Attached files

| file | filename |

|---|---|

| 8-K - ESSEX PROPERTY TRUST INC 8-K 6-12-2012 - ESSEX PROPERTY TRUST, INC. | form8k.htm |

Exhibit 99.1

June 12-14, 2012

NAREIT Investor Forum

ESSEX PROPERTY TRUST, INC.

2

Table of Contents

Pages

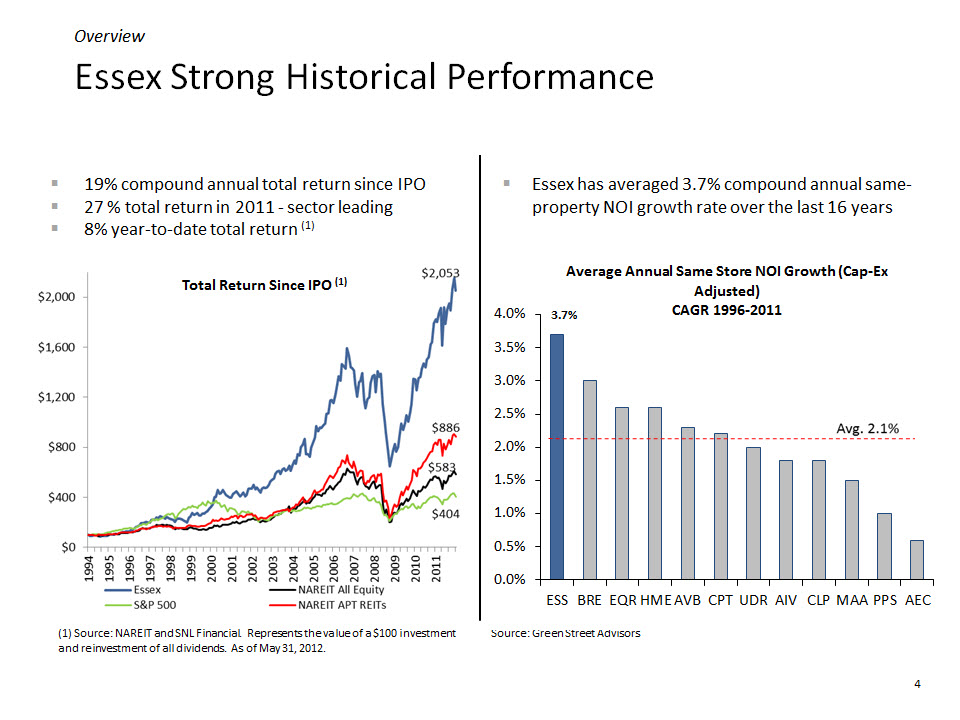

Section I. Overview: Top Performing REIT 3-5

Section II. Investment Strategy: West Coast Focus 6-13

Section III. Market Update: Focus on Three Major Markets 14-19

Section IV. Core Competencies: How Essex Creates Value 20-26

Section V. Financial Information 27-29

3

About Essex Property Trust

Multifamily REIT

§ Supply-constrained coastal markets of California

and Washington

and Washington

§ 158 properties containing +32,600 units

§ $7.7 billion in total market capitalization(1)

Strategy

§ Drive rent growth on high occupancy

§ Add value through redevelopment

§ Acquire and develop West Coast properties with

above-average growth characteristics

above-average growth characteristics

§ Maintain strong balance sheet and financial

flexibility

flexibility

Management Team

§ Top executives share an average tenure of over 20

years

years

Overview

Southern CA

46% of NOI

46% of NOI

Northern CA

35% of NOI

35% of NOI

Seattle

19% of NOI

(1) As of 5/31/12.

5

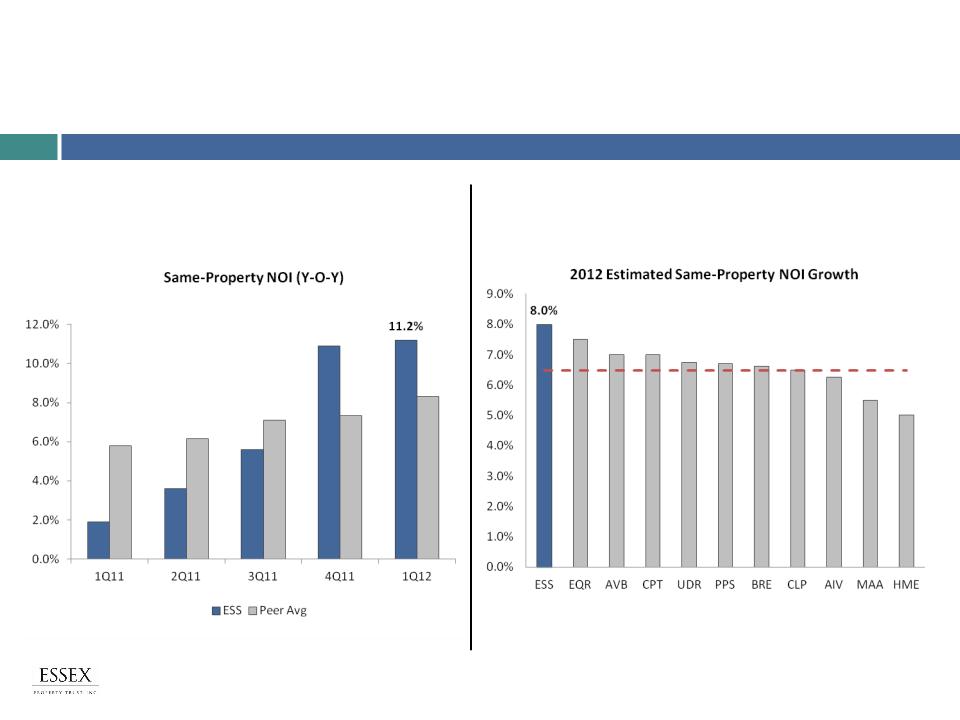

Essex Leads NOI Growth in Q1 and Is Projected Leader in 2012

§ ESS is projected to lead the peer group in NOI

growth in 2012

growth in 2012

Avg. 6.5%

Source: Midpoint of Company disclosures. Represents year-over-year growth.

Source: Company disclosures. Includes 11 multifamily REITs

§ Rents and same-property NOI growth

are accelerating

are accelerating

Overview

II. Investment Strategy

Strong West Coast Fundamentals

Anavia - Anaheim, CA

7

Why Focus on the West Coast

Robust Rent Growth

§ Rents declined further and

recovered later relative to other

major U.S. metros

recovered later relative to other

major U.S. metros

§ ESS in top 5 projected rent growth

markets over next five years

markets over next five years

Strong Job Growth

§ Better than average job growth,

especially in high paying industries

especially in high paying industries

Favorable Demographics

§ Above-average population growth

West Coast Significance

§ CA and WA have the 6th largest

GDP in the world

GDP in the world

Investment Strategy

Low Supply

§New supply remains muted, below 1%

annual addition to residential stock

annual addition to residential stock

§Difficulty to build in our coastal markets

due to lengthy entitlement process

due to lengthy entitlement process

Low Homeownership

§High cost of for-sale housing limits

transitions from renters to home owners

transitions from renters to home owners

§Tight lending standards

+

Strong Demand

Limited Supply

8

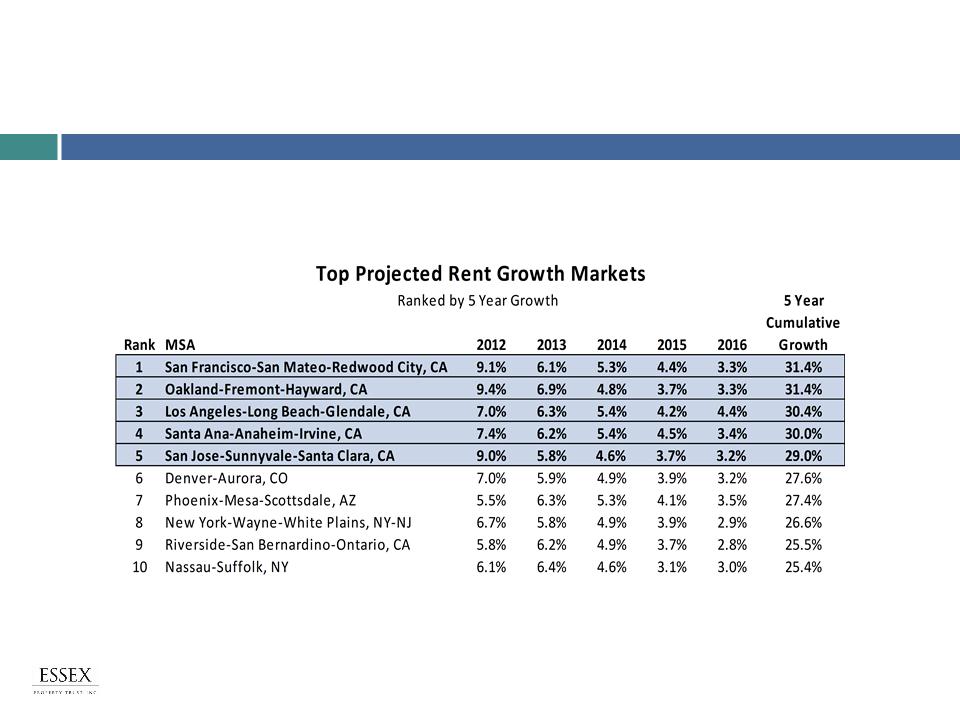

Research Driven Approach Identifies Top Markets

§ Approximately 65% of Essex’s NOI is located in the top 5 projected rent growth

markets

markets

Investment Strategy

Source: Axiometrics

9

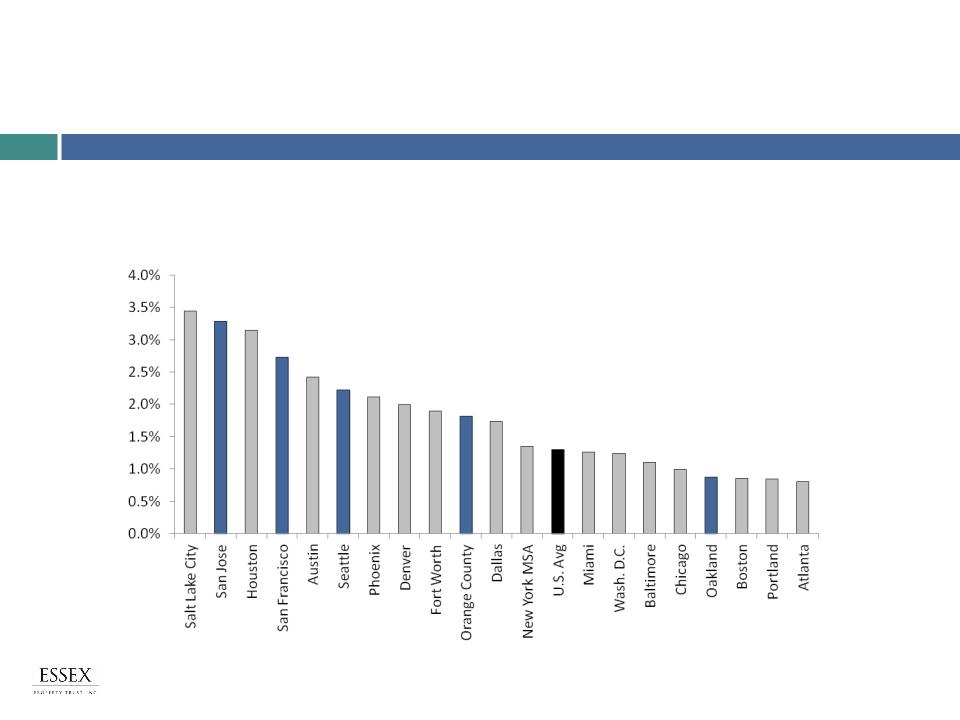

Job Growth: Favors Essex Markets

§ Job growth in many Essex markets outpaces U.S. average

§ LA job growth improving and expected to be 1% in 2012

Investment Strategy

% Job Growth: April 2012 (Year-Over-Year)

Source: BLS

10

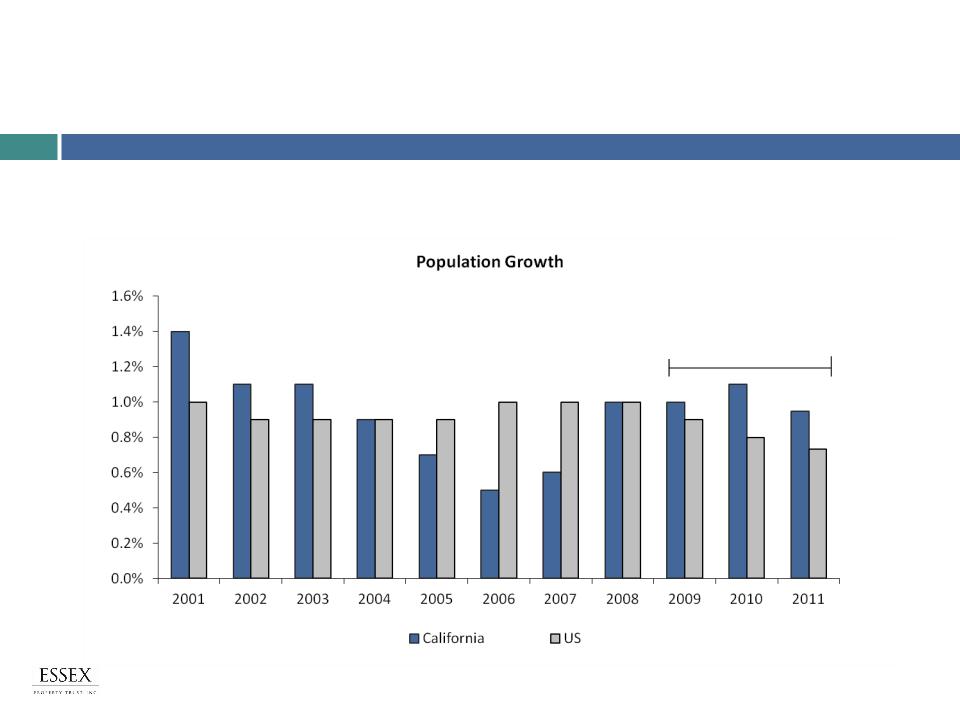

§ California population growth has outperformed the U.S. average for the last 3 years

California Population Growing Faster than U.S.

Average

Average

Investment Strategy

CA outperforms

Source: U.S. Census Bureau

11

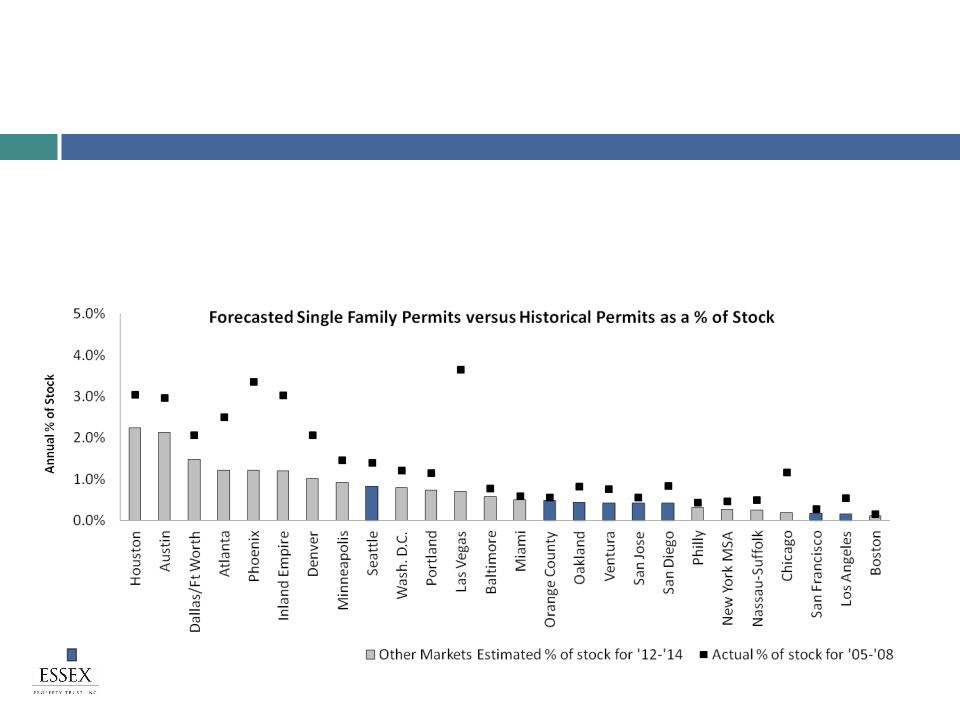

§ Coastal rental markets will have less competition from for-sale as compared to

2003-2007, due to more restrictive lending standards and higher housing costs

2003-2007, due to more restrictive lending standards and higher housing costs

§ Through varying economic cycles, supply remains low - well below 1% of stock in

ESS’s markets

ESS’s markets

Supply: For-Sale Supply Risk Low

Investment Strategy

Essex Markets Est. % of stock for ‘12-’14

Source: Economy.com and U.S. Census

12

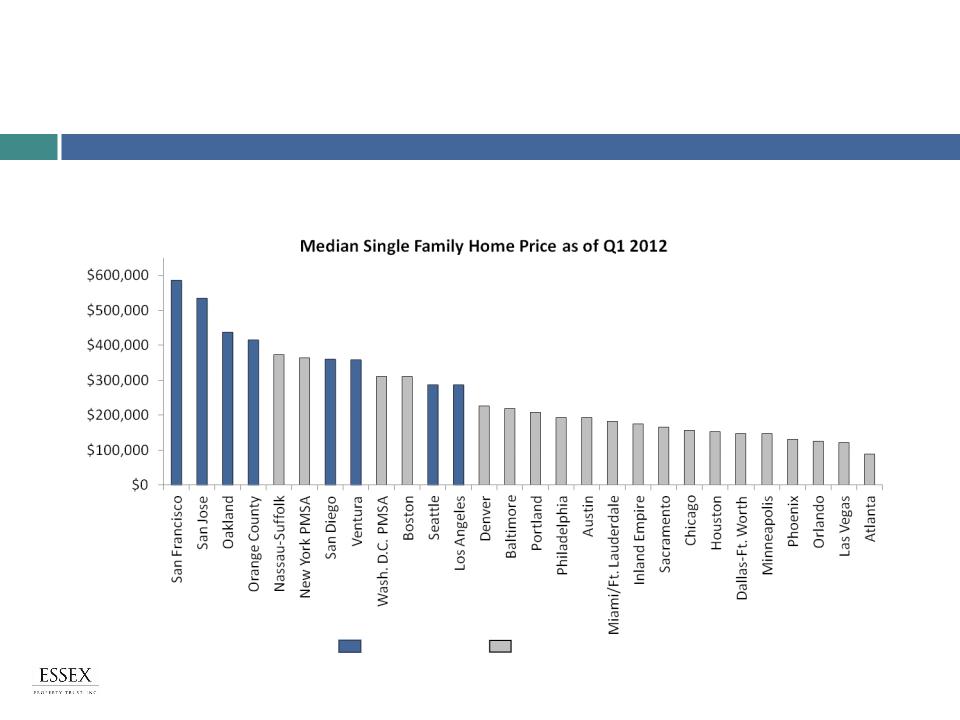

Source: National Association of Realtors, Dataquick, Essex

§ Despite the fall in home prices since 2008, prices remain high in Essex markets

Single-Family Prices Restrict Homeownership

Investment Strategy

Essex Markets

Other Markets

13

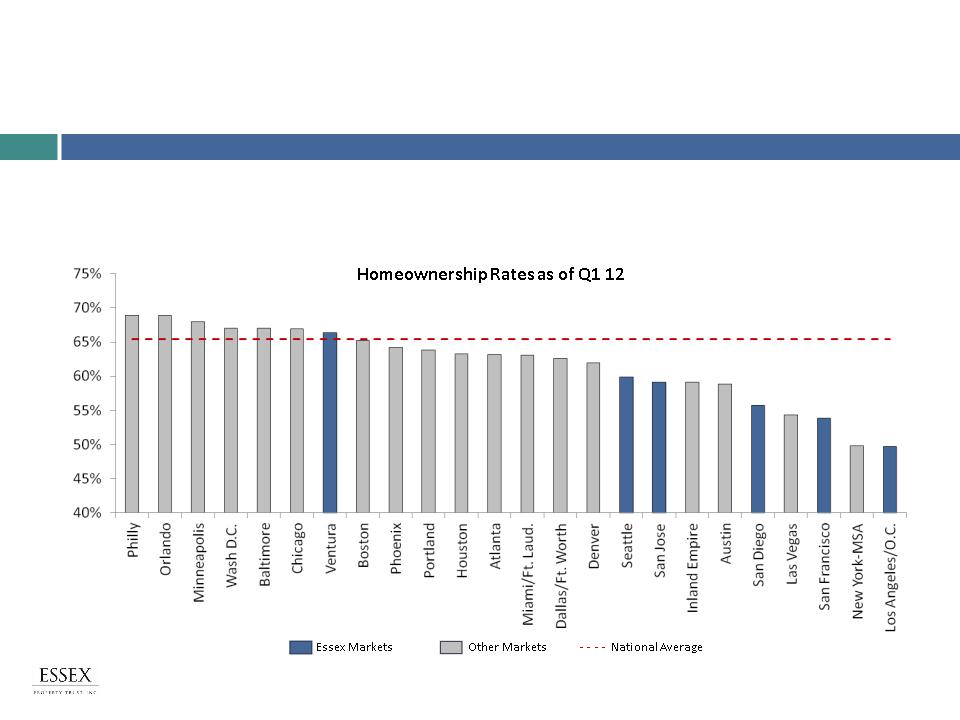

Essex Markets are Renter Markets

Investment Strategy

§ Low homeownership rates compared to the national average due to unaffordable

single family housing results in more renters and better ability to increase rents

single family housing results in more renters and better ability to increase rents

Source: U.S. Census

III. Market Update

Overview on Seattle, Northern CA, and Southern CA

Essex Skyline - Santa Ana, CA

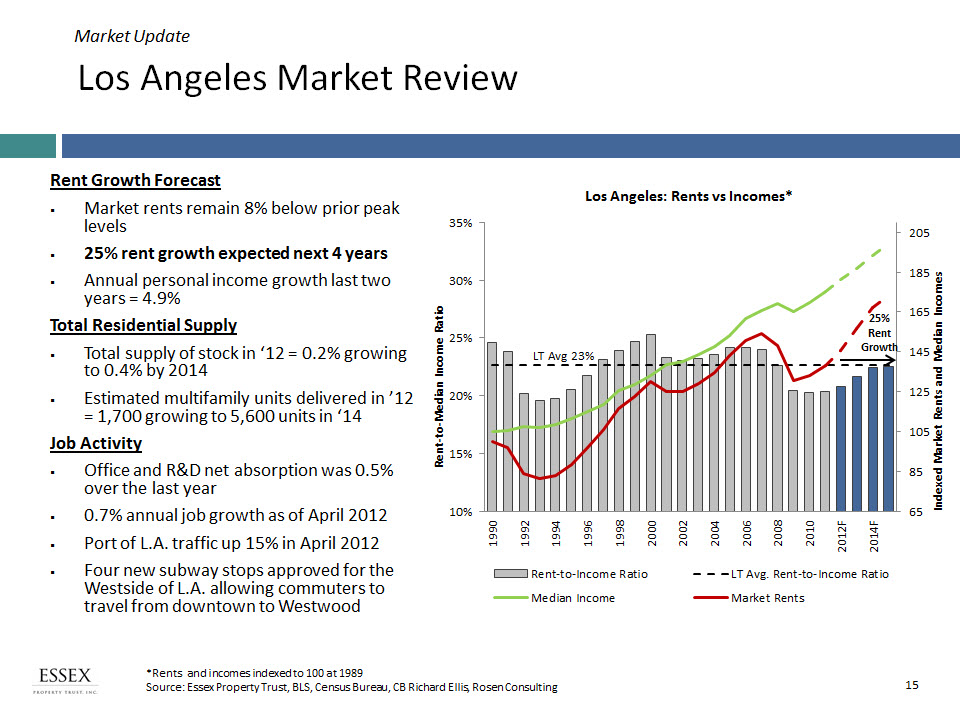

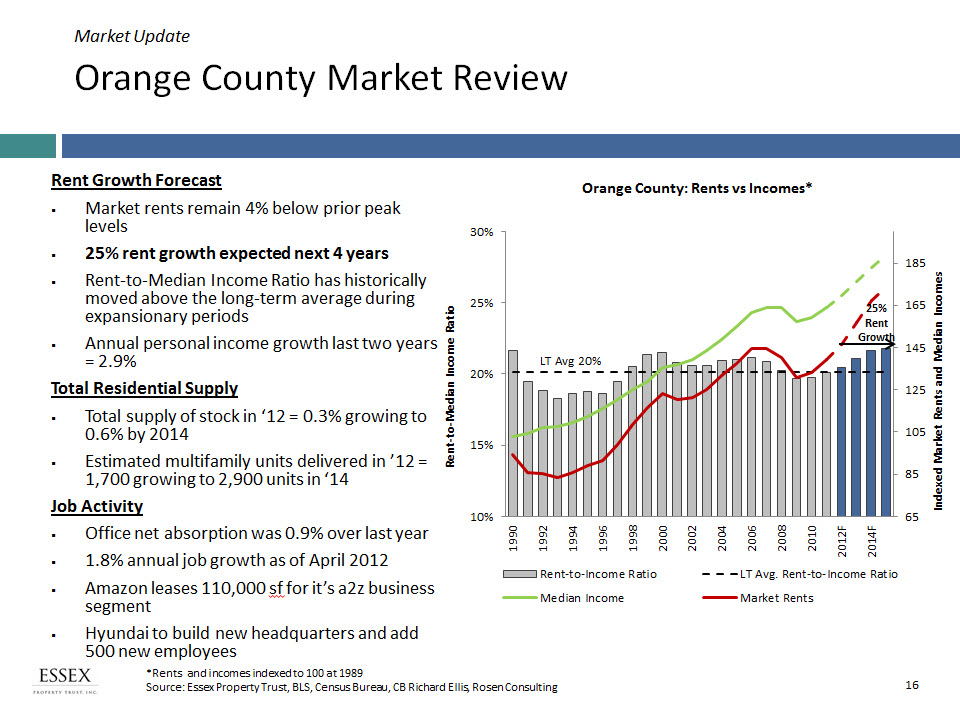

Orange County Market Review

Market Update

17

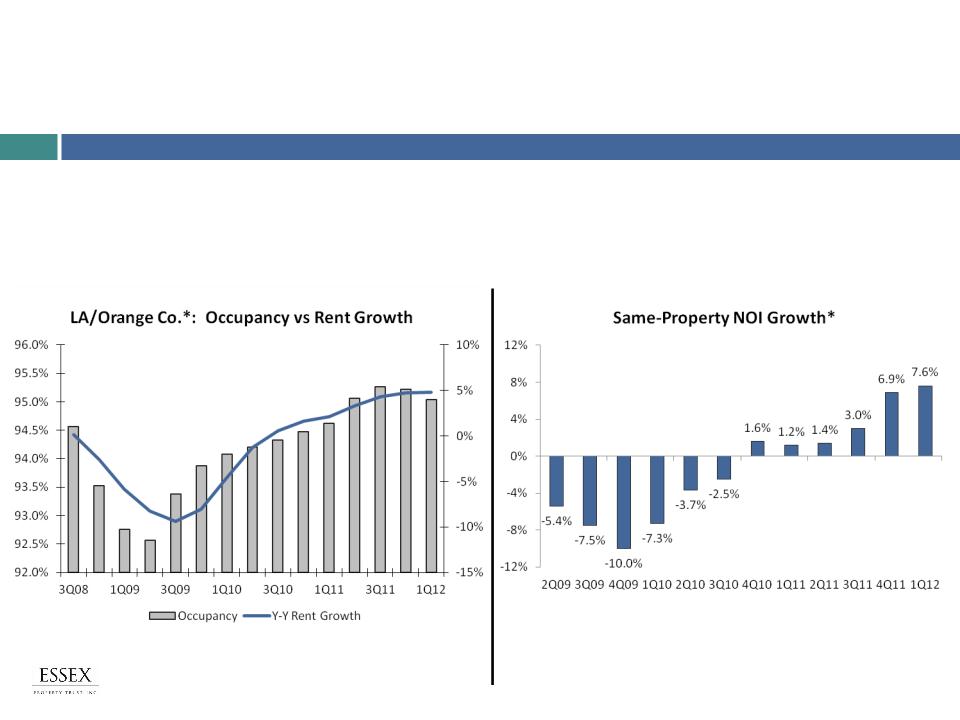

§ Occupancy rates and rents in Orange County and Los Angeles have improved

since Q2 2009

since Q2 2009

§ Pricing power shifts to the landlord as occupancy pushes over 95%

§ Essex S. CA portfolio metrics are improving

Southern CA: Recovery Progressing

Market Update

*Year-over-Year growth

Source: Axiometrics, Realfacts

* LA/Orange County Numerical Averages

18

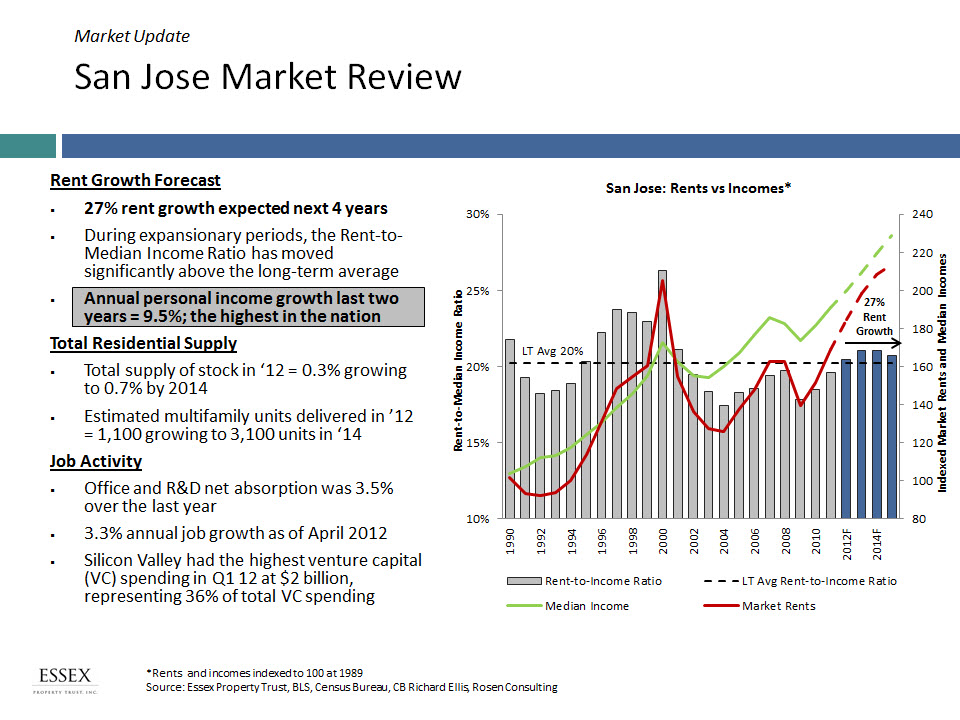

San Jose Market Review

Market Update

19

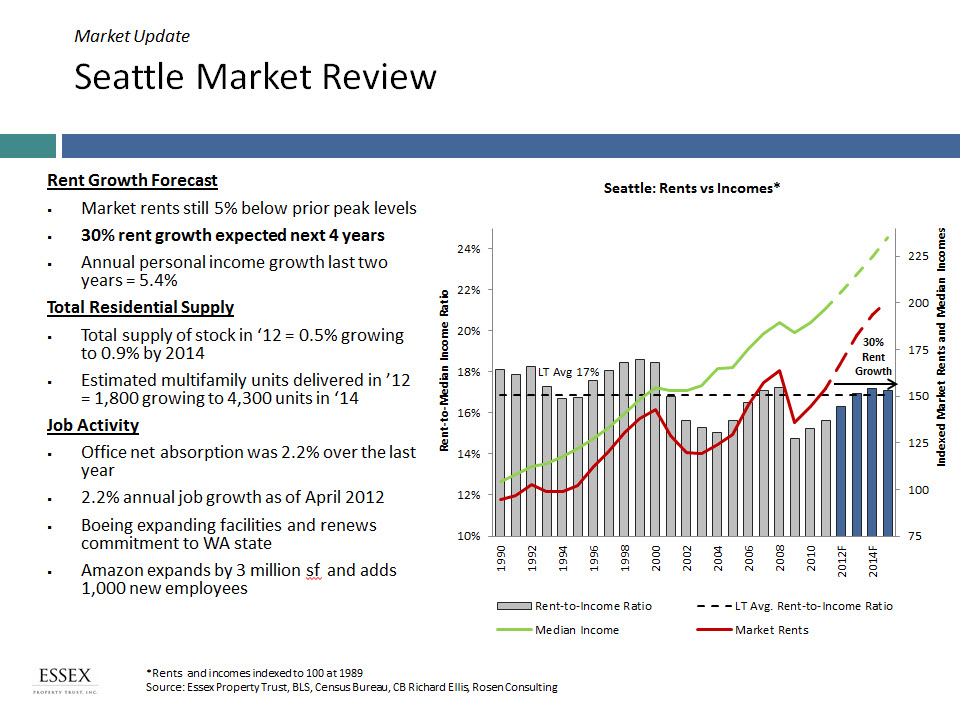

Seattle Market Review

Market Update

IV. Core Competencies

How Essex Creates Value

Bella Villagio - San Jose, CA

21

Investing Strategy

§ An innovative

management team

responsive to changing

market dynamics with the

ability to source and

structure unique

opportunities within the

multifamily space

management team

responsive to changing

market dynamics with the

ability to source and

structure unique

opportunities within the

multifamily space

§ Disciplined underwriting,

rigorous analysis, and total

return driven

rigorous analysis, and total

return driven

First multifamily REIT to create a fund business (raises $250 million

of equity for Fund I).

of equity for Fund I).

Monetizes Fund I at a +40% IRR. Creates Fund II with $265 million of

equity.

equity.

Acquires $106 million of multifamily REIT unsecured bonds yielding

10.3% near the bottom of the market.

10.3% near the bottom of the market.

Acquires early in the recovery. First acquisition was a foreclosed

condo at 55% of cost. Acquires over $1 billion of properties over the

next 24 months.

condo at 55% of cost. Acquires over $1 billion of properties over the

next 24 months.

Early entrant in preferred equity investment and achieves 13%

annual rate on a $12 million investment.

annual rate on a $12 million investment.

Establishes Wesco I joint venture partnership with $200 million of

equity. Fully invested by year-end 2011.

equity. Fully invested by year-end 2011.

Establishes Wesco II for a $175 million Preferred Equity Investment

in Park Merced at a 10.1% annual return for 7-years.

in Park Merced at a 10.1% annual return for 7-years.

2001

2004

2009

2010

2011

Acquires joint venture partner’s interest in the co-investment Essex

Skyline and receives $2.3 million promote income. Issued 320,000

fewer shares of ESS common stock by initially acquiring with a

partner.

Skyline and receives $2.3 million promote income. Issued 320,000

fewer shares of ESS common stock by initially acquiring with a

partner.

2012

Core Competencies

Began developing early in the recovery. Delivers first project post

recession 6 months ahead of schedule and $5 million below budget.

recession 6 months ahead of schedule and $5 million below budget.

22

§ Acquired $1.2 billion of assets since the beginning of 2010, representing a 30%

expansion of gross asset value

expansion of gross asset value

§ Estimated 5.5% yield in 2012, expected to grow to 6.0% in 2013

§ Improved the Net Asset Value/sh, cash flow/sh and growth prospects of the

Company

Company

Active Acquirer

Core Competencies: Acquisitions

Essex Skyline at MacArthur Place

Santa Ana, CA

349 units

Purchased joint venture partner’s

interest for $85.0 million

interest for $85.0 million

Delano & Bon Terra

Redmond, WA

126 units

$30.1 million

23

6 Developments Under Construction - $574 Million

Core Competencies: Development

Expo (formerly Queen Anne)

Seattle, WA

275 units

$79.1 million est. total cost

Nov 2012 est. initial occupancy

ESS - 50% ownership

Epic (formerly Cadance)

San Jose, CA

Phase I & II- 569 units, 17,000 sq. ft. retail

Phase III - 192 units

$192 million est. total cost (Ph I & II)

May 2013 est. initial occupancy

ESS - 55% ownership

Lync (formerly West Dublin)

Dublin, CA

309 Units

$94.5 million est. total cost

June 2013 est. initial occupancy

ESS - 55% ownership

24

6 Developments Under Construction - $574 Million

Core Competencies: Development

Santa Monica at La Brea

West Hollywood, CA

184 Units, 12,750 sq. ft. retail

$75.4 million est. total cost

July 2014 est. initial occupancy

ESS - 50% ownership

Fountain at La Brea

West Hollywood, CA

187 Units, 18,200 sq. ft. retail

$75.0 million est. total cost

February 2014 est. initial occupancy

ESS - 50% ownership

Emeryville

Emeryville, CA

190 Units

$58.0 million est. total cost

25

Redevelopment and Selective Repositioning

Core Competencies: Value-Add Redevelopment

§ Capitalize on the strategy of owning Class B quality assets in A locations, which

provides a greater potential to unlock value and improve portfolio growth

provides a greater potential to unlock value and improve portfolio growth

§ Focus on rent justified improvements to maximize NOI and value

Before

After

The Bluffs II

San Diego, CA

224 units

$9.7 million renovation cost

$43,300 cost per unit

9-10% estimated return

26

Diversified Sources of Equity

Core Competencies: Fund & Joint Ventures

§ Co-investment platform facilities growth via private capital

§ 19% of total portfolio falls under co-investments

§ Attractive risk adjusted returns via promoted interest

Fund II

• 14 properties with dispositions in 2012-2014

• $600 million of assets at book value

Programmatic JVs

• Wesco I - $425 million of assets at book value

• Wesco II - $175 million preferred equity

investment - at book value

investment - at book value

• CPPIB - two developments (878 units)

Developments with JV Partners

• Expo (formerly Queen Anne) (275 units)

• Fountain at La Brea (187 units)

• Santa Monica at La Brea (184 units)

V. Financial Information

Key Financials and 2012 Guidance

Reveal - Woodland Hills, CA

28

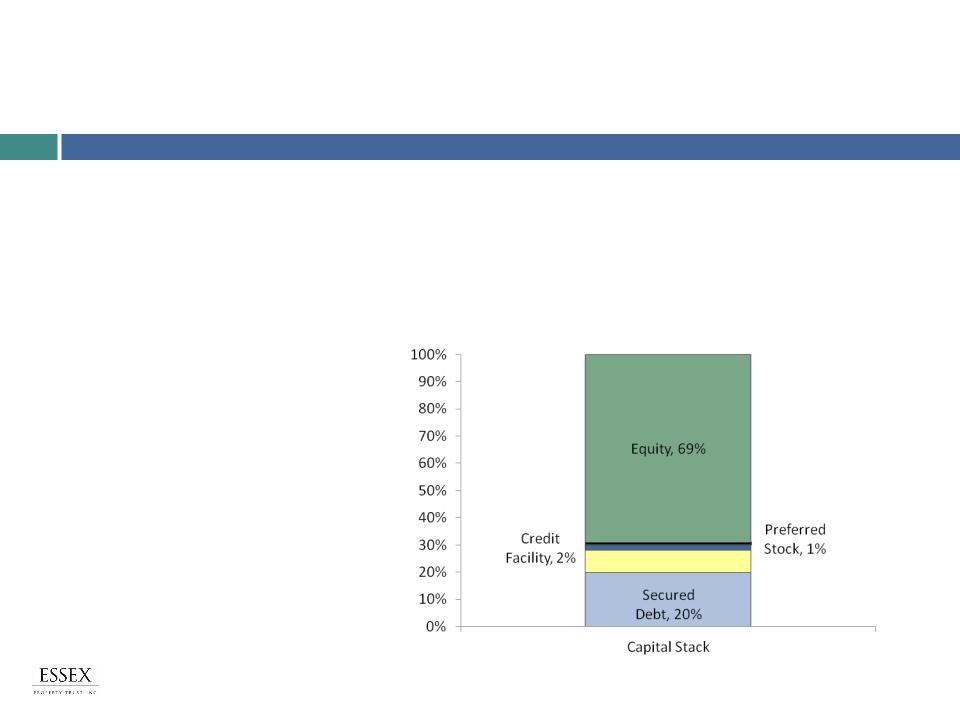

Conservatively Proportioned & Flexible Balance Sheet

Financial Information

§ Leverage: 30% on a debt to total market capitalization basis (one of the lowest of the multifamily peer

group)

group)

§ Debt: Debt to adjusted EBITDA is expected to be approximately 7.0X by year-end 2012

§ Liquidity: Nearly $475 million in available liquidity from cash on hand, marketable securities, and unused

balance on our line of credit

balance on our line of credit

§ NOI: Unencumbered NOI expected to be approximately 50% by June 30, 2012 versus 35% at year end 2010

§ Debt Maturity: Limited near term with less than 15% of debt coming due over the next 3 years

§ Investment Grade Ratings:

§ S&P: BBB - Stable

§ Moody’s: Baa2 - Stable

§ Fitch: BBB - Positive

Unsecured Debt, 8%

Source: Company filings as of 3/31/12; proforma for $200 million unsecured private

placement notes in process and $140 million repayment of secured mortgages in 2Q 12.

placement notes in process and $140 million repayment of secured mortgages in 2Q 12.

29

2012 Guidance Assumptions

Financial Information

FFO Per Share Guidance

$6.52-$6.77 , represents 14-18% growth

Same Property Revenue Growth (Midpoint)

6.0%

Same Property NOI Growth of the Consolidated portfolio (Midpoint) *

8.0%

2012 Market Expectations

Job Growth

Rent Growth

Occupancy

Southern California

1.1%

5.7%

95.5%

Northern California

1.9%

8.6%

96.8%

Seattle Metro

2.0%

9.0%

95.5%

Weighted Average

1.4%

7.3%

96.0%

US Economic Assumptions

GDP Growth of 2.6%

Job Growth of 1.3%

Target Acquisitions

$300 million - $500 million

* Excludes joint ventures which have greater exposure to Seattle and Northern California

30

Key Strengths

Conclusion

§ Proven management team with

superior performance track record

superior performance track record

§ Innovative and diverse investment

strategies within the multifamily

sector

strategies within the multifamily

sector

§ Proven core underwriting and

operating competencies

generating durable long term

results

operating competencies

generating durable long term

results

416 on Broadway - Glendale, CA

Santee Court - Los Angeles, CA

31

Safe Harbor Disclosure

Certain statements in this presentation, which are not historical facts, may be considered forward-looking

statements within the meaning of the federal securities laws. The forward looking statements, some of

which can be identified by terms and phrases such as “forecast”, “estimate”, “expect”, “anticipate”,

“should”, “could”, “may”, and similar expressions, reflect the current views of Essex Property Trust, Inc.

(“Essex” or the “Company”) and its affiliates with respect to future events and are subject to risks and

uncertainties. Such forward-looking statements involve the risk that actual results could be materially

different from those described in such forward-looking statements. Factors that could cause actual results

to be materially different are discussed under the caption “Risk Factors” in Item 1A of the Company’s

Report on Form 10-K for the year ended December 31, 2011. All forward-looking statements and reasons

why results may differ included in this presentation are made of the date hereof, and we assume no

obligation to update any such forward-looking statements or reasons why actual results may differ.

statements within the meaning of the federal securities laws. The forward looking statements, some of

which can be identified by terms and phrases such as “forecast”, “estimate”, “expect”, “anticipate”,

“should”, “could”, “may”, and similar expressions, reflect the current views of Essex Property Trust, Inc.

(“Essex” or the “Company”) and its affiliates with respect to future events and are subject to risks and

uncertainties. Such forward-looking statements involve the risk that actual results could be materially

different from those described in such forward-looking statements. Factors that could cause actual results

to be materially different are discussed under the caption “Risk Factors” in Item 1A of the Company’s

Report on Form 10-K for the year ended December 31, 2011. All forward-looking statements and reasons

why results may differ included in this presentation are made of the date hereof, and we assume no

obligation to update any such forward-looking statements or reasons why actual results may differ.

For additional information, please contact the Company’s

Investor Relations department at (650) 849-1600.

Investor Relations department at (650) 849-1600.

Fourth & U - Berkeley, CA

416 on Broadway - Glendale, CA

Joule - Seattle, WA

Via - Sunnyvale, CA

Axis 2300 - Irvine, CA

Arbors at Park Rose - Oxnard, CA