Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FINANCIAL INSTITUTIONS INC | d388182d8k.htm |

Exhibit 99.1

| Keefe, Bruyette & Woods 13th Annual Community Bank Investor Conference August 1, 2012 Well Positioned for the Future |

| Peter G. Humphrey President and Chief Executive Officer Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference Strategic Overview |

| Statements contained in this presentation which are not historical facts and which pertain to future operating results of Financial Institutions, Inc. and its subsidiaries constitute "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements involve significant risks and uncertainties. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically the Company's last filed Form 10-K and Form 10-Q. These documents contain and identify important factors that could cause actual results to differ materially from those contained in our projections or forward looking statements. The Company assumes no obligation to update any information presented herein. Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| INVESTOR HIGHLIGHTS NASDAQ GSM FISI (Global Select Market) Market capitalization $ 233.0 mil. Shares outstanding 13.8 mil. Recent price* $ 16.87 52-week range $ 12.18 - $ 18.50 Annualized Dividend Rate $ 0.56 Dividend yield 3.32% * Pricing as of July 25, 2012 Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Building a Scalable Organization - Enhanced Capital Structure - Improved Organizational Development - Successfully Completed Branch Acquisition - Effective Enterprise Risk Management YEAR IN REVIEW STRATEGIC ACHIEVEMENTS Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Enhanced Capital Structure - Completed successful follow-on common stock offering with net proceeds of $43.1 million Emphasis on Tangible Common Equity Ratio Well Positioned for Basel III Well Positioned for Growth Opportunities YEAR IN REVIEW STRATEGIC ACHIEVEMENTS Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Improved Organizational Development Reorganized Executive Management Structure: combined Retail Banking with Retail Lending Streamlined Operations Structure Enhanced Management Assessment, Development, and Succession Planning Well Positioned for the Future YEAR IN REVIEW STRATEGIC ACHIEVEMENTS Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Successfully Completed Branch Acquisition - Acquire 8 branches with $321 million in deposits and $76 million in loans - In-market opportunity - Strengthen market share - Capitalize on operational efficiencies Well Positioned for the Future YEAR IN REVIEW STRATEGIC ACHIEVEMENTS Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Effective Enterprise Risk Management - Solid Credit Risk - Loans and Securities - Strong Liquidity Levels - Disciplined Interest Rate Risk - Effective Compliance / Regulatory Risk - Low Operating Risk Well Positioned for the Future YEAR IN REVIEW STRATEGIC ACHIEVEMENTS Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

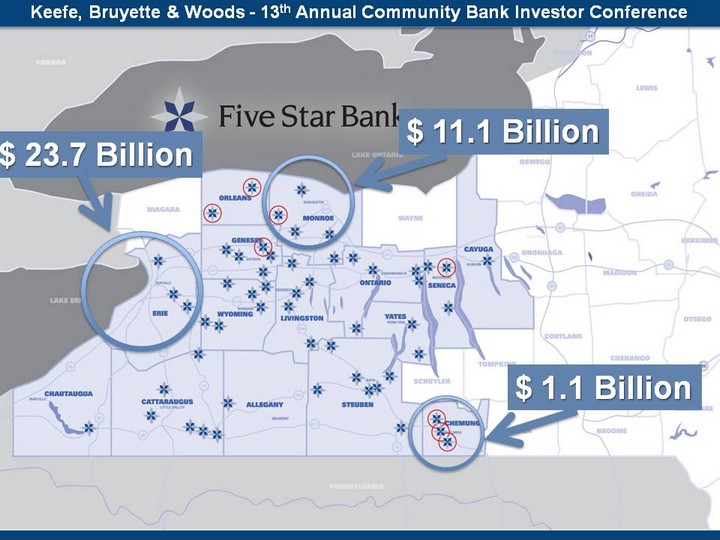

| $ 11.1 Billion $ 23.7 Billion $ 1.1 Billion Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Karl F. Krebs Executive Vice President and Chief Financial Officer Financial Overview Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

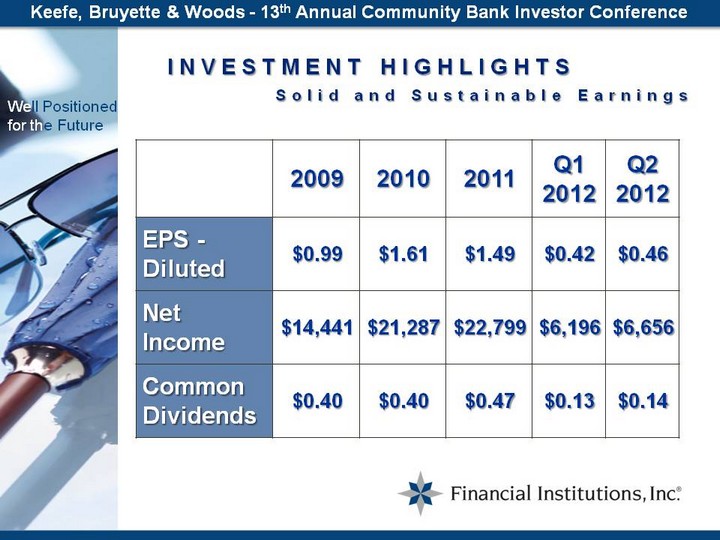

| 2009 2010 2011 Q1 2012 Q2 2012 EPS - Diluted $0.99 $1.61 $1.49 $0.42 $0.46 Net Income $14,441 $21,287 $22,799 $6,196 $6,656 Common Dividends $0.40 $0.40 $0.47 $0.13 $0.14 Well Positioned for the Future INVESTMENT HIGHLIGHTS Solid and Sustainable Earnings Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

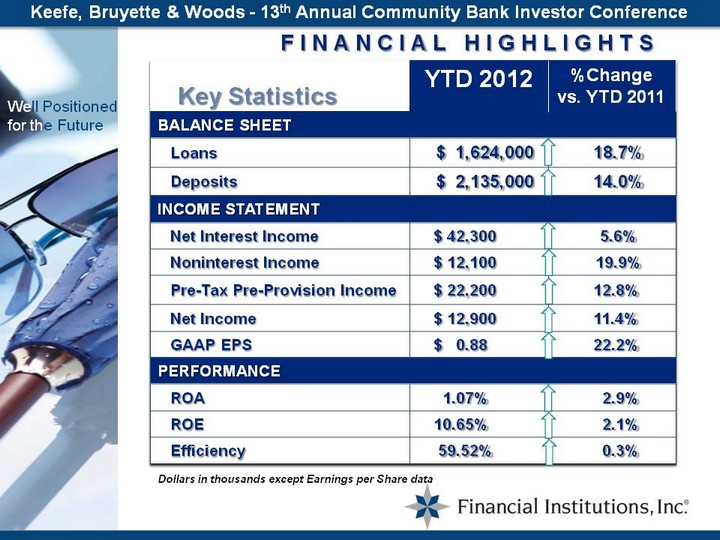

| FINANCIAL HIGHLIGHTS Key Statistics Dollars in thousands except Earnings per Share data Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

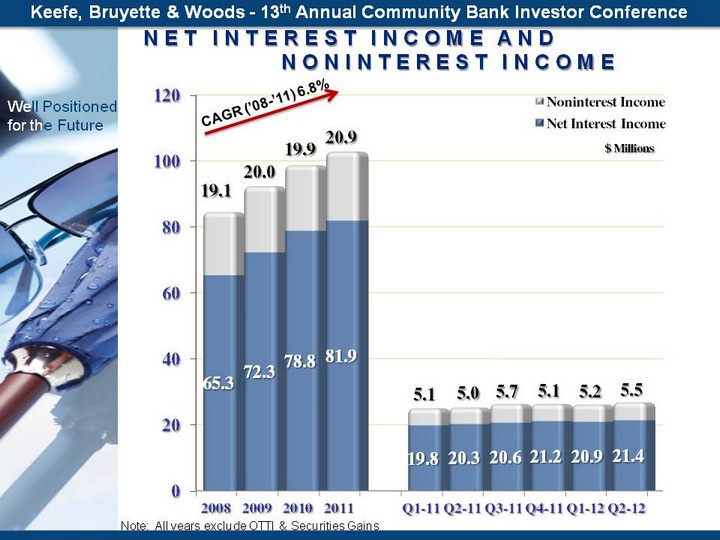

| NET INTEREST INCOME AND NONINTEREST INCOME CAGR ('08-'11) 6.8% Note: All years exclude OTTI & Securities Gains Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

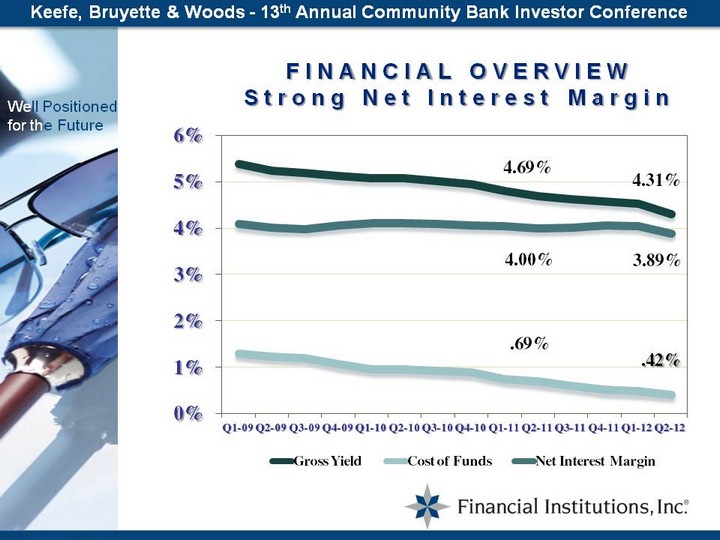

| FINANCIAL OVERVIEW Strong Net Interest Margin Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

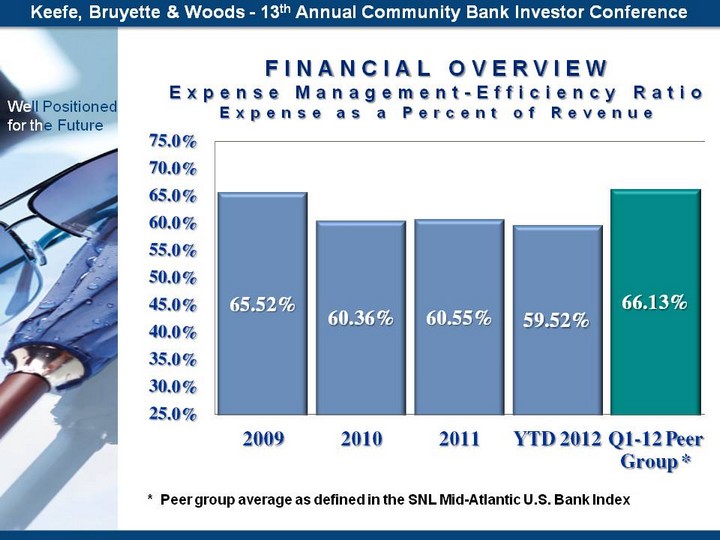

| FINANCIAL OVERVIEW Expense Management-Efficiency Ratio Expense as a Percent of Revenue * Peer group average as defined in the SNL Mid-Atlantic U.S. Bank Index Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

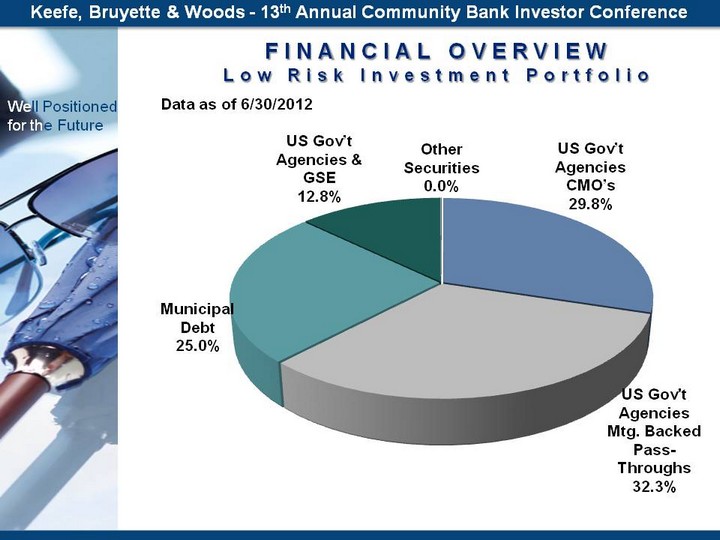

| FINANCIAL OVERVIEW Low Risk Investment Portfolio Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

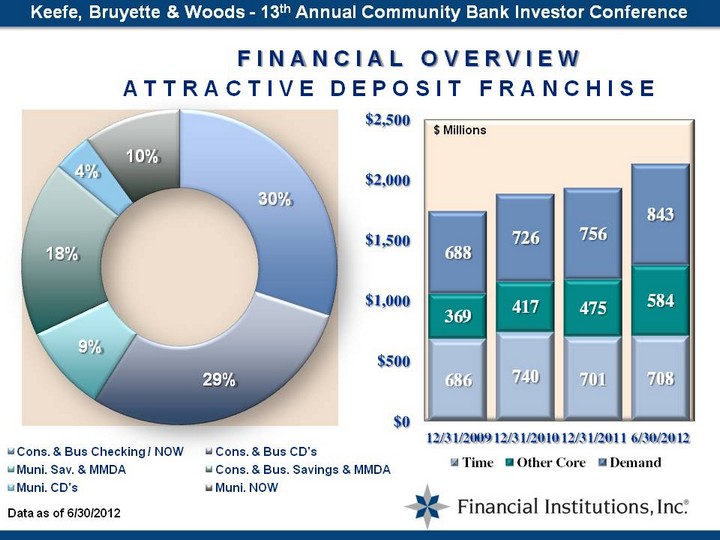

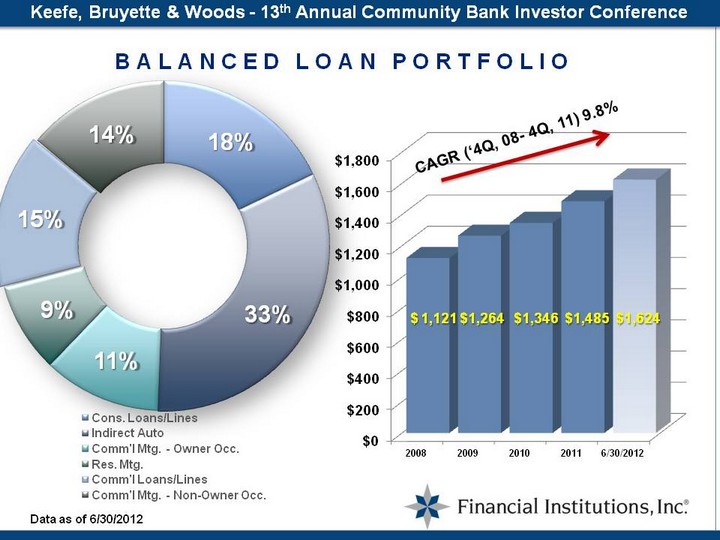

| FINANCIAL OVERVIEW Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| CAGR ('4Q, 08- 4Q, 11) 9.8% $ 1,121 $1,264 $1,346 $1,485 $1,624 Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

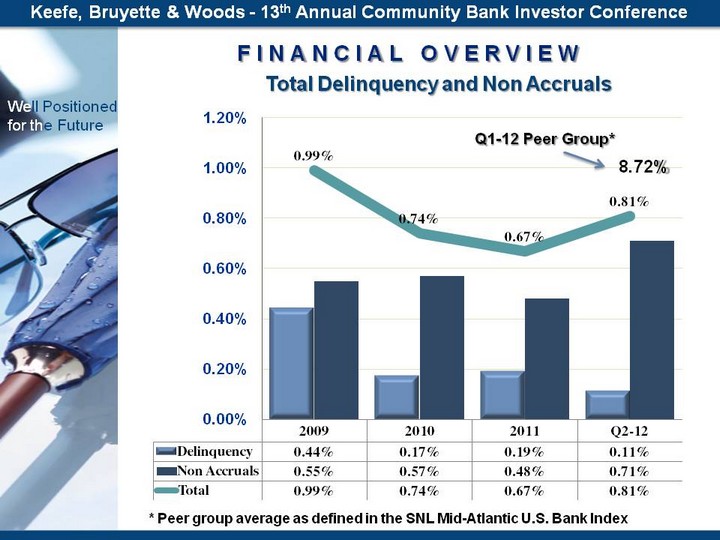

| FINANCIAL OVERVIEW Total Delinquency and Non Accruals Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference Q1-12 Peer Group* * Peer group average as defined in the SNL Mid-Atlantic U.S. Bank Index |

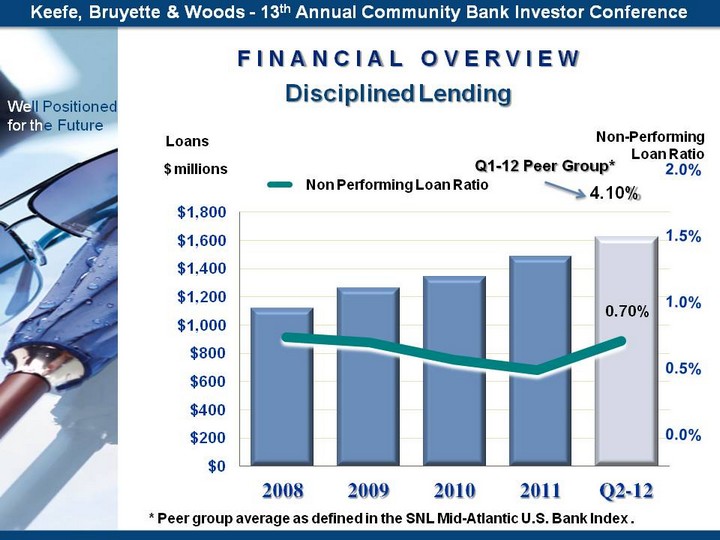

| FINANCIAL OVERVIEW Disciplined Lending $ millions Loans Non-Performing Loan Ratio 4.10% Q1-12 Peer Group* * Peer group average as defined in the SNL Mid-Atlantic U.S. Bank Index . Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

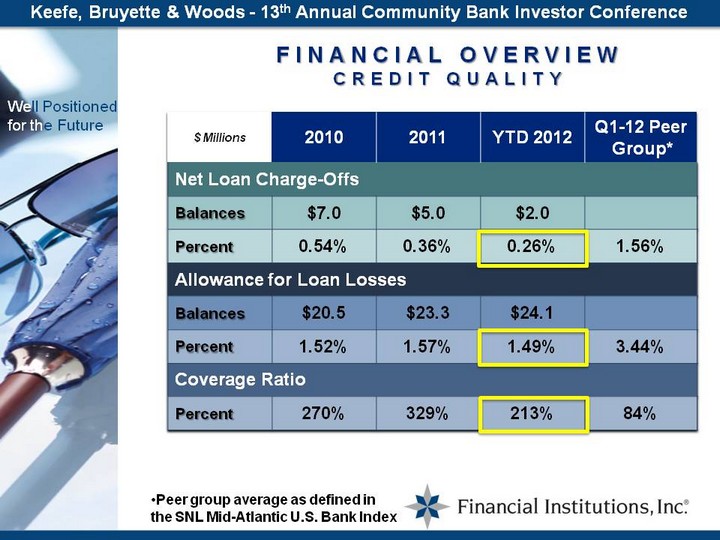

| FINANCIAL OVERVIEW CREDIT QUALITY Peer group average as defined in the SNL Mid-Atlantic U.S. Bank Index Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| FINANCIAL OVERVIEW CAPITAL MANAGEMENT * Peer group average as defined in the SNL Mid-Atlantic U.S. Bank Index Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Richard J. Harrison Executive Vice President and Retail Banking Executive Indirect Lending Program Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

| Decisioned in 2005 due to the following factors: Large market Favorable competitive conditions and risk- adjusted returns - Natural risk dispersion that comes with retail loans - Necessary expertise available Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference INDIRECT LENDING OVERVIEW Indirect Lending as a Core Business |

| Retail Banking Executive - 30+ years Underwriting Executive - 20+ years Risk Manager - 30+ years Sales Manager - 20+ years Collection Manager - 30+ years Subordinate levels of management have similar experience Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference INDIRECT LENDING OVERVIEW Key Personnel Experience |

| Application processing Credit decisions Process incoming drafts - Loan setup Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference INDIRECT LENDING OVERVIEW Risk Management/Organization Underwriting Credit Process Administration - S1 system administration Set up and monitor system parameters Manage change control matrix - Credit/QC Review (second review of 20% of originations) - Implement regulatory and compliance topics - Reporting |

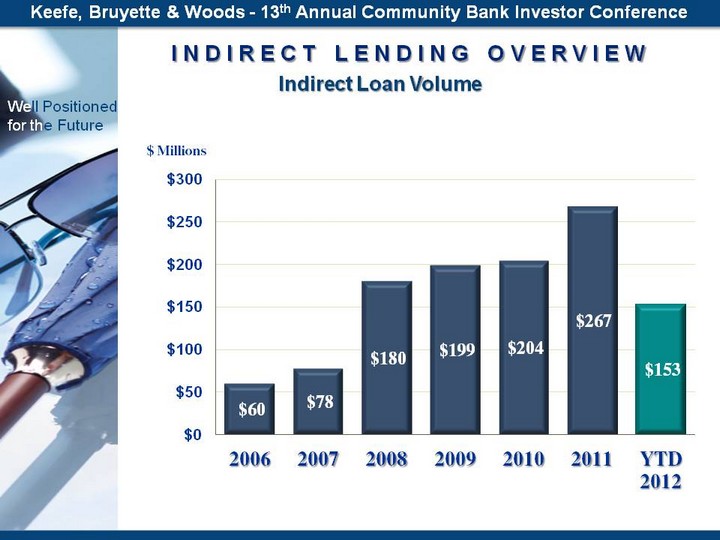

| INDIRECT LENDING OVERVIEW Indirect Loan Volume Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference $ Millions |

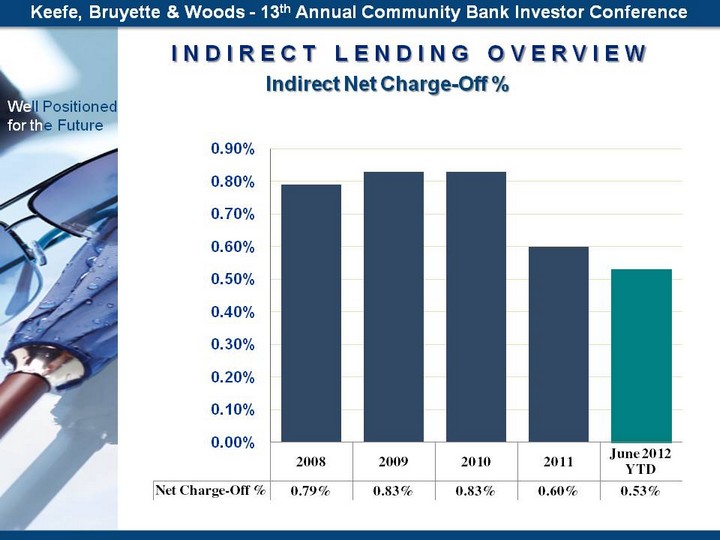

| INDIRECT LENDING OVERVIEW Indirect Net Charge-Off % Well Positioned for the Future Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

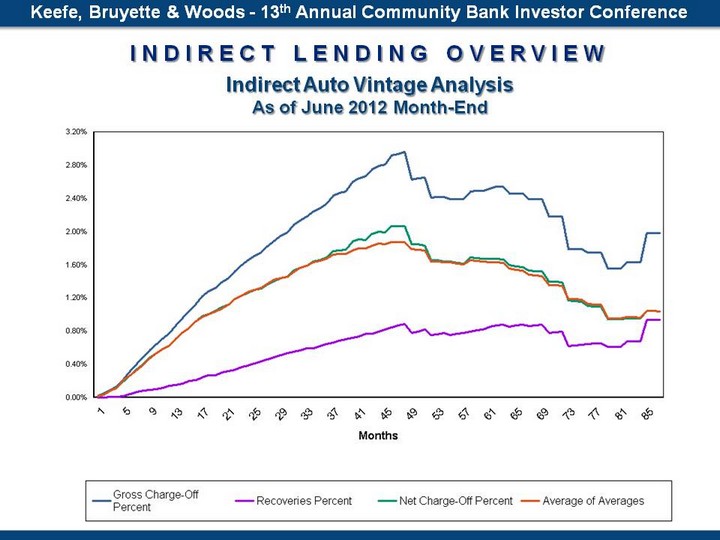

| Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference INDIRECT LENDING OVERVIEW Indirect Auto Vintage Analysis As of June 2012 Month-End |

| Peter G. Humphrey President and Chief Executive Officer Attractive Valuation Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference |

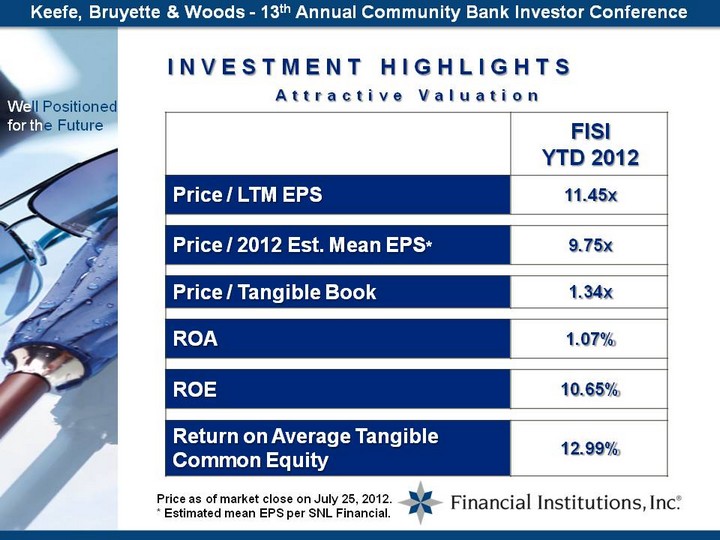

| Well Positioned for the Future INVESTMENT HIGHLIGHTS Attractive Valuation Keefe, Bruyette & Woods - 13th Annual Community Bank Investor Conference Price as of market close on July 25, 2012. * Estimated mean EPS per SNL Financial. |