Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SMITH & WESSON BRANDS, INC. | d374405d8k.htm |

Exhibit 99.1

| Smith & Wesson Investor/Analyst Day June, 2012 |

| Safe Harbor Certain statements contained in this presentation may be deemed to be forward-looking statements under federal securities laws, and the Company intends that such forward-looking statements be subject to the safe-harbor created thereby. Such forward-looking statements include but are not limited to statements regarding the Company's markets and strategies; the Company's vision and mission; the Company's new products and product development; the outcome of the divestiture of the Company's Security Solutions business; the Company's relationship with Walther; anticipated sales and GAAP EPS for the Company, the opportunity for growth of the Company; the demand for the Company's products and services; the Company's focus and objectives; and the Company's financial and operational goals for the current fiscal year and future periods. The Company cautions that these statements are qualified by important factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include the demand for the Company's products, the Company's growth opportunities, the ability of the Company to obtain operational enhancements, the success of new products, the success of the planned divestiture of the Company's Security Solutions business, and other risks detailed from time to time in the Company's reports filed with the SEC. 2 |

| Business Highlights U.S. Market Leader for Firearms: Handguns, Modern Sporting Rifles (MSR) 160 years of rich history Iconic brand with 92% aided awareness* Smith & Wesson(r) Brand = Revolver Innovative product portfolio serving broad user groups Revolvers, Polymer Pistols, Metal Pistols, Concealed Carry Pistols, Bolt Action Rifles, Black Powder Rifles, Modern Sporting Rifles Diverse sales sources: Consumer: Sporting Goods Professional: International, Law Enforcement, Government, Military Healthy balance sheet Solid, experienced management team Strong strategic direction * Survey respondents who own a firearm and do not intend to purchase in the next 12 months and respondents who intend to purchase a firearm within 12 months, whether or not they are current owners. 3 |

| Vision / Mission Our Vision: The leading firearms manufacturer Our Mission: To allow our employees to design, produce, and market high-quality, innovative firearms that meet the needs and desires of our consumer and professional customers 4 |

| Focus, Simplify, Execute Strategy - Focus on Firearms Sale of Security Solutions - Perimeter Security Business (formerly USR) U.S. Consumer - leverage professional markets Family of brands: Smith & Wesson(r) M&P(tm) Thompson/Center Arms(tm) Walther(r) M&P(tm) - Brand and product platform: Pistols and modern sporting rifles Operations: Consolidate and expand capacity - some production lines have reached record levels Deliver new products that meet needs of user groups 5 |

| Experienced Leadership Team James Debney, President & CEO 20+ years: multinational consumer and business-to- business environments including President of Presto Products Co., a $500 million business unit of Alcoa Consumer Products Jeffrey Buchanan, EVP & CFO 25+ years: private and public company experience in financial management and law: CFO for publicly traded, global manufacturing company, law firm partner, public company board member 6 |

| Experienced Management Team Mario Pasantes Sr. VP, Marketing and International Sales Alcoa, Inc. Coca-Cola Pillsbury Mark Smith VP, Manufacturing and Supply Chain Management Alvarez & Marsal Ecolab Robert Cicero VP, General Counsel, Chief Compliance Officer and Secretary Chemtura Corp. Shearman & Sterling Morgan Lewis & Bockius Mike Brown VP, U.S. Sales Camfour, Inc. KPMG 7 International Market Development Strong Global Brands Strategy Customer Development Multi-Site Ops Capacity Expansion MPS/MRP Systems S&OP Mgmt Inventory Mgmt Lean Six Sigma Public Co Leadership Corp Governance Cross-border M&A Global Compliance Finance & Pensions Labor & Employment Multiple Leadership Roles in Hunting & Shooting Sports Industries Sales Strategy Team Development |

| Q4/Full Year FY12 Highlights (Apr 30, 2012) Record-level quarterly sales growth from continuing ops of $129.8M, +27.7% Y/Y Record-level quarterly income from continuing ops of $17.8M, or $0.27 per share Exceeded high end of upwardly revised sales guidance Q4 gross profit of $46.9M, or 36.1% of sales Quarterly unit growth +26.8% vs. market growth +21.1% (Adjusted NICS) More than doubled our backlog to $439.0M versus prior sequential Q3 Increased and accelerated our manufacturing capacity & outsourcing capabilities Launched the M&P Shield(tm) - highly successful, new consumer concealed carry offering Prepared for launch of SDVE, replacing and improving on our 18-year-old Sigma pistol Established meaningful NRA sponsorship including support of new/growing user groups Continued to work on divesting Security Solutions business (Discontinued Ops) Engaged with Walther to discuss our long-term relationship Repurchased a portion of our senior debt in the bond market 8 |

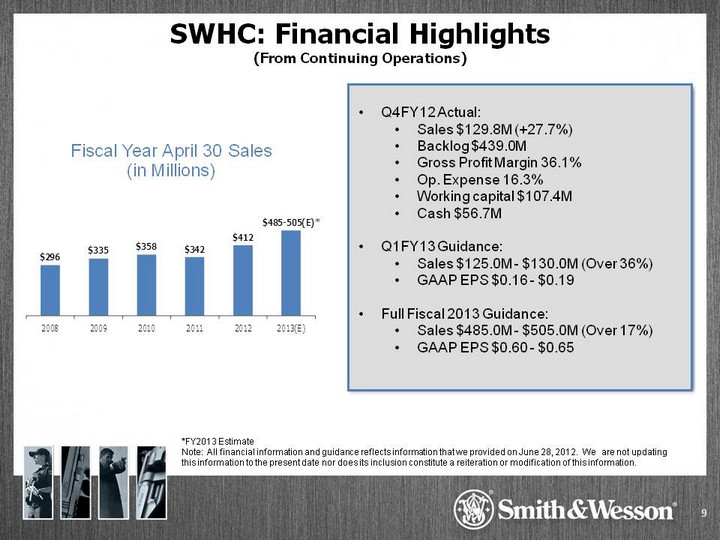

| SWHC: Financial Highlights (From Continuing Operations) Fiscal Year April 30 Sales (in Millions) Q4FY12 Actual: Sales $129.8M (+27.7%) Backlog $439.0M Gross Profit Margin 36.1% Op. Expense 16.3% Working capital $107.4M Cash $56.7M Q1FY13 Guidance: Sales $125.0M - $130.0M (Over 36%) GAAP EPS $0.16 - $0.19 Full Fiscal 2013 Guidance: Sales $485.0M - $505.0M (Over 17%) GAAP EPS $0.60 - $0.65 *FY2013 Estimate Note: All financial information and guidance reflects information that we provided on June 28, 2012. We are not updating this information to the present date nor does its inclusion constitute a reiteration or modification of this information. 9 |

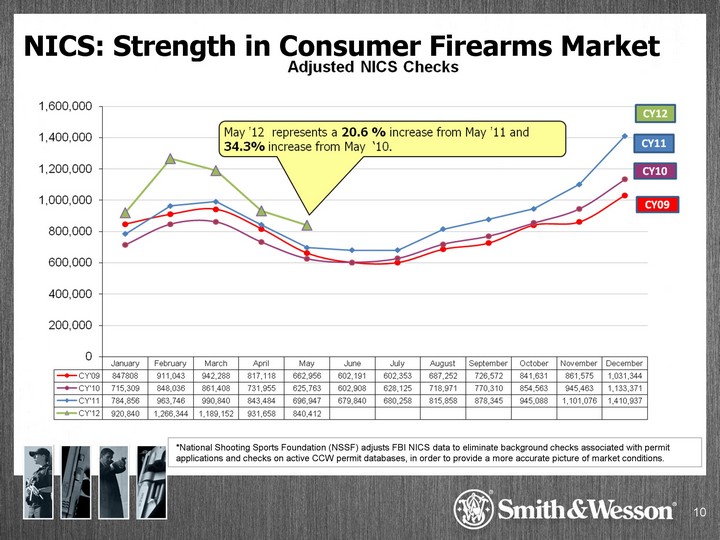

| *National Shooting Sports Foundation (NSSF) adjusts FBI NICS data to eliminate background checks associated with permit applications and checks on active CCW permit databases, in order to provide a more accurate picture of market conditions. Adjusted NICS Checks* NICS: Strength in Consumer Firearms Market 10 |

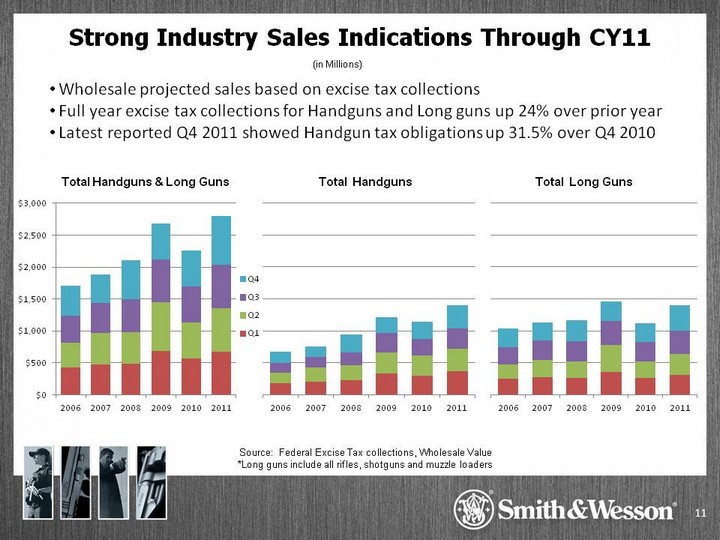

| Strong Industry Sales Indications Through CY11 Wholesale projected sales based on excise tax collections Full year excise tax collections for Handguns and Long guns up 24% over prior year Latest reported Q4 2011 showed Handgun tax obligations up 31.5% over Q4 2010 Source: Federal Excise Tax collections, Wholesale Value *Long guns include all rifles, shotguns and muzzle loaders 11 (in Millions) Total Handguns & Long Guns Total Handguns Total Long Guns |

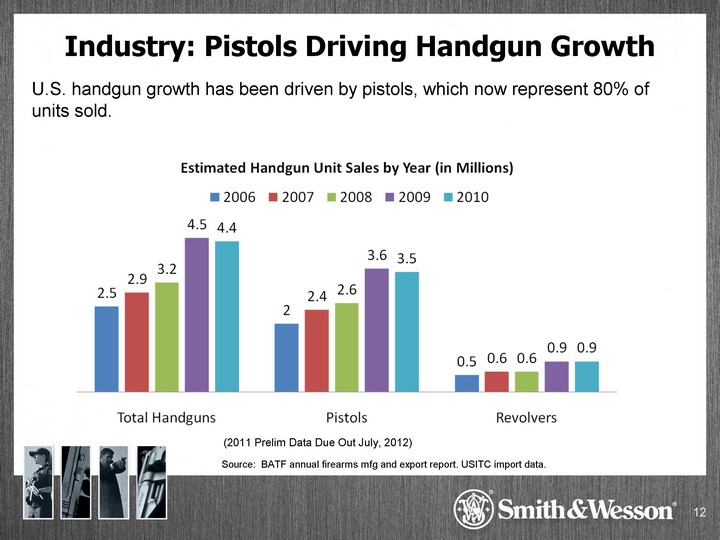

| Industry: Pistols Driving Handgun Growth U.S. handgun growth has been driven by pistols, which now represent 80% of units sold. Source: BATF annual firearms mfg and export report. USITC import data. 12 (2011 Prelim Data Due Out July, 2012) |

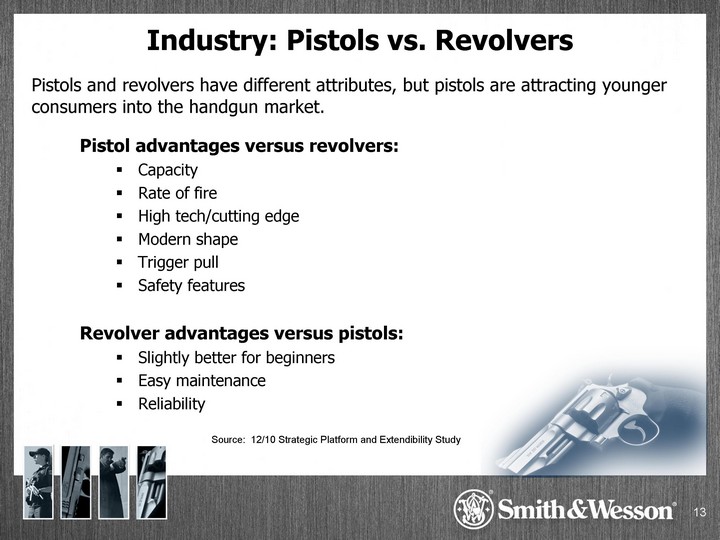

| Industry: Pistols vs. Revolvers Pistols and revolvers have different attributes, but pistols are attracting younger consumers into the handgun market. Pistol advantages versus revolvers: Capacity Rate of fire High tech/cutting edge Modern shape Trigger pull Safety features Revolver advantages versus pistols: Slightly better for beginners Easy maintenance Reliability Source: 12/10 Strategic Platform and Extendibility Study 13 |

| SWHC Firearms Growth Drivers Consumer Market - U.S. Focus on Concealed Carry, Personal Protection, Recreation Expand Market Share: Polymer Pistol Unit Growth (M&P(tm), BODYGUARD(r), S&W(r) brand) Robust New Product Pipeline Is Required Leverage Positive Halo Effect from Professional Markets Professional Market Law Enforcement - ongoing sidearm and rifle replacements, upgrades Federal Government - agencies can purchase M&P(tm) Pistol on ATF Contract Military - M9 pistol replacement opportunity International - large orders, e.g. Belgium, VICPOL 14 |

| Major Focus: M&P(tm) Pistol Growth Current Situation: Pistol category is 80% of handguns Compact and full-size polymer pistols are increasing in popularity M&P(tm) products well received by retail & consumer - M&P Shield(tm) Our Focus: Grow M&P(tm) Pistol market share: Increased consumer advertising Increasing capacity to satisfy growing orders Make it easier for dealers to support the M&P(tm) platform: Strong merchandising and store programs Armorer's Training and On-The-Hip Program 15 |

| M&P - Proven Performance M&P - Proven Performance Strong & Marketable Differences 16 |

| Demonstrated Track Record of New Products 2006 2007 2008 2009 2010 2011 2012 Walther PPS S&W M&P 15 S&W M&P Pistols Walther PK380 S&W M&P15-22 Walther PPQ S&W M&P15 Sport S&W BG380 S&W BG 38 S&W M&P15 Whisper S&W M&P 22 Thompson/Center Venture S&W Governor T/C Dimension 17 M&P Shield |

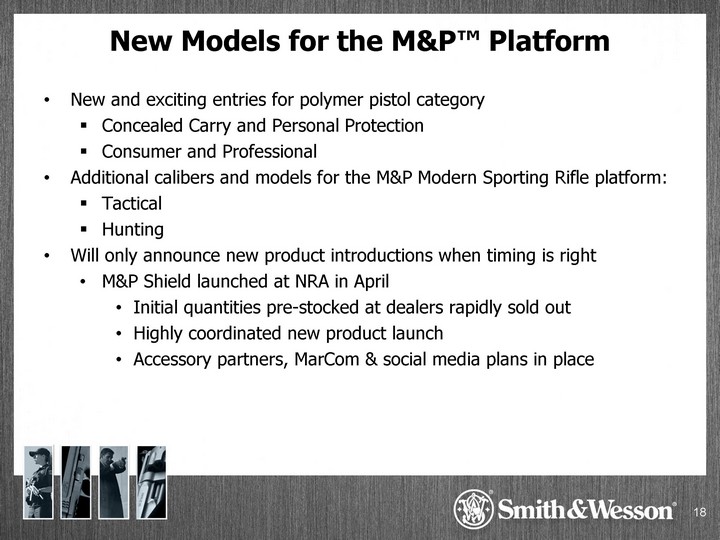

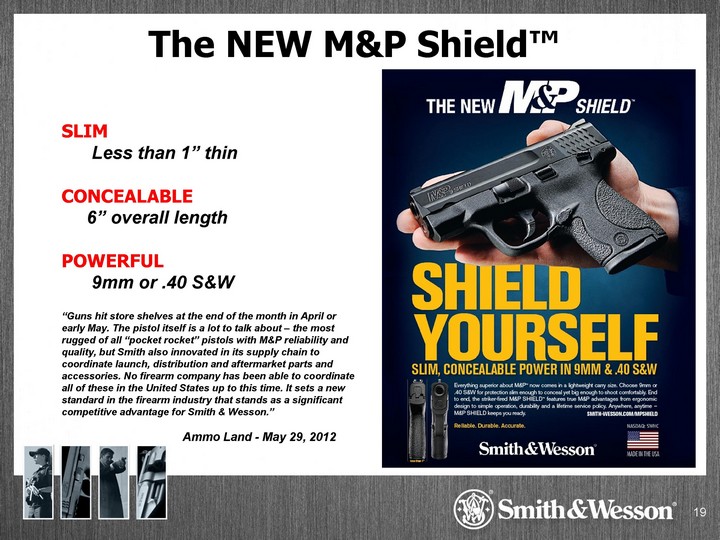

| New Models for the M&P(tm) Platform New and exciting entries for polymer pistol category Concealed Carry and Personal Protection Consumer and Professional Additional calibers and models for the M&P Modern Sporting Rifle platform: Tactical Hunting Will only announce new product introductions when timing is right M&P Shield launched at NRA in April Initial quantities pre-stocked at dealers rapidly sold out Highly coordinated new product launch Accessory partners, MarCom & social media plans in place 18 |

| The NEW M&P Shield(tm) SLIM Less than 1" thin CONCEALABLE 6" overall length POWERFUL 9mm or .40 S&W 19 "Guns hit store shelves at the end of the month in April or early May. The pistol itself is a lot to talk about - the most rugged of all "pocket rocket" pistols with M&P reliability and quality, but Smith also innovated in its supply chain to coordinate launch, distribution and aftermarket parts and accessories. No firearm company has been able to coordinate all of these in the United States up to this time. It sets a new standard in the firearm industry that stands as a significant competitive advantage for Smith & Wesson." Ammo Land - May 29, 2012 |

| Key Accessory Partners Were Ready Most Products Available at Launch 20 |

| Our Strategic Direction: Focus on Firearms Grow sales and increase profitability Expand manufacturing capacity intelligently Focus on M&P(tm) Pistol platform Optimize expenses on a company-wide basis Focus on improving gross margins Maintain robust new product pipeline Launch new products strategically Leverage existing product portfolio Objective: Deliver Enhanced Stockholder Value 21 |

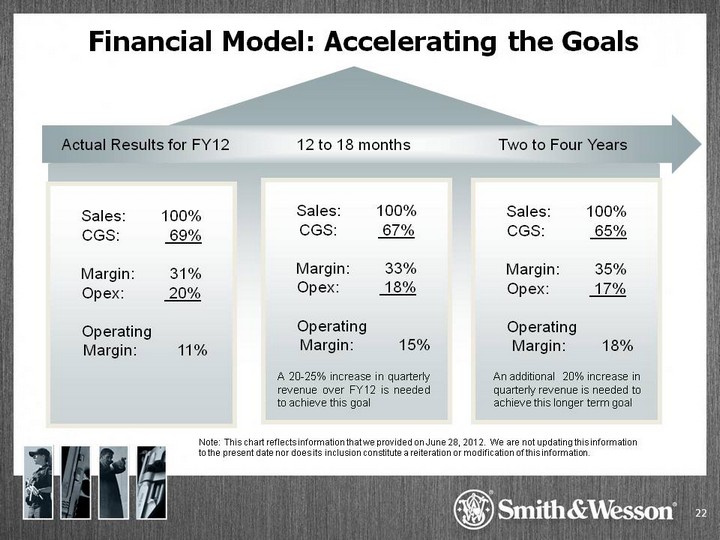

| Financial Model: Accelerating the Goals Sales: 100% CGS: 69% Margin: 31% Opex: 20% Operating Margin: 11% 22 Sales: 100% CGS: 67% Margin: 33% Opex: 18% Operating Margin: 15% Sales: 100% CGS: 65% Margin: 35% Opex: 17% Operating Margin: 18% Note: This chart reflects information that we provided on June 28, 2012. We are not updating this information to the present date nor does its inclusion constitute a reiteration or modification of this information. Actual Results for FY12 12 to 18 months Two to Four Years A 20-25% increase in quarterly revenue over FY12 is needed to achieve this goal An additional 20% increase in quarterly revenue is needed to achieve this longer term goal |

| Question & Answers For Investor Information contact Liz Sharp at lsharp@smith-wesson.com , (480) 949-9700 |