Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Synergetics, Inc. | form8k.htm |

| EX-2.2 - APPROVAL OF LICENSOR DATED JUNE 19, 2012 - Synergetics, Inc. | ex22.htm |

ASSIGNMENT AGREEMENT

THIS ASSIGNMENT OF LICENSING AGREEMENTS (the “Agreement”) entered into this 19th day of June, 2012, by and between Tellus Engineering Ltd. (Business Registration Number 1509522), Hong Kong corporation whose address is 7/F, Kin On Commercial Building 49-51 Hong Kong (the “Assignor”), Fresh Traffic Group, Inc. (Business Registration Number E0206632007-4), a Nevada corporation, whose address is 4960 S. Gilbert Road, Suite 1-111, Chandler, AZ 85249 (the “Assignee”);

WHEREAS, Assignor holds licensing agreements for North American and the Balkans granted by Assignor from OOO” SGPStroy” (the “Licensing Agreements”) for certain technology models defined as AIST-200, AIST-1000, AIST-1300 and other future modifications/improvement of the AIST base model more particularly described in Schedules A and B appended hereto (the “Technology”) and upon the terms and conditions set forth below, Assignor desires to sell and assign all of the rights in and to such Licensing Agreements granted to Assignor to Assignee, such that, following such transaction, Assignee will hold all rights and interest in and to the Licensing Agreements to the Technology

NOW THEREFORE, in consideration of the mutual covenants, agreements, representations and warranties contained in this Agreement, the Parties hereto agree as follows:

1. TERMS OF ASSIGNMENT

1.1 SALE AND ASSIGNMENT OF LICENSING AGREEMENT. Subject to the terms and conditions herein set forth, Assignor hereby agrees to sell and assign and Assignee hereby agrees to purchase from Assignor all rights and interest in and to the Licensing Agreements.

1.2 CONSIDERATION. The consideration for the sale and assignment of the Licensing Agreements from Assignor to Assignee shall be:

1.2.1 Share Consideration. The share consideration to be issued to Assignor upon the Closing of the acquisition by way of the assignment of the Licensing Agreements to Assignee shall be 10,000,000 post-split restricted shares of the common stock of Assignee.

1.2.2 Disposition of Fresh Traffic Group Corp. by Assignee. Concurrent with the Closing, Assignee enter into a disposition agreement with the shareholders of Fresh Traffic Group Corp. whereby Assignee shall cause the return the shares of its wholly owned subsidiary, Fresh Traffic Group Corp. to the prior shareholders of Fresh Traffic Group Corp., who shall return all shares issued for the acquisition of Fresh Traffic Group Corp. to the Assignee for cancellation, including the shares issued to the previous shareholders of Fresh Traffic Group Corp. and the shares issued for debt settlement pursuant to the acquisition of Fresh Traffic Group Corp. (the “Share Cancellation”) and the Company shall enter into a promissory note with Fresh Traffic Group Corp. for the amount of $14,691.74 which shall be payable on or before October 31, 2012 and shall bear interest at the rate of 5% per annum.

1.2.3 Restructure of Assignee. Concurrent with the Closing of this transaction, the Assignee shall effect a reverse split of the issued and outstanding shares of common stock of the Assignee on the basis of 1 share of common stock for each 75 common shares of common stock (the “Reverse Split”). After giving effect to the Share Cancellation and upon completion of the Reverse Split, there shall be a total of 675,000,000 shares of common stock authorized and a total of 341,333 shares of common stock issued and outstanding.

1

1.2.4 Appointment of Directors and Officers. At Closing, the current Board of Directors and Officers of the Company shall resign and shall appoint such directors and officers as Assignor shall advise (the “Appointment”). If required pursuant to SEC regulations, the Appointment shall take place 10 days after the filing of the 14F-1 with the Securities and Exchange Commission.

1.2.5 Approval of Licensor for Assignment. Assignor shall get the approval of OOO” SGPStroy” (“Licensor”) for the assignment of the License prior to Closing.

1.2.6 Settlement of Debt. Assignee shall use its best efforts to settle all outstanding debt on the balance sheet by way of negotiation with the Creditors except for the debt owing to auditors or the debt owing to the shareholders of Fresh Traffic Group Corp. as defined in 1.2.2 above. Such debt settlements may be by the way of post-split shares of Assignee if required, but in any event shall not be at less than $0.005 per common share.

2. REPRESENTATIONS AND WARRANTIES

2.1 REPRESENTATIONS AND WARRANTIES OF ASSIGNOR. The Assignor represents and warrants as follows:

a) CORPORATE AUTHORITY. Assignor has all requisite corporate power and authority to own, operate and lease its properties, to carry on its business as it is now being conducted and to execute, deliver, perform and conclude the transactions contemplated by this Agreement and all other agreements and instruments related to this Agreement.

b) AUTHORIZATION. Execution of this Agreement has been duly authorized and approved by the Board of Directors of Assignor.

c) OBLIGATIONS RELATING TO THE LICENSE AGREEMENT. Assignor has no contract or other obligation other than those disclosed in the Licensing Agreements or herein, which are threatened or contemplated against Assignor which, if decided adversely to Assignor, would impose any rights or interest or judgment against the License Agreements.

d) COMPLIANCE WITH APPLICABLE LAW AND REGULATORY MATTERS. Assignor has complied with all applicable laws and regulations, and is not in violation of, and have not received any written notices of violation with respect to, any laws and regulations in connection with the conduct of their respective businesses or the ownership or operation of their respective businesses, assets and properties, in regard to the Licensing Agreements.

e) MATERIAL CONTRACTS. There are no material contracts of Assignor currently in existence in relation to the Licensing Agreement except as disclosed in a Schedule hereto.

f) INTERESTS OF OFFICERS AND DIRECTORS. Except as disclosed herein, none of the officers or directors of Assignor has any interest in the Licensing Agreement.

g) BROKER’S FEES. Assignor has not employed any broker or finder or incurred any liability for any broker’s fees, commissions or finder’s fees in connection with the transactions contemplated by this Agreement.

h) CERTAIN BUSINESS PRACTICES. No director, officer, agent or employee of Assignor has (i) used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses relating to political activity on behalf of, or purportedly on behalf of, or for the business of Assignor, or (ii) made any unlawful payments to officials or employees of governmental entities or to directors, officers or employees of foreign or domestic business enterprises.

2

2.2 REPRESENTATIONS AND WARRANTIES OF ASSIGNEE. The Assignee represents and warrants as follows:

a) CORPORATE ORGANIZATION AND GOOD STANDING. Assignee is a corporation duly organized, validly existing, and in good standing under the laws of the State of Nevada, and is qualified to do business as a foreign corporation in each jurisdiction, if any, in which its property or business requires such qualification.

b) CORPORATE AUTHORITY. Assignee has all requisite corporate power and authority to execute, deliver, perform and conclude the transactions contemplated by this Agreement and all other agreements and instruments related to this Agreement.

c) NO VIOLATION. Consummation of the acquisition contemplated herein will not constitute or result in a breach or default under any provision of any charter, bylaw, indenture, mortgage, lease, or agreement, or any order, judgment, decree, law, or regulation by which Assignee is bound.

d) REPORTING STATUS. Assignee is a fully reporting public company under Section 15(d) of the Securities and Exchange Act of 1934, and is current on its filing obligations under Section 15. Assignee has filed all required periodic reports with the Securities & Exchange Commission (the "Commission") on Forms 10-Q and 10-K through the fiscal year ended August 31, 2011 and for the six months ended February 29, 2012, and all required Form 8-K reports, all such reports are true and correct in all material respects and contain no misrepresentation of a material fact or omission of a material fact. The common shares of Assignee are quoted on the OTC Markets OTCqb under the symbol "FTGC". Assignee has not received and there are no outstanding Commission Staff comment letters, stop orders or other regulatory actions, and no letters, comments, investigations or other actions pending or threatened by the Commission or by the Financial Industry Regulatory Authority (FINRA) against or relating to Assignee and there are no outstanding fees, fines or other amounts due to FINRA, the SEC, PCAOB or any other regulatory agency..

e) CAPITALIZATION.

(i) On the date of this Agreement, 675,000,000 shares of $0.001 par value common stock are authorized and 36,000,000 shares of common stock of Assignee are issued and outstanding, all of the shares of common stock issued are duly authorized, validly issued, fully paid and non-assessable and none were issued in violation of any preemptive rights. On the date of this Agreement (i) no shares of Assignee are reserved for issuance upon the exercise of outstanding options, warrants or other rights to purchase shares; and (ii) no shares of Assignee stock are held in the treasury of Assignee. Except as set forth herein, as of the date hereof, no shares or other voting securities of Assignee are issued, reserved for issuance, authorized to be issued or outstanding. Assignee and Assignor have agreed that the Company may effect a reverse split of its common shares issued and outstanding and that additional shares may be issued to settle outstanding liabilities of Assignee. There are no bonds, debentures, notes or other indebtedness or securities of Assignee that have the right to vote (or that are convertible into, or exchangeable for, securities having the right to vote) on any matters on which stockholders of Assignee may vote. All shares of Assignee subject to issuance as described above shall, upon issuance on the terms and conditions specified in the instruments pursuant to which they are issuable, be duly authorized, validly issued, fully paid, non-assessable and free of preemptive rights.

3

(ii) Other than as defined herein, Assignee has no contract or other obligation to repurchase, redeem or otherwise acquire any shares of Assignee stock, or make any investment(in the form of a loan, capital contribution or otherwise) in any other Person. There are no outstanding subscriptions, options, warrants, puts, calls, rights, exchangeable or convertible securities or other commitments or agreements of any character relating to the issued or unissued shares or other securities of Assignee. None of the outstanding equity securities or other securities of Assignee was issued in violation of the Securities Act of 1933 or any other legal requirement.

|

f)

|

AUTHORITY; NO VIOLATION.

|

(i) Assignee has full corporate power and authority to execute and deliver this Agreement and to comply with the terms hereof and consummate the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by Assignee. Assuming due authorization, execution and delivery by the other Parties, this Agreement constitutes the valid and binding obligation of Assignee, enforceable against Assignee in accordance with its terms, except as such enforcement may be limited by (i) the effect of bankruptcy, insolvency, reorganization, receivership, conservatorship, arrangement, moratorium or other similar laws affecting or relating to the rights of creditors generally, or (ii) the rules governing the availability of specific performance, injunctive relief or other equitable remedies and general principles of equity, regardless of whether considered in a proceeding in equity or at law, or (iii) the specific terms and conditions of this Agreement.

(ii) Neither the execution and delivery of this Agreement by Assignee nor the consummation by Assignee of the transactions contemplated hereby, nor compliance by Assignee with any of the terms or provisions hereof, will (A) violate any provision of the Certificate of Registration or Constitution or the certificates of registration or constitution, or other charter or organizational documents, of Assignee or (B) violate any statute, code, ordinance, rule, regulation, judgment, order, writ, decree or injunction applicable to Assignee or any of its properties or assets, the violation of which would have a material adverse effect, or (C) violate, conflict with, result in a breach of any provision of or the loss of any material benefit under, constitute a default (or an event which, with notice or lapse of time, or both, would constitute a default) under, result in the termination of any or all rights or benefits or a right of termination or cancellation under, accelerate the performance required by or rights or obligations under, increase any rate of interest payable or result in the creation of any lien upon any of the respective properties or assets of Assignee under, any authorization or of the terms, conditions or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement, contract, or other instrument or obligation to which is a party, or by which its properties, assets or business activities may be bound or affected.

|

g)

|

FINANCIAL STATEMENTS.

|

(i) Assignor acknowledges that all financial statements filed with the SEC are available to Assignor to view prior to the Closing Date, and Assignee confirms such financial statements are true and complete copies of the unaudited and audited financial statements of Assignee as filed with the SEC as at the Closing Date. (the “Assignee Financial Statements”).

(ii) The Assignee Financial Statements were prepared in accordance with GAAP or the equivalent applied on a basis consistent throughout the periods indicated (except as otherwise stated in such financial statements, including the related notes, and except that, in the case of unaudited statements for the subsequent quarterly periods referenced above, such unaudited statements fairly present in all material respects the consolidated financial condition and the results of operations of Assignee as at the respective dates thereof and for the periods indicated therein (subject, in the case of unaudited statements, to year-end audit adjustments).

h) ABSENCE OF CERTAIN CHANGES OR EVENTS. Since the end of its most recent fiscal year and to the date of this Agreement, (i) Assignee has, in all material respects, conducted its business in the ordinary course consistent with past practice; (ii) there has not occurred any change, event or condition that is or would reasonably be expected to result in a material adverse effect; and (iii) Assignee has not taken and will not take any of the actions that Assignee has agreed not to take from the date hereof through the Closing.

4

i) UNDISCLOSED LIABILITIES. Assignee has no material obligations or liabilities of any nature (whether accrued, matured or unmatured, fixed or contingent or otherwise) other than (i) those set forth or adequately provided for in the balance sheet (and the related notes thereto) of Assignee as of the end of the most recent fiscal year included in the Assignee Financial Statements, (ii) those incurred in the ordinary course of business consistent with past practice since the end of the most recent fiscal year and (iii) those incurred in connection with the execution of this Agreement.

j) LEGAL PROCEEDINGS. Assignee is not a party to any, and there is no pending or, to the knowledge of Assignee, threatened, legal, administrative, arbitral or other proceeding, claim, action or governmental or regulatory investigation of any nature against Assignee, or any of its officers or directors which, if decided adversely to Assignee, would, individually or in the aggregate, be material to Assignee. There is no injunction, order, judgment or decree imposed upon Assignee, or any of its officers or directors, or the assets of Assignee.

k) TAXES AND TAX RETURNS.

(a) (i) Assignee shall file or caused to be filed all federal, state, foreign and local tax returns required to be filed with any tax authority; (ii) all such tax returns shall be true, accurate, and complete in all material respects; (iii) Assignee shall pay or caused to be paid all taxes that are due and payable by any of such companies, other than taxes which are being contested in good faith and are adequately reserved against or provided for (in accordance with GAAP) in the Assignee Financial Statements, and (iv) Assignee shall not have any material liability for taxes for any current or prior tax periods in excess of the amount reserved or provided for in the Assignee Financial Statements (but excluding, for this Clause (iv) only, any liability reflected thereon for deferred taxes to reflect timing differences between tax and financial accounting methods).

a) No national, state, local or foreign audits, examinations, investigations, or other formal proceedings are pending or, to Assignee’s knowledge, threatened with regard to any taxes or tax returns of Assignee. No issue has arisen in any examination of the Assignee by any tax authority that if raised with respect to any other period not so examined would result in a material deficiency for any other period not so examined, if upheld. Any adjustment of income taxes of Assignee made in any examination that is required to be reported to the appropriate national, state, local or foreign tax authorities has been so reported.

b) There are no disputes pending with respect to, or claims or assessments asserted in writing for, any material amount of taxes upon Assignee, nor has Assignee given or been requested in writing to give any currently effective waiver extending the statutory period of limitation applicable to any tax return for any period.

l) COMPLIANCE WITH APPLICABLE LAW AND REGULATORY MATTERS.

(a) Assignee has complied with all applicable laws and regulations, and is not in violation of, and have not received any written notices of violation with respect to, any laws and regulations in connection with the conduct of their respective businesses or the ownership or operation of their respective businesses, assets and properties, except for such noncompliance and violations as would not, individually

5

(b) or in the aggregate, be material.

b) Assignee has all licenses, permits, certificates, franchises and other authorizations (collectively, the “Authorizations”) necessary for the ownership or use of its assets and properties and the conduct of its business, as currently conducted, and has complied with, and are not in violation of, any Authorization, except where such noncompliance or violation would not, individually or in the aggregate, be material. Except as would not be material to Assignee, all such Authorizations are in full force and effect and there are no proceedings pending or, to the knowledge of Assignee, threatened that seek the revocation, cancellation, suspension or adverse modification thereof.

m) GOVERNMENT ORDERS. There are no governmental orders applicable to Assignee which have had or may have a Material Adverse Effect on Assignee.

n) MATERIAL CONTRACTS. There are no material contracts of Assignee currently in existence, save for those disclosed in the financial statements of Assignee.

o) ASSETS. Assignee owns, leases or has the right to use all the properties and assets necessary or currently used for the conduct of its businesses free and clear of all liens of any kind or character. All items of equipment and other tangible assets owned by or leased to Assignee and which are material to the operations and business of Assignee are in good condition and repair (ordinary wear and tear excepted). In the case of leased equipment and other tangible assets, Assignee holds valid leasehold interests in such leased equipment and other tangible assets, free and clear of all liens of any kind or character.

p) ENVIRONMENTAL LIABILITY. Assignee is in compliance with all applicable environmental laws. To the knowledge of Assignee, there are no liabilities of Assignee of any kind, whether accrued, contingent, absolute, determined, determinable or otherwise arising under or relating to any environmental law and, to the knowledge of Assignee, there are no facts, conditions, situations or set of circumstances that could reasonably be expected to result in or be the basis for any such liability.

q) INSURANCE. Assignee has no insurance coverage with respect to its business.

r) INTERESTS OF OFFICERS AND DIRECTORS. Except AS DISCLOSED HEREIN, none of the officers or directors of Assignee has any interest in any property, real or personal, tangible or intangible, including intellectual property, used in or developed by the business of Assignee, or in any supplier, distributor or customer of Assignee, or any other relationship, contract, agreement, arrangement or understanding with Assignee, except for the normal ownership interests of a shareholder and employee rights.

s) BROKER’S FEES. Assignee has not employed any broker or finder or incurred any liability for any broker’s fees, commissions or finder’s fees in connection with the transactions contemplated by this Agreement.

t) CERTAIN BUSINESS PRACTICES. No director, officer, agent or employee of Assignee has (i) used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses relating to political activity on behalf of, or purportedly on behalf of, or for the business of Assignee, or (ii) made any unlawful payments to officials or employees of governmental entities or to directors, officers or employees of foreign or domestic business enterprises.

6

3. CONDITIONS PRECEDENT

3.1 Conditions to Each Party’s Obligations. The respective obligations of each Party hereunder shall be subject to the satisfaction prior to or at the Closing of the following conditions:

a) No Restraints. No statute, rule, regulation, order, decree, or injunction shall have been enacted, entered, promulgated, or enforced by any court or governmental entity of competent jurisdiction which enjoins or prohibits the consummation of this Agreement and shall be in effect.

b) Legal Action. There shall not be pending or threatened in writing any action, proceeding, or other application before any court or governmental entity challenging or seeking to restrain or prohibit the consummation of the transactions contemplated by this Agreement, or seeking to obtain any material damages.

3.2 Conditions to Assignor’s Obligations. The obligations of Assignor to close shall be subject to the satisfaction prior to or at the Closing of the following conditions unless waived by Assignor:

a) Representatives and Warranties of Assignee. The representations and warranties of Assignee set forth in this Agreement shall be true and correct as of the date of this Agreement and as of the Closing as though made on and as of the Closing, except: (i) as otherwise contemplated by this Agreement; or (ii) in respects that do not have a Material Adverse Effect on the Parties or on the benefits of the transactions provided for in this Agreement. “Material Adverse Effect” for purposes of this Agreement shall mean any change or effect that, individually or when taken together with all other such changes or effects which have occurred prior to the date of determination of the occurrence of the Material Adverse Effect, is or is reasonably likely to be materially adverse to the business, assets, financial condition, or results of operation of the entity.

b) Performance of Obligations of Assignee. Assignee shall have performed all agreements and covenants required to be performed by it under this Agreement prior to the Closing, except for breaches that do not have a Material Adverse Effect on the Parties or on the benefits of the transactions provided for in this Agreement.

c) Appointment of Officers and Directors. Assignee shall undertake to appoint the Directors to be appointed to the Board of Directors of Assignee and the Officers to be appointed to Assignee, pursuant to the terms of this Agreement.

3.3 Conditions to Assignee’s Obligations. The obligations of Assignee shall be subject to the satisfaction prior to or at the Closing of the following conditions unless waived by Assignee:

a) Representatives and Warranties of Assignor. The representations and warranties of Assignor set forth in this Agreement shall be true and correct as of the date of this Agreement and as of the Closing as though made on and as of the Closing, except: (i) as otherwise contemplated by this Agreement, or (ii) in respects that do not have a Material Adverse Effect on the Parties or on the benefits of the transactions provided for in this Agreement.

b) Performance of Assignor. Assignor shall have performed all agreements and covenants required to be performed by them under this Agreement prior to Closing, except for breaches that do not have a Material Adverse Effect on the Parties or on the benefits of the transactions provided for in this Agreement.

7

4. CLOSING AND DELIVERY OF DOCUMENTS

4.1 Time and Place. The Closing of the transaction contemplated by this Agreement shall take place at the offices of Assignee, unless otherwise agreed by the Parties, immediately upon the full execution of this Agreement, and the satisfaction of all conditions, specifically the delivery of all required documents, or at such other time and place as the Parties mutually agree. All proceedings to be taken and all documents to be executed at the Closing shall be deemed to have been taken, delivered and executed simultaneously, and no proceeding shall be deemed taken nor documents deemed executed or delivered until all have been taken, delivered and executed. The date of Closing may be accelerated or extended by agreement of the parties.

Any copy, facsimile telecommunication or other reliable reproduction of the writing or transmission required by this Agreement or any signature required thereon may be used in lieu of an original writing or transmission or signature for any and all purposes for which the original could be used, provided that such copy, facsimile telecommunication or other reproduction shall be a complete reproduction of the entire original writing or transmission or original signature.

4.2 Deliveries by Assignor. At Closing, Assignor shall make the following deliveries to Assignee:

a) Certified resolutions of the Board of Directors of Assignor authorizing the execution and performance of this Agreement.

b) Such documents as may be required to transfer the Licensing Agreements to Assignee and any related contracts or agreements in regard to the Licensing Agreements.

c) Assignor shall provide Assignee with written, notarized approval of the Licensor, approving the assignment of the Licensing Agreement to Assignee.

4.3 Deliveries by Assignee. At Closing, Assignee shall make the following deliveries to Assignor:

a) Stock certificates representing the Assignee Common Shares issued in the name of Assignor or its designee;

b) Certified resolutions of the Board of Directors of Assignee authorizing the execution and performance of this Agreement.

c) Certified resolutions of the Board of Directors of Assignee appointing the designees of Assignor as directors and officers of Assignee at Closing along with resignations of the existing officers of Assignee effective at Closing or pursuant to the regulations as promulgated by the Securities and Exchange Commission.

5. INDEMNIFICATION AND ARBITRATION

5.1. Indemnification. The Assignor, on the one hand, and the Assignee, on the other hand, (each party, “Indemnifying Party”) shall agree to indemnify, and hold harmless the other party (“Indemnified Party”) from any and all claims, demands, liabilities, damages, losses, costs and expenses that the other party shall incur or suffer, including attorney’s fees and costs, that arise, result from or relate to any breach of, or failure by Indemnifying Party to perform any of their respective representations, warranties, covenants, or agreements in this Agreement or in any exhibit, addendum, or any other instrument furnished by the Indemnifying Party under this Agreement.

8

5.2 Arbitration and Governing Law. The parties hereby agree that any and all claims (except only for requests for injunctive or other equitable relief) whether existing now, in the past or in the future as to which the parties or any affiliates may be adverse parties, and whether arising out of this Agreement or from any other cause, will be resolved by arbitration before the American Arbitration Association within the State of Nevada.

a) The parties hereby irrevocably consent to the jurisdiction of the American Arbitration Association and the situs of the arbitration (and any requests for injunctive or other equitable relief) within the State of Nevada. Any award in arbitration may be entered in any domestic or foreign court having jurisdiction over the enforcement of such awards.

b) The law applicable to the arbitration and this Agreement shall be that of the State of Nevada, determined without regard to its provisions which would otherwise apply to a question of conflict of laws.

c) The arbitrator may, in its discretion, allow the parties to make reasonable disclosure and discovery in regard to any matters which are the subject of the arbitration and to compel compliance with such disclosure and discovery order. The arbitrator may order the parties to comply with all or any of the disclosure and discovery provisions of the Federal Rules of Civil Procedure, as they then exist, as may be modified by the arbitrator consistent with the desire to simplify the conduct and minimize the expense of the arbitration.

d) Regardless of any practices of arbitration to the contrary, the arbitrator will apply the rules of contract and other law of the jurisdiction whose law applies to the arbitration so that the decision of the arbitrator will be, as much as possible, the same as if the dispute had been determined by a court of competent jurisdiction.

e) Any award or decision by the American Arbitration Association shall be final, binding and non-appealable except as to errors of law or the failure of the arbitrator to adhere to the arbitration provisions contained in this agreement. Each party to the arbitration shall pay its own costs and counsel fees except as specifically provided otherwise in this agreement.

f) In any adverse action, the parties shall restrict themselves to claims for compensatory damages and/or securities issued or to be issued and no claims shall be made by any party or affiliate for lost profits, punitive or multiple damages.

g) The parties covenant that under no conditions will any party or any affiliate file any action against the other (except only requests for injunctive or other equitable relief) in any forum other than before the American Arbitration Association, and the parties agree that any such action, if filed, shall be dismissed upon application and shall be referred for arbitration hereunder with costs and attorney's fees to the prevailing party.

h) It is the intention of the parties and their affiliates that all disputes of any nature between them, whenever arising, whether in regard to this agreement or any other matter, from whatever cause, based on whatever law, rule or regulation, whether statutory or common law, and however characterized, be decided by arbitration as provided herein and that no party or affiliate be required to litigate in any other forum any disputes or other matters except for requests for injunctive or equitable relief. This agreement shall be interpreted in conformance with this stated intent of the parties and their affiliates.

The provisions for arbitration contained herein shall survive the termination of this agreement for any reason.

9

6. GENERAL PROVISIONS.

6.1 FURTHER ASSURANCES. From time to time, each party will execute such additional instruments and take such actions as may be reasonably required to carry out the intent and purposes of this Agreement.

6.2 WAIVER. Any failure on the part of either party hereto to comply with any of its obligations, agreements, or conditions hereunder may be waived in writing by the party to whom such compliance is owed.

6.3 BROKERS. Each party agrees to indemnify and hold harmless the other party against any fee, loss, or expense arising out of claims by brokers or finders employed or alleged to have been employed by the indemnifying party.

6.4 NOTICES. All notices and other communications hereunder shall be in writing and shall be given by personal delivery, overnight delivery, mailed by registered or certified mail, postage prepaid, with return receipt requested, as follows:

If to Assignor to:

Tellus Engineering Ltd.

7/F, Kin On Commercial Building 49-51

Hong Kong

steven.huynh@zoho.com

If to Assignee, to:

Fresh Traffic Group, Inc.

4960 S. Gilbert Road,

Suite 1-111,

Chandler, AZ 85249

(602) 633-1617

wsl@lawlerfirm.com

The persons and addresses set forth above may be changed from time to time by a notice sent as aforesaid. If notice is given by personal delivery or overnight delivery in accordance with the provisions of this Section, such notice shall be conclusively deemed given at the time of such delivery provided a receipt is obtained from the recipient. If notice is given by mail, such notice shall be deemed given upon receipt and delivery or refusal.

6.5 ASSIGNMENT. This Agreement shall inure to the benefit of, and be binding upon, the parties hereto and their successors and assigns; provided, however, that any assignment by either party of its rights under this Agreement without the written consent of the other party shall be void.

6.6 COUNTERPARTS. This Agreement may be executed simultaneously in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Signatures sent by facsimile transmission shall be deemed to be evidence of the original execution thereof.

6.7 REVIEW OF AGREEMENT. Each party acknowledges that it has had time to review this agreement and, as desired, consult with counsel. In the interpretation of this Agreement, no adverse presumption shall be made against any party on the basis that it has prepared, or participated in the preparation of, this Agreement.

10

6.8 SCHEDULES. All schedules attached hereto, if any, shall be acknowledged by each party by signature or initials thereon.

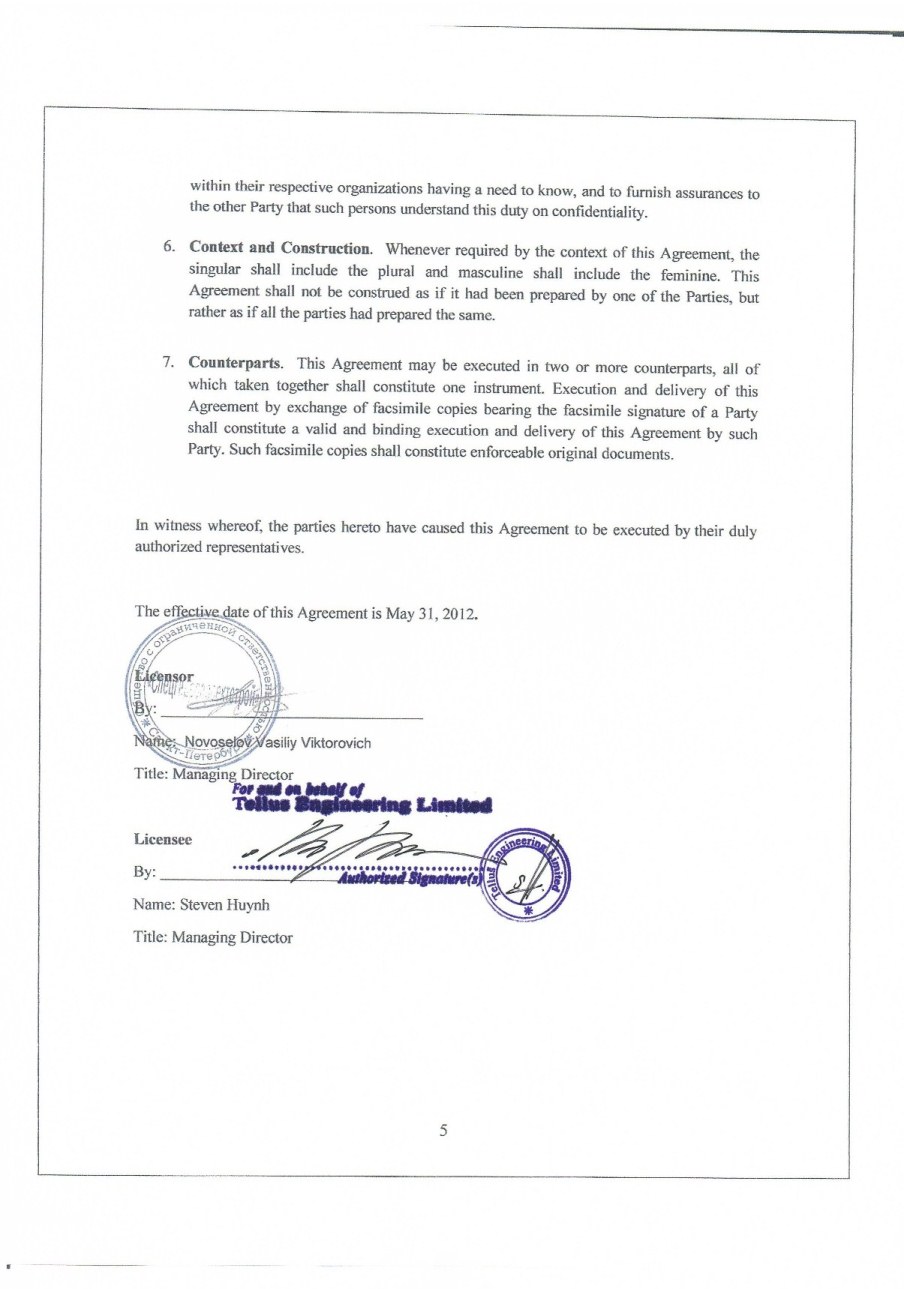

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first written above.

INTENTIONALLY LEFT BLANK

DATED this 19th day of June, 2012

FRESH TRAFFIC GROUP, INC.

(Assignee)

Per:

Name:

Title:

I have authority to bind the Company.

TELLUS ENGINEERING LTD.

(Assignor)

Per:

Name:

Title:

I have authority to bind the Company.

11