Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Tower Group International, Ltd. | d387770dex21.htm |

| EX-2.2 - LETTER AGREEMENT - Tower Group International, Ltd. | d387770dex22.htm |

| EX-99.1 - PRESS RELEASE - Tower Group International, Ltd. | d387770dex991.htm |

| 8-K - FORM 8-K - Tower Group International, Ltd. | d387770d8k.htm |

1.

July 30, 2012

Strategic Initiative and Second Quarter Earnings Pre-

Announcement

Exhibit 99.2 |

| 1

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a "safe

harbor" for forward-looking statements. This press release and

any other written or oral statements made by or on behalf of Tower may include forward-

looking statements that reflect Tower's current views with respect to future

events and financial performance. All statements other than statements

of historical fact included in this press release are forward-looking statements.

Forward-looking statements can generally be identified by the use of

forward-looking terminology such as "may," "will,"

"plan," "expect," "project," "intend," "estimate,” "anticipate," "believe" and "continue" or their negative or

variations or similar terminology. All forward-looking statements address

matters that involve risks and uncertainties. Accordingly, there are or

will be important factors that could cause the actual results of Tower to

differ materially from those indicated in these statements. Please refer to

Tower's filings with the SEC, including among others Tower's Annual

Report on Form 10-K for the year ended December 31, 2011 for a description of

the important factors that could cause the actual results of Tower to differ

materially from those indicated in these statements. Forward-looking

statements speak only as of the date on which they are made, and Tower

undertakes no obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future developments

or otherwise.

Notes on Non-GAAP Financial Measures

(1)

Operating income (loss) excludes realized gains and losses,

acquisition-related transaction costs and the results of the

reciprocal business, net of tax. Operating income is a common measurement for property and casualty

insurance companies. We believe this presentation enhances the understanding of

our results of operations by highlighting the underlying profitability

of our insurance business. Additionally, these measures are a key internal

management performance standard. Operating earnings (loss) per share is

operating income (loss) divided by diluted weighted average shares

outstanding. Operating return on equity is annualized operating income (loss)

divided by average common stockholders' equity. Second quarter realized gains

and losses, net of tax, are expected to be about $900,000 and second

quarter acquisition-related transaction costs, net of tax, are

expected to be about $700,000, and the net loss per share to Tower

shareholders is expected to be the same as the operating loss per

share.

(2)

Total premiums include gross premiums written through our insurance

subsidiaries and produced as managing general agent on behalf of other

insurance companies. |

2

Announcement Summary

Merger with Canopius Holdings Bermuda, Limited. (“CHBL”) will

enable Tower to create a global specialty insurance company with

greater diversification and profitability

•

Access to U.S. Bermuda and Lloyd’s markets supported by an efficient

international holding company structure

•

Enables Tower to increase its ROE target to 13% to 15% within 18

months of merger

As a part of its strategic review, Tower conducted a comprehensive

review of its reserves in the second quarter

•

$42M 2Q after-tax reserve strengthening is a culmination of multi-year

actions that began in the 4Q 2009 to mitigate prolonged soft market

conditions •

Reserve charge should allow Tower’s prospective financial results to

fully reflect current accident year profitability going forward

•

Tower’s on-going business continues to be profitable with a positive

earnings outlook:

»

2012 guidance -

$1.45 to

$1.55

»

2013 guidance -

$ 2.85 to $3.05 (excluding merger

impact) |

3

As previously announced on April 25, 2012, Tower, as part of its

agreement to invest in Canopius Group, Ltd. (“Canopius”), acquired an

option to merge into a subsidiary of CHBL

»

Canopius is a privately-owned international insurance and reinsurance

group underwriting a diversified portfolio of business from its

operations at Lloyd’s and around the world

»

Tower’s investment represents 10.7% interest in Canopius After a strategic review initiated in the second quarter, Tower has

decided to exercise this option and has entered into a merger agreement

with CHBL

•

For each share of Tower common stock, shareholders will receive $1.25 in cash

and a certain of number CHBL common shares equal to the quotient

obtained by dividing (X) the price per share of Tower common stock

(reduced by the $1.25 per share) at the market close on the date of the

pricing of the Canopius Secondary Offering by (Y) the adjusted CHBL

price per share

•

Upon completion of merger, CHBL’s name will be changed and its stock will

be listed on NASDAQ as an international holding company

•

Under applicable accounting principles, Tower will be regarded as the

acquiring entity Exercise of Canopius

Option |

4

Strategic Rationale

Creates an efficient global, diversified specialty insurance company that

supports our expansion plans

•

Efficient international holding company structure

•

Diversified product platform comprised of U.S and international business with

access to U.S. Bermuda and Lloyd’s markets

Improved profitability and financial strength

•

By regaining Bermuda platform, Tower will be able to increase its ROE target

range to 13% to 15% within 18 months of the merger

•

Stockholders’

equity will increase through the merger to support growth resulting

from the new business platform

»

We project the transaction will be accretive to earnings per share

Bermuda platform provides competitive advantage to support growth

opportunities in U.S. and international markets

•

Provides efficient source of capital to support Tower’s expansion in the

U.S. •

Supports international expansion plans, especially business sourced from

Lloyd’s and Bermuda |

5

Combined Business Plan, Post-Merger

Merger with CHBL will enable Tower to create a global specialty

insurance company with access to U.S., Bermuda and Lloyd’s

markets:

•

U.S.

»

Continue to focus on building commercial, specialty and personal

lines businesses with continuing reinsurance support from Bermuda

based reinsurance affiliate

•

Bermuda

»

Assumed Reinsurance business will be underwritten from the Bermuda office

utilizing the staff acquired from the merger with CHBL supplemented by

other Bermuda personnel

»

Other businesses (ex. risk sharing business previously underwritten by

CastlePoint) will be created using Bermuda platform

•

London

»

Continue to participate in Lloyd’s business through ownership in and

expanded reinsurance relationship with Canopius and continue to support

other Lloyd’s syndicates |

6

Closing Conditions and Process

Completion of Merger is subject to various customary and other closing

conditions, including:

•

Canopius’ acquisition of Omega

•

Successful completion of the secondary offering of CHBL shares at terms and

conditions acceptable to Tower

•

Approval by the SEC, Tower’s stockholders and various regulators of the

operating subsidiaries

•

Tower maintains the ability to terminate the merger agreement at any time

prior to the effective time of the merger

Sale of CHBL shares and Merger

•

As part of the merger transaction, new investors will purchase the stock of

CHBL from Canopius prior to the merger

•

Tower will seek stockholder approval of the merger concurrent with the stock

sale

•

The target investors will be institutional investors or private equity firms,

who would look to the prospective value of the combined group following

the merger to make their investment decision |

7

Reserve Strengthening -

Transitioning to Improving Market

Conditions and Focus on Strategic Initiatives

As part of our strategic review, a comprehensive review of the loss reserves in

the second quarter led to $42 million after-tax charge

•

Reserve strengthening primarily from terminated business

•

Represents 4% of the outstanding reserves,

»

The year end 2011 central estimates developed by outside actuaries exceeded

carried reserves: the June 2012 carried reserves now exceed the year

end 2011 central

estimates developed by the outside actuaries.

•

Historical loss ratio continues to remain favorable after reserve

strengthening »

64.7% loss ratio from 2008 to 2011 (includes 2.4 points of storm losses)

Reserve charge in 2Q 2012 culminates the multi-year effort that began in 4Q

2009 to mitigate soft market conditions

•

Impact of soft market conditions (2007 to mid 2011)

»

Re-assessment concluded adverse impact of new business pricing was

larger and emergence was longer than anticipated

»

Poor underwriting results from terminated program business

»

Increased claims trends (e.g. Increased WC medical costs)

•

Series of actions were taken since 4Q 2009 to mitigate the soft market

conditions •

Reserve charge enables Tower to transition to improving market environment

with profitable on-going business and focus on long-term

strategic initiatives |

8

Positive Underwriting and Reserves Outlook

Corrective Underwriting Actions

•

Multi-year corrective underwriting action plan to terminate unprofitable

business that began in 4Q 2009 was completed in 2Q 2012

•

Executed corrective underwriting actions to terminate underpriced business

projected to reduce accident year loss ratio by 1 to 2 points in

2012 •

Reduction in claims expenses is projected to reduce accident year loss ratio

by 1 point in 2012 as compared to 2011

•

As a part of its organic growth initiative, Tower has shifted its business mix

toward property, assumed reinsurance and higher margin specialty

business •

Property has outperformed Casualty by approximately 15 loss ratio points

during 2008-2011 Improving Market Conditions

•

After several years of commercial lines pricing deterioration, Tower has begun

to see an improved pricing environment on new business beginning in 3Q

2011 More Conservative Loss Ratio Selection

•

2012 loss ratio reflects emerging loss trends from prior accident year and the

benefits from improving pricing, corrective underwriting and shift in

business mix

Business Mix

2010

2011

YTD 2012

Property

37.8%

40.6%

44.7%

Casualty

62.2%

59.4%

55.3%

Improved Business Mix |

9

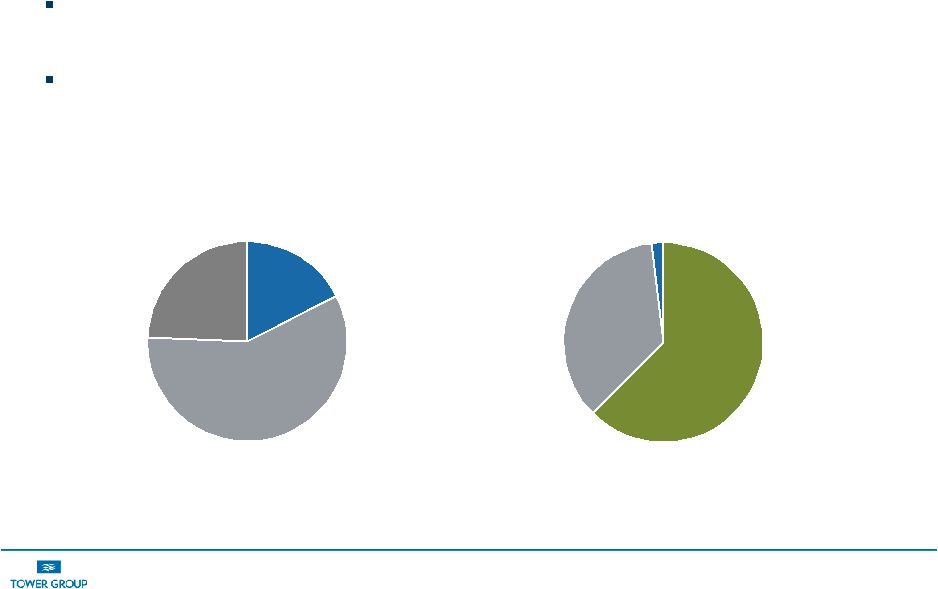

Components of Reserve Development

Programs accounted for 82% of the total commercial adverse development

•

Two thirds of program development is from terminated programs

Workers Compensation and Commercial Auto Liability accounted for

98% of

the total commercial adverse development

Other

Commercial

18%

Terminated

Programs

58%

Ongoing

Programs

24%

Workers Comp

62%

Commercial

Auto Liability

36%

Other

Commercial

2% |

10

Second Quarter Estimated Earnings and Guidance

As a result of the $42 million after-tax charge and after-tax storm

losses of $3.3 million, Tower expects its second quarter operating

result to be a loss in a range of $0.39 to $0.42 per share

Full year 2012 per share operating earnings are expected to be

$1.45 to $1.55 per share, which reflects the impact of the reserve

strengthening. Second half earnings are projected to be $1.32 to

$1.42 per share

Based on the planned business mix, Tower expects its operating

results in 2013 to produce operating earnings of $2.85 to $3.05 per

share, and an operating ROE of between 11% and 12%

This guidance does not contemplate the consummation of the

Canopius merger. The merger is expected to be accretive to per

share earnings by about 5% in the first year of consolidated activity

|

| 11

Additional Information and Where to Find It

In connection with this proposed transaction, Tower and Canopius

Bermuda will file a joint proxy statement/prospectus with the

SEC. Investors are urged to carefully read the proxy statement/prospectus and

any other relevant documents filed with the SEC when they become

available because they will contain important information. Investors will be able to obtain the proxy

statement/prospectus and all relevant documents filed by Tower with the SEC

free of charge at the SEC’s website www.sec.gov or, with respect to

documents filed by Tower, from Tower directly at 120 Broadway (31st Floor), New York, NY 10271, (212) 655-

2000; email: info@twrgrp.com.

This communication shall not constitute an offer to sell or the solicitation of

an offer to buy the securities, nor shall there be any offer,

solicitation or sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended. Participants in the Solicitation

The directors, executive officers and other members of management and employees

of Tower may be deemed participants in the solicitation of proxies from

its stockholders in favor of the transactions. Information concerning persons who may be considered

participants in the solicitation of Tower’s stockholders under the rules

of the SEC is set forth in public filings filed by Tower with

the SEC and will be set forth in the proxy statement/prospectus when it is

filed with the SEC. Information concerning Tower’s participants in

the solicitations contained in Tower’s Proxy Statement on Schedule 14A, filed with the SEC on March 16, 2012. |