Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - US DATAWORKS INC | v318611_8k.htm |

Contacts: Randy Frapart, CFO US Dataworks, Inc. 281-504-8026 Ken Dennard, Managing Partner Dennard Rupp Gray & Lascar, LLC ksdennard@drg-l.com 713-529-6600 US DATAWORKS ANNOUNCES FISCAL 2012 FOURTH QUARTER AND YEAR END RESULTS SUGAR LAND, TX – JULY 13, 2012 – US Dataworks, Inc. (OTC Bulletin Board: UDWK), a leader in payment processing solutions, today announced its financial results for its fiscal 2012 fourth quarter and year ended March 31, 2012. Revenue for the fourth quarter of fiscal 2012 was $1.6 million compared to revenue of $2.1 million for the fourth quarter of fiscal 2011. Net loss for the fourth quarter of fiscal 2012 was $41,000, or $0.01 per share, compared to net income of $116,000, or $0.01 per diluted share, for the fourth quarter of fiscal 2011. Revenue for the fiscal 2012 was $6.6 million compared to revenue of $7.3 million for fiscal 2011. Net loss for fiscal 2012 was $485,000, or $0.01 per share, compared to a net loss of $608,000, or $0.02 per share, for fiscal 2011. Charles E. Ramey, Chairman and CEO of US Dataworks, commented, “During the fiscal fourth quarter, we made changes that have laid the groundwork for achieving our strategic goal of market dominance in the cloud payment processing space. These included organizational changes, changes to our sales and marketing approach and the development of a channel partner program. We continue to execute on this plan and are beginning to see results. “We are in a strong position to help clients reduce their costs and become more efficient. First, we have a management team that is up to the challenge of taking the company to the next level. Second, our Clearingworks® product offering has set the standard in cloud payment processing. Third, we are ahead of our competitors in our approach to payment processing and the market is now ready,” added Ramey. “Our focus remains on customer acquisition, transactions under management and average price per transaction; and we believe that our future results should improve in fiscal 2013 as our unique value proposition is being introduced to additional customers of all sizes in this vast emerging market,” concluded Ramey. NEWS RELEASE FOR IMMEDIATE RELEASE

Conference Call Information US Dataworks’ management has scheduled a conference call to review its fiscal 2012 fourth quarter and year end results on Tuesday, July 17, 2012 at 11:00 a.m. Eastern time, 10:00 a.m. Central time. To listen to the call, dial (480) 629-9643 at least 10 minutes before the call begins and ask for US Dataworks’ conference call. A replay of the call will be available approximately two hours after the live broadcast ends and will be accessible until July 24, 2012. To access the replay, dial (303) 590-3030 using a pass code of 4553184#. Investors, analysts and the general public will also have the opportunity to listen to the conference call over the Internet by visiting www.usdataworks.com. To listen to the live call on the web, please visit the Company’s web site at least fifteen minutes before the call begins to register, download and install any necessary audio software. For those who cannot listen to the live webcast, an archive will be available shortly after the call. Additional information about Clearingworks as well as US Dataworks can be found on the company’s website at www.clearingworks.com. About US Dataworks US Dataworks offers on-demand payment processing services with proven enterprise-class payment, deposit, returns processing, and powerful payment analytic tools. US Dataworks is a trusted payments provider to utilities, telecommunications providers, content providers, financial institutions and government agencies. Certain statements made in this press release (other than the historical information contained herein) constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements regarding our expectations of our ability to meet our future goals and expectations. Any forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including, but not limited to, the failure of our new solutions to perform as anticipated, our ability to provide long-term customer value and agility, our ability to protect our intellectual property, our position in the marketplace, our ability to develop and timely introduce products that address market demand, the impact of alternative technological advances and competitive products, market fluctuations, our ability to repay or refinance our debt, our ability to realize the anticipated benefits from our business initiatives, including our cloud-based solutions, and other risks detailed from time to time in our SEC reports including our Annual Report on Form 10-K for the fiscal year ended March 31, 2012. These forward-looking statements speak only as of the date hereof. US Dataworks disclaims any obligation to update these forward-looking statements.

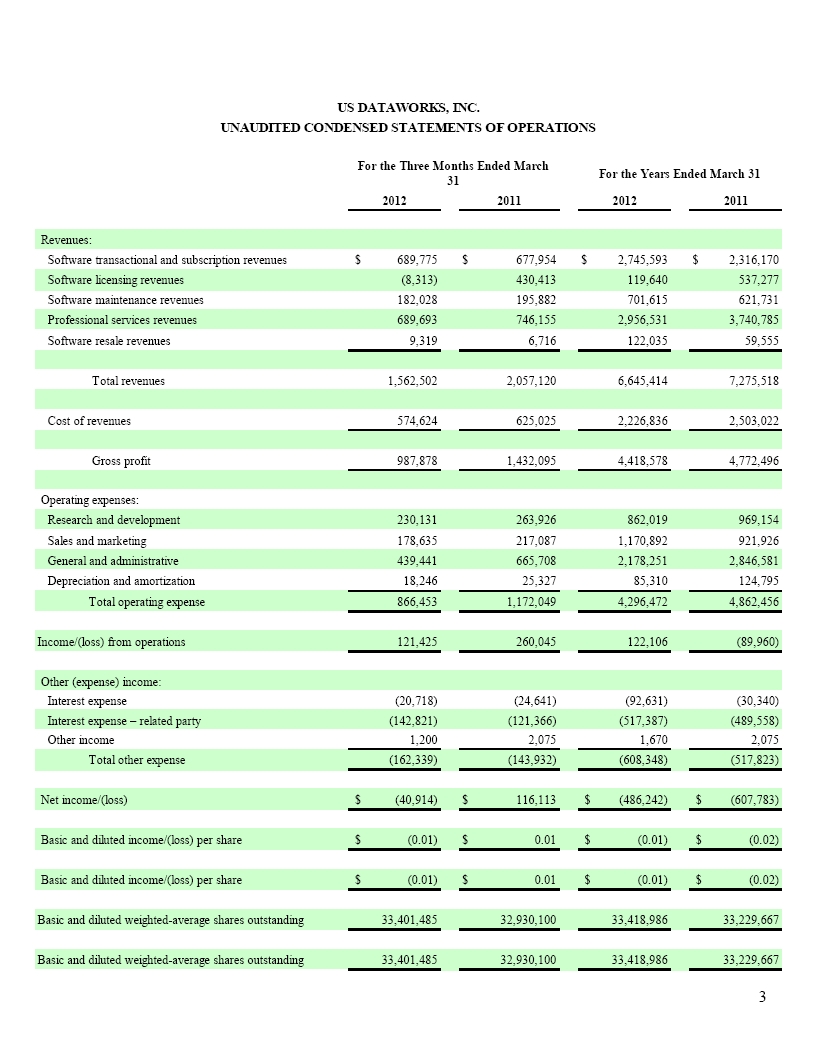

Revenues: Software transactional and subscription revenues $ 689,775 $ 677,954 $ 2,745,593 $ 2,316,170 Software licensing revenues (8,313) 430,413 119,640 537,277 Software maintenance revenues 182,028 195,882 701,615 621,731 Professional services revenues 689,693 746,155 2,956,531 3,740,785 Software resale revenues 9,319 6,716 122,035 59,555 Total revenues 1,562,502 2,057,120 6,645,414 7,275,518 Cost of revenues 574,624 625,025 2,226,836 2,503,022 Gross profit 987,878 1,432,095 4,418,578 4,772,496 Operating expenses: Research and development 230,131 263,926 862,019 969,154 Sales and marketing 178,635 217,087 1,170,892 921,926 General and administrative 439,441 665,708 2,178,251 2,846,581 Depreciation and amortization 18,246 25,327 85,310 124,795 Total operating expense 866,453 1,172,049 4,296,472 4,862,456 Income/(loss) from operations 121,425 260,045 122,106 (89,960) Other (expense) income: Interest expense (20,718) (24,641) (92,631) (30,340)Interest expense – related party (142,821) (121,366) (517,387) (489,558)Other income 1,200 2,075 1,670 2,075 Total other expense (162,339) (143,932) (608,348) (517,823) Net income/(loss)$ (40,914)$ 116,113 $ (486,242) $ (607,783) Basic and diluted income/(loss) per share $ (0.01)$ 0.01 $ (0.01) $ (0.02) Basic and diluted income/(loss) per share $ (0.01)$ 0.01 $ (0.01) $ (0.02) Basic and diluted weighted-average shares outstanding 33,401,485 32,930,100 33,418,986 33,229,667 Basic and diluted weighted-average shares outstanding 33,401,485 32,930,100 33,418,986 33,229,667 US DATAWORKS, INC.UNAUDITED CONDENSED STATEMENTS OF OPERATIONS For the Three Months Ended March 31For the Years Ended March 312012201120122011

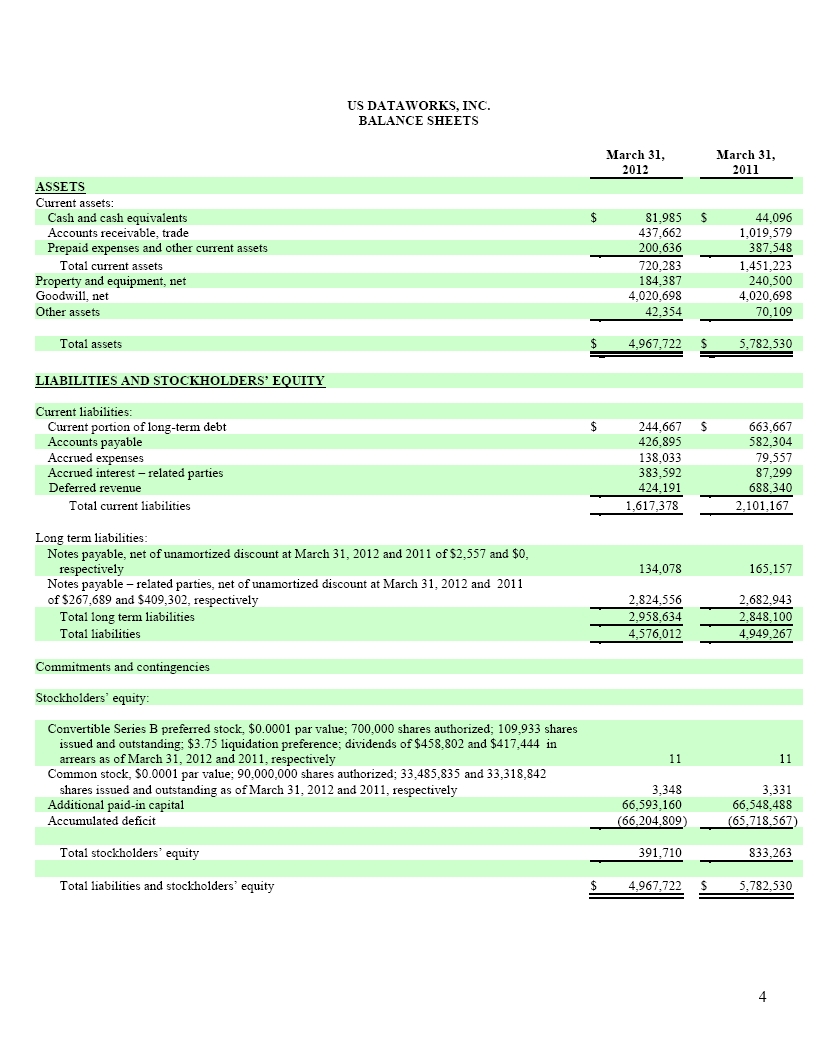

US DATAWORKS, INC. BALANCE SHEETS March 31, 2012 March 31, 2011 ASSETS Current assets: Cash and cash equivalents $ 81,985 $ 44,096 Accounts receivable, trade 437,662 1,019,579 Prepaid expenses and other current assets 200,636 387,548 Total current assets 720,283 1,451,223 Property and equipment, net 184,387 240,500 Goodwill, net 4,020,698 4,020,698 Other assets 42,354 70,109 Total assets $ 4,967,722 $ 5,782,530 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Current portion of long-term debt $ 244,667 $ 663,667 Accounts payable 426,895 582,304 Accrued expenses 138,033 79,557 Accrued interest – related parties 383,592 87,299 Deferred revenue 424,191 688,340 Total current liabilities 1,617,378 2,101,167 Long term liabilities: Notes payable, net of unamortized discount at March 31, 2012 and 2011 of $2,557 and $0, respectively 134,078 165,157 Notes payable – related parties, net of unamortized discount at March 31, 2012 and 2011 of $267,689 and $409,302, respectively 2,824,556 2,682,943 Total long term liabilities 2,958,634 2,848,100 Total liabilities 4,576,012 4,949,267 Commitments and contingencies Stockholders’ equity: Convertible Series B preferred stock, $0.0001 par value; 700,000 shares authorized; 109,933 shares issued and outstanding; $3.75 liquidation preference; dividends of $458,802 and $417,444 in arrears as of March 31, 2012 and 2011, respectively 11 11 Common stock, $0.0001 par value; 90,000,000 shares authorized; 33,485,835 and 33,318,842 shares issued and outstanding as of March 31, 2012 and 2011, respectively 3,348 3,331 Additional paid-in capital 66,593,160 66,548,488 Accumulated deficit (66,204,809 ) (65,718,567 ) Total stockholders’ equity 391,710 833,263 Total liabilities and stockholders’ equity $ 4,967,722 $ 5,782,530

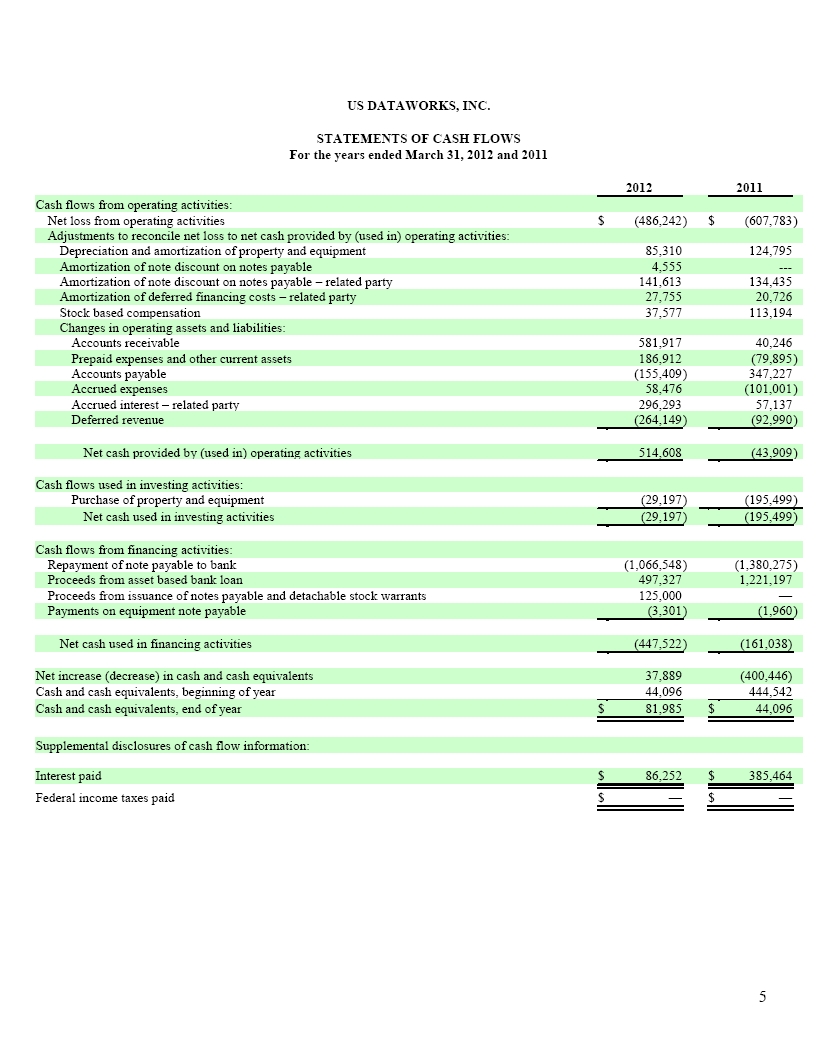

US DATAWORKS, INC. STATEMENTS OF CASH FLOWS For the years ended March 31, 2012 and 2011 2012 2011 Cash flows from operating activities: Net loss from operating activities $ (486,242 ) $ (607,783 ) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization of property and equipment 85,310 124,795 Amortization of note discount on notes payable 4,555 --- Amortization of note discount on notes payable – related party 141,613 134,435 Amortization of deferred financing costs – related party 27,755 20,726 Stock based compensation 37,577 113,194 Changes in operating assets and liabilities: Accounts receivable 581,917 40,246 Prepaid expenses and other current assets 186,912 (79,895 ) Accounts payable (155,409 ) 347,227 Accrued expenses 58,476 (101,001 ) Accrued interest – related party 296,293 57,137 Deferred revenue (264,149 ) (92,990 ) Net cash provided by (used in) operating activities 514,608 (43,909 ) Cash flows used in investing activities: Purchase of property and equipment (29,197 ) (195,499 ) Net cash used in investing activities (29,197 ) (195,499 ) Cash flows from financing activities: Repayment of note payable to bank (1,066,548 ) (1,380,275 ) Proceeds from asset based bank loan 497,327 1,221,197 Proceeds from issuance of notes payable and detachable stock warrants 125,000 — Payments on equipment note payable (3,301 ) (1,960 ) Net cash used in financing activities (447,522 ) (161,038) Net increase (decrease) in cash and cash equivalents 37,889 (400,446) Cash and cash equivalents, beginning of year 44,096 444,542 Cash and cash equivalents, end of year $ 81,985 $ 44,096 Supplemental disclosures of cash flow information: Interest paid $ 86,252 $ 385,464 Federal income taxes paid $ — $ —

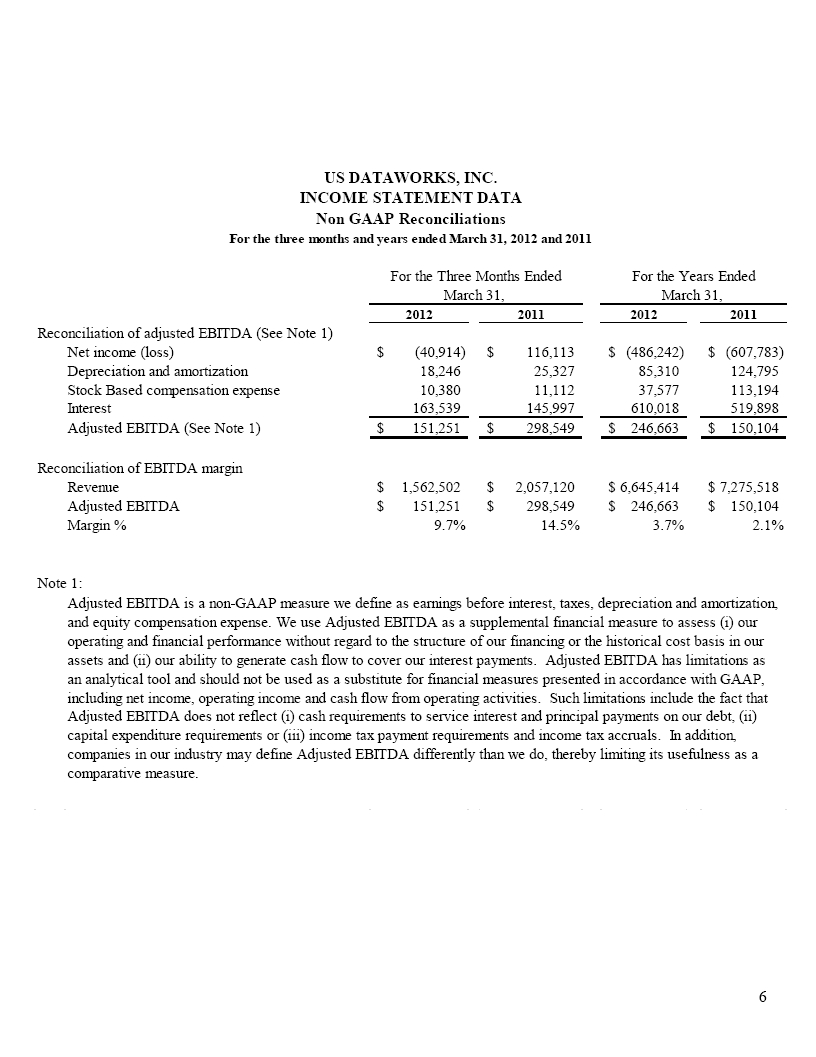

2012 2011 2012 2011 Reconciliation of adjusted EBITDA (See Note 1)Net income (loss)(40,914)$ 116,113$ (486,242)$ (607,783)$ Depreciation and amortization 18,246 25,327 85,310 124,795 Stock Based compensation expense 10,380 11,112 37,577 113,194 Interest 163,539 145,997 610,018 519,898 Adjusted EBITDA (See Note 1) 151,251 $ 298,549 $ 246,663 $ 150,104 $ Reconciliation of EBITDA margin Revenue 1,562,502 $ 2,057,120 $ 6,645,414 $ 7,275,518 $ Adjusted EBITDA 151,251 $ 298,549 $ 246,663 $ 150,104 $ Margin % 9.7% 14.5% 3.7% 2.1% Note 1: For the Years Ended March 31, Adjusted EBITDA is a non-GAAP measure we define as earnings before interest, taxes, depreciation and amortization, and equity compensation expense. We use Adjusted EBITDA as a supplemental financial measure to assess (i) our operating and financial performance without regard to the structure of our financing or the historical cost basis in our assets and (ii) our ability to generate cash flow to cover our interest payments. Adjusted EBITDA has limitations as an analytical tool and should not be used as a substitute for financial measures presented in accordance with GAAP, including net income, operating income and cash flow from operating activities. Such limitations include the fact that Adjusted EBITDA does not reflect (i) cash requirements to service interest and principal payments on our debt, (ii) capital expenditure requirements or (iii) income tax payment requirements and income tax accruals. In addition, companies in our industry may define Adjusted EBITDA differently than we do, thereby limiting its usefulness as a comparative measure.US DATAWORKS, INC.INCOME STATEMENT DATA Non GAAP Reconciliations For the three months and years ended March 31, 2012 and 2011For the Three Months Ended March 31,