Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST RELIANCE BANCSHARES INC | v316621_8k.htm |

FORWARD - LOOKING STATEMENTS This presentation contains forward - looking statements within the meaning of the Securities Litigation Reform Act of 1995. Forward - looking statements give our expectations or forecasts of future events. Any or all of our forward - looking statements here or in other publications may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining our actual future results. Consequently, no forward - looking statements can be guaranteed. Our actual results may vary materially, and there are no guarantees about the performance of our stock. We undertake no obligation to correct or update any forward - looking statements, whether as a result of new information, future results or otherwise. You are advised, however, to consult any future disclosures we make on related subjects in our reports to the SEC.

Unemployment Rate April 2012 Month/Month Year/Year National 8.1% - 0.1 - 0.9 South Carolina 8.8% - 0.1 - 1.6 S.C. Unemployment Rate Improving but still a long way to go!

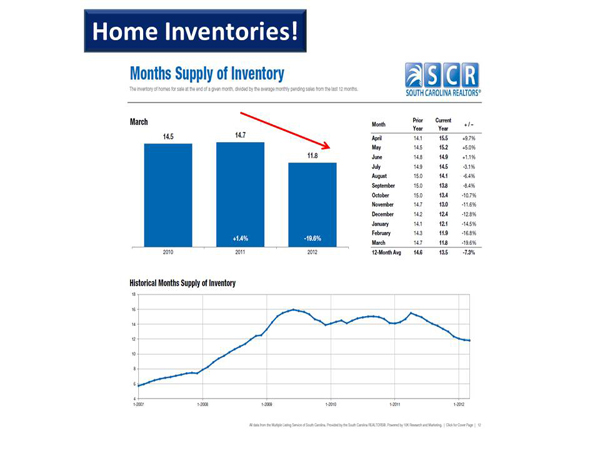

Home Inventories!

RE Values Seem to be Stabilizing U.S down 1% Home Values!

How is Our Industry Performing?

The industry is rebounding… but slowly!

The industry is well capitalized!

SC is still a challenged state

Size does seem to dictate performance

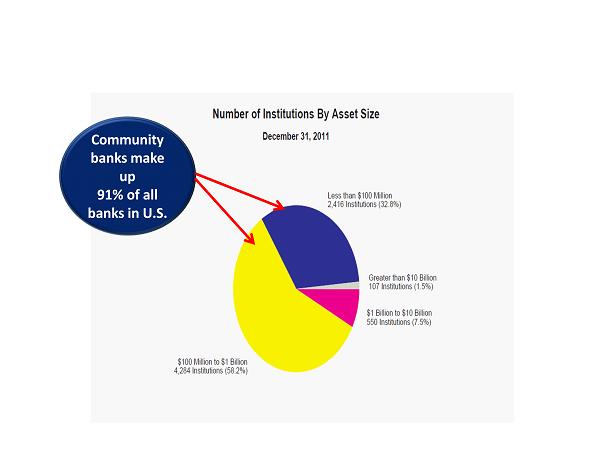

Community banks make up 91% of all banks in U.S.

Bottom Line for Community Banks! Economic Recovery Positive, but Not Robust Industry Recovery Apparent…But??? • Asset quality will continue to be a burden for small banks • Margin pressure and limited streams impacting earnings quality • Cost to operate and regulatory burden increasing…scale necessary • Consumer and small business prefer dependable quality service • Aging CEO’s, tired boards and limited access to capital will accelerate consolidation

Strategic Focus 2012 • Earnings • Risk Mitigation • Operational Capability • Customer Loyalty • Associate Experience

Company Value Franchise Value Capacity to grow earnings stream and Deliver sustained profitability Uniqueness or differentiation in terms of markets, customer segments, management style, service capability, not easily duplicated by competition Financial Value

Classified Assets / Bank Capital

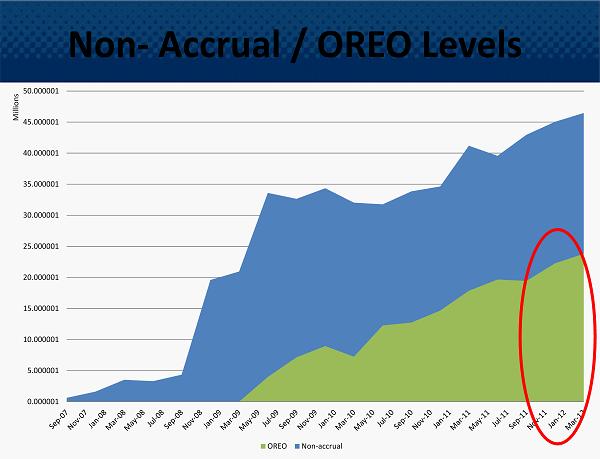

Non - Accrual / OREO Levels 0.000001 5.000001 10.000001 15.000001 20.000001 25.000001 30.000001 35.000001 40.000001 45.000001 50.000001 Millions OREO Non-accrual

Cost of OREO

OREO Sales Price to Basis

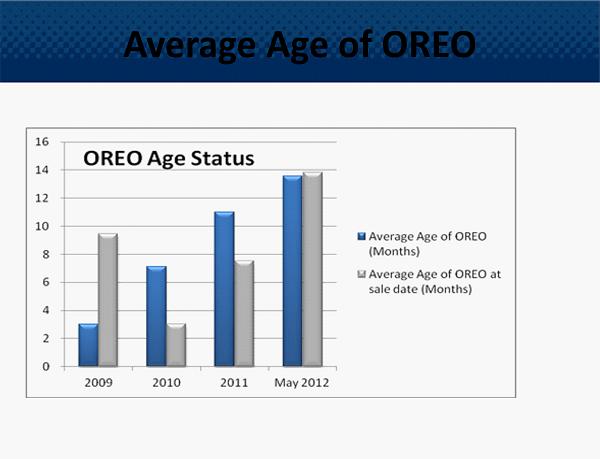

Average Age of OREO

Delinquency Trends 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% $0 $5 $10 $15 $20 $25 $30 $35 $40 Millions Delinquency Trends 30+ 90+ 30 to 89 % (RHS) 90+ % (RHS)

Revenue vs Operating Expenses • Assets Down 32% • Revenue Down 9% (nearly 100% offset by NPL) • Expenses Down 8%

Effective Deposit Pricing Strategies

Deposit Mix & It’s Impact on Cost of Funding COF 0.91% in 50 th pct absent brokered funds

Anticipated Margin Improvement

Current Avg CD Rates .45%

Net Interest Margin Improvement YE 2012 4.00%

$(5,368) $574 $(8,625) $- $6,000 -$11,000 -$9,000 -$7,000 -$5,000 -$3,000 -$1,000 $1,000 $3,000 $5,000 $7,000 2009 2010 2011 2012 Proj 2012 Adj Net Income Net Income Net Income In 000s Absent Problem Assets $4.8MM due to DTA write down - limited impact on capital $3.8MM operating loss due to $5.4MM Provision Exp and $2.7MM in OREO carrying expenses.

Customers stay with us longer Our Business Model Customer Loyalty Drives Growth and Profitability Customers do more business with us Customers refer friends and family Customers allow us to earn a fair profit Purpose “To make the lives of our customers better” Customer Value Promise Middle America Young Adults Small Businesses • Incredible experience • Distinctive programs • Unmatched convenience Vision Largest Most Profitable Bank in South Carolina Customer Loyalty Associate Promise To provide an incredible work experience • Committed and caring leadership • Opportunities to do your best work • Reward and recognition that make your life better

Driven By Purpose Purpose “To make the lives of our customers better” 96% of Our Customer Believe We achieve our Purpose

Associate Promise 3 3 Associate Promise To provide an incredible work experience • Committed and caring leadership • Opportunities to do your best work • Reward and recognition that make your life better 92 % Associate Engagement Score

Random Experience Predictable Experience Consistent Intentional Branded Experience Consistent Intentional Differentiated Valuable Customer Loyalty Incredible Experience Customer Value Promise • Incredible experience • Distinctive Programs • Unmatched convenience Customer Satisfaction 98%

Distinctive Programs 65% of customers participate in one of our Programs ! Customer Value Promise • Incredible experience • Distinctive Programs • Unmatched convenience

81% Customers Value our Convenience! Most Traditional Bank Holidays PLUS: • Free Coin Machines • Same Day Banking • Customer Care Call Center • Banker On Call Mon - Sat 8am - 11pm • Courier Services Unmatched Convenience Customer Value Promise • Incredible experience • Distinctive Programs • Unmatched convenience

Customer Loyalty Primary Financial Institution 2012 74% 2010 64% Customer Loyalty My !

Household Growth 8,063 8,938 9,702 10,679 0 2,000 4,000 6,000 8,000 10,000 12,000 December 2008 December 2009 December 2010 December 2011 Household Growth - 9% 4 - Yr Average Raddon Group - Industry Gross Household Growth 2011 5.7%

Customers Do More Business With Us 0 0.5 1 1.5 2 2.5 3 3.5 4 2009 2010 2011 2.2 3.9 3.9 Services per Household

Customers Willing To Refer For Us 81% of customers willing to refer us 0 500 1000 1500 2000 Dec-09 Dec-10 Dec-11 Customer Referrals to New DDA Households 66% 75% 70%

Customers Stay with Us Longer

Growth & Profits LOYAL CUSTOMERS DRIVES …….. Loyalty Matters