Attached files

| file | filename |

|---|---|

| EX-99.1 - CONDENSED COSOLIDATED FINANCIAL STATEMENTS - DAKOTA PLAINS HOLDINGS, INC. | dakota123090_ex99-1.htm |

|

|

|

|

|

UNITED STATES |

||

|

SECURITIES AND EXCHANGE COMMISSION |

||

|

Washington, D.C. 20549 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 8-K/A |

||

| (Amendment No. 1) | ||

|

|

||

|

CURRENT REPORT |

||

|

|

||

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

||

|

|

|

March 22, 2012 |

|

Date of Report (Date of Earliest Event Reported) |

|

|

|

Dakota Plains Holdings, Inc. |

|

(Exact Name of Registrant as Specified in its Charter) |

|

|

|

|

|

|

|

Nevada |

|

000-53390 |

|

20-2543857 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

294 Grove Lane East |

|

|

|

Wayzata, Minnesota |

|

55391 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

|

(952) 473-9950 |

|

(Registrant’s Telephone Number, Including Area Code) |

|

|

|

MCT Holding Corporation |

|

4685 South Highland Drive, Suite 202 |

|

Salt Lake City, Utah 84117 |

|

(Former Name or Former Address, if Changed Since Last Report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

This Amendment No. 1 on Form 8-K/A amends the Current Report on Form 8-K filed by Dakota Plains Holdings, Inc. originally filed on March 24, 2012, (the “Original Filing”). This Amendment is being filed to (i) incorporate certain disclosures as a result of correspondence received from the Staff of the United States Securities and Exchange Commission. In accordance with Rule 12b-15 promulgated under the Securities Exchange Act of 1934, as amended, this Amendment includes the complete text of each item as amended. Except as described above, the Original Filing has not been materially amended, updated or otherwise modified. This Amendment does not reflect events occurring after the filing of the Original Filing. All other information remains unchanged and reflects the disclosures made at the original time of filing.

FORWARD-LOOKING STATEMENTS

This current report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this report. These factors include:

|

|

|

|

|

|

• |

price trends and overall demand for natural gas liquids (NGLs), refined petroleum products, oil, carbon dioxide, natural gas, electricity, coal, steel and other bulk materials and chemicals in North America, including the securing of necessary licenses and permits; |

|

|

|

|

|

|

• |

economic activity, weather, alternative energy sources, conservation and technological advances that may affect price trends and demand; |

|

|

|

|

|

|

• |

changes in tax laws; |

|

|

|

|

|

|

• |

our indebtedness, which could make us vulnerable to general adverse economic and industry conditions, limit our ability to borrow additional funds, and/or place us at competitive disadvantages compared to our competitors that have less debt or have other adverse consequences; |

|

|

|

|

|

|

• |

capital markets conditions, inflation and interest rates; |

|

|

|

|

|

|

• |

changes in the tariff rates charged by pipeline companies implemented by the FERC, the CPUC, Canada’s National Energy Board or another regulatory agency; |

|

|

|

|

|

|

• |

changes in laws or regulations, third-party relations and approvals, and decisions of courts, regulators and government bodies that may adversely affect our business or our ability to compete; |

|

|

|

|

|

|

• |

our ability to acquire new businesses and assets and integrate those operations into existing operations, as well as the ability to expand our facilities; |

|

|

|

|

|

|

• |

interruptions of electric power supply to our facilities due to natural disasters, power shortages, strikes, riots, terrorism, war or other causes; |

|

|

|

|

|

|

• |

difficulties or delays experienced by railroads, barges, trucks, ships or pipelines in delivering products to or from terminals or pipelines; |

|

|

|

|

|

|

• |

our ability to successfully identify and close acquisitions and make cost-saving changes in operations; |

|

|

|

|

|

|

• |

our ability to complete expansion projects on time and on budget; |

|

|

|

|

|

|

• |

shut-downs or cutbacks at major refineries, petrochemical or chemical plants, ports, utilities, military bases or other businesses that use our services or provide services or products to us; |

|

|

|

|

|

|

• |

crude oil and natural gas production from exploration and production areas that we serve, including the Parshall oil field and greater Williston Basin; |

i

|

|

|

|

|

|

|

|

|

|

• |

changes in accounting pronouncements that impact the measurement of our results of operations, the timing of when such measurements are to be made and recorded and the disclosures surrounding these activities; |

|

|

|

|

|

|

• |

our ability to offer and sell equity securities and debt securities or obtain debt financing in sufficient amounts to implement that portion of our business plan that contemplates growth through acquisitions of operating businesses and assets and expansions of our facilities; |

|

|

|

|

|

|

• |

our ability to obtain insurance coverage without significant levels of self-retention of risk; |

|

|

|

|

|

|

• |

acts of nature, sabotage, terrorism or other similar acts causing damage greater than our insurance coverage limits; |

|

|

|

|

|

|

• |

the political and economic stability of the oil producing nations of the world; |

|

|

|

|

|

|

• |

foreign exchange fluctuations; |

|

|

|

|

|

|

• |

national, international, regional and local economic, competitive and regulatory conditions and developments; |

|

|

|

|

|

|

• |

the timing and extent of changes in commodity prices for oil, natural gas, electricity and certain agricultural products; |

|

|

|

|

|

|

• |

the timing and success of our business development efforts; and |

|

|

|

|

|

|

• |

other risk factors included under “Risk Factors” in this report. |

You should read the matters described in “Risk Factors” and the other cautionary statements made in this report as being applicable to all related forward-looking statements wherever they appear in this report. We cannot assure you that the forward-looking statements in this report will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this report completely. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

JUMPSTART OUR BUSINESS STARTUPS ACT DISCLOSURE

Our company qualifies as an “emerging growth company,” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”), as amended by the Jumpstart Our Business Startups Act (the “JOBS Act”). An issuer qualifies as an “emerging growth company” if it has total annual gross revenues of less than $1.0 billion during its most recently completed fiscal year, and will continue to be deemed an emerging growth company until the earliest of:

| • | the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1.0 billion or more; |

| • | the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement; |

| • | the date on which the issuer has, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or |

| • | the date on which the issuer is deemed to be a “large accelerated filer,” as defined in Section 240.12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”). |

As an emerging growth company, we are exempt from various reporting requirements. Specifically, DP is exempt from the following provisions:

| • | Section 404(b) of the Sarbanes-Oxley Act of 2002, which requires evaluations and reporting related to an issuer’s internal controls; |

| • | Section 14A(a) of the Exchange Act, which requires an issuer to seek shareholder approval of the compensation of its executives not less frequently than once every three years; and |

| • | Section 14A(b) of the Exchange Act, which requires an issuer to seek shareholder approval of its so-called “golden parachute” compensation, or compensation upon termination of an employee’s employment. |

Under the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards that have different effective dates for public and private companies until such time as those standards apply to private companies. We has elected to use the extended transition period for complying with these new or revised accounting standards. Since we will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, our financial statements may not be comparable to the financial statements of companies that comply with public company effective dates. If we were to elect to comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act.

ii

|

|

|

|

Item 1.01 |

Entry into a Material Definitive Agreement. |

On March 22, 2012, Dakota Plains Holdings, Inc., formerly known as MCT Holding Corporation (“DP” or our “Company”), Dakota Plains, Inc., a Minnesota corporation engaged in the oil and gas transportation business (“Dakota Plains”), and DP Acquisition Corporation, a Minnesota corporation (“Merger Subsidiary”) entered into an Agreement and Plan of Merger (the “Merger Agreement”). Under the Merger Agreement, Merger Subsidiary merged with and into Dakota Plains (the “Initial Merger”), the separate corporate existence of Merger Subsidiary ceased, and Dakota Plains continued as the surviving corporation and as a wholly owned subsidiary of our Company. A copy of the Merger Agreement is filed as Exhibit 2.1 to this current report on Form 8-K and is incorporated by reference into this Item 1.01.

As of March 22, 2012, the issued and outstanding common stock of Dakota Plains before the Initial Merger was converted into the right to receive an aggregate of 37,014,018 shares of our Company’s common stock, all of which are “restricted securities” under Rule 144. Of those shares, 530,000 are restricted shares of our Company’s common stock issued under certain Employment Agreements in exchange for 530,000 shares of similarly restricted Dakota Plains’ common stock. In addition, the outstanding options issued by Dakota Plains before the Initial Merger were converted into options to purchase an aggregate of 250,000 shares of our Company’s common stock, the outstanding warrants issued by Dakota Plains before the Initial Merger were converted into warrants to purchase an aggregate of 4,150,000 shares of our Company’s common stock. The shareholders of our Company before the Initial Merger retained 640,200 shares of common stock, representing approximately 1.7% of our outstanding shares of common stock immediately after the Initial Merger.

As of March 23, 2012, Dakota Plains Holdings, Inc., the surviving corporation from the Initial Merger and then a wholly owned subsidiary of our Company, merged with and into MCT Holding Corporation (the “Second Merger”). Pursuant to the plan of merger governing the Second Merger, our Company changed its name from “MCT Holding Corporation” to “Dakota Plains Holdings, Inc.” A copy of the plan of merger is filed as Exhibit 2.2 to this current report on Form 8-K and is incorporated by reference into this Item 1.01.

Disposition of Certain Assets

On December 15, 2011, our Company formed MCT Distribution Incorporated, a Utah corporation, as its wholly-owned subsidiary. Effective the same day our Company assigned substantially all of its assets and liabilities related to those assets to MCT Distribution Incorporated. Under the terms of a Stock Purchase Agreement between our Company and Lindsey Hailstone dated March 23, 2012, we transferred all of our Company’s ownership interest in MCT Distribution to Ms. Hailstone effective as of the same date.

The assets transferred from our Company to MCT Distribution Incorporated (and related assumed liabilities) consisted almost entirely of the assets remaining in our Company relating to its prior tanning bed sales business (the “Prior Business”). The purpose of the disposition of the Prior Business was to enable management of our Company and MCT Distribution Incorporated to each focus on their respective, unrelated businesses, and will greatly simplify investor analysis of each respective company. The assets transferred to, and liabilities assumed by, MCT Distribution Incorporated in anticipation of the disposition is described in detail in the Stock Purchase Agreement.

The foregoing description of the Stock Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is filed as Exhibit 2.3 to this current report Form 8-K and incorporated by reference into this Item 1.01.

Under the terms of an Indemnification Agreement between our Company, on the one hand, and two existing MCT Holding Corporation shareholders, including our former President, on the other hand, Dakota Plains is, jointly and severally indemnified for up to an aggregate $2,000,000 in losses incurred by our Company as a result of any act or omission of MCT Holding Corporation prior to the effective time of the Initial Merger. The Indemnification Agreement is set to expire two years after the date of the Initial Merger. A copy of the Indemnification Agreement is filed as Exhibit 10.19 to this current report on Form 8-K and is incorporated by reference into this Item 1.01.

1

|

|

|

|

Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

BUSINESS

The predecessor to our Company was originally organized under the laws of the State of Utah on July 15, 2002 and merged with and into our Company, then named MCT Holding Corporation, for purposes of reincorporating under the laws of the State of Nevada in 2004. Our predecessor operated a tanning salon under the name “Malibu Club Tan” until March 2011, when it changed its primary business to tanning equipment sales. In December 2011, substantially all of the assets related to the tanning salon and tanning equipment sales businesses were transferred to MCT Distribution Incorporated, a wholly owned subsidiary of our Company. The information disclosed relating to the disposition and the prior business in Item 1.01 is incorporated herein by reference.

On March 22, 2012, DP Acquisition Corporation, a wholly-owned subsidiary of our Company, merged with and into Dakota Plains, a company engaged primarily in oil and gas transportation and marketing industries. Dakota Plains was originally incorporated under the laws of the State of Nevada in 2008 under the name Dakota Plains Transport, Inc. In June 2011, it merged with and into Dakota Plains, Inc., a Minnesota corporation. The description of the Initial Merger and Secondary Merger under Item 1.01 above is incorporated herein by reference.

In connection with the Initial Merger with Dakota Plains, our board of directors has resolved to focus our business on oil and gas transportation, marketing and related activities. Unless specifically stated otherwise, the remainder of the information set forth in this Item 2.01 relates to Dakota Plains.

Overview

Our Company is principally focused on developing and owning transloading facilities, marketing and transporting of crude oil and related products from and into the Williston Basin oil fields of North Dakota. We compete by providing our customers value-added benefits, including full-service transloading and storage capabilities, competitive pricing and geographic proximity to one of the most compelling oil plays in the industry.

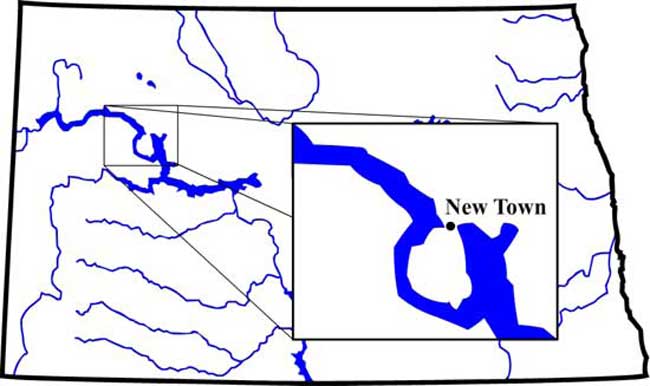

We currently have a transloading entity and a marketing entity. Our Company contracts with third parties for the delivery of crude oil and owns a strategically-located transloading facility in New Town, North Dakota, which provides a competitive means of transportation to end markets and reflects our expectation that Bakken crude oil and natural gas production will continue to grow for several years. The United States Geological Survey and the North Dakota Industrial Commission are predicting the Bakken’s production will increase for many years, with production not expected to plateau until 2022 to 2024.

Because current crude oil production in North Dakota exceeds existing pipeline takeaway capacity, we have adopted a crude by rail model. Current pipeline constraints are limiting the amount of crude takeaway from the Bakken oil fields. As such, rail transloading facilities are necessary to efficiently capture an increasing demand for transportation of supplies and product to and from the oil fields. Based on our expectations for increases in demand, we also have initiated investments in alternative means to support the loading, marketing and transporting of crude oil and related products to and from the Bakken oil fields, including owning or leasing railcars, storage tanks and other similar capital investments.

2

Crude Oil Transloading Business Segment

In 2009, we completed the acquisition and build-out of our New Town, North Dakota transloading facility, which is fully operational and consists of four rail tracks situated on approximately 27.46 acres serviced by Soo Line Railroad Company, doing business as Canadian Pacific. We extended the lengths of the rail tracks on our property during 2010 and completed excavation and grading sufficient to allow for the construction of two additional rail tracks. We then completed the construction of our third and fourth tracks in the summer of 2011. On December 29, 2011, we acquired an additional 40 acres of property adjacent to the existing facility. We now own approximately 67.46 contiguous acres in New Town, North Dakota accessible by rail.

New Town Transloading Facility

Our transloading facility is centrally located in Mountrail County, North Dakota, which continues to experience robust drilling activity in the Williston Basin. As of March 2012, the facility has capacity for 160 rail cars—over 100,000 barrels of crude oil—at any given time. Our facility transloaded 5.6 million barrels of crude oil in 2011, which translates into 8,705 rail tank cars and 25,327 truck semi-loads. In December 2011, our facility experienced its highest monthly volume when it transloaded 749,528 barrels of crude oil, for a daily average of 24,200 barrels and experienced a fourth quarter volume increase of 32% over its third quarter volume. We achieved a record at our facility on November 15, 2011, when it transloaded 35,996 barrels of crude oil in a single day. Our facility also transloaded more than 25,000 barrels of crude oil during eighteen separate days in October 2011, fourteen separate days in November 2011 and twelve separate days in December 2011. That amount of tank car capacity allows us to strategically service one 80-car unit train per day, which we hope to achieve in the second quarter of 2012.

New Town is centrally located in the heart of the Parshall Field in Mountrail County, North Dakota. Our property was formerly used to store piping for Amerada Hess and provides easy access to the railway via a spur that Canadian Pacific has constructed. Our facility became fully operational in 2009 and currently includes the following features:

|

|

|

|

|

|

• |

Private spur connecting the property to the Canadian Pacific Railway; |

|

|

|

|

|

|

• |

Four fully operational rail lines, each of which can service 40 cars (collectively 160 rail cars with capacity for approximately 100,000 barrels of oil) at any time; |

|

|

|

|

|

|

• |

Fully-enclosed electrical system between the existing tracks to provide maximum flexibility when powering transloading equipment; and |

|

|

|

|

|

|

• |

Sufficient undeveloped land providing the option to add new tracks, or various industrial use(s) to the facility at any time. |

3

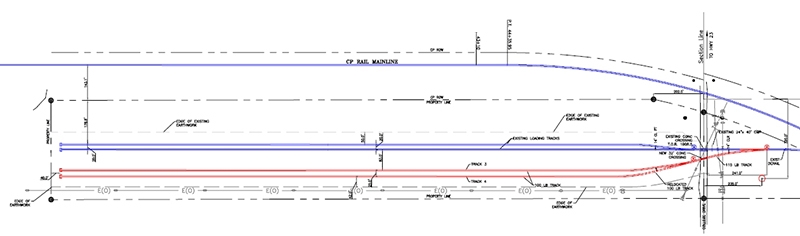

The following diagram illustrates the current layout of our transloading facility relative to the Canadian Pacific main line servicing our property. We designed the facility to be developed in multiple stages. The current facility has the capacity to transload and/or store up to 160 rail cars on-site per day, the equivalent of 100,000 plus barrels. The tracks identified in blue represent the initial two tracks constructed on our property. The tracks identified in red represent the third and fourth tracks completed in early 2011.

Engineering Diagram Depicting Transloading Facility at New Town, North Dakota.

Oil well operators currently are hauling crude oil via semi-truck as far away as 100 miles one way from New Town to various crude by rail facilities to load crude oil produced from wells located in the Parshall field onto railway systems at significant additional cost compared to the services offered by our transloading facility. In January 2012, North Dakota produced 546,000 barrels of oil per day. We estimate crude oil production within approximately a 75 mile radius to represent 80% of the volume, or over 435,000 barrels per day. One of the geographic advantages to our site is the Highway 23, Four Bears Bridge. The bridge represents the only means to cross Lake Sakakawea for approximately 90 miles in either direction.

4

The facility also can accommodate significant storage of tanker-trucks, drilling equipment and other oil exploration equipment. We continue to conceptualize future stages of expansion of the facility, which will be designed to increase tanker car traffic on-site.

New Town is located in Mountrail County, North Dakota, which continues to experience robust drilling activity in the Williston Basin. New Town is located at the entrance to a large peninsula in the heart of the Parshall oil field, and our transloading facility straddles the only road providing access to and from the peninsula. The peninsula is approximately 150 square miles of land, with 168 spacing units due to their water access to Lake Sakakawea. Three to seven drilling rigs have operated consistently on the peninsula throughout 2011, with current drilling activity focusing primarily on completing the first well in each spacing unit. Accordingly, the location constitutes the only position within the confines of the Parshall Field that was dedicated to hauling oil from that area in 2011.

Transloading Joint Venture

In November 2009, Dakota Plains entered into a joint venture with Petroleum Transport Solutions, LLC (“PTS”) pursuant to which it acquired 50% of the outstanding ownership interests of a newly formed entity, Dakota Petroleum Transport Solutions, LLC (the “transloading joint venture”), and PTS acquired the remaining 50% ownership interest. PTS is a wholly-owned subsidiary of Western Petroleum Company, which is itself a wholly-owned subsidiary of World Fuel Services Corporation. (“WFS”). In December 2011, Dakota Plains transferred its ownership interest in the transloading joint venture to a wholly owned subsidiary, Dakota Plains Transloading, LLC.

WFS is a global leader in the downstream marketing and financing of aviation, marine and ground transportation fuel products and related services. Through a team of local professionals in 48 countries, WFS delivers innovative fuel solutions and logistics at more than 6,000 locations around the world. WFS has been publicly held since 1986 and is traded on the NYSE under the stock symbol “INT”.

Western Petroleum was acquired by WFS due to their extensive history in the marketing and transportation of hydrocarbon and other products throughout the Midwest and other areas since 1969. Western Petroleum also has substantial experience with crude oil and petroleum product transloading. Western Petroleum, now a part of WFS’ Land Division, is headquartered in Minneapolis, Minnesota, and has regional offices throughout the Unites States. This Land division of WFS currently supplies over 2,000 customers with approximately 100,000 barrels per day of refined fuels, lubricants, and propane.

The terms of the joint venture require PTS to manage all aspects of the operations and logistics at our facility as well as provide rail cars and back office support to the project. The joint venture is required to pay Dakota Plains a monthly rental fee for use of our facility. After payment of this preferential fee to us as well as other operating expenses, we share all profits equally with PTS.

Our joint venture also requires that PTS and our Company assist the joint venture through their respective contacts with producers, marketers, transporters, refiners and other end-users. Under the terms of the joint venture agreement, both PTS and our Company and their affiliates are restricted from participating as an owner, investor, manager or consultant in any hydrocarbon transloading facility, anywhere in North Dakota, except through our joint venture. The joint venture has recently begun the marketing of crude oil for its own account through the marketing joint venture. We will continue to review and analyze other opportunities in order to expand our footprint in the Williston Basin’s crude oil market. We believe the vertical integration of this business line has the potential to provide for substantial profits as we continue to develop the business.

5

During 2010, the transloading joint venture entered into an agreement with UET Shipping, LLC (“UET”), a wholly-owned subsidiary of United Energy Corporation, regarding the transloading and storage of crude oil at our transloading facility. UET has transloaded crude oil through our transloading facility under contract commencing in August 2010 and transloaded a minimum of 12,500 barrels of crude oil per day through July 31, 2011. In July 2011, Dakota Petroleum Transport Solutions, LLC (DPTS) amended and restated its agreement with UET that extended their ability to utilize our facility through January 31, 2012. The extended term also incorporated a new volume commitment, based on the rail capacity allotted by the Canadian Pacific Railroad (“CP”). For the remainder of the contract term, UET was granted 60% of the rail volume committed by CP, with the marketing joint venture (discussed below) fulfilling the remaining 40% of the CP’s volume. In December 2011, the CP allotment was 25,500, which was shared 60% by UET and 40% by our marketing joint venture. The UET contract terminated effective January 31, 2012. The marketing joint venture intends to transload its maximum of 25,000 barrels per day at our transloading facility going forward. The marketing joint venture expects to gradually increase our volume to 50,000 barrels per day in 2012, utilizing a third party marketing firm that is currently being identified. While our existing transloading facility is capable of meeting the marketing joint venture’s plans for 2012, future arrangements with other marketing firms and operators may require additional expansion of our transloading facility.

Crude Oil Marketing Business Segment

Our marketing business segment is comprised of our wholly-owned subsidiary, Dakota Plains Marketing, LLC (“DPM”). In April 2011, DPM entered into a joint venture with Petroleum Transport Solutions (“PTS”) pursuant to which DPM acquired 50% of the outstanding ownership interests of a newly formed entity, DPTS Marketing LLC (the “marketing joint venture”), and PTS acquired the remaining 50% ownership interest.

In the context of the petroleum industry, “marketing” is the process of purchasing crude oil from the wellhead, or in the “field” and delivering it to the refinery. DPM and PTS and their affiliates, including our Company, Western Petroleum Company and WFS, are restricted from purchasing, selling, storing, transporting, or marketing crude oil or natural gas originating from production fields anywhere in North Dakota, except through the marketing joint venture.

The marketing joint venture began purchasing crude oil in July 2011 and ended that month with 56,192 barrels purchased. The joint venture ended 2011 with 1.2 million barrels of crude oil purchased, which equates to 1,902 rail tank cars and 5,535 truck semi-loads. The joint venture experienced a 99% increase in volume growth from the third quarter, when it purchased 407,725 barrels of crude oil as compared to the fourth quarter of 2011, when it purchased 810,045 barrels of crude oil.

Under the marketing joint venture’s member control agreement, PTS has agreed to manage the marketing of crude oil on behalf of the marketing joint venture. We share expenses and profits equally with PTS after payment by the marketing joint venture of a $0.08 per barrel trading fee and $0.0225 barrel accounting fee to PTS. All production marketed through the agreement will be concurrently hedged against fluctuations in commodity prices which we believe will substantially mitigate the market risks associated with the marketing of crude oil. We estimate the marketing joint venture will facilitate the marketing of approximately 25,000 barrels of crude oil per day by the end of the second quarter of 2012.

Gathering System Opportunity

The transloading and marketing joint ventures are constantly pursuing and considering other opportunities relating to the transportation of crude oil and related products within the Williston Basin. We anticipate investing in other ventures and assets in addition to our transloading and marketing businesses. In particular, our Company has been approached by several third parties interested in constructing a feeder pipeline, also known as a gathering system, to transport crude oil from wells directly to our transloading facility. A gathering system would allow us and our businesses to captivate a significant volume of crude oil for our transloading facility, because we anticipate it would be more cost-effective to transport crude oil through a gathering system pipeline than utilizing semi-truck tankers.

6

A gathering system would require that we construct storage tanks at our facility, in addition to other improvements. We believe constructing storage at our site would provide three primary benefits:

|

|

|

|

|

|

• |

Increased consistency of delivery timing and significantly reduced risk of weather impacting our ability to operate our transloading facility; |

|

|

|

|

|

|

• |

Increased demand for use of our transloading facility by parties considering gathering systems to enter our facility and trunk pipelines exiting our facility; and |

|

|

|

|

|

|

• |

Increased opportunity to capitalize upon short-term market conditions and other marketing opportunities. |

Though we continue to explore opportunities to work with third parties regarding the construction of a feeder pipeline, we have not established definitive plans to pursue such an opportunity nor is there any assurance that such a project will come to fruition in the future. If, however, a project were to be realized, we are not currently able to reasonably estimate the capital expenditures or sources of financing for the project.

Storage Business Opportunity

We currently expect to construct a permanent storage solution at our transloading facility. North Dakota’s crude by rail facilities collectively have the ability to store an aggregate of approximately 780,000 barrels of crude oil on site at the present time. However, approximately 1,825,000 barrels of additional storage capacity are being constructed or have been publicly announced. Accordingly, many of our competitors in that geographic region are constructing storage solutions at their facilities. We believe the purchase of the additional 40 acres adjacent to our original property will allow us to effectively implement our storage solution.

We have engaged an independent engineering firm with substantial experience designing and managing the building of storage solutions in the Williston Basin. Dakota Petroleum Transport Solutions, LLC, our indirectly owned subsidiary, recently agreed to proceed with the aforementioned engineering firm’s storage facility design. To that end, Dakota Petroleum Transport Solutions, LLC executed a letter of intent with the engineering firm pursuant to which a storage tank manufacturer has begun construction of a permanent storage facility. We anticipate that the construction of the storage facility will result in aggregate capital expenditures of approximately $7.0 million, which we expect will be funded exclusively through cash generated by the operations of Dakota Petroleum Transport Solutions, LLC.

Trucking Business Opportunity

During December 2011, the marketing joint venture was consistently transporting approximately 9,700 barrels per day of its own crude oil through our transloading facility. In the second quarter of 2012, we expect the marketing joint venture will market and, therefore, transport up to 25,000 barrels (or “bbls”) per day. In today’s environment, the marketing joint venture is contracting with third party trucking firms to haul its crude oil from the well head to our transloading facility in New Town.

We continue to evaluate the efficiencies and economics of purchasing an existing trucking firm, partnering with an existing trucking firm or starting a trucking firm.

Our Strengths

Low Overhead Business Model

Our transloading and marketing businesses are structured in a manner that minimizes overhead and leverages the experience and expertise of third-parties to identify and develop appropriate opportunities. We believe that most operational responsibilities can be handled by our current officers and through our joint venture with PTS, as well as the use of outside consultants.

7

Strategically Located

According to the US Geological Survey, or “USGS,” the Bakken Shale play in North Dakota and Montana has an estimated 3.0 to 4.3 billion barrels of undiscovered, technically recoverable oil. The Bakken Formation estimate is larger than all other current USGS oil assessments of the lower 48 states and is the largest “continuous” oil accumulation ever assessed by the USGS. While December 2011 daily oil production approximated 535,000 barrels, compared to approximately 344,000 barrels in December 2010, North Dakota officials estimate the state will produce approximately 700,000 barrels of oil per day within the next four to seven years. In addition, in December 2011 there were approximately 6,600 producing wells as compared to 5,400 in December 2010 with 202 wells currently being drilled in North Dakota.

Every horizontal drilling rig and well site in the Bakken consumes numerous railcars of inbound products each month. With several thousand drilling locations within 15 miles of our facility, we believe we have the opportunity to steadily grow our business from within and the flexibility to constantly pursue accretive investment opportunities. We anticipate investing in other ventures and assets in addition to our transloading facility, which will allow us to capture more volume from operators and marketers by making their crude oil transportation more cost-effective. In the current price environment, rail is approximately four times more fuel efficient than trucks. We estimate crude oil production to be at approximately 120,000 barrels per day within a 75-mile radius of our facility and expect production to grow to over 200,000 barrels per day over the next 18 months.

Significant volume growth

We believe that our deep market knowledge and strategic position will enable us to benefit from growth opportunities in the Bakken transloading market by increasing current volumes of business with existing clients and building new relationships with leading local producers. We are currently negotiating relationships with other parties, including an operator that controls more than 50% of the current crude oil production within a 10-mile radius of our facility and crude oil marketing firms. As such, we have sufficient unused capacity at our facility to significantly expand our current operations.

Continue to grow operating profitability

We remain focused on profitable growth. By maintaining our focus on providing greater value to our customers, gaining contracts from leading producers and efficiently managing costs through our non-operated, low overhead business model, we believe we can continue to generate positive returns on invested funds. As Williston Basin production continues to increase over the next several years, we expect that management’s focus on growing our market position by exploiting our strong geographic positioning will allow for our Company’s expansion and ability to meet the diverse crude oil transportation needs of our customers.

Our Customers

Previously, a significant portion of the income generated from the transloading joint venture originated from one customer. Our contract with this customer expired on January 31, 2012. With DPTS Marketing initiating operations in July of 2011, our customer accounted for 60% of the DPTS transloading joint venture’s income with the remaining 40% of the income generated from DPTS Marketing. We have experienced minimum disruption in our business with the loss of UET as a customer. DPTS Marketing has been able to secure the volume of oil necessary to offset the loss of volume from that former customer. We currently do not have any long-term contracts with our major customers. A reduction in or termination of our services by any major customer could have a material adverse effect on our business and operating results.

Competition

The transportation industry is highly competitive. Other companies have recently acquired and constructed transloading facilities to compete with our Company. This competition is expected to become increasingly intense as the demand to transport crude oil in North Dakota has risen in recent years. We intend initially to focus on transporting crude oil through the Canadian Pacific system. We will also compete directly with other parties transporting crude oil using Canadian Pacific, the Burlington Northern Railway, various trucking and similar concerns, the Enbridge pipeline and any other pipelines that are constructed and operated in North Dakota.

8

Twelve crude by rail sites are currently operational that could handle approximately 455,000 bbls in the aggregate, with another five sites under construction or publicly announced that could add approximately 385,000 bbls. Hess in Tioga, EOG in Stanley, Musket Corporation in Dore and Bakken Oil Express in Dickinson are the four of the largest facilities currently operational with COLT in Epping and Savage in Trenton coming on line in the next few quarters. At full capacity, we believe their sites represent an additional 480,000 bbls per day in consistent take away volume. They also represent at least 1,620,000 bbls in on-site storage. The Bakken Oil Express, the largest player as of March 2012, is capable of moving approximately 100,000 bbls per day with 210,000 bbls in on-site storage. With Hess and EOG handling a great majority of their own oil, the COLT, Savage and Bakken Oil Express sites are our new competition. Of those, the nearest one, COLT in Epping, is in excess of 80 miles one way. US Development also built a crude by rail facility in Mountrail County, and is our closest crude by rail competitor. The wells we are targeting are all within the peninsula or within a fifteen mile radius outside the peninsula. While the new sites will definitely change the landscape, we believe the economics of the total solution will still allow us to be competitive and capture as much of the volume in the target geography, as our site can support.

Additionally, other transportation companies may compete with us from time to time in obtaining capital from investors or in funding joint ventures with our prospective partners. Competitors include a variety of potential investors and larger companies, which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. If we are unable to compete effectively or adequately respond to competitive pressures, this inability may materially adversely affect our results of operation and financial condition.

Regulatory and Compliance Matters

Our operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. Changes to or limits on carbon dioxide emissions could result in significant capital expenditures to comply with these regulations with respect to our equipment, vehicles and machinery. Emission regulations could also adversely affect fuel efficiency and increase operating costs. Further, permit requirements or concerns regarding emissions and other forms of pollution could inhibit our ability to build facilities in strategic locations to facilitate growth and efficient operations. Environmental liability can extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by our subsidiaries. An accidental release of hazardous materials could result in a significant loss of life and extensive property damage. In addition, insurance premiums charged for some or all of the coverage currently maintained by our Company could increase dramatically or certain coverage may not be available to our Company in the future if there is a catastrophic event related to transportation of hazardous materials. Our Company could incur significant expenses to investigate and remediate environmental contamination and maintain compliance with licensing or permitting requirements related to the foregoing, any of which could adversely affect our operating results, financial condition or liquidity.

Employees

We currently have three full time employees, our Chief Executive Officer, President and Secretary, our Chief Financial Officer and Treasurer and our Vice President of Finance. We may hire additional employees to support the growth of our business. We believe that most operational responsibilities can be handled by our current employees and through our joint ventures with PTS, as well as the use of independent consultants. We are using and will continue to use the services of independent consultants and contractors to perform various professional services. We believe that this use of third-party service providers enhances our ability to minimize general and administrative expenses.

9

Legal Proceedings

We are not currently party to any material legal proceedings. From time to time, we may be named as a defendant in legal actions arising from our normal business activities. We believe that we have obtained adequate insurance coverage or rights to indemnification in connection with potential legal proceedings that may arise.

RISK FACTORS

Investing in our common stock involves risks. You should carefully consider the risks described below, in addition to the other information contained in this report, before investing in our common stock. Realization of any of the following risks, or adverse results from any matter listed under “Information Regarding Forward-Looking Statements,” could have a material adverse effect on our business, financial condition, cash flows and results of operations and could result in a decline in the trading price of our common stock. You might lose all or part of your investment. This report also contains forward-looking statements, estimates and projections that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements, estimates and projections as a result of specific factors, including the risks described below.

Risks Related to Our Business

We are a company with limited operating history for you to evaluate our business.

Dakota Plains’ successor was incorporated under the laws of Nevada on November 13, 2008, and has engaged in limited business operations. We are engaged in the business of developing a transloading facility and other means to support the loading, marketing and transporting of crude oil and related products from and into the North Dakota Williston Basin oil fields. We have limited operating history for you to consider in evaluating our business and prospects. As such, it is difficult for potential investors to evaluate our business.

Dakota Plains experienced negative cash flows for its operating and investing activities during 2011, primarily due to the infrastructure investment required to purchase additional land near New Town, North Dakota and the expenses related to the expansion of the transloading facility. In addition, our Company funded the initial member preferred contribution of $10,000,000 required by each member of the DPTS marketing joint venture, to support the trading activities. Dakota Plains’ financing cash flows were positive due to the proceeds from the equity and promissory notes issuances. Dakota Plains’ net cash flow for 2011 was $1,178,375. In 2010, Dakota Plains’ operating and financing cash flows were positive, while investing cash flows were negative, resulting in a net negative cash flow of $85,299.

Our operations are subject to all of the risks, difficulties, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to the transportation and oil industries. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

Our business is speculative and dependent upon the implementation of our business plan and our ability to enter into agreements with third parties for transloading, marketing and the leasing of our facility on terms that will be commercially viable for us. Our dependence on third-parties will also create significant risks that such third-parties may not fulfill their obligations under appropriate contracts and arrangements or may not be sufficiently staffed or funded to properly fulfill such obligations consistent with our needs and expectations.

10

Our lack of diversification increases the risk of an investment in our Company, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business has initially focused on a single rail car transloading facility in New Town, North Dakota. Since its inception, Dakota Plains had focused solely on generating income through transloading at the facility. We are now generating income from our marketing joint venture. We intend to continue to pursue additional business lines, including the transporting of crude oil and related products from and into the Williston Basin oil fields. Our ability to diversify our investments will depend on our access to additional capital and financing sources and the availability of real property and other assets required to allow us to load, market and transport crude oil and related products.

Larger companies have the ability to manage their risk by diversification. However, we will lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting the transportation and crude oil industries or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to successfully operate our transloading facility depends on developing and maintaining close working relationships with industry participants and on our ability to select and evaluate suitable business arrangements and to consummate transactions in a highly competitive environment. These realities are subject to change and may impair our ability to grow.

We are dependent on independent third parties to provide truck, rail and transloading services and to report certain events to us including delivery information. We may not own or control the transportation assets that deliver our customer’s products and we do not expect to employ the people directly involved in transloading products.

Dakota Plains entered into the transloading joint venture with PTS, a subsidiary of Western Petroleum of Eden Prairie, Minnesota, in November 2009. Western Petroleum was subsequently purchased by WFS in October 2010. Under the terms of the transloading joint venture, PTS is responsible for managing the day-to-day transloading operations of our New Town facility. PTS also maintain the books and records associated with the facility. Because the transloading and marketing joint ventures are our primary means for generating income, we are highly dependent on the personnel and resources of PTS to successfully execute our business plan. Our ability to successfully maintain our relationship with PTS depends on a variety of factors, many of which will be entirely outside our control. We may not be able to establish this and other strategic relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

Our reliance on PTS and other third parties could cause delays in reporting certain events, including recognizing revenue and claims. If we are unable to secure sufficient equipment or other transportation services to meet our commitments to our customers, our operating results could be materially and adversely affected, and our customers could switch to our competitors temporarily or permanently. Many of these risks include:

|

|

|

|

• |

equipment shortages in the transportation industry, particularly among rail carriers and parties that lease rail cars transporting crude oil products; |

|

|

|

|

• |

potential accounting disagreements with PTS; |

|

|

|

|

• |

potential substantial additional capital improvements required to maintain facility; |

|

|

|

|

• |

interruptions in service or stoppages in transportation as a result of labor or other issues; |

|

|

|

|

• |

Canadian Pacific’s capacity constraints; |

|

|

|

|

• |

competing facilities being constructed in close proximity; |

|

|

|

|

• |

impact of weather at origin (e.g. snow, flooding, cold temperatures) on all operations; |

|

|

|

|

• |

impact of weather at destinations (e.g. hurricanes, tornadoes, flooding); |

|

|

|

|

• |

congestion at offloading sites; |

11

|

|

|

|

• |

inadequate storage facilities; |

|

|

|

|

• |

changes in regulations impacting transportation; and |

|

|

|

|

• |

unanticipated changes in transportation rates. |

Competition for the loading, marketing and transporting of crude oil and related products may impair our business.

The transportation industry is highly competitive. Other companies have recently acquired and constructed transloading facilities to compete with our Company. This competition is expected to become increasingly intense as the demand to transport crude oil in North Dakota has risen in recent years. We intend initially to focus on transporting crude oil through the Canadian Pacific system. We will also compete directly with other parties transporting crude oil using Canadian Pacific, the Burlington Northern Railway, various trucking and similar concerns, the Enbridge pipeline and any other pipelines that are constructed and operated in North Dakota. Any material increase in the capacity and quality of these alternative methods or the passage of legislation granting greater latitude to them could have an adverse effect on our results of operations, financial condition or liquidity. In addition, a failure to provide the level of service required by our customers could result in loss of business to competitors. Our ability to defend, maintain or increase prices for our products and services is in part dependent on the industry’s capacity relative to customer demand, and on our ability to differentiate the value delivered by our products and services from our competitors’ products and services.

Additionally, other transportation companies may compete with us from time to time in obtaining capital from investors or in funding joint ventures with our prospective partners. Competitors include a variety of potential investors and larger companies, which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. If we are unable to compete effectively or adequately respond to competitive pressures, this inability may materially adversely affect our results of operation and financial condition.

We may be unable to obtain additional capital that we will require to implement our business plan, which could restrict our ability to grow.

We expect that our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital, and the income generated from our initial operations alone may not be sufficient to fund our expected continuing opportunities. We likely will require additional capital to continue to operate our business beyond our current opportunities.

Future facility expansions, acquisitions and capital expenditures, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow. There is no guarantee that we will be able to raise any required additional capital or generate sufficient cash flow from our current and proposed operations to fund our ongoing business.

We may pursue sources of additional capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources may not be sufficient to fund our operations going forward.

12

Future arrangements with other crude marketing firms and operators will require us to expand our facility to meet the logistical and storage needs that accompany larger throughput commitments. Any additional capital raised through the sale of equity may dilute the ownership percentage of our shareholders. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. Given the attractive return profiles of our potential customer arrangements, we expect that any additional capital required to fulfill our transloading commitments would be funded through one or more debt instruments to minimize dilution to existing shareholders. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets (both generally and in the oil industry in particular), our status as a new enterprise without a significant demonstrated operating history, the single location near New Town, North Dakota that we are initially operating (which limits our ability to diversify our activities) and/or the loss of key management. Further, if oil and/or natural gas prices or the commodities markets experience significant volatility or stagnation, such market conditions will likely adversely impact our income by decreasing demand for our services and simultaneously increasing our requirements for capital. If the amount of capital we are able to raise from financing activities, together with our income from operations, is not sufficient to satisfy our capital needs (even to the extent that we reduce our operations), we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which may adversely impact our financial condition.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy envisions expanding our business. If we fail to effectively manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

|

|

|

|

|

|

• |

meet our capital needs; |

|

|

|

|

|

|

• |

expand our systems effectively or efficiently or in a timely manner; |

|

|

|

|

|

|

• |

allocate our human resources optimally; |

|

|

|

|

|

|

• |

identify and hire qualified employees or retain valued employees; or |

|

|

|

|

|

|

• |

incorporate effectively the components of any business that we may acquire in our effort to achieve growth. |

If we are unable to manage our growth, our operations and our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact our business.

13

Our success depends on the ability of our management, employees and joint venture partner to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We will seek to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act.

Under the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards that have different effective dates for public and private companies until such time as those standards apply to private companies. We have elected to use the extended transition period for complying with these new or revised accounting standards. Since we will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, our financial statements may not be comparable to the financial statements of companies that comply with public company effective dates. If we were to elect to comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act.

Risks Related to Our Industry

Building and operating a transloading facility is risky and may not be commercially successful, and the advanced technologies we use cannot eliminate competition and environmental risk, which could impair our ability to generate income from our operations.

Our future success will depend initially on our success in expanding and operating our New Town, North Dakota transloading facility. We will be almost entirely dependent on the demand to transport crude oil from wells in relatively close proximity to New Town.

Our ability to generate a return on our investments, income and our resulting financial performance are significantly affected by the prices oil exploration and production companies receive for crude oil produced from their wells.

Especially in recent years, the prices at which crude oil trade in the open market have experienced significant volatility, including the recent expansion of the West Texas Intermediate and Brent spread, and will likely continue to fluctuate in the foreseeable future due to a variety of influences including, but not limited to, the following:

|

|

|

|

|

|

• |

domestic and foreign demand for crude oil by both refineries and end users; |

|

|

|

|

|

|

• |

the introduction of alternative forms of fuel to replace or compete with crude oil; |

|

|

|

|

|

|

• |

domestic and foreign reserves and supply of crude oil; |

|

|

|

|

|

|

• |

competitive measures implemented by our competitors and domestic and foreign governmental bodies; |

|

|

|

|

|

|

• |

political climates in nations that traditionally produce and export significant quantities of crude oil (including military and other conflicts in the Middle East and surrounding geographic region) and regulations and tariffs imposed by exporting and importing nations; |

|

|

|

|

|

|

• |

weather conditions; and |

|

|

|

|

|

|

• |

domestic and foreign economic volatility and stability. |

14

Demand for oil is subject to factors beyond our control, which may adversely affect our operating results. Changes in the global economy, changes in the ability of our customers to access equity or credit markets and volatility in oil prices could impact our customers’ spending levels and our revenues and operating results.

The past slowdown in global economic growth and recession in the developed economies resulted in reduced demand for oil, increased spare productive capacity and lower energy prices. Weakness or deterioration of the global economy or credit market could reduce our customers’ spending levels and reduce our revenues and operating results. Incremental weakness in global economic activity will reduce demand for oil and result in lower oil prices. Incremental strength in global economic activity will create more demand for oil and support higher oil prices. In addition, demand for oil could be impacted by environmental regulation, including “cap and trade” legislation, carbon taxes and the cost for carbon capture and sequestration related regulations.

Volatility in oil prices can also impact our customers’ activity levels and spending for our products and services. Current energy prices are important contributors to cash flow for our customers and their ability to fund exploration and development activities. Expectations about future prices and price volatility are important for determining future spending levels.

Lower oil prices generally lead to decreased spending by our joint venture customers. While higher oil prices generally lead to increased spending by our joint venture customers, sustained high energy prices can be an impediment to economic growth, and can therefore negatively impact spending by our customers. Any of these factors could affect the demand for oil and could have a material adverse effect on our results of operations. Prolonged periods of low crude oil prices could cause oil exploration and production to become economically unfeasible. Decreased drilling and/or production activities by oil exploration and production companies could reduce demand for transportation of crude oil and adversely impact our business. A decrease in crude oil prices could also adversely impact our ability to raise additional capital to pursue future diversification and expansion activities.

Our inability to obtain necessary facilities could hamper our operations.

Transporting crude oil and related products is dependent on the availability of real estate adjacent to railway and roadways, construction materials and contractors, transloading equipment, transportation methods, power and technical support in the particular areas where these activities will be conducted, and our access to these facilities may be limited. Demand for such limited real estate, equipment, construction materials and contractors or access restrictions may affect the availability of such real estate and equipment to us and may delay our business activities. The pricing and grading of appropriate real estate may also be unpredictable and we may be required to make efforts to upgrade and standardize our facilities, which may entail unanticipated costs and delays. Shortages and/or the unavailability of necessary construction materials, contractors and equipment will impair our activities, either by delaying our activities, increasing our costs or otherwise.

We may have difficulty obtaining crude oil to transport, which could harm our financial condition.

In order to transport crude oil, we depend on our ability and the ability of marketing partners to purchase production from well operators. We also rely on local infrastructure and the availability of transportation for storage and shipment of oil to our facility, but infrastructure development and storage and transportation facilities may be insufficient for our needs at commercially acceptable terms in the localities in which we operate. Well operators may also determine to utilize one or more of our competitors for any of a variety of reasons, and any lack of demand for us of our transloading facility and related services would be particularly problematic.

Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we operate, or labor disputes may impair the distribution of oil and/or natural gas and in turn diminish our financial condition or ability to maintain our operations.

Supplies of crude oil are subject to factors beyond our control, which may adversely affect our operating results.

Productive capacity for oil is dependent on our customers’ decisions to develop and produce oil reserves. The ability to produce oil can be affected by the number and productivity of new wells drilled and completed, as well as the rate of production and resulting depletion of existing wells. Advanced technologies, such as horizontal drilling and hydraulic fracturing, improve total recovery but also result in a more rapid production decline.

15

Increases in our operating expenses will impact our operating results and financial condition.

Real estate acquisition, construction and regulatory compliance costs (including taxes) will substantially impact the net income we derive from the crude oil that we transport. These costs are subject to fluctuations and variation in different locales in which we will operate, and we may not be able to predict or control these costs. If these costs exceed our expectations, this may adversely affect our results of operations. In addition, we may not be able to earn net income at our predicted levels, which may impact our ability to satisfy our obligations.

A downturn in the economy or change in government policy could negatively impact demand for our services.

Significant, extended negative changes in economic conditions that impact the producers and consumers of the commodities transported by our Company may have an adverse effect on our operating results, financial condition or liquidity. In addition, changes in United States and foreign government policies could change the economic environment and affect demand for our services. For example, changes in clean air laws or regulation promoting alternative fuels could reduce the demand for petroleum. Also, United States and foreign government agriculture tariffs or subsidies could affect the demand for petroleum.

Penalties we may incur could impair our business.

Failure to comply with government regulations could subject us to administrative, civil or criminal penalties, could require us to forfeit property rights, and may affect the value of our assets. We may also be required to take corrective actions, such as installing additional equipment or taking other actions, each of which could require us to make substantial capital expenditures. We could also be required to indemnify our third-party contractors, joint venture partners and employees in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

Our Company and the industry in which it operates are subject to stringent environmental laws and regulations, which may impose significant costs on its business operations.

Our Company’s operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. Changes to or limits on carbon dioxide emissions could result in significant capital expenditures to comply with these regulations with respect to our equipment, vehicles and machinery. Emission regulations could also adversely affect fuel efficiency and increase operating costs. Further, permit requirements or concerns regarding emissions and other forms of pollution could inhibit our ability to build or operate our facilities in strategic locations to facilitate growth and efficient operations. Environmental liability can extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by our subsidiaries. Environmental liabilities may arise from claims asserted by adjacent landowners or other third parties in toxic tort litigation. An accidental release of hazardous materials could result in a significant loss of life and extensive property damage. In addition, insurance premiums charged for some or all of the coverage currently maintained by our Company could increase dramatically or certain coverage may not be available to us in the future if there is a catastrophic event related to transportation of hazardous materials. Our Company could incur significant expenses to investigate and remediate environmental contamination and maintain compliance with licensing or permitting requirements related to the foregoing, any of which could adversely affect our operating results, financial condition or liquidity.

16

Our insurance may be inadequate to cover liabilities we may incur.

Our involvement in the transportation of oil and related products may result in us becoming subject to liability for pollution, property damage, personal injury, death or other hazards. Although we expect to obtain insurance in accordance with industry standards to address such risks and will attempt to require third-parties operating our facilities to indemnify us for such risks, such insurance and indemnification has limitations on liability that may not be sufficient to cover the full extent of such liabilities. In addition, such risks may not, in all circumstances, be insurable or, in certain circumstances, we may choose not to obtain insurance to protect against specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to us. If we suffer a significant event or occurrence that is not fully insured, or if the insurer of such event is not solvent, we could be required to divert funds from capital investment or other uses towards covering our liability for such events, and we may not be able to continue to obtain insurance on commercially reasonable terms.

Our business will suffer if we cannot obtain or maintain necessary licenses.