Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - CKE Inc. | d350029dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 3, 2012

Registration No. 333-181504

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CKE INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5812 | 27-3026224 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

6307 Carpinteria Ave., Ste A.

Carpinteria, California 93013

(805) 745-7500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Andrew F. Puzder

Chief Executive Officer

CKE Inc.

6307 Carpinteria Ave., Ste A.

Carpinteria, California 93013

(805) 745-7500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Howard A. Kenny Morgan, Lewis & Bockius LLP 101 Park Avenue New York, New York 10178 (212) 309-6000 |

Charles A. Seigel III Senior Vice President and Assistant Secretary CKE Inc. 6307 Carpinteria Ave., Ste. A Carpinteria, California 93013 (805) 745-7500 |

Steven B. Stokdyk Latham & Watkins LLP 355 South Grand Avenue Los Angeles, California 90071 (213) 485-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer |

x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated July 3, 2012

PROSPECTUS

Shares

CKE INC.

Common Stock

This is our initial public offering. We are selling of the shares being offered hereby. The selling stockholder identified in this prospectus is selling an additional shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholder.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for our common stock. We intend to apply to list our common stock on the New York Stock Exchange under the symbol “CK.” Following this offering, we will remain a “controlled company” as defined under the New York Stock Exchange listing rules, and Apollo Management, L.P. and its affiliates will beneficially own % of our shares of outstanding common stock, assuming the underwriters do not exercise their option to purchase up to additional shares.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 19 of this prospectus.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to CKE Inc. |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholder |

$ | $ | ||||||

The underwriters also have an option to purchase up to an additional shares from us and the selling stockholder at the initial public offering price less the underwriting discount.

The shares will be ready for delivery on or about , 2012.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Morgan Stanley | Citigroup | Goldman, Sachs & Co. |

| Barclays | Credit Suisse | RBC Capital Markets |

Apollo Global Securities, LLC

The date of this prospectus is , 2012.

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 19 | ||||

| 35 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

46 | |||

| 96 | ||||

| 113 | ||||

| 120 | ||||

| 143 | ||||

| 145 | ||||

| 148 | ||||

| 152 | ||||

| 156 | ||||

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK |

158 | |||

| 162 | ||||

| 167 | ||||

| 167 | ||||

| 167 | ||||

| F-1 | ||||

Dealer Prospectus Delivery Obligations

Until , 2012 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

-i-

Table of Contents

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

We have obtained certain industry and market share data from third-party sources, such as Sandelman Quick-Track reports, QSR Magazine and other industry publications that we believe are reliable. In many cases, however, we have made statements in this prospectus regarding our industry and our position in the industry based on estimates made from our experience in the industry and our own investigation of market conditions. While we believe these estimates to be accurate as of the date of this prospectus, we cannot guarantee the accuracy or completeness of the industry or market data included in this prospectus or the estimates and beliefs based on that data because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We own or have rights to trademarks, service marks or tradenames that we use in connection with the operation of our business, including our corporate names, brands, logos and product names. Other trademarks, service marks and tradenames appearing in this prospectus are the property of their respective owners. The trademarks we own include CKE Restaurants®, Carl’s Jr.® and Hardee’s® along with the names of various products offered at our restaurants. Solely for convenience, some of the trademarks, service marks and tradenames referred to in this prospectus are listed without the ® and TM symbols, but we assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and tradenames.

To supplement our financial information presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), we use additional measures to clarify and enhance understanding of past performance and prospects for the future.

Adjusted EBITDA, Adjusted EBITDA margin, company-operated restaurant-level adjusted EBITDA, company-operated restaurant-level adjusted EBITDA margin, and franchise restaurant adjusted EBITDA (each as defined below) (“Non-GAAP Measures”), as presented in this prospectus, are supplemental measures of our performance that are not required by, or presented in accordance with, U.S. GAAP. They are not measurements of our financial performance under U.S. GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with U.S. GAAP or alternatives to net cash provided by operating activities as a measure of our liquidity.

“Adjusted EBITDA” represents net income (loss), adjusted to exclude income taxes, interest income and expense, asset impairments, facility action charges, depreciation and amortization, management fees, the effects of acquisition accounting adjustments, and certain non-cash and other items. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by total revenue. See Note 5 under “Summary—Summary Historical and Pro Forma Financial and Other Data.”

-ii-

Table of Contents

We define company-operated restaurant-level adjusted EBITDA as company-operated restaurants revenue (i) less restaurant operating costs, excluding depreciation and amortization expense, and (ii) less advertising expense. Restaurant operating costs exclude advertising costs, general and administrative expenses and facility action charges. Company-operated restaurant-level adjusted EBITDA margin is defined as company-operated restaurant-level adjusted EBITDA divided by company-operated restaurants revenue. We define franchise restaurant adjusted EBITDA as franchised restaurants and other revenue less franchised restaurants and other expense, plus depreciation and amortization expense. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Presentation of Non-GAAP Measures.”

We believe the Non-GAAP Measures provide investors with helpful information with respect to our operating performance and cash flows. In addition, our calculation of Adjusted EBITDA is consistent with the equivalent measurement in the covenants contained in agreements respecting certain of our indebtedness. See “Description of Indebtedness.” Our Non-GAAP Measures may not be comparable to those of other companies.

In addition, in evaluating these Non-GAAP Measures, you should be aware that in the future we will incur expenses such as those we have excluded in calculating these measures. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by any unusual or nonrecurring items.

iii

Table of Contents

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information that may be important to you in making an investment decision and should be read together with the more detailed information and consolidated financial statements included elsewhere in this prospectus. You should read the entire prospectus, including the “Risk Factors” section and our consolidated financial statements and notes to those statements, before making an investment decision.

Unless otherwise noted, “we,” “us,” “our” and the “Company” mean, for periods after the Merger (as defined below), CKE Inc. and its consolidated subsidiaries, including CKE Restaurants, Inc. (“CKE Restaurants®”), and for the periods prior to the Merger, CKE Restaurants and its consolidated subsidiaries. “CKE” means CKE Inc. but not its subsidiaries.

We operate on a retail accounting calendar. Our fiscal year ends on the last Monday in January and typically has 13 four-week accounting periods. For clarity of presentation, we generally label all fiscal year ends as if the fiscal year ended January 31 (e.g., the fiscal year ended January 30, 2012 is referred to as fiscal 2012 or the fiscal year ended January 31, 2012). References made to our fiscal year ended January 31, 2011, or fiscal 2011, refer to the Predecessor twenty-four weeks ended July 12, 2010 and the Successor twenty-nine weeks ended January 31, 2011. The first quarter of our fiscal year has four periods, or 16 weeks. All other quarters generally have three periods, or 12 weeks. Our fiscal year ended January 31, 2011 contained 53 weeks, with the one additional week included in our fourth quarter. The first quarter of our fiscal 2013 and fiscal 2012 ended May 21, 2012 and May 23, 2011, respectively.

Unless otherwise indicated, the information contained in this prospectus assumes that (i) the underwriters’ option to purchase up to additional shares will not be exercised, (ii) each share of common stock outstanding immediately prior to the -for-one stock split will have been split into shares of common stock and (iii) the number of our authorized shares of capital stock will have been increased to shares of common stock and shares of preferred stock pursuant to our amended and restated certificate of incorporation.

Home of the Big, Juicy Burger

We are one of the world’s largest operators and franchisors of quick service restaurants (“QSR”) with 3,263 owned or franchised locations operating in 42 states and 25 foreign countries primarily under our Carl’s Jr.® and Hardee’s® brands. We believe we offer innovative, premium products that we develop for a target demographic we refer to as “young, hungry guys” but that we believe also appeal to a broader customer base of individuals who aspire to be youthful. Our target demographic of 18 to 34 year old males who enjoy premium food at a reasonable price makes up a large portion of the global QSR market, which is currently estimated to generate $225 billion in sales annually ($141 billion in the United States). Specifically, younger males account for almost one quarter of all QSR visits and have the highest frequency of any demographic group at almost 17 visits per month. We believe our focus on this customer type is anchored by our menu of high quality, premium products, and enhanced through edgy, breakthrough advertising. According to QSR Magazine (Top 50 Rankings, March 7, 2012), we are the fifth largest hamburger QSR operator globally. We have a large and rapidly growing international presence (consisting of 441 restaurants in 25 foreign countries, an 85% increase in the number of international restaurants since the end of fiscal 2007) and believe there are significant opportunities to continue to grow our brands in various markets around the world.

1

Table of Contents

As of May 21, 2012, the end of our first quarter of fiscal 2013, our system-wide restaurant portfolio consisted of:

| Carl’s Jr. | Hardee’s | Other | Total | |||||||||||||

| Company-operated |

424 | 468 | — | 892 | ||||||||||||

| Domestic franchised |

694 | 1,227 | 9 | 1,930 | ||||||||||||

| International franchised |

204 | 237 | — | 441 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

1,322 | 1,932 | 9 | 3,263 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Our primary brands, Carl’s Jr. and Hardee’s, both have a rich heritage dating back over 50 years, when Carl Karcher opened the first Carl’s Jr. restaurant in 1956 and Wilbur Hardee opened the first Hardee’s restaurant in 1960. We believe Carl’s Jr. and Hardee’s are both well recognized for their high-quality product offerings. Sandelman Quick Track reports for the first calendar quarter of 2012 ranked each of our brands #1 or #2 in their markets among national or regional hamburger QSRs in taste or flavor of food, quality of ingredients and temperature of food. Although we operate under two brands, the management, menus, operations, marketing campaigns and logos of our two primary brands are substantially similar. We are evolving into a national chain operating under two banners because each has long-standing brand equity in its respective markets. The brands often market identical new products with identical advertising campaigns and use national cable to promote these products in ads that identify both brands.

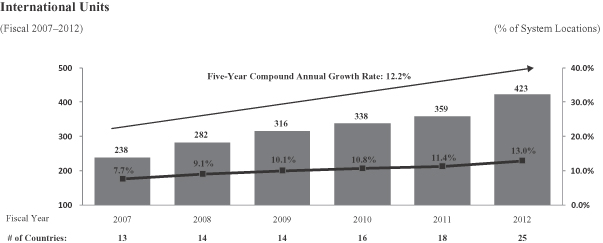

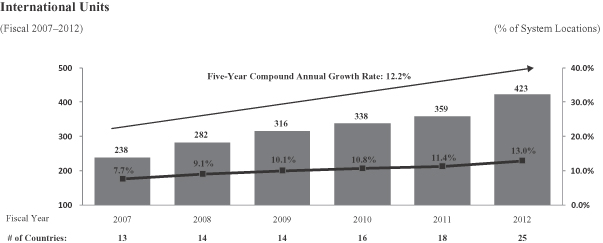

Our business objective is to continue growing our average unit volumes (“AUV”), calculated as described below, and expanding both Carl’s Jr. and Hardee’s in new and existing markets throughout the world by leveraging what we believe to be our unique brand positioning, high-quality product offerings, compelling restaurant economics and established global footprint. Our business strategy focuses on the growth of our franchise restaurant base, which provides a more stable, capital efficient income stream than company-operated restaurants. Franchise royalties are based on a percentage of our franchisees’ sales, and are thus not susceptible to fluctuations in restaurant operating costs. In addition, franchisees are responsible for making capital investments, enabling us to accelerate the growth of our restaurant system without incremental capital expenditures. From the end of fiscal 2007 through May 21, 2012, we have grown our franchise restaurants from 1,904 units (64% of total) to 2,371 units (73% of total), and we have grown our international restaurants by 85% from 238 units (8% of total) to 441 units (14% of total) over the same period.

For fiscal 2012 and the quarter ended May 21, 2012, we generated total revenue of $1.3 billion and $412.3 million, Adjusted EBITDA of $165.9 million and $61.6 million and a net (loss) income of $(19.3) million and $6.7 million, respectively. See Note 5 under “—Summary Historical and Pro Forma Financial and Other Data” for an explanation of Adjusted EBITDA and a reconciliation to net (loss) income.

What We Have Accomplished

Guided by our revitalization plan and our management team, our recent accomplishments include:

| • | Remodeled or developed over 90% of our company-operated restaurants since the end of fiscal 2005; |

| • | Achieved a 10 percentage point improvement in customer satisfaction scores across our concepts since the end of fiscal 2007; |

| • | Opened over 600 new restaurants system-wide since the end of fiscal 2007; |

| • | Signed over 875 franchise development commitments with a broad group of franchisees in the United States and internationally with over 600 of these commitments signed in the last three years; |

| • | Increased franchised restaurants from 64% of total restaurants at the end of fiscal 2007 to 73% as of May 21, 2012; |

2

Table of Contents

| • | Increased our international restaurant base by 85% from 238 restaurants in 13 foreign countries at the end of fiscal 2007 to 441 restaurants in 25 foreign countries as of May 21, 2012; |

| • | Achieved positive blended same-store sales (i.e., blended for Carl’s Jr. and Hardee’s company-operated restaurants) for the most recent seven consecutive quarters, including an increase of 3.5% in blended same-store sales for fiscal 2012 and an increase of 2.6% for the first quarter of fiscal 2013. Prior to the economic downturn, we posted six consecutive fiscal years of blended same-store sales growth from fiscal 2004 to fiscal 2009; and |

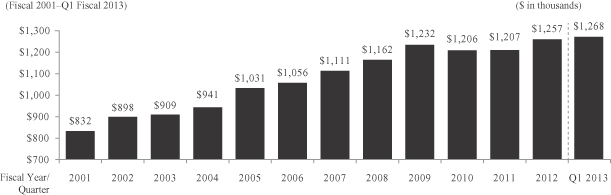

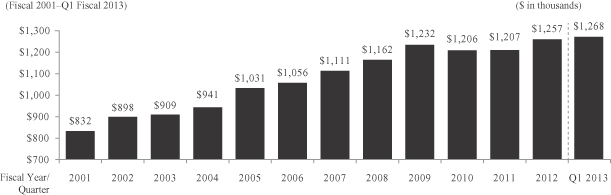

| • | Exhibited a long track-record of AUV growth at company-operated restaurants. As shown in the table below, the blended AUV at company-operated restaurants has grown from $832,000 in fiscal 2001 to $1,257,000 in fiscal 2012, an increase of $425,000, and over the same period we have increased our blended AUV in every year except fiscal 2010. |

Blended Company-Operated Average Unit Volume

We calculate AUV for each of Carl’s Jr. and Hardee’s by dividing the aggregate revenues of all of the brand’s company-operated restaurants during a fiscal year by the number of the brand’s company-operated restaurants open during that period. Blended AUV is calculated in the same manner using the aggregate revenue and number of company-operated restaurants of both brands on a combined basis. Blended AUV is calculated on a trailing-52 week basis.

3

Table of Contents

One Powerful Concept, Two Global Brands

We operate one global restaurant platform. The management, menus, operations, marketing campaigns and logos of our two primary brands are substantially similar. However, we have chosen to capitalize on the strong heritage and loyal customer base of Carl’s Jr. and Hardee’s by maintaining both brands. The brands often market identical new products with identical advertising campaigns and use national cable to promote these products in advertisements that identify both brands.

|

Carl’s Jr. has a total of 1,322 company-operated and franchised restaurants located in 14 states and 14 foreign countries as of May 21, 2012. Domestic Carl’s Jr. restaurants are predominantly located in the Western United States, with a growing presence in Texas. International Carl’s Jr. restaurants are located primarily in Mexico, with a growing presence in the rest of Latin America, Russia and Asia. Carl’s Jr. focuses on selling its signature products, such as the Western Bacon Cheeseburger® and a full line of 100% Black Angus Beef Six Dollar Burgers®, and on developing what we believe to be innovative new products, including the Steakhouse Six Dollar Burger®, Hand-Breaded Chicken Tenders™ and its line of Charbroiled Turkey Burgers. As of May 21, 2012, 549 of the domestic Carl’s Jr. restaurants were dual-branded with our Green Burrito® concept, which offers Mexican-inspired products, such as burritos, tacos and quesadillas, from a separate Green Burrito menu. At dual-branded restaurants, customers can order both Carl’s Jr. and Green Burrito product offerings at the same counter. While the target market is substantially similar, the dual-branding broadens the restaurant’s product offering. In addition, there are nine stand-alone franchised Green Burrito restaurants. | |

| We believe, based on our internal market research, that Carl’s Jr. is widely regarded by our customers as the premium choice for lunch and dinner in the QSR industry, with approximately 85% of fiscal 2012 company-operated restaurants revenue coming from the lunch and dinner day parts. Recently, Carl’s Jr. expanded its breakfast offering through the launch of Hardee’s breakfast menu featuring its Made From Scratch Biscuits™. We believe that substantial opportunity exists to further build the brand by capturing greater market share during the breakfast day part at our existing restaurants through offering Hardee’s breakfast menu. We initially tested the biscuit rollout in select markets in fiscal 2011 and then launched a larger scale rollout of these products in the second half of fiscal 2012. As of May 21, 2012, approximately 49% of our domestic restaurants offered this breakfast product line, including 72% of our company-operated locations. The launch of Hardee’s breakfast menu, featuring Made From Scratch Biscuits, at Carl’s Jr. is another meaningful step in nationalizing our brands, and we expect the rollout to be essentially complete by the end of the first quarter of fiscal 2014. | ||

| As of May 21, 2012, approximately 68% of Carl’s Jr. restaurants were franchised and the remaining 32% were company-operated. Approximately 15% of Carl’s Jr. restaurants were located outside of the U.S. as of May 21, 2012, compared to 8% at the end of fiscal 2007. We expect the Carl’s Jr. brand to be the primary driver of our international expansion in Asia, Latin America and Russia over the next several years. | ||

|

Hardee’s has a total of 1,932 company-operated and franchised restaurants located in 30 states and 11 foreign countries as of May 21, 2012. Domestic Hardee’s restaurants are located predominantly in the Southeastern and Midwestern United States, with a growing international presence in the Middle East and Central Asia. Hardee’s | |

4

Table of Contents

| primarily focuses on selling its signature products, such as its line of 100% Black Angus Beef Thickburgers® and Made From Scratch Biscuits and on developing what we believe to be innovative new products, such as the Steakhouse Thickburger®, Hand-Breaded Chicken Tenders, the Monster Biscuit® and its line of Charbroiled Turkey Burgers.

We believe, based on our internal market research, that Hardee’s is widely regarded by our customers as the best choice for breakfast in the QSR industry, with approximately 48% of company-operated restaurants revenue in fiscal 2012 and the first quarter of fiscal 2013 coming from breakfast. We also believe that substantial opportunity exists to further build the brand by capturing greater market share during the lunch and dinner day parts at our existing restaurants through offering new, high-quality products in conjunction with Carl’s Jr. and expanding the number of dual-branded locations with our Red Burrito® Mexican-inspired concept. As of May 21, 2012, 326 of the domestic Hardee’s restaurants were dual-branded with Red Burrito. As at our Carl’s Jr. restaurants, dual-branding offers Hardee’s customers broader menu choices from a separate Red Burrito menu. | ||

| As of May 21, 2012, approximately 76% of Hardee’s restaurants were franchised and the remaining 24% were company-operated. From the end of fiscal 2007 to May 21, 2012, Hardee’s international restaurants grew from 8% to 12% of the system primarily as a result of continued expansion in the Middle East and Central Asia, where we expect growth. | ||

Why We Are “The Star”

We attribute our success in the QSR industry to the following strengths:

Leader in the Premium Segment of the QSR Industry with Two Strong, Global Brands

We believe our two primary brands, Carl’s Jr. and Hardee’s, are uniquely positioned to appeal to the target audience we refer to as “young, hungry guys” and those who aspire to be youthful. We believe that our intense focus on our target audience affords us a competitive advantage, as many competitors in the QSR industry focus on the family market, which we view as more competitive and over saturated. We believe we are known for high-quality, great-tasting products that serve the premium segment of the QSR industry. Sandelman Quick-Track reports for the first calendar quarter of 2012 ranked each of our brands #1 or #2 in their markets among national or regional hamburger QSRs in taste or flavor of food, quality of ingredients and temperature of food. We have a strong market position in all day parts with Hardee’s dominant at breakfast and both Carl’s Jr. and Hardee’s having strong lunch and dinner offerings. Hardee’s breakfast offerings are differentiated by its signature Made From Scratch Biscuits, which we believe have helped make the brand known as the best choice for breakfast in the QSR industry. We recently introduced Hardee’s breakfast menu and its Made From Scratch Biscuits at Carl’s Jr. In markets where biscuits were introduced at least one year ago, breakfast sales have increased from 12% of total sales in fiscal 2010 prior to the rollout to 18% of total sales in fiscal 2012 and in the first quarter of fiscal 2013. We believe our menu innovation, focus on our targeted audience and emphasis on quality and value have allowed us to maintain our differentiated, premium position and avoid extensive price discounting. We believe that our unique, edgy advertising campaigns also help build our brands. Our advertising is generally intended to create buzz around our promotional product offerings as well as emphasize the quality and taste of our premium menu items.

5

Table of Contents

Established and Rapidly Growing International Presence

Since establishing our first international restaurant in 1978, our international strategy has been focused on countries where we believe there are significant opportunities to grow our brands rapidly. We have been particularly focused on growing our international presence since our CEO took the leadership position in fiscal 2001. We had 441 restaurants franchised in 25 foreign countries as of May 21, 2012, which compares to 238 franchised restaurants in 13 foreign countries at the end of fiscal 2007. During fiscal 2012, our international franchisees opened a total of 72 restaurants outside of the United States, eclipsing our domestic development totals for the first time in our history. This included the opening of locations in seven countries in which we had not previously operated. In the first quarter of fiscal 2013, our international franchisees opened a total of 20 restaurants outside of the United States. We expect this trend to continue and the number of international restaurant openings to continue to grow. Currently, we have franchise development commitments to build over 500 new international restaurants. As of May 21, 2012, we had Carl’s Jr. franchised restaurants in American Samoa, Canada, China, Costa Rica, Ecuador, Indonesia, Malaysia, Mexico, New Zealand, Panama, Russia, Singapore, Turkey and Vietnam and Hardee’s franchised restaurants in Bahrain, Egypt, Jordan, Kazakhstan, Kuwait, Lebanon, Oman, Pakistan, Qatar, Saudi Arabia and the United Arab Emirates.

As of May 21, 2012, there were 441 international franchise restaurants, representing 13.5% of our total restaurants, in 25 countries.

Attractive Restaurant-Level Economics Drives Franchisee Development

We believe that the economic returns from opening new restaurants offer franchisees a compelling investment opportunity. Over the past several years, we have redesigned our domestic restaurant prototypes at both Carl’s Jr. and Hardee’s to reduce the initial building construction costs for new restaurants while maintaining the expected performance from our new company-operated restaurants. The cost to develop a new Carl’s Jr. or Hardee’s restaurant, excluding land value, generally ranges from $950,000 to $1,300,000. We believe that our franchisees can achieve attractive returns from new restaurant development as demonstrated by our signing of over 600 new franchise development commitments during the last three years. In addition, our franchisees have opened a total of 273 new restaurants since the end of fiscal 2009, including 113 openings in fiscal 2012, representing the highest number of openings over the past decade, and 33 openings in the first quarter of fiscal 2013. These franchise restaurant openings in fiscal 2012 and the first quarter of fiscal 2013 represented 96% and 94% of the total new restaurant openings for the year and quarter, respectively, and further

6

Table of Contents

increased the percentage of our system that is franchised. We believe that the performance and overall health of our franchise network continues to be strong and is evidenced by our collection of greater than 99% of our royalties during fiscal 2012.

Attractive Free Cash Flow Generation

We believe our company-operated restaurant-level adjusted EBITDA margin, stable and growing franchise base and our nearly completed capital program result in attractive free cash flow (operating cash flow minus capital expenditures) generation. Over the past seven years, we have focused on improving the customer experience through the remodeling of our company-operated restaurant base. We have also focused on new franchise restaurant openings and a refranchising program. With over 2,370 franchised restaurants domestically and internationally, we have a franchisee network that generated approximately $94 million of royalties from franchises in fiscal 2012 and approximately $31 million in the first quarter of fiscal 2013. We believe the shift from a company-operated model to a predominantly franchise model allows for a more stable business since we are less impacted by changes in restaurant level profitability, including the impact of commodity costs. Further, we believe the franchise model will allow us to significantly expand our global footprint with minimal investment. Because we have remodeled or developed over 90% of our company-operated restaurants since the end of fiscal 2005, reduced the construction costs required to refresh our restaurants and shifted to a predominantly franchised model, we expect future capital expenditure requirements to be significantly lower than our average capital expenditures from fiscal 2007 to fiscal 2010. Capital expenditures in fiscal 2012 decreased to $52 million from $117 million in fiscal year 2007. Based on our current capital spending projections, we expect capital expenditures to be between $60 million and $70 million for fiscal 2013.

Proven Management Team Has Longstanding History with CKE

Our management team has been together at CKE Restaurants since fiscal 2001 and has an average of 25 years experience in the restaurant industry. During their tenure, our AUV has increased by 51%. Since our CEO took the leadership position in fiscal 2001, our franchise restaurants have increased from 47% of total units to 73% as of May 21, 2012. The management team has also significantly accelerated international unit development over the past few years.

How We Plan to Feed More “Young, Hungry Guys” Globally

We believe there are significant opportunities to grow our brands globally, improve our operating results and deliver stockholder value by executing the following strategies:

Continue Our International Growth

We believe we have demonstrated a strong track record of growing our brands into new international markets over the past five years. Since the end of fiscal 2007, the total number of international franchise restaurants has grown by 85% from 238 units (8% of total) to 441 units (14% of total), including an increase of nearly 18% during fiscal 2012. In addition, we have expanded into a total of 25 foreign countries compared to 13 at the end of fiscal 2007. We have invested in and developed the necessary infrastructure to support and continue growing our international operations. To date, our international development strategy has been primarily focused on what we believe are high growth, emerging markets in Asia, Latin America and Russia for Carl’s Jr. and the Middle East and Central Asia for Hardee’s. We plan to continue expansion in these and new international markets through the use of development agreements. We expect to accelerate franchise growth in a number of new markets with significant growth coming from Brazil, Canada, China and Russia, although we can provide no guarantee such growth will occur or will be significant. The recent signing of a 100 restaurant

7

Table of Contents

development agreement with a new franchisee in Brazil is an example of our continued progress in achieving this goal. As of May 21, 2012, we had 25 international franchise development agreements representing commitments to build over 500 franchise restaurants. We entered into approximately 80% of these development agreements in the last three years.

Accelerate Our Domestic Franchise Development

In addition to international openings, we are focused on growing our overall franchise base in the U.S. Franchises, as compared to company-operated restaurants, provide a more stable, capital efficient income stream in the form of royalties, which are insulated from fluctuations in restaurant-level costs and profitability and do not require incremental capital expenditures from our company. Increasing our scale by adding system-wide restaurants will also enable us to leverage our corporate infrastructure over a larger restaurant base. Franchising also expands the brands’ marketing reach as franchisees are required to contribute to advertising both nationally and locally. Our overall mix of franchise restaurants has increased from 64% of system restaurants at the end of fiscal 2007 to 73% as of May 21, 2012, with approximately 81% of our total franchise restaurants located in the U.S. We believe our overall franchise mix will continue to increase as our restaurant-level economics continue to entice franchisees to open new restaurants, and we expect the number of new franchise restaurant openings to significantly exceed the number of company-operated restaurant openings. We believe our system-wide mix can exceed 80% franchised over the long-term as we work with both existing and new franchisees to develop new restaurants. Domestically, we continue to focus on developing certain existing markets, such as Texas, and expanding into new and underpenetrated markets, such as the Northeastern United States. As of May 21, 2012, we had 48 domestic franchise development agreements representing commitments to build over 375 restaurants.

Continue to Increase Same-Store Sales and Free Cash Flow

We intend to continue building on our same-store sales growth momentum through the following initiatives:

Continue developing and offering innovative products: We believe we have historically had a strong track record of developing new and innovative products targeted towards “young, hungry guys” and plan to drive same-store sales growth through utilizing this expertise. We intend to continue developing and promoting what we believe to be innovative, premium burgers, supplemented by our chicken products and healthful products such as our turkey burgers. We have introduced new products at both brands including our lines of 100% Black Angus Beef Burgers, Hardee’s Made From Scratch Biscuits, Hand-Scooped Ice Cream Shakes and Malts®, Charbroiled Turkey Burgers and Hand-Breaded Chicken products. While maintaining our “young, hungry guys” focus, we plan to continue to develop and increase customer awareness of our healthful products which have historically included our Charbroiled Chicken Sandwiches and Premium Entrée Salads. More recently, we partnered with Men’s Health and the creators of the bestselling Eat This, Not That! ® brand to develop a line of Charbroiled Turkey Burgers that all have less than 500 calories.

Expand breakfast offering and cross roll-out of popular items: We have regularly rolled out popular items from one of our brands to the other since both concepts have similar market positionings. Currently, our lunch and dinner menus at both brands are centered around our line of 100% Black Angus Beef Burgers and other sandwiches. More recently, we have rolled out new products such as our line of Charbroiled Turkey Burgers and Hand-Breaded Chicken Tenders concurrently at both brands. We believe Hardee’s is regarded as the best choice for breakfast in the QSR industry, with approximately 48% of company-operated restaurant revenue in fiscal 2012 and the first quarter of fiscal 2013 coming from breakfast. Much of the success of Hardee’s breakfast menu can be attributed to its Made From Scratch Biscuits and biscuit breakfast sandwiches. Recently, Carl’s Jr. launched the roll-out of Hardee’s Made From Scratch Biscuits in the Los Angeles market in the second half of fiscal 2012 after completing the launch of these premium breakfast products in selected other markets. We anticipate offering these products at substantially all of our company-operated Carl’s Jr. restaurants and at approximately 70% of the total domestic Carl’s Jr. restaurants by the end of fiscal 2013. During the year after

8

Table of Contents

the introduction of Hardee’s Made From Scratch Biscuits at select Carl’s Jr. locations, the share of sales occurring at breakfast increased by approximately 48%. We believe Hardee’s breakfast menu is a logical extension of Carl’s Jr.’s offerings that can increase our sales and overall market share in the breakfast hours.

Emphasize and capitalize on our unique brand positioning: We believe our new product introductions are enhanced through edgy, breakthrough advertising, high visibility sports sponsorships in major markets and a creative internet presence. By introducing new products at both brands simultaneously, we have also been able to more efficiently purchase national cable television media, which has not only increased our media presence in our well-penetrated markets, but also provided a solid base of media in our under-penetrated and newer markets, which we believe will help establish demand in potential future expansion markets. In addition, our plans for continued use and focus on digital marketing, including social media and mobile channels, help to increase overall brand awareness, drive traffic into our restaurants and effectively reach our target demographic of “young, hungry guys.” As of May 21, 2012, our digital following included approximately 1.8 million total followers on Facebook and there had been nearly 700,000 downloads of our iPhone and Android mobile applications.

Capitalize on dual-branding opportunities: As of May 21, 2012, approximately 56% of our company-operated units were dual-branded with our Green Burrito and Red Burrito concepts. At a dual-branded restaurant, a customer can order Mexican-inspired Green Burrito or Red Burrito products, such as burritos, tacos and quesadillas, at the same counter as our Carl’s Jr. or Hardee’s products. We believe there is an opportunity to increase the number of dual-branded company-operated locations in the future. In addition, we believe there is an opportunity for our royalties to increase as our franchisees continue to dual-brand their locations with the Green Burrito and Red Burrito concepts. In particular, we believe that there is an attractive opportunity for our Hardee’s franchisees to dual-brand additional locations based on the financial results from recent conversions at company-operated Hardee’s units and the fact that only approximately 7% of our 1,227 domestic franchised Hardee’s restaurants were dual-branded as of May 21, 2012. With respect to the performance of recent company-operated dual-branded conversions, 47 company-operated Hardee’s restaurants were converted to dual-branded locations with Red Burrito in fiscal 2011. In fiscal 2012, these restaurants, on average, achieved an increase in sales that was 6.5% greater than comparable Hardee’s restaurants that were not dual-branded. The increase in sales also translated to an increase in profitability and greater than a 40% cash-on-cash return on the capital invested to convert these restaurants.

Continued focus on operational excellence: We also plan to remain focused on our core restaurant fundamentals of quality, service and cleanliness. From fiscal 2007 through May 21, 2012, we spent approximately $148 million on a significant remodeling of our company-operated restaurants, which we believe has improved the customer experience. Restaurants that have been remodeled have demonstrated significantly improved sales and customer satisfaction scores as reflected by a 10 percentage point improvement in customer satisfaction scores across our concepts since the end of fiscal 2007. We also stand to benefit as franchisees continue to remodel their restaurants, as the anticipated sales lift from franchise remodels increases the royalty payments to our company. As of May 21, 2012, only 64% of our domestic franchised units have been remodeled or developed since the end of fiscal 2005 compared to 93% of our company-operated restaurants. Our franchisees are obligated under their franchise agreements to remodel their restaurants to the current image, although in certain circumstances we have granted exceptions or extensions, such as where the unit is newer or where the franchisee needs to obtain additional lease term. By the end of fiscal 2014, many of the extensions will expire and, as a result, we expect that over 85% of our franchised restaurants in the U.S. will have been remodeled or developed since the end of fiscal 2005. We expect these improvements will further benefit our customer satisfaction scores and overall brand image.

9

Table of Contents

Merger and Related Transactions

On July 12, 2010, we acquired CKE Restaurants pursuant to an Agreement and Plan of Merger (the “Merger Agreement”). CKE Restaurants merged with a wholly-owned subsidiary of ours (the “Merger”), and became our wholly-owned subsidiary.

In connection with the Merger, investment funds managed by Apollo Management VII, L.P. (the “Apollo Funds”), and members of our senior management invested in our equity indirectly through a holding company, and CKE Restaurants issued $600.0 million aggregate principal amount of senior secured second lien notes (the “Senior Secured Notes”) and entered into a $100.0 million senior secured revolving credit facility (the “Credit Facility”), which was undrawn at closing. These transactions, including the Merger and payment of costs related to these transactions, are collectively referred to as the “Transactions.”

Subsequently, on March 14, 2011, CKE completed an offering of $200.0 million of its 10.50%/11.25% senior unsecured PIK toggle notes due March 14, 2016 (the “Toggle Notes,” and collectively with the Senior Secured Notes, the “Notes”).

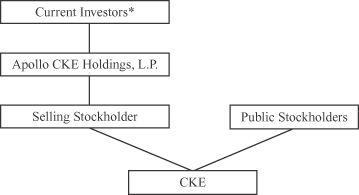

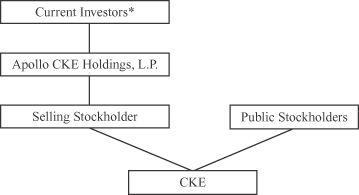

Our Principal Stockholders

The Apollo Funds and our management own their equity interests in us through a holding company, the selling stockholder in this offering, which is the record holder of all of our issued and outstanding shares.

The principal beneficial owners of our common stock are the Apollo Funds, investment funds managed by Apollo Management VII, L.P. (“Apollo Management”), an affiliate of Apollo Management, L.P., which we collectively refer to in this prospectus as “Apollo.” Apollo will beneficially own % or shares of our common stock after this offering, assuming the underwriters do not exercise their option to purchase up to additional shares. Apollo Investment Fund VII, L.P. is an investment fund with committed capital, along with its parallel investment funds, of approximately $14.7 billion. Apollo Management, L.P., is an affiliate of Apollo Global Management, LLC, a leading global alternative asset manager with offices in New York, Los Angeles, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of March 31, 2012, Apollo Global Management, LLC and its subsidiaries had assets under management of approximately $86 billion across all of their businesses.

We currently have a management services agreement with Apollo Management for advisory services. In fiscal 2012, we incurred $2.5 million in fees and out-of-pocket expenses under this agreement, which Apollo Management intends to terminate upon completion of this offering. Upon the termination of this agreement, Apollo Management will receive a fee of $ million (plus any unreimbursed expenses) from us. See “Certain Relationships and Related Party Transactions—Management Services Fee” for more detail regarding our arrangements with Apollo.

10

Table of Contents

Our Ownership Structure

The chart below is a summary of our organizational structure after giving effect to this offering.

| * | Current investors consist of the Apollo Funds, members of our management and board of directors and certain other investors, all of whom are limited partners of Apollo CKE Holdings, L.P., which is the sole member of CH Restaurant Holdings, LLC, our direct stockholder and the selling stockholder in this offering. See “Principal and Selling Stockholders.” |

Risk Factors

Investing in our common stock involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. If any of the risks or the risks described under the heading “Risk Factors” were to occur, you may lose part or all of your investment. You should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors” before making an investment decision.

Additional Information

Our principal executive offices are located at 6307 Carpinteria Avenue, Suite A, Carpinteria, California, 93013, and our telephone number is (805) 745-7500.

CKE Inc. was incorporated in Delaware on April 15, 2010 to effect the Transactions.

11

Table of Contents

The Offering

| Issuer |

CKE Inc. |

| Common stock offered by us |

shares. |

| Common stock offered by selling stockholder |

shares. |

| Common stock to be outstanding immediately after the offering |

shares. |

| Underwriters’ option to purchase additional shares of common stock in this offering |

We and the selling stockholder have granted to the underwriters a 30-day option to purchase up to and additional shares, respectively, at the initial public offering price less underwriting discounts and commissions. |

| Common stock voting rights |

Each share of our common stock will entitle its holder to one vote. |

| Dividend policy |

We currently intend to retain all future earnings, if any, for use in the operation of our business and to fund future growth. The decision whether to pay dividends will be made by our board of directors in light of conditions then existing, including factors such as our results of operations, financial condition and requirements, business conditions and covenants under any applicable contractual arrangements, including our indebtedness. See “Dividend Policy.” |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million after deducting the estimated underwriting discounts and commissions and other expenses of $ million payable by us, assuming the shares are offered at $ per share, which represents the midpoint of the range set forth on the front cover of this prospectus. We intend to use these net proceeds (i) to repay a portion of the outstanding Senior Secured Notes and to pay the related early redemption premiums and accrued interest and (ii) for general corporate purposes. The Senior Secured Notes were issued in connection with the Merger. We will not receive any proceeds from the sale of our common stock by the selling stockholder. For sensitivity analyses as to the offering price and other information, see “Use of Proceeds.” In addition, upon the completion of this offering, we will pay from cash on hand Apollo Management or its affiliates a fee of $ million (plus any unreimbursed expenses) in connection with the termination of our management services agreement, as described under “Certain Relationships and Related Party Transactions—Management Services Fee.” |

| NYSE symbol |

“CK” |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page 19 of this prospectus and all other information set forth in this prospectus before deciding to invest in our common stock. |

12

Table of Contents

| Conflicts of Interest |

Apollo Global Securities, LLC, an underwriter of this offering, is an affiliate of Apollo, our controlling stockholder. Since Apollo beneficially owns more than 10% of our outstanding common stock, a “conflict of interest” is deemed to exist under Rule 5121(f)(5)(B) of the Conduct Rules of the Financial Industry Regulatory Authority, or FINRA. As such, any underwriter that has a conflict of interest pursuant to Rule 5121 will not confirm sales to accounts in which it exercises discretionary authority without the prior written consent of the customer. Pursuant to Rule 5121, a “qualified independent underwriter” (as defined in Rule 5121) must participate in the preparation of the prospectus and perform its usual standard of due diligence with respect to the registration statement and this prospectus. has agreed to act as qualified independent underwriter for the offering. See “Underwriting (Conflicts of Interest).” |

Except as otherwise indicated, all of the information in this prospectus assumes:

| • | the for one stock split described below has been completed; |

| • | no exercise of the underwriters’ option to purchase up to additional shares of common stock; |

| • | an initial offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus; and |

| • | our amended and restated certificate of incorporation and amended and restated bylaws are in effect, pursuant to which the provisions described under “Description of Capital Stock” will become operative. |

Prior to completion of this offering, we will increase our authorized shares of common stock and effect a stock split, whereby our stockholder will receive shares of common stock for each share it currently holds. The number of shares of common stock to be outstanding after completion of this offering is based on shares of our common stock to be sold by us and the selling stockholder in this offering and, except where we state otherwise, the information with respect to our common stock we present in this prospectus does not give effect to shares of common stock reserved for future issuance under our Stock Incentive Plan (as defined in “Executive Compensation—Stock Incentive Plan”).

13

Table of Contents

Summary Historical and Pro Forma Financial and Other Data

The summary historical financial data for the fiscal year ended January 31, 2012, the twenty-nine weeks ended January 31, 2011, the twenty-four weeks ended July 12, 2010 and the fiscal year ended January 31, 2010 and as of January 31, 2012 and 2011 have been derived from our Consolidated Financial Statements, including the related notes thereto, which have been audited by KPMG LLP, an independent registered public accounting firm, and are included elsewhere in this prospectus. The summary historical financial data as of May 21, 2012 and for the sixteen weeks ended May 21, 2012 and May 23, 2011 have been derived from our unaudited Condensed Consolidated Financial Statements, including the related notes thereto, which are included elsewhere in this prospectus and have been prepared on a basis consistent with our annual audited Consolidated Financial Statements. Periods ended on or prior to July 12, 2010 reflect the consolidated results of our subsidiary, CKE Restaurants, prior to the Merger, and the periods beginning after July 12, 2010 reflect the results of CKE and its consolidated subsidiaries after the Merger. We refer to the financial statements prior to the Merger as “Predecessor” and to those after the Merger as “Successor.”

We have also presented on a supplemental basis in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” pro forma condensed consolidated financial information for the fiscal year ended January 31, 2011, which combines the Predecessor twenty-four weeks ended July 12, 2010 and the Successor twenty-nine weeks ended January 31, 2011, adjusted to give effect to the Transactions as if they had occurred on January 26, 2010, the first day of our fiscal year ended January 31, 2011. The pro forma adjustments relate primarily to interest expense, share-based compensation expense, transaction-related costs and depreciation and amortization. The summary pro forma financial data presented below has been derived from this pro forma condensed consolidated financial information. We believe this supplemental pro forma financial data will assist in comparing our results of operations between periods. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Supplemental Discussion of Historical and Pro Forma Financial Information” for further discussion.

The following data should be read in conjunction with “Risk Factors,” “Selected Historical Financial Information and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto included elsewhere in this prospectus.

14

Table of Contents

| Successor | Pro Forma(1) | Predecessor | ||||||||||||||||||

| Sixteen Weeks Ended May 21, 2012 |

Sixteen Weeks Ended May 23, 2011 |

Fiscal Year Ended January 31, 2012(2) |

Fiscal Year Ended January 31, 2011(2) |

Fiscal Year Ended January 31, 2010(2) |

||||||||||||||||

| (dollars in thousands, except per share amounts) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Company-operated restaurants |

$ | 361,466 | $ | 351,604 | $ | 1,122,430 | $ | 1,099,284 | $ | 1,084,474 | ||||||||||

| Franchised restaurants and other |

50,865 | 48,979 | 157,897 | 233,518 | 334,259 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

412,331 | 400,583 | 1,280,327 | 1,332,802 | 1,418,733 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating cost and expenses: |

||||||||||||||||||||

| Restaurant operating costs |

292,752 | 293,248 | 939,615 | 911,020 | 881,397 | |||||||||||||||

| Franchise restaurants and other |

25,629 | 25,878 | 81,372 | 158,916 | 254,124 | |||||||||||||||

| Advertising |

20,852 | 20,061 | 65,061 | 64,128 | 64,443 | |||||||||||||||

| General and administrative |

41,791 | 40,961 | 130,858 | 133,810 | 134,579 | |||||||||||||||

| Facility action charges, net |

401 | 511 | (6,018 | ) | 2,273 | 4,695 | ||||||||||||||

| Other operating expenses (income), net(3) |

— | 351 | 545 | (3,442 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating costs and expenses |

381,425 | 381,010 | 1,211,433 | 1,266,705 | 1,339,238 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

30,906 | 19,573 | 68,894 | 66,097 | 79,495 | |||||||||||||||

| Interest expense(4) |

(31,310 | ) | (28,850 | ) | (98,124 | ) | (79,842 | ) | (19,254 | ) | ||||||||||

| Other income (expense), net |

1,149 | 799 | (1,658 | ) | 2,279 | 2,935 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

745 | (8,478 | ) | (30,888 | ) | (11,466 | ) | 63,176 | ||||||||||||

| Income tax (benefit) expense |

(5,951 | ) | (3,176 | ) | (11,609 | ) | (4,391 | ) | 14,978 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 6,696 | $ | (5,302 | ) | $ | (19,279 | ) | $ | (7,075 | ) | $ | 48,198 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share (basic and diluted) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Adjusted EBITDA(5) |

$ | 61,574 | $ | 51,499 | $ | 165,878 | $ | 163,977 | $ | 165,464 | ||||||||||

| Adjusted EBITDA margin(5) |

14.9 | % | 12.9 | % | 13.0 | % | 12.3 | % | 11.7 | % | ||||||||||

| Total capital expenditures |

$ | 15,725 | $ | 13,581 | $ | 52,423 | $ | 63,098 | $ | 102,428 | ||||||||||

| Cash paid for interest, net of amounts capitalized |

3,549 | 1,656 | 72,944 | 19,590 | ||||||||||||||||

15

Table of Contents

| Sixteen Weeks Ended May 21, 2012 |

Fiscal Year Ended January 31, 2012 |

Fiscal Year Ended January 31, 2011 |

Fiscal Year Ended January 31, 2010 |

|||||||||||||

| (dollars in thousands) |

||||||||||||||||

| Other Operating Data: |

||||||||||||||||

| Franchised Carl’s Jr. and Hardee’s restaurant sales(6) |

$ | 2,481,092 | $ | 2,367,172 | $ | 2,240,175 | ||||||||||

| Blended company-operated average unit volume (trailing-52 weeks) |

$ | 1,268 | 1,257 | 1,207 | 1,206 | |||||||||||

| Blended company-operated same-store sales increase (decrease) |

2.6 | % | 3.5 | % | (0.8 | )% | (3.9 | )% | ||||||||

| Restaurants open (at end of period): |

||||||||||||||||

| Company-operated |

892 | 892 | 890 | 898 | ||||||||||||

| Domestic franchised |

1,930 | 1,928 | 1,910 | 1,905 | ||||||||||||

| International franchised |

441 | 423 | 359 | 338 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total restaurants |

3,263 | 3,243 | 3,159 | 3,141 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| International franchise restaurants as % of total restaurants (at end of period) |

13.5 | % | 13.0 | % | 11.4 | % | 10.8 | % | ||||||||

| Number of foreign countries with restaurants (at end of period) |

25 | 25 | 18 | 16 | ||||||||||||

| Successor | ||||||||||||

| May 21, 2012 |

January 31, 2012 |

January 31, 2011 |

||||||||||

| (dollars in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 125,447 | $ | 64,585 | $ | 42,586 | ||||||

| Total assets |

1,521,524 | 1,478,087 | 1,496,166 | |||||||||

| Total long-term debt and capital lease obligations, including current portion |

774,090 | 764,703 | 638,532 | |||||||||

| Stockholder’s equity |

228,008 | 219,895 | 424,769 | |||||||||

| (1) | The summary pro forma financial data for the fiscal year ended January 31, 2011 has been derived from our financial results for the Successor twenty-nine weeks ended January 31, 2011 and the Predecessor twenty-four weeks ended July 12, 2010, adjusted to reflect the pro forma effect of the Transactions as if they had occurred on January 26, 2010. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Supplemental Discussion of Historical and Pro Forma Financial Information.” Summary historical consolidated statements of operations data for the Successor twenty-nine weeks ended January 31, 2011 and the Predecessor twenty-four weeks ended July 12, 2010 is provided in the following table. |

16

Table of Contents

| Successor | Predecessor | |||||||

| Twenty-Nine Weeks Ended January 31, 2011 |

Twenty-Four Weeks Ended July 12, 2010 |

|||||||

| (dollars in thousands, except per share amounts) |

||||||||

| Revenue: |

||||||||

| Company-operated restaurants |

$ | 598,753 | $ | 500,531 | ||||

| Franchised restaurants and other |

80,355 | 151,588 | ||||||

|

|

|

|

|

|||||

| Total revenue |

679,108 | 652,119 | ||||||

|

|

|

|

|

|||||

| Operating cost and expenses: |

||||||||

| Restaurant operating costs |

495,909 | 414,171 | ||||||

| Franchise restaurants and other |

39,464 | 115,120 | ||||||

| Advertising |

34,481 | 29,647 | ||||||

| General and administrative(a) |

84,833 | 59,859 | ||||||

| Facility action charges, net |

1,683 | 590 | ||||||

| Other operating expenses, net(b) |

20,003 | 10,249 | ||||||

|

|

|

|

|

|||||

| Total operating costs and expenses |

676,373 | 629,636 | ||||||

|

|

|

|

|

|||||

| Operating income |

2,735 | 22,483 | ||||||

| Interest expense(c) |

(43,681 | ) | (8,617 | ) | ||||

| Other (expense) income, net(d) |

1,645 | (13,609 | ) | |||||

|

|

|

|

|

|||||

| (Loss) income before income taxes |

(39,301 | ) | 257 | |||||

| Income tax (benefit) expense |

(11,411 | ) | 7,772 | |||||

|

|

|

|

|

|||||

| Net loss |

$ | (27,890 | ) | $ | (7,515 | ) | ||

|

|

|

|

|

|||||

| Net loss per share (basic and diluted) |

||||||||

|

|

|

|

|

|||||

| (a) | The Successor twenty-nine weeks ended January 31, 2011 and the Predecessor twenty-four weeks ended July 12, 2010 include $10,587 and $1,521, respectively, of share-based compensation expense related to the acceleration of vesting of stock options and awards in connection with the Merger. |

| (b) | Other operating expenses, net includes transaction-related costs of $20,003 and $13,691 for the Successor twenty-nine weeks ended January 31, 2011 and the Predecessor twenty-four weeks ended July 12, 2010, respectively. Additionally, the Predecessor twenty-four weeks ended July 12, 2010 includes a gain of $3,442 on the sale of our Carl’s Jr. distribution center assets on July 2, 2010. |

| (c) | The Predecessor twenty-four weeks ended July 12, 2010 includes $3,113 of interest expense related to changes in the fair value of our Predecessor interest rate swap agreements. |

| (d) | The Predecessor twenty-four weeks ended July 12, 2010 includes a termination fee of $14,283 related to a prior merger agreement. |

| (2) | Our fiscal year is 52 or 53 weeks, ending the last Monday in January. For clarity of presentation, we generally label all fiscal years presented as if the fiscal year ended January 31. The pro forma fiscal year ended January 31, 2011 contains 53 weeks; all other fiscal years presented contain 52 weeks. |

| (3) | Other operating expenses (income), net consists of transaction-related costs of $351 and $545 for the sixteen weeks ended May 23, 2011 and fiscal 2012, respectively, and a gain of $3,442 on the sale of our Carl’s Jr. distribution center assets on July 2, 2010 in pro forma fiscal 2011. |

| (4) | Fiscal 2010 includes $6,803 of interest expense related to changes in the fair value of our Predecessor interest rate swap agreements. |

| (5) | “Adjusted EBITDA” represents net income (loss), adjusted to exclude income taxes, interest income and expense, asset impairments, facility action charges, depreciation and amortization, management fees, the effects of acquisition accounting adjustments, and certain non-cash and other items described below. |

17

Table of Contents

| “Adjusted EBITDA margin” is defined as Adjusted EBITDA divided by total revenue. We believe that the presentation of Adjusted EBITDA provides investors with a meaningful measure of operating performance, and we use it for planning purposes. In addition, our calculation of Adjusted EBITDA is consistent with the equivalent measurement in the covenants contained in agreements respecting certain of our indebtedness. See “Description of Indebtedness.” Adjusted EBITDA is not a measurement of operating performance computed in accordance with U.S. GAAP and should not be considered as a substitute for operating income, net income or cash flows from operating activities computed in accordance with U.S. GAAP. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. See “Non-GAAP Financial Measures.” |

A reconciliation of net income (loss) to Adjusted EBITDA is provided below.

| Successor | Pro Forma | Predecessor | ||||||||||||||||||

| Sixteen Weeks Ended May 21, 2012 |

Sixteen Weeks Ended May 23, 2011 |

Fiscal Year Ended January 31, 2012 |

Fiscal Year Ended January 31, 2011(a) |

Fiscal Year Ended January 31, 2010 |

||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Net income (loss) |

$ | 6,696 | $ | (5,302 | ) | $ | (19,279 | ) | $ | (7,075 | ) | $ | 48,198 | |||||||

| Interest expense |

31,310 | 28,850 | 98,124 | 79,842 | 19,254 | |||||||||||||||

| Income tax (benefit) expense |

(5,951 | ) | (3,176 | ) | (11,609 | ) | (4,391 | ) | 14,978 | |||||||||||

| Depreciation and amortization |

25,467 | 24,938 | 82,044 | 77,780 | 71,064 | |||||||||||||||

| Facility action charges, net |

401 | 511 | (6,018 | ) | 2,273 | 4,695 | ||||||||||||||

| Gain on sale of distribution center assets |

— | — | — | (3,442 | ) | — | ||||||||||||||

| Transaction-related costs(b) |

— | 351 | 545 | — | 823 | |||||||||||||||

| Management fees(c) |

765 | 767 | 2,490 | 2,541 | — | |||||||||||||||

| Share-based compensation expense |

1,417 | 1,469 | 4,593 | 4,774 | 8,156 | |||||||||||||||

| Losses on asset and other disposals |

221 | 713 | 1,801 | 6,500 | 2,341 | |||||||||||||||

| Difference between U.S. GAAP rent and cash rent |

835 | 618 | 2,690 | 2,360 | 989 | |||||||||||||||

| Other, net(d) |

413 | 1,760 | 10,497 | 2,815 | (5,034 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA(e) |

$ | 61,574 | $ | 51,499 | $ | 165,878 | $ | 163,977 | $ | 165,464 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Pro forma fiscal 2011 contained 53 weeks. We estimate the extra week resulted in additional Adjusted EBITDA of approximately $2,000. |

| (b) | Transaction-related costs include investment banking, legal, and other costs related to the Merger. |

| (c) | Represents the amounts associated with the management services agreement with Apollo Management for on-going investment banking, consulting, and financial planning services, which are included in general and administrative expense. |

| (d) | Other, net includes the net impact of acquisition accounting, early extinguishment of debt, executive retention bonus, severance costs and disposition business expense. For the fiscal year ended January 31, 2012, other, net also includes a charge of $1,976 related to the out-of-period Insurance Reserve Adjustment described in more detail in Note 1 of Notes to Consolidated Financial Statements included elsewhere in this prospectus. For the pro forma fiscal year ended January 31, 2011 and the fiscal year ended January 31, 2010, other, net also includes an adjustment to remove the Adjusted EBITDA associated with our Carl’s Jr. distribution centers, which we sold on July 2, 2010. |

| (e) | In comparing Adjusted EBITDA for periods before and after the Merger, we estimate that we would have had cost savings of $970 and $1,510 in fiscal 2011 and fiscal 2010, respectively, had we been a privately held company for those years. Adjusted EBITDA would have been $164,947 and $166,974, respectively, for such fiscal years had those estimated cost savings been realized. |

| (6) | Franchised restaurant operations are not included in our Consolidated Statements of Operations; however, franchised restaurants sales result in royalties and rental revenues, which are included in franchised restaurant and other revenue. |

18

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before investing in our common stock. We describe below those risks that are known to us and which we believe are material to our business. However, these risks are not the only risks facing us, and any of the following risks, and any additional risks or uncertainties not currently known to us or those we currently view as immaterial, could materially and adversely affect our business, financial condition, results of operations or cash flows. In such a case, you may lose part or all of your original investment.

Risks Relating to our Business

Competition is intense and may harm our business and results of operations.

The foodservice industry is intensely competitive with respect to the quality and value of food products offered, service, price, convenience, and dining experience. We compete with major restaurant chains, some of which dominate the QSR industry. Our competitors also include a variety of mid-price, full-service casual-dining restaurants, health and nutrition-oriented restaurants, delicatessens and prepared food restaurants, take-out food service companies, fast food restaurants, supermarkets and convenience stores. In addition to competing with such companies for customers, we also must compete with them for access to qualified employees and management personnel, suitable restaurant locations and capable franchisees. Many of our competitors have substantially greater brand recognition, as well as greater financial, marketing, operating and other resources than we have, which may give them competitive advantages with respect to some or all of these areas of competition. Some of our competitors have engaged and may continue to engage in substantial price discounting in response to the ongoing economic weakness and uncertainty, which may adversely impact our sales and operating results. As our competitors expand operations and marketing campaigns, we expect competition to intensify. Such increased competition could have a material adverse effect on our business and results of operations.

Changes in consumer preferences and perceptions, economic, market and other conditions could adversely affect our operating results.

The QSR industry is affected by changes in economic conditions, consumer preferences and spending patterns, demographic trends, consumer perceptions of food safety and nutrition, weather, traffic patterns, the type, number and location of competing restaurants, and other factors. Multi-location foodservice businesses such as ours can also be materially and adversely affected by publicity resulting from poor food quality, food tampering, illness, injury or other health concerns or operating issues stemming from one or a limited number of restaurants.

In addition, the ongoing economic weakness and uncertainty may cause changes in consumer preferences, and if such economic conditions persist for an extended period of time, this may result in consumers making long-lasting changes to their spending behaviors. A number of our major competitors have been increasing their “value item” offerings and implementing certain pricing promotions for various other menu items. If consumer preference continues to shift towards these “value items,” it may become necessary for us to implement temporary promotional pricing offerings. If we implement such promotional offerings, our operating margins may be adversely impacted. Any promotional offerings or temporary price cuts implemented by us are not expected to represent a permanent change in our business strategy, and would only be temporary in duration.

Changes in interest rates, commodity prices, labor costs, energy costs and other expenses could adversely affect our operating results.

Increases in interest rates, gasoline prices, commodity costs, labor and benefits costs, legal claims, as well as inflation and the availability of management and hourly employees affect our restaurant operations and administrative expenses.

19

Table of Contents

In particular, increases in interest rates may impact land and construction costs and the cost and availability of borrowed funds, and thereby adversely affect our ability and our franchisees’ ability to finance new restaurant development and improve existing restaurants. In addition, inflation can cause increased commodity and labor and benefits costs and can increase our operating expenses.

Increases in energy costs for our company-operated restaurants, principally electricity for lighting restaurants and natural gas for our broilers, could reduce our operating margins and financial results if we choose not, or are unable, to pass the increased costs to our customers. In addition, our distributors purchase gasoline needed to transport food and other supplies to us. These distributors may charge fuel surcharges if energy costs significantly increase, which could reduce our operating margins and financial results if we choose not, or are unable, to pass the increased costs to our customers.

Changes in food, packaging and supply costs could adversely affect our results of operations.