Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Bioflamex Corp | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Bioflamex Corp | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Bioflamex Corp | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - Bioflamex Corp | ex32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K /A

Amendment No. 1

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended February 29, 2012 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________ to ________ | |

| Commission file number: 000-53712 |

| Bioflamex Corporation | |||

| (Exact

name of registrant as specified in its charter) | |||

| Nevada | Pending | ||

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.) | ||

Christiansvej 28, 2920 Charlottenlund, Denmark |

________ | ||

| (Address of principal executive offices) | (Zip Code) | ||

Registrant’s telephone number: 646-233-1310

|

|||

Securities registered under Section 12(b) of the Exchange Act:

|

|||

| Title of each class | Name of each exchange on which registered | ||

| None | not applicable | ||

Securities registered under Section 12(g) of the Exchange Act:

|

|||

| Title of each class | |||

| Common Stock, $0.001 par value | |||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the proceeding past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $8,250,000

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 155,009,002 as of July 23, 2012 .

EXPLANATORY NOTE

Bioflamex Corporation is filing this Amendment No. 1 to its 10-K for the year ended February 29, 2012 that was originally filed on June 13, 2012. This Amendment No. 1 contains restated financial statements for the year ended February 28, 2012 to properly reflect previously unrecorded liabilities for various consulting agreements, which were in effect that aggregate approximately $1,387,286 and $222,200 as of February 29, 2012 and February 28, 2011, respectively. These unrecorded liabilities will affect the Company’s expenses for the period indicated. These consulting agreements were not reported as a result of material weaknesses in internal control over financial reporting. These material weaknesses include: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both United States generally accepted accounting principles and Securities and Exchange Commission guidelines.

| 1 |

PART IV

| ||

| Item 15. | Exhibits, Financial Statement Schedules | 31 |

| 2 |

PART I

Voice and Data Solutions

On July 16, 2012, we executed an Agreement and Plan of Merger (the “Merger Agreement”) by and between our company and our wholly owned subsidiary, Bioflamex Merger Sub, Inc., a Nevada corporation (“Subsidiary”) on the one hand, and Terra Asset Management, Inc., a Delaware corporation (“TAM”), on the other hand. Pursuant to the Merger Agreement, on the effective date, TAM will merge with Subsidiary, with Subsidiary surviving the merger and TAM ceasing to exist (the “Merger”). The effective date of the Merger is when we file articles of merger for the Subsidiary and TAM in Nevada and Delaware, respectively.

Terra Asset Management is an industry leader in designing, implementing and supporting state-of-the art converged voice and data solutions. Terra Asset Management is positioned to provide turnkey services solutions for all phases of the telecommunications equipment lifecycle. The company is ISO9001:2000 and TL9000 certified, has developed into a one-stop solution provider to major U.S. tier one carriers, equipment vendors, and enterprise customers.

Carriers and enterprise customers have recognized the benefit of outsourcing many of the network services that have traditionally been self-performed. Today, carriers and enterprise customers realize that service companies like Terra Asset Management can better leverage personnel over multiple carriers, multiple brands of OEM equipment and across overlapping geographies. As a result, Terra Asset Management should continue to benefit from the industry trend of outsourcing network services.

The company is organized into two distinct, but complementary business units: (1) The Enterprise Solutions Division, which offers IP-based communications, unified communications, and voice, video and data connectivity services to small, medium and large businesses, and (2) The Carrier Class Solutions Division, which offers backbone, backhaul and broadband networks for wireless operations. A backbone network provides a path for the exchange of information between different LAN(s) or subnetworks. Backhaul networks are typically used to move data from remote POPs (point of presence) or concentration points to a centralized location. Not everyone is within the reach DSL nor do all service providers have access to copper or fiber. That’s why Terra Asset Management proposes a range of broadband wireless access solutions.

WiMax/Wimesh: Terra Asset Management provides complete Broadband Wireless services from concept and design to installation and maintenance. Terra Asset Management’s expertise with Broadband wireless technologies includes In-building WiFi, Municipal WiFi (WiMesh), WiMax, and fixed broadband wireless services. Terra Asset Management utilizes the latest in system design tools and test equipment to ensure your broadband wireless success. WiMesh networks offer consumers and businesses the ability to have mobile broadband communications. The WiMesh solution can be easily deployed in communities, industrial parks, in municipal buildings and campus settings, and in many other high-density communal settings. The popularity of WiMesh technology has found its way into various city municipalities and business enterprises as well.

Microwave: Terra Asset Management was named a Preferred Supplier for microwave engineering, deployment and turn-up services for Alcatel-Lucent in late 2006. In late 2007, Terra Asset Management was selected as a national partner for Nera.

UMTS. Universal Mobile Telecommunications System (UMTS) is the standardization of third generation (3G) cellular systems. UMTS services involve preparing and expanding cell sites for new equipment. Terra Asset Management provides the preparatory work ahead of equipment manufacturers, installing cabinets, running cable and clearing space for new equipment.

Maintenance/Operations: The operations division is responsible for the general maintenance and support for carriers’ networks, including T1 testing and network audits.

| 3 |

We are in the business of developing, producing, and marketing high performance fire extinguishing and prevention products that are based on environment friendly and biological formulations.

We intend to build a leading position within the niche of environmentally friendly fire fighting and prevention solutions in the United States and internationally, both through organic growth and the acquisition of complementary companies and patents. We believe the time is right for our products. The general emphasis on environmental protection and the increased focus on health hazards in chemicals used in conventional fire fighting products paves the way for the substitution of chemical-based fire combatant products with “greener,” non-harmful products.

For this strategy to become a viable one, we have collaborated with Indonesian corporation Hartindo Industries. We are a preferred partner of Hartindo Industries, with Hartindo Saudi as its principal supply partner for logistical reasons. Hartindo Industries and its founder have developed an unparalleled line of biological extinguishing and retardant formulations, which we have utilized as a basis for our proprietary application innovations. We have also acted as an exclusive partner in the sales and marketing of the biological bulk product line of Hartindo Industries.

Fire extinguishers available on the market today mainly use dry chemical powder, chemical foam, CO2 or halon type of gaseous media as bases. These products in general will extinguish fires with a varying efficacy, but most also contain chemical substances that harm the environment or compose a hazard to people. In addition, they can be messy and damage metals (corrosion), increasing the collateral damage. Our products offer water-based clean alternatives which are completely harmless to humans and the environment, and are non-toxic. Combined with their exceptional extinguishing characteristics, we believe these products point to the future of professional and personal fire fighting. In conventional forest fire fighting, the primary media is water which offers good extinguishing power, but has some drawbacks: it must be used in large quantities; it evaporates relatively quickly; and has a short lifespan in hot environments. Chemical AFFF foams and agents are often used to enhance the fire extinguishing or retardant capabilities, but these chemicals affect the environment and leave long-lasting toxic residue. The toxins found in foams accumulate in the food-chain and are detectable in human organs. We believe our products will have no such negative effect upon life.

Our primary focus for 2012 and 2013 is the production and market penetration of our proprietary Bioflamex aerosol extinguishers intended for everyday consumers. We are now preparing the first production batches. The collaboration agreement with our key partner and supplier of core raw materials (biological fire extinguishing/retardant media), Hartindo Saudi, has been drafted but not yet finalized. We also have a draft agreement, not yet finalized, with our aerosol production partner, Dansoll A/S. The collaboration agreement with our key partner and supplier of core raw materials (biological fire extinguishing/retardant media), Hartindo Saudi, has been drafted. We also have an agreement in place with our aerosol production partner, Dansoll A/S. We have acquired the core raw materials needed for production.

Parallel to this, we have commenced the closing of key distribution agreements and we are focused on the sales and marketing of our aerosol products to consumer and business segments. We intend to submit UL and DIN certifications for our products during June-August 2012. These certifications will enable us to effectuate sales and deliveries to key clients and partners in the U.S., Europe and selected Asian markets.

We have

submitted a patent application for our Bioflamex aerosols in January 2011 to ensure the security of our intellectual property

rights and enhance the market response to our product propositions. We expect to have more information on the patent process during

Q3 2012. We plan to build a solid portfolio of intellectual property within the “clean tech” fire prevention industry.

Due to the

death of our key partner in the development and completion of the Sentinel forest fire detection and suppression system, the process

of producing a prototype of the system for testing and certification has been delayed, and we are currently exploring alternative

partners to build and/or supply the thermal/infrared fire detection units. The most probable partner will be Hartindo Saudi and

its parent corporation Hartindo Industries Malaysia. Due to the above we expect to submit the patent application for this product

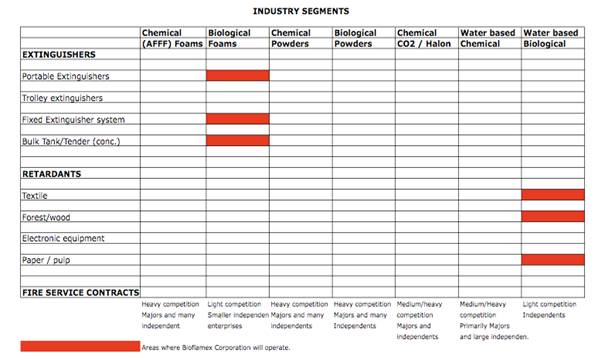

during Q4 2012/Q1 2013. Our Products Our

main products can be divided into two main product types: fire extinguishers (fight fires once they start) and fire retardants

(fight fires before they start). Our product range is set forth in the figure below. The scope of business covered by the

product range is diverse and targets professional markets, business to business markets and consumer markets across the globe. Of the various

industry segments, we focus our business on biological fire fighting. The table below depicts the various industry segments, those

industry segments we intend to engage in, and the types of extinguishers and retardants we expect to develop in those segments. Given

that most current fire fighting- and prevention methods contain toxins and chemicals that can harm humans, animals, and entire

ecosystems, there is a real market requirement for more eco-friendly fire fighting methods. In that space, there are small

number of independent companies, usually limited in geographic scope and characterized by entrepreneurship and a limited product

range. We believe that we are well-positioned to take a significant role in a relatively new “clean” niche of the

market. We intend to capture market share by organic growth and from acquisitions to make us the foremost player in this segment. Extinguishers Small

Scale Extinguishers: Our Bioflamex

aerosol extinguisher is a water-based portable fire extinguishing product that has been designed to put out oil and grease fires.

We have dubbed the concept as “the potential Red Bull of the fire fighting industry.” Bioflamex has been developed

as a user friendly, efficient and safe supplement to conventional fire fighting means. Anyone can easily use Bioflamex to quickly

and efficiently extinguish dangerous and potentially fatal frying oil or cooking fat kitchen fires. Our Bioflamex

aerosol extinguisher has been in development for a considerable period of time, with the assistance of the Copenhagen Fire Department

and the aerosol producer Dansoll A/S. Following a series of trials and tests the developers have created the perfect combination

of the extinguishing media, the bottle, the nozzle, the propellant and the pressure. The proprietary

extinguishing media used from Hartindo Industries is based on a biological formula that is composed of a mix of water, natural

potassium, salt combinations and plant root extracts in combinations with a concentrated foaming agent. The contents are under

pressure in the can and the propellant is recycled CO2. Bioflamex

is characterized by its significant “clean” extinguishing performance, as well as easy and convenient handling. The

biological formulation provide some benefits outside the pure extinguishing attributes, namely the benefits of less collateral

damage and clean-up after use. It is non-toxic, non-corrosive and bio degradable. The Bioflamex

formula provides 2 significant performance criteria: The biological additive ensures quick knock-down of flames; and the special

foam formulation creates a cover that prevents re-ignition of flames, especially relevant when combating oil based fires. Bioflamex

comes in 2 different sized bottles: In the 650

ml bottles for kitchen use, the product contains a heavy foam concentration which is developed to tackle Class F/K fire types,

i.e. frying oils and fats used in conjunction with cooking. The larger

1000 ml bottle is ideal for more all-round emergency/first response extinguishing use. It contains a smaller amount of foam, and

is suited for engine fires in cars/boats and Class A/B fire types, i.e. on dry matter such as textiles, wood etc. Both versions

of our Bioflamex aerosol extinguisher bottles are scheduled to be submitted for UL approval in Q3 2012. We intend to launch the

product in the U.S. market during Q3-Q4 2012. Consequently,

the Bioflamex products can be targeted towards both the private consumer market as well as small businesses. The product

highlights are as follows: ·

An easy way to extinguish even deep frying oil fires quickly.

One bottle of Bioflamex will extinguish a 365 degrees celcius

deep frying oil pan on fire in 2-5 seconds. ·

The same performance applies to an oil fire in an engine, e.g. on a boat or in a car. The bottle is easy to handle and

use as it works as a normal aerosol bottle. ·

Security against re-ignition. Bioflamex contains a combination of a fire extinguishing media and PFC-free foam, thus both

putting out the fire and preventing re-ignition, by creating a protective layer on the surface of the oil. ·

Less property and material damage. Bioflamex is safe to use and contains no corrosive ingredients, as opposed to certain

chemical extinguishing media. This prevents serious damage to metals, e.g. in kitchens and engines. ·

Easy clean-up. Bioflamex can be removed by using ordinary cleaning products and requires no special safety precautions.

This also reduces the potential total costs of a fire. ·

An biological solution. Bioflamex contains a biological extinguishing media, based on a combination of natural salts and

plant extracts. This reduces the environment impact as 98% of the media is biodegradable within 7 days. The propellant

is carbonic acid known from sparkling water. ·

A biological heavy duty foam concentrate that reduces the environmental impact and reinforces the uniqueness of this versatile

and effective remedy against kitchen and car fires. We believe

this product is an ideal and vital product for private households, and boat and car owners for the growing United States market.

It is the right product to always have handy in the kitchen, in the boat, in the auto camper or in the car. Large

Scale Extinguishers: Conventional

extinguishing products will be based on the current manufactured products by Hartindo Saudi, adjusted to meet EU and U.S. standards.

These products provide a viable and sustainable alternative to conventional products in terms of performance, environment and

health. They have been tested extensively by professional institutes, and have proven to be radical improvement over extinguishers

available on the market today. Using the

same base Hartindo Industries formulations of biological additives and foam, BioflamexCorp will also enter the market for conventional

fire-sized extinguishers, i.e. the 2, 3 and 6 liter EN-3 types. The formulation

ensures effective extinguishing performance against Class A, B and C fires, providing a broad base of usage in circumstances such

as small wildfires and urban residential buildings. Ideal

users would be businesses, offices, hotels and public spaces where fire regulations

dictate fire extinguishers as part of the general fire safety and emergency plan. We

believe the biological water based extinguisher type will gain market share and revenue on account of substitution for

existing chemical foam and chemical powder extinguishers. Bulk

Extinguishers: The

bulk products are suited large-scale extinguishing tasks such as fighting fires on professional equipment and tankers,

or forest fire fighting. The solutions

can be tailored to fit various needs of professional fire fighting organizations and large business operations, forest fire fighting

and prevention, chemical compounds, oil and gas installations and storage facilities. The Hartindo

extinguisher formulations have proven to be extremely efficient in fighting heavy fuel fires, such as diesel oil, petroleum and

jet fuel, especially in combination with systems like IFEX. Since the properties of the product enable the use of less fluids

to put out a fire it reduces damage to machines and property. Through

a series of tests, the products demonstrated unparalleled extinguishing power, reducing both the consumption of solution, collateral

damage and the burden on the environment. Some examples are as follows: These cases

show that we can provide users dramatic reductions in direct costs of operations, both in terms of manpower and materials. The biological

ingredients are non-toxic and non-corrosive, posing no threat to human beings. In gaseous form they can even act as direct replacement

of Halon and other chemical substances. We have

developed a plan, in collaboration with Hartindo Saudi, to create further interest amongst fire fighting organizations in the

Nordic region, in substituting conventional chemical foam types with the biological alternatives we carry. We expect this project

to commence Q3 2012 with basic trials in Copenhagen and Malmö, Sweden. In various

formulations, Bioflamex’s bulk extinguishers can be used for: Fire

Retardants Industrial

retardants: A fire retardant

inhibits fire from being nurtured in textiles, wood, insulation materials etc., and therefore obstructs fires from erupting or

spreading. Many different industrial types of fire retardants exist today, but many contain chemicals or compounds that may be

harmful to people, the environment or materials - bromides have been banned due to some of these reasons. Every year

over thousands are killed or seriously wounded in fires. Often fires are caused by cigarettes, decorations, open fire or electrical

malfunctions. The typical places for fires to start are in kitchens, living rooms, meeting rooms and bedrooms, where furniture

or textiles catch fire. The risk of a fire is especially pronounced during Christmas, where the use of candles and dry decorations

are a real threat. We

market the industrial retardants under the brand name SAFIRE®.

Due to their effectiveness and harmless eco-friendly components,

SAFIRE® fire retardants can ensure that a damaging fire

becomes a less likely event both at home and in the office. All

SAFIRE® products are based on Hartindo Industries’ 100% biological components, which contain fire inhibiting

capabilities. This makes it possible to treat textiles, wood and insulation materials in a safe and environment friendly

way. SAFIRE® not only slows down the spread of fire, but in most instances completely prevents ignition. The

active ingredients are mainly composed of salt combinations and extracts. The remaining substance is water, used to ensure

that the active ingredients are absorbed in the fibers or mass. We are working

with Hartindo Industries to create proprietary applications that ultimately pave way for patents; experience shows that the retardants

need to be contained in readymade/ready to use solutions to end users, and this opens up for a wide spectrum of product development

and innovation which we will pursue the coming years. Forest

Fire Prevention Retardants: Forest fires

are certain to proliferate in the coming decades, due to climate changes especially in the United States, Spain, Greece, France,

and Australia. The number

of wildfires in the United States range from 60,000-75,000 annually costing more than US$1.4 billion in direct damages, but long

term effects on ecosystems and personal lives are far beyond that number In the past

few years, California has experienced a number of fires, with increasing intensity and property damage. In 2008 alone, extensive

wildfire events led to both civilian casualties and casualties amongst the fire fighting units combating the fires, and led to

State of Emergency called by the President. Such events are recurring and have an ever more pronounced effect on the environment

and urban planning, as fires draw closer to urbanized/residential areas. For most

government agencies in the United States and globally, the emphasis has now been put on prevention of forest wildlife fires to

erupt, and improved preventative measures to reduce risks, especially in “high seasons” of March, July and August. We provide

an eco friendly and highly effective solution to promote better forest fire prevention. We work on several levels to develop new

methods to enhance fire protection in the high risk areas, and to improve protection of residential/industrial compounds/facilities,

in collaboration with our partners. Our plan

is to promote and develop: Internationally,

wildfires compose an equally threatening phenomenon. It is believed that in Spain alone, the incidents will increase from about

25,000 fires a year up to about 50,000 in a years to come due to dryer and warmer climate – or if the number of incidents

do not escalate, then the intensity is believed to increase with larger burnt area per fire incident. “Desertification”

is a real threat to many areas as a result of this, contributing to further climate warming in local and regional areas. The same

trend is applicable to Australia, which has experienced an increasing number of uncontrollable wildfires that approach urban areas

such as Melbourne and Sydney, causing extensive damage and casualties. Patent

Applications We are in

the process of submitting patent applications to enhance our intellectual property rights and marketing opportunities. In general,

we operate within the following categories: Our main

products have a base consisting of biological water based solutions, either by itself or in combination with specialized foam

types. We work

with a range of key partners for product development and production: The outcome

of our product development efforts will result in BioflamexCorp taking full or partial intellectual property rights on product

concepts and formulations. Below is a summary of the most imminent patent application we would like to submit to ensure protection

of those rights. The first two could be submitted as one general application, as the basic formulations are more or less the same,

except that foam concentrations vary. The Patent

Application Number 1100255.7 registered at the Intellectual Property Office (IPO) at Concept House, Cardiff Road, Newport, South

Wales, United Kingdom covers this patent. We are currently in the process of filing a counterpart patent with the United States

Patent and Trademark Office (USPTO). Basically,

the kitchen related Bioflamex product consists of 88% biologic water based fire extinguishing solution (appx 40% active ingredients,

60% water) combined with a 10-15% eco-friendly foam concentrate. This formulation

is designed to generate knock-down on even high temperature oil/fats fire and prevent reigniting, as the foam forms a protective

layer allowing the liquid to cool down. The packaging

itself also contain a special process, utilizing recycled CO2 for the pressurization, a special nozzle for the distribution of

extinguishing liquid and foam and a low pressure level, which is designed to avoid exaggerated splashing of the burning liquid. As above,

but with less foam, higher pressure and a different nozzle for longer range. This is

a water based biological solution with active ingredients (appx 60% water and 40% salts, citric compunds, natural polymers/binders)

designed to protect live vegetation against ignition. Patent application is planned for the end of 2012/start of 2013, as the

detection unit needs further development. The salts

and natural compounds are designed to slow down or prevent ignition of the vegetation. The biological binder has the purpose of

ensuring that the retardant stays on vegetation for up to 2 months, and thus enabling the product to be used as a preventive measure

around facilities in areas prone to fires. The purpose

of the product is to create or enforce fire breaks, which will slow down or hinder spread of forest fire. The application can

be by ordinary tenders (tankers with hoses) airplane or other dispersement systems. This product

concept is for implementation into the production process of carton and paper materials. Patent application is not due before

the end of 2012 as new partners must be identified. The water

based Hartindo Industries fire retardant is mixed with the paper pulp (replacing water) and thus creating en end product that

is fire protected to be used, for instance, with storage boxes. We anticipate

this concept will be completed in collaboration with a manufacturer of carton and paper products. As above,

the main difference being that the retardant will be mixed with a mix of base materials. Approvals

and Certifications We

are in the process of filing for UL approvals and Government Dep’t endorsements (USFA, NFPA, CAL FIRE) for the United States,

covering the Bioflamex aerosols and also bulk extinguishers. In addition to this, DIN and TÜV certification of aerosols covering

Europe shall be obtained. The timings of these items is Q3 2012. EN3

certification of standard extinguishers must also be initiated for the EU in collaboration with Hartindo Saudi. Forest

Fire certifications and approvals will be obtained gradually as we target markets; Spain and Cyprus/Greece will be the first focus-markets

for the approvals during Q3/Q4 2012. The

following table shows specifically where we are at in the approval and certification process.

In addition

to the above, any number of local and/or regional approvals may be necessary for the markets we aim to penetrate, as is the case

in states like California, countries like Russia and the individual CIS countries, and even some countries in EU (France for example). Product

Production We

intend to use a number of partners to develop and manufacture our products. These partners include those that follow in this section.

In order to successfully reach our objectives, a number of tests, demonstrations, approvals and certifications are in the

process of being completed. We are in

the last stages of exclusive collaboration and production agreements with Hartindo Industries/Hartindo Saudi, Dansoll A/S, Denmark

for the development of a range of versatile and multipurpose retardant and extinguishing formulations. We have also been appointed

exclusive Agent for EU on the PurifyAir smoke hoods from CY Holdings. Hartindo

Saudi: The core

biological formula has been developed by Hartindo Industries and shall form the basis for the water based biological additives

mixed with water. A key component

for our patent-pending Bioflamex aerosol extinguishers is the unique proprietary Hartindo extinguishing media. The Bioflamex extinguishers

utilize the exceptional Hartindo AF31 formula and the corresponding Foam Concentrate, to achieve its clean and extremely effective

properties. This sourcing

agreement will tie into the partner agreement with our aerosol production partner, currently being drafted, and ensure the optimal

conditions for the sale and marketing of the Bioflamex aerosols. In addition

to covering the aerosol extinguishers, the cooperation agreement will also grant us exclusive rights to market the unique Hartindo

AF31 bulk products and EN3 type extinguishers in selected EU markets. That will effectively spur growth within sales to the professional

sectors, especially forest fire fighting authorities and organizations. The understanding also embodies an expressed wish to jointly

develop new projects, to maximize synergies and commercial success for both companies over time. The collaboration

agreement has been drafted at present, and covers the direct transfer of certain WW and regional rights to Bioflamex Corp. We

expect this agreement will be formalized and signed during Q2 2012. Dansoll

A/S: Dansoll

manufactures over 3,000,000 aerosols per annum, and can easily expand operations in current location and also abroad. The primary

suppliers of cannisters and nozzle system have capacity that supercedes any need in the distant future. One significant

feature of our proprietary and patent-pending Bioflamex aerosol extinguishers is the fact that it utilizes recycled CO2 as propellant. The exclusive

partnership agreement will enable us to benefit from the production partner’s advanced proprietary CO2 aerosol production

technology, which -- amongst a number of features -- optimizes production. Using CO2 as propellant will enable us to fill up aerosol

bottles with appx. 15% more product compared to conventional aerosols, which should impact positively on material usage and margins

on sales. The partner's

production experience and technology play a significant part in enabling us to market our Bioflamex aerosol products at highly

competitive end-user prices, and still maintain satisfactory margins on the volume business. This is

currently a draft agreement which will be formalized and signed during Q2 2012. Partnerships

for Industrial Development: We are working

with two insulation manufacturers and one paper/carton manufacturer to complete trials of industrial-level fire retardants. This

work will take 3-6 months to complete after the work with Solberg has been completed, and should result in 1-2 patent applications. In addition,

development of a washable fire retardant for textiles (especially beddings) should open up for collaboration with industrial linen

service companies, as the likes of Berendsen and gain access to hospitals, hotels and prisons to mention a few institutional clients. National

Fire Departments: Upon completion of formula work, critical testing will be conducted in collaboration with fire

departments in the United States (California, Chicago and New York initially and with other states/cities to be added later),

Denmark, Spain and Greece during 2012, with close cooperation of Hartindo Saudi and PL Brandteknik.

Distribution The company

will use a number of distribution channels and distribution partners, depending on the type of product, market segment and region.

In some cases, we have already secured verbal agreements with distributors and end user outlets, which we expect to be formalized

in the near future. Distribution

in the United States will be determined by the certifications/approvals obtained, but we are in dialogue with networks that have

been developed over the years that we believe will open the distributions channels to government and retail targets. In some

instances we will enter collaboration on all products with one partner for a country or region, and in others multiple distributors

will operate individual sectors, depending on the nature of the market and the positioning of partner companies. We intend

to have our sales personnel primarily servicing the distribution partner as key account managers; however some key multinational

companies will be approached and handled directly by management. At the present,

we have discussed preliminary Exclusive Distributor/Agent agreements ready for execution with companies covering United States

and regions such as India, UAE, Kuwait, Egypt, Saudia Arabia. Partners for certain sectors and/or regions in EU and Asia have

also been identified and soft negotiations initiated. We have

initiated negotiations with personal safety solutions company Cardia Europe concerning collaboration on key market segments in

Denmark, Sweden, Norway, Finland, Austria, Poland, Germany, UK and the Global maritime market. Cardia Europe

is a dynamic Danish importer and distribution Company which distributes defibrillators, fire extinguishers and related products

to the public and private sector. The key

component for the collaboration will be Bioflamex aerosol extinguishers and the PurifyAir Smoke Escape Hoods. The first trial

projects will be conducted in Denmark Consumer

/ Retail The main

product for the Retail/Consumer segment is the Bioflamex extinguisher, which we believe holds a global potential (“The Red

Bull of fire fighting”). The key

to the distribution strategy is to gain access to consumer outlet networks as well as semi-professional / specialty outlets. The

distribution and marketing will initially be conducted through the networks’ own marketing programmes/media towards potential

end users. As an example,

the Automobile Owners’ Associations in the United States counts more than 50,000,000 members and publishes web content and

magazines directed at its members. In EU the same applies, counting more than 40,000,000 members and publishing magazines that

have circulations of more than 7,000,000 copies monthly or quarterly depending on the country/region. This composes a strong promotion

vehicle for the All-purpose Bioflamex for car/boat owners. The push

for distribution in the United States will be focused around a number of key distribution partners and 5 key states with a high

population/business density, high media saturation and high level of distribution outlets. These states include: New York, California,

Illinois, Texas and Florida. We have

identified these states as being highly relevant for penetration into the retail/private consumption sphere as well as the public

institutions and businesses.

In addition to this, the states selected individually have some characteristics that support focused efforts into certain business

areas. Examples of this include:

We also

intend to focus on a number of countries in Europe with high population/business density, high media saturation and high level

of distribution outlets. These countries include: the Nordic Countries, Germany, France, Benelux, England, and Spain. It is our

goal to achieve a 10% penetration into the market through professional, business to business and retail distribution/sales partners,

over the course of a 3 year period. Business

to Business / Professional The distribution

of product for the business to business and professional market will mainly be conducted either through large multinational corporations

with a strong sales and distribution networks in key markets or through local/regional partners with strong association and sales

record to the primary clients. Large multinational

distribution partners may include: TYCO, UTC, ISS (50+ countries), G4S (70+ countries), and Würth (40+ countries). Local/regional

distribution partners may include: Delma

Group (Middle East/India), Blue Dome Company (Middle East), and Falck (Nordic), Industrial The industrial

segment will primarily be targeted by our staff directly with potential clients, as significant consultancy and development of

applications is involved in this. Main clients are manufacturers of paper product, insulation material for construction, timber

and wood manufacturers and textile/furniture producers. PurifyAir

Smoke Escape Hoods We have

been awarded the appointment as exclusive distributor covering the EU for the PurifyAir smoke escape hoods from CY Holdings, China. The appointment

consolidates the collaboration between the companies, and represents an important addition to our product portfolio for international

sales. The PurifyAir

smoke escape hoods have been developed by the Head of the fire protection export section of CY Holdings, Mr Robert Coleman. Through

his dedication to innovation and quality, PurifyAir smoke escape hoods have become widely recognized and certified. The single-use

smoke filters provide unique benefits at very competitive pricing. The filters provide 30-60 minutes of cleaned air and the flame

protected hood material ensures face protection against fire. Being ideal

for both residents and corporate employees in multiple-storey buildings, mining personnel, forest fire fighters etc., this agreement

will help us to penetrate high interest business segments and supplement our ability to serve multiple needs of our clients.

We expect sales of PurifyAir to compose approximately 10% of total sales within the coming 5 years, amounting to $10 million. Employees Staff

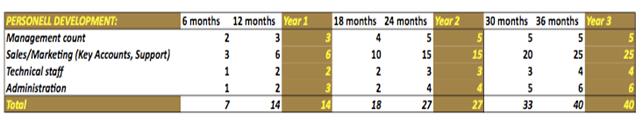

Development Our ability

to generate revenue will require 2-3 offices and a consistent increase in staff count over the first 1-4 years, as reflected in

the personnel chart below: However,

we do not have an ambition to become a high headcount operation; but rather have a tight and highly skilled group of people employed

within the technical, sales and marketing Divisions. Mainly,

the distribution sales and marketing efforts will require support and key account capacity, and we will be looking to hire individuals

with strong skills within regional or global sales, and also recruit from the professional fire services environment to ensure

deep understanding of the technical aspects within the sales/marketing force and to leverage industry insight and professional

connections. In addition

to this, we aim to recruit technical staff with fire fighting, biochemistry and/or logistics skills who can ensure strong coordination

with manufacturing partners, counseling of distributors and key clients (for the professional / industrial segments), and drive

the product development within the company. Advisory

Board We have

an advisory board that consists of a collection of individuals who bring unique knowledge and skills which complement the knowledge

and skills of our board members in order to more effectively govern the organization. We currently have 3 members on our advisory

board. A smaller

reporting company is not required to provide the information required by this Item. Item

1B. Unresolved Staff Comments A smaller

reporting company is not required to provide the information required by this Item. Our

corporate headquarters are located at Christiansvej 28, 2920 Charlottenlund, Denmark. This location is provided by our Chief Executive

Officer and Director without cost. We intend to move into another facility as soon as capital permits.

We are not

a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors,

or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us. Item

4. Mine Safety Disclosure N/A PART

II Item

5. Market for Registrant’s Common Equity and Related Stockholder Matters and

Issuer Purchases of Equity Securities Market

Information Our common

stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network

of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current

"bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “BFLX.” The following

table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by

the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily

represent actual transactions. Penny

Stock The SEC

has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally

equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges

or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities

is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock,

to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level

of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's

or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such

duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including

bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free

telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct

of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format,

as the SEC shall require by rule or regulation. The broker-dealer

also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the

penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which

such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock;

and (d) a monthly account statement showing the market value of each penny stock held in the customer's account. In addition,

the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer

must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's

written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks,

and a signed and dated copy of a written suitability statement. These disclosure

requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty

selling our securities. Holders

of Our Common Stock We are authorized

to issue 200,000,000 shares of common stock with a par value of $0.0001 per share. As of July 23 , 2012 we had 155,009,002

shares of common stock outstanding. Our shares are held by approximately 7 shareholders of record, with others held in street

name. Dividends There are

no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes,

however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend: We have

not declared any dividends and we do not plan to declare any dividends in the foreseeable future. Recent

Sales of Unregistered Securities On April 26, 2011, we authorized the issuance of 333,334

shares of common stock pursuant to a subscription agreement for cash proceeds of $50,000. As of February 29, 2012, the shares

are unissued. On December 1, 2010, we entered into a consulting agreement

with Front Range Consulting for a term of two years expiring on November 30, 2012. On January 28, 2011, we agreed to amendment

the December 2010 agreement with the inclusion of additional compensation of 1,000,000 shares of our common stock fair valued

at $200,000 to be deemed fully earned on the date of amendment. On September 20, 2011, we agreed to further amend the December

agreement for the issuance of an additional 2,500,000 shares of common stock fair valued at $375,000 also deemed to be fully earned

on the date of amendment. On August 15, 2011, we entered into a second consulting

agreement with Front Range Consulting to assist our financing activities in exchange for 1,000,000 shares of our common stock

fair valued at $150,000 deemed fully earned pursuant to the agreement. In September 2011, we authorized the issuance of 2,000,000

shares of common stock to an individual for advisory services valued at $300,000. As of February 29, 2012 1,800,000 shares were

unissued of which 1,000,000 shares were subsequently issued on April 17, 2012, On March 28, 2012, we issued 6,000,000 shares to Mr.

Kristian Schiørring, our Chief Executive Officer, and 6,000,000 shares to Mr. Henrik Dahlerup, our Chief Operating Officer,

as compensation for their services to our company in 2011. On May 21, 2012, we issued 12,000,000 shares each to

our officers as compensation for services rendered for the period beginning January 1, 2012 through June 30, 2012. In connection

with the grant, the officers agreed to waive their right to the 5,000,000 shares due them per their respective employment agreements

that were entered into on March 5, 2012. We issued 4,000,000 shares previously authorized for

Front Range Consulting Agreement. On April 17, 2012, we issued 1,000,000 shares of common

stock previously authorized to Mr. Phil Sands for advisory services. On May 14, 2012, we issued a promissory note in the amount

of $38,787 to Magna Group for the assumption of liabilities. The note was converted the note in to 5,730,400 shares of common

stock on May 17, 2012. On May 14, 2012, we entered into an Investment Agreement

with Dutchess Opportunity Fund II. to sell up to an aggregate of $10,000,000 of the Company’s common stock at a 5% discount

to market. Per the agreement, the Company issued 1,327,434 shares of its common stock as a preparation fee to Dutchess. On May 14we amended our articles of incorporation to

increase our authorized capital from 200,000,000 to 400,000,000 shares of common stock. On May 23, 2012, we entered into a Consulting Agreement

with Grey Bridge Capital and issued 750,000 shares of common stock valued at $12,225. Cash compensation totaled due under the

agreement totals $10,000. The above

shares were issued pursuant to the exemption from registration found in Regulation S. Each purchaser represented to us that the

purchaser was a Non-US Person as defined in Regulation S. We did not engage in a distribution of this offering in the United States.

Each purchaser represented their intention to acquire the securities for investment only and not with a view toward distribution.

All purchasers were given adequate access to sufficient information about us to make an informed investment decision. None of

the securities were sold through an underwriter and accordingly, there were no underwriting discounts or commissions involved. Securities

Authorized for Issuance under Equity Compensation Plans We do not

have any equity compensation plans. Item

6. Selected Financial Data A smaller

reporting company is not required to provide the information required by this Item. Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations Forward-Looking

Statements Certain

statements, other than purely historical information, including estimates, projections, statements relating to our business plans,

objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the

words “believes,” “project,” “expects,” “anticipates,” “estimates,”

“intends,” “strategy,” “plan,” “may,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. We intend such

forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions.

Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which

may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual

effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations

and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory

changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties

should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise. Further information concerning our business, including additional factors that could materially affect

our financial results, is included herein and in our other filings with the SEC. Results

of Operations for the Years Ended February 29, 2012 and February 28, 2011 We generated no

revenue for the period from August 25, 2004 (Date of Inception) until February 29, 2012. Our Operating Expenses were $1,645,159

for the year ended February 29, 2012, as compared with $267,550 for the year ended February 28, 2011. The increase was mainly

the result of increased consulting fees of $771,889 and $560,000 in compensation expenses incurred in 2012 that were not incurred

in 2011. Our operating expenses were $2,001,913 for the period from August 25, 2004 (Date of Inception) until February 29, 2012.

We recorded a net

loss of $1,650,424 for the year ended February 29, 2012, as compared with $267,550 for the year ended February 28, 2011, and $2,007,178

for the period from August 25, 2004 (Date of Inception) until February 29, 2012. Liquidity

and Capital Resources As of February 29, 2012, we had total current assets

of $191. We had total assets of $1,191,191 as of February 29, 2012. We had total current liabilities of $286,768 as of February

29, 2012. We had a working capital deficit of $286,577 as of February 29, 2012. Operating activities used $64,902 in cash for the year

ended February 29, 2012. Our net loss of $1,650,424 was the contributing factor to our negative operating cash flow, offset mainly

by $1,385,000 for shares issued for services and an increase of $172,533 accounts payable and accrued liabilities. Financing activities

for the year ended February 29, 2012 generated $65,034 as a result of the sale of common shares for proceeds of $50,000, proceeds

of $11,000 from a convertible note, and proceeds from a related party note payable of $4,034. We will require a cash injection of $2,000,000 to: begin

operations, launch a full marketing and branding campaign, manufacture and deliver products and to begin and increase revenues

from its products. On January 9, 2012, we issued a convertible promissory

note in the amount of $11,000. The note is unsecured, bears interest at a rate of 6% per annum and matures on January 8, 2013.

The note is convertible into shares our common stock at a rate equal to the market value of the common stock on the date of conversion

notice. As of February 29, 2012, the unpaid principal balance together with accrued interest totaled $11,095. On May 14,

2012, we entered into an Investment Agreement (the “Investment Agreement”) with Dutchess Opportunity Fund, II, LP,

a Delaware limited partnership (the “Investor”), pursuant to which the Investor committed to purchase, subject to

certain restrictions and conditions, up to $10,000,000 of the our common stock, par value $0.01 per share (the “Common Stock”),

over a period of 36 months from the first trading day following the effectiveness of the registration statement registering the

resale of shares purchased by the Investor pursuant to the Investment Agreement (the “Equity Line”). We may draw

on the facility from time to time, at our discretion. The maximum amount that we are entitled to put to the Investor in any one

draw down notice is up to five million shares (5,000,000) multiplied by the daily volume weighted average price (VWAP) on the

day prior to the put date. The purchase price shall be set at ninety-five percent (95%) of the lowest VWAP of the our Common Stock

during the five (5) consecutive trading day period beginning on the date of delivery of the applicable draw down notice. The Investor

will not be obligated to purchase shares if the Investor’s total number of shares beneficially held at that time would exceed

4.99% of the number of shares of the our common stock as determined in accordance with Rule 13d-1(j) of the Securities Exchange

Act of 1934, as amended. In addition, we are not permitted to draw on the facility unless there is an effective Registration Statement

(as defined below) to cover the resale of the shares. Upon notice to the Investor, the Company is entitled at any time in its

discretion to terminate the Investment Agreement. The Investment

Agreement further provides that we and the Investor are each entitled to customary indemnification from the other for, among other

things, any losses or liabilities they may suffer as a result of any breach by the other party of any provisions of the Investment

Agreement or Registration Rights Agreement, or as a result of any lawsuit brought by a third-party arising out of or resulting

from the other party’s execution, delivery, performance or enforcement of the Investment Agreement or the Registration Rights

Agreement. Pursuant

to the terms of a Registration Rights Agreement dated as of May 14, 2012 between us and the Investor (the “Registration

Rights Agreement”), we are obligated to file a registration statement (the “Registration Statement”) within

30 days with the Securities and Exchange Commission (“SEC”) to register the resale by Investor of the shares of Common

Stock issued or issuable under the Investment Agreement. We are required to initially register 16,000,000 shares of Common Stock.

We are obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC within

90 days after the filing of the Registration Statement. As of February

29, 2012, we have insufficient cash to operate our business at the current level for the next twelve months and insufficient cash

to achieve our business goals. The success of our business plan beyond the next 12 months is contingent upon us obtaining additional

financing. We intend to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our

capital expenditures, working capital, or other cash requirements. We do not have any formal commitments or arrangements for the

sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will

be available to us on acceptable terms, or at all. Off

Balance Sheet Arrangements As

of February 29, 2012, there were no off balance sheet arrangements. Going

Concern The accompanying

financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern,

which assumes that we will be able to meet our obligations and continue our operations for the next fiscal year. Realization values

may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments

that would be necessary to the carrying values and classification of assets and liabilities should we be unable to continue as

a going concern. We have not yet achieved profitable operations and since our inception (August 25, 2004) through February 29,

2012 we have accumulated losses of $5,095,876 and a working capital deficit of $314,264 . Management expects to incur

further losses in the development of our business, all of which raises substantial doubt about our ability to continue as a going

concern. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or

to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when

they come due. We expect

to continue to incur substantial losses as we execute our business plan and do not expect to attain profitability in the near

future. Since our inception, we have funded operations through short-term borrowings and equity investments in order to meet our

strategic objectives. Our future operations are dependent upon external funding and our ability to execute our business plan,

realize sales and control expenses. Management believes that sufficient funding will be available from additional borrowings and

private placements to meet our business objectives, including anticipated cash needs for working capital, for a reasonable period

of time. However, there can be no assurance that we will be able to obtain sufficient funds to continue the development of our

business operation, or if obtained, upon terms favorable to us. Critical

Accounting Policies In

December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management

Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the

portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or

complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. Our

accounting policies are set forth in Note 2 to the financial statements. Management does not believe that our accounting policies

are critical enough to mention in the body of this annual report on Form 10-K. Recently

Issued Accounting Pronouncements We

do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operation,

financial position or cash flow. Item

7A. Quantitative and Qualitative Disclosures About Market Risk A smaller

reporting company is not required to provide the information required by this Item. Item

8. Financial Statements and Supplementary Data Index

to Financial Statements Required by Article 8 of Regulation S-X: Audited

Financial Statements: Report

of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders Bioflamex Corp. New York, NY REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM We have audited the accompanying restated

balance sheets of Bioflamex Corp. for the two years ended February 29, 2012, and the related restated statements of operations,

stockholders’ equity, and cash flows for each of the years in the two year period ended February 29, 2012 and for the period

of August 25, 2004 (inception) to February 29, 2012. Bioflamex Corp.’s management is responsible for these financial statements.

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audits in accordance with

the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. Our audit of

the financial statements includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall

financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements

referred to above present fairly, in all material respects, the financial position of Bioflamex Corp. for the two year period

ended February 29, 2012, and the results of its operations and cash flows for each of the years in the two year period ended February

29, 2012, and the period from August 25, 2004 (inception) to February 29, 2012 in conformity with accounting principles generally

accepted in the United States of America. As discussed in Note 10 to the financial

statements, the previously filed unaudited statements have been restated for the correction of an error in connection with the

accrual of certain expenses previously omitted. The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. As discussed in note 2 to the financial statements,

the Company has suffered recurring losses and had negative cash flows from operations that raise substantial doubt about the Company’s

ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The

financial statements do not include any adjustments that might result from the outcome of this uncertainty. /s/ Weaver Martin & Samyn, LLC Weaver Martin & Samyn, LLC Kansas City, Missouri August 2, 2012 BIOFLAMEX

CORP. (formerly

Deer Bay Resources Inc.) (A

DEVELOPMENT STAGE COMPANY) (RESTATED) The

accompanying notes are an integral part of these financial statements. BIOFLAMEX

CORP. (A

DEVELOPMENT STAGE COMPANY) (RESTATED) The

accompanying notes are an integral part of these financial statements. BIOFLAMEX

CORP. (A

DEVELOPMENT STAGE COMPANY) STATEMENT

OF STOCKHOLDERS' EQUITY (RESTATED) The

accompanying notes are an integral part of these financial statements. BIOFLAMEX

CORP. (A

DEVELOPMENT STAGE COMPANY) (RESTATED) The

accompanying notes are an integral part of these financial statements BIOFLAMEX

CORP. (A

DEVELOPMENT STAGE COMPANY) FEBRUARY

29, 2012 (RESTATED) NOTE 1 – Significant Accounting

Policies and Procedures Organization The Company was incorporated under the

name of Deer Bay Resources Inc. in the State of Nevada, on August 25, 2004 as a mining and exploration Company. On January 26,

2011, the Company formed Bioflamex Corporation as a wholly-owned subsidiary in anticipation of its January 25, 2011 Asset Purchase

Agreement. On January 27, 2011, the wholly-owned subsidiary was merged into Deer-Bay Resources, Inc. Pursuant to the merger, Deer

Bay Resources, Inc. changed its name to Bioflamex Corporation (“the Company”). The merger subsidiary was dissolved

on January 28, 2011. The Company is listed on the Over-the-Counter Bulletin Board under the symbol BFLX. As a result of the January 25, 2011 Asset

Acquisition Agreement, the Company is now in the business of developing, producing, and marketing high performance fire extinguishing

and prevention products that are based on environment friendly and biological formulation with an emphasis on environmental protection

and the substitution of chemical-based fire combatant products with “greener,” non-harmful products. Basis of presentation The Company is in the development stage in accordance with Accounting

Standards Codification (“ASC”) Topic No. 915. Cash and cash equivalents The Company considers all highly liquid

temporary cash investments with an original maturity of three months or less to be cash equivalents. At February 29, 2012 and

February 28, 2011, the Company had no cash equivalents. Revenue recognition The Company has not yet generated revenue.

When revenue is earned, the Company will recognize in accordance with ASC subtopic 605-10 (formerly SEC Staff Accounting Bulletin

No. 104 and 13A, “Revenue Recognition”) net of expected cancellations and allowances. The Company's revenues, which do not require

any significant production, modification or customization for the Company's targeted customers and do not have multiple elements,

are recognized when (i) persuasive evidence of an arrangement exists; (ii) delivery has occurred; (iii) the Company's fee is fixed

and determinable; and (iv) collectability is probable. Loss per share The Company reports earnings (loss) per share in accordance

with ASC Topic 260-10, "Earnings per Share." Basic earnings (loss) per share is computed by dividing income (loss) available

to common shareholders by the weighted average number of common shares available. Diluted earnings (loss) per share is computed

similar to basic earnings (loss) per share except that the denominator is increased to include the number of additional common

shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were

dilutive. Diluted earnings (loss) per share has not been presented since the effect of the assumed exercise or conversion of stock

options, warrants, and debt to purchase common shares, would have an anti-dilutive effect. At February 29, 2012 and February 28,

2011 the Company had approximately 6,835,000 and no common shares, respectively, related to its convertible notes payable that

have been excluded from the computation of diluted net loss per share. Income taxes The Company follows ASC subtopic 740-10

for recording the provision for income taxes. ASC 740-10 requires the use of the asset and liability method of accounting for

income taxes. Under the asset and liability method, deferred tax assets and liabilities are computed based upon the difference

between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable

when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based

on the changes in the asset or liability each period. If available evidence suggests that it is more likely than not that some

portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets

to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision

for deferred income taxes in the period of change. Deferred income taxes may arise from temporary

differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred

taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate.

Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current

depending on the periods in which the temporary differences are expected to reverse. Fair Value of Financial Instruments The Company has financial instruments whereby

the fair value of the financial instruments could be different from that recorded on a historical basis in the accompanying balance

sheets. The Company's financial instruments consist of cash, receivables, accounts payable, accrued liabilities, and notes payable.

The carrying amounts of the Company's financial instruments approximate their fair values as of February 29, 2012 and February

28, 2011 due to their short-term nature. Long-lived assets The Company accounts for its long-lived

assets in accordance with ASC Topic 360-10-05, “Accounting for the Impairment or Disposal of Long-Lived Assets.” ASC

Topic 360-10-05 requires that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate

that the historical cost or carrying value of an asset may no longer be appropriate. The Company assesses recoverability of the

carrying value of an asset by estimating the future net cash flows expected to result from the asset, including eventual disposition.

If the future net cash flows are less than the carrying value of the asset, an impairment loss is recorded equal to the difference

between the asset’s carrying value and its fair value or disposable value. For the years ended February 29, 2012, and the

year ended February 29, 2012, the Company determined that none of its long-term assets were impaired. Use of estimates The preparation of financial statements in conformity with accounting

principles generally accepted in the United States of America requires management to make estimates and assumptions that affects

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates. Advertising The Company expenses advertising costs

as incurred. During the years ended February 29, 2012 and February 28, 2011 and for the period from August 25, 2004 (inception)

to February 29, 2012, the Company did not incur advertising expenses. Research and development Research and development costs are expensed

as incurred. During the years ended February 29, 2012 and February 28, 2011 and for the period from August 25, 2004 (inception)

to February 29, 2012, the Company did not incur research and development costs. Concentration of Business and Credit

Risk The Company has no significant off-balance

sheet risk such as foreign exchange contracts, option contracts or other foreign hedging arrangements. The Company’s financial

instruments that are exposed to concentration of credit risks consist primarily of cash. The Company maintains its cash in bank

accounts which may at times, exceed federally-insured limits. Foreign currency transactions The Company’s functional and reporting

currency is the United States dollar. Monetary assets and liabilities denominated in foreign currencies are translated in accordance

with ASC 820, using the exchange rate prevailing at the balance sheet date. Gains and losses arising on settlement of foreign

currency denominated transactions or balances are included in the determination of income. Share-Based Compensation The Company accounts for stock-based payments

to employees in accordance with ASC 718, “Stock Compensation” (“ASC 718”). Stock-based payments to employees

include grants of stock, grants of stock options and issuance of warrants that are recognized in the consolidated statement of

operations based on their fair values at the date of grant. The Company accounts for stock-based payments

to non-employees in accordance with ASC 718 and Topic 505-50, “Equity-Based Payments to Non-Employees.” Stock-based

payments to non-employees include grants of stock, grants of stock options and issuances of warrants that are recognized in the

consolidated statement of operations based on the value of the vested portion of the award over the requisite service period as

measured at its then-current fair value as of each financial reporting date. The Company calculates the fair value of

option grants and warrant issuances utilizing the Black-Scholes pricing model. The amount of stock-based compensation recognized

during a period is based on the value of the portion of the awards that are ultimately expected to vest. ASC 718 requires forfeitures

to be estimated at the time stock options are granted and warrants are issued to employees and non-employees, and revised, if

necessary, in subsequent periods if actual forfeitures differ from those estimates. The term “forfeitures” is distinct

from “cancellations” or “expirations” and represents only the unvested portion of the surrendered stock

option or warrant. The Company estimates forfeiture rates for all unvested awards when calculating the expense for the period.

In estimating the forfeiture rate, the Company monitors both stock option and warrant exercises as well as employee termination

patterns. The resulting stock-based compensation