Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Convenience TV Inc. | Financial_Report.xls |

| EX-32.1 - SECTION 906 CERTIFICATION - Convenience TV Inc. | exhibit32-1.htm |

| EX-32.2 - SECTION 906 CERTIFICATION - Convenience TV Inc. | exhibit32-2.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - Convenience TV Inc. | exhibit31-1.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - Convenience TV Inc. | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2012

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the transition period from [ ] to [ ]

Commission file number 000-54210

CONVENIENCE TV INC.

(Exact name of registrant as specified in its charter)

| Nevada | 30-0518293 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| 248 Main Street, Venice, CA | 90291 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (877) 331-8777

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.00001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act

Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports) and (2) has been subject to such

filing requirements for the last 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-K (§229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of Common Stock held by non-affiliates of the Registrant on September 30, 2011 was $283,830 based on a $0.0069 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s

classes of common stock as of the latest practicable date.

222,112,615 common shares as of July 12, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

3

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms we", "us", "our" and "our company" mean Convenience TV Inc. and our wholly owned subsidiary C-Store Networks LLC., unless otherwise indicated.

General Overview

We were incorporated in Nevada on December 4, 2008, under the name "Costa Rica Paradise Inc.", to engage in the business of real estate investment consulting with respect to properties located in Costa Rica. On April 23, 2010 our board of directors authorized a change in name to “Convenience TV Inc.” and a forward split of our common stock on a basis of 7 for 1 which became effective with the OTC Bulletin Board on June 15, 2010. On May 5, 2010 we experienced a change of control upon the closing of an acquisition of C-Store Networks LLC. Our statutory registered agent in Nevada is National Registered Agents Inc. of NV located at 1000 East William Street, Suite 204, Carson City, Nevada 89701. Our business office is located at 248 Main Street, Venice, CA, 90219 and our telephone number is 310-566-3696.

Effective July 20, 2011, our authorized shares of common stock increased from 100,000,000 to 600,000,000 shares of common stock, par value of $0.00001 per share. Our preferred stock remains unchanged.

Our Current Business

We are engaged in the provision of advertising services through a network of in-location televisions installed at various convenience store locations.

On May 1, 2012, we entered into a joint venture agreement with Autumn Peach Worldwide Inc., a British Virgin Islands corporation, wherein the parties are mutually interested in creating a joint venture to market and distribute Culinary Truths brand products and to provide digital marketing devices to promote sales. Autumn Peach is in the business of producing natural spices under the brand name of Culinary Truths and wishes to market and distribute the products in North America.

4

Pursuant to the terms of the joint venture agreement, the parties have agreed to that our company will receive a commission of 10% per sale for products sold by us or our affiliates, that our company will supply its expertise in screen placement within the designated locations, that Autumn Peach’s distributors will be responsible for the ordering and payment of equipment as required, that we will pay Autumn Peach 20% of the net billing advertising revenue, and that the initial term of the joint venture agreement shall be 5 years, with annual renewals based upon mutually acceptable terms.

Principal Products

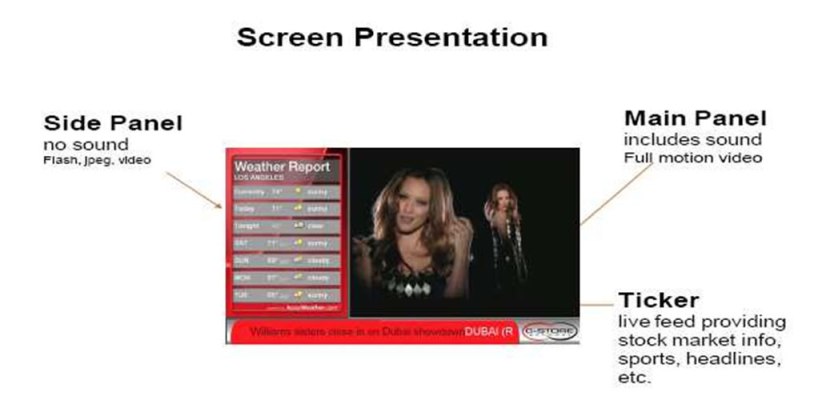

We will pursue exclusive agreements with a variety of convenience store operators to provide them with in-location television network advertising. We have a relationship with Universal Distributing Co. Ltd., to organize location acquisitions. Universal currently has representatives who focus mainly on the convenience store industry with a variety of products. Universal covers approximately 40 states. Our advertising network is designed to deliver both entertaining content and targeted advertising on a demographic basis to each retail location. In addition our advertising network delivers promotional advertising tied to products within the retail location. The programming can be up-dated quickly and is tailored to meet the specific clients’ need for increased sales, customer enjoyment and brand reinforcement.

We customize the installation at each store depending on the particular store’s configuration and size. In general, we install one 42 inch LCD screen in the highest traffic area of the store (generally in the cooler section) and one 32 inch LCD screen in the cash area. Currently, we purchase the screens from LG and our playback computers are purchased from Dell, however we are constantly reviewing the products of all screen and computer manufacturers to ensure that we receive the best price possible. We contract out our in-store installations to several independent installation companies. We sign a 5 year agreement with the location owner that contains a 3 to 5 year renewal option. The renewal is at our sole discretion.

We supply all of the equipment and programming as well as advertising sales on a revenue sharing basis. Revenue from advertising sales for our convenience store network is split with the location on a net basis (after all costs of the network are deducted). Revenue splits vary from customer to customer.

5

We generate revenues mainly through the sale of advertisements on our advertising network which is displayed on screens throughout convenience store locations. SeeSaw Networks has developed a costing formula for advertisements on our network as one of our primary advertising distributors.

Our network’s monthly average of active viewers is discounted by 40% then divided by 1,000 to reach what is called “Customers Per Thousand” (CPM). That number is then multiplied by the rate charged to the Ad Buyer (the CPM Rate) to determine the revenue generated per month, per store.

We receive revenue from two main and two ancillary sources:

Main:

- Advertising Sales on our network ; and

- Physical Product Sales – We receive a commissions on products sold to the stores from those companies wishing to promote their new products on a direct basis if we place products within store which did not previously sell them.

Ancillary:

- Digital Downloads of ringtones, songs and games – customers who purchase one of these products due to our advertising do so using a special code which signifies our network as the origin of the purchase and we receive commissions for this purchase;

- Outbound Text Messaging campaigns – We are paid a percentage for each text message sent by a customer when they participate in a promotion being advertised on our network.

Content and Advertisements

Content is an extremely important element to the success of our advertising network. It must be current, relevant and entertaining so as to attract viewers. The national average of a customer’s dwell time within a convenience store is approximately 6 minutes per visit. We split our network programming into 3 minute segments of both advertising and entertaining content such as movie trailers, music videos, extreme sports, outdoors shows, and trivia. An added feature is the ability to sell branded content or “advertainment”, which is the combination of entertainment and advertising into one content piece.

Our content strategy was developed during an initial 9 month testing phase. We tested: remote management software; internet connectivity; and, developed installation criteria. In addition, we tested different types of content, various lengths of content playtime, the process of receiving and in-putting store promotions and, the development of a system that would deliver those promotions in a timely manner back to the network.

We currently have arrangements with content owners that allow us to provide a continuous content mix to our network.

Our management will take an active role in selling the advertising for the network. They will also work with agencies to ensure that the network is available to all levels of purchasing. In order to expose our advertising network to potential corporate clients who wish to include their marketing items on our network.

- Media Rich Marketing – Media Rich is a product placement and sponsorship marketing company specializing in partnering brands with television, radio and online media outlets. The company has placed products on shows in prime time to local television programming. The company has worked with TV programs on ABC and Fox, syndicated programs such as: Regis and Kelly; The Ellen Degeneres Show; NASCAR Angels; and The Today Show; as well as cable networks including Fox News Channel, MSNBC and CNN.

6

Markets

We sell our services primarily to companies looking to advertise their products on our convenience store network. Frequently these companies hire advertising placement agents and these agents are generally our intermediaries between the actual customers.

Frost & Sullivan, a global growth consulting firm, estimates that by the year 2012, advertising on U.S. and Canadian networked displays will be a $1 billion-a-year business at a compound growth rate of more than 20%.

Jonathan Barnard, head of publications at ZenithOptimedia, forecasts that outdoor advertising will grow 7 percent next year, from $6.9 billion to $7.4 billion. "New digital displays are making out-of-home more eye-catching and attractive, and because they can be updated very quickly they open up out-of-home to time-sensitive campaigns. We forecast cinema and out-of-home grow a total of 17 percent each between 2010 and 2013."

Barnard says a similar system introduced in European markets several years ago led to a noticeable gain in spending, with buyers and planners pleased with the medium's new accountability. ZenithOptimedia predicts that digital and alternative media together will grow at a rate of 10 percent next year, with many new advertisers trying them out for the first time.

We have targeted the convenience store market for these reasons:

- Overwhelming number of locations overall (167,000+);

- Large In-Store traffic – national average 1500 people per day;

- Easy to establish a large “captive audience “.

- Minimal deployment costs as targeted stores are on average 2000 sq. ft.

- Large “Male Audience” in the hard to reach 18-44 age group;

- Multiple Vendors as Advertising Prospects.

Competition

We face competition from various advertising companies ranging from small, private businesses to large, state-sponsored enterprises.

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

7

- develop highly marketable content and sales strategies;

- continue developing our relationships with major advertising companies and sales agencies; and

- increase our financial resources.

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

We believe that we will be able to compete effectively in our industry because of a successful placement strategy and focus on in-store advertising in convenience stores. We believe our competitive advantages of our advertising network are:

- Greater message impact by using full-motion, full-color video;

- The ability to change the message faster, more easily and less expensively than replacing printed signage and point of sale material;

- The ability to change the message based on time of day, day of week - even due to weather;

- The ability to efficiently and inexpensively provide regional, local and even site-specific programming;

- Reduces the length of time required to deploy new promotional programs;

- Offer product partners a more relevant/cost-effective merchandising platform;

- Ability to reduce merchandising clutter by promoting multiple products and perishables in the store and at the right time.

However, as we are a newly-established company, we face the same problems as other new companies starting up in an industry, such as lack of available funds. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may develop similar technologies to ours and use the same methods as we do and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Intellectual Property

We have not filed for any protection of our name or trademark. We own all content on our website: http://www.cstorenet.com/.

Employees and Consultants

As of July 12, 2012, we had no employees other than our directors and officers.

Government Regulations

We are not aware of any government regulations which would have a significant impact on our operations.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

8

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

Item 1A. Risk Factors

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections and estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”.

Risks Related to Our Business

We have a history of losses and no revenues, which raise substantial doubt about our ability to continue as a going concern.

From inception to March 31, 2012, we have incurred aggregate net losses of $1,430,205. We can offer no assurance that we will ever operate profitably or that we will generate positive cash flow in the future. In addition, our operating results in the future may be subject to significant fluctuations due to many factors not within our control, such as the unpredictability of when customers will order products, the size of customers’ orders, the demand for our products, and the level of competition and general economic conditions.

Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. No assurance can be given that we may be able to operate on a profitable basis.

Due to the nature of our business and the early stage of our development, our securities must be considered highly speculative. We have not realized a profit from our operations to date and there is little likelihood that we will realize any profits in the short or medium term. Any profitability in the future from our business will be dependent upon the successful commercialization or licensing of our core products, which themselves are subject to numerous risk factors as set forth below.

We expect to continue to incur development costs and operating costs. Consequently, we expect to incur operating losses and negative cash flows until our products gain market acceptance sufficient to generate a commercially viable and sustainable level of sales, and/or additional products are developed and commercially released and sales of such products made so that we are operating in a profitable manner. Our history of losses and no revenues raise substantial doubt about our ability to continue as a going concern.

9

We have had negative cash flows from operations since inception. We will require significant additional financing, the availability of which cannot be assured, and if our company is unable to obtain such financing, our business may fail.

To date, we have had negative cash flows from operations and have depended on sales of our equity securities and debt financing to meet our cash requirements. We may continue to have negative cash flows. We have estimated that we will require approximately $1,340,520 to carry out our business plan for the next twelve months. There is no assurance that actual cash requirements will not exceed our estimates. We will require additional financing to finance working capital and pay for operating expenses and capital requirements until we achieve a positive cash flow.

Our ability to market and sell our advertising services will be dependent upon our ability to raise significant additional financing. If we are unable to obtain such financing, we will not be able to fully develop our business. Specifically, we will need to raise additional funds to:

- support our planned growth and carry out our business plan;

- hire top quality personnel for all areas of our business; and

- address competing technological and market developments.

We may not be able to obtain additional equity or debt financing on acceptable terms as required. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements. Any additional equity financing may involve substantial dilution to our then existing shareholders. If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results and compete effectively. More importantly, if we are unable to raise further financing when required, we may be forced to scale down our operations and our ability to generate revenues may be negatively affected.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have no history of revenues from operations and have no significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Accordingly, we must be considered in the development stage. Our success is significantly dependent on a successful commercialization of our advertising services. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to develop a successful advertising service or achieve commercial acceptance of our advertising services or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

If we fail to effectively manage the growth of our company and the commercialization of our advertising services, our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the commercialization of our advertising services and the expansion of our marketing and commercialization efforts, we expect to experience significant growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We anticipate that we will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a material adverse effect on our business and financial condition.

10

Because we face intense competition from larger and better-established companies that have more resources than we do, we may be unable to implement our business plan or increase our revenues.

The market for our advertising services is intensely competitive and highly fragmented. Many of these competitors may have longer operating histories, greater financial, technical and marketing resources, and enjoy existing name recognition and customer bases. New competitors may emerge and rapidly acquire significant market share. In addition, new services and technologies likely will increase the competitive pressures we face. Competitors may be able to respond more quickly to technological change, competitive pressures, or changes in consumer demand. As a result of their advantages, our competitors may be able to limit or curtail our ability to compete successfully.

In addition, many of our large competitors may offer customers a broader or superior range of services and technologies. Some of our competitors may conduct more extensive promotional activities and offer lower commercialization and licensing costs to customers than we do, which could allow them to gain greater market share or prevent us from establishing and increasing our market share. Increased competition may result in significant price competition, reduced profit margins or loss of market share, any of which may have a material adverse effect on our ability to generate revenues and successfully operate our business. Our competitors may develop technologies superior to those that our company currently possess. In the future, we may need to decrease our prices if our competitors lower their prices. Our competitors may be able to respond more quickly to new or changing opportunities, services, technologies and customer requirements. Such competition will potentially affect our chances of achieving profitability, and ultimately affect our ability to continue as a going concern.

Our by-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our by-laws contain provisions with respect to the indemnification of our officers and directors against all expenses, liability and loss (including attorneys’ fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by him or her in connection with any action, suit or proceeding to which they were made parties by reason of his or her being or having been one of our directors or officers.

Risks Related to Our Common Stock

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors to not choose to invest in our stock. If we are unable to raise the funds we require for all of our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer and not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

We are authorized to issue up to 600,000,000 shares of common stock and 100,000,000 preferred shares with a par value of $0.00001. Our board of directors may choose to issue some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares will result in a reduction of the book value and market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will cause a reduction in the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our company.

11

Trading of our stock may be restricted by the Securities Exchange Commission's penny stock regulations, which may limit a stockholder's ability to buy and sell our stock.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a stockholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, the Financial Industry Regulatory Authority (FINRA), formerly the National Association of Securities Dealers or NASD, has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

Our business office is located at 248 Main Street, Venice, CA, 90219. Our 500 square meter office space is provided to us at no charge by our management.

12

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock quoted on the OTC Bulletin Board under the Symbol "CRPZ". Our common stock was listed for quotation on November 12, 2009.

The following table reflects the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| OTC Bulletin Board | ||

| Quarter Ended | High | Low |

| March 31, 2012 | $0.006 | $0.001 |

| December 31, 2011 | $0.0089 | $0.0014 |

| September 30, 2011 | $0.0116 | $0.0016 |

| June 30, 2011 | $0.025 | $0.01 |

| March 31, 2011 | $0.06 | $0.02 |

| December 31, 2010 | $0.201 | $0.03 |

| September 30, 2010 | $0.38 | $0.08 |

| June 30, 2010 | $3.50 | $0.60 |

| March 31, 2010 | N/A(1) | N/A(1) |

(1) Our first trade did not occur until April 20, 2010.

As of July 12, 2012, there were approximately 51 holders of record of our common stock. As of July10, 2012, 222,112,615 common shares were issued and outstanding.

Our common shares are issued in registered form. Empire Stock Transfer Inc, 1859 Whitney Mesa Drive Henderson, NV 89014 (Telephone: (702) 818-5898) is the registrar and transfer agent for our common shares.

13

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Other than as disclosed herein, we did not sell any equity securities which were not registered under the Securities Act during the year ended March 31, 2012 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended March 31, 2012.

-

On January 3, 2012, we issued 4,032,258 shares of common stock pursuant to the conversion of $2,500 of the convertible note. The fair value of the conversion option was determined to be $6,356 on the date of conversion and was recorded as additional paid-in capital. These shares were issued pursuant to an exemption from registration relying on Section 4(2) of the Securities Act of 1933.

-

On January 17, 2012, we issued 3,846,154 shares of common stock pursuant to the conversion of $2,000 of the convertible note. The fair value of the conversion option was determined to be $8,141 on the date of conversion and was recorded as additional paid-in capital. These shares were issued pursuant to an exemption from registration relying on Section 4(2) of the Securities Act of 1933.

-

On February 6, 2012, we issued 5,208,333 shares of common stock pursuant to the conversion of $2,500 of the convertible note. The fair value of the conversion option was determined to be $11,332 on the date of conversion and was recorded as additional paid-in capital. These shares were issued pursuant to an exemption from registration relying on Section 4(2) of the Securities Act of 1933.

-

On February 15, 2012, we issued 5,208,333 shares of common stock pursuant to the conversion of $2,500 of the convertible note. The fair value of the conversion option was determined to be $13,327 on the date of conversion and was recorded as additional paid-in capital. These shares were issued pursuant to an exemption from registration relying on Section 4(2) of the Securities Act of 1933.

-

On February 24, 2012, we issued 5,000,000 shares of common stock pursuant to the conversion of $1,000 of the convertible. The fair value of the conversion option was determined to be $3,367 on the date of conversion and was recorded as additional paid-in capital. These shares were issued pursuant to an exemption from registration relying on Section 4(2) of the Securities Act of 1933.

Equity Compensation Plan Information

Except as disclosed herein, we do not have a stock option plan in favor of any director, officer, consultant or employee of our company.

Convertible Securities

On December 3, 2010, we issued a $55,000 convertible note which bears interest at 8% per annum and matures on September 3, 2011. The note is not convertible until 180 days after the date of issuance and, thereafter, is convertible into shares of common stock on or after June 1, 2011 at a conversion rate of 58% of the average of the three lowest closing bid prices of our common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to us. Upon an event of default, the entire principal balance and accrued interest outstanding is due immediately, and interest shall accrue on the unpaid principal balance at 22% per annum.

14

On January 14, 2011, we issued a $42,500 convertible note which bears interest at 8% per annum and matures on October 18, 2011. The note is not convertible until 180 days after the date of issuance and, thereafter, is convertible into shares of common stock on or after July 13, 2011 at a conversion rate of 58% of the average of the three lowest closing bid prices of our common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to us. Upon an event of default, the entire principal balance and accrued interest outstanding is due immediately, and interest shall accrue on the unpaid principal balance at 22% per annum.

On July 26, 2011, we issued a $37,500 convertible note which bears interest at 8% per annum and matures on April 30, 2012. The note is convertible into shares of common stock 180 days after the date of issuance at a conversion rate of 58% of the average of the three lowest closing bid prices of our common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to our company. Upon an event of default, the entire principal balance and accrued interest outstanding is due immediately, and interest shall accrue on the unpaid principal balance at 22% per annum. On October 6, 2011, the conversion rate was amended to be 35% of the average of the three lowest closing bid prices of our common stock for the ten trading days ending one trading day prior to the date of conversion.

On October 12, 2011, we issued a $32,500 convertible note which bears interest at 8% per annum and matures on July 17, 2012. The note is convertible into shares of common stock 180 days after the date of issuance at a conversion rate of 35% of the average of the three lowest closing bid prices of our common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to our company. Upon an event of default, the entire principal balance and accrued interest outstanding is due immediately, and interest shall accrue on the unpaid principal balance at 22% per annum.

On March 29, 2012, we issued a $32,500 convertible note which bears interest at 8% per annum and matures on January 2, 2013. The note is convertible into shares of common stock 180 days after the date of issuance at a conversion rate of 45% of the average of the three lowest closing bid prices of our common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to our company. Upon an event of default, the entire principal balance and accrued interest outstanding is due immediately, and interest shall accrue on the unpaid principal balance at 22% per annum. As at March 31, 2012, we had not received the proceeds from the holder of the convertible note.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended March 31, 2012.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended March 31, 2012 and March 31, 2011 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 9 of this annual report.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

15

Purchase of Significant Equipment

We intend to purchase approximately $495,000 worth of equipment for expansion of our operations over the next twelve months. We do not currently have the funds necessary to initiate this expansion and there can be no assurance that we will be able to secure the required funding.

Personnel Plan

We do not expect any material changes in the number of employees over the next 12 month period (although we may enter into employment or consulting agreements with our officers or directors). We do and will continue to outsource contract employment as needed.

Results of Operations

For the Year Ending March 31, 2012 and 2011

| Year Ended | ||||||

| March 31, | ||||||

| 2012 | 2011 | |||||

| Revenue | $ | 6,628 | $ | Nil | ||

| Operating Expenses | $ | 206,739 | $ | 436,035 | ||

| Net Loss | $ | (684,366 | ) | $ | (450,906 | ) |

Expenses

Our operating expenses for our years ended March 31, 2012 and 2011 are outlined in the table below:

| Year Ended | ||||||

| March 31, | ||||||

| 2012 | 2011 | |||||

| Amortization of property and equipment | $ | 36,835 | $ | 51,938 | ||

| Consulting fees | $ | 22,098 | $ | 6,700 | ||

| Foreign exchange loss (gain) | $ | 512 | $ | (2,705 | ) | |

| Investor relations | $ | Nil | $ | 112,840 | ||

| Management fees | $ | 40,500 | $ | 114,000 | ||

| Network management | $ | 38,497 | $ | 98,485 | ||

| Office and general | $ | 3,129 | $ | 10,758 | ||

| Professional fees | $ | 47,881 | $ | 34,844 | ||

| Transfer agent and filing fees | $ | 17,067 | $ | 8,788 | ||

| Travel and promotion | $ | 220 | $ | 387 | ||

Operating expenses for year ended March 31, 2012 decreased by 111% as compared to the comparative period in 2011 primarily as a result of a decrease in investor relations, management fees and network management.

Revenue

We have earned revenues of $20,954 since our inception.

Equity Compensation

We currently do not have any stock option or equity compensation plans or arrangements.

16

Liquidity and Financial Condition

| Working Capital | ||

| At | At | |

| March 31, | March 31, | |

| 2012 | 2011 | |

| Current Assets | $ 19,552 | $ 70,679 |

| Current Liabilities | $ 370,967 | $ 68,544 |

| Working Capital (Deficit) | $ (351,415) | $ 2,135 |

| Cash Flows | ||

| Year Ended | Year Ended | |

| March 31, | March 31, | |

| 2012 | 2011 | |

| Net Cash used in Operating Activities | $ (116,127) | $ (308,876 ) |

| Net Cash used in Investing Activities | $ Nil | $ 6,755 |

| Net Cash Provided by Financing Activities | $ 65,000 | $ 370,700 |

| Increase (decrease) in Cash During the Period | $ (51,127) | $ 51,518 |

We will require additional funds to fund our budgeted expenses over the next 12 months. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is still no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on his investment in our common stock. Further, we may continue to be unprofitable. We need to raise additional funds in the immediate future in order to proceed with our budgeted expenses.

Specifically, we estimate our operating expenses and working capital requirements for the next 12 months to be as follows:

| Description |

Estimated Completion Date |

Estimated Expenses ($) |

| Legal and accounting fees | 12 months | 100,000 |

| Marketing and advertising | 12 months | 17,600 |

| Management and operating costs | 12 months | 452,920 |

| Salaries and consulting fees | 12 months | 200,000 |

| Fixed asset purchases | 12 months | 495,000 |

| General and administrative expenses | 12 months | 75,000 |

| Total | 1,340,520 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement financings. If we are not able to successfully complete any private placement financings, we plan to cooperate with film and television producers or obtain shareholder loans to meet our cash requirements. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan.

Future Financings

We will require additional financing in order to enable us to proceed with our plan of operations, as discussed above, including approximately $1,340,520 over the next 12 months to pay for our ongoing expenses. These expenses include legal, accounting and audit fees as well as general and administrative expenses. These cash requirements are in excess of our current cash and working capital resources. Accordingly, we will require additional financing in order to continue operations and to repay our liabilities. There is no assurance that any party will advance additional funds to us in order to enable us to sustain our plan of operations or to repay our liabilities.

17

We anticipate continuing to rely on equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned business activities.

We presently do not have any arrangements for additional financing for the expansion of our exploration operations, and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with our plan of operations.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

We generated minimal revenues since inception and are dependent upon obtaining outside financing to carry out our operations and pursue our pharmaceutical research and development activities. If we are unable to generate future cash flows, raise equity or secure alternative financing, we may not be able to continue our operations and our business plan may fail. You may lose your entire investment.

If our operations and cash flow improve, management believes that we can continue to operate. However, no assurance can be given that management's actions will result in profitable operations or an improvement in our liquidity situation. The threat of our ability to continue as a going concern will cease to exist only when our revenues have reached a level able to sustain our business operations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Use of Estimates

The preparation of financial statements in conformity with US generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Our company regularly evaluates estimates and assumptions related to the useful life and recoverability of long-lived assets, fair value of convertible debt, fair value of derivative liabilities, and deferred income tax asset valuation allowances. Our company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by our company may differ materially and adversely from our company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

18

Impairment of Long-lived Assets

In accordance with ASC 360, “Property, Plant, and Equipment”, our company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value.

Revenue Recognition

Our company recognizes revenue in accordance with ASC 605, “Revenue Recognition”. Revenue consists of streaming advertising services. Revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, the service is performed, and collectability is reasonably assured.

Recent Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

19

CONVENIENCE TV INC.

(A

Development Stage Company)

March 31, 2012

(Expressed in US dollars)

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Convenience TV Inc. (A Development Stage Company)

We have audited the accompanying consolidated balance sheets of Convenience TV Inc. (A Development Stage Company) as of March 31, 2012 and 2011, and the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended and accumulated from March 31, 2008 (date of inception) to March 31, 2012. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of March 31, 2012 and 2011, and the results of its operations and its cash flows for the years then ended and accumulated from March 31, 2008 (date of inception) to March 31, 2012, in conformity with accounting principles generally accepted in the United States.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has a working capital deficit and has incurred operating losses since inception. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 1 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ SATURNA GROUP CHARTERED ACCOUNTANTS LLP

Saturna Group Chartered Accountants LLP

Vancouver, Canada

July 12, 2012

F-1

CONVENIENCE TV INC.

(A

Development Stage Company)

Consolidated Balance Sheets

(Expressed in US

Dollars)

| March 31, | March 31, | |||||

| 2012 | 2011 | |||||

| $ | $ | |||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash | 391 | 51,518 | ||||

| Due from Global Fusion Media Inc. (Note 7) | 19,161 | 19,161 | ||||

| Total Current Assets | 19,552 | 70,679 | ||||

| Property and equipment (Note 3) | 305 | 37,140 | ||||

| Deferred financing costs (Note 5(f)) | 1,236 | 3,472 | ||||

| Total Assets | 21,093 | 111,291 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||

| Current Liabilities | ||||||

| Accounts payable | 38,718 | 3,324 | ||||

| Accrued liabilities | 7,382 | 2,155 | ||||

| Convertible debt, less unamortized discount of $40,691 (2011 - $34,435) (Note 5) | 71,809 | 63,065 | ||||

| Derivative liabilities (Note 6) | 250,558 | – | ||||

| Due to related party (Note 7) | 2,500 | – | ||||

| Total Liabilities | 370,967 | 68,544 | ||||

| Nature of Operations and Continuance of Business (Note 1) | ||||||

| Subsequent Events (Note 11) | ||||||

| Stockholders’ Equity (Deficit) | ||||||

| Preferred Stock | ||||||

| Authorized: 100,000,000

preferred shares, $0.00001 par value Issued and outstanding: no shares |

– | – | ||||

| Common Stock | ||||||

| Authorized: 600,000,000 common

shares, $0.00001 par value Issued and outstanding: 121,064,350 shares (2011 – 56,070,000) |

1,211 | 561 | ||||

| Additional paid-in capital | 1,079,120 | 788,025 | ||||

| Deficit accumulated during the development stage | (1,430,205 | ) | (745,839 | ) | ||

| Total Stockholders' Equity (Deficit) | (349,874 | ) | 42,747 | |||

| Total Liabilities and Stockholders' Equity (Deficit) | 21,093 | 111,291 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-2

CONVENIENCE TV INC.

(A

Development Stage Company)

Consolidated Statements of Operations

(Expressed in US Dollars)

| Accumulated from | |||||||||

| Year | Year | March 31, 2008 (date | |||||||

| Ended | Ended | of inception) to | |||||||

| March 31, | March 31, | March 31, | |||||||

| 2012 | 2011 | 2012 | |||||||

| $ | $ | $ | |||||||

| Revenue | 6,628 | – | 20,954 | ||||||

| Operating expenses | |||||||||

| Amortization of property and equipment | 36,835 | 51,938 | 155,511 | ||||||

| Consulting fees | 22,098 | 6,700 | 35,298 | ||||||

| Content services | – | – | 6,470 | ||||||

| Foreign exchange loss (gain) | 512 | (2,705 | ) | 17,562 | |||||

| Investor relations | – | 112,840 | 112,840 | ||||||

| Management fees (Note 7) | 40,500 | 114,000 | 276,805 | ||||||

| Network management | 38,497 | 98,485 | 182,742 | ||||||

| Office and general | 3,129 | 10,758 | 17,925 | ||||||

| Professional fees | 47,881 | 34,844 | 96,694 | ||||||

| Transfer agent and filing fees | 17,067 | 8,788 | 25,855 | ||||||

| Travel and promotion | 220 | 387 | 24,331 | ||||||

| Total Operating Expenses | 206,739 | 436,035 | 952,033 | ||||||

| Loss from Operations | (200,111 | ) | (436,035 | ) | (931,079 | ) | |||

| Other Expenses | |||||||||

| Accretion of discounts on convertible debt | (118,749 | ) | (10,688 | ) | (129,437 | ) | |||

| Amortization of deferred financing costs | (7,236 | ) | (2,028 | ) | (9,264 | ) | |||

| Interest expense | (7,770 | ) | (2,155 | ) | (9,925 | ) | |||

| Loss on change in fair value of derivative liabilities | (315,629 | ) | – | (315,629 | ) | ||||

| Loss on extinguishment of debt | (34,871 | ) | – | (34,871 | ) | ||||

| Total Other Expenses | (484,255 | ) | (14,871 | ) | (499,126 | ) | |||

| Net Loss for the Period | (684,366 | ) | (450,906 | ) | (1,430,205 | ) | |||

| Net Loss Per Share, Basic and Diluted | (0.01 | ) | (0.01 | ) | |||||

| Weighted Average Shares Outstanding | 77,974,000 | 50,200,438 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-3

CONVENIENCE TV INC.

(A

Development Stage Company)

Consolidated Statements of Stockholders’ Equity

(Deficit)

(Expressed in US Dollars)

| Deficit | |||||||||||||||

| Accumulated | |||||||||||||||

| Additional | During the | ||||||||||||||

| Shares | Paid-in | Development | |||||||||||||

| Amount | Capital | Stage | Total | ||||||||||||

| # | $ | $ | $ | $ | |||||||||||

| Balance, March 31, 2008 (date of inception) | – | – | – | – | – | ||||||||||

| Shares issued | 36,000,000 | 360 | (359 | ) | – | 1 | |||||||||

| Net loss for the year | – | – | – | (179,591 | ) | (179,591 | ) | ||||||||

| Balance, March 31, 2009 | 36,000,000 | 360 | (359 | ) | (179,591 | ) | (179,590 | ) | |||||||

| Net loss for the year | – | – | – | (115,342 | ) | (115,342 | ) | ||||||||

| Balance, March 31, 2010 | 36,000,000 | 360 | (359 | ) | (294,933 | ) | (294,932 | ) | |||||||

| May 5, 2010 – recapitalization transactions | |||||||||||||||

| Shares of Convenience TV Inc., net of shares cancelled | 17,700,000 | 177 | (10,615 | ) | – | (10,438 | ) | ||||||||

| Forgiveness of related party debt | – | – | 385,198 | – | 385,198 | ||||||||||

| Shares issued per private placements | 1,770,000 | 18 | 278,682 | – | 278,700 | ||||||||||

| Shares issued per investor relations agreement | 600,000 | 6 | 89,994 | – | 90,000 | ||||||||||

| Fair value of beneficial conversion feature | – | – | 45,125 | – | 45,125 | ||||||||||

| Net loss for the year | – | – | – | (450,906 | ) | (450,906 | ) | ||||||||

| Balance, March 31, 2011 | 56,070,000 | 561 | 788,025 | (745,839 | ) | 42,747 | |||||||||

| Fair value of beneficial conversion feature | |||||||||||||||

| recorded upon issuance of convertible debt | – | – | 70,000 | – | 70,000 | ||||||||||

| Fair value of derivative liability portion of convertible debenture | – | – | (37,500 | ) | – | (37,500 | ) | ||||||||

| Shares issued for conversion of debt and accrued interest | 64,994,350 | 650 | 56,550 | – | 57,200 | ||||||||||

| Fair value of beneficial conversion features recorded upon conversion of debt. | – | – | 192,447 | – | 192,447 | ||||||||||

| Stock-based compensation | – | – | 9,598 | – | 9,598 | ||||||||||

| Net loss for the year | – | – | – | (684,366 | ) | (684,366 | ) | ||||||||

| Balance, March 31, 2012 | 121,064,350 | 1,211 | 1,079,120 | (1,430,205 | ) | (349,874 | ) | ||||||||

(The accompanying notes are an integral part of these consolidated financial statements)

F-4

CONVENIENCE TV INC.

(A

Development Stage Company)

Consolidated Statements of Cash Flows

(Expressed in US Dollars)

| Accumulated from | |||||||||

| Year | Year | March 31, 2008 (date | |||||||

| Ended | Ended | of inception) to | |||||||

| March 31, | March 31, | March 31, | |||||||

| 2012 | 2011 | 2012 | |||||||

| $ | $ | $ | |||||||

| Operating Activities | |||||||||

| Net loss | (684,366 | ) | (450,906 | ) | (1,430,205 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating | |||||||||

| activities: | |||||||||

| Accretion of discounts on convertible debt | 118,749 | 10,688 | 129,437 | ||||||

| Amortization of property and equipment | 36,835 | 51,938 | 155,511 | ||||||

| Amortization of deferred financing costs | 7,236 | 2,028 | 9,264 | ||||||

| Loss on change in fair value of derivative liabilities | 315,629 | – | 315,629 | ||||||

| Loss on extinguishment of debt | 34,871 | – | 34,871 | ||||||

| Stock-based compensation | 9,598 | 90,000 | 99,598 | ||||||

| Changes in operating assets and liabilities: | |||||||||

| Due from related party | 2,500 | (19,161 | ) | (16,661 | ) | ||||

| Prepaid expenses | – | 8,457 | – | ||||||

| Accounts payable | 35,394 | (2,938 | ) | 35,764 | |||||

| Accrued liabilities | 7,427 | 1,018 | 9,582 | ||||||

| Net Cash Used In Operating Activities | (116,127 | ) | (308,876 | ) | (657,210 | ) | |||

| Investing Activities | |||||||||

| Acquisition of property and equipment | – | – | (155,816 | ) | |||||

| Net cash acquired on acquisition of subsidiary | – | 6,755 | 6,755 | ||||||

| Net Cash Provided By (Used In) Investing Activities | – | 6,755 | (149,061 | ) | |||||

| Financing Activities | |||||||||

| Advances from related party | – | – | 348,482 | ||||||

| Proceeds from convertible debt | 70,000 | 97,500 | 167,500 | ||||||

| Deferred financing costs | (5,000 | ) | (5,500 | ) | (10,500 | ) | |||

| Proceeds from issuance of common stock | – | 278,700 | 278,701 | ||||||

| Net Cash Provided By Financing Activities | 65,000 | 370,700 | 784,183 | ||||||

| Effect of Exchange Rate Changes on Cash | – | (17,061 | ) | 22,479 | |||||

| Change in Cash | (51,127 | ) | 51,518 | 391 | |||||

| Cash, Beginning of Period | 51,518 | – | – | ||||||

| Cash, End of Period | 391 | 51,518 | 391 | ||||||

| Non-cash Investing and Financing Activities: | |||||||||

| Share issued upon conversion of debt | 55,000 | – | 55,000 | ||||||

| Fair value of beneficial conversion options upon conversion of | |||||||||

| debt recorded as additional paid-in capital | 194,647 | – | 194,647 | ||||||

| Fair value of beneficial conversion options of convertible debt | 22,500 | – | 67,625 | ||||||

| Supplemental Disclosures: | |||||||||

| Interest paid | – | – | – | ||||||

| Income taxes paid | – | – | – |

(The accompanying notes are an integral part of these consolidated financial statements)

F-5

CONVENIENCE TV INC.

(A

Development Stage Company)

Notes to the Consolidated Financial Statements

March 31, 2012

(Expressed in US dollars)

| 1. |

Nature of Operations and Continuance of Business |

|

Convenience TV Inc. (the “Company”) was incorporated under the laws of the State of Nevada on December 8, 2008. On April 24, 2010, the Company changed its name from Costa Rica Paradise Inc. to Convenience TV Inc. The Company’s prior business was real estate investment consulting with respect to properties located in Costa Rica. Upon completion of an acquisition agreement with Global Fusion Media Inc. (“Global Fusion”), as described below, the Company adopted the business of C-Store Network, LLC (“C-Store”). The Company is a development stage company, as defined by Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 915, “Development Stage Entities” and is now engaged in the business of providing advertising services through a network of in-location televisions installed at various convenience store locations. | |

|

On May 5, 2010, the Company closed an acquisition agreement with Global Fusion in which the Company acquired C-Store, a private company fully owned by Global Fusion, in exchange for the issuance of 36,000,000 shares of common stock to Global Fusion. Refer to Note 4. | |

|

These financial statements have been prepared on a going concern basis, which implies that the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated significant revenues since inception and is unlikely to generate significant revenue or earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. As at March 31, 2012, the Company has not generated significant revenue, has a working capital deficit of $351,415, and has an accumulated deficit of $1,430,205 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. | |

|

The Company will need additional working capital to continue or to be successful in any future business activities. Management plans to seek debt or equity financing, or a combination of both, to raise the necessary working capital. | |

| 2. |

Summary of Significant Accounting Principles |

|

Basis of Presentation | |

|

These financial statements are prepared in conformity with accounting principles generally accepted in the United States and are presented in US dollars, unless otherwise noted. The Company’s fiscal year end is March 31. | |

|

Cash and Cash Equivalents | |

|

The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. | |

|

Use of Estimates | |

|

The preparation of financial statements in conformity with US generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the useful life and recoverability of long-lived assets, fair value of convertible debt, fair value of derivative liabilities, and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. | |

|

Property and Equipment | |

|

Property and equipment, consisting primarily of computer and equipment, is stated at cost and is amortized using the straight-line method over their estimated lives of three years. |

F-6

CONVENIENCE TV INC.

(A

Development Stage Company)

Notes to the Consolidated Financial Statements

March 31, 2012

(Expressed in US dollars)

| 2. |

Summary of Significant Accounting Principles (continued) |

|

Impairment of Long-lived Assets | |

|

In accordance with ASC 360, “Property, Plant, and Equipment”, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value. | |

|

Foreign Currency Translation | |

|

The Company’s functional currency and reporting currency is the United States dollar and foreign currency transactions are primarily undertaken in Canadian dollars. Monetary balance sheet items expressed in foreign currencies are translated into US dollars at the exchange rates in effect at the balance sheet date. Non-monetary assets and liabilities are translated at historical rates. Revenues and expenses are translated at average rates for the period. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. | |

|

Revenue Recognition | |

|

The Company recognizes revenue in accordance with ASC 605, “Revenue Recognition”. Revenue consists of streaming advertising services. Revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, the service is performed, and collectability is reasonably assured. | |

|

Loss Per Share | |

|

The Company computes net income (loss) per share in accordance with ASC 260, "Earnings per Share" which requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive | |

|

Income Taxes | |

|