Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ryman Hospitality Properties, Inc. | d370536d8k.htm |

Gaylord Entertainment Company

Investor Presentation

June 2012

Exhibit 99.1 |

Gaylord Entertainment Co.

FORWARD LOOKING

STATEMENTS AND IMPORTANT DISCLOSURES

This slide presentation contains “forward-looking statements”

concerning the Gaylord Entertainment

Company’s (the “Company”) goals, beliefs, expectations, strategies,

objectives, plans, future operating results and underlying assumptions, and

other statements that are not necessarily based on historical facts. Important

factors that could cause actual results to differ materially from those in the forward-

looking statements include, among other things, the following risks and uncertainties:

risks and uncertainties associated with economic conditions affecting the

hospitality business generally; the failure

to

receive,

on

a

timely

basis

or

otherwise,

the

required

approvals

by

the

Company’s

stockholders or the private letter ruling from the IRS; the Company’s expectation

to elect and qualify for REIT status and the timing and effect of that election;

the Company’s ability to remain qualified as a REIT; the form, timing and

amount of the special earnings and profits distribution; the Company’s and

Marriott ’s ability to consummate the sale; operating costs and business

disruption may be greater than expected; and the Company’s ability to

realize cost savings and revenue enhancements from the proposed REIT conversion.

Other factors that could cause operating and financial results to differ are

described in the filings made from time to time by the Company with the Securities and

Exchange Commission (the “SEC”). The Company does not undertake any

obligation to release publicly any revisions

to

forward-looking

statements

made

by

it

to

reflect

events

or

circumstances

occurring

after

the date hereof or the occurrence of unanticipated events.

2 |

Gaylord Entertainment Co.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The Company expects to restructure its operations in connection with the proposed REIT

conversion and as part of this restructuring it intends to file with the SEC a

proxy statement/prospectus and other documents regarding the proposed REIT

conversion. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS

REGARDING THE PROPOSED REIT CONVERSION AND ANY OTHER RELEVANT DOCUMENTS

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT

INFORMATION

ABOUT

THE

PROPOSED REIT CONVERSION. The final proxy statement/prospectus will be mailed to the

Company’s stockholders. You may obtain copies of all documents filed with

the SEC concerning the proposed transaction, free of charge, at the SEC’s

website at www.sec.gov. In addition, stockholders may obtain free copies of the

documents filed with the SEC by the Company by going to the Company’s

Investor Relations website page at www.gaylordentertainment.com or by sending a written

request

to

the

Company’s

Secretary

at

Gaylord

Entertainment

Company, One Gaylord Drive, Nashville,

Tennessee 37214, or by calling the Secretary at (615) 316-6000.

3 |

Gaylord Entertainment Co.

INTERESTS OF PARTICIPANTS

The Company and its directors and executive officers may be deemed to be participants

in the solicitation of proxies from the stockholders of the Company in

connection with the proposed REIT conversion. Information regarding the

Company’s directors and executive officers is set forth in the

Company’s proxy statement for its 2012 annual meeting of stockholders and its

Annual Report on Form 10-K for the fiscal year ended December 31, 2011,

which were filed with the SEC on April 3, 2012

and

February

24,

2012,

respectively.

Additional

information

regarding

persons

who

may

be

deemed to be participants in the solicitation of proxies in respect of the proposed

REIT conversion will be contained in the proxy statement/prospectus to be filed

by the Company with the SEC when it becomes available.

4 |

Gaylord Entertainment Co.

SITUATION OVERVIEW

5

Gaylord

Entertainment

(“Gaylord”

or

the

“Company”)

is

a

hospitality

lodging

company

with

a

unique

focus

on

the

large

group

meetings/convention

sector

On May 31, Gaylord announced its plans to sell the management company and brand for its

hotel business for $210 million to Marriott International ("Marriott")

and subsequently reorganize as a REIT

Gaylord will be the only publicly traded REIT focused on group-oriented destination

hotel assets located in urban and resort markets

Conversion to a tax-efficient REIT structure will allow Gaylord to more effectively

allocate capital and grow its asset base

Working with Marriott, a world-class lodging operator, will deliver significant

revenue and cost synergies through new customer flows and economies of scale, an

expansive frequent traveler program and a leading capability in managing group

business |

Gaylord Entertainment Co.

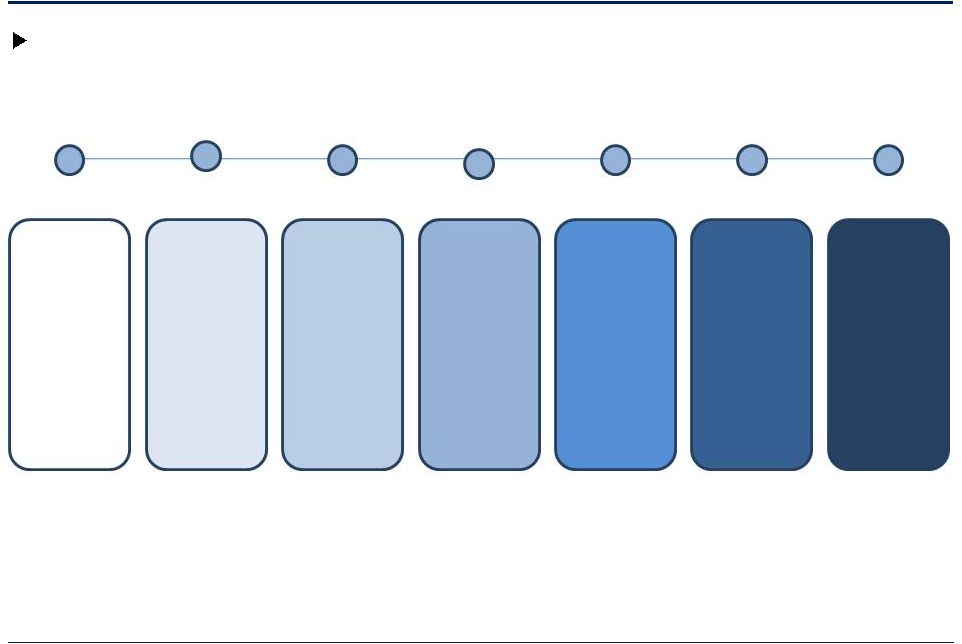

REIT CONVERSION TIMELINE

6

Gaylord intends to declare REIT status effective January 1, 2013

May 31

Announcement

of sale of

management

contracts to

Marriott

International

June

File proxy

statement /

prospectus

with the SEC

August

Shareholder

vote to

approve

transaction

October

Marriott to

commence

management

of hotel assets

November

Ex-dividend

date for

earnings and

profits purge

January

Conversion

from C-

corporation to

REIT

November

2011

Board

initiated

review of

strategic

alternatives

Gaylord Entertainment Co. |

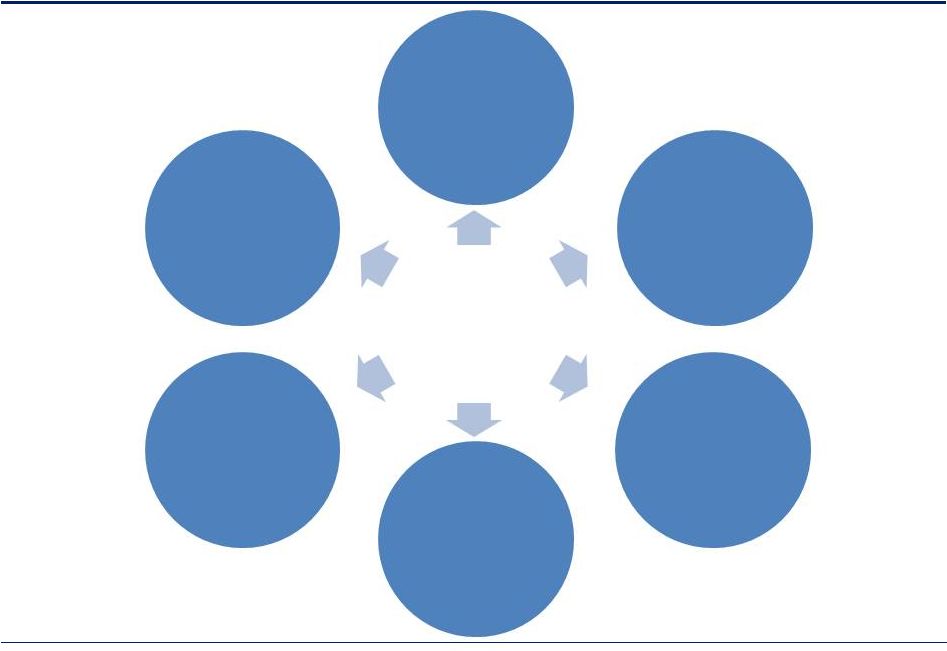

INVESTMENT HIGHLIGHTS High quality

purpose-built

assets

Unique business

model

Improving lodging

fundamentals

Solid organic and

external growth

strategy

Flexible capital

structure

Significant

synergies from

partnership with

Marriott

New Co REIT

7

Gaylord Entertainment Co. |

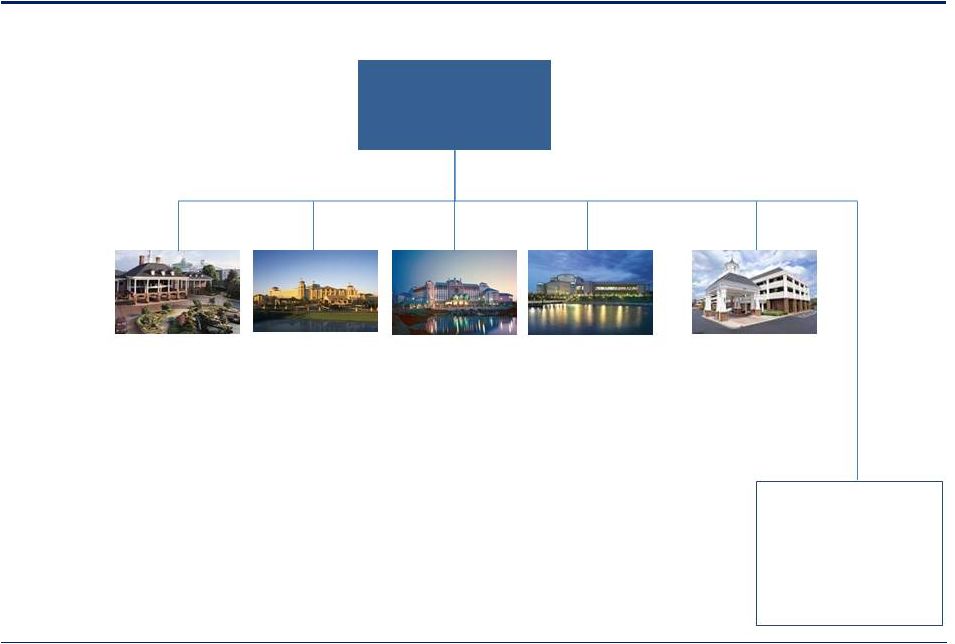

Gaylord Entertainment Co.

Taxable REIT subsidiary

Ryman Auditorium

Grand Ole Opry

General Jackson

Wildhorse Saloon

Gaylord Springs Golf Course

8

RADISSON

NASHVILLE

Gaylord Entertainment Co.

303 rooms

(to

be

managed

by

independent-3

Party Operator)

Gaylord

a Delaware REIT

G A Y L O R D

O P R Y L A N D

G A Y L O R D

P A L M S

G A Y L O R D

T E X A N

G A Y L O R D

N A T I O N A L

Year Completed

1977

2002

2004

2008

Location

Nashville, TN

Kissimmee, FL

Dallas, TX

Washington, D.C.

Rooms

2,882

1,406

1,511

1,996

Meeting Space

640,000 sq ft

400,000 sq ft

400,000 sq ft

470,000 sq ft

Atriums

9 acres

4 acres

4 acres

2 acres

F&B Outlets

17

9

11

10

Retail Outlets

25

9

7

5

rd

OVERVIEW OF

CURRENT

ASSETS |

Gaylord Entertainment Co.

9

Gaylord Entertainment Co.

EXTENSIVE

MEETING

SPACE

AND

ELEGANTT

BANQUETING

OFFERINGS |

Gaylord Entertainment Co.

TASTEFULLY DECORATED

ROOMS PROVIDE WARMTH AND COMFORT

10 |

Gaylord Entertainment Co.

ENTERTAINING ENVIRONMENTS FOR MEETING AND NETWORKING 11

|

Gaylord Entertainment Co.

BEST-IN-CLASS

LODGING REIT 12

Total RevPAR

2

Second

highest

Total

RevPAR

in

the

sector,

reflecting

ability

to

capture a

greater share of guest spending

$305

ADR

4

ADR is reflective of high quality assets and will further benefit from the addition

of Marriott as an operator

$167

EBITDA /

Available Rooms

3

Highest EBITDA/available room relative to other lodging REITs

$25,374

Debt /

EBITDA

5

Well capitalized with a strong balance sheet and lower leverage than the

majority of lodging REITs

4.5x

Interest

Coverage

6

Among the strongest interest coverage relative to other lodging REITs

6.0x

Rooms

Considerable number of rooms places the Company in the middle one-third of

the

comparable

set

as

measured

by

total

number

of

guest

rooms

1

8,098

Note: Lodging REITs include HST, HPT, AHT, RLJ, FCH, SHO, DRH, LHO, HT, INN, BEE, PEB,

CHSP and CLDT.

Room count includes pro rata share of consolidated and unconsolidated rooms. Based on 2011

total revenue and 2011 estimated available rooms derived from Company reported RevPAR.

Based on 2011 estimated available rooms derived from Company reported RevPAR and 2011

EBITDA. For

full year period ending 2011.

Based on debt as of Q1 2012 and 2012E EBITDA. Gaylord 2012E EBITDA per high end of

consolidated EBITDA guidance and excludes one-time transactions costs and

synergies.

Based on LTM EBITDA and LTM net cash interest expense as of Q1 2012. Sources: Company

projections, Company filings, Wall Street Research and Capital IQ

1

2

3

4

5

6 |

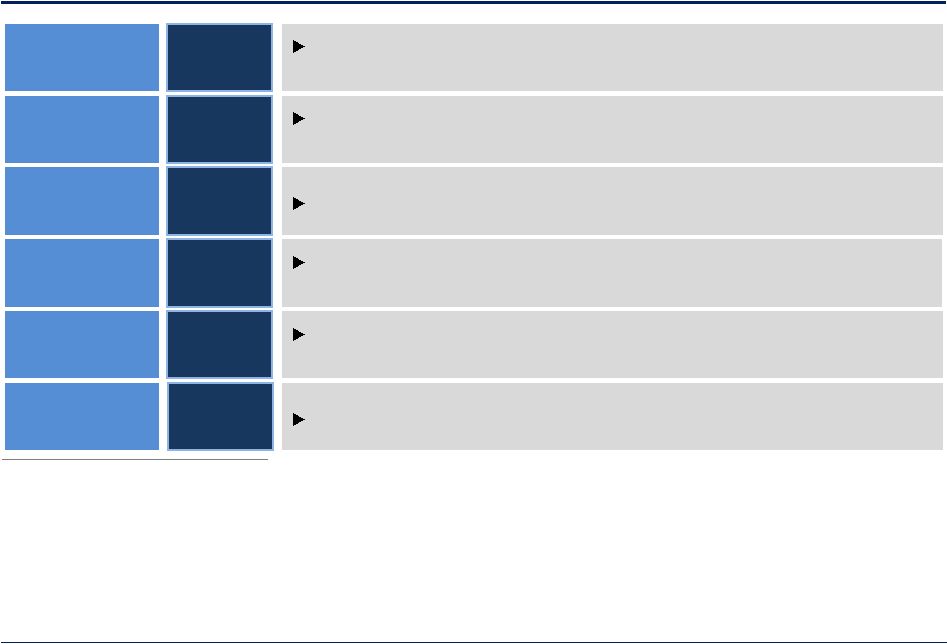

Gaylord Entertainment Co.

Gaylord's track record as an owner and operator of group-focused convention hotels

will provide the REIT with unique asset management capabilities

13

Deep insights and knowledge

of meeting planner

preferences

Understanding of preferred

group destinations based on

extensive research and

experience

Strengths and weaknesses

of operators at specific

markets and properties

Superior ability to underwrite

asset performance and

allocate capital

THE GAYLORD

ADVANTAGE |

Gaylord Entertainment Co.

14

Significant brand and

marketing scale

Preferred operator by

meeting planners

Marriott Rewards

program

Ability to drive visitation

Dominant large group distribution with 66 convention hotels managed worldwide

Network hotels command 112% RevPAR index premium over competitive set

#1

ranked

preferred

brand

for

booking

large

meetings

requiring

200

–

2,000

rooms

#1 ranked operator for satisfying all large meeting needs

38 million members worldwide

11.2 million members reside within 300 miles of a Gaylord hotel

2,960 sales associates across eight U.S. markets

Sources: Marriott International presentation, Company projections, and Company

research Significant recurring cost

savings

$19-$24 million gross property level cost and procurement reductions anticipated

annually (net of management fees)

WHY MARRIOTT? |

Gaylord Entertainment Co.

15

Unique revenue mix and

visibility

1

Assets custom built to serve meeting planners, resulting in a unique customer mix

that provides unmatched visibility and protection

78% group and 22% transient customers

Average group booking window of over 2 ½

years

Significant non-room

revenue

2

"All under one roof”

offerings capture a greater share of meeting attendee spending

Approximately

60%

of

our

revenue

reflects

“outside

the

room”

spend

Contractual model

Contractual model and group focus worked as designed and delivered high margin

revenue that partially offset declines in RevPAR during the recession

Attrition and cancellation fee collections peaked in 2009 and have steadily

decreased as the market continues to recover

1

Group business mix data represents occupied rooms for Gaylord Hotels based on full year

2011; booking window per historical averages. 2

Revenue profile numbers are based on full year 2011 for all hotels (includes Opryland,

Palms, Texan, National and Radisson). Source: Company research, Company

presentation Approximately 70% of outside the room spend is related to food and

beverage offerings

UNIQUE BUSINESS

MODEL The addition of

Marriott will further improve the quality of the group business mix |

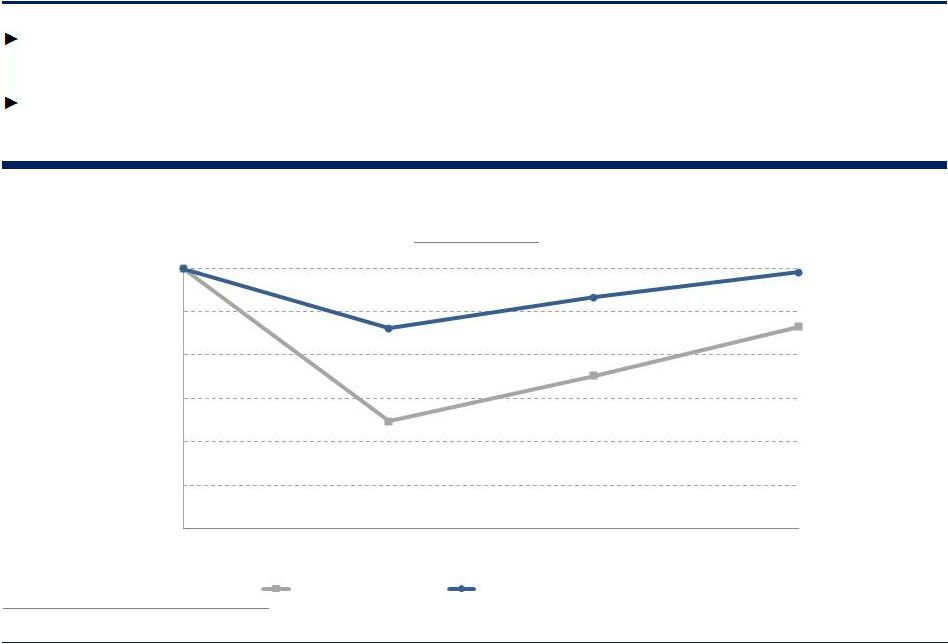

Gaylord Entertainment Co.

Contractual nature of advance group bookings provides a measure of top-line

protection during periods of economic volatility –

as a result, Gaylord’s group-focused model outperformed during the

downturn Additional upside exists beyond prior peak as Gaylord National continues

to ramp up and as a result of recent investments in leisure offerings

16

Note: Adjusted Gaylord Hotels includes Palms, Texan, National and Radisson. Upper

Upscale segment numbers per Smith Travel Research. Relative RevPAR

Performance Base Year = 2008

82.4

87.6

93.3

93.1

96.8

99.6

70

75

80

85

90

95

100

2008

2009

2010

2011

Upper Upscale

Adjusted Gaylord Hotels

UNIQUE

MODEL

OUTPERFORMED

DURING

THE

RECESSION |

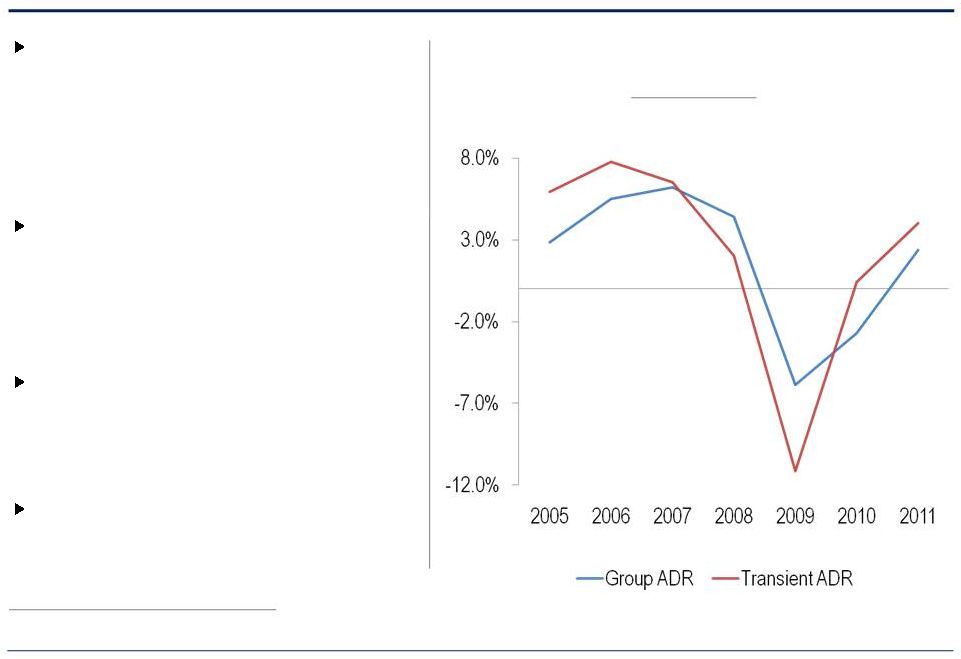

GROUP SEGMENT IS POSITIONED FOR RECOVERY

Lodging fundamentals suffered more

severe declines during the downturn vs.

other sectors

–

Expected to recover at a stronger rate

over the next few years

Group ADR has lagged the transient

ADR recovery and presents a greater

opportunity for upside at this point in the

cycle

Occupancy is expected to return to peak

2007 levels in 2012 giving operators

pricing power to drive rate growth

Rate growth is expected to drive strong

RevPAR gains until supply growth

accelerates in 2015

17

Group ADR vs. Transient ADR

(Year-Over-Year Growth)

Source: Smith Travel Research; reflects Upper Upscale segment across all U.S.

markets Gaylord Entertainment Co. |

Gaylord Entertainment Co.

Pursue “low-hanging-fruit”

growth opportunities which include expansion opportunities at existing assets

Recent capital investments present a high-return, compelling opportunity for

organic growth Marriott

synergies

provide

an

opportunity

to

further

enhance

the

returns

on

these

investments

The

pipeline

of

potential

investment

opportunities

is

robust

and

attractive

SIGNIFICANT

ORGANIC GROWTH OPPORTUNITIES

18

~$25 million

Investment at Gaylord Palms

for a Sports Bar & 2 Pools

$13 million

Resort pool at Gaylord Texan

Recent Investments

Robust Pipeline

Texan room expansion

Opryland room expansion

Palms room expansion

Dollywood joint venture

(adjacent to Opryland)

Resort pool at National |

Gaylord Entertainment Co.

VALUE

ENHANCING ACQUISITIONS

We intend to broaden the geographic diversity of our portfolio through

acquisitions Acquisition opportunities will be pursued only if our cost of

capital is competitive and accretive to shareholders

–

The REIT will seek to purchase below replacement cost and apply its group expertise in

yielding attractive returns on group-oriented, resort assets

The following parameters will be used to target acquisition opportunities:

–

Group-oriented

large

hotels

and

“overflow”

hotels

with

existing

or

potential

leisure

appeal

•

Upper-Upscale assets with over 400 hotel rooms in top group destination

markets •

Highly accessible assets located in urban and resort markets

•

Possess or are located near convention centers

–

Present a repositioning opportunity and/or would significantly benefit from capital

investment in additional rooms or meeting space

Existing property brand flag will no longer be a constraint to acquisitive growth

19 |

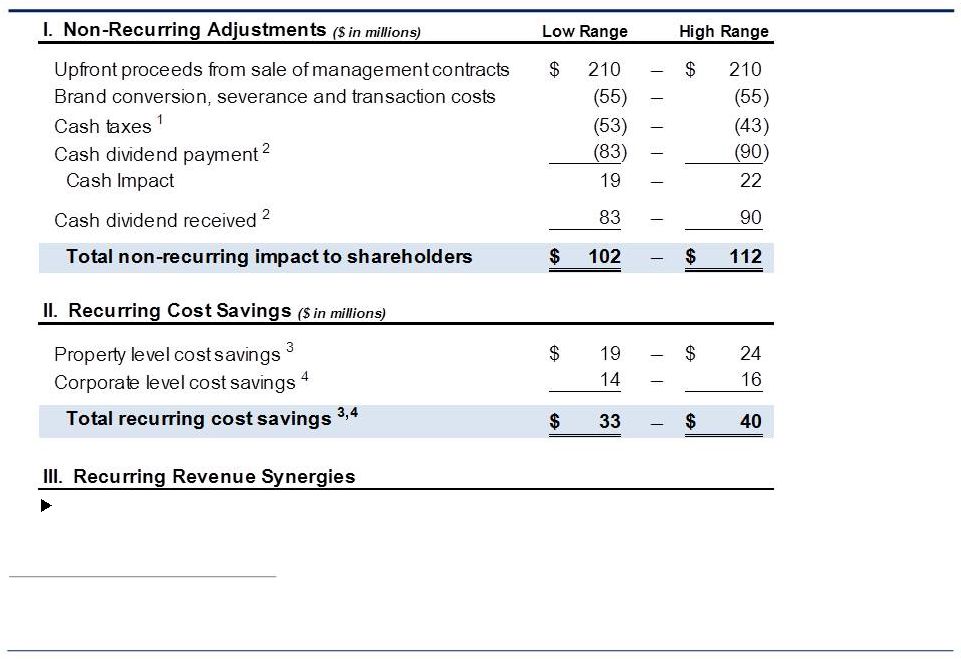

ESTIMATED REIT VALUE

CREATION – THREE COMPONENTS

20

In addition to the cost savings highlighted above, Gaylord expects revenue synergies

from a combination of: o

Marriott’s strong relationships with meeting planners and group customers

o

Access to Marriott Rewards program members

Gaylord Entertainment Co.

1

Represents taxes associated with up-front payment net of the Company’s

remaining Net Operating Losses (NOLs). 2

Based

on

estimated

earnings

and

profits

purge

$415

-

$450

million

resulting

from

REIT

conversion,

with

20%

being

funded

with

cash

and

80%

funded

with

stock.

3

Property level cost savings include estimated cost and procurement synergies; savings

shown are net of management fees. 4

Corporate savings shown are net of management fees. |

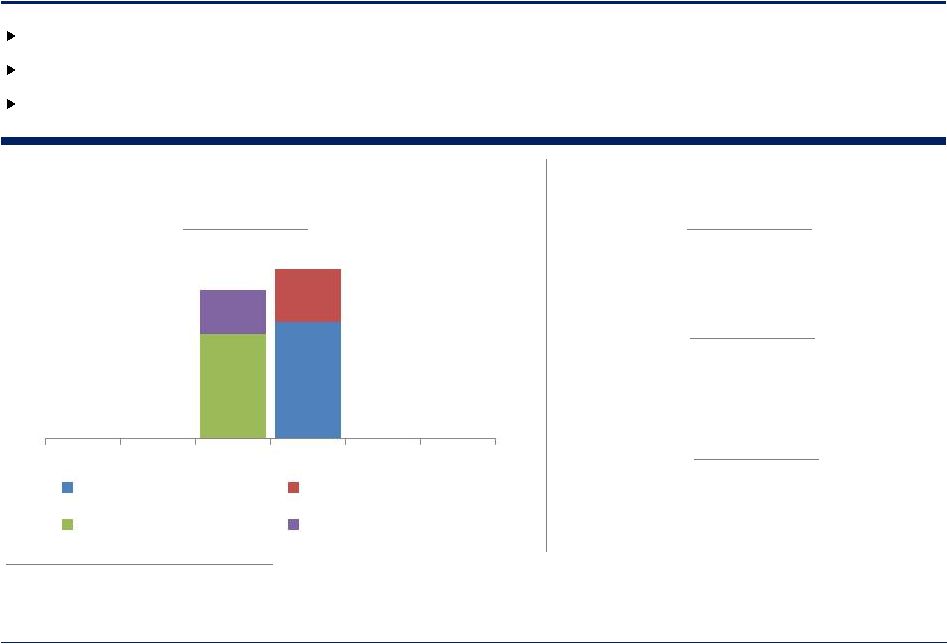

BALANCE SHEET AND LIQUIDITY

Company has no maturities until the third quarter of 2014 and has ample liquidity

Gaylord

has

less

leverage

than

the

majority

of

lodging

REITs

(4.5x

vs.

lodging

REIT

average

5.4x)

Gaylord

will

have

adequate

interest

coverage

relative

to

other

lodging

REITs

(6.0x

vs.

lodging

REIT

average

3.4x)

21

B3/B+

Corporate Family Rating

Caa2/B

Senior Unsecured Rating

$340 million

Revolver capacity

Debt Maturity Schedule

US$ in millions

1

Based on debt as of Q1 2012 and 2012E EBITDA per high end of Gaylord Entertainment

consolidated EBITDA guidance. 2

Based on LTM EBITDA and LTM net cash interest expense as of Q1 2012.

3

Subject

to

compliance

with

terms

of

Notes

indentures

for

6.75%

Unsecured

Notes.

4

Source:

Company

filings

As of

March 31, 2012

1

2

Gaylord Entertainment Co.

3

$400.0

$185.0

$360.0

$152.2

2012

2013

2014

2015

2016

2017

Term Loan (L+225)

Revolver (L+225)

3.75% Convertible Notes

6.75% Unsecured Notes |

Gaylord Entertainment Co.

REIT – DIVIDEND POLICY

22

On January 1, 2013, Gaylord Entertainment will declare its status as a Real Estate

Investment Trust

–

As

required

by

the

IRS,

the

REIT

will

distribute

at

least

90%

of

its

taxable

income

to

shareholders

through

an

annual

dividend

–

Distributions

greater

than

90%

of

taxable

income

will

be

at

the

discretion

of

the

REIT’s

Board

of

Directors

and

will

be

based

on

the

level

of

cash

flow

generated

and

the

liquidity

needs

of

the

business |

INVESTMENT HIGHLIGHTS

23

New Co REIT

Flexible capital

structure

High quality

purpose-built

assets

Significant

synergies from

partnership with

Marriott

Improving lodging

fundamentals

Solid organic and

external growth

strategy

Gaylord Entertainment Co.

Unique business

model |

RECONCILIATION OF NON-GAAP FINANCIAL METRICS |

Gaylord Entertainment Co.

25

Reconciliation of Non-GAAP Financial Metrics

RECONCILIATION OF NON-GAAP

FINANCIAL METRICS

Source:

Company

filings

$ in thousands

Full Year

TTM

Gaylord Entertainment Company

2011

as of 3/31/12

Net income (loss)

$10,177

$18,162

(Income) loss from discontinued operations, net of taxes

(109)

(126)

Provision (benefit) for income taxes

7,420

12,856

Other (gains) and losses, net

916

725

Income from unconsolidated companies

(1,086)

(913)

Interest expense, net

62,213

55,785

Operating income (loss)

$79,531

$86,489

Depreciation & amortization

125,289

128,666

EBITDA

$204,820

$215,155

Full Year

Gaylord Entertainment Company

2012 Guidance

Estimated operating income (loss)

$118,450

Estimated depreciation & amortization

122,400

Estimated EBITDA

$240,850

Note: Full Year 2012 Guidance shown is the high end of the range. |