Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - LianDi Clean Technology Inc. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - LianDi Clean Technology Inc. | v318018_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - LianDi Clean Technology Inc. | v318018_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - LianDi Clean Technology Inc. | v318018_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - LianDi Clean Technology Inc. | v318018_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

| For the Fiscal Year Ended March 31, 2012 | ||

| OR | ||

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

| For the transition period from _____ to __________ |

COMMISSION FILE NO. 000-52235

LIANDI CLEAN TECHNOLOGY INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 75-2834498 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

4th Floor, Tower B, Wanliuxingui Building,

No. 28 Wanquanzhuang Road,

Haidian District, Beijing, China, 100089

(Address of principal executive offices)

+86-10-5872-0171

(Issuer’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12 (B) OF THE ACT: None.

| Title of Each Class | Name of Exchange On which Registered | |

SECURITIES REGISTERED PURSUANT TO SECTION 12 (G) OF THE ACT:

| Common Stock, par value $0.001 per share |

| (Title of class) |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a “smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the 7,709,547 shares of common equity stock held by non-affiliates of the Registrant was approximately $16,267,144 on the last business day of the Registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $2.11 per share, as reported on the OTC Bulletin Board.

The number of shares outstanding of the Registrant’s common stock, $0.001 par value as of July 12, 2012 was 36,444,850.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| PART I | 2 | |

| ITEM 1 | BUSINESS | 2 |

| ITEM 1A. | RISK FACTORS | 22 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 35 |

| ITEM 2 | PROPERTIES | 35 |

| ITEM 3 | LEGAL PROCEEDINGS | 36 |

| ITEM 4 | MINE SAFETY DISCLOSURES | 36 |

| PART II. | 36 | |

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 36 |

| ITEM 6 | SELECTED FINANCIAL DATA | 37 |

| ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 38 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 63 |

| ITEM 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 64 |

| ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTS ON ACCOUNTING AND FINANCIAL DISCLOSURES | 64 |

| ITEM 9A. | CONTROLS AND PROCEDURES | 64 |

| ITEM 9B. | OTHER INFORMATION | 66 |

| PART III. | 66 | |

| ITEM 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 66 |

| ITEM 11 | EXECUTIVE COMPENSATION | 69 |

| ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 72 |

| ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 73 |

| ITEM 14 | PRINCIPAL ACCOUNTANT FEE AND SERVICES | 73 |

| PART IV. | 75 | |

| ITEM 15 | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 75 |

| i |

INTRODUCTORY NOTE

Except as otherwise indicated by the context, references in this Annual Report on Form 10-K (this “Form 10-K”) to the “Company,” “LianDi,” “we,” “us” or “our” are references to the combined business of LianDi Clean Technology Inc. and its consolidated subsidiaries. References to “China LianDi” are references to our wholly-owned subsidiary, China LianDi Clean Technology Engineering Ltd.; references to “Hua Shen HK” are references to our wholly-owned subsidiary, Hua Shen Trading (International) Ltd.; references to “PEL HK” are to our wholly-owned subsidiary, Petrochemical Engineering Ltd.; references to “Bright Flow” are references to our wholly-owned subsidiary, Bright Flow Control Ltd.; references to “Hongteng HK” are references to our wholly-owned subsidiary, Hongteng Technology Limited.; references to “Beijing JianXin” are references to our wholly-owned subsidiary, Beijing JianXin Petrochemical Engineering Ltd.; references to “Beijing Hongteng” are references to our wholly-owned subsidiary, Beijing Hongteng Weitong Technology Co., Ltd.; and references to “Anhui Jucheng” are references to our equity method affiliate, Anhui Jucheng Fine Chemicals Co., Ltd. References to “China” or “PRC” are references to the People’s Republic of China. References to “RMB” are references to Renminbi, the legal currency of China, and all references to “$” and dollar are references to the U.S. dollar, the legal currency of the United States.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements and information relating to LianDi Clean Technology Inc. that are based on the beliefs of our management as well as assumptions made by and information currently available to us. Such statements should not be unduly relied upon. When used in this report, forward-looking statements include, but are not limited to, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as well as statements regarding new and existing products, technologies and opportunities, statements regarding market and industry segment growth and demand and acceptance of new and existing products, any projections of sales, earnings, revenue, margins or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements regarding future economic conditions or performance, uncertainties related to conducting business in China, any statements of belief or intention, and any statements or assumptions underlying any of the foregoing. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions. There are important factors that could cause actual results to vary materially from those described in this report as anticipated, estimated or expected, including, but not limited to: competition in the industry in which we operate and the impact of such competition on pricing, revenues and margins, volatility in the securities market due to the general economic downturn; Securities and Exchange Commission (the “SEC”) regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future. Depending on the market for our stock and other conditional tests, a specific safe harbor under the Private Securities Litigation Reform Act of 1995 may be available. Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

PART I

| ITEM 1 | BUSINESS |

Company Background

We are a holding company that provides downstream flow equipment and engineering services to China’s leading petroleum and petrochemical companies. Prior to the consummation of the share exchange transaction described below, we were a shell company with nominal operations and nominal assets. Our wholly-owned subsidiary, China LianDi, was established in July 2004 to serve the largest Chinese petroleum and petrochemical companies. Through our operating subsidiaries, which are Hua Shen HK, PEL HK, Bright Flow, Hongteng HK, Beijing JianXin and Beijing Hongteng, we: (i) distribute a wide range of petroleum and petrochemical valves and equipment, including unheading units for the delayed coking process, as well as provide associated value-added technical services; (ii) provide systems integration services; (iii) develop and market proprietary optimization software; and (iv) distribute and lease oil sludge cleaning equipment and provide oil sludge cleaning services, which we expect to be launched in fiscal 2013. We are also engaged in manufacturing and selling of industrial chemical products through our equity method affiliate, Anhui Jucheng. Our products and services are provided both bundled or individually, depending on the needs of the customer.

Our objectives are to enhance the reputation of our brand, continue our growth and strengthen our position in production automation and process optimization, as well as clean and advanced technology for the petroleum and petrochemical industry in China. In the next three years, we intend to expand the range of the industrial equipment to be delivered to our customers, which we expect will expand our ability to bid for a broader range of projects while meeting more of our customers’ needs. We intend to strengthen our optimization software for the efficiency and safety of the production and management processes for petroleum and petrochemical companies, enhancing its function and reliability. We also intend to expand and further develop our long-term relationships with our customers, helping them reduce their production costs and increase the efficiency and safety of their facilities.

| 2 |

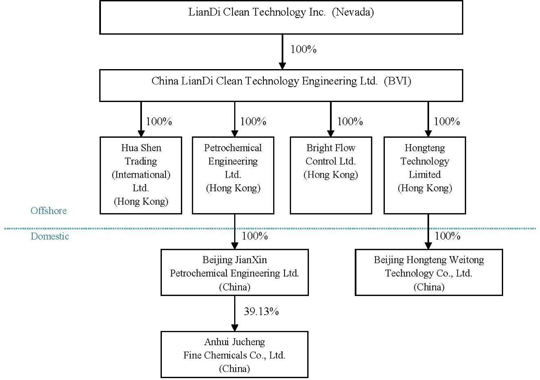

Corporate Structure

Our current corporate structure is set forth below:

Our Operating Subsidiaries and Equity Method Affiliate

Hua Shen HK is a company organized under the laws of Hong Kong Special Administrative Region of the PRC and was incorporated in 1999. Beginning in 2005, Hua Shen HK started to distribute industrial equipment for the petroleum and petrochemical industry in China. Currently, Hua Shen HK is a qualified supplier for China Petroleum & Chemical Corporation, China National Petroleum Corporation, China National Offshore Oil Corporation, SinoChem Corporation and ChemChina Group Corporation.

| 3 |

PEL HK was established in Hong Kong under the laws of Hong Kong Special Administrative Region of the PRC in 2007. This company primarily distributes petroleum and petrochemical equipment and provides related technical services. Currently, PEL HK is a qualified supplier for China National Petroleum Corporation, China National Offshore Oil Corporation, SinoChem Corporation, ChemChina Group Corporation and China Shenhua Energy Company Limited.

Bright Flow was established in Hong Kong under the laws of Hong Kong Special Administrative Region of the PRC in 2007. This company is mainly engaged in the distribution of petrochemical equipment.

Hongteng HK was established in Hong Kong under the laws of Hong Kong Special Administrative Region of the PRC in 2009. In December 2010, we acquired a 100% interest in Hongteng HK (including its wholly-owned subsidiary, Beijing Hongteng) from Mr. Jianzhong Zuo, our Chief Executive Officer, President and Chairman.

Beijing JianXin was incorporated in Beijing, PRC in May 2008, and is a wholly-owned subsidiary of PEL HK. Beijing JianXin is primarily engaged in distributing industrial oil and gas equipment and providing related technical and engineering services, developing and marketing optimization software and providing clean technology solutions for the delayed coking industry.

Beijing Hongteng was incorporated in Beijing, PRC in January 2010, and is a wholly-owned subsidiary of Hongteng HK. Beijing Hongteng is primarily engaged in delivering industrial equipment with the related integration and technical services, developing and marketing software, and providing other technical consultancy services for petrochemical, petroleum and other energy companies in the production safety management field, including distributing and leasing of oil sludge cleaning equipment and providing oil sludge cleaning services, which we expect to be launched in fiscal 2013.

Anhui Jucheng was incorporated in Anhui, PRC in January 2005. On July 5, 2010, we acquired a 51% interest in Anhui Jucheng and it became our majority-owned subsidiary through August 30, 2011. On August 30, 2011, as approved by the shareholders of Anhui Jucheng, six unaffiliated third party investors invested in the aggregate of RMB142 million (approximately $22.23 million) in cash in Anhui Jucheng, and obtained a 23.28% equity interest in the increased registered capital of Anhui Jucheng. As a result, our share of the equity interests in Anhui Jucheng decreased from 51% to 39.13% and we ceased to have a controlling financial interest in Anhui Jucheng, but still retained an investment in, and a significant influence over, Anhui Jucheng. Accordingly, Anhui Jucheng became an equity method affiliate of ours. Anhui Jucheng is primarily engaged in developing, manufacturing and selling organic and inorganic chemicals and high polymer fine chemicals with related technical services.

Name Change

Prior to April 1, 2010, our company’s name was Remediation Services, Inc. For the sole purpose of changing our name, on April 1, 2010, we merged into a newly-formed, wholly owned subsidiary incorporated under the laws of Nevada called LianDi Clean Technology Inc. As a result of the merger, our corporate name was changed to LianDi Clean Technology Inc.

| 4 |

Share Exchange Agreement with China LianDi and Private Placement

Share Exchange Agreement

On February 26, 2010 (the “Closing Date”), we entered into a Share Exchange Agreement (the “Exchange Agreement”), by and among (i) China LianDi and China LianDi’s shareholders, SJ Asia Pacific Ltd., a company organized under the laws of the British Virgin Islands, which is a wholly-owned subsidiary of SJI Inc., a Jasdaq listed company organized under the laws of Japan, China Liandi Energy Resources Engineering Technology Limited, a company organized under the laws of the British Virgin Islands, Hua Shen Trading (International) Limited, a company organized under the laws of the British Virgin Islands, Rapid Capital Holdings Limited, a company organized under the laws of the British Virgin Islands, Dragon Excel Holdings Limited, a company organized under the laws of the British Virgin Islands, and TriPoint Capital Advisors, LLC, a limited liability company organized under the laws of Maryland (collectively, the “China LianDi Shareholders”), who together owned shares constituting 100% of the issued and outstanding ordinary shares of China LianDi (the “China LianDi Shares”) and (ii) Reed Buley, our former principal stockholder. Pursuant to the terms of the Exchange Agreement, the China LianDi Shareholders transferred to us all of the China LianDi Shares in exchange for 27,354,480 shares of our common stock (such transaction, the “Share Exchange”). As a result of the Share Exchange, we are now a holding company, which through our operating companies in the PRC, provide downstream flow equipment and engineering services, optimization software packages, clean and advanced industrial technology based equipment and services to the leading petroleum and petrochemical companies in the PRC.

Private Placement

On February 26, 2010 and immediately following the Share Exchange, we entered into a securities purchase agreement with certain investors (collectively, the “Investors”) for the issuance and sale in a private placement of 787,342 units (the “Units”) at a purchase price of $35 per Unit, consisting of, in the aggregate, (a) 7,086,078 shares of Series A convertible preferred stock, par value $0.001 per share (the “Series A Preferred Stock”) convertible into the same number of shares of common stock (the “Conversion Shares”), (b) 787,342 shares of common stock (the “Issued Shares”), (c) three-year Series A Warrants (the “Series A Warrants”) to purchase up to 1,968,363 shares of common stock, at an exercise price of $4.50 per share (the “Series A Warrant Shares”), and (d) three-year Series B Warrants (the “Series B Warrants” and, together with the Series A Warrants, the “Warrants”) to purchase up to 1,968,363 shares of common stock, at an exercise price of $5.75 per share (the “Series B Warrant Shares” and, together with the Series A Warrant Shares, the “Warrant Shares”), for aggregate gross proceeds of approximately $27.56 million (the “Private Placement”). The issuance of the Units was exempt from registration pursuant to Section 4(2) of the Securities Act, and Regulation D or Regulation S promulgated thereunder.

In connection with the Private Placement, we also entered into a registration rights agreement (the “Registration Rights Agreement”) with the Investors, in which we agreed to file a registration statement with the SEC to register for resale the Issued Shares, the Conversion Shares and the Warrant Shares within 30 calendar days of the Closing Date, and to have such registration statement declared effective within 180 calendar days of the Closing Date. We agreed to keep such registration statement continuously effective under the Securities Act until such date as is the earlier of the date when all of the securities covered by such registration statement have been sold or the date on which such securities may be sold without any restriction pursuant to Rule144. If we do not comply with the foregoing obligations under the Registration Rights Agreement, we will be required to pay cash liquidated damages to each investor, at the rate of 2% of the applicable subscription amount for each 30 day period in which we are not in compliance; provided, that such liquidated damages will be capped at 10% of the subscription amount of each investor and will not apply to any shares that may be sold pursuant to Rule 144 under the Securities Act, or are subject to an SEC comment with respect to Rule 415 promulgated under the Securities Act. The registration statement was declared effective by the SEC on August 20, 2010 and remains effective as of the date of this Annual Report on Form 10-K.

We also entered into a make good escrow agreement with the Investors (the “Securities Escrow Agreement”), pursuant to which China LianDi Energy Resources Engineering Technology Ltd., an affiliate of Jianzhong Zuo, our Chief Executive Officer, President and Chairman, delivered into an escrow account 1,722,311 shares of common stock (the “Escrow Shares”) to be used as a share escrow for the achievement of a fiscal year 2011 adjusted net income performance threshold of $20.5 million.

| 5 |

Our net income for the fiscal year ended March 31, 2011 for the purposes of the Securities Escrow Agreement was $24.1 million and exceeded the 2011 performance threshold. Therefore, the escrow shares were released to China LianDi Energy Resources Engineering Technology Ltd on August 24, 2011.

On February 26, 2012, pursuant to the Certificate of Designations, Preferences and Rights of the Series A Convertible Preferred Stock, all outstanding shares of the Series A Convertible Preferred Stock were converted into the same number of shares of our common stock.

Transactions Between Certain Stockholders

On September 27, 2011, two of our existing stockholders, SJ Asia Pacific Limited ("SJ Asia") and China LianDi Energy Resources Engineering Technology Ltd. ("LianDi Energy"), and Jianzhong Zuo, a director and the sole stockholder of LianDi Energy and the Chairman, President and Chief Executive Officer of our company, consummated the transactions contemplated by the Share Purchase Agreement (the "Share Purchase Agreement") dated as of September 22, 2011 relating to the purchase by SJ Asia from LianDi Energy of 5,400,000 shares of our common stock in exchange for an aggregate purchase price of $25,920,000 ($4.80 per share). The source of funds used for this investment was the capital increase of SJI, Inc., which is the sole shareholder of SJ Asia. The purpose of the Share Purchase Agreement and the transactions contemplated thereby was for SJ Asia to acquire in excess of 51% of the outstanding common shares of our company and consolidate our company's business with that of SJI, Inc., the parent company of SJ Asia. In addition to the Share Purchase Agreement described above, SJ Asia entered into a joinder agreement to a lock-up agreement with our company whereby SJ Asia agreed that it may only sell up to one-twelfth (1/12) of SJ Asia's holdings every month through February 26, 2012.

On March 30, 2012, SJ Asia signed an Accord and Satisfaction Agreement pursuant to which it agreed to accept on May 9, 2012 (the “Transfer Date”), in lieu of an outstanding debt in the amount of Japanese Yen (J¥) 539,255,277 (approximately US$6,763,518 at an exchange rate of US$1.00 = J¥80.00 on May 10, 2012), 100% of the shares of Rapid Capital Holdings Limited, a corporation organized under the laws of the British Virgin Islands (“Rapid Capital”), who in turn, owns 1,367,725 shares of our common stock. Therefore, SJ Asia indirectly, beneficially owns 1,367,725 shares of our common stock through Rapid Capital.

As a result, SJ Asia beneficially owns an aggregate of 19,881,463 shares of our common stock, which constitutes approximately 54.55% of the outstanding common shares of our company as of the date of this Annual Report on Form 10-K. Following the consummation of the above transactions, Mr. Zuo remains the Chairman, President and Chief Executive Officer of our company with the backing of SJ Asia.

Industry and Market Overview

China Petroleum and Petrochemical Industries

We have obtained the following industry and market overview from the U.S. Energy Information Administration Report dated May 2011.

According to the Oil & Gas Journal (OGJ), China had 20.4 billion barrels of proven oil reserves as of January 2011, up over 4 billion barrels from two years ago. China's largest and oldest oil fields are located in the northeast region of the country. China produced an estimated 4.3 million bbl/d of total oil liquids in 2010, of which 96 percent was crude oil. China's oil production is forecast to rise by about 290 thousand bbl/d to over 4.5 million bbl/d in 2012.

| 6 |

China consumed an estimated 9.2 million barrels per day (bbl/d) of oil in 2010, up nearly 900 thousand bbl/d, or over 10 percent from year-earlier levels. China's net oil imports reached about 4.8 million bbl/d in 2010 and it became the second-largest net oil importer in the world behind the United States in 2009. EIA forecasts that China's oil consumption will continue to grow during 2012, and the anticipated growth of 1.1 million bbl/d between 2010 and 2012 would represent almost 40 percent of projected world oil demand growth during the 2-year period.

Energy Policy

The Chinese government's energy policies are dominated by the country's growing demand for oil and its reliance on oil imports. The National Development and Reform Commission (NDRC) is the primary policymaking and regulatory authority in the energy sector, while four other ministries oversee various components of the country's oil policy. The government launched the National Energy Administration (NEA) in July 2008 in order to act as the key energy regulator for the country. The NEA, linked with the NDRC, is charged with approving new energy projects in China, setting domestic wholesale energy prices, and implementing the central government's energy policies, among other duties. The NDRC is a department of China's State Council, the highest organ of executive power in the country. In January 2010, the government formed a National Energy Commission with the purpose of consolidating energy policy among the various agencies under the State Council.

China Oil Companies

China's national oil companies (NOCs) wield a significant amount of influence in China's oil sector. Between 1994 and 1998, the Chinese government reorganized most state-owned oil and gas assets into two vertically integrated firms: the China National Petroleum Corporation (CNPC) and the China Petroleum and Chemical Corporation (Sinopec). These two conglomerates operate a range of local subsidiaries, and together dominate China's upstream and downstream oil markets. CNPC is the leading upstream player in China and, along with its publicly-listed arm PetroChina, accounts for roughly 60 percent and 80 percent of China's total oil and gas output, respectively. CNPC's current strategy is to integrate its sectors and capture more downstream market share. Sinopec, on the other hand, has traditionally focused on downstream activities, such as refining and distribution, with these sectors making up nearly 80 percent of the company's revenues in recent years and is gradually seeking to acquire more upstream assets.

Additional state-owned oil firms have emerged over the last several years. The China National Offshore Oil Corporation (CNOOC), which is responsible for offshore oil exploration and production, has seen its role expand as a result of growing attention to offshore zones. Also, the company has proven to be a growing competitor to CNPC and Sinopec by not only increasing its exploration and production expenditures in the South China Sea but also extending its reach into the downstream sector particularly in the southern Guangdong Province. The Sinochem Corporation and CITIC Group have also expanded their presence in China's oil sector, although they are still relatively small.

Whereas onshore oil production in China is mostly limited to CNPC and CNOOC, international oil companies (IOCs) have been granted greater access to offshore oil prospects, mainly through production sharing agreements. IOCs involved in offshore E&P work in China include: Conoco Phillips, Shell, Chevron, BP, Husky, Anadarko, and Eni, among others. IOCs leverage their technical expertise in order to partner with a Chinese NOC and make a foray into the Chinese markets.

| 7 |

Pricing Reform

The Chinese government launched a fuel tax and reform of the country's product pricing mechanism in December 2008 in order to tie retail oil product prices more closely to international crude oil markets, attract downstream investment, ensure profit margins for refiners, and reduce energy intensity caused by distortions in the market pricing. When international crude oil prices increased in 2010, the NDRC did not increase downstream fuel prices at the same level, causing refiners, especially NOCs to incur profit losses on the downstream business and increase exports to help offset the losses.

Refining

China is steadily increasing its oil refining capacity in order to meet robust demand growth. Most industry sources estimate China's installed crude refining capacity at over 11 million bbl/d. China's goal is to augment refining capacity by about 3.3 million bbl/d by 2015. A recent report by Sinopec stated that the national oil refining capacity would rise to 15 million bbl/d by 2016.

Sinopec and CNPC are the two dominant players in China's oil refining sector, accounting for 50 percent and 35 percent of the capacity, respectively. However, CNOOC entered the downstream sector through the commission of the company's first refinery, the 240,000 bbl/d Huizhou plant. Sinochem has also proposed a number of new refineries, and national oil companies from Kuwait, Saudi Arabia, Russia, Qatar, and Venezuela have also entered into joint-ventures with Chinese companies to build new refining facilities. The Chinese NOCs recently expanded their refining portfolios through commissioning two more refineries in 2010, Sinopec's Tianjin and CNPC's Quinzhou, each with a capacity of 200,000 bbl/d. By 2010, China's total refinery processing reached around 8.5 million bbl/d, up by 13 percent over the previous year.

PetroChina (CNPC) is branching out to acquire refinery stakes in other countries in efforts to move downstream and secure more global trading and arbitrage opportunities. The company's purchase of Singapore Petroleum Corporation and a portion of Japan's Osaka refinery are cases where PetroChina is looking for a foothold within the region's refining opportunities.

The refining sector has undergone modernization and consolidation in recent years, with dozens of small refineries (“teapots” and independent refiners), ranging from 40,000 bbl/d to 120,000 bbl/d and accounting for about 15 percent of total refinery capacity, shut down. The NDRC plans to eliminate refineries smaller than 20,000 bbl/d that are mostly owned by independent companies in efforts to encourage economies of scale and energy efficiency measures.

Domestic price regulations for finished petroleum products have hurt Chinese refiners, particularly small ones, in the past few years when oil prices were high. Lower domestic prices compared to international market prices for retail products provides incentives for Chinese refiners, especially those run by national companies, to export high volumes of products. In 2010, China imported approximately 700,000 bbl/d and exported 600,000 bbl/d of petroleum products including LPG, gasoline, diesel, jet fuel, fuel oil, and lubricants. Exports of products are expected to remain high as refining capacity is added in 2011 and beyond.

Oil Imports

The Middle East remains the largest source of China's crude oil imports, although African countries also contribute a significant amount. China imported nearly 4.8 million bbl/d of crude oil in 2010, of which over 2.2 million bbl/d (47 percent) came from the Middle East, 1.5 million bbl/d (30 percent) from Africa, 176,000 bbl/d (4 percent) from the Asia-Pacific region, and 938,000 bbl/d (20 percent) came from other countries. In 2010, Saudi Arabia and Angola were China's two largest sources of oil imports, together accounting for over one-third of China's total crude oil imports. Crude oil imports rose over 17 percent from 4.1 million bbl/d in 2009. Angola has become as significant an exporter of crude to China as Saudi Arabia and in some months has been the largest supplier. The EIA expects China to import about 72 percent of its crude oil by 2035, a significant rise from the current 50 percent.

| 8 |

China Environmental Regulations

In recent years, the Chinese government has made protection of the environment a priority, strengthening its environmental legislation. In 2005, the Chinese government’s State Environmental Protection Administration enacted a new, far-reaching regulatory and environmental initiative including reduced total emissions by 15% and increasing China’s energy efficiency by 30%. Furthermore, each province in China has followed the central government’s directive and established their own targets for pollution issues that affect their province. Most of the provinces pollution reduction targets have focused on air pollution caused largely by sulfur dioxide emissions and water pollution. Also, since China entered the World Trade Organization in 2001 and has begun to play an increasingly larger role in international politics, the government has been held more accountable for its climate footprint. At the Copenhagen Climate Conference, the central Chinese government pledged to cut emissions by 40 percent and reaffirmed this pledge at the U.N. Climate Change Conference in Durban South Africa in November and December 2011.

Our Principal Products and Services

Our principal products and services include:

| · | distributing a wide range of petroleum and petrochemical valves and equipment, including unheading units for the delayed coking process, as well as providing associated value-added technical services; |

| · | providing systems integration services; |

| · | developing and marketing proprietary optimization software; |

| · | distributing and leasing oil sludge cleaning equipment and providing oil sludge cleaning services which we expect to be launched in fiscal 2013; and |

| · | manufacturing and selling industrial chemical products through our equity method affiliate, Anhui Jucheng. |

Distribution & Technical Services

We distribute hundreds of different types of valves and related equipment from manufacturers/suppliers such as Cameron (NYSE: CAM), Poyam Valves, ABB and ROTORK. Recently, we also successfully developed our relationship with several new industrial equipment suppliers, such as: Sandvik, GE and Finder Pompes, to distribute their products to our customers pursuant to the distribution agreements we signed with them. We also provide related value-added technical services to manufacturers and petroleum and petrochemical companies. We provide locally customized technical services for international companies who sell products in China but who do not have local offices or sufficient local technical services manpower. For these companies, we offer our services by enlisting our engineers on the ground to provide localized services for their products. Our technical services include, but are not limited to: communicating with the design and R&D arms of the large Chinese oil companies; verifying and confirming the specification of products; and product inspecting, maintenance and debugging assistance. We also provide Hazard and Operability Analysis (“HAZOP”) consultancy technical services to our customers.

| 9 |

Systems Integration

We provide systems integration services for self-control of the chemical production process. This process includes integration of storage operations and transportation of valve instruments from tank farms, as well as providing upgrading services of programmable logic controllers with instrument systems. Currently, we are undertaking systematic integrations of operations in several chemical plant tank farm projects.

Software

Polymerization reaction is very important in the petrochemical process. It converts ethylene, propylene and other major gas-phase products into solid products which in turn can be further processed. Polymerization provides raw materials for downstream industries. The conditions important to the polymerization reaction process are mainly temperature, pressure, flow, liquid level and the catalyst. Prior to using a new process or before a catalyst is put into mass production, as well as before products are officially used, the process needs to be tested. Our software helps test the processes by producing data collection, performance analysis and process optimization indications. Polymerization reaction data collection and analysis software provides production process automation control. Our software can also be applied to other industries including the coal and steel industries. Beside polymerization reaction optimization software, we also resell other software products, such as production process stimulation software, purchased from third parties to our customers.

Oil Sludge Cleaning

The PRC government recently mandated automated cleaning technologies to be used in all oil refiners in China starting on July 1, 2010 in order to improve the safety of refining operations. However, in practice, the implementation of this regulation was not widely carried out by the PRC refineries due to a funding shortfall. Currently, only less than 20% of Chinese oil refineries use automated cleaning technologies compared to 80%-90% in developed countries. We estimate, if this regulation is fully implemented by PRC refineries in the future, the value for using this cleaning technology will be approximately US$120 million, growing at about 7% per annum.

We have imported three sets of the automated oil sludge cleaning equipment from System Kikou Co., Ltd (“SKK”), located in Tokyo, Japan, one of the world’s leading automated oil sludge treatment companies. Our key employees who are in charge of this business have strong experience and extensive resources in the industrial production processes safety area.

We may generate revenue from this segment through:

| · | providing the oil sludge cleaning services directly to the oil refiners in China; |

| · | distributing the oil sludge cleaning equipment in China; and |

| · | leasing the oil sludge cleaning equipment to other oil sludge cleaning companies in China. |

We are now in the bidding process for a project initiated by one of the refineries in northwest China. The potential client conducting the process is interested in our SKK oil sludge cleaning equipment.

Manufacturing and selling of industrial chemical products

Our equity method affiliate, Anhui Jucheng, was incorporated in January 2005, and is currently the sixth largest polyacrylamide products manufacturer in China, (according to China Polyacrylamide Industry Competition Trends Forecast Report issued by China National Functional Polymer Industry Committee) with a total maximum production capacity of approximately 18,000 metric tons per annum. Polyacrylaminde is mainly used in (1) tertiary oil recovery; (2) wastewater, organic wastewater disposal and sewage treatments; (3) an auxiliary for the papermaking industry; and (4) flocculant for river water treatments.

| 10 |

Anhui Jucheng is constructing three new production lines in order to expand its production capacity to approximately 53,000 metric tons per year. The new production lines are expected to be completed in the middle of fiscal 2013. After having completed these new production lines, management estimates Anhui Jucheng will become the fourth largest polyacrylamide products manufacturer in China.

We believe our investment in Anhui Jucheng enabled us to improve our product structure and diversify our channels of business opportunities. Currently, Anhui Jucheng sells polyacrylaminde products mainly though the distributors to the end users, who are mostly large oil fields.

Depending on customers’ needs, our products and services may be bundled together or provided individually.

Our Competitive Strengths

Our competitive strengths include:

Product advantages

We import high-quality petroleum and petrochemical valves and equipment, and distribute them to our domestic clients who are large petroleum and petrochemical companies located and operating in China. Our suppliers are global and reputable industrial equipment manufacturers with leading technology among their competitors. Our international suppliers include Cameron, DeltaValve, Poyam Valves, Rotork, Bornemann, Metso, Ruhrpumpen, ABB, Sandvik, GE and Finder Pompes. We also work with the design and R&D subsidiaries of CNPC and Sinopec, as well as other independent design and research institutes, to determine standards in the petroleum and petrochemical industries and help them to select equipment. Our software is used by petrochemical companies during the polymerization reaction of ethylene production for data collection, performance analysis and process optimization. We believe it has several advantages over similar products, including lower cost, better quality control, improved process optimization and customization to individual customers.

Client relationship advantages

Most of the petroleum and petrochemical companies are very large state-owned enterprises in China which set high standards and thresholds for products and services providers. We have worked closely with the largest industry leaders, CNOOC, Sinochem Group, Sinopec and CNPC, to provide equipment and technical services, for almost 10 years. Each of our key management personnel have at least 10-20 years of experience in the industry and have established broad channels and networks within the industry and have earned the trust of these large state-owned industry leaders. We have also maintained strong relationships with our suppliers and research institutions.

Design and research and development advantage

We have partnered with the leading industrial design and research and development institutions throughout China to develop standards and select equipment for the petroleum and petrochemical industries, which has led to the development of our integrated products and services and their achievement of a higher level of technological sophistication as compared with our competitors. Specifically, we have partnered and/or worked with Luoyang Petrochemical Engineering Corporation and Sinopec Engineering Incorporation, which are the design and R&D institutions wholly owned by Sinopec; and China Huanqiu Contracting & Engineering Corporation and China Petroleum Pipeline Engineering Corporation, which are the design and R&D institutions wholly owned by CNPC. These companies assist Sinopec and CNPC with the design and construction of both new and old production facilities. Generally, our role focuses on assisting these companies with locating suitable products from around the world to complete various aspects of the facilities design. For example, we use our expertise in flow control equipment to help identify and select valves and other equipment that meet specific design requirements.

| 11 |

We currently have approximately 157 employees (excluding employees of Anhui Jucheng), many from China’s largest petroleum and petrochemical companies and their design and R&D subsidiaries, and they possess extensive technology and design and R&D capabilities.

Comprehensive localized system integration advantage

We have accumulated more than seven years of comprehensive system integration services experience with a relatively stable base of clients and products and an effective operational team. This experience has allowed us to emerge as a high-end integrator of industrial products and related engineering services. We have the ability to understand our customers’ current systems and needs, and then design the total solution to integrate international products and technologies with their local systems.

Advanced and Clean technology advantage

We are the first company to bring DeltaValve’s affordable, environment-friendly, safe and maintenance-free coke-drum enclosed unheading system to the Chinese marketplace. The delayed coking process produces more pollution than any other refining step. The totally enclosed unheading units we distribute and install significantly reduce emissions. Given the Chinese government’s aggressive industry targets to reduce air pollution, traditional delayed coking units will have to be updated.

Our automatic oil tank sludge cleaning equipment imported from SKK includes the following technical advantages:

| · | sealed operation, safe and reliable |

| · | environment friendly, with no emissions; |

| · | recovery of the remaining crude oil in the tank, and increasing production efficiency; and |

| · | convenient for installation and transportation, with a high degree of commonality for different refineries. |

In light of the Chinese government’s long-term industry targets to improve production safety and reduce the occurrence of accidents, we expect that this business segment will help us generate more revenue.

Benefit from income tax policy

Our PRC subsidiary, Beijing JianXin, has been qualified as a software enterprise by the required government authorities. Accordingly, Beijing JianXin has benefited from an income tax exemption for two years beginning with its first profitable calendar year of 2009 and a 50% tax reduction to a rate of 12.5% for the subsequent three years through December 31, 2013. This tax benefit will reduce the capital demands in our operating activities and allow us to invest more funding into long-term projects and to better serve our clients.

| 12 |

Experienced workforce

Currently, many of our senior managers and engineers have significant prior experience in the petroleum and petrochemical industry. Many of our employees have graduated from petrochemical based institutions and colleges. Our executive team has over 100 years of management experience in the aggregate and provides excellent operating and technical administration for our company.

Growth Strategy

We plan to strengthen our leading position and achieve stable growth through the following strategies:

| · | Strengthening our research and development effort to increase the functions and the stability of our optimization software to increase the sales volume of our software products which have a relatively high gross margin; |

| · | Expanding our distribution channels and network by increasing our sales force and collecting more industrial information and enhancing our communication with existing and potential clients; |

| · | Expanding and diversifying our supplier base and alliances and maintaining broader products and service solutions to be introduced to our customers; |

| · | Increasing our business opportunities through acquisitions to boost operational and cross-selling synergies and further diversify our products and channels of business. |

Competition

We compete against other companies which seek to provide the Chinese petroleum refinery industry with a wide range of petroleum and petrochemical valves and equipment and associated technical and engineering services. Much like us, these companies compete on the basis of cost, the size of their distribution product portfolio, and level of technical and engineering expertise. In addition, similar products to those distributed by us are available from domestic Chinese and foreign manufacturers and compete with the products in our distribution portfolio.

Z&J Technologies GmbH is a German industrial valve company and a direct competitor to China LianDi/DeltaValve’s enclosed unheading units. Honeywell is also a competitor with respect to our optimization software. Oreco A/S, a company in Denmark, that specializes in the development and production of automated, non-man entry oil tank cleaning and oil recovery systems, is a competitor of LianDi/SKK’s oil sludge cleaning equipment and technology.

Methods of Distribution

We maintain aggressive sales channels and distribution networks in China with an approximately 16 member sales team, with the backing of our engineering department, which has 39 members and provides seamless pre-sale and after-sale support to our sales team and our customers. We have spent significant amount of time developing relationships with our international equipment suppliers, and with the PRC’s largest petroleum and petrochemical companies.

| 13 |

Our Suppliers

We maintain close relationships with, and distribute products for large, industry leading valve and equipment manufacturers, including Cameron, DeltaValve, Poyam Valves, Rotork, Bornemann, Metso, Ruhrpumpen, ABB, Sandvic, GE and Finder Pompes. Most of our suppliers enter into supply contracts with us on a project by project basis. We expect all existing supplier relationships will continue on an ongoing basis and that going forward we will add new partners to diversify our supplier base.

Significant Customers

For the fiscal year ended March 31, 2012, our major customer breakdown as a percentage of revenues was as follows: Sinopec: 27%; CNPC: 49%; and other: 24% (of which 9% represented the industrial chemicals revenue of Anhui Jucheng). We are dependent on China’s largest petroleum and petrochemical companies in our distribution business. As we grow our business, we intend to diversify our customer relationships that can benefit from our technology and software business.

Design and Research and Development

We have partnered with the leading industrial design and R&D institutions throughout the PRC to develop standards and select equipment for the petroleum and petrochemical industries, which has led to the development of our integrated products and services and their achievement of a higher level of technological sophistication as compared with our competitors.

Specifically, our engineering staff understands all specifications, budget parameters and functional project requirements. We then use this understanding to find suitable products and suppliers. As part of this process, we help our partners reduce costs by designing and/or improving certain systems, including hydraulic systems, control systems, supporting bracket, and other systems. Finally, we assist with the integration of these products within their core products.

We currently have approximately 74 employees dedicated to technical design and R&D activities. During the fiscal year ended March 31, 2012, we spent approximately $0.30 million on such activities, excluding the amount incurred by Anhui Jucheng before it was deconsolidated from us on August 30, 2011.

Government Regulation

Our business operations do not require any special government licenses or permits.

Compliance with Environmental Laws

We believe that we are in compliance with the current material environmental protection requirements. Our costs attributed to compliance with environmental laws are negligible.

Intellectual Property

The PRC has adopted legislation governing intellectual property rights, including patents, copyrights and trademarks. The PRC is a signatory to the main international conventions on intellectual property rights and became a member of the Agreement on Trade Related Aspects of Intellectual Property Rights upon its accession to the WTO in December 2001.

We have five software copyright certificates issued by the State Copyright Office of the PRC as listed below:

| 14 |

| Names of Software | Registration Number | |

V1.0 V1.0 |

2008SRBJ6676 | |

| Software V1.0 of Data Processing Platform for Chemical Production System. | ||

V1.0 V1.0 |

2009SRBJ5672 | |

| Software V1.0 of Dispatch Management Platform for Oil and Gas Pipeline | ||

V1.0 V1.0 |

2009SR036455 | |

| Software V1.0 of Automatic Calibration for Oil and Gas Pipeline Measuring Station | ||

V1.0 V1.0 |

2009SR036454 | |

| Software V1.0 of Data Collection Post-Processing Platform | ||

V1.0 V1.0 |

2009SRBJ5783 | |

| Software V1.0 of Oil Tank Information Management |

With this intellectual property, we believe we can facilitate the services that are in demand by our customers.

Employees

As of March 31, 2012, we had 157 full-time employees (excluding Anhui Jucheng’s employees), including 16 in sales, 39 in engineering, 74 in technology and R&D; 3 members of management and 25 others, including accounting, importation, administration and human resources.

We are compliant with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

As required by PRC regulations, we participate in various employee benefit plans that are organized by municipal and provincial governments, including pension, work-related injury benefits, maternity insurance, medical and unemployment benefit plans. We are required under PRC laws to make contributions to the employee benefit plans at specified percentages of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from time to time. Members of the PRC governmental retirement plan are entitled to a pension equal to a fixed proportion of the salary prevailing at the member’s retirement date.

Generally, we enter into a standard employment contract with our officers, managers and other employees for a set period of years. According to these contracts, all of our employees are prohibited from engaging in any activities that compete with our business during the period of their employment with us. Furthermore, the employment contracts with officers or managers include a covenant that prohibits officers or managers from engaging in any activities that compete with our business for two years after the period of employment.

Corporation Information

Our principal executive offices are located at Unit 401-405, 4/F, Tower B, Wanliuxingui Building, 28 Wanquanzhuang Road, Haidian District, Beijing, China 100089, Tel: (86) (0)10-5872 0171, Fax: (86) (0)10-5872 0181.

| 15 |

PRC Government Regulations

Various aspects of our operations are subject to numerous laws, regulations, rules and specifications of the PRC. We are in compliance in all material respects with such laws, regulations, rules and specifications and have obtained all material permits, approvals and registrations relating to human health and safety, the environment, taxation, foreign exchange administration, financial and auditing, and labor and employment. We make expenditures from time to time to stay in compliance with applicable laws and regulations. Below we set forth a summary of the most significant PRC regulations or requirements that may affect our business activities operated in the PRC or our shareholders’ right to receive dividends and other distributions of profits from Beijing JianXin and Beijing Hongteng, wholly foreign owned enterprises under the PRC laws (collectively “PRC subsidiaries”).

Business License

Any company that conducts business in the PRC must have a business license that covers a particular type of work. The business licenses of our PRC subsidiaries cover their present business activities. Prior to expanding our PRC subsidiaries’ business beyond that of their business license, we are required to apply and receive approval from the PRC government.

Annual Inspection

In accordance with relevant PRC laws, all types of enterprises incorporated under the PRC laws are required to conduct annual inspections with the State Administration for Industry and Commerce of the PRC or its local branches. In addition, foreign-invested enterprises are also subject to annual inspections conducted by PRC government authorities. In order to reduce enterprises’ burden of submitting inspection documentation to different government authorities, the Measures on Implementing Joint Annual Inspection issued by the PRC Ministry of Commerce together with other six ministries in 1998 stipulated that foreign-invested enterprises shall participate in a joint annual inspection conducted by all relevant PRC government authorities. Our PRC subsidiaries, as foreign-invested enterprises, have participated and passed all such annual inspections since their incorporation.

Employment Laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, citizenship requirements, work permits and travel restrictions. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permits workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract.

| 16 |

Foreign Investment in PRC Operating Companies

The Foreign Investment Industrial Catalogue jointly issued by the Ministry of Commerce, or the MOFCOM, and the National Development and Reform Commission, or the NDRC, in 2007 classified various industries/businesses into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed industries/businesses permitted to have foreign investment. Except for those expressly provided restrictions, encouraged and permitted industries/businesses are usually 100% open to foreign investment and ownership. With regard to those industries/businesses restricted to or prohibited from foreign investment, there is always a limitation on foreign investment and ownership. Our PRC subsidiaries’ business do not fall under the industry categories that are restricted to or prohibited from foreign investment and are not subject to limitation on foreign investment and ownership.

Regulation of Foreign Currency Exchange

Foreign currency exchange in the PRC is governed by a series of regulations, including the Foreign Currency Administrative Rules (1996), as amended, and the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), as amended. Under these regulations, Renminbi is freely convertible for trade and service-related foreign exchange transactions, but not for direct investment, loans or investments in securities outside the PRC without the prior approval of the State Administration of Foreign Exchange, or SAFE. Pursuant to the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), Foreign Invested Enterprises, or FIEs, may purchase foreign exchange without the approval of the SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange, subject to a cap approved by SAFE, to satisfy foreign exchange liabilities or to pay dividends. However, the relevant Chinese government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside the PRC are still subject to limitations and require approvals from the SAFE.

Regulation of FIEs’ Dividend Distribution

The principal laws and regulations in the PRC governing distribution of dividends by FIEs include:

| (i) | The Sino-foreign Equity Joint Venture Law (1979), as amended, and the Regulations for the Implementation of the Sino-foreign Equity Joint Venture Law (1983), as amended; |

| (ii) | The Sino-foreign Cooperative Enterprise Law (1988), as amended, and the Detailed Rules for the Implementation of the Sino-foreign Cooperative Enterprise Law (1995), as amended; |

| (iii) | The Foreign Investment Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended. |

Under these regulations, FIEs in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, foreign-invested enterprises in the PRC are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

| 17 |

Regulation of a Foreign Currency’s Conversion into RMB and Investment by FIEs

On August 29, 2008, the SAFE issued a Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises or Notice 142, to further regulate the foreign exchange of FIEs. According to the Notice 142, FIEs shall obtain a verification report from a local accounting firm before converting its registered capital of foreign currency into Renminbi, and the converted Renminbi shall be used for the business within its permitted business scope. The Notice 142 explicitly prohibits FIEs from using RMB converted from foreign capital to make equity investments in the PRC, unless the domestic equity investment is within the approved business scope of the FIE and has been approved by SAFE in advance.

Regulation of Foreign Exchange in Certain Onshore and Offshore Transactions

In October 2005, the SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or SAFE Notice 75, which became effective as of November 1, 2005, and was further supplemented by two implementation notices issued by the SAFE on November 24, 2005 and May 29, 2007, respectively. SAFE Notice 75 states that PRC residents, whether natural or legal persons, must register with the relevant local SAFE branch prior to establishing or taking control of an offshore entity established for the purpose of overseas equity financing involving onshore assets or equity interests held by them. The term “PRC legal person residents” as used in SAFE Notice 75 refers to those entities with legal person status or other economic organizations established within the territory of the PRC. The term “PRC natural person residents” as used in SAFE Notice 75 includes all PRC citizens and all other natural persons, including foreigners, who habitually reside in the PRC for economic benefit. The SAFE implementation notice of November 24, 2005 further clarifies that the term “PRC natural person residents” as used under SAFE Notice 75 refers to those “PRC natural person residents” defined under the relevant PRC tax laws and those natural persons who hold any interests in domestic entities that are classified as “domestic-funding” interests.

PRC residents are required to complete amended registrations with the local SAFE branch upon: (i) injection of equity interests or assets of an onshore enterprise to the offshore entity, or (ii) subsequent overseas equity financing by such offshore entity. PRC residents are also required to complete amended registrations or filing with the local SAFE branch within 30 days of any material change in the shareholding or capital of the offshore entity, such as changes in share capital, share transfers and long-term equity or debt investments or, providing security, and these changes do not relate to return investment activities. PRC residents who have already organized or gained control of offshore entities that have made onshore investments in the PRC before SAFE Notice 75 was promulgated must register their shareholdings in the offshore entities with the local SAFE branch on or before March 31, 2006.

Under SAFE Notice 75, PRC residents are further required to repatriate into the PRC all of their dividends, profits or capital gains obtained from their shareholdings in the offshore entity within 180 days of their receipt of such dividends, profits or capital gains. The registration and filing procedures under SAFE Notice 75 are prerequisites for other approval and registration procedures necessary for capital inflow from the offshore entity, such as inbound investments or shareholders loans, or capital outflow to the offshore entity, such as the payment of profits or dividends, liquidating distributions, equity sale proceeds, or the return of funds upon a capital reduction.

Government Regulations Relating to Taxation

On March 16, 2007, the National People’s Congress or the NPC, approved and promulgated the PRC Enterprise Income Tax Law, which we refer to as the New EIT Law. The New EIT Law took effect on January 1, 2008. Under the New EIT Law, FIEs and domestic companies are subject to a uniform tax rate of 25%.

| 18 |

The New EIT Law provides that an income tax rate of 20% may be applicable to dividends payable to non-PRC investors that are “non-resident enterprises.” Non-resident enterprises refer to enterprises which do not have an establishment or place of business in the PRC, or which have such establishment or place of business in the PRC but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC. The income tax for non-resident enterprises shall be subject to withholding at the income source, with the payer acting as the obligatory withholder under the New EIT Law, and therefore such income taxes are generally called withholding tax in practice. The State Council of the PRC has reduced the withholding tax rate from 20% to 10% through the Implementation Rules of the New EIT Law. It is currently unclear in what circumstances a source will be considered as located within the PRC. We are a U.S. holding company and substantially all of our income is derived from dividends we receive from our subsidiaries located in the PRC. Thus, if we are considered as a “non-resident enterprise” under the New EIT Law and the dividends paid to us by our subsidiary in the PRC are considered income sourced within the PRC, such dividends may be subject to a 10% withholding tax.

Such income tax may be exempted or reduced by the State Council of the PRC or pursuant to a tax treaty between the PRC and the jurisdictions in which our non-PRC shareholders reside. For example, the 10% withholding tax is reduced to 5% pursuant to the Double Tax Avoidance Agreement Between Hong Kong and Mainland China if the beneficial owner in Hong Kong owns more than 25% of the registered capital in a company in the PRC.

The new tax law provides only a framework of the enterprise tax provisions, leaving many details on the definitions of numerous terms as well as the interpretation and specific applications of various provisions unclear and unspecified. Any increase in any of our subsidiaries’ tax rates in the future could have a material adverse effect on our financial condition and results of operations.

Regulations of Overseas Investments and Listings

On August 8, 2006, six PRC regulatory agencies, including the MOFCOM, the China Securities Regulatory Commission or the CSRC, the State Asset Supervision and Administration Commission or the SASAC, the State Administration of Taxation, or the SAT, the State Administration for Industry and Commerce or the SAIC and SAFE, amended and released the New M&A Rule, which took effect as of September 8, 2006. This regulation, among other things, includes provisions that purport to require that an offshore special purpose vehicle (“SPV”) formed for purposes of an overseas listing of equity interest in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange.

On September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by SPVs. The CSRC approval procedures require the filing of a number of documents with the CSRC. The application of the New M&A Rule with respect to overseas listings of SPVs remains unclear with no consensus currently existing among the leading PRC law firms regarding the scope of the applicability of the CSRC approval requirement.

Regulation of the Software Industry

Software Copyright

The China State Council promulgated the Regulations on the Protection of Computer Software, or the Software Protection Regulations, on December 20, 2001, which became effective on January 1, 2002. The Software Protection Regulations were promulgated, among other things, to protect the copyright of computer software in China. According to the Software Protection Regulations, computer software that is independently developed and exists in a physical form or is attached to physical goods will be protected. However, such protection does not apply to any ideas, mathematical concepts, processing and operation methods used in the development of software solutions.

| 19 |

Under the Software Protection Regulations, PRC citizens, legal persons and organizations shall enjoy copyright protection over computer software that they have developed, regardless of whether the software has been published. Foreigners or any person without a nationality shall enjoy copyright protection over computer software that they have developed, as long as such computer software was first distributed in China. Software of foreigners or any person without a nationality shall enjoy copyright protection in China under these regulations in accordance with a bilateral agreement signed between China and the country to which the developer is a citizen of or in which the developer habitually resides, or in accordance with an international treaty to which China is a party.

Under the Software Protection Regulations, owners of software copyright protection shall enjoy the rights of publication, authorship, modification, duplication, issuance, lease, transmission on the information network, translation, licensing and transfer. Software copyright protection takes effect on the day of completion of the software’s development.

The protection period for software developed by legal persons and other organizations is 50 years and ends on the thirty-first day of December of the fiftieth year from the date the software solution was first published. However, the Software Protection Regulations will not protect the software if it is published within 50 years of the completion of its development. A contract of licensing shall be made to license others to exploit the software copyright, and if the licensing of exploitation of software copyright is exclusive, a written contract shall be made. A written contract also shall be made for the transfer of any software copyright.

Civil remedies available under the Software Protection Regulations against infringements of copyright include cessation of the infringement, elimination of the effects, apology and compensation for losses. The administrative department of copyright shall order the infringer of software copyright to stop all infringing acts, confiscate illegal gains, confiscate and destroy infringing copies, and may impose a fine on the offender under certain circumstances. Disputes regarding infringements of software copyright may be settled through mediation. In addition, the parties involved in the disputes may apply for arbitration in accordance with any arbitration provisions set forth in the copyright contract or arbitration agreement otherwise entered into between or among the parties. If the parties neither have an arbitration provision in the copyright contract, nor an arbitration agreement, they may resolve their dispute through the PRC courts directly.

Software Copyright Registration

On February 20, 2002, the State Copyright Administration of the PRC promulgated and enforced the Measures Concerning Registration of Computer Software Copyright Procedures, or the Registration Procedures, to implement the Software Protection Regulations and to promote the development of China’s software industry. The Registration Procedures apply to the registration of software copyrights and software copyright exclusive licensing contracts and assignment contracts. The registrant of a software copyright will either be the copyright owner, or another person (whether a natural person, legal person or an organization) in whom the software copyright becomes vested through succession, assignment or inheritance.

Pursuant to the Registration Procedures, the software to be registered must (i) have been independently developed or (ii) significantly improve in its function or performance after modification from the original software with the permission of the original copyright owner. If the software being registered is developed by more than one person, the copyright owners may nominate one person to handle the copyright registration process on behalf of the other copyright owners. If the copyright owners fail to reach an agreement with respect to the registration, any of the copyright owners may apply for registration but the names of the other copyright owners must be recorded on the application.

| 20 |

The registrant of a software copyright and the parties to a software copyright assignment contract or exclusive licensing contract may apply to the Copyright Protection Center of the PRC for registration of such software copyright and contracts. To register a software copyright, the following documents shall be submitted: (i) a completed software copyright registration application form in accordance with relevant requirements; (ii) identification materials of software; and (iii) relevant documentation demonstrating ownership. To register a software copyright assignment contract or exclusive licensing contract, the following materials shall be submitted: (i) a completed contract registration form in accordance with relevant requirements; (ii) a copy of the contract; and (iii) the applicant’s identification documents. The Copyright Protection Center of the PRC will complete its examination of an accepted application within 60 days of the date of acceptance. If an application complies with the requirements of the Software Protection Regulations and the Registration Procedures, a registration will be granted, a corresponding registration certificate will be issued and the registration will be publicly announced.

Software Products Administration

On October 27, 2000, the MIIT issued and enforced the Measures Concerning Software Products Administration, to regulate and administer software products and promote the development of the software industry in China. Pursuant to the Measures Concerning Software Products Administration, all software products operated or sold in China had to be duly registered and recorded with the relevant authorities, and no entity or individual is allowed to sell or distribute any unregistered and unrecorded software products.

To produce software products in China, a software producer was required to meet the following requirements: (i) it possessed the status of an enterprise legal person, and its scope of operations included the computer software business (including technology development of software or production of software products); (ii) it had a fixed production site; (iii) it possessed necessary conditions and technologies for producing software products; and (iv) it possessed quality control measures and capabilities for the production of software products. Software developers or producers were allowed to sell their registered and recorded software products independently or through agents, or by way of licensing. Software products developed in China had to be registered with the local provincial governmental authorities in charge of the information industry and then filed with the taxation authority at the same level and MIIT. Imported software products (software developed overseas and sold or distributed into China), had to be registered with the MIIT. Upon registration, the software products had to be granted registration certificates. Each registration certificate was valid for five years from the issuance date and could be renewed upon expiry. The MIIT and other relevant departments carried out supervision and inspection over the development, production, operation and import/export activities of software products in China.

On March 1, 2009, the MIIT promulgated the amended and restated Measures Concerning Software Products Administration, or the New Measures, which became effective on April 10, 2009. Under the New Measures, software products operated or sold in China are not required to be registered or recorded by relevant authorities, and software products developed in China (including those developed in China on the basis of imported software) can enjoy certain favorable policies when they have been registered and recorded. The New Measures also eliminated the October 2000 requirements set forth above.

Policies to Encourage the Development of Software and Integrated Circuit Industries

On June 24, 2000, the State Council issued Certain Policies to Encourage the Development of Software and Integrated Circuit Industries, or the Policies, to encourage the development of the software and integrated circuit industries in China and to enhance the competitiveness of the PRC information technology industry in the international market. The Policies encourage the development of the software and integrated circuit industries in China through various methods, including: