Attached files

| file | filename |

|---|---|

| EX-99.02 - COURT?S ORDER - WEED, INC. | ex992.htm |

| 8-K - CURRENT REPORT - WEED, INC. | unmn_8k.htm |

Exhibit 99.01

JAMES M. LAGANKE, ESQ. (SB # 006913)

JAMES M. LaGANKE, P.L.L.C.

13236 North 7th Street, Suite 4-257

Phoenix, Arizona 85022

Telephone: (602) 279-6399

Facsimile: (602) 993-5323

Email: jameslaganke@aol.com

ATTORNEY FOR PLAINTIFFS

IN THE SUPERIOR COURT OF THE STATE OF ARIZONA

IN AND FOR THE COUNTY OF MARICOPA

|

UNITED MINES, INC., an Arizona corporation, LAWRENCE G. DYKERS, an Arizona resident, GLYNN BURKHARDT, an Arizona resident, ROBERT METZ, an Arizona resident, ROGER McCASLIN, an Arizona resident, JOHN CESAR, an Arizona resident, VOLKER SPIETH, an Arizona resident, and NICHOLAS BARR, an Arizona resident,

Plaintiffs,

V.

GLENN E. MARTIN AND JANE DOE MARTIN, husband and wife, NICOLE M. BREEN and RYAN BREEN, wife and husband, GEM MANAGEMENT GROUP, LLC., an Arizona Limited Liability Company, John Does 1-X, Jane Does 1-X, and ABC partnerships, or corporate entities 1-X,

Defendants.

|

Case No.

COMPLAINT

|

1

Plaintiffs, United Mines, Inc., Lawrence G. Dykers, Glynn Burkhardt, Robert Metz, Roger McCaslin, John Cesar, Volker Spieth, and Nicholas Barr, by and through their undersigned attorney, for their Complaint herein allege the following.

THE PARTIES

The Plaintiffs

1. Plaintiff, United Mines, Inc. (“United Mines”), is a corporation organized and existing under the laws of the State of Arizona with its principal place of business in the State of Arizona. United Mines is a public company whose stock is traded on the Over-the-Counter Bulletin Board exchange.

2. Plaintiff, Lawrence G. Dykers, is a resident of the State of Arizona, and a member of the Board of Directors and a shareholder of United Mines.

3. Plaintiff, Glynn Burkhardt, is a resident of the State of Arizona, and a member of the Board of Directors and a shareholder of United Mines.

4. Plaintiff, Robert Metz, is a resident of the State of Arizona, and a member of the Board of Directors and a shareholder of United Mines.

5. Plaintiff, Roger McCaslin, is a resident of the State of Arizona, and a member of the Board of Directors and a shareholder of United Mines.

6. Plaintiff, John Cesar, is a resident of the State of Arizona, and a shareholder of United Mines.

7. Plaintiff, Volker Spieth, is a resident of the State of Arizona, and a shareholder of United Mines.

8. Plaintiff, Nicholas Barr, is a resident of the State of Arizona, and a shareholder of United Mines.

2

The Defendants

9. Defendants, Glenn E. Martin and Jane Doe Martin, are husband and wife, and residents of the State of Arizona. Upon Information and belief, the liability of Defendant Glenn E. Martin was incurred in furtherance of the community of his marriage to Jane Doe Martin. Jane Doe Martin is a fictitious name and the Plaintiffs will seek leave of the Court to insert the appropriate name when ascertained.

10. Defendants, Nicole M. Breen and Ryan Breen, are wife and husband, and residents of the State of Arizona. Upon information and belief, the liability of Defendant Nicole M. Breen was incurred in furtherance of the community of her marriage to Ryan Breen. Defendant Nicole M. Breen is the daughter of Defendant Glenn E. Martin.

11. Defendant, GEM Management Group, LLC., is an Arizona Limited Liability Company owned and controlled by Defendants Glenn E. Martin and Nicole M. Breen.

12. Defendants, John Does 1-X, Jane Does 1-X, and ABC partnerships or corporate entities 1-X, are unnamed parties at this time who may be responsible for the acts complained about herein, or may be parties from which Plaintiff United Mines will seek recovery of corporate assets.

JURISDICTION AND VENUE

13. Jurisdiction lies and venue is proper as the acts and events at issue in this case occurred in the State of Arizona. Further, United Mines has mining claims in multiple counties in the State of Arizona.

14. At all times mentioned in the Complaint, the Defendants, and each every one of them, in connection with the acts and conduct alleged herein, directly and indirectly used the means and instrumentalities of interstate and foreign commence, including mail, wires, highways, internet, and facsimile and/or telephone communication systems.

3

NATURE OF THE ACTION

15. This action concerns a public company with over two (200) hundred shareholders whose stock is traded on the Over-the-Counter Bulletin Board exchange. That company is United Mines which became a public company in the latter part of 2008. The Plaintiffs in this action are United Mines, four (4) members of the Board of Directors who are also shareholders (Plaintiffs Dykers, Burkhardt, Metz, and McCaslin), and three (3) shareholders (Plaintiffs Cesar, Spieth, and Barr). The Defendants are the parties that have been operating United Mines solely for their own benefit for the last six (6) or seven (7) years.

As background, United Mines is in the mining business with various claims to mineral deposits such as gold, silver, and copper. However, United Mines has been an exploration stage company for many years that has yet to produce a single ounce of any precious metal or a dollar in revenues, although it did generate more than two million ($2,000,000) dollars in losses in 2011 alone and, accumulated losses of seven million ($7,000,000) dollars through 2011.

In a situation that has become far too common today in public markets, a small group of people have used a public company purely to further their own interests. In this case, those people are Defendants Glenn E. Martin and his daughter, Nicole M. Breen, who through a series of stock scams and manipulations, among other acts, have victimized United Mines and more than two hundred (200) shareholders.

4

16. In what is a non-exhaustive list, Plaintiffs believe that the Defendants Martin and Breen have done the following:

|

a.

|

Illegally issued stock in United Mines to themselves, GEM Management, the entity controlled by them, and various friends and supporters;

|

|

b.

|

Manipulated the stock value of United Mines for their own benefit, and filed false and fraudulent 10-Qs (the quarterly reports) and 10-Ks (the annual reports) with the Securities and Exchange Commission over the objection of the independent members of the Board of Directors (Plaintiffs Dykers, Burkhardt, Metz, and McCaslin);

|

|

c.

|

Forged the signatures of the independent members of the Board on the last 10-K for 2011;

|

|

d.

|

Sold assets of United Mines without the knowledge or approval of the Board of Directors or shareholders;

|

|

e.

|

Have paid management fees in the form of cash and stock to GEM Management Group, LLC, an entity owned and controlled by Defendants Martin and Breen, without the approval of the Board;

|

|

f.

|

Paid themselves salaries in the form of cash and stock without Board approval;

|

5

|

g.

|

Have failed to pay critical monthly bills, and have engaged in a pattern of defrauding professionals by accepting services then refusing to pay their fees;

|

|

h.

|

Have failed to file Federal and State Income tax returns for at least the last several years, and Plaintiffs believe have also failed to pay payroll taxes or file quarterly returns for years;

|

|

i.

|

Paid their own personal expenses and monthly bills with corporate funds;

|

|

j.

|

Have consistently for a period of years refused access to the books and records of United Mines to the Board of Directors;

|

|

k.

|

Have engaged in a money laundering scheme through illegal sales of stock; and,

|

|

l.

|

Transported a hazardous substance (i.e., cyanide used to refine silver which is rated as a Class 6 poison by the EPA) without a permit or the approval of the EPA or the Arizona Department of Environmental Quality.

|

17. On June 12, 2012 the Board of Directors lawfully terminated Defendants Glenn E. Martin and Nicole Breen as officers of United Mines. Defendant Glenn Martin has not disputed that there are six (6) directors of United Mines and that four (4) of them (Plaintiffs Dykers, Burkhardt, Metz, and McCaslin) terminated him and his daughter as officers on June 12, 2012. Nonetheless, he still refuses to provide access to Company books and records and is still operating United Mines today. In fact, Defendant Glenn Martin has orchestrated a sham shareholders meeting for July 25, 2012, designed to remove the Directors who fired him as an officer on June 12, 2012.

6

18. In terms of Defendant Glenn Martin’s transportation of a hazardous substance (i.e., more than 3,000 pounds of cyanide) in a U-Haul truck without a permit or any safety measures at all, which will be discussed further herein, it is a Class 3 felony (See, A.R.S. §49-925) if a person knowingly or recklessly manifests an extreme indifference to human life by transporting a hazardous substance without appropriate authority. Defendant Glenn Martin transported more than 3,000 pounds of cyanide across sixty (60) miles through commercial and residential areas without authority and without a permit. For the record, Defendant Glenn E. Martin has a prior felony conviction for conspiracy to possess cocaine with intent to distribute and related felony drug offenses.

19. In this action, Plaintiffs seek compensatory, punitive, and treble damages, as applicable, for Federal and State Racketeering, Common Law Fraud, Breach of Fiduciary Duty, Conversion, Breach of the Covenant of Good Faith and Fair Dealing, Breach of Contract, and Disgorgement under Sarbanes-Oxley. Plaintiffs also seek injunctive relief preventing the Defendants from causing any further damage to United Mines and its shareholders, including enjoining the sham shareholders meeting scheduled for July 25, 2012 by Defendant Glenn Martin so he can regain control over United Mines. It is the position of the Plaintiffs that a shareholders meeting of this time would be so tainted by the Defendants illegal and unauthorized stock sales, the illegal issuance of common stock to themselves, their money laundering scheme, and their stock manipulation scams, that it would have no meaning other than as an endorsement of what Plaintiffs submit is the criminal conduct of the Defendants. Among other things, the Plaintiffs are requesting that a Temporary Restraining Order be issued staying the July 25, 2012, shareholders meeting until at least after the hearing on a Preliminary Injunction.

7

GENERAL ALLEGATIONS

20. United Mines is a public company whose stock is traded on the Over-the-Counter Bulletin Board exchange with about two hundred and twenty (220) shareholders. The current Board of Directors are Plaintiffs Lawrence G. Dykers, Glynn Burkhardt, Robert Metz, and Roger McCaslin, and Defendants Glenn E. Martin and Nicole M. Breen, Mr. Martin’s daughter. Until June 12, 2012, Defendant Glenn Martin was the Chief Executive Officer, President, Chief Financial Officer, and Executive Vice President of United Mines, and Nicole Breen was the Secretary and Treasurer.

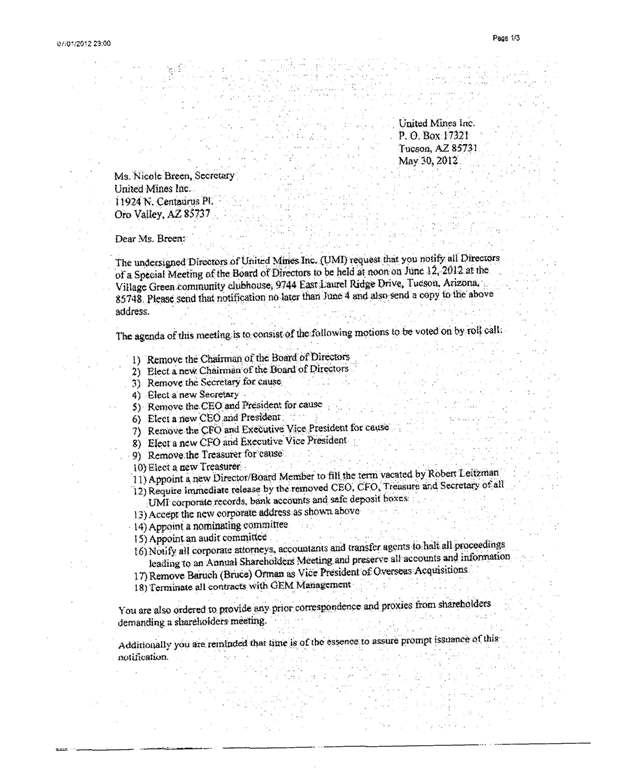

21. On May 30, 2012, Plaintiffs Glynn Burkhardt and Robert Metz sent a letter to Nicole Breen in her capacity as Secretary of the Corporation requesting that she notice a Special Meeting of the Board of Directors for June 12, 2012, with a specific agenda which included the removal of Glenn Martin and Nicole Breen as officers of United Mines. A copy of the letter is attached hereto as Exhibit “A”. The letter was sent by regular and certified mail to Defendant Nicole Breen in her capacity as Secretary of the Corporation. On three (3) occasions, delivery of the Certified Mail was attempted but Nicole Breen refused to accept it each time. An E-Mail of that letter was also sent to Defendant Glenn Martin who has acknowledged that he received it, and Nicole Breen.

22. On June 11, 2012, the day before the scheduled Special Meeting of the Board of Directors, Glenn Martin filed a Schedule 14(a) with the Securities and Exchange Commission soliciting proxy statements for an Annual Meeting of Shareholders to be scheduled for July 25,2012. In the Schedule 14(a) signed by Glenn Martin as CEO and President, he recognized that there were six (6) directors, Plaintiffs Dykers, Burkhardt, Metz, and McCaslin, and Defendants Martin and Breen (See, Pg. 20 of the Schedule 14(a) Filing). In the Schedule 14(a) Filng, Defendant Glenn Martin proposed a new Board of Directors consisting of himself, Nicole Breen, his daughter, and a shareholder named Baruch Orman (See, pg. 27 of the Schedule 14(a) filing).

8

23. On June 12, 2012, the Special Meeting of the Board of Directors was held and Glenn Martin and Nicole Breen were removed as officers of United Mines and new officers were elected. A copy of the Minutes of the June 12, 2012 meeting is attached hereto as Exhibit “B”.

24. On June 22, 2012, United Mines filed a Form 8-K with the Securities and Exchange Commission disclosing the change in management of the Company. A copy of the Form 8-K is attached hereto as Exhibit “C”.

25. On June 27, 2012, Defendant Glenn Martin illegally filed his own Form 8-K with the Securities and Exchange Commission, a copy of which is attached hereto as Exhibit “D”. Mr. Martin’s Form 8-K is a rambling attack on the independent members of the Board; however, as in the Schedule 14(a) Filing, Mr. Martin acknowledges that Plaintiffs Dykers, Burkhardt, Metz, and McCaslin are members of the Board. The undisputed fact is that Mr. Martin and Nicole Breen were lawfully terminated for cause as officers of the Company on June 12, 2012, and Mr. Martin knows it. Nonetheless, Mr. Martin closes his Form 8-K by saying that he is “still the Chairman of the Board, President, CEO, CFO, and Principal Accounting Officer” of United Mines, and, finally, “The LORD and the law is on my side…..”

9

26. The reasons for the termination of Mr. Martin and Mrs. Breen as officers of the Company are set forth in the Minutes of the June 12, 2012, meeting (See, Exhibit “B”), and in this Complaint (See, ¶16 hereof).

27. On the same day Mr. Martin’s Form 8-K was filed, there was a meeting between Plaintiff Lawrence G. Dykers, Christine Glanz, a computer person Mr. Dykers brought with him, Glenn Martin, and Nicole Breen at Mr. Martin’s residence. The purpose of the meeting was to allow Mr. Dykers to review United Mines’ business and financial records. For the record, Mr. Martin has never permitted the independent members of the Board to review the books and records of the Company. In fact, as recently as April 26, 2012, the independent members of the Board sent a letter to Defendant Glenn Martin discussing their concerns and requesting information which was ignored by Mr. Martin. A copy of that letter is attached to Mr. Dykers Declaration as Exhibit “A”. The meeting was arranged by Baruch Orman, a shareholder who is also one of the proposed Directors for the July 25, 2012 meeting, who wrote to Mr. Dykers, “I believe all records should be open and in the board’s hands.”

28. At the June 27, 2012, meeting between Mr. Dykers, Christine Glanz, Glenn Martin, and Nicole Breen, Mr. Martin once again refused to provide the Board of Directors with any records other than a few outstanding bills (See, the Declaration of Lawrence G. Dykers attached hereto as Exhibit “E”, and the Declaration of Christine Glanz attached hereto as Exhibit “F”). During the meeting, Mr. Martin was highly emotional, yelling and screaming, and complaining about perceived personal attacks on himself and his family. Mr. Martin also referred to both Mr. Dykers and Ms. Glanz as “Satan” and said “you will both be damned to hell.” Finally, Mr. Martin told Mr. Dykers that he would be happy to provide him with Company records if he and the other three (3) independent directors would agree to resign immediately (See, the Declaration of Mr. Dykers, Exhibit “E”, ¶7 and 8, and the Declaration of Christine Glanz, Exhibit “F”, ¶3, 4, 5, and 6).

10

29. The state of United Mines today is that a man who was properly and lawfully removed for cause by a majority vote of the acknowledged Board of Directors claims that he’s still in charge apparently based on a future event which is the sham shareholders meeting scheduled for July 25, 2012. Clearly, that shareholders’ meeting was scheduled after Defendant Glenn Martin received notice of the Special Meeting of the Board for June 12, 2012 when he was removed as an officer. It is equally clear that the new shareholders’ meeting is designed to reverse his termination. The Plaintiffs’ concern today is that Defendant Glenn Martin, in concert, combination, and conspiracy with Nicole Breen, will continue to sell stock and assets of the Company without the knowledge or approval of the Board or shareholders, and will continue to act recklessly and irresponsibly in connection with the transportation of a hazardous substance (i.e., cyanide) placing the public at risk.

The Sale of Company Assets

30. At the meeting on June 27, 2012, between Mr. Dykers, Ms. Glanz, Mr. Martin, and Ms. Breen, Mr. Dykers asked Mr. Martin if he had sold any assets of United Mines. Mr. Martin said that he had sold the Pilgrim mining claims to Baruch Orman for $10,000 about thirty (30) days before that meeting. That sale occurred without the knowledge or approval of the Board or shareholders. Mr. Martin said that he had used the money on the sale of the Pilgrim mining claims to notice out the shareholders meeting for July 25, 2012 and for the issuance of voting proxies. In other words, Mr. Martin sold a potentially significant asset of the Company in order to maintain his control over United Mines. In the Schedule 14(a) Notice Mr. Martin filed with the Securities and Exchange Commission dated June 11, 2012, which is after he sold the Pilgrim mining claim to Mr. Orman, he wrote that the Pilgrim claim is a “100% Company owned property” (See, pg. 13 of the Schedule 14(a) filing) (See, also the Declaration of Mr. Dykers, Exhibit “E”, ¶8 and the Declaration of Christine Glanz, Exhibit “F”, ¶6).

11

31. The Plaintiffs believe that if they are provided access to the books and records of the Company that they will be able to establish that Defendants Glenn Martin and Nicole Breen sold other Company assets for their own benefit.

Illegal Stock Sales-the Money Laundering Scheme

32. The Plaintiffs believe that one of the many reasons why Defendants Martin and Breen will not permit access to the books and records of United Mines is that they are hiding evidence of illegal stock sales, as well as a money laundering scheme as follows:

|

a.

|

Step 1 – Investor money would come into United Mines;

|

|

b.

|

Step 2 – Defendants Martin and Breen would write United Mines checks from the funds to various parties purportedly as compensation for services, products, or mining claims;

|

|

c.

|

Step 3 – The United Mines’ checks were then cashed by the payees and the majority of the money given back to Defendants Martin and Breen or used to purchase stock in United Mines, with the recipients of the checks keeping some money for their time and trouble (the money laundering fee);

|

12

|

d.

|

Step 4 – The money returned by the check recipients would be deposited in United Mines accounts as “loans” from Glenn Martin creating the appearance of cash flow for potential investors; and,

|

|

e.

|

Step 5 – This circle of money is then used to pay salary and expenses, in part, of Defendants Martin, Breen, and GEM Management.

|

33. This stock and money laundering scheme obviously results in false and fraudulent financial records, as well as false and fraudulent 10-Qs and 10-Ks filed with the Securities and Exchange Commission.

34. The last 10-K for the year ended 2011 was filed on April 16, 2012. Because of concerns over the financial records of United Mines, the independent members of the Board of Directors refused to authorize Defendant Glenn Martin to file it or place their signatures on the 10-K. Nonetheless, Defendant Glenn Martin filed the 10-K and forged the signatures of the independent members of the Board on that filing.

35. The Plaintiffs believe that Defendants Martin and Breen have engaged in a series of illegal stock sales designed for their own financial interest, to provide a base support group of shareholders for them, and to create the appearance of cash flow in United Mines. The Plaintiffs believe that this is why Defendants Martin and Breen refused to provide Mr. Dykers with a current shareholder list at the June 27, 2012 meeting (See, the Declaration of Mr. Dykers, Exhibit “E”, ¶9).

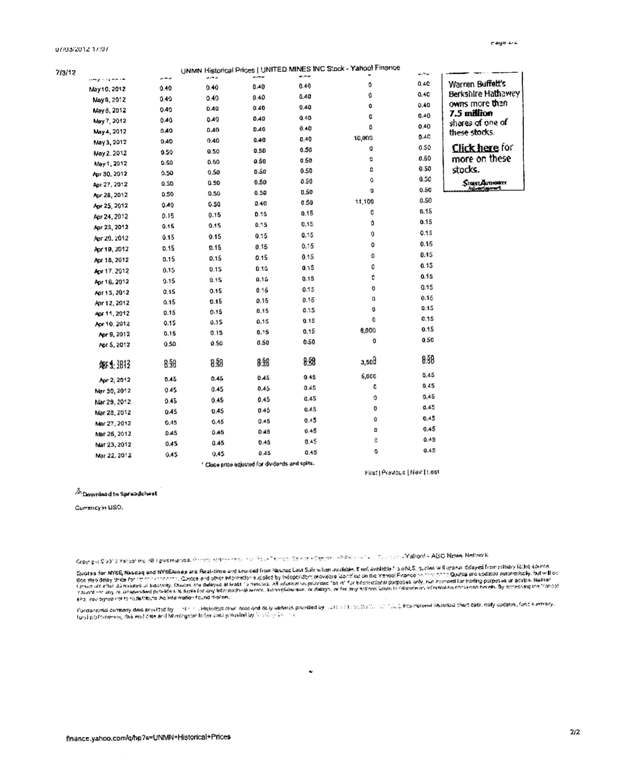

36. In addition to illegal stock sales and the money laundering scheme, Defendants Martin and Breen have illegally inflated the price of the stock of the United Mines through friends they asked to purchase stock at a price higher than market value, thereby increasing the value of their own stock holdings. This scheme was also designed to attract legitimate third-party investors (See, the Declaration of Roger McCaslin, Exhibit “G”, ¶2 in which he discusses a telephone call with Glenn Martin on April 25, 2012, during which Mr. Martin said he was manipulating the stock price to attract investors). Attached hereto as Exhibit “H” is a listing of historical prices for United Mines’ stock. From April 10, 2012, through April 24, 2012, the stock price was $0.15 cent per share without any trading volume at all. On April 24, 2012, the closing stock price was $0.15 cents per share; however, on April 25, 2012, the day Defendant Glenn Martin called Roger McCaslin, the trading volume was 11,100 shares and the stock price at close was $0.50 cent per share, an increase in twenty four (24) hours of more than three hundred (300%) percent. From April 26, 2012 through May 2, 2012, the stock price stayed at $0.50 per share with absolutely no trading volume at all. On May 3, 2012, the trading volume was 10,000 shares and the stock closed at $0.40 cent per share. Since May 3, 2012, when Plaintiffs believe Mr. Martin’s friends sold most of the stock they purchased on April 25, 2012, there has been virtually no trading volume at all and as of June 22, 2012, the price was $0.15 cents per share.

13

The Illegal Transportation and Storage of a Hazardous Substance (i.e., cyanide)

37. The following is from Mr. Dykers’ Declaration (Exhibit “E”) concerning Defendant Glenn Martin’s illegal transportation of cyanide:

“10. Sodium and Potassium Cyanide are “reagents” used to refine silver. Cyanide is a hazardous substance which requires a permit to move it. United Mines has a substantial stockpile of unused cyanide. More than a year ago, Glenn Martin was told to remove the cyanide from a mine site. Again, in order to move cyanide a permit is required from the Arizona Department of Environmental Quality. Glenn Martin rented a U-Haul truck and loaded the cyanide containers onto the U-Haul truck. He tried to hire a person to drive the truck to another location to store it, but that person refused because Mr. Martin did not have a permit. Prior to renting the U-Haul, Glenn Martin called Carlos Esteban of Southwest Mobile Storage, rented an empty container, and told Carlos to deliver it to 9100 East Indian Hills Road, Tucson, AZ 85749, which he said was United Mines’ business address. Actually that address is the residence of Glynn Burkhardt one of the Directors of United Mines. Mr. Martin drove the truck through a U.S. Border Patrol check point without a permit and delivered it to Mr. Burckhardt’s residence where the cyanide is today. Cyanide is an extremely hazardous substance. The cyanide transported is in granulated form. If a liquid comes into contact with it, it can become hydrogen cyanide gas which is deadly. The cost of proper transportation and disposal of the cyanide is about $20,000, significantly more than the price to rent a single U-Haul truck. The currently elected officers of United Mines presented a program for removal and disposal of the cyanide which has been approved by the Arizona Department of Environmental Quality. The Board has been asking Glenn Martin to address the cyanide issue since 2011 and he did nothing other than transport it himself to Mr. Burkhardt’s property.”

14

38. Defendant Glenn Martin called Carlos Esteban, the Tucson Branch Manager for Southwest Mobile Storage, to rent the storage container for the cyanide. A copy of Mr. Esteban’s Declaration is attached hereto as Exhibit “I”.

39. In an E-Mail Defendant Glenn Martin sent to Carlos Esteban of Southwest Mobile Storage on March 12, 2012, he told Carlos Esteban for the first time that the property being stored in Southwest Mobile’s container was cyanide and attached a list, a copy of which is attached hereto as Exhibit “J”. Mr. Martin’s list is titled “HAZ Materials – Cyanide,” and lists twenty four (24) drums with more than 3000 pounds of cyanide.

40. Cyanide is listed as a Class 6 poison by the Environmental Protection Agency which means it can be deadly if ingested, inhaled, or absorbed through the skin. If liquid had come into contact with the granulated form of cyanide on Glenn Martin’s U-Haul truck during transportation, there could have been a significant environmental event even in moderately populated areas. Defendant Glenn Martin was ordered to remove the cyanide from its location at the Cerro La Colorada mine by the Bureau of Land Management. The distance between the Cerro La Colorada mine and Mr. Burkhardt’s property, which is where Defendant Glenn Martin delivered the cyanide, is about sixty (60) miles. That trip would have taken a little more than two (2) hours and during that trip Defendant Glenn Martin drove through both commercial and residential areas.

15

41. In the Form 10-K filing with the Securities and Exchange Commission for the year 2011, certified as true and accurate by Glenn Martin as Chief Financial Officer and Principle Accounting Officer, the following was written:

“We strive to comply with all applicable environmental, health, and safety laws and regulations are currently taking the steps indicated above. We believe that our operations are in compliance with applicable laws and regulations on environmental matters. (See, Exhibit “K” which are the applicable pages from the 10-K for 2011).

The year 2011 is the same year Mr. Martin rented a U-Haul truck without a permit or any safety measures at all and transported more than 3,000 pounds of cyanide over about sixty (60) miles.

FIRST CAUSE OF ACTION

|

|

(The Racketeer Influenced and Corrupt Organizations Act and the Arizona Racketeering Statute)

|

42. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 41 of this Complaint as though fully contained herein.

43. These Defendants have engaged in a conspiracy to convert assets and in a scheme or artifice to defraud the Plaintiffs and its shareholders through conversion of corporate funds; mail fraud pursuant to 18 U.S.C. § 1341; wire fraud pursuant to 18 U.S.C. § 1343; and money laundering pursuant to 18 U.S.C. §1956.

16

44. The acts of these Defendants in knowingly and willfully converting assets, and in executing their fraudulent scheme through the use of the United States mail and wire services, constitute a continuing pattern of racketeering as defined in 18 U.S.C. § 1961, which embraced criminal acts having the same or similar purposes, results, participants, victims, and methods of commission.

45. These Defendants were direct beneficiaries of this pattern of racketeering activity.

46. The acts of the Defendants also constitute a violation of A.R.S. § 13-2301 (D)(4)(t), under the Arizona Racketeering Statute.

47. All of the foregoing acts were committed by these Defendants for financial gain and are chargeable or indictable under the laws of the United States and punishable by imprisonment for a period of not less than five (5) years, and under the laws of the State of Arizona punishable by imprisonment for a period of not less than one (1) year.

48. As a result of the foregoing, Plaintiffs are entitled to recover treble damages, plus costs, and attorney's fees.

SECOND CAUSE OF ACTION

(Common Law Fraud)

49. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 48 of this Complaint as though fully contained herein.

50. As set forth herein, the representations of these Defendants were fraudulent, inasmuch as they were false, material, known to be false, made with the intent that Plaintiffs, and their shareholders, would act thereon while ignorant of their falsity, and made in such manner as to cause Plaintiffs to rightfully rely thereon, thereby resulting in direct and proximate damage to Plaintiffs in an amount to be proven at the trial of this action.

17

51. The foregoing acts of these Defendants were fraudulent, willful, wanton, intentional, malicious, and done with a reckless and conscious disregard for Plaintiffs’ rights, and therefore, warrant the assessment of exemplary or punitive damages in such amount as is determined to be appropriate at the trial of this action.

THIRD CAUSE OF ACTION

(Breach of Fiduciary Duty)

52. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 51 of this Complaint as though fully contained herein.

53. At all times material hereto, a fiduciary relationship existed between the Plaintiffs and Defendants which imposed upon these Defendants an obligation of loyalty, good faith, fairness, and honesty.

54. Defendants Martin and Breen breached their fiduciary duties by the actions set forth in this Complaint, among other things, all of which has resulted in direct and proximate damage to Plaintiffs in an amount to be proven at the trial of this action.

55. The foregoing acts of the Defendants were willful, wanton, intentional, malicious, and done with a reckless and conscious regard for Plaintiffs’ rights and thereby warrant the assessment of exemplary or punitive damages in an amount deemed to be appropriate at the trial of this action.

FOURTH CAUSE OF ACTION

(Conversion)

18

56. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 55 of this Complaint as though fully contained herein.

57. The Defendants conspired to and unlawfully converted Plaintiffs’ property for their own use and benefit as set forth herein.

58. As a direct result of these Defendants' wrongful conversion of Plaintiffs’ property, Plaintiffs have suffered damages in an amount to be proven at the trial of this action. Plaintiffs are also entitled to recover punitive damages in an amount sufficient to deter such conduct in the future.

FIFTH CAUSE OF ACTION

(Breach of the Covenant of Good Faith and Fair Dealing)

59. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 58 of this Complaint as though fully contained herein.

60. There is implied in the agreements between the Plaintiffs and these Defendants a covenant of good faith and fair dealing pursuant to which these Defendants covenanted that they would in good faith, and in the exercise of fair dealing, act fairly and honestly toward Plaintiffs, and do nothing to impair, interfere with, hinder, or injure Plaintiffs.

61. These Defendants breached the covenant of good faith and fair dealing as set forth herein, which has resulted in direct and proximate damage to Plaintiffs in an amount to be proven at the trial of this action.

62. The foregoing acts of these Defendants were willful, wanton, intentional, malicious, and done with a reckless and conscious disregard for Plaintiffs’ rights, and thereby warrant the assessment of exemplary or punitive damages in an amount to be determined at the trial of this action.

19

SIXTH CAUSE OF ACTION

(Breach of Contract)

63. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 62 of this Complaint as though fully contained herein.

64. As officers, directors, shareholders, and management personnel, these Defendants had an obligation to Plaintiffs, and their shareholders, of loyalty and good faith. As a direct, proximate, and foreseeable result of these Defendants' wrongful breach contract, Plaintiffs have suffered damages consisting of lost profits and business opportunities in an amount to be proven at the trial of this action.

65. Plaintiffs have incurred, and will continue to incur, in the prosecution of this action reasonable attorney’s fees, which are recoverable under Arizona law.

SEVENTH CAUSE OF ACTION

(Injunctive Relief)

66. Plaintiffs reallege and incorporate the allegations contained in paragraphs 1 through 65 above, as if set forth herein again in full.

67. Unless these Defendants, and their agents and employees, are restrained by this Court from their continuing efforts to interfere with and damage Plaintiffs’ business, Plaintiffs will suffer immediate and irreparable harm and injury for which recoverable damages would be inadequate and for which there is no adequate remedy at law.

68. Accordingly, Plaintiffs request that this Court issue a Temporary Restraining Order enjoining these Defendants, and their agents and employees, from taking any actions on behalf of United Mines, including the sale of United Mines’ stock and assets, transportation or disposal of any hazardous substance, filing anything with the Securities and Exchange Commission, holding themselves out as officers of United Mines, issuing any checks from any United Mines’ accounts, paying any salary, bonuses, or fees to themselves, or conducting a shareholders’ meeting. For the record, Defendant Glenn Martin was still holding himself out as the President and CEO of United Mines as recently as July 2, 2012, three (3) weeks after he was terminated from those positions (See, Mr. Martin’s E-Mail dated July 2, 2012 which is attached hereto as Exhibit “L”).

20

EIGHTH CAUSE OF ACTION

(Disgorgement under Sarbanes – Oxley)

69. Plaintiffs hereby repeat and reallege the allegations contained in paragraphs 1 through 68 above, as if set forth herein again in full.

70. In managing United Mines, Defendants Martin and Breen have engaged in misconduct, if not criminal actions, which has resulted in material non-compliance with SEC financial reporting requirements.

71. Specifically, Defendant Martin and Breen caused United Mines to engage in accounting irregularities.

72. There is a substantial likelihood that United Mines will be required to restate its financial statements as a result of these accounting irregularities as well as other accounting irregularities.

73. Pursuant to Section 304 of the Sarbanes-Oxley Act of 2002, Defendants Martin and Breen must disgorge any bonuses, incentive-based compensation, or equity–based compensation received during the 12-month period following the first public issuance or filing of the financial documents embodying the financial reporting requirement and any personal profits realized on the sale of company securities during that twelve (12) month period.

21

RELIEF REQUESTED

WHEREFORE, Plaintiffs pray for relief as follows:

|

1.

|

For the issuance of a Temporary Restraining Order enjoining and preventing the Defendants, and their agents and employees, from taking any actions on behalf of United Mines, including the sale of United Mines stock and assets, transportation or disposal of any hazardous substance, from filing anything with the Securities and Exchange Commission, holding themselves out as officers of United Mines, issuing any checks from any United Mines’ accounts, paying any salary, bonuses, or fees to themselves, or conducting a shareholders’ meeting;

|

|

2.

|

For an Order compelling the Defendants to appear at an Order to Show Cause Hearing before the Court on a date certain, and further and there show cause, if any, why a Preliminary Injunction should not be issued restraining and enjoining the Defendants, and their agents and employees, from taking any actions on behalf of United Mines, including the sale of United Mines stock and assets, transportation or disposal of any hazardous substance, from filing anything with the Securities and Exchange Commission, holding themselves out as officers of United Mines, issuing any checks from any United Mines’ accounts, paying any salary, bonuses, or fees to themselves, or conducting a shareholders’ meeting;

|

|

3.

|

For compensatory damages;

|

22

|

4.

|

For punitive damages;

|

|

5.

|

For treble damages;

|

|

6.

|

For disgorgement of personal profits and compensation realized by the Defendants;

|

|

7.

|

For Plaintiffs’ reasonable attorneys’ fees, costs and expenses; and,

|

|

8.

|

For such other and further relief as the Court may deem just and proper in the premises.

|

DATED THIS 5th day of July, 2012

|

JAMES M. LaGANKE, P.L.L.C.

|

|||

|

By:

|

/s/ James LaGanke | ||

|

JAME M. LaGANKE, ESQ.

|

|||

|

13236 North 7th Street, Suite 4257

|

|||

|

Phoenix, AZ 85022

|

|||

|

Attorney for the Plaintiffs

|

|||

|

DEMAND FOR JURY TRIAL

|

|||

|

Plaintiffs hereby demand a trial by jury in this matter.

|

|||

| JAMES M. LaGANKE, P.L.L.C. | |||

|

By:

|

/s/ James LaGanke | ||

| JAMES M. LaGANKE, ESQ. | |||

| 13236 North 7th Street, Suite 4257 | |||

| Phoenix, AZ 85022 | |||

| Attorney for the Plaintiffs | |||

23

VERIFICATION

Lawrence G. Dykers, the President, Chief Executive Officer, and a Director of United Mines, Inc., hereby states that he has reviewed the foregoing Complaint, and that it is true and accurate to the best of his knowledge and belief, including those matters stated upon information and belief which he believes to be true.

I sign under penalty of perjury.

Dated this 5th day of July, 2012.

|

By:

|

/s/ Lawrence G. Dykers | ||

|

Lawrence G. Dykers

|

24

EXHIBIT A

EXHIBIT B

EXHIBIT C

U.S. Securities and Exchange Commission

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) June 12, 2012

____________________

Commission File No. 000-53727

____________________

UNITED MINES, INC.

(Name of small business issuer as specified in its charter)

| Arizona | 83-0452269 | |

| State of Incorporation | IRS Employer Identification No. | |

7301 East 22nd Street, Suite 6W, Tucson, AZ 85710

(Formerly 11924 North Centaurus Place, Oro Valley, AZ 85737)

(Address of principal executive offices)

(520) 777-7130

(Formerly 520-742-3111)

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Effective June 12, 2012, Glenn E. Martin was removed as Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, President, and Chairman of the Board of Directors. The Board of Directors had a quorum, the meeting was duly noticed to all members of the Board of Directors, and removed Mr. Martin for cause in accordance with Article 4, Section 3 of the By-Laws of United Mines, Inc.

Effective June 12, 2012 Lawrence G. Dykers was appointed as Interim Chief Executive Officer, and President of the Company. Mr. Dykers’ biography is incorporated by reference to the Company’s filing on Form 10-K on April 16, 2012. No formal compensation agreement has been executed.

Effective June 12, 2012 Glynn Burkhardt was appointed as Chairman of the Board of the Company. Mr. Burkhardt’s biography is incorporated by reference to the Company’s filing on Form 10-K on April 16, 2012. No formal compensation agreement has been executed.

Effective June 12, 2012, Nicole Breen was removed as Secretary and Treasurer. The Board of Directors had a quorum, the meeting was duly noticed to all members of the Board of Directors, and removed Ms. Breen for cause in accordance with Article 4, Section 3 of the By-Laws of United Mines, Inc.

Effective June 12, 2012, Roger McCaslin was appointed as Secretary and Treasurer. Mr. McCaslin’s biography is incorporated by reference to the Company’s filing on Form 10-K on April 16, 2012. No formal compensation agreement has been executed.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant |

United Mines, Inc.

|

||

|

Date: June 22, 2012

|

By:

|

/s/ Lawrence Dykers | |

|

Lawrence Dykers

|

|||

|

Chief Executive Officer, President

|

|||

EXHIBIT D

U.S. Securities and Exchange Commission

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) June 12th. 2012

____________________

Commission File No. 000-53727

____________________

United Mines, Inc.

____________________

(Name of small business issuer as specified in its charter)

|

Arizona

|

83-0452269

|

|

State of Incorporation

|

IRS Employer Identification No.

|

11924 N. Centaurus Place, Oro Valley, AZ

________________________________________

(Address of principal executive offices)

(520) 742-3111

____________________

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On June 22, 2012, Mr. Lawrence Dykers filed an 8-k that was not authorized nor did Mr. Dykers have any legal authority to do so. Mr. Lawrence Dykers, Mr. Roger McCaslin, Mr. Robert Metz and Mr. Glynn Burkhardt are out going Directors and were not nominated by any Board members to be re-elected to sit on the New Board of Directors at our Annual Stockholders meeting set for July 25th, 2012 at 12 noon at the principal executive offices of United Mines, Inc. at 11924. N Centaurus Place, Oro Valley Arizona.

A duly noticed Special Board of Directors meeting was called by the President for the specific purpose of nominating the new slate for the Board of Directors and ratify our PCAOB auditor. The Special Board was held at 12 noon on June 1st. 2012 at United Mines, Inc. corporate offices. The President called the meeting on behalf of the shareholders in response to several complaints about the 4 above mentioned individuals. Over 51% of the shareholders approved the replacement of these aforementioned Directors. United Mines by-laws state that the Annual Stockholders meeting is to be held the first week in May or as soon as possible after that.

Subsequently, to our Special Board of Directors meeting, our official 14-A was filed and the "record" date was set for June 11th. 2012 with the Annual Stockholders meeting to be set for July 25th.2012 at 12 noon at 11924 N. Centaurus Place, Oro Valley, Arizona.

Due to the fact that the above 4 directors were not nominated for re-election, I believe they have decided to maliciously attack my family and myself both personally and professionally with false accusations that have no merit or proof. They have proceeded with a "scorched earth" policy to try and takeover the company without proper and legal procedures. The 4 above Directors are also trying to thwart the will of the shareholders and have made numerous attempts to halt the Annual Stockholders meeting to no avail thus far. I encourage and ask my shareholders to make their voices heard and respond to the proxy's for the upcoming Annual Stockholders meeting.

These 4 Directors in just the past 2 weeks, have already damaged United Mines by giving up approximately 25% of our land holdings that I feel was for no reason but vindictiveness. I believe this is gross negligence and highly unprofessional behavior on the part of Mr. Metz and Mr. Dykers as they have over 100 years of mining experience between them. All four will be held accountable for these actions to my shareholders. Therefore, due to the invalid and improper procedures all documents, contracts, loans or commitments made by these 4 above mentioned Directors will not be honored and considered "null and void".

FOR THE RECORD; I, Glenn E. Martin, state that I am the Founder, and still Chairman of the Board, President, CEO, CFO and Principal Accounting Officer. All inquires or questions should be directed to me. I will respond personally to all my shareholders. Ms. Nicole Breen is a Founding Director, and still Secretary and Treasurer. The LORD and the law is on my side and that of the shareholders. May God Bless you all.

2

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Registrant

Date: June 26, 2012

|

United Mines, Inc.

By: /s/ Glenn E. Martin

|

|

|

Glenn E. Martin

|

||

|

Director, Chief Executive Officer

|

3

EXHIBIT E

DECLARATION OF LAWRENCE G. DYKERS

|

1.

|

I am currently the duly elected Chief Executive Officer and President of United Mines, Inc., an Arizona Corporation. I am also a member of the Board of Directors. United Mines, Inc. is a public company whose stock is traded on the Over-the-Counter Bulletin Board Exchange. Today, United Mines, Inc. has about two hundred and twenty (220) shareholders. United Mines is an exploration stage company which means it has not developed any mining claims or generated any revenues, although it has generated more than $5,000,000 in losses. I am a mining engineer with over fifty (50) years experience in the industry.

|

|

2.

|

The current Board of Directors of United Mines, Inc., consists of myself, Robert A. Metz, Glynn A. Burkhardt, Roger McCaslin, Glenn E. Martin, and Nicole M. Breen. The Company has been managed and operated by Glenn Martin and his daughter, Nicole Breen, for the last several years.

|

|

3.

|

For an extended period of time, Mr. Metz, Mr. McCaslin, Mr. Burkhardt, and myself, four (4) of the six (6) Directors of United Mines, have been trying to secure the business and financial records of the Company. Those requests have been consistently refused by Mr. Martin and Nicole Breen. For example, on April 26, 2012, the four (4) of us sent a letter to Mr. Martin listing our concerns and requesting information. A copy of that letter is attached hereto as Exhibit “A”. As with the others, that request for information was ignored.

|

|

4.

|

On June 12, 2012, a meeting of the Board of Directors was held to evaluate the status of United Mines. The meeting was property noticed to all six (6) Directors. In fact, Mr. Martin acknowledged in a recent telephone call that he did receive notice of the meeting. Four (4) Directors attended that meeting - - myself, Robert Metz, Glynn Burkhardt, and Robert McCaslin. At that meeting, the Board terminated Mr. Martin as President, Chief Executive Officer, Chief Financial Officer, and Executive Vice President, and Nicole Breen, his daughter, as Secretary and Treasurer. A copy of the Minutes of that Board Meeting is attached hereto as Exhibit “B”.

|

|

5.

|

On June 22, 2012, we filed a Form 8K with the Securities and Exchange Commission disclosing the change in the management of the Company. A copy of that 8K is attached hereto as Exhibit “C”.

|

1

|

6.

|

On June 27, 2012, Glenn E. Martin filed his own 8K with the Securities and Exchange Commission, a copy of which is attached hereto as Exhibit “D”. Mr. Martin’s “8K” is replete with inflammatory and false representations, including invocations to a higher power (“The Lord and the law is on my side….”); however, Mr. Martin does acknowledge that as of today Mr. Metz, Mr. McCaslin, Mr. Burkhardt, and myself are four (4) of the six (6) Directors of United Mines. At the June 12, 2012, meeting of the Board, four (4) Directors removed Mr. Martin as the President, CEO, CFO, and Executive Vice President of United Mines, Inc.

|

|

7.

|

During the week of June 25, 2012, a shareholder named Baruch Orman agreed that the Board should be given access to the Company’s books and records (See, Mr. Oman’s E-Mail attached hereto as Exhibit “E”). Mr. Orman arranged a meeting for me with Mr. Martin and Nicole Breen for Wednesday, June 27, 2012 at 1:00 p.m. I took to that meeting Christine Glanz, a computer expert, to download documents from the Company’s computers located at Mr. Martin’s residence. Present at the meeting were Glenn Martin, Nicole Breen, Christine Glanz, and myself. The meeting lasted a little more than one hour and thirty minutes and, as he has done before, Mr. Martin denied access to the Company’s books and records. I left the meeting with three (3) or four (4) pieces of papers that were Company bills and invoices that I assume Mr. Martin wanted me to pay. During that meeting, Mr. Martin was highly emotional, yelling and screaming at times, and complaining about purported personal attacks on himself and his family. On several occasions, Mr. Martin referred to me and Christine Glanz as “Satan” and said “You will both be damned to hell”. After saying that several times, I asked him not to say it again. Mr. Martin did say he would be happy to provide me with access to the Company’s books and records if I and the other three (3) Directors (Metz, McCaslin, and Burkhardt) agreed to resign immediately. During the meeting, I told Mr. Martin that I did not have signed copies of the Minutes of the Board Meetings and requested them. Mr. Martin said he would copy them for me, but it would take a long time and I would not receive them until after July 25, 2012, when I would be gone as a Director. That date is the day Mr. Martin scheduled for the next annual meeting of the shareholders without Board of Directors approval.

|

|

8.

|

During the meeting on June 27, 2012, I asked Mr. Martin if he had recently sold the Pilgrim Tailings Precious Metal Project. The Pilgrim project consists of one (1) USBLM placer claim, one (1) USBLM lode mining claim, and some 400-700,000 tons of milled tailings containing varying amounts of gold and silver owned by United Mines near Kingman, Arizona. Mr. Martin said he had sold the Pilgrim claim to Baruch Orman, the shareholder who arranged the meeting, for ten thousand ($10,000) dollars about thirty (30) days earlier. Mr. Orman was until very recently the Vice-President of Overseas Acquisitions for United Mines. In fact, the Board of Directors accepted Mr. Orman’s resignation at the June 12, 2012 meeting. Mr. Martin further said that he had used that money to pay the stock transfer agent to notice out the upcoming meeting of the shareholders and for issuance of proxies. Mr. Orman, Mr. Martin, and Nicole Breen are the three (3) individuals nominated by Mr. Martin to be the new board of directors at the July 25, 2012 shareholders meeting. The Pilgrim claim was a potentially significant asset of United Mines, which was sold without the knowledge or approval of the Board of the Directors. The Rule 14(a) Notice created by Mr. Martin on June 11, 2012, to schedule the meeting of the shareholders discusses the Pilgrim claim as a “100% company owned property” (See pg. 13 of the Rule 14(a)). Clearly that representation contained in the document filed with the Securities and Exchange Commission is false and fraudulent if Mr. Martin sold the Pilgrim claim to Baruch Orman in May of 2012, as he told me.

|

2

|

9.

|

Finally, during the meeting with Mr. Martin on June 27, 2012, I asked Mr. Martin if I could see a current shareholder list. Mr. Martin showed me, briefly, a shareholder list from November of 2011, refused to give me a copy, and told me that it was the most current one he had. Members of the Board, and shareholders of United Mines have requested copies of the shareholders list from Pacific Stock Transfer, the stock transfer agent for the Company, but Pacific Stock has refused to provide us with a copy of the shareholders list (See, our attorneys’ letter to Pacific Stock Transfer dated June 26, 2012 attached hereto as Exhibit “F”). Pacific Stock Transfer has not responded to that letter.

|

|

10.

|

Sodium and Potassium Cyanide are “reagents” used to refine silver. Cyanide is a hazardous substance which requires a permit to move it. United Mines has a substantial stockpile of unused cyanide. More than a year ago, Glenn Martin was told to remove the cyanide from a mine site. Again, in order to move cyanide a permit is required from the Arizona Department of Environmental Quality. Glenn Martin rented a U-Haul truck and loaded the cyanide containers onto the U-Haul truck. He tried to hire a person to drive the truck to another location to store it, but that person refused because Mr. Martin did not have a permit. Prior to renting the U-Haul, Glenn Martin called Carlos Esteban of Southwest Mobile Storage, rented an empty container, and told Carlos to deliver it to 9100 East Indian Hills Road, Tucson, AZ 85749, which he said was United Mines’ business address. Actually that address is the residence of Glynn Burkhardt one of the Directors of United Mines. Mr. Martin drove the truck through a U.S. Border Patrol check point without a permit and delivered it to Mr. Burckhardt’s residence where the cyanide is today. Cyanide is an extremely hazardous substance. The cyanide transported is in granulated form. If a liquid comes into contact with it, it can become hydrogen cyanide gas which is deadly. The cost of proper transportation and disposal of the cyanide is about $20,000, significantly more than the price to rent a single U-Haul truck. The currently elected officers of United Mines presented a program for removal and disposal of the cyanide which has been approved by the Arizona Department of Environmental Quality. The Board has been asking Glenn Martin to address the cyanide issue since 2011 and he did nothing other than transport it himself to Mr. Burckhardt’s property.

|

3

|

11.

|

The state of United Mines today is that is being operated by a man who has refused any access to the books and records of the Company to the members of the Board. The company had losses of more than $5,000,000 in 2011, and as yet to generate one dollar in revenues. Mr. Martin sold a potentially significant asset of United Mines to an insider without the knowledge or approval of the Board to fund his personal efforts to stay in control of the Company. Tax returns have not been filed for several years. Mr. Martin has filed 10-Q’s and 10-K’s with the Securities and Exchange Commission with false and/or misleading information over the objection of the Board. And a hazardous substance has been transported in violation of federal and state law in the same way used furniture is moved. All of the foregoing are only some of the reasons why the Board terminated.

|

|

12.

|

All of the foregoing are only some of the reasons why the Board terminated Mr. Martin and his daughter as officers of the corporation on June 12, 2012. Nonetheless, Mr. Martin has deliberately ignored his termination as an officer and continues today to act as if he were in complete control of the Company

|

I sign below under penalty of perjury.

/s/ Lawrence G. Dykers

Lawrence G. Dykers

June 28, 2012

4

Exhibits to Lawrence Dykers Declaration

EXHIBIT A

Exhibits to Lawrence Dykers Declaration

EXHIBIT B

Exhibits to Lawrence Dykers Declaration

EXHIBIT C

U.S. Securities and Exchange Commission

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) June 12, 2012

____________________

Commission File No. 000-53727

____________________

UNITED MINES, INC.

(Name of small business issuer as specified in its charter)

| Arizona | 83-0452269 | |

| State of Incorporation | IRS Employer Identification No. | |

7301 East 22nd Street, Suite 6W, Tucson, AZ 85710

(Formerly 11924 North Centaurus Place, Oro Valley, AZ 85737)

(Address of principal executive offices)

(520) 777-7130

(Formerly 520-742-3111)

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Effective June 12, 2012, Glenn E. Martin was removed as Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, President, and Chairman of the Board of Directors. The Board of Directors had a quorum, the meeting was duly noticed to all members of the Board of Directors, and removed Mr. Martin for cause in accordance with Article 4, Section 3 of the By-Laws of United Mines, Inc.

Effective June 12, 2012 Lawrence G. Dykers was appointed as Interim Chief Executive Officer, and President of the Company. Mr. Dykers’ biography is incorporated by reference to the Company’s filing on Form 10-K on April 16, 2012. No formal compensation agreement has been executed.

Effective June 12, 2012 Glynn Burkhardt was appointed as Chairman of the Board of the Company. Mr. Burkhardt’s biography is incorporated by reference to the Company’s filing on Form 10-K on April 16, 2012. No formal compensation agreement has been executed.

Effective June 12, 2012, Nicole Breen was removed as Secretary and Treasurer. The Board of Directors had a quorum, the meeting was duly noticed to all members of the Board of Directors, and removed Ms. Breen for cause in accordance with Article 4, Section 3 of the By-Laws of United Mines, Inc.

Effective June 12, 2012, Roger McCaslin was appointed as Secretary and Treasurer. Mr. McCaslin’s biography is incorporated by reference to the Company’s filing on Form 10-K on April 16, 2012. No formal compensation agreement has been executed.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant |

United Mines, Inc.

|

||

|

Date: June 22, 2012

|

By:

|

/s/ Lawrence Dykers | |

|

Lawrence Dykers

|

|||

|

Chief Executive Officer, President

|

|||

Exhibits to Lawrence Dykers Declaration

EXHIBIT D

U.S. Securities and Exchange Commission

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) June 12th. 2012

____________________

Commission File No. 000-53727

____________________

United Mines, Inc.

____________________

(Name of small business issuer as specified in its charter)

|

Arizona

|

83-0452269

|

|

State of Incorporation

|

IRS Employer Identification No.

|

11924 N. Centaurus Place, Oro Valley, AZ

________________________________________

(Address of principal executive offices)

(520) 742-3111

____________________

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On June 22, 2012, Mr. Lawrence Dykers filed an 8-k that was not authorized nor did Mr. Dykers have any legal authority to do so. Mr. Lawrence Dykers, Mr. Roger McCaslin, Mr. Robert Metz and Mr. Glynn Burkhardt are out going Directors and were not nominated by any Board members to be re-elected to sit on the New Board of Directors at our Annual Stockholders meeting set for July 25th, 2012 at 12 noon at the principal executive offices of United Mines, Inc. at 11924. N Centaurus Place, Oro Valley Arizona.

A duly noticed Special Board of Directors meeting was called by the President for the specific purpose of nominating the new slate for the Board of Directors and ratify our PCAOB auditor. The Special Board was held at 12 noon on June 1st. 2012 at United Mines, Inc. corporate offices. The President called the meeting on behalf of the shareholders in response to several complaints about the 4 above mentioned individuals. Over 51% of the shareholders approved the replacement of these aforementioned Directors. United Mines by-laws state that the Annual Stockholders meeting is to be held the first week in May or as soon as possible after that.

Subsequently, to our Special Board of Directors meeting, our official 14-A was filed and the "record" date was set for June 11th. 2012 with the Annual Stockholders meeting to be set for July 25th.2012 at 12 noon at 11924 N. Centaurus Place, Oro Valley, Arizona.

Due to the fact that the above 4 directors were not nominated for re-election, I believe they have decided to maliciously attack my family and myself both personally and professionally with false accusations that have no merit or proof. They have proceeded with a "scorched earth" policy to try and takeover the company without proper and legal procedures. The 4 above Directors are also trying to thwart the will of the shareholders and have made numerous attempts to halt the Annual Stockholders meeting to no avail thus far. I encourage and ask my shareholders to make their voices heard and respond to the proxy's for the upcoming Annual Stockholders meeting.

These 4 Directors in just the past 2 weeks, have already damaged United Mines by giving up approximately 25% of our land holdings that I feel was for no reason but vindictiveness. I believe this is gross negligence and highly unprofessional behavior on the part of Mr. Metz and Mr. Dykers as they have over 100 years of mining experience between them. All four will be held accountable for these actions to my shareholders. Therefore, due to the invalid and improper procedures all documents, contracts, loans or commitments made by these 4 above mentioned Directors will not be honored and considered "null and void".

FOR THE RECORD; I, Glenn E. Martin, state that I am the Founder, and still Chairman of the Board, President, CEO, CFO and Principal Accounting Officer. All inquires or questions should be directed to me. I will respond personally to all my shareholders. Ms. Nicole Breen is a Founding Director, and still Secretary and Treasurer. The LORD and the law is on my side and that of the shareholders. May God Bless you all.

2

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Registrant

Date: June 26, 2012

|

United Mines, Inc.

By: /s/ Glenn E. Martin

|

|

|

Glenn E. Martin

|

||

|

Director, Chief Executive Officer

|

3

Exhibits to Lawrence Dykers Declaration

EXHIBIT E

Exhibits to Lawrence Dykers Declaration

EXHIBIT F

JAMES M. LAGANKE,P.L.L.C.

ATTORNEY AT LAW

13236 North 7th Street, Suite 4-257

Phoenix, Arizona 85022

Office: 602-279-6399

Direct: 602-993-5490

Facsimile: 602-993-5323

Mobile: 602-402-8555

jameslaganke@aol.com

jamesmlaganke@gmail.com

James M. LaGanke

Attorney At Law

June 27, 2012

Via E-Mail: beth@pacificstocktransfer.com

Beth Looker

Pacific Stock Transfer

RE: United Mines, Inc.

Dear Beth:

As you are aware, we spoke yesterday and I requested a shareholder list on behalf of four (4) members of the Board of Directors of United Mines, Inc. Those Board members are Glynn Burkhardt, Roger McCaslin, Robert Metz, and Lawrence G. Dykers. I have been told that there have been previous requests by members of the Board and Shareholders for a shareholder list which you have completely ignored. The only reason you gave me for your refusal to provide the list yesterday was the current infighting at United Mines. At the end of our brief conversation, you told me the attorney for Pacific Stock Transfer, Chris Dobbins, would call me, which has not happened.

Surely you must be aware that Board Members and Shareholders are entitled to a Shareholder list under Arizona law. I would also note that you refused to comment on Pacific Stock Transfer’s participation, if any, in the Shareholder meeting scheduled for July 25, 2012.

Both Glenn Martin and Nicole Breen were lawfully removed for cause as officers of United Mines at meeting of the Board of Directors on June 12, 2012. I do not understand why Pacific Stock Transfer would dispute this fact in any way or act in concert with Glenn Martin in his continuing efforts to maintain his position as the CEO of United Mines.

By ignoring legitimate requests by shareholders and directors of United Mines for something as simple as a shareholder list, you are potentially exposing Pacific Stock Transfer to liability for any acts of Glenn Martin subsequent to June 12, 2012.

I would appreciate it if you would notify me when I will be receiving the shareholder list. My E-Mail address is listed above.

|

Sincerely

|

|||

|

JAMES M. LaGANKE P.L.L.C.

|

|||

| /s/ James M. LaGanke | |||

|

James M. LaGanke

|

|||

Cc: Lawrence G. Dykers

CEO, United Mines, Inc.

EXHIBIT F

DECLARATION OF CHRISTINE GLANZ

|

1.

|

I am a resident of Tucson, Arizona. I have been the owner of Computers, Etc., for fourteen (14) years. I repair computers and set up networking systems for businesses in Tucson.

|

|

2.

|

On June 26, 2012, Mr. Lawrence Dykers asked me to go with him for a meeting the following day to download certain computers files. I met Mr. Dykers for lunch on Wednesday, June 27, 2012, and then we went together to a home located at 11924 North Centaurus Place, Oro Valley, Arizona. Mr. Dykers told me that he was meeting with a man named Glenn Martin and probably his daughter, Nicole Breen, to secure business and financial records on a company named United Mines, Inc.

|

|

3.

|

We arrived at the house at 1:00 p.m. and met with Glenn Martin and Nicole Breen. The meeting lasted a little more than an hour and a half. During the meeting, Mr. Martin was visibly emotional, angry and shouting at times, and pacing around. Initially, he was angry with me because he said I would become a witness to what happened at that meeting. Mr. Martin complained for some time about perceived personal attacks on him and his family. I remember he made a specific reference to his prior felony conviction for I think the sale of drugs. Shortly into the meeting, he described me and Mr. Dykers as “Satan” and said “you both will be damned to hell.” After he made those statements several times, Mr. Dykers asked him not to say it again I remember thinking as I listened to Mr. Martin shouting, complaining, and accusing me of being “Satan”, that I had only been asked to come along to download corporate records of United Mines, Inc. from the Company’s computers.

|

|

4.

|

Mr. Martin refused to provide Mr. Dykers with access to the computers and offered several reasons. AT one time, I remember he said the computers had crashed. At another time, he said the computers were his or his daughters, and he needed to see if there were any personal matters on them before he let anyone look at them. I remembered thinking that the meeting had been set up to review company records which was the only reason I was there.

|

|

5.

|

Mr. Dykers said he did not have signed copies of the Board meetings and requested them. Mr. Martin said it would take a long time to copy them and by the time he finished Mr. Dykers would be gone as a director.

|

|

6.

|

Mr. Dykers asked Mr. Martin if he sold a certain mining claim, I think Mr. Dykers said the Pilgrim claim. Mr. Martin said that he had sold that claim about thirty (30) days ago to a shareholder for $10,000. Mr. Dykers said the Board had no knowledge of the sale and had not approved it. Mr. Martin said he didn’t need the approval of the Board. Mr. Martin said he used the money from the sale of the mining claim to pay the stock agent to notice out the meeting of shareholder to change the Board of Directors.

|

|

7.

|

When we left the meeting, Mr. Dykers was only given a few pieces of papers which Mr. Dykers told me were outstanding bills of United Mines.

|

I sign below under penalty of perjury.

/s/ Christine Glanz

Christine Glanz

June 29, 2012

EXHIBIT G

DECLARATION OF ROGER McCASLIN

|

1.

|

I am a resident of the State of Arizona. I am a member of the Board of Directors of United Mines, Inc., and have been since 2009.

|

|

2.

|

I spoke with Glenn Martin, the President and CEO of United Mines at that time, by telephone on April 25, 2012, at about 10:30 a.m. Mr. Martin called me and said that he had an investor for United Mines on the hook, but he needed to increase the price of the stock first. Mr. Martin told me that he had some friends, a man named Don Steinberg and others, buying stock at a higher than market price. He told me that he needed to increase the price of the stock to $0.50 cents per share to attract investors. During the call, Mr. Martin was watching the stock on his computer and said the price was going up and, at one point, he said it was at $0.40 cents per share. After the call ended, I checked the stock price on my computer and it was in fact at $0.50 cents per share which was significantly higher than the price at the beginning of the day.

|

I sign below under penalty of perjury.

/s/ Roger McCaslin

Roger McCaslin

July 2, 2012

EXHIBIT H

EXHIBIT I

DECLARATION OF CARLOS S. ESTEBAN

|

1.

|

I am the Tucson Branch Manager for Southwest Mobile Storage, Inc.

|

|

2.

|

In January, 2011, Glenn E. Martin called me to rent a storage container. The storage container Mr. Martin wanted was 8 feet wide and 20 feet long. Mr. Martin told me to deliver the empty container to his business address which he said was at 9100 East Indian Hills Road, Tucson, AZ 85749. I later learned that address was actually the residential property of Glynn Burkhardt. The rental agreement was between United Mines, Inc. and Southwest Mobile Storage, Inc.

|

|

3.

|

The monthly bills for the rent were sent to Glenn Martin at 11924 North Centaurus Place, Oro Valley, Arizona, which is a residence located close to my own home.

|

|

4.

|

I later learned that the product that Mr. Martin was storing in Southwest Mobile’s storage container was cyanide, which is a hazardous substance.

|

|

5.

|

About two (2) weeks ago, Glenn Martin called me because the monthly rental payments on the storage container were delinquent for four (4) months and Mr. Martin was receiving collection calls from Southwest Mobile Storage. Mr. Martin told me then that he was out of United Mines and that the company was broke. I reminded Mr. Martin that he had told me when he rented the storage container that United Mines had gold mines and was worth millions of dollars. I suggested that if it were true, he should be able to pay the delinquent rent of a little more than two hundred ($200) dollars. Glenn Martin also told me that he had called the police, the fire department, and the environmental protection agency concerning the storage of the cyanide on Glynn Burckhardt’s property. I told him that Mr. Burkhardt had told me and sent me an E-Mail which indicated that he had notified the authorities.

|

I sign below under penalty of perjury.

/s/ Carlos S. Esteban

Carlos S. Esteban

June 28, 2012

EXHIBIT J

EXHIBIT K

EXHIBIT L