Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Financial Engines, Inc. | d365827d8k.htm |

Income+ Plan Sponsor Briefing

How it works and early results

Christopher L. Jones

EVP and Chief Investment Officer

Financial Engines

Forward Looking Statements

The

following

plan

sponsor

briefing

contains

forward-looking

statements.

These

forward-

looking statements are based on the Company’s current expectations and

beliefs, as well as a number of assumptions.

These forward-looking statements include, but are not limited to,

adoption of Income+, enrollment rates and related risk. These statements are

subject to risks, uncertainties, assumptions and other important factors,

many of which are outside the Company’s control, that could cause

actual results to differ materially from the results discussed in the

forward-looking statements. You are cautioned not to place undue

reliance on such forward-looking statements because actual results may

vary materially from those expressed

or

implied.

For

more

information

on

the

risks

and

uncertainties

affecting

the

Company please see our most recent SEC filings, including our Form 10-K for the

year ending December 31, 2011 and our most recent Form 10-Q.

Exhibit 99.1 |

Proprietary & Confidential | Not for participant use.

Participants need help transitioning from saving to spending

2

Building

your retirement

portfolio

Spending

your retirement portfolio

Income+

gives participants the

support they need to

transition to spending

Income+ early results presentation is for informational purposes only, and not necessarily indicative

of future service usage or enrollment. Information should not be construed as investment

advice, testimonial, or as an offer of advisory services or any specific recommendation to buy, sell,

or hold any investment. The report is based upon information and data we believe to be

reliable, but we do not guarantee its accuracy or completeness. Financial Engines undertakes no

obligation to publicly revise and/or update such results going forward. As of 12/31/2011, eight

plans, with over $19 billion in assets and nearly 300,000 participants had rolled out Income+. Early results data used in this presentation are based on five plans that had completed full

communications campaigns by 12/31/2011. Enrollment data were measured between 12/31/2011 and

3/31/2011. Two of the five plans used default enrollment. For plans already offering managed

accounts, when Income+ was rolled out, current eligible managed account participants were transitioned. Reference to potential one-year loss is based on the application of

Financial Engines’ forecasting methodology. This methodology projects the likelihood of various

investment outcomes that are hypothetical in nature, do not reflect actual results or

adjustment over time, and are not guaranties of future results.

Financial Engines provides advisory services through Financial Engines Advisors L.L.C., a federally

registered investment adviser and wholly owned subsidiary of Financial Engines, Inc. Financial

Engines is a registered trademark of Financial Engines, Inc. Neither Aon Hewitt nor Financial Engines guarantees future results, and a diversified risk-adjusted portfolio is not a

guarantee against loss.

|

Proprietary & Confidential | Not for participant use.

Income+

Feature of Professional Management

–

No additional fee for participants or sponsors

–

Uses plan’s existing investment options—no in-plan annuity

required Helps prepare for retirement payouts

–

Income Checkup with an advisor to develop an income plan

–

Gets portfolio income-ready via higher fixed income allocation

–

Maintains equity exposure for growth

Generates retirement payouts directly from a 401(k) account*

–

Steady with limited downside

–

Last for life**

–

Can go up with the market

–

Flexible

As extension of Professional Management, qualifies as QDIA

3

*Account balance minimums may apply.

**Requires purchase of an out-of-plan annuity. Issuer minimum purchase

requirements may apply. |

Proprietary & Confidential | Not for participant use.

Safe and easy for sponsors

4 |

Proprietary & Confidential | Not for participant use.

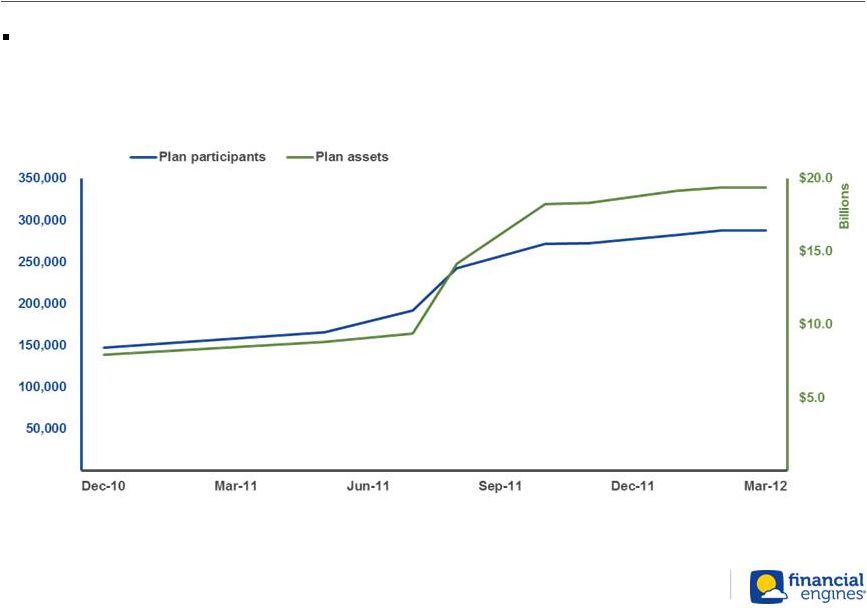

Income+ is getting strong traction with plan sponsors*

Plans with over $19 billion in plan assets and nearly 300,000 participants have

implemented Income+ *

Financial Engines Data Warehouse as of 3/31/12.

Income+ highlights

Large TX-based health

care system live

FORTUNE 20

financial services

co. 1 live

FORTUNE 200 tech.

co. 1st live with opt-

out Income+

2nd sponsor live with

opt-out Income+

FORTUNE 300

energy co. live

5

st |

Proprietary & Confidential | Not for participant use.

Early

Results

-

What

we’re

seeing

1.

Strong enrollment uptake

2.

Passive (opt-out) enrollment has biggest impact

3.

Income+ enrollees likely to be taking too much risk

6 |

Proprietary &

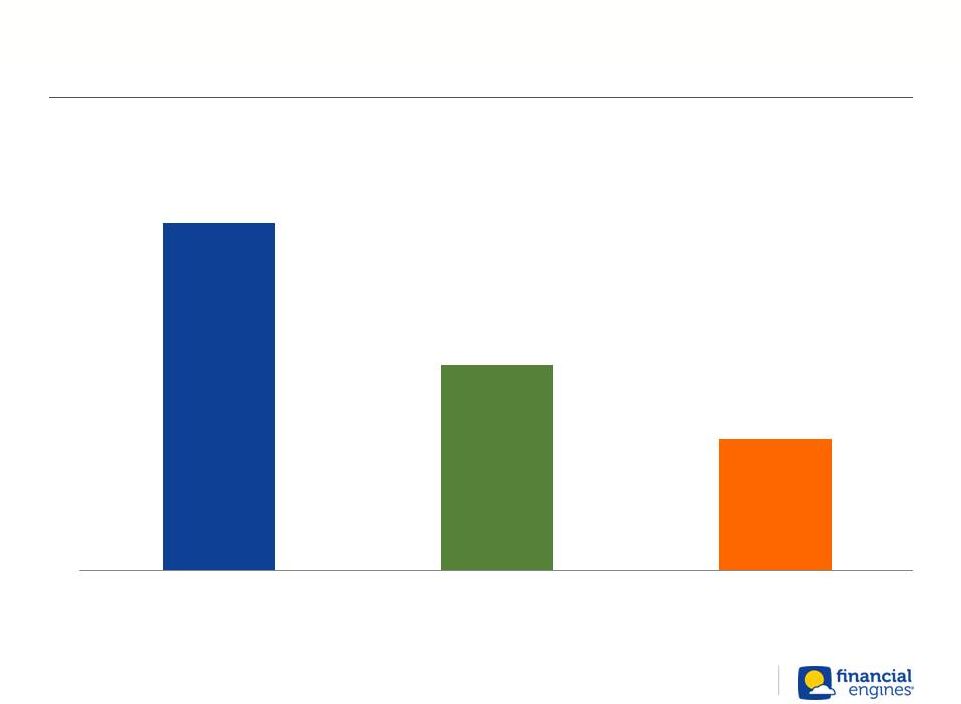

Confidential | Not for participant use. Strong enrollment uptake

7

16.4%

9.7%

6.2%

Plans w/Income+

All Professional

Management plans

Target date funds*

Enrollment rate of participants 60 and older

*TDFs

= 60+ participants with 95% or more invested in TDFs.

Financial Engines does not sell or distribute target date funds.

Enrollment rates for “All

Professional Management plans”

and “TDFs”

represent usage by participants 60 and older

across all plans offering Financial Engines’

managed account services. |

Proprietary & Confidential | Not for participant use.

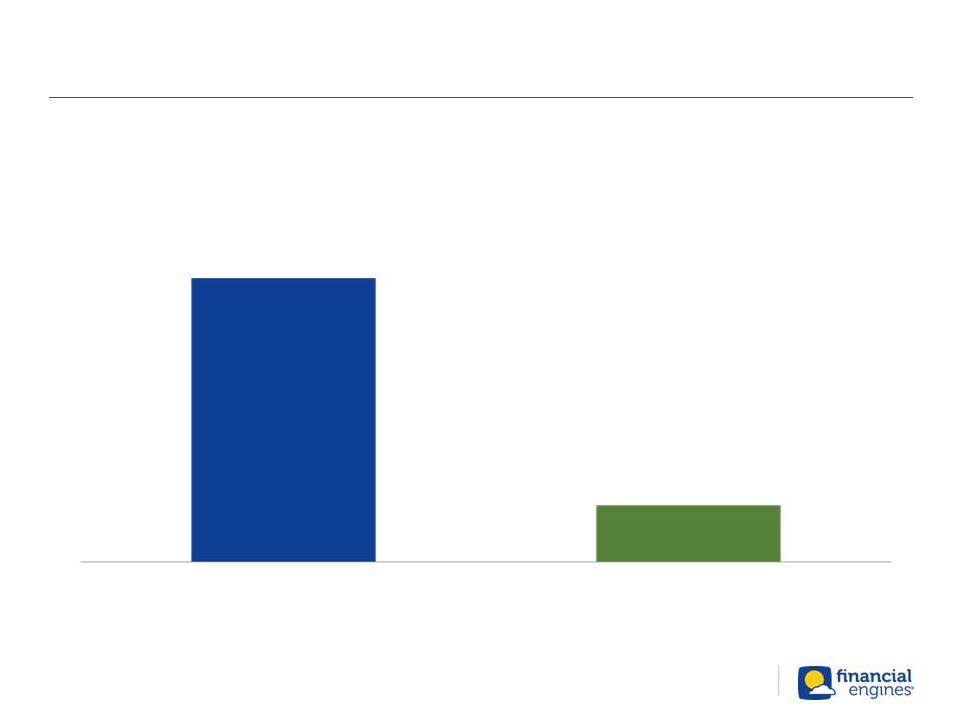

Passive (opt-out) enrollment makes big impact

8

Figures represent average enrollment rates into Professional Management

by participants age 60 and older in plans offering Income+.

Income+ passive enrollment rate

5X higher than active enrollment

50.3%

10.1%

Passive enrollment

Active enrollment |

Proprietary & Confidential | Not for participant use.

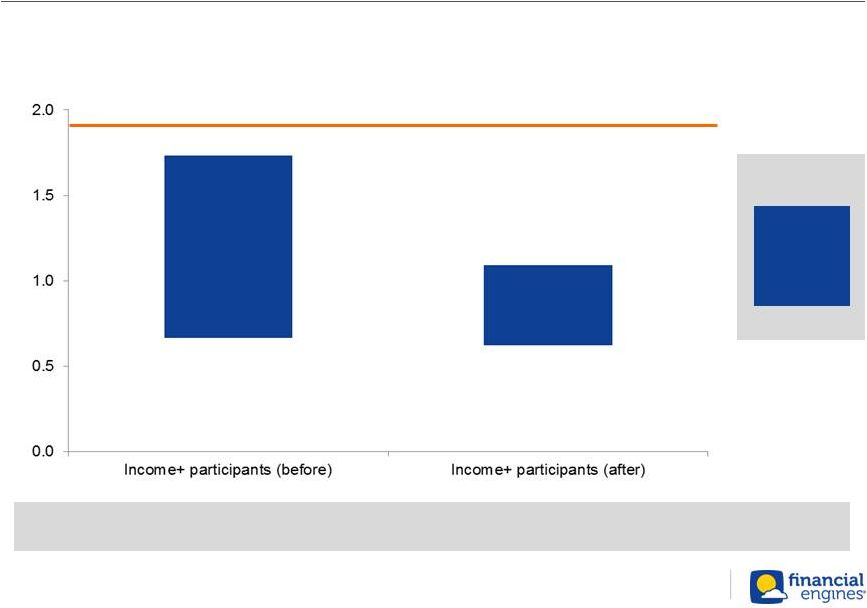

Many taking too much risk

9

Risk levels, before and after enrollment

Potential 1-year loss reduction: 31%

1.7

0.7

1.1

0.6

90

percentile

10 percentile

Legend

S&P 500

Risk level

th

th |

Proprietary & Confidential | Not for participant use.

Summary

Early in adoption cycle

Gaining more traction than other in-plan retirement income solutions

Strong interest from near-retirees and retirees

10 |