Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SWISS HELVETIA FUND, INC. | swisshelvetia-8k_061512.htm |

The Swiss Helvetia Fund, Inc.

Shareholders Meeting

New York, June 20, 2012

New York, June 20, 2012

Agenda

Swiss Market Review & Analysis

SWZ Portfolio Review

Stock Repurchase Program - Basic Data

Private Equity - An Alternative Asset Class

Investment Strategy

Marketing

Market Price / NAV / Discount

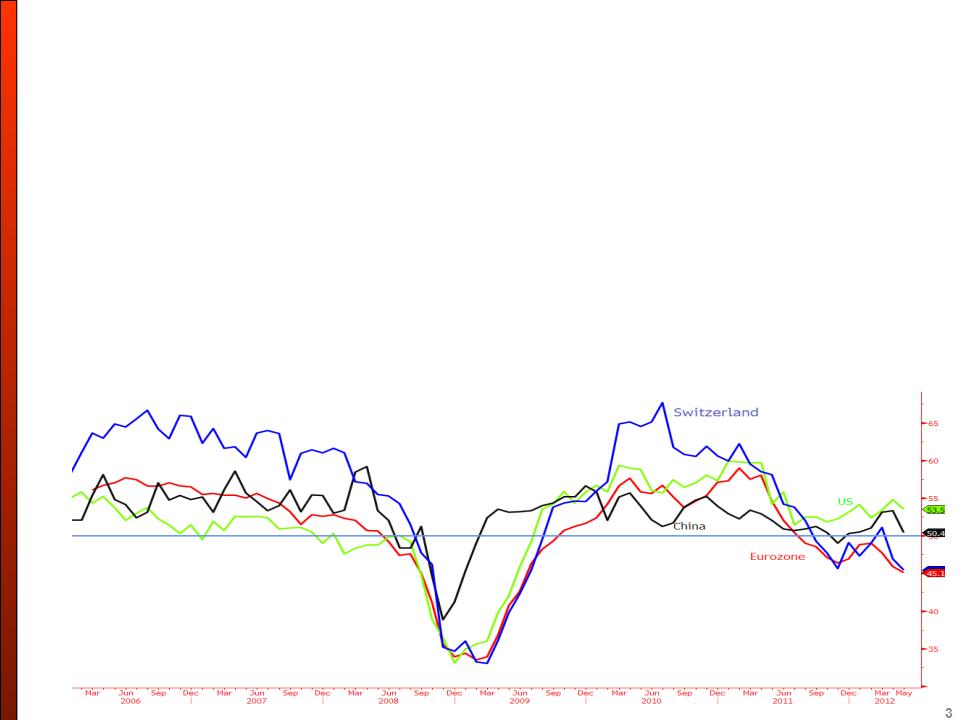

World economy growth mediocre and falling back into a stalemate

scenario

scenario

• 4 years after the financial crisis economies of developed countries remain below par:

ü US doing somewhat better than the others

• Global Manufacturing PMI slowed down in May to its lowest reading in five months:

ü Europe remained the main drag falling to three-year lows

NB: ECB usually reacts when PMI is below 47

ü Signs of slowdown in the U.S. and Asia (conditions deteriorated in China)

ü Global growth of new orders remained lackluster, while global manufacturing production increased

ü Marked drop in inflationary pressures due to recent reductions in some commodities’ prices

Source: BLOOMBERG

Purchasing Managers Index Manufacturing (PMI)

4

Risky assets impacted by very negative global economic surprises

• The Citigroup Economic Surprise Indices:

• Weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median)

• Pointed out to substantial disappointments in terms of economic surprises in US, Europe, China and Emerging

markets that led to the recent risky assets correction

markets that led to the recent risky assets correction

• Worst macro surprises data in 3 years

• Equity markets had recovered substantially since last November through March but were slightly overbought

Citigroup Economic Surprise Indices US, Euro, China and EM

Source: BLOOMBERG

… and Eurozone GDP growth still impacted by the tightening of credit

conditions

conditions

• ECB’s Bank Lending Survey showed continued tightening credit standards by euro banks as they are deleveraging:

ü Albeit in a less aggressive and broad-based manner than in the prior three months:

Ø LTRO prevents liquidity squeeze and softens credit conditions in Q1 2012

Ø Pressures from cost of funding and balance sheet constraints are reduced

ü Bank loan officers expect credit standards to remain little changed in Q2:

Ø Demand for household credit should fall further in Q2, albeit far less sharply than in Q1

Ø But a small net increase in business demand for loans/credit is reported

Changes in quarterly demand for loans or credit lines to enterprises (green) & Eurozone GDP growth YOY

Source: BLOOMBERG

6

… risk aversion is back especially in the banking sector

• The mean for global equities has reversed to the 200 day moving average with emerging markets lagging both US and

European equity markets year-to-date

European equity markets year-to-date

• Risk-on rally ended abruptly on the back of Spanish public deficit and Greek elections

• Fears of renewed European crisis will reinforce pro-growth policies supporting global equities if the contagion from Greece is

avoided

avoided

• Political negotiations will probably end-up with a restructuration of the Greek debt

• Global equity markets could rebuild some potential when looking at the very high equity risk premium

Source: BLOOMBERG

Volatility of the S&P 500, Euro Stoxx 50 and SMI indices

Underlying pace of global economic growth lukewarm - Part II

9

European sovereign debt crisis

• EU-wide coordination of domestic bank regulatory frameworks into a European banking union

• European banking supervision to avoid moral hazard and thus transfer of sovereignty:

• Reluctance of some governments

• Increasingly stressed by the European Commission and the ECB

• Ireland: over 60% approved the Irish referendum on the EU fiscal compact

• ECB: still reluctant to further increase the size of its balance sheet amounting to 30% of Eurozone GDP

• Eurozone main issue : grouping in a single monetary union economies whose per capita income, productivity, labor market,

current account and social system are not similar

current account and social system are not similar

• Current account and competitiveness: key issues to address and more adjustment expected

• Greece and Portugal remain an issue in terms of long run solvency

Two scenarios

Spain: too big to fail

Switzerland leading in key worldwide indicators

WORLD BANK INDEX

Government Efficiency

-2.5 (weak) - +2.5 (strong)

Swiss consumer sentiment stabilizing

• Sustained private consumption stance on the back of:

ü Retail sales reached new all-time high, while posting a slight positive growth in April

Ø signs of slowing momentum after 7 month of positive yearly growth rate

• Consumer confidence recovered from depressed levels late last year on the back of:

ü Solid real income growth

ü Historically elevated savings rates

ü Solid state of the Swiss labor market

ü Sustained Swiss housing prices

Consumer Sentiment Indicators (Switzerland, US and Eurozone)

Source: BLOOMBERG

Swiss GDP growth encouraging

Source: BLOOMBERG

Swiss GDP growth yoy & PMI

SNB 1.2 EUR/CHF under pressure but resilient

14

SNB inflation forecasts

Agenda

Macro-Economic Conditions

SWZ Portfolio Review

Stock Repurchase Program - Basic Data

Private Equity - An Alternative Asset Class

Investment Strategy

Marketing

Market Price / NAV / Discount

16

Swiss Equity Valuations

17

Bloomberg estimates

Sector Valuation

Agenda

Macro-Economic Conditions

Swiss Market Review & Analysis

Stock Repurchase Program - Basic Data

Private Equity - An Alternative Asset Class

Investment Strategy

Marketing

Market Price / NAV / Discount

20

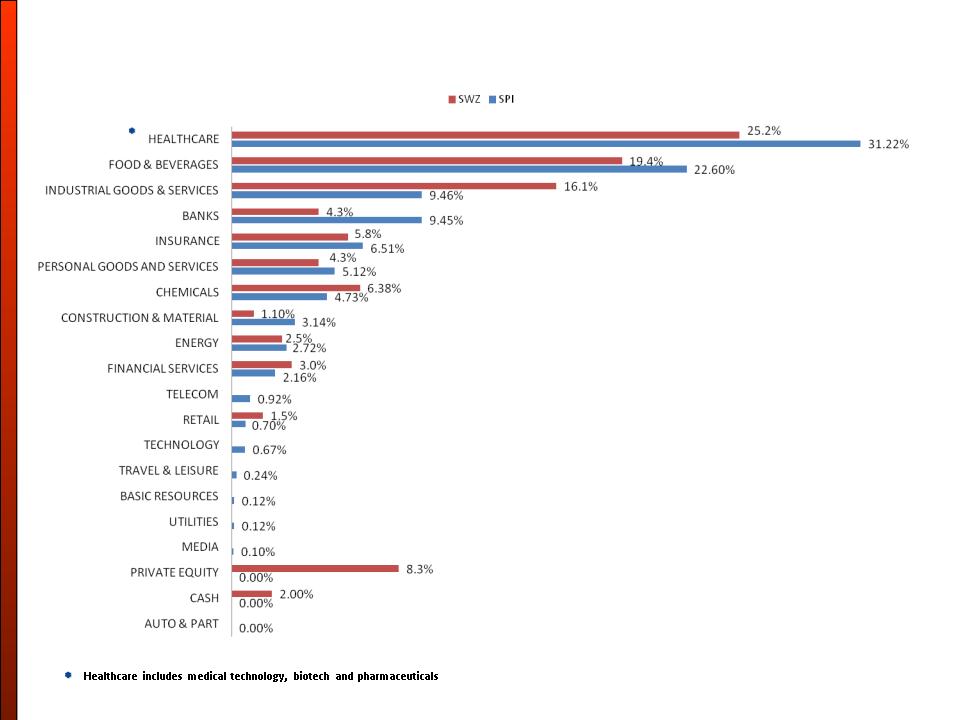

SWZ Sector Exposure Sector Weight versus SPI as of 06/08/12

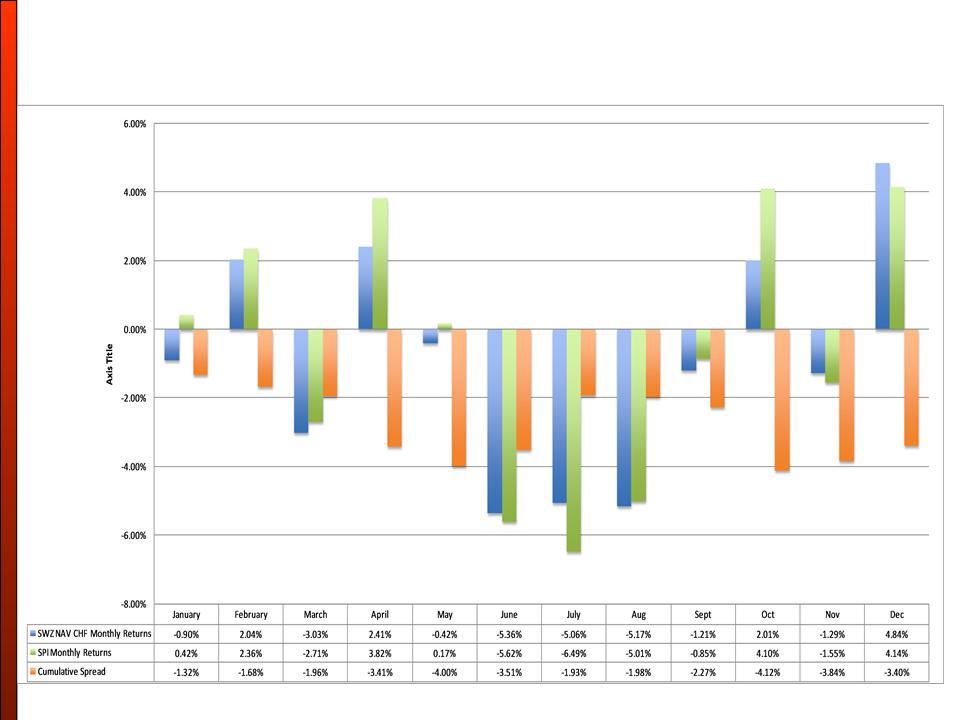

SWZ Total Return Comparison versus SPI

12/31/10-12/31/11 (CHF) Monthly Data and Cumulative Spread

21

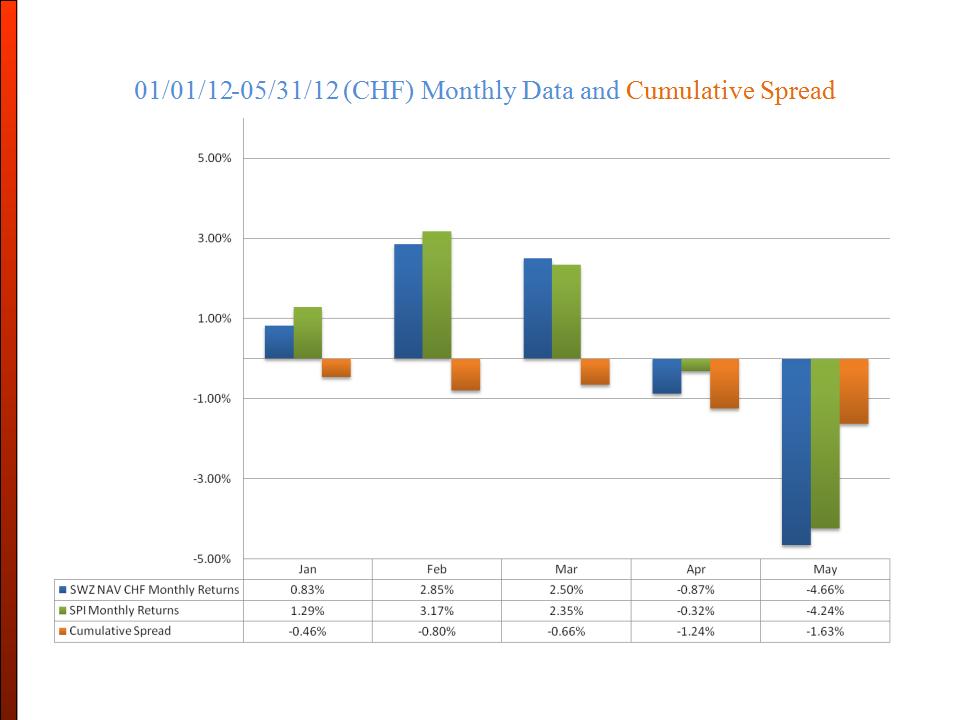

SWZ Total Return Comparison versus SPI

22

SWZ shareholders' return analysis

YTD 12/31/11 - 5/31/12 (USD)

S&P 500 total return : + 5.16 %

23

SWZ shareholders’ return analysis

1 year 12/31/10 - 12/31/11 (USD)

1 year 12/31/10 - 12/31/11 (USD)

S&P 500 total return : +2.11 %

24

25

Agenda

Macro-Economic Conditions

Swiss Market Review & Analysis

SWZ Portfolio Review

Stock Repurchase Program - Basic Data

Investment Strategy

Marketing

Market Price / NAV / Discount

• Opportunities in private equity and venture capital financing in different industries and

various stages of development

various stages of development

• Closely networked, internationally oriented and infrastructure to support transactions

• Strong expertise in certain niche markets with the predominance of mid-market segments,

going along with reasonably priced transaction

going along with reasonably priced transaction

• SWZ exposure in private equity is balanced between investments in Funds and direct holdings

• European economic environment has slow down the private activity. Exit opportunities

through IPOs remains very challenging and M&A activity has not recovered

through IPOs remains very challenging and M&A activity has not recovered

Attractiveness of Switzerland for Private Equity

27

SWZ Exposure to Private Equity

• Private equity exposure has increased from 6% in ‘11 to 8% of the NAV of the Fund in June ‘12

• Diversification through investments in funds and in direct holdings

• Buy out and late stage ventures create investment opportunities across investment cycles

• Limited Partnerships totaling investment of CHF 13mn (5%) with total commitment of CHF

17mn, unchanged from 2011

17mn, unchanged from 2011

ü Zurmont Madison Private Equity LP

- Portfolio companies invested in mid-sized industrial and consumer goods companies

- Investment focus on MBOs, successions and corporate spin offs

ü Aravis LP

- One of the most active venture capital in the Swiss market

• Illiquid direct Investments totaling investments of CHF15mn (4.5%)

ü Six different holdings

ü One exit in ‘11 through the merger with a listed company on the Finnish stock exchange

28

29

SWZ 2012 performance review YTD (as of 6/8/12)

without private Equity

30

SWZ 2012 performance review YTD (as of 6/8/12)

with private Equity

Agenda

Macro-Economic Conditions

Swiss Market Review & Analysis

SWZ Portfolio Review

Stock Repurchase Program - Basic Data

Private Equity - An Alternative Asset Class

Marketing

Market Price / NAV / Discount

Market environment

32

Market outlook : scenario analysis

Scenarios outcome the market most likely prices in

Markets already price in returns that are skewed on the downside because

of macro imbalances are clearly visible although their severity is quite difficult to assess :

as a consequence downside appears limited but fat tails are larger than in the past

Portfolio strategy is to have:

A) Core holdings in defensive sectors even though relative valuation is high

B) Satellite holdings with higher earnings volatility and medium to low balance sheet risk

because their relative valuation is very low, exposures to these holdings depends on underlying

because their relative valuation is very low, exposures to these holdings depends on underlying

industry cycles

34

Investment Strategy

35

36

Investment strategy : valuation - main holdings as of 6/8/12

37

Investment strategy : valuation - main holdings as of 6/8/12 (II)

Agenda

Macro-Economic Conditions

Swiss Market Review & Analysis

SWZ Portfolio Review

Private Equity - An Alternative Asset Class

Investment Strategy

Marketing

Market Price / NAV / Discount

SWZ 25 Years Distribution History (USD)

39

*two for one stock split

*

SWZ 25 Years Distribution History (USD)

|

Total contributions by shareholders

|

|

299,483,721.16

|

|

Dividend Reinvested

|

|

75,877,681.71

|

|

Buy-backs

|

|

(91,964,914.30)

|

|

Total Net contributions by shareholders

|

|

283,396,488.57

|

|

Total distributions to shareholders

|

|

434,942,562.02

|

|

|

|

|

40

Stock repurchase program 2009 - 2011

41

Agenda

Macro-Economic Conditions

Swiss Market Review & Analysis

SWZ Portfolio Review

Stock Repurchase Program - Basic Data

Private Equity - An Alternative Asset Class

Investment Strategy

Market Price / NAV / Discount

43

• On July 30, 2011 The Fund participated in Swiss National Day 2011 which was organized by

the Swiss Benevolent Society of New York (SBS). The SBS sent out 9,000 flyers advertising

the event which was held at the Central Park Zoo in New York City, and was attended by

approximately 2,500 people. Three representatives of the Fund manned an information

booth handing out SWZ quarterly reports, logo key chains and historical information on the

Fund. Many attendees showed interest in the Fund’s investment strategy.

the Swiss Benevolent Society of New York (SBS). The SBS sent out 9,000 flyers advertising

the event which was held at the Central Park Zoo in New York City, and was attended by

approximately 2,500 people. Three representatives of the Fund manned an information

booth handing out SWZ quarterly reports, logo key chains and historical information on the

Fund. Many attendees showed interest in the Fund’s investment strategy.

• Ongoing efforts in keeping www.swz.com up to date with current news and statistics

• Conducted Shareholder visits

Marketing efforts since June 2011

Agenda

Macro-Economic Conditions

Swiss Market Review & Analysis

SWZ Portfolio Review

Stock Repurchase Program - Basic Data

Private Equity - An Alternative Asset Class

Investment Strategy

Marketing

45

Basic data