Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STANLEY BLACK & DECKER, INC. | d385108d8k.htm |

| EX-99.1 - PRESS RELEASE - STANLEY BLACK & DECKER, INC. | d385108dex991.htm |

Exhibit 99.2

ACQUISITION OF INFASTECH

July 24, 2012

Cautionary Statements

Stanley Black & Decker makes forward-looking statements in this presentation which represent its expectations or beliefs about future events and financial performance. Forward-looking statements are identifiable by words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “may” and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Forward looking statements made in this presentation, include, but are not limited to, statements concerning: the expected timetable for consummation of the acquisition; Infastech’s business complementing and expanding Stanley Black and Decker’s existing operations and international presence; cost savings; accretion to earnings and other potential benefits; synergy expectations and earnings per share.

You are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are not guarantees of future events and involve risks, uncertainties and other known and unknown factors that may cause actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements, including, but not limited to, the failure to consummate, or a delay in the consummation of, the transaction for various reasons.

Forward-looking statements made herein are also subject to risks and uncertainties, described in: Stanley’s 2011 Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q; the press release accompanying this presentation; and other filings the Company makes with the Securities and Exchange Commission. In addition, actual results could differ materially from those suggested by the forward-looking statements, and therefore you should not place undue reliance on the forward-looking statements. The Company makes no commitment to revise or update any forward-looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statement.

2

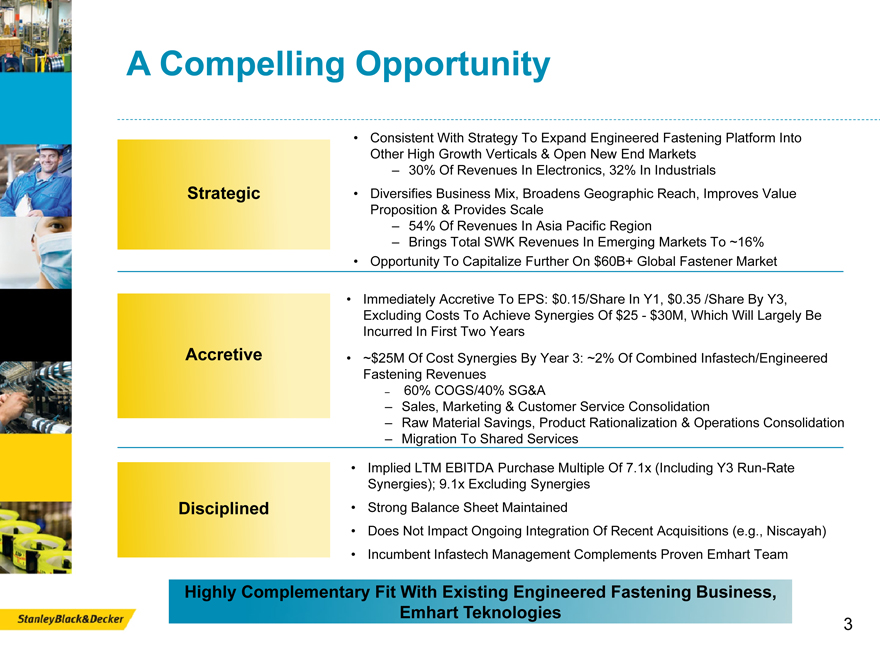

A Compelling Opportunity

Strategic

Consistent With Strategy To Expand Engineered Fastening Platform Into Other High Growth Verticals & Open New End Markets

30% Of Revenues In Electronics, 32% In Industrials

Diversifies Business Mix, Broadens Geographic Reach, Improves Value Proposition & Provides Scale

54% Of Revenues In Asia Pacific Region

Brings Total SWK Revenues In Emerging Markets To ~16%

Opportunity To Capitalize Further On $60B+ Global Fastener Market

Accretive

Immediately Accretive To EPS: $0.15/Share In Y1, $0.35 /Share By Y3, Excluding Costs To Achieve Synergies Of $25—$30M, Which Will Largely Be Incurred In First Two Years

$25M Of Cost Synergies By Year 3: ~2% Of Combined Infastech/Engineered

Fastening Revenues

60% COGS/40% SG&A

Sales, Marketing & Customer Service Consolidation

Raw Material Savings, Product Rationalization & Operations Consolidation

Migration To Shared Services

Disciplined

Implied LTM EBITDA Purchase Multiple Of 7.1x (Including Y3 Run-Rate Synergies); 9.1x Excluding Synergies

Strong Balance Sheet Maintained

Does Not Impact Ongoing Integration Of Recent Acquisitions (e.g., Niscayah)

Incumbent Infastech Management Complements Proven Emhart Team

Highly Complementary Fit With Existing Engineered Fastening Business, Emhart Teknologies

3

Transaction Details

Acquisition Of Infastech Establishes Stanley Black & Decker As A Global Leader Of Specialty Engineered Fasteners…

Infastech Overview

• Headquartered In Hong Kong, Infastech Is An Asia Centric Global Manufacturer And Distributor Of Specialty Engineered Fastening Technologies For Electronic, Automotive And General Industry OEM’s

• 2011 Revenues Of ~$500M (17.0% Growth YOY) And EBITDA Of ~$90M (~18% Margin)

• Formed By The Combination Of The Global Electronics & Commercial (“GEC”) And Avdel Fastener Businesses From Acument Global Technologies In 2010

History Of Dialogue/ Transaction

In April 2012, Infastech’s Owners Initiated An Auction Process To Sell The Company

Purchase Price

• USD$850M

Timing

• Subject To Customary Closing Conditions, Including Regulatory Approvals

• Transaction Is Expected To Close In 4Q’12

… And The Engineered Fastening Platform Becomes The First Of SWK’s Recently Identified New Growth Platforms To Achieve Its Mid-Decade Goal Of $1—$2B In Revenue

4

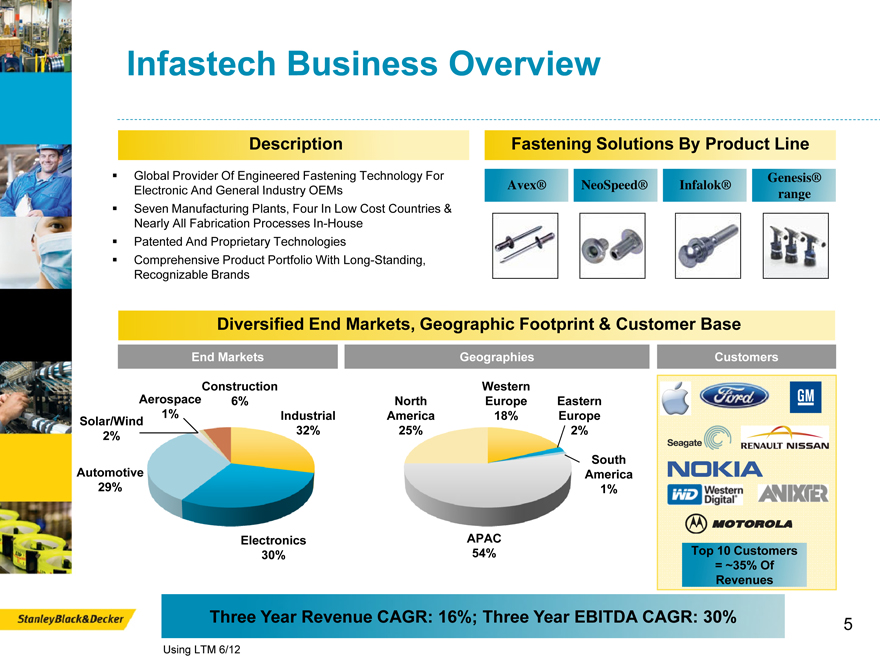

Infastech Business Overview

Description

Global Provider Of Engineered Fastening Technology For

Electronic And General Industry OEMs

Seven Manufacturing Plants, Four In Low Cost Countries & Nearly All Fabrication Processes In-House Patented And Proprietary Technologies Comprehensive Product Portfolio With Long-Standing, Recognizable Brands

Fastening Solutions By Product Line

Avex®

NeoSpeed®

Infalok®

Genesis® range

Diversified End Markets, Geographic Footprint & Customer Base

End Markets

Construction 6%

Aerospace 1%

Solar/Wind 2%

Automotive 29%

Industrial 32%

Electronics 30%

Geographies

North America 25%

Western Europe 18%

Eastern Europe 2%

South America 1%

APAC 54%

Customers

Three Year Revenue CAGR: 16%; Three Year EBITDA CAGR: 30%

Top 10 Cutomers = -35% Of Revenues

Using LTM 6/12

5

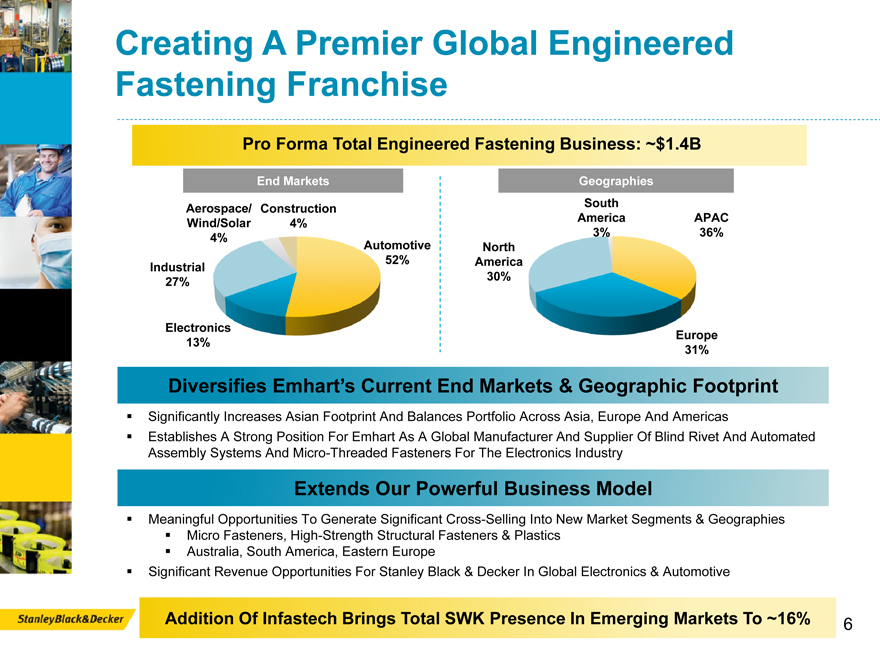

Creating A Premier Global Engineered Fastening Franchise

Pro Forma Total Engineered Fastening Business: ~$1.4B

End Markets

Aerospace/ Wind/Solar 4%

Construction 4%

Automotive 52%

Industrial 27%

Electronics 13%

Geographies

South America 3%

APAC 36%

North America 30%

Europe 31%

Diversifies Emhart’s Current End Markets & Geographic Footprint

Significantly Increases Asian Footprint And Balances Portfolio Across Asia, Europe And Americas

Establishes A Strong Position For Emhart As A Global Manufacturer And Supplier Of Blind Rivet And Automated Assembly Systems And Micro-Threaded Fasteners For The Electronics Industry

Extends Our Powerful Business Model

Meaningful Opportunities To Generate Significant Cross-Selling Into New Market Segments & Geographies Micro Fasteners, High-Strength Structural Fasteners & Plastics Australia, South America, Eastern Europe Significant Revenue Opportunities For Stanley Black & Decker In Global Electronics & Automotive

Addition Of Infastech Brings Total SWK Presence In Emerging Markets To ~16%

| 6 |

|

Summary

Acquisition Of Infastech Establishes Stanley Black & Decker As A Global Leader Of Specialty Fasteners…

Compelling, Strategic, Accretive Transaction

• Increases Scale, Expands Presence In Emerging Markets & Opens New End Markets

• $0.35 Of EPS Accretion By Year 3*

Excellent Fit With Vision To Expand Further Into High Growth, High Margin Businesses

• Double-Digit Revenue & EBITDA Growth Track Record

Clear Synergy Opportunity: ~$25M By Year 3; High Level Of Confidence Given SWK’s Strong Global Integration Track Record

• Complementary Fit With Current $900M Emhart Engineered Fastening Business

Opportunity To Implement The Stanley Fulfillment System To Drive Greater Efficiencies

…In The High Growth $60B+ Global Fastener Market

*Before Costs To Achieve Of $25-$30M

| 7 |

|

ACQUISITION OF INFASTECH

July 24, 2012