Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF MERGER, DATED AS OF JULY 20, 2012 - GenOn Energy, Inc. | d383531dex21.htm |

| EX-99.1 - JOINT PRESS RELEASE OF GENON AND NRG, ISSUED JULY 22, 2012 - GenOn Energy, Inc. | d383531dex991.htm |

| 8-K - FORM 8-K - GenOn Energy, Inc. | d383531d8k.htm |

Creating the

Foundation for the Leading 21

Century

Competitive

Energy

Provider

NRG Energy

Exhibit 99.2

st |

1

Safe Harbor

In addition to historical information, the information presented in this communication

includes forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Exchange Act. These statements involve estimates, expectations,

projections, goals, assumptions, known and unknown risks and uncertainties and can typically

be identified by terminology such as “may,” “will,”

“should,” “could,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “expect,” “intend,” “seek,” “plan,”

“think,” “anticipate,” “estimate,” “predict,”

“target,” “potential” or “continue” or the negative of these terms or other comparable terminology. Such

forward-looking statements include, but are not limited to, statements about the

anticipated benefits of the proposed transaction between NRG and GenOn, each

party’s and the combined company’s future revenues, income, indebtedness, capital structure, plans, expectations,

objectives, projected financial performance and/or business results and other future events,

each party’s views of economic and market conditions, and the expected timing of

the completion of the proposed transaction.

Forward-looking statements are not a guarantee of future performance and

actual events or results may differ materially from any forward- looking statement

as result of various risks and uncertainties, including, but not limited to, those relating to: the ability to satisfy the

conditions to the proposed transaction between NRG and GenOn, the ability to successfully

complete the proposed transaction (including any financing arrangements in connection

therewith) in accordance with its terms and in accordance with expected schedule, the ability to obtain

stockholder, antitrust, regulatory or other approvals for the proposed transaction, or an

inability to obtain them on the terms proposed or on the anticipated schedule,

diversion of management attention on transaction-related issues, impact of the transaction on relationships with

customers, suppliers and employees, the ability to finance the combined business

post-closing and the terms on which such financing may be available, the financial

performance of the combined company following completion of the proposed transaction, the ability to successfully

integrate the businesses of NRG and GenOn, the ability to realize anticipated benefits of the

proposed transaction (including expected cost savings and other synergies) or the risk

that anticipated benefits may take longer to realize than expected, legislative, regulatory and/or

market developments, the outcome of pending or threatened lawsuits, regulatory or tax

proceedings or investigations, the effects of competition or regulatory intervention,

financial and economic market conditions, access to capital, the timing and extent of changes in law

and regulation (including environmental), commodity prices, prevailing demand and market

prices for electricity, capacity, fuel and emissions allowances, weather conditions,

operational constraints or outages, fuel supply or transmission issues, hedging ineffectiveness.

Additional information concerning other risk factors is contained in NRG's and

GenOn's most recently filed Annual Reports on Form 10-K, subsequent Quarterly

Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings.

Many of these risks, uncertainties and assumptions are beyond NRG's or GenOn's

ability to control or predict. Because of these risks, uncertainties and assumptions,

you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking

statements speak only as of the date they are made, and neither NRG nor GenOn undertakes any

obligation to update publicly or revise any forward-looking statements to reflect

events or circumstances that may arise after the date of this communication. All subsequent written and

oral forward-looking statements concerning NRG, GenOn, the proposed transaction, the

combined company or other matters and attributable to NRG or GenOn or any person acting

on their behalf are expressly qualified in their entirety by the cautionary statements above.

Forward Looking Statements |

2

Safe Harbor Continued

This communication does not constitute an offer to sell or the solicitation of an offer to buy

any securities or a solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. The

proposed business combination transaction between NRG and GenOn will be submitted to

the respective stockholders of NRG and GenOn for their consideration. NRG will file with the Securities and

Exchange Commission (“SEC”) a registration statement on Form S-4 that will

include a joint proxy statement of NRG and GenOn that also constitutes a prospectus of

NRG. NRG and GenOn will mail the joint proxy statement/prospectus to their respective stockholders. NRG and

GenOn also plan to file other documents with the SEC regarding the proposed transaction. This

communication is not a substitute for any prospectus, proxy statement or any other

document which NRG or GenOn may file with the SEC in connection with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF GENON AND NRG ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and stockholders will be able to

obtain free copies of the joint proxy statement/prospectus and other documents containing

important information about NRG and GenOn, once such documents are filed with the SEC,

through the website maintained by the SEC at www.sec.gov. NRG and GenOn make available free of

charge at www.nrgenergy.com and www.genon.com, respectively (in the “Investor

Relations” section), copies of materials they file with, or furnish to, the SEC.

attributable to NRG or GenOn or any person acting on their behalf are expressly qualified in their entirety by the

cautionary statements above.

NRG, GenOn, and certain of their respective directors and executive officers may be deemed to

be participants in the solicitation of proxies from the stockholders of GenOn and NRG

in connection with the proposed transaction. Information about the directors and executive officers

of NRG is set forth in its proxy statement for its 2012 annual meeting of stockholders, which

was filed with the SEC on March 12, 2012. Information about the directors and

executive officers of GenOn is set forth in its proxy statement for its 2012 annual meeting of stockholders,

which was filed with the SEC on March 30, 2012. These documents can be obtained free of

charge from the sources indicated above. Other information regarding the

participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or

otherwise, will be contained in the joint proxy statement/prospectus and other relevant

materials to be filed with the SEC when they become available.

Additional

Information

And

Where

To

Find

It

Participants

In

the

Merger

Solicitation |

3

Transaction Overview and NRG

Strategic Update

D. Crane

Transaction Rationale and GenOn

Update

E. Muller

Transaction Benefits

A. Cleary

Financial Summary

K. Andrews

Closing Remarks and Q&A

D. Crane, E. Muller

Agenda |

4

Executive Summary

$300

MM

Annual

Free

Cash

Flow

Benefits

from

the

Combination

$200

MM

Annual

EBITDA

From

Cost

and

Operational

Efficiency

Synergies

Significant EBITDA and Free Cash Flow per Share Accretion by 2014

:

Initiating Pro Forma Guidance

:

A Value Creating Event for All Stakeholders

2013

2014

Consolidated Adjusted EBITDA:

~$2,535-2,735

~$2,630-2,830

~$825-1,025

~$845-1,045

1

Per share figures based on midpoint of NRG and Pro Forma guidance ranges. Assumes 227.8 MM

shares currently outstanding and 321.7 MM pro forma shares outstanding 2

Assumes transaction closing on January 2, 2013, $150 MM of synergies in 2013, and $200 MM in

2014 ($MM)

7%

12%

EBITDA

FCF, before growth

investments

¹

²

FCF, before growth investments: |

5

Key Transaction Terms

Consideration

100% Stock, fixed exchange ratio

GenOn

shareholders

will

receive

0.1216

shares

of

NRG

in

exchange

for

each

share

of

GenOn

20.6% premium based on closing prices at close of business on July 20, 2012

Pro Forma

Ownership

71% NRG shareholders

29% GenOn shareholders

Governance

Directors –

12 from NRG, 4 from GenOn

Howard Cosgrove (Chairman)

Edward R. Muller (Vice-Chairman)

Timing &

Approvals

Expected to close by Q1 2013

Shareholder approvals for NRG and GenOn expected Q4 2012

Regulatory

approvals

include

FERC,

antitrust,

New

York

and

Texas

Public

Utilities Commission

No debt holder consents or amendments required

Dual

Headquarters

Commercial/Financial: Princeton, NJ

Operational: Houston, TX

Company Name

NRG Energy

Retail Brands:

Management

David Crane –

President and Chief Executive Officer

Kirk Andrews –

Chief Financial Officer

Mauricio Gutierrez –

Chief Operating Officer

Anne Cleary –

Chief Integration Officer

NRG

Reliant

Green Mountain |

6

Expanding and Strengthening the Base Enables NRG

to Grow Across Its Competitive Energy Business Model

The Strategic Benefits of the Combination

-

Retail -

-

Wholesale -

-

Clean -

Energy

–

Wholesale –

Multi-market, multi

-fuel,

economic generation across the

merit order, scale conventional

power generation company

-

Retail -

Multi-market,

multi-brand competitive

retail energy providers

with distinct value

propositions

-

Clean -

Energy

EV

Charging

Smart

Metering

Distributed

Solar |

7

Enabling NRG’s Retail Growth Platform

Eastern

Markets

(TWh)

ERCOT Market

(TWh)

NRG Generation

GenOn

A Foundation to Duplicate NRG’s

Successful Texas-based Integrated Model

NRG Plants

GenOn Plants

NRG Plants

GenOn Plants

States served by NRG retail

Source: Company filings; NRG and GEN capacity as of June 30, 2012, generation based on 2011

TWhs 1

Includes co-op and contracted loads

2

Includes full year Energy Plus volumes

3

Potential generation based on nameplate capacity at 85% availability factor

NRG potential

generation in TX w/

existing capacity³

Potential load

assuming 20%

net length

(TWh basis)

NRG Retail Load

Pro Forma potential

generation in East w/

existing capacity³

Potential load

assuming 20%

net length

(TWh basis)

Pro Forma East

23 GW capacity

3 TWh 2011

competitive retail

load

2

Pro Forma Gulf Coast

16

GW capacity

55 TWh 2011

competitive retail load

in ERCOT; contract

and co-op loads

States

Served

by

NRG

retail

1

46

55

80

67

0

50

100

150

200

2011 Generation

2011 Load

34

7

3

174

144

0

50

100

150

200

2011 Generation

2011 Load |

8

The Combined Company Expects to Build on NRG’s Leadership in the

Clean Energy Economy on the Strength of its Greening Conventional Portfolio

Greening Conventional; Clean Renewables

Clean Energy Leadership

Continuous Improvement in

Environmental Performance

Source: EPA and companies’

estimates. Includes domestic units reporting through the EPA Acid Rain program

1

Excludes NRG International and Thermal assets. 2015 emissions estimates based on

2011 unit emissions adjusted for controls and retirements

2

Net MWs AC

772 MW

(utility scale) by 2014

~80% reduction

in SO emissions

Alpine

Avenal

Blythe

CVSR

Ivanpah

Agua Caliente

Avra

Valley

Roadrunner

California

Arizona

New Mexico

Utility Scale Solar

Distributed Solar

NRG Wind: 450 MW

~70% reduction

in NO

x

emissions

NRG

GEN ~35% reduction

in CO emissions

2

2

2

1 |

9

2012 On Track

NRG Update

Delivering on

Financial

Performance

Q2 2012 EBITDA ~$530 million (YTD ~$830 million)

Reaffirming 2012 Full Year Guidance:

Consolidated Adjusted EBITDA: $1,825-$2,000 million

FCF before growth investments: $800-$1,000 million

Delivering on

Capital

Allocation

Objectives

First ever quarterly dividend payment of $0.09/share ($0.36/share annually)

Record Date: August 1, 2012

Payable Date: August 15, 2012

Implied

dividend

yield

of

~2.0%

1

Payout

ratio:

~9%

of

FCF

before

growth

investments

2

Sale of Schkopau resulting in $174 million in net proceeds and expansion of

the RP basket

2

nd

Quarter

Results

Announcing full results on August 8, 2012

1

Based on NRG stock price as of July 20, 2012

2

Payout ratio based on the midpoint of 2012 FCF before growth investments guidance

|

10

Transaction Rationale and GenOn Updates |

11

Transaction Rationale

Combination efficiencies are a key driver of shareholder value in

our sector

A multi-region, multi-fuel portfolio that will be better positioned to

compete throughout the commodity cycle

Real, measurable, and actionable cost synergies of $175 million

per year plus $25 million in annual operational efficiency

synergies achievable within first full year of combined operations

Total transaction free cash flow benefits of $300 million per year

to be realized from cost and operational efficiency synergies as

well as balance sheet efficiencies

Greater scale enhances combined company’s ability to revitalize

its generation fleet and optimize portfolio value |

12

(GW)

Source: SNL, company filings as of YE 2011 filings; NRG and GEN capacity as of June 30,

2012. Excludes NRG International, NRG Thermal, and NRG and GEN projects under

construction

Largest Owner of Competitive Generation

47

38

28

24

23

15

14

13

12

12

11

10

9

0

5

10

15

20

25

30

35

40

45

50

NRG/GEN

EXC

CPN

NRG

GEN

NEE

EFH

PSEG

GDF

DYN

PPL

EIX

AES

Top U.S. Companies By Competitive Generation Capacity

The Largest Competitive Power Generation

Company in the US |

13

MA

MD

MT

FL

NM

TX

OK

KS

NE

SD

ND

WY

CO

UT

ID

AZ

NV

WA

CA

OR

KY

NY

MI

NH

CT

VA

WV

OH

IN

IL

NC

TN

SC

AL

AR

LA

MO

IA

MN

WI

GA

MS

VT

NJ

DE

ME

RI

MA

MD

PA

Enhanced Generation, Fuel and Revenue Diversity

The Combined Company Becomes a Truly Diversified

Competitive Power Generation Company

West

Total (Pro Forma)

East

Gulf Coast

Pro Forma

Pro Forma

16 GW; 64 TWh

23 GW; 40 TWh

Pro Forma

8 GW; 0.8 TWh

47 GW; 105 TWh

Note: Totals may not sum to 100 due to rounding

Source: Company filings; NRG and GEN capacity as of June 30, 2012, generation based on 2011

TWhs Excludes NRG International, NRG Thermal, and NRG and GEN projects under

construction GWs by Region

GWs by Fuel Type

Power Plants

NRG

GenOn

Coal,

38%

Oil/Gas,

62%

East, 49%

Gulf

Coast,

35%

West,

16%

Coal, 31%

Nuclear,

3%

Solar,

Wind, 1%

Oil/Gas,

66%

Solar,

2%

Oil/Gas,

98%

Coal, 35%

Nuclear,

7%

Wind, 3%

Oil/Gas,

55% |

14

Substantial Transaction Benefits

Total Annual Free Cash Flow Benefits of

$300 MM, Including $200 MM of EBITDA

Significant Opportunities Across the

Combined Company

Cost

Create an integrated “best in

class”

organization by aligning

key cost functions, including:

Personnel Synergies

IT Systems

Facilities

Fees / Services

Insurance

Other

Operational

$175 MM/year

$25 MM/year

$100 MM/year

Synergies

Balance Sheet Efficiencies

Operational improvement and

efficiencies across the

combined fleet, driven by the

application of:

Create a more efficient pro

forma capital structure,

including:

Reduce leverage

Lower cash balance and

liquidity requirements

Improve cost of capital

through prudent cash

management and stronger

pro forma balance sheet

Collateral benefits |

15

GenOn Update

1

Guidance numbers are based on forward curves as of July 9, 2012

2012 On Track

2012

Raising

Adjusted

EBITDA

Guidance

1

to

$467

million

from

$446

million

2013 and

2014

Raising

2013

Adjusted

EBITDA

Guidance

1

to

$687

million

from

$669

million

Providing

2014

Adjusted

EBITDA

Guidance

1

of

$730

million

2

nd

Quarter

Results

Announcing Q2 2012 results on August 9, 2012 |

16

Transaction Benefits |

17

Real, Measurable and Actionable Cost Synergies

$175 MM of Annual Cost Synergies to be Fully

Realized in First Full Year of Operation

2013

1

Cost to achieve excludes advisor fees, bridge commitment fees, and other

transaction-related costs; includes non-cash related expenses of approx. $14 MM

Delivering Synergy Value by YE 2013

Cost Synergies by Functional Area ($MM)

1

($100)

($50)

$0

$50

$100

$150

$200

Q1

Q2

Q3

Q4

Incremental Cost to Achieve

Cumulative Annual Synergies

Target Run Rate:

$175 MM/year

Target One Time Cost:

$155 MM

G&A Overlap

$116

Redundant

Fees/Services

$27

IT and

Facilities

$18

Other Misc.

$14 |

18

Operational Efficiency Synergies

$25 MM/year by 2014 –

a 25% Improvement to NRG’s Existing Plan

Leveraging

the

Program

Reliability, capacity and

efficiency improvements

Procurement savings

Asset optimization

($MM)

Incremental $25 MM

operational efficiency

synergies:

$30

$65

$100

$75

$125

$0

$20

$40

$60

$80

$100

$120

$140

2012

2013

2014

Pro Forma Upside

1Q12 NRG Plan |

19

Transaction Benefit Summary

Cost Synergies

Operational Efficiency Synergies

Balance Sheet Efficiencies

$175 MM

$25 MM

$100 MM

The Pro Forma Combination Will Drive

$300 MM in Annual Transaction Benefits |

20

Financial Summary |

21

Transaction Structure

Description of Structure

GenOn will combine with and, upon closing,

become an excluded project subsidiary of

NRG (non-guarantor)

A shared services agreement between both

companies will enable the value of synergies

to be captured by the parent

Structure permitted under indentures, with

no bondholder approvals required from

either NRG or GenOn bondholders

Structure triggers a change of control put

right by holders of GenOn’s HoldCo debt

Cash on hand and $1.6 billion bridge

in place to fund if exercised

NRG

Energy,

Inc.

GenOn

(Excluded

Project

Sub)

NRG

Operating

Subs

NRG

Excluded

Project

Subs

GenOn

Operating

Subs

GenOn

Excluded

Project

Subs

Shared

Services

Agreement

Transaction Structure Provides Maximum Flexibility |

22

1

2

3

4

2013

2014

NRG

$650-$850

$500-$700

GenOn¹

(75)

43

Synergies

150

200

Balance Sheet

Efficiencies

100

100

Pro Forma

~$825-$1,025

~$845-$1,045

(141)

-

Significant Accretion to Key Metrics

EBITDA ($MM)

Free Cash Flow Before Growth

¹

($MM)

EBITDA per Share

4

FCF Before Growth per Share

4

2013

2014

2013

2014

2013

2014

NRG

$1,700-$1,900

$1,700-$1,900

GenOn

²

687

730

Synergies

150

200

Balance Sheet

Efficiencies

N/A

N/A

Pro Forma

~$2,535-$2,735

~$2,630-$2,830

One-time Costs

³

$7.90

$8.49

$2.63

$2.94

Transition

Year

$7.90

$8.19

$3.29

$2.88

Transition

Year

Including

one-time

costs

Significantly Accretive to EBITDA

and

Free Cash Flow before Growth in First Full Year of Operations

7% Accretion

12% Accretion

Assumes transaction closes on Jan 1 2013 and synergies are fully realized by

2014; Based on forward curves as of July 9, 2012

Excludes $14 MM non-cash related expenses. Also excludes advisor fees, bridge

commitment fees, and other transaction-related costs

Per share figures based on midpoint of NRG and Pro Forma guidance ranges. Assumes 227.8 MM

shares currently outstanding and 321.7 MM pro forma shares outstanding

|

23

Balance Sheet Efficiencies

Reduced Leverage of At Least $1 Billion and Other

Collateral Synergies Drives Approximately $100 MM of

Annual Incremental Cash Flow Benefits

1

Debt excludes discounts/premiums from balances

2

Assumes that no debt is put and $1.6 Bn bridge is not utilized

3

Debt subject to change of control puts, that if exercised will be repurchased

4

Present value of remaining lease payments is $903 million and $458 million, respectively

As of March 31, 2012

Exchange and Debt

Paydown

March 31, 2012

NRG

GEN

ProForma

Cash and cash equivalents

$1,014

$1,693

($1,000)

$1,707

Restricted cash

217

12

-

229

Total cash:

1,231

1,705

(1,000)

1,936

Recourse debt:

Term loan facility

1,588

-

-

1,588

Unsecured Notes

6,090

-

-

6,090

Tax Exempt Bonds

273

-

-

273

Recourse subtotal

7,951

-

-

7,951

Non-Recourse debt:

Solar non-recourse debt

1,561

-

-

1,561

Term Loan Facility

-

690

(690)

-

Unsecured

Notes

-

2,525

-

2,525

GenOn Americas Generation Notes

-

850

-

850

Conventional non-recourse debt

636

170

-

806

GMA/REMA

Operating

Leases

-

-

-

-

Non-Recourse subtotal

2,197

4,235

(690)

5,742

To Be Determined

(310)

(310)

Total Debt

$10,148

$4,235

($1,000)

$13,383

4

3

1

1

2

$ in millions |

24

Immediately Accretive to Target Credit Metrics

Transaction Structure Meaningfully Improves Target

Prudent Balance Sheet Management Metrics

1

NRG results assume the midpoint of guidance

2

Net debt assumed for GenOn is based on balances as of March 31, 2012. Pro Forma metrics

reflects impact of transaction benefits Credit Ratings

NRG

GenOn

S&P

Moody's

S&P

Moody's

First Lien Debt

BB+

Baa3

B+

B1

Unsecured Debt

BB-

B1

B-

B3

Corporate (Outlook)

BB-

Negative

Ba3 Negative

B-

Stable

B2 Negative

Credit Statistics

NRG

Stand

Alone

Long Term

NRG

Pro

Forma

2013

2014

Target

2013

2014

Net Debt/Total Capital

54.1%

53.1%

45% -

60%

55.1%

54.4%

Corporate Debt/

Corporate EBITDA

4.8x

4.6x

4.25x

4.4x

4.1x

Corporate FFO/

Corporate Debt

13.3%

13.9%

> 18%

15.2%

16.4%

2

1 |

25

Liquidity Surplus

Currently, the available combined

liquidity meaningfully surpasses needs

Surplus liquidity permits:

At least $1 billion debt reduction

Elimination of GenOn credit facility

($788 million)

Combined with other collateral

efficiencies, $100 million annual free

cash flow benefits

$2.8 billion pro forma liquidity more

than sufficient to support the combined

business

Minimum cash balance will be

maintained at $900 million

Liquidity Improvement

As of March 31, 2012

$ in millions

NRG

GEN

Debt Pay

down /

Retirement

Pro Forma

Cash and Cash Equivalents

$1,014

$1,693

($1,000)

$1,707

Restricted/Reserved Cash

217

12

-

229

Total Cash

1,231

1,705

(1,000)

1,936

Revolver Availability

1,141

532

1

(788)

885

Total Current Liquidity

$2,372

$2,237

($1,788)

$2,821

1

Excludes availability under Marsh Landing credit facility

Balance Sheet Efficiency and Liquidity Surplus

Delivers Annual Free Cash Flow Uplift of $100 million |

26

Closing Remarks and Q&A |

27

Transaction Benefit Summary

Cost Synergies

Operational Efficiency Synergies

Balance Sheet Efficiencies

$175 MM

$25 MM

$100 MM

The Pro Forma Combination Will Drive

$300 MM in Annual Transaction Benefits |

28

Appendix |

29

Expected Transaction Timeline

3Q2012

4Q2012

1Q2013

File Registration

Statement /

Proxy Statement

Announcement

Shareholder

Meetings

Transaction Close

Regulatory Approval Process

(Antitrust, FERC, State Agencies)

NRG

Dividend

NRG

Dividend

NRG

Dividend

Expect to Close the Transaction by the First

Quarter of 2013 |

30

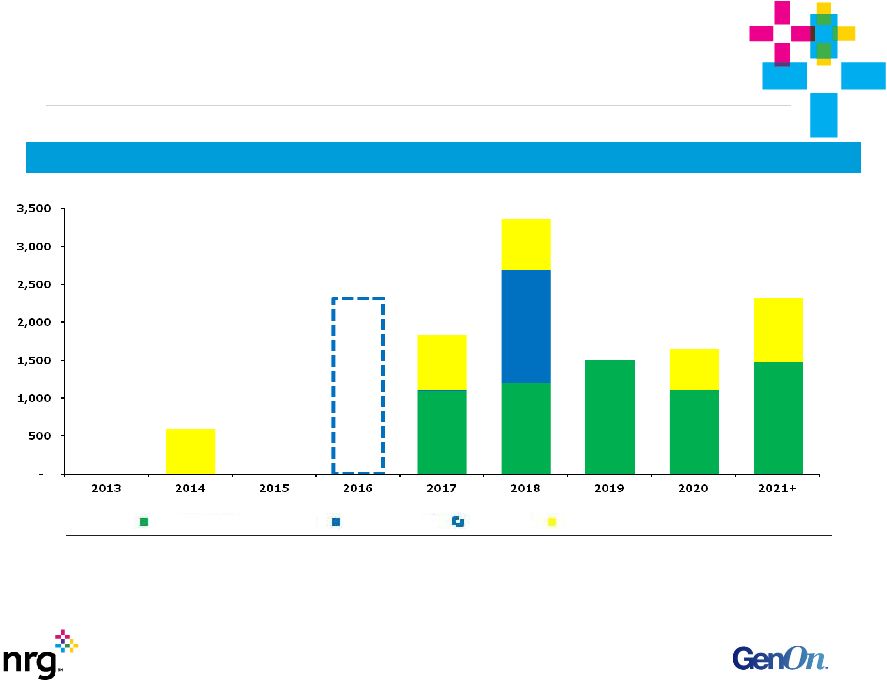

Manageable Proforma Debt Maturity Profile

1

Based on preliminary analysis

2

Debt maturity schedule as of 3/31/12: Excludes Marsh Landing Project Financings

3

Does not include $310 MM of debt repayment as the company will apply the payment to the best

available option 4

Includes $850 MM of GenOn Americas Generation notes in 2021 and beyond

Debt Maturity Profile (2013–2021)

1,2,3

($MM)

4

Unsecured Notes NRG

Term Loan B

Revolver

Unsecured Notes Genon |

31

Combined Federal NOL Tax Attributes

(assuming transaction is consummated)

As a result of the combination:

GenOn will experience an ownership change under Section 382 which

further limits the utilization of its $2.6 billion in NOLs

GenOn is expected to be in a Net Unrealized Built in Loss position

(NUBIL) which further restricts the utilization of immediate tax

deductions

during

the

5

year

observable

period

2013

–

2017

NRG anticipates that it will not be subject to a Section 382 limitation for its

$600 million NOL balance as a result of the combination

NRG expects to pay Alternative Minimum Tax and some state tax on

taxable income over the next four years

Any incremental NOLs generated post closing of the combination will be

unrestricted |

32

Transaction Detail

Sources and Uses

Sources ($MM)

Uses ($MM)

NRG Equity Issuance

$1,694

Equity Purchase Price

$1,694

Debt Assumed

3,235

Debt Assumed

3,235

Cash

1,060

Repayment of GenOn TLB

690

310

Transaction

Costs

2

60

Total Sources Of Funds

$5,989

Total Uses Of Funds

$5,989

Pro Forma Ownership

Exchange Ratio

0.1216

Implied Premium

20.6%

Shares Owned:

NRG

227.8

GenOn

93.8

Total Shares

321.67

% of Combined Company Owned:

NRG

71%

GenOn

29%

Total

100%

1

Pro Forma based on 7/18/2012 share balances and share prices as of 7/20/2012

2

Expected transaction costs at closing

Repayment of Debt – TBD

1 |