Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d378588d8k.htm |

| EX-99.1 - FINANCIAL SUPPLEMENT (UNAUDITED) FOR SECOND QUARTER 2012 - PNC FINANCIAL SERVICES GROUP, INC. | d378588dex991.htm |

The PNC

Financial Services Group, Inc. Second Quarter 2012

Earnings Conference Call

July 18, 2012

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

2 |

3

Significant 2Q12 Achievements

PNC Is Positioned to Deliver Even Greater Shareholder Value.

PNC Is Positioned to Deliver Even Greater Shareholder Value.

2Q12 financial

summary

Net income

Diluted EPS from

net income

Return on

average assets

$546 million

$0.98

.74%

Net income of $546 million and EPS of $0.98

Strong performance driven by customer growth and our Southeast expansion

Grew commercial and consumer loans

Overall credit quality improved

Well-managed expenses -

continuous improvement initiatives remained on track

Continued to maintain strong capital levels and liquidity positions

2Q12 highlights

(1) Further information is provided in the Appendix.

3

–

Includes $403 million or $0.76 EPS charge associated with residential mortgage

repurchase obligations, trust preferred securities redemptions and integration

1 |

Business

Fundamentals Continued to Improve 2Q12 Retail Banking

2Q12 Corporate & Institutional Banking

2Q12 Asset Management Group

2Q12 Residential Mortgage

Grew

net

organic

checking

relationships

by

128,000 or 4% annualized YTD12; greater than

1.9% footprint population growth

65%

of

new

accounts opened

in

2Q12

were

relationship accounts

Virtual Wallet surpassed one million accounts

Active online bill payment customers increased

8% in 1H12; 14% from 2Q11

Serving Customers Tomorrow strategy -

deployed over 400 image enabled ATMs

Continued

strong

client

additions

–

added

nearly

500

new Corporate Banking primary clients in 1H12

Continued loan growth

–

Total average loans increased $9 billion or 12%

from 1Q12 and 32% from 2Q11

Commercial mortgage banking activities increased by

$65 million in 1H12 from 1H11 driven by higher

mortgage loan servicing income and lower CMSR

impairment

Assets under administration of $214 billion

Strong

growth

in

new

primary

clients

Referral sales

grew 25% linked quarter

Total sales increased by 10% compared to 1Q12

Loan sales revenue

up 142% from 2Q11

Driven by increased loan origination volumes up 38%

from 2Q11up 38% from

2Q11 Spreads increased 18% from 2Q11

Purchase money mortgage originations

increased

21% from 2Q11

Increased mortgage repurchase reserves reflect

increasing GSE demands -

GSEs represent 64% of

remaining UPB

(1) Net organic checking relationship growth refers to consumer and small business accounts

exclusive of 57,000 accounts acquired through acquisition in 1Q12. (2) Relationship

checking accounts refer to accounts with a committed balance level or self-service accounts with lower cost of servicing. (3) A

Corporate Banking primary client is defined as a corporate banking relationship with annual

revenue generation of $50,000 or more or, within corporate banking, a commercial

banking client relationship with annual revenue generation of $10,000 or more. AMG primary client relationships are defined as client

relationships with annual revenue generation of $10,000 or more.(4) New client sales referred

to AMG by Retail Banking or C&IB. (5) Refers to loan sales revenue

before

provision.

(6)

A

mortgage

with

a

borrower

as

part

of

a

residential

real

estate

purchase

transaction.

4

Treasury Management revenues up 3% linked quarter

1

2

3

4

5

3

6

–

Driven by increased loan origination volumes

–

Spreads increased 18% from 2Q11 |

Earnings

2Q12

1Q12

2Q11

YTD12

YTD11

Net income ($ millions)

$546

$811

$912

$1,357

$1,744

Earnings per diluted share

$0.98

$1.44

$1.67

$2.42

$3.24

Select

charges

EPS impact

($0.76)

($0.22)

($0.04)

($0.98)

($0.05)

Performance

Measures

2Q12

1Q12

2Q11

YTD12

YTD11

Return on average assets

.74%

1.16%

1.40%

.94%

1.34%

Return

on

Tier

1

common

capital

9.3%

14.0%

16.1%

11.5%

15.5%

(1) At period-end. (2) Charges for residential mortgage repurchase obligations,

unamortized discounts related to redemptions of trust preferred

securities,

and

integration

costs.

Further

information is provided in the Appendix. (3) Tier 1 common capital at June 30, 2012 is

estimated. Return on Tier 1 common capital is calculated as annualized net income divided by

period-end Tier 1 common capital. Further information is provided in the

Appendix. Balance

Sheet

Growth

2Q12

1Q12

2Q11

Loans

$180

$176

$150

Deposits

$207

$206

$182

1

($ billions)

1

($ billions)

3

2

5

Strong Financial Performance Affected by Select

Charges |

Strong

Commercial Loan Growth Funded by Favorable Deposit Mix

Loans increased $4.2 billion or 2%

from 1Q12, primarily driven by

total commercial loan growth of

3%

Consumer loan growth increased

1%

linked

quarter,

primarily driven

by growth in automobile

Transaction deposits increased

$1.5 billion from 1Q12, reflecting

increased commercial and

consumer liquidity

Retail CDs declined $3.1 billion

from 1Q12, reflecting expected

run-off as the final wave of higher

rate CDs matured in the quarter

Loans to deposits and capital

ratios remained stable

% change from:

Category (billions)

Jun. 30,

2012

Mar. 31,

2012

Jun. 30,

2011

Commercial

78.9

5%

35%

Commercial real estate

18.5

0%

14%

Total commercial lending

104.1

3%

28%

Home equity/Residential RE

51.7

(1%)

7%

Automobile

7.2

24%

95%

Other

17.4

(2%)

2%

Total consumer lending

76.3

1%

10%

Total loans

$180.4

2%

20%

Transaction deposits

$166.0

1%

21%

Retail CDs & other deposits

40.9

(1%)

(9%)

Total deposits

$206.9

0%

14%

Key ratios:

Loans to deposits ratio

87%

85%

83%

Tier 1 common capital ratio

9.3%

9.3%

10.5%

(1)

Total commercial lending includes commercial, commercial real estate and also includes $6.8

billion of equipment lease financing. (2)

Includes credit card, education and other loans. (3) Tier 1 common capital ratio is

period-end Tier 1 common capital divided by period-end risk weighted assets and

is estimated for June 30, 2012. 2Q12 highlights

1

3

6

2 |

Loan Growth and

Reduced Funding Costs Driving Net Interest Income

(millions)

2Q12

1Q12

4Q11

3Q11

2Q11

Interest income -

loans

$2,163

$1,951

$1,902

$1,904

$1,905

Total interest income

2,796

2,597

2,534

2,530

2,547

Total interest expense

270

306

335

355

397

Total net interest income

$2,526

$2,291

$2,199

$2,175

$2,150

Average

interest

earning

assets

grew

$12

billion

or

5%

from

1Q12

and 13% from 2Q11

Net

interest

margin

improved

primarily

due

to

lower

funding

costs

and

higher

yielding

assets

Total

net

interest

income

grew

10%

from

1Q12

and

17%

from

2Q11

–

Higher loan balances

–

Impact of Southeast expansion

–

Lower funding costs

(1) Calculated as annualized taxable-equivalent net interest income divided by average

earning assets. See Appendix for additional information. 2Q12

1Q12

4Q11

3Q11

2Q11

Average interest earning

assets (in billions)

$250.1

$237.7

$228.4

$224.1

$220.7

Average yields/rate:

Interest-earning assets

4.51%

4.41%

4.44%

4.52%

4.64%

Interest-bearing liabilities

.58

.70

.80

.86

.95

Interest rate spread

3.93

3.71

3.64

3.66

3.69

Net interest margin

4.08%

3.90%

3.86%

3.89%

3.93%

10% LQ

17% YOY

2Q12 highlights

7

1 |

3

Client Growth and Sales Impact Noninterest Revenue

2Q12 highlights

(1) Asset management includes the Asset Management Group and BlackRock. (2) Residential

mortgage consists of residential mortgage banking less provision for residential

mortgage repurchase obligations. (3) The Dodd-Frank Act limits related to interchange rates on debit

card transactions, which were effective October 1, 2011; 3Q11 and 2Q11 amounts reflect the

estimated impact of Durbin if it had been in effect for those quarters.

Noninterest income in the quarter

included provision for residential

mortgage

repurchase

obligations

of

$438

million

Excluding the residential mortgage

repurchase provision and Durbin

impact, noninterest income grew

4% linked quarter and 9%

compared to the same period last

year

Consumer,

corporate

and mortgage

services

delivered

strong

fee

income

growth

from

prior

periods

(millions)

2Q12

1Q12

4Q11

3Q11

2Q11

Asset management

$278

$284

$250

$287

$288

Consumer services

290

264

269

330

333

Corporate services

290

232

266

187

228

Residential mortgage

banking

265

262

193

229

184

Provision for residential

mortgage repurchase

obligations

(438)

(32)

(36)

(31)

(21)

Deposit service charges

144

127

140

140

131

Net gains on sales of

securities less net OTTI

28

19

18

33

43

Other

240

285

250

194

266

Total noninterest income

$1,097

$1,441

$1,350

$1,369

$1,452

Provision for residential

mortgage repurchase

obligations

438

32

36

31

21

Durbin impact

(70)

(70)

Total noninterest income,

excl. mortgage

repurchase obligations

and Durbin impact

$1,535

$1,473

$1,386

$1,330

$1,403

9% YOY

8

4% LQ

2

1 |

Key

Statistics Total

Portfolio

GSEs

($ billions)

Total

Portfolio

‘06-‘08

Vintages

Original UPB

$384

$214

$57

Remaining UPB

106

68

15

Life-to-date demands

3.9

2.4

1.7

Life-to-date repurchases

2.3

1.3

1.0

Life-to-date losses

1.2

0.6

0.4

Future expected losses

0.5

0.4

0.3

Total expected losses

$1.7

$1.0

$0.7

Residential Mortgage Repurchase Obligations

Summary of Changes in Residential Mortgage Repurchase Reserve

($ millions)

2Q12

1Q12

4Q11

3Q11

2Q11

Beginning Reserve

$101

$83

$85

$95

$124

Provision

438

32

36

31

21

RBC Bank (USA)

-

26

-

-

-

Losses

(77)

(40)

(38)

(41)

(50)

Ending Balance

$462

$101

$83

$85

$95

Recent and expected elevated

levels of GSE-related repurchase

demands

As a result, PNC added provision of

approximately $438 million to

residential mortgage repurchase

reserves in 2Q12

(1) As of June 30, 2012.

2Q12 highlights

9

–

Expect lifetime losses of $1.7

billion

–

Barring significant changes in

the expected future behaviors

and demand patterns of

investors/guarantors or other

unforeseen circumstances, we

believe we are appropriately

reserved against future

demands

1 |

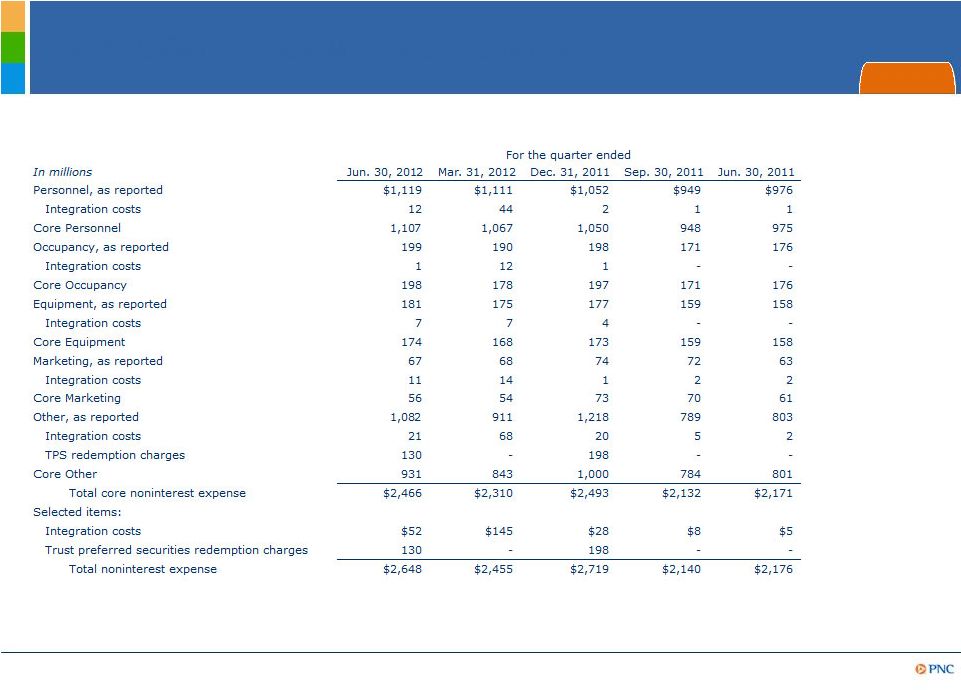

Disciplined

Expense Management While Investing for Growth

(millions)

2Q12

1Q12

4Q11

3Q11

2Q11

Core

:

Personnel

$1,107

$1,067

$1,050

$948

$975

Occupancy

198

178

197

171

176

Equipment

174

168

173

159

158

Marketing

56

54

73

70

61

Other

931

843

1,000

784

801

Total core noninterest

expense

$2,466

$2,310

$2,493

$2,132

$2,171

Integration costs

52

145

28

8

5

Trust preferred securities

redemption charges

130

-

198

-

-

Total noninterest

expense

$2,648

$2,455

$2,719

$2,140

$2,176

(1) Core noninterest expense items do not include the impact of integration costs and trust

preferred securities redemption charges, which are listed separately in the table

above, but do include the impact of RBC Bank (USA) operating expenses. See the Appendix for the impact of

integration costs and trust preferred securities redemptions charges for unamortized discount

on each category of noninterest expense. 2Q12 highlights

10

Includes $149 million of RBC Bank (USA)

1

1

Total core noninterest expense

increased $156 million from 1Q12

primarily due to:

Core noninterest expense

increased $295 million from 2Q11

due to:

Successfully completed 60% of our

$550 million continuous

improvement annualized cost

savings goals

RBC Bank (USA) operating

costs of $149 million

Higher additions to legal

reserves, other real estate

owned expenses, mortgage

foreclosure-related expenses

and pension costs

Full quarter impact of RBC

Bank (USA) operating expenses

of $149 million vs. $40 million

in 1Q12 |

Strong Capital

and Liquidity Position (1) Regulatory requirements are inclusive of the capital

conservation buffer and subject to further regulatory guidance and clarity on Basel

NPRs. (2) Estimated at June 30, 2012. (3) Based on Basel III NPRs and including application of

Basel II (as modified by NPRs) and Basel II.5 rules. (4) Parent company liquidity

coverage defined as liquid assets divided by funding obligations within a two year period.

2Q12 highlights

Basel I Tier 1 common ratio of 9.3%

Capital priorities:

–

Build capital to support client growth and

business investment

–

Maintain appropriate capital in light of

economic uncertainty

–

Return excess capital to shareholders

Basel III Tier 1 common ratio goal of 8.0-8.5%

by year-end 2013 without benefit of phase-ins

Strong liquidity position

–

Loans to deposits ratio of 87%

–

Parent company two year liquidity

coverage

4

of 117%

Basel III Tier 1 common ratio

8.0% -

8.5%

2013 Goal

Basel III

2013 2014 2015 2016 2017 2018 2019

3.5%

4.0%

4.5%

5.1%

5.8%

6.4%

7.0%

11

–

Improved capital treatment expected on

sub-investment grade securities

1

2

3

Basel III requirements |

Outlook –

Full Year 2012 vs. 2011

PNC is Positioned to Deliver Strong Results in 2012.

PNC is Positioned to Deliver Strong Results in 2012.

Loans

Increase mid to high teens

Total revenue

Noninterest expense

Loan loss provision

Increase high single digits

Increase high single digits

Improving

Combined

Balance sheet

Combined

Income

statement

1

4

5,6

6

2

Estimated % Change

3

Strong loan and revenue growth expected

RBC Bank (USA) acquisition expected to be accretive in 2012

Disciplined credit and expense management

(1)

Refer

to

the

Cautionary

Statement

in

the

Appendix,

including

assumptions.

(2) Excluding

integration

costs.

(3)

Estimated

change

for

2012

is based on comparable 2011 results. (4) Excluding future significant residential mortgage

repurchase provisions. (5) Excluding integration costs and capital actions related to

TPS redemptions for 2011 and 2012. (6) Excludes future significant legal and regulatory costs that may be

incurred in the remainder of the year.

12 |

Cautionary

Statement Regarding Forward-Looking Information

Appendix

13 |

14

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix |

Cautionary

Statement Regarding Forward-Looking Information

(continued) Appendix

15 |

16

Non-GAAP to GAAP Reconcilement

Appendix |

17

Appendix

Non-GAAP to GAAP Reconcilement |

18

Appendix

Non-GAAP to GAAP Reconcilement |