Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mastercard Inc | d385081d8k.htm |

| EX-99.1 - PRESS RELEASE - Mastercard Inc | d385081dex991.htm |

Exhibit 99.2

MasterCard Incorporated Second-Quarter 2012 Financial Results Conference Call

August 1, 2012

Business Update

• Operational Overview

• Economic Update

• Business Highlights

| 2 |

|

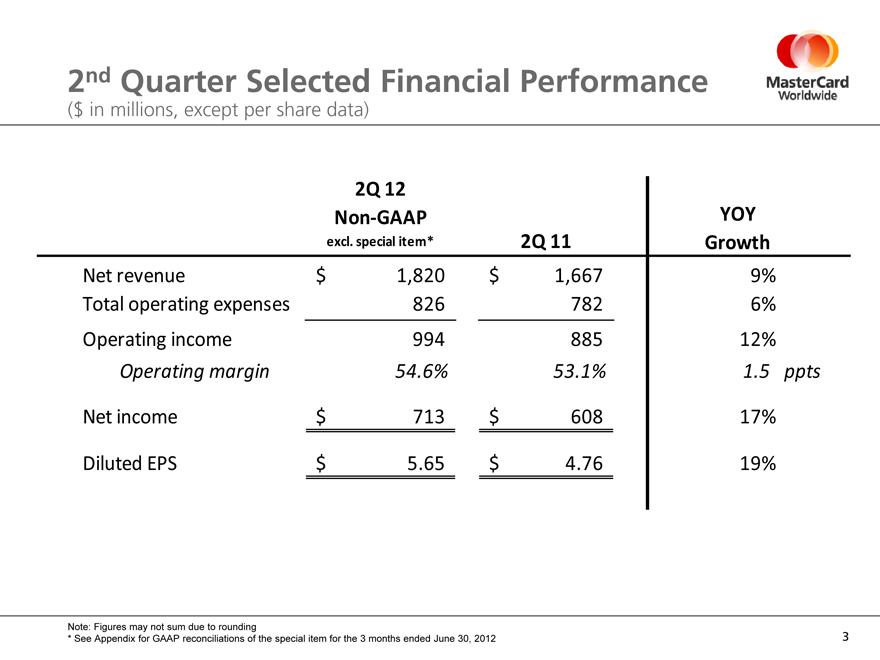

2nd Quarter Selected Financial Performance

($ in millions, except per share data)

2Q 12

Non-GAAP YOY

excl. special item* 2Q 11 Growth

Net revenue $ 1,820 $ 1,667 9%

Total operating expenses 826 782 6%

Operating income 994 885 12%

Operating margin 54.6% 53.1% 1.5 ppts

Net income $ 713 $ 608 17%

Diluted EPS $ 5.65 $ 4.76 19%

Note: Figures may not sum due to rounding

| * |

|

See Appendix for GAAP reconciliations of the special item for the 3 months ended June 30, 2012 |

| 3 |

|

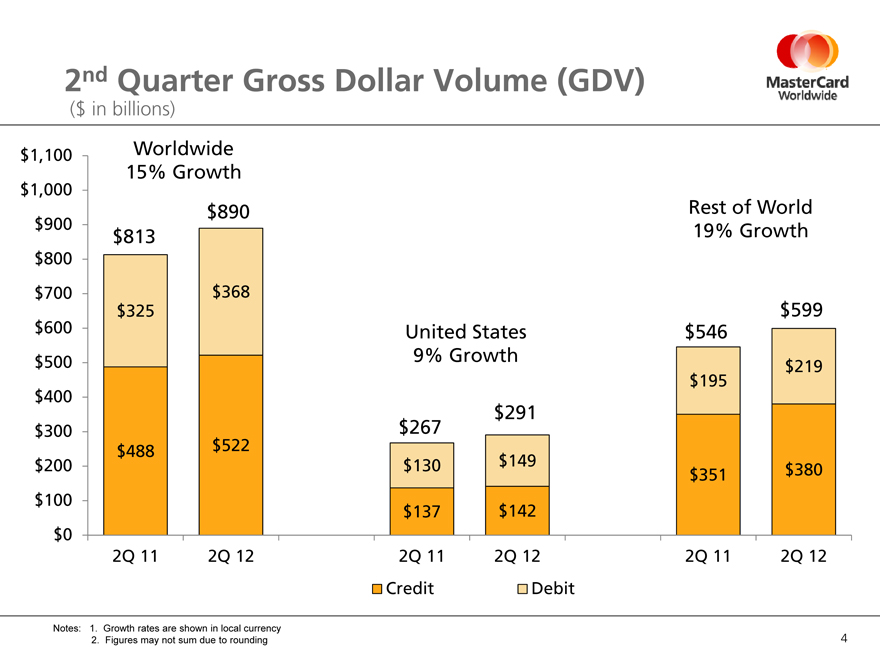

2nd Quarter Gross Dollar Volume (GDV)

($ in billions)

$1,100 $1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0

Worldwide 15% Growth

$813

$325

$488

$890

$368

$522

2Q 11

2Q 12

United States

9% Growth

$267

$130

$137

2Q 11

$291

$149

$142

2Q 12

Rest of World 19% Growth

$546

$195

$351

$599

$219

$380

2Q 11

2Q 12

Credit

Debit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

| 4 |

|

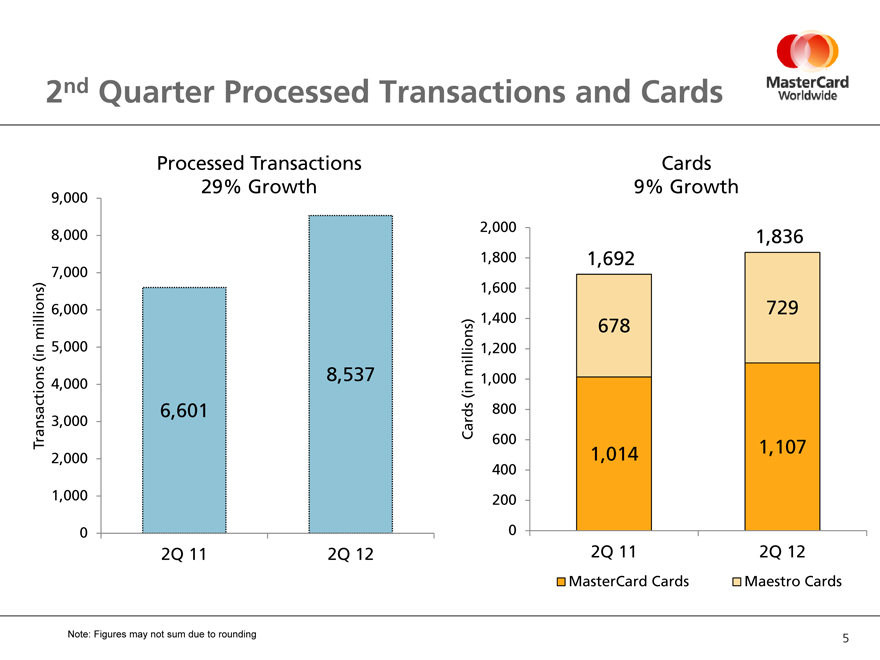

2nd Quarter Processed Transactions and Cards

Processed Transactions

29% Growth

9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0

Transactions (in millions)

6,601

2Q 11

8,537

2Q 12

Cards

9% Growth

Cards (in millions)

2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0

1,692

678

1,014

2Q 11

1,836

729

1,107

2Q 12

MasterCard Cards

Maestro Cards

Note: Figures may not sum due to rounding

| 5 |

|

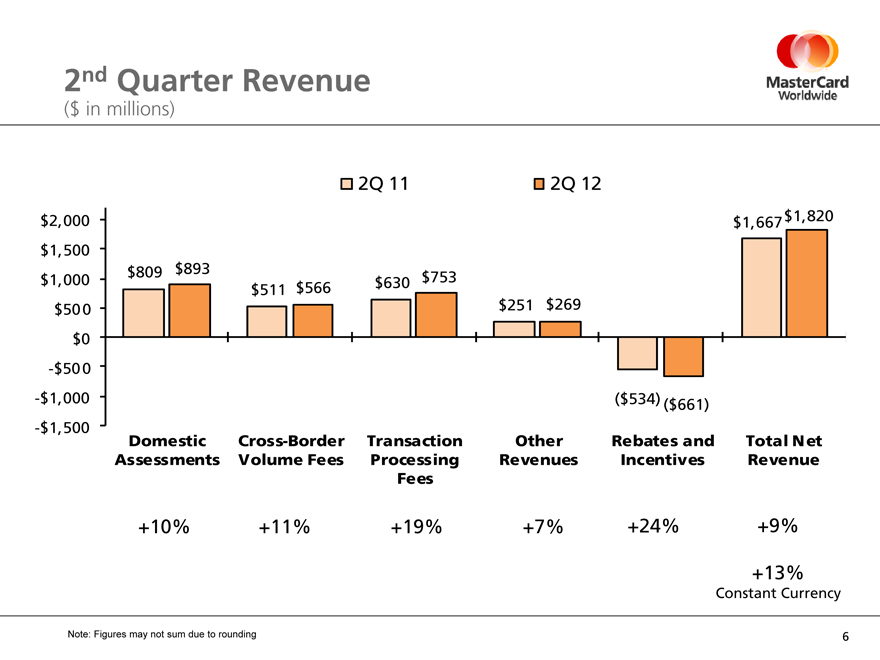

2nd Quarter Revenue

($ in millions)

2Q 11

2Q 12

$2,000

$1,500

$1,000 $500 $0

-$500

-$1,000

-$1,500

$809

$893

$511

$566

$630

$753

$251

$269

$1,667

$1,820

($534)

$661)

Domestic Assessments

Cross-Border Volume Fees

Transaction Processing Fees

Other Revenues

Rebates and Incentives

Total Net Revenue

+10%

+11%

+19%

+7%

+24%

+9%

+13%

Constant Currency

Note: Figures may not sum due to rounding

| 6 |

|

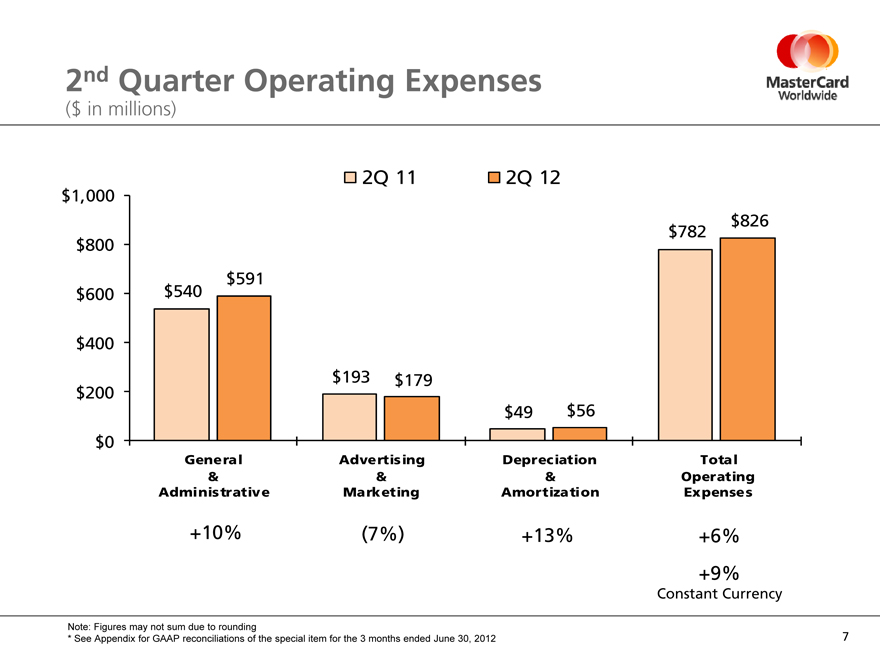

2nd Quarter Operating Expenses

($ in millions)

$1,000 $800 $600 $400 $200 $0

$540

$591

General & Administrative

+10%

2Q 11

2Q 12

$193

$179

Advertising & Marketing

(7%)

$49

$56

Depreciation & Amortization

+13%

$782

$826

Total Operating Expenses

+6%

+9%

Constant Currency

Note: Figures may not sum due to rounding

| * |

|

See Appendix for GAAP reconciliations of the special item for the 3 months ended June 30, 2012 |

| 7 |

|

Thoughts for the Future

Business update through July 28

Thoughts for 2012

Net Revenue Total Operating Expenses Tax Rate

Long-term financial objectives

| 8 |

|

The Heart of Commerce™

9

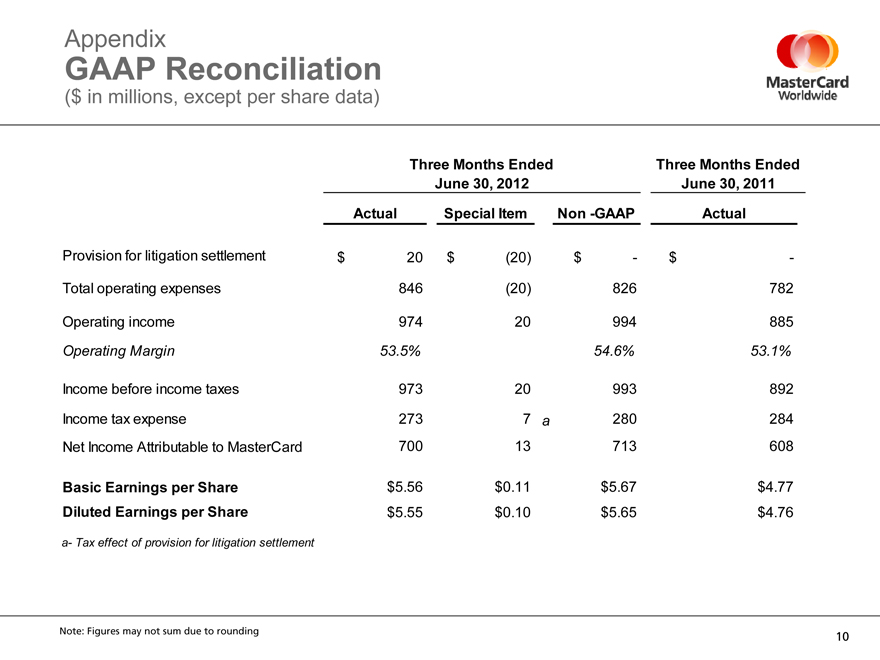

Appendix

GAAP Reconciliation

($ in millions, except per share data)

Three Months Ended Three Months Ended

June 30, 2012 June 30, 2011

Actual Special Item Non -GAAP Actual

Provision for litigation settlement $ 20 $ (20) $—$ -

Total operating expenses 846 (20) 826 782

Operating income 974 20 994 885

Operating Margin 53.5% 54.6% 53.1%

Income before income taxes 973 20 993 892

Income tax expense 273 7 a 280 284

Net Income Attributable to MasterCard 700 13 713 608

Basic Earnings per Share $5.56 $0.11 $5.67 $4.77

Diluted Earnings per Share $5.55 $0.10 $5.65 $4.76

a- Tax effect of provision for litigation settlement

Note: Figures may not sum due to rounding

10