Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - China Internet Cafe Holdings Group, Inc. | v315594_ex5-1.htm |

| EX-23.1 - EXHIBIT 23.1 - China Internet Cafe Holdings Group, Inc. | v315594_ex23-1.htm |

| EX-23.2 - EXHIBIT 23.2 - China Internet Cafe Holdings Group, Inc. | v315594_ex23-2.htm |

As filed with the Securities and Exchange Commission on June 14, 2012

Registration No. 333-173407

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHINA INTERNET CAFE HOLDINGS GROUP, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

5960

(Primary Standard Industrial Classification Code Number)

98-0500738

(I.R.S. Employer Identification Number)

#1707, Block A, Genzon Times Square

Longcheng Blvd, Centre City, Longgang District

Shenzhen, Guangdong Province

People’s Republic of China 518172

86 -755- 89896008

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mr. Dishan Guo

Chief Executive Officer

#1707, Block A, Genzon Times Square

Longcheng Blvd, Centre City, Longgang District

Shenzhen, Guangdong Province

People’s Republic of China 518172

86 -755- 89896008

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Gregory Sichenzia, Esq.

Benjamin Tan, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, NY 10006

Tel: (212) 930 9700

Fax: (212) 930 9725

Approximate date of commencement of proposed sale to the public: From time to time after the Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum Aggregate Offering Price |

Proposed Offering Price per Unit |

Amount of Registration Fee (2) |

||||||||||||

| Common Stock, par value $0.00001 | 7,247,996 | $ | 9,059,995 | $ | 19.07 | $ | 1,051.87 | (3) | ||||||||

| (1) | All shares registered pursuant to this registration statement are to be offered by the selling stockholders. |

| (2) | Estimated solely for purposes of calculating the registration fee. The registration fee is calculated pursuant to Rule 457(c). Our Common Stock is quoted under the symbol "CICC" on the Over-the-Counter Bulletin Board (“OTCBB”) administered by FINRA. As of April 8, 2011, the last reported sale price was for $1.25 per share. | |

| (3) |

An aggregate registration fee of $1,051.87 has been previously paid in connection with the initially filed registration statement on Form S-1 (File No. 333-173407).

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer and sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED ______, 2012 |

CHINA INTERNET CAFE HOLDINGS GROUP, INC.

7,247,996 SHARES OF COMMON STOCK

The selling stockholders identified in this prospectus are offering for sale from time to time up to 7,247,996 shares of our common stock, par value $0.00001, (the “Common Stock”) including (i) 474,967 shares of Common Stock, (ii) 4,274,703 shares of Common Stock issuable upon conversion of preferred shares, (iii) and 2,498,326 shares of Common Stock that they may acquire from time to time upon exercise of certain warrants.

The Common Stock and warrants have already been issued to the selling stockholders in a private placement transaction on February 22, 2011, which was exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended (the “Offering”).

In the Offering, Investors were issued warrants to purchase 949,934 shares of Common Stock at a purchase price of $2.00 (the “Series A Warrants”) and another 949,934 shares of Common Stock at a purchase price of $3.00 (the “Series B Warrants”). Additionally, the placement agents were issued warrants to purchase 427,470 shares of Common Stock at a purchase price of $1.35 per share (the “Placement Agent Warrants”), Series A Warrants to purchase 85,494 shares of Common Stock at a purchase price of $2.00 per share, and Series B Warrants to purchase 85,494 shares of Common Stock at a purchase price of $3.00 per share. The Series A Warrants, Series B Warrants, and Placement Agent Warrants all have a term of three years from the date of issue (equivalent to February 21, 2014).

The resale of the shares of Common Stock is not being underwritten. The selling stockholders may sell or distribute the shares, from time to time, depending on market conditions and other factors, through underwriters, dealers, brokers or other agents, or directly to one or more purchasers. Each selling stockholder will determine the prices at which it sells its shares. Although we will incur expenses in connection with the registration of the Common Stock (estimated to be approximately $68,262), we will not receive any proceeds from the sale of the shares of Common Stock by the selling stockholders. To the extent the warrants are exercised for cash, if at all, we will receive the exercise price for those warrants. We cannot assure you that the warrants will be exercised for cash or at all.

To the extent the warrants are exercised to purchase shares of our Common Stock, if at all, we will receive the exercise price for those warrants. To the extent that the warrants are exercised using a cashless exercise, we will not receive the exercise price for those warrants.

Our Common Stock is quoted on the Over-the-Counter Bulletin Board (the “OTCBB”) over seen by the Financial Industry Regulatory Authority (“FINRA”) under the symbol “CICC” but there is a limited and/or sporadic trading market for our Common Stock. On June 13, 2012, the last reported sale price of our Common Stock quoted on the OTCBB was $0.31 per share.

Investing in our Common Stock involves a high degree of risk. You may lose your entire investment. See “Risk Factors” beginning on page 11 for a discussion of certain risk factors that you should consider.

You should read the entire prospectus before making an investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _____, 2012

| 3 |

TABLE OF CONTENTS

| Page | |

| PART I – INFORMATION REQUIRED IN PROSPECTUS | |

| Prospectus Summary | 5 |

| Cautionary Note Regarding Forward-Looking Statements and Other Information Contained in this Prospectus | 10 |

| Risk Factors | 11 |

| Use of Proceeds | 25 |

| Dilution | 25 |

| Selling Shareholders | 26 |

| Plan of Distribution | 31 |

| Description of Securities to be Registered | 32 |

| Interests of Named Experts and Counsel | 33 |

| Business | 33 |

| Properties | 45 |

| Legal Proceedings | 46 |

| Market for Common Equity and Related Stockholder Matters | 46 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operation | 46 |

| Changes In and Disagreements with Accountants | 59 |

| Directors, Executive Officers, Promoters and Control Persons | 59 |

| Executive Compensation | 63 |

| Security Ownership of Certain Beneficial Owners and Management | 65 |

| Certain Relationships and Related Transactions | 66 |

| Legal Matters | 67 |

| Experts | 67 |

| Available Information | 67 |

| Financial Statements | 67 |

| PART II – INFORMATION NOT REQUIRED IN PROSPECTUS | |

| Other Expenses of Issuance and Distribution | 68 |

| Indemnification of Directors and Officers | 68 |

| Recent Sales of Unregistered Securities | 69 |

| Exhibits | 70 |

| Undertakings | 73 |

| Signatures | 75 |

| 4 |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The selling stockholders are offering to sell and seeking offers to buy shares of our Common Stock, including shares they acquire upon exercise of their warrants, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us or any selling stockholder. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Common Stock. You should read the entire prospectus, including “Risk Factors” and the consolidated financial statements and the related notes before making an investment decision. Contents from our website, www.chinainternetcafe.com, are not part of this prospectus. Except as otherwise specifically stated or unless the context otherwise requires, the “Company,” “we,” “our” and “us” refers collectively to China Internet Cafe Holdings Group, Inc.

THE COMPANY

Business Overview

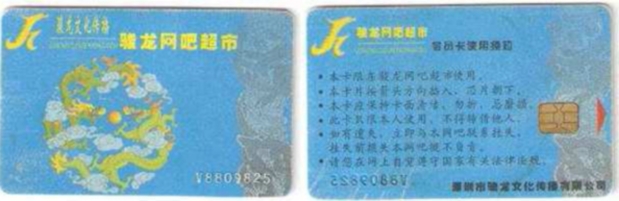

We operate a chain of 59 internet cafés in Shenzhen, Guangdong, PRC that are generally open 24 hours a day, seven days a week. We provide internet café facilities to our customers and we believe we are the largest internet café chain in Shenzhen. We provide internet access at prices that we believe are affordable to both students and migrant workers. Although we sell snacks, drinks, and game access cards, over 95% of our revenue comes from selling access time to our computers. We sell internet café memberships to our customers. Members purchase prepaid IC cards (a pocket-sized card with embedded integrated circuits that can be used for identification, authentication, data storage and application processing), which include stored value that will be deducted based on time usage of a computer at the internet café. The cards are only sold at our cafés. We deduct the amount that reflects the access time used by a customer when the customer’s IC card is inserted into the IC card slot on the computer.

Our History

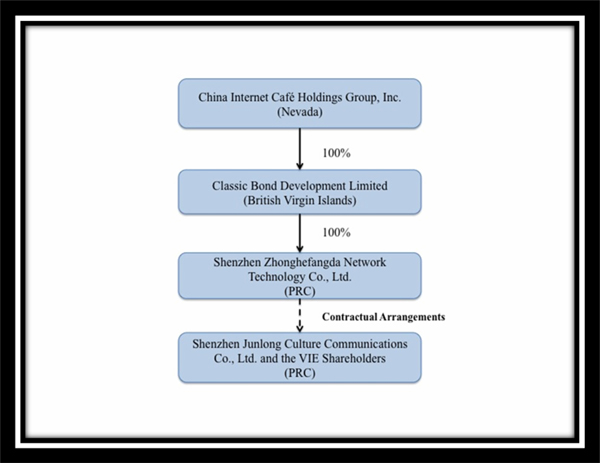

China Internet Cafe Holdings Group, Inc. (“we”, “us”, or the “Company”) is a Nevada holding company for our direct and indirect subsidiaries in the British Virgin Islands (“BVI”) and the People’s Republic of China (“PRC”). We own all of the issued and outstanding capital stock of Classic Bond, a BVI corporation. Classic Bond is a holding company that owns 100% of the outstanding capital stock of Shenzhen Zhonghefangda Network Technology Co., Limited (“Zhonghefangda”), a PRC company.

Current PRC laws and regulations impose substantial restrictions on foreign ownership of the internet café business in the PRC. Therefore, our principal operations and sales and marketing activities in the PRC are conducted through Shenzhen Junlong Culture Communications Co., Ltd (“Junlong”), our variable interest entity (“VIE”), which holds the licenses and approvals for conducting the internet café business in the PRC

| 5 |

Junlong was incorporated in the PRC in December 2003. It obtained its license to operate internet cafés in 2005. Our effective control over the VIE is contingent on a series of contractual arrangements. These contracts include a Management and Consulting Services Agreement, an Option Agreement, an Equity Pledge Agreement, and a Voting Rights Proxy Agreement. The Management and Consulting Services Agreement, dated June 11, 2010, is between our indirect, wholly owned subsidiary, Zhonghefangda, and our VIE. The rest of the agreements, also dated June 11, 2010, are among Zhonghefangda, our VIE and its shareholders. These contracts are summarized below. Please also refer to the full text of the contracts, which are filed as exhibits to this report.

| • | Management and Consulting Services Agreement. Under the Management and Consulting Services Agreement between Junlong and Zhonghefangda, Zhonghefangda provides management and consulting services to the VIE in exchange for service fees up to 100% of the VIE’s Aggregate Net Profits (as defined in the agreement). In consideration for its right to receive the VIE’s aggregate net profits, Zhonghefangda will reimburse to the VIE the full amount of Net Losses (as defined in the Agreement) incurred by the VIE. During the term of the agreement, the VIE may not contract with any other party to provide services that are the same or similar to the services to be provided by Zhonghefangda pursuant to the agreement. The term of this agreement is 20 years, renewable for succeeding periods of the same duration until terminated pursuant to terms of the agreement. |

| • | Option Agreement. Under the Option Agreement, the shareholders of the VIE, Mr. Dishan Guo, Mr. Jinzhou Zeng and Ms. Xiaofen Wang (the “VIE Shareholders”), who collectively own 100% of the equity interest in the VIE, granted Zhonghefangda an exclusive, irrevocable option to purchase all or part of their equity interests in the VIE, exercisable at any time and from time to time, to the extent permitted under PRC law. The purchase price of the equity interest will be equal to the original paid-in registered capital of the transferor, adjusted proportionally if less than all of the equity interest owned by the transferor is purchased. |

| • | Equity Pledge Agreement. The VIE Shareholders have pledged their entire equity interest in the VIE to Zhonghefangda pursuant to the Equity Pledge Agreement. The equity interests are pledged as collateral to secure the obligations of the VIE under the Management and Consulting Services Agreement and the VIE Shareholders’ obligations under the Option Agreement and the Proxy Agreement. |

| • | Voting Rights Proxy Agreement. Pursuant to the Voting Rights Proxy Agreement, each of the VIE Shareholders has irrevocably granted and entrusted Zhonghefangda with all of the voting rights as a shareholder of the VIE for the maximum period of time permitted by law. Each VIE Shareholder has also covenanted not to transfer his or her equity interest in the VIE to any party other than Zhonghefangda or a designee of Zhonghefangda. |

We believe that the terms of these agreements are no less favorable than the terms that we could obtain from disinterested third parties. According to our PRC counsel, China Commercial Law Firm, our conduct of business through these agreements complies with existing PRC laws, rules and regulations.

As a result of these contractual arrangements, Junlong became our controlled VIE. A variable interest represents a contractual or ownership interest in another entity that causes the holder to absorb the changes in fair value of the other entity’s net assets. Potential variable interests include: holding economic interests, voting rights, or obligations to an entity; issuing guarantees on behalf of an entity; transferring assets to an entity; managing the assets of an entity; leasing assets from an entity; and providing financing to an entity. In such cases consolidation of the VIE is required by the enterprise that controls the economic risks and rewards of the entity, regardless of ownership. We have consolidated Junlong’s historical financial results in our financial statements as a variable interest entity pursuant to U.S. generally accepted accounting principles (“GAAP”).

| 6 |

Acquisition of Classic Bond

On July 2, 2010, we completed a reverse acquisition transaction through a share exchange with Classic Bond and its shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Classic Bond, in exchange for 19,000,000 shares of our Common Stock, which shares constituted 94% of our issued and outstanding shares on a fully-diluted basis, as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Classic Bond became our wholly owned subsidiary and the former shareholders of Classic Bond, became our controlling shareholders. The share exchange transaction with Classic Bond was treated as a reverse acquisition, with Classic Bond as the acquirer and China Internet Cafe Holdings Group, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Classic Bond and its consolidated subsidiaries.

Upon the closing of the reverse acquisition, Xuezheng Yuan, our sole director and officer, submitted a resignation letter pursuant to which he resigned, with immediate effect, from all offices that he held and from his position as our sole director that became effective on the August 13 2010, ten days following the mailing by us of an information statement to our stockholders complying with the requirements of Section 14f-1 of the Exchange Act (the “Information Statement”). Also upon the closing of the reverse acquisition, our board of directors (the “Board of Directors”) increased its size from one to five members and appointed Dishan Guo, Zhenquan Guo, Lei Li, Wenbin An and Lizong Wang to fill the vacancies created by the resignation of Xuezheng Yuan and such increase. Mr. Dishan Guo's appointment became effective upon closing of the reverse acquisition, while the remaining appointments became effective on August 23, 2010. In addition, our executive officers were replaced by the Classic Bond executive officers upon the closing of the reverse acquisition as indicated in more detail below.

As a result of our acquisition of Classic Bond, we now own all of the issued and outstanding capital stock of Classic Bond. Classic Bond was incorporated in the British Virgin Islands on November 2, 2009 to serve as an investment holding company. Junlong was incorporated in the PRC in December 2003. It obtained its first licenses from the Ministry of Culture to operate an internet café chain in 2005 and opened its first internet café in April 2006.

The following chart represents our organizational structure as of the date of this report:

| 7 |

On July 2, 2010, our Board of Directors approved a change in our fiscal year end from June 30 to December 31, which was effectuated in connection with the reverse acquisition transaction described above.

On January 20, 2011, the Company filed with the Nevada Secretary of State a Certificate of Amendment to Articles of Incorporation to give effect to a name change from “China Unitech Group, Inc.” to “China Internet Cafe Holdings Group, Inc.” The Certificate of Amendment was approved by our Board of Directors on July 30, 2010 and was approved by a stockholder holding 59.45% of our outstanding Common Stock by written consent on July 30, 2010. In connection with the name change, on January 25, 2011, the Company filed an Issuer Company-Related Action Notification Form with FINRA requesting a name change from “China Unitech Group, Inc.” to “China Internet Cafe Holdings Group, Inc.” as well as an OTC voluntary symbol change from “CUIG” to “CICC.” These changes became effective on February 1, 2011. Our Common Stock began trading under the Company’s new name on the Over-the Counter Bulletin Boards on Tuesday, February 1, 2011 under our new trading symbol “CICC.”

On February 22, 2011, in connection with a security purchase agreement between the Company and certain investors (collectively, the “Investors”), we closed a private placement of approximately $6.4 million from offering a total of 474,967 units (the “Units”) at a purchase price of $13.50 per Unit, each consisting of:(i) nine shares of the Company’s 5% Series A Convertible Preferred Stock, par value $0.00001 per share (the “Preferred Shares ”), convertible on a one to one basis into nine shares of the Company’s Common Stock; (ii) one share of Common Stock; (iii) two three-year Series A Warrants, each exercisable for the purchase of one share of Common Stock, at an exercise price of $2.00 per share; and (iv) two three-year Series B Warrants, each exercisable for the purchase of one share of Common Stock, to purchase one share of Common Stock, at an exercise price of $3.00 per share.

Our Corporation Information

We maintain our corporate offices at #1707, Block A, Genzon Times Square, Longcheng Blvd, Centre City, Longgang District, Shenzhen, Guangdong Province, People’s Republic of China. Our telephone number is 86-755-89896008 and our facsimile number is 86-755-89896018. We also have a website at http://www.chinainternetcafe.com/

THE OFFERING

The Offering

This prospectus relates to (i) 474,967 shares of Common Stock, (ii) 2,498,326 shares of Common Stock underlying certain convertible warrants, and (iii) 4,274,703 shares of Common Stock underlying Preferred Shares.

| Common Stock outstanding prior to offering | 21,361,534 | |

| Common Stock offered by Company | 0 | |

| Total shares of Common Stock offered by selling shareholders | 7,247,996 (comprising 2,498,326 shares of Common Stock underlying certain warrants, 4,274,703 shares of Common Stock underlying certain convertible preferred stock, and 474,967 shares of Common Stock) | |

| Common Stock to be outstanding after the offering (assuming all the warrants have been either exercised or converted and all Preferred Shares have been converted) | 28,134,563 | |

| Use of proceeds of sale | We will not receive any of the proceeds of sale of the shares of Common Stock by the selling stockholders. However, we will receive proceeds from any exercise or conversion of the warrants into and up to 2,498,326 shares of our Common Stock, which are presently offered under this prospectus unless the warrants are exercised on a cashless basis, in which case we will not receive any proceeds from the exercise of the warrants. We intend to use any proceeds received from the exercise or conversion, as the case may be, for working capital and other general corporate purposes. We, however, cannot assure you that any of the warrants will be exercised or converted. | |

| Risk Factors | See “Risk Factors” beginning on page 11 and other information included in this prospectus for a discussion of factors you should consider before deciding to invest in shares of our Common Stock. |

| 8 |

Background

On February 22, 2011( the “Closing Date”), in connection with a security purchase agreement between the Company and the Investors, we closed a private placement (the “Offering”) of approximately $6.4 million from offering a total of 474,967 units (the “Units”) at a purchase price of $13.50 per Unit, each consisting of:(i) nine shares of the Company’s Preferred Shares, convertible on a one to one basis into nine shares of the Company’s Common Stock; (ii) one share of Common Stock; (iii) two three-year Series A Warrants, each exercisable for the purchase of one share of Common Stock, at an exercise price of $2.00 per share; and (iv) two three-year Series B Warrants, each exercisable for the purchase of one share of Common Stock, to purchase one share of Common Stock, at an exercise price of $3.00 per share.

As a condition to the Offering, we agreed to grant certain registration rights to the Investors pursuant to a Registration Rights Agreement dated February 22, 2011. We agreed to register for resale with the Securities and Exchange Commission (i) the shares of Common Stock issuable upon conversion of the Preferred Shares (4,274,703); (ii) the Common Shares (474,967); (iii) the shares of Common Stock issuable upon exercise of the Warrants (2,498,326); and (iv) any securities issued or issuable upon any stock split, dividend or other distribution, recapitalization or similar event with respect to the foregoing.

For more information on the Offering, please refer to our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 23, 2011 and in the “Recent Sales of Unregistered Securities” section below.

Plan of Distribution

This offering is not being underwritten. The selling stockholders directly, through agents designated by them from time to time or through brokers or dealers also to be designated, may sell their shares from time to time, in or through privately negotiated transactions, or in one or more transactions, including block transactions, on the OTC Bulletin Board or on any stock exchange on which the shares may be listed in the future pursuant to and in accordance with the applicable rules of such exchange or otherwise. The selling price of the shares may be at market prices prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices. To the extent required, the specific shares to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any such agent, broker or dealer and any applicable commission or discounts with respect to a particular offer will be described in an accompanying prospectus. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus. We will keep this prospectus current until the expiration dates of the convertible warrants, even if the convertible warrants which underlie certain shares of our Common Stock subject to this prospectus are out of the money.

The selling security holders and any other persons participating in the sale or distribution of the shares offered under this prospectus will be subject to applicable provisions of the Exchange Act, and the rules and regulations under that act, including Regulation M. These provisions may restrict activities of, and limit the timing of purchases and sales of any of the shares by, the selling security holders or any other person. Furthermore, under Regulation M, persons engaged in a distribution of securities are prohibited from simultaneously engaging in market making and other activities with respect to those securities for a specified period of time prior to the commencement of such distributions, subject to specified exceptions or exemptions. All of these limitations may affect the marketability of the shares.

We will not receive any proceeds from sales of shares by the selling stockholders. However, if any of the selling stockholders decide to exercise their warrants, we will receive the net proceeds of the exercise of such security held by the selling stockholders. We intend to use any proceeds we receive from the exercise or conversion of warrants for working capital and other general corporate purposes. We cannot assure you that any of the warrants will ever be exercised or converted. To the extent that the warrants are exercised on a cashless basis, we will not receive any proceeds from the exercise of the warrants.

We will pay all expenses of registration incurred in connection with this offering (estimated to be $68,262), but the selling stockholders will pay all of the selling commissions, brokerage fees and related expenses.

The selling stockholders and any broker-dealers or agents that participate with the selling stockholders in the distribution of any of the shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

| 9 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER

INFORMATION

CONTAINED IN THIS PROSPECTUS

This prospectus contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans and (e) our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under “Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of our forward-looking statements in this report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to publicly update any forward-looking statements, whether as the result of new information, future events, or otherwise.

Currency, exchange rate, and “China” and other references

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "Yuan" or "RMB" are to the Chinese Yuan, which is also known as the Renminbi . According to the currency exchange website www.xe.com, on June 14, 2012, $1.00 was equivalent to 6.37 Yuan.

References to “PRC” or “China” are to the People’s Republic of China.

Unless otherwise specified or required by context, references to “we,” “the Company”, “our” and “us” refer to China Internet Cafe Holdings Group, Inc.

References to the “Bulletin Board,” the “OTC Bulletin Board” is to the Over-the-Counter Bulletin Board, a securities quotation service, which is accessible at the website www.otcbb.com.

| 10 |

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our Common Stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our limited operating history makes evaluating our business and prospects difficult.

Our VIE, Junlong, was established in December 2003 and obtained the license to operate internet cafés in Shenzhen in 2005. Our limited operating history may not provide a meaningful basis for you to evaluate our business and prospects. Our business strategy has not been proven over time and we cannot be certain that we will be able to successfully expand our business.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the market price of our securities. Operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in operating results could cause the value of our securities to decline. Investors should not rely on comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods results of operations may be below the expectations of public market analysts and investors. This could cause the market price of our securities to decline. Factors that may affect our quarterly results include:

| · | vulnerability of our business to a general economic downturn in the PRC; |

| · | changes in the laws of the PRC that affect our operations; |

| · | competition from other similar service providers; and |

| · | our ability to obtain necessary government certifications and/or licenses to conduct our business. |

We are dependent on our management team and the loss of any key member of that team could have a material adverse effect on our operations and financial condition.

We attribute our success to the leadership and contributions of our managing team comprising executive directors and key executives, in particular, to our Chief Executive Officer and Chief Financial Officer, Dishan Guo and our Chief Technology Officer Zhenfan Li.

Our continued success is therefore dependent to a large extent on our ability to retain the services of these key management personnel. The loss of their services without timely and qualified replacement, will adversely affect our operations and hence, our revenue and profits.

We have limited internal controls due to our lack of sufficient personnel with an appropriate level of technical accounting knowledge, experience, and training in the application of GAAP.

During the year ended December 31, 2011, we lacked personnel with an appropriate level of technical accounting knowledge, experience, and training in the application of GAAP commensurate with our complexity and our financial accounting and reporting requirements. Due to this lack of qualified personnel, there is a reasonable possibility that material misstatements of the financial statements including disclosures will not be prevented or detected on a timely basis.

| 11 |

We have not obtained social insurance benefits for all of our employees and could incur administrative fines and penalties that could materially affect our financial condition and reputation.

We have obtained social benefits coverage for employees who work at the headquarters of Junlong. For other employees, because of the high mobility of their work, they usually work on a probationary basis and will not enter into a long employment relationship with us. We are subject to administrative fines and penalties as a result of our failure to obtain social insurance for these employees. The amount of these fines and penalties, in the aggregate, may adversely affect our financial condition and our public image.

Tightened regulations on internet cafés may adversely affect our operations and revenues.

The PRC government has been tough on internet café regulations. In 2003, the PRC government imposed a minimum capital requirement of RMB 10 million (approximately $1.47 million) for regional café chains and RMB 50 million (approximately $7.32 million) for national café chains. On September 29, 2002, the State Council issued “Regulations on the Administration of Business Sites of Internet Access Services.” The regulations require a license to operate internet cafés which may not be assigned or leased to any third parties. The regulations also have detailed provisions regarding internet cafes’ business operations and security control. The number of internet cafés in China was reduced after these regulations went effective.

If the PRC government decided to impose more stringent regulations on internet cafés and their operations, our business may be adversely affected and our revenues may decrease as a result.

There may be reduced use of internet cafés with the increase in computer ownership and internet connections at home and any such reduction would negatively affect our financial performance.

With the rapid economic development and growing disposable income, computer ownership and internet connections at home will gradually increase as the price for computer hardware, software and internet access decreases. The increase in computer ownership and internet connections at home may result in decreased demand for our services. Such decrease in demand may adversely affect our business and our revenues may decrease as a result.

Negative media coverage of internet cafés may reduce the number of customers that visit our internet cafés and result in lower revenues.

In the last few years there have been several negative stories in the media about internet cafés. A fatal fire in Beijing's Lanjisu Internet café in June 2002 raised nationwide concern about the country’s burgeoning internet café business. In 2006, a report from the China National Children's Center, a government think-tank, said that 13 percent of the PRC's 18 million internet users under 18 were internet addicts. Responding to the problems associated with internet cafés, the PRC imposed more stringent laws and regulations on internet cafés. In 2007, fearful of soaring internet addiction and juvenile crime, the PRC banned the opening of new internet cafés for a year. Such negative media coverage may result in stricter government regulations and reduced number of customers.

Interruption or failure of our own information technology and communications systems or those of third-party service providers we rely upon could impair our ability to effectively provide our services, which could damage our reputation and harm our operating results.

Our ability to provide our services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could interrupt our service. Service interruptions could reduce our revenues and profits, and damage our brand if our system is perceived to be unreliable. Our systems are vulnerable to damage or interruption as a result of terrorist attacks, wars, earthquakes, floods, fires, power loss, telecommunications failures, undetected errors or “bugs” in our software, and computer viruses.

| 12 |

Our servers are vulnerable to break-ins, sabotage and vandalism. The occurrence of a natural disaster or a closure of an Internet data center by a third-party provider without adequate notice could result in lengthy service interruptions.

The steps we take to increase the reliability and redundancy of our systems are expensive, reduce our operating margin and may not be successful in reducing the frequency or duration of service interruptions.

Our business may be adversely affected by third-party software applications or practices that interfere with our receipt of information from, or provision of information to, our customers, which may impair our customers’ experience.

Our business may be adversely affected by third-party malicious or unintentional software applications that make changes to our computers and interfere with our services. These software applications may be difficult or impossible to remove or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. The ability to provide a superior user experience is critical to our success. If we are unable to successfully combat third-party software applications that interfere with our products and services, our reputation may be harmed.

The successful operation of our business depends upon the performance and reliability of the Internet infrastructure and fixed telecommunications networks in China.

Our business depends on the performance and reliability of the Internet infrastructure in China. Almost all access to the Internet is maintained through state-owned telecommunication operators under the administrative control and regulatory supervision of the Ministry of Industry and Information Technology (or its predecessor, the Ministry of Information Industry, before its formal establishment in 2008), or the MIIT. In addition, the national networks in China are connected to the Internet through international gateways controlled by the PRC government. These international gateways are the only channels through which a domestic user can connect to the Internet. We cannot assure you that a more sophisticated Internet infrastructure will be developed in China. We may not have access to alternative networks in the event of disruptions, failures or other problems with China’s Internet infrastructure. In addition, the Internet infrastructure in China may not support the demands associated with continued growth in Internet usage.

Any unscheduled service interruption could damage our reputation and result in a decrease in our revenues. Furthermore, if the prices that we pay for telecommunications and Internet services rise significantly, our gross margins could be adversely affected.

Concerns about the security of electronic commerce transactions and confidentiality of information on the Internet may reduce use of our internet cafes and impede our growth.

A significant barrier to electronic commerce and communications over the Internet in general has been a public concern over security and privacy, including the transmission of confidential information. If these concerns are not adequately addressed, they may inhibit the growth of the Internet and other online services generally, especially as a means of conducting commercial transactions. If a well-publicized Internet breach of security were to occur, general Internet usage could decline, which could cause our operations to be adversely affected.

Regulation and censorship of information disseminated over the Internet in China may adversely affect our business.

The PRC government has adopted regulations governing Internet access and the distribution of news and other information over the Internet. Under these regulations, Internet content providers and Internet publishers are prohibited from posting or displaying over the Internet content that, among other things, violates PRC laws and regulations, impairs the national dignity of China, or is reactionary, obscene, superstitious, fraudulent or defamatory. Failure to comply with these requirements may result in the revocation of licenses to provide Internet content and other licenses and the closure of the concerned websites.

| 13 |

The Ministry of Public Security has the authority to order any local Internet service provider to block any Internet website at its sole discretion. From time to time, the Ministry of Public Security has stopped the dissemination over the Internet of information which it believes to be socially destabilizing. The State Secrecy Bureau is also authorized to block any website it deems to be leaking state secrets or failing to meet the relevant regulations relating to the protection of State secrets in the dissemination of online information.

Such regulation and censorship could lead to a decrease in our customers’ interest in utilizing our internet cafes which would cause our operations to be adversely affected.

Intensified government regulation of Internet cafes could cause our operations to be adversely affected.

The PRC government has tightened its regulation of Internet cafes in recent years. In particular, a large number of unlicensed Internet cafes have been closed. In addition, the PRC government has imposed higher capital and facility requirements for the establishment of Internet cafes. Furthermore, the PRC government’s policy, which encourages the development of a limited number of national and regional Internet cafe chains and discourages the establishment of independent Internet cafes, may slow down the growth of Internet cafes. In June 2002, the Ministry of Culture, together with other government authorities, issued a joint notice, and in February 2004, the State Administration for Industry and Commerce issued another notice, suspending the issuance of new Internet cafe licenses. In May 2007, the State Administration for Industry and Commerce reiterated its position not to register any new Internet cafes in 2007. In 2008 and 2009, the Ministry of Culture, the State Administration for Industry and Commerce and other relevant government authorities, individually or jointly, issued several notices that provide various ways to strengthen the regulation of Internet cafes, including investigating and punishing Internet cafes that accept minors, cracking down on Internet cafes without sufficient and valid licenses, limiting the total number of Internet cafes and approving Internet cafes within the planning made by relevant authorities, screening unlawful and adverse games and websites, and improving the coordination of regulation over Internet cafes and online games. Such intensified government regulation of Internet cafes and any additional government regulation that may arise in the future could adversely affect our operations by limiting the services currently provided by our cafes, which in turn could decrease our customer base or have similar negative effect on our operations.

If we fail to successfully update our computer hardware, software, and systems to customer requirements or emerging industry standards, our business, prospects and financial results may be materially and adversely affected.

To remain competitive, we must continue to update the computer hardware, software and systems in our internet cafes. The computer industry is characterized by rapid technological evolution, changes in user requirements and preferences, frequent introductions of new products and services embodying new technologies and the emergence of new industry standards and practices that could render our existing proprietary technologies and systems obsolete. If we are unable to adapt in a cost-effective and timely manner in response to changing market conditions or customer requirements, whether for technical, legal, financial or other reasons, our business, prospects, financial condition and results of operations would be materially adversely affected.

We may be unable to adequately safeguard our intellectual property or we may face claims that may be costly to resolve or that limit our ability to use such intellectual property in the future.

Our business is reliant on our intellectual property. Our software SAFLASH is the result of our research and development efforts, which we believe to be proprietary and unique. However, we are unable to assure you that third parties will not assert infringement claims against us in respect of our intellectual property or that such claims will not be successful. It may be difficult for us to establish or protect our intellectual property against such third parties and we could incur substantial costs and diversion of management resources in defending any claims relating to proprietary rights. If any party succeeds in asserting a claim against us relating to the disputed intellectual property, we may need to obtain licenses to continue to use the same. We cannot assure you that we will be able to obtain these licenses on commercially reasonable terms, if at all. The failure to obtain the necessary licenses or other rights could cause our business results to suffer.

| 14 |

Further, we rely upon a combination of trade secrets, non-disclosure and other contractual agreements with our employees as well as limitation of access to and distribution of our intellectual property in our efforts to protect intellectual property. However, our efforts in this regard may be inadequate to deter misappropriation of our proprietary information or we may be unable to detect unauthorized use and take appropriate steps to enforce our rights. Policing unauthorized use of our intellectual property is difficult and there can be no assurance that the steps taken by us will prevent misappropriation of our intellectual property.

Where litigation is necessary to safeguard our intellectual property, or to determine the validity and scope of the proprietary rights of others, this could result in substantial costs and diversion of our resources and could have a material adverse effect on our business, financial condition, operating results or future prospects.

We may not have sufficient insurance coverage and an interruption of our business or loss of a significant amount of property could have a material adverse effect on our financial condition and operations.

We currently do not maintain any insurance policies against loss of key personnel and business interruption as well as product liability claims. If such events were to occur, our business, financial performance and financial position may be materially and adversely affected.

Inability to maintain our competitiveness would adversely affect our financial performance.

We operate in a competitive environment and face competition from existing competitors and new market entrants. Some of these existing competitors, especially the national chains of internet cafés have more resources than us and may provide better services to customers.

There is no assurance that we will be able to compete successfully in the future. Any failure by us to remain competitive would adversely affect our financial performance.

We may be adversely affected by a significant or prolonged economic downturn in the level of consumer spending in the industries and markets served by our customers.

We rely on the spending of our customers in our cafés for our revenues, which may in turn depend on the customers’ level of disposable income, perceived future earning capabilities and willingness to spend. Any significant or prolonged decline of the PRC economy or economy of such markets served by our customers will affect consumers’ disposable income and consumer spending in these markets, and lead to a decrease in demand for consumer products.

To the extent that such decrease in demand for consumer products translates into a decline in the demand for internet café services, our performance will be adversely affected.

Revocation of the license for operating internet café chain will adversely affect our business.

We hold a license for operating a regional internet café chain in Shenzhen and each of our internet cafés obtains a license for the internet access services. These licenses are currently valid, and will continue to be valid within the term of the corresponding business licenses. These licenses do not need to be renewed unless there is change of information thereon. But the competent authorities are entitled to examine and reevaluate our internet cafés any time upon their initiatives or following orders of the higher-level authorities, and we must comply with the then prevailing standards and regulations which may change from time to time. Failure to comply with these changing standards and regulations could result in our licenses being revoked or suspended, which could have a material adverse effect on our operations. Furthermore, if escalating compliance costs associated with governmental standards and regulations restrict or prohibit any part of our operations, it may adversely affect our operations and profitability.

We may be unable to effectively manage our expansion.

We have identified several growth plans. These expansion plans may strain our financial resources. In addition, any significant growth into new markets may require an expansion of our employee base for managerial, operational, financial, and other purposes. During any growth, we may face problems related to our operational and financial systems and controls. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

| 15 |

If we are unable to successfully manage our expansion, we may encounter operational and financial difficulties which would in turn adversely affect our business and financial results.

We may require additional funding for our growth plans, and such funding may result in a dilution of your investment.

We attempted to estimate our funding requirements in order to implement our growth plans.

If the costs of implementing such plans should exceed these estimates significantly or if we come across opportunities to grow through expansion plans which cannot be predicted at this time, and our funds generated from our operations prove insufficient for such purposes, we may need to raise additional funds to meet these funding requirements.

These additional funds may be raised by issuing equity or debt securities or by borrowing from banks or other resources. We cannot assure you that we will be able to obtain any additional financing on terms that are acceptable to us, or at all. If we fail to obtain additional financing on terms that are acceptable to us, we will not be able to implement such plans fully. Such financing even if obtained, may be accompanied by conditions that limit our ability to pay dividends or require us to seek lenders’ consent for payment of dividends, or restrict our freedom to operate our business by requiring lender’s consent for certain corporate actions.

Further, if we raise additional funds by way of a rights offering or through the issuance of new shares, any shareholders who are unable or unwilling to participate in such an additional round of fund raising may suffer dilution in their investment.

Our strategy to acquire companies may result in unsuitable acquisitions or failure to successfully integrate acquired companies, which could lead to reduced profitability.

We intend to expand our business through acquisitions of companies or operations similar to our own. We may be unsuccessful in identifying suitable acquisition candidates, or may be unable to consummate a desired acquisition. To the extent any future acquisitions are completed, we may be unsuccessful in integrating acquired companies or their operations, or if integration is more difficult than anticipated, we may experience disruptions that could have a material adverse impact on future profitability. Some of the risks that may affect our ability to integrate, or realize any anticipated benefits from, acquisitions include:

| · | unexpected losses of key employees or customer of the acquired company; | |

| · | difficulties integrating the acquired company's standards, processes, procedures and controls; | |

| · | difficulties hiring additional management and other critical personnel; | |

| · | difficulties increasing the scope, geographic diversity and complexity of our operations; | |

| · | difficulties consolidating facilities, transferring processes and know-how; | |

| · | difficulties reducing costs of the acquired company's business; and | |

| · | diversion of management's attention from our management. |

We may be exposed to potential risks relating to our internal controls over financial reporting.

The Company’s management is responsible for establishing and maintaining adequate internal control over our financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act. The Company’s management is also required to assess and report on the effectiveness of the Company’s internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of the Company’s financial reporting for external purposes in accordance with generally accepted accounting principles. Internal control over financial reporting includes policies and procedures that: (i) pertain to maintaining records that in reasonable detail accurately and fairly reflect the Company’s transactions; (ii) provide reasonable assurance that transactions are recorded as necessary for preparation of the Company’s financial statements and that receipts and expenditures of company assets are made in accordance with management authorization; and (iii) provide reasonable assurance that unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements would be prevented or detected on a timely basis.

| 16 |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiaries and contractual relationship with Junlong. Should we decide in the future to pay dividends, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars. Further, dividends paid to non-PRC stockholders may be subject to a 10% withholding, as further discussed in a later section. Under the EIT Law, we may be classified as a ‘resident enterprise’ of the PRC. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders.”

Relevant PRC statutory laws and regulation permit payments of dividends by the Company’s subsidiaries in the PRC only out of their accumulated profits, if any, as determined in accordance with the PRC accounting standards and regulations.

Our subsidiary in the PRC is also required to set aside a portion of its after tax profits according to PRC accounting standards and regulations to fund certain reserve funds. Currently, our subsidiary in the PRC is the only sources of revenues or investment holdings for the payment of dividends. If it does not accumulate sufficient profits under PRC accounting standards and regulations to first fund certain reserve funds as required by PRC accounting standards, we will be unable to pay any dividends.

As of December 31, 2011 and 2010, $718,744 was appropriated from retained earnings and set aside for the statutory reserve by the Company’s subsidiaries in the PRC. As a result of these PRC laws and regulations, the Company’s subsidiaries in the PRC are restricted in their ability to transfer a portion of their net assets to either in the form of dividends, loans or advances, which consisted of paid-up capital and statutory reserves, amounting to $2,214,999 as of December 31, 2011and 2010.

RISKS RELATING TO OUR COMMERCIAL RELATIONSHIP WITH JUNLONG

All of our revenues are generated through our VIE, and we rely on payments made by our VIE to Zhonghefangda, our subsidiary, pursuant to contractual arrangements to transfer any such revenues to Zhonghefangda. Any restriction on such payments and any increase in the amount of PRC taxes applicable to such payments may materially and adversely affect our business and our ability to pay dividends to our shareholders.

We conduct substantially all of our operations through Junlong, our VIE, which generates all of our revenues. As Junlong is not owned by our subsidiary, it is not able to make dividend payments to our subsidiary. Instead, Zhonghefangda, our subsidiary in China, entered into a number of contracts with Junlong, including a Management and Consulting Services Agreement, an Equity Pledge Agreement, an Option Agreement and a Voting Rights Proxy Agreement, pursuant to which Junlong pays Zhonghefangda for certain services that Zhonghefangda provides to Junlong. However, depending on the nature of services provided, certain of these payments are subject to PRC taxes at different rates, including business taxes and VATs, which effectively reduce the amount that Zhonghefangda receives from Junlong. We cannot assure you that the PRC government will not impose restrictions on such payments or change the tax rates applicable to such payments. Any such restrictions on such payment or increases in the applicable tax rates may materially and adversely affect our ability to receive payments from Junlong or the amount of such payments, and may in turn materially and adversely affect our business, our net income and our ability to pay dividends to our shareholders.

| 17 |

Dishan Guo, Jinzhou Zeng, and Xiaofen Wang’s association with Junlong could pose a conflict of interest which may result in Junlong decisions that are adverse to our business.

Dishan Guo, Jinzhou Zeng and Xiaofen Wang, who hold controlling interest in Classic Bond are also controlling shareholders of our VIE. Conflicts of interests between their dual roles as owners of both Junlong and our company may arise. We cannot assure you that when conflicts of interest arise, any or all of these individuals will act in the best interests of our company or that any conflict of interest will be resolved in our favor. In addition, these individuals may breach or cause Junlong to breach or refuse to renew the existing contractual arrangements, which will have a material adverse effect on our ability to effectively control Junlong and receive economic benefits from it. If we cannot resolve any conflicts of interest or disputes between us and the beneficial owners of Junlong, we would have to rely on legal proceedings, the outcome of which is uncertain and which could be disruptive to our business.

Messrs Guo, Zeng and Wang do not have a formalized dispute resolution agreement. However, it is anticipated that parties will resolve any conflict through mutual consultation and negotiations as is typical in China. Should such conflict endure, the parties will subject their dispute to be adjudicated before a court of competent jurisdiction in China. The Company does not have a policy pursuant to which its directors, such as Messrs. Guo, Zeng and Wang must resolve any conflict of interest that arise as a result of their ownership interests in or management of other companies, such as Classic Bond.

If Junlong or the VIE Shareholders violate our contractual arrangements with it, our business could be disrupted and we may have to resort to litigation to enforce our rights which may be time consuming and expensive.

Our operations are currently dependent upon our commercial relationship with Junlong. If Junlong or their shareholders are unwilling or unable to perform their obligations under our commercial arrangements with them, including payment of revenues under the Management and Consulting Service Agreement, we will not be able to conduct our operations in the manner currently planned.

If the PRC government determines that the agreements establishing the structure for operating our China business do not comply with applicable PRC laws, rules and regulations, we could be subject to severe penalties including being prohibited from continuing our operations in the PRC.

On August 8, 2006, six PRC regulatory agencies, including Ministry of Commerce (the “MOFCOM ”), the China Securities Regulatory Commission (the “ CSRC ”), the State Asset Supervision and Administration Commission (the “ SASAC ”), the State Administration of Taxation (the “SAT ”), the State Administration for Industry and Commerce (the “ SAIC ”) and the State Administration of Foreign Exchange (the “ SAFE ”), jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule (the “ M&A Rule ”), which became effective on September 8, 2006. This new regulation, among other things, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. In the opinion of our PRC counsel, China Commercial Law Firm, this approval process was not required in our case because we have not acquired either the equity or assets of a company located in the PRC, and that the VIE agreements do not constitute such an acquisition. If the PRC government were to take a contrary view, we might be subject to fines or other enforcement action, and might be forced to amend or terminate our contractual arrangements with Junlong, which could have an adverse effect on our business.

Uncertainties in the PRC legal system may impede our ability to enforce the commercial agreements that we have entered into with Junlong or any arbitral award thereunder and any inability to enforce these agreements could materially and adversely affect our business and operation.

While disputes under the Consulting Agreement with Junlong are subject to binding arbitration before the China International Economic and Trade Arbitration Commission, or CIETAC, in accordance with CIETAC Arbitration Rules, the agreements are governed by PRC law and an arbitration award may be challenged in accordance with PRC law. For example, a claim that the enforcement of an award in our favor will be detrimental to the public interest, or that an issue does not fall within the scope of the arbitration would require us to engage in administrative and judicial proceedings to defend an award. PRC legal system is a civil law system based on written statutes and unlike common law systems, it is a system in which decided legal cases have little value as precedent. As a result, PRC administrative and judicial authorities have significant discretion in interpreting and implementing statutory and contractual terms, and it may be more difficult to evaluate the outcome of administrative and judicial proceedings and the level of legal protection available than in more developed legal systems. These uncertainties may impede our ability to enforce the terms of the Consulting Agreement and the other contracts that we may enter into with Junlong. Any inability to enforce the Consulting Agreement or an award thereunder could materially and adversely affect our business and operation.

| 18 |

Our arrangements with Junlong and the VIE Shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with Junlong and the VIE Shareholders were not entered into based on arm’s length negotiations. If the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

RISKS RELATED TO DOING BUSINESS IN THE PRC

New labor law in the PRC may adversely affect our results of operations.

On June 29, 2007, the National People’s Congress promulgated the Labor Contract Law of PRC, or the Labor Law, which became effective as of January 1, 2008. On September 18, 2008, the PRC State Council issued the PRC Labor Contract Law Implementation Rules, which became effective as of the date of issuance. The Labor Law and its implementation rules are intended to give employees long-term job security by, among other things, requiring employers to enter into written contracts with their employees and restricting the use of temporary workers. The Labor Law and its implementation rules impose greater liabilities on employers, require certain terminations to be based upon seniority rather than merit and significantly affect the cost of an employer’s decision to reduce its workforce. Employment contracts lawfully entered into prior to the implementation of the Labor Law and continuing after the date of its implementation remain legally binding and the parties to such contracts are required to continue to perform their respective obligations thereunder. However, employment relationships established prior to the implementation of the Labor Law without a written employment agreement were required to be memorialized by a written employment agreement that satisfies the requirements of the Labor Law within one month after it became effective on January 1, 2008. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost effective manner, thus materially and adversely affecting our financial condition and results of operations.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law, and any determination that we violated such laws could hurt our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We are also subject to Chinese anti-corruption laws, which strictly prohibit bribery. We have operations, agreements with third parties and make sales in the PRC, which may experience corruption. Our activities in the PRC create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our Company, even though these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and our employees, consultants, sales agents or distributors may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption law may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the United States government may seek to hold us liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

| 19 |

Changes in PRC political or economic situation could harm us and our operating results.

Some of the changes in PRC political or economic situation that could harm us and our operating results are the:

| • | level of government involvement in the economy; | |

| • | control of foreign exchange; | |

| • | methods of allocating resources; | |

| • | balance of payments position; |

| • | international trade restrictions; and | |

| • | international conflict. |

The PRC economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the PRC economy and weak corporate governance and a lack of flexible currency exchange policy still prevail in the PRC. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the PRC economy was similar to those of the OECD member countries.

Our business is largely subject to the uncertain legal environment in China and your legal protection could be limited.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the legal protections afforded to foreign invested enterprises in the PRC. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses. In addition, all of our executive officers and our directors are residents of the PRC and not of the U.S., and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against our PRC operations and our controlled VIE.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC only recently has permitted provincial and local economic autonomy and private economic activities. The PRC government has exercised and continues to exercise substantial control over virtually every sector of the PRC economy through regulation and state ownership. Our ability to operate in the PRC may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in the PRC are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions thereof, and could require us to divest ourselves of any interest we then hold in PRC properties or joint ventures.

Future inflation in the PRC may inhibit our ability to conduct business in the PRC.