Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Neogenix Oncology Inc | v317307_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Neogenix Oncology Inc | v317307_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Neogenix Oncology Inc | v317307_ex32-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Neogenix Oncology Inc | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended December 31, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ___to___.

Commission file number: 0-53963

Neogenix Oncology, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 16-1697150 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

15010 Broschart Road, Suite 270, Rockville, MD 20850

(Address, including zip code, of principal offices)

Registrant’s telephone number, including area code: (301) 917-6880

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨(do not check if smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

As of July 9, 2012 there were 22,924,419 shares of common stock, par value $.00001 per share, outstanding. The most recent sale of our common stock occurred in August 2011 for $12.50 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| Page | |||

| PART I | 1 | ||

| ITEM 1. | Business | 1 | |

| ITEM 1A. | Risk Factors | 9 | |

| ITEM 1B. | Unresolved staff comments | 19 | |

| ITEM 2. | Properties | 19 | |

| ITEM 3. | Legal Proceedings | 19 | |

| ITEM 4. | Mine Safety Disclosures | ||

| PART II | 20 | ||

| ITEM 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 20 | |

| ITEM 6. | Selected Financial Data | 20 | |

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 | |

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 28 | |

| ITEM 8. | Financial Statements and Supplementary Data | 28 | |

| ITEM 9 | Change and Disagreements with Accountants on Accounting and Financial Disclosure | 28 | |

| ITEM 9A. | Controls and Procedures | 28 | |

| ITEM 9B. | Other Information | 30 | |

| PART III | 31 | ||

| ITEM 10. | Directors, Executive Officers, and Corporate Governance | 31 | |

| ITEM 11. | Executive Compensation | 36 | |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 | |

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 40 | |

| ITEM 14. | Principal Accounting Fees and Services | 40 | |

| PART IV | 41 | ||

| ITEM 15. | Exhibits, Financial Statement Schedules | 41 |

| i |

PART I

| ITEM 1. | BUSINESS |

Introduction - Our Company

Neogenix Oncology, Inc. (“Neogenix” or the “Company”) is a clinical stage biotherapeutic company focused on developing novel therapeutic and companion diagnostic products for detection and treatment of cancer. The Company’s initial focus includes pancreatic and colorectal cancer, but it holds a pipeline of preclinical monoclonal antibodies with specificity towards other cancers. The market for diagnostic and therapeutic products for these cancers are substantial and growing. Neogenix has not commenced its planned or principal operations and has not generated any revenues since its inception, and, as such, is considered a development stage enterprise. The products being developed will require substantial funding for further research and development, clinical testing, and regulatory approval prior to their commercialization.

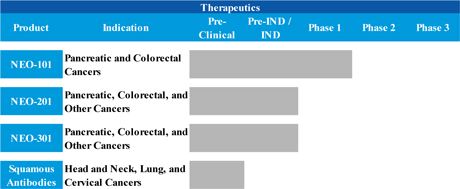

Pipeline:

Our pipeline currently consists of three novel monoclonal antibodies or “mAb” product candidates targeting solid tumors. The Company has both issued and pending patent applications related to the composition and utility of these mAb’s. The Company also has a companion diagnostics strategy to develop diagnostic products to be used in conjunction with its therapeutics as well as possible stand-alone diagnostics products.

| · | The Company’s lead product candidate, NEO-101 (Ensituximab), is a monoclonal antibody that recognizes a unique variant of MUC5AC associated with pancreatic or colorectal cancer. NEO-101 (Ensituximab) is a novel Phase IIa mAb that is targeted for colorectal and pancreatic cancer indications. NEO-101 has been granted Orphan Drug Status by the FDA for the treatment of pancreatic cancer. |

| · | NEO-201 is a preclinical humanized mAb that recognizes a distinct TSA and has been found in pancreatic, colorectal cancers and adenocarcinoma human tissue samples. |

| · | NEO-301 is a preclinical chimeric mAb that recognizes a TSA from pancreatic and colorectal cancers and adenocarcinoma and has been shown to induce potent tumor cell killing activity in tumors. |

Clinical Trials:

In December 2009, Neogenix initiated a Phase I clinical trial of our lead therapeutic product candidate for advanced pancreatic and colorectal cancer, referred to as “NEO-101” (formerly known as “NPC-1C”) at Johns Hopkins University Hospital and North Shore University Hospital, following approval by the United States Food and Drug Administration (the “FDA”) of our investigational new drug application (“IND”). In late 2010, Duke University Medical Center joined the Phase I clinical trial of NEO-101.

The primary objectives of the Phase I clinical trial were (1) to determine the safety and tolerability of escalating doses of NEO-101 monoclonal antibody therapy and (2) to assess pharmacokinetics and select immune responses to the antibody at each dose level. We completed accrual of patients in the Phase I clinical trial during the fourth quarter 2011. The Phase I trial protocol currently provides that following completion of the Phase I trial, we would continue enrollment of patients with pancreatic cancer in a Phase IIA component, subject to FDA and Institutional Review Board (“IRB”) approval.

| 1 |

As part of the process related to clinical trials, Neogenix is developing a companion diagnostic assay immunohistochemistry (“IHC”) test for co-development with our therapeutic candidates. This diagnostic assay will screen patients for the presence of the NEO-101 antigenic marker and the applicability of the NEO-101 treatment.

Companion Diagnostics:

The Company has also devoted efforts towards the research and development of diagnostic tests for the detection of pancreatic and colon cancer. The Company's diagnostic tests are expected to serve as “companion diagnostics” for its therapeutic drug and also have the potential to serve as standalone tests for the diagnosis and detection of cancer. Such independent diagnostic tests will require FDA regulatory approval.

Currently, the Company

has demonstrated the tumor specificity of NEO-101, NEO-201

and NEO-301 monoclonal antibodies using a immunohistochemistry (IHC) diagnostic test. The NEO-101 IHC test is currently serving

as a companion diagnostic to identify patients expressing the NEO-101 antigen and meeting the eligibility criteria for clinical

trials with the NEO-101 therapeutic antibody.

During the first quarter of 2009, Conemaugh Health System began patient enrollment and collection of tissue and blood samples from patients. As of December 31, 2011, approximately 85 patients had been enrolled in this research study. Tumor tissue samples from patients in the study were tested using our research phase assays and Neogenix mAbs.

In 2011, Neogenix commenced an IHC collaboration agreement with San Raffaele-Pisana (“SRP”), a leading healthcare company in Rome, Italy, to study the expression of tumor-specific biomarkers using NEO-101, NEO-201, and NEO-301. SRP has a bio-bank containing thousands of serum and tissue specimens from healthy donors and patients with various types of cancer. Testing for the IHC testing program is currently active and it is anticipated that both parties will jointly submit the outcome of the IHC studies during 2012.

In 2011, Neogenix commenced an agreement with Cambridge Biomedical, Inc, based in Boston, MA., for the development of its pancreatic and colorectal cancer diagnostic serum ELISA assays. Cambridge Biomedical provides core expertise in assay optimization and validation within an FDA recognized laboratory that is CLIA certified and CAP accredited. This relationship is consistent with the Company’s revised strategy of independent validation of research protocols to meet commercial standards of performance. Neogenix retains all current and future rights to its products through this agreement.

| 2 |

Recent Development

On June 29, 2012, the Company notified its shareholders that it has entered into a Letter of Intent (the “LOI”) with Precision Biologics, Inc., a corporation funded by a number of Neogenix shareholders, to investigate a potential transaction in which Precision Biologics would acquire all of the assets of Neogenix in a sale conducted through a Chapter 11 bankruptcy proceeding, subject to superior offers received during an auction period. The proposed transaction would include the purchase by Precision Biologics of substantially all of the assets of Neogenix in a “Section 363” asset sale approved by the bankruptcy court. The consideration for the purchase would be payment to Neogenix of up to approximately $3.5 million and the issuance to the current Neogenix shareholders of five million shares of the common stock of Precision Biologics and the right for the Neogenix shareholders to purchase up to an additional five million Precision Biologic’s shares at $1.50 per share for a limited period. The LOI is non-binding, and there can be no assurance that a definitive agreement with Precision Biologics will be entered into, or that a transaction with Precision Biologics will be completed. For additional information, please see the Company’s letter to its shareholders dated June 29, 2012, filed as an exhibit to the Company’s Current Report on Form 8-K filed on July 3, 2012.

Business Strategy

Company Core Operational Focus:

| · | Parallel companion diagnostic and drug development strategies in order to develop affordable and targeted therapies. The Company hopes to enable physicians to deliver patients with a tailored treatment strategy. |

| · | Focused translation of our early pipeline towards advancement into the clinic and achieving regulatory standards as required for our companion diagnostic and therapeutic products. |

| · | Expand collaborations and external partnerships to advance key programs and clinical trials. |

| · | Operational efficiency and alignment to maximize use of cash. |

| · | Targeted market segments that represent a high unmet medical need and favorable reimbursement guidance. |

| · | Financing strategies that meet Company compliance standards. |

Company Highlights:

Business developments

| · | The Company has advanced trials with its lead compound, NEO-101 and completed patient enrollment for Phase 1 during fourth quarter 2011. |

| · | The Company has established high specificity for its IHC based Companion Diagnostic test. |

| · | The Company initiated cGMP manufacture of the second lot of NEO-101 drug product (NEO-102) |

| · | The Company has maintained an open IND with Johns Hopkins, Duke Medical Center and North Shore Hospital. |

Operational developments

| · | The Company has aligned its intellectual property portfolio and claims to advance and support commercialization goals. The patent portfolio consists of a number of granted patents and pending applications which claim novel antibodies, fragments that target antigens, and both therapeutic and diagnostic methods of use. |

| · | The Company has reduced operating expenses through operational alignment and focus on key commercial goals. |

| · | The Company has successfully formulated an accounting model to support the completion of its 2011 financial statements. This model was reviewed and accepted by the OCA (Office of Chief Accountant at the SEC) and the Company Auditors and was adopted for the September 30, 2011 Form 10Q. |

Legal and regulatory developments

| · | The Company has been subject to an informal inquiry from the SEC which has resulted in unbudgeted legal and advisory costs. We are voluntarily providing the SEC with requested information. |

| · | The Company has been provided for notice of allowance for certain of its pending international intellectual property claims. |

Awards and rankings

| · | The Company was selected for the Windhover industry review panels at “Top 10 Projects to Watch in Oncology 2011” |

| · | The Company was selected and among the first 11 companies during 2011 to receive investments as a result of the Montgomery County Biotech Investment Tax Credit Program. |

Company History and Proprietary Library of Tumor Antigens:

Neogenix was incorporated in Maryland in December 2003 to build on the work of our founder, Dr. Myron Arlen, who began working in the field of oncology thirty years earlier. In the 1970s and 1980s, Dr. Ariel Hollinshead, along with her collaborators, isolated a variety of TAAs from numerous cancer patients’ tumors. Neogenix holds exclusive rights to a unique discovery platform consisting of a library of vaccines that include a variety of tumor associated antigens, or “TAAs.” Some of these TAAs were administered to cancer patients in Phase I, II and III clinical trials conducted in the United States during the late 1970s and early 1980s, referred to here as the “Early Clinical Trials.” Data from the Early Clinical Trials suggested anti-tumor responses and prolonged survival for cancer patients. This TAA library is owned by Neogenix and serves as a unique platform for pipeline expansion.

Scientific, Medical and Industry Background

Relevant Cancer Facts

Cancer therapeutics currently represents the largest pharmaceutical category with respect to global sales, and estimated to be approximately $74 billion during 2012. Specifically, targeted cancer therapeutics, particularly monoclonal antibodies representing 50% of the targeted therapies, have become mainstays of cancer treatment due to the favorable efficacy and tolerability profiles relative to traditional chemotherapeutics. The current worldwide market for targeted cancer therapeutics is approximately $33 billion per year and is expected to grow to more than $57 billion by 2016, representing a five-year CAGR of 12%. Colorectal cancer treatment is an approximately $8 billion market in the U.S. with an annual incidence rate of approximately 141,000. Pancreatic cancer treatment is an approximately $2 billion market in the U.S. with an annual incidence rate of approximately 44,000 [Global Business Insights, 2010].

| 3 |

Worldwide, one in eight deaths is linked to cancer, and cancer treatment represents a growing component of overall medical costs. The National Institutes for Health estimated the overall cost of cancer in 2010 at $263.8 billion: $102.8 billion for direct medical costs (total of all health expenditures); $20.9 billion for indirect morbidity costs (costs of lost productivity due to illness); and $140.1 billion for indirect mortality costs (costs of lost productivity due to premature death). Costs also are likely to increase at the individual patient level as new, more advanced, and more expensive treatments are adopted as standards of care.

Cell Line Production and Manufacturing

Neogenix manufactured its first lot of cGMP drug product NEO-101 through a contract manufacturer (Goodwin Biosciences). Neogenix currently relies on contract manufacturers to produce monoclonal antibodies used for our clinical studies. Neogenix plans to continue to rely upon contract manufacturers to manufacture our antibody- product candidates. Neogenix currently relies on a small number of manufacturers for such production. Although Neogenix believes that there are other manufacturers that can satisfy our clinical study requirements, if a contract manufacturer provides us with insufficient or faulty antibody supply or we are forced to identify and establish new relationships with contract manufacturers, we may suffer significant delay or additional material costs.

Neogenix completed its Services Agreement (the “Selexis NEO-101 Agreement”) with Selexis SA (“Selexis”) for the development of a high-expression production cell line expressing our NEO-101 antibody. Selexis has completed the work under the Selexis NEO-101 Agreement. In December 2010, the Company exercised its option to enter into a commercial license agreement with Selexis to commercialize the Selexis-developed high performance NEO-101 cell line (“Neo-102”), the terms of which were negotiated prior to the initiation of the research project. The commercial license agreement includes a non-exclusive license to the Company of all Selexis intellectual property rights in the higher expression NEO-102 cell lines developed by Selexis, with a right to sublicense as needed, based on reaching certain milestone payments.

Neogenix completed its August 2010 service agreement with Catalent Pharma Solutions LLC (“Catalent”) for the development of two high-expression production cell lines expressing our NEO-201 and NEO-301 antibodies. We have the right to obtain access to cell lines developed by Catalent upon execution of a sale and license agreement and upon initiation of our cGMP program for NEO201.

In 2010, Neogenix entered into a contract manufacturing relationship with Cytovance Biologics, for cGMP production of NEO-101 (“NEO-102”). Subsequently, in 2011 this agreement was modified and renegotiated the scope to enhance efficiency and manage costs. The manufacture of NEO-102 was fully implemented during 3rd and 4th Quarter 2011 and release of the drug product is expected to be completed during 3rd Quarter of 2012, unless there are unplanned manufacturing or regulatory challenges. We must show that the new manufacturer’s product is comparable to the previous manufacturer’s product. If the products are not comparable, the FDA may require us to postpone planned trials while we perform additional studies including preclinical safety toxicology and possibly a new Phase I trial. The use of more efficient cell lines and associated modifications in manufacturing protocols are not unusual and typically done to reduce the cost of cGMP drug manufacturing but such changes require the completion of adequate bridging studies. The Company will work with Cytovance and its regulatory advisors to complete required FDA documents and responses for approved use of NEO 102 in clinical trials.

Regulatory Matters

The FDA and other federal, state, local, and foreign governmental authorities, extensively regulate, among other things, the research and development, clinical testing, manufacture, record keeping, quality control, safety, effectiveness, packaging, labeling, storage, distribution, advertising and promotion of therapeutic products and medical devices, including products intended for clinical diagnostic purposes. Failure to comply with applicable FDA or other requirements may result in civil or criminal penalties, recall or seizure of products, partial or total suspension of production or withdrawal of a product from the market.

In the United States, the FDA regulates medical device and drug products under the Federal Food, Drug, and Cosmetic Act, or FFDCA, and its implementing regulations, and regulates biologic products under the Public Health Service Act, or PHS Act, and its implementing regulations.

| 4 |

For purposes of NDA or BLA submission and approval, human clinical trials are typically conducted in the following phases, which may overlap:

| · |

Phase I – Studies are initially conducted in a limited population to test the product candidate for safety, dosage tolerance, absorption, metabolism, distribution and excretion in healthy humans or in patients, such as cancer patients.

| |

| · |

Phase II – Studies are generally conducted in a limited patient population to identify possible adverse effects and safety risks, to determine preliminary efficacy of the product for specific targeted indications and to determine dosage tolerance and optimal dosage. Multiple Phase II clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more expensive Phase III clinical trials. In some cases, a sponsor may decide to run what is referred to as a “Phase IIb” evaluation, which is a second, confirmatory Phase II clinical trial that could, if positive and accepted by the FDA, serve as a pivotal trial in the approval of a product candidate.

| |

| · |

Phase III – These are commonly referred to as pivotal studies. Phase III clinical trials are undertaken in large patient populations to further evaluate dosage, to provide substantial evidence of clinical efficiency with statistical significance, and to further test for safety in an expanded and diverse patient population at multiple, geographically-dispersed clinical trial sites.

| |

| · | Phase IV – In some cases, FDA may condition approval of an NDA/BLA for a product candidate on the sponsor’s agreement to conduct additional clinical trials to further assess the drug’s safety and effectiveness after NDA/BLA approval. Such post-approval trials are typically referred to as Phase IV studies. |

New Drug Applications and Biologic Licensing Applications:

Results of product development, pre-clinical studies and clinical trials, as well as detailed information about the manufacturing process, quality control methods and product composition, among other things, are submitted to the FDA as part of the NDA or BLA seeking approval to market and commercially distribute the product on the basis of a determination that the product is safe and effective for its intended use. The submission of an NDA is subject to the payment of user fees, but a waiver of such fees may be obtained under specified circumstances. The FDA reviews all NDAs before it accepts them for filing. It may request additional information before it accepts an NDA or BLA for filing.

Orphan Drug Designation and Exclusivity:

The FDA grants “orphan drug” designation to drugs intended to treat a rare disease or condition, which generally is a disease or condition that affects fewer than 200,000 individuals in the United States. Orphan drug designation must be requested before submitting an NDA. If the FDA grants orphan drug designation, which it may reject, the identity of the therapeutic agent and its potential orphan use are publicly disclosed by the FDA. Orphan drug designation does not convey an advantage in, or shorten the duration of, the review and approval process. If a product with an orphan drug designation subsequently receives the first FDA approval for the indication for which it has such designation, the product is entitled to seven years of orphan drug exclusivity, meaning that the FDA may not approve any other applications to market the same drug for the same indication for a period of seven years, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity (superior efficacy, safety, or a major contribution to patient care). Orphan drug designation does not prevent competitors from developing or marketing different drugs for that indication. We have obtained orphan drug designation for our first clinical stage product (NEO-101).

Under EU medicine laws, the criteria for designating a product as an “orphan medicine” are similar but somewhat different from those in the United States. A drug is designated as an orphan drug if the sponsor can establish that the drug is intended for a life-threatening or chronically debilitating condition affecting no more than five in 10,000 persons in the European Union or is unlikely to be profitable, and if there is no approved satisfactory treatment or if the drug would be a significant benefit to those persons with the condition. Orphan medicines are entitled to 10 years of marketing exclusivity, except under certain limited circumstances comparable to U.S. law. During this period of marketing exclusivity, no “similar” product, whether or not supported by full safety and efficacy data, will be approved unless a second applicant can establish that its product is safer, more effective or otherwise clinically superior. This period may be reduced to six years if the conditions that originally justified orphan designation change or the sponsor makes excessive profits. Neogenix intends to pursue orphan drug status outside the U.S. upon establishing the cost of undergoing such process.

Intellectual Property

Neogenix is focused on building its patent portfolio related to antibody-based cancer therapies and diagnostics. Neogenix is executing an aggressive international filing strategy to secure an exclusive position in key markets, including markets which are expected to have high growth potential in the next 10 years (e.g, China and India). Neogenix has secured patent protection on some of our products through to at least the year 2022, and the terms of our U.S. patents may be extended under the provisions of 35 U.S.C. §156.

| 5 |

Neogenix’s first patent, U.S. Patent No. 7,314,622, encompasses the novel molecular aspects of NEO-101, as well as chimeric and labeled derivatives of NEO-101. This patent expires on April 14, 2026. U.S. Patent No. 7,763,720 issued in July 2010, expanding the coverage of NEO-101 to the genes encoding it. This patent expires on August 20, 2026. Moreover, Neogenix is pursuing patents to NEO-101 in relevant foreign jurisdictions (e.g, Europe, Japan, Canada, Australia) with claims drawn to therapeutic and diagnostic uses for NEO-101. Neogenix recently filed provisional patent applications with claims relating to an antigen of NEO-101 and claims relating to the antigen bound by NEO-101. This provisional patent application will be converted into utility and foreign patent filings that will expire in 2031.

Our patent portfolio includes U.S. Patent No. RE39,760 obtained from the IBS acquisition and related to an antibody against colon cancer. The reissued patent expires on November 18, 2014. Recently, one of these IBS patent applications, European Patent No. 1 411 962, was granted including claims drawn to a NEO- 301 antibody and methods of diagnosing and treating pancreatic cancer using this antibody. This patent expires on March 15, 2022.

Neogenix has one U.S. patent (U.S. Patent No. 7,829,678) and ten pending patent applications in., U.S., Canada, and Europe Each of these applications has foreign counterparts allowing us to pursue patent protection overseas. U.S. Patent No. 7,829,678 covers the NEO-201 antibody which may be useful for treatment or diagnosis of pancreatic or colorectal cancer. This patent expires on November 7, 2028. Neogenix recently filed a provisional patent application relating to the NEO-201 antigen and methods of use related to the target. This provisional patent application will be converted into utility and foreign patent filings that will expire in 2031.

Competition

Tables 66: Sales of leading players in the global cancer market ($m), 2010

| Company | Sales 2010 ($m) | Growth 2009-10 (%) | Market share 2010 (%) | CAGR 2006-10 (%) | ||||||||||||

| Roche | 20,598 | 5.6 | 38.2 | 12.0 | ||||||||||||

| Novartis | 6,283 | 14.4 | 11.6 | 17.7 | ||||||||||||

| AstraZeneca | 3,930 | -12.0 | 7.3 | -1.8 | ||||||||||||

| Sanofi-Aventis | 3,486 | -16.0 | 6.5 | -6.5 | ||||||||||||

| Eli Lilly | 3,428 | 8.4 | 6.4 | 14.1 | ||||||||||||

| Pfizer | 2,138 | 10.7 | 4.0 | 5.1 | ||||||||||||

| Johnson & Johnson | 2,029 | 17.1 | 3.8 | 21.4 | ||||||||||||

| Takeda | 1,939 | 1.1 | 3.6 | 7.5 | ||||||||||||

| Bristol-Myers Squibb | 1,791 | 2.4 | 3.3 | 5.9 | ||||||||||||

| Merck & Co | 1,350 | 0.0 | 2.5 | 10.4 | ||||||||||||

| Top 10 total | 46,972 | 5.9 | 87.1 | 9.4 | ||||||||||||

| Others | 6,969 | -0.5 | 12.9 | 19.7 | ||||||||||||

| Grand total | 53,941 | 5.1 | 100.0 | 10.5 | ||||||||||||

| Source: PharmaVitae | BUSINESS INSIGHTS | |||||||||||||||

| 6 |

The above table reflects the leading companies participating in the global cancer market (Business Insights). There are many other smaller biotechnology companies that have developed and are working on developing mouse, chimeric, and humanized antibodies or other types of drugs for treating cancers and could be competitive with the Neogenix drug candidates. Competitors with greater resources, disruptive technologies and successful clinical trials may succeed in commercializing products that could have an adverse impact on the competitive profile of our drug candidates. In addition we may also be adversely impacted by the timing and market conditions at the time of our product approval, performance and efficacy of our product, pricing and availability of our products, sales and distribution capabilities, reimbursement challenges, patient response to the method and frequency of delivery, available funding and resources and ability to hire and retain talent.

Location and Facilities

We have locations in Great Neck, NY and Rockville, Maryland. See “Item 2 - Properties.”

Personnel

As of December 31, 2011, we had 14 full time employees. Our core leadership team brings a combination of clinical development, general management and corporate/business development experience within the therapeutic, life sciences and diagnostics sectors. In addition, we have expanded our external advisory team to include sector experts to advise management on scientific and business issues as needed. This strategy has resulted in the creation of a high quality team and significantly reduced operating costs. As of April 30, 2012, we have 10 full time employees.

Executive Officers

The executive officers of our company as of December 31, 2011 were as follows

| Name | Age | Position |

| Philip Arlen, MD | 48 | President and Chief Executive Officer |

| Myron Arlen, MD | 80 | Director of Medical Affairs |

| Andy Bristol, Ph.D. | 47 | SVP Research and Development |

| Albine Martin, Ph.D. | 52 | Chief Operating Officer and Acting Chief Accounting Officer |

| Robert Washington | 51 | Vice President Business Development |

Our Chief Executive Officer is the son of our Chairman of the Board. Otherwise, there are no family relationships among members of our management or our board of directors.

Philip M. Arlen, MD: Dr. Arlen became the Company’s CEO in March 2010, having served as President and Chief Medical Officer since July 2008. Prior to 2008, Dr. Arlen spent 11 years at the National Cancer Institute (NCI), USA, most recently as the Director of the Clinical Research Group for the Laboratory of Tumor Immunology and Oncology. At the NCI, Dr. Arlen focused on the development of a programmatic approach to vaccine clinical trials conducted at the NCI as well as at numerous other Cancer Centers throughout the U.S. During his tenure at the NCI, Dr. Arlen was the Principal Investigator and/or Associate Investigator on numerous clinical trials involving the use of cancer vaccines and other immunostimulatory molecules.

Dr. Arlen remains on the clinical staff at both the NCI Clinical Center as well as the National Naval Medical Center. He has authored or co-authored over 100 peer-reviewed manuscripts in internationally known scientific and medical journals. Dr. Arlen received an NIH Award of Merit for major contributions to the field of cancer immunotherapy in 2003. He is a board certified medical oncologist and received his BA from Emory University and his MD from Medical College of Georgia, School of Medicine.

Albine Martin, Ph.D: Dr. Martin became the Company’s COO in February 2011 and has over 20 years of diversified portfolio management and corporate development experience within the biotechnology, diagnostics and life sciences sector. Prior to joining Neogenix, Dr. Martin’s tenure included 3 public companies. Most recently, she served as the Vice President at Compugen (CGEN), a drug and diagnostic product candidate company, where she led the commercialization and licensing of novel products, launched a new revenue model and managed diagnostic and therapeutic strategic alliances.

During her tenure at Life Technologies, Inc. (LIFE), Dr. Martin served as Senior Business Director and held a number of leadership positions for commercialization of life science consumable products. As Business Director for Cell and Gene Therapy, she also worked with FDA/CBER to develop guidance for ancillary products. As the first senior employee at startup Digene Diagnostics, she was responsible for development and marketing of the company's initial revenue generating product portfolio and market launch of the HPV diagnostic tests. Dr. Martin holds a BS in Chemistry from Trinity College and a PhD from the University of Maryland. In addition, she served as a post doctoral Staff Fellow at the National Institutes of Health and is a graduate of the Program of Leadership and Strategy in Pharmaceuticals and Biotech at the Harvard Business School.

| 7 |

Andrew Bristol, Ph.D: Dr. Bristol served as Senior Vice-President of Research & Development and lead the company’s discovery and product development efforts. Prior to Neogenix Oncology, Dr. Bristol was Deputy Director of Immunology at GTI-Novartis, and has additional industry experience at Genetics Institute. Dr. Bristol received his BA in Molecular Biology from UC Berkeley, his PhD in Biochemistry from Tufts University, and performed post-doctoral research at the NIH. Dr. Bristol has more than 20 years of experience in cancer research with special emphasis in monoclonal antibodies, tumor immunology and cancer vaccines.

Robert Washington: Mr. Washington has more than 19 years of experience in pharmaceuticals and biotechnology with Ortho McNeil and Amgen. He has served in several commercial positions including his most recent as Corporate Accounts/National Accounts Executive with responsibilities for more than $550 million in revenue while at Amgen. With his strong background in oncology, he has served as Director of Business Development for Neogenix and previously as a company Director. He was a standout athlete at Penn State and was inducted into the Beaver County Hall of Fame in 2008.

| 8 |

| ITEM 1A. | RISK FACTORS |

In addition to the other information contained in this Form 10-K, prospective investors should consider carefully the following risk factors before investing in our securities. If any of the following risks actually occurs, our business, financial condition or results of operations could be adversely affected.

RISKS RELATED TO OUR BUSINESS

If we do not raise additional capital we will not be able to continue operations.

To date, we have financed our operations principally through offerings of securities intended to be exempt from the registration requirements of the Securities Act. We do not have available cash or cash flow to meet our anticipated working capital needs. We will require substantial additional funds in order to meet such needs, and we are investigating potential sources of funding. There can be no assurance that any such additional funding will be available to us. As a result, management believes that there is substantial doubt about the Company’s ability to continue as a going concern. To date, we have been unable to identify potential investors or a source of potential equity investment. If additional funds are raised by issuing equity securities, such securities will likely be sold at a significantly reduced purchase price from the most recent offering, further dilution to existing stockholders may result, and future investors may be granted rights superior to those of existing stockholders. If adequate funds are not available, the Company will not be able to continue operations. We are currently evaluating potential strategic alternatives, including bankruptcy and a sale of assets.

Certain shares of our common stock were sold through finders who were paid fees in spite of not being licensed as broker dealers.

The Company has concluded that finders’ fees were paid to certain individuals who were not registered as broker-dealers or otherwise licensed under applicable state law. Accordingly, it is possible that at least some investors who purchased shares of common stock in transactions in which finders’ fees were paid may have the right to rescind their purchases of shares, depending on applicable federal and state laws and subject to applicable defenses, if any. In addition, the Company may be subject to additional liability under state and/or federal laws in connection with the use of unlicensed broker-dealers. If the Company is forced to rescind a significant number of share purchases and/or pay substantial damages, it will impact the ability of the Company to continue operations; therefore management believes that there is substantial doubt about the Company’s ability to continue as a going concern.

We are a development stage company with a history of operating losses and have not achieved revenues to date.

We are a development stage company formed in 2003 and have a limited operating history. To date we have engaged only in research and development activities. Accordingly, we are subject to all of the risks inherent in the establishment of a new business enterprise.

Since inception, we have generated no revenues from product sales. As of December 31, 2011, we had a deficit accumulated during the development stage of approximately $115.5 million. We expect to incur additional losses as our research, development, clinical trial, manufacturing and marketing programs expand. The extent of future losses and the time required to achieve profitability is highly uncertain. There can be no assurance that we will ever achieve a profitable level of operations or that profitability, if achieved, can be sustained on an ongoing basis.

We have no products available for sale and if at all.

Our potential products are in the early stages of development and the products we have under development, and any future product candidates, will require significant R&D efforts to establish safety and efficacy, including extensive clinical testing, non-clinical (animal and laboratory) testing and regulatory approval prior to commercial sale. Our therapeutic products will be subject to more extensive testing and regulatory requirements, and therefore, we do not expect to have a therapeutic product ready for sale until at least 2015 or possibly not all. We cannot assure you that we will successfully complete our product development efforts, the manufacturing of our product candidates, that we will obtain required regulatory approvals in a timely manner, if at all, that we will be able to manufacture our product candidates at an acceptable cost and with acceptable quality or that we can successfully market any approved products.

| 9 |

Development of our products will involve a lengthy and complex process.

Our product candidates are currently a development stage company and will require additional research and development, manufacturing, extensive clinical testing and regulatory approval prior to any commercial sales. We cannot predict if or when any of our products under development will be commercialized. We must complete clinical trials in the United States to demonstrate the safety and efficacy of our proposed products, prior to obtaining FDA approval. We cannot predict with any certainty the amount of time necessary to obtain regulatory approvals that our clinical trials will be successful, or that FDA approval will be obtained. In addition, delays in obtaining necessary regulatory approvals of any proposed product could have an adverse effect on the product’s potential commercial success and on our business, prospects and financial condition. It is also possible that a product may be found to be ineffective or unsafe due to conditions or facts which arise after development has been completed and regulatory approvals have been obtained. In this event we may be required to discontinue any sales or withdraw such product from the market.

Any failure by our collaborative partners and other third-parties on which we rely to grow our cell lines and manufacture our products may delay or impair our ability to test, develop and eventually commercialize our products.

We rely on a small number of strategic partners for product manufacturing, critical services, clinical trials and product validation for our business. Any disruption in these collaborations could be detrimental and lead to an inability to commercialize our products.

The cost of compliance with the internal controls over financial reporting requirements of the Sarbanes-Oxley Act of 2002 could be significant.

Effective internal controls are necessary for us to provide reliable financial reports, to limit the risk of fraud and to operate successfully as a public reporting company. The cost to maintain compliance with these standards could become a burden that we cannot afford to continue to comply with. Management’s initial assessment of internal control over financial reporting included deficiencies in our internal controls. This could have an adverse effect on our business, financial position and results of operations. In addition, it could cause our investors to lose confidence in the accuracy and completeness of our financial reports.

If we are unable to successfully compete in the field defined by therapeutics and drug development, our business, product development and financial condition would be materially adversely affected.

We are engaged in the intensely competitive field of drug development . A number of companies are seeking to develop products that may compete directly or indirectly with our own. Competition from these companies and others is expected to increase. Many of these competitors have substantially greater capital, and greater experience in the development, manufacturing, marketing and distribution of products than us. Our competitors may succeed in developing technologies and products that are more effective than those of our company, and such companies may be more successful than us in developing, manufacturing, gaining regulatory approval for and marketing their products. There can be no assurance that products, if any, resulting from our development efforts will obtain regulatory approval in the United States or elsewhere more rapidly than competitors’ products, or at all. Our inability to compete effectively against competitors could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to keep up with technological changes in our industry our products may not become commercially viable.

No assurance can be given that unforeseen problems will not develop with the technologies used by us or that commercially feasible products or services will ultimately be developed by us.

Our success will depend upon our ability to secure patents for our products and protect our trade secrets.

Our success will depend, in part, on our ability to obtain patents and protect trade secrets. However, there can be no assurance that any additional patents will be issued as a result of such patent applications or that issued patents will provide us with significant protection against competitors. There can be no assurance that our patents will be held valid if subsequently challenged. Moreover, there can be no assurance that any patents issued to or licensed by us will not be infringed or that third parties have not or will not independently develop either the same or similar technology. Similarly, no assurance can be given that other parties will not be issued patents which will prevent, limit or interfere with one or more of our products, or will require licensing and the payment of significant fees or royalties by us to such third parties in order to enable us to conduct our business. Any of these occurrences could have a material adverse effect on our business, financial condition and results of operations. Even if we are successful in obtaining patent protection, there can be no assurance that one or more competing products will not be developed and marketed or that any such patents will provide competitive advantages for our products.

| 10 |

We also rely upon unpatented proprietary technology, know-how and trade secrets. We seek to protect our trade secrets and proprietary know-how, in part, through confidentiality agreements with employees, consultants and advisors, and we seek to require any corporate sponsor with which we enter into a collaborative research and development agreement to do so as well. No assurance can be given that these confidentiality agreements will not be violated, that we will have adequate remedies for any breach, that others will not independently develop or otherwise acquire substantially equivalent proprietary technology and trade secrets or disclose such technology or that we can meaningfully protect our rights in trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure. Any disclosure of such information could have a material adverse effect on our business, financial condition and results of operations. In addition, others may hold or receive patents that contain claims that may cover products developed by us.

Protecting our intellectual property could expose us to costly litigation.

Litigation, which could result in substantial cost to and diversion of effort by us, may be necessary to enforce patents issued to us, to protect trade secrets or know-how owned by us, to defend ourselves against claimed infringement of the rights of others and to determine the scope and validity of the proprietary rights of others. Patent litigation is costly and time consuming, and we may not have sufficient resources to pursue such litigation. We may have to alter our products or processes, pay licensing fees, defend an infringement action or challenge the validity of the patents in court, or cease activities altogether because of patent rights of third parties, thereby causing additional unexpected costs and delays to us. If we do not obtain a license under such patents, are found liable for infringement or are not able to have such patents declared invalid, we may be liable for significant money damages, may encounter significant delays in bringing products to market or may be precluded from using products requiring such licenses.

We may incur material cost increases as a result of product liability claims that may be brought against us.

Our business will expose us to potential liability risks that are inherent in the testing, manufacturing and marketing of medical products. There can be no assurance that we will be able to obtain and maintain adequate insurance coverage at acceptable cost, if at all. There can be no assurance that the level or breadth of insurance coverage maintained by us will be adequate to fully cover potential claims. As of December 31, 2011, our level of products liability insurance coverage is $5,000,000 in the aggregate, and excludes damages for product recalls. No assurance can be given that we will be able to maintain or increase this level of products liability insurance coverage. A successful claim or series of claims brought against us in excess of our insurance coverage, and the effect of any product liability litigation upon the reputation and marketability of our products, together with the diversion of the attention of our key personnel, could have a material adverse effect on our business, financial condition and results of operations.

We are dependent on key personnel and scientific consultants and the loss of these key personnel and consultants could have a material adverse effect on our business, including our research and development objectives.

Because of the specialized nature of our business, our success will depend, in large part, on our ability to attract and retain highly qualified personnel. Failure to attract, or the subsequent loss of, key scientists and other executive officers would be detrimental to us and would impede the achievement of our development objectives. The competition for experienced management personnel amongst the numerous biotechnology, pharmaceutical and healthcare companies, universities and nonprofit research institutions is intense, and there can be no assurance that we will be able to attract and retain qualified personnel necessary for the development of our business

We are subject to extensive government regulation in jurisdictions around the globe in which we expect to do business. Regulations imposed by the FDA and similar agencies in other countries can significantly increase our costs.

The FDA and comparable agencies in foreign countries impose substantial requirements upon the introduction of pharmaceutical and diagnostic products through lengthy and detailed pre-clinical, laboratory, manufacturing and clinical testing requirements and other costly and time-consuming procedures to establish their safety and efficacy. The approval process is expensive, time-consuming, uncertain and subject to unanticipated delays. Satisfaction of the requirements typically takes a significant number of years and can vary substantially or never be achieved based upon the type, complexity and novelty of the product. Delays in obtaining governmental regulatory approval could adversely affect our marketing as well as our ability to generate significant revenues from commercial sales. There can be no assurance as to when or whether we, independently or with any collaborative partners, might first submit a product application for FDA or other regulatory review, and there can be no assurance that FDA or other regulatory approvals for any product candidates developed by us will be granted on a timely basis or at all. The effect of government regulation may be to delay marketing of our potential products for a considerable or indefinite period of time, impose costly procedural requirements upon our activities and furnish a competitive advantage to larger companies or companies more experienced in regulatory affairs. In addition, product approvals, if obtained, could be withdrawn for failure to comply with regulatory requirements or the occurrence of unforeseen clinical or other problems following initial marketing.

As with many biotechnology and pharmaceutical companies, we are subject to numerous costly and diverse environmental, laboratory animal and safety laws, rules, policies and regulations. Any violation of these regulations could materially adversely affect our business, financial condition and results of operations.

| 11 |

We plan to rely upon third-party partners for the manufacture of any products we develop. If such partnerships are unsuccessful, we could be prevented from commercializing our products on a timely or profitable basis.

We have not invested in the development of internal manufacturing, marketing or sales capabilities. We currently, and plan to continue to, rely on contracted third parties and/or pharmaceutical partners for the manufacture of products in accordance with cGMP as prescribed by the FDA and other regulatory authorities and to produce adequate supplies to meet future development and commercial requirements. If we are unable to retain third-party manufacturing on commercially acceptable terms or if third-party manufacturers are unable to manufacture products in accordance with cGMP or to produce adequate supplies, our ability to advance our products will be adversely affected, and the submission of products for final regulatory approval and initiation of marketing would be delayed. This, in turn, may prevent us from commercializing our product candidates as planned, on a timely basis or on a profitable basis, which may have a material adverse effect on our business, financial condition and results of operations.

In order for our business to succeed, products we develop must achieve market acceptance with the medical community and third-party payors.

The commercial success of the products we may develop, when and if approved for marketing by the FDA and corresponding foreign agencies, will depend on their acceptance by the medical community and third-party payors as clinically useful, cost-effective and safe. Market acceptance, and thus sales of our product candidates, will depend on several factors, including clinical effectiveness, the degree to which our product offers an improvement versus current therapies, safety, price, ease of administration, and the rate of adoption of new cancer treatment and diagnostic options. Market acceptance will also depend on our ability to establish our products as a new standard of care in appropriate treatment guidelines, and that of our strategic partners to educate the medical community and third-party payors about their benefits. We cannot be certain that our product candidates will gain market acceptance. If our products do not achieve market acceptance, we may not generate sufficient revenues to achieve or maintain profitability.

We may pursue acquisition opportunities and strategic alliances, which may subject us to considerable business and financial risk.

We may pursue acquisitions of companies, assets or complementary technologies or strategic alliances in the future. Acquisitions and strategic alliances may expose us to business and financial risks that include, but are not limited to:

| · | diverting management’s attention; | |

| · | incurring additional indebtedness; | |

| · | dilution of our common stock due to issuances of additional equity securities; | |

| · | assuming additional liabilities; | |

| · | incurring significant additional capital expenditures, transaction and operating expenses; | |

| · | failing to integrate the operations of an acquired business into our own, including personnel, technologies and corporate cultures; | |

| · | failing to achieve operating and financial synergies anticipated to result from the acquisitions and strategic alliances; and | |

| · | failing to retain key personnel of, vendors to and customers of the acquired businesses. |

If we are unable to successfully address the risks associated with acquisitions and strategic alliances, or if we encounter unforeseen expenses, difficulties, complications or delays frequently encountered in connection with the integration of acquired entities and participation in strategic alliances and the expansion of operations, our growth may be impaired, we may fail to achieve anticipated synergies and we may be required to focus resources on integration and other activities rather than on our primary business.

| 12 |

Conducting clinical trials is a lengthy, costly and uncertain process that may not demonstrate that our product candidates are safe or effective, or result in regulatory approval.

To receive regulatory approval for the commercial sale of NEO-101 or any other product candidates, we must successfully complete adequate and well controlled clinical trials demonstrating, with substantial evidence, the efficacy and safety of our product candidates in the indications being studied. Clinical testing is expensive, takes many years to complete and has an uncertain outcome. Clinical failure can occur at any stage of the testing. Our clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical and/or non-clinical testing. In addition, the results of our clinical trials may show that our product candidates may cause undesirable side effects, which could interrupt, delay or halt clinical trials, resulting in the denial of regulatory approval by the FDA and other regulatory authorities.

Although we have initiated clinical studies for NEO-101 in patients with advanced pancreatic and colorectal cancer, we cannot be certain if or when we will initiate or complete additional testing, including required registration trials. The results of preclinical or earlier stage clinical trials do not necessarily predict safety or efficacy in humans. Furthermore, we cannot guarantee that our clinical trial designs are adequate to satisfy regulatory requirements for proof of safety and efficacy necessary for approval of our products.

Clinical trial data may reveal new safety concerns that may require additional clinical trials to, among other things, assess and possibly reduce the risk. Clinical trials that successfully meet their efficacy endpoints may nonetheless require additional clinical trials for regulatory approval. If we are required to conduct additional clinical trials or other testing of our product candidates beyond those that we currently contemplate, particularly for our NEO-101 product candidate, we may be delayed in obtaining, or may not be able to obtain, marketing approval for these product candidates. In addition, we may not be able to obtain approval for indications that are as broad as we intended.

Delays in the commencement, enrollment and successful completion of clinical testing could result in increased costs to us and delay or limit our ability to obtain regulatory approval for our product candidates.

Although for planning purposes we project the commencement, continuation and completion of our clinical trials, delays in the commencement, enrollment and completion of clinical testing could significantly affect our product development costs. We do not know whether planned clinical trials for NEO-101 or our other potential product candidates will begin on time or be completed on schedule, if at all. Clinical trials may not be commenced, may be delayed or may be unsuccessful for a variety of reasons, including:

| · | we may not reach agreements on acceptable terms with prospective clinical research organizations, or CROs, and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; | |

| · | we may be unable to engage a sufficient number of adequate trial sites because many candidate sites are already engaged in other clinical trial programs for the same indication as our product candidates; | |

| · | we may not recruit and enroll patients to participate in clinical trials due, among other things, to small numbers of patients in the target population, changing standards of medical care, failure to meet enrollment criteria and competition from other clinical trial programs for patients with the same indication as our product candidates; | |

| · | patients who do not meet enrollment criteria may be erroneously enrolled in our clinical trials, which may negatively impact our clinical data and/or result in unforeseen patient safety issues; | |

| · | we may be unable to maintain sites that we have engaged if such sites are required to withdraw from a clinical trial or become ineligible to participate in clinical studies for contractual, legal or medical reasons; | |

| · | we may not retain patients who have initiated a clinical trial due, among other things, to patients’ tendencies to withdraw due to inability to comply with the treatment protocol, perceived lack of efficacy, personal issues, side effects from the therapy or unavailability for further follow-up; and | |

| · | we may not secure adequate funding to continue or complete our clinical trials. |

Successful completion of a clinical trial requires clinical sites to store, handle, document and administer the product candidate appropriately and to perform outcome assessments according to the trial’s protocol. Any site’s failure to handle the clinical trial material properly, to follow the protocol or to perform the outcome assessments appropriately could result in contamination or inactivation of the clinical trial material or could generate incomplete or potentially misleading data that might call the trial results into question. If any of these events were to occur, we may have to repeat all or a portion of the clinical trial.

| 13 |

If we experience delays in the commencement, enrollment or successful completion of our clinical trials, or if our clinical trials fail, we would experience significant increases in costs and we may not obtain regulatory approval in a timely manner, if at all.

All of our products in development require regulatory review and approval prior to commercialization. Any delay in the regulatory review or approval of any of our products in development will harm our business.

All of our products in development require regulatory review and approval prior to commercialization. Any delays in the regulatory review or approval of our products in development would delay market launch, increase our cash requirements and result in additional operating losses.

The process of obtaining FDA and other required regulatory approvals, including foreign approvals, takes many years and varies substantially based upon the type, complexity and novelty of the products involved. Furthermore, this approval process is extremely complex, expensive and uncertain. We may not be able to maintain our proposed schedules for the submission of any NDA, BLA, 510(k) or PMA in the United States or any marketing approval application or other foreign applications for any of our products.

We may seek fast track

designation, priority review or accelerated approval for our product candidates, which are FDA programs intended to facilitate

the development of and expedite the review of drugs intended to treat serious or life-threatening conditions and that demonstrate

the potential to address unmet medical needs. We cannot predict whether any of our product candidates will obtain a fast track,

priority review or accelerated approval designation, or the ultimate impact, if any, of the fast track, priority review or accelerated

approval process on the timing or likelihood of FDA approval of any of our product candidates.

Furthermore, if we receive accelerated approval of one of our product candidates based on a surrogate endpoint and fail to timely demonstrate statistically significant benefit under a clinical endpoint post-approval, we will be required to withdraw our product from the market.

If we submit any NDA or PMA, including any amended NDA or PMA, to the FDA seeking marketing approval for any of our products, the FDA must decide whether to either accept or reject the submission for filing. We cannot be certain that any of these submissions will be accepted for filing and reviewed by the FDA, or that our marketing approval application submissions to any other regulatory authorities will be accepted for filing and reviewed by those authorities. We cannot be certain that we will be able to respond to any regulatory requests during the review period in a timely manner without delaying potential regulatory action. We also cannot be certain that any of our products will receive favorable recommendation from any FDA advisory committee or foreign regulatory bodies or be approved for marketing by the FDA or foreign regulatory authorities.

In addition, delays in approvals or rejections of marketing applications may be based upon many factors, including regulatory requests for additional analyses, reports, data and/or studies, regulatory questions regarding data and results, changes in regulatory policy during the period of product development and/or the emergence of new information regarding our products or other products. Approvals may not be granted on a timely basis, if at all, and if granted may not cover all of the indications for which we may seek approval. Also, an approval might contain significant limitations in the form of warnings, precautions or contraindications.

We are presently developing a diagnostic test for patient selection for NEO-101, and such test may not be accurate or useful for the intended purposes, and may itself require regulatory approval.

We are presently developing a diagnostic test for patient selection for NEO-101 (NEO-102) clinical trials. If we cannot develop a test that we can successfully use to identify the appropriate patients expressing the NEO-101 antigen, the clinical development and regulatory approval of NEO-101 could be significantly delayed. We believe such a test will require its own regulatory approval and delays or failure to obtain such regulatory approval would delay or prevent us from commercializing our product.

We have no experience manufacturing large clinical-scale or commercial-scale pharmaceutical products and have no manufacturing facility. As a result, we are dependent on numerous third parties for the manufacture of our product candidates and our supply chain, and if we experience problems with any of these suppliers the manufacturing of our products could be delayed.

We do not own or operate manufacturing facilities for clinical or commercial manufacture of our product candidates, which includes the drug substance and the finished drug product. We currently outsource all manufacturing and packaging of our pre-clinical and clinical product candidates to third parties. In addition, we do not currently have any agreements with third-party manufacturers for the long-term commercial supply of many of our product candidates. The manufacturers, therefore, could discontinue the manufacture or supply of our products at any time. Our inability to obtain adequate supply could delay or otherwise adversely affect the clinical development of our product candidates.

| 14 |

We may be unable to enter into agreements for future clinical or commercial supply of our product candidates with third-party manufacturers, or may be unable to do so on acceptable terms. Even if we enter into these agreements, the various manufacturers of each product candidate will likely be single source suppliers to us for a significant period of time. We may not be able to establish additional sources of supply for our products prior to commercialization.

The manufacturers of our product candidates are also subject to various licensing and regulatory requirements. Our manufacturers are subject to the licensing requirements of the FDA, and state and foreign regulatory authorities. Our manufacturers’ facilities are subject to inspection by the FDA, and state and foreign regulatory authorities. Failure to obtain or maintain these licenses or to meet the inspection criteria of these agencies would disrupt our manufacturing processes and adversely affect our ongoing clinical trials and our business and future prospects, results of operations, financial condition and cash flow. Any failure by our manufacturers to follow or document their adherence to cGMP regulations or satisfy other manufacturing and product release regulatory requirements may lead to significant delays in the availability of products for commercial use or clinical study, may result in the termination of or hold on a clinical study, or may delay or prevent filing or approval of marketing applications for our products. Failure to comply with applicable regulations could also result in sanctions being imposed on us, including fines, injunctions, civil penalties, failure of regulatory authorities to grant marketing approval of our products, delays, suspension or withdrawal of approvals, license revocation, seizures or recalls of products, operating restrictions, criminal prosecutions and damage of product during storage or shipment, any of which could harm our business. Failure by any of our suppliers to comply with applicable regulations or inability or unwillingness to supply on the part of any of these suppliers may result in long delays and interruptions to our manufacturing capacity while we seek to secure and qualify another supplier who meets all applicable regulatory requirements.

Any of these factors could cause the delay or suspension of initiation or completion of our clinical trials, regulatory submissions, required approvals or commercialization of our products, could cause us to incur higher costs in connection with the manufacture of our product candidates and could prevent us from commercializing our product candidates successfully. Furthermore, if our third-party manufacturers fail to deliver the required commercial quantities of our finished product, if and when it is approved for marketing, on a timely basis and at commercially reasonable prices and we are unable to find one or more replacement manufacturers capable of production at a substantially equivalent cost, in substantially equivalent volumes and quality, and on a timely basis, we would likely be unable to meet demand for our products and we would lose potential revenue.

Even if our product candidates receive regulatory approval, they will be subject to ongoing regulatory requirements and may face regulatory and enforcement action.

Even if U.S. regulatory approval is obtained, the FDA may still impose significant restrictions on a product’s indicated uses or marketing or impose ongoing requirements for potentially costly post-approval studies. Given the number of recent high-profile adverse safety events with certain drug products, the FDA may require, as a condition of approval, costly risk management programs which may include safety surveillance, restricted distribution and use, patient education, enhanced labeling, special packaging or labeling, expedited reporting of certain adverse events, pre-approval of promotional materials and restrictions on direct-to-consumer advertising. For example, any labeling approved for NEO-101 or any other product candidates may include a restriction on the term of its use, or it may not include one or more of our intended indications.

Our product candidates, if approved for commercial use, will also be subject to ongoing FDA requirements for the labeling, packaging, storage, advertising, promotion, record keeping and submission of safety and other post-market information on the product. In addition, approved products, manufacturers and manufacturers’ facilities are subject to continual review and periodic inspections. If a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency or problems with the facility where the product is manufactured, the regulatory agency may impose restrictions on that product or us, including correcting promotional literature or requiring withdrawal of the product from the market. If our product candidates fail to comply with applicable regulatory requirements, such as cGMPs, a regulatory agency may:

| · | issue warning letters; | |

| · | require us to enter into a consent decree, which can include imposition of various fines, reimbursements for inspection costs, required due dates for specific actions and penalties for noncompliance; | |

| · | impose civil or criminal penalties; | |

| · | suspend regulatory approval; | |

| · | suspend any ongoing clinical trials; |

| 15 |

| · | refuse to approve pending applications or supplements to approved applications filed by us; | |

| · | impose restrictions on operations, including costly new manufacturing requirements; or | |

| · | seize or detain products or require a product recall. |

Even if our product candidates receive regulatory approval in the United States, we may never receive approval or commercialize our products outside of the United States.

In order to market and commercialize any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. For example, European regulatory authorities generally require a trial comparing the efficacy of the new drug to an existing drug prior to granting approval. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval processes in other countries include all of the risks detailed above regarding FDA approval in the United States as well as other risks. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in others. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval could have the same adverse effects regarding FDA approval in the United States. Such effects include the risks that our product candidates may not be approved for all indications requested, which would limit the uses for which our products may be marketed and have an adverse effect on product sales and potential royalties, and that such approval may be subject to limitations on the indicated uses for which the product may be marketed or require costly, post-marketing follow-up studies.

RISKS RELATED TO OUR COMMON STOCK

Certain shares of our common stock were sold through finders who were paid fees in spite of not being licensed as broker-dealers.

The Company has concluded that finders’ fees were paid to certain individuals who were not registered as broker-dealers or otherwise licensed under applicable state law. Accordingly, it is possible that at least some investors who purchased shares of common stock in transactions in which finders’ fees were paid may have the right to rescind their purchases of shares, depending on applicable federal and state laws and subject to applicable defenses, if any. In addition, the Company may be subject to additional liability under state and/or federal laws in connection with the use of unlicensed broker-dealers. If the Company is forced to rescind a significant number of share purchases and/or pay substantial damages, it will impact the ability of the Company to continue operations; therefore management believes that there is substantial doubt about the Company’s ability to continue as a going concern.

There is currently no trading market for our securities and only a limited trading market may develop.

No market, public or private, for our common stock is in existence at this time and there can be no assurance that a market for our common stock will develop in the future. Accordingly, investors in our securities cannot be expected to be readily liquid. We are not currently applying for listing or quotation on any national securities exchange or other market. While our shares may be quoted on the OTC Bulletin Board or another market in the future, there can be no assurance that an active trading market for our common stock will develop or, if it does develop, that it will be maintained. Accordingly, no assurance can be given that a holder of common stock will be able to sell those shares in the future or as to the price at which any such sale would occur.

Our trading market will also be limited by contractual transfer restrictions placed upon our outstanding shares of common stock.