Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ManpowerGroup Inc. | form_8k.htm |

| EX-99.1 - PRESS RELEASE DATED JULY 20, 2012 - ManpowerGroup Inc. | exhibit_99-1.htm |

Exhibit 99.2

ManpowerGroup

2nd Quarter

July 20, 2012

ManpowerGroup 2012 2nd Quarter Results July 2012

Forward-Looking Statement

This presentation includes forward-looking statements,

including earnings projections which are subject to risks and

uncertainties. Actual results might differ materially from those

projected in the forward-looking statements. Additional

information concerning factors that could cause actual

results to materially differ from those in the forward-looking

statements is contained in the Manpower Inc. Annual Report

on Form 10-K dated December 31, 2011, which information

is incorporated herein by reference, and such other factors

as may be described from time to time in the Company’s

SEC filings.

including earnings projections which are subject to risks and

uncertainties. Actual results might differ materially from those

projected in the forward-looking statements. Additional

information concerning factors that could cause actual

results to materially differ from those in the forward-looking

statements is contained in the Manpower Inc. Annual Report

on Form 10-K dated December 31, 2011, which information

is incorporated herein by reference, and such other factors

as may be described from time to time in the Company’s

SEC filings.

ManpowerGroup 2012 2nd Quarter Results July 2012

|

As

Reported

|

Excluding Non

-recurring Items |

Q2 Financial Highlights

|

|

8%

|

8%

|

Revenue $5.2B

|

|

1% CC

|

1% CC

|

|

|

40 bps

|

40 bps

|

Gross Margin 16.6%

|

|

37%

|

18%

|

Operating Profit $94M

|

|

30% CC

|

11% CC

|

|

|

90 bps

|

30 bps

|

OP Margin 1.8%

|

|

41%

|

13%

|

EPS $.51

|

|

34% CC

|

5% CC

|

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

Consolidated Financial Highlights

3

(1)

(1) Excludes the impact of non-recurring items of $28.7M in Q2 2012.

ManpowerGroup 2012 2nd Quarter Results July 2012

Q2 Non-Recurring Items

($ in millions, except per share amounts)

4

(1) Includes reorganization charges for the Americas ($8.3M) and Right Management ($10.4M).

|

|

|

||

|

|

Pre-tax

Earnings

|

Net

Earnings

|

EPS -

Diluted

|

|

Earnings, As Reported

|

$ 83.1

|

$ 41.0

|

$ 0.51

|

|

Reorganization Charges

|

18.7

|

13.9

|

0.17

|

|

Legal Costs - US

|

10.0

|

6.5

|

0.08

|

|

Earnings, Excluding non-

recurring items |

$ 111.8

|

$ 61.4

|

$ 0.76

|

(1)

ManpowerGroup 2012 2nd Quarter Results July 2012

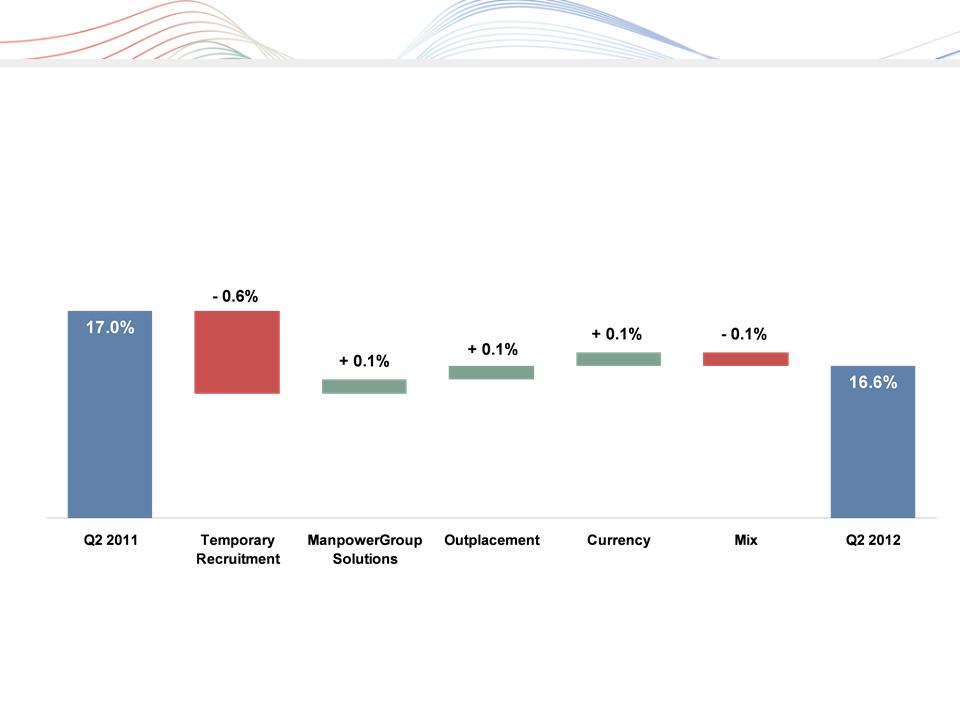

Consolidated Gross Margin Change

5

ManpowerGroup 2012 2nd Quarter Results July 2012

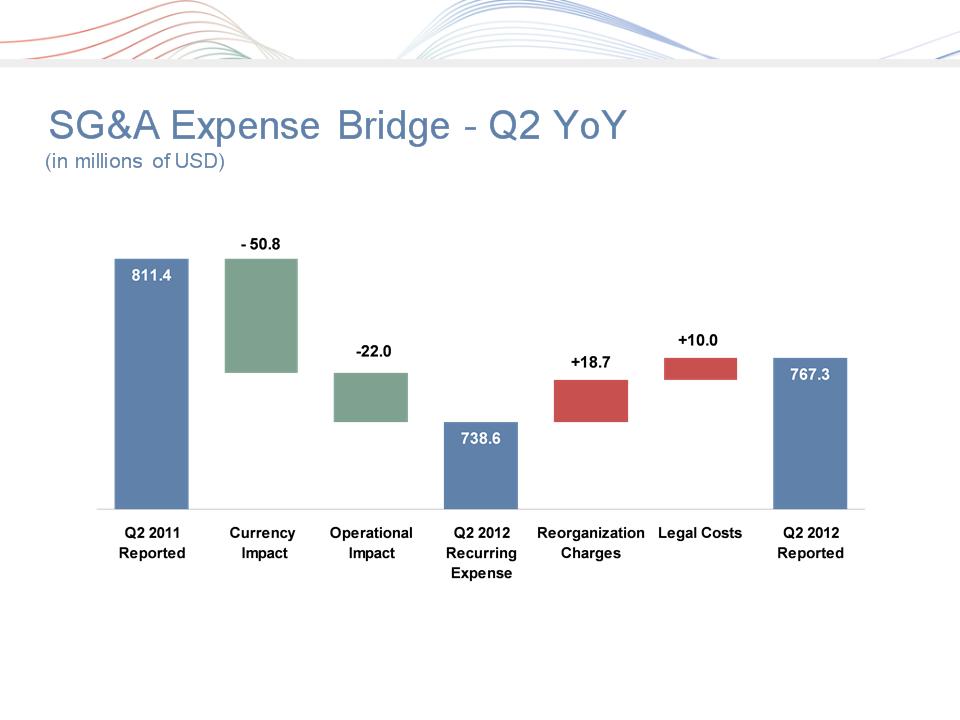

6

ManpowerGroup 2012 2nd Quarter Results July 2012

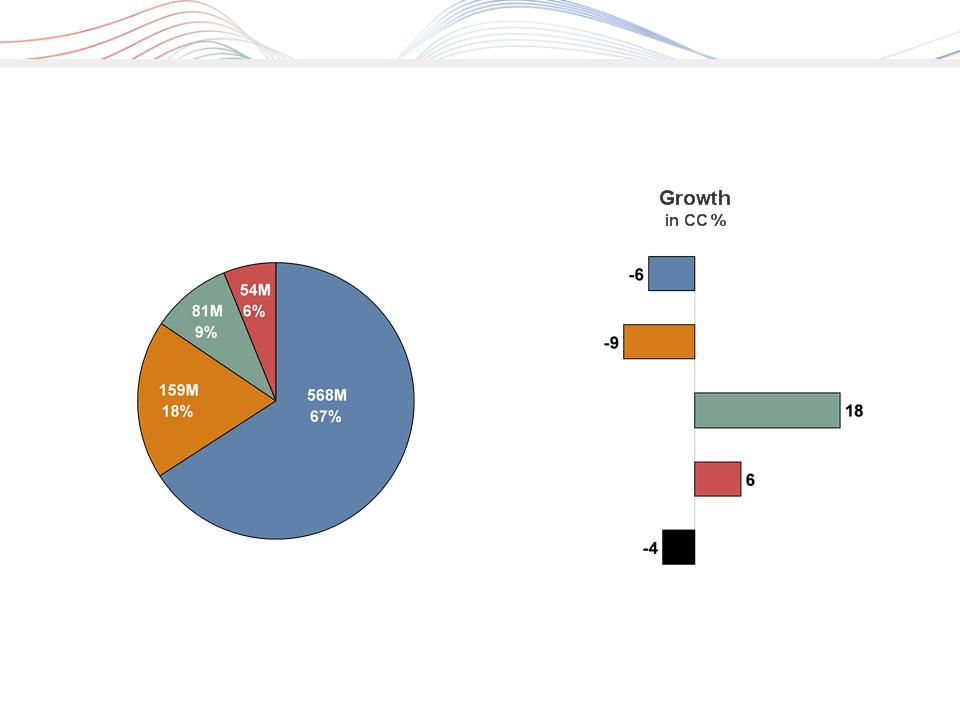

7

$862M

Business Line Gross Profit - Q2 2012

█ Manpower █ Experis █ ManpowerGroup - Total

█ ManpowerGroup Solutions █ Right Management

ManpowerGroup 2012 2nd Quarter Results July 2012

|

As

Reported

|

Excluding

Non-recurring

Items |

Q2 Financial Highlights

|

|

2%

|

2%

|

Revenue $1.2B

|

|

1% CC

|

1% CC

|

|

|

54%

|

7%

|

OUP $18M

|

|

52% CC

|

5% CC

|

|

|

180 bps

|

20 bps

|

OUP Margin 1.6%

|

8

(1)

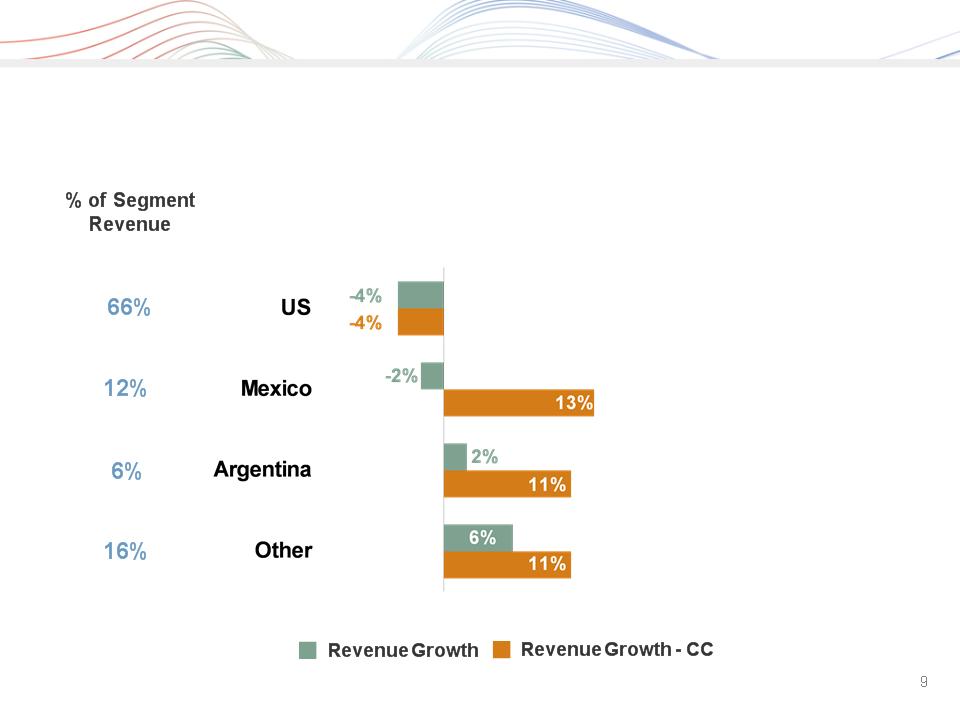

Americas Segment

(22% of Revenue)

(1) Included in these amounts is the US, which had revenue of $763M (-4%) and OUP of $8M (-72%, or -10%

excluding non-recurring items).

excluding non-recurring items).

(2) Excludes the impact of non-recurring items of $18.3M in Q2 2012

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is

equal to segment revenues less direct costs and branch and national headquarters operating

costs.

equal to segment revenues less direct costs and branch and national headquarters operating

costs.

(2)

ManpowerGroup 2012 2nd Quarter Results July 2012

Americas - Q2 Revenue Growth YoY

ManpowerGroup 2012 2nd Quarter Results July 2012

|

As

Reported

|

Q2 Financial Highlights

|

|

13%

|

Revenue $1.9B

|

|

3% CC

|

|

|

38%

|

OUP $31M

|

|

30% CC

|

|

|

70 bps

|

OUP Margin 1.6%

|

10

(1)

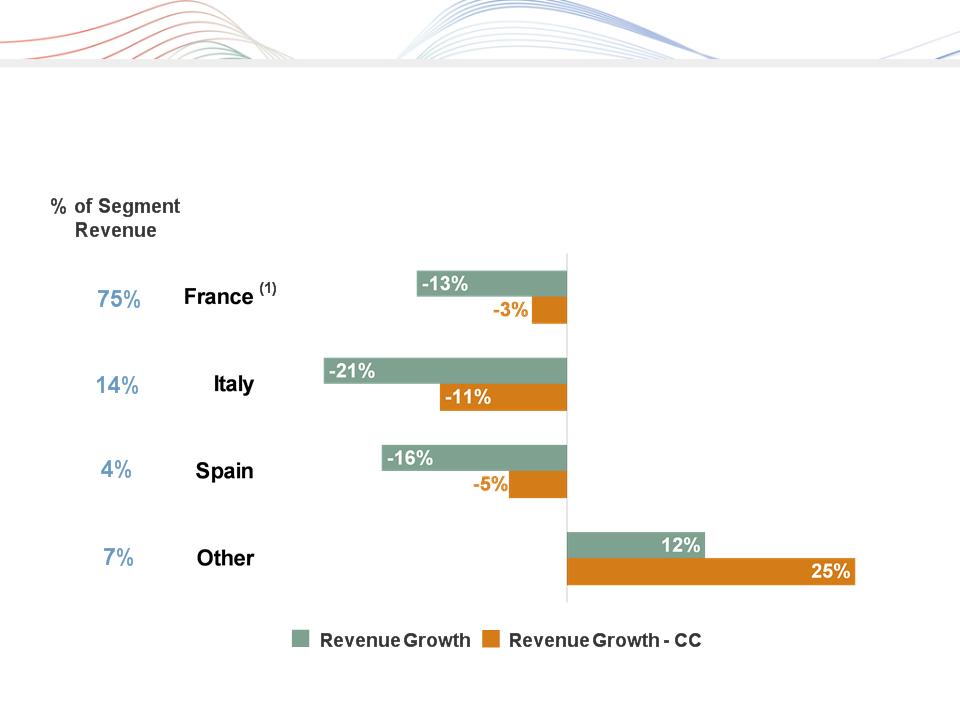

Southern Europe Segment

(36% of Revenue)

(1) Included in these amounts is France, which had revenue of $1.4B (-3% CC) and OUP of $16M (-29% CC). On

an organic basis, France revenue decreased 15% (-5% in CC).

an organic basis, France revenue decreased 15% (-5% in CC).

(2) On an organic basis, Segment revenue decreased 15% (-4% in CC).

(2)

ManpowerGroup 2012 2nd Quarter Results July 2012

Southern Europe - Q2 Revenue Growth YoY

11

(1) On an organic basis, France revenue decreased 15% (-5% in CC).

ManpowerGroup 2012 2nd Quarter Results July 2012

|

As

Reported

|

Q2 Financial Highlights

|

|

10%

|

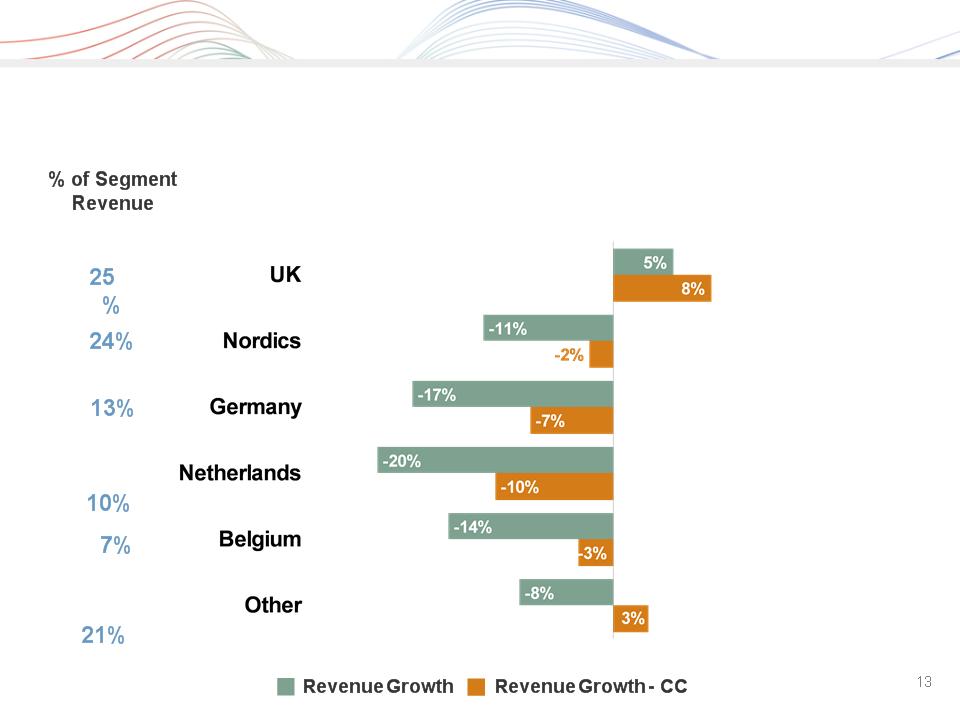

Revenue $1.4B

|

|

1% CC

|

|

|

30%

|

OUP $39M

|

|

24% CC

|

|

|

80 bps

|

OUP Margin 2.8%

|

12

Northern Europe Segment

(27% of Revenue)

ManpowerGroup 2012 2nd Quarter Results July 2012

Northern Europe - Q2 Revenue Growth YoY

ManpowerGroup 2012 2nd Quarter Results July 2012

|

As

Reported

|

Q2 Financial Highlights

|

|

0%

|

Revenue $663M

|

|

2% CC

|

|

|

16%

|

OUP $22M

|

|

18% CC

|

|

|

50 bps

|

OUP Margin 3.3%

|

APME Segment

(13% of Revenue)

14

ManpowerGroup 2012 2nd Quarter Results July 2012

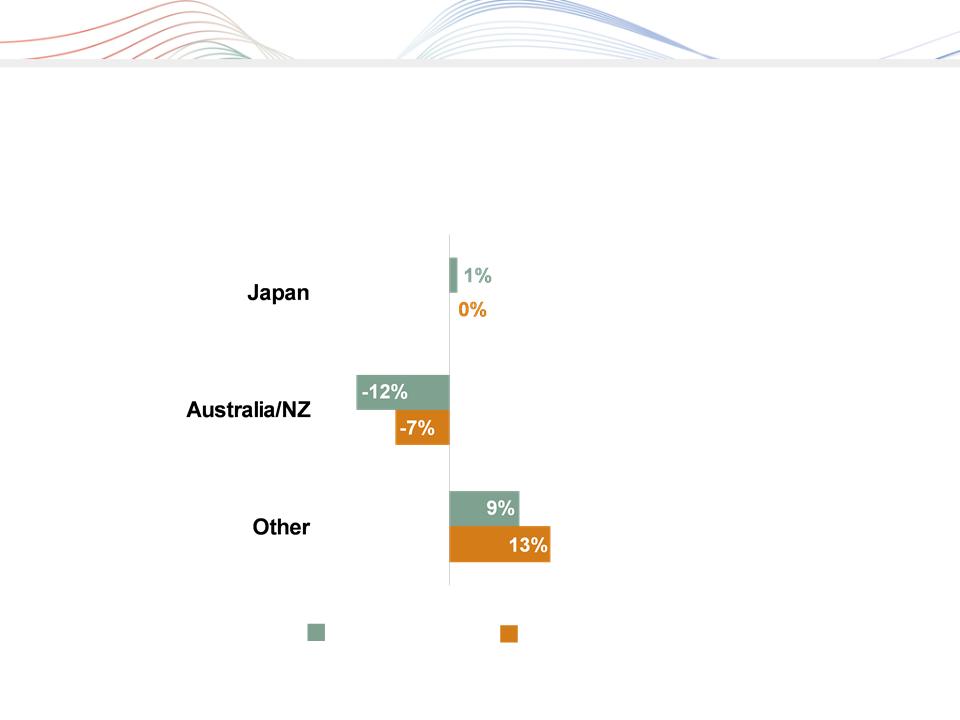

APME - Q2 Revenue Growth YoY

15

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

44%

25%

31%

ManpowerGroup 2012 2nd Quarter Results July 2012

|

As

Reported

|

Excluding

Non-recurring

Items |

Q2 Financial Highlights

|

|

1%

|

1%

|

Revenue $84M

|

|

3% CC

|

3% CC

|

|

|

N/A

|

166%

|

OUP ($3M)

|

|

N/A

|

172% CC

|

|

|

680 bps

|

550 bps

|

OUP Margin (3.5%)

|

16

Right Management Segment

(2% of Revenue)

(1)

(1) Excludes the impact of reorganization charges of $10.4M in Q2 2012.

ManpowerGroup 2012 2nd Quarter Results July 2012

|

($ in millions)

|

2012

|

|

2011

|

|

Cash used in operating activities

|

(40)

|

|

(192)

|

|

Capital Expenditures

|

(34)

|

|

(28)

|

|

Free Cash Flow

|

(74)

|

|

(220)

|

|

Change in Debt

|

56

|

|

4

|

|

Share Repurchases

|

(33)

|

|

(19)

|

|

Dividends paid

|

(34)

|

|

(33)

|

|

Acquisitions of Businesses

net of cash acquired

|

(34)

|

|

(15)

|

|

Effect of Exchange Rate Changes

|

(7)

|

|

31

|

|

Other

|

-

|

|

23

|

|

Change in Cash

|

(126)

|

|

(229)

|

|

|

|

|

|

|

|

|

|

|

Cash Flow Summary - First Half

17

ManpowerGroup 2012 2nd Quarter Results July 2012

Balance Sheet Highlights

Total Debt

($ in millions)

Total Debt to

ManpowerGroup 2012 2nd Quarter Results July 2012

|

|

Interest

Rate

|

Maturity

Date

|

Total

Outstanding

at 6/30/12 |

|

Remaining

Available

at 6/30/12

|

|

|

Euro Notes:

|

|

|

|

|

|

|

|

- Euro 200M

|

4.86%

|

Jun 2013

|

253

|

|

-

|

|

|

- Euro 350M

|

4.505%

|

Jun 2018

|

443

|

|

-

|

|

|

Revolving Credit Agreement

|

1.52%

|

Oct 2016

|

-

|

|

798

|

|

|

Uncommitted lines and Other

|

Various

|

Various

|

59

|

|

325

|

|

|

Total Debt

|

|

|

755

|

|

1,123

|

Credit Facilities

($ in millions)

($ in millions)

19

Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $383.7M. Total subsidiary borrowings are limited to $300M due to

restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

(1)

(2)

(2)

(1)

The $800M agreement requires that we comply with a Leverage Ratio (Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage

Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.13

and a fixed charge coverage ratio of 3.08 as of June 30, 2012. As of June 30, 2012, there were $1.6M of standby letters of credit issued under the

agreement.

Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.13

and a fixed charge coverage ratio of 3.08 as of June 30, 2012. As of June 30, 2012, there were $1.6M of standby letters of credit issued under the

agreement.

ManpowerGroup 2012 2nd Quarter Results July 2012

|

Revenue

|

Total

|

Down 11-13% (Down 3-5% CC)

|

|

|

Americas

|

Down 3-5% (Down 1-3% CC)

|

|

|

Southern Europe

|

Down 18-20% (Down 6-8% CC)

|

|

|

Northern Europe

|

Down 11-13% (Down 2-4% CC)

|

|

|

APME

|

Down 2-4% (Up 0-2% CC)

|

|

Right Management

|

Down 0-2% (Up 2-4% CC)

|

|

|

Gross Profit Margin

|

16.3 - 16.5%

|

|

|

Operating Profit Margin

|

2.1 - 2.3%

|

|

|

Tax Rate

|

46% (34% excl. reclassification of France business tax)

|

|

|

EPS

|

$0.64 - $0.72 (Neg. $.08 Currency)

|

|

Third Quarter Outlook

20

ManpowerGroup 2012 2nd Quarter Results July 2012

Strategic Drivers

21

ManpowerGroup 2012 2nd Quarter Results July 2012

ManpowerGroup 2012 2nd Quarter Results July 2012

Questions

22