Attached files

| file | filename |

|---|---|

| 8-K - LIVE FILING - Federal Home Loan Bank of New York | htm_45679.htm |

July 31, 2012

| TO: | All Stockholders (Addressed Individually) |

|

| SUBJECT: | Report from the President |

At the Bank

FHLBNY Announces Second Quarter 2012 Results

On Monday, July 30, 2012, the Federal Home Loan Bank of New York announced our unaudited Second Quarter 2012 Operating Highlights. I am proud to report that we executed well throughout the first half of 2012. The Home Loan Bank posted a net income for the second quarter of 2012 of $86.5 million, an increase of $33.2 million, or 62.3 percent, from net income of $53.3 million for the second quarter of 2011. Return on average equity (“ROE”) for the quarter was 6.75 percent, compared to an ROE of 4.35 percent for the second quarter of 2011.

As of June 30, 2012, our total assets were $102.4 billion, an increase of $6.7 billion, or 7.0 percent, from total assets of $95.7 billion at March 31, 2012. As of June 30, 2012, our advances were $77.6 billion, an increase of $5.5 billion, or 7.7 percent, from $72.1 billion at March 31, 2012. As of June 30, 2012, our total capital was $5.5 billion, an increase of $309.1 million, or 5.9 percent, from $5.2 billion as of March 31, 2012. In addition, the Bank’s unrestricted retained earnings grew during the quarter by $19.4 million to $765.7 million as of June 30, 2012. The Bank also increased our restricted retained earnings by $17.3 million during the quarter to $61.7 million as of June 30, 2012. At June 30, 2012, the Bank met its regulatory capital-to-assets ratios and liquidity requirements.

A vote on the second quarter 2012 dividend is expected to take place at the meeting of your Board of Directors scheduled for August 16, 2012, and the distribution of any declared dividend is expected to take place on August 17, 2012.

Advances Averaged $70.8 Billion in June 2012

Our region continues to weather the financial storm better than most, due in no small part to the responsible lending the local lenders that comprise our cooperative did leading up to and during the financial crisis. And as we slowly pass every mile marker along this long road to recovery, these local lenders continue to perform well.

But the overall economy is still struggling, and there are some areas within our region that are experiencing unique challenges. Whether those challenges be elevated unemployment levels, limited lending to small businesses or stagnant loan generation, the Home Loan Bank can be a valuable partner in helping our members continue to support the communities they serve.

We do this best with our advances. And our members continue to put these advances to good use across the region. In June, the book value of advances averaged $70.8 billion, an increase of $1.9 billion over the prior month’s average. During June, the Home Loan Bank experienced its largest settlement day on record, with $8.3 billion in advances closing on the final business day of the month.

Bucking the Trend

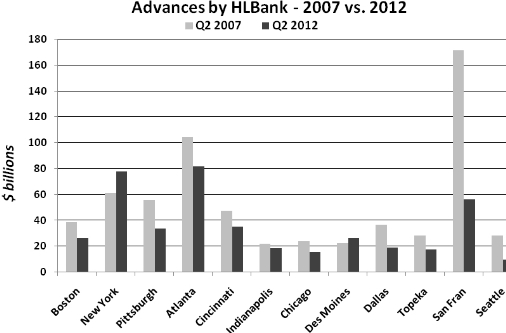

As I noted earlier, our advances were $77.6 billion as of June 30, 2012. As the below bar chart indicates, as of the end of the second quarter of 2012, we are one of only two Home Loan Banks whose advance levels are above what they were at June 30, 2007 – before the beginning of the financial crisis.

Over these many years, the veteran staff at the Home Loan Bank of New York has committed itself to keep our focus on operating as an advances bank. These latest results confirm that we are meeting that goal, to the benefit of our members and the communities you serve.

Nominations Period Opening for 2012 Election of Directors of the FHLBNY

Election Announcement packages containing nomination certificates and other related information regarding the 2012 Director election process were mailed to all eligible stockholders in our district on July 30, 2012. One Member Director seat from New Jersey, one Member Director seat from New York, and two district-wide Independent Director seats will be up for election later this year for terms that will each begin on January 1, 2013.

As the announcement package indicates, the deadline for receipt at the FHLBNY of your nomination certificates with regard to the open New Jersey and New York Member Directorships is 5:00 p.m. on August 29, 2012. As also mentioned in the package, persons who are interested in being considered for nominations for the open Independent Directorships must submit their Independent Director Application Forms to the FHLBNY by the same date and time.

Please be on the lookout for your Director election announcement package. If you have any questions about the election process, please email the Bank’s General Counsel, Paul Friend, at GeneralCounsel@fhlbny.com.

I ask that you all participate in the election process. Our Board is active and involved, experienced and knowledgeable, and vital to the operations of the Home Loan Bank.

Prior to the financial crisis, August was a quiet month when many across the banking industry would relax with family, unwind on summer vacation, and recharge our batteries for the final months of the year. Of course, since 2007, quiet days, let alone months, have been few and far between. I, and the entire team at the Home Loan Bank, appreciate the work all of our members do every day to continue to strengthen our communities and our economy, and hope that you will all at least get some time in the coming month to enjoy the remnants of summer.

Sincerely,

Alfred A. DelliBovi

President and CEO

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.