UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 4

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 14, 2011

DISCOVERY GOLD CORPORATION

(Exact name of registrant as specified in its charter)|

Nevada

|

333-167284

|

27-2616571

|

||

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

||

|

of Incorporation)

|

Identification Number)

|

|||

|

2817 NE 32 Street, #201

Fort Lauderdale, FL 33306

|

||||

|

(Address of principal executive offices)

|

||||

|

(954)683-3766

|

||||

|

(Registrant’s Telephone Number)

|

with a copy to:

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, NY

Telephone: (212)930-9700

Fax: (212)930-9725

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

We are filing this Amendment No. 4 to our Current Report on Form 8-K/A (“Amendment No. 4”) to amend certain disclosures in our Current Report on Form 8-K, originally filed with the Securities and Exchange Commission (“SEC”) on October 17, 2011(the “Original Report”), as amended by Amendment No. 1 filed with the SEC on December 5, 2011, Amendment No. 2 filed with the SEC on May 11, 2012 and Amendment No. 3 filed with the SEC on June 5, 2012.

We have made the following amendments in this Amendment No. 4.

|

·

|

Revised our disclosure regarding the Option Assignment Agreement;

|

|

·

|

Added disclosure on the Earn-In Agreement;

|

|

·

|

Added disclosure on the name change of the Company;

|

|

·

|

Added a risk factor concerning the governmental approval of the Option Assignment Agreement;

|

|

·

|

Added an “Overview” section under “Management’s Discussion and Analysis Offinancial Condition And Results Of Operations”;

|

|

·

|

Updated the exhibit list.

|

Except to the extent required to reflect the above-referenced amendments, all other information in our Original Report, as amended by prior Amendments, remains unchanged. For the convenience of the reader, this Amendment No.4 includes, in their entirety, those items in our Original Report not being amended. This Amendment No. 4 continues to describe conditions as of our Original Report, and does not update disclosures contained herein to reflect events that occurred at a later date. Accordingly, this Amendment No.4 should be read in conjunction with our other filings made with the SEC subsequent to the filing of our Original Report, if any.

FORWARD LOOKING STATEMENTS

This current report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future results of operation or future financial performance, including, but not limited to, the following: statements relating to our ability to raise sufficient capital to finance our planned operations for the next 12 months. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “intends”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” in this current report, which may cause our or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that we may issue in the future. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms “we”, “us”, “our”, the “Company” and “ DCGD ” refer to Discovery Gold Corporation (F/K/A Norman Cay Development, Inc.) .

3

FORM 10 DISCLOSURE

ITEM 1. BUSINESS

Corporate History

We were incorporated in the State of Nevada on April 28, 2010 under the name Norman Cay Development, Inc. From the time that we were incorporated until September 1, 2011, we were a development stage company that had not commenced any operations other than initial corporate formation and capitalization, and the development of our business plan. It was our initial intention to be an authorized retailer of wireless telephones and service plans with our initial operation in Michigan or elsewhere in the Midwest. Due to lack of cell phone and service plan sales, in September 2011, we abandoned the original business plan and began seeking out potential acquisition candidates in the mining industry.

On July 12, 2012, we changed the name of the Company from Norman Cay Development, Inc. to Discovery Gold Corporation to better reflect the direction and business of the Company.

Share Exchange Agreement

On September 2, 2011, Discovery Gold Corporation (F/K/A Norman Cay Development, Inc.), a Nevada corporation (the “Company”) entered into a certain Share Exchange Agreement (the “Share Exchange Agreement”) by and among the Company, Discovery Gold Ghana Limited, a company organized under the laws of the country of Ghana (“DGG”), the stockholders of DGG (the “DGG Stockholders”), and the majority stockholder of the Company. Pursuant to the Share Exchange Agreement, the Company acquired one hundred percent (100%) of the issued and outstanding ordinary shares of DGG, and in exchange the Company: (i) made a one-time payment of one hundred thousand dollars ($100,000) to DGG and (ii) issued seventeen million five hundred thousand (17,500,000) newly-issued shares of restricted common stock of the Company to the DGG Stockholders resulting in the acquisition of DGG by the Company (the “Acquisition”). As a result of closing the Share Exchange Agreement, the Company has acquired DGG, as its wholly-owned subsidiary. The acquisition of DGG by the Company did not require Ghana government regulatory consent under the Mining Act or any other applicable legislation of Ghana.

There were no material relationships that existed between the Company and its affiliates, DGG and its affiliates at the time of the execution of the Share Exchange Agreement. Shelley Guidarelli, the controlling shareholder of the Company and Donald Ross, the controlling shareholder of DGG are longtime friends and both parties considered the transaction mutually beneficial. As such, their legal counsel prepared the agreement for each party to execute. No promoters were involved in the transaction.

Accordingly, we plan on conducting our proposed business through our wholly-owned subsidiary, DGG, which is described in greater detail below.

A description of the specific terms and conditions of the Share Exchange Agreement was previously described in the Form 8-K filed by the Company on September 7, 2011 and is incorporated herein by reference. All references to the Share Exchange Agreement and other exhibits to this Report are qualified, in their entirety, by the text of such exhibits.

Our Proposed Business

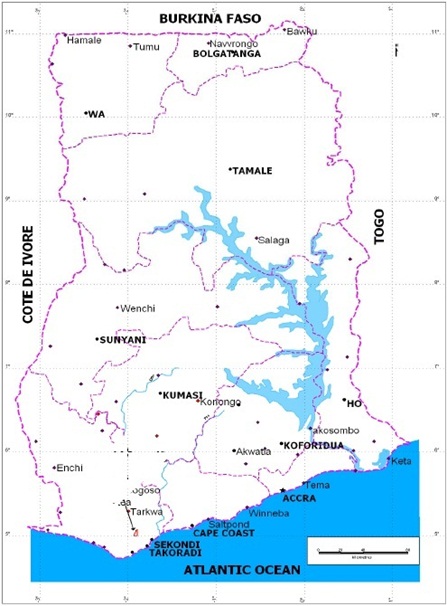

Currently, our focus is on the Country of Ghana and, more specifically, the Edum Banso Concession (the “Property”), located in Mpohor Wasa East District of the Western Region of Ghana in West Africa. At this point, we are considered an exploration or exploratory stage company because we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of these minerals, and their extent. Once we exercise the Option, the primary focus of our exploration activities will be for gold.

The expenditures to be made by us on our exploration program may not result in the discovery of commercially exploitable reserves of valuable minerals. Exploration for minerals is a speculative venture involving substantial risk. The probability of any mineral property ever having commercially exploitable reserves is unlikely, and it is probable that this Property may not contain any commercially exploitable reserves. If we are unable to find reserves of valuable minerals or if we cannot remove the minerals because we either do not have the capital to do so, or because it is not economically feasible to do so, then we will cease operations relating to the Property and we will attempt to seek out alternate properties. In the event that we cease operations relating to the Property, any funds received by the Company will be used to pay our working capital expenses and potential investors will lose their investment in the Company.

4

Because we are an exploration stage company, there is no assurance that commercially viable mineral deposits exist on the Property, and a great deal of further exploration will be required before a final evaluation is made as to the economic viability of the Property. To date, we have no known reserves of any type of mineral on the Property and we have not discovered economically viable mineral deposits on the Property, and there is no assurance that we will discover such deposits.

If we decide to stop further exploration of the Property, we may seek to acquire other natural resource exploration properties. Any such acquisition(s) will involve due diligence costs in addition to the acquisition costs. We will also have an ongoing obligation to maintain our periodic filings with the appropriate regulatory authorities, which will involve legal and accounting costs. In the event that our available capital is insufficient to acquire an alternative resource property and sustain minimum operations, we will need to secure additional funding or else we will be compelled to discontinue our proposed business. We are presently in the exploration stage of our business and have not commenced planned principal operations. We can provide no assurance that we will discover commercially exploitable levels of mineral resources on the Property, or if such deposits are discovered, that we will enter into further substantial exploration programs.

If commercially marketable quantities of valuable mineral deposits exist on the Property and sufficient funds are available, we will evaluate the technical and financial risks of mineral extraction, including an evaluation of the economically recoverable portion of the deposits, market rates for the minerals, engineering concerns, infrastructure costs, finance and equity requirements, safety concerns, regulatory requirements and an analysis of the Property from initial excavation all the way through to reclamation. After we conduct this analysis and determine that a given mineral deposit is worth recovering, we will begin the development process. Development will require us to obtain a processing plant and other necessary equipment including equipment to extract, transport and store the minerals.

Since our inception through April 30, 2011, the Company has earned no revenue and has incurred a net loss of $106,319. We do not anticipate earning revenues until such time, if ever, as we enter into commercial production of the Property. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its plan of operations described herein and eventually attain profitable operations.

As of April 30, 2011, the Company has a working capital deficit of $31,319. We anticipate that any additional funding that we require will be in the form of equity financing from the sale of our Common Stock. However, there is no assurance that we will be able to raise sufficient funding from the sale of our Common Stock. The risky nature of this enterprise and lack of tangible assets places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as an economically viable mine can be demonstrated. We do not have any arrangements in place for any future equity financing. If we are unable to secure additional funding, we will cease or suspend operations. We have no plans, arrangements or contingencies in place in the event that we cease operations.

The Property

Prospecting Rights

The Prospecting License

On May 8, 1991, Adom Mining Ltd. (“Adom”), a 100% wholly registered Ghanaian company, was granted a prospecting license (the “License”) by the Government of Ghana covering the Property. Under the terms and conditions of the License, Adom was given the right to prospect for and prove gold under or in the Property including the right to conduct such geological and geophysical investigations in the Property in order to determine an adequate quantity of geologically proven and mineable reserve of gold (directly or through agents, contractors or sub-contractors). Under the License, Adom had the right to (i) assign or mortgage its interest in the License, subject to obtaining the consent of the Government of Ghana who may impose certain conditions in connection therewith; (ii) surrender its interest in the License; and (iii) renew the term of the License for a period of two years or such other renewal period as may be granted in accordance with applicable mining laws of Ghana. The License granted to Adom was originally set to expire on or about July 2006. On July 27, 2006, the Government of Ghana approved extension of the License to July 20, 2008, which was further extended to November 30, 2010. On September 24, 2010, an application was made for renewal of the License and on July 21, 2011, the Government of Ghana approved the application and extended the License for an additional two year period to July 20, 2013. Pursuant to the 2006 Mining Act of Ghana, where a holder of a prospecting license makes application for extension of the term of the license, the license remains in force until the application is determined. Consequently Adom’s rights under the License remain unaffected during the pendency of the application for renewal.

5

The holder of the License has the right by itself or through sub-contractors or agents to conduct such geological and geophysical investigation within the License area as it considers necessary to determine the existence of an adequate quantity of geologically proven and mineable reserve of gold in the License area. However, the holder of the License does not have the rights to mine or participate in mining the property covered by the License.

The Government of Ghana has the right to terminate the License in the event the holder of the License (i) fails to make payments when due; (ii) contravenes or fails to comply with terms and conditions of License; (iii) becomes insolvent or commits an act of bankruptcy; or (iv) submits false statements to the Government of Ghana. In any of the foregoing events, the holder of the License will have twenty one days in which to remedy any of these occurrences. If upon expiration of License, the holder of the License has fulfilled its obligations and has established to the Government of Ghana that development of a mine from ore and reserves established within the Property is economical and financially feasible, the Government of Ghana shall grant the holder of the License with first option to (i) acquire a license for purposes of mining gold in the Property; and (ii) participate in a mining project on the Property, subject to negotiation with the Government of Ghana of satisfactory terms for such license and participation. As part of the requirements for the grant of a mining license, the holder will have to submit a feasibility report on the gold deposits to the Government of Ghana for approval and also conduct an environmental impact assessment (“EIA”) on the proposed gold development project for approval by the Environmental Protection Agency (“EPA”). Upon approval of the EIA, the EPA will issue an Environmental Permit to the holder prior to the commencement of the mining operations.

If DGG exercises the Option to acquire all rights under the License and becomes the holder of the License, DGG may apply to the Government of Ghana for a license to mine the property provided that the requirements for a mining license are satisfied.

Adom Option Agreement

On October 17, 2005, Xtra-Gold Exploration Limited (“XGEL” fka Canadiana Gold Resources Limited), a Ghanaian company and wholly-owned subsidiary of Xtra-Gold Resources Corp., a Nevada Corporation, (“Xtra Gold”) entered into an option agreement (the “Adom Option Agreement”) with Adom. Pursuant to the Adom Option Agreement, XGEL paid Adom $15,000 upon execution of the agreement. XGEL was granted the sole and exclusive right and option (the “Option”) to acquire all rights to the License from Adom. Upon exercising the Option, XGEL’s rights to the Property were subject to paying Adom (i) five thousand dollars ($5,000) yearly for each year that XGEL holds an interest in the Option; (ii) a fee when the production of gold is commenced in or on the Property equal to (a) two hundred thousand dollars ($200,000) if two million or more ounces of provable reserves are discovered in or on the Property OR (b) one hundred thousand dollars ($100,000) if less than two million ounces of provable reserves is discovered in or on the Property, and (iii) a reserved royalty (the “Reserved Royalty”) of the net smelter returns from all ores, minerals, or other products mined and removed from the Property and sold by XGEL based on the amount of reserves discovered and sold by XGEL. Additionally, Adom granted XGEL the right to purchase the Reserved Royalty for the sum of two million dollars ($2,000,000), or one million dollars ($1,000,000) in the event that less than two million ounces of reserves are discovered on the Property, exercisable at any time during the term of the Adom Option Agreement. The term of the Adom Option Agreement was for five years.

The license area covered under the License was 39.65 km2 when the Adom Option Agreement was executed. However, Adom was required by the Mining Law to relinquish 50% of the license area whenever the License becomes due for renewal. Consequently, in Adom’s application for renewal of the License through the Minerals Commission to the Minister, Adom attached a site plan of the original license area clearly showing part of the license area it wished to retain and the area that it wished to relinquish. The Minerals Commission’s recommendation for renewal of the license and the actual renewal letter dated July 21, 2006 issued by the Minister therefore covered only the 20.60 km2 that Adom had opted to retain. The current mining law Minerals and Mining Act, 2006 (Act703), which came into force on March 31, 2006, provides that the 50% shed-0ff requirement is subject to retention of a minimum of 25 square kilometers. As a result, the license area will not be shred off 50% upon future renewal of the License.

On October 19, 2006, Adom and XGEL entered into an amended option agreement (the “Amended Option Agreement”), confirmed that the size of the license area was reduced from 39.65 km2 to 20.60 km2 and the License had been renewed for a two year period, extended to July 20, 2008, and gave XGEL the right to assign or transfer the Option granted pursuant to the Adom Option Agreement to any third party or enter into a joint venture pursuant to the terms and conditions thereof.

On January 24, 2010, Adom and XGEL executed an Addendum (the “Addendum”) to the Amended Adom Option Agreement, extending the term of the Adom Option Agreement for an additional three years to November 11, 2013.

6

Option Assignment Agreement

On August 22 , 2011, DGG entered into an Agreement for Assignment of Option Interest (the “Option Assignment Agreement”), by and among XGEL, Xtra Gold (collectively XGEL and Xtra Gold are referred to hereinafter as “Xtra-Gold Resources”), Adom and DGG, pursuant to which DGG was assigned the exclusive Option, for those mineral rights related to the Property. Pursuant to the terms thereof, Xtra-Gold Resources sold, assigned and transferred 100% of its right, title and interest in to the Option to DGG. Adom agreed to the assignment. In exchange for the Option, Xtra Gold Resources was to receive an aggregate payment of two hundred fifty thousand dollars ($250,000), of which $125,000 was paid in cash upon execution of the Option Assignment Agreement and the remainder $125,000 together with additional expense of $10,000 was issued in the form of a note by DGG, payable in six months from the date of the Option Assignment Agreement. The Option Assignment Agreement shall not be filed with the Government of Ghana until the note is paid in full. The note was paid off on January 23, 2012. Additionally, Xtra Gold Resources received a one-time issuance of DGG’s common stock, representing 5.71% of the issued and outstanding common stock of Discovery Gold Corporation upon acquisition of DGG by Discovery Gold Corporation .

Although the Option Assignment Agreement was dated August 22 , 2011, Adom did not sign it until the early part of 2012 as Adom raised some issues concerning its residual rights under the Option Agreement after XGEL had assigned the Option to DGG. The issues raised by Adom were eventually resolved to Adom’s satisfaction. On April 4, 2012, the Option Assignment Agreement was executed by all parties. The time lag between the raising of the issues by Adom and their resolution caused the delay in the execution of the Option Assignment Agreement thereby causing XGEL’s inability to seek Ghana Government approval of the Option Assignment Agreement until April 4, 2012.

Following an application made by XGEL on April 4, 2012, a formal approval of the Option Assignment Agreement was given by the Minerals Commission (“Mincom”) of Ghana by a letter dated May 4, 2012 (the “Letter”). The Letter is the official response of the Mincom to XGEL’s application for government approval of the Option Assignment Agreement as required by Section 14 of the Mining Law. The Minister responsible for mines is required by the Mining Law to act on the advice of the Mincom when exercising his powers and discretions conferred on him under the Mining Law. Consequently, all applications to the Minister for the exercise of such powers under the Mining Law are lodged with the Mincom which reviews the application and makes the appropriate recommendation to the Minister. The Mincom charges a consideration fee for reviewing and making recommendations to the Minister. In the case of the XGEL’s application dated April 4, 2012 the letter dated May 4, 2012 was the official response of the Mincom confirming that the Mincom had received the application and accompanying documents, reviewed the XGEL’s application with its supporting documents and would recommend the application to the Minister, subject to the payment of a consideration fee of US$10,000 to the Commission. DGG, as the assignee of the option rights, has since May 29, 2012 paid the consideration fee of US$10,000 to the Mincom, which will now forward its recommendation to the Minister to grant approval of the assignment of the Option rights from XGEL to DGG. The Minister is required under the Mining Law not to unreasonably withhold such approval or grant such approval on unreasonable terms. The Minister is also required to grant such approval within thirty (30) days of receipt of the recommendation from the Mincom or give written reasons to the applicant for failing to decide on the application within such period.

Pursuant to Section 14 of the Mining Law of Ghana, mineral right shall not in whole or in part be transferred, assigned, mortgaged or otherwise encumbered or dealt with in any manner without the prior approval in writing of the Minister, which approval shall not be unreasonably withheld or given subject to unreasonable conditions. In the opinion of our Ghana counsel, the Option Assignment Agreement which is subject to this statutory provision will not be legally effective and enforceable prior to receiving the ministerial approval. The US$10,000 fee paid to the Mincom is not a prescribed statutory fee but rather an administrative fee which is charged by the Mincom for reviewing and recommending applications under the Mining Law to the Minister. Thus the fee will not affect the legality and enforceability of the assignment of the Option rights.

In addition, the Option Assignment Agreement prescribed that it would become effective upon receipt of all regulatory approvals in Ghana, U.S.A, and Canada including approval from the Minister of Mines and the TSX Exchange if applicable. Pursuant to Section 6 of the Option Assignment Agreement, the procurement of the ministerial approval is one of the pre-conditions for the completion and effectiveness of the transfer of the option interest to DGG. The approval of the Minster of mines is the only regulatory approval that is required in Ghana for the effectiveness of the assignment of the option interest. This regulatory approval has been duly applied for and following demand made in its letter dated May 4, 2012, the requisite consideration fee of US$10,000 has been paid by DGG to the Ghana Minerals Commission on 29th May, 2012. Such ministerial approval should ordinarily be issued by the Minister within thirty days after receipt of the favorable recommendation from the Minerals Commission.

As of the date of this report, the Minister has not granted approval for the Option Assignment Agreement due to an internal clerical error by the Minerals Commission. The appropriate internal documents were not submitted until July 4, 2012. As a result, the assignment of the Option to DGG is not currently legally effective or enforceable. Therefore, DGG has not succeeded to the Option Assignment Agreement.

7

Earn-In Agreement

On January 25, 2012, the Company, through its wholly-owned subsidiary, DGG, entered into certain Earn-In Agreement (the “Earn-In Agreement”) by and between DGG and North Springs Resources Corp., a Nevada corporation (“NSRS”). Pursuant to the Earn-In Agreement, NSRS shall acquire working interest (the “Working Interest”) in DGG’s interest (“DGG’s Interest”) in the Property, per the terms of the Earn-In Agreement as follows:

Working Interest:

NSRS shall provide a total of one million two hundred fifty thousand dollars ($1,250,000) to DGG according to the following payment schedule (each a “Commitment Payment”):

(i) an initial payment of two hundred fifty thousand dollars ($250,000) (the “Initial Payment”), of which one hundred fifty thousand dollars ($150,000) is due within five (5) days of the execution of the Earn-In Agreement and the remaining one hundred thousand dollars ($100,000) is due within thirty (30) days of the execution of the Earn-In Agreement;

(ii) five hundred thousand dollars ($500,000) on or before July 31, 2012 (the “Second Commitment Payment”); and

(iii) five hundred thousand dollars ($500,000) on or before December 31, 2012 (the “Third Commitment Payment”).

Upon making the full Initial Payment to DGG, NSRS acquired a ten percent (10%) Working Interest in DGG’s Interest.

In the event that NSRS fails to provide the Second Commitment Payment to DGG on or before July 31, 2012, fifty percent (50%) of NSRS’ Working Interest shall automatically revert back to DGG and NSRS shall be deemed to have forfeited its right to provide the Third Commitment Payment. DGG shall then have the option to buy back an additional twenty five percent (25%) of NSRS’ Working Interest in exchange for one hundred fifty thousand dollars ($150,000).

Additional Working Interest:

NSRS shall acquire an additional twenty five percent (25%) Working Interest in DGG’s Interest (the “Additional Interest”) in exchange for ten million (10,000,000) shares of common stock of NSRS (the “NSRS Shares”). The Additional Interest is in addition to the ten percent (10%) Working Interest described above.

In the event that the value of the NSRS Shares is less than two million five hundred dollars ($2,500,000) on October 1, 2012, DGG shall have the option to either: (a) take back the Additional Interest from NSRS and return the NSRS Shares to NSRS; or (b) keep the NSRS Shares and allow NSRS to keep the Additional Interest. If DGG elects option (a), DGG shall notify NSRS of its decision in writing within five (5) business days from October 1, 2012.

8

There were no material relationships that existed between NCDL and its affiliates, DGG and its affiliates, and NSRS and its affiliates at the time of the Earn-In Agreement. NCDL and DGG were introduced to NSRS through Gerry Bellanger of Live Call Investor Relations Company located in Toronto, Canada, the investor relations firm for both NCDL and NSRS. Gerry Bellanger introduced Harry Lapa, President of NSRS, to Dean Huge, Chief Financial Officer of NCDL and Donald Ross, director of NCDL and President of DGG. NCDL was in need of financial resources for development and believed the terms of financing under the Earn-In Agreement favorable to the Company. NSRS, on the other hand, considered the transaction a good investment opportunity. Thus the parties proceeded to consummate the transaction. The Earn-In Agreement and related documents were prepared by the counsels for NCDL and NSRS.

The only known gold production on the Property was from local miners working the auriferous gravels and quartz veins as reported by J.W. Lunn in the 1930s. Amercosa (formerly Anglo American) reportedly worked on the project in the late 1990’s, however the results from this work are not published. St. Jude Resources, a Canadian public mining company, conducted geophysical surveys including magnetic and induced polarization surveys. The prospective structures identified in these surveys were followed up by geochemical surveys which included soil, trench and pit sampling.

Previously, Newmont Ghana Limited (“Newmont”), entered into an option Agreement with Adom and Newmont took over the management of the project undertaken on the Property. The initial work by Newmont included stream sediments soil sampling and prospecting using a grid 400m line spacing and sample intervals of 50m along the gridlines. Approximately 24 stream sediments samples, 13 rock chips samples and 1,946 soil samples were analyzed for gold. Although the rock chips did not return any significant results, stream sediments returned anomalous values ranging from 11ppb to 216ppb. The soil sampling returned gold values ranging from <1ppb to 1278ppb.

Stream sediment sampling throughout the Property by Newmont in 2003 defined a broad anomalous gold zone approximately 7 km long by 1.5 km wide, roughly conforming to the regional geological trend. Follow-up soil (1,109 samples) and rock sampling by Newmont in 2004 further constrained this broadly anomalous area into two distinctive anomalies, while geophysical interpretation suggests they are coincident with the surface expression of two major North-South oriented thrust faults.

Although the Newmont work was successful in outlining some major gold-in-soil anomalies, they concluded that there were no clear targets that would meet their +1 million ounce threshold. Consequently, Newmont relinquished their interest in the Property in 2004.

Prior Exploration by Xtra-Gold – 2008 to 2010 Exploration Program(s):

An exploration program was implemented on the Property from August 2007 to January 2008 by Torkornoo & Associates Limited (“TAL”), at a cost of approximately $177,000. TAL is a Ghanaian geological consultancy with the principal of TAL being a professional geologist registered with The Australasian Institute of Mining and Metallurgy (AusIMM).

9

Based on the complex structural nature of gold deposits identified to date by third parties within the Hwini-Butre/Benso-Subriso gold district, the Phase I Work Program encompassed infill soil sampling, reconnaissance geology / prospecting, hand auger sampling and trenching designed to identify cost-effective drill targets. The tighter soil geochemical coverage (200m) was implemented to better define the length-extents and trends of the gold-in-soil anomalies detected by the historical Newmont soil program (2004). The deep auger components of the program was proposed to test the geochemical signature of gold-in-soil anomalies at depth in order to better define trenching and drilling targets. The results of this program are noted hereunder.

Phase I fieldwork consisted of the following:

|

·

|

Grid establishment: 8.4 km baseline, 73.8 km gridlines;

|

|

·

|

Soil sampling: 2,703 samples collected, 1,815 samples submitted for gold analysis;

|

|

·

|

Rock sampling: 68 samples;

|

|

·

|

Hand auger sampling: 252 holes / samples;

|

|

·

|

Trenching: 6 trenches (319 m), 214 channel samples.

|

Soil / Rock Sampling; Methodology – Results

The first pass of the soil sampling survey was carried out using a classical digging tool called a “soso” to a typical depth 0.5 m. Infill sampling in areas of interest was implemented by shallow auger sampling to a 1.0 meter depth. A total 1,815 soil samples were submitted for gold analysis.

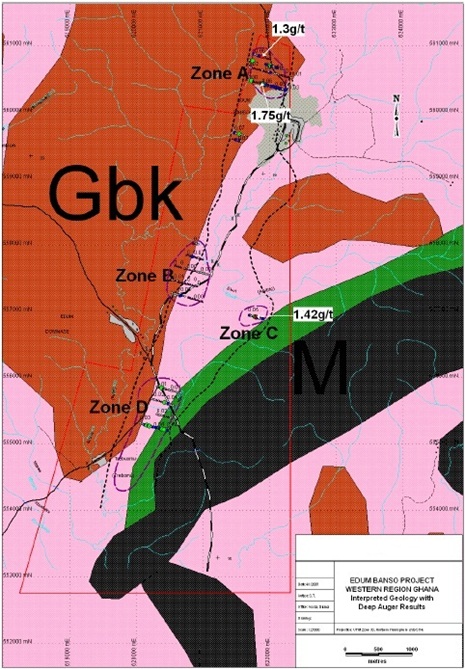

TAL arbitrarily set the anomalous threshold for the soil sample results at 0.05 ppm gold based on past work experience in the Hwini-Butre / Benso-Subriso gold district. 123 out of the 1,815 soil samples (approx. 7%) returned gold values greater than the 0.05 ppm anomalous threshold. The soil geochemistry survey outlined a 8.0 km long by approximately 0.6 km wide, gold-in-soil anomalous trend conforming to the regional NNE structural trend. This gold-in-soil anomaly (> 0.05 ppm Au) tends to be patchy in nature and / or to pinch-out along its 8.0 km extent. The term “ppm” represents “part per million” where 1 ppm = 1 gram per tonne (g/t) = 1,000 part per billion (ppb). Four areas (i.e. Zone A, B, C and D) within the defined gold-in-soil anomalous corridor were relative continuity and / or the favorable geological and structural settings of the gold-in-soil anomalies.

Zone A, located to the north of the town of Edum Banso, extends from gridline 14700N to 15200N (500 m). Zone B, located to the northeast of the hamlet of Edum Dominase, extends from line 11300N to 12100N (800 m). Zone C is an approximately 200 m by 200 m area located in the east-central portion of the concession. This zone is characterized by three (3) consecutive, strongly anomalous gold-in-soil values over a 50 meter distance on Line 11300N. Zone D consists of a NE-trending zone of discrete gold-in-soil values extending from L8200N to L9900N (1,700 m) at the south-western extremity of the concession.

Based on geophysical interpretation, including airborne magnetic and radiometric data, the Zone C and Zone D gold-in-soil anomalies appear to be spatially associated with the contact between the Birimian Metavolcanics and the circular Mpohor Intrusive Complex.

A total of 68 rock (float) samples were collected during reconnaissance geological mapping carried out alongside the soil sampling. This rock sampling produced a single exploration-significant gold value from a float of iron oxide stained quartz located to the south of the Zone D gold-in-soil anomaly. Similarly to the Zone C and Zone D anomalies this anomalous quartz float also appears to lie proximate to the inferred metavolcanic-Mpohor Complex contact.

Deep Auger Sampling; Methodology – Results

As a follow up to the soil sampling a deep auger program was implemented on the four priority areas to test the geochemical signature of the gold-in-soil anomalies at depth within the saprolite horizon in order to better define trenching targets. A total of 252 sites were augered to an average depth of approximately 4.0 m with a one (1) meter sample collected from the saprolite horizon at the bottom of each hole. Auger hole spacing was typically 25 m, with some 12.5 meter infilling.

10

TAL set the anomalous threshold for the auger sample results at 0.10 ppm gold based on past work experience in the Hwini-Butre / Benso-Subriso gold district. 19 (7.5%) out of the 252 deep auger samples returned gold values greater than the 0.10 ppm anomalous threshold.

11

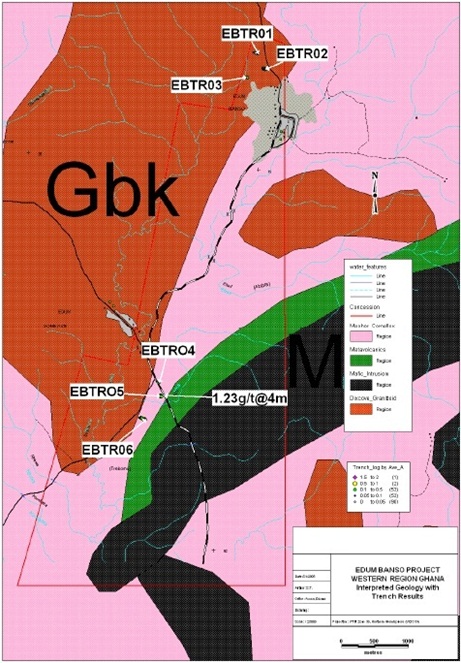

Manual Trenching; Methodology – Results

The Zone A and Zone D deep auger anomalies (> 0.10 ppm Au) were further tested by three (3) trenches totaling 160 m and three (3) trenches totaling 159 m, respectively. The trenches were manually excavated with pickaxes and shovels to a vertical depth of 4 m. A total of 214 channel samples were collected from the sidewall of the six (6) trenches totaling 319 m. Samples consisted of horizontal channels, typically 1 m or 2 m in length, cut approximately 0.1 m above the floor of the trench.

The Zone A trenching failed to yield any significant gold results. Trench EBTR005 yielded the only exploration – significant gold results from the Zone D trenching in the form of a length-weighted average grade of 1.23 ppm gold over a 4 meter trench-length (2 samples). The anomalous section is characterized by chlorite altered mafic metavolvanic rock hosting fine, iron oxide stained, quartz stringers.

12

Results / Recommendations

It was established that within the vicinity of the circular mafic Mpohor Complex, the work carried out by TAL revealed the following: The soil program returned gold grades of 1099ppb, 793ppb and 606ppb; deep auger on the soil revealed 1.42g/t; One trench over 4m revealed 1.23g/t, and further south, a rock chip revealed a grade of 3.6g/t. Thus the results of the prospecting work undertaken by TAL provides more than sufficient evidence that the Property is predominantly underlain by the Mpohor complex, the dixcove granitoid and Birimian metavolcanics which could host auriferous ore body of economic significance.

The spatial association of the Zone C and Zone D gold-in-soil and deep auger anomalies, the anomalous trench EBTR005 channel samples, and the auriferous quartz float, with the geophysically interpreted, north-western rim of the Mpohor Intrusive Complex is of considerable exploration significance.

Economically significant gold mineralization is known to exist along the south-eastern margin of the circular Mpohor Complex, approximately 2 km to the south-east of the Property. Although published information, geophysical interpretation, and the results of the present work program indicate that the Property shares a similar geological / structural setting as the deposits located on the south-eastern rim of the Mpohor Complex, it by no means implies that the Property hosts similar mineral deposits.

Recommended work to further advance the project includes: (a) additional deep auger sampling of the Zone C and Zone D gold-in-soil anomalies; (b) continued reconnaissance geology and rock (float) sampling along the inferred margin of the Mpohor Complex; and (c) detail structural interpretation of the property area based on the airborne magnetic and radiometric data. No significant work was carried out on the Property in 2010.

Resources and Reserves

As of the date of this Report, no ore resources or reserves have been identified on the Property.

The Property is currently at an early stage of evaluation. As at the date of this Report, no mineralized material or reserve estimates have been made at the Property. As of the date of this Report, there are no exploration activities currently being conducted on the Property. Prior to this Report, there were preliminary lode gold exploration programs undertaken at the Property and their respective results are noted herein.

Location and Access

The Property in Figure 2 is located in the Mpohor Wasa East District of the Western Region of Ghana. The Property is about 270km west of Accra, and 35km north of Takoradi a major commercial centre. The Property covers an area of about 20.6sq. Km. The Property is located in an area of Birimian metasediments, metavolcanics and intrusive rocks, which are part of the Ashanti Belt, which extends over 250 km from Axim on the coast northeast to Konongo in the north and is the most intensively mined area in Ghana. The Property covers the Eastern margin of the massive Granitoid Complex, which are most common in the western part of the Property with extensive structural features, the most dominant being a NNE to N-S trending fracture system.

13

Figure 2: Location Map

The Property area is situated within the survey field sheet 0502c3 and 0402a1 and bounded by following coordinates (Table 1).

|

Table 1: Edum Banso Concession Pillars

|

||||

|

Pillar

|

Longitude

|

Latitude

|

||

| P1 |

1° 54' 40"

|

5° 03' 59"

|

||

| P2 |

1° 54' 15"

|

5° 03' 55"

|

||

| P3 |

1° 54' 03"

|

5° 04' 33"

|

||

| P4 |

1° 53' 48"

|

5° 04' 27"

|

||

| P5 |

1° 53' 48"

|

5° 00' 00"

|

||

| P6 |

1° 56' 00 ''

|

5° 00' 00"

|

||

| P7 |

1° 55' 27"

|

5° 01' 53"

|

||

| P8 |

1° 55' 05"

|

5° 01' 49"

|

||

14

The Main SW Ghana Gold Belts

15

Access

The Property is accessible by a good road from Apowa on the Takoradi to Tarkwa highway. The road runs through Mpohor in the south, to Edum Banso in the north, and it carries on through the Benso Oil Palm Plantation (BOPP). From Mpohor to other areas within the Property can be accessed by a rough field tracks negotiable by 4 x 4 vehicles, and walking trails through farms, jungle and oil palm or rubber plantations.

Infrastructure and Population

The Property and the surrounding area is highly populated with groupings of villages scattered within the surrounding area. Edum Banso, Edum Domnase and Trebuomu are the three biggest settlements in the area. Edum Banso and Domnase are connected to the national power grid. The principal economic activities in the surrounding area are limited to subsistence farming and trading.

Takoradi is the nearest commercial centre with a new thermal plant with a 250 MW capacity, hospital, post office, court, police station, Naval and commercial seaports. A local air force base has a runway that is accessible to light to medium size fixed wing and jet aircraft.

Drainage and Relief

The Property is drained by Butre, Eburi Ntra river systems and small tributaries (Ntrawa, Aboabaka, etc.). The Property and the surrounding area as a whole has a trellised drainage pattern in which a system of parallel and sub-parallel rivers are aligned almost on the strike of the structural formations in a general way and make occasional turns to cross the strike. The trellised drainage pattern is made more prominent for the Butre drainage area by the underlying granitoid, which are more resistant to weathering.

The Property and surrounding area is undulating, with modest relief of 30 to 100 m. Topographic relief in the north-western part is 75 to 100 m above valley floors, which are approximately 100 m above sea level. In the southern part of the Property, topographic relief is flat, low-lying flood plains. In general, the topography varies considerably, with round to flat-topped hills, low-lying flood plains and swamps.

Vegetation and Climate

The low-lying valleys are marshy and cleared farmlands carrying both subsistence and cash crops such as palm, cassava, bananas, oil palm, and vegetables. Areas of slightly hilly relief tend to have retained some remnant tropical vegetation. The north-western part of the Property contains part of the BOPP oil plantation.

The climate is typically wet tropical (equatorial) with daily temperatures ranging on an annual basis, between 30º - 36ºC, maxima and 15º - 20ºC minima. Rainfall for most of the Western Region of Ghana is in the range 1500mm - 2000mm annually. There is a main wet season from March to July, peaking in May-June, and a minor wet season from September to November, peaking in October.

Land Tenure

The Property is covered by a License, number LVB 2324/91 which was initially registered in 1991 with the land registry No 1130/1991. This was held by Adom and has been renewed until July 20, 2013.

Geology

Regional Geology and Mineralization

Stratigraphically, Ghana lies within the West African Precambian Shield. Gold producing Precambian rocks of the Eburnean tectonic province (2.17-2.18 billion years) underlie much of the south-western and the north-eastern half of Ghana, as well as parts of Cote D’Ivoire, Mali and Burkina Faso (See Figure 5).

16

The Precambian in Ghana is dominated by the Birimian which is unconformably overlain by the Tarkwaian. The former is made up of a meta volcanic (greenstone) type lithologies, and meta sediments believed to have formed from erosion of the rising volcanic belts, resulting in the formation of argillites, turbidites, and fine grained tuffs of relatively deep quiet water basins. The later is a fossil placer similar to the Witwaterstrand and Transvaal “banket reefs” of South Africa.

The regional structural fabric of the Eburnean of West Africa are characterized by NE-SW trending belts bounded by major regional structures which probably represent early extension-related faults that controlled the location and deposition of sediments in both the Birimian and Tarkwaian basins. Subsequent reactivation of these faults during a compressional tectonics phase resulted in thrusting and folding evident in the Tarkwaian rock units. Late right lateral transgressional tectonics has resulted in the kinks, jogs and sigmoidal geometries evident along the major gold belts.

Property Geology

Regional Geiology on Ghana in relation to West Africa

17

Exposures in the Property are quite scarce, however, extrapolation from the Aerodat airborne geophysical data as well as an interpretation of the airborne geophysics by Watson Geophysics and Dr. R.J. Griffins are enough to provide a good idea of the major rock types that can be found. The Property is located in an area of Birimian metasediments, metavolcanics and intrusive rocks which are part of the Ashanti Belt.

Exploration works within the Property have revealed that the rocks are basically metavolcanics, metasediments and intrusive such as diorite and granodiorite. The eastern part to the Property is predominantly metasediments, metavolcanics, and metavolcaniclastics. Dixcove Granitoids are most common in the western part of the Property.

Four main types of rocks were identified in the six trenches dug so far which covers an average of 8km from the North East to the South West direction. The units are as follows:

Tuffaceous phyllite: Predominantly fine grained, massive mottled whitish to yellowish brown to pinkish saprolite. Occasionally interbedded with carbon altered weakly foliated silicified phyllite. The unit exhibit very weak foliation normally parallel or sub-parallel to associated quartz stringers and almost invariably, moderate to steep dipping (65-88 deg), usually to the west.

Tuffs: Appear as mottled clay material with fine grained massive saprolite meta tuff inclusions.

Granodiorite/diorite: Looked dark grey in colour usually massive and coarse grained. Silica and chlorite alteration are very common. They look fresh inside but the outside is usually coated with either Manganese and/or iron oxide.

Quartz: They occur as veins, stringers and stock works. They are white to milky in colour and in some cases glassy to light grey. They measure from a few millimeters to 7m thick in trench EBTR003. The attitude of quartz found in trench 3 was 100/56 and another one associated with a diorite in trench EBTR006 was 208/68. Quartz boulders, pebbles and gravels are common and floats occupy every single space in the Property. They are common because they are hard and resist weathering. The veins found in all trenches are crushed in the shear zones and are found to be stained with iron and/or muscovite/sericite. In most trenches they usually occur as micro stringer or micro quartz stock works.

The rocks underlying the Property have undergone alteration and shearing, which is commonly associated with gold mineralization. Alteration along the margins of veins is very common. Alteration consists mainly of silicification, chlorite and muscovite/sericite. There appears to be numerous types of pre-metamorphic intrusives throughout the area. Some of these intrusives found in trenches could be interpreted as mafic (diorite or granodiorite) intrusives. The interpreted geology from the Aero data image of Potassium for the Property shows that the circular mafic Mpohor Complex extends south into Golden Star’s adjoining Hwini-Butre Concession where significant gold mineralization has been found.

18

Geology of the Location and Main Deposits or Occurrences

19

Glossary of Technical Geological Terms

The following defined geological terms are used in this Report:

|

Term

|

Definition

|

|

|

Argillite:

|

Is a fine-grained sedimentary rock composed predominantly of indurated clay particles. Argillaceous rocks are basically lithified muds and oozes. They contain variable amounts of silt-sized particles. The argillites grade into shale when the fissile layering typical of shale is developed.

|

|

|

Assay:

|

The act of testing the content or quality of a substance.

|

|

|

Attitude:

|

The orientation of a planar or linear feature in three-dimensional space. Planar features that are not horizontal, such as tilted strata, are described by their strike, or the azimuth of the intersection of the plane with a horizontal surface, and the dip, or the magnitude of its inclination from a horizontal reference. The trend and plunge of linear features, such as the axis of a fold, describe the azimuth of the line and its deviation from horizontal.

|

|

|

Auriferous:

|

Containing gold; gold-bearing.

|

|

|

Diorite:

|

A coarse-grained, intrusive igneous rock that contains a mixture of feldspar, pyroxene, hornblende and sometimes quartz.

|

|

|

Felsic:

|

Refers to silicate minerals, magma, and rocks which are enriched in the lighter elements such as silicon, oxygen, aluminum, sodium, and potassium.

|

|

|

Foliated:

|

Composed of thin easily separable layers.

|

|

|

Foliation:

|

The planar or layered characteristics of metamorphic rocks that are evidence of the pressures and/or temperatures to which the rock was exposed. These can be structural such as cleavage, textural such as mineral grain flattening or elongation, or compositional such as mineral segregation banding.

|

|

|

Granite:

|

A common and widely occurring type of intrusive, felsic, igneous rock. Granites usually have a medium- to coarse-grained texture.

|

|

|

Granitoid:

|

A granitoid or granitic rock is a variety of coarse grained plutonic rock similar to granite which mineralogically are composed predominately of feldspar and quartz.[1] Examples of granitoid rocks include granite, quartz monzonite, quartz diorite, syenite, granodiorite and trondhjemite. Many are created by continental volcanic arc subduction or the collision of sialic masses. Volcanic rocks are common with granitoids and typically have the same origins.

|

|

|

Granodiorite:

|

A plutonic rock composed of black biotite, dark-gray hornblende, off-white plagioclase, and translucent gray quartz.

|

|

|

Hand Auger:

|

A tool used to collect disturbed soil samples, while core samplers are used to collect partially disturbed samples. Hand augers are also used to remove soil above a desired sampling location.

|

|

|

Igneous Rock:

|

A rock relating to, resulting from, or suggestive of the intrusion or extrusion of magma or volcanic activity.

|

|

|

Intrusive:

|

Igneous rocks that crystallize below Earth's surface

|

|

|

Lithologies:

|

The study and description of rocks, including their mineral composition and texture. Also used in reference to the compositional and textural characteristics of a rock.

|

|

|

Lode:

|

A classic vein, ledge, or other rock in place between definite walls.

|

|

|

Metamorphic Rock:

|

Rock altered by pressure or heat.

|

|

|

Metasediment:

|

Is sediment or sedimentary rock that shows evidence of having been subjected to metamorphism. The overall composition of a metasediment can be used to identify the original sedimentary rock, even where they have been subject to high-grade metamorphism and intense deformation.

|

|

|

Metavolcanic

|

Metavolcanic rock is a type of metamorphic rock. Such a rock was first produced by a volcano, either as lava or tephra. Then, the rock was buried underneath subsequent rock and was subjected to high pressures and temperatures, causing the rock to recrystallize.

|

|

|

Muscovite/ Sericite:

|

A kind of muscovite occuring in silky scales having a fibrous structure. It is characteristic of sericite schist.

|

|

|

Mica:

|

Any of a group of chemically and physically related aluminum silicate minerals, common in igneous and metamorphic rocks.

|

|

|

Mineralization:

|

The concentration of metals and their chemical compounds within a body of rock.

|

|

20

|

Mineralized Material:

|

Projection of mineralization in rock based on geological evidence and assumed continuity.

|

|

|

Ore:

|

An ore is a type of rock that contains minerals with important elements including metals. The ores are extracted through mining; these are then refined to extract the valuable element(s).

|

|

|

Phyllite:

|

A foliate metamorphic rock that is made up mainly of very fine-grained mica. The surface of phyllite is typically lustrous and sometimes wrinkled. It is intermediate in grade between slate and schist.

|

|

|

Quartz:

|

A very hard mineral composed of silica, SiO2, found worldwide in many different types of rocks, including sandstone and granite.

|

|

|

Reserve:

|

(For the purposes of this Report): That part of a mineral deposit which could be economically and legally extracted or produced. Reserves consist of:

Proven (Measured) Reserves: Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling; and (c) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well-defined that size, shape, depth and mineral content of reserves are well-established.

Probable (Indicated) Reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

|

|

|

Saprolite:

|

Disintegrated somewhat decomposed rock that lies in its original place.

|

|

|

Schist:

|

A foliated metamorphic rock the grains of which have a roughly parallel arrangement; generally developed by shearing.

|

|

|

Shear Zone:

|

Involve volumes of rock deformed by shearing stress under brittle-ductile or ductile conditions, typically in subduction zones at depths down to 10-20 km. Shear zones often occur at the edges of tectonic blocks, forming discontinuities that mark distinct terranes.

|

|

|

Silica:

|

"Silica stone" is an industrial term for materials such as quartzite, novaculite and other microcrystalline quartz rocks. These are used to produce abrasive tools, deburring media, grinding stones, hones, oilstones, stone files, tube-mill liners and whetstones.

|

|

|

Silicate:

|

Any of numerous compounds containing silicon, oxygen, and one or more metals.

|

|

|

Silicified Phyllite:

|

Silicified "petrified" wood is formed when buried plant debris is infiltrated with mineral-bearing waters which precipitate quartz.

|

|

|

Stock works:

|

A complex system of structurally controlled or randomly oriented veins. Stock works are common in many ore deposit types and especially notable in greisens. They are also referred to as stringer zones.

|

|

|

Tectonics:

|

The study of processes that move and deform Earth's crust.

|

|

|

Thrust Fault

|

A reverse fault that has a dip of less than 45 degrees.

|

|

|

Transgression:

|

An advance of the sea over land areas. Possible causes include a rise in sea level or subsidence.

|

|

|

Trellis Drainage:

|

A drainage pattern in which streams intersect at right angles. This forms in areas of long parallel valleys such as in folded mountain belts. Rivers occupy the valleys and tributary streams join them at right angles.

|

|

|

Trenching:

|

A geologic process whereby a long, narrow, deep depression in the ocean floor that parallels a convergent boundary involving at least one oceanic plate, is made.

|

|

|

Turbidite:

|

A vertical sequence of sediments deposited by a turbidity current. Because the largest particles of the current settle first a turbidite will be graded deposits with coarsest grain sizes at the bottom and finer grain sizes going upwards.

|

|

|

Tuff:

|

A rock composed of pyroclastic materials that have been ejected from a volcano. In many instances these fragments are still hot when they land, producing a "welded" rock mass.

|

|

|

Vein:

|

A fracture that has been filled with mineral material.

|

|

|

Volcanic:

|

Characteristic of, pertaining to, situated in or upon, formed in, or derived from volcanoes.

|

|

21

Plan of Operation

Once we exercise the Option, we plan to commence the first phase (Phase I) of the exploration program on the Property around the fourth calendar quarter of 2011. Phase I work will consist of retaining a consultant(s) to conduct exploration activities on the Property, including: geological mapping, geological prospecting, assaying and information review. Geological mapping involves plotting previous exploration data relating to a property area on a map in order to determine the best property locations to conduct subsequent exploration work. Geological prospecting involves analyzing rocks on the property surface in order to discover indications of potential mineralization. All samples gathered will be sent to a laboratory where they are crushed and analyzed for mineral content. Assaying is the chemical analysis of a substance to determine its components. We expect Phase I to take approximately 60 days to complete and an additional month for the consulting geologist to receive the lab results from these activities and prepare an analytic report. We have estimated the cost of Phase I to be approximately $100,000.

If Phase I proves successful in identifying valuable mineral deposits and we have sufficient funds to continue, we intend to proceed with the second phase (Phase II) of the program as soon as practicable upon completion of Phase I. In Phase II, we will retain such third-parties necessary to begin trenching, surveying localized soils, and detailed sampling of historic zones. Trenching is the process of turning over land to uncover underlying material. Soil surveying is the systematic examination, description, classification, and mapping of soils in an area. The objective of sampling in mineral processing is to estimate grades and contents of sample soils, rocks, and other discovered materials. The estimated cost of Phase II is between $30,000 and $50,000, depending on the level of our activities during this phase and the funds available. It will take approximately 50 days to complete Phase II and at least an additional month for the consulting geologist to receive the lab results from these activities (depending on lab availability and amount of work to be done) and prepare an analytic report. We expect to commence work on Phase III the third calendar quarter of 2012, subject to the availability of funds.

After all surveys and initial samples have been collected and positive results have been obtained from such activities, we expect to begin the third phase (Phase III) of the program around the third calendar quarter of 2012, assuming we have adequate funds to continue our operations. Phase III will consist of retaining a consultant(s) to conduct core sampling and analysis. Core sampling is the process of drilling holes to a depth of up to 500 feet in order to extract a sample of earth. Depending on the availability of funds, we intend to drill a minimum of 15 holes to a depth of 500 feet each (totaling 7,500 feet) and a maximum of 30 holes to a depth of 500 feet each (totaling 15,000 feet). We anticipate that it will take between one to two months to drill 15-30 holes to a depth of 500 feet each. Our estimated cost for drilling is approximately $50.00 per foot; thus to drill 15 holes to a depth of 500 feet, it will cost approximately $375,000 and to drill 30 holes to a depth of 500 feet, it will cost approximately $750,000. We anticipate that we will need to pay a consultant(s) up to a maximum of $15,000 per month for his or her services during Phase III. Additionally, we anticipate that it will take between one to two months to conduct Phase III; thus, we will pay the consultant(s) a minimum of $15,000 and a maximum of $30,000.

As part of Phase III, after core sampling, the consultant(s) will analyze the samples collected from the core drilling. The total estimated cost for analyzing the core samples is $40,000, and we estimate this process will take approximately 30 days. The core samples will be tested to determine if mineralized material is located on the Property. We intend to take our core samples to analytical chemists, geochemists and registered assayers located in the western United States. We have not selected any of the foregoing persons as of the date of this Report. Based upon the tests of the core samples, we will determine if we will terminate operations, proceed with additional exploration of the Property, or develop the Property. If we do not find mineralized material or we cannot remove mineralized material, either because we do not have the funds or because it is not economically feasible to proceed, we will cease operations in relation to the Property.

Total maximum expenditures for the exploration of the Property over the next 12 months are expected to range from approximately $560,000 to $970,000, depending largely on the number of holes drilled. If Phase I proves to be successful and sufficient funds are available after completion of such Phase, we will continue with Phase II and so on until funds are no longer available. In the event we have enough money to begin but not to complete one of the Phases, we will be forced to suspend operations until we raise the funds necessary to continue our exploration. If we cannot, or do not, raise sufficient money to complete one or more Phases, or if our exploration activities are not successful, we will discontinue exploration of the Property and any funds spent on exploration will likely be lost.

22

|

Phase

|

Exploration Activities

|

Anticipated Timeframe

|

Cost

|

|

Phase 1

|

Retention of consultant(s) to conduct: Geological Mapping, Geological Prospecting, Assaying and Information Review.

|

Expected to begin during the fourth calendar quarter of 2011 (dependent on funding).

|

$100,000

|

|

Phase II

|

Retention of consultant(s) to conduct: Trenching, Surveying of Localized Soil, and Detailed Sampling and Mapping of Historic Zones.

|

Expected to begin between the first calendar quarter of 2012 and the second calendar quarter of 2012 (dependent on funding and the results of Phase I activities).

|

$30,000 – $50,000

|

|

Phase III

|

Retention of consultant(s) to conduct: Core sampling and analysis of samples derived from core sampling.

|

Expected to begin in the third calendar quarter of 2012 (dependent on funding and the results of Phase I and Phase II activities).

|

$430,000 - $820,000

(dependent on the number of holes drilled and the duration of consultant’s services)

|

|

TOTAL

|

$560,000 – $970,000

|

Quality Assurance/Quality Control

The data obtained from our exploration program will consist of survey data, sampling data, and assay results. Quality Assurance/Quality Control (QA/QC) protocols will be in place at the mining site and at the laboratory to test the sampling and analysis procedures.

The Company will utilize statistical methodologies to calculate mineral reserves based on interpolation between and projection beyond sample points. Interpolation and projection are limited by certain factors including geologic boundaries, economic considerations and constraints to safe mining practices. Sample points will consist of variably spaced drill core intervals obtained from drill sites located on the surface and in underground development workings. Results from all sample points within the mineral reserve area will be evaluated and applied in determining the mineral reserves.

Samples will be sent to a laboratory for analysis. The samples will be under a strict monitoring and tracking system from log-in to completion. Samples will be logged-in immediately upon receipt and carefully checked for any special handling that may be needed. All analytical procedures, sample handling, and preservation techniques used will strictly adhere to those approved by the Environmental Protection Agency (“EPA”), where applicable. To test assay accuracy and reproducibility, pulps from core samples will be submitted and then resubmitted for analysis and compared. To test for sample errors or cross-contamination, blank core (waste core) samples will be submitted with the mineralized samples and compared. Reference samples from EPA or from private sources will also be tested with every set of samples to provide an additional measure of accuracy.

The QA/QC protocols will be practiced on both resource development and production samples. The data will be entered into a 3-dimensional modeling software package and analyzed to produce a 3-dimensional solid block model of the resource. The assay values will be further analyzed by a geostatistical modeling technique to establish a grade distribution within the 3-dimensional block model. Dilution will then be applied to the model and a diluted tonnage and grade will be calculated for each block. Mineral and waste tons, contained ounces and grade will then be calculated and summed for all blocks. A percent mineable factor based on historic geologic unit values will be applied and the final proven reserve tons and grade will be calculated.

The Company will review its methodology for calculating mineral reserves on an annual and as-needed basis. Conversion, an indicator of the success in upgrading probable mineral reserves to proven mineral reserves, will be evaluated as part of the reserve process. The review will examine the effect of new geologic information, changes implemented or planned in mining practices and mine economics on factors used for the estimation of probable mineral reserves. The review will include an evaluation of the Company’s rate of conversion of probable reserves to proven reserves.

23

Management Experience

Mr. Stephen E. Flechner, our President, Chief Executive Officer and director, has nearly 35 years of mining management and consulting experience. He has served numerous private and publicly traded mining companies in senior management and consultant capacities. From 1978 to 1993, he held the positions of Vice President & General Counsel of Gold Fields Mining Company, the U.S. operating subsidiary of former global mining giant Consolidated Gold Fields. During his tenure with Gold Fields, the organization grew from 12 to 1200 people while acquiring, exploring, permitting, financing, developing, and operating three highly profitable gold mines (Ortiz, Mesquite & Chimney Creek), producing an aggregate of 400,000 oz. gold/year. The Mesquite and Chimney Creek mines were subsequently acquired by Newmont Mining. Later in the 1990s, Mr. Flechner served as president of a TSX-V listed mining company that acquired and explored an early stage gold project in Ghana. Subsequently, he consulted to a TSX company regarding gold and uranium acquisitions in Europe and Nevada, culminating in a $40 million bought deal financing. More recently, he served as president/consulting counsel of a TSX-V company which acquired South Korea’s largest past producing gold and tungsten mines (a subsidiary of Berkshire Hathaway recently agreed to joint venture the tungsten project). He currently consults with other gold exploration and development companies. Mr. Flechner is a graduate of the Yale Law School and has lectured at the Rocky Mt. Mineral Law Institute on “Environmental Laws & Regulations Governing Gold Mining.”

Mr. Dean Huge, our Chief Executive Officer, Treasurer, Sectary and director, has had experience in both the public and private sectors and has raised funding through different financing structures over his career. From September 2010 to July 2011, Mr. Huge served as the Chief Financial Officer and Treasurer of China Chemical Corp., a manufacturer of fine chemicals used in the production of reinforced plastics and resins. In 2008 and 2009 Mr. Huge, served as a Senior Business Consultant to the small business-consulting firm, International Profit Association. From 2000 through 2008, Mr. Huge acted as President of Major Marketing Concepts, Inc., an affinity and incentive marketing services provider. Mr. Huge received a Bachelor of Science Degree in Accounting and Finance from Southern Illinois University.

Mr. Ralph Shearing, our director, is a professional geologist with extensive experience throughout North America and internationally. He is a graduate of the University of British Columbia, earning a B.Sc. Geology degree. Since graduating in 1981, he has been directly involved in several world class exploration and development projects and has gained hands-on experience in all aspects of mineral exploration, including geophysics, geochemistry, geology, and diamond core drilling. In 1986, Mr. Shearing founded and is currently the CEO and President of Soho Resources Corp., a TSX Venture Exchange listed mining company developing the Tahuehueto Project, a gold and silver deposit in Mexico. The Company appointed Mr. Shearing as a Director and Geological Consultant on account of his 25 years of active involvement with the management and directing of publicly traded companies, combined with his practical mining experience, which have given him unique insight into the industry and allowed him to develop a well-rounded business approach for junior resource companies.

Mr. Donald Ross, director of the Company is founder and President of Discovery Gold Ghana Limited, a wholly-owned subsidiary of the Company. Prior to his involvement in the mining sector, Mr. Ross spent over 30 years as a senior operational manager with United Parcel Service (UPS), retiring in 2000 following their successful Initial Public Offering. He is currently the founder and CEO of BDM Marketing, a firm specializing in placement and financing of automobiles to individuals with poor credit.

Competitive Factors

We are a new mineral resources exploration company. The gold mining industry is fragmented meaning that there are many gold prospectors and producers, small and large. While we will generally compete with other exploration companies, there is no competition for the exploration or removal of minerals from the Property, as we currently hold all interest and rights to the Property.

24

However, we will compete with other mineral resource exploration companies for the acquisition of new mineral properties and for available resources. Many of the mineral resource exploration companies with whom we will compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact our ability to finance further exploration and development of our mineral properties. We will be competing with other mineral resource exploration companies for available resources, including, but not limited to: professional geologists, camp staff, mineral exploration supplies, exploration vehicles and drill rigs. Competing for available resources will depend on our technical abilities, financial capacities, industry contacts, and any consulting arrangements we may have in place.

We will also compete with other mineral resource exploration companies for financing from investors that are prepared to make investments in mineral resource exploration companies. The presence of competing mineral resource exploration companies may impact our ability to raise additional capital in order to fund our exploration programs if investors view our competitors as more attractive investments, based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We have not yet identified any methods by which we will compete with other mineral resource companies.

If the Company is able to develop commercial operations, process the minerals that we extract from the Property, and ultimately sell these minerals, we anticipate that we will sell these minerals throughout the world, given the ever-increasing demand for these types of minerals and the variety of uses for these minerals in high tech applications, computers, jewelry, coinage, medicine, dentistry, and more.

Employees

As of the date of this Report we have no employees, other than our directors and officers. We may use third party consultants to assist in the completion of various projects; third parties are instrumental to keep the development of projects on time and on budget. Our management expects to continue to use consultants, attorneys, and accountants as necessary, to complement services rendered by our employees.

Government Regulation

Ghanaian Ownership and Special Rights

Rights to explore and develop a mine in Ghana are administered by the Minister of Lands and Natural Resources, acting upon the advice of the Minerals Commission, a governmental organization established under the 1992 Constitution (the “Constitution) to promote and regulate the development of Ghana's mineral wealth in accordance with the Constitution and the Minerals and Mining Act of 2006 (Act 703), which came into effect in March 2006 (“2006 Mining Act”).