Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - PEREGRINE SEMICONDUCTOR CORP | d118905dex231.htm |

| EX-23.3 - CONSENT OF FROST & SULLIVAN - PEREGRINE SEMICONDUCTOR CORP | d118905dex233.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 23, 2012.

Registration No. 333-170711

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 8 to

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

PEREGRINE SEMICONDUCTOR CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 3674 | 86-0652659 | ||

| (State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| Incorporation or Organization) | Classification Code Number) | Identification Number) |

9380 Carroll Park Drive San Diego, California 92121 Telephone: (858) 731-9400

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Jay C. Biskupski

Chief Financial Officer

9380 Carroll Park Drive San Diego, California 92121 Telephone: (858) 731-9400

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| Gari L. Cheever Jeffrey P. Higgins John M. Tolpa Gunderson Dettmer Stough San Diego, California 92130 |

Eric C. Jensen Jason L. Kent Charles J. Bair Cooley LLP 4401 Eastgate Mall San Diego, California 92121 Telephone: (858) 550-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION. DATED , 2012.

shares

Common Stock

This is our initial public offering of shares of common stock of Peregrine Semiconductor Corporation. The selling stockholders named in this prospectus are offering an additional 159,220 shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We have applied to list our common stock on the Nasdaq Global Market under the symbol “PSMI.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to selling stockholders |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from us at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2012.

| Deutsche Bank Securities | J.P. Morgan |

| RBC Capital Markets | Needham & Company | Oppenheimer & Co. | Pacific Crest Securities |

, 2012

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | |||

| 69 | ||||

| 83 | ||||

| 101 | ||||

| 102 | ||||

| 106 | ||||

| 110 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders |

112 | |||

| 116 | ||||

| 120 | ||||

| 120 | ||||

| 120 | ||||

| 120 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

No action is being taken in any jurisdiction outside the U.S. to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in a jurisdiction outside the U.S. are required to inform themselves about, and to observe any restrictions as to, this offering and the distribution of this prospectus applicable to that jurisdiction.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the following summary together with the more detailed information appearing in this prospectus, including our consolidated financial statements and related notes, and our risk factors beginning on page 9, before deciding whether to purchase shares of our common stock. Unless the context otherwise requires, we use the terms “Peregrine,” the “company,” “we,” “us,” and “our” in this prospectus to refer to Peregrine Semiconductor Corporation and its subsidiaries.

Overview

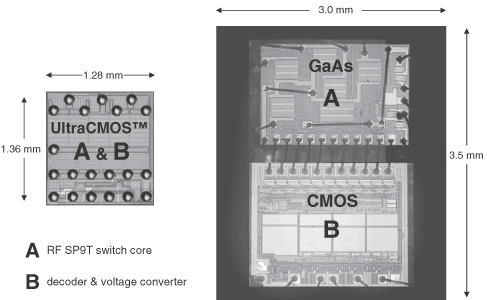

We are a fabless provider of high performance radio frequency integrated circuits, or RFICs. Our solutions leverage our proprietary UltraCMOS® technology, which enables the design, manufacture, and integration of multiple radio frequency, or RF, mixed signal, and digital functions on a single chip. We believe our products deliver an industry leading combination of performance and monolithic integration. Our solutions target a broad range of applications in the aerospace and defense, broadband, industrial, mobile wireless device, test and measurement equipment, and wireless infrastructure markets. We have shipped over one billion RFICs based on our UltraCMOS technology since January 1, 2006.

Our UltraCMOS technology combines the ability to achieve the high levels of performance of traditional specialty processes, with the fundamental benefits of standard complementary metal oxide semiconductor, or CMOS, the most widely used semiconductor process technology. UltraCMOS technology utilizes a synthetic sapphire substrate, a near-perfect electrical insulator, providing greatly reduced unwanted electrical interaction between the RFIC and the substrate (referred to as parasitic capacitance), which enables high signal isolation and excellent signal fidelity with low distortion over a broad frequency range (referred to as broadband linearity). These two technical attributes result in RF devices with excellent high-frequency performance and power handling performance, and reduced crosstalk between frequencies. In addition, increased broadband linearity provides for faster data throughput and greater subscriber capacity over a wireless network, resulting in enhanced network efficiency. UltraCMOS technology also provides the benefits of standard CMOS, such as high levels of integration, low power consumption, reusable circuit libraries, widely available design tools and outsourced manufacturing capacity, and the ability to scale to smaller geometries. We own fundamental intellectual property, or IP, in UltraCMOS technology consisting of more than 125 U.S. and international issued and pending patents, and over 300 documented trade secrets covering basic circuit elements, RF circuit designs, manufacturing processes, and design know-how.

We leverage our extensive RF design expertise and systems knowledge to develop RFIC solutions that meet the stringent performance, integration, and reliability requirements of the rapidly evolving wireless markets. As of June 30, 2012, we offer a broad portfolio of more than 160 high performance RFICs including switches, digital attenuators, mixers / upconverters, prescalers, digitally tunable capacitors, or DTCs, and DC-DC converters, and we are currently developing power amplifiers, or PAs. During the year ended December 31, 2011, our products were sold to more than 1,500 module manufacturers, original equipment manufacturers, or OEMs, contract manufacturers, and other customers, including such companies as Ericsson AB, Flextronics International Ltd., Hitachi Metals, Ltd., Itron, Inc., Jabil Circuit Inc., LG Innotek Co., Ltd., Mini-Circuits, Inc., Motorola Solutions, Inc., Murata Manufacturing Company, Ltd., Northrop Grumman Corporation, Planet Technology Corp., Rockwell Collins, Inc., Rohde & Schwarz, Inc., SIPAT Co., Ltd., Skyworks Solutions, Inc., Sony Corporation, Source Photonics, Inc., TDK-EPC Corporation, Thales Alenia Space, and TriQuint Semiconductor, Inc. We believe our RFICs are included in products sold by many of the leading mobile handset OEMs. For the years ended December 25, 2010 and December 31, 2011, we generated net revenue of $91.1 million and $107.8 million, respectively, representing year-over-year growth of 18%. We generated net income of $3.8 million for the year ended December 25, 2010 and a net loss of $9.7 million for the year ended

1

Table of Contents

December 31, 2011. We recorded net revenue of $80.3 million and a net loss of $3.1 million for the six months ended June 30, 2012. As of June 30, 2012, we had an accumulated deficit of $231.3 million.

Industry Overview

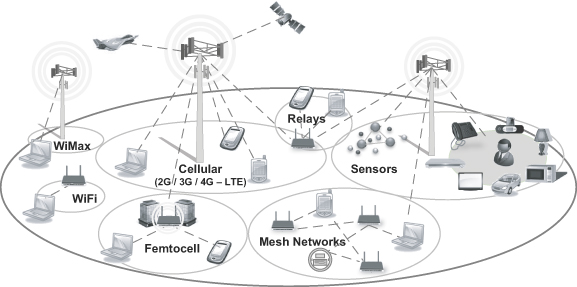

Proliferation of wireless devices coupled with rapid advances in RF technologies have significantly enhanced wireless connectivity and revolutionized the mobile wireless, wireless infrastructure, broadband, and satellite communications markets. In addition, an array of other consumer, public safety, aerospace and defense, and industrial markets are increasingly incorporating advanced RF functionality into a wide variety of applications, resulting in increased demand for high performance RFICs in these markets. According to Frost & Sullivan, the worldwide market for RFICs across the aerospace and defense, broadband, industrial, mobile wireless device, test and measurement equipment, and wireless infrastructure industries is expected to grow from $12.2 billion in 2010 to $29.2 billion in 2015, representing a compound annual growth rate, or CAGR, of 19.1%.

The need for higher performance wireless solutions, combined with the increased demand for integrated components that reduce costs, overall power consumption, and size, has significantly increased the performance demands on the RF front-end subsystems used in wireless devices. However, the fundamental physical limitations of silicon have prevented standard CMOS solutions from meeting the high frequency and power handling requirements of high performance RF front-ends. As a result, RF front-end semiconductor manufacturers have historically utilized traditional specialty process technologies such as gallium arsenide, or GaAs, heterojunction bipolar transistor, or GaAs HBT, GaAs pseudomorphic high electron mobility transistor, or GaAs pHEMT, silicon-germanium, or SiGe, or bipolar junction transistor and CMOS, or BiCMOS. While discrete RF components produced with these processes may attain sufficient levels of performance, these technologies lack the ability to monolithically integrate multiple discrete components and digital logic, cannot leverage existing high volume standard CMOS manufacturing infrastructure, and are inherently limited in their ability to scale to smaller geometries as compared to standard CMOS.

Our Solution and Competitive Strengths

We design, develop, market, and sell high performance RFICs based on our patented UltraCMOS technology. Our UltraCMOS technology enables us to monolithically integrate multiple RF and mixed signal components and digital circuitry into high performance RFICs. Our UltraCMOS technology provides the fundamental benefits of standard CMOS, including high levels of integration, low power consumption, reusable circuit libraries, widely available design tools and outsourced manufacturing capacity, and the ability to scale to smaller geometries.

Our strengths that distinguish us from the competition include:

| • | Unique, Proprietary UltraCMOS Technology. We pioneered the development of UltraCMOS technology for production of high performance RFICs and believe we are the only high volume commercial supplier of RFICs based on silicon-on-sapphire, or SOS. |

| • | Broad, System Level Integration Capabilities. Our extensive RFIC design experience allows us to approach the challenges of RF integration at the system level, as well as the component level. We have created a proprietary design platform that includes a comprehensive portfolio of cell libraries, reference designs, design tools, and other IP that allows the design, production, and integration of highly scalable RFICs. |

| • | Broad, Highly Differentiated IP Portfolio. We have more than 125 U.S. and international issued and pending patents encompassing a broad range of technologies that include basic materials processing, fundamental “building block” circuit elements enabled by our UltraCMOS material system, and higher-level circuit designs comprised of these unique circuit elements. In addition, we have substantial materials, process, design, packaging, and testing know-how that we retain as documented trade secrets. |

2

Table of Contents

| • | Proven and Efficient Fabless Model. Our UltraCMOS manufacturing process is highly portable to third-party foundries and allows us to scale our business, utilize established and proven standard CMOS production technologies, and transition to smaller geometries and larger wafer sizes relative to specialty process technologies. |

| • | Broad Markets and Diverse Customer Base. Our products address broad end markets, including aerospace and defense, broadband, industrial, mobile wireless device, test and measurement equipment, and wireless infrastructure markets. We offer over 160 different products across eight product families, and in 2011, our products were sold to more than 1,500 customers worldwide. |

Our Strategy

Our goal is to be the market leader in large and growing markets where our UltraCMOS technology can provide a superior RFIC solution. Key elements of our strategy include:

| • | Drive Integration Across RF Applications. We intend to continue to integrate additional discrete RF components and digital circuits into comprehensive single-chip solutions. |

| • | Expand our Served Addressable Market. We intend to continue to invest in the development of future generations of our products to meet the evolving performance, form factor, and cost demands of customers in our existing markets, while also expanding our product offerings to address the requirements of new products and markets. |

| • | Deepen Relationships with Existing Customers and Expand our Customer Base. We intend to enhance our global reach and increase our penetration of key customers in our target markets and continue to develop and broaden our relationships with key players in the wireless ecosystem, including wireless network operators, leading device and equipment OEMs, and reference design partners. |

| • | Leverage our Flexible, Scalable Outsourced Manufacturing Model. We have rapidly scaled our business by leveraging the high-volume manufacturing expertise and capacity of our third-party partners involved in the supply of key raw materials, wafer foundry, and assembly and testing services. We intend to continually expand and improve our efficient and robust global supply chain utilizing a variety of business partners located around the world. |

Risks Affecting Us

Our business is subject to numerous risks, which are highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Some of these risks are:

| • | our operating results may fluctuate significantly and our future results are difficult to predict, which may cause us to fail to meet the expectations of investors; |

| • | we have incurred significant losses and may incur losses in the future; |

| • | we may be unable to sustain our historical net revenue growth rate and if net revenue growth falls short of our expectations, we may not be able to immediately reduce our operating expenses proportionately, which could eliminate our profitability; |

| • | changes in our product mix and in our manufacturing operations utilization may adversely affect our gross margins and operating results; |

| • | we rely on a small number of customers for a significant percentage of our net revenue, and the loss of, or a reduction in, orders from these customers could result in a significant decline in our net revenue; |

| • | if we fail to develop new or enhanced products that achieve market acceptance in a cost-effective and timely manner, our operating results could be adversely affected; |

3

Table of Contents

| • | our failure to continue to keep pace with new or improved semiconductor process technologies could impair our competitive position; |

| • | we depend on outside semiconductor foundries to manufacture our products and implement our fabrication processes, and any failure to maintain sufficient foundry capacity could significantly delay our ability to ship our products, damage our relationships with module manufacturers, OEMs, distributors, and contract manufacturers, reduce our sales, and increase our expenses; |

| • | we depend on limited sources of supply for some of the key components and materials in our products, and a limited number of suppliers for wafer preparation, which makes us susceptible to shortages, price fluctuations, and quality risks that could adversely affect our operating results; |

| • | if our principal end markets fail to grow or experience declines, our net revenue may decrease; |

| • | we are currently, and expect to be in the future, party to patent lawsuits and other intellectual property rights claims that are expensive and time consuming, and, if resolved adversely, could have a significant impact on our business, financial condition, or results of operations; and |

| • | claims by others that we infringe their proprietary technology could adversely affect our business. |

For further discussion of these and other risks you should consider before making an investment in our common stock, see the section titled “Risk Factors” immediately following this prospectus summary.

Corporate Information

We were incorporated in Delaware in February 1990 and founded by Mark Burgener, Rory Moore, and Ron Reedy. Our principal executive offices are located at 9380 Carroll Park Drive, San Diego, California 92121. Our telephone number is (858) 731-9400. Our website address is www.psemi.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website to be part of this prospectus or in deciding whether to purchase shares of our common stock.

“Peregrine Semiconductor Corporation,” “Peregrine Semiconductor,” “Peregrine,” “UltraCMOS,” “HaRP,” “DuNE,” “STeP,” and other trademarks or service marks of Peregrine appearing in this prospectus are the property of Peregrine. This prospectus contains additional trade names, trademarks, and service marks of ours and of other companies. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

4

Table of Contents

The Offering

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

159,220 shares |

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and other general corporate purposes. While we have not allocated the net proceeds of this offering to specified general corporate purposes, we may utilize such proceeds by allocating them amongst the following categories: finance our growth; develop new products; assert and defend our intellectual property rights; and fund capital expenditures. In addition, we may choose to repay our loan facility with Silicon Valley Bank or expand our current business through acquisitions of other businesses, products, or technologies. However, we do not have agreements or commitments for any specific acquisitions at this time. See “Use of Proceeds.” We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. In connection with our initial public offering, eight employees are exercising options and selling a total of 159,220 shares issued upon exercise of these options. All of the options that are being exercised would otherwise expire during the 180-day lock-up period, when the holders would not be able to sell the shares, and therefore these holders are exercising these options and we are allowing them to sell these shares in our initial public offering. |

| Dividend policy |

Currently, we do not anticipate paying cash dividends, and under our loan and security agreement, we may not pay dividends without the prior written consent of Silicon Valley Bank. |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in shares of our common stock. |

| Proposed Nasdaq Global Market trading symbol |

PSMI |

The number of shares of our common stock to be outstanding following this offering is based on 25,229,301 shares of our common stock outstanding as of June 30, 2012, and excludes:

| • | 7,406,006 shares of common stock issuable upon the exercise of options outstanding under the Peregrine Semiconductor Corporation – 1996 Stock Plan, or 1996 Stock Plan, and the Peregrine Semiconductor Corporation – 2004 Stock Plan, or 2004 Stock Plan, as of June 30, 2012, at a weighted average exercise price of $4.48 per share; |

| • | 196,090 shares of common stock issuable upon the exercise of common and convertible preferred stock warrants outstanding as of June 30, 2012, at a weighted average exercise price of $6.86 per share; and |

5

Table of Contents

| • | 4,551,217 shares of common stock reserved for future issuance under our stock-based compensation plans, including 2,000,000 shares of common stock reserved for issuance under our 2012 Equity Incentive Plan, and 1,000,000 shares of common stock reserved for issuance under our 2012 Employee Stock Purchase Plan, subject in each case to automatic annual adjustment in accordance with the terms of the plan. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the automatic conversion of all outstanding shares of our convertible preferred stock as of June 30, 2012, into 22,384,097 shares of common stock, upon the completion of this offering; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to completion of this offering; |

| • | no exercise by the underwriters of their over-allotment option; and |

| • | a 1-for-7.34 reverse stock split of our outstanding capital stock prior to the completion of this offering. |

6

Table of Contents

Summary Consolidated Financial Data

The following tables set forth summary consolidated financial data. The consolidated statements of operations data for the years ended December 25, 2010 and December 31, 2011 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statements of operations data for the six months ended June 25, 2011 and June 30, 2012, and the consolidated balance sheet data as of June 30, 2012 have been derived from our unaudited consolidated financial statements, included elsewhere in this prospectus. The unaudited financial statements include all adjustments, consisting of normal recurring accruals, which we consider necessary for a fair presentation of the financial position and the results of operations for these periods. You should read this summary consolidated financial data in conjunction with the sections titled “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected for any future period.

| Fiscal Year Ended | Six Months Ended | |||||||||||||||

| December 25, 2010 |

December 31, 2011 |

June 25, 2011 |

June 30, 2012 |

|||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||

| Net revenue |

$ | 91,071 | $ | 107,771 | $ | 45,729 | $ | 80,334 | ||||||||

| Cost of net revenue (1) |

49,520 | 70,955 | 26,720 | 52,858 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

41,551 | 36,816 | 19,009 | 27,476 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expense |

||||||||||||||||

| Research and development (1) |

18,040 | 22,730 | 10,248 | 14,163 | ||||||||||||

| Selling, general and administrative (1) |

18,889 | 23,252 | 10,812 | 15,193 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expense |

36,929 | 45,982 | 21,060 | 29,356 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

4,622 | (9,166 | ) | (2,051 | ) | (1,880 | ) | |||||||||

| Interest expense |

(610 | ) | (318 | ) | (185 | ) | (1,076 | ) | ||||||||

| Other income (expense), net |

(105 | ) | (2 | ) | 66 | (38 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

3,907 | (9,486 | ) | (2,170 | ) | (2,994 | ) | |||||||||

| Provision for income taxes |

147 | 196 | 125 | 74 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

3,760 | (9,682 | ) | (2,295 | ) | (3,068 | ) | |||||||||

| Net income allocable to preferred stockholders (2) |

(3,760 | ) | — | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common stockholders |

$ | — | $ | (9,682 | ) | $ | (2,295 | ) | $ | (3,068 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted net income (loss) per share attributable to common stockholders |

$ | — | $ | (3.57 | ) | $ | (0.85 | ) | $ | (1.10 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing basic and diluted net income (loss) per share |

2,504 | 2,715 | 2,693 | 2,790 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Unaudited pro forma net income (loss) per share attributable to common stockholders: |

||||||||||||||||

| Basic |

$ | (0.39 | ) | $ | (0.12 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

$ | (0.39 | ) | $ | (0.12 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Unaudited pro forma weighted average common shares outstanding: |

||||||||||||||||

| Basic |

25,080 | 25,157 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

25,080 | 25,157 | ||||||||||||||

|

|

|

|

|

|||||||||||||

Footnotes on following page

7

Table of Contents

| As of June 30, 2012 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted |

||||||||||

| (unaudited) | ||||||||||||

| (in thousands) |

||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 42,918 | $ | 42,918 | $ | |||||||

| Working capital |

15,100 | 15,100 | ||||||||||

| Total assets |

131,504 | 131,504 | ||||||||||

| Obligations under capital leases, less current portion |

114 | 114 | 114 | |||||||||

| Notes payable, less current portion |

310 | 310 | 310 | |||||||||

| Other long-term liabilities |

5,391 | 4,583 | 4,583 | |||||||||

| Convertible preferred stock |

172,907 | — | — | |||||||||

| Total stockholders’ equity (deficit) |

(143,594 | ) | 30,121 | |||||||||

The pro forma column in the consolidated balance sheet data table above reflects the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 22,384,097 shares of common stock and the conversion of our remaining warrants to purchase convertible preferred stock into warrants to purchase common stock and the related reclassification of $808,000 of other long-term liabilities into stockholders equity (deficit).

The pro forma as adjusted column in the consolidated balance sheet data table above reflects (1) the automatic conversion of all outstanding shares of our convertible preferred stock as of June 30, 2012 into an aggregate of 22,384,097 shares of common stock upon completion of this offering, (2) the conversion of our remaining warrants to purchase convertible preferred stock into warrants to purchase common stock and the related reclassification of $808,000 of other long-term liabilities into stockholders equity (deficit), and (3) our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the initial public offering price range reflected on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

Footnotes from prior page:

| (1) | Includes stock-based compensation as follows: |

| Fiscal Year Ended | Six Months Ended | |||||||||||||||

| December 25, 2010 |

December 31, 2011 |

June 25, 2011 |

June 30, 2012 |

|||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands) | ||||||||||||||||

| Cost of net revenue |

$ | 407 | $ | 431 | $ | 208 | $ | 271 | ||||||||

| Research and development |

556 | 762 | 332 | 567 | ||||||||||||

| Selling, general and administrative |

1,554 | 1,891 | 943 | 1,126 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 2,517 | $ | 3,084 | $ | 1,483 | $ | 1,964 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (2) | Please see Note 1 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate net income allocable to preferred stockholders and net income (loss) attributable to common stockholders, including the method used to calculate the number of shares used in the computation of the per share amount. |

8

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations, and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

Our operating results may fluctuate significantly and our future results are difficult to predict, which may cause us to fail to meet the expectations of investors.

We operate in a highly dynamic industry and our future results could be subject to significant fluctuations, particularly on a quarterly basis. Our quarterly net revenue and operating results have fluctuated significantly in the past and may continue to vary from quarter-to-quarter due to a number of factors, many of which are not within our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. A significant percentage of our net revenue in each quarter is dependent on sales that are booked and shipped during that quarter, typically attributable to a large number of orders placed through our distributors for diverse end users and markets. As a result, accurately forecasting our operating results, including our total net revenue and gross margins, in any quarter is difficult. For example, it is difficult for us to forecast the demand for our products, in part because of the complex supply chain between us and the end users of our products. We have limited visibility into future module manufacturer, OEM, distributor, and contract manufacturer demand and the product mix that they will require, which could adversely affect our net revenue forecasts and operating margins.

In addition, our failure to accurately forecast demand can lead to product shortages that can impede production by the module manufacturers and OEMs, and harm our relationships with them and the distributors of our products. Conversely, our failure to forecast declining demand or shifts in product mix can result in excess or obsolete inventory. The rapid pace of innovation in our industry could also render significant portions of our inventory obsolete. Excess or obsolete inventory levels could result in unexpected expenses or increases in our reserves that could adversely affect our business, operating results, and financial condition. In contrast, if we were to underestimate demand or if sufficient manufacturing capacity were unavailable, we could forego net revenue opportunities, potentially lose market share, and damage our relationships with parties that use or distribute our products.

Additional factors that can contribute to fluctuations in our operating results include:

| • | the rescheduling, increase, reduction, or cancellation of significant orders from module manufacturers, OEMs, distributors, or contract manufacturers; |

| • | our ability to develop, introduce, and ship in a timely manner new products and product enhancements that meet the requirements of module manufacturers, OEMs, or end users of our products, including performance, functionality, reliability, form factor, and cost requirements; |

| • | the rate at which module manufacturers, OEMs, and end users adopt our technologies in our target end markets; |

| • | the timing and success of the introduction of new products and technologies by us and our competitors, and the acceptance of our new products by module manufacturers, OEMs, and end users; |

| • | our gain or loss of a key module manufacturer, OEM, distributor, or contract manufacturer; |

| • | the availability, cost, and quality of materials and components that we purchase from third-party foundries and any problems or delays in the fabrication, wafer preparation, assembly, testing, or delivery of our products; |

9

Table of Contents

| • | fluctuations in manufacturing yields associated with new product introductions or changes in process technologies; |

| • | the quality of our products and any remediation costs, including costs associated with the return of previously sold products due to manufacturing defects; and |

| • | general economic conditions in our domestic and foreign markets. |

Due to these and other factors, quarter-to-quarter comparisons of our historical operating results should not be relied upon as accurate indicators of our future performance.

We have incurred significant losses and may incur losses in the future.

As of June 30, 2012, we had an accumulated deficit of $231.3 million. Although we achieved profitability on a quarterly basis in 2010, and our net income for the year ended December 25, 2010 was $3.8 million, we incurred net losses of $9.7 million for the year ended December 31, 2011 and $3.1 million for the six months ended June 30, 2012, and we expect to continue to make significant expenditures related to the development of our business. These include expenditures to hire additional personnel related to the sales, marketing, and development of our products, and to maintain and expand our research and development facilities. We may not have sufficient net revenue growth to offset increased expenses or to achieve or maintain profitability in future periods.

We may be unable to sustain our historical net revenue growth rate and if net revenue growth falls short of our expectations, we may not be able to immediately reduce our operating expenses proportionately, which could eliminate our profitability.

Our net revenue has grown rapidly in recent years. Our net revenue grew from $38.2 million in 2006 to $53.4 million in 2007, and to $68.4 million in 2008. In 2009, our net revenue continued to grow to $70.5 million, but at a less rapid pace than the year prior. Over our history, we have experienced periods of relatively flat period-over-period growth, as well as periods of more rapid growth. From 2007 through 2011, our annual net revenue has increased at a CAGR of 19%. Our net revenue in the year ended December 31, 2011 increased by 18% over the corresponding period in 2010. We believe that in planning our growth, it is prudent to take into account the cyclical nature of some of the end markets that we serve, as well as the longer term historical patterns in the development of our business. Even if our net revenue increases to higher levels, we believe that a decline in the rate of growth of our net revenue is, to some extent, inevitable. Although we base our planned operating expenses in large part on our expectations of future net revenue, a substantial portion of our expenses is relatively fixed, and cannot immediately be eliminated if our net revenue falls short of our expectations. Thus, if the rate in growth of our net revenue in any quarter is substantially less than we had anticipated, we may be unable to reduce our operating expenses commensurately in that quarter, which could negatively affect our results of operations for that quarter. For instance, for the quarter ended March 26, 2011, our net revenue declined to $21.2 million from $23.4 million for the quarter ended December 25, 2010. In addition, we experienced net losses of $1.0 million, $1.3 million, $4.5 million, $2.7 million, and $3.0 million for the quarters ended March 26, 2011, June 25, 2011, September 24, 2011, December 31, 2011, and March 31, 2012, respectively, compared to a net income of $1.2 million for the quarter ended December 25, 2010.

Changes in our product mix and in our manufacturing operations utilization may adversely affect our gross margins and operating results.

Our products have a wide range of gross margins, and our overall gross margin in any period is highly dependent on the percentage of our net revenue attributable to higher or lower margin products in that period. The product mix that module manufacturers, OEMs, distributors, and contract manufacturers will require varies greatly from period-to-period and is difficult for us to predict, and a shift in product mix in any given period to a greater percentage of lower margin products would adversely affect our gross margins and operating results. For

10

Table of Contents

example, for the three month periods ended December 25, 2010, March 26, 2011, June 25, 2011, September 24, 2011, December 31, 2011, March 31, 2012, and June 30, 2012, our gross margins were 48%, 43%, 40%, 27%, 30%, 31%, and 37%, respectively. As a result of changes in product mix, our operating results will vary from period-to-period and could be adversely affected.

In addition, we are generally faced with a decline in the utilization of our manufacturing operations during periods of reduced demand, as a certain portion of our manufacturing costs are relatively fixed. During periods of reduced demand, these overhead costs are allocated over a smaller number of units, which will result in increased product cost. Reduced market demand in the future may adversely affect our utilization and consequently result in lower gross margins for our products. Fluctuations in our gross margins for our products could have a material negative impact on our business, financial condition and results of operations.

We rely on a small number of customers for a significant percentage of our net revenue, and the loss of, or a reduction in, orders from these customers could result in a significant decline in net revenue.

Although we have shipped our products to a large number of customers, we have historically depended on a small number of customers for a significant percentage of our annual net revenue. The composition of this group can change from year to year. Net revenue derived from our three largest direct customers as a percentage of our annual net revenue was 59% and 68% for the years ended December 25, 2010 and December 31, 2011, respectively, and 60% and 82% for the six months ended June 25, 2011 and June 30, 2012, respectively. Included in these percentages for our three largest direct customers are sales to two of our distributors. Based on records from our distributors of shipments to their customers, net revenue derived from our three largest end customers as a percentage of annual net revenue was 39% and 49% for the years ended December 25, 2010 and December 31, 2011, respectively, and 38% and 67% for the six months ended June 25, 2011 and June 30, 2012, respectively. Sales through our distributor Macnica to module manufacturer Murata represented 39% of our net revenue for the year ended December 31, 2011 and 61% of our net revenue for the six months ended June 30, 2012 and we believe substantially all of the products sold by Murata are to a limited number of mobile handset manufacturers. Any decrease in mobile handset sales by such manufacturers could have a material negative impact on our business, financial condition and results of operations. While the composition of our top customers varies from year to year, we expect that shipments to a limited number of customers will continue to account for a significant percentage of our net revenue for the foreseeable future.

With the exception of a supply and prepayment agreement with Murata, substantially all of our business, including that from our largest customers, is conducted through standard purchase orders, which provide no contractual guarantees beyond the purchase order itself. It is possible that any of our major customers could terminate its purchasing relationship with us or significantly reduce or delay the amount of our products that it orders, purchase products from our competitors, or develop its own products internally. The loss of, or a reduction in, orders from any major customer could cause a decline in net revenue and adversely affect our results of operations. To date, we have not experienced significant risk with respect to customer credit risk, but this could change as we expand our business in size and into new geographies in the future.

If we fail to develop new or enhanced products that achieve market acceptance in a cost-effective and timely manner, our operating results could be adversely affected.

The markets for our products are characterized by frequent new product introductions and changes in product and process technologies. The future success of our business will depend on our ability to develop new products for existing and new markets, introduce these products in a cost-effective and timely manner, have our products designed into the products of leading module manufacturers and OEMs, and have our products gain broad adoption by end users. The development of new high performance RFICs is highly complex, and from time-to-time we may experience delays in completing the development and introduction of new products or fail to efficiently manufacture such products in the early production phase. Our ability to successfully develop, introduce, and deliver new high performance RFICs will depend on various factors, including our ability to:

| • | complete and introduce new product designs; |

| • | achieve design wins with module manufacturers and OEMs, and broad adoption by end users; |

11

Table of Contents

| • | meet the time pressures associated with the demands of the module manufacturers and OEMs to which we sell through our distributors and contract manufacturers; |

| • | accurately understand market requirements; |

| • | attract and retain skilled engineering, operations, and manufacturing personnel; |

| • | obtain adequate supplies of materials and components that meet our quality requirements; and |

| • | achieve adequate manufacturing yields and maintain sufficient supply through our third-party foundry relationships. |

We believe that our UltraCMOS platform gives us a competitive advantage because it enables us to develop new products that integrate RF, analog, digital, and other functions on a single chip. However, if demand for integrated components in the future is smaller than anticipated, our competitive advantage would be diminished and our business could be adversely affected.

Our failure to continue to keep pace with new or improved semiconductor process technologies could impair our competitive position.

The semiconductor industry has historically been characterized by advancing technology through smaller geometries and larger wafer sizes, as well as through other proprietary and non-proprietary techniques. Although we have certain proprietary semiconductor processes, such as the application of silicon on a sapphire substrate in our UltraCMOS process, we constantly seek to develop new and improved techniques and methods internally and with the assistance of our suppliers. For example, we are currently working with numerous suppliers with respect to our next generation technologies. There can be no assurance that our efforts with these suppliers will ultimately be successful or result in next generation technologies that enable us to cost effectively produce our products in the future. For example, higher costs associated with the introduction and start up of new technologies could negatively impact our gross margins if the selling prices for our products based on new technologies do not sufficiently offset our higher costs for these technologies. For instance, we implemented new manufacturing processes in 2011 which resulted in low yields of certain wafers. As such, we recorded reductions to the carrying value of inventory as a result of a lower of cost or market valuation. Gross margins declined in our third and fourth quarter of fiscal 2011 as a result. Our future success depends in part upon our ability to continue to improve our semiconductor process technologies in order to adapt to emerging module manufacturer and OEM requirements and to competitive market conditions. If we fail for any reason to remain abreast of new and improved semiconductor process technologies as they emerge, we may lose market share which could adversely affect our operating results.

Standard CMOS is the semiconductor industry’s most broadly used manufacturing process technology and the semiconductor industry has committed significantly greater resources to standard CMOS, silicon on insulator, or SOI, and GaAs process technologies, as compared to our technology. Therefore, with the resources available to competitors using those technologies, they may more quickly adapt to emerging module manufacturer and OEM requirements and competitive market conditions than we can.

If the manufacturing yields that we realize in our production of integrated circuits, or ICs, were to decrease, our operating results could be adversely affected.

The manufacture and assembly of ICs, particularly high performance RFICs that we supply, is a highly complex process that is sensitive to a wide variety of factors, including the level of contaminants in the manufacturing environment, impurities in the materials used, and the performance of the fabrication equipment. As is typical in the semiconductor industry, we have from time to time experienced lower than anticipated manufacturing yields. In particular, we have in the past and may experience in the future lower manufacturing yields with respect to the introduction of new products, migration to smaller geometries, or the installation and start up of new process technologies. Our operating results could be adversely affected if we were unable to maintain current manufacturing yields through our third-party foundry relationships. For example, for the quarter ended September 25, 2011 we experienced lower than anticipated yields on certain wafers due to the implementation of new manufacturing processes and recorded an inventory write-down of $3.1 million as a result of a lower of cost or market valuation.

12

Table of Contents

We depend on LAPIS Semiconductor Co., Ltd., MagnaChip Semiconductor Ltd., Silanna Semiconductor Pty Ltd., and other outside semiconductor foundries to manufacture our products and implement our fabrication processes, and any failure to maintain sufficient foundry capacity could significantly delay our ability to ship our products, damage our relationships with module manufacturers, OEMs, distributors, and contract manufacturers, reduce our sales, and increase our expenses.

We do not own or operate any fabrication facilities and instead outsource fabrication of our products to independent foundries. Prior to June 2008, we owned and operated a manufacturing facility in Sydney, Australia. In June 2008, after achieving volume outsourced production of our UltraCMOS products, we sold our ownership interest in this manufacturing operation to Silanna Foundries Pty. Ltd. and entered into an outsourced manufacturing arrangement with this company. Silanna Foundries and its wafer manufacturing subsidiary are referred to in this prospectus as Silanna Semiconductor. LAPIS Semiconductor, MagnaChip Semiconductor, and Silanna Semiconductor manufactured 100% of the wafers used in our products for the years ended December 25, 2010 and December 31, 2011, and the six months ended June 30, 2012.

We place our purchase orders with foundries based on sales forecasts for our products. If any third-party foundry does not provide competitive pricing or is not able to meet our required capacity for any reason, or if our business relationship with LAPIS Semiconductor, MagnaChip Semiconductor, Silanna Semiconductor, or any other semiconductor foundry deteriorates, we may not be able to obtain the required capacity and would have to seek alternative foundries, which may not be available on commercially reasonable terms, or at all. The process for qualifying a new foundry is time consuming, difficult, and may not be successful, particularly if we cannot promptly integrate our proprietary process technology with the process used by the new foundry. Using a foundry with which we have no established relationship could expose us to potentially unfavorable pricing, unsatisfactory quality, or insufficient capacity allocation.

We face a number of other significant risks associated with outsourcing fabrication, including:

| • | limited control over delivery schedules, quality assurance and control, and production costs; |

| • | discretion of foundries to reduce deliveries to us on short notice, allocate capacity to other customers that may be larger or have long-term customer or preferential arrangements with foundries we use; |

| • | inability of foundries to adequately allocate additional capacity to us based upon an increase in demand for our products; |

| • | unavailability of, or potential delays in accessing, key process technologies; |

| • | damage to equipment and facilities, power outages, equipment, or materials shortages that could limit manufacturing yields and capacity at the foundries; |

| • | potential unauthorized disclosure or misappropriation of IP, including use of our technology by the foundries to make products for our competitors; |

| • | financial difficulties and insolvency of foundries; |

| • | acquisition of foundries by third parties; and |

| • | lack of long-term manufacturing commitments by the foundries. |

Any of the foregoing risks could delay shipment of our products, result in higher expenses and reduced net revenue, damage our relationships with module manufacturers, OEMs, distributors, and contract manufacturers, and otherwise adversely affect our operating results.

We depend on limited sources of supply for some of the key components and materials in our products, and a limited number of suppliers for wafer preparation, which makes us susceptible to shortages, price fluctuations, and quality risks that could adversely affect our operating results.

We purchase a number of key components and materials used in our products from limited source suppliers. For example, we currently obtain synthetic sapphire substrates from three third-party suppliers, including Kyocera Corporation, Rubicon Technology, Inc., and Maintech Japan Corporation. Our current consumption

13

Table of Contents

levels of synthetic sapphire represent less than approximately two percent of worldwide synthetic sapphire production. We believe that our suppliers currently have manufacturing capacity adequate to meet our foreseeable requirements. However, if competition for capacity were to increase, our suppliers could increase the lead times required to deliver materials to us or could seek to increase the prices of materials we purchase from them. For example, competition for synthetic sapphire wafer capacity has increased significantly in recent years due to the use of sapphire as a substrate for blue and white light-emitting diodes, or LEDs. This increasing demand for synthetic sapphire for use in LEDs has resulted in substantial increases in the cost of sapphire substrates and could adversely impact our manufacturing costs as well as the availability of sapphire substrate supply. In addition, we and our outside foundries use a limited number of suppliers for wafer preparation. For example, we currently obtain bonded SOS substrate from Soitec USA, Inc.

If our limited source suppliers and suppliers for wafer preparation were to experience difficulties that affected their manufacturing yields or the quality of the materials they supply to us, our cost of net revenue could be adversely affected. Longer lead times and quality problems experienced by our suppliers could also prevent us from fulfilling the demands of the module manufacturers, OEMs, distributors, and contract manufacturers for our products on a timely basis, and thus adversely affect our net revenue. The ability of our suppliers to meet our requirements could be impaired or interrupted by factors beyond their control, such as earthquakes or other natural phenomena, labor strikes or shortages, or political unrest. In the event one of our suppliers is unable to deliver products to us or is unwilling to sell materials or components to us, our operations may be adversely affected. We might also experience difficulty identifying alternative sources of supply for the materials or components used in our products or products we obtain through outsourcing. We could experience delays if we were required to test and evaluate products of potential alternative suppliers or products we obtain through outsourcing. Furthermore, financial or other difficulties faced by our suppliers, or significant changes in demand for the components or materials they use in the products they supply to us, could limit the availability of those products, components, or materials to us. Any of these occurrences could negatively impact our operating results and adversely affect our business.

If our principal end markets fail to grow or experience declines, our net revenue may decrease.

Although our products are used in a variety of end markets, our future growth depends to a significant extent on the success of our principal end markets. The rate at which these markets will grow is difficult to predict. These markets may fail to grow or decline for many reasons, including insufficient consumer demand, decreased demand for bandwidth, lack of access to capital, changes in the U.S. defense budget and procurement processes, and changes in regulatory environments. If demand for high performance RFICs or devices in which our products are incorporated declines, fails to grow, or grows more slowly than we anticipate, purchases of our products may be reduced, and our net revenue could decline.

In particular, a significant portion of our products are incorporated into mobile wireless devices. Accordingly, demand for our products is dependent on the ability of mobile wireless device manufacturers to successfully sell wireless devices that incorporate our products. We cannot be certain whether these manufacturers will be able to create or sustain demand for their wireless devices that contain our products or how long they will remain competitive in their business, if at all. The success of these mobile wireless device manufacturers and the demand for their wireless devices can be affected by a number of factors, including:

| • | market acceptance of their mobile wireless devices that contain our products; |

| • | the impact of slowdowns or declines in sales of mobile wireless devices in general; |

| • | their ability to design products with features that meet the evolving tastes and preferences of consumers; |

| • | fluctuations in foreign currency; |

| • | relationships with wireless carriers in particular markets; |

14

Table of Contents

| • | the implementation of, or changes to, mobile wireless device certification standards and programs; |

| • | technological advancements in the functionality and capabilities of mobile wireless devices; |

| • | the imposition of restrictions, tariffs, duties, or regulations by foreign governments on mobile wireless device manufacturers; |

| • | failure to comply with governmental restrictions or regulations; |

| • | cost and availability of components for their products; and |

| • | inventory levels in the sales channels into which mobile wireless device manufacturers sell their products. |

Our future net revenue growth depends on demand for bandwidth for many of our relevant markets, including mobile wireless device, wireless infrastructure, and aerospace and defense. However, such bandwidth demands are subject to market changes and the evolving requirements of end users and therefore may not occur.

If we fail to penetrate key players in our existing markets or fail to penetrate new markets, our net revenue, net revenue growth rate, if any, and financial condition could be materially and adversely affected.

We currently sell most of our products into the aerospace and defense, broadband, industrial, mobile wireless device, test and measurement equipment, and wireless infrastructure markets. Our net revenue growth, if any, will depend in part on our ability to penetrate key customers in these target markets and to continue to develop and broaden our relationships with key players in the wireless ecosystem including wireless network operators, leading device and equipment OEMs, and reference design partners. Each of the markets we serve presents distinct and substantial risks. If any of these markets does not develop as we currently anticipate or if we are unable to penetrate them successfully, it could materially and adversely affect our net revenue and net revenue growth rate, if any.

In addition, the markets for certain of our products, such as DC-DC converters and DTCs, are new, still developing and relatively small. We have sold or provided samples of limited quantities of our products into these markets and cannot predict how or to what extent demand for our products in these markets will develop. If we fail to penetrate these or other new markets upon which we target our resources, our net revenue and net revenue growth rate, if any, likely will decrease over time and our financial condition could suffer.

If module manufacturers or OEMs do not design our RFICs into their product offerings, or if such module manufacturers’ or OEMs’ product offerings are not commercially successful, we would have difficulty selling our RFICs and our business could be adversely affected.

Our products are sold directly and through our distributors and contract manufacturers to module manufacturers who include our RFICs in the products they supply to OEMs, and to OEMs who include our RFICs in their products. Our RFICs are generally incorporated into the module manufacturers’ and OEMs’ products at the design stage. As a result, we rely on module manufacturers and OEMs to design our RFICs into the products they sell. Without these design wins, our business would be materially and adversely affected. We often incur significant expenditures on the development of a new RFIC without any assurance that a module manufacturer or OEM will select our RFIC for design into its own product. Once a module manufacturer or OEM designs a competitor’s semiconductor into its product offering, it becomes significantly more difficult for us to sell our RFICs directly or indirectly to that module manufacturer or OEM because changing suppliers involves significant cost, time, effort, and risk for the module manufacturer or OEM. Furthermore, even if a module manufacturer or OEM designs one of our RFICs into its product offering, we cannot be assured that its product will be commercially successful and that we will receive any net revenue from that product. If the module manufacturers’ or OEMs’ products incorporating our RFICs fail to meet the demands of their customers or otherwise fail to achieve market acceptance, we will be unable to achieve broad adoption of our UltraCMOS technology. As a result, our net revenue and business would be adversely affected.

15

Table of Contents

We design custom RFICs to meet specific requirements of the module manufacturers and OEMs. The amount and timing of net revenue from such products can cause fluctuations in our quarterly operating results.

The design and sales cycle for our custom RFICs, from initial contact by our sales force to the commencement of shipments of those products in commercial quantities, is lengthy and can range from six months to as long as two years or more. As part of this process, our sales and application engineers work closely with either the module manufacturer or OEM to analyze their respective product requirements and establish a technical specification for the custom RFIC. We then evaluate test wafers and components, and establish assembly and test procedures before manufacturing in commercial quantities can begin. The length of this cycle is influenced by many factors, including the difficulty of the technical specification, the novelty and complexity of the design and the module manufacturers’ or OEMs’ procurement processes. Module manufacturers and OEMs typically do not commit to purchase significant quantities of a custom RFIC until they are ready to commence volume shipment of their own products, and volume purchases of our custom RFICs by module manufacturers or OEMs generally do not occur until they have successfully introduced the modules or products incorporating our RFICs. Our receipt of substantial net revenue from sales of a custom RFIC depends on the module manufacturer’s or OEM’s commercial success in manufacturing and selling its product incorporating our custom RFIC. As a result, a significant period may elapse between our investment of time and resources in a custom RFIC and our receipt of substantial net revenue from sales of that product.

The length of this process increases the risk that such module manufacturer or OEM will decide to cancel or change its product plans. Such a cancellation or change in plans by the module manufacturer or OEM could cause us to lose anticipated sales. In addition, our financial condition and results of operations would be adversely affected if a significant module manufacturer or OEM curtails, reduces, or delays orders during our sales cycle, chooses not to release equipment that contains our custom RFICs, or are themselves not successful in the sale and marketing of their products that incorporate our custom RFICs. Additionally, a module manufacturer or OEM occasionally requests that we create custom RFICs and they agree to purchase such products only if we provide periods of exclusivity during which we will provide those custom RFICs only to that customer. These exclusivity periods restrict our ability to generate sales of these products with other customers and may cause us to lose significant sales to other module manufacturers and OEMs. Finally, if we fail to achieve initial design wins in the module manufacturer’s or OEM’s qualification process, we may lose the opportunity for significant sales to that module manufacturer or OEM for a lengthy period of time because the module manufacturer or OEM may be unlikely to change its source for those products in the future due to the significant costs associated with qualifying a new supplier and potentially redesigning its product.

The average selling prices of RFICs in our markets have historically decreased over time and will likely do so in the future, which could adversely impact our net revenue and gross profits.

Average selling prices of RFICs in the markets we serve have historically decreased over time and we expect such declines to continue to occur. Our gross profits and financial results will suffer if we are unable to offset reductions in our average selling prices by reducing our costs, developing new or enhanced RFICs on a timely basis with higher selling prices or gross profits, or increasing our sales volumes. Additionally, because we do not operate our own manufacturing, assembly, or testing facilities, we may not be able to reduce our costs as rapidly as companies that operate their own facilities, and our costs may even increase, which could also reduce our margins. In the past, we have reduced the prices of our RFICs in anticipation of future competitive pricing pressures, new product introductions by us or our competitors, and other factors. We expect that we will have to continue to do so in the future.

Our financial results are exposed to the cyclicality of the semiconductor industry, and as a result, we may experience reduced net revenue or operating income during any future semiconductor industry downturn.

The semiconductor industry is highly cyclical and has historically experienced significant fluctuations in demand, resulting in product overcapacity, high inventory levels, and accelerated erosion of average selling prices. These conditions have sometimes lasted for extended periods of time. Downturns in our target markets

16

Table of Contents

have in the past contributed to weak demand for semiconductor products. We experienced slower growth during periods of weak demand in the past, and our operating results may be adversely impacted by any downturns in the future. Future downturns in the semiconductor industry could adversely impact our net revenue and adversely affect our business, financial condition, and results of operations.

The segment of the semiconductor industry in which we participate is intensely competitive, and our inability to compete effectively could adversely affect our business.

The markets for our products are extremely competitive, and are characterized by rapid technological advances, frequent new product introductions, evolving industry standards, price erosion, and the continuously evolving requirements of module manufacturers and OEMs. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses, and failure to increase, or the loss of, market share, any of which could adversely affect our business. We compete primarily with other suppliers of high performance RFICs. We currently compete in the mobile wireless device and wireless infrastructure markets with Avago Technologies Limited, Hittite Microwave Corporation, M/A-COM Technology Solutions Inc., NEC Corporation, Renesas Electronics Corporation, RF Micro Devices, Inc., Skyworks, Sony Corporation, Texas Instruments Incorporated, Toshiba Corporation, TriQuint Semiconductor, Inc., and others. In the broadband, test and measurement equipment, and industrial markets, we principally compete with Hittite, M/A-COM, Renesas, Skyworks, and others. Our principal competitors in the aerospace and defense markets include Analog Devices, Inc., Hittite, Intersil Corporation, M/A-COM, and others. We expect increased competition from other established and emerging companies if our market continues to develop and expand. For example, current or potential competitors have established or may establish financial and strategic relationships with each other or with existing or potential customers or other third parties to increase the ability of their products to address the needs of our prospective customers. Accordingly, it is possible that new competitors or alliances among competitors could emerge and rapidly acquire significant market share, which would adversely affect our business. In addition, a competitor could acquire a partner to which we have licensed certain rights to sell products using our technology. There can be no assurance that we will be able to compete successfully against current or potential competitors, or that competition will not have a material adverse effect on our business, financial condition, and results of operations.

In addition, we may face competition because of the potential risks customers associate with purchasing products from sole sources. Because our products are manufactured using a proprietary technology, customers may be reluctant to purchase our products because they may view us as a sole source supplier for certain of their component parts. Customers generally prefer to incorporate components into their products that can be sourced from multiple suppliers.

We rely substantially on distributors for the sale of our products, and if we fail to retain or find additional distributors, or if these parties fail to perform as expected, it could reduce our future net revenue.

A significant portion of our net revenue is derived from a limited number of distributors, in particular, Macnica and Richardson. Our distributor sales to Macnica are primarily flow-through sales to Murata, since the vast majority of the sales of our products by Macnica are to Murata. For the year ended December 31, 2011, approximately 48% and 16% of our net revenue was derived from Macnica and Richardson, respectively, and for the six months ended June 30, 2012, Macnica and Richardson accounted for 66% and 14% of our net revenue, respectively. We anticipate that we will continue to be dependent upon a limited number of distributors, including a limited number of end customers purchasing from Macnica, for a significant portion of our net revenue in the foreseeable future. The portion of our net revenue attributable to certain distributors may also fluctuate in the future since we are unable to predict the extent to which these distributors will be successful in marketing and selling our products. Furthermore, termination of a relationship with a major distributor, either by us or by the distributor, could result in a temporary or permanent loss of net revenue. We may not be successful in finding suitable alternative distributors on satisfactory terms, or at all, and this could adversely affect our ability to sell in certain geographical locations or to certain end customers. Additionally, if we terminate our relationship with a major distributor, we may be obligated to repurchase unsold products, which could be difficult or impossible to sell to other end customers. Furthermore, distributors we do business with may face issues obtaining credit, which could impair their ability to make timely payments to us.

17

Table of Contents

In addition to distribution and sales activities, some of our distributors provide technical sales support to module manufacturers and OEMs. The activities of our distributors are not within our direct control. Our failure to manage our relationships with these distributors could impair the effectiveness of our sales, marketing, and support activities. A reduction in the sales efforts, technical capabilities, or financial viability of these parties, a misalignment of interest between us and them, or a termination of our relationship with our distributors could have a negative effect on our sales, financial results, and ability to support the OEMs and module manufacturers who purchase our products. We generally engage our distributors under short-term contracts, which typically may be terminated by either party upon 90 days’ notice. It generally takes approximately three months for a distributor to become educated about our products and capable of providing quality sales and technical support to the module manufacturers and OEMs. Recruiting and retaining qualified distributors and training them in our technology and product offerings requires significant time and resources. However, it may be difficult to terminate foreign distributors if they are not performing as expected. If our relationship with one of our other distributors were terminated for any reason, shipments to current and prospective module manufacturers and OEMs could be disrupted or delayed, and we could experience a diversion of substantial time and resources as we seek to identify, contract with, and train a replacement, all of which could adversely affect our operating results.

Defects and poor performance in our products could result in loss of module manufacturers and OEMs purchasing our products, decreased net revenue, unexpected expenses, and loss of market share, and we may face warranty and product liability claims arising from defective products.