBPS”) announced $179 million

planned acquisition of:

•

a credit and debit card sales organization;

•

a credit and debit card processing company; and

•

a payroll processing and a tax filing company

GoDaddy announced strategic purchase of a cloud-based financial

management application company to reach more small businesses

Newtek has the advantage of:

•

Experience

in

providing

a

“suite

of

services”

to

small

businesses

over

the

past

8

years

•

All of our business divisions operating on a similar, coordinated platform

•

All business service solutions will be available to business owners in the cloud

and available on their iphones and ipads

12

Medallion Financial Corp (TAXI)

Heartland Payment Systems (HPY)

Web.com Group, Inc. (WWWW)

Cbeyond, Inc. (CBEY)

8 x 8, Inc. (EGHT)

ReachLocal, Inc. (RLOC)

Stamps.com, Inc. (STMP)

Marchex, Inc. (MCHX)

Vistaprint, NV (VPRT) |

Developments in EPP

Q2 2012 EPP revenue up $657 thousand, or 3% compared with year

ago period; excluding impact of Durbin Amendment, revenue

increased by 11.1%

Q2 2012 EPP pretax income of $1.9 million, a 42% increase

compared with Q2 2011

–

Cash flow positive business

–

Significant operating leverage

–

EPP segment does not have any debt

–

eCommerce : Single most important corporate initiative and identifier

13 |

Managed Technology Solutions Initiatives

Q2 2012 Web hosting and design revenue down 4% compared to year ago

quarter

Q2 2012 MTS pretax income increased by 12% over prior year

–

Decrease in total number of web hosting plans; however,

–

Increase in average revenue per plan resulting from increase in number of cloud

instances and higher-cost plans sold

–

Decrease in professional fees for web design development and other general and

administrative costs

Changeover in management in:

–

Presidency of MTS

–

Customer Service

–

Sales Department

All products cloud-solutions oriented

Improve

our

position

in

products

in

addition

to

Microsoft

®

products

14 |

Developments in Small Business Finance

Q2 2012 SBF revenue, after adjusting for fair value accounting adjustment

related to timing of recognition of premium income included in prior quarter,

increased 30% over year ago period

Q2 2012 SBF pretax income $1.5 million, a 43% increase compared with

prior year

This sector offers the best opportunity for Newtek stockholders

–

We have a very strong lending infrastructure (origination, underwriting, funding,

servicing, and collection); this infrastructure is valuable more so

today –

111 to 116 pricing on governments

–

FDIC contract

–

We are an S&P-rated commercial servicer

Closed $10-15 million in mezzanine loan in April 2012

This will increase our capability to increase our lending in $100 million

increments; every $100 million in additional originations results in

approximately $4 million in annual pretax dollars

15 |

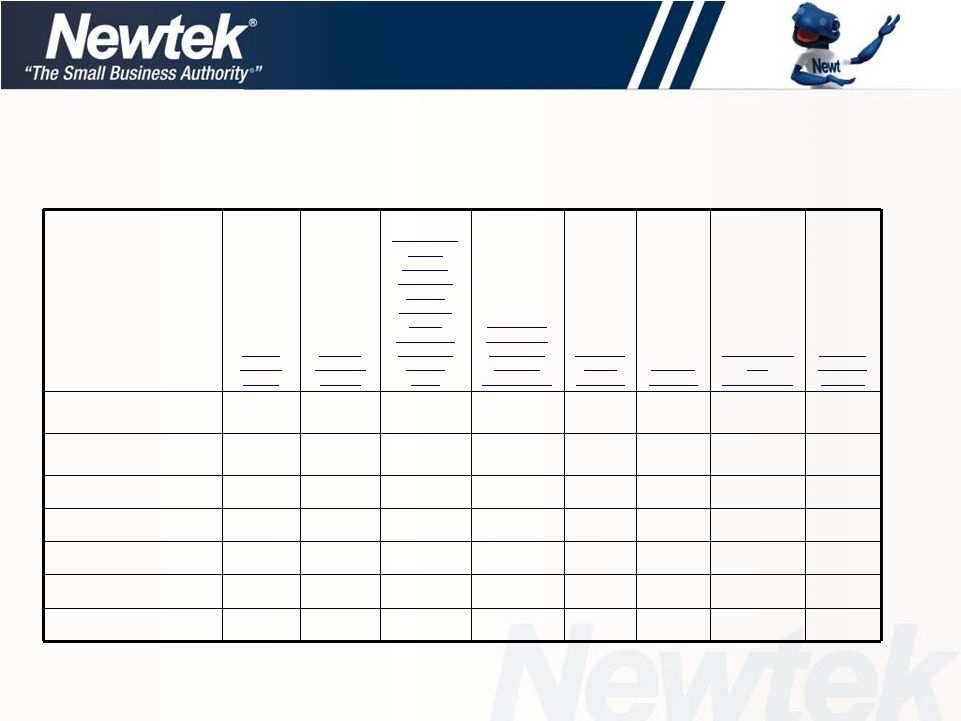

16

Small Business Finance

From June 30, 2011 to June 30, 2012, our total servicing portfolio

increased by 74%

We added an additional $128 million in external servicing in the

second

quarter 2012

We anticipate our total servicing portfolio increasing to $650 million by

December 31, 2012

Q2 2012

Q2 2011

Increase

Servicing for our loans

$ 309,500

$ 249,600

$ 59,900

Servicing for others

257,000

75,900

181,100

Total servicing portfolio

$ 566,500

$ 325,500

$ 241,000

Servicing Portfolio:

In thousands of dollars |

Newtek Payroll Services

Payroll management, payment and reporting service

Competitively priced and ideal for small and medium sized

businesses

Currently servicing customers in 34 states

Complements existing Newtek Products

–

Insurance

–

WC Pay-go

–

“Payroll in the Cloud”

17 |

Growth Strategy

Market Newtek ®

“The Small Business Authority”

brand through

www.thesba.com

Emphasize cross-selling and cross-marketing into the customer base

Continue to grow alliance channels as outsourcing of our services is

attractive to banks, credit unions and other affinity groups

Outbound campaign with direct focus on small businesses through television

and radio

Grow our presence as a business service provider with all of our

business

applications hosted in the cloud

18 |

Our Strategy & Mission

We are a thought leader and destination for independent owner

operators

of

small

businesses.

Newtek

®

The

Small

Business

Authority

provides products, services, and data to small and

medium size businesses across the United States to grow their

sales, reduce their expenses, reduce their risk and offer state of

the art efficient business strategies, structures, and content to

run their businesses. |

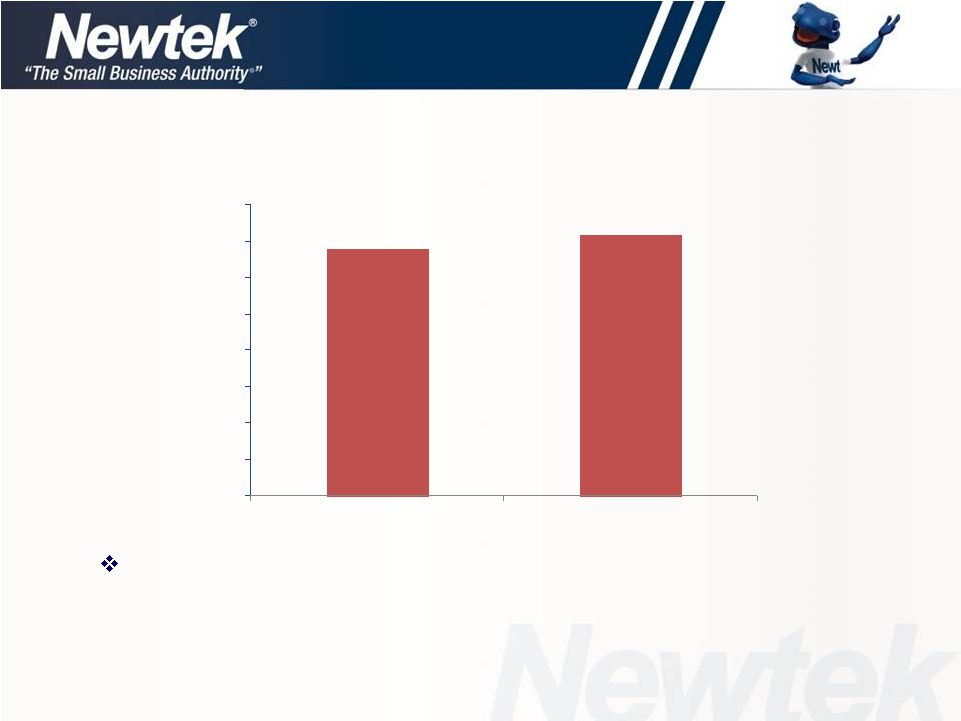

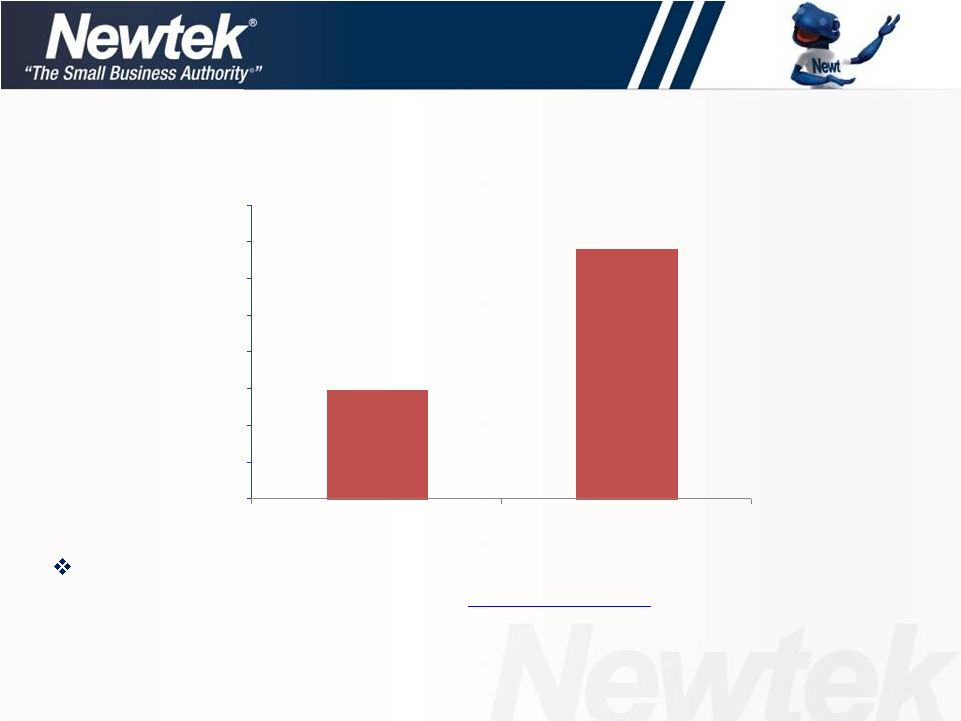

Total Referrals

Total referrals received increased 6% as compared with the year ago

quarter as a result of our new initiatives

6,777

7,181

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Q2'11

Q2'12 |

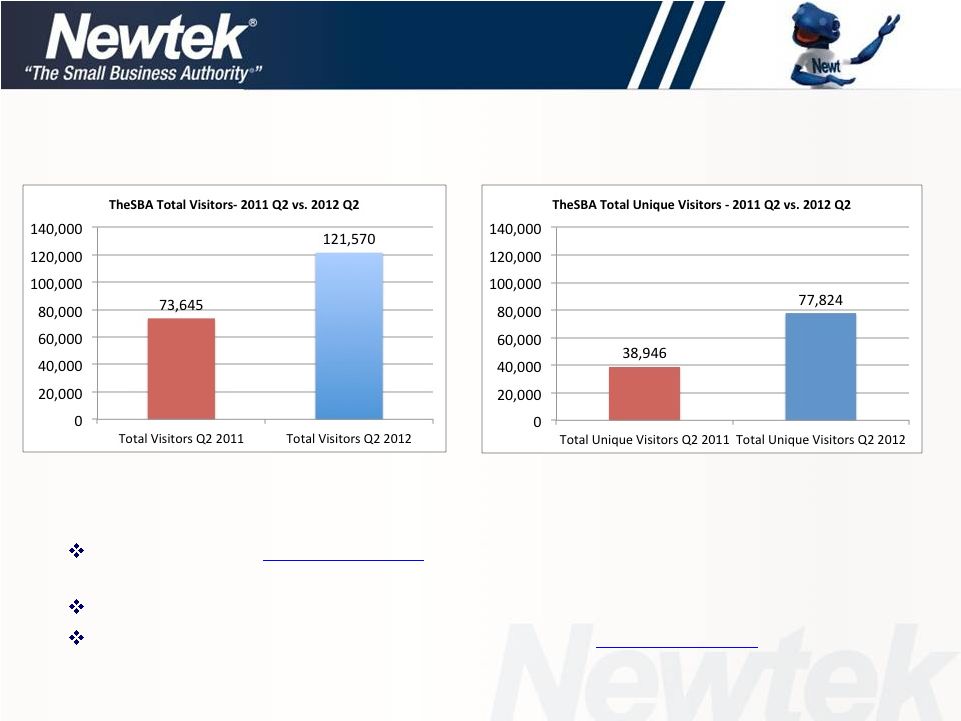

Visitor Trend to www.thesba.com

As a result of our direct marketing initiatives:

Total Visitors to www.thesba.com

increased by 65% in the current quarter

compared to the year ago quarter

Total Unique Visitors increased by nearly 100% in the current quarter

64%

of

Visitors

in

the

current

quarter

are

Unique

to

www.thesba.com |

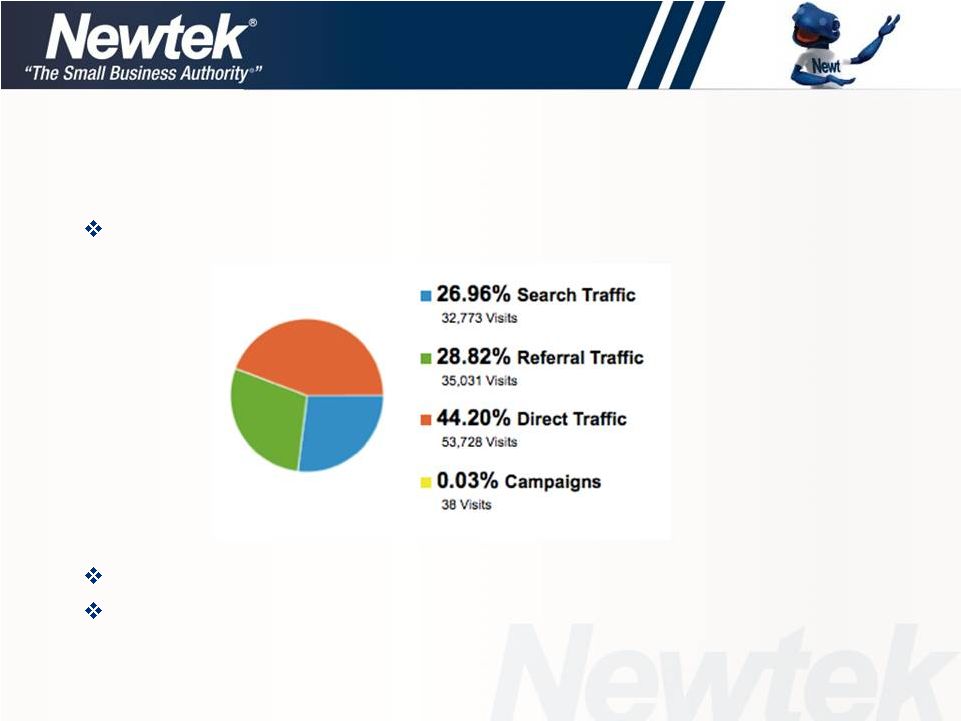

Current General Statistics

Our Alexa traffic ranking in the U.S. is 42,434 with 568 sites linking in

69% Bounce Rate; average time on site is 1 minute and 51

seconds An average of approximately 1,000 unique visitors per

day 22 |

Small Business Authority

Branding Achievements

The

Small

Business

Authority

Index

is

published

by

Bloomberg

Newswire monthly

The

Small

Business

Authority

Market

Sentiment

Survey

is

published

on

CNBC, NYDailyNews, Small Business Trends, etc.

Forbes

publishes

The

Small

Business

Authority

Blog

daily

which

can

be

viewed at http://blogs.forbes.com/thesba/

23 |

Forbes Blog -

The Small Business Authority

Our introductory post which explains what our blog will do can be

viewed

at

http://blogs.forbes.com/thesba/2011/06/15/your-

authority-on-small-business/

Forbes Contributor

Since June 2011

Over 70 published articles regarding issues that affect

entrepreneurs and their companies: health care, small business

lending, small business regulations, taxes, IT costs, insurance)

Some of our posts have received in excess of 20,000 views

24 |

Current Marketing Strategy

Generate awareness to qualified small business owners through a

National prime-time television advertising campaign with a 50%

increased budget

Media parameters will include National TV exposure through

commercials, online display and search

Key product offerings will include: small business

loans, eCommerce and cloud

services 25 |

SB Authority Index

Financial barometer for small business economy

Made up of eight primary business and economic components

of the small business economy

SB Authority Index released at beginning of every month

Available in our newsletter with approximately 60,000 in

distribution

Available

on

our

website

now

at

www.thesba.com

26 |

SB Authority Market Sentiment Survey

On a monthly basis, delivers the pulse of the small business

economy by polling our client base on topical issues like health

care, the lending environment and other important issues

affecting small businesses

Usually poll in excess of 1,200 respondents

Released once per month

Results are available in our newsletter with approximately

60,000 in distribution

Available to all to participate in and view results on our website

at www.thesba.com

27 |

Marketing Focus |

29

Percent of Referrals from Direct Channel

As a result of our revised marketing message focused on Small Business

Lending, Direct Channel referrals to

www.thesba.com increased from 5.9% to

13.6% over the year ago quarter

5.9%

13.6%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

Q2'11

Q2'12 |

Small Business Authority Channel

Grow internet web based direct business

-

through search

-

through branding on TV, radio, print and public relations

Grow as the destination spot for independent owner/operator

businesses

Increase

recognition

as

being

“The

Authority”

in

business

issues

for small businesses, and in each of the following areas:

-

Lending

-

Electronic payment processing

-

Insurance brokerage

-

Outsourced technology managed services

-

Business information

-

Payroll

-

Data storage

-

Health insurance

30 |

In Conclusion

31 |

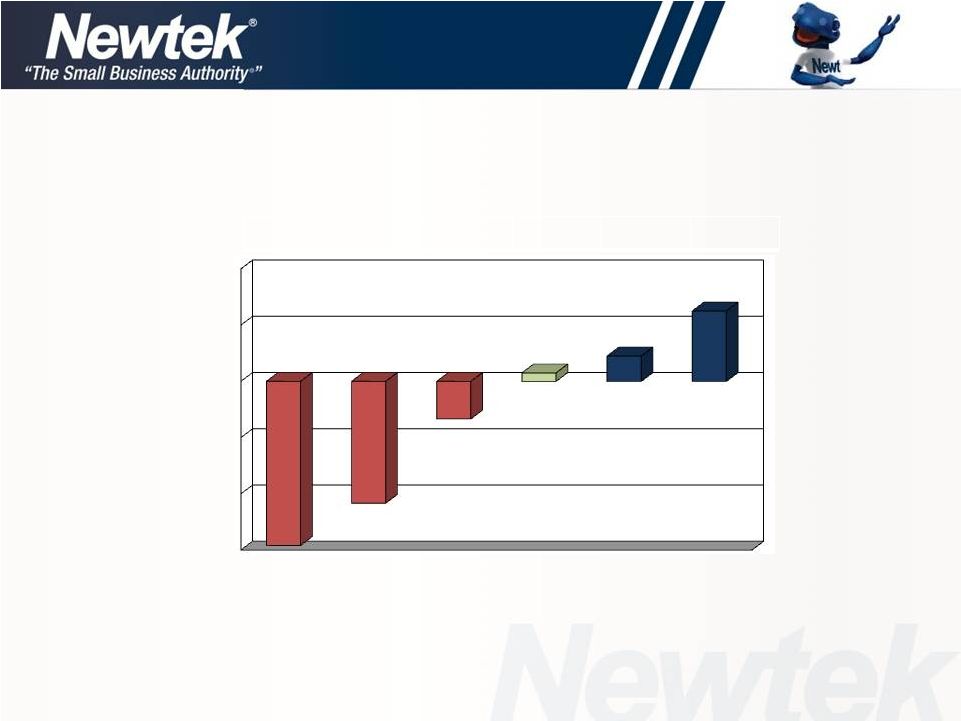

Annual Pretax Income Trend

32

Pretax income (loss), in millions

$(17.5)

$(13.1)

$(4.0)

$0.9

$2.3

$7.5

-$18

-$12

-$6

$0

$6

$12

2007

Actual

2008

Actual

2009

Actual

2010

Actual

2011

Actual

2012

Forecast

Midpoint |

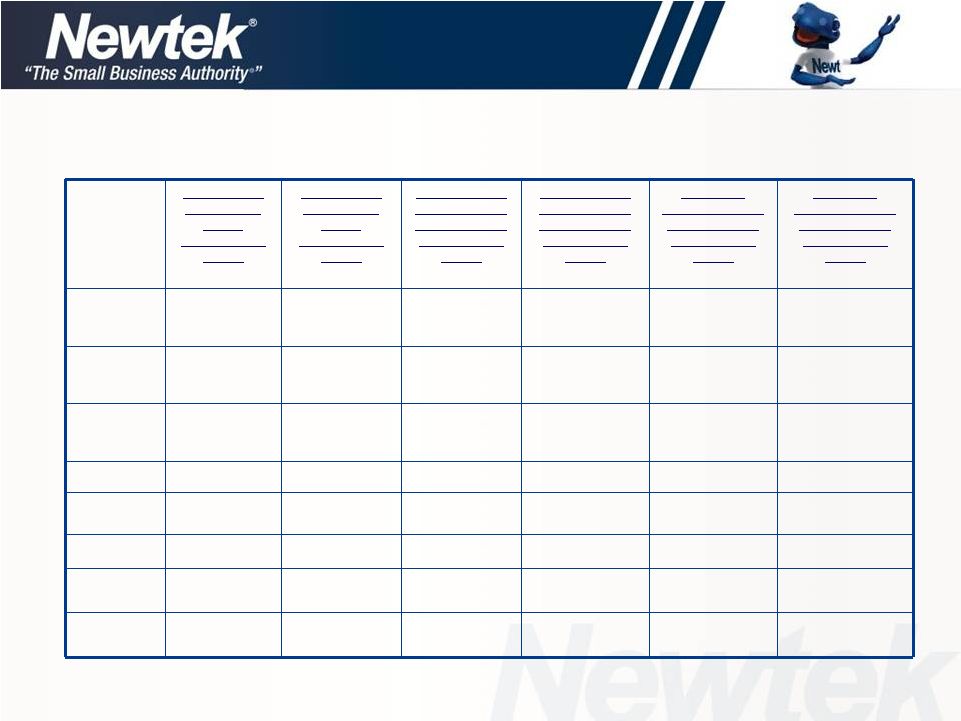

2012 Segment Guidance

33

*Note: totals may not add due to rounding

In millions of dollars

Electronic

Managed

Small

Total

Payment

Technology

Business

All

Corporate

Business

CAPCO

Intercompany

Processing

Solutions

Finance

Other

Activities

Segments

Segment

Eliminations

Total

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

2012 Full Year

Revenue

84.3

85.7

18.8

19.2

24.2

25.2

1.7

2.0

0.8

0.8

129.8

132.9

0.8

0.8

(1.5)

129.1

132.2

Pretax Income (Loss)

8.2

8.6

4.3

4.5

5.5

6.7

(1.0)

(0.9)

(8.5)

(8.4)

8.5

10.5

(2.0)

(2.0)

-

6.5

8.5

Income from tax credits

-

-

-

-

-

-

-

-

-

-

-

-

(0.8)

(0.8)

-

(0.8)

(0.8)

Net change in fair value of

credits in lieu of cash and

notes payable in credits in

lieu of cash

-

-

-

-

-

-

-

-

-

-

-

-

0.1

0.1

-

0.1

0.1

Deferred compensation

expense

-

-

-

-

-

-

-

-

0.4

0.4

0.4

0.4

-

-

-

0.4

0.4

Lease loss amortization

-

-

-

-

-

-

-

-

(0.2)

(0.2)

(0.2)

(0.2)

-

-

-

(0.2)

(0.2)

Interest Expense

-

-

0.1

0.1

3.8

3.8

-

-

-

-

3.9

3.9

0.7

0.7

-

4.6

4.6

Depreciation and

Amortization

0.8

0.8

1.2

1.2

1.5

1.5

-

-

0.2

0.2

3.7

3.7

-

-

-

3.7

3.7

Modified EBITDA

9.0

9.4

5.6

5.8

10.8

12.0

(1.0)

(0.9)

(8.1)

(8.0)

16.3

18.3

(2.0)

(2.0)

-

14.3

16.3 |

Financial Review

Jennifer C. Eddelson –

CAO |

Non-GAAP Financial Measures

In evaluating its business, Newtek considers and uses modified EBITDA as a

supplemental measure of its operating performance. The Company defines

modified EBITDA as earnings excluding income from

tax

credits,

net

change

in

fair

value

of

credits

in

lieu

of

cash

and

notes

payable

in

credits

in

lieu

of

cash, interest expense, deferred compensation expense, lease loss expense, taxes,

depreciation and amortization. Newtek uses modified EBITDA as a

supplemental measure to review and assess its operating performance.

The Company also presents modified EBITDA because it believes it is

frequently used by securities analysts, investors and other interested parties as a

measure of financial performance.

The term modified EBITDA is not defined under U.S. generally accepted accounting

principles, or U.S. GAAP, and is not a measure of operating income(loss),

operating performance or liquidity presented in accordance

with

U.S.

GAAP.

Modified

EBITDA

has

limitations

as

a

analytical

tool

and,

when

assessing the Company’s operating performance, investors should not consider

modified EBITDA in isolation, or as a substitute for net income (loss) or

other consolidated income statement data prepared in accordance with U.S.

GAAP. Among other things, modified EBITDA does not reflect the

Company’s

actual

cash

expenditures.

Other

companies

may

calculate

similar

measures

differently

than Newtek, limiting their usefulness as comparative tools. Newtek

compensates for these limitations by relying primarily on its GAAP results

and using modified EBITDA only supplementally. 35

|

Q2 2012 Actual vs. Q2 2011 Actual

36

In millions of dollars

Revenue For

The Quarter

Ended

June 30, 2012

Actual

Revenue For

The Quarter

Ended

June 30, 2011

Actual

Pretax Income

(Loss) For The

Quarter Ended

June 30, 2012

Actual

Pretax Income

(Loss) For The

Quarter Ended

June 30, 2011

Actual

MODIFIED

EBITDA For The

Quarter Ended

June 30, 2012

Actual

MODIFIED

EBITDA For The

Quarter Ended

June 30, 2011

Actual

Electronic

Payment

Processing

21.373

20.717

1.904

1.344

2.082

1.735

Managed

Technology

Solutions

4.570

4.767

1.114

.997

1.446

1.386

Small

Business

Finance

5.963

6.299

1.478

1.036

2.669

1.722

All Other

0.451

0.347

(0.238)

(0.342)

(0.228)

(0.314)

Corporate

Activities

0.205

0.304

(1.930)

(2.414)

(1.895)

(2.262)

CAPCO

0.141

0.324

(0.398)

(0.485)

(0.386)

(0.524)

Interco

Eliminations

(0.365)

(0.436)

–

–

–

–

Total

32.338

32.322

1.930

0.136

3.688

1.743

*Note: totals may not add due to rounding |

2012 Segment Guidance

37

*Note: totals may not add due to rounding

In millions of dollars

Electronic

Managed

Small

Total

Payment

Technology

Business

All

Corporate

Business

CAPCO

Intercompany

Processing

Solutions

Finance

Other

Activities

Segments

Segment

Eliminations

Total

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

2012 Full Year

Revenue

84.3

85.7

18.8

19.2

24.2

25.2

1.7

2.0

0.8

0.8

129.8

132.9

0.8

0.8

(1.5)

129.1

132.2

Pretax Income (Loss)

8.2

8.6

4.3

4.5

5.5

6.7

(1.0)

(0.9)

(8.5)

(8.4)

8.5

10.5

(2.0)

(2.0)

-

6.5

8.5

Income from tax credits

-

-

-

-

-

-

-

-

-

-

-

-

(0.8)

(0.8)

-

(0.8)

(0.8)

Net change in fair value of

credits in lieu of cash and

notes payable in credits in

lieu of cash

-

-

-

-

-

-

-

-

-

-

-

-

0.1

0.1

-

0.1

0.1

Deferred compensation

expense

-

-

-

-

-

-

-

-

0.4

0.4

0.4

0.4

-

-

-

0.4

0.4

Lease loss amortization

-

-

-

-

-

-

-

-

(0.2)

(0.2)

(0.2)

(0.2)

-

-

-

(0.2)

(0.2)

Interest Expense

-

-

0.1

0.1

3.8

3.8

-

-

-

-

3.9

3.9

0.7

0.7

-

4.6

4.6

Depreciation and

Amortization

0.8

0.8

1.2

1.2

1.5

1.5

-

-

0.2

0.2

3.7

3.7

-

-

-

3.7

3.7

Modified EBITDA

9.0

9.4

5.6

5.8

10.8

12.0

(1.0)

(0.9)

(8.1)

(8.0)

16.3

18.3

(2.0)

(2.0)

-

14.3

16.3 |

Going Forward: 2012

Barry Sloane -

CEO |

Questions & Answers |

Addendum |

41

Pretax

Income

(Loss)

Income

from Tax

Credits

Net Change

in Fair Value

of Credits in

Lieu of Cash

and Notes

Payable in

Credits in

Lieu of Cash

Deferred

Comp

Expense

Lease

restructuring

charges

Interest

Expense

Depreciation

and

amortization

Q2 2012

Modified

EBITDA

Electronic Payment

Processing

1.904

-

-

0.009

-

-

0.169

2.082

Managed Technology

Solutions

1.114

-

-

0.008

-

0.021

0.303

1.446

Small Business Finance

1.478

-

-

0.016

-

0.969

0.206

2.669

All Other

(0.238)

-

-

0.008

-

-

0.002

(0.228)

Corporate Activities

(1.930)

-

-

0.077

(0.073)

0.002

0.029

(1.895)

CAPCO

(0.398)

(0.129)

(0.005)

-

-

0.144

0.002

(0.386)

Total

1.930

(0.129)

(0.005)

0.118

(0.073)

1.136

0.711

3.688

Modified EBITDA Reconciliation

Modified EBITDA Reconciliation from Pretax Income (Loss)

For the three months ended June 30, 2012

In millions of dollars

*Note: totals may not add due to rounding |

42

Pretax

Income

(Loss)

Income

from Tax

Credits

Net Change

in Fair

Value of

Credits in

Lieu of

Cash and

Notes

Payable in

Credits in

Lieu of

Cash

Other than

Temporary

Decline in

Value of

Investments

Deferred

Comp

Expense

Interest

Expense

Depreciation

and

amortization

Q2 2011

Modified

EBITDA

Electronic Payment

Processing

1.344

-

-

-

0.011

-

0.380

1.735

Managed Technology

Solutions

0.997

-

-

-

0.007

0.027

0.355

1.386

Small Business Finance

1.036

-

-

-

0.011

0.451

0.224

1.722

All Other

(0.342)

-

-

-

0.008

-

0.020

(0.314)

Corporate Activities

(2.414)

-

-

-

0.105

-

0.047

(2.262)

CAPCO

(0.485)

(0.317)

(0.001)

(0.051)

-

0.327

0.003

(0.524)

Total

0.136

(0.317)

(0.001)

(0.051)

0.142

0.805

1.029

1.743

Modified EBITDA Reconciliation

Modified EBITDA Reconciliation from Pretax Income (Loss)

For the three months ended June 30, 2011

In millions of dollars

*Note: totals may not add due to rounding |