Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - Trunkbow International Holdings Ltd | v316813_ex31-2.htm |

| EX-31.1 - CERTIFICATION - Trunkbow International Holdings Ltd | v316813_ex31-1.htm |

| EX-10.24 - EXHIBIT 10.24 - Trunkbow International Holdings Ltd | v316813_ex10-24.htm |

| EX-10.26 - EXHIBIT 10.26 - Trunkbow International Holdings Ltd | v316813_ex10-26.htm |

| EX-10.23 - EXHIBIT 10.23 - Trunkbow International Holdings Ltd | v316813_ex10-23.htm |

| EX-10.22 - EXHIBIT 10.22 - Trunkbow International Holdings Ltd | v316813_ex10-22.htm |

| EX-10.20 - EXHIBIT 10.20 - Trunkbow International Holdings Ltd | v316813_ex10-20.htm |

| EX-10.25 - EXHIBIT 10.25 - Trunkbow International Holdings Ltd | v316813_ex10-25.htm |

| EX-10.21 - EXHIBIT 10.21 - Trunkbow International Holdings Ltd | v316813_ex10-21.htm |

| EX-10.27 - EXHIBIT 10.27 - Trunkbow International Holdings Ltd | v316813_ex10-27.htm |

| EX-32.1 - CERTIFICATION - Trunkbow International Holdings Ltd | v316813_ex32-1.htm |

| EX-32.2 - CERTIFICATION - Trunkbow International Holdings Ltd | v316813_ex32-2.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 3)

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from _______________ to _________________

Commission file number: 000-53934

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED

(Exact name of Registrant as Specified in Its Charter)

| NEVADA | 26-3552213 | |

| (State or Other Jurisdiction | (I.R.S. Employer Identification No.) | |

| of Incorporation or Organization) |

Unit 1217-1218, 12F of Tower B, Gemdale Plaza, No. 91 Jianguo Road Chaoyang District, Beijing, People’s Republic of China |

100022 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(86) 10-8571-2518

Securities Registered Pursuant To Section 12 (B) Of The Act:

Common Stock, Par Value $0.001 Per Share

Securities Registered Pursuant To Section 12 (G) Of The Act:

Name of each exchange on which registered: The NASDAQ Stock Market LLC

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ |

Accelerated filer ¨ |

Non-accelerated filer ¨ |

Smaller reporting company x |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the shares of common stock, par value $0.001 per share, of the registrant held by non-affiliates on June 30, 2010 was zero.

There were 36,807,075 shares of common stock of the registrant outstanding as of July 2, 2012.

Explanatory Note

This Amendment No. 3 to the Annual Report on Form 10-K filed by Trunkbow International, Inc., a Nevada corporation (“we,” “our,” “us,” or the “Company”), on March 29, 2011 is being filed to (i) amend Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operation (ii) amend Item 8 – Financial Statements and Supplementary Data and (iii) include certain additional exhibits and updated Exhibit 31 and 32 certifications for our principal executive and financial officers.

On March 21, 2012, the Company announced that it has engaged the independent registered public accounting firm Holtz Rubenstein Reminick LLP (“HRR”) to review and issue a new audit report regarding its consolidated financial statements for the year ending December 31, 2009 because the SEC did not consider B&P “independent” as defined in the SEC’s rules regarding auditor independence. Even though the Company disagreed, for the interests of investor transparency and to avoid a complicated on-going regulatory process, on March 20, 2012 the Company engaged HRR to review and issue a new audit report regarding its consolidated financial statements for the year ended December 31, 2009. The amendments to Items 7 and 8 are being made to reflect that the financial statements for the 2009 fiscal year have now been audited by HRR, the report of which firm is included together with such financial statements under Item 8.

Except as specifically referenced herein, this Amendment No. 3 to the Annual Report on Form 10-K/A does not reflect any event occurring subsequent to March 29, 2011, the filing date of the original report, and no other changes have been made to the report.

PART I

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of the financial condition and results of our operations should be read in conjunction with our financial statements and the notes to those statements. This discussion contains forward-looking statements reflecting our management’s current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed on page 18 entitled “Risk Factors” and elsewhere in this Form 10-K.

We provide technology platform solutions for mobile telecom operators in the People’s Republic of China. Our patented platforms provide a comprehensive solution for Chinese telecom operators to deliver and manage the distribution of various mobile value added service (“MVAS”) applications to their subscribers. We believe that the Trunkbow brand is regarded by the telecom operators as a well managed, trusted provider of technology solutions. Our research and development focused business model provides us with a defensible market position as a technology provider to the telecom operators.

As of December 31, 2010, our technology is the subject of 164 filed patent applications, of which 50 have been granted by the National Intellectual Property Administration of the People’s Republic of China. We have recently begun the process of filing for international and U.S. patents in order to protect our intellectual properties globally.

The primary geographic focus of our operations is in the PRC, where we derive substantially all of our revenues. We conduct our business operations primarily through our wholly-owned subsidiaries Trunkbow Asia Pacific (Shenzhen) Limited and Trunkbow Asia Pacific (Shandong) Limited. Both companies are registered in PRC as Wholly-Owned Foreign Enterprises.

Overview

Our History and Corporate Structure

We were incorporated as a “shell” company with nominal assets under the name Bay Peak 5 Acquisition Corp. We were incorporated in the State of Nevada on September 3, 2004 as a wholly owned subsidiary of Visitalk Capital Corporation (“VCC”). We were formed as part of the implementation of the Chapter 11 reorganization plan (the “Visitalk Plan”) of visitalk.com, Inc. (“Visitalk.com”), a former provider of VOIP services. The Visitalk Plan was deemed effective by the Bankruptcy Court on September 17, 2004 (the “Effective Date”). On September 22, 2004, Visitalk.com was merged into VCC, which was authorized as the reorganized debtor under the Visitalk Plan.

On July 28, 2008, pursuant to Stock Purchase Agreements (“SPAs”), we sold 5,971,898 shares of common stock to two parties unaffiliated with us (the “Purchasing Shareholders”) for a total payment of $51,000, or approximately $.008 per share (the “Change of Control Transactions”). On August 29, 2008, the SPAs were approved by our shareholders at a special shareholders’ meeting and all the closing conditions of the SPAs were met. After the Change of Control Transactions, including the impact of a related master settlement agreement, these newly issued shares represented 85.5% ownership of us. One of the parties, Bay Peak, LLC (“Bay Peak”), had contacts with various companies and individuals in Asia, in particular the PRC. Cory Roberts, the managing member of Bay Peak, was appointed to our Board of Directors and elected President in conjunction with the Change of Control Transactions. Mr. Roberts resigned as a member of our Board of Directors on March 30, 2011. On August 28, 2008, shareholders authorized adopting the name of Bay Peak 5 Acquisition Corp. Also on August 28, 2008, shareholders ratified a one-for-seven reverse stock split (the “First Reverse Split”), which was implemented on January 6, 2010 and in January 2010, authorized a further reverse split of 4.14 for 1, which was implemented on January 27, 2010 (the “Second Reverse Split”).

Effective as of September 24, 2008, we entered into a Plan and Agreement of Merger (the “Plan and Agreement of Merger”) with VT Dutch Services, also a subsidiary of VCC, pursuant to which VT Dutch Services merged with and into us. Pursuant to the merger, holders of shares of common stock of VT Dutch Services received the identical number and class of our stock as they held in VT Dutch Services, and holders of warrants of VT Dutch Services received the identical number and class of our warrants as they held in VT Dutch Services. In connection with the Plan and Agreement of Merger, VT Dutch Services also changed its name to “Bay Peak 5 Acquisition Corp.” All shares of common stock of BP5 held prior to the consummation of the transactions contemplated by the Plan and Agreement of Merger were cancelled. The sole purpose of the merger was to change the corporate domicile of VT Dutch Services from Arizona to Nevada and to effect a name change of VT Dutch Services.

| 1 |

In February 2010 we entered into the Share Exchange Agreement with Trunkbow BVI and the shareholders of Trunkbow BVI (the “Shareholders”), who together owned shares constituting 100% of the issued and outstanding ordinary shares of Trunkbow BVI (the “Trunkbow BVI Shares”), and Bay Peak, our former principal shareholder. Pursuant to the terms of the Share Exchange Agreement, the Shareholders transferred to us all of the Trunkbow BVI Shares in exchange for the issuance of 19,562,888 (the “Shares”) shares of our common stock (the “Share Exchange”). As a result of the Share Exchange, Trunkbow BVI became our wholly owned subsidiary. After giving effect to the Share Exchange, the sale of common stock in the February 2010 Offering and the BP5 Warrant Financing (as defined below) (i) existing shareholders of Trunkbow BVI owned approximately 60.25% of our outstanding common stock, (ii) purchasers of common stock in the February 2010 Offering owned approximately 26.01% of our outstanding common stock (including 7.7% owned by VeriFone, Inc.), (iii) the holders of BP5 warrants owned approximately 8.54% of our outstanding common stock and (iv) the pre-existing shareholders of BP5 owned approximately 5.2% of our outstanding common stock.

We were founded in 2001 by former Silicon Valley engineers with extensive experience in the telecom industry. We have been able to develop first to market application platforms that enable telecom operators to generate significant new revenue streams by leveraging our extensive knowledge of the mobile network technology. Since our inception, we have invested significant time and resources to develop cutting edge technology solutions for our customers. We were the first to create and develop a Color Ring Back Tone (“CRBT”) application platform for Shandong Unicom in 2003. Since then, this innovative service solution has become the third largest revenue contributor for China Mobile after voice and Short Message Service (“SMS”).

Concurrent with the Share Exchange, (i) we entered into a securities purchase agreement (the “Purchase Agreement”) with certain investors (the “Investors”) for the sale of an aggregate of 8,447,575 shares (the “Investor Shares”) and 1,689,515 warrants (the “Investor Warrants”), for aggregate gross proceeds equal to $16,895,150 (the “February 2010 Offering”) and (ii) certain holders of our outstanding warrants issued to creditors and claimants of Visitalk.com, in accordance with the Visitalk Plan, referred to herein as the “BP5 Warrant Investors” exercised the 2,774,500 warrants owned by them for an aggregate exercise price of $5.5 million and received warrants to purchase an aggregate of 554,900 shares of common stock (“BP5 Warrant Financing”).

We believe that we have a competitive advantage over our primary competitors by our proven track record of innovation. We believe Chinese telecom operators continue to utilize our technology platforms because of our superior technological solutions and unique product offerings.

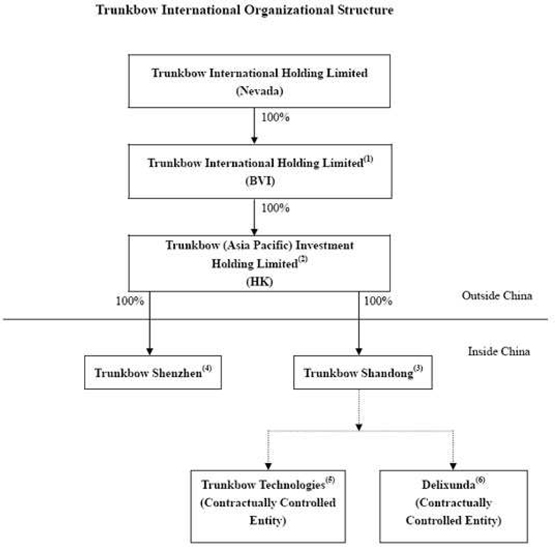

Our organizational structure is as follows:

| 2 |

| (1) | Trunkbow International Holdings Limited (“Trunkbow BVI”) was established in the British Virgin Islands (“BVI”) on July 17, 2009. Trunkbow BVI itself has no significant business operations and assets other than holding of equity interests in its subsidiaries through a series of reorganization activities described below (the “Reorganization”). |

| (2) | Trunkbow (Asia Pacific) Investment Holdings Limited (“Trunkbow Hong Kong”) was established as an Investment Holding Company in Hong Kong Special Administrative Region of the People’s Republic of China (the “PRC”) on July 9, 2004. As part of the reorganization, on September 16, 2009, the entire issued share capital Trunkbow Hong Kong was transferred to Trunkbow BVI. |

| (3) | Trunkbow Asia Pacific (Shandong) Company, Limited (“Trunkbow Shandong”) was established as a wholly foreign owned enterprise on December 10, 2007 in Jinan, Shandong Province, the PRC by Trunkbow Hong Kong. It is principally engaged in research and development of application platforms for mobile operators in the PRC. |

| (4) | Trunkbow Asia Pacific (Shenzhen) Company, Limited (“Trunkbow Shenzhen”) was established as a wholly foreign owned enterprise on June 7, 2007 in Shenzhen, Guangdong Province, the PRC by Trunkbow Hong Kong. It is principally engaged in research and development of application platforms for mobile operators in the PRC. |

| (5) | Trunkbow Technologies (Shenzhen) Company, Limited (“Trunkbow Technologies”) was established as a limited liability company on December 4, 2001 in Shenzhen, Guangdong Province, the PRC. Trunkbow Technologies was formerly engaged in research and development of application platforms for mobile operators in China as well as wireless application systems for the international market. Trunkbow Technologies no longer accounts for any of our new business, currently represents less than 10% of our current revenues and is being operationally wound down. |

| 3 |

| (6) | We entered into a series of contractual arrangements with Beijing Delixunda Technology Co., Ltd. (“Delixunda”) and its shareholders on March 10, 2011. Delixunda is a telecom value-added service licensed company and was established as a limited liability company on December 1, 2009 in Beijing, the PRC. Delixunda has no operations prior to February 10th, 2011. As a result of the contractual arrangements with Delixunda, we indirectly own the telecom value-added service license, which would enble us to offer telecom wireless value-added conten service to individual clients. |

How We Generate Revenue

We develop wireless enablement platforms targeted at cellular carriers and provide them with constantly improving interactive delivery vehicles to improve cellular performance and end-user functionality. We leverage our patented technology platforms to help telecom operators in China to increase their per subscriber revenue and reduce subscriber churn. We generate revenues through direct and indirect revenue sharing agreements with the relevant provincial branch of the telecom operators, one-time service and product sales, and maintenance fees. We charge a one time licensing fee and an annual maintenance fee of approximately 5 – 10% of the initial system purchasing amount. We also have monthly revenue sharing contracts in place with resellers and directly with the relevant provincial branch of the telecom providers for up to a 50% share in the revenue generated through our proprietary applications platforms. In addition to one-time sales and revenue sharing, we also generate revenue through transaction fees for our Mobile Payment System solution.

Our current MVAS Application Platform solutions generate revenue through one time sales and recurring revenues. For our Caller Color Ring Back Tone (“Caller CRBT”) and Color Numbering solution, we have revenue sharing agreements with resellers and directly with telecom providers to receive up to 50% of the subscription revenues generated for up to 5 years and then renewable upon expiration. For our Number Change Notification (“NCN”) solution, we receive revenues from one-time system sales and maintenance fees.

For our Mobile Payment System solution, we generate both one-time and recurring revenues.

We generate non-recurring revenues in the following ways:

| • | System sales to telecom providers which enables the mobile payment function on their network; |

| • | System sales to telecom providers that enables various MPS compatible SIM and mobile payment functions for their corporate clients; and |

| • | Revenue share on the MPS compatible SIM cards that are sold to the telecom providers. |

We generate recurring revenues in the following ways:

| • | Up to a 50% share of the monthly function fee charged by the telecom providers; |

| • | 0.1 – 0.5% of total transaction cost on purchases made through the mobile payment application; and |

| • | Monthly rental revenues on POS (Point of Sales) machines deployed by Trunkbow. |

We operate under exclusive patent licensing and revenue sharing agreements for Caller CRBT in three provinces with local branches of China Telecom, two provinces with local branches of China Mobile and two provinces with local branches of China Unicom, Number Change Notification in two provinces with local branches of China Unicom and two provinces with local branches of China Telecom, and Mobile Payment System in four provinces with local branches of China Telecom. These agreements typically have a one to five year term. In addition, we have sold over 10 different other platform services to the mobile operators over the past years.

In determining development priorities, we conduct research efforts which include client input, market analysis, economic considerations, revenue potential and technical feasibility. Only when these factors each rise above a predefined threshold will a true development undertaking ensue. As an ISO 9000 certified business entity, which is a family of standards for quality management systems that is maintained by the International Organization for Standardization, and in keeping with this practice, all projects must adhere to a pre-defined regimen of development and only ends when acceptance by the client is gained.

| 4 |

Our business has grown rapidly since inception and we anticipate that our business will continue to grow at a rapid pace in the next three to five years. We expect that our growth will be driven by the broad adoption of our Caller CRBT and Mobile Payment services, geographic expansion and the introduction of new products and services.

Our customers are primarily telecom service providers in the PRC, including local branches of China’s three major cellular carriers, China Telecom, China Unicom and China Mobile. Collectively, these carriers provide services to greater than 700 million cellular subscribers. For the fiscal years ended December 31, 2009 and 2008, revenues generated directly by sales to China Telecom, China Unicom and China Mobile accounted for approximately 3%, 6% and nil, and 4%, 95% and nil, respectively, of our total revenues, and 7%, 5% and nil, and 3%, 6% and nil, respectively, for the year ended December 31, 2010 and 2009. When we include resales of our products to these carriers through intermediaries (i.e., direct and indirect sales to these carriers), then revenues generated from sales to these three carriers for the fiscal years ended December 31, 2009 and 2008 accounted for approximately 42%, 15% and 42%, and 4%, 95% and nil, respectively, of our total revenues, and 16%, 47% and 28%, and 42%, 15% and 42%, respectively, for the year ended December 31, 2010 and 2009. The significant increase in revenues generated from sales to China Mobile for 2009 as compared to 2008 is attributable to the sale in 2009 of two platforms to two resellers that provided an air-charge system to China Mobile in two provinces. The large variations in revenues attributable to China Unicom and China Mobile during 2008 and 2009 are mainly attributable to a reorganization of China Unicom which resulted in that company’s CDMA segment being spun-off into China Telecom and the remaining company being merged with China Netcom. Even though our relationship with these three continues to expand, it is important to understand the complexity of these relationships. The significant increase in revenues generated from sales to China Unicom for 2010 as compared to 2009 is contributed from the sale in 2010 of the deployment of our systems including Caller CRBT, Color Numbering, Mobile Business Card and Mobile Payment.

To be accepted as an approved vendor of services to any of these carriers, a company must first gain approval at a corporate level by successfully completing a series of tests of its technology. Once completed, the next step is to gain contracted business from each operating unit. Each of the 30 provinces, municipalities and autonomous regions contains its own self sufficient cellular operating unit with separate P&L responsibility. In other words, with 30 regions, there are 30 separate operating companies per cellular carrier. This model is replicated in each of the three major carriers, resulting in a total of ninety potential clients within China.

The PRC government has mandated that these mobile payment services and MVAS functions must be available to all provinces over the next five years. With such services currently available in 13 provinces, the 17 remaining provinces will be seeking them from the market with Trunkbow being a major incumbent; fully vetted at a corporate level and with patented technology.

While we were initially focused exclusively on the PRC market, we have built a product set for the global sector. To this end, we are now actively positioning our product sets with carriers in the US and Europe, and we are entering the global market with a well accepted product set and excellent credentials.

Seasonality

Our quarterly operating results have varied significantly in the past and are likely to continue to vary significantly in the future. Historically, we have generally experienced a slowdown or decrease in generating revenues in the first and fourth quarter of the year due to the Chinese Lunar New Year as a majority of the businesses in the PRC shut down for a month long holiday and slow down for a month prior to the New Year celebration. We believe that this fluctuation will gradually subside as we increase our recurring revenue streams.

Results of Operations

Fiscal Years Ended December 31, 2010 versus 2009

Net Revenues: Net revenues increased $10.96 million, or 81.6%, from $13.43 million for the year ended December 31, 2009 to $24.39 million for the year ended December 31, 2010. Software sales increased $10.69 million, or 252.6%, from $4.23 million for the year ended December 31, 2009 to $14.92 million for the year ended December 31, 2010, mainly due to increased sales in Mobile Payment by $8.85 million and MVAS software of Caller CRBT, NCN and Color Numbering by $2.52 million in additional provinces. Our net revenues shifted to more software sales and less system integration sales during 2010. System integration revenues increased $0.87 million, from $8.5 million for the year ended December 31, 2009 to $9.37 million for the year ended December 31, 2010, due to the change in demand of our customers for the various components of our services. And our company’s competitive edge is in R&D. So the increase in Software sales is more than System integration revenues.

| 5 |

We started to deploy MPS platforms with our customers from the third quarter of 2009. We generated revenues of $12.66 million and $12.18 million, $10.14 million and $3.33 million, from MVAS and MPS solutions for the year ended December 31, 2010 and 2009. MPS solutions have become a significant revenue segment, representing 49% and 25% for the year ended December 31, 2010 and 2009.

Gross Margin: Gross margin increased $8.25 million, or 73.6%, from $11.21 million for the year ended December 31, 2009 to $19.46 million for the year ended December 31, 2010. The increase in gross margin was due to revenue growth associated with the software sales. Gross margin rate decreased by 3.7% from 83.5% for the year ended December 31, 2009 to 79.8% for the year ended December 31, 2010. The decrease in gross margin rate was due to the sale of point of sale system, of which gross margin rate was 23.6%. The increase in business tax and surcharges in line with the increase of revenues also cut down the gross margin.

The gross margin or the gross margin rate for the MVAS and MPS was $11.2 million or 90.9% and $8.27 million or 68.5%, respectively, for the year ended December 31, 2010, and $8.64 million or 85.5% and $2.57 million or 77.2%, respectively, for the year ended December 31, 2009.

Operating expenses: Operating expenses, including selling, general and administrative expenses and R&D increased $2.84 million, or 99.9%, from $2.85 million for the year ended December 31, 2009 to $5.69 million for the year ended December 31, 2010. The increase in operating expenses was related to the expansion of administrative and R&D departments with recruitment of more employees, related office expenses, as well as the addition of public company related expenses.

Interest expenses: Interest expenses increased $0.15 million, or 234.26%, from $0.07 million for the year ended December 31, 2009 to $0.22 million for the year ended December 31, 2010 due to an increase in interest expenses from the notes payable with an annual interest rate of 12% and short-term loans with an annual interest rate of 6.6375%.

Research and Development: For the year ended December 31, 2010 and 2009, we spent $1.2 million and $0.44 million on research and development expenses, of which $0.61 million and $0.34 million was attributable to MVAS and $0.59 million and $0.1 million was attributable to MPS.

Income from Operations: Income from operations increased $5.4 million, or 64.6%, from $8.36 million for the year ended December 31, 2009 to $13.76 million for the year ended December 31, 2010, principally due to revenue growth associated with our geographic expansion into additional provinces. Income from operations margin rate decreased 5.8% from 62.2% for the year ended December 31, 2009 to 56.4% for the year ended December 31, 2010, mainly caused by the excessive increase of cost and expenses over the growth of revenue.

Critical Accounting Policies and Estimates. We prepare our financial statements in conformity with U.S. GAAP, which requires us to make estimates and assumptions that affect our reporting of, among other things, assets and liabilities, contingent assets and liabilities and revenues and expenses. We continually evaluate these estimates and assumptions based on the most recently available information, our own historical experiences and other factors that we believe to be relevant under the circumstances. Since our financial reporting process inherently relies on the use of estimates and assumptions, our actual results could differ from what we expect. This is especially true with some accounting policies that require higher degrees of judgment than others in their application. We consider the policies discussed below to be critical to an understanding of our audited consolidated financial statements because they involve the greatest reliance on our management’s judgment.

Revenue Recognition. We derive revenues from our MVAS Technology Platforms and Mobile Payment Solutions in the form of providing system integration, sales of software, patent licensing and maintenance services. With respect to the system integration, we sign contracts with telecommunication and mobile operators and system integrators to install and integrate the Group’s software with the hardware and software purchased from third-party suppliers. Deliverables of system integration include: software, hardware, integration, installation and training. No Post-Contract Customer Support (PCS) arrangement is included in system integration. Revenue is recognized when the last deliverable in the arrangement is delivered and when all of the following criteria have been met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the vendor’s fee is fixed or determinable; and (4) collectability is probable.

| 6 |

With respect to the sales of software, revenue is recognized when the last deliverable in the arrangement is delivered and when all of the following criteria have been met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the vendor’s fee is fixed or determinable; and (4) collectability is probable.

With respect to patent licensing, we enter into contracts with local system integrators who further contract with telecommunication and mobile operators, and provide these system integrators with our patents which permit the system integrators to use our patents. The system integrators pay the Group a one-time license fee for obtaining the programs and technologies. Patent licensing revenues are recognized when all revenue recognition criteria according to ASC 985-605 have been met.

Revenue derived from technical support contracts primarily includes telephone consulting, on-site support, product updates, and releases of new versions of products previously purchased by the customers, as well as error reporting and correction services. Maintenance contracts are typically sold for a separate fee with initial contractual period of one year with renewal for additional periods thereafter. Technical support service revenue is recognized ratably over the term of the service agreement.

Accounts Receivable. We sell our products and services to telecommunication and mobile operators directly or through resellers. We do not require collateral from our customers.

We perform ongoing credit evaluations of our customers and review the composition of accounts receivable, analyze historical bad debts, customer concentration, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate if allowance for doubtful accounts is needed.

Recently issued accounting pronouncements

The FASB issued ASU 2010-13, Compensation — Stock Compensation (ACS Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades. The ASU codifies the consensus reached in Emerging Issues Task Force (EITF) Issue No. 09-J. The amendments to the Codification clarify that an employee share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity shares trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity would not classify such an award as a liability if it otherwise qualifies as equity.

The amendments in the ASU are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. Earlier adoption is permitted. The amendments are to be applied by recording a cumulative-effect adjustment to beginning retained earnings. We are currently evaluating the impact of adopting this update on our consolidated financial statements.

Foreign Currency Translation

The functional currency of the Company is United States dollars (“US$”), and the functional currency of Trunkbow Hong Kong is Hong Kong dollars (“HK$”). The functional currency of the Company’s PRC subsidiaries and VIE is the Renminbi (“RMB”), and the PRC is the primary economic environment in which the Company operates.

For financial reporting purposes, the financial statements of the Company’s PRC subsidiaries and VIE, which are prepared using the RMB, are translated into the Company’s reporting currency, the United States Dollar. Assets and liabilities are translated using the exchange rate at each balance sheet date. Revenue and expenses are translated using average rates prevailing during each reporting period, and shareholders’ equity is translated at historical exchange rates. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income in shareholders’ equity.

| 7 |

For financial reporting purposes, our financial statements, which are prepared using the functional currency, have been translated into U.S. dollars. Assets and liabilities are translated at the exchange rates at the balance sheet date and revenue and expenses are translated at the average exchange rates and stockholders’ equity is translated at historical exchange rates. Any translation adjustments resulting are not included in determining net income but are included in foreign currency translation adjustment of other comprehensive income, a component of stockholders’ equity.

The exchange rates applied are as follows:

| December 31, | |||||

| 2010 | 2009 | ||||

| Year end RMB exchange rate | 6.6118 | 6.8372 | |||

| Average RMB exchange rate | 6.7788 | 6.8409 | |||

There is no significant fluctuation in exchange rate for the conversion of RMB to U.S. dollars after the balance sheet date.

Liquidity and Capital Resources

Dividends

We are a holding company and conduct our operations primarily through our subsidiaries and VIEs in the PRC. As a result, our ability to pay dividends depends upon dividends paid by our subsidiaries and VIEs. The VIEs’ earnings are transferred to our subsidiaries in the form of payments under the technology support and related consulting agreements. If our subsidiaries incur debt on their own behalf, the instruments governing their debt may restrict their ability to pay dividends to us. In addition, our subsidiaries are permitted to pay dividends to us only out of their retained earnings, if any, as determined in accordance with accounting standards and regulations applicable to such subsidiaries. As of December 31, 2010, our PRC subsidiaries and VIEs had aggregate unappropriated earnings of approximately $21.1 million that were available for distribution. These unappropriated earnings are considered to be indefinitely reinvested, and will be subject to PRC dividend withholding taxes upon distribution.

Under PRC law, each of our PRC subsidiaries must set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of our PRC subsidiaries with foreign investments must also set aside a portion of its after-tax profits to fund an employee welfare fund at the discretion of the board. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, companies may not distribute the reserve funds as cash dividends except upon a liquidation of these subsidiaries. In addition, dividend payments from our PRC subsidiaries could be delayed as we may only distribute such dividends upon completion of annual audits of the subsidiaries.

As an offshore holding company, we may rely principally on dividends from our subsidiaries in the PRC for our cash requirements, including to pay dividends or make other distributions to our shareholders or to service our debt we may incur and to pay our operating expenses. The payment of dividends by entities organized in the PRC is subject to limitations. In particular, the PRC regulations permit our subsidiaries to pay dividends to us only out of their accumulated profits, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in the PRC is required to set aside a certain amount of its after-tax profits each year, if any, to fund certain statutory reserves. These reserves are not distributable as cash dividends.

If our subsidiaries in the PRC incur debt on their own behalf, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. Any limitation on the ability of our subsidiaries to distribute dividends or other payments to us could materially adversely limit our ability to grow, make investments or acquisitions, pay dividends and otherwise fund and conduct our business.

Government Control of Currency Conversion

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all of our revenues in Renminbi. Under our current corporate structure, our Nevada holding company primarily relies on dividend payments from our wholly-owned PRC subsidiaries in the PRC to fund any cash and financing requirements we may have.

Under existing PRC foreign exchange

regulations, payments of current account items, including profit distributions, interest payments and trade and service-related

foreign exchange transactions, can be made in foreign currencies without prior SAFE approval by complying with certain procedural

requirements. Therefore, our wholly owned PRC subsidiaries may pay dividends in foreign currency to us without pre-approval from

SAFE. However, approval from or registration with competent government authorities is required where the Renminbi is to be converted

into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of loans denominated in foreign

currencies. With the prior approval from SAFE, cash generated from the operations of our PRC subsidiary may be used to pay off

debt they owe to entities outside the PRC in a currency other than the Renminbi. The PRC government may at its discretion restrict

access to foreign currencies for current account transactions in the future. If the foreign exchange control system prevents us

from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign

currencies to our shareholders.

Cash Flows

In summary, our cash flows were as follows:

| Years Ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| Net cash flows used in operating activities | $ | (8,637,933 | ) | $ | (1,305,453 | ) | ||

| Net cash flows used in investing activities | (999,465 | ) | (825,535 | ) | ||||

| Net cash flows provided by financing activities | 16,333,451 | 5,046,382 | ||||||

| Effect of foreign currency fluctuation on cash and cash equivalents | 258,224 | (100,880 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | $ | 6,954,277 | $ | 2,814,514 | ||||

| Cash and cash equivalents – beginning of year | $ | 3,305,473 | $ | 490,959 | ||||

| Cash and cash equivalents – end of year | $ | 10,259,750 | $ | 3,305,473 | ||||

| 8 |

Operating Activities

Net cash flows used in operating activities for the year ended December 31, 2010 was $8.64 million as compared with $1.31 million used in operating activities for the year ended December 31, 2009, for a net increase of $7.33 million. This increase was mainly due to the significant increase in the change of accounts receivable, loans receivable and other current assets and inventory, offset by the effect of an increase in changes of tax payable and net income during the year ended December 31, 2010.

The increase in the change of accounts receivable caused the operating cash flows to be out about $14.48 million. It’s mainly because of the increasing revenue, which increased by $11.38 million, from $13.47 million to $24.84 million for the year ended December 31, 2009 and 2010, respectively, while our revenue only increased by $0.55 million, when compared the data from year ended December 31, 2009 to year ended December 31, 2008.

The decrease in operating cash flows was also attributable to a substantial increase in cash out flows from advances to suppliers of $6.88 million as of December 31, 2010 when compared to December 31, 2009, due to large demand of third party software and hardware to be used in our MVAS and MPS platform deployment in 2011, and also due to the fact that we obtained lower price through large purchase. While there was no material change in advance to suppliers as of December 31, 2009 when compared to December 31, 2008, there was no material effect on the cash flow by advance to suppliers for the year ended December 31, 2009.

The inventory balance increased significantly by $3.37 million from $0.31 million as of December 31, 2009 to $3.68 million as of December 31, 2010, due to the purchase of point of sale systems from Verifone, related to the deployment of our mobile payment platforms.

The increase in operating cash flows was attributable to a substantial increase in tax payable of $2.05 million as of December 31, 2010 when compared to December 31, 2009, due to our large gross margin which caused significant portion of value added tax output not offset by value added tax input.

Investing Activities

For the year ended December 31, 2010, our main use of investing activities was for loans to third parties. The cash payments used in investing activities was netted against the collections from amounts due from directors.

Financing Activities

Net cash flows provided by financing activities for the year ended December 31, 2010 was $16.33 million as compared with $5.05 million provided by financing activities for the year ended December 31, 2009.

Of the $5 million notes payable as of December 31, 2009, $2 million was repaid in cash to the note holders in February and March 2010, and $3 million was converted to 1,500,000 shares of common stock at $2.00 per share as a result of the share exchange and the February 2010 Offering.

The cash provided by financing activities for the year ended December 31, 2010 included the net proceeds from the February 2010 Offering of $17.07 million and the short-term loan of $1.77 million, offset by the repayment of $2 million notes payable.

Restricted Net Assets

As a result of these PRC laws and regulations that require annual appropriations of 10% of after-tax income to be set aside prior to payment of dividends as general reserve fund, our PRC operating entities are restricted in their ability to transfer a portion of their net assets to us. Amounts restricted include paid-in capital and statutory reserve funds of our PRC operating subsidiaries as determined pursuant to PRC generally accepted accounting principles, totaling approximately US$24.4 million as of December 31, 2010.

Operating lease commitment

We lease office space under a lease agreement with a term expiring in April 2014. The lease may be cancelled by either party with 30-days prior written notice.

| 9 |

Future minimum rental payments under this operating lease are as follows:

| Office Rental | ||||

| Year ending December 31, 2011 | $ | 227,946 | ||

| Year ending December 31, 2012 | 155,897 | |||

| Year ending December 31, 2013 | 28,025 | |||

| Year ending December 31, 2014 | 6,171 | |||

| Total | $ | 418,039 | ||

We do not have other commitments besides the commitment in office rental.

Off-Balance Sheet Arrangements

We currently have no off-balance sheet arrangements.

Inflation

Inflation has not historically been a significant factor impacting our financial results.

| Item 8. | Financial Statements and Supplementary Financial Data |

Consolidated Financial Statements

The financial statements required by this item begin on page F-1 hereof.

| 10 |

PART IV

| Item 1. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

|

Exhibit Number |

Description | |

| 2.1 | Share Exchange Agreement, dated as of January 27, 2010(1) | |

| 3.1 | Amended Articles of Incorporation(1) | |

| 3.2 | Bylaws(1) | |

| 4.1 | Form of Investor Warrant(1) | |

| 4.2 | Registration Rights Agreement, dated as of February 10, 2010(1) | |

| 4.3 | Specimen Common Stock Certificate(5) | |

| 4.4 | Form of Underwriter Warrant(5) | |

| 10.1 | Subscription Agreement, dated as of February 10, 2010(1) | |

| 10.2 | Make Good Escrow Agreement(1) | |

| 10.3 | Form of Director Repayment Agreement(1) | |

| 10.4 | Exclusive Business Cooperation Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.5 | Exclusive Option Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Wanchun Hou and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.6 | Exclusive Option Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Qiang Li and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.7 | Exclusive Option Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Liangyao Xie and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.8 | Loan Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Wanchun Hou(2) | |

| 10.9 | Loan Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Qiang Li(2) | |

| 10.10 | Loan Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Liangyao Xie(2) | |

| 10.11 | Power of Attorney of Wanchun Hou in favor of Trunkbow Asia Pacific (Shandong) Co., Ltd.(2) | |

| 10.12 | Power of Attorney of Qiang Li in favor of Trunkbow Asia Pacific (Shandong) Co., Ltd.(2) | |

| 10.13 | Power of Attorney of Liangyao Xie in favor of Trunkbow Asia Pacific (Shandong) Co., Ltd.(2) | |

| 10.14 | Share Pledge Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Wanchun Hou and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.15 | Share Pledge Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Qiang Li and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.16 | Share Pledge Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Liangyao Xie and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.17 | Nominee Letter to Wanchun Hou(2) | |

| 10.18 | Nominee Letter to Qiang Li(2) | |

| 10.19 | Nominee Letter to Liangyao Xie(2) | |

| 10.20* | RMB 2.75 million Factoring Agreement by and between Trunkbow Asia Pacific (Shangdong) Co. Limited and Agricultural Bank of China, Jian Hi-Tech Development Zone Branch | |

| 10.21* | Guaranty of Dr. Wanchun Hou with respect to Exhibit 10.20 | |

| 10.22* | Guaranty of Qiang Li with respect to Exhibit 10.20 | |

| 10.23* | Pledge Agreement by and between Trunkbow Asia Pacific (Shandong) Co. Limited and Agricultural Bank of China, Jinan Hi-Tech Development Zone Branch with respect to Exhibit 10.20 | |

| 10.24* | RMB 5.25 million Factoring Agreement by and between Trunkbow Asia Pacific (Shangdong) Co. Limited and Agricultural Bank of China, Jian Hi-Tech Development Zone Branch | |

| 10.25* | Guaranty of Dr. Wanchun Hou with respect to Exhibit 10.24 | |

| 10.26* | Guaranty of Qiang Li with respect to Exhibit 10.24 | |

| 10.27* | Pledge Agreement by and between Trunkbow Asia Pacific (Shandong) Co. Limited and Agricultural Bank of China, Jinan Hi-Tech Development Zone Branch with respect to Exhibit 10.24 | |

| 14.1 | Code of Ethics(3) |

| 11 |

| 21.1 | Subsidiaries of Trunkbow Holdings International Limited(1) | |

| 31.1* | Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2* | Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1* | Certification of Principal Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2* | Certification of Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| * | Filed herewith. |

| (1) | Incorporated herein by reference to the Registration Statement on Form 10 filed by Trunkbow on June 4, 2010. |

| (2) | Incorporated herein by reference to Amendment No. 2 to the Registration Statement on Form S-1/A filed by Trunkbow on December 15, 2010. |

| (3) | Incorporated herein by reference to Amendment No. 4 to the Registration Statement on Form S-1/A filed by Trunkbow on January 18, 2011. |

| 12 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TRUNKBOW INTERNATIONAL HOLDINGS LIMITED | |||

| July 3, 2012 | By: | /s/ Li Qiang | |

| (Date Signed) | Li Qiang, Chief Executive Officer | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated.

Signature |

Capacity |

Date | ||

| /s/ Dr. Hou WanChun | Chairman of the Board of Directors | July 3, 2012 | ||

| Dr. Hou WanChun | ||||

| /s/ Li Qiang | Chief Executive Officer and Director (Principal Executive Officer) | July 3, 2012 | ||

Li Qiang |

||||

| /s/ Ye Yuan Jun | Chief Financial Officer (Principal Accounting Officer) | July 3, 2012 | ||

Ye Yuan Jun |

||||

| /s/ Bao Jihong | Director | July 3, 2012 | ||

Bao Jihong |

||||

| /s/ Wang Xin | Director | July 3, 2012 | ||

Wang Xin |

||||

| /s/ Albert Liu | Director | July 3, 2012 | ||

Albert Liu |

||||

| /s/ Regis Kwong | Director | July 3, 2012 | ||

| Regis Kwong | ||||

| /s/ Dr. Tan Kok Hui | Director | July 3, 2012 | ||

| Dr. Tan Kok Hui | ||||

| /s/ Iris Geng | Director | July 3, 2012 | ||

| Iris Geng | ||||

| /s/ Dr. Lv Ting Jie | Director | July 3, 2012 | ||

| Dr. Lv Ting Jie | ||||

| /s/ Huang Zhaoxing | Director | July 3, 2012 | ||

| Huang Zhaoxing | ||||

| /s/ Li Dong | Director | July 3, 2012 | ||

| Li Dong |

Exhibit Index

|

Exhibit Number |

Description | |

| 2.1 | Share Exchange Agreement, dated as of January 27, 2010(1) | |

| 3.1 | Amended Articles of Incorporation(1) | |

| 3.2 | Bylaws(1) | |

| 4.1 | Form of Investor Warrant(1) | |

| 4.2 | Registration Rights Agreement, dated as of February 10, 2010(1) | |

| 4.3 | Specimen Common Stock Certificate(5) | |

| 4.4 | Form of Underwriter Warrant(5) | |

| 10.1 | Subscription Agreement, dated as of February 10, 2010(1) | |

| 10.2 | Make Good Escrow Agreement(1) | |

| 10.3 | Form of Director Repayment Agreement(1) | |

| 10.4 | Exclusive Business Cooperation Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.5 | Exclusive Option Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Wanchun Hou and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.6 | Exclusive Option Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Qiang Li and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.7 | Exclusive Option Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Liangyao Xie and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.8 | Loan Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Wanchun Hou(2) | |

| 10.9 | Loan Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Qiang Li(2) | |

| 10.10 | Loan Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd. and Liangyao Xie(2) | |

| 10.11 | Power of Attorney of Wanchun Hou in favor of Trunkbow Asia Pacific (Shandong) Co., Ltd.(2) | |

| 10.12 | Power of Attorney of Qiang Li in favor of Trunkbow Asia Pacific (Shandong) Co., Ltd.(2) | |

| 10.13 | Power of Attorney of Liangyao Xie in favor of Trunkbow Asia Pacific (Shandong) Co., Ltd.(2) | |

| 10.14 | Share Pledge Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Wanchun Hou and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.15 | Share Pledge Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Qiang Li and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.16 | Share Pledge Agreement among Trunkbow Asia Pacific (Shandong) Co., Ltd., Liangyao Xie and Trunkbow Technologies (Shenzhen) Co., Ltd.(2) | |

| 10.17 | Nominee Letter to Wanchun Hou(2) | |

| 10.18 | Nominee Letter to Qiang Li(2) | |

| 10.19 | Nominee Letter to Liangyao Xie(2) | |

| 10.20* | RMB 2.75 million Factoring Agreement by and between Trunkbow Asia Pacific (Shangdong) Co. Limited and Agricultural Bank of China, Jian Hi-Tech Development Zone Branch | |

| 10.21* | Guaranty of Dr. Wanchun Hou with respect to Exhibit 10.20 | |

| 10.22* | Guaranty of Qiang Li with respect to Exhibit 10.20 | |

| 10.23* | Pledge Agreement by and between Trunkbow Asia Pacific (Shandong) Co. Limited and Agricultural Bank of China, Jinan Hi-Tech Development Zone Branch with respect to Exhibit 10.20 | |

| 10.24* | RMB 5.25 million Factoring Agreement by and between Trunkbow Asia Pacific (Shangdong) Co. Limited and Agricultural Bank of China, Jian Hi-Tech Development Zone Branch | |

| 10.25* | Guaranty of Dr. Wanchun Hou with respect to Exhibit 10.24 | |

| 10.26* | Guaranty of Qiang Li with respect to Exhibit 10.24 | |

| 10.27* | Pledge Agreement by and between Trunkbow Asia Pacific (Shandong) Co. Limited and Agricultural Bank of China, Jinan Hi-Tech Development Zone Branch with respect to Exhibit 10.24 | |

| 14.1 | Code of Ethics(3) | |

| 21.1 | Subsidiaries of Trunkbow Holdings International Limited(1) | |

| 31.1* | Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2* | Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1* | Certification of Principal Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2* | Certification of Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| * | Filed herewith. |

| (1) | Incorporated herein by reference to the Registration Statement on Form 10 filed by Trunkbow on June 4, 2010. |

| (2) | Incorporated herein by reference to Amendment No. 2 to the Registration Statement on Form S-1/A filed by Trunkbow on December 15, 2010. |

| (3) | Incorporated herein by reference to Amendment No. 4 to the Registration Statement on Form S-1/A filed by Trunkbow on January 18, 2011. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Trunkbow International Holdings Limited

We have audited the accompanying consolidated balance sheet of Trunkbow International Holdings Limited (“the Company”) as of December 31, 2010, and the related consolidated statement of income and comprehensive income, changes in stockholders’ equity and cash flows for the year then ended. The Company’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2010, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ Bernstein & Pinchuk LLP

March 31, 2011 except for Note 24, as to which the date is December 30, 2011 and Note 26, which is dated July 3, 2012

New York, New York

| F-1 |

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders

Trunkbow International Holdings Limited

Beijing, China

We have audited the accompanying consolidated balance sheet of Trunkbow International Holdings Limited and Subsidiaries (the “Company”) as of December 31, 2009, and the related consolidated statements of income and comprehensive income, stockholders’ equity, and cash flows for the year then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as, evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Trunkbow International Holdings Limited and Subsidiaries as of December 31, 2009, and the consolidated results of its operations and its consolidated cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/ Holtz Rubenstein Reminick LLP

Melville, New York

July 3, 2012

| F-2 |

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED BALANCE SHEETS

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 10,259,750 | $ | 3,305,473 | ||||

| Restricted deposit | 362,987 | — | ||||||

| Accounts receivable | 25,658,184 | 10,455,284 | ||||||

| Advances to suppliers | 6,881,368 | 7,580 | ||||||

| Loans receivable and other current assets, net | 3,900,168 | 1,078,075 | ||||||

| Due from directors | 79,256 | 2,088,168 | ||||||

| Inventories | 3,681,450 | 307,182 | ||||||

| Total current assets | 50,823,163 | 17,241,762 | ||||||

| Property and equipment, net | 484,761 | 39,817 | ||||||

| Long-term prepayment | 358,397 | — | ||||||

| TOTAL ASSETS | $ | 51,666,321 | $ | 17,281,579 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 853,762 | $ | 331,654 | ||||

| Accrued expenses and other current liabilities | 593,846 | 603,266 | ||||||

| Short-term loan | 1,814,937 | — | ||||||

| Due to directors | — | 24,430 | ||||||

| Notes payable | — | 5,000,000 | ||||||

| Taxes payable | 3,718,963 | 1,561,599 | ||||||

| Total current liabilities | 6,981,508 | 7,520,949 | ||||||

| Other non-current liabilities | 138,767 | — | ||||||

| Total liabilities | 7,120,275 | 7,520,949 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred Stock: par value USD0.001, authorized 10,000,000 shares, none issued and outstanding at December 31, 2010 and 2009 | — | — | ||||||

| Common Stock: par value USD0.001, authorized 190,000,000 shares, issued and outstanding 32,472,075 shares at December 31, 2010 and 19,562,888 at December 31, 2009 | 32,472 | 19,563 | ||||||

| Additional paid-in capital | 21,384,050 | 1,323,239 | ||||||

| Appropriated retained earnings | 2,428,847 | 1,010,486 | ||||||

| Unappropriated retained earnings | 20,125,001 | 8,002,477 | ||||||

| Accumulated other comprehensive income/(loss) | 575,676 | (595,135 | ) | |||||

| Total stockholders’ equity | 44,546,046 | 9,760,630 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 51,666,321 | $ | 17,281,579 | ||||

See notes to the consolidated financial statements.

| F-3 |

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

| Years Ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| Revenues | $ | 24,843,836 | $ | 13,468,581 | ||||

| Less: Business tax and surcharges | 455,919 | 38,624 | ||||||

| Net revenues | 24,387,917 | 13,429,957 | ||||||

| Cost of revenues | 4,929,974 | 2,220,577 | ||||||

| Gross margin | 19,457,943 | 11,209,380 | ||||||

| Operating expenses | ||||||||

| Selling and distribution expenses | 1,412,499 | 533,633 | ||||||

| General and administrative expenses | 3,075,833 | 1,877,732 | ||||||

| Research and development expenses | 1,203,264 | 435,712 | ||||||

| 5,691,596 | 2,847,077 | |||||||

| Income from operations | 13,766,347 | 8,362,303 | ||||||

| Interest income | (37,204 | ) | (350 | ) | ||||

| Interest expense | 220,668 | 66,016 | ||||||

| Other expenses | 41,998 | 3,655 | ||||||

| 225,462 | 69,321 | |||||||

| Income before income tax expense | 13,540,885 | 8,292,982 | ||||||

| Income tax expense | — | — | ||||||

| Net income | 13,540,885 | 8,292,982 | ||||||

| Foreign currency translation fluctuation | 1,170,811 | (92,830 | ) | |||||

| Comprehensive income | $ | 14,711,696 | $ | 8,200,152 | ||||

| Weighted average number of common shares outstanding | ||||||||

| Basic and diluted | 31,022,002 | 19,562,888 | ||||||

| Earnings per share | ||||||||

| Basic and diluted | $ | 0.44 | $ | 0.42 | ||||

See notes to the consolidated financial statements.

| F-4 |

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Years Ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 13,540,885 | $ | 8,292,982 | ||||

| Adjustments to reconcile net income to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 93,135 | 20,362 | ||||||

| Loss on disposal of property and equipment | — | 1,281 | ||||||

| Provision for doubtful debts | — | 366,912 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (14,480,828 | ) | (9,791,845 | ) | ||||

| Advance to suppliers and other assets | (6,369,759 | ) | 95,224 | |||||

| Inventories | (3,280,951 | ) | (307,017 | ) | ||||

| Long-term prepayment | (784,576 | ) | (241,583 | ) | ||||

| Accounts payable | 498,222 | (85,218 | ) | |||||

| Accrued expenses and other current liabilities | 118,273 | 383,859 | ||||||

| Amount due to directors | (24,641 | ) | 24,417 | |||||

| Taxes payable | 2,052,307 | (64,827 | ) | |||||

| Net cash flows used in operating activities | (8,637,933 | ) | (1,305,453 | ) | ||||

| Cash flows from investing activities | ||||||||

| Acquisition of property and equipment | (449,169 | ) | (4,729 | ) | ||||

| Loans to third parties | (2,579,165 | ) | 57,070 | |||||

| Collection in (increase in) amount due from directors | 2,028,869 | (877,876 | ) | |||||

| Net cash flows used in investing activities | (999,465 | ) | (825,535 | ) | ||||

| Cash flows from financing activities | ||||||||

| Increase in restricted deposit | (362,987 | ) | — | |||||

| Proceeds from issuance of common stock (net of finance costs) | 17,073,720 | 100,000 | ||||||

| Repayment of loans from third parties | (147,520 | ) | (53,618 | ) | ||||

| Repayment of notes payable | (2,000,000 | ) | — | |||||

| Proceeds from issuance of notes payable | — | 5,000,000 | ||||||

| Proceeds from short-term loan | 1,770,238 | — | ||||||

| Net cash flows provided by financing activities | 16,333,451 | 5,046,382 | ||||||

| Effect of exchange rate fluctuation on cash and cash equivalents | 258,224 | (100,880 | ) | |||||

| Net increase in cash and cash equivalents | 6,954,277 | 2,814,514 | ||||||

| Cash and cash equivalents – beginning of the year | 3,305,473 | 490,959 | ||||||

| Cash and cash equivalents – end of the year | $ | 10,259,750 | $ | 3,305,473 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for interest | $ | 220,668 | $ | — | ||||

| Cash paid for income taxes | $ | — | $ | — | ||||

| Supplemental disclosure of noncash financing activities | ||||||||

| Conversion of notes payable to common stock | $ | 3,000,000 | $ | — | ||||

See notes to the consolidated financial statements

| F-5 |

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

| Common stock | Additional paid-in |

Appropriated retained |

Unappropriated retained |

Accumulated other comprehensive |

||||||||||||||||||||||||

| Shares | Amount | Capital | earnings | earnings | income/(loss) | Total | ||||||||||||||||||||||

| Balance at January 1, 2009 | 19,562,888 | $ | 19,563 | $ | 1,323,239 | $ | 27,518 | $ | 692,463 | $ | (502,305 | ) | $ | 1,560,478 | ||||||||||||||

| Net income | - | - | - | - | 8,292,982 | - | 8,292,982 | |||||||||||||||||||||

| Appropriation of statutory surplus reserve | - | - | - | 982,968 | (982,968 | ) | - | - | ||||||||||||||||||||

| Foreign currency Translation adjustment | - | - | - | - | - | (92,830 | ) | (92,830 | ) | |||||||||||||||||||

| Balance at December 31, 2009 | 19,562,888 | 19,563 | 1,323,239 | 1,010,486 | 8,002,477 | (595,135 | ) | 9,760,630 | ||||||||||||||||||||

| Net income | - | - | - | - | 13,540,885 | - | 13,540,885 | |||||||||||||||||||||

| Stock issued in recapitalization | 1,687,112 | 1,687 | (1,687 | ) | - | - | - | - | ||||||||||||||||||||

| Issue of shares | 11,222,075 | 11,222 | 20,062,498 | - | - | - | 20,073,720 | |||||||||||||||||||||

| Appropriation of statutory surplus reserve | - | - | - | 1,418,361 | (1,418,361 | ) | - | - | ||||||||||||||||||||

| Foreign currency Translation adjustment | - | - | - | - | - | 1,170,811 | 1,170,811 | |||||||||||||||||||||

| Balance at December 31, 2010 | 32,472,075 | $ | 32,472 | $ | 21,384,050 | $ | 2,428,847 | $ | 20,125,001 | $ | 575,676 | $ | 44,546,046 | |||||||||||||||

See notes to the consolidated financial statements.

| F-6 |

TRUNKBOW INTERNATIONAL HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1 — ORGANIZATION AND PRINCIPAL ACTIVITIES

Trunkbow International Holdings Limited (formerly named as Bay Peak 5 Acquisition Corp. (“BP5”)) (the “Company”), was incorporated in the State of Nevada on September 3, 2004. The Company was formed as part of the implementation of the Chapter 11 reorganization plan (the “Visitalk Plan”) of visitalk.com, Inc. (“Visitalk.com”), a former provider of VOIP services. The Visitalk Plan was deemed effective by the Bankruptcy Court on September 17, 2004 (the “Effective Date”). On September 22, 2004, Visitalk.com was merged into VCC, which was authorized as the reorganized debtor under the Visitalk Plan.

In February 2010, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with Trunkbow International Holdings Limited, a company organized under the laws of the British Virgin Islands (“Trunkbow”), the shareholders of Trunkbow (the “Shareholders”), who together own shares constituting 100% of the issued and outstanding ordinary shares of Trunkbow (the “Trunkbow Shares”), and the principal shareholder of the Company (“Principal Shareholder”). Pursuant to the terms of the Exchange Agreement, the Shareholders transferred to the Company all of the Trunkbow Shares in exchange for the issuance of 19,562,888 (the “Shares”) shares of our common stock (the “Share Exchange”). As a result of the Share Exchange, Trunkbow became our wholly owned subsidiary. After giving effect to the Share Exchange, the sale of common stock in the February 2010 Offering (defined below) and the BP5 Warrant Financing referred to below (i) existing shareholders of Trunkbow owned approximately 60.25% of the Company’s outstanding Common Stock, (ii) purchasers of Common Stock in the Offering owned approximately 26.01% of the Company’s outstanding Common Stock (including 7.7% owned by VeriFone, Inc.), (iii) the holders of BP5 Warrants owned approximately 8.54% of the Company’s outstanding Common Stock and (iv) the pre-existing shareholders of BP5 owned approximately 5.2% of the Company’s outstanding Common Stock.

Concurrent with the Share Exchange, (i) we entered into a securities purchase agreement (the “Purchase Agreement”) with certain investors (the “Investors”) for the sale of an aggregate of 8,447,575 shares (the “Investor Shares”) and 1,689,515 warrants (the “Investor Warrants”), for aggregate gross proceeds equal to $16,895,150 (the “February 2010 Offering”) and (ii) certain holders of outstanding warrants of the Company issued to creditors and claimants of visitalk.com., in accordance with the Visitalk Plan, referred to herein as the “BP5 Warrant Investors” exercised the 2,774,500 warrants owned by them for an aggregate exercise price of $5.5 million and received warrants to purchase an aggregate of 554,900 shares of Common Stock (“BP5 Warrant Financing”).

The Company’s wholly owned subsidiary, Trunkbow, was established in the British Virgin Islands (“BVI”) on July 17, 2009, with no significant business operations and assets other than holding of equity interests in its subsidiaries and variable interest entity (“VIE”). Trunkbow’s wholly owned subsidiary, Trunkbow (Asia Pacific) Investment Holdings Limited (“Trunkbow Hong Kong”) was established as an Investment Holding Company in Hong Kong Special Administrative Region of the People’s Republic of China (the “PRC”) on July 9, 2004.

Trunkbow Hong Kong established two wholly foreign owned subsidiaries in the PRC, Trunkbow Asia Pacific (Shandong) Company, Limited (“Trunkbow Shandong”) which was established on December 10, 2007 in Jinan, Shandong Province and Trunkbow Asia Pacific (Shenzhen) Company, Limited (“Trunkbow Shenzhen”) which was established on June 7, 2007 in Shenzhen, Guangdong Province. Both subsidiaries are principally engaged in research and development of application platforms for mobile operators in China.

Trunkbow Technologies (Shenzhen) Company, Limited (“Trunkbow Technologies”) was established as a limited liability company on December 4, 2001 in Shenzhen, Guangdong Province, the PRC. Trunkbow Technologies was formerly engaged in research and development of application platforms for mobile operators in China as well as wireless application systems for the international market. In December 2007, a series of agreements were entered into amongst Trunkbow Shandong, Trunkbow Technologies and its controlling shareholders, providing Trunkbow Shandong the ability to control Trunkbow Technologies, including its financial interest. As a result of these contractual arrangements, which assigned all of Trunkbow Technologies’ equity owners’ rights and obligations to Trunkbow Shandong resulting in the equity owners lacking the ability to make decisions that have a significant effect on Trunkbow Technologies’ operations and Trunkbow Shandong’s ability to extract the profits from the operation of Trunkbow Technologies, and assume the Trunkbow Technologies’ residual benefits. Because Trunkbow Shandong and its indirect parent are the sole interest holders of Trunkbow Technologies, the Company consolidates Trunkbow Technologies from its inception consistent with the provisions of FASB Accounting Standards Codification (“ASC”) 810-10.

The Company, its subsidiaries and VIE are collectively referred to as the “Group”.

| F-7 |

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

| a) | Change of reporting entity and basis of presentation |

As a result of the Share Exchange on February 10, 2010, the former Trunkbow shareholders owned a majority of the common stock of the Company. The transaction was regarded as a reverse merger whereby Trunkbow was considered to be the accounting acquirer as its shareholders retained control of the Company after the Share Exchange, although the Company is the legal parent company. The share exchange was treated as a recapitalization of the Company. As such, Trunkbow (and its historical financial statements) is the continuing entity for financial reporting purposes. Pursuant to the terms of the Share Exchange, BP5 was delivered with no assets and no liabilities at time of closing. Following the Share Exchange, the company changed its name from Bay Peak 5 Acquisition Corp. to Trunkbow International Holdings Limited. The financial statements have been prepared as if Trunkbow had always been the reporting company and then on the share exchange date, had changed its name and reorganized its capital stock.

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and include the accounts of the Company, and its subsidiaries and VIE, Trunkbow, Trunkbow Hong Kong, Trunkbow Shandong, Trunkbow Shenzhen and Trunkbow Technologies.

| b) | Principles of Consolidation |

The consolidated financial statements include the financial statements of the Company, the Company’s subsidiaries and the Company’s VIE. All transactions and balances between the Company and its subsidiaries and VIE have been eliminated upon consolidation.

| c) | Reclassification |

The comparative figures have been reclassified to conform to current year presentation.

| d) | Use of estimates |

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ from those estimates.

| e) | Foreign currency translation |

The functional currency of the Company is United States dollars (“US$”), and the functional currency of Trunkbow Hong Kong is Hong Kong dollars (“HK$”). The functional currency of the Company’s PRC subsidiaries and VIE is the Renminbi (“RMB”), and the PRC is the primary economic environment in which the Company operates.