Attached files

| file | filename |

|---|---|

| 8-K - USA TECHNOLOGIES, INC. 8-K 6-28-2012 - CANTALOUPE, INC. | form8k.htm |

Exhibit 99.1

SHAREHOLDERS MEETING

June 28, 2012

COMPANY PRESENTATION

Stephen P. Herbert, Chairman and CEO

SAFE HARBOR STATEMENT

All statements other than statements of historical fact included in this presentation are forward

-looking statements. Actual results could differ materially from those contemplated by the

forward-looking statements as a result of certain factors, including but not limited to, business,

financial, market and economic conditions and the outcome of the pending proxy contest. A

detailed discussion of risks and uncertainties that could cause actual results and events to

differ materially from such forward-looking statements is included in USA’s most recent filings

with the Securities and Exchange Commission (the “SEC”), including the Form 10-Q report for

the quarter ended March 31, 2012, which you will find on our website, www.usatech.com,

under the “Investor Relations” tab and USAT’s Definitive Proxy Statement filed with the SEC on

May 18, 2012. Undue reliance should not be placed on any such forward looking statement,

which speak only as of the time they are made. The Company undertakes no obligation to

update any forward looking statement, whether as a result of new information, future events or

otherwise.

-looking statements. Actual results could differ materially from those contemplated by the

forward-looking statements as a result of certain factors, including but not limited to, business,

financial, market and economic conditions and the outcome of the pending proxy contest. A

detailed discussion of risks and uncertainties that could cause actual results and events to

differ materially from such forward-looking statements is included in USA’s most recent filings

with the Securities and Exchange Commission (the “SEC”), including the Form 10-Q report for

the quarter ended March 31, 2012, which you will find on our website, www.usatech.com,

under the “Investor Relations” tab and USAT’s Definitive Proxy Statement filed with the SEC on

May 18, 2012. Undue reliance should not be placed on any such forward looking statement,

which speak only as of the time they are made. The Company undertakes no obligation to

update any forward looking statement, whether as a result of new information, future events or

otherwise.

Non-GAAP Information: This presentation will include a discussion of Adjusted EBITDA which

is a non-GAAP financial measure which we believe is useful for an understanding of our

ongoing operations. This non-GAAP financial measure is supplemental to, and not a substitute

for, GAAP financial measures such as net income or loss. Details of these items and a

reconciliation of this non-GAAP financial measure to GAAP financial measures can be found in

this presentation and in our Form 10-Q report for the quarter ended March 31, 2012 which is

on our website, www.usatech.com, under the “Investor Relations” tab.

is a non-GAAP financial measure which we believe is useful for an understanding of our

ongoing operations. This non-GAAP financial measure is supplemental to, and not a substitute

for, GAAP financial measures such as net income or loss. Details of these items and a

reconciliation of this non-GAAP financial measure to GAAP financial measures can be found in

this presentation and in our Form 10-Q report for the quarter ended March 31, 2012 which is

on our website, www.usatech.com, under the “Investor Relations” tab.

COMPANY OVERVIEW

DELIVERING ON SHAREHOLDER COMMITMENTS

STRATEGIC GROWTH PLAN

RESULTS/FINANCIALS

COMPANY OVERVIEW

Provide leading edge wireless

cashless payment services for

small ticket unattended retail.

cashless payment services for

small ticket unattended retail.

Connect remote, self-service retail

locations so owners and operators

can better manage their business.

locations so owners and operators

can better manage their business.

COMPANY OVERVIEW

USA Technologies is a service company.

Its ePort Connect service represents 80% of all revenue.

Its ePort Connect service represents 80% of all revenue.

$

$

$

$

A PCI compliant, end-to-end, suite of cashless

payment and telemetry services tailored to fit

the needs of self-service retail industries.

payment and telemetry services tailored to fit

the needs of self-service retail industries.

Card

Processing

Processing

Services

Wireless

Connectivity

Online Sales

Reporting

Over the Air

Updates &

Remote Data

Management

Updates &

Remote Data

Management

Data

Security

Health

Alerts

Consumer

Services

Settlement

COMPANY OVERVIEW

COMPANY OVERVIEW

The ePort Connect service is open and flexible

USAT PRODUCTS

G8

EDGE

THIRD PARTY

HARDWARE

HARDWARE

Coinco

MEI

Crane

THIRD PARTY SERVICES

(VEND MANAGEMENT

SYSTEMS)

SYSTEMS)

Sources:

US Department of Transportation, 2008, IHL Kiosk Study, 2010 (2011 projections)First Research, March

2011, June 2010, Automatic Merchandisers State of the Coffee Industry 2009Vending Times Census 2010,

Smart Card Alliance 2006

2011, June 2010, Automatic Merchandisers State of the Coffee Industry 2009Vending Times Census 2010,

Smart Card Alliance 2006

*Includes self-checkout systems, ticketing kiosks check-in

kiosks, food ordering kiosks, postal and other retail kiosks.

kiosks, food ordering kiosks, postal and other retail kiosks.

Kiosks $45B*

Vending $43B

Parking (not in total)

Commercial Laundry $11B

Tolls $8B

Automated Car Wash $4B

Amusement and Gaming $5B

Office Coffee $4B

$120 billion

The small ticket, self-serve market is largely untapped.

Market Opportunity is Vast

COMPANY OVERVIEW

• Leading provider of wireless, cashless payment and machine-to-machine solutions

for small ticket, self-serve retail industries such as vending & kiosk

for small ticket, self-serve retail industries such as vending & kiosk

• Provider of energy saving technology to the cold beverage industry

• Cashless and contactless small ticket, unattended market is largely untapped, having

traditionally relied on cash transactions

traditionally relied on cash transactions

• Millions of potential locations (connections)

• Existing customers have potential for 2.5 million connections (USAT est.)

• Growing and reliable revenue stream driven by value-added service model

(network service fees; transaction processing)

(network service fees; transaction processing)

• 80% of revenues 3Q FY12

• Working toward profitability; building scale and improving margins as connection

rates and customer wins grow

rates and customer wins grow

• Proprietary technology with a strong patent portfolio

• 79 patents, trade secrets and “know how”

• New leadership; new strategic plan capitalizes on market trends, geared towards

sustainable growth and profitability

sustainable growth and profitability

• Stronger board composition

COMPANY OVERVIEW

MARKET LEADERSHIP

LARGE, UNTAPPED

MARKET OPPORTUNITY

MARKET OPPORTUNITY

RECURRING REVENUES

FUELED BY SERVICE

MODEL

FUELED BY SERVICE

MODEL

IMPROVING

OPERATIONAL

PERFORMANCE

OPERATIONAL

PERFORMANCE

TECHNOLOGY

BARRIERS

BARRIERS

STRENGTHENED

LEADERSHIP AND

DIRECTION

LEADERSHIP AND

DIRECTION

(1) Based on expectations communicated on June 25, 2012 (2) Expectation communicated June 8, 2012, including financial assumptions

DELIVERING ON SHAREHOLDER COMMITMENTS

Turn Around Strategy: Four Defined Objectives

USAT’S COMMITMENT TO THESE FOUR AREAS WAS STATED IN THE CEO’S

LETTER TO SHAREHOLDERS IN JANUARY. USAT HAS MADE PROGRESS ON

EACH AND EVERY FRONT.

LETTER TO SHAREHOLDERS IN JANUARY. USAT HAS MADE PROGRESS ON

EACH AND EVERY FRONT.

Increased

Shareholder

Value

1. Path to sustainable profitability

2. Increased customer value

3. High standards of governance

4. Improved visibility, transparency

DELIVERING ON SHAREHOLDER COMMITMENTS

STRATEGIC GROWTH PLAN

The confluence of several compelling drivers

should further drive market adoption.

should further drive market adoption.

MARKET

(STAKEHOLDERS)

(STAKEHOLDERS)

• VISA supporting the drive for

more acceptance points

more acceptance points

• Emerging mobile payments and

wallet providers (Google, ISIS,

PayPal)

wallet providers (Google, ISIS,

PayPal)

• Verizon driving M2M

CUSTOMERS

• Need for new or higher growth revenue

streams

streams

• Move toward new operating efficiency

opportunities through telemetry services

opportunities through telemetry services

• Overall need to improve net operating

profits

profits

TECHNOLOGY

• Cellular wireless reliability up,

costs down

costs down

• Migration to cloud/SAAS solution

• Significant manufacturing ramp

up of NFC-smart phones with bi-

directional communications

up of NFC-smart phones with bi-

directional communications

STRATEGIC GROWTH PLAN

CONSUMER

• Demand for convenience;

cashless preferred

cashless preferred

• Increasing reliance on mobile

phones

phones

• Small ticket

growthIncreasingly “social”

growthIncreasingly “social”

STRATEGIC GROWTH PLAN

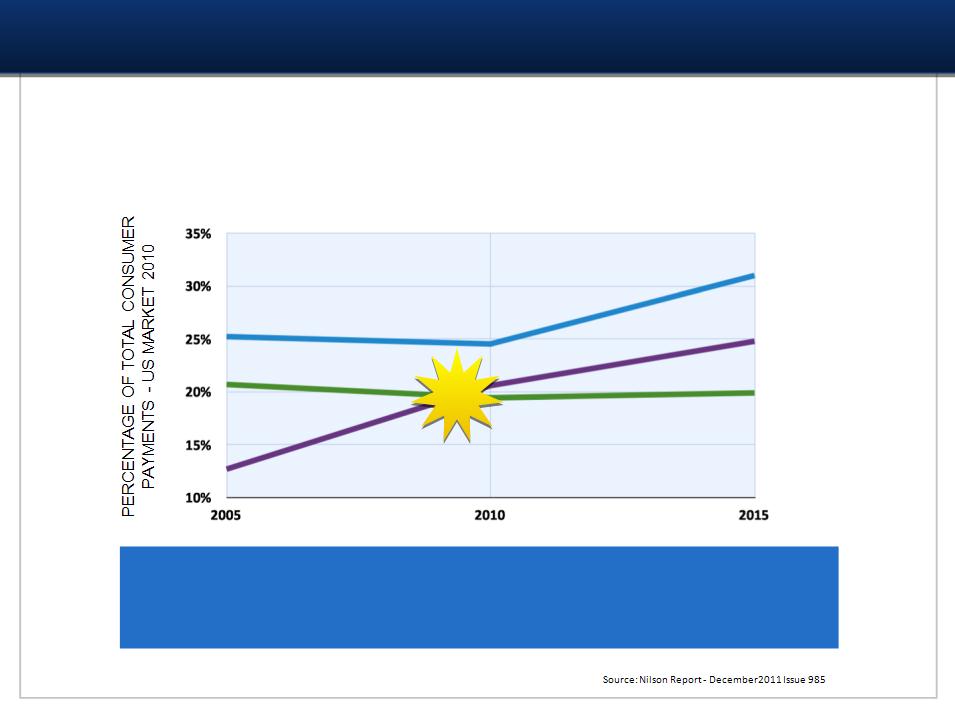

CASH

DEBIT

CREDIT

CONSUMER SPENDING BY PAYMENT TYPE

BETWEEN 2005 AND 2015, DEBIT CARD PAYMENTS ARE

PROJECTED TO INCREASE 95.3% WHILE CASH PAYMENTS

CONTINUE THEIR DECLINE.

PROJECTED TO INCREASE 95.3% WHILE CASH PAYMENTS

CONTINUE THEIR DECLINE.

Credit and debit cards have overtaken cash as a preferred

method of payment and continues to increase as a share of

consumer spending.

method of payment and continues to increase as a share of

consumer spending.

STRATEGIC GROWTH PLAN

Generation Y represents a paradigm

shift in how we buy-now and in the

future.

shift in how we buy-now and in the

future.

STRATEGIC GROWTH PLAN

Mobile payment is poised to further fuel

adoption and expand ePort Connect service

opportunities.

adoption and expand ePort Connect service

opportunities.

USAT already has over 75,000 NFC-enabled devices in the

field.

field.

2012 Knowledge Base continues to validate benefits of cashless

STRATEGIC GROWTH PLAN

USAT Knowledge Base provides us

with a significant competitive

advantage that we continue to

leverage to drive more connections

to the ePort Connect service.

with a significant competitive

advantage that we continue to

leverage to drive more connections

to the ePort Connect service.

2012 Knowledge Base continues to validate benefits of cashless

STRATEGIC GROWTH PLAN

Cashless sales 84% higher in Mature

Installations compared to New Installation

group

Installations compared to New Installation

group

2012 Knowledge Base continues to validate benefits of cashless

STRATEGIC GROWTH PLAN

Avg Annualized Cashless Sales per Machine by Channel

Powerful intelligence to guide our customers

on how to best leverage our solution

on how to best leverage our solution

STRATEGIC GROWTH PLAN

• Leverage dominant market share and customer base to:

- Grow connections

- Grow revenue per each connection

CUSTOMER

FOCUSED MARKET

LEADERSHIP

FOCUSED MARKET

LEADERSHIP

CONTINUOUS

INNOVATION

LEVERAGE

INTELLECTUAL

PROPERTY

FINANCIAL

STABILITY/

STABILITY/

PERFORMANCE

STRATEGIC GROWTH PLAN

USAT Strategic Pillars

EXISTING BASE

STRATEGIC GROWTH PLAN

Customer Focused Market Leadership

Three key drivers of connections/market penetration

customers(1)

EXPANDED REACH

VERTICAL MARKETS

(1) USAT estimate for quarter ending 6/30/2012

STRATEGIC GROWTH PLAN

100,000 added

over 10 quarters

25,000 added

over 7 quarters

Customer Focused Market Leadership

(1)

Our strategy has accelerated adoption, increased

revenues and created competitive advantage

revenues and created competitive advantage

TOTAL CONNECTED DEVICES

(1) USAT estimate for quarter ending 6/30/2012

STRATEGIC GROWTH PLAN

385 added

over 7 quarters

Customer Focused Market Leadership

Our ePort Connect customer base has increased 316% since 1/1/10

(1)

EPORT CONNECT CUSTOMERS

(1) USAT estimate for quarter ending 6/30/2012

Verizon Susie Ad

http://www.youtube.com/watch?v=KQnDK9tvb-Y

• Technology roadmap developed with customer input

• High ROI product development through internal

development and by leveraging suppliers/partners

development and by leveraging suppliers/partners

• Leverage dominant market share and customer base to:

- Grow connections

- Grow revenue per each connection

CUSTOMER

FOCUSED MARKET

LEADERSHIP

FOCUSED MARKET

LEADERSHIP

CONTINUOUS

INNOVATION

LEVERAGE

INTELLECTUAL

PROPERTY

FINANCIAL

STABILITY/

STABILITY/

PERFORMANCE

STRATEGIC GROWTH PLAN

USAT Strategic Pillars

Media

Services(2)

Services(2)

NEW SERVICES

STRATEGIC GROWTH PLAN

Mobile

Merchant(3)

Continuous Innovation

TRADITIONAL OFFERINGS

Services

Connectivity

Reporting

Data

Security

Machine

Health

Alerts

Services

Settlement

PLUS

Two-tier

Pricing(1)

(1) In market (2) Commercial launch anticipated quarter ending 12/31/12 (3) In development

STRATEGIC GROWTH PLAN

• Leverage dominant market share and customer base to:

- Grow connections

- Grow revenue per each connection

• Technology roadmap developed with customer input

• High ROI product development through internal

development and by leveraging suppliers/partners

development and by leveraging suppliers/partners

• Competitive advantage

• Block/slow competition

• Create revenue through licensing/avoid patent litigation

• Fundamental financial strength (profitability; healthy

balance sheet)

balance sheet)

• Leveraging key strategic partners (Verizon, Visa, Elavon)

• Access to lower cost financing to fund growth

CUSTOMER

FOCUSED MARKET

LEADERSHIP

FOCUSED MARKET

LEADERSHIP

CONTINUOUS

INNOVATION

LEVERAGE

INTELLECTUAL

PROPERTY

FINANCIAL

STABILITY/

STABILITY/

PERFORMANCE

USAT Strategic Pillars

FINANCIALS/RESULTS

FINANCIALS/RESULTS

(1)

Connections are driving total revenue

(1) USAT estimate for quarter ending 6/30/2012

COMPANY RESULTS

Quarterly Revenue Mix

55%

80%

Recurring service fees now 80% of our total revenue(1)

(1) USAT estimate for quarter ending 6/30/2012

FINANCIALS/RESULTS

(1)

Scale and growth in recurring service fees is

delivering increased gross margins

delivering increased gross margins

(1) USAT estimate for quarter ending 6/30/2012

Growing Total Revenues While Controlling Operating Expenses

FINANCIALS/RESULTS

“Of particular note… The company has been able to achieve a reduction in costs

while growing the business. In particular, we note that while total revenue nearly

doubled, from $15.8 million in fiscal 2010 to $28.0 million in fiscal 2012, the company

reduced SG&A by $3 million (20 percent), from $14.9 million to $11.9 million, over the

same period.”

while growing the business. In particular, we note that while total revenue nearly

doubled, from $15.8 million in fiscal 2010 to $28.0 million in fiscal 2012, the company

reduced SG&A by $3 million (20 percent), from $14.9 million to $11.9 million, over the

same period.”

- Institutional Shareholders Services (ISS) Report on USAT dated 6/16/12

(1)

(1) USAT estimate for quarter ending 6/30/2012

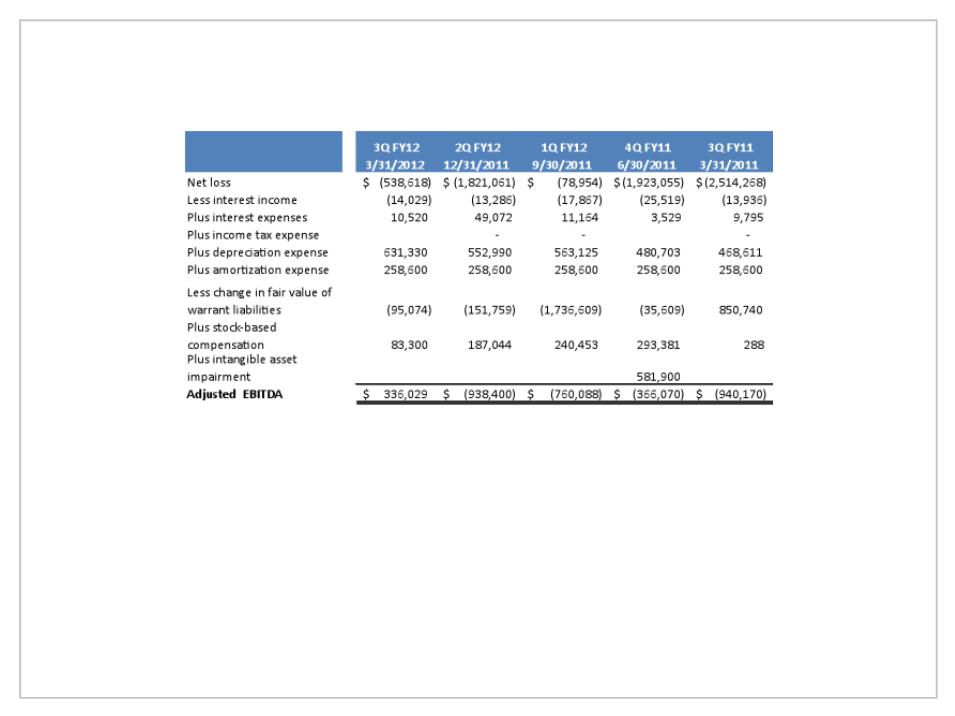

ADJUSTED EBITDA(1)

3/31/12

Positive Adjusted

EBITDA; GAAP

net loss narrows

to $.9 million

EBITDA; GAAP

net loss narrows

to $.9 million

(1) See definition of Net Loss to Adjusted EBITDA included herein. (2) USAT estimate for quarter ending 6/30/2012

(3) Based on expectations communicated June 8, 2012 including related Financial Assumptions included herein.

(3) Based on expectations communicated June 8, 2012 including related Financial Assumptions included herein.

Path to Profitability Fueled by Growing Recurring Revenue Base

FINANCIALS/RESULTS

(1)

12/31/11

Actions taken to

accelerate path

to profitability

accelerate path

to profitability

6/30/12

Expect Adjusted EBITDA

to be higher than 3Q

FY2012, (excluding

proxy contest costs); Net

Loss, as a result, will be

higher than 3Q

FY2012(2)

to be higher than 3Q

FY2012, (excluding

proxy contest costs); Net

Loss, as a result, will be

higher than 3Q

FY2012(2)

Non-GAAP Reconciliation

ADJUSTED EBITDA

1. Adjusted EBITDA represents net income (loss) before interest income, interest expense, income taxes, depreciation,

amortization, and change in fair value of warrant liabilities and stock -based compensation expense. We have excluded the non-

operating item, change in fair value of warrant liabilities, because it represents a non-cash charge that is not related to USA

Technologies' (USAT) operations. We have excluded the non-cash expenses, stock-based compensation, as it does not reflect the

cash-based operations of USAT. Adjusted EBITDA is a non-GAAP financial measure which is not required by or defined under

GAAP (Generally Accepted Accounting Principles). The presentation of this financial measure is not intended to be considered in

isolation or as a substitute for the financial measured prepared and presented in accordance with GAAP, including the net

income or net loss of USAT or net cash used in operating activities. Management recognizes that non-GAAP financial measures

have limitations in that they do not reflect all of the items associated with USAT's net income or net loss as determined in

accordance with GAAP, and are not a substitute for or a measure of USAT's profitability or net earnings. Adjusted EBITDA is

presented because USAT believes it is useful to investors as a measure of comparative operating performance and liquidity, and

because it is less susceptible to variances in actual performance resulting from depreciation and amortization and non-cash

charges for changes in fair value of warrant liabilities and stock-based compensation expense.

amortization, and change in fair value of warrant liabilities and stock -based compensation expense. We have excluded the non-

operating item, change in fair value of warrant liabilities, because it represents a non-cash charge that is not related to USA

Technologies' (USAT) operations. We have excluded the non-cash expenses, stock-based compensation, as it does not reflect the

cash-based operations of USAT. Adjusted EBITDA is a non-GAAP financial measure which is not required by or defined under

GAAP (Generally Accepted Accounting Principles). The presentation of this financial measure is not intended to be considered in

isolation or as a substitute for the financial measured prepared and presented in accordance with GAAP, including the net

income or net loss of USAT or net cash used in operating activities. Management recognizes that non-GAAP financial measures

have limitations in that they do not reflect all of the items associated with USAT's net income or net loss as determined in

accordance with GAAP, and are not a substitute for or a measure of USAT's profitability or net earnings. Adjusted EBITDA is

presented because USAT believes it is useful to investors as a measure of comparative operating performance and liquidity, and

because it is less susceptible to variances in actual performance resulting from depreciation and amortization and non-cash

charges for changes in fair value of warrant liabilities and stock-based compensation expense.

1. Fair value of warrant liability: Assumes no increase in the fair value of USAT’s warrant liabilities at December 31, 2012 compared to

the fair value of the warrant liabilities at September 31, 2012. Changes in fair value of USAT’s warrant liabilities create a non-cash

expense and/or income in the Consolidated Statement of Operations.

the fair value of the warrant liabilities at September 31, 2012. Changes in fair value of USAT’s warrant liabilities create a non-cash

expense and/or income in the Consolidated Statement of Operations.

2. Connections: Assumes USAT is able to maintain its existing level of connections, which were approximately 155,000 as last reported

by USAT and that USAT adds new connections at a minimum level of approximately 8,000 per quarter.

by USAT and that USAT adds new connections at a minimum level of approximately 8,000 per quarter.

3. Margins and Expenses: Assumes USAT maintains or slightly improves gross margin percent and maintains the approximate same

level of SG&A expenses as the March 31, 2012 quarter.

level of SG&A expenses as the March 31, 2012 quarter.

4. Regulated debit interchange rates: Assumes (1) USAT renews its existing agreement with Visa expiring in October 2012 or (2)

regulated debit interchange rates promulgated by Visa and MasterCard return to rates that existed prior to the Durbin Amendment

or (3) in the event 1 or 2 do not occur, USAT is successful in implementing its Two-Tier Pricing Program with customers so any

increased interchange rates can be passed through by them to end users.

regulated debit interchange rates promulgated by Visa and MasterCard return to rates that existed prior to the Durbin Amendment

or (3) in the event 1 or 2 do not occur, USAT is successful in implementing its Two-Tier Pricing Program with customers so any

increased interchange rates can be passed through by them to end users.

5. Proxy contest: Assumes there is no negative impact on customer retention, existing connections, rate of new connections to the

ePort Connect service, or costs or charges associated with the proxy contest incurred or accrued during the December 31, 2012

quarter.

ePort Connect service, or costs or charges associated with the proxy contest incurred or accrued during the December 31, 2012

quarter.

Financial Assumptions Related to December 31, 2012 Net Income Expectation

• Based upon our improved performance and visibility as a result of

efforts to increase recurring service revenues, reduce expenses and

enhance gross and operating margins

efforts to increase recurring service revenues, reduce expenses and

enhance gross and operating margins

We expect USAT will achieve quarterly net

income for the quarter ending December 31,

2012.

income for the quarter ending December 31,

2012.

FINANCIALS/RESULTS

Financial Improvements Scorecard

FINANCIALS/RESULTS

• Considerably improved.

• Reduced costs by leveraging growing connected base,

strategic partnerships, innovation

• Considerably Improved.

• Leveraging growing connected base, strategic

partnerships, innovation

• Healthy balance sheet

• First USAT credit line commitment letter due to

improved operational performance

Financial Improvements Scorecard

• Continued demonstrated growth

• Growth platforms that drive customer loyalty and

recurring revenue

REVENUES

GROSS

MARGINS

MARGINS

OPERATING

MARGINS

MARGINS

LIQUIDITY

• Positioned to capture benefits of market shift to cashless

• Growing recurring revenue customer & connection base

• Growth strategies building scale and closing in on profitability

• New verticals and expanded service opportunities

SUMMARY

IN THE NEWS

Visa London 2012 Olympic Games Trip For Life

Sweepstakes to be promoted on USA Technologies Network

Sweepstakes to be promoted on USA Technologies Network

Announced June 26, 2012

Visa Olympic Ad

http://www.youtube.com/watch?v=JodSbCX_tKw

Q & A

SHAREHOLDERS MEETING

June 28, 2012