Attached files

| file | filename |

|---|---|

| EX-10.1 - LICENSING AGREEMENT - Car Monkeys Group | delaine_ex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

May 15, 2012

DELAINE CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-171861

|

27-2901464

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer of

Identification No.)

|

361 N Dalton Avenue

Albany, IN 47320

(Address of principal executive offices)

(765) 744-8383

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Item 1.01 Entry into a Material Definitive Agreement.

On June 13, 2012, Delaine Corporation (the “Registrant”, also the “Company”), entered into an agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.1 (the “Agreement”) with Mariusz Girt, an individual (“Girt”), whereby Girt granted to the Company sole and exclusive license, within the United States of America, including without limitation its territories and possessions, in and to certain proprietary technology relating to online procurement of certain goods (the “Technology”). Prior to the Agreement there was no material relationship between the Registrant and Girt.

Pursuant to the Agreement, Girt granted to the Company sole and exclusive license, within the United States of America, including without limitation its territories and possessions, in and to the Technology for consideration of: (a) 576,160 restricted shares of the Company’s common stock, par value $0.001; and (b) 400,000 shares of the Company’s Class A Preferred Stock (the “Preferred Stock”).

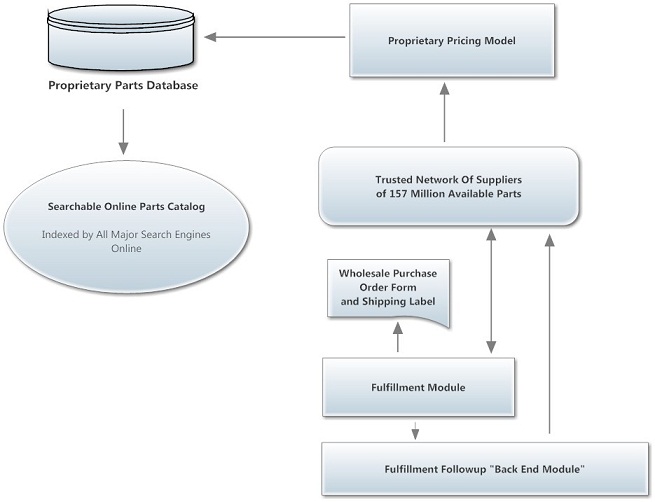

The Technology consists of internet search algorithms tailored to searching, cross referencing, and pricing used auto parts. The search algorithms enable a vast and detailed online catalog of used auto parts, which surpasses what is currently available from any other online source. Together with the pricing algorithms, the technology provides the display of product information, together with a price that is both competitive and offers a good profit margin for an online retail entity utilizing the Technology. This pricing model is based on availability and wholesale cost of each particular part from a trusted network of automotive recyclers nationwide.

The technology also includes a fulfillment module, and a fulfillment follow-up module, allowing real time searching of over 157 million auto parts from a trusted network of suppliers, as well as an automated process to identify in-transit shipments, and shipment problems.

The following diagram describes the technology in a more visual format:

2

3

Item 2.01 Completion of Acquisition or Disposition of Assets.

As disclosed in Item 1.01 of this Current Report on Form 8-K, on June 13, 2012, the Company acquired sole and exclusive license, within the United States of America, including without limitation its territories and possessions, in and to the Technology for consideration of: (a) 576,160 restricted shares of the Company’s common stock, par value $0.001; and (b) 400,000 shares of Preferred Stock.

Item 3.02 Unregistered Sales of Equity Securities.

Between May 15, 2012 and June 12, 2012, the Registrant sold 673,840 restricted shares of its common stock, par value $0.001, for total consideration of $243,808. The securities were sold to accredited investors pursuant to Rule 506 of Regulation D.

Item 5.01 Changes in Control of Registrant.

On June 13, as reported in Item 1.01 of this Current Report on Form 8-K, the Company entered into an Agreement with Mariusz Girt, for the sale to the Company of certain technology in exchange for: (a) 576,160 restricted shares of the Company’s common stock, par value $0.001; and (b) 400,000 shares of the Company’s Preferred Stock.

The issuance of common and Preferred Stock to Mr. Girt pursuant to the Agreement will result in a Change of voting control of the Registrant to Mr. Girt.

Subsequent to the designation and issuance of the Preferred Stock, and the payment of the Stock Dividend, as reported in Section 5.07 of this Current Report on Form 8-K, the issuance of common and preferred shares to Mr. Girt pursuant to the Agreement will result in Mr. Girt controlling approximately 35% of the voting equity of the Registrant.

The information required by section a (8) of this section is disclosed on the Registrant’s Registration Statement of Form S-1, as amended, effective October 11, 2011, and the Registrant’s most recent quarterly report on Form 10-Q, filed May 18, 2012.

4

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Effective June 14, 2012, Mr. Tim Moore resigned from all executive positions and as director of the Registrant. Mr. Moore’s resignation was not due to any disagreement with the Registrant on any matter relating to the Registrant’s operations, policies or practices.

(c) Effective June 14, 2012, Mariusz Girt was appointed as the Company’s president and sole director. Mr. Girt will also act as the company’s principal financial officer, principal accounting officer, and principal operating officer until such positions are otherwise filled.

Background / Experience

Mariusz Grit, 42, is a dedicated and highly skilled professional with strong interpersonal, communication and leadership skills. Since September 2011 Mr. Girt has been employed as a Senior Computer Systems Analyst for EcoSafe Automotive, LLC, in Wyckoff, NJ, where he provided leadership in launching company's two online auto parts stores and it's back end support applications including a computerized store management system. From August 2004 through September 2011 Mr. Girt served as Senior Computer Systems Analyst at AccessPoint Communications, Inc. in West Palm Beach, Florida and Orange, NJ. At AccessPoint, Mr. Girt was responsible for managing and

supervising an IT consulting staff and outside marketing and Public Relations contractors, and the design and development of data warehousing and database marketing software technologies that automate the analysis of business data. From May 2002 through July 2004, Mr. Girt worked at DP Martin & Associates, Inc., in Palm Beach, Florida as a Computer Systems Analyst.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers, during the past ten years, has been involved in any legal proceeding of the type required to be disclosed under applicable SEC rules, including:

|

1.

|

Any petition under the Federal bankruptcy laws or any state insolvency law being filed by or against, or a receiver, fiscal agent or similar officer being appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

|

|

2.

|

Conviction in a criminal proceeding, or being a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

3.

|

Being the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

|

|

|

i.

|

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

|

5

|

ii.

|

Engaging in any type of business practice; or

|

|

|

iii.

|

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

|

|

|

4.

|

Being the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (3)(i) of this section, or to be associated with persons engaged in any such activity;

|

|

|

5.

|

Being found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

|

|

|

6.

|

Being found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

|

|

|

7.

|

Being the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

|

|

|

i.

|

Any Federal or State securities or commodities law or regulation; or

|

|

|

ii.

|

Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

|

|

|

iii.

|

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

8.

|

Being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Compensation

Since its inception, none of the Registrant’s executive officers or directors has received any compensation. There is currently no compensatory plan, contract, arrangement or other understanding regarding compensation between the Registrant and any of its former, present or prospective executive officers or directors.

6

Section 5.06 -Change in Shell Company Status.

The Registrant has fully commenced operations through the operation of its online catalog of items for sale, and is no longer a shell company as defined in Rule 12b-2. Furthermore, as disclosed in Item 1.01 of this Current Report on Form 8-K, effective June 13, 2012, the Registrant entered into an Agreement whereby the Company gained exclusive license in and to proprietary technology relating to the online procurement of goods, allowing the Company to expand the scope of its business operations.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On June 11, 2012, in lieu of a meeting of the shareholders and in accordance with Section 78.330 of the Nevada General Corporation Law, the holders of 78.7% of the voting capital stock of the Registrant voted to approve the following:

|

1.

|

The acquisition of intellectual property, pursuant to the terms and conditions set forth in that certain Technology Licensing Agreement, between Mariusz Girt and the Company (hereinafter the “Tech Agreement”).

|

|

2.

|

The designation of a preferred class of shares of the Company, to be designated as “Class A Preferred Shares,” and the issuance of 400,000 of such Class A Preferred Shares to Mariusz Girt, pursuant to the Tech Agreement; the Class A Preferred Shares to have the following rights and preferences:

|

|

a.

|

Each share of the Stock shall have a par value and liquidation value equal to that of a share of the Company’s common stock.

|

|

b.

|

The Stock shall rank senior to the Company’s Common Stock.

|

|

c.

|

Each share of the Stock shall carry 25 votes on all matters subject to vote by the Company’s shareholders.

|

|

d.

|

Each Share of the Stock shall be entitled to the same dividends as shall be declared from time to time for each share of the Company’s common stock.

|

|

(i)

|

in the event of a stock dividend, the stock received as a dividend shall be of the same class as would have been received if the Stock had been common stock.

|

|

e.

|

Each share of the Stock shall be convertible into one common share of the Company at the sole discretion of the holder of the Stock.The Class A Preferred Shares shall have such other rights and preferences as shall be determined by the board of directors of the company.

|

|

3.

|

The amendment of the Company’s articles of incorporation and/or bylaws as necessary to accommodate the designation and issuance of the Class A Preferred Shares.

|

|

4.

|

The Election of Mariusz Girt as Director of the Company, and appointment of Mariusz Girt as President of the Company.

|

|

5.

|

A stock dividend, of 5 shares of Delaine common stock, par value $0.001, for each 1 share of delaine common stock held as of July 6, 2012, and 5 shares of common stock for each 1 share of Delaine preferred stock held as of July 6, 2012.

|

7

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| 10.1 | Licensing Agreement dated June 13, 2012, between Mariusz Girt and the Registrant. |

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

DELAINE CORPORATION

|

|||

| Dated: June 15, 2012 |

By:

|

/s/ Mariusz Girt

|

|

|

Mariusz Girt

|

|||

|

President and Director

|

|||

9