Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Philip Morris International Inc. | d384627d8k.htm |

| EX-99.2 - CONFERENCE CALL TRANSCRIPT DATED JULY 19, 2012 - Philip Morris International Inc. | d384627dex992.htm |

| EX-99.1 - PHILIP MORRIS INTERNATIONAL INC. PRESS RELEASE DATED JULY 19, 2012 - Philip Morris International Inc. | d384627dex991.htm |

Exhibit 99.3

2012 Second-Quarter Results

July 19, 2012 |

2

Introduction

Unless otherwise stated, we will be talking about results for the second-

quarter 2012 and comparing them with the same period in 2011

References to PMI volumes refer to PMI shipment data, unless

otherwise stated

Industry volume and market shares are the latest data available from a

number of internal and external sources

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as

operating income before general corporate expenses and the

amortization

of

intangibles.

OCI

growth

rates

are

on

an

adjusted

basis,

which excludes asset impairment, exit and other costs

Data tables showing adjustments to net revenues and OCI for currency,

acquisitions, asset impairment, exit and other costs, free cash flow

calculations, adjustments to EPS, and reconciliations to U.S. GAAP

measures are at the end of today’s webcast slides and are posted on

our web site |

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain forward-looking statements.

Achievement of projected results is subject to risks, uncertainties and

inaccurate assumptions, and PMI is identifying important factors that,

individually or in the aggregate, could cause actual results to differ materially

from those contained in any forward-looking statements made by PMI

PMI’s business risks include: significant increases in cigarette-related

taxes; the imposition of discriminatory excise tax structures; fluctuations

in customer inventory levels due to increases in product taxes and prices;

increasing marketing and regulatory restrictions, often with the goal of

preventing

the

use

of

tobacco

products;

health

concerns

relating

to

the

use

of

tobacco

products and

exposure to environmental tobacco smoke; litigation related to tobacco use; intense

competition; the effects of global and individual country economic,

regulatory and political developments; changes in adult smoker

behavior;

lost

revenues

as

a

result

of

counterfeiting, contraband and cross-border

purchases; governmental investigations; unfavorable currency exchange rates and

currency devaluations; adverse changes in applicable corporate tax laws;

adverse changes in the cost and quality of tobacco and other agricultural

products and raw materials; and the integrity of its information systems.

PMI’s future profitability may also be adversely affected should it be

unsuccessful in its attempts to produce products with the potential to reduce the

risk of smoking- related diseases; if it is unable to successfully

introduce new products, promote brand equity, enter new markets

or

improve

its

margins

through

increased prices and productivity gains; if it is unable to

expand its brand portfolio internally or through acquisitions and the development

of strategic business relationships; or if it is unable to attract and

retain the best global talent

PMI is further

subject

to

other

risks

detailed

from

time

to

time

in

its

publicly

filed

documents, including

the Form 10-Q for the quarter ended March 31, 2012. PMI cautions that the

foregoing list of important factors is not a complete discussion of all

potential risks and uncertainties. PMI does not undertake to update any

forward-looking statement that it may make from time to time, except in the normal

course of its public disclosure obligations |

4

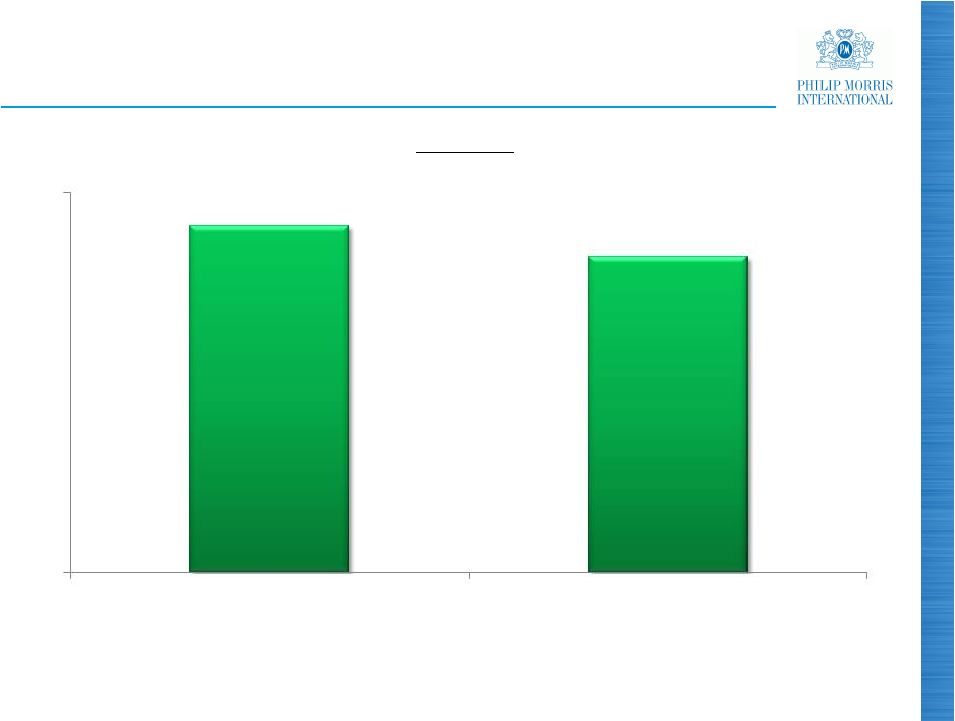

Strong Underlying Business Results in Q2, 2012

Organic cigarette volume down by 1.2%

Organic cigarette volume, excluding Japan hurdle, up by

1.4%

Organic OTP volume up by 11.8%

Note: OTP stands for other tobacco products, including cigars, cigarillos, fine

cut, pipe tobacco and snus. Fine cut converted to cigarette equivalents

based on conversion ratio of 1 unit = 0.75g

Source: PMI Financials |

5

Strong Underlying Business Results in Q2, 2012

Organic cigarette volume down by 1.2%

Organic cigarette volume, excluding Japan hurdle, up

by 1.4%

Organic OTP volume up by 11.8%

Net revenues, excluding currency and acquisitions, up

by 2.9%

Adjusted OCI, excluding currency and acquisitions, up

by 3.5%

Note: OTP stands for other tobacco products, including cigars, cigarillos, fine

cut, pipe tobacco and snus. Fine cut converted to cigarette equivalents

based on conversion ratio of 1 unit = 0.75g

Source: PMI Financials |

6

Strong Underlying Business Results in Q2, 2012

Organic cigarette volume down by 1.2%

Organic cigarette volume, excluding Japan hurdle, up by

1.4%

Organic OTP volume up by 11.8%

Net revenues, excluding currency and acquisitions,

up by 2.9%

Adjusted OCI, excluding currency and acquisitions,

up by 3.5%

Adjusted diluted EPS, excluding currency, up by 9.0%

Adjusted diluted EPS, excluding currency and Japan

hurdle, up by 17.7%

Note: OTP stands for other tobacco products, including cigars, cigarillos, fine

cut, pipe tobacco and snus. Fine cut converted to cigarette equivalents

based on conversion ratio of 1 unit = 0.75g

Source: PMI Financials |

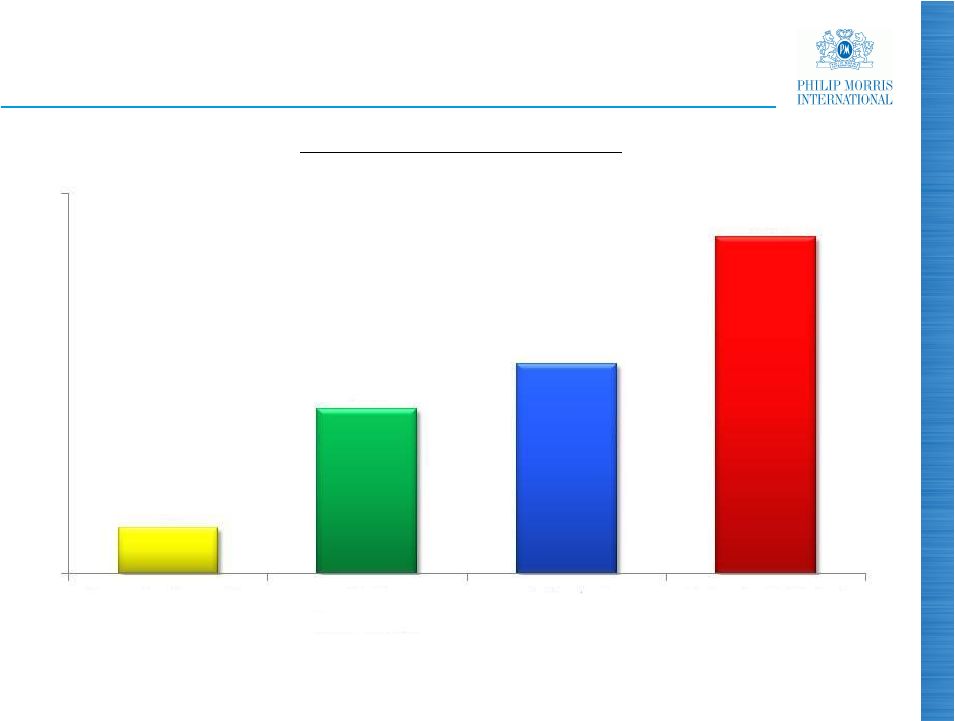

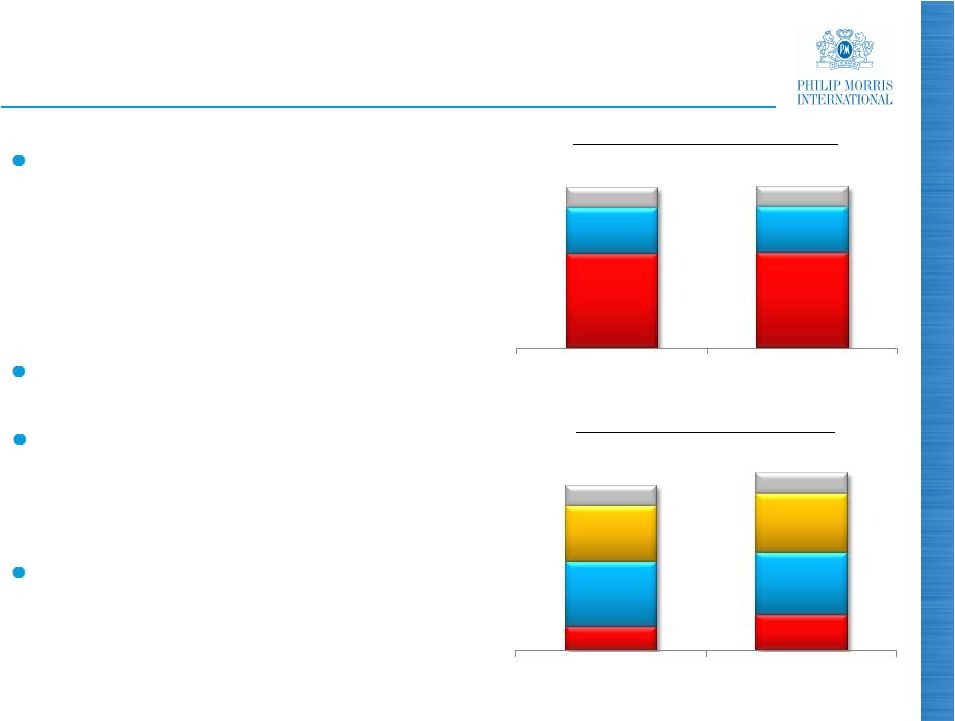

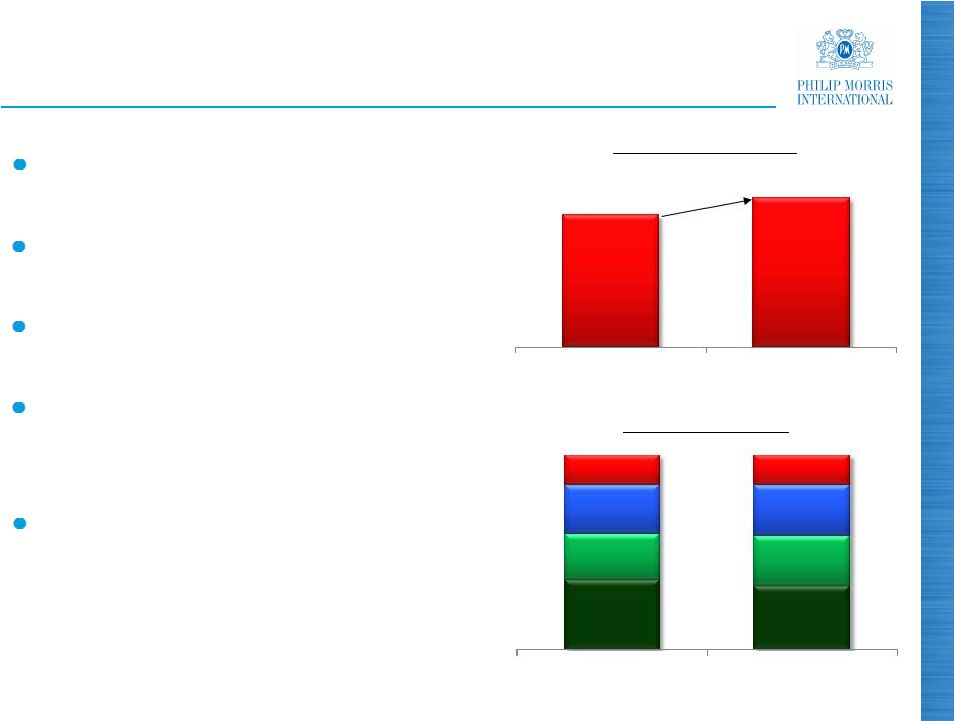

Excellent First-Half 2012 Results

(a)

Excluding currency and acquisitions

(b)

Excluding currency

Source: PMI Financials

(a)

(a)

7

(%)

Growth H1, 2012 vs. H1, 2011

(b)

1.8

6.5

8.3

13.3

0

15

Organic Cigarette

Volume

Net

Revenues

Adjusted

OCI

Adjusted Diluted

EPS |

8

2012 EPS Guidance

These results confirm our expectation of solid organic

cigarette volume growth in 2012

Continued strong pricing and a favorable product mix only

partially offset by an unfavorable geographic mix

At current prevailing exchange rates, forecast currency

headwind slightly above the 25 cents per share predicted in

June for full year

Strong underlying business momentum expected to offset

the additional unfavorable currency impact of 2 cents per

share

Source: PMI forecasts |

9

2012 EPS Guidance

Reported diluted 2012 EPS guidance range reaffirmed at

$5.10 to $5.20, compared to $4.85 in 2011

On a currency-neutral basis, our guidance implies a

forecast growth rate of approximately 10% to 12%,

compared to adjusted diluted EPS of $4.88 in 2011

Source: PMI forecasts |

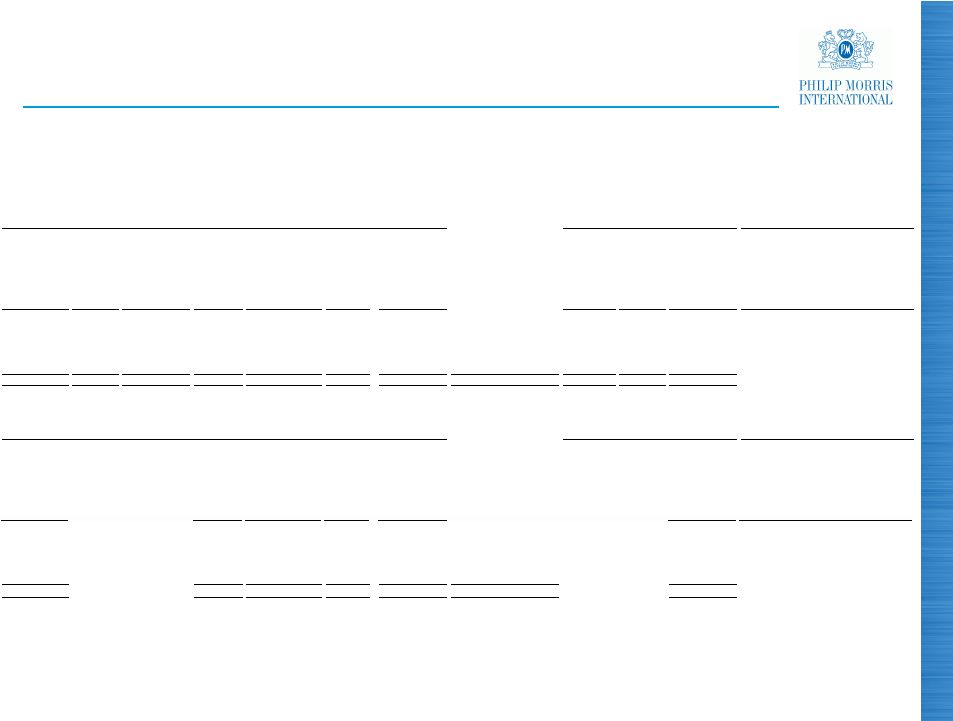

EU

Region: Cigarette Industry Volume Under Considerable Pressure

% Change

Q2, 2012

H1, 2012

Greece

(16.8)

(18.9)

Hungary

(16.0)

(10.9)

Spain

(18.0)

(10.0)

Italy

(10.5)

(8.5)

Netherlands

(5.7)

(6.0)

EU Region

(9.7)

(5.8)

France

(5.9)

(4.0)

Poland

(7.7)

(3.7)

Czech Republic

(4.2)

(3.6)

UK

(6.0)

(3.1)

Germany

(5.1)

(1.3)

10

Source: PMI estimates |

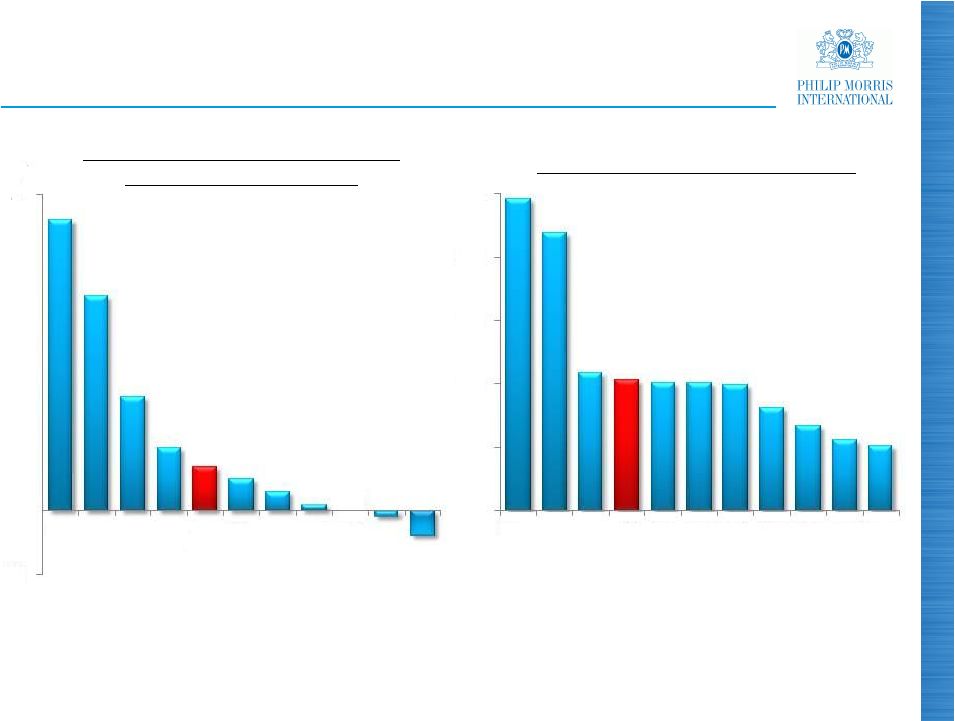

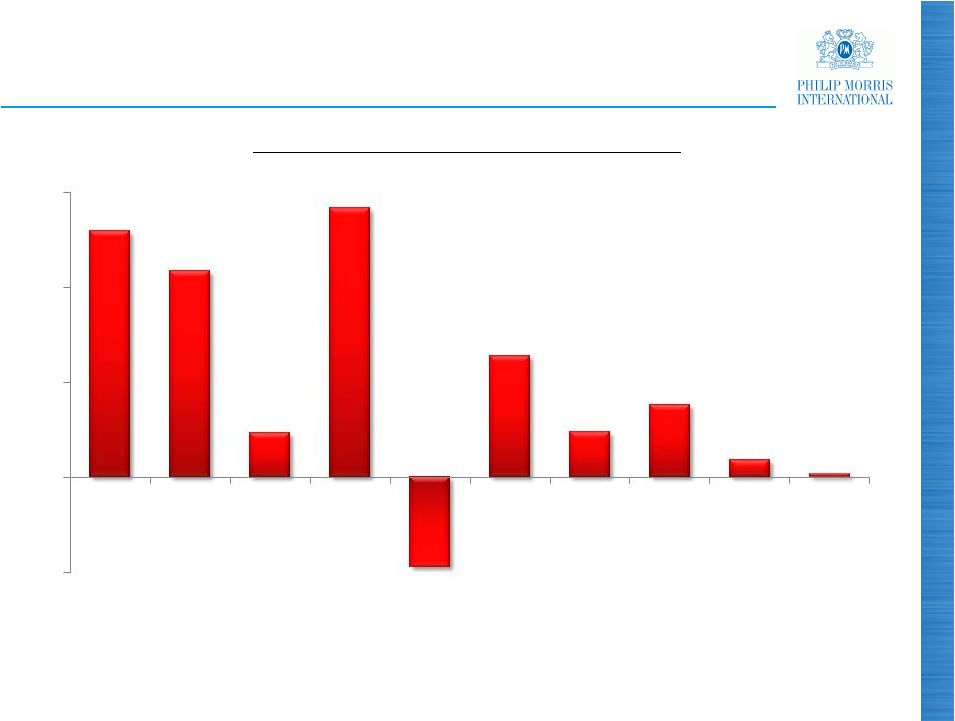

EU

Region: Deteriorating Job Market 11

(a) March 2012 vs. June 2011

(b) March

2012

Note:

Gre.

is

Greece,

Spa.

is

Spain,

Ita.

is

Italy,

Neth.

is

Netherlands,

EU

Avg.

is

EU

average,

Fra.

is

France,

Pol.

is

Poland,

Hun.

is

Hungary,

Cze.

is

Czech Republic and Ger. is Germany

Source: Eurostat

(pp)

Avg.

(a)

(a)

Variance in Unemployment Rates

May 2012 vs. June 2011

0

(%)

Unemployment Rates (May 2012)

Avg.

Cze.

Ger.

(b)

(b)

0.7

5

Gre.

Spa.

Ita.

Neth.

EU

Fra.

Pol.

UK

Hun.

10.3

0

5

10

15

20

25

Spa.

Gre.

Hun.

EU

Ita.

Fra.

Pol.

UK

Cze.

Ger.

Neth.

(1) |

EU

Region: Resilient Cigarette Market Shares Variance vs. PY

Q2, 2012

H1, 2012

Q2, 2012

H1, 2012

Total PMI

38.5%

37.9%

(0.2)pp

(0.4)pp

Marlboro

18.4

18.0

()

()pp

L&M

6.6

6.6

(0.2)

(-

)pp Chesterfield

3.5

3.4

()

(p

12

Source: PMI estimates

0.3

0.1

0.3

0.4 |

EU

Region: PMI Gaining Share in Expanding Fine Cut Category

Variance vs. PY

Q2, 2012

H1, 2012

Q2, 2012

H1, 2012

Industry Volume (units billion)

30.9

59.3

(

PMI Share (%)

14.1

14.0

(

(

13

Note: Fine cut converted to cigarette equivalents based on conversion ratio of 1

unit = 0.75g Source: PMI estimates

7.7%

7.9%

1.4pp

1.7pp |

Cigarette industry volume

declined by 10.5% in Q2,

2012:

-

Reduced consumer

purchasing power

-

Impact of price increases

-

Substitution by fine cut

-

Increase in illicit trade

Marlboro

performing strongly

with share up in Q2, 2012

PMI overall share down

despite

launch

of

Philip

Morris

Selection

in low-price segment

Fine cut leadership

14

Italy: Increased Pressure due to Weak Economy

Note: Totals may not add up due to rounding

Source: PMI estimates

Cigarettes

Marlboro

23.0%

22.6%

(

(

-)pp

Chesterfield

3.5%

3.5%

(0.2)pp

(0.2)p

Diana

12.4 %

12.6 %

(0.8)pp

(0.7)pp

Other

14.0 %

14.1 %

(

()pp

Total PMI

52.9 %

52.8 %

(0.5)pp

(0.6)pp

Fine Cut

Total PMI

31.0 %

29.8 %

24.5pp

26.0

Q2

2012

H1

2012

Q2

H1

Market Shares

Variance

vs. PY

0.3

pp

0.2

0.2 |

15

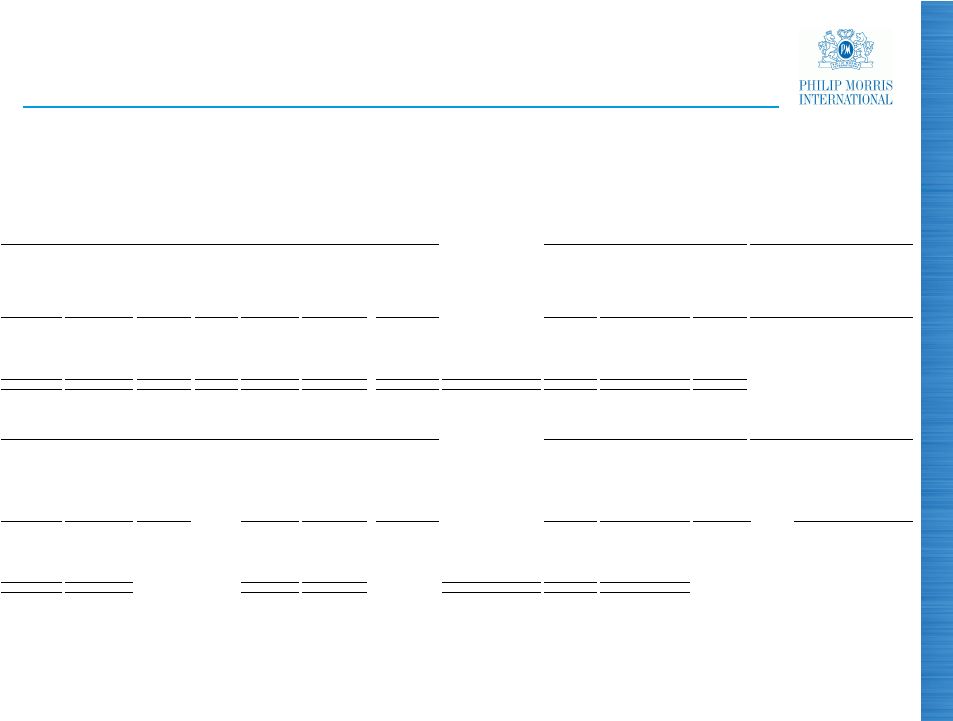

Germany: Positive PMI Share Momentum

Cigarette industry volume declined

by 5.1% in Q2, 2012:

-

Recent price increases

-

Lower consumer confidence

-

Difficult comparison with 2011

-

Some timing issues

PMI achieved modest share gains

in cigarette category and

continued strong momentum in

fine cut

Marlboro

gained share in both

cigarettes and fine cut in Q2, 2012

Source: PMI estimates

PMI Fine Cut Market Share (%)

PMI Cigarette Market Share (%)

Total PMI

Other

Chesterfield

Marlboro

L&M

Total PMI

Other

Marlboro

L&M

2.0

3.2

5.9

5.6

5.0

5.3

14.8

16.0

Q2

2011

Q2

2012

21.1

21.4

10.4

10.5

36.1

36.4

Q2

2011

Q2

2012

Cigarette industry volume down

by 1.3% YTD June, 2012 |

EU

Region: Weaker Results in Q2, 2012 Variance vs. PY

Q2, 2012

H1, 2012

Q2, 2012

H1, 2012

Cigarette Volume (units billion)

51.8

99.6

(9.4)%

(5.8)%

OTP Volume (units billion)

4.7

9.1

()%

()%

Net Revenues ($ billion)

2.3

4.3

(0.7)%

()%

Adjusted OCI ($ billion)

1.1

2.1

(2.7)%

()%

16

(a) Excluding currency and acquisitions

Note: OTP stands for other tobacco products, including cigars, cigarillos, fine

cut, pipe tobacco and snus. Fine cut converted to cigarette equivalents

based on conversion ratio of 1 unit = 0.75g

Source: PMI Financials

(a)

(a)

(a)

(a)

18.2

23.1

2.0

0.2 |

EEMA

Region: Another Very Strong Quarter 17

(a) Excluding acquisitions

(b) Excluding currency and acquisitions

Source: PMI Financials

Variance vs. PY

Q2, 2012

H1, 2012

Q2, 2012

H1, 2012

Cigarette Volume (units billion)

79.2

145.1

(

Net Revenues ($ billion)

2.2

4.0

Adjusted OCI ($ billion)

0.9

1.8

4.9%

(a)

12.7

(b)

22.9

(b)

4.2%

(a)

12.6

(b)

20.6

(b) |

18

EEMA Region: Positive Pricing and Volume/Mix

Note: Variances at OCI level

Source: PMI Financials

0

125

($ million)

Q2, 2012

114

104

Pricing

Variance

Volume/Mix

Variance |

EEMA

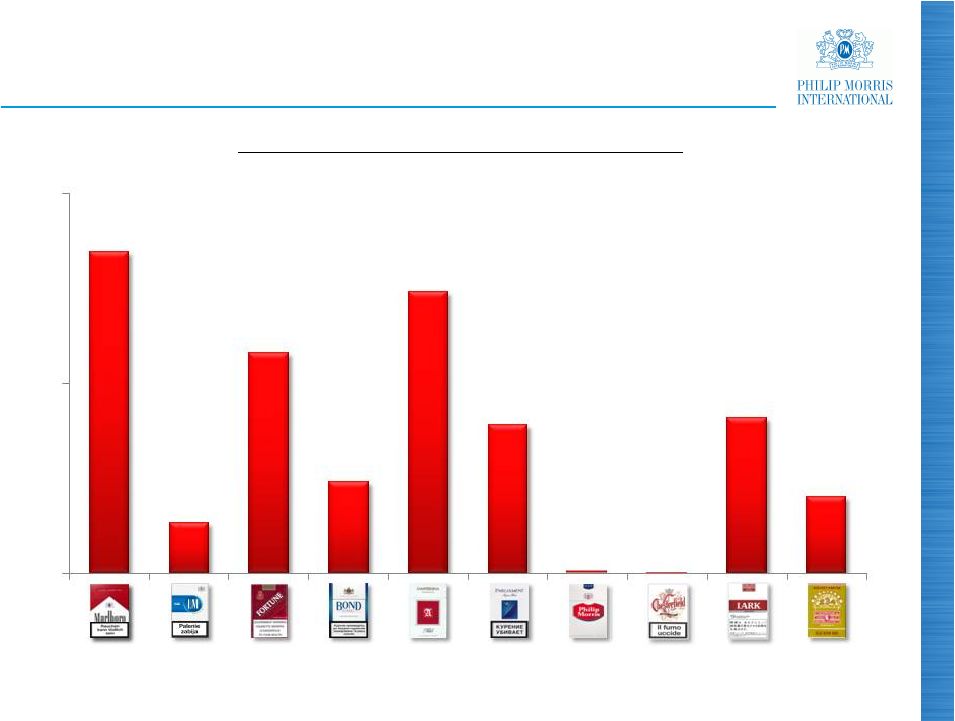

Region: Growth of Key Brands (units million)

19

Chest.

Note:

Marlb.

is

Marlboro,

Parl.

is

Parliament

and

Chest.

is Chesterfield

Source: PMI Financials

Street

Soyuz

Volume Growth (Q2, 2012 vs. Q2, 2011)

(400)

0

400

800

1,200

Marlb.

Bond

L&M

Parl.

Lark

Optima

Next

Muratti

Apollo

- |

Total market grew slightly

during first half of 2012

PMI volume increased by

8.7% in Q2, 2012

Adult smokers continue to

uptrade gradually

PMI market share gains QTD

May thanks to Parliament,

L&M, Bond Street

and Next

Price increase of RUB 3/pack

in July 2012

Price Segments (%)

Russia: Market and Share Growth

20

PMI Market Share (%)

Premium

Mid

Low

Super-

Low

(a) Q2 and H1 data through end May

Source: PMI estimates, PMI Financials and Nielsen

+0.7pp

(a)

(a)

(a)

(a)

25.4

26.1

Q2

2011

Q2

2012

35.7

32.5

23.7

26.0

24.9

25.7

15.7

15.8

H1

2011

H1

2012 |

21

Russia: Marlboro ClearTaste Launched |

Asia

Region: Japan Hurdle Masks Another Very Strong Quarter

Variance vs. PY

Q2, 2012

H1, 2012

Q2, 2012

H1, 2012

Cigarette Volume (units billion)

83.5

164.5

(0.7)%

(5.4

)%

Cigarette Volume

ex. Japan Hurdle

(7.4

)% (9.8)%

Adjusted OCI ($ billion)

1.4

2.8

(2.6)%

(8.9

)% 22

(a) Excluding currency and acquisitions

Source: PMI Financials

(a)

(a) |

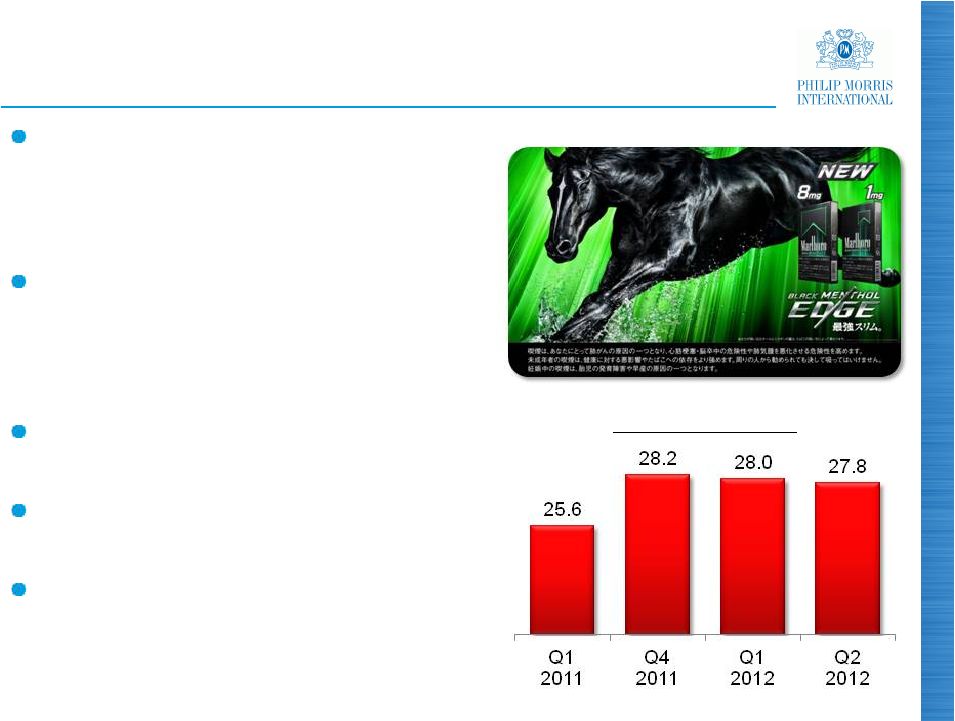

Japan: Resilient Share Performance

23

Industry volume should be

stable in 2012 and underlying

trend remains a moderate

decline of 1-2% per year

PMI Q2, 2012 market share

slightly down due to

acceleration in new launches

by Japan Tobacco

Marlboro Black Menthol Edge

launched in Q2, 2012

Marlboro

Ice

Blast

5mg

/

1mg

launched this July

Increase of Consumption Tax

from 5% to 8% in 2014 and

10% in 2015 approved

Source: PMI estimates and Tobacco Institute of Japan

PMI Market Share (%) |

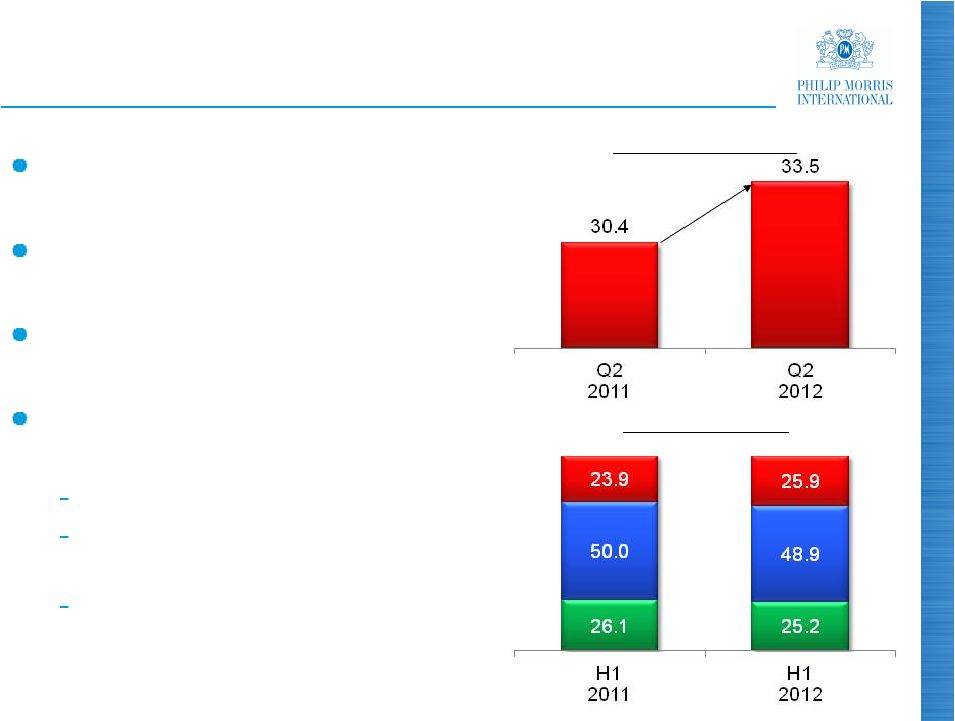

Indonesia: PMI Momentum Continues

24

Industry volume growth of

6.9% in Q2, 2012

PMI volume increased by

17.8% in second quarter

Adult smokers uptrading in

strong economy

PMI share up 3.1 points to

33.5% in Q2, 2012:

Strongest and broadest portfolio

Sampoerna

A

fastest-growing

brand

Rounded price points

Premium

(a)

Mid

Low

(a) Includes above premium

Source: PMI estimates and PMI Financials

+3.1pp

Price Segments (%)

PMI Market Share (%) |

25

Favorable Pricing Continued in Q2, 2012

Note: Variances at OCI level

Source: PMI Financials

($ million) |

Strong Brand Performance Continues

Volume Growth (H1, 2012 vs. H1, 2011)

(a)

26

(a) Excluding Japan hurdle

Source: PMI Financials

(units billion)

0

2.5

5.0 |

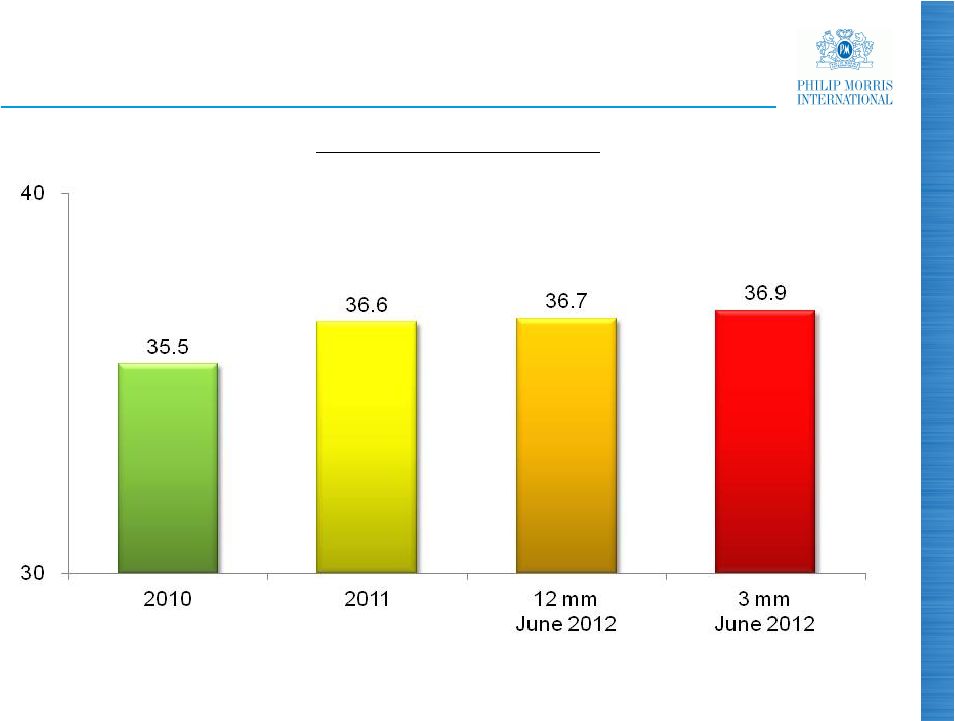

PMI

Expanding its Market Share 27

Top 30 PMI OCI Markets

(a)

(%)

(a) Excluding duty free

Note: Historical data adjusted for pro forma inclusion of business combination with

Fortune Tobacco Corporation in the Philippines and Jordan acquisition

Source: PMI Financials and PMI estimates |

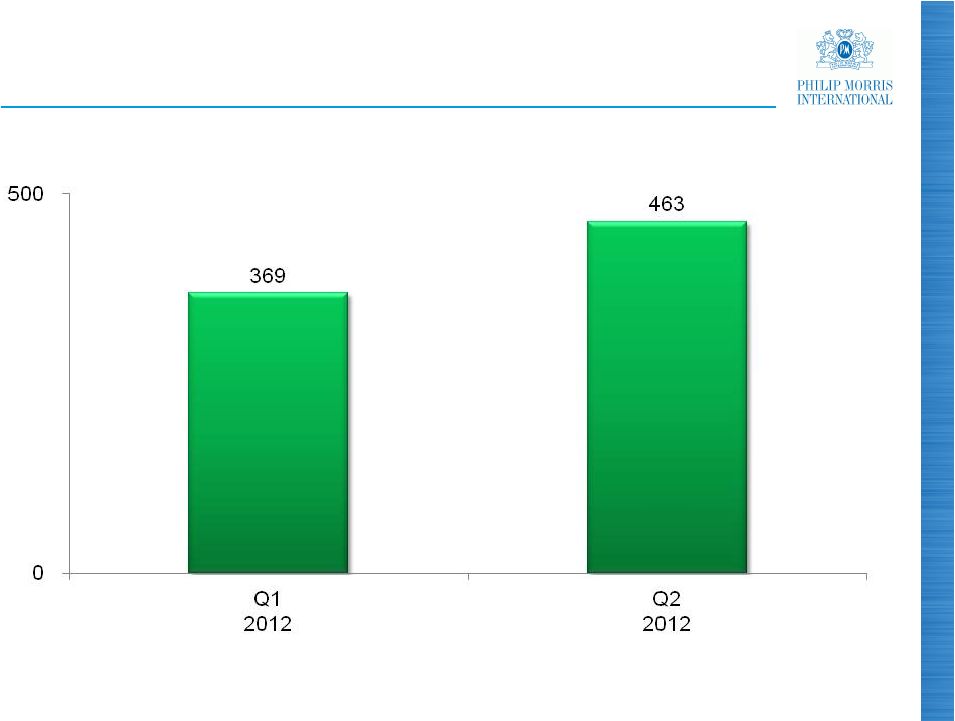

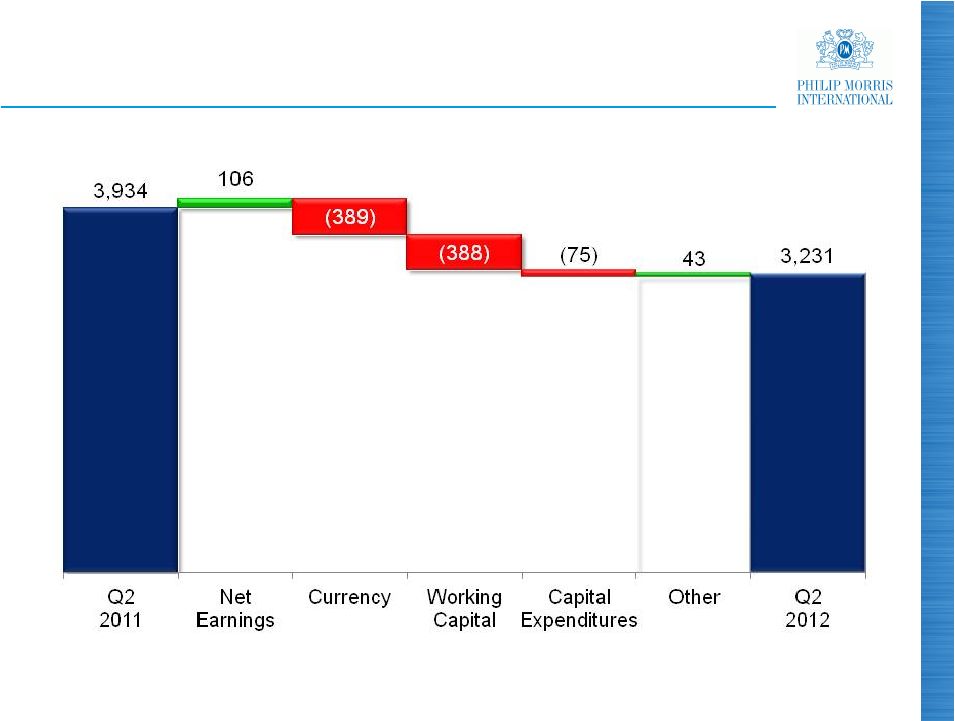

28

Free Cash Flow

(a)

Impacted by Currency and

Working Capital Requirements

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures Source: PMI Financials

($ million) |

29

Share Repurchase Program Further Extended

In Q2, 2012, PMI spent $1.5 billion to repurchase

17.8 million shares

New three-year $18 billion share repurchase program to

start in August when funds from previous authorization fully

utilized

Target for 2012 remains $6 billion in share repurchases

Since spin, $24.4 billion spent to repurchase 21.3% of

shares outstanding at the time

Source: PMI Financials |

Underlying business momentum remains strong

Very strong results in EEMA and Asia Regions offset unusually

weak industry volume in EU Region and the Japan hurdle

Breadth of footprint, superior brand portfolio and continued

strong pricing environment driving growth

Net revenues and adjusted OCI increased in Q2, 2012,

excluding currency and acquisitions

Adjusted diluted EPS, excluding currency, up 9.0% in Q2, 2012

Reaffirmed guidance range of $5.10 to $5.20 for reported diluted

EPS in 2012, despite slightly greater currency unfavorability

This represents a growth rate of approximately 10% to 12% on a

currency-neutral basis, compared to adjusted diluted EPS of

$4.88 in 2011

30

Conclusion

Source: PMI Financials |

2012

Second-Quarter Results Questions & Answers

|

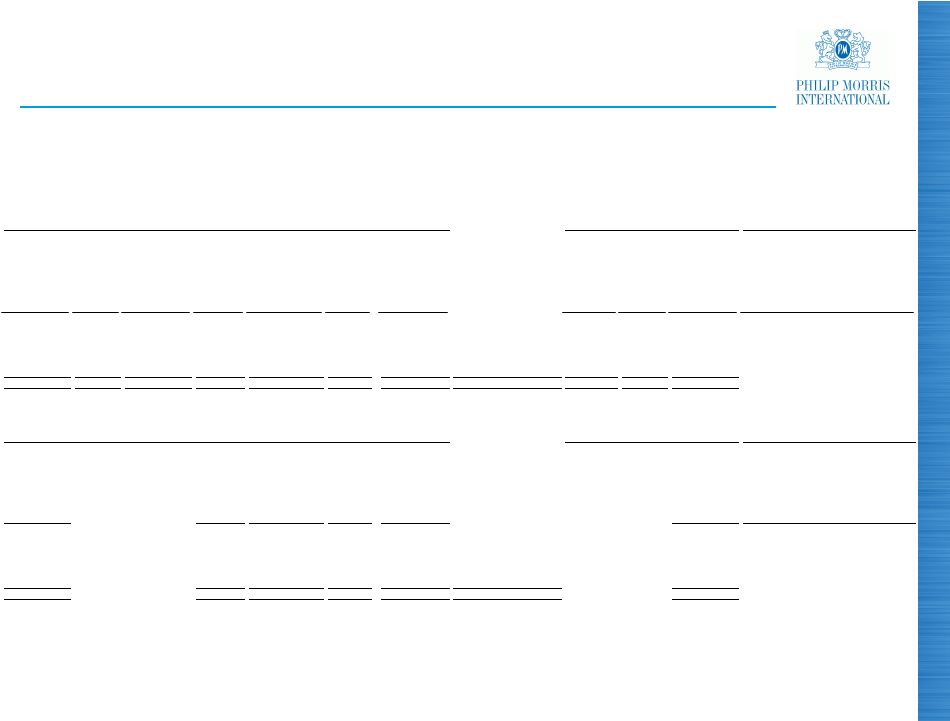

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended June 30,

($ in millions)

(Unaudited)

32

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

7,280

$

4,995

$

2,285

$

(195)

$

2,480

$

-

$

2,480

$

European Union

8,080

$

5,583

$

2,497

$

(8.5)%

(0.7)%

(0.7)%

5,062

2,911

2,151

(127)

2,278

11

2,267

EEMA

4,603

2,591

2,012

6.9%

13.2%

12.7%

5,317

2,462

2,855

(29)

2,884

-

2,884

Asia

5,146

2,210

2,936

(2.8)%

(1.8)%

(1.8)%

2,378

1,549

829

(51)

880

-

880

Latin America & Canada

2,405

1,577

828

0.1%

6.3%

6.3%

20,037

$

11,917

$

8,120

$

(402)

$

8,522

$

11

$

8,511

$

PMI Total

20,234

$

11,961

$

8,273

$

(1.8)%

3.0%

2.9%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,117

$

(130)

$

1,247

$

-

$

1,247

$

1,280

$

(12.7)%

(2.6)%

(2.6)%

948

(80)

1,028

2

1,026

835

13.5%

23.1%

22.9%

1,364

3

1,361

-

1,361

1,398

(2.4)%

(2.6)%

(2.6)%

249

(25)

274

-

274

268

(7.1)%

2.2%

2.2%

3,678

$

(232)

$

3,910

$

2

$

3,908

$

3,781

$

(2.7)%

3.4%

3.4%

2012

2011

% Change in Reported Operating

Companies Income

2012

2011

% Change in Reported Net Revenues

excluding Excise Taxes |

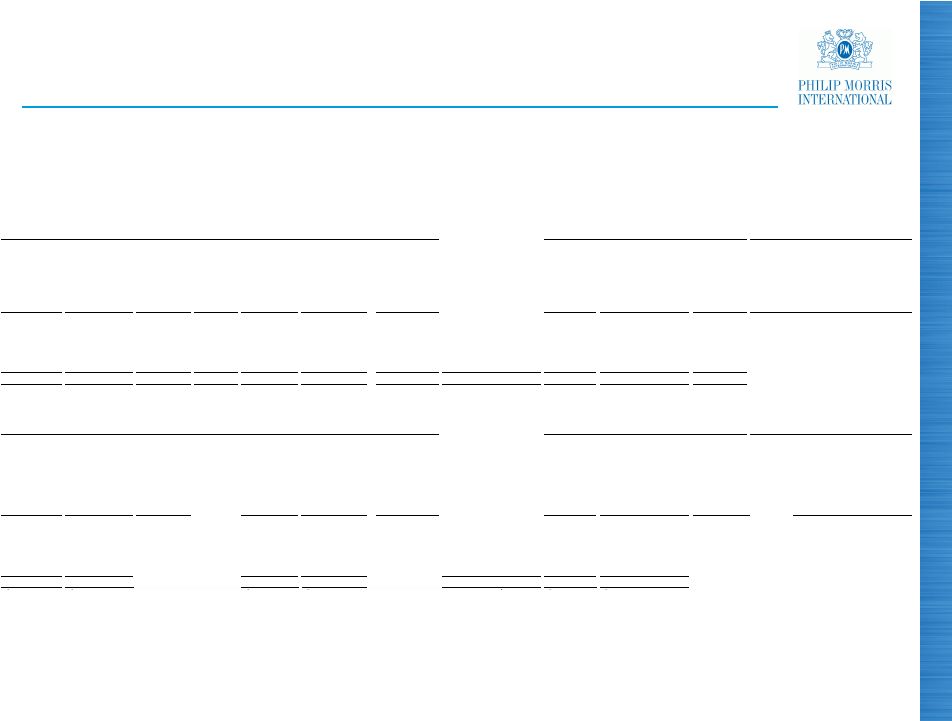

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended June

30, ($ in millions)

(Unaudited)

33

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,117

$

-

$

1,117

$

(130)

$

1,247

$

-

$

1,247

$

European Union

1,280

$

(1)

$

1,281

$

(12.8)%

(2.7)%

(2.7)%

948

-

948

(80)

1,028

2

1,026

EEMA

835

-

835

13.5%

23.1%

22.9%

1,364

-

1,364

3

1,361

-

1,361

Asia

1,398

-

1,398

(2.4)%

(2.6)%

(2.6)%

249

(8)

257

(25)

282

-

282

Latin America & Canada

268

-

268

(4.1)%

5.2%

5.2%

3,678

$

(8)

$

3,686

$

(232)

$

3,918

$

2

$

3,916

$

PMI Total

3,781

$

(1)

$

3,782

$

(2.5)%

3.6%

3.5%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(a)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

1,247

$

2,480

$

50.3%

1,247

$

2,480

$

50.3%

European Union

1,281

$

2,497

$

51.3%

(1.0)

(1.0)

1,028

2,278

45.1%

1,026

2,267

45.3%

EEMA

835

2,012

41.5%

3.6

3.8

1,361

2,884

47.2%

1,361

2,884

47.2%

Asia

1,398

2,936

47.6%

(0.4)

(0.4)

282

880

32.0%

282

880

32.0%

Latin America & Canada

268

828

32.4%

(0.4)

(0.4)

3,918

$

8,522

$

46.0%

3,916

$

8,511

$

46.0%

PMI Total

3,782

$

8,273

$

45.7%

0.3

0.3

% Change in Adjusted Operating

Companies Income

2011

2012

2011

2012

(a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer

to previous slide |

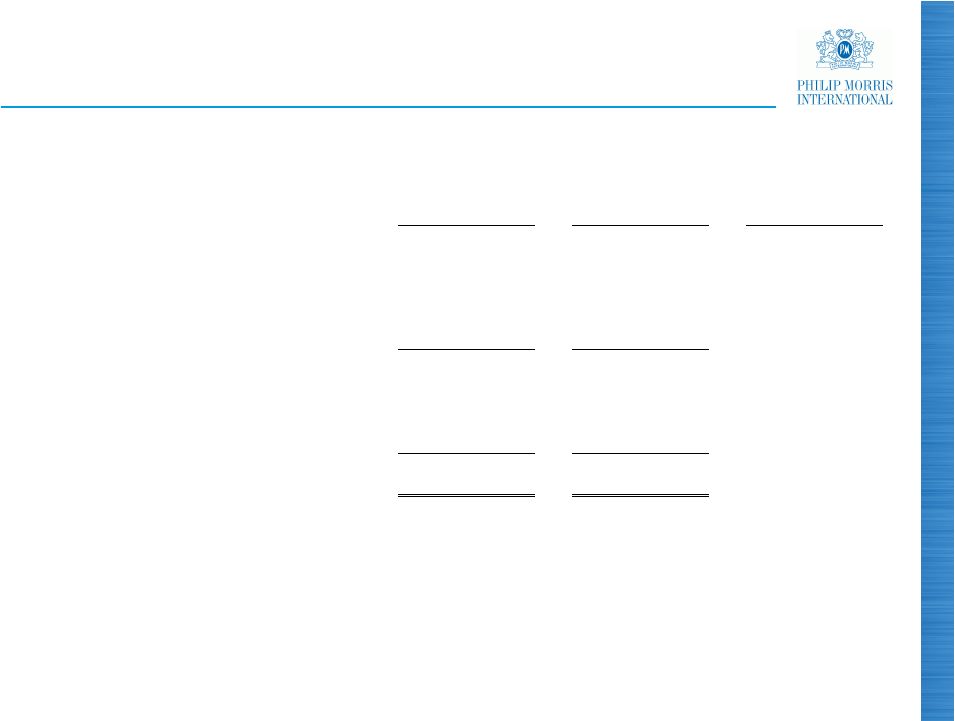

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended June 30,

(Unaudited)

34

2012

2011

% Change

Reported Diluted EPS

1.36

$

1.35

$

0.7%

Adjustments:

Asset impairment and exit costs

-

-

Tax items

-

(0.01)

Adjusted Diluted EPS

1.36

$

1.34

$

1.5%

Less:

Currency impact

(0.10)

Adjusted Diluted EPS, excluding Currency

1.46

$

1.34

$

9.0% |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding

Currency For the Quarters Ended June 30,

(Unaudited)

35

2012

2011

% Change

Reported Diluted EPS

1.36

$

1.35

$

0.7%

Less:

Currency impact

(0.10)

Reported Diluted EPS, excluding Currency

1.46

$

1.35

$

8.1% |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Six Months Ended June 30,

($ in millions)

(Unaudited)

36

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

13,750

$

9,412

$

4,338

$

(249)

$

4,587

$

-

$

4,587

$

European Union

14,495

$

9,997

$

4,498

$

(3.6)%

2.0%

2.0%

9,131

5,145

3,986

(200)

4,186

20

4,166

EEMA

8,274

4,575

3,699

7.8%

13.2%

12.6%

10,494

4,862

5,632

45

5,587

1

5,586

Asia

9,434

4,175

5,259

7.1%

6.2%

6.2%

4,684

3,072

1,612

(90)

1,702

-

1,702

Latin America & Canada

4,561

2,953

1,608

0.2%

5.8%

5.8%

38,059

$

22,491

$

15,568

$

(494)

$

16,062

$

21

$

16,041

$

PMI Total

36,764

$

21,700

$

15,064

$

3.3%

6.6%

6.5%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

2,147

$

(155)

$

2,302

$

-

$

2,302

$

European Union

2,286

$

(6.1)%

0.7%

0.7%

1,758

(124)

1,882

2

1,880

EEMA

1,557

12.9%

20.9%

20.7%

2,771

56

2,715

-

2,715

Asia

2,491

11.2%

9.0%

9.0%

486

(42)

528

-

528

Latin America & Canada

519

(6.4)%

1.7%

1.7%

7,162

$

(265)

$

7,427

$

2

$

7,425

$

PMI Total

6,853

$

4.5%

8.4%

8.3%

2012

2011

% Change in Reported Operating

Companies Income

2012

2011

% Change in Reported Net Revenues

excluding Excise Taxes |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

37

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Six Months Ended June

30, ($ in millions)

(Unaudited)

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

2,147

$

-

$

2,147

$

(155)

$

2,302

$

-

$

2,302

$

European Union

2,286

$

(12)

$

2,298

$

(6.6)%

0.2%

0.2%

1,758

-

1,758

(124)

1,882

2

1,880

EEMA

1,557

(2)

1,559

12.8%

20.7%

20.6%

2,771

-

2,771

56

2,715

-

2,715

Asia

2,491

(2)

2,493

11.2%

8.9%

8.9%

486

(16)

502

(42)

544

-

544

Latin America & Canada

519

(1)

520

(3.5)%

4.6%

4.6%

7,162

$

(16)

$

7,178

$

(265)

$

7,443

$

2

$

7,441

$

PMI Total

6,853

$

(17)

$

6,870

$

4.5%

8.3%

8.3%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding

Excise Taxes &

Currency

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(a)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(a)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

2,302

$

4,587

$

50.2%

2,302

$

4,587

$

50.2%

European Union

2,298

$

4,498

$

51.1%

(0.9)

(0.9)

1,882

4,186

45.0%

1,880

4,166

45.1%

EEMA

1,559

3,699

42.1%

2.9

3.0

2,715

5,587

48.6%

2,715

5,586

48.6%

Asia

2,493

5,259

47.4%

1.2

1.2

544

1,702

32.0%

544

1,702

32.0%

Latin America & Canada

520

1,608

32.3%

(0.3)

(0.3)

7,443

$

16,062

$

46.3%

7,441

$

16,041

$

46.4%

PMI Total

6,870

$

15,064

$

45.6%

0.7

0.8

2012

2011

2012

2011

% Change in Adjusted Operating

Companies Income

(a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer

to previous slide |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Six Months Ended June 30,

(Unaudited)

38

2012

2011

% Change

Reported Diluted EPS

2.60

$

2.42

$

7.4%

Adjustments:

Asset impairment and exit costs

0.01

0.01

Tax items

-

(0.02)

Adjusted Diluted EPS

2.61

$

2.41

$

8.3%

Less:

Currency impact

(0.12)

Adjusted Diluted EPS, excluding Currency

2.73

$

2.41

$

13.3% |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding

Currency For the Six Months Ended June 30,

(Unaudited)

39

2012

2011

% Change

Reported Diluted EPS

2.60

$

2.42

$

7.4%

Less:

Currency impact

(0.12)

Reported Diluted EPS, excluding Currency

2.72

$

2.42

$

12.4% |

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS

For the Year Ended December 31,

(Unaudited)

40

2011

Reported Diluted EPS

4.85

$

Adjustments:

Asset impairment and exit costs

0.05

Tax items

(0.02)

Adjusted Diluted EPS

4.88

$

|

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

For the Quarters and Six Months Ended June 30,

($ in millions)

(Unaudited)

(a) Operating Cash Flow

41

For the Quarters Ended

For the Six Months Ended

June 30,

June 30,

2012

2011

% Change

2012

2011

% Change

Net

cash

provided

by

operating

activities

(a)

3,480

$

4,120

$

(15.5)%

5,378

$

6,515

$

(17.5)%

Less:

Capital expenditures

249

186

476

345

Free cash flow

3,231

$

3,934

$

(17.9)%

4,902

$

6,170

$

(20.6)%

Less:

Currency impact

(389)

(439)

Free cash flow, excluding currency

3,620

$

3,934

$

(8.0)%

5,341

$

6,170

$

(13.4)% |

2012

Second-Quarter Results July 19, 2012 |