Attached files

| file | filename |

|---|---|

| 8-K - INVESTOR PRESENTATION 8-K - GLOBE SPECIALTY METALS INC | investorpres8k.htm |

July 18, 2012

Globe Specialty Metals Investor Day

Disclaimer

This presentation may contain statements that relate to future events and expectations and, as such, constitute

"forward-looking statements" within the meaning of the federal securities laws. These statements can be

identified by the use of words such as “believes,” “expects,” “may,” “will,” “intends,” “plans,” “estimates” or

“anticipates,” or other comparable terminology, or by discussions of strategy, plans or intentions. These

statements are based on management’s current expectations and assumptions about the industries in which

Globe operates. Globe disclaims any intention or obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise, except as required by applicable law.

Forward-looking statements are not guarantees of future performance and are subject to significant risks and

uncertainties that may cause actual results or achievements to be materially different from the future results or

achievements expressed or implied by the forward-looking statements. These risks and uncertainties include,

but are not limited to, those risks and uncertainties described in Globe’s most recent Annual Report on Form 10

-K, including under “Special Note Regarding Forward-Looking Statements” and “Risk Factors” and Globe’s

quarterly reports on Form 10-Q. These reports can be accessed through the “Investors” section of Globe’s

website at www.glbsm.com.

"forward-looking statements" within the meaning of the federal securities laws. These statements can be

identified by the use of words such as “believes,” “expects,” “may,” “will,” “intends,” “plans,” “estimates” or

“anticipates,” or other comparable terminology, or by discussions of strategy, plans or intentions. These

statements are based on management’s current expectations and assumptions about the industries in which

Globe operates. Globe disclaims any intention or obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise, except as required by applicable law.

Forward-looking statements are not guarantees of future performance and are subject to significant risks and

uncertainties that may cause actual results or achievements to be materially different from the future results or

achievements expressed or implied by the forward-looking statements. These risks and uncertainties include,

but are not limited to, those risks and uncertainties described in Globe’s most recent Annual Report on Form 10

-K, including under “Special Note Regarding Forward-Looking Statements” and “Risk Factors” and Globe’s

quarterly reports on Form 10-Q. These reports can be accessed through the “Investors” section of Globe’s

website at www.glbsm.com.

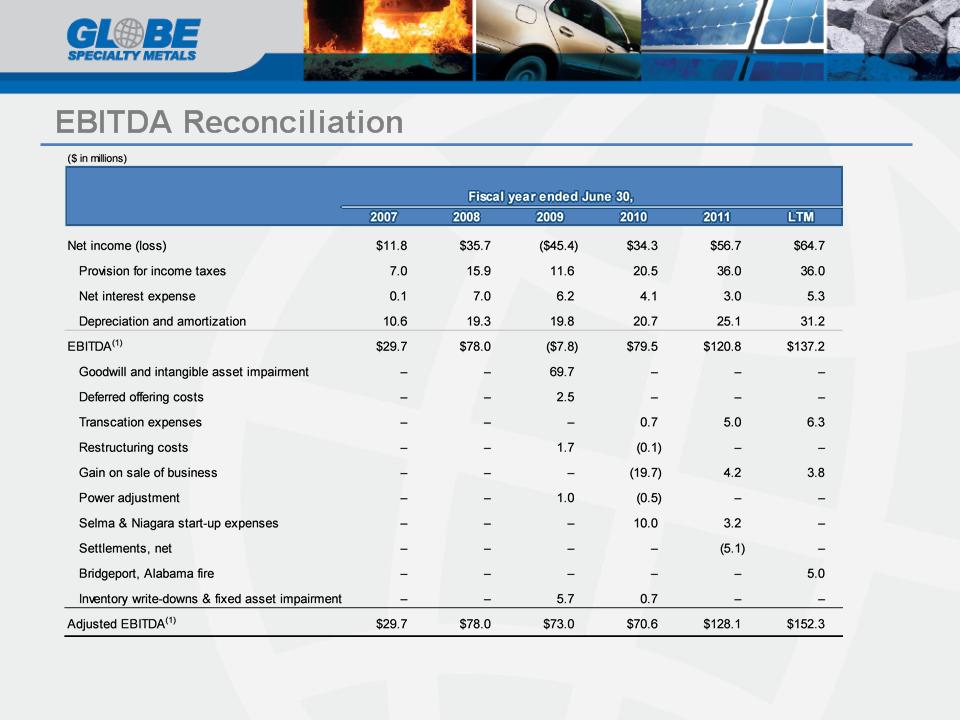

EBITDA is a non-GAAP measure. We have included EBITDA to provide a supplemental measure of our

performance which we believe is important because it eliminates items that have less bearing on our current

and future operating performance and so highlights trends in our core business that may not otherwise be

apparent when relying solely on GAAP financial measures. A reconciliation of EBITDA to net income is

provided in the attached appendix.

performance which we believe is important because it eliminates items that have less bearing on our current

and future operating performance and so highlights trends in our core business that may not otherwise be

apparent when relying solely on GAAP financial measures. A reconciliation of EBITDA to net income is

provided in the attached appendix.

All references to “MT” or “tons” mean metric tons, each of which equals 2,204.6 pounds.

1

Recent Accomplishments

n Added additional 25% silicon capacity (= 10% additional revenue)

through acquisition of 51% of Quebec Silicon - a 47,000MT silicon

metal plant

through acquisition of 51% of Quebec Silicon - a 47,000MT silicon

metal plant

n Acquisition of Alden Resources - secured source for best quality

ultra-low ash, high purity coal in the world for silicon production

ultra-low ash, high purity coal in the world for silicon production

n Significant liquidity of ~$445m consisting of:

− $300m revolving credit facility at LIBOR + 175, less $120m drawn

− $125m accordion

− $141m cash*

2

*As of 3/31/12

GSM: The Leader in Silicon - Well Positioned for Further Growth

n One of the world’s largest and the lowest cost silicon metal

producers

producers

n Leading global silicon-based alloy producer

n Global reach with 12 facilities in 5 countries - U.S., Canada,

Argentina, Poland, and China

Argentina, Poland, and China

n Strong profitability through all phases of the cycle with

substantial leverage to price - control across all raw material

inputs - only one in the industry

substantial leverage to price - control across all raw material

inputs - only one in the industry

n Beneficiary of new USA natural gas phenomenon

n Strong, flexible balance sheet - designed for growth

n Built and run by entrepreneurs with strong and proven M&A and

operational backgrounds and unique investment approach

operational backgrounds and unique investment approach

3

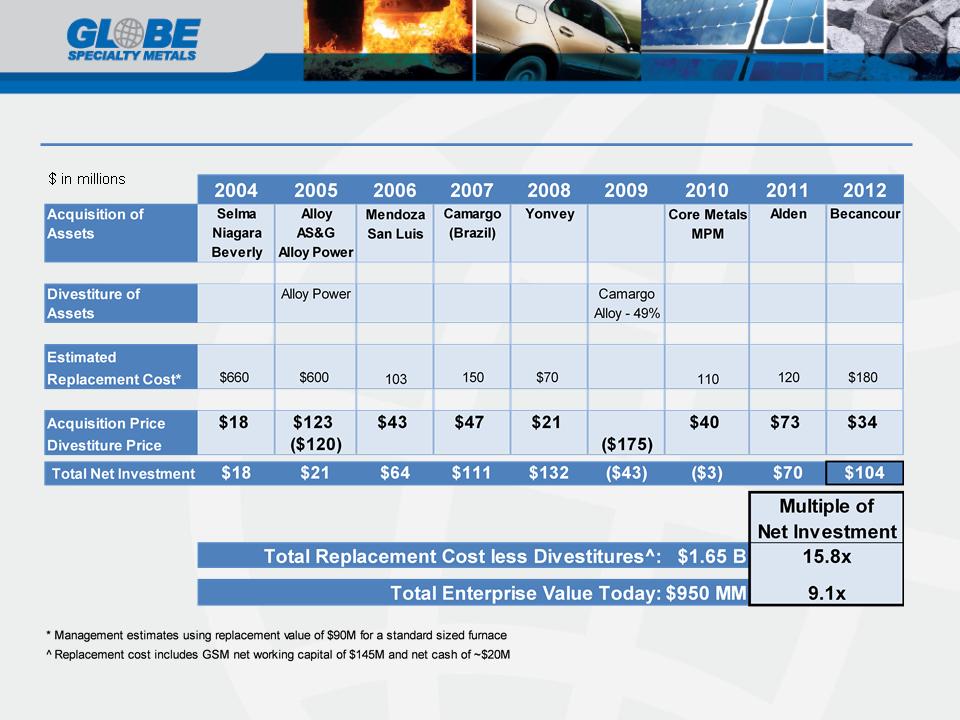

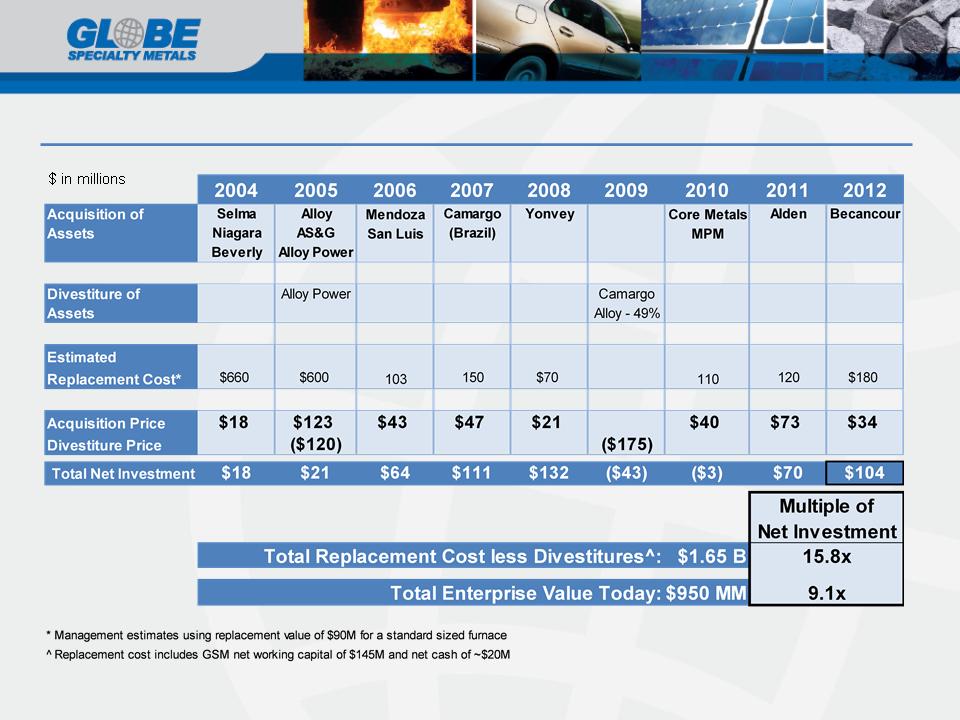

Growth Through Key, Strategic, Timely & Accretive Acquisitions

4

5

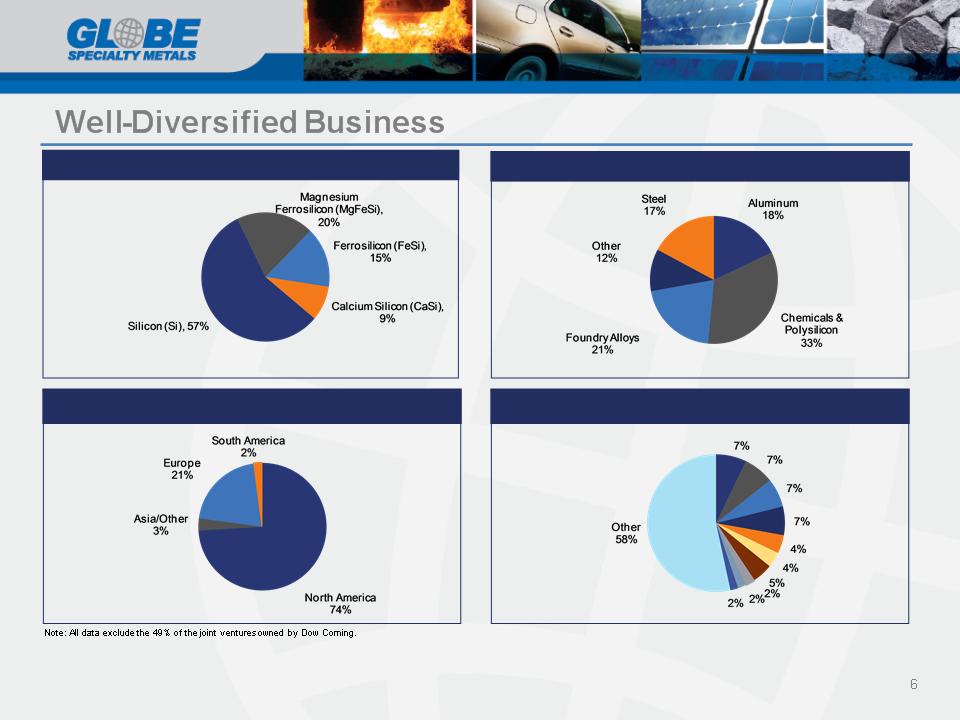

LTM Revenue Mix

End-markets

Customers - Minimal Concentration

Revenue by region

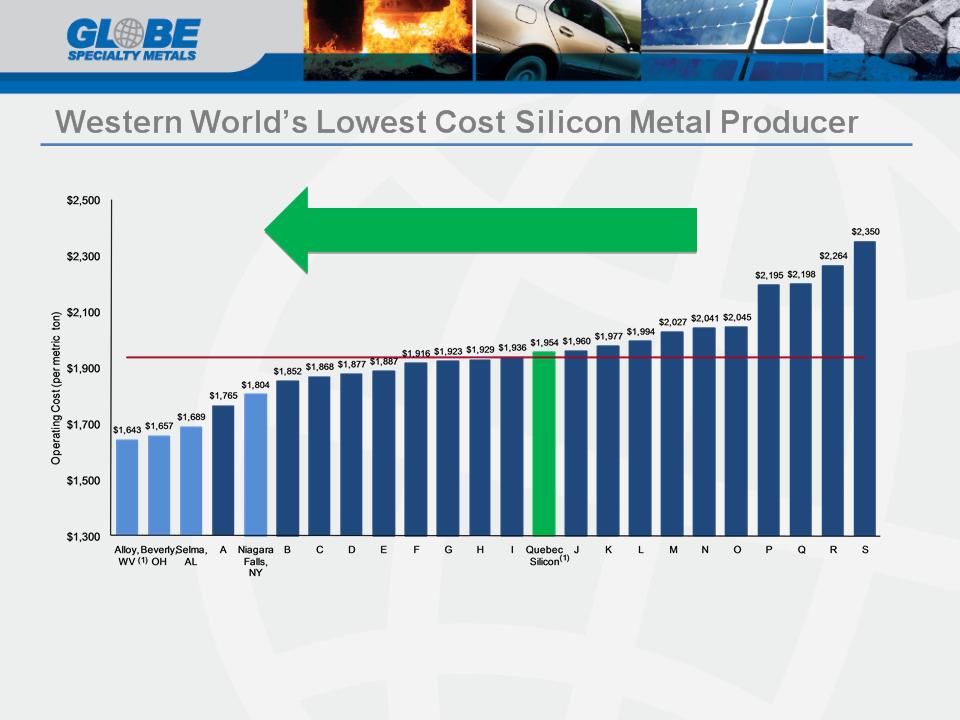

2011 Western World Silicon Metal Cost Curve

Source: CRU, 2012.

Note: Red line denotes median operating cost per ton.

Costs are Ex-works and exclude depreciation expense

Costs are Ex-works and exclude depreciation expense

(1) 49% of Alloy, WV capacity sold to Dow Corning Corporation.

(2) GSM acquired a 51% stake in Quebec Silicon on June 13, 2012.

7

Quebec Silicon Expected Cost Reduction

n Raw materials

n Technology

n Labor

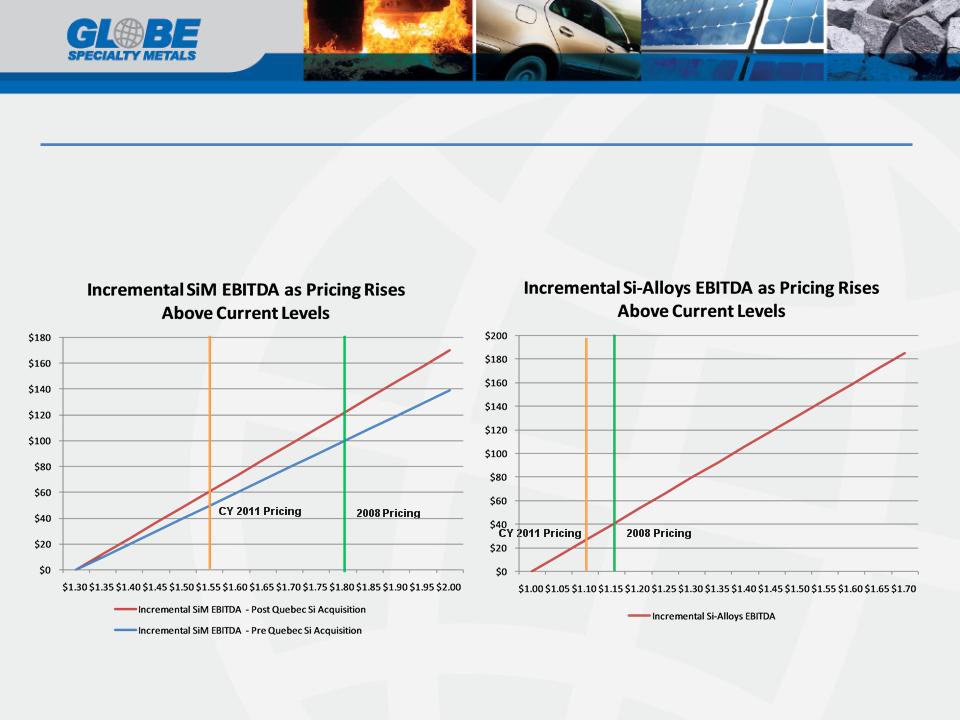

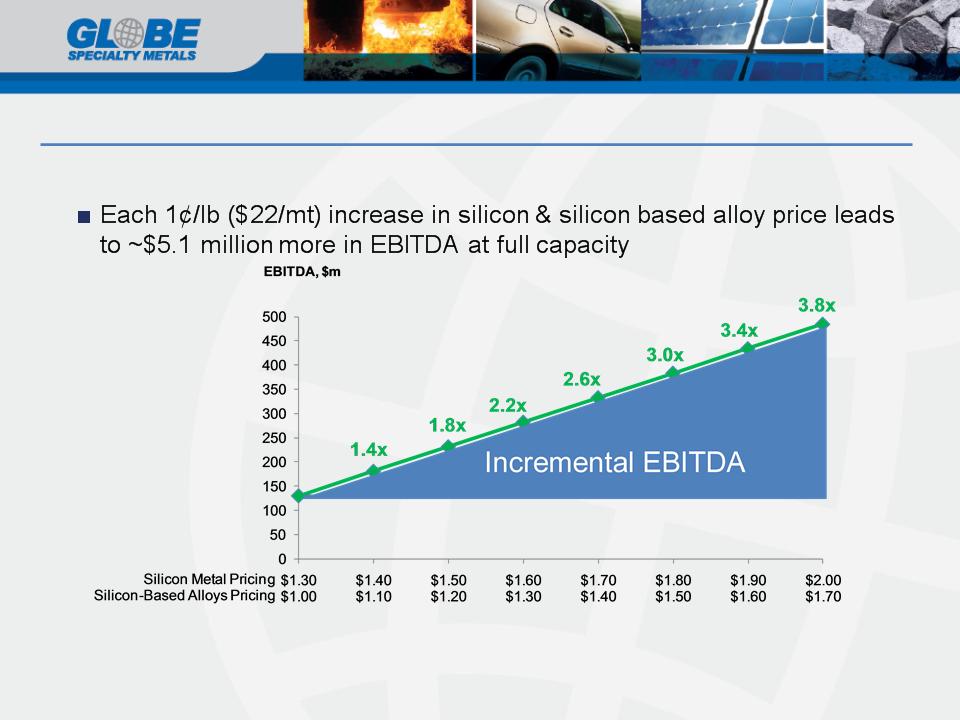

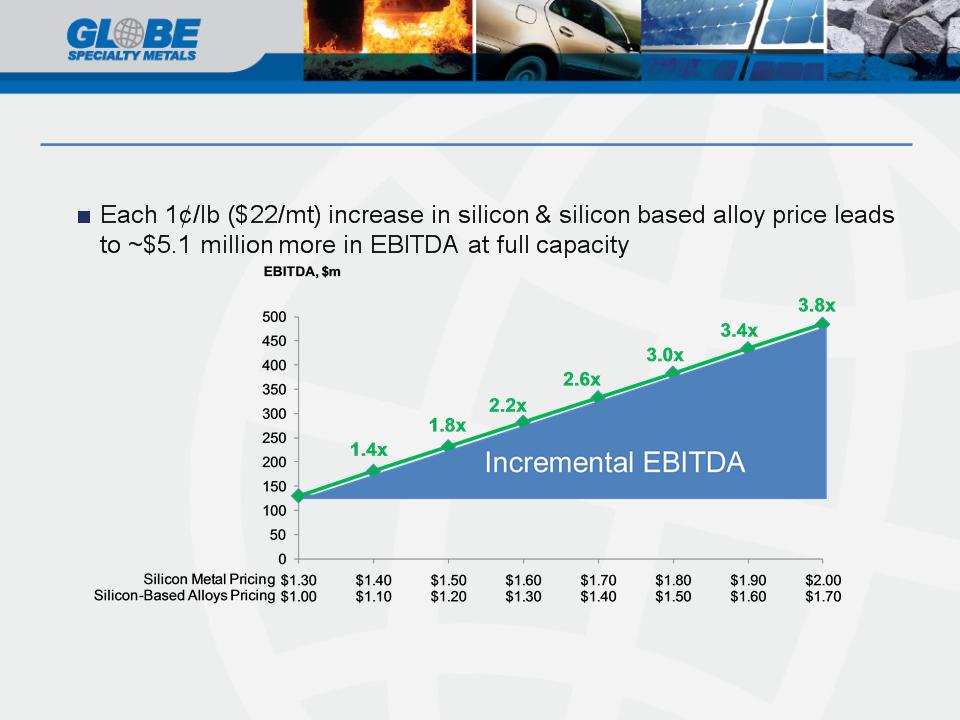

Substantial Leverage to Price

n Costs are stable and facilities are some of the most efficient in the world

n Each 1¢/lb ($22/mt) increase in silicon & silicon based alloy price leads

to ~$5.1 million more in EBITDA at full capacity

to ~$5.1 million more in EBITDA at full capacity

Note: EBITDA impact estimated based on assumed $0.01/lb increase on all 110,000 and 120,000 tons of silicon metal and silicon-based alloys capacity, respectively.

8

Substantial Leverage to Price - Combined

n Costs are stable and facilities are some of the most efficient in the world

Note: EBITDA impact estimated based on assumed $0.01/lb increase on all 110,000 and 120,000 tons of silicon metal and silicon-based alloys capacity, respectively.

9

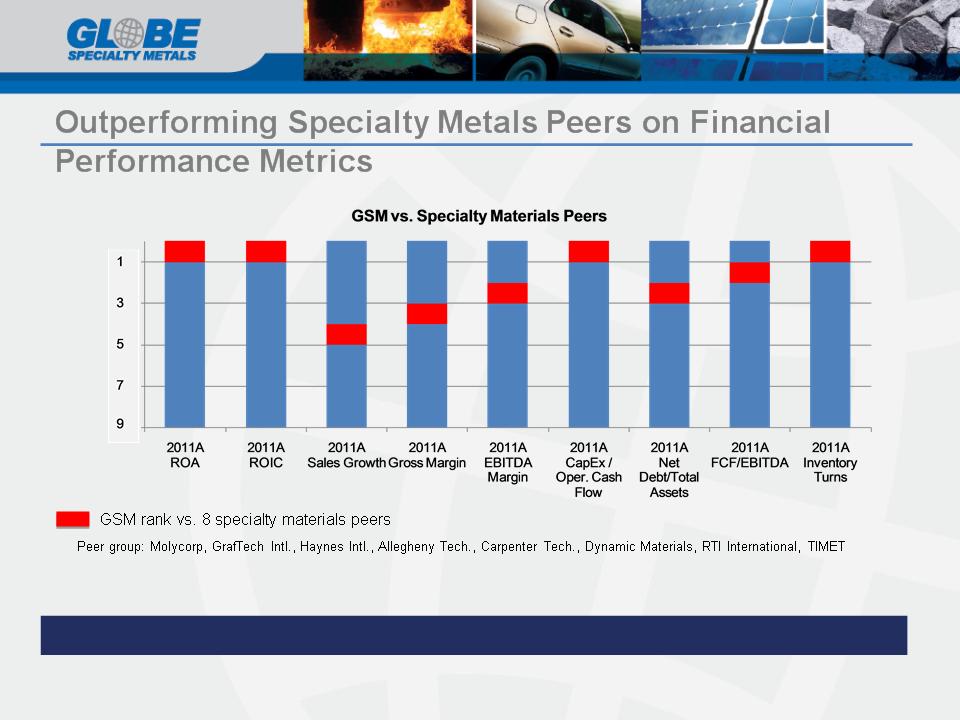

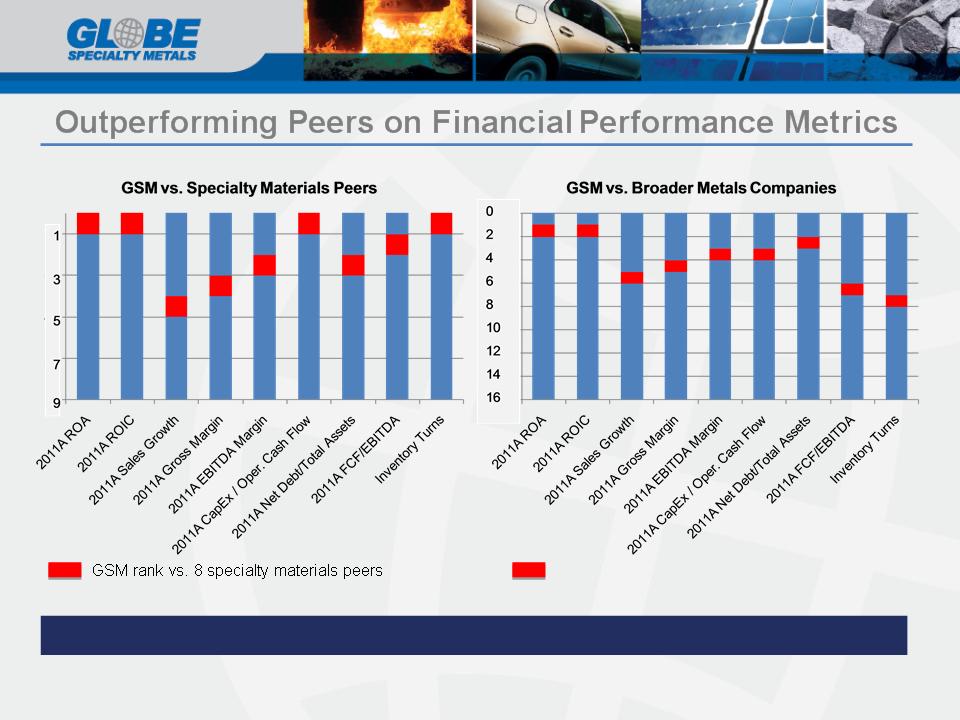

Focused on Financial Measures

10

Focused on Financial Measures

11

New Capacity Pre-requisites

1. Capital cost, lead time, and permitting obstacles of green field

construction

construction

2. Technology and operational expertise

3. Power (36% of cost) - requires stable, long-term supply of low cost

electricity

electricity

4. Raw materials (40% of cost) - requires access to high purity, low cost

raw materials

raw materials

6.6 tons of

raw materials

1 ton of

silicon

metal

metal

Raw materials are emerging as the most critical factor

12

Silicon Production Process

13

Raw Material

Inputs

Inputs

Highest Quality

Metallurgical

Coal from Alden

Metallurgical

Coal from Alden

Woodchips

High Purity Quartz

Gravel

Gravel

Materials are heated at

temperatures in

excess of 4,000°F

temperatures in

excess of 4,000°F

6.6 tons of

raw materials

1 ton of

silicon

metal

metal

Chemical Reaction:

2C + SiO2 à 2CO + Si

Globe is vertically integrated--Only company that controls its supply chain from end to end

14

Silicon Prices Becoming More Resilient

$1.29

Source: Metal s Bulletin.

Silicon Metal Price Movement ($/lb.)

15

What’s supporting improved pricing resiliency?

Supply

n Pre-requisites for entry

n Reluctance to produce below variable cost due to flexible start/stop capability

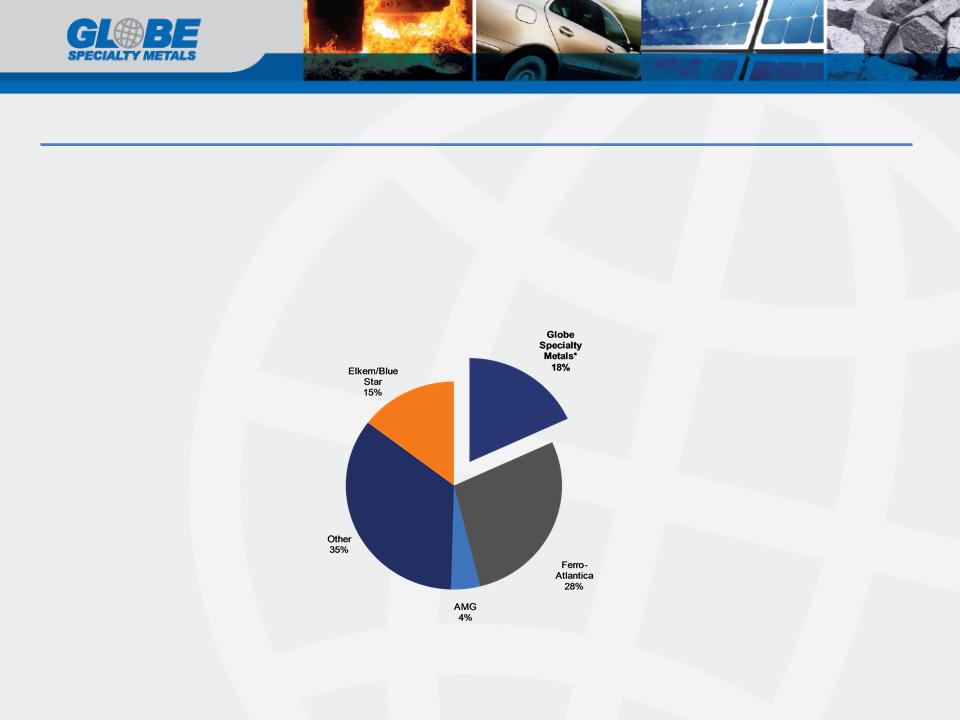

n Consolidated supply base:

16

Source: CRU, 2012. Globe supply excludes 49% of the Alloy, WV and Becancour, Canada facilities owned by Dow Corning.

Merchant supply excludes Dow Corning and Wacker captive capacity of 207,000 and 55,000 metric tons, respectively.

*GSM Pro Forma including 51% share of QSLP joint venture at Becancour, Canada

Western World Silicon Metal “Merchant” Production

Top 3 producers = 61%

What’s supporting improved pricing resiliency?

Global demand continues to increase

n Polysilicon* - increasing solar installations driven by steep pricing declines

• 20% y-o-y growth in 2012 and continued competitive improvements when

compared to thin film solar technology

compared to thin film solar technology

• New polysilicon plants - 2 new polysilicon plants will come online in the US, one

in 2012 and another in 2013 with demand of ~40,000MT of silicon metal

in 2012 and another in 2013 with demand of ~40,000MT of silicon metal

n Growth in silicones market driven by:

a) an expanding middle class in developing nations

b) new applications of silicones across all industries (www.silicones.eu)

n Auto production is increasing along with auto producers’ use of silicon containing

aluminum alloys and many components containing silicones

aluminum alloys and many components containing silicones

n New applications being developed continuously (eg. Li-ion batteries for cars &

electricity)

electricity)

17

*Note - Polysilicon is purified silicon with a minimum purity of 99.999%

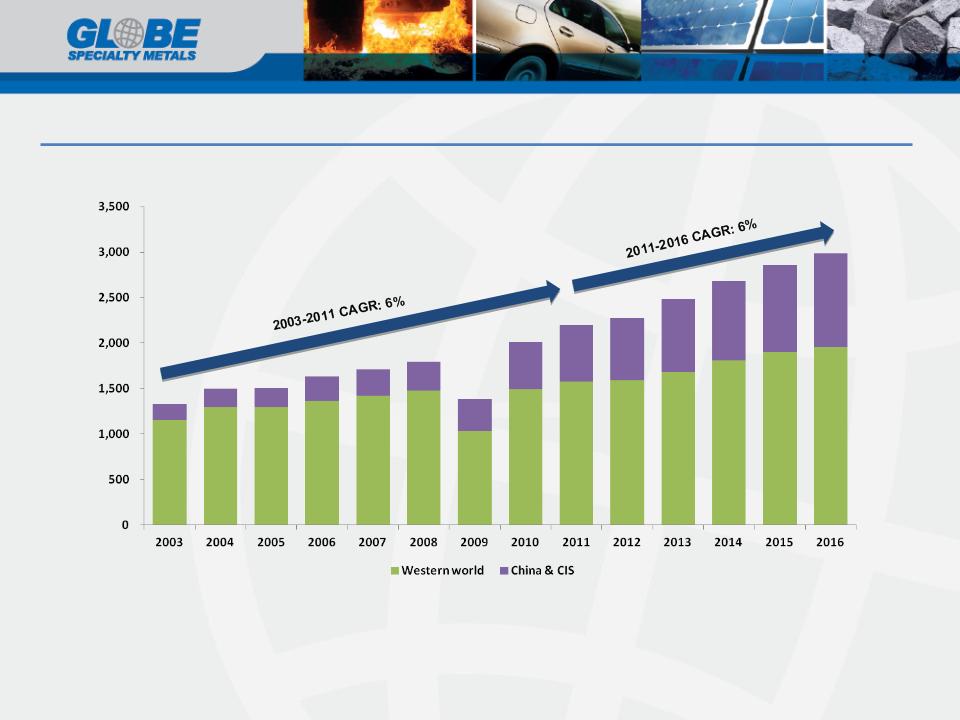

Global silicon consumption to grow +35% by 2016, from 2011 levels

Source: CRU 2012

18

kMT

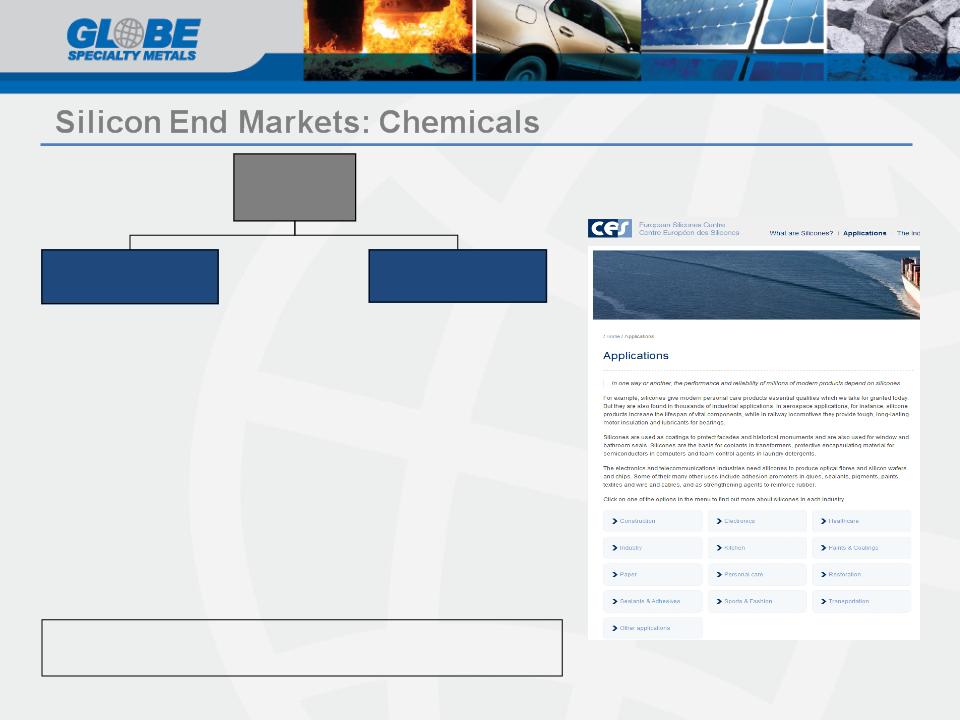

Oils

n Cosmetics

n Hydraulics

n Textiles

n Polishes

n Mechanical fluids

Resins

n Insulators

n Waterproofing

n Paints

Rubber

n Automotive

n Insulators

n Consumer items

Silicones

Coatings

Chemicals

(50% of market)

(50% of market)

n Coatings

n Adhesives

n Sealants

n Rubber

n Thermoplastics

n Fiberglass

n 750,000 tons consumed by chemical industry

n GDP + 4% growth

Note: % of sales figures represent industry estimates of western world consumption

19

www.silicones.eu

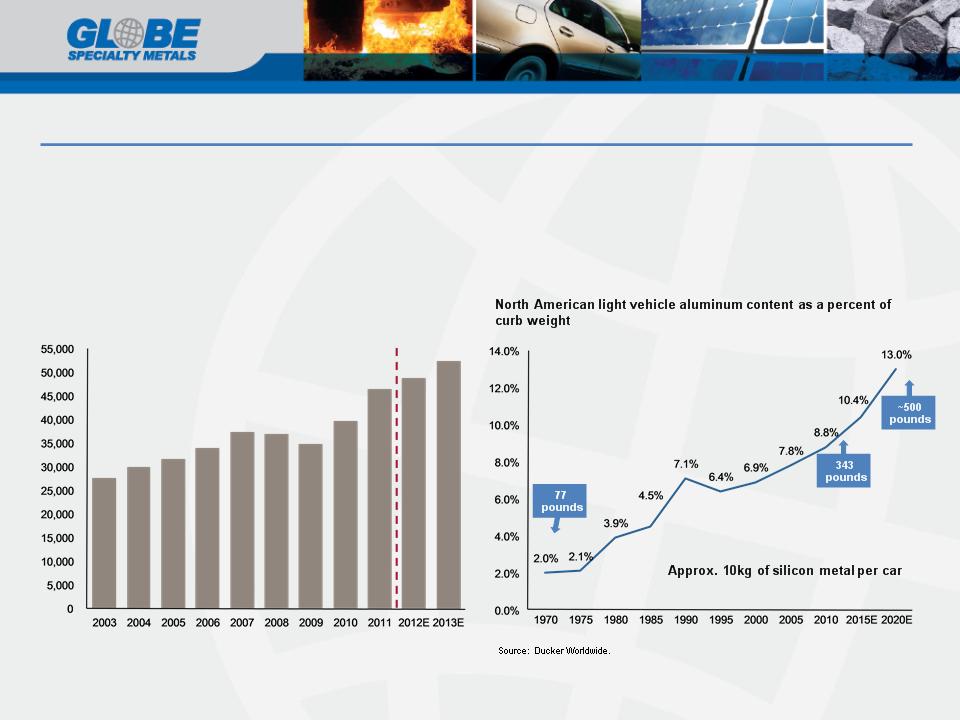

Silicon End Markets: Aluminum

n Silicon metal is required in aluminum as a strengthener and alloying agent to improve castability and

minimize shrinking and cracking

minimize shrinking and cracking

n Aluminum provides a lighter weight alternative to steel

n Aluminum demand has increased at a 5%+ CAGR for the past 20 years

Note: Based on 3,600 lbs of curb weight.

Global primary aluminum demand

(000s tons)

(000s tons)

Source: Bloomberg, Brook Hunt and Street research.

20

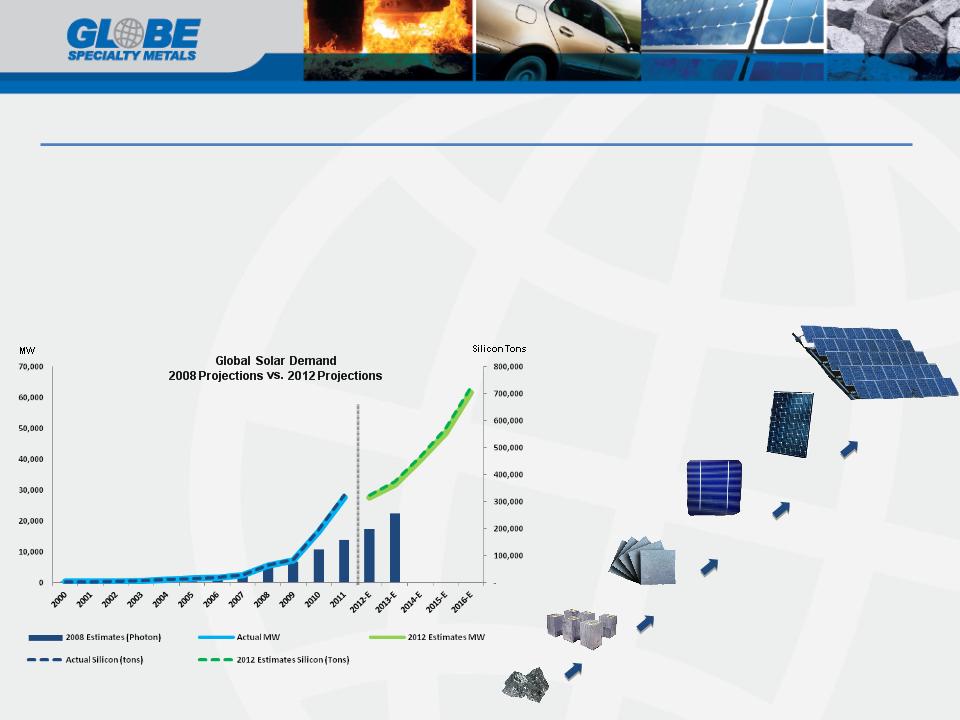

Silicon End Markets: Solar

n Continued decreases in solar wafer and module prices stimulating demand and taking

market share away from thin film makers (eg Solyndra)

market share away from thin film makers (eg Solyndra)

n Most recent estimates for 2012 global solar demand ahead of previous estimates

n Global Solar related silicon demand to double, exceeding 700,000 tons by 2016

n Projections have been consistently beaten by actual growth

Sources: Credit Suisse, CRU’12, Photon Consulting, GTM Research, EPIA, HIS, GSM Analysis

21

Silicon

Polysilicon

Wafer

Solar Cell

Solar

Panel

Panel

Solar

Installation

Installation

Silicon End Markets: Semiconductors

22

n Silane gas is an essential material used in the production of semi-conductors and LCD display panels

Ø NAND and ASIC demand will be driven by media tablets and smartphones

Ø Microprocessor growth will be driven by notebooks

Source: IHS

Silicon End Markets: New Applications & Products

Example: Lithium Ion Batteries

§ Silicon anode Li-ion battery technology

§ Greater energy storage capabilities

§ Higher capacity than other battery systems

§ Allows for smaller sizes batteries for electronic devices and electric cars

23

Silicon Alloys End Markets: Steel

Ferrosilicon

(FeSi)

Calcium Silicon

(CaSi)

Steel

n Only 6 producers in

Western World

Western World

n ~18% global market share

and ~50% U.S. share

and ~50% U.S. share

n High grade

specifications

specifications

n Requires technical

know-how

know-how

n Used in

production of

carbon steels,

stainless steels

and other steel

alloys

production of

carbon steels,

stainless steels

and other steel

alloys

n Competitive advantage in providing technical advice and service

by tailoring composition to customers’ requirements

by tailoring composition to customers’ requirements

n Just-in-time delivery - short lead times

n 1 of 2 U.S. producers

n 1 of 2 U.S. producers

n ~50% U.S. capacity and

~40% North American

capacity

~40% North American

capacity

n ~50% U.S. capacity and

~40% North American

capacity

~40% North American

capacity

Commodity

Specialty

24

Ductile Iron

Pipe

Magnesium Ferrosilicon

(MgFeSi)

Foundry

n Used in applications where

strength and formability are

required

strength and formability are

required

− Automotive components

n Often sole supplier

n Short lead times and variety

of grades discourage

imports

of grades discourage

imports

n Water transmission

n ~50% share of the magnesium ferrosilicon market in the Americas

and 20% in the Western World

and 20% in the Western World

25

Silicon Alloys End Markets: Foundry Products

n Collected in bag houses -- sold to re-marketers who sell to

cement makers as a by product

cement makers as a by product

• Physical strength of concrete (added to cement)

• Reduced permeability of cement (bridges)

• Whiter appearance than FeSi fumes

Silica Fume End Markets: Building & Construction

Silica Fume: From “By-Product” to “Product”?

26

GSM’s Silica Fume Used in

Key Projects:

Key Projects:

NYC Subway Improvements

One World Trade Center- NYC

Panama Canal Expansion

Oil Rigs

RECENT

ACCOMPLISHEMENTS

ACCOMPLISHEMENTS

Recent Acquisitions - Alden Resources

Alden Coal Advantage

Alden Coal Advantage

n Only significant North American supplier of specialty low ash

metallurgical coal used in the production of SiM and specialty FeSi

metallurgical coal used in the production of SiM and specialty FeSi

n Newly upgraded coal preparation plant in eastern Kentucky

n Best quality low ash coal in the world for silicon production—

management estimates coal improves furnace efficiency up to 10%

management estimates coal improves furnace efficiency up to 10%

n Other currently available alternatives are Charcoal & Colombian coal

• Charcoal - more expensive and supply constrained

• Colombian coal - not as reactive

n Globe secured a stable, long-term and low-cost supply of this key raw

material to support its continued growth worldwide

material to support its continued growth worldwide

n Alden meeting its operational, financial, and quality goals resulting in

improved operations and lower costs

improved operations and lower costs

27

Example of Blue Gem Coal Advantage

28

n Furnace production tonnage output

Ø Have already seen more than 5% increase in

production tonnage since switching 1 furnace from

Colombian to a blend of Blue Gem and Colombian coal

at Quebec Silicon

production tonnage since switching 1 furnace from

Colombian to a blend of Blue Gem and Colombian coal

at Quebec Silicon

n Electrode consumption

Ø Have already seen more than a 15% decrease in

electrode consumption since switching 1 furnace from

Colombian to Blue Gem and Colombian blended coal at

Quebec Silicon

electrode consumption since switching 1 furnace from

Colombian to Blue Gem and Colombian blended coal at

Quebec Silicon

Recent Acquisition - Quebec Silicon

29

n Purchased from bankrupt shareholder

n One of the largest and most robust plants in the world - 47,000 MT capacity

n 51% / 49% Joint-venture with Dow Corning Corporation

n On river - good for inbound and outbound logistics

n Stable and competitive power from Hydro Quebec

n Purchased for less than 1/3 of the cost of building a new smelter without

engineering, permitting risks, or timing

engineering, permitting risks, or timing

n Additional quartz reserves mines

n Significant upside on cost reduction:

Ø Operational improvements

Ø Raw material

Ø Efficiencies & synergies

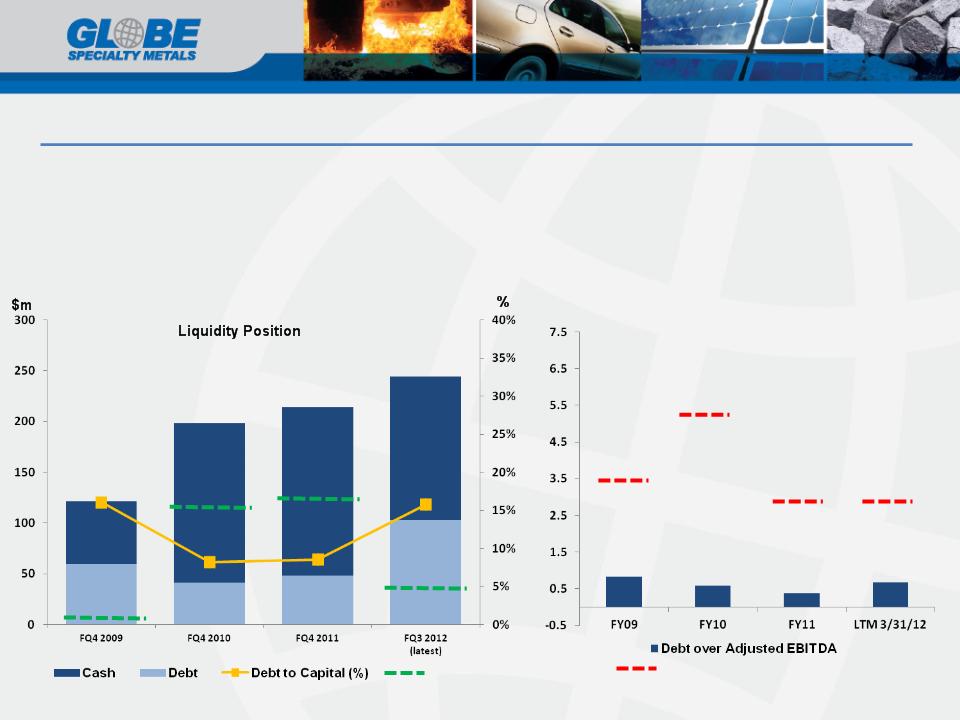

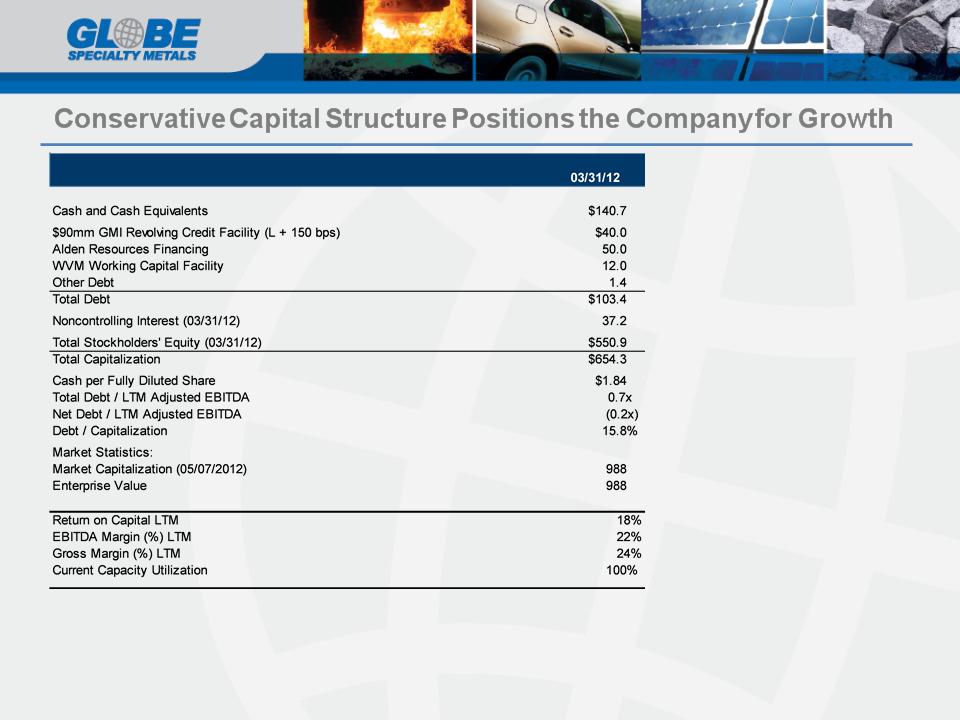

Significant Liquidity & Net Cash Positive Balance Sheet

30

Poised for continued growth:

n $445 million of liquidity

Ø New $300 million credit facility provides an additional ~$180 million of borrowing availability and a

$125 million accordion feature at LIBOR + 175 (at current leverage ratio)

$125 million accordion feature at LIBOR + 175 (at current leverage ratio)

Ø Usable for general corporate purposes, share buy backs, dividends and M&A

Ø $141 million of cash on hand*

n Strong balance sheet with significant liquidity

n Positions Globe for further growth through acquisitions

* As of March 31, 2012

Strong Balance Sheet Provides Opportunity to Pursue Growth

Debt / Adjusted EBITDA

Ratio

n Historical acquisition and financial discipline has maintained strong liquidity position

n Balance sheet strength facilitates action when growth and value opportunities are identified

n Unique approach to investing

31

Net Cash

*

*

*

*

Broad Metals Peer Avg Debt to Capital (%)

*

Broad Metals Peer Avg Debt / EBITDA

Substantial Leverage to Price

n Costs are stable and facilities are some of the most efficient in the world

Note: EBITDA impact estimated based on assumed $0.01/lb increase on all 110,000 and 120,000 tons of silicon metal and silicon-based alloys capacity, respectively.

32

Growth Through Key, Strategic, Timely & Accretive Acquisitions

33

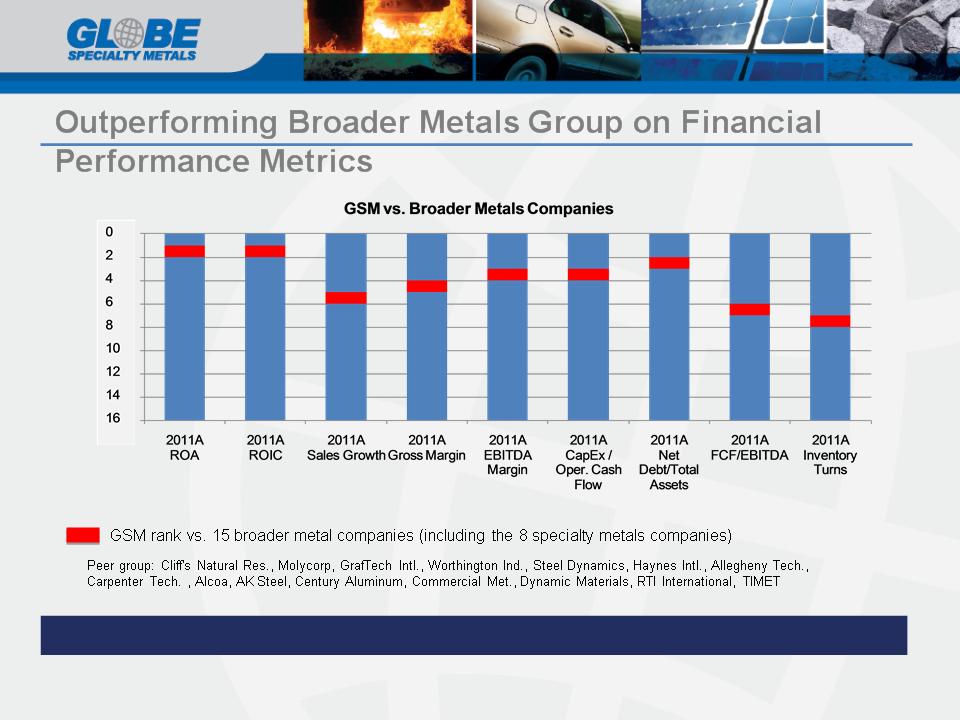

Focused on Financial Measures

34

GSM rank vs. 15 broader metal companies

Vision for the Future - The World has Changed

35

n Economic cycles are driven by the shifting credit bubble

n Cycles are shorter

n Less forward visibility

n Other companies have over-paid at cycle peaks—permanently hurting their

capital structures; (GSM hasn’t)

capital structures; (GSM hasn’t)

n Acquisitions in the trough, at the right time and at the right price, achieves

faster growth at much lower cost of investment

faster growth at much lower cost of investment

n Globe’s track record proves this thesis

Globe’s Strategy & Roadmap in the New World

36

n Global uncertainty

n Shorter Cycles

n Less forward visibility

n Necessity of discipline

n Increased risk of mis-timing

and over paying for

investments

and over paying for

investments

Environment

n Continue cyclical trough

acquisitions at low costs

acquisitions at low costs

n Patience

n Discipline

Globe’s Strategy

Faster Growth & Higher Returns

Highlights

n Production and input costs are largely fixed, which yields substantial leverage to price

• Highly variable cost structure and low overhead - variable costs account for 85% of production

costs

costs

• Ownership of all key raw materials - only one in industry

• Competitive power rates and industrial demand should improve even more due to natural gas

phenomenon

phenomenon

n Business decisions, including M&A and CAPEX, are taken with a focus on financial metrics

n Conservative capital structure with flexibility -- well positioned to pursue growth opportunities, in our

differentiated style

differentiated style

n Paid $0.15 annual dividend in October 2010 and $0.20 in October 2011- shareholder friendly

37

APPENDIX

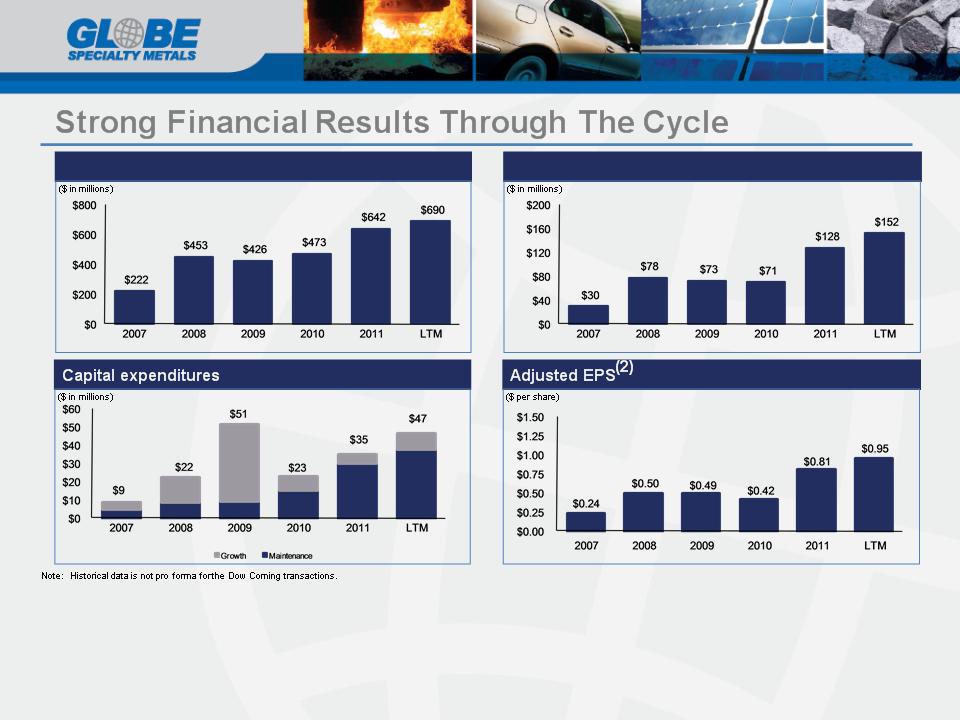

Adjusted EBITDA(1)

Revenue

(1) Adjusted EBITDA for fiscal 2009 is EBITDA plus goodwill and asset impairment charges of $69.7 million, deferred offering costs of $2.5 million, restructuring costs of $1.7 million, prior period power penalty of

$1.0 million and inventory write-downs of $5.8 million. Adjusted EBITDA for fiscal 2010 is EBITDA plus, prior period power adjustment of ($0.5) million, fixed asset impairment of $0.7 million, transaction

expenses of $0.7 million and start-up costs of $10.0 million, less a gain on the sale of Globe Metais of $19.7 million. Adjusted EBITDA for fiscal 2011 is EBITDA plus, transaction expenses of $5.0 million,

start-up costs of $3.2 million, and gain on the sale of business of $4.2 million, less net settlements of $5.1 million. Adjusted EBITDA for LTM (the 12 months ended Mar 31, 2012) is EBITDA plus transaction

expenses of $6.3 million, Bridgeport fire related loss of $5.0 million, and loss on the sale of business of $3.8 million.

$1.0 million and inventory write-downs of $5.8 million. Adjusted EBITDA for fiscal 2010 is EBITDA plus, prior period power adjustment of ($0.5) million, fixed asset impairment of $0.7 million, transaction

expenses of $0.7 million and start-up costs of $10.0 million, less a gain on the sale of Globe Metais of $19.7 million. Adjusted EBITDA for fiscal 2011 is EBITDA plus, transaction expenses of $5.0 million,

start-up costs of $3.2 million, and gain on the sale of business of $4.2 million, less net settlements of $5.1 million. Adjusted EBITDA for LTM (the 12 months ended Mar 31, 2012) is EBITDA plus transaction

expenses of $6.3 million, Bridgeport fire related loss of $5.0 million, and loss on the sale of business of $3.8 million.

(2) Fiscal 2009 EPS adjusted for goodwill and asset impairment charges of $69.7 million, deferred offering costs of $2.5 million, restructuring costs of $1.7 million, prior period power penalty of $1.0 million and

inventory write-downs of $5.8 million. Fiscal 2010 EPS adjusted for prior period power adjustment of ($0.5) million, fixed asset impairment of $0.7 million, transaction expenses of $0.7 million and start-up

costs of $10.0 million, less a gain on the sale of Globe Metais of $19.7 million. EPS for fiscal 2011 is adjusted for, transaction expenses of $5.0 million, start-up costs of $3.2 million, and gain on the sale of

business of $4.2 million, less net settlements of $5.1 million. Adjusted EPS for LTM (the 12 months ended Mar 31, 2012) is adjusted for transaction expenses of $6.3 million, Bridgeport fire related loss of

$5.0 million, and loss on the sale of business of $3.8 million.

inventory write-downs of $5.8 million. Fiscal 2010 EPS adjusted for prior period power adjustment of ($0.5) million, fixed asset impairment of $0.7 million, transaction expenses of $0.7 million and start-up

costs of $10.0 million, less a gain on the sale of Globe Metais of $19.7 million. EPS for fiscal 2011 is adjusted for, transaction expenses of $5.0 million, start-up costs of $3.2 million, and gain on the sale of

business of $4.2 million, less net settlements of $5.1 million. Adjusted EPS for LTM (the 12 months ended Mar 31, 2012) is adjusted for transaction expenses of $6.3 million, Bridgeport fire related loss of

$5.0 million, and loss on the sale of business of $3.8 million.

38

Share information

n 75,048,873 basic shares outstanding

n 4,314,249 options outstanding

39

Presenting Management Team

40

Alan Kestenbaum, Executive Chairman

n Founded GSM through the roll-up of global silicon assets and subsequently led GSM through it’s IPO on NASDAQ and several key acquisition

and divestitures

and divestitures

n Over 20 years' experience in metals trading, distribution, finance and manufacturing

n Founded leading international metals trader, Marco International, in 1985 and led its expansion into China and former Soviet Union.

n Managed a series of successful metals private equity transactions

n Began his career in metals with Glencore and Philip Brothers in New York

Malcolm Appelbaum, Chief Financial Officer

n Joined GSM in 2008

n President of AppleTree Advisors, Inc. from 2000 until September 2008 - worked with various HIG Capital companies

n Prior roles include: Interim-Chief Financial Officer for several underperforming companies; Principal - Wand Partners; Financial Analyst -

Goldman Sachs; and, Senior Consultant at Deloitte

Goldman Sachs; and, Senior Consultant at Deloitte

Jeff Bradley, Chief Executive Officer

n Over 27 years experience in the metals industry

n Joined GSM in 2008

n Prior roles include: CEO - Claymont Steel (former public company); Vice President and General Manager - Worthington Industries

Board of Directors

GSM’s Board of Directors is comprised of seasoned executives with strong management,

metals, finance and international experience

metals, finance and international experience

n Alan Kestenbaum (Executive Chairman)

n Stuart Eizenstat

− Partner, Covington & Burling LLP; Former Deputy Secretary of the United States Department of

the Treasury; International Advisory Board Member of Coca-Cola, Board Member of UPS

the Treasury; International Advisory Board Member of Coca-Cola, Board Member of UPS

n Franklin Lavin

− Chairman of the Public Affairs practice for Asia-Pacific at Edelman; Former Managing Director

and Chief Operating Officer of Cushman & Wakefield Investors Asia; Former Under Secretary for

International Trade at the United States Department of Commerce

and Chief Operating Officer of Cushman & Wakefield Investors Asia; Former Under Secretary for

International Trade at the United States Department of Commerce

n Thomas Danjczek

− President of the Steel Manufacturers Association; former senior executive at Wheeling-Pittsburgh

Steel Corporation

Steel Corporation

n Donald Barger, Jr.

− Former Chief Financial Officer at YRC Worldwide, Worthington Industries and Hillenbrand

Industries; Board Member and Audit Chair of Gardner Denver and Quanex

Industries; Board Member and Audit Chair of Gardner Denver and Quanex

41

(1) EBITDA and Adjusted EBITDA include non-cash share-based compensation expense of $2.3 million, $4.3 million, $5.7 million, $6.4 million, $8.2 million and $2.4 million for the latest twelve months

ended March 31, 2012, and the fiscal years ended June 30, 2011, June 30, 2010, June 30, 2009, June 30, 2008, and June 30, 2007, respectively.

ended March 31, 2012, and the fiscal years ended June 30, 2011, June 30, 2010, June 30, 2009, June 30, 2008, and June 30, 2007, respectively.

Note: LTM represents the latest twelve months ended March 31, 2012.

42