Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BANCORP /PR/ | d390532d8k.htm |

Financial

Results Second Quarter 2012

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation contains “forward-looking statements” concerning First

BanCorp’s (the “Corporation”) future economic performance. The words or phrases “would

be,” “will allow,” “intends to,” “will likely result,”

“are expected to,” “expect,” “anticipate,” “look forward,” “should,” “believes” and similar expressions are meant to

identify “forward-looking statements” within the meaning of Section 27A of the

Private Securities Litigation Reform Act of 1995, and are subject to the safe harbor

created by such section. The Corporation wishes to caution readers not to place undue reliance

on any such “forward-looking statements,” which speak only as of the date

made, and to advise readers that various factors, including, but not limited to, uncertainty about whether the Corporation and FirstBank Puerto Rico (“FirstBank”

or “the Bank”) will be able to fully comply with the written agreement dated

June 3, 2010 that the Corporation entered into with the Federal Reserve Bank of New

York (the “FED”) and the order dated June 2, 2010 (the “Order”)that

FirstBank entered into with the FDIC and the Office of the Commissioner of Financial Institutions

of Puerto Rico that, among other things, require FirstBank to maintain certain capital levels

and reduce its special mention, classified, delinquent and non-performing assets;

the risk of being subject to possible additional regulatory actions; uncertainty as to the availability of certain funding sources, such as retail brokered CDs; the

Corporation’s reliance on brokered CDs and its ability to obtain, on a periodic basis,

approval from the FDIC to issue brokered CDs to fund operations and provide

liquidity in accordance with the terms of the Order; the risk of not being able to fulfill the Corporation’s cash obligations or resume paying dividends to the

Corporation’s stockholders in the future due to the Corporation’s inability to

receive approval from the FED to receive dividends from FirstBank or FirstBank’s failure to

generate sufficient cash flow to make a dividend payment to the Corporation; the strength or

weakness of the real estate markets and of the consumer and commercial credit sectors

and their impact on the credit quality of the Corporation’s loans and other assets, including the Corporation’s construction and commercial

real estate loan portfolios, which have contributed and may continue to contribute to, among

other things, the high levels of non-performing assets, charge-offs and the

provision expense and may subject the Corporation to further risk from loan defaults and foreclosures; adverse changes in general economic conditions in the

United States and in Puerto Rico, including the interest rate scenario, market liquidity,

housing absorption rates, real estate prices and disruptions in the U.S. capital

markets, which may reduce interest margins, impact funding sources and affect demand for all

of the Corporation’s products and services and the value of the Corporation’s

assets; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; a decrease in demand for the Corporation’s

products and services and lower revenues and earnings because of the continued recession in

Puerto Rico and the current fiscal problems and budget deficit of the Puerto Rico

government; uncertainty about regulatory and legislative changes for financial services companies in Puerto Rico, the United States and the U.S. and

British Virgin Islands, which could affect the Corporation’s financial performance and

could cause the Corporation’s actual results for future periods to differ materially

from prior results and anticipated or projected results; uncertainty about the effectiveness

of the various actions undertaken to stimulate the United States economy and stabilize

the United States’ financial markets, and the impact such actions may have on the Corporation’s business, financial condition and results of operations;

changes in the fiscal and monetary policies and regulations of the federal government,

including those determined by the Federal Reserve System, the FDIC,

government-sponsored housing agencies and regulators in Puerto Rico and the U.S. and

British Virgin Islands; the risk of possible failure or circumvention of controls and

procedures and the risk that the Corporation’s risk management policies may not be adequate; the risk that the FDIC may further increase the deposit insurance

premium and/or require special assessments to replenish its insurance fund, causing an

additional increase in the Corporation’s non-interest expense; risks of not

being able to recover the assets pledged to Lehman Brothers Special Financing, Inc.; the

impact on the Corporation’s results of operations and financial condition

associated with acquisitions and dispositions; a need to recognize additional impairments on

financial instruments or goodwill relating to acquisitions; risks that downgrades in

the credit ratings of the Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access necessary external funds; the

impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act on the

Corporation’s businesses, business practices and cost of operations; and general

competitive factors and industry consolidation. The Corporation does not undertake, and

specifically disclaims any obligation, to update any “forward-looking

statements” to reflect occurrences or unanticipated events or circumstances after the

date of such statements except as required by the federal securities laws. Investors

should refer to the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2011 for a discussion of such factors and certain risks and

uncertainties to which the Corporation is subject.

|

Agenda

Second Quarter 2012 Highlights:

Aurelio Alemán, President & Chief Executive Officer

Second Quarter Results of Operations:

Orlando Berges, Executive Vice President & Chief Financial Officer

Summary

Questions & Answers

3 |

SECOND QUARTER

2012 Highlights |

Second Quarter

2012 Highlights: ACHIEVED PROFITABILITY

1

st

quarter of profitability achieved since March 2009, through the

implementation and execution of strategic plan.

Focused on the following levers to return to profitability:

Reduction of non-performing and classified assets;

Profitable loan growth;

Core deposit growth;

Non-interest income growth;

Improve efficiencies;

NIM expansion; and

Continued strengthening of governance and risk management.

5

$9.4 million of net income; Diluted EPS $0.05 |

6

Taking advantage of opportunities within market

Second Quarter 2012 Highlights:

MARKET OPPORTUNITIES Puerto Rico showing signs of

improvement; projected positive GNP growth of 0.9% for 2012

Growing core deposits through focus on enhancing relationships with

responsive team and product offerings

Transaction banking business developed to increase non-interest

income

Re-energizing loan production in key focus areas: consumer, auto,

residential mortgages & small commercial |

7

Second

Quarter

2012

Highlights:

LOAN

PORTFOLIO

DIVERSIFICATION

($ in millions)

Loan Portfolio

Loan Originations

Significant commercial loan maturities and pay-offs

during Q2 offset by the increase in Consumer due to

the credit card portfolio acquisition.

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

2,881

2,874

2,874

2,799

2,764

1,612

1,577

1,562

1,553

1,950

516

474

428

399

365

4,166

4,123

4,131

4,044

3,738

1,591

1,585

1,565

1,501

1,479

21

14

16

44

60

Residential

Consumer

Construction

Commercial and Industrial

Commercial Real Estate

Loans Held for Sale

10,786

10,647

10,575

10,340

10,357

Implementing strategies to increase Consumer and

Residential Mortgage loan originations

Strong origination activity in Q2 vs. Q1:

Residential

mortgages

increased

$32

million

20%

Consumer:

Auto

loans

increased

$29

million

25%

Consumer:

Personal

loans

increased

$13

million

31%

Consumer:

Credit

card

utilization

activity

of

$34

million

C&I

loan

originations

increased

$151

million

66% |

8

Acquisition of $406 million credit card portfolio

Second Quarter 2012 Highlights:

CREDIT CARD

PORTFOLIO

On May 31, 2012, completed purchase of a $406 million FirstBank-branded

consumer credit card portfolio from FIA Card Services, N.A.

The portfolio consists of approximately 140,000 active credit card relationships.

Recorded

at

an

initial

fair

value

of

approximately

$369

million,

and

recognized

an intangible asset of $24.4 million.

Diversifies revenue streams and the composition of the loan portfolio.

Provides significant opportunity to broaden and deepen relationships with

customers and accelerates cross sell targets.

Positive contributor to NIM, non-interest income and efficiency ratio since first

month of operation. |

Successful

execution of deposit growth strategy; deposits (net of brokered CDs) grew $148 million

or 2%; we achieved this while reducing the cost of deposits net of brokered from 1.11%

to 0.99%. Continue expanding electronic services offering to support deposit growth

strategy including electronic banking and mobile banking enhancements

Reduced reliance on brokered deposits

35% of deposits are brokered, a decrease of $156 million or 4% compared to Q1 2012

9

($ in millions)

Deposits, Net of Brokered CDs

Total Deposit Composition

Second Quarter Highlights:

DEPOSIT MIX $-

$6,500

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

2,476

2,584

2,654

2,782

2,826

772

866

915

963

959

2,137

2,195

2,126

2,055

2,066

481

520

481

487

584

$5,866

$6,164

$6,176

$6,286

$6,434

Retail

Commercial

CDs & IRAs

Public Funds

Interest

Bearing

57%

Non-interest

Bearing

8%

Brokered CDs

35% |

SECOND QUARTER

2012 Results of Operations |

Interest

income 153,652

$

152,107

$

1,545

$

Interest expense

44,947

50,241

(5,294)

Net interest income

108,705

101,866

6,839

Provision for loan and lease losses

24,884

36,197

(11,313)

Non-interest income

16,513

14,711

1,802

Equity in losses of unconsolidated entities

(2,491)

(6,236)

3,745

Total non-interest income

14,022

8,475

5,547

Personnel expense

31,101

31,611

(509)

Occupancy and equipment expense

15,181

15,676

(495)

Insurance and supervisory fees

13,302

13,008

294

REO expense

6,786

3,443

3,343

Other operating expenses

20,572

21,455

(839)

Pre-tax income (loss)

10,901

(11,049)

17,139

Income tax expense

1,545

2,133

(588)

Net income (loss)

9,356

$

(13,182)

$

22,537

$

Adjusted Pre-tax, pre-provision income

37,913

$

34,797

$

3,116

$

Fully diluted EPS

0.05

$

(0.06)

$

0.11

$

Book value per share

6.72

$

6.65

$

0.07

$

Tangible book value per share

6.42

$

6.46

$

(0.04)

$

Common stock price

3.96

$

4.40

$

(0.44)

$

Net Interest Margin (GAAP)

3.46%

3.20%

0.26%

Efficiency ratio

70.7%

77.2%

(6.5%)

11

($ in thousands, except per share data)

Select Financial Information

Q2 2012

Q1 2012

Variance

Results of Operations: SECOND QUARTER

2012 FINANCIAL HIGHLIGHTS

|

12

Net interest income

growth of 7% and 15%

when compared to Q1

2012 and Q2 2011,

respectively.

Revenue growth due to:

Growth in higher yield

consumer loan

segment including

$406 million credit card

portfolio acquisition in

May 2012;

Growth in core

deposits of $148

million; and

Reduction in cost of

funds.

* Non interest income is net of debentures

Results of Operations:

REVENUE GROWTH & MARGIN EXPANSION |

13

The average rate paid on non-brokered

deposits, including interest-bearing

checking accounts, savings and retail

CDs, declined by 12 basis points to

1.13% during the second quarter while

the average volume increased by $114.0

million.

Cost of total deposits net of brokered

also decreased to 0.99% from 1.11% in

Q1 2012

Cost of other borrowed funds declined 20 basis points due to:

The

maturity

of

a

$100

million

repurchase

agreement

that

carried

a

cost

of

4.38%;

The

maturity

of

a

$40

million

public

fund

CD

that

carried

a

cost

of

4.66%;

The prepayment of a $15.4 million medium-term note that carried a cost of 6%; and

Growth in core deposits

Further reductions in interest expense and the average cost of funds could be realized during

2012, as maturing brokered CDs and advances are renewed at lower current rates.

$2.2 billion of brokered CDs at an average cost of 2.04% mature in the next twelve

months. (Renewals at current rates range between 75 and 125 basis points).

Cost of Deposits

1.54%

1.48%

1.39%

1.25%

1.13%

1.35%

1.32%

1.23%

1.11%

0.99%

0.00%

2.00%

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Interest Bearing Deposits, Net of Brokered CDs

Total Deposits, Net of Brokered CDs

Results of Operations: COST OF

FUNDS

|

1,639

1,066

$1,790

$1,701

$1,669

$1,562

$1,410

$1,390

$1,377

$1,337

$1,332

$1,308

$-

$1,800

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Loans Held for Sale

Repossessed Assets & Other

Non-performing Loans

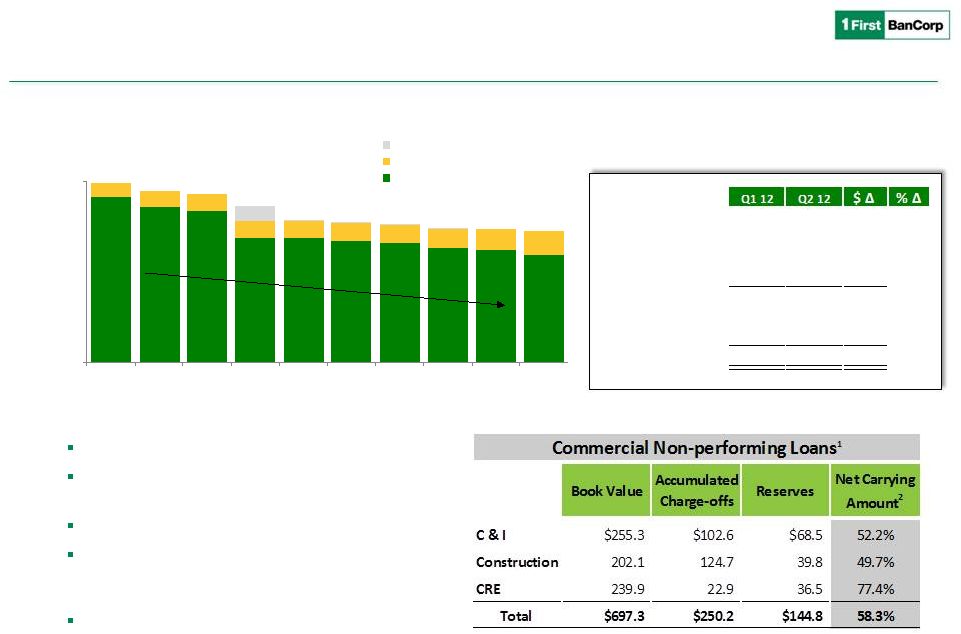

Reduced NPLs by 35% since peak in 1Q 2010

Reduced exposure to construction loans by 70%

since peak, a major driver of losses

Stabilized migration to NPL

OREO increased $30MM mainly due to foreclosed

commercial properties as a result of Special Asset

Group’s workout / legal strategies

Commercial NPLs are being carried at 58% of

unpaid principal balance, net of specific reserves

($ in millions)

1 As of June 30, 2012

2 Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated

charge-offs Non-performing Assets

Residential

341

$

333

$

(8)

$

(2%)

Consumer

39

35

(4)

(10%)

C&I and CRE

508

495

(13)

(3%)

Construction

231

202

(29)

(13%)

NPLs

1,119

1,066

(54)

(5%)

Repossessed Assets

148

178

30

20%

Other

65

65

-

0%

NPAs

1,332

$

1,308

$

(24)

$

(2%)

14

Results of Operations: ASSET QUALITY

|

15

($ in millions)

Total net charge-offs for 2Q 2012 were $51.7 million

or 2.03% of average loans on an annualized basis, a

$5.5 million increase compared to 1Q 2012:

–

CRE loans net charge-offs were $6.3 million, up

from $3.6 million, the increase related to

foreclosures.

–

C&I loans net charge-offs were $8.4 million, or an

annualized 0.9% of related average loans, down

from $12.7 million

–

Residential Mortgages: $14.2 million, or an

annualized 2.0% of related average loans, up from

$5.7 million, due to a higher level of properties

subject to updated appraisals.

Net Charge-offs

Allowance coverage ratio of 4.4%

$80

The increase in charge-offs for the quarter did not

represent a need for additional provision since 67%

of the commercial and construction charge-offs

recorded in the quarter were against previously

established reserves.

ALLL & Coverage Ratios

* Annualized

$

$90

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

9

16

9

6

14

10

9

8

9

8

11

23

17

13

8

3

3

14

4

6

47

17

19

15

15

Construction

Commercial Real Estate

Commercial and Industrial

Consumer

Residential

$541

$520

$494

$484

$457

5.02%

4.89%

4.68%

4.70%

4.44%

2.91%

2.50%

2.55%

1.78%

2.03%

0.0%

2.0%

4.0%

6.0%

$-

$200

$400

$600

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

ALLL

ALLL to Loans

NCOs to Average Loans *

$80

$68

$68

$46

$52

Net Charge-offs |

16

Results

of

Operations:

CAPITAL

POSITION

The

Corporation’s

total

stockholders’

equity

amounted

to

$1.45

billion

as

of

June

30,

2012,

an

increase

of

$15.9

million from March 31, 2012, driven by internal capital generation including the net income of

$9.4 million The capital levels continue to be strong as First BanCorp executes on its

strategic plan. Capital Ratios

12.4%

17.4%

17.3%

11.1%

16.0%

16.0%

8.0%

12.3%

12.5%

4.9%

13.1%

13.1%

3.8%

10.2%

10.3%

0.0%

5.0%

10.0%

15.0%

20.0%

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Total Capital

Tier 1

Leverage

Tier 1 Common

Tangible Common |

SECOND QUARTER

2012 Summary |

18

Summary

Strong capital position:

–

Total capital, Tier 1 capital and Leverage ratios of the Corporation of 17.3%, 16.0% and

12.5%, respectively.

Provision for loan and lease losses of $25 million, down $11 million.

Stable asset quality:

–

Non-performing

assets

-

decreased

by

$24

million.

–

Non-performing

loans

-

decreased

by

$54

million.

Net income of $9.4 million is the first quarterly profit since 2009 first quarter.

Growth in Net Interest Income and Margin:

–

Net

interest

income,

excluding

fair value

adjustments,

increased

by

$6.6

million.

–

Net

interest

margin,

excluding

fair

value

adjustments,

increased

by

24

basis

points

to

3.44%.

Re-entered the credit card business with the acquisition of an approximate $406 million

portfolio of First Bank-branded credit card accounts from FIA Card Services

(FIA). Strong

loan

originations

amounted

to

$838

million

for

the

second

quarter,

excluding

the

purchase

of

the

credit card portfolio.

Growth of $148 million in deposits, net of brokered CDs, while brokered CDs decreased by $156

million. |

SECOND QUARTER

2012 Q&A |

EXHIBITS

|

Average loans

& leases: Residential mortgage loans

(6,359)

(0.26%)

(1,918)

Construction loans

(33,156)

0.10%

(103)

C&I and commercial mortgage loans

(295,723)

0.05%

(2,322)

Consumer loans

132,622

0.67%

6,247

Total average loans

(206,017)

0.18%

1,818

Average total interest-earning assets

(153,737)

0.12%

1,803

Interest-bearing liabilities:

Brokered CDs

(163,139)

(0.12%)

1,930

Other interest-bearing deposits

114,031

(0.12%)

1,315

Other borrowed funds

(79,747)

(0.20%)

1,248

Average total interest-bearing liabilities

(148,108)

(0.15%)

4,706

Increase in net interest income *

6,509

$

21

Q1 vs. Q2 Change in Average Interest Earning Assets & Interest Bearing Liabilities

* On a tax equivalent basis and excluding valuations

$

in

%

in

Average

Average

Volume

Rate

Net Interest

Income

Changes

Results

of

Operations:

SECOND

QUARTER

KEY

MARGIN

DRIVERS |

June 30,

March 31,

December 31,

September 30,

June 30,

2012

2012

2011

2011

2011

Tangible Common Equity

(In thousands, except ratios and per share information)

Total equity -

GAAP

$ 1,448,959

$ 1,433,023

$ 1,444,144

$ 986,847

$ 1,009,578

Preferred equity

(63,047)

(63,047)

(63,047)

(430,498)

(428,703)

Goodwill

(28,098)

(28,098)

(28,098)

(28,098)

(28,098)

Purchased credit card relationship

(24,342)

-

-

-

-

Core deposit intangible

(10,512)

(11,100)

(11,689)

(12,277)

(12,866)

Tangible common equity

$ 1,322,960

$ 1,330,778

$ 1,341,310

$ 515,974

$

539,911 Total assets -

GAAP

$ 12,913,650

$ 13,085,623

$ 13,127,275

$ 13,475,572

$ 14,113,973

Goodwill

(28,098)

(28,098)

(28,098)

(28,098)

(28,098)

Purchased credit card relationship

(24,342)

-

-

-

-

Core deposit intangible

(10,512)

(11,100)

(11,689)

(12,277)

(12,866)

Tangible assets

$ 12,850,698

$ 13,046,425

$ 13,087,488

$ 13,435,197

$ 14,073,009

Common shares outstanding

206,134

206,134

205,134

21,304

21,304

Tangible common equity ratio

10.29%

10.20%

10.25%

3.84%

3.84%

Tangible book value per common share

6.42

$

6.46

$

6.54

$

24.22

$

25.34

$

Tangible Equity:

Tangible Assets:

22

Use of Non-GAAP Financial Measures

Basis of Presentation

Use of Non-GAAP Financial Measures

This presentation may contain non-GAAP financial measures. Non-GAAP

financial measures are set forth when management believes they will be helpful to an

understanding of the Corporation’s results of operations or financial

position. Where non-GAAP financial measures are used, the comparable GAAP financial

measure, as well as the reconciliation to the comparable GAAP financial measure,

can be found in the text or in the attached tables to the earnings release.

Tangible Common Equity Ratio and Tangible Book Value per Common Share

The tangible common equity ratio and tangible book value per common share are

non-GAAP measures generally used by the financial community to evaluate capital

adequacy. Tangible common equity is total equity less preferred equity, goodwill,

core deposit intangibles and purchased credit card relationship intangible. Tangible

assets are total assets less goodwill, core deposit intangibles and purchased

credit card relationship intangible. Management and many stock analysts use the tangible

common

equity

ratio

and

tangible

book

value

per

common

share

in

conjunction

with

more

traditional

bank

capital

ratios

to

compare

the

capital

adequacy

of

banking

organizations with significant amounts of goodwill or other intangible assets,

typically stemming from the use of the purchase method of accounting for mergers and

acquisitions.

Neither

tangible

common

equity

nor

tangible

assets,

or

the

related

measures

should

be

considered

in

isolation

or

as

a

substitute

for

stockholders’

equity,

total assets or any other measure calculated in accordance with GAAP. Moreover, the

manner in which the Corporation calculates its tangible common equity,

tangible assets and any other related measures may differ from that of other

companies reporting measures with similar names. |

23

Use of Non-GAAP Financial Measures

Basis of Presentation

Use of Non-GAAP Financial Measures

This presentation may contain non-GAAP financial measures. Non-GAAP

financial measures are set forth when management believes they will be helpful to an

understanding of the Corporation’s results of operations or financial

position. Where non-GAAP financial measures are used, the comparable GAAP financial

measure, as well as the reconciliation to the comparable GAAP financial measure,

can be found in the text or in the attached tables to the earnings release.

Tier 1 Common Equity to Risk-Weighted Assets Ratio

The Tier 1 common equity to risk-weighted assets ratio is calculated by

dividing (a) tier 1 capital less non-common elements including qualifying perpetual

preferred

stock

and

qualifying

trust

preferred

securities

by

(b)

risk-weighted

assets,

which

assets

are

calculated

in

accordance

with

applicable

bank

regulatory

requirements. The Tier 1 common equity ratio is not required by GAAP or on a

recurring basis by applicable bank regulatory requirements. However, this ratio will

be required under Basel III capital standards as proposed. Management is

currently monitoring this ratio, along with the other ratios discussed above, in evaluating

the Corporation’s capital levels and believes that, at this time, the ratio

may be of interest to investors. Tier 1 Common Equity to Risk-Weighted Assets

(Dollars in thousands)

June 30,

March 31,

December 31,

September 30,

June 30,

2012

2012

2011

2011

2011

Total

equity

-

GAAP

1,448,959

$

1,433,023

$

1,444,144

$

$ 986,847

$ 1,009,578

Qualifying preferred stock

(63,047)

(63,047)

(63,047)

(430,498)

(428,703)

Unrealized gain on available-for-sale securities

(1)

(26,623)

(20,233)

(19,234)

(13,957)

(12,659)

Disallowed deferred tax asset

(2)

(41)

(25)

-

(267)

(272)

Goodwill

(28,098)

(28,098)

(28,098)

(28,098)

(28,098)

Core deposit intangible

(10,512)

(11,100)

(11,689)

(12,277)

(12,866)

Cumulative change gain in fair value of liabilities

accounted for under a fair value option

-

(2,434)

(2,009)

(952)

(1,889)

Other disallowed assets

(2,917)

(807)

(922)

(907)

(808)

Tier 1 common equity

$ 1,317,721

$ 1,307,279

$ 1,319,145

$ 499,890

$

524,283 Total risk-weighted assets

$ 10,046,284

$ 9,947,559

$ 10,180,226

$ 10,432,804

$ 10,630,162

Tier 1 common equity to risk-weighted assets ratio

13.12%

13.14%

12.96%

4.79%

4.93%

As of

Tier 1 Common Equity:

1- Tier 1 capital excludes net unrealized gains (losses) on

available-for-sale debt securities and net unrealized gains on available-for-sale

equity securities with readily determinable fair values, in accordance

with regulatory risk-based capital guidelines. In arriving at

Tier 1 capital, institutions are required to deduct net unrealized

losses on available-for-sale equity securities with readily determinable

fair values, net of tax.

2- Approximately $12 million of the Corporation's deferred

tax assets at June 30, 2012 (March 31, 2012 - $12 million; December 31, 2011 - $13 million;

September 30, 2011 - $12 million; June 30, 2011 - $11 million)

was included without limitation in regulatory capital pursuant to the risk-based capital guidelines,

while approximately $41k of such assets at June 30, 2012 (March 31,

2012 - $25k; December 31, 2011 - $0; September 30, 2011 - $0.3 million;

June 30, 2011 - $0.3 million) exceeded the limitation imposed by

these guidelines and, as "disallowed deferred tax assets," was deducted in arriving at Tier 1 capital.

According to regulatory capital guidelines, the deferred tax assets

that are dependent upon future taxable income are limited for

inclusion in Tier 1 capital to the lesser of: (i) the amount of such

deferred tax asset that the entity expects to realize within one year of

the calendar quarter end-date, based on its projected future

taxable income for that year, or (ii) 10% of the amount of the entity's

Tier 1 capital. Approximately $7 million of the Corporation's

other net deferred tax liability at June 30, 2012 (March 31, 2012 - $7 million;

December 31, 2011 - $8 million; September 30, 2011 - $7

million; June 30, 2011 - $5 million) represented primarily the deferred tax effects of unrealized gains and losses on

available-for-sale debt securities, which are permitted to be

excluded prior to deriving the amount of net deferred tax assets subject to limitation under the guidelines. |

24

Use of Non-GAAP Financial Measures

Basis of Presentation

Use of Non-GAAP Financial Measures

This presentation may contain non-GAAP financial measures. Non-GAAP

financial measures are set forth when management believes they will be helpful to an

understanding of the Corporation’s results of operations or financial

position. Where non-GAAP financial measures are used, the comparable GAAP financial

measure, as well as the reconciliation to the comparable GAAP financial measure,

can be found in the text or in the attached tables to the earnings release.

Adjusted Pre-Tax, Pre-Provision Income

One non-GAAP performance metric that management believes is useful in analyzing

underlying performance trends, particularly in times of economic stress, is

adjusted pre-tax, pre-provision income. Adjusted pre-tax,

pre-provision income, as defined by management, represents net (loss) income excluding income tax

expense (benefit), the provision for loan and lease losses, gains on sale and OTTI

of investment securities, fair value adjustments on derivatives and liabilities

measured at fair value, equity in earnings or losses of unconsolidated entities as

well as certain items identified as unusual, non-recurring or non-operating.

From time to time, revenue and expenses are impacted by items judged by management

to be outside of ordinary banking activities and/or by items that, while they

may be associated with ordinary banking activities, are so unusually large that

management believes that a complete analysis of its Corporation’s performance

requires consideration also of results that exclude such amounts. These items

result from factors originating outside the Corporation such as regulatory

actions/assessments, and may result from unusual management decisions, such as the

early extinguishment of debt. Pre-Tax, Pre-Provision Income

(Dollars in thousands)

June 30,

March 31,

December 31,

September 30,

June 30,

2012

2012

2011

2011

2011

Income (loss) before income taxes

$

(11,049)

$

(14,600) $ (21,158)

$ (12,318)

Add: Provision for loan and lease losses

36,197

41,987

46,446

59,184

Less: Net loss (gain) on sale and OTTI of investment securities

1,207

1,014

(12,156)

(21,342)

Add: Unrealized (gain) loss on derivatives instruments and

liabilities measured at fair value

(283)

1,746

2,555

1,162

Add:

Contingency

adjustment

-

tax

credits

2,489

-

-

-

Add: Loss on early extinguishment of borrowings

-

-

9,012

1,823

Add: Equity in losses (earnings) of unconsolidated entities

6,236

(1,666)

4,357

1,536

Adjusted Pre-tax, pre-provision income (1)

$

34,797

$

28,482

$ 29,056

$ 30,045

Change

from

most

recent

prior

quarter

-

amount

3,116

$

6,315

$

(574)

$

(989)

$

(11,920)

$

Change

from

most

recent

prior

quarter

-

percent

9.0%

22.2%

-2.0%

-3.3%

-28.4%

Quarter Ended

$

10,901 24,884

143

(506)

2,491

$

37,913 |