Attached files

| file | filename |

|---|---|

| 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | a63012ceoletter8-k.htm |

Dear Shareholders and Friends of First Business,

2012 is proving to be a year of outstanding execution and accomplishment for First Business. At the beginning of this year, we established strategic priorities which aim to position our company to take advantage of future growth opportunities. We outlined objectives focused on sustainable revenue growth and disciplined asset quality management. We set out to gather even more in-market deposits while selectively funding new loans. Additionally, we made hiring first-rate talent and attracting first-rate clients a primary strategic focus. We challenged our business development officers (BDOs) to improve client profitability in a measurable and sustainable way - and the results speak for themselves, just halfway through the year.

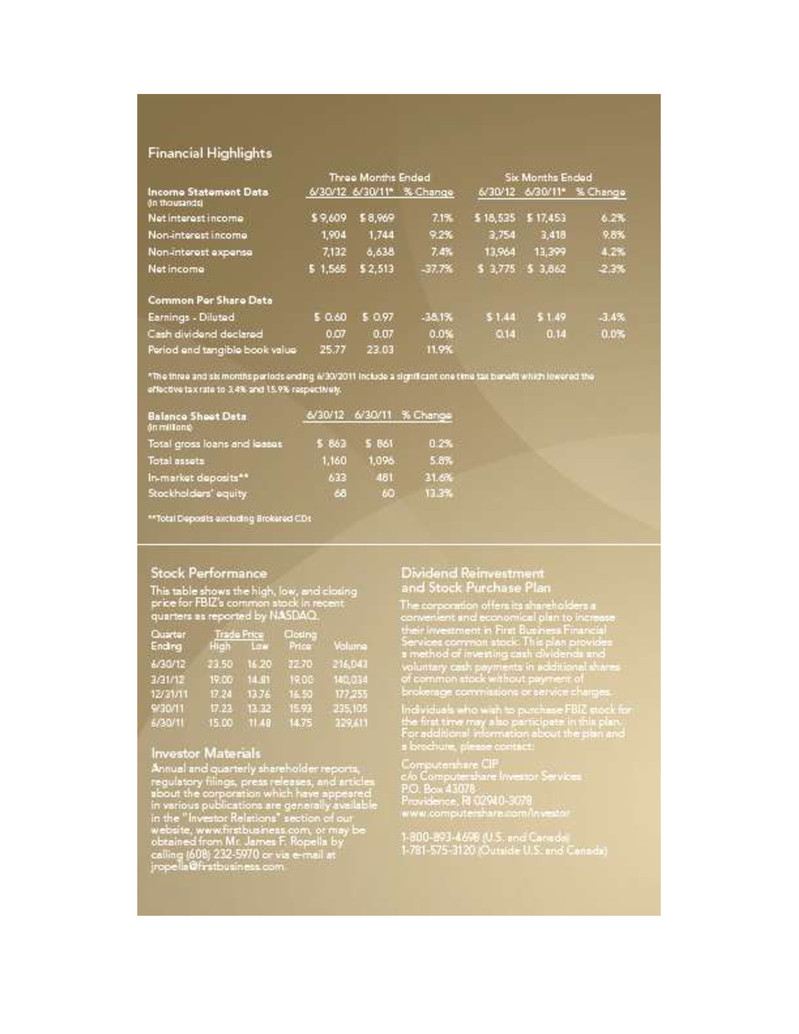

In the first six months of 2012 net income was a solid $3.8 million, roughly equivalent to the same period in 2011. Last year's net income was significantly enhanced by a one-time tax benefit, masking strong year-over-year improvement in our fundamental earnings. Top line revenue, a combination of net interest income and non-interest income, grew to a record $22.3 million, 7% higher than in the first six months of 2011 - which itself marked an 11% increase over the first half of 2010. Net interest income grew more than 6%, reflecting expansion in our net interest margin - a key driver of profitability. Growth across fee income lines was directly related to our BDOs' success in building deeper relationships with our existing clients while also attracting profitable new clients. This heightened level of engagement drove a 25% year-over-year increase in average in-market, client deposits in the first half of 2012. Likewise, as we continue to target commercial and industrial (C&I) client relationships, which tend to hold larger deposit balances and transact in greater volumes, our deposit service charge income grew 23% over the first half of 2011.

Loan growth and asset quality measures for the first six months of 2012 further demonstrate successful execution of our strategic plan. During the second quarter of 2012 we saw loan growth of 4% from March 31, 2012, even while we reduced nonperforming loans by 24% over that same period. In fact, our ratio of nonperforming assets to total assets fell to 1.50% - the lowest level since September 30, 2008. We do not seek loan growth simply for growth's sake, however. Rather, we aim to make the best use of our talent and earn the best return on our capital, at all times.

We have long focused on “core earnings” as a key measure of our success. In stripping away credit costs, taxes, and other items unrelated to our core business activities, “core earnings” simply measures the earnings power of our commercial bank - the organic franchise value our team is creating each quarter. In the first six months of 2012 we generated core earnings of $8.6 million, 13% higher than in the first half of 2011, which itself grew 31% over 2010. A key contributor to this improvement was our net interest margin, which grew 10 basis points to 3.49% in the second quarter - a record during our tenure as a public company.

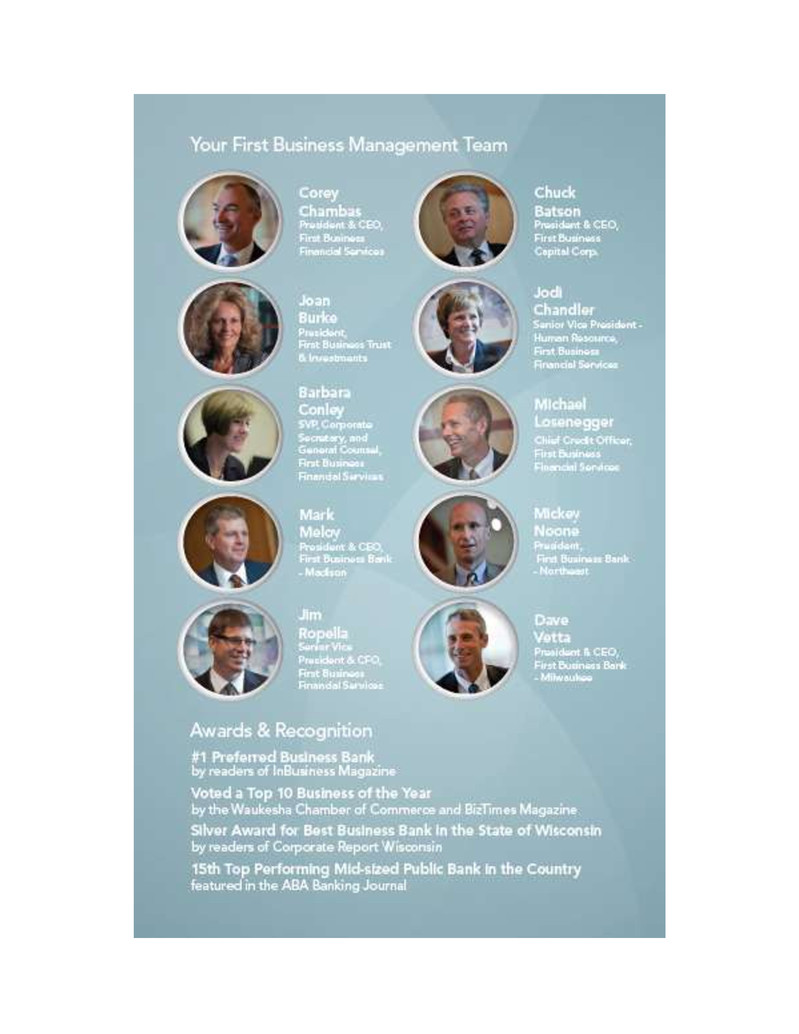

These outstanding results are 100% attributable to our people. We operate in an ultra-competitive, increasingly commoditized industry where our people are truly our differentiator and our most valuable asset. For more than 20 years we've worked to build highly specialized teams of bankers who deliver first-rate service to clients across diverse niche businesses. In 2012 we elevated the importance of our people even further by naming talent acquisition a corporate strategic priority. As I said last quarter, and I cannot repeat enough: whoever builds the best team wins. Last quarter we announced the addition of nine new hires to our team, including five BDOs with extensive experience and local market knowledge. This quarter I'm pleased to announce the addition of another two BDOs. One individual joins us with deep experience in trust services, multiplying our ability to grow assets under management and advancing our strategic priority of growing fee income. We welcomed another

BDO to our commercial lending team, where our expanded calling will help increase penetration of our C&I clients, grow in-market deposits and increase fee revenue sources. You can expect we'll continue to pursue additional key producers who can further quicken our pace of revenue, asset and deposit generation.

Our consistent and measured success, boosted by our recent investments in talent, has not gone unnoticed. I am very pleased to report that in the last 90 days our top-notch execution has been independently recognized by two nationally regarded institutions in the banking industry.

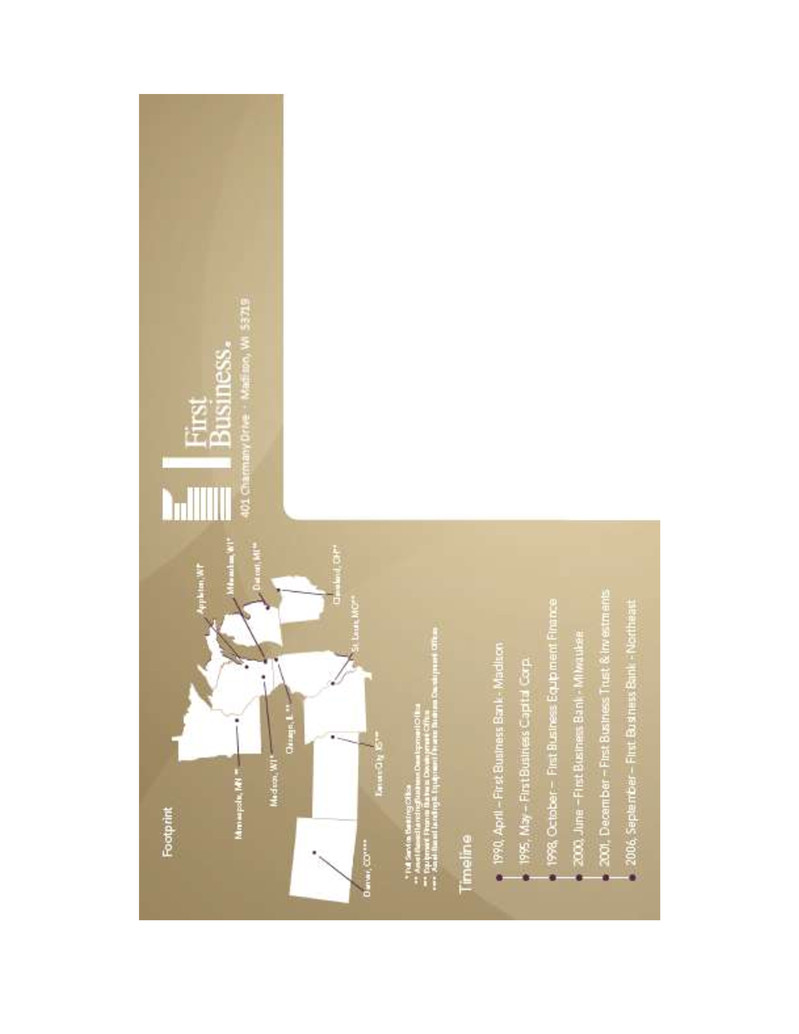

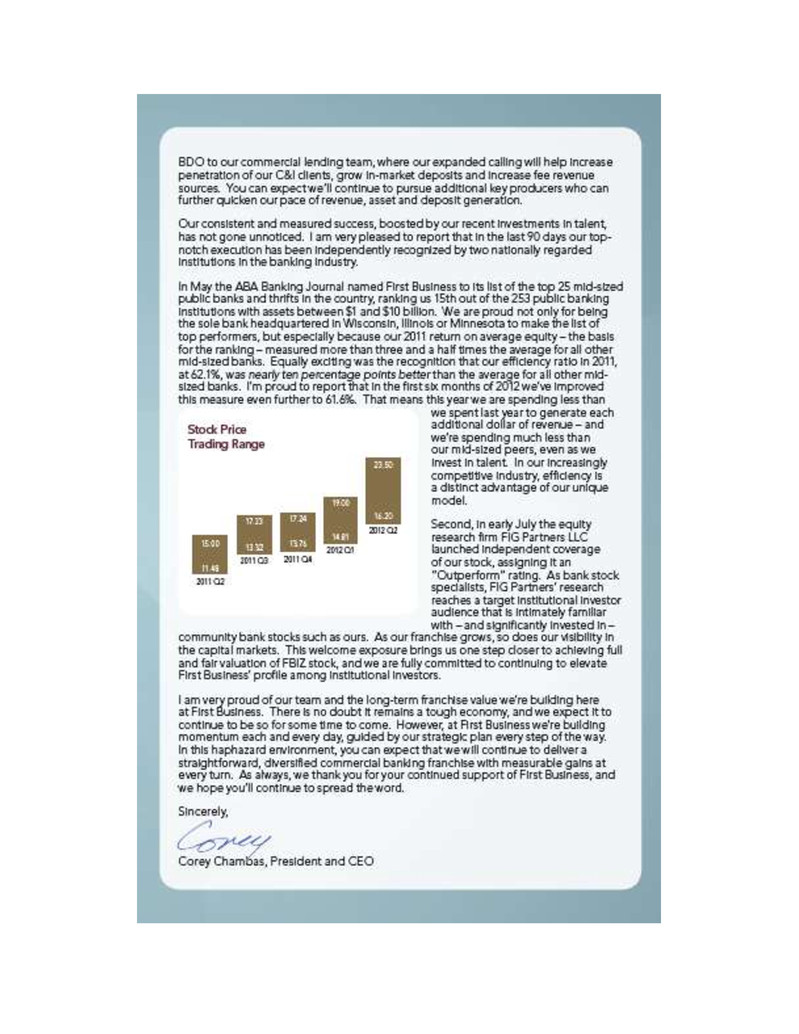

In May the ABA Banking Journal named First Business to its list of the top 25 mid-sized public banks and thrifts in the country, ranking us 15th out of the 253 public banking institutions with assets between $1 and $10 billion. We are proud not only for being the sole bank headquartered in Wisconsin, Illinois or Minnesota to make the list of top performers, but especially because our 2011 return on average equity - the basis for the ranking - measured more than three and a half times the average for all other mid-sized banks. Equally exciting was the recognition that our efficiency ratio in 2011, at 62.1%, was nearly ten percentage points better than the average for all other mid-sized banks. I'm proud to report that in the first six months of 2012 we've improved this measure even further to 61.6%. That means this year we are spending less than we spent last year to generate each additional dollar of revenue - and we're spending much less than our mid-sized peers, even as we invest in talent. In our increasingly competitive industry, efficiency is a distinct advantage of our unique model.

Second, in early July the equity research firm FIG Partners LLC launched independent coverage of our stock, assigning it an “Outperform” rating. As bank stock specialists, FIG Partners' research reaches a target institutional investor audience that is intimately familiar with - and significantly invested in - community bank stocks such as ours. As our franchise grows, so does our visibility in the capital markets. This welcome exposure brings us one step closer to achieving full and fair valuation of FBIZ stock, and we are fully committed to continuing to elevate First Business' profile among institutional investors.

I am very proud of our team and the long-term franchise value we're building here at First Business. There is no doubt it remains a tough economy, and we expect it to continue to be so for some time to come. However, at First Business we're building momentum each and every day, guided by our strategic plan every step of the way. In this haphazard environment, you can expect that we will continue to deliver a straightforward, diversified commercial banking franchise with measurable gains at every turn. As always, we thank you for your continued support of First Business, and we hope you'll continue to spread the word.

Sincerely,

Corey Chambas, President and CEO