Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | a8kcoverpage63012.htm |

| EX-99.1 - EX-99.1 - STATE BANK FINANCIAL CORP | pressrelease63012.htm |

State Bank Financial Corporation 2nd Quarter 2012 Earnings Deck Dan Speight - Vice Chairman and COO Tom Callicutt - Executive Vice President and CFO Kim Childers - Vice Chairman, President and CCO July 30, 2012

2 Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this earnings deck that are not statements of historical fact may constitute forward-looking statements. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “may,” “would,” “could,” “will,” “expect,” “anticipate,” “believe,” “intend,” “plan” and “estimate,” as well as similar expressions. These forward-looking statements include statements related to our projected growth, anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to the anticipated effects on results of operations and financial condition from expected developments or events, or business and growth strategies, including anticipated internal growth and plans to establish or acquire banks or the assets of failed banks. These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those anticipated in such statements. Potential risks and uncertainties include the following: • general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a continued deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values; • the general decline in the real estate and lending markets, particularly in our market areas, may continue to negatively affect our financial results; • our ability to raise additional capital may be impaired if current levels of market disruption and volatility continue or worsen; • we may be unable to collect reimbursements on losses that we incur on our assets covered under loss share agreements with the FDIC as we anticipate; • costs or difficulties related to the integration of the banks we acquired or may acquire from the FDIC as receiver may be greater than expected; • restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • competitive pressures among depository and other financial institutions may increase significantly; • changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; • other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; • our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry; • adverse changes may occur in the bond and equity markets; • war or terrorist activities may cause further deterioration in the economy or cause instability in credit markets; • economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate; and • we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the SEC. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this report. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on Form 10-K for the year ended December 31, 2011, as well as Part II, Item 1A, Risk Factors, in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, for a description of some of the important factors that may affect actual outcomes.

3 2Q12 Results Summary Interest income on noncovered loans increased $1.9mm from 1Q12, based on strong organic loan growth Accretion income on covered loans of $32.2mm, increased $8.7mm from 1Q12 driven by an acceleration of cash flows relative to expectations Noninterest income was negatively impacted by $4.0mm of FDIC receivable amortization, down from $7.0mm in 1Q12 $22.4mm of noninterest expense in the quarter was down $787 thousand from 1Q12, primarily due to lower net costs of operations of other real estate owned Net income of $11.0mm in 2Q12, equates to diluted earnings per share of $.34 Income Statement Highlights 2Q12 Variance to: (dol lars in thousands , except per share data) 2Q12 1Q12 2Q11 Total interest income on invested funds $3,027 $22 $259 Interest income on noncovered loans, including fees 13,722 1,888 4,548 Accretion income on covered loans 32,191 8,701 7,052 Total interest expense 2,566 (286) (3,891) Net interest income 46,374 10,897 15,750 Provision for loan losses (noncovered loans) 2,125 590 532 Provision for loan losses (covered loans) 2,902 4,185 2,451 Net interest income after provision for loan losses 41,347 6,122 12,767 Total noninterest income (1,243) 2,535 (9,078) Total noninterest expense 22,426 (787) (668) Income before income taxes 17,678 9,444 4,357 Income tax expense 6,647 3,551 1,908 Net income $11,031 $5,893 $2,449 Diluted earnings per share .34 .18 .08 Balance Sheet Highlights Total noncovered loans $881,120 $78,165 $334,966 Total assets 2,670,229 (6,419) (96,052) Total noninterest-bearing deposits 343,214 30,247 87,127 Total deposits 2,165,136 (23,739) (194,294)

4 Continued Progress on Strategic Priorities Efficiency Funding Earning Assets Actively managing noninterest expense, which at $22.4mm in 2Q12, was down 3.4% from 1Q12 Announced the closure of 1 branch in 2Q12, which will bring total branches to 22, versus the 41 that were operated by acquired institutions Cost of funds was 47 bps at end of 2Q12, down 5 bps from 1Q12 and down 94 bps since 4Q10 Noninterest-bearing deposits grew 9.7% from 1Q12 and now make up 15.9% of total deposits Significant progress over the past 3 years replacing covered loans with noncovered organic loans Noncovered loans grew by $78.2mm in 2Q12 and now make up 56.2% of total gross loans (after a reclass, noncovered loan growth in 1Q12 was $101.9mm)

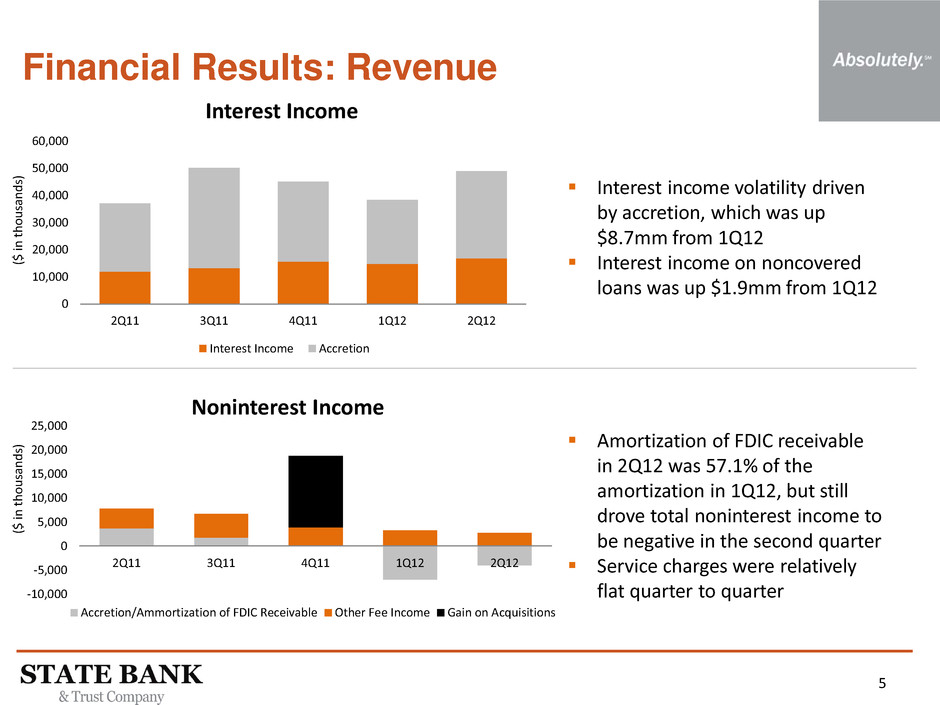

5 Financial Results: Revenue ($ in t ho us an ds ) Interest income volatility driven by accretion, which was up $8.7mm from 1Q12 Interest income on noncovered loans was up $1.9mm from 1Q12 ($ in t ho us an ds ) Amortization of FDIC receivable in 2Q12 was 57.1% of the amortization in 1Q12, but still drove total noninterest income to be negative in the second quarter Service charges were relatively flat quarter to quarter 0 10,000 20,000 30,000 40,000 50,000 60,000 2Q11 3Q11 4Q11 1Q12 2Q12 Interest Income Interest Income Accretion -10,000 -5,000 0 5,000 10,000 15,000 20,000 25,000 2Q11 3Q11 4Q11 1Q12 2Q12 Noninterest Income Accretion/Ammortization of FDIC Receivable Other Fee Income Gain on Acquisitions

6 Financial Results: Expense ($ in t ho us an ds ) 0 5,000 10,000 15,000 20,000 25,000 30,000 2Q11 3Q11 4Q11 1Q12 2Q12 Noninterest Expense Salary & Employee Benefits Other Noninterest Expense OREO Costs Total noninterest expense improved 3.4% compared to 1Q12, primarily from lower OREO costs, which were down $1.6mm Other noninterest expense increased slightly from 1Q12, as lower data processing expense was offset by higher legal and professional fees Ef fic ie nc y Ra ti o N IE /N on co ve re d Lo an s Efficiency ratio volatility driven by swings in the denominator Noninterest expense as a percent of noncovered loans improved to 2.5% 30 40 50 60 70 80 1.50 2.00 2.50 3.00 3.50 4.00 4.50 2Q11 3Q11 4Q11 1Q12 2Q12 Expense Metrics NIE/Noncovered Loans Efficiency Ratio % %

7 Financial Results: Yield and Funding 0 5 10 15 20 2Q11 3Q11 4Q11 1Q12 2Q12 Yield Yield on Total Earning Assets Yield on Covered Loans Yield on Noncovered Loans Yield on total earning assets of 9.34% benefited from the 2Q12 spike in accretion Yield on noncovered loans of 6.57% was up 15 bps in the quarter Progress in transforming our balance sheet resulted in an average cost of funds of 47 bps for 2Q12 DDAs increased 9.7% from 1Q12 to $343.2mm, reflecting traction in growing commercial relationship balances N on in te re st -B ea ri ng D ep os it s to T ot al D ep os it s Co st o f F un ds % % % 0.0 0.2 0.4 0.6 0.8 1.0 1.2 0 2 4 6 8 10 12 14 16 2Q11 3Q11 4Q11 1Q12 2Q12 Funding

8 Financial Results: Balance Sheet Ratios Loans to deposits ratio trend, up 14.8% since 2Q11, reflects progress effectively replacing covered assets with noncovered assets and the active management of funding cost Tier 1 Risk-Based Ratio at 31.45% benefits from 20% risk weighing on covered assets, but decreasing as those assets comprise less of the balance sheet Leverage ratio of 15.24% in 2Q12 provides significant optionality 40 50 60 70 80 2Q11 3Q11 4Q11 1Q12 2Q12 Loans/Deposits % 10 15 20 25 30 35 2Q11 3Q11 4Q11 1Q12 2Q12 Capital Tier 1 Risk-Based Ratio Leverage Ratio %

9 Credit: Loan Compostion and OREO ($ in t ho us an ds ) OREO balances decreased by $3.2mm from 1Q12 and are down $42.3mm from 2Q11 98.4% of OREO balances are covered 40,000 60,000 80,000 100,000 120,000 2Q11 3Q11 4Q11 1Q12 2Q12 OREO Covered Noncovered Commercial Real Estate 69% C&I 21% Residential Real Estate 5% Consumer and Other 5% Noncovered Loan Breakdown CRE comprises 69.3% of noncovered loans; however, within this portfolio there is significant diversification by industry, source of repayment and geography C&I remains an incredibly competitive asset class

10 Credit: Provision and Allowance ($ in t ho us an ds ) $2.1mm of loan loss provision for noncovered loans in 2Q12, commensurate with strong organic loan growth $2.9mm of loan loss provision for covered loans in 2Q12 NPLs to total noncovered loans stayed relatively stable with an uptick of 3 bps from 1Q12 Noncovered allowance to noncovered loans is at 1.51 bps, which is 3.4x noncovered NPLs -5,000 0 5,000 10,000 15,000 20,000 25,000 2Q11 3Q11 4Q11 1Q12 2Q12 Loan Loss Provision Provision for Noncovered Provision for Covered 0.2 0.6 1 1.4 1.8 2Q11 3Q11 4Q11 1Q12 2Q12 Noncovered Credit Ratios Noncovered Nonperforming Loans to Total Noncovered Loans Noncovered Allowance for Loan Losses (ALL) to Noncovered Loans %

11 Well Positioned Franchise Efficient Network in Attractive Markets Special Asset Expertise Mitigated Credit Risk Balance Sheet Strength Management Depth Scalable core banking operations in attractive markets A highly effective problem asset resolution business Capital levels to support organic and opportunistic growth Team with a track record of successful integrations and building long-term shareholder value Credit risk mitigated by covered assets and timing of when noncovered assets were generated (commencing July 2009)