Attached files

| file | filename |

|---|---|

| EX-15 - EXHIBIT 15 - WHITE FOX VENTURES, INC. | ex15.htm |

| EX-21 - EXHIBIT 21 - WHITE FOX VENTURES, INC. | ex21.htm |

| EX-23.1 - EXHIBIT 23.1 - WHITE FOX VENTURES, INC. | ex23_1.htm |

| EX-10.5 - EXHIBIT 10.5 - WHITE FOX VENTURES, INC. | ex10_5.htm |

As filed with the Securities and Exchange Commission on June 27, 2012

Registration No. 333-178624

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NUMBER EIGHT

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

DNA PRECIOUS METALS, INC.

(Exact Name of Registrant)

|

Nevada

|

1040

|

37-1640902

|

|

(State or Other Jurisdiction of

Organization)

|

(Primary Standard Industrial

Classification Code)

|

(IRS Employer

Identification Number)

|

9125 rue Pascal Gagnon, Suite 204

Saint Leonard, Quebec

Canada H1P 1Z4

|

|

(514) 852-2111

|

|

|

(Address and telephone number of principal executive officers)

|

James Chandik

9125 rue Pascal Gagnon, Suite 204

Saint Leonard, Quebec

Canada HIP 1Z4

|

(514) 852-2111

|

||

|

(Name, address and telephone number of agent for service)

|

Copies to:

Jeffrey G. Klein, P.A.

301 Yamato Road, Suite 1240

Boca Raton, FL 33431

(561) 953-1126

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. T

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. £

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer”, a “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934.

|

Large Accelerated Filer £

|

Accelerated Filer £

|

|

Non-accelerated Filer £

|

Smaller Reporting Company T

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Proposed maximum

aggregate

offering price(1)

|

Amount of registration fee

|

|||

|

Common Stock, $0.001 par value per share

|

$3,000,000

|

$348.30

|

|||

|

(1)

|

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”), or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

|

Prospectus Summary

|

2

|

|

The Offering

|

4

|

|

Selected Financial Information

|

5

|

|

Risk Factors

|

5

|

|

Cautionary Note Regarding Forward-Looking Statements

|

15

|

|

Use of Proceeds

|

16

|

|

Determination of Offering Price

|

17

|

|

Dilution

|

18

|

|

Plan of Distribution

|

18

|

|

Dividend Policy

|

19

|

|

Management’s Discussion and Analysis of Financial Condition and Plan of Operations

|

19

|

|

Business

|

22

|

|

Management

|

34

|

|

Executive Compensation

|

36

|

|

Principal Shareholders

|

38

|

|

Description of Securities

|

39

|

|

Certain Transactions

|

40

|

|

Experts

|

40

|

|

Legal Matters

|

40

|

|

Where You Can Find Additional Information

|

40

|

|

Index to Financial Statements

|

F-1

|

The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED _______________, 2012

PRELIMINARY PROSPECTUS

DNA PRECIOUS METALS, INC.

12,000,000 Shares of Common Stock

Offered at $0.25 per share

Total Offering $3,000,000

We are offering 12,000,000 (12 million) shares of our common stock at a price of $0.25 per share. We may retain the services of licensed broker/dealers and compensate these broker/dealers with a cash commission not to exceed 10% of the proceeds raised by the broker/dealer. To the extent that our common stock is sold by our officers or directors, no commissions will be paid.

The Offering will continue until all 12,000,000 shares of common stock are sold, the expiration of 360 days from the date of this prospectus, which period may be extended for up to an additional 180 days in our discretion, or until we elect to terminate the Offering, whichever event occurs first. If all 12,000,000 shares are not sold within this period, the Offering for the balance of the shares will terminate and no further shares will be sold.

There is no assurance as to the amount of proceeds that we may raise in this offering. We are not required to sell a minimum number of shares in this offering. There will be no escrow of investor funds. We will have immediate access to the proceeds of this offering.

There is no public market for our common stock and no assurance that a trading market will develop or, if it develops, that it will continue. Although we intend to apply, through a market maker, for trading of our common stock on the OTC Bulletin Board (“OTCBB”), public trading of our common stock may never materialize. If our common stock becomes traded on the OTCBB, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by us and the selling shareholders.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved.

The purchase of the securities offered through this Prospectus involves a high degree of risk. See “Risk Factors” beginning on page 5.

We are offering the securities on a best effort no minimum basis. There are no minimum purchase requirements.

|

Price to Investor

|

Commission (1)

|

Proceeds to the Company

|

|

|

Price per share

|

$0.25

|

$0.025

|

$.225

|

|

Maximum

|

$3,000,000

|

$300,000

|

$2,700,000

|

(1) There are no arrangements nor plans to use underwriters or broker/dealers to offer our Common Stock. However, we reserve the right to utilize the services of licensed broker/dealers and compensate these broker/dealers with a commission not to exceed 10% of the proceeds raised.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________________, 2012

1

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before buying shares of our common stock. You should read the entire prospectus carefully, especially the “Risk Factors” section and our consolidated financial statements and the related notes appearing at the end of this prospectus before deciding to invest in shares of our common stock. Unless the context provides otherwise, all references to “DNA,” “DNA Precious Metals,” “we,” us,” “our,” or similar terms, refer to DNA Precious Metals, Inc. and its wholly owned subsidiary DNA Precious Metals Canada Inc.

In this prospectus all references to “$” or “dollars” mean the U.S. dollar, and unless otherwise indicated all currency amounts in this prospectus are stated in U.S. dollars. All references to “Cdn.$” refer to the Canadian dollar. All financial statements have been prepared in accordance with accounting principles generally accepted in the United States and are reported in U.S. dollars.

Background

We were incorporated on June 2, 2006 in the state of Nevada. Our original name was Celtic Capital, Inc. On October 20, 2008, Celtic Capital, Inc. changed its name to Entertainment Educational Arts Inc. and on May 12, 2010, the Company changed its name to DNA Precious Metals, Inc. (the “Company”).

Our executive offices are located at 9125 rue Pascal Gagnon, Suite 204, Saint Leonard, Québec, H1P 1Z4, Canada and our telephone number is 514-852-2111. We lease approximately 1,100 square feet of space at a monthly cost of $1,320. We believe this space will be adequate for our ongoing operations.

Our Business

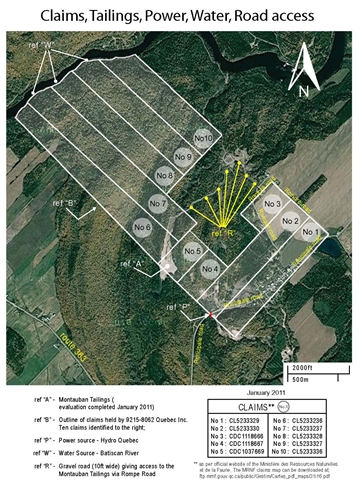

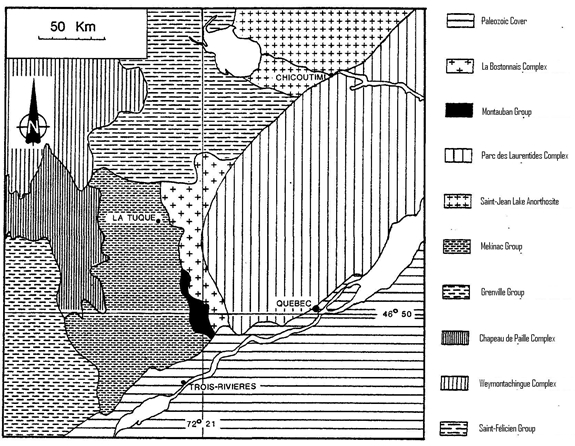

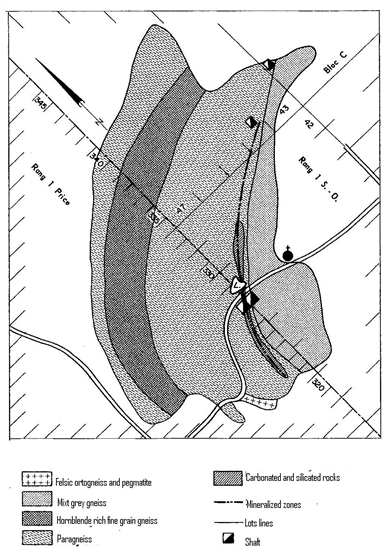

We are an exploration stage mining company. We are in the business of exploring for gold, silver and base metal deposits, primarily muscovite (mica). On June 9, 2011 we acquired ten (10) mining claims in the Montauban Mining Project located in the Montauban and Chavigny townships near Grondines-West in Portneauf County, Quebec, Canada (the “Property”). We acquired the Property from 9215-8062 Quebec Inc. in consideration for the issuance of 5,000,000 (5 million) shares of our common stock. We valued the shares of our common stock at $0.003 per share for total consideration of $15,000.

There is no affiliation between 9215-8062 Quebec Inc. and the Company or its officers and directors

The Property is easily accessible and all transportation infrastructures on the Property are in place. Information from past prospectors indicates that there are zones of gold, silver and base metal mineralization on the Property.

Our primary objective is to recuperate the precious metals from the mining residues (tailings) on the Property. The recuperation of the precious metals from the tailings is less expensive than traditional mining operations primarily because the mining residues have already been crushed and grinded by prior mining companies

The Mountauban Property in Quebec, Canada is our principal asset. The entire Mountauban Property is approximately 340.36 hectares. Our development plan for the Mountauban Property involves initiating mining and production in two phases, which we believe will reduce the amount of total capital required to bring the Mountauban Property into production.

We intend to apply for permitting and begin construction of the mill. However, before we can commence processing the tailings, we must obtain a Certificate of Authorization from the Quebec Provincial government The Certificate of Authorization will give us the right to operate a mine waste treatment plant. Prior to submitting the application for the Certificate of Authorization, we must obtain a construction permit from the municipality and conduct a hydro geological study around the localization of the processing site. All architectural drawings for the steel structural building must be prepared, We also require plans for a footing foundation, drawings and design for the process mining circuit with specification sheets for all mining equipment. We must also present a process flow sheet, drawings for the tailing storage facilities, water management report, and a closure and restoration plan.

2

In March, we applied for the Certificate of Authorization and anticipate the review process will take up to 90 days.

Management

James Chandik serves as our president and chief executive officer. Claude Girard serves as our vice president and director of field operations. Jeffrey Bercovitch serves as our chief financial officer. All three serve on our Board of Directors. (See “Management” for a detailed description of their business experience.

Our Common Stock

As of the date of this prospectus, we had 76,100,000 shares of our common stock issued and outstanding.

Currently, there is no public market for our common stock. We intend to request a market maker to file a Form 211 to be approved for quotation on the Over-the-Counter Bullet Board electronic quotation system, (“OTCBB). The Company is not permitted to file a Form 211 with the OTCBB as only Market Makers may apply to the OTCBB for the issuer to get approval to quote the security. We cannot provide you any assurance that our common stock will ever be quoted on the OCTBB.

Our Funding requirements

We will require approximately $2,700,000 to complete the infrastructure and construct a mill and implement and operate our business during the next 12 months. We cannot provide any assurance that we will be able to raise sufficient funds to satisfy our funding requirements to secure required permitting, acquire the necessary equipment, to construct a mill and commence mining operations.

We have not entered into the necessary agreements that would enable us to obtain additional financing. There is no guarantee or assurance that we will be able to enter into any agreement that will enable us to obtain additional financing.

We are an exploration stage company. At March 31, 2012 we had a working capital surplus of $175,388. However, we have incurred losses from operations since inception, have no revenues, may incur further significant losses, have no established source of revenue, and are dependent on our ability to raise capital from shareholders or, possibly, advances or loans from related parties to sustain operations. As such, our independent auditors have concluded that there is a substantial doubt that we will be able to continue as a going concern.

During the three months ended March 31, 2012, we incurred significant operating costs and expenses. Based on our current working capital, we have significantly reduced our ongoing operations in order to ensure sufficient working capital for no less than twelve months of operations. We have reduced our engineering costs and those expenses related to the development of the Property. If we are not able to secure additional funding in the short term, we will stop further development of the Property. Our officers may defer their salaries. General and administrative expenses will be significantly reduced. We will continue to incur legal and accounting fees associated with the filing of this Registration Statement but believe that these expenses will be significantly reduced on a going forward basis. If all officer salaries are deferred and we stop further development on the Property, we believe that we will be able to reduce our monthly overhead to $7,500 per month consisting primarily of professional fees, office lease obligations, out-of-pocket expenses and costs related to maintaining the Property and equipment in its current condition.

Based on our current working capital surplus, our planned operations and assuming the proceeds from this offering, we believe that we will have sufficient working capital to continue our operations for no less than twelve months.

If we do not sell all of the securities being offered, we will significantly curtail operations the extent of which will be dependent on the amount of securities sold in this offering.

We are an emerging growth company

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during its last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as a company is deemed an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

|

|

·

|

a requirement to have only two years of audited financial statements and only two years of related Management's Discussion and Analysis included in an initial public offering registration statement;

|

|

|

·

|

an exemption to provide less than five years of selected financial data in an initial public offering registration statement;

|

|

|

·

|

an exemption from the auditor attestation requirement in the assessment of the emerging growth company's internal controls over financial reporting;

|

|

|

·

|

an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies;

|

|

|

·

|

an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and

|

|

|

·

|

reduced disclosure about the emerging growth company's executive compensation arrangements.

|

As an emerging growth company the company is also exempt from Section 404(b) of Sarbanes Oxley. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting. Similarly, as a Smaller Reporting Company we are exempt from Section 404(b) of the Sarbanes-Oxley Act and our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until such time as we cease being a Smaller Reporting Company.

3

As an emerging growth company the company is exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

The Company shall continue to be deemed an emerging growth company until the earliest of--

|

|

A.

|

the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

|

|

|

B.

|

the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

|

|

|

C.

|

the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

|

|

|

D.

|

the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information.

THE OFFERING

|

Securities being offered:

|

Up to 12,000,000 shares of our common stock, par value $.001

|

|

Offering price per share:

|

$0.25 per share

|

|

Net proceeds:

|

$2,700,000 (Assumes the sale of all shares of common stock by

broker dealers. No commissions will be paid to our officers or directors who sell any shares of common stock offered pursuant to this prospectus).

|

|

Use of proceeds:

|

We will use the proceeds of this offering to continue with our

exploration program apply for permitting, construct a mill and

commence mining operations on the Property. Specifically, net proceeds

will be used to construct necessary facilities, purchase necessary

equipment, fund the bonding of the affected areas for reclamation and

closure, recruit and hire key operating positions, build a mill to process,

gold silver and base metals for our own operations and third party

mining companies and for general administrative and working capital

needs.

|

|

Number of shares of

common stock authorized

and outstanding:

|

150,000,000 shares of common stock authorized and 76,100,000 shares of common stock issued and outstanding before the offering.

|

|

Risk Factors:

|

See Risk Factors included in this Prospectus for a discussion of factors

that you should carefully consider before deciding to invest in shares

of our common stock.

|

4

SELECTED FINANCIAL INFORMATION

We have derived the following summary of our statements of operations data for the years ended December 31, 2011 and for the three months ended March 31, 2012 (unaudited) our historical results are not necessarily indicative of the results that may be expected in the future. The summary of our financial data set forth below should be read together with our financial statements and the related notes to those statements, as well as our “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in this prospectus

Selected Financial Information

|

BALANCE SHEET DATA:

|

As of March 31, 2012

Unaudited

|

As of December 31, 2011

|

||||||

|

Cash

|

$

|

239,361

|

$

|

556,674

|

||||

|

Prepaid Expenses

|

$

|

12,144

|

$

|

11,911

|

||||

|

Fixed Assets

|

$

|

226,192

|

$

|

198,700

|

||||

|

Mining Assets

|

$

|

15,000

|

$

|

15,000

|

||||

|

TOTAL ASSETS

|

$

|

492,697

|

$

|

782,285

|

||||

|

Current Liabilities

|

$

|

76,117

|

$

|

110,069

|

||||

|

Long Term Liabilities

|

||||||||

|

Promissory Note

|

$

|

501,250

|

$

|

491,650

|

||||

|

TOTAL LIABILITES

|

$

|

577,367

|

601,719

|

|||||

|

Deficit accumulated during Developmental stage

|

$

|

(1,252,834

|

)

|

$

|

(975,921

|

)

|

||

|

STATEMENT OF

OPERATIONS

DATA:

|

For the

Three Months Ended

March 31,

2012(unaudited)

|

For the

Three Months Ended

March 31,

2011(unaudited)

|

June 2, 2006

(Inception) to

March 31,

2012(unaudited)

|

|||||||||

|

Net Revenue:

|

-

|

-

|

-

|

|||||||||

|

Gross Profit:

|

-

|

-

|

-

|

|||||||||

|

Operating Expenses

|

||||||||||||

|

Engineering Costs

|

$

|

135,924

|

-

|

$

|

503,017

|

|||||||

|

Wages and Related Expenses

|

$

|

47,938

|

-

|

$

|

445,326

|

|||||||

|

Total Expenses

|

$

|

276,913

|

$

|

11,073

|

$

|

1,249,735

|

||||||

The foregoing summary information is qualified by and should be read in conjunction with our financial statements and accompanying footnotes, appearing elsewhere in this registration statement.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risk factors described below together with all of the other information contained in this prospectus, including our consolidated financial statements and the notes thereto, before deciding whether to invest in shares of our common stock. Each of these risks could have a material adverse effect on our business, operating results, financial condition and/or growth prospects. As a result, you might lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks described below.

5

We are an exploration stage company and our business plan is unproven. We have generated no revenues from our operations and incurred operating losses since our inception.

We are an exploration stage company, our business plan is unproven, and we cannot assure you that we will ever achieve profitability or, if we achieve profitability, that it will be sustainable. We are subject to all of the risks inherent in a new business. We have not generated any revenues to date. At March 31, 2012 we had current assets in the amount of $251,505 and current liabilities totaling $76,117. Long term liabilities totaled $501,250. We had an accumulated deficit of $(1,252,834) as of March 31, 2012. We have a working capital surplus at March 31, 2012 of $175,388. Unless we secure additional funding, we will be required to limit our operations; specifically, we will reduce or stop further development of the Property, our officers may defer salaries and we will reduce our other operating expenses to the extent possible. We have no commitment for additional funding and will require the proceeds of this offering to begin construction on a mill. If we are not successful in securing funding from the sale of the securities being offered, we will seek private financing sources. There can be no assurance that we will secure private financing, or if available, available on terms acceptable to us.

We have no proven reserves.

The Property does not have known reserves of commercial gold or silver. Our long-term success will be related to the cost and success our exploration and mining programs. Mining for gold and silver and base metals is a highly speculative business, involving a high degree of risk. Few properties which are explored are ultimately developed into producing mines. There is no assurance that our exploration program will result in any discoveries of commercial quantities of gold or silver. There is also no assurance that, even if commercial quantities of gold or silver are discovered, a mine can be brought into commercial production. Production/discovery of gold and silver is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mine is also dependent upon a number of factors, many of which are beyond our control, such as the worldwide economy, the price of gold and silver, government regulations, including regulations relating to royalties, allowable production and environmental protection.

During our operations unexpected events may occur, including labor unrest, changes in government regulations, fires, floods, or earthquakes. It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they may impede our exploration activities, raise costs and otherwise reduce the commercial viability of the Property.

We may not identify proven reserves and our estimates may be inaccurate.

There is no certainty that any expenditures made in our exploration program will result in discoveries of commercially recoverable quantities of gold, silver or any base metal. Most exploration projects do not result in the discovery of commercially extractable deposits of gold or silver and no assurance can be given that any particular level of recovery will in fact be realized or that any identified leasehold interest will ever qualify as a commercially developed. Estimates of mineralization, reserves, deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in estimated reserves, exploration and mining costs may affect the economic viability of any project.

We will be required to locate mineral reserves for our long-term success.

Mines have limited lives based on proven and probable mineral reserves that are depleted in the course of production. To ensure continued viability we must offset depleted reserves by replacing and expanding our mineral reserves, through further exploration at the Property and/or the acquisition of new properties. Even if additional reserves are discovered, the process from exploration to production can take many years, during which the economic feasibility of production may change. Therefore, our ability to maintain or increase annual production of gold and other base or precious metals once mining activities commence, if at all, will be dependent almost entirely on our ability to bring new mines into production.

Mining is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business.

Mining involves various types of risks and hazards, including:

|

•

|

environmental hazards;

|

|

|

•

|

power outages;

|

|

|

•

|

metallurgical and other processing problems;

|

|

|

•

|

unusual or unexpected geological formations;

|

|

|

•

|

flooding, fire, explosions, cave-ins, landslides and rock-bursts;

|

|

|

•

|

inability to obtain suitable or adequate machinery, equipment, or labor;

|

|

|

•

|

metals losses; and

|

|

|

•

|

periodic interruptions due to inclement or hazardous weather conditions.

|

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability.

6

Exploration for economic deposits of gold and silver is speculative.

Our business is very speculative since there is generally no way to recover any of the funds expended on exploration unless the existence of commercially exploitable reserves are established and the Company can exploit those reserves by either commencing mining operations, selling or leasing its interest in the property, or entering into a joint venture with a larger company that can further develop the property. Unless we can establish and exploit reserves before our funds are exhausted, we will have to discontinue operations.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold and other metals and minerals produced from our mineral properties. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

|

•

|

expectations with respect to the rate of inflation;

|

|

|

•

|

the relative strength of the U.S. dollar and certain other currencies;

|

|

|

•

|

interest rates;

|

|

•

|

global or regional political, financial, or economic conditions;

|

|

|

•

|

supply and demand for jewelry and industrial products containing metals; and

|

|

|

•

|

sales by central banks and other holders, speculators and producers of gold and

other metals in response to any of the above factors.

|

A decrease in the market price of gold and other metals could affect the commercial viability of our Montauban Property and our anticipated development and production assumptions. Lower gold prices could also adversely affect our ability to finance future development at the Montauban Property, all of which would have a material adverse effect on our financial condition and results of operations. There can be no assurance that the market price of gold and other metals will remain at current levels or that such prices will improve.

Our estimates of resources are subject to uncertainty.

Estimates of resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques, and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use drilling results to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold or silver that can be economically processed and mined by us.

The mineralization estimates are based on interpretation and assumptions and may yield less mineral production, if any, under actual conditions than is currently estimated.

We have relied on independent geologists to conduct drilling samples on the Property. When making determinations whether to continue any project, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on the Property. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

|

•

|

these estimates will be accurate;

|

|

|

•

|

reserve or other mineralization estimates will be accurate; or

|

|

|

•

|

this mineralization can be mined or processed profitably.

|

7

Any material changes in mineral reserve estimates and grades of mineralization may affect the economic viability of placing a property into production and a property’s return on capital. Because we have not started mining operations at the Property and have not commenced actual production, mineralization estimates may require adjustments or downward revisions based upon further drilling and/or actual production experience.

In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our testing results to date. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale. Declines in market prices for gold and silver may render portions of our mineralization, reserve estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of the Property. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

Our exploration activities at the Montauban Property may not be successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to identify proven reserves and mine the Property and any other properties we may acquire, if any. Exploration activities are highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of our exploration program is determined in part by the following factors:

|

•

|

the identification of potential gold mineralization based on surficial analysis;

|

|

|

•

|

availability of government-granted exploration permits;

|

|

|

•

|

the quality of our management and our geological and technical expertise;

and

|

|

|

•

|

the capital available for exploration.

|

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at the Property. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. We cannot assure you that we will discover mineralized resources in sufficient quantities on the Property to commence commercial development.

We will need the proceeds from this offering to begin mining activities.

We are offering our shares of common stock on a best efforts basis. If we do not sell all of the securities being offered, there is a substantial likelihood that we will not be able to begin mining activities. Should this occur, we may cease operations and you will lose your investment .If all of the shares being offered are subscribed for, we expect that the proceeds from this offering will provide enough capital to acquire equipment, construct a mill and fund the first phase of our mining operation. Thereafter we anticipate that revenues from mining operations will fund later phases of production. However, there can be no assurance that future revenues, if any, will be sufficient to fund future operations.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there is no assurance that our development activities will result in profitable mining operations.

We plan to estimate operating and capital costs for the Property based on information available to us and that we believe to be accurate. However, costs for labor, regulatory compliance, energy, mine and plant equipment and materials needed for mine development and construction may fluctuate significantly. In light of these factors, actual costs related to our proposed mine development and construction may exceed any estimates we may make. We do not have an operating history upon which we can base estimates of future operating costs related to the Property. We intend to rely upon our analysis of the future economic feasibility of the project and any estimates that may be contained therein. Studies derive estimates of cash operating costs based upon, among other things:

|

•

|

anticipated tonnage, grades and metallurgical characteristics of the ore to

be mined and processed;

|

|

|

•

|

anticipated recovery rates of gold and other metals from the ore;

|

|

•

|

cash operating costs of comparable facilities and equipment; and

|

8

|

•

|

anticipated climatic conditions.

|

Capital and operating costs, production and economic returns, and other estimates may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs will not be higher than anticipated or disclosed.

In addition, any calculations of cash costs and cash cost per ounce may differ from similarly titled measures of other companies and are not intended to be an indicator of projected operating profit.

There can be no assurance that we will be successful in establishing mining operations or profitably exploiting mineral deposits.

Our goal is to commence mining operations on the Property. Commencement of any mining activities will be subject to construction of a processing mill, roads, and other related work and infrastructure. As a result, we are subject to all of the risks associated with establishing new mining operations and business enterprises including:

|

•

|

the timing and cost, which can be considerable, of the construction of mining

and processing facilities;

|

|

|

•

|

the ability to find sufficient gold reserves to support a mining operation;

|

|

|

•

|

the availability and costs of skilled labor and mining equipment;

|

|

|

•

|

the availability and cost of appropriate smelting and/or refining arrangements;

|

|

|

•

|

compliance with environmental and other governmental approval and permit

requirements;

|

|

|

•

|

the availability of funds to finance construction and development activities;

|

|

|

•

|

potential opposition from non-governmental organizations, environmental

groups, local groups or local inhabitants which may delay or prevent development

activities; and

|

|

|

•

|

potential increases in construction and operating costs due to changes in the cost

of fuel, power, materials, supplies, and other costs.

|

It is common in new mining operations to experience unexpected problems and delays during construction, development and mine start-up; delays in the commencement of mineral production often occur. Accordingly, we cannot assure you that our activities will result in profitable mining operations or that we will successfully establish mining operations or profitably extract gold or silver at the Property.

Historical production at the Property may not be indicative of the potential for future development.

We currently have no commercial production at the Property and have never recorded any revenues from gold or silver production. You should not rely on the fact that there were historical mining operations at the Property as an indication that we will ever have future successful commercial operations at the Property. We expect to continue to incur losses unless and until such time, if ever, as the Property enters into commercial production and generates sufficient revenues to fund our continuing operations. The development of new mining operations requires the commitment of substantial resources for operating expenses and capital expenditures, which may increase in subsequent years as needed consultants, personnel and equipment associated with advancing exploration, development and commercial production are added. The amount and timing of expenditures will depend on the progress of ongoing exploration and development, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners and other factors, many of which are beyond our control.

We have no history as a company engaged in the mining business.

We have no history of earnings or cash flow from mining activities. If we identify proven reserves and are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in the prices of gold and silver, the cost of construction and operating a mining operation, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration as well as the costs of protection of the environment.

9

We face many operating hazards.

The development and operation of a mining property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages.

A shortage of critical equipment, supplies and resources could adversely affect our operations.

We are dependent on equipment, supplies and resources to carry out our mining operations, including input commodities, drilling equipment and skilled labor. A shortage in the market for any of these factors could cause unanticipated cost increases and delays in delivery times, which could in turn adversely impact production schedules and costs.

Operations at the Property will require a significant amount of water. Successful mining and processing will require careful control of project water usage and efficient reclamation of project solutions in the process.

Current global financial conditions have made access to financing more difficult.

Since the fall of 2008 there has been severe deterioration in global credit and equity markets. This has resulted in the need for government intervention in major banks, financial institutions and insurers, and has also led to greater volatility, increased credit losses and tighter credit conditions. These unprecedented disruptions in the credit and financial markets have had a significant adverse impact on a number of financial institutions and have limited access to capital and credit for many companies. These disruptions could, among other things, make it more difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations.

We do not insure against all risks to which we may be subject in our planned operations.

We currently do not maintain insurance to insure against general commercial liability claims and losses of equipment. Any insurance that we secure will in all likelihood not cover all of the potential risks associated with a mining company’s operations, and we may be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not be available or may not be adequate to cover any resulting liability. Moreover, we expect that insurance against certain hazards as a result of exploration and production may be prohibitively expensive to obtain for a company of our size and financial means.

We might also become subject to liability for pollution or other hazards which may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to us or to other companies within the mining industry.

Losses from events that are not covered by our insurance policies may cause us to incur significant costs that could negatively affect our financial condition and ability to fund our activities on the Property. A significant loss could force us to terminate our operations.

Drilling operations are hazardous, raise environmental concerns and raise insurance risks.

We intend to conduct our business in a way that safeguards public health and the environment and in compliance with applicable laws and regulations. Environmental hazards may exist on properties in which we hold an interest which are unknown to us and may have been caused by prior owners. Changes to drilling and mining laws and regulations could require additional capital expenditures and increase operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain operations uneconomic.

Local infrastructure may impact our exploration activities and results of operations.

Our activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges and power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage or government or other interference in the maintenance of such infrastructure could adversely affect our activities.

Our officers have no experience in managing a public company.

Our officers and directors do not have experience in managing a public company. We do not have any employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our operations, we may identify other deficiencies that we may not be able to remedy in time to satisfy the requirements imposed by the Sarbanes-Oxley Act for compliance with that Section 404. If we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information.

10

We are subject to significant governmental regulations.

The Property is located in Quebec, Canada and is subject to extensive federal, provincial, and local laws and regulations governing various matters, including:

|

•

|

environmental protection;

|

|

|

•

|

management and use of toxic substances and explosives;

|

|

|

•

|

management of natural resources;

|

|

|

•

|

exploration, development of mines, production and post-closure reclamation;

|

|

|

•

|

labor standards and occupational health and safety, including mine safety

|

|

|

•

|

labor standards and occupational health and safety, including mine safety; and

|

|

|

•

|

historic and cultural preservation.

|

Noncompliance may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in us incurring significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations will be more stringent which could cause additional expense, capital expenditures, restrictions on our operations and delays in the development of the Property.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All of our exploration and potential development and production activities are in the province of Quebec, Canada and are subject to regulation by governmental agencies under various environmental laws. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations.

Additionally, our operations will result in emissions of greenhouse gases, which may be subject to increased regulation in the future. In general, environmental legislation is evolving and the trend has been towards stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations requires significant capital outlays, and future changes in these laws and regulations may cause material changes or delays in our financial position, operations and future activities. More stringent regulation may cause us to re-evaluate our activities.

Land reclamation requirements for the Property may be burdensome.

Land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

|

•

|

control dispersion of potentially deleterious effluents; and

|

|

|

•

|

reasonably re-establish pre-disturbance land forms and vegetation.

|

In order to carry out reclamation obligations we will have to allocate a portion of our financial resources that might otherwise be spent on further exploration and development programs. Unanticipated reclamation work will adversely impact our operations.

We are required to obtain government permits and approvals.

Permits and approvals from various government agencies will be required. We do not have the requisite permitting at this time. We believe that we will be able to obtain required permitting. However, there can be no assurance that delays will not occur to obtain these permits. Moreover, any permits that we secure may be revoked if we cannot comply with applicable regulations.

11

We may experience difficulty attracting and retaining qualified management.

We are dependent on the services of key executives including James Chandik, Claude Girard and Jeffrey Bercovitch. We will have to hire other highly skilled and experienced consultants. Due to our relatively small size, the loss of these persons or our inability to attract and retain highly skilled employees may have a material adverse effect on our business or future operations. We do not maintain key-man life insurance on any of our officers or directors.

We compete with larger, better capitalized competitors in the mining industry.

The mining industry is intensely competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Larger companies with significant resources have an advantage over us. Competition for resources at all levels is very intense, particularly affecting the availability of manpower, drill rigs, mining equipment and production equipment. As a result, we may be unable to maintain or acquire financing, personnel or technical resources.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Since our operations are in Canada, resource estimates disseminated outside the United States are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements,. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred resources, which are generally not permitted in filings with the SEC. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically.

Our directors and officers may have conflicts of interest as a result of their relationships with other companies.

Our directors and officers may serve as officers or directors for other companies engaged in natural resource exploration and development. The directors and officers owe us a fiduciary obligation. We have not yet established a policy to deal with potential conflicts of interest.

Legislation, including the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.

We may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of rules and regulations which govern publicly-held companies. The Sarbanes-Oxley Act has resulted in a series of rules and regulations that increase responsibilities and liabilities of directors and executive officers. We are a small company with a limited operating history and no revenues. This may influence the decisions of potential candidates we may recruit as directors or officers. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles.

Risks Related To Our Securities

As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements .

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

|

- have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

- comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

- submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and

|

|

|

- disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation.

|

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

12

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Our financial statements may not be comparable to those of companies that comply with new or revised accounting standards.

We have elected to take advantage of the benefits of the extended transition period that Section 107 of the JOBS Act provides an emerging growth company, as provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

Our status as an “emerging growth company” under the JOBS Act OF 2012 may make it more difficult to raise capital when we need to do it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

We will incur increased costs and demands upon management as a result of complying with the laws and regulations that affect public companies, which could materially adversely affect our results of operations, financial condition, business and prospects.

As a public company and particularly after we cease to be an “emerging growth company,” we will incur significant legal, accounting and other expenses that we did not incur as a private company, including costs associated with public company reporting and corporate governance requirements. These requirements include compliance with Section 404 and other provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, as well as rules implemented by the SEC and NASDAQ. In addition, our management team will also have to adapt to the requirements of being a public company. We expect that compliance with these rules and regulations will substantially increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

The increased costs associated with operating as a public company will decrease our net income or increase our net loss, and may require us to reduce costs in other areas of our business or increase the prices of our products or services. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our results of operations, financial condition, business and prospects.

However, for as long as we remain an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

We will not be required to comply with certain provisions of the Sarbanes-Oxley Act for as long as we remain an “emerging growth company.”

We are not currently required to comply with the SEC rules that implement Sections 302 and 404 of the Sarbanes-Oxley Act, and are therefore not required to make a formal assessment of the effectiveness of our internal controls over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with certain of these rules, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. Though we will be required to disclose changes made in our internal control procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an “emerging growth company” as defined in the JOBS Act.

Our independent registered public accounting firm is not required to formally attest to the effectiveness of our internal control over financial reporting until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an “emerging growth company.” At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

13

Reduced disclosure requirements applicable to emerging growth companies may l make our common stock less attractive to investors.

As an “emerging growth company” , we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In the event that your investment in our shares is for the purpose of deriving dividend income or in expectation of an increase in market price of our shares from the declaration and payment of dividends, your investment will be compromised because we do not intend to pay dividends.

We have never paid a dividend to our shareholders. We intend to retain cash for the continued development of our business. As a result, your return on investment will be solely determined by your ability to sell your shares in a secondary market.

The market valuation of our business may fluctuate due to factors beyond our control and the value of your investment may fluctuate correspondingly.

The market valuation of developmental stage companies, such as us, frequently fluctuate due to factors unrelated to the past or present operating performance of such companies. Our market valuation may fluctuate significantly in response to a number of factors, many of which are beyond our control, including:

|

· changes in securities analysts’ estimates of our financial performance, although there are

currently no analysts covering our stock;

|

|

· fluctuations in stock market prices and volumes, particularly among securities of emerging

growth companies;

|

|

· changes in market valuations of similar companies;

|

|

· announcements by us or our competitors of significant contracts, new technologies,

acquisitions, commercial relationships, joint ventures or capital commitments;

|

|

· variations in our quarterly operating results;

|

|

· fluctuations in related commodities prices; and

|

|

· additions or departures of key personnel.

|

Purchasers of our common stock will experience immediate and substantial book value dilution.

The price of the Shares offered hereunder is substantially higher than the net tangible book value of each outstanding share of stock. Investors who purchase Shares in this Offering will suffer immediate and substantial dilution.

The Company is selling the shares of common stock offered in this prospectus without an underwriter and may not be able to sell any of the shares offered herein.

The common stock is being offered by our officers and directors. No broker-dealer has been retained as an underwriter and no broker-dealer is under any obligation to purchase any common shares. There are no firm commitments to purchase any of the shares in this offering. Consequently, there is no guarantee that the Company s capable of selling all, or any, of the common shares offered hereby.

Currently there is no established public market for our common stock, and there can be no assurances that any established public market will ever develop or that our common stock will be quoted for trading.

There is currently no established public market whatsoever for our securities. A market maker will be asked to file an application with FINRA on our behalf so as to be able to quote the shares of our common stock on the OTCBB maintained by FINRA. There can be no assurance that the market maker’s application will be accepted by FINRA nor can we estimate as to the time period that the application will require. We are not permitted to file such application on our own behalf. If the application is accepted, there can be no assurances as to whether

14

|

(i) any market for our shares will develop;

|

|

(ii) the prices at which our common stock will trade; or

|

|

(iii) the extent to which investor interest in us will lead to the development of an active, liquid trading

market. Active trading markets generally result in lower price volatility and more efficient execution of buy

and sell orders for investors.

|

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of exploratory stage mining companies and general economic and market conditions.

Because of the anticipated low price of the securities being registered, many brokerage firms may not be willing to effect transactions in these securities. Purchasers of our securities should be aware that any market that develops in our stock will be subject to the penny stock restrictions.

Because the SEC imposes additional sales practice requirements on brokers who deal in penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty reselling your shares.

Our common stock is classified as a penny stock and will be covered by Section 15(g) of the Securities Exchange Act of 1934. These rules impose additional sales practice requirements on brokers/dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement prior to making a sale for you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the price of the shares to decline.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

FINRA has adopted rules that require s broker-dealer to have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker-dealers may be willing to make a market in our common stock, which may limit your ability to buy and sell our stock.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements”. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of our management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

|

•

|

the timing and possible outcome of pending regulatory and permitting matters;

|

|

|

•

|

the timing and outcome of our possible feasibility study;