Attached files

| file | filename |

|---|---|

| EX-13.1 - AUDITED CONSOLIDATED FINANCIAL STATEMENTS - US GEOTHERMAL INC | exhibit13-1.htm |

| EX-23.4 - CONSENT OF GEOTHERMAL SCIENCE, INC. - US GEOTHERMAL INC | exhibit23-4.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - US GEOTHERMAL INC | exhibit21-1.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - US GEOTHERMAL INC | exhibit31-2.htm |

| EX-23.1 - CONSENT OF MARTINELLIMICK, PLLC - US GEOTHERMAL INC | exhibit23-1.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - US GEOTHERMAL INC | exhibit32-1.htm |

| EX-23.2 - CONSENT OF GEOTHERMEX INC. - US GEOTHERMAL INC | exhibit23-2.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - US GEOTHERMAL INC | exhibit31-1.htm |

| EX-23.3 - CONSENT OF BLACK MOUNTAIN TECHNOLOGY, INC. - US GEOTHERMAL INC | exhibit23-3.htm |

| EXCEL - IDEA: XBRL DOCUMENT - US GEOTHERMAL INC | Financial_Report.xls |

| EX-32.2 - SECTION 906 CERTIFICATION - US GEOTHERMAL INC | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[ x ]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2012

or

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to ______

Commission File Number 001-34023

U.S. GEOTHERMAL

INC.

(Exact name of Registrant as specified in its

charter)

| Delaware | 84-1472231 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

| 1505 Tyrell Lane | |

| Boise, Idaho | 83706 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code 208-424-1027

Securities registered under Section 12(b) of the Exchange Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | NYSE MKT LLC |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is well-known seasoned

issuer, as defined in Rule 405 of the Securities Act

[ ]Yes [ x ]No

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

[ ]Yes [ x ]

No

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for at least the past 90 days.

[ x ] Yes [ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of

Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files).

[ x ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller | Smaller reporting company [ x ] |

| reporting company) |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

[ ] Yes [ x ] No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of July 11, 2012: $32,913,701

The number of shares outstanding of the registrant’s common stock as of July 12, 2012 was 88,955,948.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the Registrant’s 2012 Annual Meeting of Shareholders to be held on October 12, 2012 are incorporated by reference into Part III of this Form 10-K.

| U.S. Geothermal Inc. and Subsidiaries |

| Form 10-K |

| INDEX |

| For the Year Ended March 31, 2012 |

| U.S. Geothermal Inc. and Subsidiaries |

| Form 10-K |

| INDEX |

| For the Year Ended March 31, 2012 |

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Information Regarding Forward Looking Statements

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties. We caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. These statements are based on current expectations of future events. You can find many of these statements by looking for words like “believes,” “expects,” “anticipates,” “intend,” “estimates,” “may,” “should,” “will,” “could,” “plan,” “predict,” “potential,” or similar expressions in this document or in documents incorporated by reference in this document. Examples of these forward-looking statements include, but are not limited to:

-

our business and growth strategies;

-

our future results of operations;

-

anticipated trends in our business;

-

the capacity and utilization of our geothermal resources;

-

our ability to successfully and economically explore for and develop geothermal resources;

-

our exploration and development prospects, projects and programs, including construction of new projects and expansion of existing projects;

-

availability and costs of drilling rigs and field services;

-

our liquidity and ability to finance our exploration and development activities;

-

our working capital requirements and availability;

-

our illustrative plant economics;

-

market conditions in the geothermal energy industry; and

-

the impact of environmental and other governmental regulation.

These forward-looking statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations and projections. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements:

-

the failure to obtain sufficient capital resources to fund our operations;

-

unsuccessful construction and expansion activities, including delays or cancellations;

-

incorrect estimates of required capital expenditures;

-5-

-

increases in the cost of drilling and completion, or other costs of production and operations;

-

the enforceability of the power purchase agreements for our projects;

-

impact of environmental and other governmental regulation, including delays in obtaining permits;

-

hazardous and risky operations relating to the development of geothermal energy;

-

our ability to successfully identify and integrate acquisitions;

-

our dependence on key personnel;

-

the potential for claims arising from geothermal plant operations;

-

general competitive conditions within the geothermal energy industry; and

-

financial market conditions.

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable U.S. securities law. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

The U.S. dollar is the Company’s functional currency; however some transactions involved the Canadian dollar. All references to “dollars” or “$” are to United States dollars and all references to $ CDN are to Canadian dollars.

U.S. Geothermal Inc. (the “Company,” “HTM” or “we” or “us” or words of similar import) is in the renewable “green” energy business. Through its subsidiary, U.S. Geothermal Inc., an Idaho corporation (“Geo-Idaho,” although our references to the Company include and refer to our operations through Geo-Idaho), we are engaged in the acquisition, development and utilization of geothermal resources in the Western Region of the United States of America. Geothermal energy is the natural heat energy stored within the earth’s crust. In some areas of the earth, economic concentrations of heat energy result from a combination of geological conditions that allow water to penetrate into hot rocks at depth, become heated, and then circulate to a near surface environment. In these settings, commercially viable extraction of the geothermal energy and its conversion to electricity become possible and a “geothermal resource” is present.

Development of Business

History

Geo-Idaho was formed as an Idaho corporation in February 2002 to conduct geothermal resource development. On March 5, 2002, Geo-Idaho entered into a letter agreement with the previous owner, pursuant to which Geo-Idaho agreed to acquire all of the real property, personal property and permits that comprised the owner’s interest in the Raft River project located in southeastern Idaho.

-6-

The Company and Geo-Idaho entered into a merger agreement on February 28, 2002, which was amended and restated on November 30, 2003, and closed on December 19, 2003. In accordance with the merger agreement, the Company acquired Geo-Idaho through the merger of Geo-Idaho with a subsidiary, EverGreen Power Inc., an Idaho corporation formed for that purpose. Geo-Idaho is the surviving corporation and the subsidiary through which the Company conducts operations. As part of this acquisition, we changed our name to U.S. Geothermal Inc. Because the former Geo-Idaho shareholders became the majority holders of the Company, the transaction is treated as a “reverse takeover” for accounting purposes.

We currently operate two power plants that include, Raft River Unit I in Idaho (through our joint venture with Raft River I Holdings, LLC, a subsidiary of Goldman Sachs) and a plant located in the San Emidio Desert in Nevada. We also have several other properties under development or exploration. Raft River Unit I (“RREI”) commenced commercial operations on January 3, 2008. Raft River Unit I is currently selling an annual average of 8 megawatts (“MWs”) of power to Idaho Power Company under a net 13 MW power purchase agreement (“PPA”) which expires in 2032. Management is currently evaluating alternatives to bring the RREI plant operations to its nameplate capacity of 13 MW.

In May 2008, we acquired the geothermal assets, including a 3.6 net MW nameplate generating capacity power plant, from Empire Geothermal Power LLC and Michael B. Stewart, located in Washoe County, Nevada for approximately $16.6 million which includes the Granite Creek geothermal and certain ground water rights. The plant currently generates an approximate average net output of 2.5 MWs, which is sold to Sierra Pacific Power Corporation. With the recent downturn in the economy we have been focusing our efforts on maximizing the available leverage to our existing equity investments and pursuing a development plan with lower risks by avoidance of exploration drilling of production wells. As a result we are planning a 35 MW development in three phases with the first phase a “repower” facility at San Emidio which will use the existing geothermal fluid feeding the existing plant to feed a new plant. The plant size is estimated to be 8.6 net MWs and is substantially complete and is in the process of becoming commercially operational. The second phase is a planned 8.6 net MW module similar to the first phase unit and is expected to be online in the fourth calendar quarter of 2013. The third phase is planned as a further expansion for 17.2 MW net utilizing two additional power modules similar to the first and second phases. The third phase is planned to be on line the fourth calendar quarter of 2014.

On September 5, 2006, the Company announced the acquisition of property for a geothermal project at Neal Hot Springs, Oregon located in eastern Oregon near the Idaho border. The property is 8.5 square miles of geothermal energy and surface rights. On May 5, 2008, the Company announced that drilling had begun on the first full size production well (“NHS-1”) which was completed on May 23, 2009. In February 2009, the Company submitted an application for the project to the U.S. Department of Energy’s (“DOE”) Energy Efficiency, Renewable Energy and Advanced Transmission and Distribution Solicitation loan guarantee program under Title XVII of the Energy Policy Act of 2005. On May 26, 2009, the Company announced that it had been selected by DOE to enter into due diligence review on a project loan. Construction on a drill pad was completed in August 2009. In September 2009, the Company began drilling production well number 5 (“NHS-5”), which was substantially completed on October 15, 2009. Also, in September 2009, the Company began a temperature gradient well program to expand the knowledge of the entire geothermal resource. On December 14, 2009, the Company announced that its wholly owned subsidiary USG Oregon LLC has signed a 25-year power purchase agreement with Idaho Power Company that provides for the sale of up to 25 MWs. The PPA was approved by the Idaho PUC in May of 2010. The financial closing for the DOE loan guarantee took place in February 2011 which secured a $96.8 million loan guarantee from the Department of Energy and a direct loan from the U.S. Treasury’s Federal Financing Bank. The $96.8 million loan represents 75% of the total project cost which is now estimated to be $129 million for the project. The DOE loan is a combined construction and 22 year term loan. The interest rate on the loan is set at the 22 year treasury rate plus approximately 37 basis points when each advance is drawn. The project’s partner (Enbridge Inc.) has contributed over $32.8 million as of May 31, 2012. Enbridge’s equity interest has not been determined; however it will exceed 20%. The project is expected to be fully financed with the partners’ contributions and the DOE loan proceeds.

-7-

In October 2011, USG Oregon LLC began drawing on the DOE loan. During the fiscal year ended March 31, 2012, the Company completed drilling several wells for the Neal Hot Springs Oregon Project and substantial progress was made on construction of the power plant modules, cooling towers, support buildings and other critical components.

Plan of Operations

Our management examines different factors when assessing potential acquisitions or projects at different stages of development, such as the internal rate of return of the investment, technical and geological matters and other relevant business considerations. We evaluate our operating projects based on revenues and expenses, and our projects under development, based on costs attributable to each project.

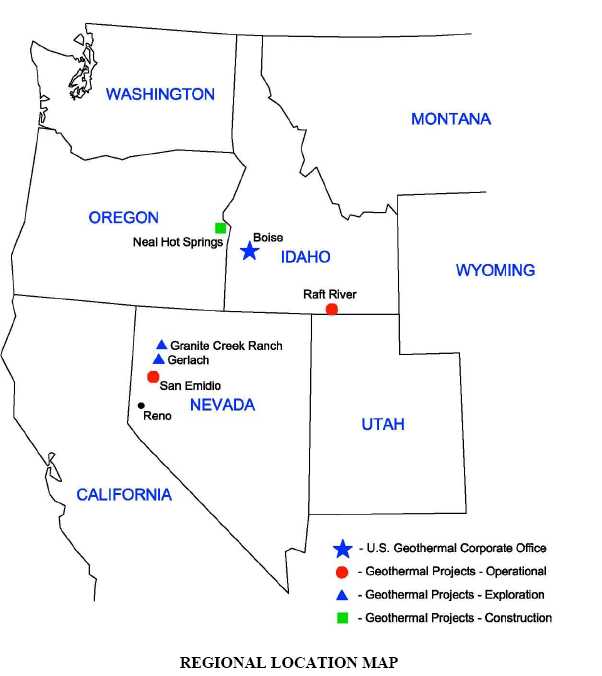

We have exploration and development properties located in:

- Raft River, Idaho;

- Neal Hot Springs, Oregon;

- San Emidio, Nevada;

- Gerlach, Nevada;

- Granite Creek, Nevada; and,

- Republic of Guatemala.

Our business strategy is to identify, evaluate, acquire, develop and operate geothermal assets and resources economically, safely and efficiently. We intend to execute this strategy in several steps outlined below:

- Leverage Management Team Capabilities and Experience – Our strategy is focused on the identification and acquisition of resources that can be developed in a cost-effective manner to produce attractive returns. In particular, we seek to acquire projects that have already undergone geothermal resource discovery. In addition, we intend to operate and manage construction of the projects, while using internal personnel and third-party contractors to efficiently and cost-effectively develop those resources. We believe that we have the strategic personnel in place to determine which resources provide the greatest opportunity for efficient development and operation. We have developed relationships and employed personnel that will allow us to develop and utilize geothermal resources as efficiently as possible.

-8-

-

Develop Our Pipeline of Quality Projects – Our project pipeline currently consists of several projects that we believe are aligned with our growth strategy. These projects have consulting reports from various industry experts supporting our belief in those projects’ potential, and we have started PPA negotiations for power off-take with counterparties for some of these growth opportunities. If realized, our identified project pipeline will greatly expand our renewable power generation capacity.

-

Utilize Production Tax Credits, Investment Tax Credits and Other Incentives – Although geothermal power production can be cost competitive with fossil fuel power generating facilities without government subsidies in some cases, production tax credits (“PTC”) and Investment Tax Credits (“ITC”) available to geothermal power producers enhance the project economics and attract capital investment. For the Raft River Unit I project, we partnered with Goldman Sachs as a tax equity partner to fully utilize production tax credits available to the project. Our strategy going forward is to structure project ownership to be the primary beneficiary of project economics. Recent legislation enacted as part of the stimulus funding has provided an election to take 30% ITC in lieu of the PTC for certain qualified investments being initiated before the end of 2010 and being placed in service before the end of 2013. This ITC election may be available to us at our San Emidio and Neal Hot Springs projects.

-

Pursue Acquisition Strategy – The geothermal market, particularly in the United States, is fragmented and characterized by a few large players and a number of smaller ones. Geothermal exploration and development is costly, technically challenging and requires long lead times before a project will produce revenue. We believe that geothermal technical and managerial talent is limited in the industry and that access to capital to develop projects will not be equally available to all participants. As a result, we believe that there will be opportunities in the future to pursue acquisitions of geothermal projects and/or geothermal development companies with attractive project pipelines.

-

Evaluate Other Potential Revenue Streams from Geothermal Resources – In addition to electricity generation, we may evaluate additional applications for our geothermal resources including industrial, agriculture, and aquaculture purposes. These uses generally constitute lower temperature applications where, after driving a turbine generator, residual hot water can be cycled for secondary processes before being returned to the geothermal reservoir by injection wells, which can provide incremental revenue streams. We may evaluate the optimal use for each geothermal resource and determine whether selling heat for industrial purposes or generating and subsequently selling power to a grid will generate the highest return on the asset.

-9-

Cash Requirements

We believe our cash and liquid investments at March 31, 2012 are adequate to fund our general operating activities through December 31, 2012 including drilling at Neal Hot Springs, general development support activities at San Emidio and repair activities at Raft River. Other project development, such as Guatemala, may require additional funding. In addition to government loans and grants discussed below, we anticipate that additional funding may be raised through financial and strategic partnerships, market loans, the issuance of equity and/or through the sale of ownership interest in tax credits and benefits.

The current financial credit crisis is not anticipated to impact the ability of our customers, Idaho Power Company and Sierra Pacific Power, to pay for their power. This power is sold under long-term contracts at fixed prices to large utilities. The current status of the credit and equity markets could delay our project development activities while the Company seeks to obtain economic credit terms or a favorable equity market price to further the drilling and construction activities. The Company continues discussions with potential investors to evaluate alternatives for funding at the corporate and project levels.

For projects under construction before the end of 2010 and online before the end of 2013, a project can elect to take a 30% investment tax credit (“ITC”) in lieu of the production tax credit (“PTC”). The ITC may be converted into a cash grant within the first 60 days of operation of the plant. Phase I at San Emidio attained commercial operation on May 25, 2012. An application will be submitted in July 2012 electing to take the ITC cash grant in lieu of the PTC, which will result in a check from the U.S. Treasury for approximately $11 million by September 2012 and will be used to retire an existing bridge loan of approximately $7.5 million.

On May 21, 2012, U.S. Geothermal Inc. (the “Company”) entered into a purchase agreement (the “Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“LPC”), pursuant to which the Company has the right to sell to LPC up to $10,750,000 in shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), subject to certain limitations and conditions set forth in the Purchase Agreement and imposed by the Company’s board of directors and pricing committee thereof.

Pursuant to the Purchase Agreement, upon the satisfaction of all of the conditions to the Company’s right to commence sales under the Purchase Agreement (the “Commencement”), LPC initially purchased $750,000 in shares of Common Stock at $0.38 per share. Thereafter, on any business day and as often as every other business day over the 36-month term of the Purchase Agreement, and up to an aggregate amount of an additional $10,000,000 (subject to certain limitations) in shares of Common Stock, the Company has the right, from time to time, at its sole discretion and subject to certain conditions to direct LPC to purchase up to 250,000 shares of Common Stock, which amount may be increased in accordance with the Purchase Agreement if the closing sale price of Common Stock on the NYSE MKT LLC exceeds certain specified levels. The purchase price of shares of Common Stock pursuant to the Purchase Agreement will be based on prevailing market prices of Common Stock at the time of sales without any fixed discount, and the Company will control the timing and amount of any sales of Common Stock to LPC. No sales of Common Stock under the Purchase Agreement will be made through the Toronto Stock Exchange.

-10-

The Purchase Agreement contains customary representations, warranties and agreements of the Company and LPC, limitations and conditions to completing future sale transactions, indemnification rights and other obligations of the parties. There is no upper limit on the price per share that LPC could be obligated to pay for Common Stock under the Purchase Agreement. LPC shall not have the right or the obligation to purchase any shares of Common Stock if the purchase price of those shares, determined as set forth in the Purchase Agreement, would be below $0.25 per share. The Company has the right to terminate the Purchase Agreement at any time, at no cost or penalty. Actual sales of shares of Common Stock to LPC under the Purchase Agreement will depend on a variety of factors to be determined by the Company from time to time, including (among others) market conditions, the trading price of the Common Stock and determinations by the Company as to available and appropriate sources of funding for the Company and its operations. As consideration for entering into the Purchase Agreement, the Company has issued to LPC 651,819 shares of Common Stock. The Company will not receive any cash proceeds from the issuance of these 651,819 shares.

As of June 30, 2012, the Company has sold 750,000 shares of common stock pursuant to the Purchase Agreement for net proceeds of approximately $259,425. Sales of shares of our common stock by our sales agent have been made in privately negotiated transactions or in any method permitted by law deemed to be an “At The Market” offering as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on the NYSE MKT LLC or sales made through a market maker other than on an exchange. Our sales agent has made all sales using commercially reasonable efforts consistent with its normal sales and trading practices on mutually agreed upon terms between our sales agent and us.

The Company has entered into an agreement with Kuhns Brothers Securities Corporation (“KBSC”), pursuant to which KBSC agreed to act as the placement agent in connection with the sale of shares of Common Stock to LPC. Subject to the Company’s and KBSC’s receipt of written confirmation that the Corporate Finance Department of Financial Industry Regulatory Authority, Inc. (“FINRA”) has determined not to raise any objection with respect to the fairness or reasonableness of the compensation terms of the Company’s arrangement with KBSC, the Company will pay KBSC the following compensation for its services in acting as placement agent in the sale of Common Stock to LPC: (A) the Company will pay a cash fee to KBSC in an amount equal to: (i) 6% of the aggregate gross proceeds received by the Company from the initial sale of $750,000 in shares of Common Stock to LPC pursuant to the Purchase Agreement, and (ii) 3% of the aggregate gross proceeds received by the Company from additional sales of Common Stock to LPC pursuant to the Purchase Agreement; and (B) the Company will issue to KBSC the number of warrants (the “Compensation Warrants”) equal to: (i) in the case of the initial sale of $750,000 in shares of Common Stock to LPC, 6% of the aggregate number of shares sold to LPC; and (ii) in the case of additional sales of Common Stock to LPC, 3% of the aggregate gross proceeds received by the Company from such sales divided by 115% of the closing sale price of one share of Common Stock on the day prior to the respective issuance of the Compensation Warrant. The Compensation Warrants issued pursuant to clause (ii) in the preceding sentence will be based on incremental sales to LPC of $2 million in aggregate gross proceeds. Each Compensation Warrant will have an exercise price equal to 115% of the closing sale price of one share of Common Stock on the day prior to its issuance, a term of five years from the date of its issuance and will otherwise comply with the rules of FINRA.

-11-

On November 14, 2011, U.S. Geothermal Inc. entered into a bridge loan agreement between its wholly owned subsidiary USG Nevada LLC and Ares Capital Corporation. The bridge loan has monetized the Section 1603 ITC cash grant associated with the planned commercial operation of the new Phase I power plant at the San Emidio Geothermal Project, located in Washoe County, Nevada. The loan agreement provides for payment to the Company of approximately 90% of the total expected cash grant and consists of an initial funding of $7.5 million which has been received by the Company. The funds are drawn from a loan facility that includes commercial terms for the payment of interest and associated fees. Once the placed in service date has been achieved, an application will be submitted to the United States Department of the Treasury for an estimated $11 million ITC cash grant. The cash grant proceeds will be used to repay the Ares Capital bridge loan facility with the remaining balance payable to USG Nevada LLC.

On September 30, 2011, U.S. Geothermal Inc., a Delaware corporation (the “Company”), entered into an At Market Issuance Sales Agreement (the “Sales Agreement”) with McNicoll, Lewis & Vlak LLC (“MLV”), pursuant to which the Company, from time to time, may issue and sell through MLV, acting as the Company’s sales agent, shares of the Company’s common stock. The Company’s board of directors has authorized the issuance and sale of shares of the Company’s common stock under the Sales Agreement for aggregate gross sales proceeds of up to $10,000,000, subject to certain limitations based on the sales price per share, for a period of one year from the date of execution of the Sales Agreement. Pursuant to the Sales Agreement, MLV will be entitled to compensation at a fixed commission rate of the greater of (i) 3% of the gross sales price per share sold or (ii)(1) $0.03 per share sold if the sale price per share is $0.80 or greater or (2) $0.0225 per share sold if the sale price per share is less than $0.80 (but in no event shall compensation exceed 8% of gross proceeds). The Company has agreed to reimburse a portion of MLV’s expenses in connection with the offering of the Company’s common stock under the Sales Agreement. This agreement was cancelled effective May 19, 2012.

As of May 19, 2012, the Company has sold 241,989 shares of common stock pursuant to the Sales Agreement for net proceeds of approximately $126,133. Sales of shares of our common stock by our sales agent have been made in privately negotiated transactions or in any method permitted by law deemed to be an “At The Market” offering as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on the NYSE MKT LLC or sales made through a market maker other than on an exchange. Our sales agent has made all sales using commercially reasonable efforts consistent with its normal sales and trading practices on mutually agreed upon terms between our sales agent and us.

On March 7, 2011, the Company closed a direct registered placement of 5,000,000 shares of Common Stock at a price of $1.00 per share for gross proceeds of $5 million. Each investor also received a Common Stock Purchase Warrant exercisable for 50% of number of shares of Common Stock purchased. Each Warrant will entitle the holder to purchase one additional share of Common Stock for $1.075 per share. The Warrants expire March 3, 2012. The issue included a placement agent fee of 112,000 Common Shares and 56,000 Warrants plus expenses of approximately $15,000. The securities were offered by the Company pursuant to a registration statement filed with the Securities and Exchange Commission (“SEC”), which became effective on December 31, 2010. A prospectus supplement relating to the offering was filed with the SEC on February 28, 2010. After deducting for fees and expenses, the net proceeds were approximately $4.95 million. The net proceeds of the offering will be used for general working capital, including exploration, development and expansion of its geothermal properties

-12-

On February 24, 2011, the Company completed the financial closing with the U.S. Department of Energy (“DOE”) of a $96.8 -million loan guarantee to construct its planned 23-megawatt-net power plant at Neal Hot Springs in Eastern Oregon. Neal Hot Springs is the first geothermal project to complete a loan guarantee under DOE’s Title XVII loan guarantee program, which was created by the Energy Policy Act of 2005 to support the deployment of innovative clean energy technologies. The DOE loan guarantee will guarantee a loan from the U.S. Treasury’s Federal Financing Bank. The $96.8 -million Federal Financing Bank loan represents 75% of total project cost. When combined with the previously announced equity investment by Enbridge Inc., the loan provides 100% of the anticipated capital remaining to fully construct the project.

In September 2010, USG Oregon LLC (a wholly owned subsidiary) entered into agreements with Enbridge (U.S.) Inc. that formed a strategic and financial partnership to finance the Neal Hot Springs project located in eastern Oregon. A component of these agreements included a $5 million convertible promissory note. Upon conversion, the note was considered to be an equity contribution to the Company’s subsidiary. The conversion occurred automatically upon the closing of the Department of Energy (“DOE”) guaranteed project loan. The agreements also provide for additional equity contributions of $13.8 million from Enbridge that when combined with the $5 million convertible promissory note, will earn Enbridge a 20% direct ownership in the subsidiary. In the event of cost overruns for the project, and at the election of the Company, an additional payment obligation of up to $8 million was contributed by Enbridge that increased their direct ownership by 1.5 percentage points for each $1 million contributed. Added to their base 20% ownership, additional payments could increase Enbridge’s ownership to a maximum of 27.5% . An additional $6 million cost overrun facility was established by Enbridge to cover costs that resulted from unexpected poor results from injection well drilling. The additional investment by Enbridge will increase their ownership in USG Oregon LLC based on running a project financial model and determine what percentage of the forecasted project income will be allocated to Enbridge to arrive at a predetermine rate of return for the additional investment. Current estimates of the ownership assuming that all of the investment is used for drilling shows that Enbridge could own up to 44% of the subsidiary. The model will be rerun after all of the variables have been fixed which is anticipated to be in the 4th quarter of 2012 to set the final ownership ratios between the two parties.

In August 2010, USG Nevada LLC (a wholly owned subsidiary) entered into agreements with Benham Companies, LLC (subsidiary of Science Applications International Corporation) for a project loan. The project loan is expected to provide substantially all of the funding needed to construct an 8.6 net megawatt power plant for Phase I of the San Emidio project in northwest Nevada. Construction costs are estimated to be approximately $32 million and expected to be completed in October 2011. The construction loan is planned to be repaid with long term financing from available commercial sources.

-13-

On March 16, 2010, the Company closed a private placement of securities issued pursuant to a securities purchase agreement (the "Purchase Agreement") entered into with several institutional investors, pursuant to which the Company issued 8,209,519 shares of common stock at a price of $1.05 per share for gross proceeds of approximately $8.6 million (the "Private Placement"). Pursuant to the terms of the Private Placement, each investor was also issued a common share purchase warrant (a "Warrant") exercisable for 50% of the number of shares of common stock purchased by the investor. The Company paid commissions to agents in connection with the Private Placement in the amount of approximately $516,000 and issued warrants to purchase up to 246,285 shares of common stock. The net proceeds of the offering (approximately $8.0 million) will be used by the Company to further develop its Neal Hot Springs geothermal project and for general working capital purposes.

On October 30, 2009, the Company was awarded $3.77 million in Recovery Act funding for the exploration and development of its San Emidio geothermal power project using advanced geophysical exploration techniques. This award was categorized under the “Innovative Exploration and Drilling Projects” section of the American Recovery and Reinvestment Act. The project at San Emidio will apply innovative, seismic and satellite imagery techniques along with state-of-the-art structural modeling, to locate large aperture fractures that represent high-productivity geothermal drilling targets.

On August 17, 2009, the Company completed a private placement of 8,100,000 Subscription Receipts (“Receipt”) at $1.35 CDN per Receipt for aggregate gross proceeds of CDN $10,935,000. Each Receipt was exchanged on December 17, 2009 for one share of common stock of the Company and one half of one common stock purchase warrant (a "Warrant"). Each Warrant entitles the holder thereof to acquire one additional share of common stock of the Company for $1.75 for 24 months from closing. The placement agents have been paid an aggregate cash fee of CDN $656,100, representing 6% of the aggregate gross proceeds of the offering, and have been issued compensation options, exercisable for 24 months, entitling the placement agents to purchase up to 243,000 shares of common stock of the Company at $1.22. The proceeds provided funds to drill production size wells at Neal Hot Springs to increase production capacity to 22 MW and allow a 30-day flow test to verify the well reservoir capacity. Completion of drilling is a condition precedent to the funding from the DOE loan program, if our application is approved.

Material Acquisitions/Development

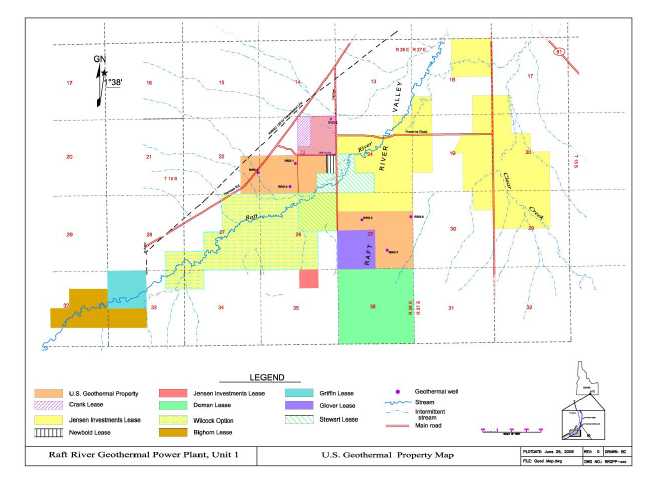

Raft River, Idaho

Raft River Energy Unit I, located in southern Idaho, is a binary cycle geothermal power plant with 13 net megawatts of installed capacity. The power plant achieved commercial operation in January 2008.

Raft River Unit I operated at 96.8% availability and generated an average of 9.3 net megawatts during the third fiscal quarter. For the 2011 calendar year, the plant averaged 7.6 net megawatts of generation with 97.3% availability.

-14-

The plant operated at reduced output during the month of March due to a mechanical problem with the production pump in well RRG-2. The potential causes are being evaluated and plans are being made to pull the pump and inspect it.

The $10.2 million Department of Energy (“DOE”) cost-shared thermal fracturing program has been delayed while a NEPA evaluation was being done to address any potential seismic issues that may result from the program. The Company’s contributions are made in-kind by the use of the RRG-9 well, well field data and monitoring support totaling $228,089. Eight solar powered seismic stations were installed in June 2010 to provide a base line of seismic data and will be used to monitor potential impacts from the test. Construction is complete on the injection pipeline that extends from the Unit 1 power plant to well RRG-9. A detailed, 3-D magnetotelluric survey was completed during the 3rd fiscal quarter of 2010.

A drill rig for the DOE program was mobilized to the Raft River site in late December and began operations on December 30. A 9 7/8” liner was installed and cemented in place in preparation for the first phase of stimulation. The well was side-tracked during operations to remove a packer in the wellbore, and a new leg was completed through the geothermal target formation. A short duration, high pressure stimulation test was performed which indicated a temporary increase in permeability. Due to funding requirements, the project was placed on stand-by pending review of the results generated to date and further funding from the DOE.

On May 16, 2011, Eugene Water and Electric Board notified the Company that the PPA for Raft River Unit II has been terminated since a Notice to Proceed had not been issued on or before the required milestone date.

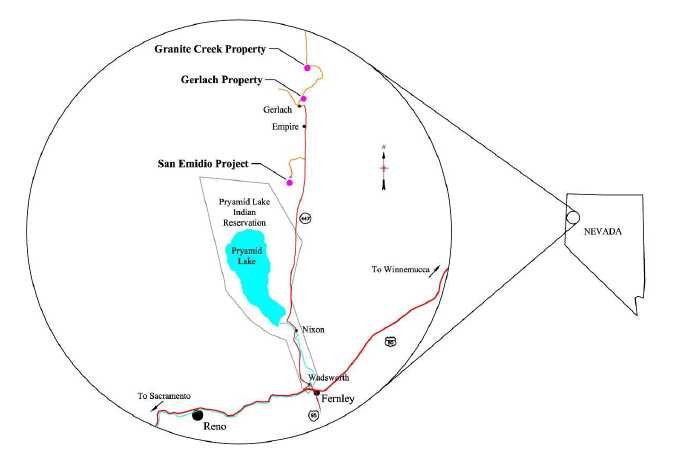

San Emidio, Nevada

The original San Emidio geothermal power plant produced power beginning in 1987 and sold electricity to Sierra Pacific Power Corporation. The original plant was shut down on December 12, 2011 and placed on operational standby in preparation for start up of the new Phase I power plant.

The San Emidio expansion is planned to take place in three phases. Phase I is a repower, and Phases II and III are planned to be expansions. Phase I utilizes the existing production and injection wells with installation of a new, more efficient 8.6 MW net power plant which achieved commercial operation on May 25, 2012. Phase II is a planned expansion within the bounds of the existing San Emidio geothermal reservoir and is subject to the successful development of additional production wells through exploration and drilling activities. Phase III is planned as a further expansion for 17.2 MW net utilizing two additional power modules similar to Phases I and II.

For Phases I and II, the Company made an application for the DOE’s 1705 loan guarantee program anticipating that 75% of the total project capital may be funded by a Department of Energy loan guarantee, with the remainder funded through equity financing. Due to funding difficulties experienced by the DOE loan guarantee program, a DOE loan guarantee is no longer available to the San Emidio project. Discussions with several senior lenders for a long term loan to take out the SAIC construction loan are ongoing.

-15-

On November 14, 2011, U.S. Geothermal Inc.’s wholly owned subsidiary USG Nevada LLC entered into a bridge loan agreement with Ares Capital Corporation. The bridge loan monetized the Section 1603 ITC cash grant associated with the new Phase I power plant at the San Emidio Geothermal Project, located in Washoe County, Nevada. The loan agreement provides for borrowing of up to 90% of the total expected cash grant and consisted of an initial funding of $7.5 million which has been received by the Company. No addition borrowings are expected at this time. The funds are drawn from a loan facility that includes commercial terms for the payment of interest and associated fees. Once the placed in service date has been achieved, an application will be submitted to the United States Department of the Treasury for an estimated $11 million ITC cash grant. The cash grant proceeds will be used to repay the Ares Capital bridge loan facility, with the remaining balance payable to USG Nevada LLC.

The Phase I repower began construction in the third calendar quarter of 2010 and was delayed in the startup due to technical issues related to the new plant. The Phase II expansion began construction in the second calendar quarter of 2011 with commercial operations originally anticipated to commence in the fourth calendar quarter of 2013. Given the delay in getting Phase I online we are not able to accurately determine when Phase II will be completed. The Company expects to utilize the cash grant in lieu of the Investment Tax Credit in connection with both the repower and the Phase II expansion. The Phase II expansion is still dependent on successful development of additional production well capacity.

The capital cost of the Phase I repower is estimated at approximately $32 million, with Phase II at approximately $50 million and Phase III approximately $100 million. We expect that 75% of the Phase I and Phase II development may be funded by project loans, with the remainder funded through equity financing.

Phase I achieved mechanical completion in December 2011 and commercial operation on May 25, 2012. Commissioning was extended due to a series of mechanical issues that include defective capacitors, the mechanical failure of the 2,500 horsepower process pump, and excessive vibration in the turbine gear box. Performance testing of the power plant began in early May. The EPC contractor is providing its services under a fixed price contract that includes financial guarantees for the original completion date and power output of the plant.

Phase II began development in the second calendar quarter of 2010 with commercial operations, subject to successful production well development and timing related to financing availability for the construction of the plant, originally anticipated to commence in the fourth calendar quarter of 2013. The Company anticipated that the project would be granted approximately $16 million for Phase II in ITC cash grant in lieu of PTC in connection with the estimated $50 million of capital cost for Phase II development. There is uncertainty at this time if financing will be available to construct the Phase II plant in time to qualify for a startup prior to the end of 2013.

On June 1, 2011, an amended and restated PPA was signed with Sierra Pacific Power Company d/b/a NV Energy for the sale of up to 19.9 megawatts of electricity on an annual average basis. The PPA has a 25 year term with a base price of $89.75 per megawatt-hour, and a 1 percent annual escalation rate. The electrical output from both Phase I and Phase II will be sold under the terms of the amended and restated PPA. The PPA was approved by the Public Utility Commission of Nevada on December 27, 2011.

-16-

The Company entered into agreements with Science Applications International Corporation (“SAIC”) for a project loan and an engineering procurement and construction contract for the San Emidio Phase I power plant. SAIC’s design-build subsidiary, SAIC Energy, Environment & Infrastructure LLC, is executing the construction of an 8.6 net megawatt power plant at San Emidio, Nevada. TAS Energy of Houston, Texas will supply a modular power plant to the project. The financing agreement calls for the contractor to provide a non-recourse project loan for the estimated $32 million dollar project. The construction loan is expected to be repaid with a long term project loan.

Two System Feasibility Studies were initiated in July 2008 with Sierra Pacific Power Company to begin the FERC mandated transmission study process for the development of the San Emidio resource. The studies examined two levels of power generation; 15 megawatts and 45 megawatts, several transmission routes and the cost associated with each level of generation. The 15 megawatt study, which was directed at providing transmission for the Phase I and Phase II plants, completed the study process and resulted in an increase of available transmission to 16 megawatts. A Small Generator Interconnection Agreement for 16 megawatts of transmission capacity was executed with Sierra Pacific Power Company on December 28, 2010. An additional System Impact Study was initiated on September 8, 2011 for an additional 3.9 megawatts of transmission to increase the transmission capacity to match the maximum limit of the new PPA. The 3.9 megawatt System Impact Study was completed in April and is being reviewed by the Company.

The 45 megawatt study, which was directed toward the full build out of San Emidio with the addition of the 17.2 megawatt Phase III project, completed the second phase System Impact Study in April. A draft Interconnection Facilities Study, the third and final study, was received on November 22, 2010. The remainder of the 45 megawatt study has been put on hold pending further exploration of the project.

On October 30, 2009, the Company was awarded $3.77 million in Recovery Act funding for the exploration and development of its San Emidio geothermal power project using advanced geophysical exploration techniques. This award was categorized under the “Innovative Exploration and Drilling Projects” section of the American Recovery and Reinvestment Act. The project at San Emidio has applied innovative, seismic and satellite imagery techniques along with state-of-the-art structural modeling, to locate large aperture fractures that represent high-productivity geothermal drilling targets. Two zones along the 4.5 mile long San Emidio fault structure were identified as high quality targets for drilling during the first phase of the DOE program.

The second stage of the DOE program is a cost shared drilling plan that follows up on the targets identified in the first stage. In order to meet construction targets for Phase II plant construction, the drilling stage of the program commenced prior to DOE approval, and two observation/temperature gradient wells were completed by the Company. The proposed drilling program was approved by the DOE in early November 2011. One of the first two wells was deepened and three additional wells have been completed in the South Resource Area under the 50-50 cost share grant.

-17-

Three of the five wells exhibit commercial permeability and temperature with well OW-10 producing a flowing temperature of 302°F, well OW-9 exhibited a flowing temperature of 280°F and well OW-6 with a flowing temperature of 279°F. Well OW-9 also has a zone of high permeability at 1,830’ deep, which was put behind casing during drilling operations that has a measured static temperature of 294°F. Additional drilling operations would be required to test this zone. Well OW-8 encountered 320°F fluid, but did not produce commercial quantities during flow testing. The last well drilled, 45A-21, has just been completed and will undergo testing after a heat up period. The North Resource Area has an additional five observation/temperature gradient wells and one production well planned.

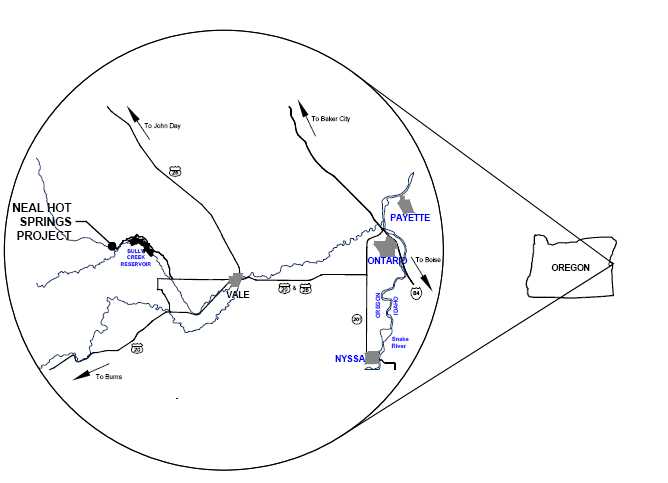

Neal Hot Springs, Oregon

Neal Hot Springs is a commercial geothermal resource located in Eastern Oregon that has a planned 23 megawatt power plant under construction.

On February 26, 2009 U.S. Geothermal submitted a loan application for the Neal Hot Springs project to the DOE’s Energy Efficiency, Renewable Energy and Advanced Transmission and Distribution Solicitation loan guarantee program under Title XVII of the Energy Policy Act of 2005. The financial closing for the DOE loan guarantee took place on February 23, 2011 which secured a $96.8 million loan guarantee from the Department of Energy and a direct loan from the U.S. Treasury’s Federal Financing Bank. The $96.8 million loan represents 67% of the total project cost which is now estimated to be $143.6 million for the project, a $14.6 million increase. The DOE loan is a combined construction and 22 year term loan. The interest rate on the loan is set at 37.5 basis points over the current average yield on outstanding marketable obligations of the United States of comparable maturity as determined on each date that a draw is made on the loan. As of May 31, 2012, eight monthly draws totaling $64.16 million have been taken on the DOE loan, which have a combined annual interest rate of 2.654% .

Over the course of the ongoing construction, the budget was increased by $14.6 million in equity contributions by the partners. The first increase was for $7.0 million to cover additional drilling costs and modifications in plant controls and the cooling mechanism. Enbridge Inc. of Canada, our partner at Neal Hot Springs, provided the additional investment in exchange for increased ownership interest in the project from 20% to approximately 27%. The project already has 100% of the required production capacity and about 60% of the required injection capacity proven. Certain wells were drilled into deep injection zones but two of these wells do not have satisfactory capacity; therefore, a second increase of $6 million has been established for an extended drilling program, about to be initiated, that is engineered to provide the required 40% capacity. Depending on the amounts contributed by each partner, this cash call may result in further adjustments in the ownership of the project.

Notice to proceed was issued to both the EPC contractor (Industrial Builders Inc.) and equipment supplier (TAS Energy) on February 24, 2011. Detailed design and construction of the supercritical cycle power plant utilizing significantly improved technology is currently in progress. The new plant, which will consist of three separate power modules, is designed to deliver approximately 23 megawatts of power net to the grid. The first module is scheduled to begin commercial operations during the third calendar quarter of 2012 and the full plant is scheduled to be completed late in the 3rd quarter 2012. As of May 31, construction of the total project is estimated to be 90 percent complete with about 65% of the DOE loan already drawn.

-18-

The EPC contractor has continued site construction work and the equipment supplier commenced equipment delivery. On May 27, the Company was notified by the EPC contractor that mechanical completion was achieved. All of the air cooled condensers for the three units have been installed and all major components are on site for Unit 2. Unit 2 mechanical completion is scheduled for June 7 and Unit 3 mechanical completion for by the end of June. Production and injection pipelines are being completed and insulation installed. Four production pumps have been installed and are ready to supply fluid to the power plant.

After the long term flow test that was completed in January 2011, a reservoir model was completed on March 24, 2011 by the Company’s consulting reservoir engineer, and after review, the DOE independent reservoir engineer issued a reservoir certificate on March 31, 2011. The final reservoir report and certificate confirmed that the reservoir was able to sustain the production necessary for the planned 23 megawatt project from the existing four production wells. An injection plan was developed as part of the plan, and drilling operations resumed in April 2011 to complete the injection well field for the project.

Four large diameter injection wells (NHS-3, NHS-9, NHS-12, and NHS-13) and three slim hole injectors (NHS-10, T/G 16b and T/G 3) have been completed and provide an estimated 70 percent of the capacity needed. NHS-4 and NHS-11, both planned as deep injectors, did not find the capacity needed. Three additional injection wells (two shallow ones and one deep injector) have been planned with drilling expected to be initiated during the first week of June. Once the Unit 1 power plant has achieved substantial completion and is operating continuously, reservoir and tracer testing will be started to complete the numerical reservoir model for the project.

The Company received the Conditional Use Permit from the Malheur County Planning Commission for construction of its proposed 23 net megawatt power plant at Neal Hot Springs in eastern Oregon. The Conditional Use Permit received unanimous approval at a September 24, 2009 Planning Commission meeting and was issued on October 28, 2009. All of the Federal Energy Regulatory Commission (“FERC”) mandated transmission studies have been completed by Idaho Power Company. An interconnection agreement was signed with the Idaho Power Company in February 2009. As of the end of the quarter, Idaho Power has completed the transmission line and substation, and it is ready to accept power delivery.

The Power Purchase Agreement (“PPA”) for the project was signed on December 11, 2009 with the Idaho Power Company. The PPA has a 25 year term with a starting price of $96.00 per megawatt-hour and escalates at a variable percentage annually. On May 20, 2010, the Idaho Public Utilities Commission approved the PPA with no changes to the terms and conditions.

-19-

Gerlach Joint Venture

The Gerlach Joint Venture, located adjacent to the town of Gerlach in Washoe County, Nevada is made up of both private and BLM geothermal leases. The Peregrine well, a historic exploration slim hole that encountered a lost circulation zone at a depth of 975 feet, was redrilled and the hole was opened from a 6.5 inch diameter well to a 12.5 inch diameter well. Lost circulation was confirmed with three zones through the 900 to 1,024 foot interval. The well was stopped at 1,070 feet total depth. Temperature surveys and a short clean out flow test were conducted on the well. The well flowed at an estimated 300-400 gallons per minute and the flowing temperature was 208°F. Geochemistry indicates an average potential source temperature of 374°F for the Gerlach site.

Drilling commenced on observation well 18-10a on October 30. The upper section of the well was drilled to 826 feet deep and an 8 inch liner was cemented in place. The well was secured and the drill rig was moved back to San Emidio. Temperature measurements in the well have provided the highest measured temperature in the field to date at 268°F within 160’ of surface and a temperature gradient of 6.4°F per 100’ in the bottom section of the hole. There are two previously identified lost circulation targets at 1,600’ and 2,800’ deep that will be targeted when drilling is resumed.

Drilling resumed on well 18-10a on April 14 and was stopped on April 18 at 1,943 feet deep. Circulation was lost in minor zones at 1,530 and 1,595 feet deep. Subsequent temperature surveys indicate an isothermal temperature profile at 241°F which may indicate that higher temperature fluid does not occur below the 18-10a well site.

Granite Creek, Nevada

The Granite Creek assets are located about 6 miles north of Gerlach, Nevada along a geologic structure known to host geothermal features including the Great Boiling Spring and the Fly Ranch Geyser. A first stage gravity geophysical program was completed in the third quarter of 2008 and will be used to evaluate the resource potential, and help determine where to drill temperature-gradient exploration wells.

After a detailed review of the geologic setting, the lease position at Granite Creek was reduced to 2,443.7 acres (3.8 square miles). One full lease and portions of the two remaining leases were relinquished to the Bureau of Land Management.

Republic of Guatemala

A geothermal energy rights concession located 14 kilometers southwest of Guatemala City was awarded to U.S. Geothermal Guatemala S.A., a wholly owned subsidiary of the Company in April. The concession contains 24,710 acres (100 square kilometers) in the center of the Aqua and Pacaya twin volcano complex.

-20-

The concession contains the El Ceibillo geothermal project which has nine existing geothermal wells that were drilled in the l990s and have depths ranging from 560 to 2,000 feet (170 to 610 meters). Six of the wells have measured reservoir temperatures in the range of 365°F to 400°F and have high conductive gradients that indicate rapidly increasing temperature with depth. Fluid samples and mineralization from the wells indicate the existence of a high permeability reservoir below the existing well field.

An office and staff are located in Guatemala City and planning is underway to advance the project with initial work focused on negotiating necessary surface and access rights, a power sales agreement with the local utility company, strategic investors, and potential project lenders. Follow up work will include a detailed geophysical program, geologic mapping, sampling of hot springs, and to redrill one or two of the existing wells to test for deep, high temperature permeability. Discussions and planning are underway for the development of a power purchase agreement. Also, discussions are taking place with several interested parties for the potential sale of a minority equity interest in the El Ceibillo project to a qualified local partner.

| Projects in Operation | ||||||||||

| Generating | ||||||||||

| Capacity | Contract | |||||||||

| Project | Location | Ownership | (megawatts)(1) | Power Purchaser | Expiration | |||||

Raft River (Unit I) |

Idaho |

JV(2) |

13.0 |

Idaho Power Company |

2032 | |||||

| San Emidio (New Phase I) |

Nevada |

100% |

8.6 |

Sierra Pacific Power Corp. |

2038 | |||||

| (1) |

Based on the designed annual average net output. The actual output of the Raft River Unit I plant currently varies between 7.1 and 10.0 megawatts and output of the recently decommissioned San Emidio plant was approximately 2.6 megawatts. |

| (2) |

As part of the financing package for Unit I of the Raft River project, we have contributed $16.5 million in cash and approximately $1.5 million in property to Raft River Energy I LLC, the Unit I project joint venture company. Raft River I Holdings, LLC, a subsidiary of The Goldman Sachs Group, contributed $34 million to finance the construction of the project. Additional investment may be required for Unit I to operate at design capacity. |

| Projects Under Development | ||||||

| Estimated | ||||||

| Target | Projected | Capital | ||||

| Development | Commercial | Required | ||||

| Project | Location | Ownership | (Megawatts) | Operation Date | ($million) | Power Purchaser |

| San Emidio Phase II (Expansion) |

Nevada |

100% |

8.6 |

TBD (3) |

$50 |

NV Energy |

| San Emidio Phase III | Nevada | 100% | 17.2 | TBD (3) | $100 | TBD |

| Neal Hot Springs I | Oregon | JV(1) | 23 | 3rd Quarter 2012 | $143 | Idaho Power |

| Neal Hot Springs II | Oregon | 100% | 28 | TBD | TBD | TBD |

| El Ceibillo | Guatemala | 100% | 25 | 1st Quarter 2015 | $118 | TBD |

| Raft River I (Repower) | Idaho | JV(2) | 3 | TBD | $8 | Idaho Power |

| Raft River (Unit II) | Idaho | 100% | 26 | TBD | $134 | TBD |

| Raft River (Unit III) | Idaho | 100% | 32 | TBD | $166 | TBD |

| (1) |

In September 2010, the Company’s wholly owned subsidiary (Oregon USG Holdings LLC) entered into agreements that formulated a strategic partnership with Enbridge (U.S.) Inc. (“Enbridge”) may provide up to $23.8 million in funds for the Neal Hot Springs geothermal project. After the planned debt conversion and additional contribution in April and August of 2011, Enbridge has contributed $18.8 million which they have received a 20% ownership interest in the project. |

| (2) |

As part of the financing package for Unit I of the Raft River project, we have contributed $16.5 million in cash and approximately $1.5 million in property to Raft River Energy I LLC, the Unit I project joint venture company. Raft River I Holdings, LLC, a subsidiary of The Goldman Sachs Group, contributed $34 million to finance the construction of the project. |

| (3) |

Due to the delays experienced with bringing San Emidio Phase I on line, development dates for Phase II and Phase III at San Emidio have been effected and will be determined after Phase I has reached final completion. |

-21-

| Additional Properties | ||||||

| Project | Location | Ownership | Target Development (Megawatts) | |||

| Gerlach | Nevada | 60% | To be determined | |||

| Granite Creek | Nevada | 100% | To be determined | |||

| Resource Details | ||||||||||

| Resource | ||||||||||

| Property Size | Temperature | Potential | ||||||||

| Property | (square miles) | (°F) | (Megawatts) | Depth (Ft) | Technology | |||||

| Raft River | 10.8(1) | 275-302 (2) | 127.0(1) | 4,500-6,000 | Binary | |||||

| San Emidio | 35.8 | 289-305 (2) | 64.0(4) | 1,500-2,000 | Binary | |||||

| Neal Hot Springs | 9.6 | 311-347 (3) | 50.0(5) | 2,500-3,000 | Binary | |||||

| Gerlach | 5.6 | 338-352 (3) | 18.0 | TBD | Binary | |||||

| Granite Creek | 8.5 | TBD | TBD | TBD | Binary | |||||

| El Ceibillo | 38.6 | 410-446 (3) | 25.0(6) | TBD | Steam | |||||

| (1) |

A third party’s assessment of 94 megawatts was based on 6.0 square miles. The Company acquired additional acreage. The resource estimate of 127.0 megawatts was provided by Geothermex. |

| (2) |

Actual production temperatures for existing wells. |

| (3) |

Probable reservoir temperature as measured with a geothermometer. |

| (4) |

An estimate by Black Mountain Technology of 44.0 megawatts. |

| (5) |

A third party resource estimate with respect to 23.0 megawatts, remainder is an internal estimate. |

| (6) |

Internal estimate. |

Employees

At March 31, 2012, the Company had 42 full-time and one part time employee (14 administrative and project development, and 28 field and plant operations). The Company continuously considers acquisition opportunities, and if the Company is successful in making acquisitions, additional management and administrative staff may be added.

The Company did not experience any labor disputes or labor stoppages during the current fiscal year.

Principal Products

The principal product is based upon activities related to the production of electrical power from the utilization of the Company’s geothermal resources. The primary product will be the direct sale of power generated by our interests in our geothermal power plants. Currently, our principal revenues consist of energy sales, energy credit sales, management fees and lease income. All power plants currently under exploration or development are sites located in the Western Region of the United States of America. The Company was granted a geothermal energy rights concession in the Republic of Guatemala located in Central America in April of 2010. Development options are currently being explored to determine how to maximize this opportunity.

-22-

Sources and Availability of Raw Materials

Geothermal energy is natural heat energy stored within the Earth’s crust at economically accessible depth. In some areas of the Earth, economic concentrations of heat energy result from a combination of geological conditions that allow water to penetrate into hot rocks at depth, become heated, and then circulate to a near surface environment. In these settings, commercially viable extraction of the geothermal energy and its conversion to electricity become possible and a “geothermal resource” is present.

There are four major components (or factors) to a geothermal resource:

| 1. |

Heat source and temperature – The economic viability of a geothermal resource is related to the amount of heat generated. The higher the temperature, the more valuable the geothermal resource. | |

| 2. |

Fluid – A geothermal resource is commercially viable only when the system contains water and/or steam as a medium to transfer the heat energy to the surface. | |

| 3. |

Permeability – The fluid present underground must be able to move. In general, significant porosity and permeability within the rock formation are needed to create a viable reservoir. | |

| 4. |

Depth – The cost of development increases with depth, as do resource temperatures. The proximity of the reservoir to the surface is therefore a key factor in the economic valuation of a geothermal resource. |

Electrical power is directly produced through the utilization of geothermal resources; however, these resources are not a direct component of the final product.

The reservoir located in Raft River, Idaho is a proven geothermal resource, and has a 13 net MW capacity geothermal power plant in operation (Raft River Energy I LLC). San Emidio, Nevada is a proven geothermal resource, and has a 3.6 net MW capacity geothermal plant in operation. Based upon the tests of the completed wells and other studies, the reservoir in Neal Hot Springs Oregon has been established as a commercial geothermal resource. Unless major geological changes occur that impact the geothermal reservoirs, the condition of the existing resources is expected to remain consistent over time.

Significant Patents, Licenses, Permits, Etc.

Raft River. Five significant permits are in place for the Raft River project and are necessary for continued operations:

| 1. |

Geothermal well permits for production and injection wells issued by the Idaho Department of Water Resources. | |

| 2. |

A Conditional Use Permit for the first two power plants was issued by the Cassia County Planning and Zoning Commission on April 21, 2005. | |

| 3. |

The Idaho Department of Environmental Quality issued the Air Quality Permit to Construct on May 26, 2006. |

-23-

| 4. |

A Wastewater Reuse Permit issued by the Idaho Department of Environmental Quality on February 23, 2007. |

San Emidio. The San Emidio project has five significant permits in place necessary for continued operations:

| 1. |

Geothermal well permits for production and injection wells issued by the Nevada Division of Minerals. | |

| 2. |

A Special Use Permit issued by the Washoe County Board of Commissioners on July 1, 1987. | |

| 3. |

An Air Quality Permit to Operate from Washoe County renewed on January 1, 2008. | |

| 4. |

A Surface Discharge Permit from Nevada Division of Environmental Protection issued on June 11, 2001. | |

| 5. |

An Underground Injection Permit from Nevada Division of Environmental Protection issued on August 18, 2000. |

Neal Hot Springs. The Neal Hot Springs project has received all necessary permits for construction and operation of a 22 MW power plant.

Agency |

Approval Status |

Effective Date |

Approval Number or Designation |

| ODEQ (Oregon Department of Environmental Quality) (Underground Injection Control Permit) |

Approved |

3/29/2010 |

13281-8 |

| ODWR (Oregon Department of Water Resources) (Water Right) |

Approved |

3/13/2008 |

LL-1103 |

| ODEQ (WPCF-1200 C; Storm Water Discharge Permit) |

Approved |

10/12/2010 |

ORR10-C818 |

| US Fish and Wildlife Service (Endangered Species Act Consultation) |

Completed |

7/30/2009 |

13420-2009-TA- 0134 |

| Bureau of Land Management (Drilling Permit) |

Approved |

12/07/2009 |

OR-66192 |

| Bureau of Land Management (Right-of-Way) |

Approved |

1/12/2010 |

OR-65701 |

| Bureau of Land Management (NEPA/Environmental Assessment) |

Completed |

9/14/2009 |

DOI-BLM-OR- V040-2009-030- EA |

| Oregon Department of Geology and Mineral Industries (Well Drilling Permits) |

Approved |

2/11/2008 through 10/7/2010 |

DOGAMI Well ID-184 through 193 |

| Malheur County (Conditional Use Permit) |

Approved |

8/13/2009 |

10/21/2009 |

| Malheur County (Road Crossing Permit) |

Approved |

3/5/2008 |

08-10 |

| Idaho PUC Approval regarding the PPA | Approved |

5/20/2010 |

Final Order #31087 |

-24-

Seasonality of Business

The Company and its major subsidiary (RREI) have been producing energy revenues under the terms of two PPAs. These contracts specify favorable rate periods and levels of production. The San Emidio Nevada plant’s contractual terms provide for premium rates in the months from September to April. The RREI contract pays favorable rates in the months of July/August and November/December. Energy production can be influenced by the seasonal temperatures. Generally, the Company’s binary geothermal plants can operate more efficiently in cooler temperatures. Cooler temperatures facilitate the cooling process of the secondary fluid that is used to power the turbines. Drilling and other construction activities could be negatively impacted by inclement weather that can occur, primarily, during the winter months.

Industry Practices/Needs for Working Capital

The Company is heavily involved in development operations; therefore high levels of working capital are committed, either directly or indirectly to the construction efforts. After a plant becomes commercially operational, the needs of working capital are expected to be low. The Company is expecting to be significantly involved in development activities for the next 5 to 10 years.

Dependence on Few a Customers

Ultimately, the market for electrical power is vast; however, the numbers of entities that can physically, logistically and economically purchase the commodity in large quantities in our area of operations are limited. The Company’s primary revenues originate from energy sales and the sale of energy credits. Currently, the Company generates energy revenues from two sources and energy credits from two separate sources. Energy sales are collected from the Idaho Power Company (through the Company’s major subsidiary Raft River Energy Unit I) and Sierra Pacific Power Company. The Company expects to sell power to Idaho Power Company for energy produced at the Neal Hot Springs, Oregon plant. Energy credits are currently being sold to Holy Cross Energy and Barrick Goldstrike Mines Inc. Even at planned levels of operation, it is expected that the Company and its interests will have a small number of direct customers that may amount to less than 8 or 9 within the next 5 to 10 years.

Competitive Conditions

Although the market for different forms of energy is large and dominated by very powerful players, we perceive our industrial competition to be independent power producers and in particular those producers who provide “green” renewable power. Our definition of green power is electricity derived from a source that does not pollute the air, water or earth. Sources of green power, in addition to geothermal, include wind, solar, biomass and run-of-the river hydroelectric. A number of states have instituted renewable portfolio standards (“RPS”) that require utilities to purchase a minimum percentage of their power from renewable sources. For example, RPS statutes in California and Nevada require 20% renewable. On November 17, 2008, the Governor of California signed executive order which mandated a RPS of 33% by 2020 which sits in addition to the 20% order. According to the Department of Energy’s Energy Efficiency and Renewable Energy department, utilities in 34 states nationwide are providing their customers with the opportunity to purchase green, renewable power through premium pricing programs. As a result, we believe green power is an important sub-market in the broader electric market, in which many power purchasers are increasing or committing to increase their investments. Accordingly, the conventional energy producers do not provide direct competition.

-25-

In the Pacific Northwest there is currently only one geothermal facility (Raft River Energy Unit I). There are a number of wind farms, as well as biomass and run-of-the river hydroelectric facilities. However, the Company believes that the combination of greater reliability and baseload generation from geothermal, access to infrastructure for deliverability, and a low "full life" cost will allow it to successfully compete for long term power purchase agreements.

Factors that can influence the overall market for our product include some of the following:

- number of market participants buying and selling electricity;

- availability and cost of transmission;

- amount of electricity normally available in the market;

- fluctuations in electricity supply due to planned and unplanned outages of competitors’ generators;

- fluctuations in electricity demand due to weather and other factors;

- cost of fuel used by generators, which could be impacted by efficiency of generation technology and fluctuations in fuel supply;

- environmental regulations that impact us and our competitors;

- availability of production tax credits and other benefits allowed by tax law;

- relative ease or difficulty of developing and constructing new facilities; and

- credit worthiness and risk associated with buyers.

Environmental Compliance

The Raft River project is in compliance with all environmental permits and water quality monitoring requirements. The most significant investment in environmental compliance in terms of time and cost was associated with water quality monitoring which had been required on a weekly basis. The Company’s second petition to the Idaho Department of Water Resources (IDWR) to reduce the monitoring obligations was accepted. IDWR has concurred that there is no impact from the Company’s operations on adjacent aquifers.

Since operations have been initiated, key environmental reports include:

| 1) |

Monthly production and injection reports which are filed with the IDWR; | |

| 2) |

Quarterly ground water monitoring reports which are filed with IDWR; | |

| 3) |

Annual land application and blowdown water quality reports filed with the Idaho Department of Environmental Quality. | |

| 4) |

Annual Tier II reporting filed with the Idaho Bureau of Homeland Security, Local Emergency Planning Committee, and the local fire department. |

-26-

The Raft River project is ideally suited in a rural agricultural area. The nearest full time resident is located over one mile south of the plant. The nearest part time resident is located approximately one half mile north of the plant. Additionally, there are no unique plant or animal communities in the area and no unique cultural or environmental constraints.

Financial Information about Geographic Areas

As described in detail in the Property section, the Company’s interest in the Raft River Unit I power plant, located in the southeastern part of the State of Idaho, became operational on January 3, 2008. Similar plants are in the planning stages at the same location as well as locations in Nevada and Oregon. The Company acquired a 3.6 MW geothermal plant and geothermal rights in San Emidio, Nevada. Land acquisitions and rights have been obtained to explore the development and construction of power plants in the southeastern part of the State of Oregon. Substantial drilling and testing activities have occurred during the last fiscal year. In April of 2010, the Company was granted a geothermal energy rights concession in the Republic of Guatemala located in Central America. Significant project strategies have just begun.

The Company’s operating revenues for the three most recent fiscal years ended March 31, 2012 and 2011 were $5,894,113 and $3,253,545; respectively. All of these revenues were attributable to customers in the Northwest of the United States.

Available Information